UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22806

Oppenheimer Main Street Small Cap Fund

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette

OFI Global Asset Management, Inc.

225 Liberty Street, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: April 30

Date of reporting period: 10/31/2016

Item 1. Reports to Stockholders.

Table of Contents

Class A Shares

AVERAGE ANNUAL TOTAL RETURNS AT 10/31/16

| | | | | | |

| | | Class A Shares of the Fund | | |

| | | Without Sales Charge | | With Sales Charge | | Russell 2000 Index |

| 6-Month | | 3.73% | | -2.24% | | 6.13% |

| 1-Year | | 2.92 | | -3.00 | | 4.11 |

| Since Inception (5/17/13) | | 7.11 | | 5.29 | | 6.76 |

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns include changes in share price, reinvested distributions, and a 5.75% maximum applicable sales charge except where “without sales charge” is indicated. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. Returns for periods of less than one year are cumulative and not annualized. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677). See Fund prospectuses and summary prospectuses for more information on share classes and sales charges.

2 OPPENHEIMER MAIN STREET SMALL CAP FUND

Fund Performance Discussion

The Fund’s Class A shares (without sales charge) returned 3.73% during the reporting period. In comparison, the Russell 2000 Index (the “Index”) returned 6.13% during the same period. The Fund underperformed the Index within the materials, industrials, financials, and health care sectors, due largely to stock selection as well as below-Index exposure to “micro-caps”, which outperformed sharply late in the reporting period. The Fund outperformed the Index within the telecommunication services, energy and utilities sectors primarily as a result of stock selection.

MARKET OVERVIEW

Markets remained turbulent during the reporting period. A large trend for the first half of 2016 was the demand for so called bond proxy stocks with above average dividend yields. This trend was magnified post the Brexit vote as treasury yields, already at historic lows, were under further pressure and future rate hike expectations continued to be pushed farther out. However, the market environment shifted over the third quarter of 2016, when the “risk-on” trade returned. This meant a sharp rebound in lower quality cyclicals, outperformance by smaller versus larger cap stocks, and a rotation away from more stable earnings and defensive-oriented higher dividend companies.

The reporting period saw the market driven by a number of important macroeconomic trends and events:

| ● | | Uncertainty over when or if the Federal Reserve (the “Fed”) would raise interest rates. |

| ● | | Continued slow but steady recovery in domestic consumer employment and consumption. |

| ● | | Decelerating emerging markets growth, contributing to the weakness in export demand for commodities and other industrial products. |

| ● | | Competitive currency devaluations, including negative interest rates in a growing number of jurisdictions, thrusting the world economy into uncharted territory. |

| ● | | Impact of Brexit and the increased uncertainty for global markets as a result. |

| ● | | The U.S. Presidential elections, and its potential impacts on global trade. |

As investors, it is important to know what is and what is not within one’s circle of competence. As such, we strive to keep the portfolio in an all-weather orientation. Whether rates, commodity prices, currencies or even whole economies go up or down, we seek to have a portfolio that is positioned to outperform no matter the environment.

|

| 3 OPPENHEIMER MAIN STREET SMALL CAP FUND |

Second, we believe we have the skills to identify company management teams that are likely to successfully execute on their plans. Lastly, valuing stocks and seeing what expectations the market is pricing in is also within our skillset. It is not by accident that we weight the portfolio more heavily towards companies that have management teams that are executing (e.g., gaining market share, expanding profit margins), with at least reasonable stock valuations.

FUND REVIEW

Top performing stocks for the Fund this reporting period included MKS Instruments, Inc., Fleetmatics Group PLC, and Endurance Specialty Holdings Ltd. MKS Instruments is a global provider of instruments, subsystems and process control solutions that measure, control, power, monitor and analyze critical parameters of advanced manufacturing processes to improve process performance and productivity. During the reporting period, the company benefited from completing its acquisition of Newport Corporation, a worldwide leader in photonics solutions. MKS Instruments also reported several quarters of strong earnings. Fleetmatics offers software-as-a-service technology (SaaS) through mobile workforce solutions. The company was acquired by Verizon during the summer of 2016 and we exited the position. In October, Japan-based casualty insurer Sompo Holdings announced plans to acquire casualty insurance provider Endurance Specialty Holdings at a significant premium. We exited our position in Endurance as well.

Detractors from performance this period included Sonic Corp., Korn/Ferry International, Prestige Brands Holdings, Inc. Sonic operates and franchises a chain of fast food restaurants. A deceleration in the Quick Service Restaurants (QSR) industry growth rate and stepped up promotional activity negatively impacted the company’s sales trends during the reporting period. The company’s comparisons hence slowed from above an industry growth rate to a sub-industry growth rate during the quarter. Korn/Ferry is an executive staffing and talent management company. The stock detracted from performance after disappointing forward guidance on the company’s fiscal year-end earnings report released in June. Growing economic uncertainty led to a slowdown in the company’s core executive search business, causing a negative earnings revision. Shortly thereafter, the UK Brexit vote led to additional share weakness, as Korn/Ferry does a substantial amount of business in Europe including in Great Britain. As of the reporting period’s end, we maintained our position as we believe the market is pricing in far too pessimistic a view on the company’s business, and therefore, valuation appears to be quite compelling. Prestige Brands sells a variety of over-the-counter healthcare products. Concerns over a decelerating organic growth rate have weighed on the stock. The stock outperformed when organic growth accelerated to mid-single digits, and then retracted when it appeared that its historical low single-digit growth rate is the more sustainable trend line.

|

| 4 OPPENHEIMER MAIN STREET SMALL CAP FUND |

STRATEGY & OUTLOOK

While bottom-up company research and stock selection continue to be central to our process and strategy, we do have some observations about the current environment. First, the U.S. economy continues its “slow and steady” growth. This is being driven by favorable employment and inflation data while home prices and innovation also continue to help drive the economy higher. However, the potential for protectionist trade policies by the incoming Trump administration could cause global contagion by slowing global trade.

Secondly, U.S. corporate revenues, earnings and free cash flow seem to have topped out for the near term, but earnings growth may resume if tax cuts and stimulative fiscal spending materialize under President Trump. Election results aside, the energy and industrials sectors have shown signs of bottoming. Additionally, while we have previously seen revenue and accounting earnings growth, it has not translated into commensurate cash available for shareholders.

