As Filed with the Securities and Exchange Commission on November 15, 2013 Registration No. 333-190941

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

GEO JS TECH GROUP CORP.

(Exact name of registrant as specified in its charter)

| Texas | 1011 | 27-2359458 |

(State or jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

6360 Corporate Drive, Houston, Texas 77036

(347-341-0731)

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Jimmy Yee

c/o GEO JS Tech Group Corp.

6360 Corporate Drive, Houston, Texas 77036

(347-341-0731)

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Leonard E. Neilson, Esq.

Leonard E. Neilson, P.C.

8160 South Highland Drive, Suite 104

Sandy, Utah 84093

Phone: (801) 733-0800

Fax: (801) 733-0808

Approximate date of commencement of proposed sale to the public: As promptly as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delay or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] | Smaller reporting company | [ X] |

| (Do not check if a smaller reporting company) | | |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities To Be Registered | | Amount to Be Registered (1) | | | Proposed Maximum Offering Price per Share | | | Proposed Maximum Aggregate Offering Price | | | Amount of Registration Fee | |

| Common stock | | | 57,930,000 | | | $ | 0.10 | (2) | | $ | 5,793,000 | (2) | | $ | 790.17 | (3) |

| | (1) | We are registering the resale by selling stockholders of 57,930,000 shares of common stock that we have previously issued. In accordance with Rule 416 under the Securities Act of 1933, as amended, common stock offered hereby shall also be deemed to cover additional securities to be offered or issued to prevent dilution resulting from stock splits, stock dividends or similar transactions. |

| | | |

| | (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457 of the Securities Act and based on the most recent closing price. |

| | | |

| | (3) | Registration fee of $790.17 was paid when Form s-1 registration statement was filed on August 30, 2013. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling security holders will not sell these securities until after the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated November 15, 2013

PROSPECTUS

GEO JS Tech Group Corp.

57,930,000 Shares of Common Stock

This prospectus relates to the offer for sale of up to a total of 57,930,000 shares of our common stock that may be sold from time to time by certain existing stockholders named in this prospectus and their successors and assigns. The selling stockholders may be deemed underwriters of the common shares that they are offering.

The shares offered for resale by this prospectus were issued to the applicable selling stockholders in private transactions completed prior to the filing of the registrations statement, of which this prospectus is a part. This offering is not being underwritten. We will not receive any proceeds from the sale of shares in this offering. We have agreed to pay all costs and expenses of registering this offering of securities.

Our common stock is not traded on any public market. We intend to request a market maker to apply to have our common stock quoted on the Over-The-Counter Bulletin Board (“OTCBB”) maintained by the Financial Industry Regulatory Authority (“FINRA”) upon the effectiveness of the registration statement. However, there can be no assurance that the application will be approved and there is a possibility that our common stock may never trade in any market.

Selling stockholders will initially offer their shares at $0.10 per share until such time as the shares are approved for and quoted on the OTC Bulletin Board. Thereafter, selling stockholders, to the extent a public market exists at such time, may offer and sell shares through public transactions at prices related to the prevailing market prices, or through private transactions at privately negotiated prices.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (“JOBS Act”) and, as such, will be subject to reduced public company reporting requirements.

Investing in our common stock involves substantial risks. You should carefully consider the matters discussed under “Risk Factors” beginning on page 8 of this prospectus.

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 15, 2013

TABLE OF CONTENTS

| | Page |

| | |

| Prospectus summary | 3 |

| | |

| Summary Financial Information | 5 |

| | |

| Risk factors | 6 |

| | |

| Forward looking statements | 12 |

| | |

| USE OF PROCEEDS | 13 |

| | |

| DETERMINATION OF OFFERING PRICE | 13 |

| | |

| Dilution | 13 |

| | |

| Market for common stock | 13 |

| | |

| Dividend policy | 14 |

| | |

| The Offering - Plan of distribution | 15 |

| | |

| Selling Stockholders | 16 |

| | |

| Capitalization | 18 |

| | |

| Legal proceedings | 18 |

| | |

| Business | 19 |

| | |

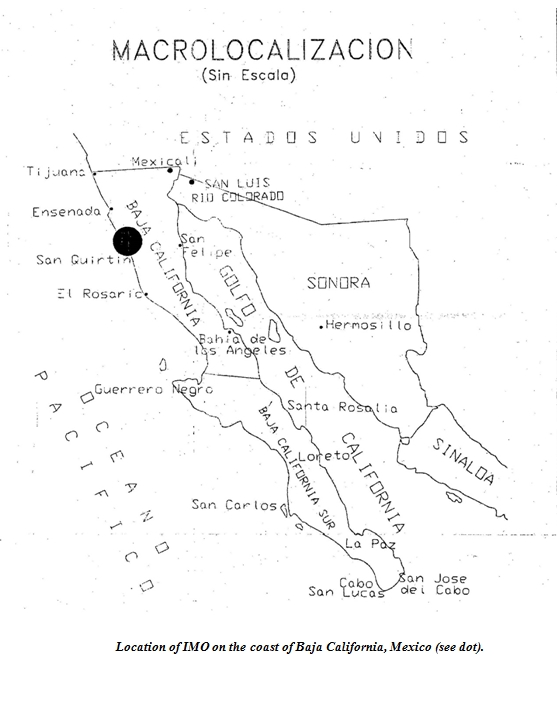

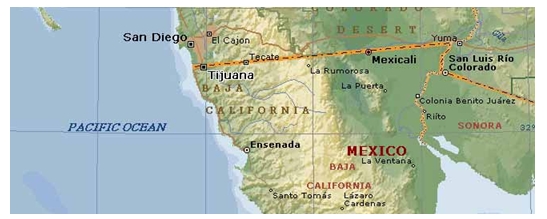

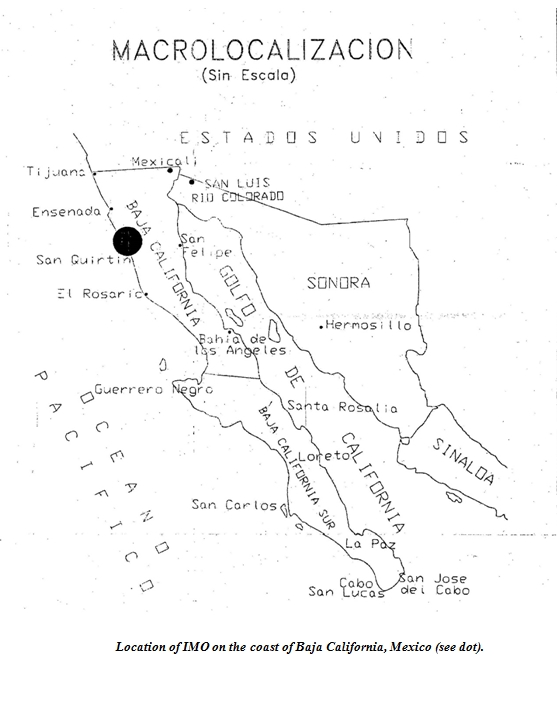

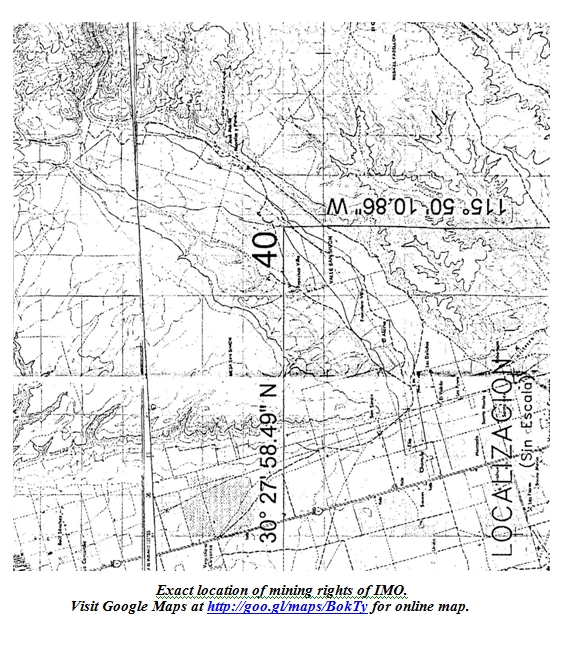

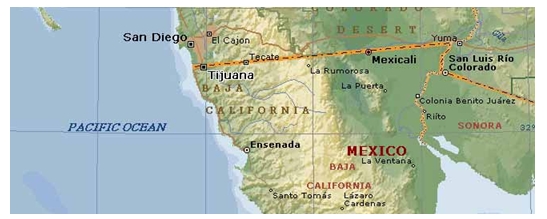

| Maps of Properties | 24 |

| | |

| History | 28 |

| | |

| Plan of Operations | 28 |

| | |

| Management's discussion and analysis of Financial Condition and Results of Operations | 31 |

