1CLICK TO EDIT MASTER TITLE STYLE GUIDANCE PRESENTATION 2022

2 PAGE 03 FORWARD-LOOKING STATEMENTS 04 2022 OUTLOOK & ASSUMPTIONS 05 EVOLVING PORTFOLIO GAAP NOI COMPOSITION 06 ESTIMATED NOI & FEE INCOME 07 MULTIFAMILY SEGMENT 08 OFFICE SEGMENT 09 RETAIL SEGMENT 10 DEVELOPMENT VALUE CREATION 11 ACQUISITION NOI 12 CORE LOCATIONS 13 EXELON HQ ACQUISITION 14 DEVELOPMENT DETAILS TABLE OF CONTENTS SECTION

3FORWARD-LOOKING STATEMENTS This presentation should be read in conjunction with the unaudited condensed consolidated financial statements appearing in our press release dated February 11, 2021, which has been furnished as Exhibit 99.1 to our Form 8-K filed on February 10, 2022. The Company makes statements that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)). In particular, statements pertaining to our capital resources, portfolio performance and results of operations contain forward-looking statements. Likewise, all of our statements regarding our 2022 outlook and related assumptions, projections, anticipated growth in our funds from operations, normalized funds from operations, adjusted funds from operations, funds available for distribution and net operating income are forward-looking statements. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “intends,” “plans,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods which may be incorrect or imprecise and the Company may not be able to realize them. The Company does not guarantee that the transactions and events described will happen as described (or that they will happen at all). For further discussion of risk factors and other events that could impact our future results, please refer to the section entitled “Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”), and the documents subsequently filed by us from time to time with the SEC. The Company's actual future results and trends may differ materially from expectations depending on a variety of factors discussed in the Company's filings with the SEC. These factors include, without limitation: (a) the impact of the coronavirus (COVID-19) pandemic on macroeconomic conditions and economic conditions in the markets in which the Company operates, including, among others: (i) disruptions in, or a lack of access to, the capital markets or disruptions in the Company's ability to borrow amounts subject to existing construction loan commitments; (ii) adverse impacts to the Company's tenants' and other third parties' businesses and financial condition that adversely affect the ability and willingness of the Company's tenants and other third parties to satisfy their rent and other obligations to the Company, including deferred rent; (iii) the ability and willingness of the Company's tenants to renew their leases with the Company upon expiration of the leases or to re-lease the Company's properties on the same or better terms in the event of nonrenewal or early termination of existing leases; and (iv) federal, state and local government initiatives to mitigate the impact of the COVID-19 pandemic, including additional restrictions on business activities, shelter-in place orders and other restrictions, and the timing and amount of economic stimulus or other initiatives; (b) the Company's ability to continue construction on development and construction projects, in each case on the timeframes and on terms currently anticipated; (c) uncertainty regarding the timing of distribution and effectiveness of COVID-19 vaccines; (d) the Company's ability to accurately assess and predict the impact of the COVID-19 pandemic on its results of operations, financial condition, dividend policy, acquisition and disposition activities and growth opportunities; and (e) the Company's ability to maintain compliance with the covenants under its existing debt agreements or to obtain modifications to such covenants from the applicable lenders. The Company expressly disclaims any obligation or undertaking to update or revise any forward-looking statement contained herein, to reflect any change in the Company's expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required by applicable law. The Company does not provide a reconciliation for its guidance range of Normalized FFO per diluted share to net income per diluted share, the most directly comparable forward-looking GAAP financial measure, because it is unable to provide a meaningful or accurate estimate of reconciling items and the information is not available without unreasonable effort as a result of the inherent difficulty of forecasting the timing and/or amounts of various items that would impact net income per diluted share. For the same reasons, the Company is unable to address the probable significance of the unavailable information and believes that providing a reconciliation for its guidance range of Normalized FFO per diluted share would imply a degree of precision for its forward-looking net income per diluted share that could be misleading to investors.

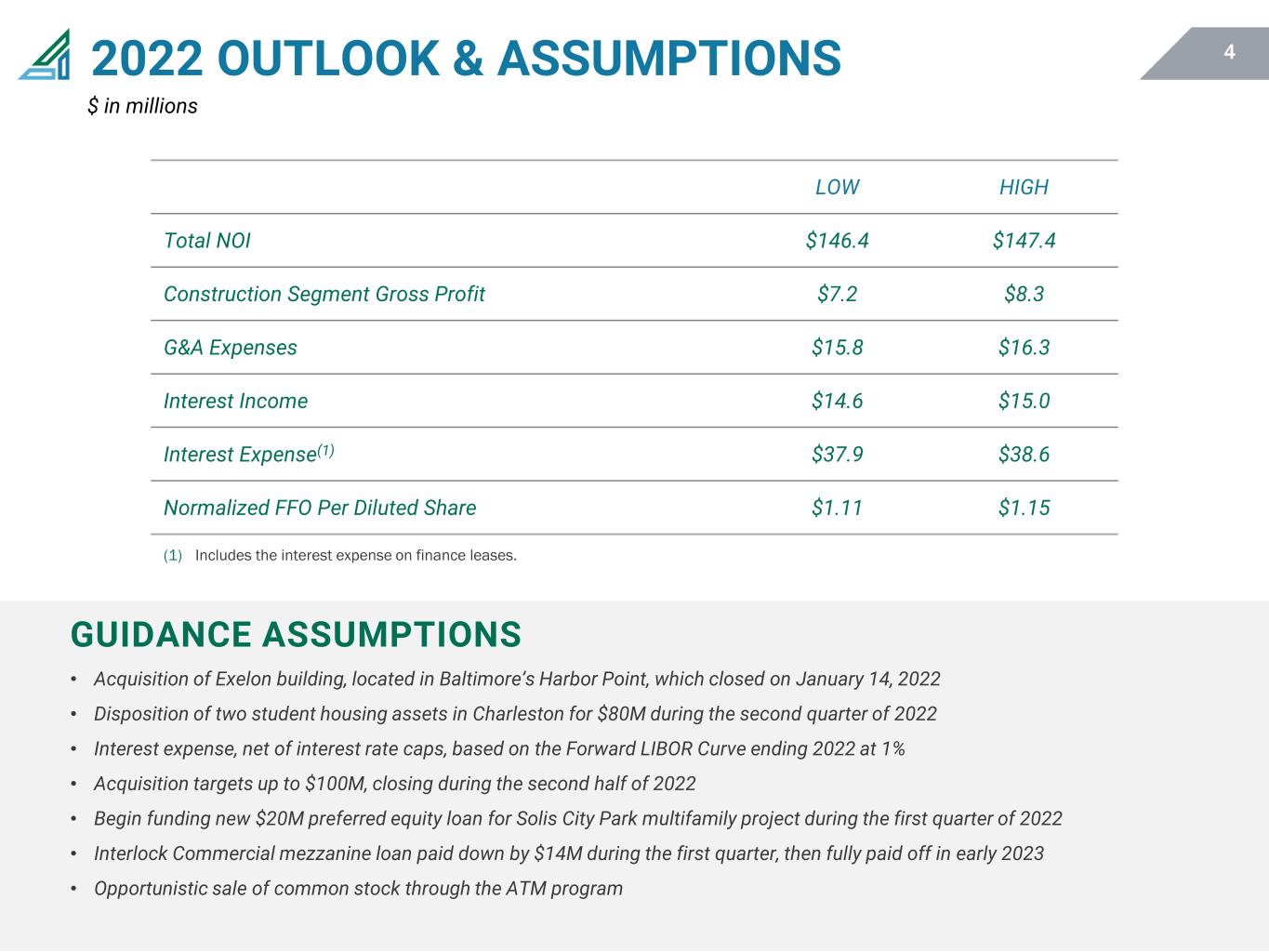

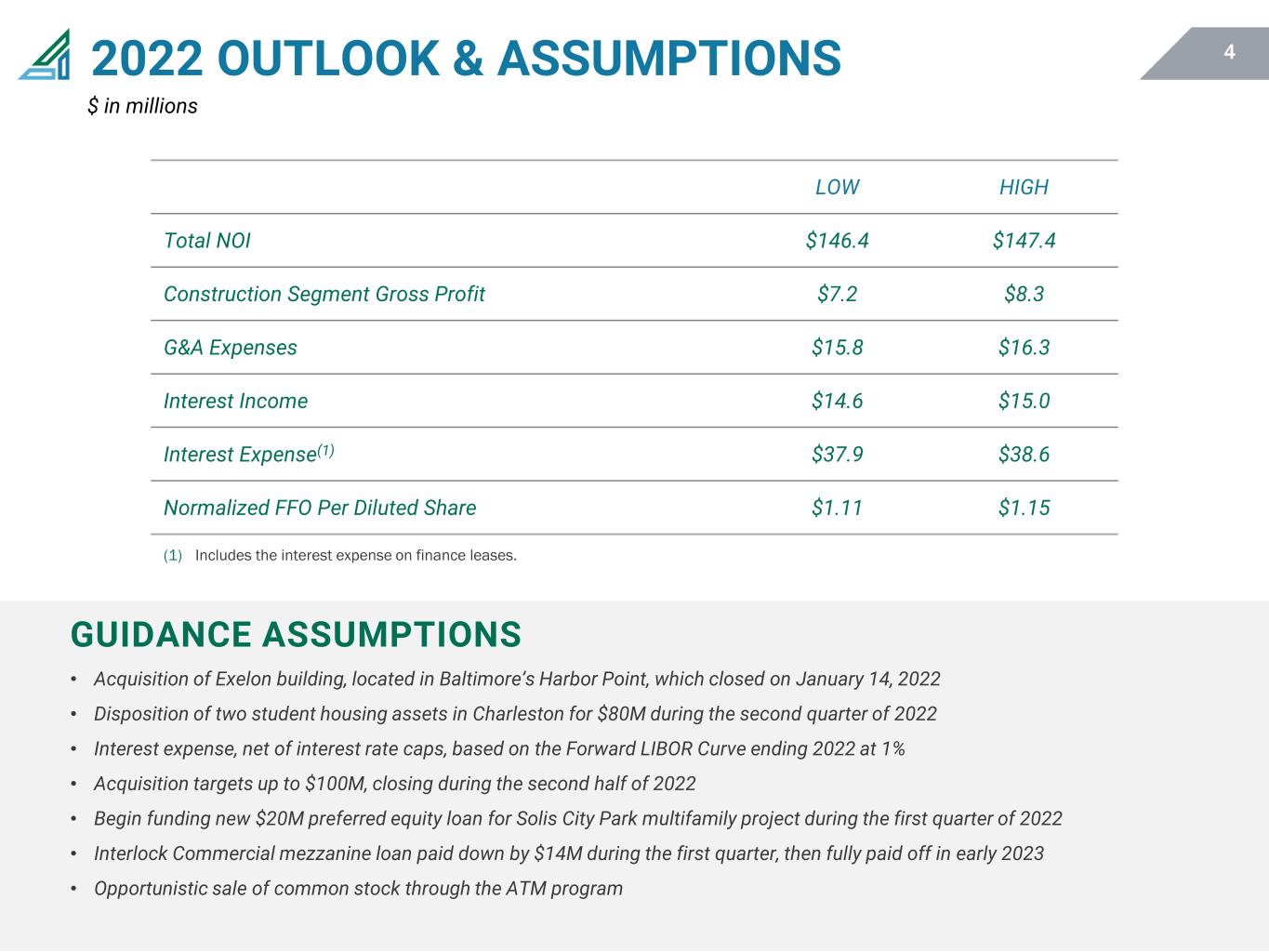

42022 OUTLOOK & ASSUMPTIONS LOW HIGH Total NOI $146.4 $147.4 Construction Segment Gross Profit $7.2 $8.3 G&A Expenses $15.8 $16.3 Interest Income $14.6 $15.0 Interest Expense(1) $37.9 $38.6 Normalized FFO Per Diluted Share $1.11 $1.15 GUIDANCE ASSUMPTIONS • Acquisition of Exelon building, located in Baltimore’s Harbor Point, which closed on January 14, 2022 • Disposition of two student housing assets in Charleston for $80M during the second quarter of 2022 • Interest expense, net of interest rate caps, based on the Forward LIBOR Curve ending 2022 at 1% • Acquisition targets up to $100M, closing during the second half of 2022 • Begin funding new $20M preferred equity loan for Solis City Park multifamily project during the first quarter of 2022 • Interlock Commercial mezzanine loan paid down by $14M during the first quarter, then fully paid off in early 2023 • Opportunistic sale of common stock through the ATM program (1) Includes the interest expense on finance leases. $ in millions