We believe the risks inherent to this market include the misallocation of capital, fueled by an environment of ongoing relatively low interest rates and possibly leading to “bubble-like” valuations for some companies. We intend to maintain our discipline around valuation. Additionally, while innovation is alive and well and continuing to help generate economic growth, fundamental disruptions across market segments have been elevated. We continue to be focused on potential disruption risk to our companies.

Traditionally, during periods of economic uncertainty and heightened market volatility, investors favor stocks of higher quality companies—with greater consistency and stability of revenue and earnings—leading to relatively better stock performance of those companies. We think focusing on companies with economic moats and skilled management teams positions us well, should this environment come to pass. During times of economic volatility such companies frequently widen their lead over weaker competitors. We seek to invest in companies, characterized by these qualities, at compelling valuations and believe this disciplined approach is essential to generating superior long-term performance.

Matthew P. Ziehl, CFA and Co-Lead Portfolio Manager, on behalf of the Portfolio Management team: Adam Weiner, Raymond Anello, CFA, Raman Vardharaj, CFA, Joy Budzinski, Kristin Ketner and Magnus Krantz. Mr.Ziehl and Mr. Weiner serve as co-lead Portfolio managers of the Fund

|

| 5 OPPENHEIMER MAIN STREET SMALL CAP FUND |

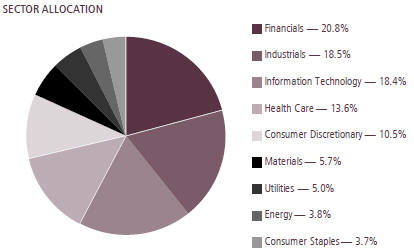

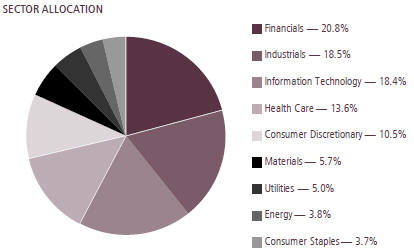

Top Holdings and Allocations

TOP TEN COMMON STOCK HOLDINGS

| | | | |

| Prestige Brands Holdings, Inc. | | | 2.3 | % |

| Webster Financial Corp. | | | 2.1 | |

| MB Financial, Inc. | | | 2.0 | |

| MKS Instruments, Inc. | | | 1.9 | |

| WellCare Health Plans, Inc. | | | 1.9 | |

| CACI International, Inc., Cl. A | | | 1.9 | |

| ALLETE, Inc. | | | 1.7 | |

| Portland General Electric Co. | | | 1.7 | |

| j2 Global, Inc. | | | 1.7 | |

| Korn/Ferry International | | | 1.6 | |

Portfolio holdings and allocations are subject to change. Percentages are as of October 31, 2016, and are based on net assets. For more current Fund holdings, please visit oppenheimerfunds. com.

TOP TEN COMMON STOCK INDUSTRIES

| | | | |

| Commercial Banks | | | 8.2 | % |

| Real Estate Investment Trusts (REITs) | | | 7.9 | |

| Software | | | 6.0 | |

| Health Care Providers & Services | | | 5.2 | |

| Commercial Services & Supplies | | | 5.2 | |

| IT Services | | | 4.7 | |

| Hotels, Restaurants & Leisure | | | 4.4 | |

| Semiconductors & Semiconductor Equipment | | | 4.1 | |

| Specialty Retail | | | 3.6 | |

| Electric Utilities | | | 3.5 | |

Portfolio holdings and allocations are subject to change. Percentages are as of October 31, 2016, and are based on net assets.

Portfolio holdings and allocations are subject to change. Percentages are as of October 31, 2016, and are based on the total market value of common stocks.

|

| 6 OPPENHEIMER MAIN STREET SMALL CAP FUND |

Share Class Performance

AVERAGE ANNUAL TOTAL RETURNS WITHOUT SALES CHARGE AS OF 10/31/16

| | | | | | | | | | | | | | |

| | | Inception

Date | | 6-Month | | | 1-Year | | | Since Inception | |

| Class A (OSCAX) | | 5/17/13 | | | 3.73 | % | | | 2.92 | % | | | 7.11 | % |

| Class C (OSCCX) | | 5/17/13 | | | 3.38 | | | | 2.17 | | | | 6.23 | |

| Class I (OSSIX) | | 5/17/13 | | | 3.95 | | | | 3.42 | | | | 7.59 | |

| Class R (OSCNX) | | 5/17/13 | | | 3.58 | | | | 2.62 | | | | 6.76 | |

| Class Y (OSCYX) | | 5/17/13 | | | 3.87 | | | | 3.25 | | | | 7.49 | |

AVERAGE ANNUAL TOTAL RETURNS WITH SALES CHARGE AS OF 10/31/16

| | | | | | | | | | | | | | |

| | | Inception

Date | | 6-Month | | | 1-Year | | | Since Inception | |

| Class A (OSCAX) | | 5/17/13 | | | -2.24 | % | | | -3.00 | % | | | 5.29 | % |

| Class C (OSCCX) | | 5/17/13 | | | 2.38 | | | | 1.17 | | | | 6.23 | |

| Class I (OSSIX) | | 5/17/13 | | | 3.95 | | | | 3.42 | | | | 7.59 | |

| Class R (OSCNX) | | 5/17/13 | | | 3.58 | | | | 2.62 | | | | 6.76 | |

| Class Y (OSCYX) | | 5/17/13 | | | 3.87 | | | | 3.25 | | | | 7.49 | |

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800. CALL OPP (225.5677). Fund returns include changes in share price, reinvested distributions, and the applicable sales charge: for Class A shares, the current maximum initial sales charge of 5.75% and for Class C shares, the contingent deferred sales charge (“CDSC”) of 1% for the 1-year period. There is no sales charge for Class I, Class R and Y shares. See Fund prospectuses and summary prospectuses for more information on share classes and sales charges.

The Fund’s performance is compared to the performance of the Russell 2000 Index, which measures the performance of the small-cap segment of the U.S. equity universe. The Index is unmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the Index. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

The Fund’s investment strategy and focus can change over time. The mention of specific fund holdings does not constitute a recommendation by OppenheimerFunds, Inc. or its affiliates.