| | |

| Management | 35 |

| | |

| Stock ownership of certain beneficial owners and management | 37 |

| | |

| Description of securities to be Registered | 38 |

| | |

| Disclosure of Commission position of indemnification for securities act liabilities | 39 |

| | |

| Legal matters | 39 |

| | |

| Experts | 39 |

| | |

| Interests of named experts and counsel | 39 |

| | |

| Where you can find more information | 39 |

| | |

| Financial statements | 40 |

____________

As used in this prospectus, unless otherwise indicated, “we”, “us”, “our”, “GEO Tech” and the “company” refer to GEO JS Tech Group Corp., unless otherwise indicated.

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission (the “SEC”). You should rely only on the information provided in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the common stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. The selling stockholders are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted.

Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus or that the information contained by reference to this prospectus is correct as of any time after its date. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of common stock. The rules of the SEC may require us to update this prospectus in the future.

PROSPECTUS SUMMARY

This summary highlights information contained throughout this prospectus and is qualified in its entirety to the more detailed information and financial statements included elsewhere herein. This summary may not contain all the information that may be important to you. We are an “emerging growth company” under the federal securities laws and will therefore be subject to reduced public company reporting requirements. Before making an investment decision, you should read carefully the entire prospectus, including the information under the "Risk Factors" section and our financial statements and related notes.

Our Business

GEO JS Tech Group Corp., a Texas corporation organized on April 13, 2010, is an exploration stage company engaged in procuring and delivering commodities in the international market with a primary focus on Mexican-based iron ore trading. We currently hold joint ventures and licensing rights to iron ore mines in the outskirts of Ensenada and Manzanillo, Mexico that we intend to exploit in the future in order to obtain marketable product. We also have strategic relationships directly with end users in China for delivery of iron ore. We anticipate fulfilling our business objectives by procuring iron ore product and the future excavation and retrieval of iron ore in the Mexican mines and, in turn, selling the product to Chinese contacts with whom the company has had prior contact. The company does not have any definitive agreements with these contacts, only previous business relationships.

Iron ore is the main source of primary iron minerals required for the global iron and steel industries. It is essential as part of the production process of steel, which is critical to the global economy as steel is used in such items as ships, buildings, cars, appliances and many other products. Management believes that China has a substantial and increasing demand for iron ore to produce steel and that it represents a viable market for the company’s iron ore production.

We expect that we will need approximately $2.5 million in new capital during the next 12 months in order to attain our objectives.

Our principal executive offices are located at 6360 Corporate Drive, Houston, Texas 77036 and our telephone number is (347)-341-0731.

Our Strategy

Management maintains a strategic plan of procuring iron ore product and acquiring additional mineral rights and developing working business relationships with end users of iron ore. In addition to acquiring iron ore product in Mexico and reselling the ore in China and elsewhere, we will continue conducting mine evaluations of mineralized materials and mine reserves in Mexico and other feasible countries. We have entered into certain joint ventures in connection with the planned future construction, operation and extraction of iron ore in Ensenada and Colima, Mexico. Management believes that the arrangements will assist in the funding and future operations of mines in Mexico.

Our goal is to become a key producer of iron ore in Mexico. To achieve this goal we plan to increase our ability to secure iron ore product and to develop a capacity to extract product through acquisitions, licensing rights and joint venture partnerships. Additionally, we intend to further develop current mine right concessions with joint venture partners.

By acquiring or mining iron ore in Mexico, we believe that we will be able to deliver product to China at a lower cost and shorter delivery time. We further believe that this make it possible to compete with other larger competing ore producers based in Brazil, Argentina, and Chile. We also anticipate that we will be able to maintain existing relationships and establish new relationships with major logistics operators to keep operating costs to a minimum without compromising operation. We have applied to the Mexican government for our own export permit that could ultimately reduce our cost of logistics and port costs.

[ ]

The Offering

Selling Stockholders

As of the date hereof, we have 204,980,000 shares of common stock issued and outstanding. Of those shares, 125,050,000 shares (approximately 61%) are held by affiliates of the company and 79,930,000 shares are held by non-affiliates. All 58 selling stockholders are considered non-affiliates and the 57,930,000 shares offered hereunder represent approximately 28% of our total issued and outstanding shares.

Selling stockholders will initially offer their shares at $0.10 per share until such time as the shares are approved for and quoted on the OTCBB. Thereafter, selling stockholders, to the extent a public market exists at such time, are expected to offer and sell shares primarily through public transactions at prices related to the prevailing market prices, or through private transactions at privately negotiated prices.

For a list of selling stockholders and the number of shares offered by each, please refer to the “Selling Stockholder” section. Of the 58 selling stockholders, the 13 largest holders are offering an aggregate of 44,650,000 shares, or approximately 77% of the total shares offered.

Shares of common stock offered by the company – None

Shares of common stock outstanding before the offerings – 204,980,000 shares

Shares of common stock outstanding after the offerings – 204,980,000 shares

Shares of common stock, which may be sold by the selling stockholders – 57,930,000 shares

Terms of the offering – The selling stockholders will determine when and how they will sell the securities offered in this prospectus.

Use of proceeds

We will not receive any proceeds from the resale of shares offered by the selling stockholders hereby, all of which proceeds will be paid to the selling stockholders.

Risk factors - The purchase of our common stock involves a high degree of risk. Investor should not purchase our stock if they cannot afford the loss of their entire investment. Also see “Risk Factors” below.

Trading Market – None.

We intend to apply for quotation on the OTC Bulletin Board (“OTCBB”). We will require the assistance of a market-maker to apply for the quotation and there is no guarantee that a market-maker will agree to assist us.

Plan of distribution

Selling stockholders will initially offer their shares at $0.10 per share until the shares are approved for and quoted on the OTCBB. Thereafter, to the extent a public market exists, we expect selling stockholders to offer and sell shares, from time-to-time, through public transactions at prices related to the prevailing market prices they consider appropriate. Selling stockholders may also sell their shares through private transactions at privately negotiated prices. See "The Offering - Plan of Distribution."

Our Common Stock

We currently have an authorized capitalization of 500 million shares of common stock, par value $0.001 per share, of which 204,980,000 shares are issued and outstanding. The shares of common stock outstanding before and after this offering are 204,980,000 and will not have changes.