5EVOLVING PORTFOLIO GAAP NOI COMPOSITION 2021 2022 Guidance Midpoint Retail Entertainment & Mixed-Use Retail Multifamily Office Projected Property Segment NOI Fully Stabilized (4)(5) (1) Includes AHH rent and excludes expenses associated with the Company’s in house asset management division (2) Includes $100M acquisition target per 2022 guidance (3) Excludes student housing assets (4) Fully Stabilized Portfolio assumes announced pipeline is delivered and stabilized per schedule on page 10 (5) Assumes company acquired 100% interest in Parcel 4 Mixed-Use development and disposes of T. Rowe Price world headquarters 42% 6% 26% 26% 38% 6% 33% 23% 35% 6% 31% 28% $ in millions PORTFOLIO COMPOSITION(1) 2021 2022 MIDPOINT FULLY STABILIZED RETAIL(2) $51 $57 $68 ENTERTAINMENT & MIXED USE RETAIL $8 $9 $11 OFFICE $31 $50 $60 MULTIFAMILY(3) $31 $35 $54 TOTAL $121 $151 $193

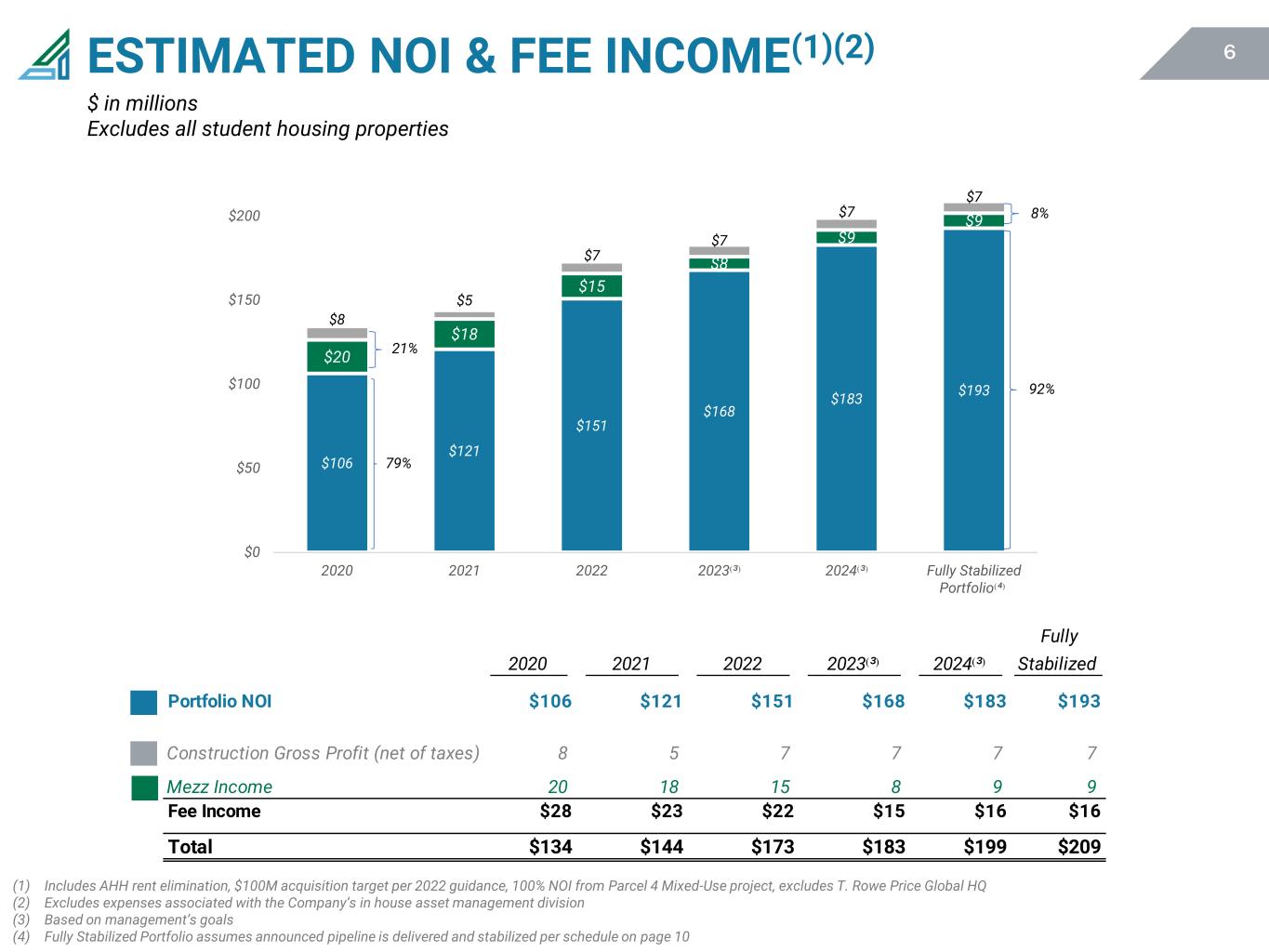

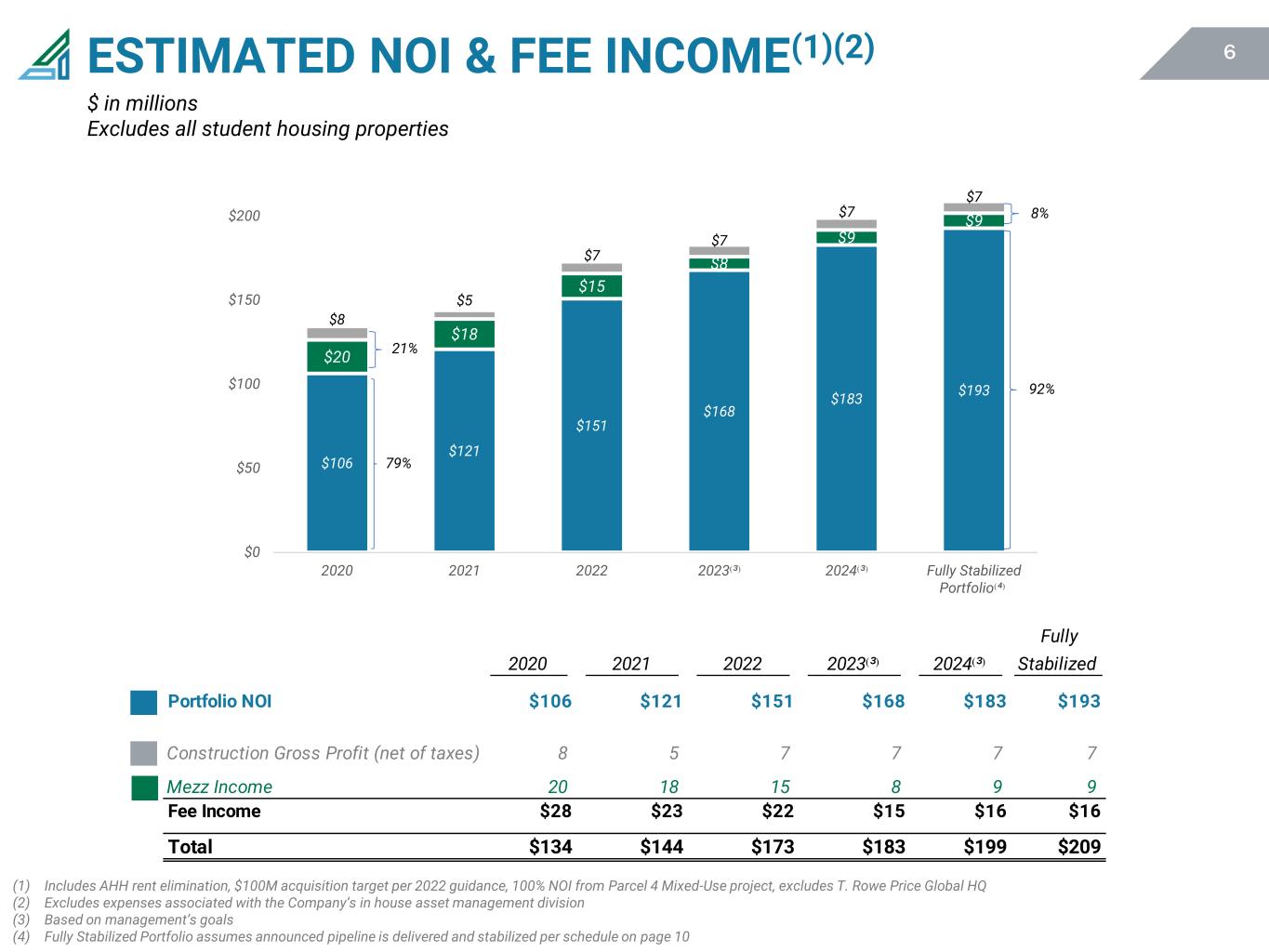

6ESTIMATED NOI & FEE INCOME(1)(2) (1) Includes AHH rent elimination, $100M acquisition target per 2022 guidance, 100% NOI from Parcel 4 Mixed-Use project, excludes T. Rowe Price Global HQ (2) Excludes expenses associated with the Company’s in house asset management division (3) Based on management’s goals (4) Fully Stabilized Portfolio assumes announced pipeline is delivered and stabilized per schedule on page 10 $ in millions Excludes all student housing properties 2020 2021 2022 2023⁽³⁾ 2024⁽³⁾ Fully Stabilized Portfolio NOI $106 $121 $151 $168 $183 $193 Construction Gross Profit (net of taxes) 8 5 7 7 7 7 Mezz Income 20 18 15 8 9 9 Fee Income $28 $23 $22 $15 $16 $16 Total $134 $144 $173 $183 $199 $209 $106 $121 $151 $168 $183 $193 $20 $18 $15 $8 $9 $9 $8 $5 $7 $7 $7 $7 $0 $50 $100 $150 $200 2020 2021 2022 2023⁽³⁾ 2024⁽³⁾ Fully Stabilized Portfolio⁽⁴⁾ 92% 8% 79% 21%