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund

|

| 7 OPPENHEIMER MAIN STREET SMALL CAP FUND |

prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com, or calling 1.800.CALL OPP (225.5677). Read prospectuses and summary prospectuses carefully before investing.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

|

| 8 OPPENHEIMER MAIN STREET SMALL CAP FUND |

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments and/or contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended October 31, 2016.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During 6 Months Ended October 31, 2016” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or contingent deferred sales charges (loads). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| 9 OPPENHEIMER MAIN STREET SMALL CAP FUND |

| | | | | | | | |

| Actual | | Beginning

Account

Value

May 1, 2016 | | Ending

Account

Value October 31, 2016 | | Expenses

Paid During

6 Months Ended

October 31, 2016 | | |

| Class A | | $ 1,000.00 | | $ 1,037.30 | | $ 6.34 | | |

| Class C | | 1,000.00 | | 1,033.80 | | 10.20 | | |

| Class I | | 1,000.00 | | 1,039.50 | | 4.07 | | |

| Class R | | 1,000.00 | | 1,035.80 | | 7.62 | | |

| Class Y | | 1,000.00 | | 1,038.70 | | 4.64 | | |

| | | | |

Hypothetical (5% return before expenses) | | | | | | | | |

| Class A | | 1,000.00 | | 1,019.00 | | 6.28 | | |

| Class C | | 1,000.00 | | 1,015.22 | | 10.11 | | |

| Class I | | 1,000.00 | | 1,021.22 | | 4.03 | | |

| Class R | | 1,000.00 | | 1,017.74 | | 7.55 | | |

| Class Y | | 1,000.00 | | 1,020.67 | | 4.59 | | |

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended October 31, 2016 are as follows:

| | | | |

| Class | | Expense Ratios | |

| Class A | | | 1.23 | % |

| Class C | | | 1.98 | |

| Class I | | | 0.79 | |

| Class R | | | 1.48 | |

| Class Y | | | 0.90 | |

The expense ratios reflect voluntary and/or contractual waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

|

| 10 OPPENHEIMER MAIN STREET SMALL CAP FUND |

STATEMENT OF INVESTMENTS October 31, 2016 Unaudited

| | | | | | | | |

| | |

Shares | | | Value | |

| Common Stocks—97.3% | | | | | | | | |

| Consumer Discretionary—10.3% | |

| Auto Components—1.1% | |

| Visteon Corp. | | | 68,247 | | | $ | 4,818,921 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure—4.4% | |

| International Speedway Corp., Cl. A | | | 106,484 | | | | 3,503,324 | |

| Popeyes Louisiana Kitchen, Inc.1 | | | 88,036 | | | | 4,699,362 | |

| Sonic Corp. | | | 267,341 | | | | 6,124,782 | |

| Texas Roadhouse, Inc., Cl. A | | | 132,472 | | | | 5,367,765 | |

| | | | | | | 19,695,233 | |

| | | | | | | | | |

| Media—1.2% | |

| Madison Square Garden Co. (The), Cl. A1 | | | 20,172 | | | | 3,338,264 | |

| MDC Partners, Inc., Cl. A | | | 207,149 | | | | 1,750,409 | |

| | | | | | | 5,088,673 | |

| | | | | | | | | |

| Specialty Retail—3.6% | |

| Aaron’s, Inc. | | | 121,514 | | | | 3,002,611 | |

| Burlington Stores, Inc.1 | | | 69,782 | | | | 5,229,463 | |

| Group 1 Automotive, Inc. | | | 95,654 | | | | 5,765,067 | |

| Sally Beauty Holdings, Inc.1 | | | 74,361 | | | | 1,928,924 | |

| | | | | | | 15,926,065 | |

| | | | | | | | | |

| Consumer Staples—3.6% | |

| Beverages—0.7% | |

| Boston Beer Co., Inc. (The), Cl. A1 | | | 20,536 | | | | 3,188,214 | |

| | | | | | | | | |

| Food Products—1.4% | |

| Pinnacle Foods, Inc. | | | 117,180 | | | | 6,025,395 | |

| | | | | | | | | |

| Tobacco—1.5% | |

| Universal Corp. | | | 127,074 | | | | 6,887,411 | |

| | | | | | | | | |

| Energy—3.6% | |

| Energy Equipment & Services—0.4% | |

| RigNet, Inc.1 | | | 126,363 | | | | 1,895,445 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels—3.2% | |

