UNITED STATES BANKRUPTCY COURT

EASTERN DISTRICT OF MISSOURI

EASTERN DIVISION

In re: Peabody Energy Corporation, et al., Debtors. | Case No. 16-42529 CHAPTER 11 (Jointly Administered) Hearing Date: January 26, 2017 10:00 a.m. (Central Time) Objection Deadline January 19, 2017 Hearing Location: United States Courthouse Thomas F. Eagleton Federal Building 111 S. 10th Street St. Louis, Missouri 63102 |

MOTION OF THE MANGROVE PARTNERS MASTER

FUND, LTD. FOR AN ORDER APPOINTING AN

OFFICIAL COMMITTEE OF EQUITY SECURITY HOLDERS

The Mangrove Partners Master Fund, Ltd. (the “Shareholder”), a holder of common stock issued by Peabody Energy Corporation (“Peabody” and, collectively with its affiliated debtors and debtors in possession, the “Debtors”), by and through this motion (the “Motion”), seeks entry of an order under section 1102(a)(2) of title 11 of the United States Code, 11 U.S.C. §§ 101 et seq. (the “Bankruptcy Code”) directing the appointment of an official committee of equity security holders (an “Equity Committee”) in the Debtors’ chapter 11 cases, in the form attached hereto as Exhibit A. In support of this Motion, the Shareholder respectfully represents as follows:

PRELIMINARY STATEMENT

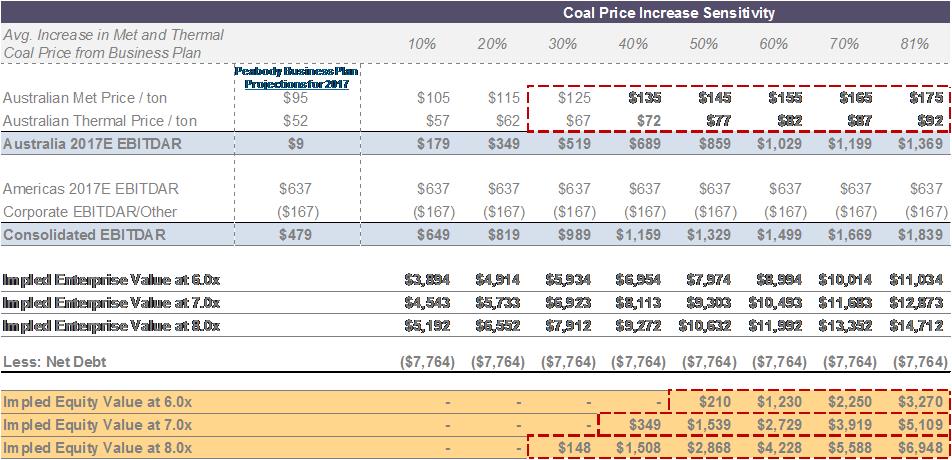

1. The Debtors’ own business plan demonstrates that Peabody shares are likely worth at least hundreds of millions of dollars. As described in detail below, a straightforward calculation based on the assumptions that Peabody included in its own business plan (which the Shareholder believes considerably underestimates the value of Peabody’s assets), reveals that equity will recover meaningful value if metallurgical and thermal coal prices stabilize at or around $145/ton and $77/ton or higher, respectively – prices that are well below both historical averages and current prices. This is more than enough to show that Peabody is not “hopelessly insolvent” – all that is required to show at this stage to obtain appointment of an equity committee.1

2. When the Debtors filed their bankruptcy petition, they acknowledged that the filing was a result of a “storm that has beset the coal industry” in the form of reduced demand and significantly lower coal prices. Since the filing of these cases, the coal industry has rebounded. Spot pricing for seaborne metallurgical coal has increased 235%, while thermal coal has increased 77%. Similarly, recent market projections indicate strong demand for coal for the foreseeable future. Had the current market conditions been present in April 2016, there is no reasonable dispute that the Debtors would not have filed for bankruptcy. Indeed, the equity holders of Peabody likely would be experiencing a significant increase in the value of their holdings. Notably, the stock prices of Peabody’s peers have increased dramatically during the same period, with the stock of Cloud Peak and Whitehaven increasing 205% and 342%, respectively. (Factset, Dec. 7, 2016.)

| 1 | In making this Motion, the Shareholder makes a number of statements regarding valuation of the Debtors’ business using assumptions provided by the Debtors. The Shareholder does not concede the accuracy of those assumptions or the information provided by the Debtors, nor does the Shareholder concede that the calculations referenced in this Motion are the proper method for valuing the Debtors’ business. The Shareholder refers to that information merely to demonstrate that a properly-executed valuation of the Debtors’ business would reveal substantial value to equity holders, even at prices below current levels. The Shareholder reserves its rights to challenge the Debtors’ valuation analyses and the assumptions underlying those analyses in connection with a proper evidentiary hearing with regard to valuation. |

3. In the middle of this market reversal that is significantly impacting the value of Peabody’s assets, the Debtors are poised to file a chapter 11 plan of reorganization (a “Plan”). To reach that milestone, the Debtors have “engaged in multi-day, in person negotiations with, among others, the First Lien Lenders, the Creditors’ Committee, the Second Lien Noteholders’ Group and the Ad Hoc Noteholders,” and have made “considerable progress toward a consensual plan.” (Second Motion of the Debtors for an Order Extending Their Exclusive Periods (the “Second Exclusivity Motion”), at 10 [Docket No. 1676].)