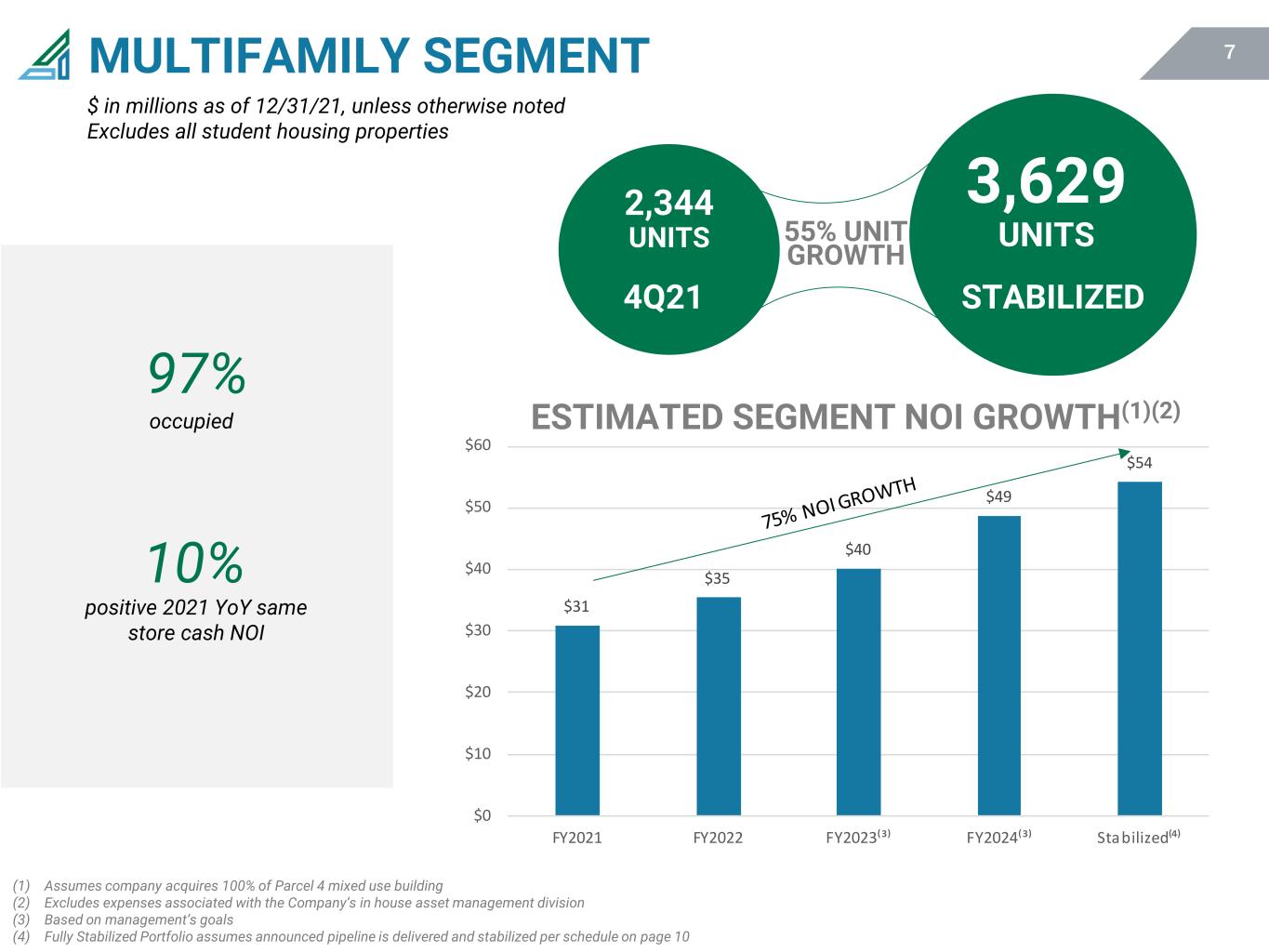

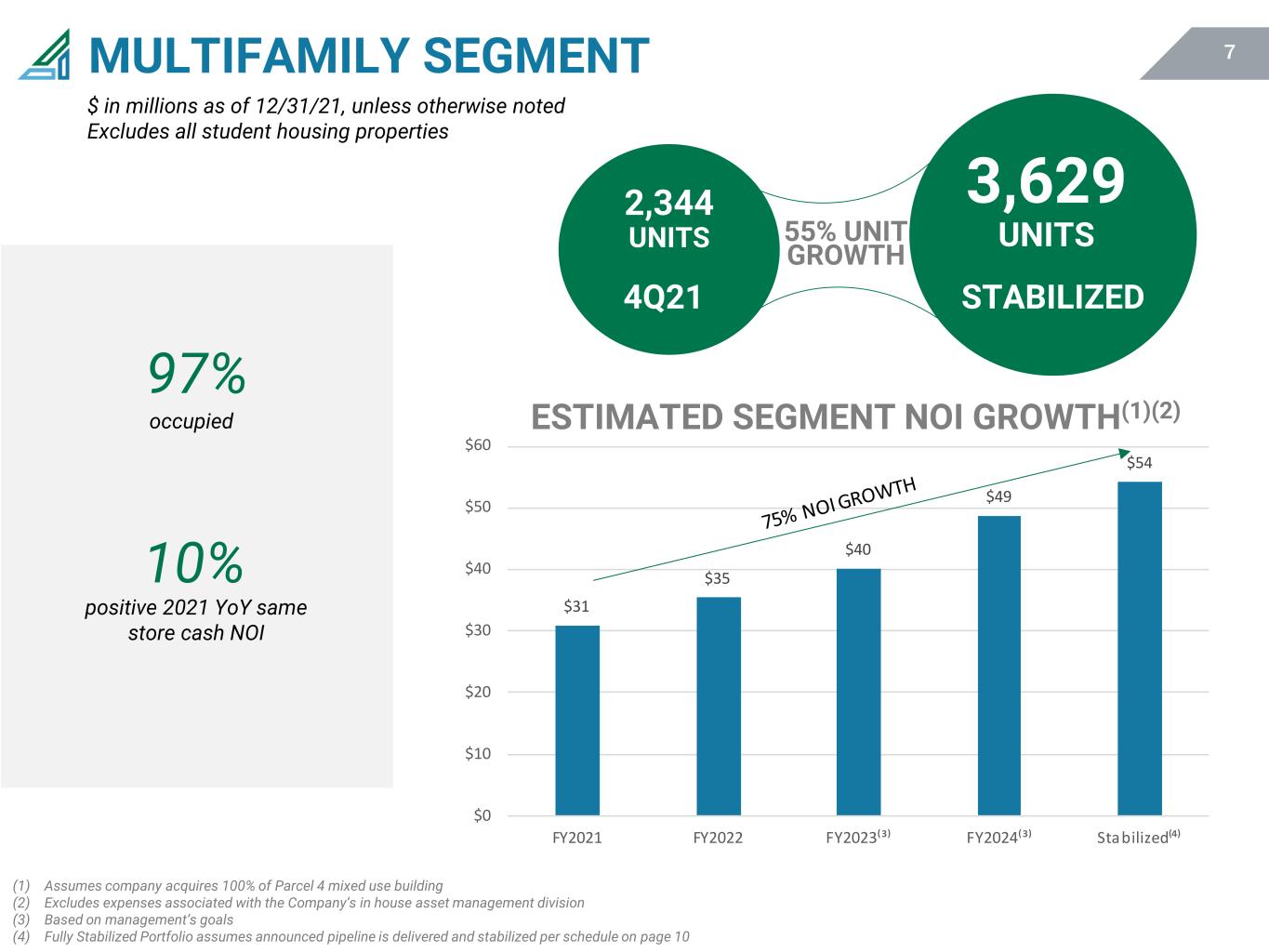

7MULTIFAMILY SEGMENT 2,344 UNITS 3,629 UNITS 4Q21 STABILIZED 55% UNIT GROWTH ESTIMATED SEGMENT NOI GROWTH(1)(2) $ in millions as of 12/31/21, unless otherwise noted Excludes all student housing properties 97% occupied 10% positive 2021 YoY same store cash NOI (1) Assumes company acquires 100% of Parcel 4 mixed use building (2) Excludes expenses associated with the Company’s in house asset management division (3) Based on management’s goals (4) Fully Stabilized Portfolio assumes announced pipeline is delivered and stabilized per schedule on page 10 $31 $35 $40 $49 $54 $0 $10 $20 $30 $40 $50 $60 FY2021 FY2022 FY2023⁽³⁾ FY2024⁽³⁾ Stabilized⁽⁴⁾

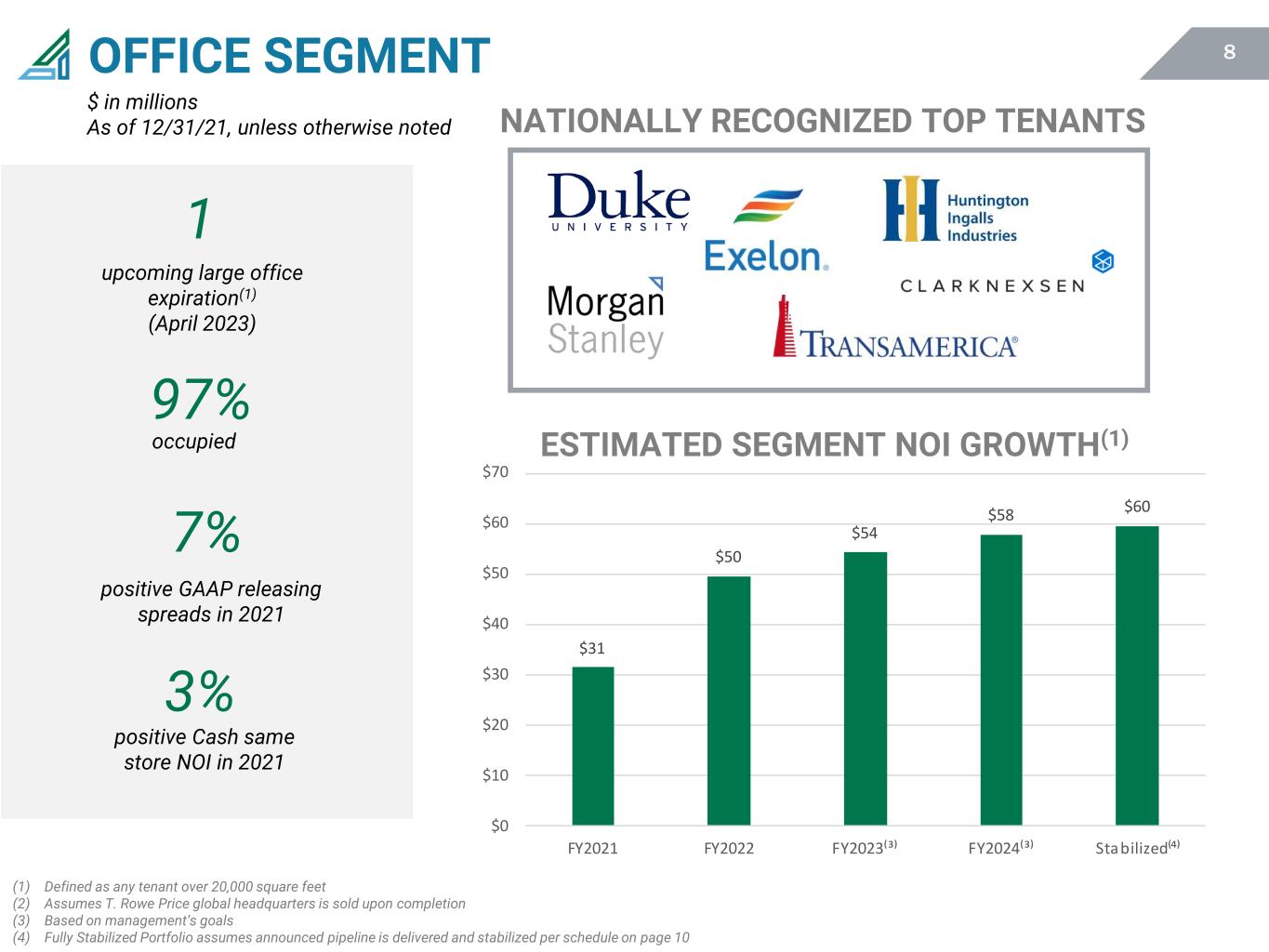

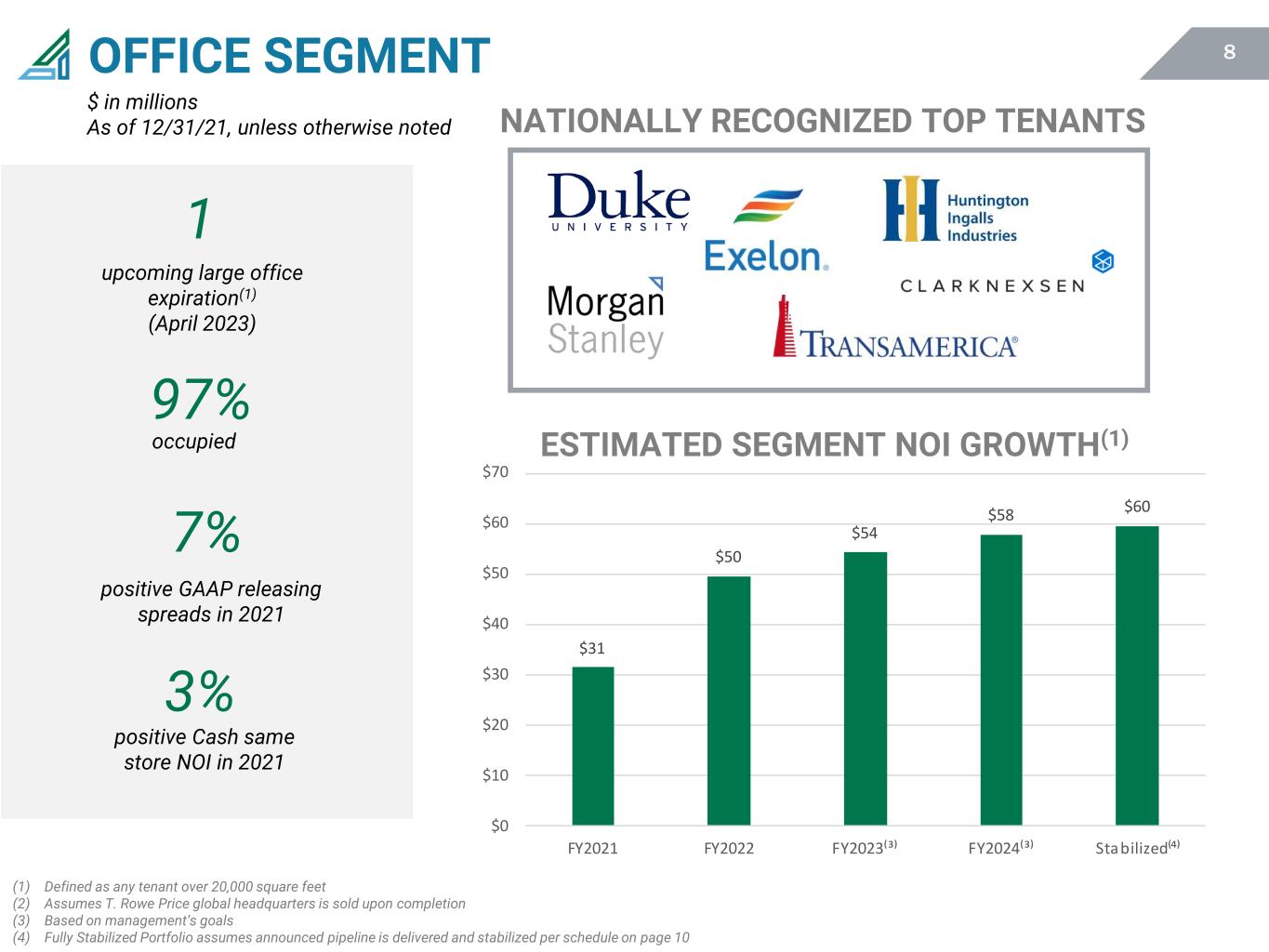

8OFFICE SEGMENT ESTIMATED SEGMENT NOI GROWTH(1) 1 upcoming large office expiration(1) (April 2023) 97% occupied 3% positive Cash same store NOI in 2021 (1) Defined as any tenant over 20,000 square feet (2) Assumes T. Rowe Price global headquarters is sold upon completion (3) Based on management’s goals (4) Fully Stabilized Portfolio assumes announced pipeline is delivered and stabilized per schedule on page 10 $ in millions As of 12/31/21, unless otherwise noted 7% positive GAAP releasing spreads in 2021 NATIONALLY RECOGNIZED TOP TENANTS $31 $50 $54 $58 $60 $0 $10 $20 $30 $40 $50 $60 $70 FY2021 FY2022 FY2023⁽³⁾ FY2024⁽³⁾ Stabilized⁽⁴⁾