| Cone Midstream Partners LP2 | | | 246,108 | | | | 5,195,340 | |

| HollyFrontier Corp. | | | 140,152 | | | | 3,496,792 | |

| Noble Midstream Partners LP1,2 | | | 51,481 | | | | 1,544,430 | |

| | | | | | | | |

| | |

Shares | | | Value | |

| Oil, Gas & Consumable Fuels (Continued) | |

| Renewable Energy Group, Inc.1 | | | 464,170 | | | $ | 4,061,488 | |

| | | | | | | 14,298,050 | |

| | | | | | | | | |

| Financials—20.3% | |

| Capital Markets—0.8% | |

| Stifel Financial Corp.1 | | | 90,605 | | | | 3,546,280 | |

| | | | | | | | | |

| Commercial Banks—8.2% | |

| BankUnited, Inc. | | | 190,130 | | | | 5,540,388 | |

| Berkshire Hills Bancorp, Inc. | | | 87,096 | | | | 2,573,687 | |

| Chemical Financial Corp. | | | 79,503 | | | | 3,414,654 | |

| FCB Financial Holdings, Inc., Cl. A1 | | | 64,988 | | | | 2,424,052 | |

| IBERIABANK Corp. | | | 68,269 | | | | 4,481,860 | |

| MB Financial, Inc. | | | 246,075 | | | | 8,954,669 | |

| Webster Financial Corp. | | | 225,145 | | | | 9,095,858 | |

| | | | | | | 36,485,168 | |

| | | | | | | | | |

| Insurance—1.4% | |

| James River Group Holdings Ltd. | | | 140,258 | | | | 5,279,311 | |

| Old Republic International Corp. | | | 49,036 | | | | 826,747 | |

| | | | | | | 6,106,058 | |

| | | | | | | | | |

| Real Estate Investment Trusts (REITs)—7.9% | |

| Brandywine Realty Trust | | | 414,879 | | | | 6,430,625 | |

| Chatham Lodging Trust | | | 211,853 | | | | 3,749,798 | |

| CYS Investments, Inc. | | | 401,054 | | | | 3,457,086 | |

| DiamondRock Hospitality Co. | | | 512,967 | | | | 4,693,648 | |

| DuPont Fabros Technology, Inc. | | | 112,966 | | | | 4,610,143 | |

| Four Corners Property Trust, Inc. | | | 287,868 | | | | 5,780,389 | |

| National Storage Affiliates Trust | | | 249,016 | | | | 4,875,733 | |

| Seritage Growth Properties | | | 27,848 | | | | 1,268,476 | |

| | | | | | | 34,865,898 | |

| | | | | | | | | |

| Real Estate Management & Development—0.5% | |

| Realogy Holdings Corp. | | | 95,193 | | | | 2,178,968 | |

| | | | | | | | |

|

| 11 OPPENHEIMER MAIN STREET SMALL CAP FUND |

STATEMENT OF INVESTMENTS Unaudited / Continued

| | | | | | | | |

| | |

Shares | | | Value | |

| Thrifts & Mortgage Finance—1.5% | |

| Beneficial Bancorp, Inc. | | | 164,071 | | | $ | 2,379,030 | |

| Oritani Financial Corp. | | | 283,636 | | | | 4,438,903 | |

| | | | | | | 6,817,933 | |

| | | | | | | | | |

| Health Care—13.2% | |

| Biotechnology—1.4% | |

| ACADIA Pharmaceuticals, Inc.1 | | | 68,673 | | | | 1,600,768 | |

| Axovant Sciences Ltd.1 | | | 67,163 | | | | 826,777 | |

| Sage Therapeutics, Inc.1 | | | 36,089 | | | | 1,571,315 | |

| Ultragenyx Pharmaceutical, Inc.1 | | | 34,876 | | | | 2,057,335 | |

| | | | | | | 6,056,195 | |

| | | | | | | | | |

| Health Care Equipment & Supplies—2.5% | |

| NuVasive, Inc.1 | | | 63,932 | | | | 3,818,658 | |

| NxStage Medical, Inc.1 | | | 189,314 | | | | 4,305,000 | |

| Spectranetics Corp. (The)1 | | | 142,488 | | | | 3,091,990 | |

| | | | | | | 11,215,648 | |

| | | | | | | | | |

| Health Care Providers & Services—5.2% | |

| Acadia Healthcare Co., Inc.1 | | | 59,072 | | | | 2,124,229 | |

| Addus HomeCare Corp.1 | | | 47,610 | | | | 1,204,533 | |

| Amedisys, Inc.1 | | | 93,466 | | | | 4,043,339 | |

| Diplomat Pharmacy, Inc.1 | | | 77,958 | | | | 1,806,287 | |

| HealthSouth Corp. | | | 135,899 | | | | 5,456,345 | |

| WellCare Health Plans, Inc.1 | | | 75,030 | | | | 8,516,655 | |

| | | | | | | 23,151,388 | |

| | | | | | | | | |

| Life Sciences Tools & Services—0.8% | |

| VWR Corp.1 | | | 124,146 | | | | 3,415,256 | |

| | | | | | | | | |

| Pharmaceuticals—3.3% | |

| Akorn, Inc.1 | | | 63,315 | | | | 1,516,394 | |

| Intersect ENT, Inc.1 | | | 128,536 | | | | 1,876,626 | |

| Prestige Brands Holdings, Inc.1 | | | 227,655 | | | | 10,308,218 | |

| TherapeuticsMD, Inc.1 | | | 207,059 | | | | 1,188,519 | |

| | | | | | | 14,889,757 | |

| | | | | | | | |

| | | | | | | | |

| | |

Shares | | | Value | |

| Industrials—18.0% | |

| Aerospace & Defense—2.9% | |

| AAR Corp. | | | 92,736 | | | $ | 2,983,317 | |

| Curtiss-Wright Corp. | | | 49,348 | | | | 4,422,568 | |

| Hexcel Corp. | | | 56,400 | | | | 2,565,636 | |

| Wesco Aircraft Holdings, Inc.1 | | | 224,615 | | | | 2,886,303 | |

| | | | | | | 12,857,824 | |

| | | | | | | | | |

| Airlines—1.2% | |

| Spirit Airlines, Inc.1 | | | 110,369 | | | | 5,289,986 | |

| | | | | | | | | |

| Building Products—1.1% | |

| Masonite International Corp.1 | | | 85,216 | | | | 4,848,790 | |

| | | | | | | | | |

| Commercial Services & Supplies—5.2% | |

| ABM Industries, Inc. | | | 166,261 | | | | 6,497,480 | |

| ACCO Brands Corp.1 | | | 505,390 | | | | 5,609,829 | |

| Advanced Disposal Services, Inc.1 | | | 115,099 | | | | 2,305,433 | |

| Matthews International Corp., Cl. A | | | 80,834 | | | | 4,841,956 | |

| Pitney Bowes, Inc. | | | 216,914 | | | | 3,869,746 | |

| | | | | | | 23,124,444 | |

| | | | | | | | | |

| Construction & Engineering—2.1% | |

| AECOM1 | | | 94,592 | | | | 2,634,387 | |

| Dycom Industries, Inc.1 | | | 37,499 | | | | 2,884,798 | |

| KBR, Inc. | | | 259,668 | | | | 3,845,683 | |

| | | | | | | 9,364,868 | |

| | | | | | | | | |

| Electrical Equipment—1.0% | |

| Generac Holdings, Inc.1 | | | 117,907 | | | | 4,491,078 | |

| | | | | | | | | |

| Professional Services—3.2% | |

| Korn/Ferry International | | | 350,813 | | | | 7,153,077 | |

| On Assignment, Inc.1 | | | 204,501 | | | | 7,036,880 | |

| | | | | | | 14,189,957 | |

| | | | | | | | | |

| Road & Rail—1.3% | |

| Genesee & Wyoming, Inc., Cl. A1 | | | 83,485 | | | | 5,671,971 | |

| | | | | | | | | |

| Information Technology—17.9% | |

| Electronic Equipment, Instruments, & Components—1.4% | |

SYNNEX Corp. | | | 60,239 | | | | 6,176,907 | |

|

| 12 OPPENHEIMER MAIN STREET SMALL CAP FUND |

| | | | | | | | |

| | |

Shares | | | Value | |

| Internet Software & Services—1.7% | |

| j2 Global, Inc. | | | 105,457 | | | $ | 7,503,265 | |

| | | | | | | | | |

| IT Services—4.7% | |

| Black Knight Financial Services, Inc., Cl. A1 | | | 151,995 | | | | 5,981,003 | |

