UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant ☐ Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted byRule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Pursuant to§240.14a-12 |

BRISTOW GROUP INC.

(Name of Registrant as Specified In Its Charter)

GLOBAL VALUE INVESTMENT CORP.

STEN L. GUSTAFSON

JONATHAN A. MERETSKY

ANTHONY J. GRAY

JEFFREY R. GEYGAN

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules14a-6(i)(4) and0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange ActRule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange ActRule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | |

| | | | |

| | (3) | | Filing Party: |

| | |

| | | | |

| | (4) | | Date Filed: |

| | |

| | | | |

Bristow Group Inc. (NYSE: BRS) Investor’s Case for Change Published May 7, 2019 The following is a presentation released by Global Value Investment Corp.:

Disclosures Global Value Investment Corp. (“GVIC”) is a registered investment adviser and does not provide investment banking services. GVIC does not receive fees or other compensation (including “in kind” compensation) in connection with preparing and distributing this presentation. The opinions reflect the judgement of GVIC as of the report date and are subject to change without notice. The material, information and facts contained in this presentation were based solely on publicly available information about the featured company and were obtained from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This presentation is for informational purposes only and should not be used as a complete analysis of any company, industry or security discussed within the report. This report does not constitute an offer or solicitation to buy or sell any security. Employees of GVIC may have positions in any security referenced in this presentation. An investment in any security referenced in this report may involve risks and uncertainties that could cause actual results to differ from the analysis provided herein, which may not be suitable for all investors. Past performance should not be taken as an indication or guarantee of future results. Additional information is available upon request. Certain statements contained in this presentation may constitute “forward-looking statements.” Shareholders should be aware that these forward looking statements are subject to a number of risks and uncertainties, many of which are beyond GVIC’s control. Except as required by law, GVIC undertakes no obligation to update or revise any forward-looking statements. Copyright 2019. All rights reserved.

GVIC, Sten Gustafson, Jonathan Meretsky, Anthony Gray, Jeffrey Geygan and James Geygan are participants in the solicitation of proxies from shareholders of Bristow Group Inc. (“Bristow”) in connection with Bristow's 2019 Annual Meeting of Shareholders (the “Annual Meeting”). GVIC intends to file a proxy statement (the “Proxy Statement”) with the Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies for the Annual Meeting. GVIC is the beneficial owner of 245,940 shares of Bristow’s common stock. Messrs. Jeffrey Geygan and James Geygan, by virtue of their position as President and Chief Executive Officer and as Vice President, respectively, of GVIC may each be deemed to be the beneficial owner of the shares of Bristow common stock beneficially owned by GVIC. In their respective personal capacities, Mr. Jeffrey Geygan owns 14,910 of these shares and Mr. James Geygan owns 2,295 of these shares. Mr. Meretsky is the beneficial owner of 73,275 shares of Bristow’s common stock, and Messrs. Gray and Gustafson do not own any shares. Additional information regarding such participants, including any other direct or indirect interests, by security holdings or otherwise, will be included in the Proxy Statement and other relevant documents to be filed by GVIC with the SEC in connection with the Annual Meeting. Promptly after filing its definitive Proxy Statement with the SEC, GVIC will mail its definitive Proxy Statement and a WHITE proxy card to each shareholder entitled to vote at the Annual Meeting. SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT GVIC WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders may obtain, free of charge, the Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by GVIC with the SEC in connection with the Annual Meeting at the SEC’s website (http://www.sec.gov). Copies of GVIC’s definitive Proxy Statement, any amendments or supplements thereto and any other relevant documents filed by GVIC with the SEC in connection with the Annual Meeting will also be available, free of charge, by contacting GVIC’s proxy solicitor, InvestorCom, at 19 Old Kings Highway S., Suite 210, Darien, CT 06820, or by phone at (203) 972-9300. Additional Information and Where to Find It

Introduction Bristow Group Inc. (“Bristow” or the “Company”) is a preeminent provider of industrial aviation services, operating a fleet of aircraft around the world. Bristow provides its services primarily to the offshore oil and gas industry and public or private entities requiring helicopter search and rescue services. Bristow’s reputation as a safe and established provider of these services is well-established. However, Bristow’s reaction to the recent decline in oil prices, which resulted in dramatically reduced spending on services by its core oil and gas customer base, has been utterly insufficient. Diversification efforts, cost cutting, and asset rationalization have fallen far short of what is needed to ensure Bristow’s financial and operational health. As such, shareholders, bond holders, customers, vendors, and employees have suffered. GVIC attributes Bristow’s inadequate adaptation to entrenched management and a Board of Directors lacking the knowledge, ability, and resolve to guide the Company through this difficult period. New directors with fresh perspectives are needed to unlock the real value that underlies Bristow.