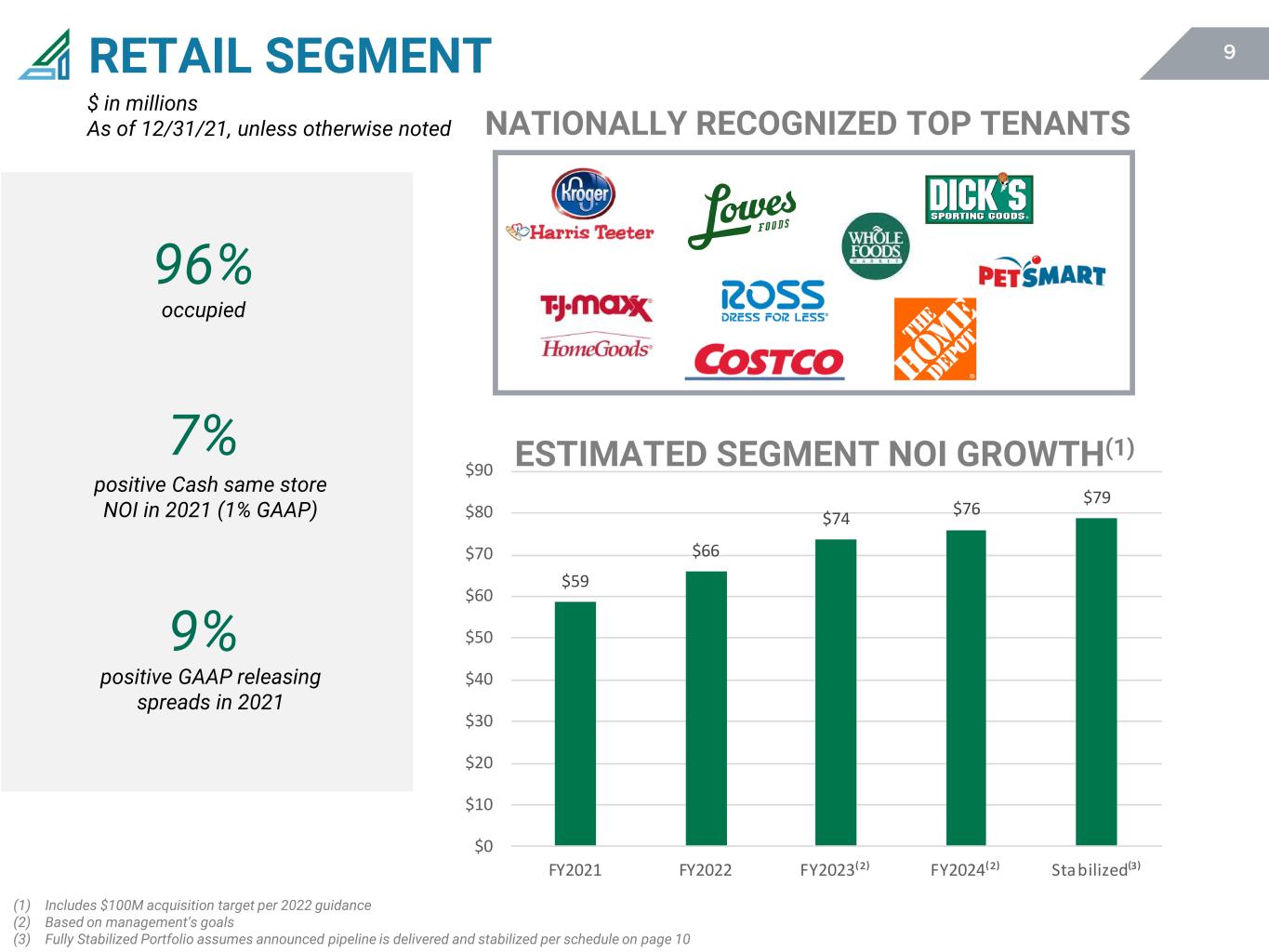

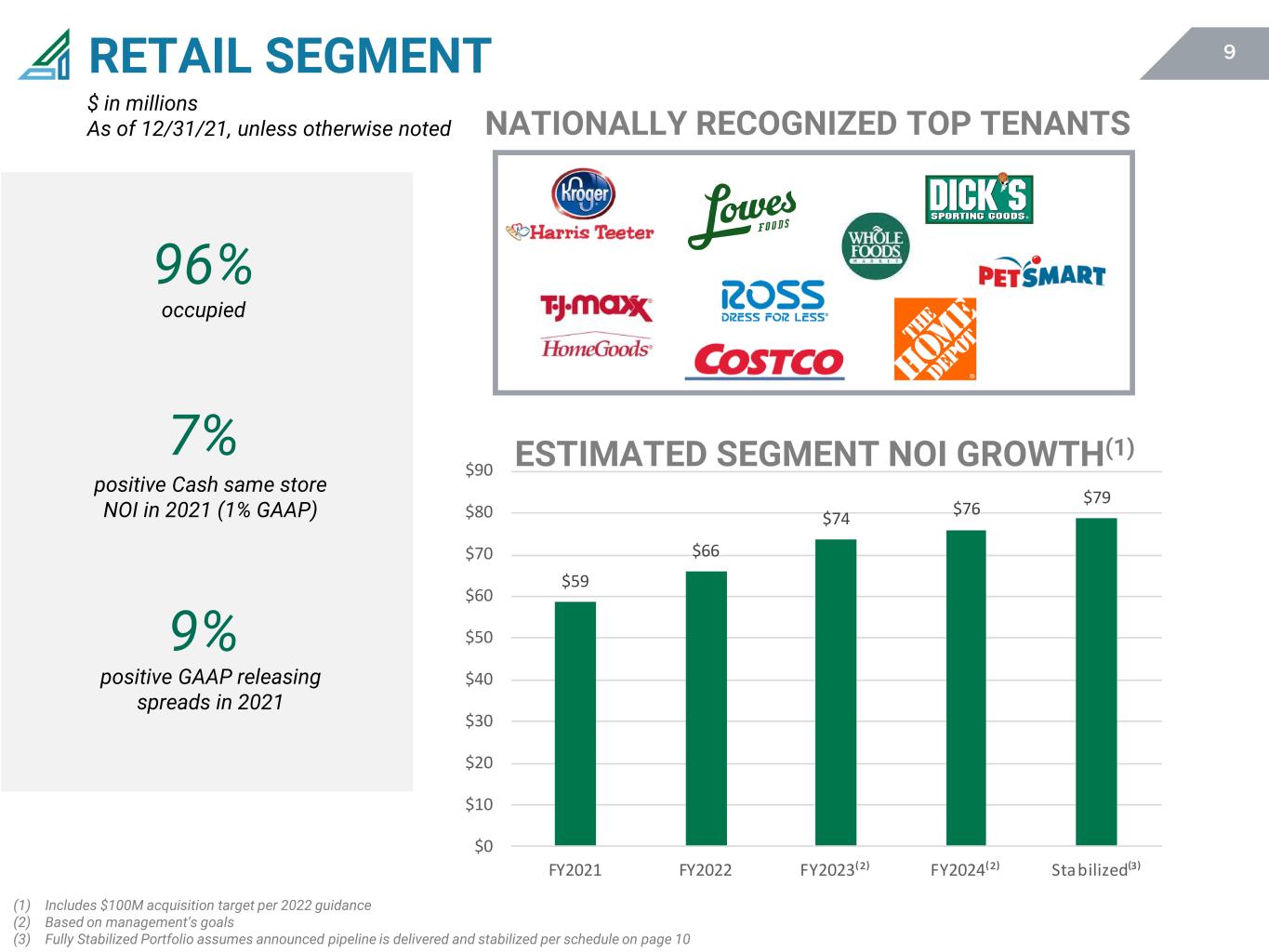

9RETAIL SEGMENT ESTIMATED SEGMENT NOI GROWTH(1) $ in millions As of 12/31/21, unless otherwise noted NATIONALLY RECOGNIZED TOP TENANTS (1) Includes $100M acquisition target per 2022 guidance (2) Based on management’s goals (3) Fully Stabilized Portfolio assumes announced pipeline is delivered and stabilized per schedule on page 10 $59 $66 $74 $76 $79 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 FY2021 FY2022 FY2023⁽²⁾ FY2024⁽²⁾ Stabilized⁽³⁾ 96% occupied 7% positive Cash same store NOI in 2021 (1% GAAP) 9% positive GAAP releasing spreads in 2021