| Booz Allen Hamilton Holding Corp., Cl. A | | | 209,173 | | | | 6,373,501 | |

| CACI International, Inc., Cl. A1 | | | 85,803 | | | | 8,395,824 | |

| | | | | | | 20,750,328 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment—4.1% | |

| Cavium, Inc.1 | | | 77,456 | | | | 4,372,391 | |

| Cypress Semiconductor Corp. | | | 233,288 | | | | 2,325,882 | |

| MaxLinear, Inc., Cl. A1 | | | 167,730 | | | | 3,138,228 | |

| MKS Instruments, Inc. | | | 169,742 | | | | 8,563,484 | |

| | | | | | | 18,399,985 | |

| | | | | | | | | |

| Software—6.0% | |

| Fortinet, Inc.1 | | | 112,318 | | | | 3,600,915 | |

| Guidewire Software, Inc.1 | | | 74,870 | | | | 4,301,281 | |

| Imperva, Inc.1 | | | 50,838 | | | | 1,875,922 | |

| Paylocity Holding Corp.1 | | | 143,840 | | | | 6,255,602 | |

| Proofpoint, Inc.1 | | | 85,649 | | | | 6,713,169 | |

| Zynga, Inc., Cl. A1 | | | 1,397,369 | | | | 3,926,607 | |

| | | | | | | 26,673,496 | |

| | | | | | | | | |

| Materials—5.6% | |

| Chemicals—0.6% | | | | | | | | |

| Ingevity Corp.1 | | | 62,650 | | | | 2,593,710 | |

| | | | | | | | | |

| Construction Materials—0.6% | |

| Summit Materials, Inc., Cl. A1 | | | 140,520 | | | | 2,633,345 | |

| | | | | | | | |

| | |

Shares | | | Value | |

| Metals & Mining—1.5% | |

| Kaiser Aluminum Corp. | | | 90,770 | | | $ | 6,579,917 | |

| | | | | | | | | |

| Paper & Forest Products—2.9% | |

| Boise Cascade Co.1 | | | 191,805 | | | | 3,692,246 | |

| PH Glatfelter Co. | | | 304,114 | | | | 6,757,413 | |

| Schweitzer-Mauduit International, Inc. | | | 68,174 | | | | 2,516,303 | |

| | | | | | | 12,965,962 | |

| | | | | | | | | |

| Utilities—4.8% | |

| Electric Utilities—3.5% | | | | | | | | |

| ALLETE, Inc. | | | 125,576 | | | | 7,696,553 | |

| Portland General Electric Co. | | | 176,025 | | | | 7,681,731 | |

| | | | | | | 15,378,284 | |

| | | | | | | | | |

| Gas Utilities—1.3% | |

| Suburban Propane Partners LP2 | | | 186,403 | | | | 6,000,313 | |

Total Common Stocks

(Cost $402,281,870) | | | | | | | 432,046,386 | |

| | | | | | | |

| Investment Company—2.9% | |

| Oppenheimer Institutional Government Money Market Fund, Cl. E, 0.28%3,4 (Cost $12,654,607) | | | 12,654,607 | | | | 12,654,607 | |

| Total Investments,at Value (Cost $414,936,477) | | | 100.2% | | | | 444,700,993 | |

| Net Other Assets (Liabilities) | | | (0.2) | | | | (1,038,730 | ) |

| Net Assets | | | 100.0% | | | $ | 443,662,263 | |

| | | | | | | | |

Footnotes to Statement of Investments

1. Non-income producing security.

2. Security is a Master Limited Partnership.

3. Rate shown is the 7-day yield at period end.

|

| 13 OPPENHEIMER MAIN STREET SMALL CAP FUND |

STATEMENT OF INVESTMENTS Unaudited / Continued

Footnotes to Statement of Investments (Continued)

4. Is or was an affiliate, as defined in the Investment Company Act of 1940, as amended, at or during the reporting period, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the reporting period in which the issuer was an affiliate are as follows:

| | | | | | | | | | | | | | | | |

| | | Shares

April 29, 2016a | | | Gross

Additions | | | Gross

Reductions | | | Shares

October 31, 2016 | |

| Oppenheimer Institutional Government Money Market Fund, Cl. Eb | | | 12,209,334 | | | | 71,273,759 | | | | 70,828,486 | | | | 12,654,607 | |

| | | | |

| | | | | | | | | Value | | | Income | |

| Oppenheimer Institutional Government Money Market Fund, Cl. Eb | | | | | | | | | | $ | 12,654,607 | | | $ | 23,215 | |

a. Represents the last business day of the Fund’s reporting period.

b. Prior to September 28, 2016, this fund was named Oppenheimer Institutional Money Market Fund.

See accompanying Notes to Financial Statements.

|

| 14 OPPENHEIMER MAIN STREET SMALL CAP FUND |

STATEMENT OF ASSETS AND LIABILITIES October 31, 2016 Unaudited

| | | | |

Assets | | | | |

Investments, at value—see accompanying statement of investments: | | | | |

Unaffiliated companies (cost $402,281,870) | | $ | 432,046,386 | |

Affiliated companies (cost $12,654,607) | | | 12,654,607 | |

| | | | |

| | | 444,700,993 | |

Cash | | | 100,000 | |

Receivables and other assets: | | | | |

Investments sold | | | 10,345,965 | |

Shares of beneficial interest sold | | | 436,164 | |

Dividends | | | 385,327 | |

Other | | | 25,005 | |

| | | | |

Total assets | | | 455,993,454 | |

Liabilities | | | | |

Payables and other liabilities: | | | | |

Investments purchased | | | 11,813,247 | |

Shares of beneficial interest redeemed | | | 466,742 | |

Distribution and service plan fees | | | 18,923 | |

Shareholder communications | | | 6,909 | |

Trustees’ compensation | | | 5,972 | |

Other | | | 19,398 | |

| | | | |

Total liabilities | | | 12,331,191 | |

Net Assets | | $ | 443,662,263 | |

| | | | |

| | | | |

Composition of Net Assets | | | | |

Par value of shares of beneficial interest | | $ | 35,261 | |

Additional paid-in capital | | | 433,410,026 | |

Accumulated net investment income | | | 1,815,206 | |

Accumulated net realized loss on investments and foreign currency transactions | | | (21,362,746) | |