History of Financial Decline The dramatic decline in Bristow’s fundamental financial position is evident: Income Statement From March 31, 2015 to December 31, 2018: TTM revenue declined from $1,858.67 million to $1,408.32 million (-24.2%) TTM operating income declined from $190.87 million to -$41.91 million (-122.0%) TTM adjusted EBITDA declined from $474.97 million to $23.64 million (-95.0%) Balance Sheet From March 31, 2015 to September 30, 2018: Total debt increased from $864.42 million to $1,449.71 million (+67.7%) Shareholders’ equity declined from $1,611.56 million to $968.12 million (-39.9%)

History of Financial Decline Operational Metrics From March 31, 2015 to December 31, 2018: Helicopter fleet size as measured by large aircraft equivalent (LACE, a capacity-weighted measurement), remained unchanged at 167, with only minor interim fluctuations. TTM operating expenses decreased only modestly, from $1,667.80 million on March 31, 2015 to $1,450.23 million on December 31, 2018 (-13.0%). Bristow’s two fixed-wing airlines are both projected to be unprofitable on an adjusted EBITDA basis in fiscal year 2019 (which ended on March 31, 2019). Since mid-2016, Bristow’s owned fleet of 16 model H225 helicopters has not operated commercially, following the fatal crash of another company’s helicopter of the same model. There has been no known effort to divest this fleet.