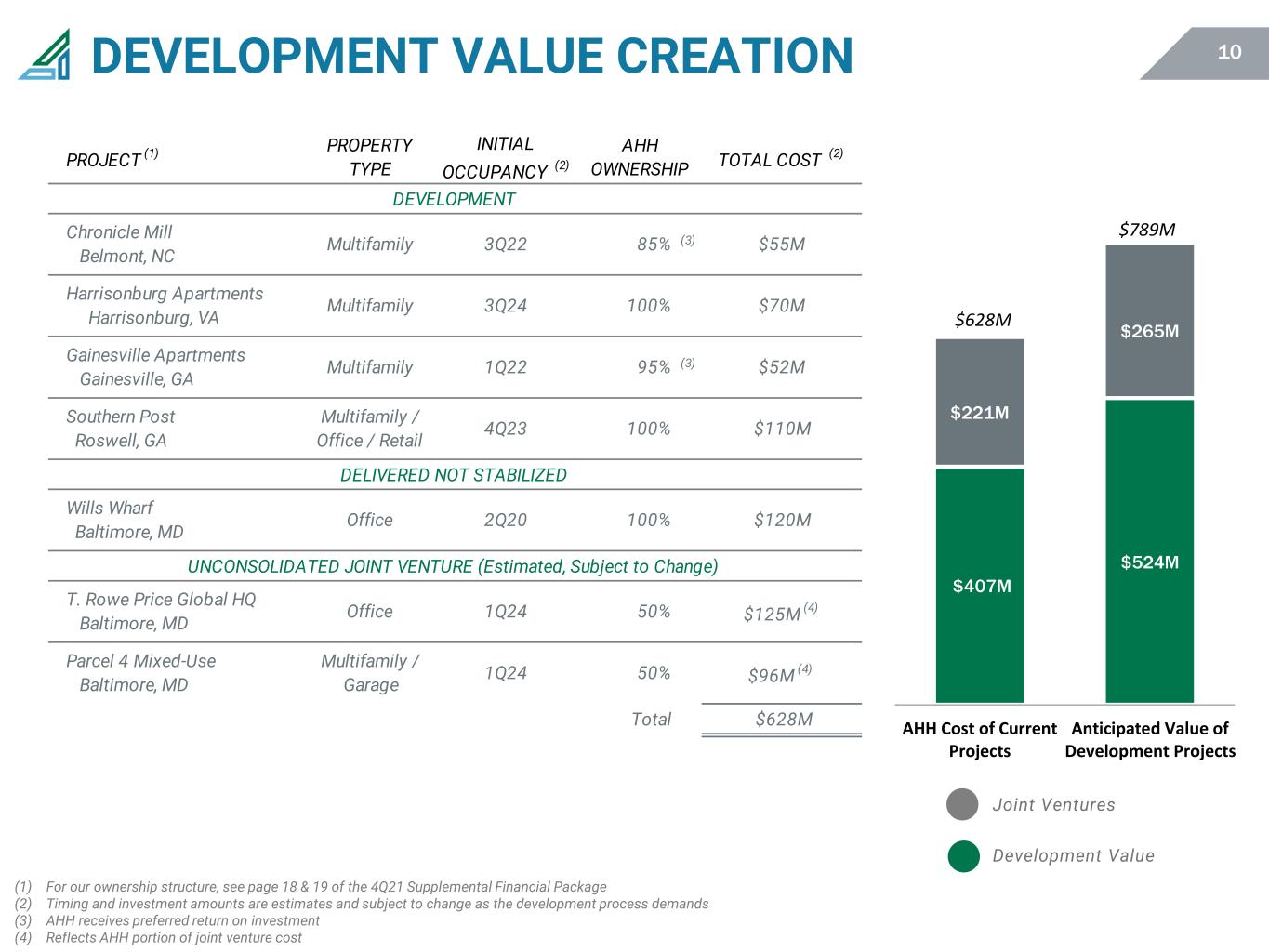

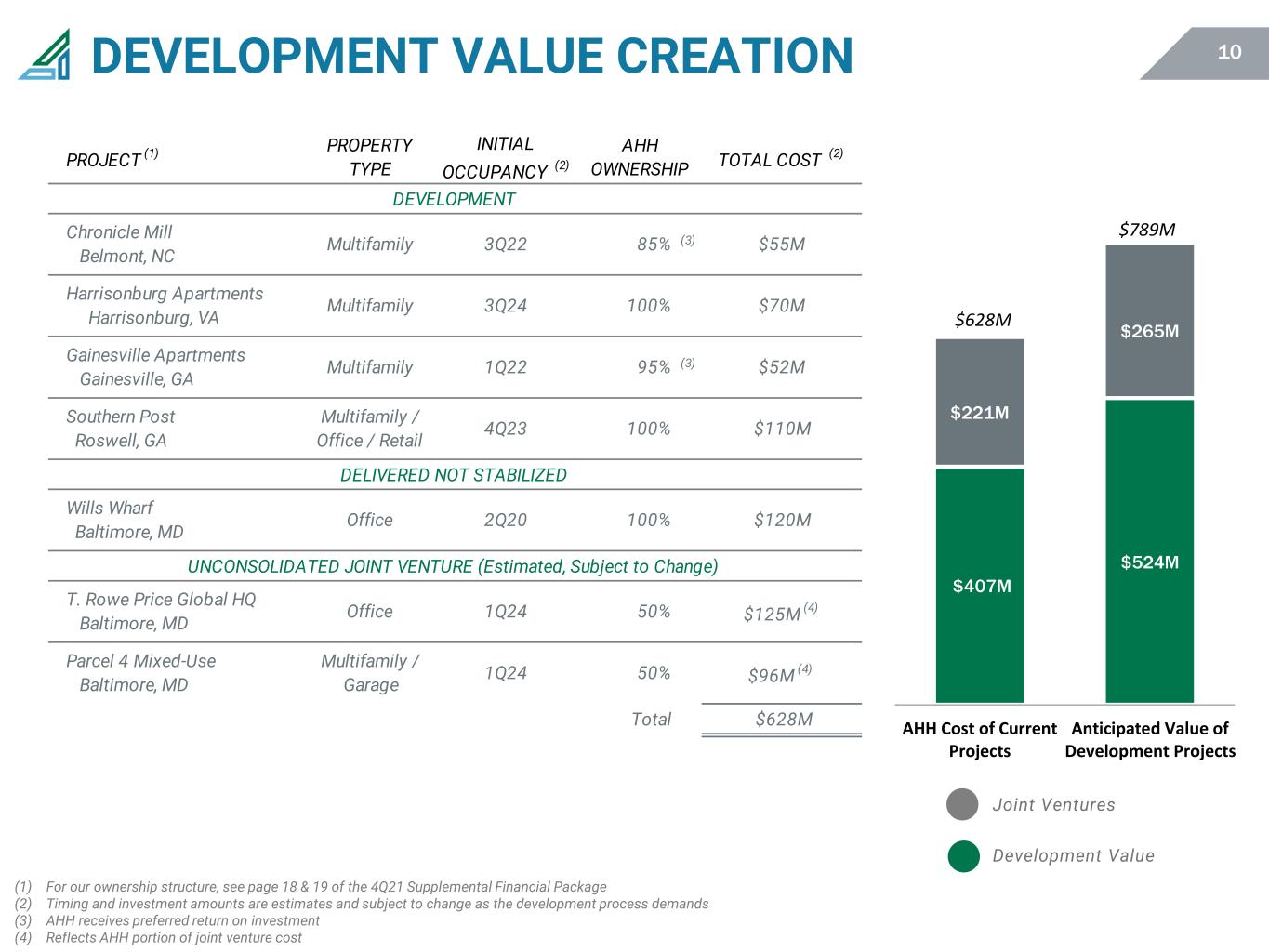

10DEVELOPMENT VALUE CREATION (1) For our ownership structure, see page 18 & 19 of the 4Q21 Supplemental Financial Package (2) Timing and investment amounts are estimates and subject to change as the development process demands (3) AHH receives preferred return on investment (4) Reflects AHH portion of joint venture cost Joint Ventures Development Value PROJECT (1) PROPERTY TYPE INITIAL OCCUPANCY (2) AHH OWNERSHIP TOTAL COST (2) DEVELOPMENT Chronicle Mill Belmont, NC Multifamily 3Q22 85% (3) $55M Harrisonburg Apartments Harrisonburg, VA Multifamily 3Q24 100% $70M Gainesville Apartments Gainesville, GA Multifamily 1Q22 95% (3) $52M Southern Post Roswell, GA Multifamily / Office / Retail 4Q23 100% $110M DELIVERED NOT STABILIZED Wills Wharf Baltimore, MD Office 2Q20 100% $120M UNCONSOLIDATED JOINT VENTURE (Estimated, Subject to Change) T. Rowe Price Global HQ Baltimore, MD Office 1Q24 50% $125M (4) Parcel 4 Mixed-Use Baltimore, MD Multifamily / Garage 1Q24 50% $96M (4) Total $628M $407M $524M $221M $265M AHH Cost of Current Projects Anticipated Value of Development Projects $628M $789M