Net unrealized appreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | 29,764,516 | |

| | | | |

Net Assets | | $ | 443,662,263 | |

| | | | |

|

| 15 OPPENHEIMER MAIN STREET SMALL CAP FUND |

STATEMENT OF ASSETS AND LIABILITIES Unaudited / Continued

| | | | |

| Net Asset Value Per Share | |

| Class A Shares: | | | | |

| Net asset value and redemption price per share (based on net assets of $63,585,313 and 5,073,686 shares of beneficial interest outstanding) | | $ | 12.53 | |

| Maximum offering price per share (net asset value plus sales charge of 5.75% of offering price) | | $ | 13.29 | |

| |

| |

| Class C Shares: | | | | |

| Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $19,561,103 and 1,598,509 shares of beneficial interest outstanding) | | $ | 12.24 | |

| |

| |

| Class I Shares: | | | | |

| Net asset value, redemption price and offering price per share (based on net assets of $290,539,610 and 23,028,255 shares of beneficial interest outstanding) | | $ | 12.62 | |

| |

| |

| Class R Shares: | | | | |

| Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $5,642,802 and 454,005 shares of beneficial interest outstanding) | | $ | 12.43 | |

| |

| |

| Class Y Shares: | | | | |

| Net asset value, redemption price and offering price per share (based on net assets of $64,333,435 and 5,106,122 shares of beneficial interest outstanding) | | $ | 12.60 | |

See accompanying Notes to Financial Statements.

|

| 16 OPPENHEIMER MAIN STREET SMALL CAP FUND |

STATEMENT OF

OPERATIONS For the Six Months Ended October 31, 2016 Unaudited

| | | | |

| |

| Investment Income | | | | |

Dividends: | | | | |

Unaffiliated companies (net of foreign withholding taxes of $6,356) | | $ | 3,068,577 | |

Affiliated companies | | | 23,215 | |

| |

Interest | | | 190 | |

| | | | |

Total investment income | | | 3,091,982 | |

|

| |

| Expenses | | | | |

Management fees | | | 1,625,810 | |

| |

Distribution and service plan fees: | | | | |

Class A | | | 68,807 | |

Class C | | | 86,099 | |

Class R | | | 12,012 | |

| |

Transfer and shareholder servicing agent fees: | | | | |

Class A | | | 62,283 | |

Class C | | | 18,954 | |

Class I | | | 45,168 | |

Class R | | | 5,293 | |

Class Y | | | 71,682 | |

| |

Shareholder communications: | | | | |

Class A | | | 2,546 | |

Class C | | | 848 | |

Class R | | | 173 | |

Class Y | | | 1,384 | |

| |

Trustees’ compensation | | | 11,039 | |

| |

Borrowing fees | | | 3,642 | |

| |

Custodian fees and expenses | | | 1,380 | |

| |

Other | | | 39,547 | |

| | | | |

Total expenses | | | 2,056,667 | |

Less reduction to custodian expenses | | | (29) | |

Less waivers and reimbursements of expenses | | | (30,519) | |

| | | | |

Net expenses | | | 2,026,119 | |

| |

Net Investment Income | | | 1,065,863 | |

| |

| Realized and Unrealized Gain (Loss) | | | | |

Net realized gain on: | | | | |

Investments from unaffiliated companies | | | 5,384,800 | |

Foreign currency transactions | | | 1,734 | |

| | | | |

Net realized gain | | | 5,386,534 | |

| |

Net change in unrealized appreciation/depreciation on: | | | | |

Investments | | | 9,787,070 | |

Translation of assets and liabilities denominated in foreign currencies | | | (92,413) | |

| | | | |

Net change in unrealized appreciation/depreciation | | | 9,694,657 | |

| |

Net Increase in Net Assets Resulting from Operations | | $ | 16,147,054 | |

| | | | |

| |

See accompanying Notes to Financial Statements. | | | | |

|

| 17 OPPENHEIMER MAIN STREET SMALL CAP FUND |

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Six Months Ended October 31, 2016 (Unaudited) | | | Year Ended April 29, 20161 | |

| |

| Operations | | | | | | | | |

| Net investment income | | $ | 1,065,863 | | | $ | 2,898,074 | |

| |

| Net realized gain (loss) | | | 5,386,534 | | | | (25,020,940) | |

| |

| Net change in unrealized appreciation/depreciation | | | 9,694,657 | | | | 6,342,145 | |

| | | | |

| Net increase (decrease) in net assets resulting from operations | | | 16,147,054 | | | | (15,780,721) | |

| |

| Dividends and/or Distributions to Shareholders | | | | | | | | |

| Dividends from net investment income: | | | | | | | | |

| Class A | | | — | | | | (135,493) | |

| Class C | | | — | | | | — | |

| Class I | | | — | | | | (2,213,988) | |

| Class R | | | — | | | | (2,189) | |

| Class Y | | | — | | | | (367,390) | |

| | | | |

| | | — | | | | (2,719,060) | |

| |

| Beneficial Interest Transactions | | | | | | | | |

| Net increase (decrease) in net assets resulting from beneficial interest transactions: | | | | | | | | |

| Class A | | | 12,512,784 | | | | 18,471,290 | |

| Class C | | | 4,747,100 | | | | 5,263,567 | |

| Class I | | | (15,258,307) | | | | 117,733,894 | |

| Class R | | | 1,454,002 | | | | 1,228,864 | |

| Class Y | | | 2,534,962 | | | | 14,953,452 | |

| | | | |

| | | 5,990,541 | | | | 157,651,067 | |

| |

| Net Assets | | | | | | | | |

| Total increase | | | 22,137,595 | | | | 139,151,286 | |

| |

| Beginning of period | | | 421,524,668 | | | | 282,373,382 | |

| | | | |

| End of period (including accumulated net investment income of $1,815,206 and $749,343, respectively) | | $ | 443,662,263 | | | $ | 421,524,668 | |

| | | | |

1. Represents the last business day of the Fund’s reporting period.

See accompanying Notes to Financial Statements.