SUMMARY FINANCIAL INFORMATION

The following financial information summarizes the more complete historical financial information, included at the end of this prospectus, as of and for the years ended March 31, 2013 and 2012, and for the three months ended September 30, 2013 .

| Statement of Operations Data | | | | | | | | | | | | |

| | | For the Year Ended | | | For the Year Ended | | | For the Three Months Ended | | | For the Three Months Ended | |

| | | March 31, 2013 | | | March 31, 2012 | | | September 30, 2013 | | | September 30, 2012 | |

| | | | | | | | | (Unaudited) | | | (Unaudited) | |

| | | | | | | | | | | | | |

| Net Revenues | | $ | 5,568,172 | | | $ | 9,180,832 | | | | 2,248,936 | | | $ | 0 | |

| | | | | | | | | | | | | | | | | |

| Cost of net revenues | | | (5,019,636 | ) | | | (7,719,386 | ) | | | (2,010,643 | ) | | | 0 | |

| Gross profit | | | 548,536 | | | | 1,461,446 | | | | 283,293 | | | | 0 | |

| Operating expenses | | | (539,924 | ) | | | (1,244,261 | ) | | | (1,190,603 | ) | | | (66,723 | ) |

| | | | | | | | | | | | | | | | | |

| Profit (loss) from operations | | | 8,612 | | | | 217,185 | | | | (952,310 | ) | | | (66,723 | ) |

| | | | | | | | | | | | | | | | | |

| Interest expense | | | 0 | | | | 111,896 | | | | 0 | | | | 0 | |

| Income (loss before taxes) | | | 8,612 | | | | 105,289 | | | | (952,310 | ) | | | (66,723 | ) |

| Income taxes | | | 0 | | | | 0 | | | | | | | | 0 | |

| | | | | | | | | | | | | | | | | |

| Net profit (loss) | | | 8612 | | | | 105,289 | | | | (952,310 | ) | | | (66,723 | ) |

| | | | | | | | | | | | | | | | | |

| Basic income (loss) per share | | $ | .0001 | | | $ | .0011 | | | | (.0064 | ) | | | (0.0008 | ) |

| | | | | | | | | | | | | | | | | |

Weighted average number of shares outstanding | | | 87,133,699 | | | | 95,327,869 | | | | 149,716,264 | | | | 85,000,000 | |

| Balance Sheet Data | | | | | | | | | |

| | | March 31, 2013 | | | March 31, 2012 | | | September 30, 2013 | |

| | | | | | | | | (Unaudited) | |

| ASSETS | | | | | | | | | |

| Total current assets | | $ | 950,047 | | | $ | 687 | | | | 2,738,416 | |

| | | | | | | | | | | | | |

| Total long term assets | | | 1,889,961 | | | | 2,103,171 | | | | 1,783,356 | |

| | | | | | | | | | | | | |

| Total assets | | $ | 2,840,008 | | | $ | 2,103,858 | | | | 4,521,772 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | | |

| Total current liabilities | | $ | 44,101 | | | $ | 614,563 | | | | 558,372 | |

| | | | | | | | | | | | | |

| Total liabilities | | | 44,101 | | | | 614,563 | | | | 558,372 | |

| | | | | | | | | | | | | |

| STOCKHOLDERS' EQUITY | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Common Stock | | | 97,980 | | | | 85,000 | | | | 204,980 | |

| Additional paid-in capital | | | 3,452,520 | | | | 2,167,500 | | | | 5,995,520 | |

| Accumulated deficit | | | (754,593 | ) | | | (763,205 | ) | | | (2,237,100 | ) |

| | | | | | | | | | | | | |

| Total stockholders’ equity | | $ | 2,795,907 | | | $ | 1,489,295 | | | | 3,963,400 | |

| | | | | | | | | | | | | |

| Total liabilities and stockholders’ equity | | $ | 2,840,008 | | | $ | 2,103,858 | | | | 4,521,772 | |

RISK FACTORS

An investment in our common stock involves significant risks, and should not be made by anyone who cannot afford to lose his or her entire investment. You should consider carefully the following risks, together with all other information contained in this prospectus, before deciding to invest in our common stock. If any of the following events or risks should occur, our business, operating results and financial condition would likely suffer materially and you could lose all or part of your investment.

Risks Relating to Our Business

Our auditors have expressed a going concern modification to their audit report.

Our independent auditors include a modification in their report to our financial statements expressing that certain matters regarding the company raise substantial doubt as to our ability to continue as a going concern. Note 8 to the March 31, 2013 financial statements states that we have accumulated significant losses, that we presently have insufficient cash flows from operations and will be required to raise capital to fund operations until we are able to generate sufficient revenue to support future development. We intend to satisfy future financial needs through the sale of debt and equity securities. There is also an expectation of further losses during the development of our business, all of which raises substantial doubt about our ability to continue as a going concern. There is no assurance that we will be able to obtain adequate financing, achieve profitability, or to continue as a going concern in the future.

If we fail to maintain an effective system of internal controls over financial reporting, we may not be able to accurately report our financial results, which could have a material adverse effect on our share price.

Effective internal controls are necessary for us to provide accurate financial reports. We are in the process of documenting and testing our internal control procedures to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and related SEC rules. These regulations require, among other things, management to assess annually the effectiveness of our internal control over financial reporting. During the course of this documentation and testing, we may identify significant deficiencies or material weaknesses that we may be unable to remediate before the deadline for those reports. If our controls fail or management or our independent auditors conclude in their reports that our internal control over financial reporting was not effective, investors could lose confidence in our reported financial information and negatively affect the value of our shares. Also, we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

We have a limited operating history and if we are unable to generate sufficient revenues to pay operating expenses in the future, our business may fail resulting in the loss of any money invested in our common stock.

We have a limited operating history and our revenues have been volatile. We face many of the risks and challenges associated with businesses in their early stages in a competitive environment. Prospective investors have only limited information on which to make an evaluation of our business prospects.

If we are unable to successfully procure, produce and market our ores on a profitable basis, we may not be able to generate sufficient cash flows to meet operating expenses. Our prospects should be considered in light of the risks, expenses and difficulties frequently encountered in the establishment of any new business in a competitive environment. There can be no assurance that future operations will be profitable. Future revenues and profits, if any, will depend upon various factors, including our ability to successfully produce ore on in a commercial quantity, fluctuating costs and general economic conditions such as the spot price of minerals. There can be no assurance that we will achieve our projected goals or accomplish our business plans. Such a failure would have a material adverse effect on us and the value and price of our shares.

Our business involves procuring and exploring for minerals and there is no guarantee that we will be successful in locating and commercially exploiting ores.

In addition to acquiring iron ore for resale, we are continually looking for and acquiring new properties in addition those that we presently control. Although we believe that initial exploratory results and other geologic information concerning these properties are promising, we can give no assurance that a viable mineral deposit of any kind exists on these properties. We anticipate that extensive future exploration will be required before we can make a final evaluation as to the economic and legal feasibility of potential ore deposits. In the event we are unable to procure adequate iron ore product and/or locate a commercially viable mineral deposit, our business could fail and investors in our shares could lose a portion or all of their investment.

The mineral ore trading business and exploration and mining industry is highly competitive, and we are at a disadvantage since many of our competitors are larger and better funded.

Procuring and marketing iron ore product is very competitive and requires adequate funding to secure and market the product. Also, discovering, exploring and exploiting a mineral prospect are highly speculative ventures. There are many companies more established in this industry who are better financed and/or who have closer working relationships with productive mining companies. This places our company at a competitive disadvantage. If we are unable to fund our projects internally, we may have to seek a partner such as a larger, more established mining company that could assist in financing our operations. We have entered into joint venture agreements with third parties to produce and market minerals from our property, but there can be no guarantee that the joint ventures or any other future arrangements will be successful. If we are unable to successfully procure, produce and market minerals, either through our own efforts or through a joint venture, we will most likely be unable to generate sufficient revenues, which could cause us to cease active business operations.

Our business could be adversely affected by economic developments in the minerals industry and/or the economy in general.