4. The Shareholder and other holders of Peabody equity have not been invited to participate in discussions regarding the Plan and issues of valuation, and have not been privy to the same information as creditors (despite having requested that the Debtors provide it access to that information). At the same time, the Debtors and their creditors apparently have already concluded that they do not believe there is any opportunity for the equity holders to meaningfully recover. It is critical that the equity holders of Peabody be given a fair opportunity to demonstrate that they are entitled to recover on their investments, before their interests are improperly wiped out entirely. Without an Equity Committee, the shareholders will have no means to preserve and realize the value that they believe exists in the Debtors.

5. The Shareholder does not seek appointment of an Equity Committee indefinitely, but solely for this stage of these cases so that it can be determined whether there is value to its holdings. Under these circumstances – where there is substantial evidence of value to the Peabody equity, and where the Debtors and creditors who stand to gain at the expense of equity have shut the equity holders out of plan negotiations – meaningful consideration of whether there is value to Peabody equity can only be achieved by appointment of an Equity Committee.

BACKGROUND

A. The Debtors.

6. On April 13, 2016 (the “Petition Date”), the Debtors commenced their reorganization cases by filing voluntary petitions for relief under chapter 11 of the Bankruptcy Code. (Declaration of Amy B. Schwetz, Executive Vice President & Chief Financial Officer of Debtor Peabody Energy Corporation, In Support of First Day Motions of Debtors and Debtors in Possession (the “First Day Declaration”) ¶ 2 [Docket No. 7].) The Debtors are authorized to continue to operate their businesses and manage their properties as debtors in possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code. Each of the other Debtors is a wholly-owned direct or indirect subsidiary of Peabody. (First Day Declaration ¶ 6.)

7. On April 29, 2016, the U.S. Trustee for the Eastern District of Missouri (the “U.S. Trustee”) appointed an official committee of unsecured creditors (the “Creditors’ Committee”) in these chapter 11 cases.

8. Peabody is the world’s largest private-sector coal company (by volume), with 26 active coal mining operations located in the United States and Australia. (First Day Declaration ¶¶ 6,12.) The Debtors’ domestic mines produce and sell thermal coal, which is primarily purchased by electricity generators. (Id. ¶12.) Peabody’s Australian operations mine both thermal and metallurgical coal, a majority of which is exported to international customers. (Id.) As of December 31, 2015, Peabody and its subsidiaries’ property holdings include 6.3 billion tons of proven and probable coal reserves and approximately 500,000 acres of surface property through ownership and lease agreements. (Id.) In the United States alone, as of December 31, 2015, the Debtors held an estimated 5.5 billion tons of proven and probable coal reserves, and generated sales of approximately 180 million tons of coal. (Id.) In addition to their mining operations, the Debtors market and broker coal from other coal producers across the United States, Australia, Europe and Asia. (Id. ¶ 13.)

B. The Shareholder’s Efforts to Obtain Appointment of an Equity Committee.

9. On November 18, 2016, the Shareholder submitted a letter to the U.S. Trustee requesting the appointment of an Equity Committee. In that letter, the Shareholder explained, among other things, that the equity holders were not adequately represented in the negotiations regarding a plan of reorganization, and that the recent significant price increases in the coal market, among other economic factors, demonstrated that Peabody equity has value. On November 22, 2016, the Debtors responded to that letter, opposing appointment of an Equity Committee. On November 29, the Shareholder submitted to the U.S. Trustee a supplemental submission in support of its request for an Equity Committee, which the Debtors responded to on December 5, 2016. During this time, the Shareholder also participated in discussions with counsel for the U.S. Trustee to address, among other things, any concerns that the U.S. Trustee had with the appointment of an Equity Committee. On December 7, 2016, the U.S. Trustee denied the Shareholder’s request.