|

| 18 OPPENHEIMER MAIN STREET SMALL CAP FUND |

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | |

| Class A | | Six Months Ended October 31, 2016

(Unaudited) | | | Year Ended April 29,

20161 | | | Year Ended April 30,

2015 | | | Period Ended April 30,

20142 | |

| |

| Per Share Operating Data | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 12.08 | | | $ | 12.76 | | | $ | 11.57 | | | $ | 10.00 | |

| |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

| Net investment income3 | | | 0.01 | | | | 0.05 | | | | 0.03 | | | | 0.06 | |

| Net realized and unrealized gain (loss) | | | 0.44 | | | | (0.69) | | | | 1.20 | | | | 1.57 | |

| | | | |

| Total from investment operations | | | 0.45 | | | | (0.64) | | | | 1.23 | | | | 1.63 | |

| |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | 0.00 | | | | (0.04) | | | | (0.00)4 | | | | (0.02) | |

| Distributions from net realized gain | | | 0.00 | | | | 0.00 | | | | (0.04) | | | | (0.04) | |

| | | | |

| Total dividends and/or distributions to shareholders | | | 0.00 | | | | (0.04) | | | | (0.04) | | | | (0.06) | |

| |

| Net asset value, end of period | | $ | 12.53 | | | $ | 12.08 | | | $ | 12.76 | | | $ | 11.57 | |

| | | | |

|

| |

| Total Return, at Net Asset Value5 | | | 3.73% | | | | (5.06)% | | | | 10.67% | | | | 16.33% | |

|

| |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 63,585 | | | $ | 49,494 | | | $ | 34,343 | | | $ | 21,892 | |

| |

| Average net assets (in thousands) | | $ | 56,232 | | | $ | 43,949 | | | $ | 26,518 | | | $ | 14,944 | |

| |

| Ratios to average net assets:6 | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.16% | | | | 0.44% | | | | 0.25% | | | | 0.57% | |

| Expenses excluding specific expenses listed below | | | 1.23% | | | | 1.25% | | | | 1.30% | | | | 1.40% | |

| Interest and fees from borrowings | | | 0.00%7 | | | | 0.00%7 | | | | 0.00% | | | | 0.00% | |

| | | | |

| Total expenses8 | | | 1.23% | | | | 1.25% | | | | 1.30% | | | | 1.40% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.23% | | | | 1.25% | | | | 1.25% | | | | 1.24% | |

| |

| Portfolio turnover rate | | | 30% | | | | 53% | | | | 55% | | | | 52% | |

1. Represents the last business day of the Fund’s reporting period.

2. For the period from May 17, 2013 (commencement of operations) to April 30, 2014.

3. Per share amounts calculated based on the average shares outstanding during the period.

4. Less than $0.005 per share.

5. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

6. Annualized for periods less than one full year.

7. Less than 0.005%.

8. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| Six Months Ended October 31, 2016 | | | 1.23% | | | |

| Year Ended April 29, 2016 | | | 1.25% | | | |

| Year Ended April 30, 2015 | | | 1.30% | | | |

| Period Ended April 30, 2014 | | | 1.40% | | | |

See accompanying Notes to Financial Statements.

|

| 19 OPPENHEIMER MAIN STREET SMALL CAP FUND |

FINANCIAL HIGHLIGHTS Continued

| | | | | | | | | | | | | | | | |

| Class C | | Six Months Ended October 31, 2016

(Unaudited) | | | Year Ended April 29,

20161 | | | Year Ended April 30,

2015 | | | Period Ended April 30,

20142 | |

| |

| Per Share Operating Data | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 11.84 | | | $ | 12.57 | | | $ | 11.49 | | | $ | 10.00 | |

| |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

| Net investment loss3 | | | (0.04) | | | | (0.04) | | | | (0.07) | | | | (0.04) | |

| Net realized and unrealized gain (loss) | | | 0.44 | | | | (0.69) | | | | 1.19 | | | | 1.57 | |

| | | | |

| Total from investment operations | | | 0.40 | | | | (0.73) | | | | 1.12 | | | | 1.53 | |

| |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Distributions from net realized gain | | | 0.00 | | | | 0.00 | | | | (0.04) | | | | (0.04) | |

| | | | |

| Total dividends and/or distributions to shareholders | | | 0.00 | | | | 0.00 | | | | (0.04) | | | | (0.04) | |

| |

| Net asset value, end of period | | $ | 12.24 | | | $ | 11.84 | | | $ | 12.57 | | | $ | 11.49 | |

| | | | |

|

| |

| Total Return, at Net Asset Value4 | | | 3.38% | | | | (5.81)% | | | | 9.77% | | | | 15.29% | |

|

| |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 19,561 | | | $ | 14,441 | | | $ | 9,878 | | | $ | 2,252 | |

| |

| Average net assets (in thousands) | | $ | 17,116 | | | $ | 12,117 | | | $ | 5,461 | | | $ | 879 | |

| |

| Ratios to average net assets:5 | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.60)% | | | | (0.34)% | | | | (0.59)% | | | | (0.34)% | |

| Expenses excluding specific expenses listed below | | | 1.98% | | | | 2.01% | | | | 2.13% | | | | 2.31% | |

| Interest and fees from borrowings | | | 0.00%6 | | | | 0.00%6 | | | | 0.00% | | | | 0.00% | |

| | | | |

| Total expenses7 | | | 1.98% | | | | 2.01% | | | | 2.13% | | | | 2.31% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.98% | | | | 2.01% | | | | 2.13% | | | | 2.23% | |

| |

| Portfolio turnover rate | | | 30% | | | | 53% | | | | 55% | | | | 52% | |

1. Represents the last business day of the Fund’s reporting period.

2. For the period from May 17, 2013 (commencement of operations) to April 30, 2014.

3. Per share amounts calculated based on the average shares outstanding during the period.

4. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

5. Annualized for periods less than one full year.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| Six Months Ended October 31, 2016 | | | 1.98% | | | |

| Year Ended April 29, 2016 | | | 2.01% | | | |

| Year Ended April 30, 2015 | | | 2.13% | | | |

| Period Ended April 30, 2014 | | | 2.31% | | | |

See accompanying Notes to Financial Statements.