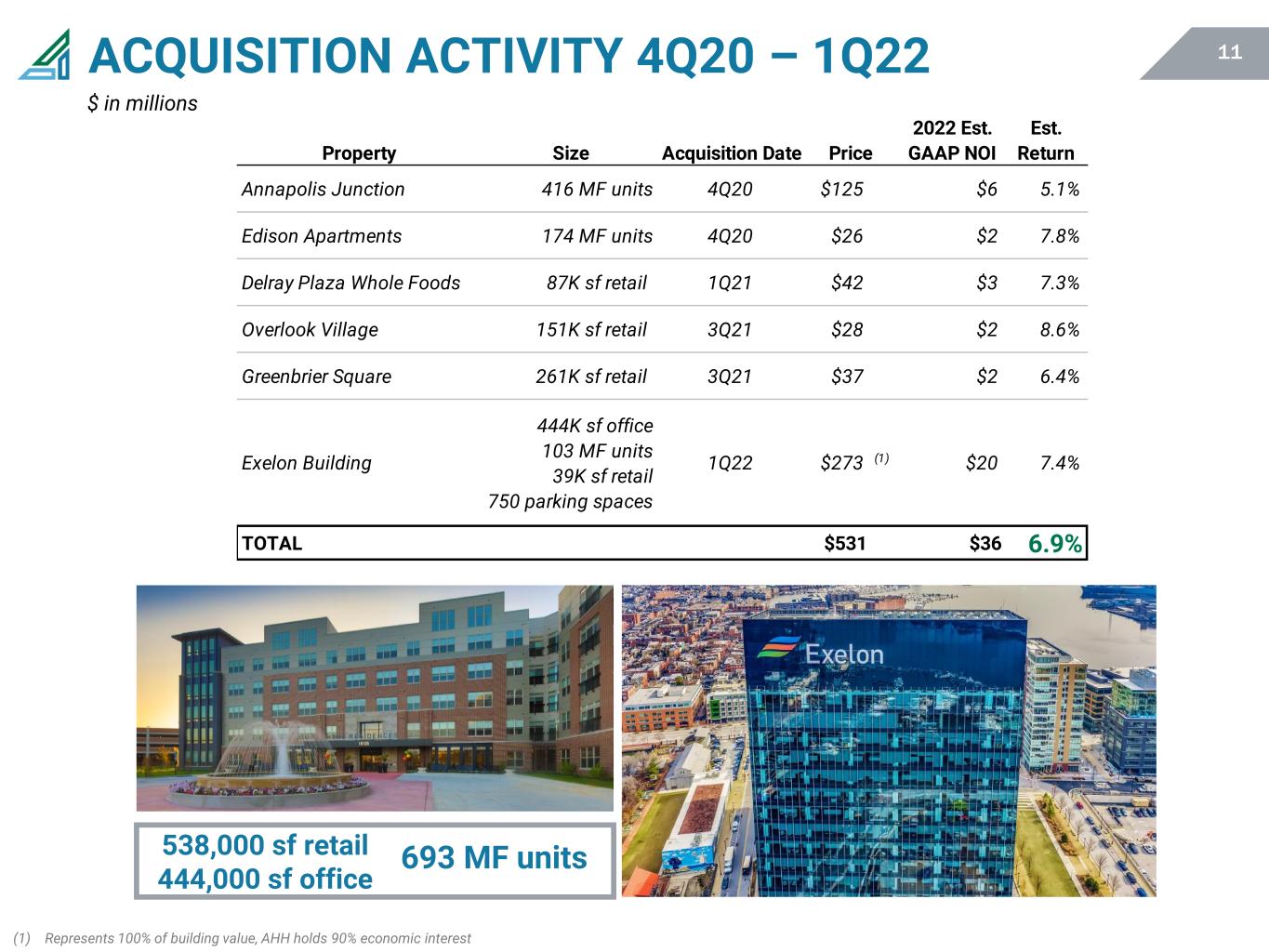

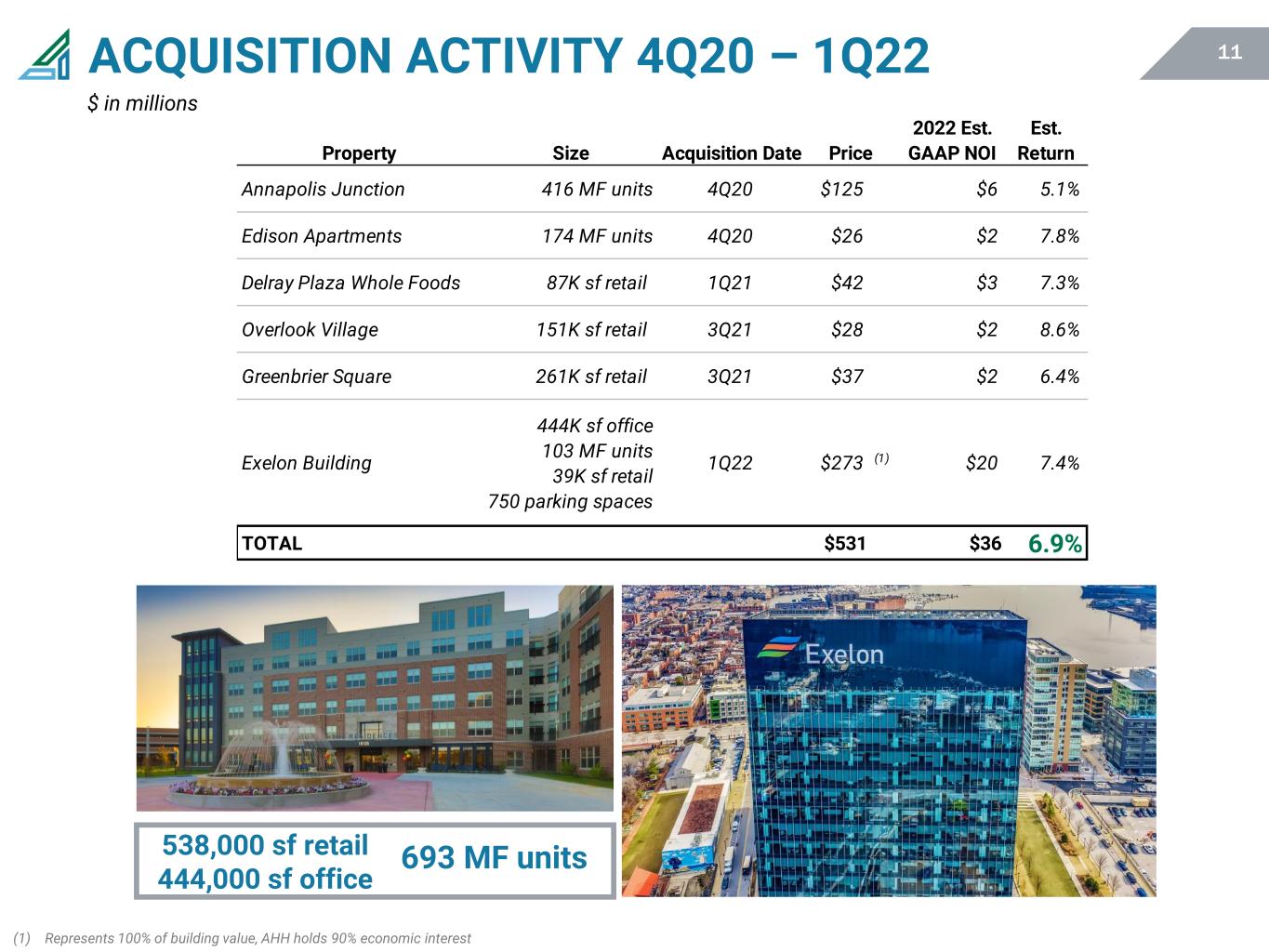

11ACQUISITION ACTIVITY 4Q20 – 1Q22 (1) Represents 100% of building value, AHH holds 90% economic interest 538,000 sf retail 444,000 sf office 693 MF units $ in millions Property Size Acquisition Date Price 2022 Est. GAAP NOI Est. Return Annapolis Junction 416 MF units 4Q20 $125 $6 5.1% Edison Apartments 174 MF units 4Q20 $26 $2 7.8% Delray Plaza Whole Foods 87K sf retail 1Q21 $42 $3 7.3% Overlook Village 151K sf retail 3Q21 $28 $2 8.6% Greenbrier Square 261K sf retail 3Q21 $37 $2 6.4% Exelon Building 444K sf office 103 MF units 39K sf retail 750 parking spaces 1Q22 $273 (1) $20 7.4% TOTAL $531 $36 6.9%

12CORE LOCATIONS Maryland Virginia North Carolina South Carolina Georgia

13EXELON HQ ACQUISITION Investment Thesis ✓ Acquisition of Exelon Building is immediately accretive to FFO ✓ Multifamily component is complimentary to adjacent Baltimore multifamily property ✓ Consistent with long-term plan of building scale in Harbor Point submarket ✓ Highly familiar with Exelon Building ‒ AHH constructed in 2016 alongside Beatty Development Group (25 year working relationship) Acquisition Details ✓ Acquisition value of $246M(1) ‒ Acquired 90% economic interest for $105M plus debt assumption(2) ‒ 10% retained by Beatty Development Group ($12mm) ‒ Refinanced $175M of note debt at BSBY 1.5% ✓ Estimated Year 1 cap rate: 7.4% GAAP, 6.1% cash Financial Features ✓ Strong credit tenant base ‒ Lead tenant - Exelon Constellation ✓ Exelon lease has 15 remaining years ‒ Contractual rent escalation of 3% annually ✓ Upside of cost synergies due to adjacent multifamily property ✓ Desirable retail location and square footage ‒ Upside from ~13,500 sf of vacant retail space (1) Excludes $12M of equity and its 10% share of related debt retained by the Beatty Development Group for a total value of $273M (2) Represents a 79% interest and an additional 11% economic interest Acquired the Exelon Building at Harbor Point, Baltimore’s premiere downtown waterfront property

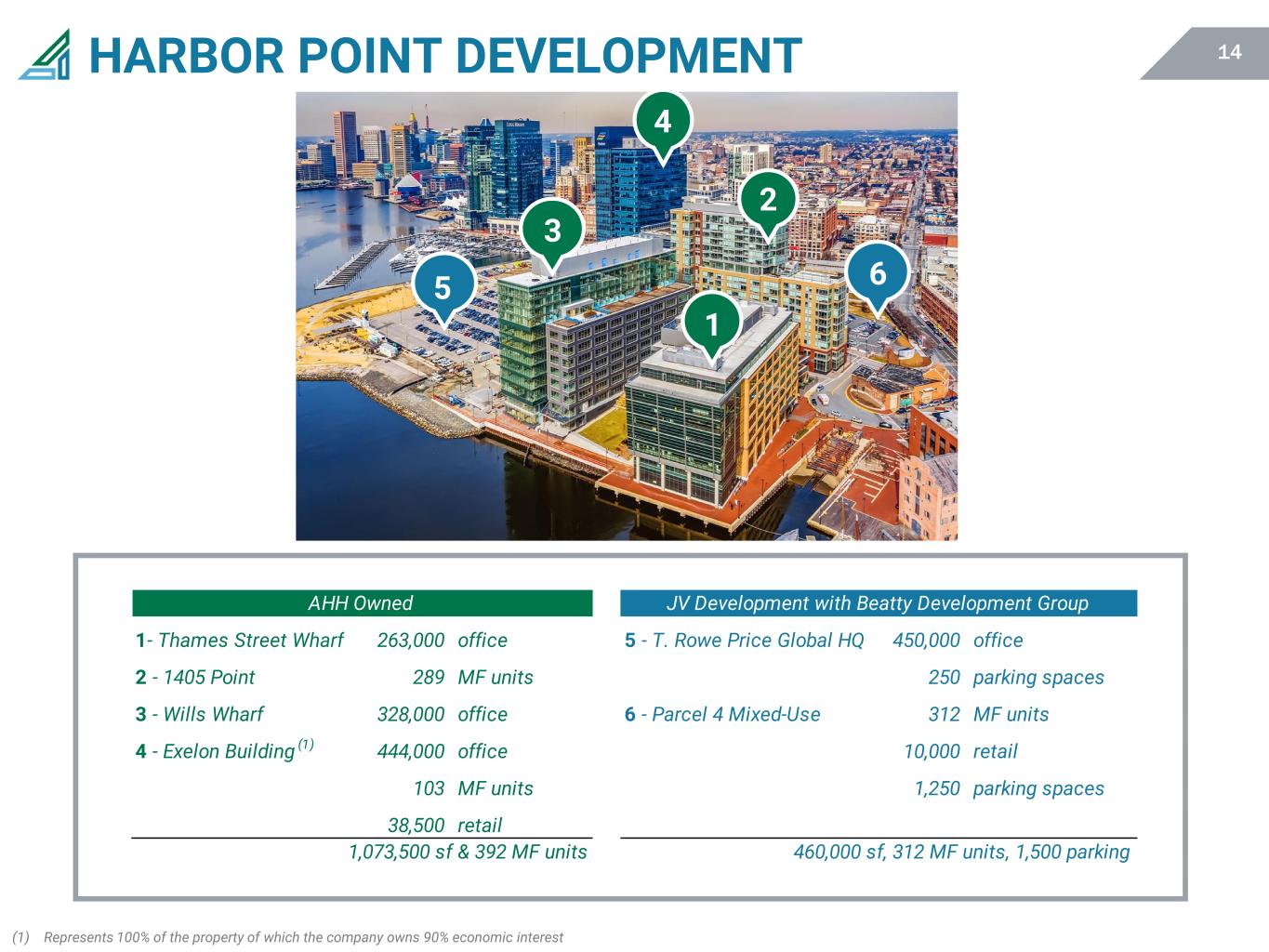

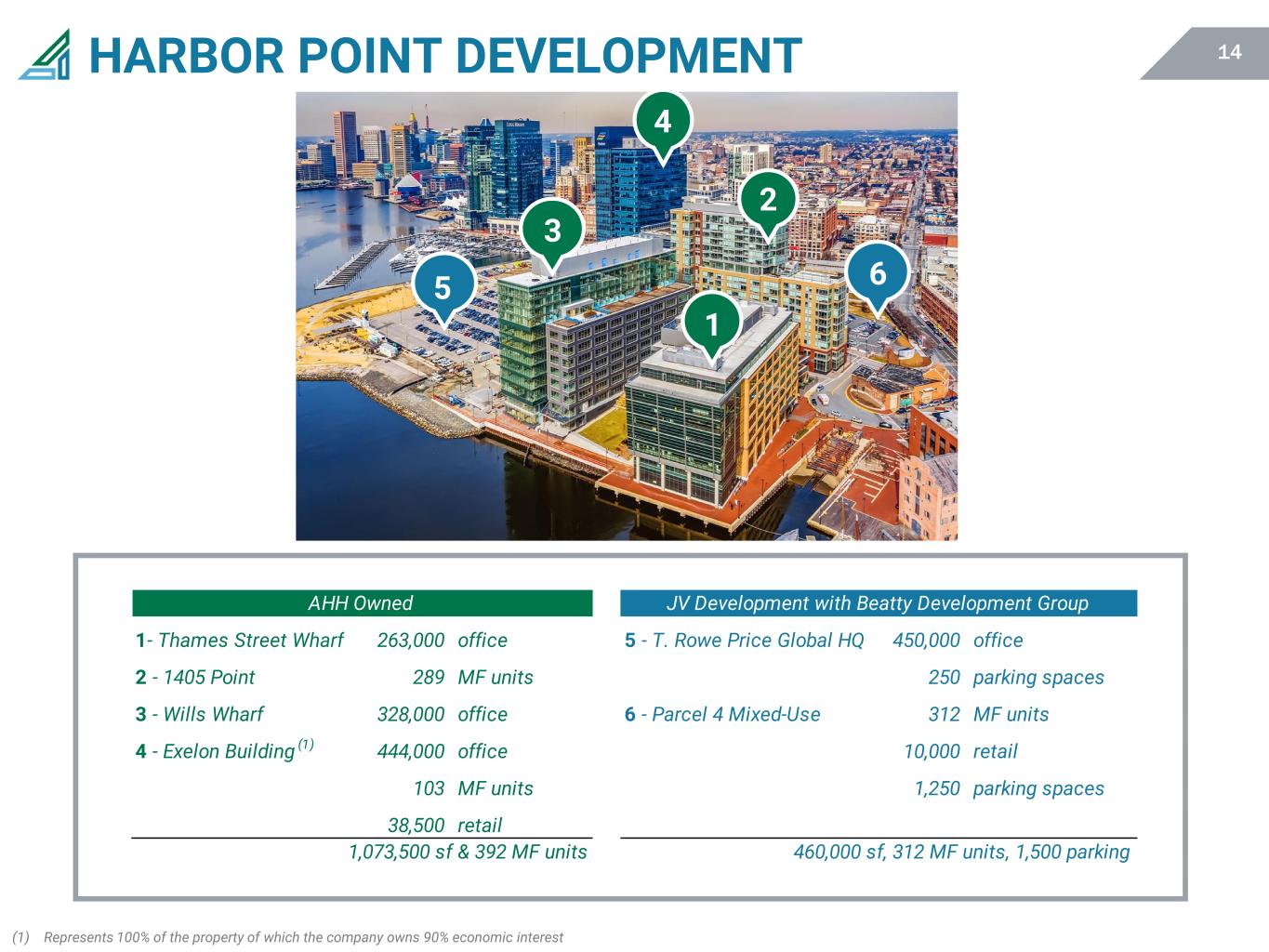

14HARBOR POINT DEVELOPMENT 1 2 3 5 6 4 (1) Represents 100% of the property of which the company owns 90% economic interest AHH Owned JV Development with Beatty Development Group 1- Thames Street Wharf 263,000 office 5 - T. Rowe Price Global HQ 450,000 office 2 - 1405 Point 289 MF units 250 parking spaces 3 - Wills Wharf 328,000 office 6 - Parcel 4 Mixed-Use 312 MF units 4 - Exelon Building (1) 444,000 office 10,000 retail 103 MF units 1,250 parking spaces 38,500 retail 1,073,500 sf & 392 MF units 460,000 sf, 312 MF units, 1,500 parking