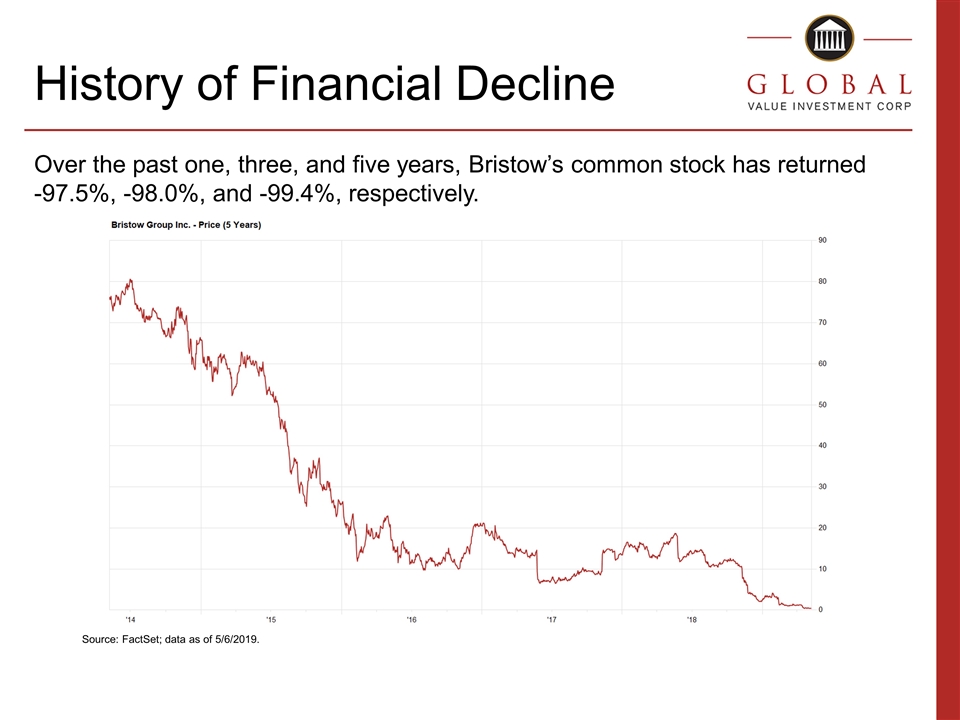

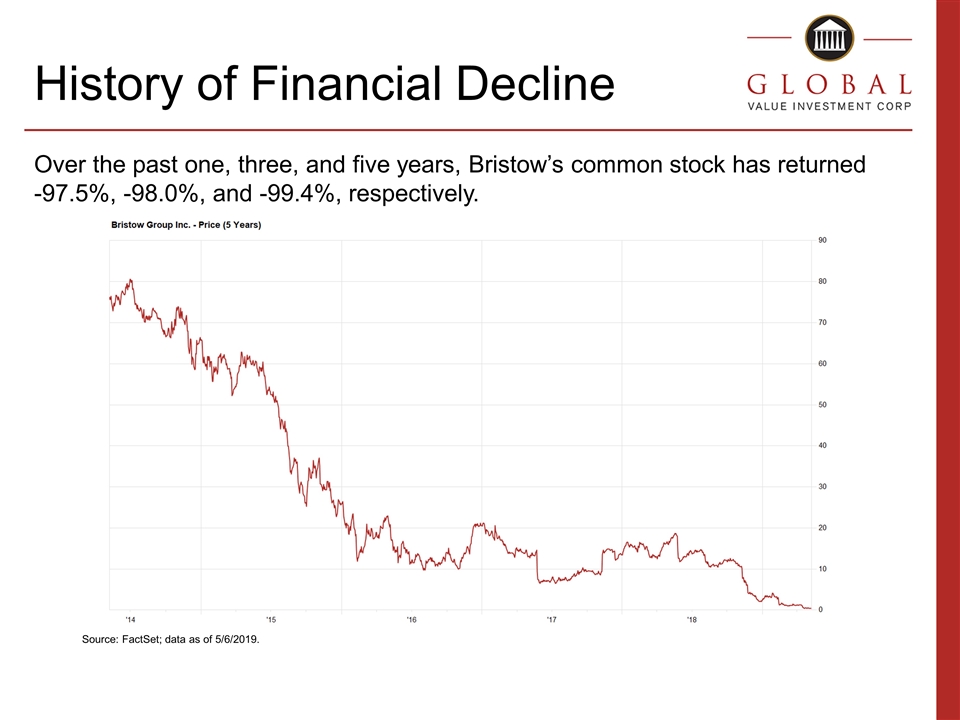

History of Financial Decline Over the past one, three, and five years, Bristow’s common stock has returned -97.5%, -98.0%, and -99.4%, respectively. Source: FactSet; data as of 5/6/2019.

Operational Blunders Bristow’s management and Board of Directors have been unable to implement necessary operational improvements when faced with market headwinds. Rather than undertake the difficult and diligent work necessary to improve Bristow’s business and balance sheet, on November 9, 2018, Bristow’s board approved a self-described “transformational” acquisition of Columbia Helicopters, Inc. for $560 million, financed with: $360 million bridge loan at LIBOR + 8.0% $135 million convertible note (convertible into approximately 26.2 million newly issued shares of common stock) An additional 7.1 million shares of common stock The Columbia acquisition ultimately would have diluted existing Bristow shareholders by approximately 93%. On February 11, 2019, the transaction was terminated, resulting in Bristow paying a $20 million termination fee to Columbia.

Operational Blunders At the same time that the Columbia acquisition was terminated, Bristow announced that it would be unable to file its Form 10-Q for the quarter ended December 31, 2018 in a timely manner and identified a material weakness in internal controls over financial reporting. This Form 10-Q been repeatedly delayed since then, leading to an increasing lack of transparency regarding Bristow’s financial position and implying a worst-case scenario may be possible. The cascading failure of financial reporting was created by those entrusted to attentively manage Bristow’s assets, which ultimately belong to shareholders. Despite these announcements, on March 1, 2019, Bristow’s board promoted CFO L. Don Miller to the position of CEO, filling a vacancy created by the departure of former CEO Jonathan Baliff. The hasty promotion of a senior executive who was intimately involved in Bristow’s failed financial undertakings is a testament to the poor business judgement and sense of timing demonstrated by Bristow’s directors.

Operational Blunders Bristow has delayed the filing of its Form 10-Q for the period ending December 31, 2018 four times, forcing negotiation with creditors and retention of legal and financial advisors. On April 15, 2019, Bristow delayed a scheduled $12.5 million interest payment on its 6.25% Senior Unsecured Notes due 2022. Concurrently, management suggested in a filing with the Securities and Exchange Commission that the Bristow may be considering Chapter 11 reorganization, despite reporting $202.1 million in liquidity as of April 12, 2019. Even though high leverage is purported to be at the center of Bristow’s issues and the impetus for consideration of Chapter 11 restructuring, management and the Board of Directors have made no apparent effort to divest certain idle assets, unprofitable operations, or explore the outright sale of the Company. In this period of heightened uncertainty, Bristow’s communication to shareholders has been entirely inadequate.

Weak Board of Directors Over the past year, the Board of Directors has: Promoted CFO Don Miller to CEO, despite grave issues in Bristow’s financial reporting, a debt burden that increased more than 50% during Miller’s tenure as CFO, and the failed acquisition of Columbia Helicopters, Inc. Failed to sell idle or unprofitable assets or meaningfully rationalize Bristow’s operations, while squandering liquidity. Ceased transparent communication with shareholders, while hiring expensive legal and financial advisors at shareholders’ expense. Continued to ineptly navigate evolving market conditions, evidenced by the deterioration of Bristow’s fundamental financial condition. Seemingly ignored offers of capital or operational turnaround plans presented by stakeholders. GVIC believes that it speaks for the preponderance of shareholders in saying that the Board of Directors has grossly failed to develop and implement an acceptable strategy for Bristow.