Successfully procurring and marketing our minerals is highly dependent on volatile commodities prices. Prices for iron ores and other minerals may fluctuate that could make it difficult for us to sell our ores on a profitable basis. Accordingly, we are susceptible to the commodities markets as well as possible downturns in the economy in general. Any significant downturn in the market or in general economic conditions would likely negatively affect our business and your investment in our common stock.

Future operating results are difficult to predict.

Our revenues have been volatile in recent years and we will likely experience significant quarter-to-quarter fluctuations in revenues and net income or loss in the near future. Until we are able to evidence a consistent revenue and cash flow from operation, our quarter-to-quarter comparisons of historical operating results will not be a good indication of future performance. It is likely that in some future quarter, operating results may fall below the expectations of securities analysts and investors, which could have negative impact on the price of our common stock.

In the event we are able to operate our own mines in the future , we will be subject to extensive government laws and regulations particular to mining operations, compliance with which could impose significant costs and limit our ability to produce iron ore or other minerals.

Our business is subject to all current and future government regulations generally associated with conducting business. In addition the mineral exploration and mining industry is subject to increasingly strict regulation by federal, state and local authorities in the United States and Mexico. These regulations include, but are not limited to:

| ● | limitations on land use; |

| | |

| ● | mine permitting and licensing requirements; |

| | |

| ● | reclamation and restoration of properties after mining is completed; |

| | |

| ● | management of materials generated by mining operations; and |

| | |

| ● | storage, treatment and disposal of wastes and hazardous materials. |

The risks and obligations associated with the laws and regulations related to these and other matters, including air emissions, water discharges and other environmental matters, may be costly and time-consuming and may restrict, delay or prevent commencement or continuation of exploration or production operations. If we become engaged in future mining operations, it is possible that we may not be able to comply with all current and future regulations applicable to our business. Although we intend to make all reasonable efforts to comply with applicable laws and regulations, we cannot assure you of our ability to do so. Failure to comply with material regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of cleanup and site restoration costs and liens, the issuance of injunctions to limit or cease operations, suspension or revocation of permits or authorizations and other enforcement measures. This would have an adverse effect on our ability to conduct business and could result in curtailing or ceasing business operations. We have not made an assessment nor made a determination as to whether significant site reclamation costs related to our operations will be required in the future.

Our Mexican operations are subject to additional political, economic and other uncertainties not generally associated with domestic operations.

We are subject to significant risks inherent in exploration and resource extraction by foreign companies in Mexico. Exploration, development, production and closure activities in Mexico are potentially subject to heightened political, economic, regulatory and social risks that are beyond our control. Some of these risks include:

| ● | possible unilateral cancellation or forced re-negotiation of contracts; |

| | |

| ● | unfavourable changes in laws and regulations; |

| | |

| ● | royalty and tax increases; |

| | |

| ● | claims by governmental entities or indigenous communities; |

| | |

| ● | expropriation or nationalization of property; |

| | |

| ● | political instability; |

| | |

| ● | uncertainty regarding the enforceability of contractual rights and judgments; and |

| | |

| ● | other risks arising out of foreign governmental sovereignty over areas in which our mineral properties are located. |

Additionally, the right to export iron ore and other metals may depend on obtaining certain licenses and permits, which could be delayed or denied at the discretion of the relevant regulatory authorities, or meeting certain quotas. Any of these conditions could lead to lower productivity and higher costs, which would adversely affect our financial performance, financial position and results of operations.

Any of these developments could require us to curtail or terminate future operations at our mineral properties in Mexico, incur significant costs to meet newly-imposed environmental or other standards, pay greater royalties or higher prices for labor or services and recognize higher taxes, which could materially and adversely affect our results of operations, cash flows and financial condition.

Because we are conducting business in Mexico, we could be adversely affected by local laws and possible political or economic instability in that country.

Conducting business and mineral exploration operations in a foreign country could subject us to certain unique risks not otherwise associated with operating in the United States. If we do not comply with the operating and environmental standards established by the government, our license may be suspended or cancelled. Also, Mexico, like many other countries, is currently facing economic and financial difficulties. Although we believe the political situation to be relatively stable in Mexico, there can be no assurance that the present worldwide economic conditions will not result in added financial risks of doing business in Mexico, or in any other country. Any significant worsening of economic and financial conditions in Mexico, or in general, would likely hurt our business and operating results.

We are dependent upon our directors, officer and consultants, the loss of any of whom would negatively affect our business.

We are dependent upon the experience and efforts of our directors, officers and consultants to operate our business. If any of these persons leave or otherwise be unable to perform their duties, or should any consultant cease their activities for any reason before qualified replacements could be found, there could be material adverse effects on our business and prospects. We have not entered into employment agreements with any individuals, and do not maintain key-man life insurance. Unless and until additional employees are hired, our attempt to manage our business and projects and meet our obligations with a limited staff could have material adverse consequences, including without limitation, a possible failure to meet a contractual or SEC deadline or other business related obligation.

Our future success depends on our ability to procure iron ore product and to identify and acquire viable mineral deposits and successfully explore these properties.

As a mineral exploration company, we must continue to investigate, explore and acquire new mineral reserves, which will involve many factors, including the following:

| ● | our ability to exploit those properties upon which we hold concession rights and to acquire new rights on promising properties; |

| | |

| ● | our ability to secure the necessary funds to conduct future activities on prospective mining properties; |

| | |

| ● | the presence of viable mineral reserves on our properties; |

| | |

| ● | our ability to maintain and expand future operations as necessary; and |

| | |

| ● | our ability to attract and retain a qualified work force. |

Currently, we are not engaged in direct mining activities. We cannot assure you that if we commence mining operations in the future, we will achieve or maintain any of the foregoing factors or realize profitable operations.

We may not be able to manage future growth effectively, which could adversely affect our operations and financial performance.

The ability to manage and operate our business as we execute our business plan will require effective planning. Significant rapid growth and/or possible future acquisitions could strain management and internal resources that could adversely affect financial performance. We anticipate that future growth could place a significant strain on personnel, management systems, infrastructure and other resources. Our ability to manage future growth effectively will also require attracting, training, motivating, retaining and managing new employees and continuing to update and improve operational, financial and management controls and procedures. If we do not manage growth effectively, our operations could be adversely affected resulting in slower growth and a failure to achieve or sustain profitability.

We anticipate needing additional financing in order to accomplish our business plan.

At October 28, 2013 , we had cash on hand of $75,000 . Management estimates that we will require approximately an additional $2,500,000 during the next 12 months to fully implement our current business plan. There is no assurance that we will be able to secure necessary financing, or that any financing available will be available on terms acceptable to us, or at all. Any additional offerings of our stock will dilute the holdings of our then-current stockholders. If we borrow funds, we would likely be obligated to make periodic interest or other debt service payments and be subject to additional restrictive covenants. If alternative sources of financing are required, but are insufficient or unavailable, we will be required to modify our growth and operating plans in accordance with the extent of available funding. At the present time, we do not intend to obtain any debt financing from a lending institution. If necessary, our board of directors or other stockholders may agree to loan funds to the company, although there are no formal agreements to do so. Failure to secure additional capital, if needed, could force us to curtail our growth strategy, reduce or delay capital expenditures and downsize operations, which would have a material negative effect on our financial condition.

Being a public company involves increased administrative costs, including compliance with SEC reporting requirements, which could result in lower net income and make it more difficult for us to attract and retain key personnel.

As a public company subject to the reporting requirements of the Securities Exchange Act of 1934 (the “Exchange Act,”) we incur significant legal, accounting and other expenses. The Sarbanes-Oxley Act of 2002, as well as new rules subsequently implemented by the SEC, require changes in corporate governance practices of public companies. We expect these new rules and regulations will increase our legal and financial compliance costs and make some activities more time consuming. For example, in connection with being a public company, we may have to create new board committees, implement additional internal controls and disclose controls and procedures, adopt an insider trading policy and incur costs relating to preparing and distributing periodic public reports. These rules and regulations could also make it more difficult for us to attract and retain qualified executive officers and members of our board of directors, particularly to serve on our audit committee.