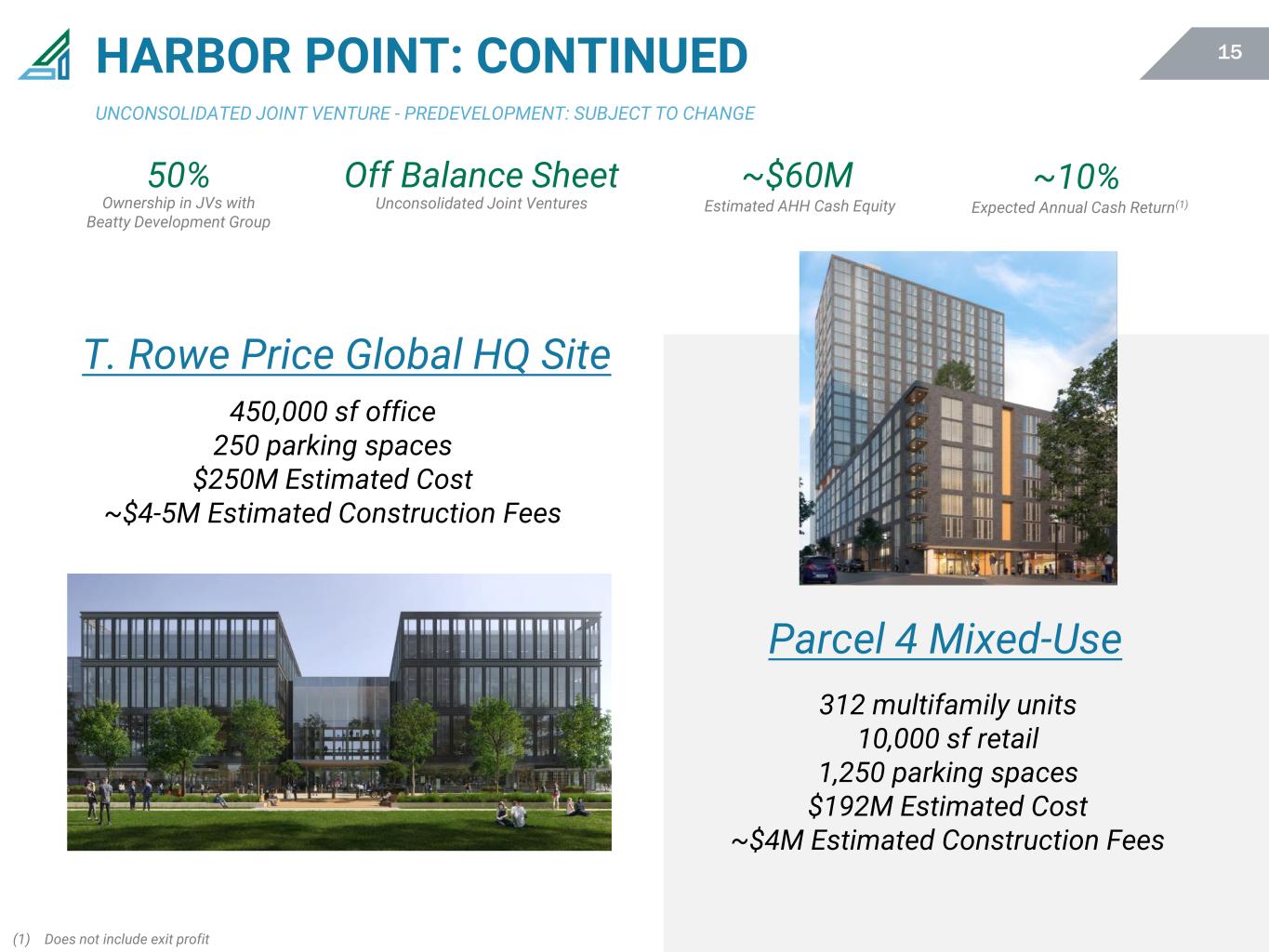

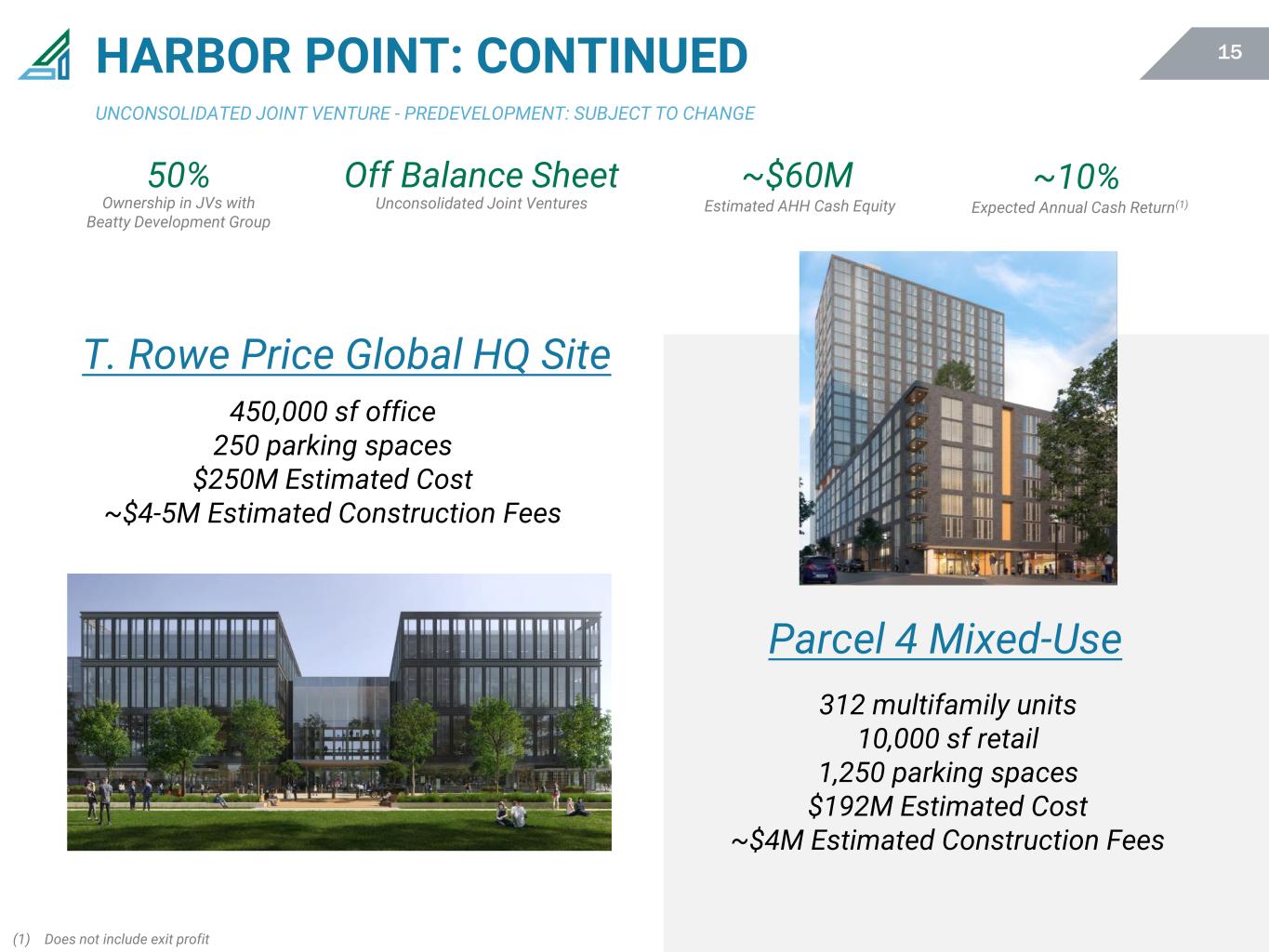

15HARBOR POINT: CONTINUED Estimated AHH Cash Equity ~$60M Ownership in JVs with Beatty Development Group 50% T. Rowe Price Global HQ Site Unconsolidated Joint Ventures Off Balance Sheet Parcel 4 Mixed-Use Expected Annual Cash Return(1) ~10% UNCONSOLIDATED JOINT VENTURE - PREDEVELOPMENT: SUBJECT TO CHANGE 450,000 sf office 250 parking spaces $250M Estimated Cost ~$4-5M Estimated Construction Fees 312 multifamily units 10,000 sf retail 1,250 parking spaces $192M Estimated Cost ~$4M Estimated Construction Fees (1) Does not include exit profit