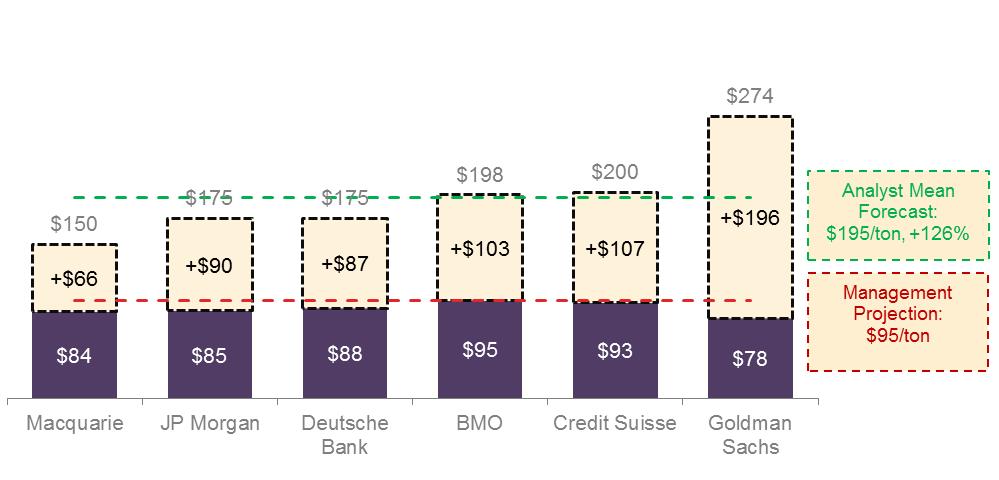

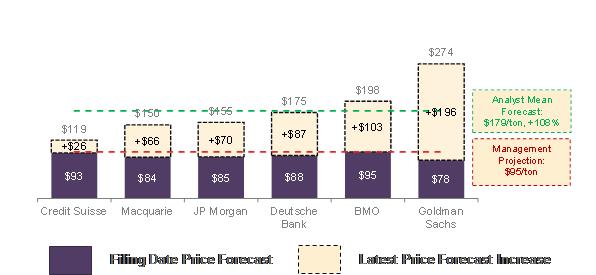

10. The Shareholder has had discussions with counsel for the Debtors and the Creditors’ Committee since submission of its letters, but those discussions have not led the Shareholder to believe that equity holders’ interests are being adequately represented in these cases. Among other things, on November 23, 2016, the Shareholder’s advisors asked to execute a confidentiality agreement with the Debtors in order to obtain information about the proceedings and discussions between the Debtors and the various creditor constituencies. To date, the Debtors have not provided the Shareholder any access to confidential materials (even on an advisors’ eyes only basis).

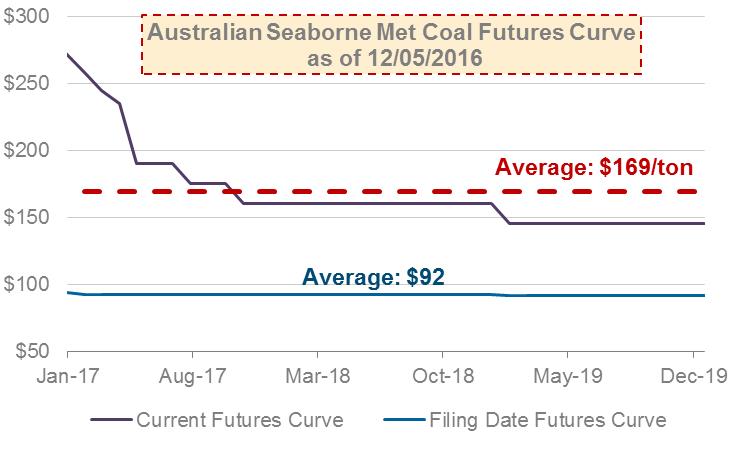

JURISDICTION AND VENUE

11. This Court has jurisdiction over this Motion pursuant to 28 U.S.C. §§ 157(b)(2)(A) and (D). Venue is proper pursuant to 28 U.S.C. §§ 1408 and 1409. The statutory predicates for the relief sought herein are section 1102(a) of the Bankruptcy Code and Rule 9014 of the Federal Rules of Bankruptcy Procedure.

ARGUMENT

12. As the facts set forth herein demonstrate, Peabody’s shareholders are entitled to, and the Shareholder respectfully requests, the appointment of an Equity Committee. Section 1102(a)(2) of the Bankruptcy Code provides that, upon the request of a party in interest, the court may appoint an official committee of equity holders if “necessary” to provide “adequate representation” of the interests of the equity holders. 11 U.S.C. § 1102(a)(2). In providing shareholders the ability to seek appointment of an equity committee, Congress recognized that public investors in chapter 11 could be particularly vulnerable, and a committee could be required to “counteract the natural tendency of a debtor in distress to pacify large creditors, with whom the debtor would expect to do business, at the expense of small and scattered investors.” S. Rep. No. 95-989, at 10 (1978), attached hereto as Exhibit B.

13. The Court’s determination of the need for an Equity Committee is unfettered and de novo, without regard to any determination on such matter by the U.S. Trustee. In re Park West Circle Realty, LLC, No. 10-12965 (AJG), 2010 WL 3219531, at *2 (Bankr. S.D.N.Y. Aug. 11, 2010) (a court reviews de novo a decision of the U.S. Trustee not to appoint an additional committee); In re Enron Corp., 279 B.R. 671, 684 (Bankr. S.D.N.Y. 2002) (same).

14. While the Bankruptcy Code does not provide a test for determining whether shareholders are “adequately represented,” courts have considered a variety of factors in making that case-by-case determination, including:

| (a) | whether the debtor appears to be hopelessly insolvent; |

| (b) | whether the interests of shareholders are already adequately represented; |

| (c) | the complexity of the case; |

| (d) | whether the stock is widely held and actively traded; |

| (e) | the timing of the request; and |

| (f) | whether the cost of the additional committee significantly outweighs the concerns for adequate representation. |

See, e.g., In re Pilgrim’s Pride Corp., 407 B.R. 211 (Bankr. N.D. Tex. 2010) (directing U.S. Trustee to appoint equity committee over objections of creditors); In re Exide Technologies, Case No. 02-11125 (Bankr. D. Del. 2002) (appointing equity committee over objections of debtor and official committee of unsecured creditors); In re Wang Laboratories, Inc., 149 B.R. 1 (Bankr. D. Mass. 1992) (appointing equity committee over objections of United States Trustee and official committee of unsecured creditors). In this case, each of these factors favors the establishment of an Equity Committee.