Management must invest significant time and energy to stay current with public company responsibilities, which limits the time they can apply to other tasks associated with operating our business. It is possible that the additional burden and expense of operating as a public company could hinder our ability to achieve and maintain profitability, which would cause our business to fail and our investors to lose all their money invested in our stock.

We estimate that being a public company will cost us in excess of $100,000 annually. This is in addition to all other costs of doing business. It is important that we maintain adequate cash flow not only to operate our business, but also to pay the cost of remaining public. If we fail to pay public company costs as incurred, we could become delinquent in our reporting obligations and our shares may no longer remain qualified for quotation on a public market. Further, investors may lose confidence in the reliability of our financial statements causing our stock price to decline.

If we cease to be classified as an emerging growth company, we would not be able to take advantage of reduced regulatory reporting and financial requirements and related cost advantages.

The recently enacted JOBS Act reduces certain disclosure requirements for “emerging growth companies,” thereby decreasing related regulatory compliance costs. We qualify as an emerging growth company as of the date of this offering and may continue to qualify as an “emerging growth company” for up to five years. However, we would cease to qualify as an emerging growth company if:

| ● | we have annual gross revenues of $1.0 billion or more in a fiscal year; |

| | |

| ● | we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt; or |

| | |

| ● | we become a “large accelerated filer”, defined by the SEC as a company with a word-wide public float of its common equity of $700 million or more. |

Upon the occurrence of any of the above, we would not be able to take advantage of the reduced regulatory requirements and any associated cost savings.

The exploration and mining industry is highly competitive, and we are at a disadvantage since many of our competitors are larger and better funded.

Discovering, exploring and exploiting a mineral prospect are highly speculative ventures. There are many companies already established in this industry, who are larger, better financed and/or who have closer working relationships with productive mining companies. This places our company at a competitive disadvantage. A significant portion of our business involves entering into joint venture agreements with strategic partners to operate our mines and market our ores. There are no guarantees that our partnerships will be successful in producing and marketing production grade minerals from our property, in which event our business would be materially and adversely affected. If we are able to generate sufficient revenues from our operations, our business could fail causing us to cease active business operations.

Risks Relating to the Offering and Ownership of Our Common Stock

Currently, there is no public market for our common stock and there can be no assurance that any public market will ever develop or that our stock will be quoted for trading.

As of the date of this prospectus, there has not been any established trading market for our common stock and there is currently no public market whatsoever for our shares. We intend to contact a broker/dealer to make an initial application to FINRA to have our common shares quoted on the OTCBB. There can be no assurance that FINRA will approve the application or, if approved, that any market for our common stock will develop. If a trading market does develop, we cannot predict the extent to which investor interest will result in an active, liquid trading market.

We do not anticipate our common stock to be followed by any market analysts and, most likely, only a few institutions would act as market makers for our shares. Either of these factors could adversely affect the liquidity and trading price of our common stock. Until an orderly market develops, if ever, the price at which the shares trade will probably fluctuate significantly. Share price will likely be determined in the market and may be influenced by many factors including liquidity, business developments, investor perception and general economic and market conditions. No assurance can be given that an orderly or liquid market for our shares will be developed or maintained. Because of the anticipated low price of our common stock, many brokerage firms may not be willing to effect transactions in our common stock.

The stock price of our common stock in the public market may be volatile and subject to numerous factors.

There can be no assurance that our common stock will be accepted for quotation on the OTCBB or that an active trading market for our shares will ever develop or be maintained. Accordingly, even if a market is created it could be difficult for holders of our common stock to liquidate their shares. Any trading market for our shares will most likely be very volatile and subject to numerous factors, many beyond our control. Some factors that may influence the price of our shares are:

| ● | our ability to develop our patents and technology into commercially viable products; |

| | |

| ● | our ability to achieve and maintain profitability; |

| | |

| ● | changes in earnings estimates and recommendations by financial analysts; |

| | |

| ● | actual or anticipated variations in our quarterly and annual results of operations; |

| | |

| ● | changes in market valuations of similar companies; |

| | |

| ● | announcements by us or our competitors of significant contracts, new products or drugs, acquisitions, commercial relationships, joint ventures or capital commitments; and |

| | |

| ● | general market, political and economic conditions. |

In the past, following periods of extreme volatility in the market price of a particular company's securities, securities class action litigation has often been instituted. A securities class action suit against us could result in substantial costs and divert management's time and attention, which would otherwise be used to benefit our business.

Any trading market that may develop could be restricted because of state securities “Blue Sky” laws that prohibit trading absent compliance with individual state laws.

Transfer of our common stock may be restricted under the securities laws promulgated by various states and foreign jurisdictions, commonly referred to as Blue Sky laws. Individual state Blue Sky laws could make it difficult or impossible to sell our common stock in those states. A number of states require that an issuer’s securities be registered in their state, or appropriately exempted from registration, before the securities can trade in that state. We have no immediate plans to register our securities in any particular state. Absent compliance with such laws, our common stock may not be traded in such jurisdictions. Whether stockholders may trade their shares in a particular state is subject to various rules and regulations of that state.

Future operating results are difficult to predict.

In the past, our revenues have fluctuated significantly and we will likely experience significant quarter-to-quarter fluctuations in revenues and net income (loss) in the future. Accordingly, our quarter-to-quarter comparisons of historical operating results will not be a good indication of future performance. It is likely that in some future quarter, operating results may fall below the expectations of securities analysts and investors, which could have negative impact on the price of our common stock.

Effective voting control of our company is held by directors and certain principal stockholders.

Approximately 71.8% of our outstanding shares of common stock are held by directors and a small number of principal (5%) stockholders. These persons have the ability to exert significant control in matters requiring stockholder vote and may have interests that conflict with other stockholders. As a result, a relatively small number of stockholders acting together, have the ability to control all matters requiring stockholder approval, including the election of directors and approval of other significant corporate transactions. This concentration of ownership may have the effect of delaying, preventing or deterring a change in control of our company. It could also deprive our stockholders of an opportunity to receive a premium for their shares as part of a sale of our company and it may affect the market price of our common stock.

We do not expect to pay dividends in the foreseeable future, which could make our stock less attractive to potential investors.

We anticipate that we will retain any future earnings and other cash resources for operation and business development and do not intend to declare or pay any cash dividends in the foreseeable future. Any future payment of cash dividends will be at the discretion of our board of directors after taking into account many factors, including operating results, financial condition and capital requirements. Corporations that pay dividends may be viewed as a better investment than corporations that do not.

Future trading in our shares will most likely be subject to certain "penny stock” regulation, which could have a negative effect on the price of our shares in the marketplace.

In the event our common stock is approved for quotation of the OTCBB or other marketplace, of which there can be no assurance, trading will likely be subject to certain provisions and broker-dealer requirements, commonly referred to as penny stock rules, promulgated under the Exchange Act. A penny stock is generally defined to be any equity security that has a market price less than $5.00 per share, subject to certain exceptions. These sales practice provisions may require a broker dealer to:

● make a special suitability determination for purchasers of penny stocks;

● receive the purchaser's prior written consent to the transaction; and

● deliver to a prospective purchaser of a penny stock, prior to the first transaction, a risk disclosure document relating to the penny stock market.

Consequently, penny stock rules may restrict the ability of broker-dealers to trade and/or maintain a market in our common stock, which would affect the ability of stockholders to sell their shares. Broker-dealers may consider these requirements to be too cumbersome and impact their willingness to make a market in our shares. Also, many prospective investors may not want to get involved with the additional administrative requirements, which may have a material adverse effect on the trading of our shares.