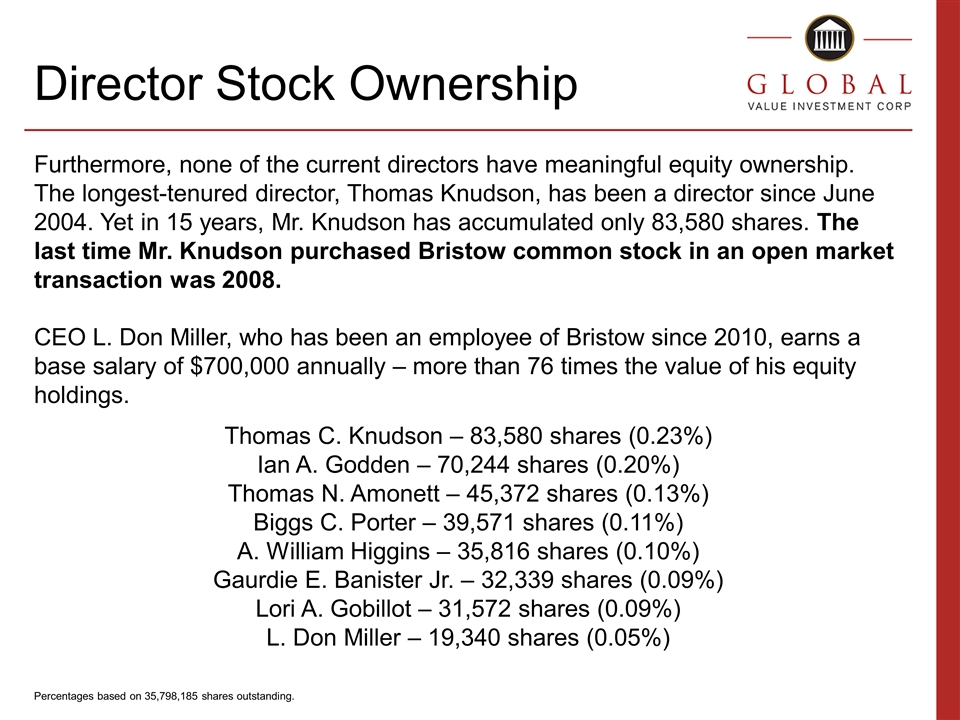

Director Stock Ownership Furthermore, none of the current directors have meaningful equity ownership. The longest-tenured director, Thomas Knudson, has been a director since June 2004. Yet in 15 years, Mr. Knudson has accumulated only 83,580 shares. The last time Mr. Knudson purchased Bristow common stock in an open market transaction was 2008. CEO L. Don Miller, who has been an employee of Bristow since 2010, earns a base salary of $700,000 annually – more than 76 times the value of his equity holdings. Thomas C. Knudson – 83,580 shares (0.23%) Ian A. Godden – 70,244 shares (0.20%) Thomas N. Amonett – 45,372 shares (0.13%) Biggs C. Porter – 39,571 shares (0.11%) A. William Higgins – 35,816 shares (0.10%) Gaurdie E. Banister Jr. – 32,339 shares (0.09%) Lori A. Gobillot – 31,572 shares (0.09%) L. Don Miller – 19,340 shares (0.05%) Percentages based on 35,798,185 shares outstanding.

Chapter 11 Unnecessary GVIC believes any Chapter 11 reorganization proceeding at Bristow is avoidable and ill-advised. With $202.1 million in liquidity as of April 12, 2019, Bristow has sufficient liquidity to service its debt and operate its business in the short- and medium-term. Bristow’s recent retention of legal and financial advisors at extraordinary expense threatens its liquidity, while obvious alternatives exist. Rather than a value-destructive Chapter 11 process, Bristow should: Focus in growing revenue on its core markets and cutting costs, leading to meaningful EBITDA growth Sell idle, unprofitable, and/or non-core assets, using the proceeds to retire debt. Through these measures, Bristow’s leverage profile improves significantly while preserving the Company’s competitiveness in its core markets. To reiterate: seeking reorganization under Chapter 11 is the wrong strategy.

Management Changes The first and most urgent change proposed by GVIC is that of senior management. GVIC does not believe that Don Miller has the expertise or disposition to effectively lead Bristow. GVIC has identified specific individuals with extensive experience in industrial aviation, oil and gas services, offshore oil and gas operations, helicopter aviation, and turnaround situations who are willing and able to immediately assume key management positions, including that of CEO. Since former CEO Jonathan Baliff was appointed CEO in mid-2014, GVIC believes that more than 40 senior managers left Bristow, either voluntarily or involuntarily. This is a testament to Mr. Baliff’s poor strategic vision, enabled by a weak board of directors. In conjunction with industry experts, GVIC has communicated with several former senior Bristow managers, many of whom are prepared to assume management positions and assist in Bristow’s turnaround.

Revenue Growth While Bristow’s revenue has suffered through the downturn in offshore oil and gas from which the market is now emerging, commercial efforts have been lacking. Bristow’s ability to provide the high level of service expected by its offshore oil and gas customers depends on mutually beneficial relationships. In conjunction with industry experts, GVIC believes that $100 million of revenue growth can be achieved within 12 to 24 months by fostering deeper relationships with existing or former customers. For example, GVIC believes that Cougar Helicopters Inc., a Canadian offshore helicopter operator in which Bristow owns a 40% economic interest, could readily absorb additional capacity. Longer-term, it is imperative that Bristow diversify its source of revenue while remaining within its area of expertise – industrial helicopter aviation. GVIC has identified numerous opportunities to expand into additional markets, either organically or through joint ventures, and is prepared to introduce Bristow to potential partners.