A. The Public Record And The Debtors’ Own Filings Demonstrate That The Debtors Are Not Hopelessly Insolvent.

15. The Court need not make a definitive finding at this time as to the value of Peabody’s equity in order to appoint an Equity Committee. The Court need only conclude that the Debtors do not “appear[] to be hopelessly insolvent.” In re Sun Edison, Inc. et al., 556 B.R. 94, 103 (2016) (emphasis in original). Public data and the Debtors’ own filings demonstrate that the Debtors’ financial situation has improved considerably since the Petition Date, the equity now has significant value, and that the Debtors are far from being hopelessly insolvent.2

______________________

| 2 | It is significant to note that in opposing the Shareholder’s request to the U.S. Trustee for appointment of an Equity Committee, the Debtors did not claim to be insolvent nor do they suggest as much in their filings to this Court. The Debtors’ most recent monthly operating report (“MOR”) shows $711.6 million of cash as compared to a DIP budget of $419 million, and equity of $511 million. This Court is entitled to rely, as courts regularly do, on the Debtors’ filings and their own statements regarding their financial condition. See e.g., Pilgrim’s Pride, 407 B.R. at 217 (relying on company’s monthly operating reports and the statements of its management in concluding it was not hopelessly insolvent). |

16. The value of Peabody’s business depends greatly on the price of coal. The Debtors concede as much, having previously explained that the chapter 11 filings were triggered “due to a number of near-term pressures placed on the Debtors’ liquidity”3 including significant negative impacts on the Debtors due to a decline in coal prices. (See Id. ¶¶ 52, 74.) On the Petition Date, the Debtors stated that they believed that filing for bankruptcy would enable them to continue to restructure their debt and operations while “riding out the storm that has beset the coal industry.” (See Id. ¶ 74.) All indications are that the “storm” has now passed.4

17. Since the Petition Date, market prices for coal have rallied. Spot pricing for premium metallurgical coal has risen from approximately $89/ton to $299/ton – an increase of 235% since the filing of Peabody’s bankruptcy petition. (IHS Markit and Bloomberg Terminal). Similarly, prices for thermal coal (Newcastle FOB) have increased from approximately $50/ton to $89/ton – an increase of 77% during that same time period. (Id.)

___________________________

| 3 | With regard to liquidity, just eight months ago, the Debtors asked this Court to approve a substantial DIP loan. The Debtors have now determined in their business judgment that they have sufficient cash to pay the approximately $500 million outstanding under the DIP facility, cash collateralize all of their credit and self-fund these cases. Despite the Debtors’ assertions to the contrary, repayment of the DIP clearly evidences that the Debtors believe that the current rise in coal prices and demand are not anomalies but sustainable for the foreseeable future. |

| 4 | Other recent bankruptcy cases demonstrate the windfall that creditors can receive at the expense of equity holders. In the cases of Arch Coal Inc. (“Arch Coal”), which exited chapter 11 on October 5, 2016 of this year, the company estimated in its pre-petition disclosure statements dated July 2016 that its first lien holders would recover only 41.1% to 58.2% par value of their $1.9 billion claim from a $145 million cash payment (less adequate protection payments), $326.5 million of new first lien debt, and 94% of the equity. That same consideration package is now worth over $2.4 billion based on public market prices and represents a recovery of approximately 135% of par just two months after the company exited bankruptcy – due, in large part, to significant increases in coal prices which has, in turn, resulted in considerable increases in the value of Arch Coal’s equity. (Factset, Dec. 7, 2016) In fact, the company’s financial advisor estimated in July 2016 that the value of the reorganized equity would be between $324 million and $666 million but the public market capitalization of the equity was $1.5 billion as of the day it exited bankruptcy and is now worth $2.1 billion. (Id.) The 215% - 550% increase in Arch Coal’s equity value flowed directly to pre-petition creditors. |

18. Not only are current price levels much improved since the Petition Date, but market analysts have also revised their forecasts for future coal pricing considerably. Since the Debtors filed for bankruptcy, leading Wall Street brokers have increased their Hard Coking (metallurgical) and Newcastle (thermal) coal forecasts between 79% – 251% and 36% – 49% for 2017 prices, and 2% – 51% and 20% – 40% for 2018 prices.5

19. Despite all indications of a rebounding coal market, the Debtors continue to undervalue Peabody. On August 10, 2016, the Debtors provided a comprehensive five-year business plan for their United States and Australian operations and a five-year consolidated business plan encompassing the entire enterprise (the “Business Plan”), attached hereto as Exhibit C. That Business Plan, based on now-outdated views of the coal market, concludes that there is no value to Peabody’s equity. But that same Business Plan also recognizes that the Debtors’ “[f]inancial performance is highly sensitive to changes in assumptions,” explaining that each “10% change in seaborne met and thermal pricing from current levels would impact EBITDAR by ~$170M” in 2017. (Business Plan at 30.) Given the Debtors’ own recognition of the magnitude of Peabody’s sensitivity to coal prices, every 10% change in coal pricing at a 6.0x multiple increases Peabody’s Equity Value by over $1 billion. When the sensitivity assumptions that Peabody included in its own Business Plan are applied to current market data, equity is poised to recover meaningful value as long as metallurgical and thermal coal prices stabilize around $145/ton and $77/ton or higher (at a conservative 6.0x multiple). This is

_______________________

| 5 | See Goldman Sachs Equity Research – Americas: Metals & Mining, Nov. 15, 2016; Goldman Sachs Equity Research – Rocks & Ores, Jan. 13, 2016; Macquarie Equity Research – Canadian Base Metals, Mar. 15, 2016; Macquarie Equity Research – European Steel, Oct. 28, 2016; Credit Suisse Equity Research – Commodities Forecasts, Apr. 7, 2016; Credit Suisse Equity Research – Commodities Forecasts, Dec. 7, 2016, attached hereto as Exhibit D; J.P. Morgan Equity Research – Global Coal Update, Apr. 11, 2016; J.P. Morgan Equity Research – Updating Coal Prices, Oct. 27, 2016; J.P. Morgan Equity Research – Coking Coal Price Update, Dec. 4, 2016; BMO Equity Research – Earnings and Targets Increased on Higher Met Coal Price Outlook, Nov. 22, 2016; BMO Equity Research – Metal Minutes, Apr. 12, 2016; Deutsche Bank Equity Research – Metals in the Americas: The Weekly Extract, Nov. 21, 2016; and Deutsche Bank Equity Research – 2Q16 Commodity Outlook, Mar. 22, 2016. |

reflected in the below table:

20. The pricing levels necessary for the equity to be “in the money” are more than attainable. For example, the average weekly metallurgical coal spot price since November 2010 – the earliest date for which historical seaborne metallurgical coal prices are available from data firm IHS Markit – is $165/ton. This is above the approximate $145/ton price that Peabody’s Business Plan indicates is necessary to deliver value to the equity at a 6.0x EBITDA multiple. Similarly, since December 2005, thermal coal has averaged a price of $82.31/ton – again above the $77/ton price necessary to deliver value to the equity. Thus, even if future prices are assumed to decline and revert towards the historical mean, by Peabody’s own assumptions, equity will have meaningful value.

21. Analysis of the historical settlement benchmark price for metallurgical coal produces similar findings; namely, that recent price levels are in-line with historical figures and more common than prices evident in the recent down cycle prior to the Debtors’ filing. The benchmark price for metallurgical coal – or the industry established quarterly reference price for buyers and sellers of the coal – has averaged $171/ton for the last 10 years, and has settled at or above $200/ton in 15 out of 40 quarters (approximately 37.5% of the time). This historical data demonstrates that nearly 40% of the time over the past 10 years, settlement prices have been at or above the most recent benchmark. The historical data also shows that the recent benchmark was above

the highest price used in the Business Plan ($123/ton) over 60% of the time in the past 10 years, and above the Business Plan’s 2017 price assumption ($95/ton) over 85% of the time over the past 10 years.

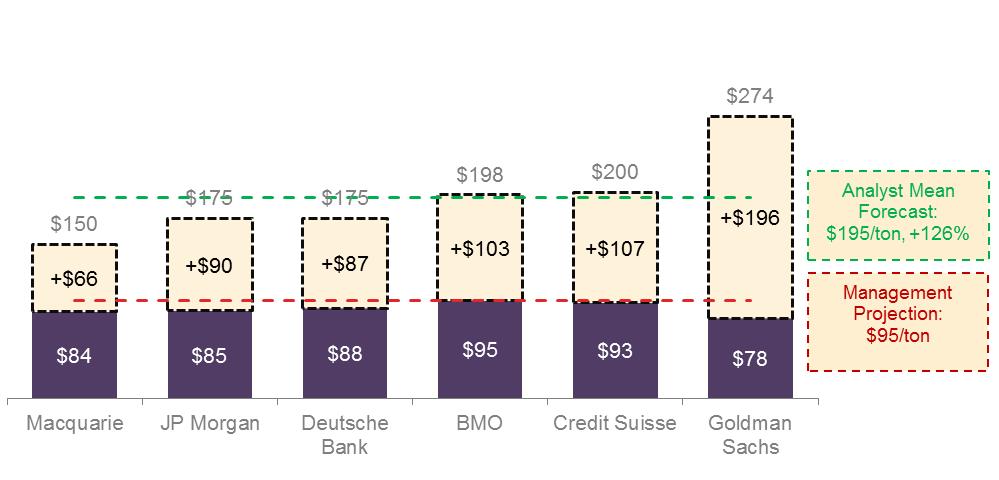

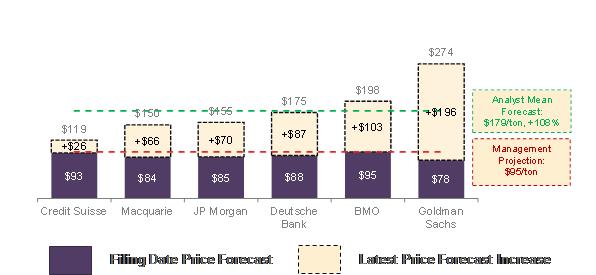

22. These pricing levels also receive support from third-party analysts. The following chart depicts the price forecast provided by various leading Wall Street institutions for metallurgical coal for 2017. Specifically, analysts have revised 2017 metallurgical coal pricing forecasts upward since Peabody’s filing, on average by 126%. The mean forecast for 2017 metallurgical coal of the below selected institutions is now $195/ton. The Debtors do not project prices that even remotely reflect these third party analyses in their Business Plan, and instead forecast near-term coal prices at figures close to historical cycle lows.

23. In addition, the futures curve for metallurgical coal delivery in 2017 currently averages $193/ton – considerably above the $95/ton in the Business Plan for 2017 and the $93/ton average futures price for 2017 at the time of the Debtors’ filing.6 Even through 2019, the futures curve currently reflects an average price of $169/ton, which is well above the 2017-2019 average futures curve of $92 at the time of the Debtors’ filing.

24. Indeed, equity is likely to be “in the money” at market prices even lower than $145/ton for met coal and $77/ton for thermal coal. The 6.0x multiple of EBITDA employed in the Business Plan represents a discount to Peabody’s 10 and 5 year historical forward trading multiples of approximately 8.0x. If a multiple of 7.0x or 8.0x EBITDA is instead applied to the figures contained in the Business Plan, the price at which meaningful recovery is obtained by the equity reduces to around $125-$135/ton for metallurgical coal and $67-$72/ton for thermal coal.

B. An Equity Committee Must Be Appointed To Ensure That The Interests Of Peabody’s Shareholders Are Adequately Represented.