Future sales or the potential sale of a substantial number of shares of our common stock could cause our market value to decline.

As of the date of this prospectus, we have 204,980,000 shares of common stock outstanding, of which 57,930,000 shares, or approximately 28% of the total outstanding, are being offered by selling stockholders under this prospectus. The shares offered by selling stockholders will be freely tradable without restriction upon the effectiveness of our registration statement.

Of the remaining shares outstanding, 147,050,000 shares are considered restricted securities and may be sold only pursuant to a registration statement or the availability of an appropriate exemption from registration, such as Rule 144. Our stockholders may not avail themselves to Rule 144 until 90 after the effective date of the registration statement to which this prospectus relates. Sales of a substantial number of these restricted shares in the public markets, or the perception that these sales may occur, could cause the market price of our common stock to decline and materially impair our ability to raise capital through the sale of additional equity securities.

In the event we issue additional common stock in the future, current stockholders could suffer immediate and significant dilution, which could have a negative effect on the value of their shares.

We are authorized to issue 500 million shares of common stock, of which 295,020,000 shares are unissued. Our board of directors has broad discretion for future issuances of common stock, which may be issued for cash, property, services rendered or to be rendered, or for several other reasons. We also could possibly issue shares to make it more difficult or to discourage an attempt to obtain control of the company by means of a merger, tender offer, proxy contest, or otherwise. For example, if in the due exercise of its fiduciary obligations the board determines that a takeover proposal was not in the company's best interests, unissued shares could be issued by the board without stockholder approval. This might prevent, or render more difficult or costly, completion of an expected takeover transaction.

We do not presently contemplate additional issuances of common stock in the immediate future, except to raise addition capital, although we presently do not have an agreement or understanding to sell additional shares. Our board of directors has authority, without action or vote of our stockholders, to issue all or part of the authorized but unissued shares. Any future issuance of shares will dilute the percentage ownership of existing stockholders and likely dilute the book value of the common stock, which could cause the price of our shares to decline and investors in the shares to lose all or a portion of their investment.

The existence of warrants, options, debentures or other convertible securities would likely dilute holdings of current stockholders and new investors.

As of the date of this prospectus, there are no options, warrants or other rights outstanding to purchase our common stock. If management decides to issue convertible securities, such as funding instruments or incentive options to key employees, the existence of these convertibles may hinder future equity offerings. The exercise of outstanding options or convertible securities would further dilute the interests of all of our existing stockholders. Future resale of common shares issuable on the exercise of convertible securities may have an adverse effect on the prevailing market price of our common stock. Furthermore, holders of convertible securities may have the ability to exercise them at a time when we would otherwise be able to obtain additional equity capital on terms more favourable to us.

As an “emerging growth company,” we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an "emerging growth company," as defined in the JOBS Act. Accordingly, we are eligible to take advantage of certain exemptions from various reporting requirements applicable to other public companies that are not emerging growth companies. Additionally, Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. An emerging growth company can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected not to take advantage of the benefits of this extended transition period and, therefore, will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

As long as we are an emerging growth company, we cannot predict if investors will find our common stock less attractive because we may rely on exemptions provided by the JOBS Act. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

FORWARD-LOOKING INFORMATION

This prospectus contains certain forward-looking statements relating to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “will” “should," “expect," "intend," "plan," anticipate," "believe," "estimate," "predict," "potential," "continue," or similar terms, variations of such terms or the negative of such terms. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including those risks discussed in the “Risk Factors” section beginning on page 6. Although forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment, actual results could differ materially from those anticipated in such statements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

USE OF PROCEEDS

We will not receive any proceeds from the resale of shares offered by the selling stockholders hereby, all of which proceeds will be paid to the selling stockholders. We have agreed to bear the expenses relating to the registration of the shares for the selling security holders.

DETERMINATION OF OFFERING PRICES

Since our common stock is not listed or quoted on any exchange or quotation system, the offering price of the shares of common stock was determined by the price of the common stock that was sold to our security holders pursuant to an exemption under Section 4(2) of the Securities Act or Regulation D or Regulation S promulgated under the Securities Act.

The offering price of the shares of our common stock does not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria of value.

Although our common stock is not listed on a public exchange, we will be filing to obtain a quotation on the OTC Bulletin Board concurrently with the filing of this prospectus. In order to be quoted on the OTC Bulletin Board, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, which operates the OTC Bulletin Board, nor can there be any assurance that such an application for quotation will be approved.

In addition, there is no assurance that our common stock will trade at market prices in excess of the initial offering price as prices for the common stock in any public market which may develop will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity.

DILUTION

We are not offering or selling any of the shares of common stock in this offering. All of the offered shares are held by selling stockholders and, accordingly, no dilution will result from the sale of the shares.

MARKET FOR OUR COMMON STOCK

There is not currently, nor has there ever been, a public trading market for our common stock. As of the date hereof, there are approximately 69 stockholders of record of our common stock. We are requesting a broker/dealer to make an initial application to FINRA to have our shares quoted on the OTCBB. The application consists of current corporate information, financial statements and other documents as required by Rule 15c2-11 of the Exchange Act.

Inclusion on the OTCBB will permit price quotations for our shares to be published by that service, although we do not anticipate a public trading market in our shares in the immediate future. Except for the application to the OTCBB, we have no plans, proposals, arrangements or understandings with any person concerning the development of a trading market in any of our securities. There can be no assurance that our shares will be accepted for quotation and trading on the OTCBB or any other recognized trading market. Also, there can be no assurance that a public trading market will develop following acceptance by the OTCBB or at any other time in the future or, that if such a market does develop, that it can be sustained.

The ability of individual stockholders to trade their shares in a particular state may be subject to various rules and regulations of that state. A number of states require that an issuer's securities be registered in their state or appropriately exempted from registration before the securities are permitted to trade in that state. Presently, we have no plans to register our securities in any particular state.

Penny Stock Rule

It is unlikely that our securities will be listed on any national or regional exchange or The NASDAQ Stock Market in the foreseeable future. Therefore our shares most likely will be subject to the provisions of Section 15(g) and Rule 15g-9 of the Exchange Act, commonly referred to as the "penny stock" rule. Section 15(g) sets forth certain requirements for broker-dealer transactions in penny stocks and Rule 15g-9(d)(1) incorporates the definition of penny stock as that used in Rule 3a51-1 of the Exchange Act.

The SEC generally defines a penny stock to be any equity security that has a market price less than $5.00 per share, subject to certain exceptions. Rule 3a51-1 provides that any equity security is considered to be a penny stock unless that security is:

| ● | registered and traded on a national securities exchange meeting specified criteria set by the SEC; |

| | |

| ● | authorized for quotation on the NASDAQ Stock Market; |

| | |

| ● | issued by a registered investment company; |

| | |

| ● | excluded from the definition on the basis of price (at least $5.00 per share) or the issuer's net tangible assets; or |

| | |

| ● | exempted from the definition by the SEC. |

Broker-dealers who sell penny stocks to persons other than established customers and accredited investors, are subject to additional sales practice requirements. An accredited investor is generally defined as a person with assets in excess of $1,000,000, excluding their principal residence, or annual income exceeding $200,000, or $300,000 together with their spouse.

For transactions covered by these rules, broker-dealers must make a special suitability determination for the purchase of such securities and receive the purchaser's written consent to the transaction prior to the purchase. Additionally, the rules require the delivery, prior to the first transaction, of a risk disclosure document relating to the penny stock market. A broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements must be sent to clients disclosing recent price information for the penny stocks held in the account and information on the limited market in penny stocks. Consequently, these rules may restrict the ability of broker-dealers to trade and/or maintain a market in our common stock and may affect the ability of stockholders to sell their shares.