Cost Cutting GVIC has identified between $100 million and $150 million in annualized cost savings. These changes can be implemented in six to 12 months. GVIC and others strongly believe that lessors and OEMs are prepared to negotiate with Bristow on the cost and terms of its leases and service agreements in an effort to ensure Bristow remains a financially healthy counterparty. Cost savings from lease renegotiations and OEM agreements alone are estimated to approach $40 million annually, before accounting for possible changes in projected capital spending. General and administrative expenses represent and area ripe for cost cutting. This includes trimming executive and director compensation and professional fees (including those of the financial and legal advisors retained by Bristow). GVIC estimates that $40 million in annual costs can be removed. Finally, GVIC believes that direct labor costs can be reduced by approximately $40 million annually. A portion of labor cost savings will stem from the rationalization of operations and assets.

Fleet Optimization By optimizing Bristow’s fleet of helicopters, maintenance and operating costs can be reduced meaningfully. As leases expire, leased capacity should be replaced with owned capacity. GVIC expects the returning leased aircraft can result in a dramatic reduction in lease costs within 24 months, absent renegotiated lease rates and terms. With a smaller and more concentrated fleet of aircraft, OEM maintenance support, training, and labor costs can be reduced. Compliance with lease or credit facility covenants concerning assets should be simplified as well.

Asset Rationalization GVIC believes there is significant book value and fair market value in Bristow’s assets. As part of a turnaround, each business segment should be evaluated on an individual basis for profitability and operational sensibility. In order to facilitate strengthening of the balance sheet and decreasing Bristow’s overall leverage, GVIC believes the following business segments should be reviewed for sale: Eastern Airways – Bristow first invested in Eastern Airways in 2014. The business has consistently become less profitable, and in 2019 is projected to be EBITDA-negative. In the hands of an operator familiar with and able to run a scheduled fixed-wing airline business, Eastern Airways has significant value. GVIC estimates proceeds from its sale of up to $160 million. Capiteq Limited (operating as Airnorth) – Bristow first invested in Airnorth in 2015. The business has consistently become less profitable, and in 2019 is projected to be EBITDA-negative. In the hands of an operator familiar with and able to run a scheduled fixed-wing airline business, Airnorth has significant value. GVIC estimates proceeds from its sale of up to $70 million.

Asset Rationalization H225 Fleet – Since April 2016, Bristow has not operated its fleet of 16 owned H225 helicopters for commercial purposes. While the aircraft is unlikely to be used in offshore oil and gas operations, demand exists for utility and military variants of the H225. GVIC believes this fleet can be sold for between $90 million and $140 million, and has spoken with several interested potential buyers. GVIC is aware of at least one offer to purchase H225 airframes or inventory that was disregarded by Bristow. Líder – Bristow’s unconsolidated investments, including the Company’s investment in Líder, should be evaluated for sale. GVIC is aware of an interested buyer for Líder; GVIC believes this equity investment can be sold at or above book value, or approximately $50 million. Geographic Operations – While Bristow’s global footprint makes it unique amongst its peer companies, certain geographies are exceptionally competitive, and Bristow has not achieved the necessary scale to be acceptably profitable. In select geographies, Bristow should consider selling its operations to direct competitors.