25. The Shareholder currently holds 895,500 shares of Peabody’s common stock, constituting approximately 4.8% of the shares outstanding.7 The Shareholder is a value-oriented investment manager that currently manages approximately $800

_________________________

| 6 | A futures contract is an agreement on behalf of a seller to deliver a good or commodity to a buyer at a specified future date. A futures curve is a graphical representation of the current market pricing points for delivery of such good or commodity over a range of future dates. |

| 7 | On November 3, 2016 the Debtors provided the Shareholder with a written waiver of the equity transfer procedures with regard to their existing equity holdings. |

million in assets after launching in April 2010 with less than $10 million. The Shareholder invests internationally, across asset classes, focusing its attention on situations where it believes there is a higher likelihood of finding valuable investments. In particular, the Shareholder has prior experience with restructurings and invests in companies in situations in which it believes that there is mispricing.

26. In light of its position as a substantial holder of Peabody equity, the Shareholder is willing to serve on the Equity Committee should one be appointed. In addition, the Shareholder has spoken with holders of almost 3 million shares of Peabody, including both common stock and call options – certain of whom have expressed an interest in serving on the Equity Committee and all of which support the formation of an Equity Committee.

27. Among those who have indicated an interest and willingness in serving on the Equity Committee are Mr. Judson Kroh and Mr. Hans Mende, both of whom have significant experience in the coal industry. Mr. Kroh, both individually and together with related parties, currently holds approximately 2.7% of Peabody’s common stock and is CFO of Robindale Energy Services & Associated Companies, a diversified group of privately held companies that includes power generation, mining, commodity brokerage, and material handling. Mr. Mende currently holds approximately 0.5% of Peabody’s common stock and co-founded AMCI Group in 1986, one of the largest privately owned natural resources companies with mining operations across the world including North America, South America, Africa and Australia.

28. An Equity Committee must be appointed here because no other constituency in these cases can or will adequately represent Peabody’s shareholders. With respect to the Creditors’ Committee, it is well recognized that although unsecured creditors and equity holders might share a common interest in seeing that the unsecured creditors are paid, such interests are not always aligned. See In re Pilgrim’s Pride Corp., 407 B.R. at 217, n.17 (While “shareholders and unsecured creditors often have

common interests . . . when it comes to valuation . . . their agendas are likely to be very much at odds.”); In re Saxon Indus., Inc., 29 B.R. 320, 321 (Bankr. S.D.N.Y. 1983) (official committees of unsecured creditors and equity holders “are separate and distinct entities with the members . . . possessing variant priorities and interests with respect to their relationship with the debtor”). The Creditors’ Committee’s role is to act as fiduciary for the unsecured creditors, not the equity holders or any other parties in interest. If it were the case that the existence of a Creditors’ Committee obviates the need for an equity committee, then there would be no reason for an equity committee to be appointed in practically any chapter 11 case.

29. The potential for divergent interests between creditors and equity holders is especially true with respect to issues relating to valuation – the core issue in these proceedings. For example, in the case of In re Horsehead Holding Corp., No. 16-10287 CSS at 85-87 (Bankr. Del. May 4, 2016), attached hereto as Exhibit E, the court stressed the important role of equity committees, as “an official committee of unsecured creditors and equity’s interests are never truly aligned, because a recovery of ninety-five cents on the dollar is a huge victory for unsecured creditors. There’s no need for them to go to the extra mile to get 105 cents on the dollar, which leaves 5 cents for equity.” Id. at 92. See also Pilgrim’s Pride, 407 B.R. at 217, n.17 (“[W]hen it comes to valuation and determination of future capital structure for plan purposes, their agendas are likely to be very much at odds.”).

30. Shareholders also are not adequately represented by the board of directors or management of Peabody. Once a bankruptcy petition has been filed, the Debtors’ directors and officers have a broadened fiduciary duty to the estates as a whole, not only the shareholders. Commodity Futures Trading Comm’n v. Weintraub, 471 U.S. 343, 355 (1985). This often creates conflicts in interest to the detriment of equity holders. See Pilgrim’s Pride, 407 B.R. at 218-19 (“The dynamics of chapter 11 are such

that Debtors-and their management-are likely to be constrained to accept and advocate to the court a conservative value for their business in order to obtain creditor assent to a reorganization plan”); Addendum at 2, In re Breitburn Energy Partners LP, No. 16-11390, (S.D.N.Y. Oct. 7, 2016), ECF No. 650, attached hereto as Exhibit F (“As for management, it is the [SEC] staff’s view that equity-owning officers and directors generally cannot adequately represent shareholders due to their conflicting fiduciary duties to creditors in a bankruptcy and other possible conflicts of interest (i.e. management incentive and retention plans).”).