These requirements may be considered cumbersome by broker-dealers and impact the willingness of a particular broker-dealer to make a market in our shares, or they could affect the value at which our shares trade. Classification of the shares as penny stocks increases the risk of an investment in our shares.

Rule 144

A total of 147,050,000 shares of our common stock presently outstanding and not being registered for resale under this prospectus, are deemed to be “restricted securities” as defined by Rule 144 under the Securities Act of 1933 (the “Securities Act”). Rule 144 is the common means for a stockholder to resell restricted securities and for affiliates, to sell their securities, either restricted or non-restricted control shares. The SEC amended Rule 144, effective February 15, 2008.

Under the amended Rule 144, an affiliate of a company filing reports under the Exchange Act who has held their shares for more than six months, may sell in any three-month period an amount of shares that does not exceed the greater of:

| ● | the average weekly trading volume in the common stock, as reported through the automated quotation system of a registered securities association, during the four calendar weeks preceding such sale, or |

| | |

| ● | 1% of the shares then outstanding. |

Sales by affiliates under Rule 144 are also subject to certain requirements as to the manner of sale, filing appropriate notice and the availability of current public information about the issuer.

Rule 144 is not available to our stockholders for a period of 90 days after we become subject to the reporting requirements of the Exchange Act. The 90-day period will begin upon the effective date of the registration statement to which this prospectus relates. A non-affiliate stockholder of a reporting company who has held their shares for more than six months, may make unlimited resale under Rule 144, provided only that the issuer has available current public information about itself. After a one-year holding period, a non-affiliate may make unlimited sales with no other requirements or limitations.

We cannot predict the effect any future sales under Rule 144 may have on the market price of our common stock, if a market for our shares develops, but such sales may have a substantial depressing effect on such market price.

DIVIDEND POLICY

We have never declared cash dividends on our common stock, nor do we anticipate paying any dividends on our common stock in the future.

THE OFFERING – PLAN OF DISTRIBUTION

Commencing the date of this prospectus, selling stockholders identified herein may offer and sell up to 57,930,000 shares of our common stock. Selling stockholders will initially offer their shares at $0.10 per share until such time as the shares are approved for and quoted on the OTCBB. Thereafter, the shares will be offered at market prices, if a market develops, or at privately negotiated prices. There is currently no trading market or quoted price for our stock. The above offering price has been arbitrarily determined without any relation to factors such as a value determination, price earnings ratio, book value, or any other objective criteria.

Contemporaneously with the filing of the registration statement, to which this prospectus relates, we will request that a broker-dealer submit an application to have our shares quoted on the OTCBB. There can be no assurance that our shares will be accepted by the OTCBB, or that an active market for our shares will be established.

The term "selling stockholders" includes pledges, transferees or other successors-in-interest selling shares received from the selling stockholders as pledges, assignees, and borrowers or in connection with other non-sale-related transfers. This prospectus may also be used by transferees of selling stockholders, including broker-dealers or other transferees who borrow or purchase the shares to settle or close out short sales. Selling stockholders will act independently of the company in making decisions with respect to the timing, manner and size of each sale or non-sale related transfer. We will not receive any of the proceeds from sales by the selling stockholders.

At such time when our shares are approved for quotation on the OTCBB, we expect selling stockholders will sell their shares primarily through the over-the-counter at prevailing market prices. Selling stockholders may sell, from time-to-time in, one or more transactions at or on any stock exchange, market or trading facility on which the shares are traded, or in private transactions. Sales may be made at fixed or negotiated prices, and may be affected by means of one or more of the following transactions, which may involve cross or block transactions:

| ● | Ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| ● | block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction; |

| ● | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| ● | an exchange distribution in accordance with the rules of the applicable exchange; |

| ● | Privately negotiated transactions; |

| ● | settlement of short sales; |

| ● | transactions in which broker-dealers may agree with one or more selling stockholders to sell a specified number of such shares at a stipulated price per share; |

| ● | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; or |

● | a combination of any of the above or any other method permitted pursuant to applicable law. |

Selling stockholders may also sell shares under existing exemptions under the Securities Act, such as Rule 144 if available, rather than under this prospectus. Each selling stockholder has the sole discretion to not accept any purchase offer or make any sale if they deem the purchase price to be unsatisfactory at a particular time. To the extent required, this prospectus may be amended and supplemented from time to time to describe a specific plan of distribution.

Broker-dealers engaged by selling stockholders may arrange for other broker-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholders or, if any broker-dealer acts as agent for the purchase of shares, from the purchaser in amounts to be negotiated. Selling stockholders do not expect these commissions and discounts to exceed what is customary in the types of transactions involved.

In connection with sales of common stock or interests therein, selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales in the course of hedging the positions they assume. Selling stockholders may engage in short sales, puts and calls or other transactions in our shares or derivatives of our securities, and may sell and deliver shares in connection with these transactions.

Selling stockholders and broker-dealers or agents involved in an arrangement to sell any of the offered shares may, under certain circumstances, will be deemed an "underwriter" within the meaning of the Securities Act. Any profit on such sales and any discount, commission, concession or other compensation received by any such underwriter, broker-dealer or agent, may be deemed an underwriting discount and commission under the Exchange Act. No selling stockholder has informed us that they have an agreement or understanding, directly or indirectly, with any person to distribute the common stock. If a selling stockholder notifies us that they have a material arrangement with a broker-dealer for the resale of their shares, we will be required to amend the registration statement, of which this prospectus is a part, and file a prospectus supplement to describe such arrangement.

We have agreed to pay all fees and expenses related to the registration of the common stock, including SEC filing fees. Each selling stockholder will be responsible for all costs and expenses in connection with the sale of their shares, including brokerage commissions or dealer discounts. We will indemnify selling stockholders against certain losses, claims, damages and liabilities, including certain liabilities under the Securities Act.

Common shares sold pursuant to this prospectus will be considered freely tradable in the hands of persons acquiring the shares, other than our affiliates.

Selling stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, which provisions may limit the timing of purchases and sales of our common stock by them. The foregoing may affect the marketability of such securities. To comply with the securities laws of certain jurisdictions, if applicable, the common stock will be offered or sold in such jurisdictions only through registered or licensed brokers or dealers.

Selling stockholders and others participating in the sale or distribution of the shares offered hereby, are subject to Regulation M of the Exchange Act. With certain exceptions, Regulation M restricts certain activities of, and limits the timing of purchases and sales of shares by, selling stockholders, affiliated purchasers and any broker-dealer or other person participating in the sale or distribution. Under Regulation M, these persons are precluded from bidding for or purchasing, or attempting to induce any person to bid for or purchase, any security subject to the distribution until the distribution is complete. Regulation M also prohibits any bids or purchases made in order to stabilize the price of a security in connection with the distribution of that security. All of these limitations may affect the marketability of the shares offered by this prospectus.

No selling stockholder is a broker-dealer or an affiliate of a broker-dealer.

SELLING STOCKHOLDERS

We are registering the common stock offered for resale pursuant to this prospectus in order to afford stockholders the opportunity to sell their shares in a public transaction. Selling stockholders are offering up to 57,930,000 shares of our common stock. The following table provides information regarding the beneficial ownership of our common stock being offered by selling stockholders. Each selling stockholder’s percentage of ownership depicted below is based on 204,980,000 shares outstanding as of the date of this prospectus. The table includes the number of shares owned beneficially by each selling stockholder, the number of shares that may be offered for resale and the number of shares to be owned beneficially by each selling stockholder after the offering. The table has been prepared on the assumption that all the shares of common stock offered hereby will be sold.