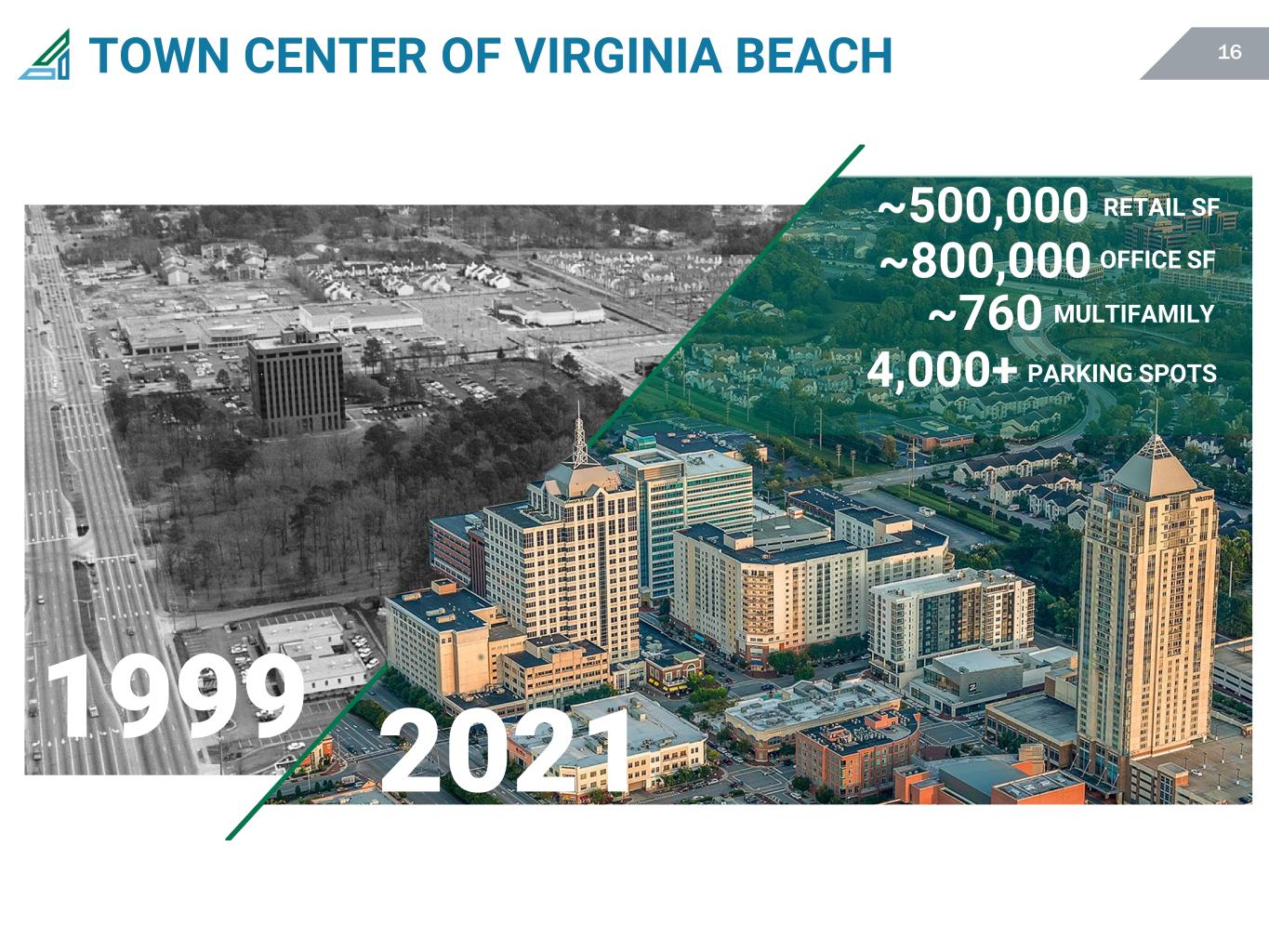

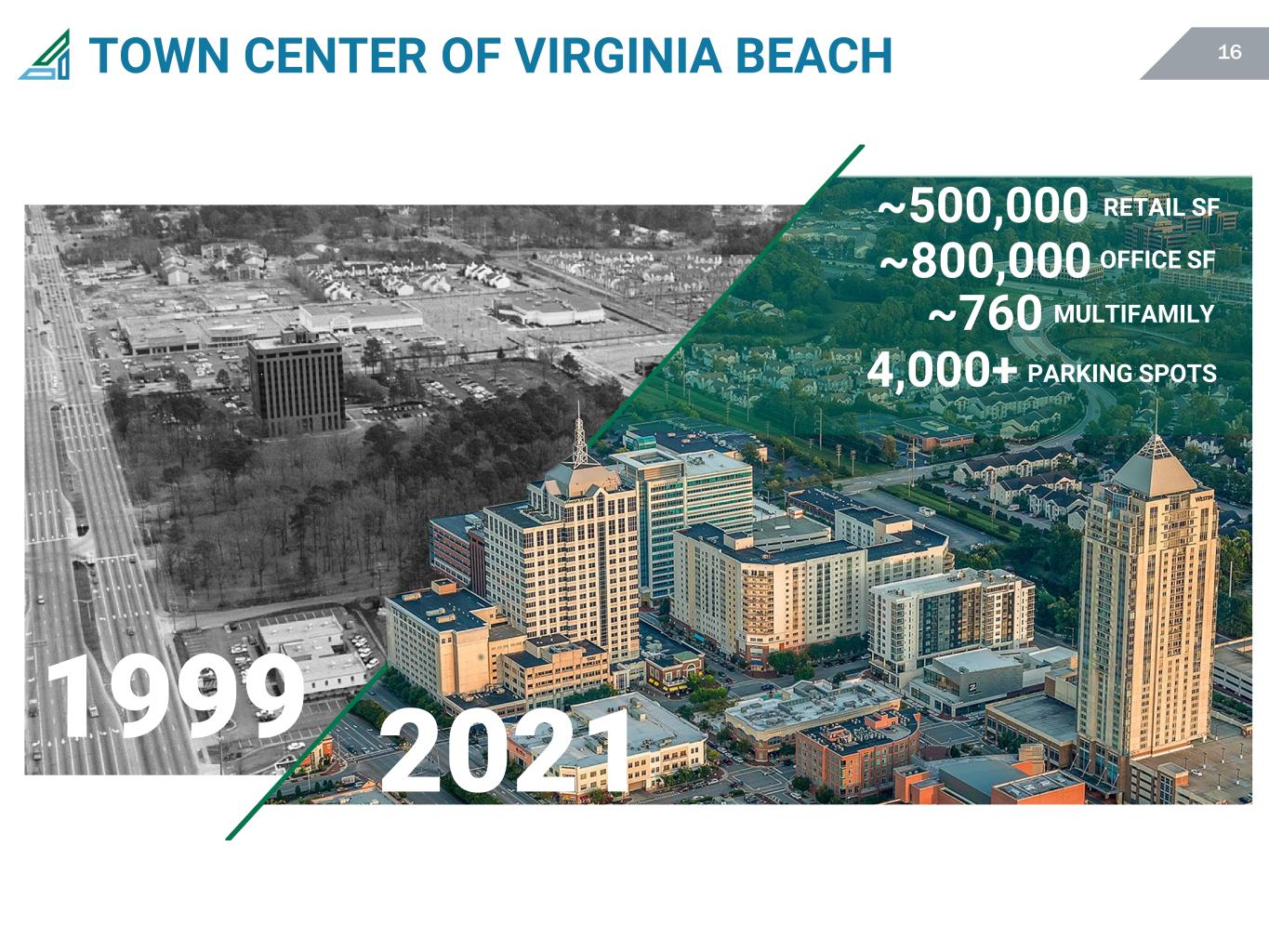

16TOWN CENTER OF VIRGINIA BEACH ~500,000 RETAIL SF ~800,000 OFFICE SF ~760 MULTIFAMILY 4,000+ PARKING SPOTS 1999 2021

17TOWN CENTER OF VIRGINIA BEACH Block 2 is a 1.3-acre future site for development, currently used as a surface parking lot a 5-acre retail center currently featuring Bed, Bath & Beyond with future redevelopment opportunities 1 2 Additional Development Opportunities 3 an 8-acre retail center currently featuring Regal Cinemas with future redevelopment opportunities

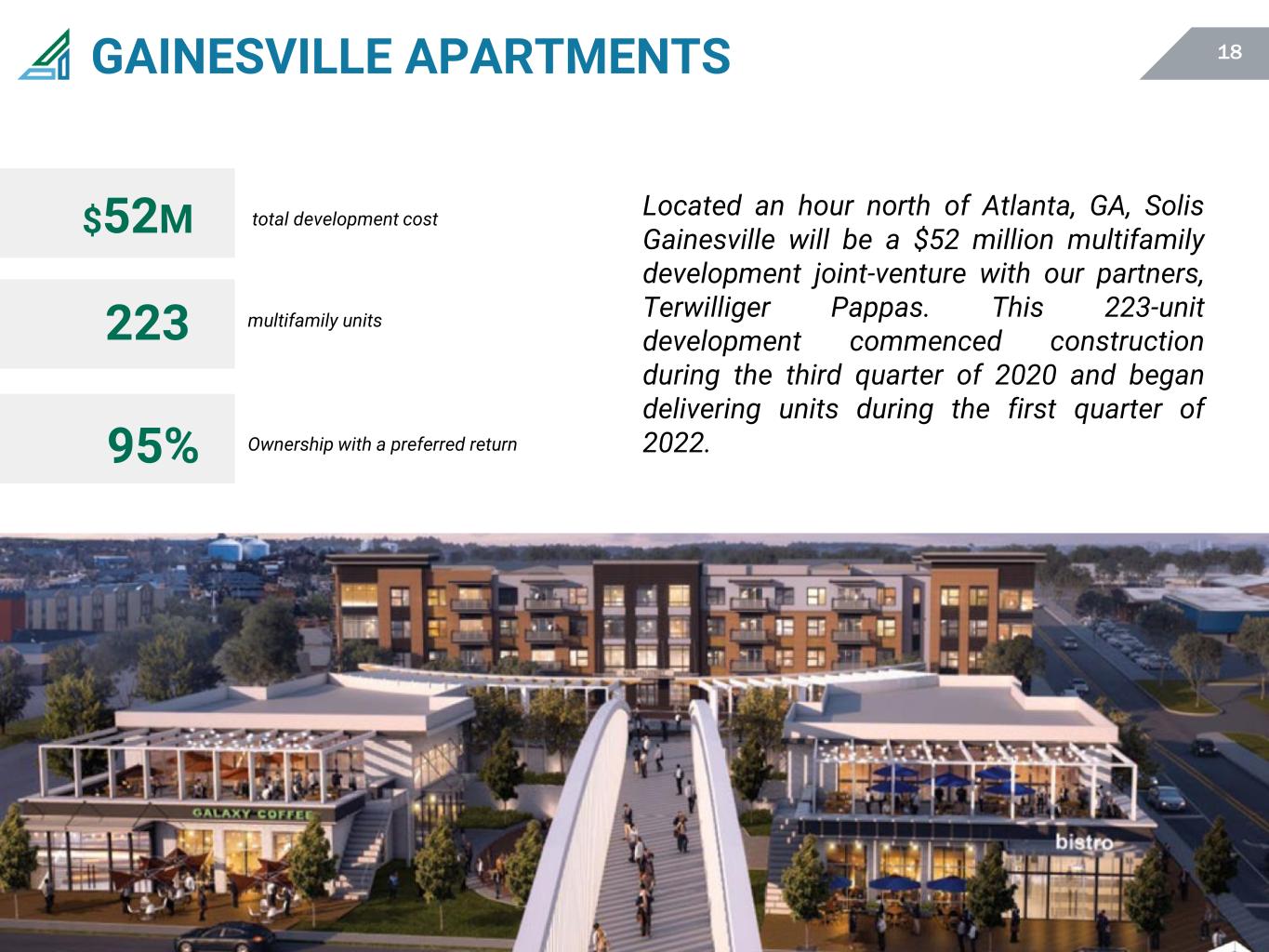

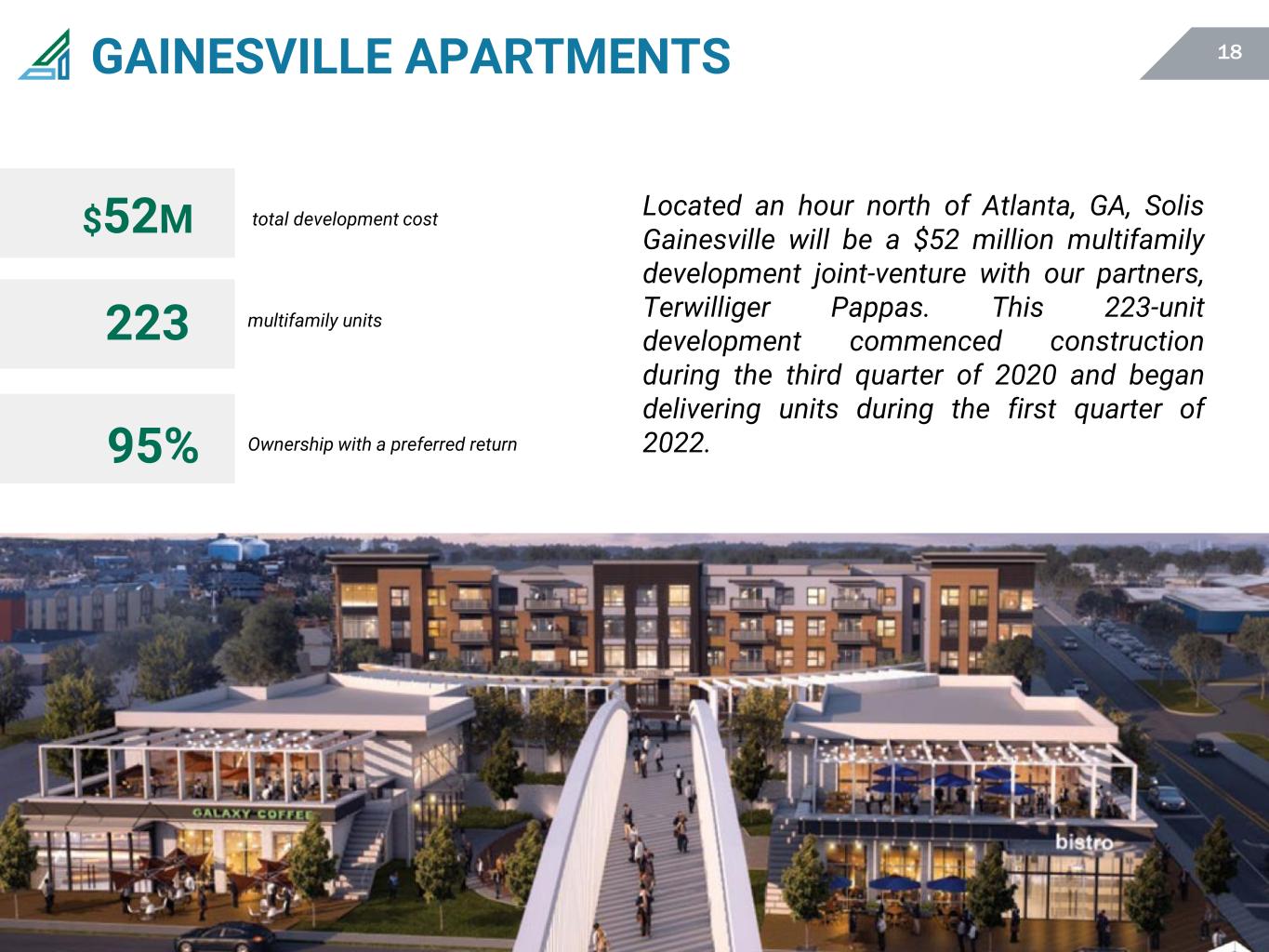

18GAINESVILLE APARTMENTS $52M total development cost 223 multifamily units Located an hour north of Atlanta, GA, Solis Gainesville will be a $52 million multifamily development joint-venture with our partners, Terwilliger Pappas. This 223-unit development commenced construction during the third quarter of 2020 and began delivering units during the first quarter of 2022.95% Ownership with a preferred return

19CHRONICLE MILL Chronicle Mill is an historic textile mill that will be revitalized into a mixed-use project just steps from historic downtown Belmont, NC (Charlotte MSA). The project will encompass 244 apartment units and 14,700 square feet of commercial space and is expected to begin delivery during the third quarter of 2022. $55M total development costs 244 apartment units 14,700 square feet of commercial space 85% Ownership with a preferred return

20WILLS WHARF $120M total estimated development cost ~70% leased 328,000 square feet of mixed-use hotel and class A office space THAMES STREET WHARF WILLS WHARF FUTURE T ROWE PRICE GLOBAL HQ 1405 POINT Harbor Point Baltimore, MD 100% AHH ownership Delivered in 2020 Notable Tenants Transamerica, RBC, Morgan Stanley, and Canopy by Hilton

21SOUTHERN POST - ROSWELL Roswell, GA Location 137,000 Square Feet 100% AHH Ownership Roswell Town Center is a mixed-use project expected to total 137,000 square feet that began construction in late 2021. The center will include 42,000 square feet of retail, 95,000 square feet of office, 137 multifamily units.$110M Estimated Cost

22HARRISONBURG APARTMENTS Harrisonburg Apartments is a multifamily project located within the central business district of Harrisonburg, VA and adjacent to James Madison University. The Company negotiated redevelopment rights to the property in 2021 and construction is expected to start in the second quarter of 2022. 100% AHH ownership 266 apartment units $70M total development cost estimated