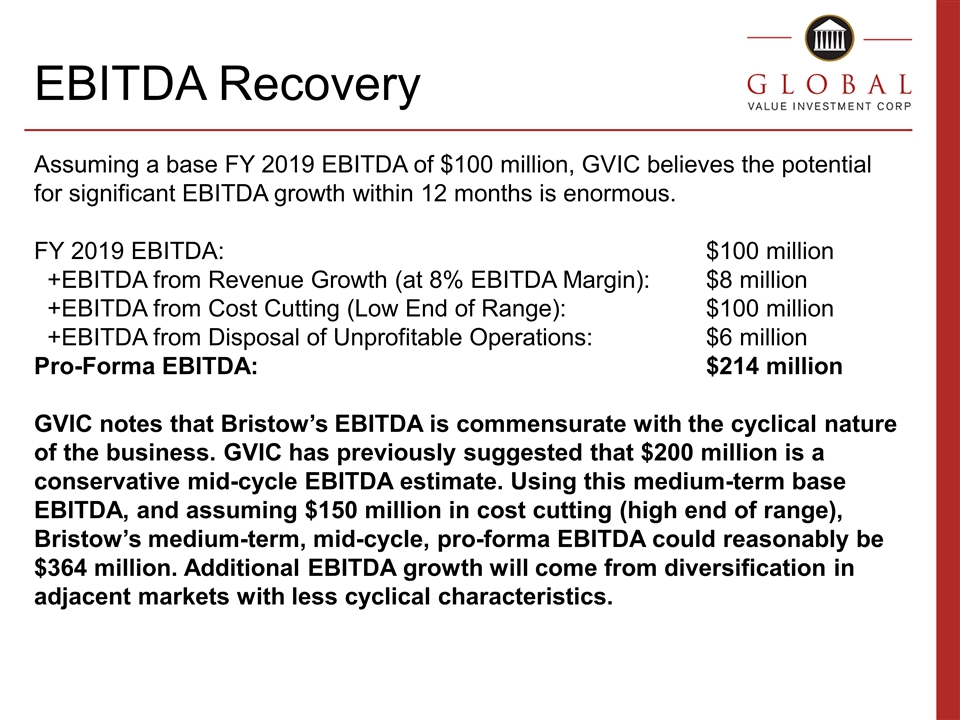

EBITDA Recovery Assuming a base FY 2019 EBITDA of $100 million, GVIC believes the potential for significant EBITDA growth within 12 months is enormous. FY 2019 EBITDA:$100 million +EBITDA from Revenue Growth (at 8% EBITDA Margin):$8 million +EBITDA from Cost Cutting (Low End of Range):$100 million +EBITDA from Disposal of Unprofitable Operations:$6 million Pro-Forma EBITDA:$214 million GVIC notes that Bristow’s EBITDA is commensurate with the cyclical nature of the business. GVIC has previously suggested that $200 million is a conservative mid-cycle EBITDA estimate. Using this medium-term base EBITDA, and assuming $150 million in cost cutting (high end of range), Bristow’s medium-term, mid-cycle, pro-forma EBITDA could reasonably be $364 million. Additional EBITDA growth will come from diversification in adjacent markets with less cyclical characteristics.