None of the selling stockholders is presently, or has been for the past three years, an affiliate of GEO Tech whether as an officer, director, promoter or principal stockholders. The majority of selling stockholder, except as individually referenced below, acquired their shares for $0.10 per share cash between October 10, 2012 and January 31, 2013 pursuant to the private placement of 12,980,000 shares of common stock. The remaining stockholders acquired their shares individually directly from the company in private transaction at the price and per the terms indicated in the table.

In computing the number of shares beneficially owned by a selling stockholder and the percentage ownership of that selling stockholder, we have included all shares of common stock owned or beneficially owned by that selling stockholder. Each selling stockholder may offer shares for sale, from time-to-time, in whole or in part. Except where otherwise noted, each selling stockholder named below has, to the best of our knowledge, sole voting and investment power with respect to the shares beneficially owned by them.

Any or all of the securities listed below may be retained by any of the selling stockholders and, therefore, no accurate forecast can be made as to the number of securities that will be held by the selling stockholders upon termination of this offering. The selling stockholders are not making any representation that any shares covered by this prospectus will be offered for sale.

Beneficial Ownership Name | Date Acquired | Price/Share | Shares Acquired | Amount of Consideration | Number of Shares Owned and Registered | Number of Shares Owned After Offering | Percentage After Offering |

| Roman Avzski | 5/18/2013(2) | $ 0.0105 | 3,000,000 | $ 31,500 | 3,000,000 | 0 | 0.0000 % |

| Janet Banea | 1/31/2013(1) | 0.10 | 100,000 | 10,000 | 100,000 | 0 | 0.0000 |

| Que Bo | 1/31/2013(1) | 0.10 | 460,000 | 46,000 | 460,000 | 0 | 0.0000 |

| Jonathan Brennan | 6/30/2013(3) | 0.10 | 500,000 | 50,000 | 500,000 | 0 | 0.0000 |

| Danny Chen | 1/31/2013(1) | 0.10 | 200,000 | 20,000 | 200,000 | 0 | 0.0000 |

| Anita Cheung | 1/31/2013(1) 5/18/2013(2) | 0.10 0.0105 | 500,000 1,700,000 | 50,000 17,850 | 2,200,000 | 0 | 0.0000 |

| Bill Cheung | 1/31/2013(1) | 0.10 | 400,000 | 40,000 | 400,000 | 0 | 0.0000 |

| Tat Lim Cheung | 1/31/2013(1) | 0.10 | 500,000 | 50,000 | 500,000 | 0 | 0.0000 |

| Patrick Chew | 1/31/2013(1) | 0.10 | 200,000 | 20,000 | 200,000 | 0 | 0.0000 |

| Henry Chong | 1/31/2013(1) | 0.10 | 100,000 | 10,000 | 100,000 | 0 | 0.0000 |

| Lan Dan | 1/31/2013(1) | 0.10 | 300,000 | 30,000 | 300,000 | 0 | 0.0000 |

| David Eng | 6/30/2013(3) | 0.10 | 500,000 | 50,000 | 500,000 | 0 | 0.0000 |

| Khristine K. Espinoza | 1/31/2013(1) | 0.10 | 200,000 | 20,000 | 200,000 | 0 | 0.0000 |

| Samin Fnu | 1/31/2013(1) | 0.10 | 500,000 | 50,000 | 500,000 | 0 | 0.0000 |

| Elie Adam Goldenberg | 1/31/2013(1) | 0.10 | 100,000 | 10,000 | 100,000 | 0 | 0.0000 |

| Joseph Greco, Jr. | 5/7/2010(4) | 0.05 | 1,000,000 | 50,000 | 1,000,000 | 1,500,000 | 0.073 |

| | 5/18/2013(2) | 0.0105 | 1,500,000 | 15,750 | | | |

| Joseph Greco, Sr. | 5/7/2010(4) | 0.05 | 1,000,000 | 50,000 | 1,000,000 | 1,500,000 | 0.073 |

| | 5/18/2013(2) | 0.0105 | 1,500,000 | 15,750 | | | |

| Wei Jun Guan | 1/31/2013(1) | 0.10 | 500,000 | 50,000 | 500,000 | 0 | 0.0000 |

| Bao Ling Huang | 1/31/2013(1) | 0.10 | 200,000 | 20,000 | 200,000 | 0 | 0.0000 |

| Qing Huang | 1/31/2013(1) | 0.10 | 100,000 | 10,000 | 100,000 | 0 | 0.0000 |

| Yin Huang | 1/31/2013(1) | 0.10 | 500,000 | 50,000 | 500,000 | 0 | 0.0000 |

| Yu Lian Huang | 1/31/2013(1) | 0.1 | 500,000 | 50,000 | 500,000 | 0 | 0.0000 |

| Richard Le | 1/31/2013(1) | 0.10 | 200,000 | 20,000 | 200,000 | 0 | 0.0000 |

| Sylvia Cheung Lee | 1/31/2013(1) | 0.10 | 200,000 | 20,000 | 200,000 | 0 | 0.0000 |

| Ting F. Li | 2/8/2011(4) | 0.10 | 7,000,000 | 700,000 | 7,000,000 | 0 | 0.0000 |

| Ling Cong Li | 2/8/2011(4) | 0.10 | 3,000,000 | 300,000 | 3,000,000 | 0 | 0.0000 |

| Wan Hong Li | 1/31/2013(1) | 0.10 | 500,000 | 50,000 | 500,000 | 0 | 0.0000 |

| Yong Liao | 1/31/2013(1) | 0.10 | 500,000 | 50,000 | 500,000 | 0 | 0.0000 |

| Xiang Liao | 1/31/2013(1) | 0.10 | 500,000 | 50,000 | 500,000 | 0 | 0.0000 |

| Jui An Lin | 1/31/2013(1) | 0.10 | 100,000 | 10,000 | 100,000 | 0 | 0.0000 |

| Zhi Min Liu | 1/31/2013(1) | 0.10 | 100,000 | 10,000 | 100,000 | 0 | 0.0000 |

| Chalermchai Losirisup | 1/31/2013(1) | 0.10 | 500,000 | 50,000 | 500,000 | 0 | 0.0000 |

| Ricky Lu | 1/31/2013(1) | 0.10 | 400,000 | 40,000 | 400,000 | 0 | 0.0000 |

| Wen Huo Lu | 2/28/2011(4) | 0.065 | 1,000,000 | 65,000 | 1,000,000 | 0 | 0.0000 |

| Kwon Wing Ng | 1/31/2013(1) | 0.10 | 200,000 | 20,000 | 200,000 | 0 | 0.0000 |

| Nancy Shui Yin Ng | 1/31/2013(1) | 0.10 | 100,000 | 10,000 | 100,000 | 0 | 0.0000 |

| Patrick Ng | 8/27/2010(4) | 0.07 | 10,000,000 | 700,000 | 10,000,000 | 0 | 0.0000 |

| Peter Ng | 1/31/2013(1) | 0.10 | 500,000 | 50,000 | 500,000 | 0 | 0.0000 |

| Vy Nguyen | 6/30/2013(3) | 0.10 | 300,000 | 30,000 | 300,000 | 0 | 0.0000 |

| Michael Palescandolo | 6/30/2013(3) | 0.10 | 500,000 | 50,000 | 500,000 | 0 | 0.0000 |

| Zhenrong Situ | 1/31/2013(1) | 0.10 | 100,000 | 10,000 | 100,000 | 0 | 0.0000 |

| Elliot Tebele | 1/31/2013(1) | 0.10 | 100,000 | 10,000 | 100,000 | 0 | 0.0000 |

| Robert Thomas | 6/30/2013(3) | 0.10 | 500,000 | 50,000 | 500,000 | 0 | 0.0000 |

| Kan Nam Tong | 1/31/2013(1) | 0.10 | 100,000 | 10,000 | 100,000 | 0 | 0.0000 |