31. The Debtors and their management also have every incentive to make concessions to creditors and lenders, with whom they hope to engage in future business, and disregard the interests of shareholders who otherwise have no voice in the process to ensure appropriate checks and balances.8

32. In order to be adequately represented in these chapter 11 cases, an Equity Committee must be appointed. The Debtors have already had discussions with the various creditor constituencies regarding critical issues, including valuation. Thus far, holders of equity have not participated in those discussions, nor have they been privy to the same information as the creditors. To date, the Shareholder has not been permitted to execute a confidentiality agreement with the Debtors to obtain information about

__________________________

| 8 | For example, the Debtors are currently engaged in litigation with certain of their creditors over the subject of consolidated net tangible assets (the “CNTA Dispute”). Peabody Energy Corp., et al. v. Citibank, N.A., et al., Adv. No. 16-4068 (E.D. Mo.) The CNTA Dispute relates to the extent to which the Debtors’ secured lenders, representing $4.3 billion of debt, are secured. The Debtors wish to resolve the CNTA Dispute and may offer concessions to the secured lenders in the bankruptcy proceeding as incentive for those lenders to agree to a favorable settlement of the CNTA Dispute. In addition to the CNTA Dispute, the Debtors have intimated that they are also engaged with other parties in separate litigation over valuation. See Objection of Debtors to Motion of Certain Second-Lien Noteholders to Intervene in CNTA Adversary Proceeding ¶ 5, Peabody Energy Corp., et al. v. Citibank, N.A., et al., No. 16-04068 (Bankr. E.D. Mo. Nov. 14, 2016) [ECF No. 192] (“At this point, however, Peabody should not be compelled to accept the entry of other adverse parties in the proceeding with whom it may be engaged in separate litigation on valuation issues and that appear more concerned with gaining leverage in that context than providing substantive input on how the CNTA Issues are litigated.”) (emphasis added). The Debtors may also be inclined to offer concessions to these other parties in order to resolve all valuation disputes in the bankruptcy proceedings. |

the proceedings and discussions between the Debtors and the various creditor constituencies.9 Without representation through an Equity Committee, shareholders will continue to be denied critical information and the opportunity to advocate for value to the Debtors’ equity.

C. The Appointment Of An Equity Committee Is Warranted Due To The Size And Complexity Of These Cases.

33. In bankruptcy cases involving large public companies (other than primarily financial companies), equity committees are regularly appointed. See Breitburn Energy Partners, No. 16-11390 (Bankr. S.D.N.Y. Oct. 14, 2016); Horsehead Holding Corp., No. 16-10287 CSS at 85-87 (Bankr. Del. May 4, 2016); In re Energy XXI, Ltd., Case No. 16-31928 (S.D. Tex. June 17, 2016); In re Hancock Fabrics, Inc., Case No. 07-10353 (BLS) (Bankr. D. Del. May 22, 2007); In re Mirant Corp., Case No. 03-46590 (DML) (Bankr. N.D. Tex. July 14, 2003); In re Adelphia Communications Corp., Case No. 02-41729 (REG) (Bankr. S.D.N.Y. June 25, 2002); In re Kmart Corp., Case No. 01-15034 (AJG) (Bankr. S.D.N.Y. Dec. 2, 2001); In re Federal-Mogul Corporation, Case No. 01-10578 (RTL) (Bankr. D. Del. June 12, 2002); In re Texaco, Inc., Case No. 87-20142 (ASH) (Bankr. S.DN.Y. Apr. 12, 1987).

_______________________

| 9 | The Shareholder also understands that the Debtors are preparing a revised business plan that contains revised assumptions, but that plan will only be available to creditors with an NDA in place with the Debtors. |

34. These cases are undoubtedly large and complex, involving 154 affiliated debtors. Peabody is the world’s largest private sector coal company by volume, with operations across the United States and Australia.10 In 2015, Peabody was ranked #1 on the list of “Major U.S Coal Producers, 2015” by the U.S. Energy Information Administration (“EIA”) and produced 175,908 tons of coal, or 19.6% of total U.S production of coal. U.S. Energy Info. Admin., Annual Coal Report 2015 at 15-16 (2016), attached hereto as Exhibit G.

35. Peabody conducts its business through seven segments: (a) Powder River Basin (“PRB”) Mining; (b) Midwestern U.S. Mining; (c) Western U.S. Mining; (d) Australian Metallurgical Mining; (e) Australian Thermal Mining; (f) Trading and Brokerage; and (g) Corporate and Other, which includes, among other things, selling and administrative expenses, corporate hedging activities, mining and export/transportation joint ventures, restructuring charges and activities associated with the optimization of the Debtors’ coal reserve and real estate holdings, minimum charges on certain transportation-related contracts, the closure of inactive mining sites and certain energy-related commercial matters.

36. Peabody’s key U.S. mining operations are in the PRB. The Debtors are the largest coal producer and holder of reserves in the PRB, controlling an estimated 3 billion tons in proven and probable reserves, representing more than 20 years of capacity at current production levels. The EIA listed Peabody’s PRB North Antelope Rochelle Mine as the largest mine in the U.S., with 109 million short tons of coal produced in 2015. U.S. Energy Info. Admin., Annual Coal Report 2015 at 15 (2016). This mine employs approximately 1,150 workers. In 2015, the Debtors shipped nearly 140 million tons of coal from their PRB operations to approximately 100 separate facilities in 24 states.

_________________________

| 10 | The Australian subsidiaries of Peabody have not commenced chapter 11 cases and continue to operate in the ordinary course of business. |

37. As of December 31, 2015, Peabody had 6.3 billion tons of proven and probable coal reserves, with the vast majority (5.5 billion tons) located in the United States. As of the same date, on a consolidated basis, Peabody had $11 billion in assets, $5.6 billion in revenue for the year, and approximately 7,600 employees. Most recently, Peabody’s October 2016 MOR identifies $11.64 billion in assets for the Debtors. (October MOR ¶ 14.)

38. Moreover, the Debtors are seeking to restructure approximately $4.3 billion worth of secured obligations and $4.5 billion worth of unsecured indebtedness. (First Day Declaration ¶¶ 12-13.)