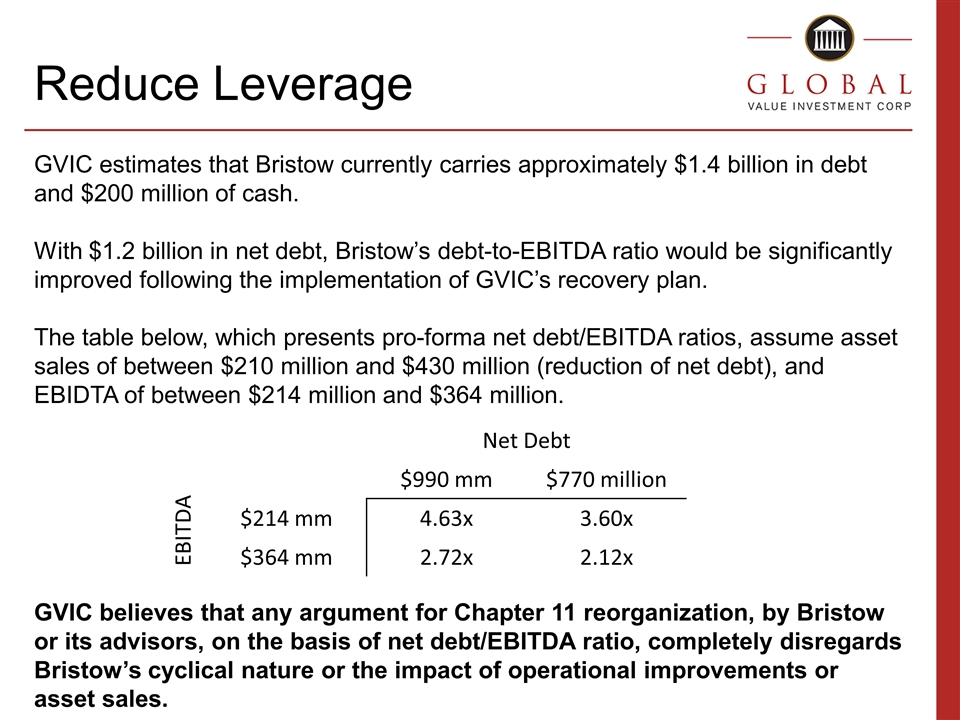

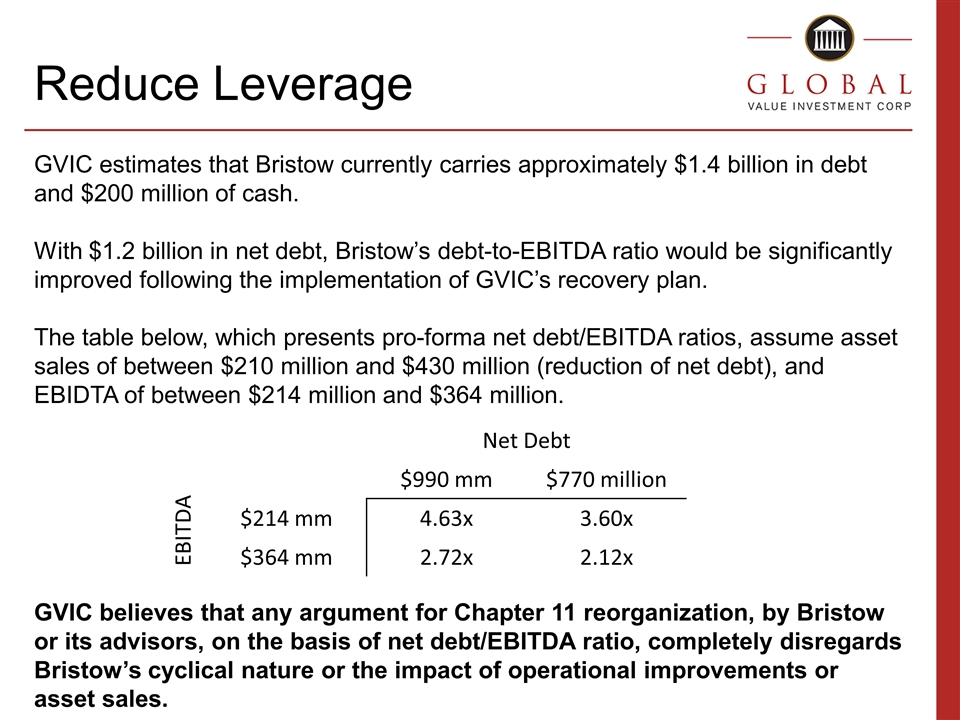

Reduce Leverage GVIC estimates that Bristow currently carries approximately $1.4 billion in debt and $200 million of cash. With $1.2 billion in net debt, Bristow’s debt-to-EBITDA ratio would be significantly improved following the implementation of GVIC’s recovery plan. The table below, which presents pro-forma net debt/EBITDA ratios, assume asset sales of between $210 million and $430 million (reduction of net debt), and EBIDTA of between $214 million and $364 million. GVIC believes that any argument for Chapter 11 reorganization, by Bristow or its advisors, on the basis of net debt/EBITDA ratio, completely disregards Bristow’s cyclical nature or the impact of operational improvements or asset sales. Net Debt EBITDA $990 mm $770 million $214 mm 4.63x 3.60x $364 mm 2.72x 2.12x

Additional Capital Available GVIC has identified several sources of capital available for the purposes of adding liquidity or replacing existing indebtedness. However, as previously noted, GVIC believes that Bristow currently has sufficient liquidity to service its contractual debt obligations and operate its business. Under the indenture for the 8.75% Senior Secured Notes due 2023, Bristow has the ability to redeem 100% of the notes outstanding at par plus an applicable premium. GVIC believes these notes can be retired for $380 million or less.

Diversification Approximately 67% of Bristow’s operating revenue is attributable to its oil and gas operations, 16% attributable to U.K. search and rescue operations, and 17% attributable to fixed wing operations. GVIC believes that diversification into adjacent rotor-wing aviation operations must occur to ensure long-term viability of the overall business. Such diversification must be undertaken on sensible terms, with careful consideration given to absolute leverage, leverage ratios under a range of operating assumptions, and the interests of existing equity owners. GVIC is prepared to introduce several potential partners to Bristow to further diversification efforts.

Industry Consolidation GVIC believes that Bristow’s industry is ripe for consolidation, and Bristow is well-positioned to be an important player in this process. A limited number of transactions can result in meaningful industry consolidation, both in specific geographies and across the globe. Meaningful synergies can be achieved by combining similar fleets in overlapping geographic areas. Long-term, Bristow must consider consolidation through the sale or purchase of operations in specific geographies, cooperation agreements, or joint ventures.

Outright Sale GVIC believes there are several public and private entities that would have an interest in acquiring Bristow’s entire enterprise. It would be imprudent for Bristow to enter Chapter 11 reorganization proceedings before these options are thoroughly explored, and a report made to shareholders on the results of the contemplation of an outright sale.

Equity Value GVIC believes there is substantial equity value in Bristow, and for that reason, any attempt to enter Chapter 11 reorganization proceedings would destroy equity value and constitute a breach of fiduciary duty. As of September 30, 2019, Bristow’s book value per share was approximately $27.00 and Bristow’s tangible book value per share was approximately $26.50. In its November 9, 2019 presentation, Bristow stated the net asset fair market value per share was $21.86. GVIC’s pro-forma EBITDA estimates of $214 million to $364 million and pro-forma net debt estimates of $770 million to $990 million imply value per share of between $8.20 and $39.50 using a conservative 6.0x EV/EBITDA multiple. Chapter 11 proceedings would almost certainly render equity worthless.

Turnaround Summary GVIC expects that the existing Board of Directors to fully explore all options, including GVIC’s turnaround plan, before electing to commence Chapter 11 reorganization proceedings. GVIC welcomes engagement from Bristow, equity owners, debt holders, vendors, lessors, and other stakeholders and interested parties.

GVIC’s Nominees In an open letter dated April 18, 2019, GVIC called for the resignation of directors Thomas C. Knudson, Thomas N. Amonett, Lori A. Gobillot, and Biggs C. Porter. On April 24, 2019, GVIC nominated four highly qualified directors: Sten Gustafson, Jonathan Meretsky, Anthony Gray, and Jeffrey Geygan. New directors with fresh perspectives are needed at Bristow.

GVIC’s Nominees Sten Gustafson Sten Gustafson has nearly 25 years of experience in the global energy sector. Mr. Gustafson’s began his career as an attorney in 1990, holding positions at the international law firms of Cleary, Gottlieb, Steen & Hamilton and Baker Botts L.L.P. He continued his career in investment banking, ultimately rising to serve as the Managing Director and Head of the Energy Group, Americas at Deutsche Bank from 2009 to 2012. From 2012 to 2014, Mr. Gustafson served as Chief Executive Officer and Director of Era Group Inc., where he generated record quarterly revenues every quarter during his tenure while meaningfully de-leveraging the balance sheet. From 2017 to 2019, Mr. Gustafson served as a director at CHC Helicopter. Since 2018, he has served as Chairman of the Board of Directors of Golden Energy Offshore, a fully integrated shipowner and operator of offshore service vessels for the global oil and gas service industry. Mr. Gustafson is also the founder of Parliament Energy Capital LLC, a provider of oilfield equipment lease financing. Mr. Gustafson graduated from Rice University and earned a Juris Doctor from the University of Houston Law Center.

GVIC’s Nominees Jonathan Meretsky Jonathan Meretsky is a lawyer by education with significant complex international finance practice experience. He has been in the role of Managing Director at Merit House since 2009, one of Atlantic Canada's most respected private investment and finance houses. After graduation from Harvard Law School, he started his career at such firms as LeBoeuf, Lamb, Green, & MacRae LLP serving primarily global energy enterprises, and later at Holland & Knight LLP as Senior Counsel often representing leading finance, leasing, and corporate advisory firms to major transportation companies. As president of Eastern Trust securities services, a Merit House company, he developed various technical securities industry innovations. He has served on the Stock Transfer Association of Canada Policy and Regulatory Committee. Mr. Meretsky’s investments and activities focus on macroeconomic, geostrategic, and technological change in “ocean-tech” and on global oil and gas exploration and production, and respective infrastructure and services. He graduated from Colgate University with a degree in political science.

GVIC’s Nominees Anthony Gray Anthony Gray has deep experience in legal, compliance, and ethical matters. From 2010 to 2013, Mr. Gray served as the global compliance office at Sikorsky Aircraft Corporation, a subsidiary of United Technologies, where he created and led an ethics and compliance program to enhance the compliance and risk priorities across the 15,000-employee organization. From 2007 to 2010, Mr. Gray was as an attorney at Day Pitney, LLP, providing expertise in matters including corporate governance, federal and state regulatory compliance, and mergers and acquisitions, among other matters. Since 2013, Mr. Gray has served as the president and chief executive officer at the Institute for Global Ethics, a think tank providing ethical decision-making training and ethics research. Mr. Gray graduated from the University of Connecticut, earned a Master of Arts in Ethics from Yale University, and earned a Juris Doctor from the University of Wisconsin School of Law.

GVIC’s Nominees Jeffrey Geygan Jeffrey Geygan has more than 30 years of experience as an investment professional. From 1987 to 2007, Mr. Geygan served as a vice president and senior portfolio manager at Smith Barney, Inc. and UBS Financial Services, Inc. In 2007, Mr. Geygan founded Global Value Investment Corp. GVIC actively engages with companies to deliver shareholder value, and when necessary, assumes an activist role. Mr. Geygan has taught undergraduate and graduate-level courses at IE University in Madrid, Spain, the University of Wisconsin – Milwaukee Lubar School of Business, and the College of Charleston. He serves as the Chairman of the Board of Directors of Wayside Technology Group, Inc. (NASDAQ: WSTG), on the advisory board of the University of Wisconsin – Madison Department of Economics, and on the board of directors of Service Heat Treat Corporation. Mr. Geygan graduated from the University of Wisconsin – Madison with a degree in Economics.

About GVIC Global Value Investment Corp. is a value-oriented investment research and advisory firm focused on investing in the equity and debt of publicly traded companies around the world. The firm identifies undervalued investments and concentrates on closing the valuation gap. The firm was founded in 2007 in Mequon, WI. Global Value investment Corp has additional offices in Boston, MA, Charleston, SC and Hyderabad, India. Phone: 262-478-0640 Email: info@gvi-corp.com Website: www.gvi-corp.com