39. The vast size and complexity of these cases is not in question. Indeed, one of the Debtors’ main arguments in its recently filed motion seeking a second extension of exclusivity is that “the Debtors’ 154 chapter 11 cases and their attendant complexities alone justifies an extension of the Exclusive Periods.” (Second Exclusivity Motion ¶ 15.)

D. The Debtors’ Stock Is Widely Held And Actively Traded.

40. As of December 31, 2015, there were approximately 19.3 million shares of common stock of Peabody issued and 18.5 million shares of common stock outstanding. With the largest five shareholders accounting for only 10.54% of the equity, the stock is widely held in the market.11 Accordingly, unlike companies that have large institutional holders that can readily form an ad hoc committee to represent equity holders, the appointment of an Equity Committee is essential for Peabody shareholders to be adequately represented in these cases.

41. Peabody’s stock is also actively traded – over the last thirty days, the average daily trading volume was 1.1 million shares. The trading price of Peabody’s equity shares is trending significantly higher since the Debtors’ filing, rising from $0.74

___________________

11 Stock data for Peabody Corp. via FactSet, accessed December 6, 2015.

on April 15, 2016 to a closing price of $13.06 on December 7, 2016. The value in Peabody equity is based, in part, on dramatic and sustainable improvements across the entire coal market. This considerable rise in trading prices in conjunction with the trading volume suggests that the public increasingly believes there is significant value in the Debtors for shareholders.

E. This Request is Timely.

42. The Debtors have not yet filed a plan of reorganization and are currently engaged in mediation with their principal creditor constituencies regarding a consensual plan of reorganization and the Debtors’ value is still unclear. The Debtors have indicated that they will file a Plan by December 14, 2016. (Second Exclusivity Motion ¶ 15.)

43. Given the very high likelihood that shareholders are an “in the money” constituency, it is imperative that they be provided with representation and a seat at the table as soon as possible. As courts have explained, involvement of an equity committee should occur sooner rather than later. See e.g. Tr. at 147, In re Energy XXI, Ltd., No. 16-31928, (Bankr. S.D. Tex. June 15, 2016) ECF No. 532, attached hereto as Exhibit H (an equity committee must be “involved early if [the court is] going to let them get involved at all . . .”).

F. The Need For Adequate Representation of Shareholders Far Outweighs The Minimal Costs Of An Equity Committee.

44. Courts apply a balancing test to weigh the costs of such formation against the concern for adequate representation. In re Wang Laboratories, Inc., 149 B.R. 1, 3 (Bankr. D. Mass. 1992). While the Shareholder understands that concerns regarding the additional cost associated with the formation of an Equity Committee are appropriate to consider, “[c]ost alone cannot, and should not, deprive… security holders of representation.” In re McLean Indus., Inc., 70 B.R. 852, 860 (Bankr. S.D.N.Y. 1987).

45. In this case, the cost of an Equity Committee would be minimal in comparison to the high value of the Debtors and the professional fees already incurred to date in the proceeding. According to the Debtors most recent Monthly Operating Report, the Debtors’ value their assets at $11.642 billion. (October MOR at 14 [Docket No. 1646]). The Court has approved the payment of significant professional fees thus far, with the Debtors’ retained professionals already incurring over $23 million in fees and expenses for just the period of July through October 2016.

46. The addition of an Equity Committee will add negligible additional burden when weighed against the size of the Debtors’ estate and the significant fees already being paid each month by the estate, while ensuring that the holders of Peabody equity receive fair representation. In addition, the Bankruptcy Code provides means for controlling costs including allowing costs to be reviewed by the parties involved and the U.S. Trustee, and also leaving costs at the discretion of the Bankruptcy Court. See 11 U.S.C. § 330(a)(1).

47. Furthermore, the Shareholder does not ask for an Equity Committee to be appointed and funded indefinitely – but only for the opportunity now to protect the likely existing value of the equity holders’ interests in the Debtors. A renewed assessment may be made in a few months as to the continuing likelihood of value for equity holders. Accordingly, the benefits of an Equity Committee far outweigh any additional costs in a case such as this where the Debtors are solvent and there is significant value in the Debtors’ equity.

48. For all the foregoing reasons, the Shareholder believes it would be unjust to permit the Debtors to prosecute a plan of reorganization without the input of their shareholders, and accordingly seeks the appointment of an Equity Committee to protect the interests of equity holders.

CONCLUSION

The Shareholder respectfully requests that the Court appoint an Equity Committee and grant such other relief as is just.

| Dated: | St. Louis, Missouri |

| | December 8, 2016 |

| | SANDBERG PHOENIX & VON GONTARD P.C.

|

| | |

| | By: /s/ Scott Greenberg |

| | Scott Greenberg, #33575MO |

| | Kyle P. Lane, #66028MO |

| | 600 Washington Avenue - 15th Floor |

| | St. Louis, MO 63101-1313 |

| | (314) 231-3332 (314) 241-7604 Fax |

| | sgreenberg@sandbergphoenix.com |

| | klane@sandbergphoenix.com |

| | |

| | Co-Counsel to the Shareholder |

| | |

| | |

| | |

| | |

| | WILLKIE FARR & GALLAGHER LLP |

| | |

| | |

| | By: /s/ Rachel C. Strickland |

| | Rachel C. Strickland (pro hac vice pending) |

| | Joseph T. Baio (pro hac vice pending) |

| | Benjamin P. McCallen (pro hac vice pending) |

| | 787 Seventh Avenue |

| | New York, New York 10019 |

| | (212) 728-8000 |

| | Co-Counsel to the Shareholder |