|

| 20 OPPENHEIMER MAIN STREET SMALL CAP FUND |

| | | | | | | | | | | | | | | | |

| Class I | | Six Months Ended October 31, 2016

(Unaudited) | | | Year Ended April 29,

20161 | | | Year Ended April 30,

2015 | | | Period Ended April 30,

20142 | |

| |

| Per Share Operating Data | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 12.14 | | | $ | 12.82 | | | $ | 11.58 | | | $ | 10.00 | |

| |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

| Net investment income3 | | | 0.04 | | | | 0.11 | | | | 0.10 | | | | 0.09 | |

| Net realized and unrealized gain (loss) | | | 0.44 | | | | (0.70) | | | | 1.20 | | | | 1.58 | |

| | | | |

| Total from investment operations | | | 0.48 | | | | (0.59) | | | | 1.30 | | | | 1.67 | |

| |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | 0.00 | | | | (0.09) | | | | (0.02) | | | | (0.05) | |

| Distributions from net realized gain | | | 0.00 | | | | 0.00 | | | | (0.04) | | | | (0.04) | |

| | | | |

| Total dividends and/or distributions to shareholders | | | 0.00 | | | | (0.09) | | | | (0.06) | | | | (0.09) | |

| |

| Net asset value, end of period | | $ | 12.62 | | | $ | 12.14 | | | $ | 12.82 | | | $ | 11.58 | |

| | | | |

|

| |

| Total Return, at Net Asset Value4 | | | 3.95% | | | | (4.63)% | | | | 11.26% | | | | 16.73% | |

|

| |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 290,540 | | | $ | 294,108 | | | $ | 187,997 | | | $ | 12 | |

| |

| Average net assets (in thousands) | | $ | 298,508 | | | $ | 256,727 | | | $ | 95,238 | | | $ | 12 | |

| |

| Ratios to average net assets:5 | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.61% | | | | 0.91% | | | | 0.80% | | | | 0.86% | |

| Expenses excluding specific expenses listed below | | | 0.79% | | | | 0.80% | | | | 0.80% | | | | 1.09% | |

| Interest and fees from borrowings | | | 0.00%6 | | | | 0.00%6 | | | | 0.00% | | | | 0.00% | |

| | | | |

| Total expenses7 | | | 0.79% | | | | 0.80% | | | | 0.80% | | | | 1.09% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.79% | | | | 0.80% | | | | 0.79% | | | | 0.80% | |

| |

| Portfolio turnover rate | | | 30% | | | | 53% | | | | 55% | | | | 52% | |

1. Represents the last business day of the Fund’s reporting period.

2. For the period from May 17, 2013 (commencement of operations) to April 30, 2014.

3. Per share amounts calculated based on the average shares outstanding during the period.

4. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

5. Annualized for periods less than one full year.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| Six Months Ended October 31, 2016 | | | 0.79% | | | |

| Year Ended April 29, 2016 | | | 0.80% | | | |

| Year Ended April 30, 2015 | | | 0.80% | | | |

| Period Ended April 30, 2014 | | | 1.09% | | | |

See accompanying Notes to Financial Statements.

|

| 21 OPPENHEIMER MAIN STREET SMALL CAP FUND |

FINANCIAL HIGHLIGHTS Continued

| | | | | | | | | | | | | | | | |

| Class R | | Six Months Ended October 31, 2016

(Unaudited) | | | Year Ended April 29,

20161 | | | Year Ended April 30,

2015 | | | Period Ended April 30,

20142 | |

| |

| Per Share Operating Data | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 12.00 | | | $ | 12.68 | | | $ | 11.53 | | | $ | 10.00 | |

| |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

| Net investment income (loss)3 | | | (0.01) | | | | 0.02 | | | | (0.01) | | | | 0.02 | |

| Net realized and unrealized gain (loss) | | | 0.44 | | | | (0.69) | | | | 1.20 | | | | 1.56 | |

| | | | |

| Total from investment operations | | | 0.43 | | | | (0.67) | | | | 1.19 | | | | 1.58 | |

| |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | 0.00 | | | | (0.01) | | | | 0.00 | | | | (0.01) | |

| Distributions from net realized gain | | | 0.00 | | | | 0.00 | | | | (0.04) | | | | (0.04) | |

| | | | |

| Total dividends and/or distributions to shareholders | | | 0.00 | | | | (0.01) | | | | (0.04) | | | | (0.05) | |

| |

| Net asset value, end of period | | $ | 12.43 | | | $ | 12.00 | | | $ | 12.68 | | | $ | 11.53 | |

| | | | |

|

| |

| Total Return, at Net Asset Value4 | | | 3.58% | | | | (5.31)% | | | | 10.34% | | | | 15.82% | |

|

| |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 5,643 | | | $ | 4,060 | | | $ | 3,027 | | | $ | 650 | |

| |

| Average net assets (in thousands) | | $ | 4,781 | | | $ | 3,544 | | | $ | 1,403 | | | $ | 271 | |

| |

| Ratios to average net assets:5 | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.09)% | | | | 0.15% | | | | (0.09)% | | | | 0.19% | |

| Expenses excluding specific expenses listed below | | | 1.48% | | | | 1.51% | | | | 1.61% | | | | 1.76% | |

| Interest and fees from borrowings | | | 0.00%6 | | | | 0.00%6 | | | | 0.00% | | | | 0.00% | |

| | | | |

| Total expenses7 | | | 1.48% | | | | 1.51% | | | | 1.61% | | | | 1.76% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.48% | | | | 1.51% | | | | 1.60% | | | | 1.71% | |

| |

| Portfolio turnover rate | | | 30% | | | | 53% | | | | 55% | | | | 52% | |

1. Represents the last business day of the Fund’s reporting period.

2. For the period from May 17, 2013 (commencement of operations) to April 30, 2014.

3. Per share amounts calculated based on the average shares outstanding during the period.

4. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

5. Annualized for periods less than one full year.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| Six Months Ended October 31, 2016 | | | 1.48% | | | |

| Year Ended April 29, 2016 | | | 1.51% | | | |

| Year Ended April 30, 2015 | | | 1.61% | | | |

| Period Ended April 30, 2014 | | | 1.76% | | | |

See accompanying Notes to Financial Statements.

|

| 22 OPPENHEIMER MAIN STREET SMALL CAP FUND |

| | | | | | | | | | | | | | | | |

| Class Y | | Six Months Ended October 31, 2016

(Unaudited) | | | Year Ended April 29,

20161 | | | Year Ended April 30,

2015 | | | Period Ended April 30,

20142 | |

| |

| Per Share Operating Data | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 12.13 | | | $ | 12.81 | | | $ | 11.59 | | | $ | 10.00 | |

| |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

| Net investment income3 | | | 0.03 | | | | 0.09 | | | | 0.04 | | | | 0.09 | |

| Net realized and unrealized gain (loss) | | | 0.44 | | | | (0.69) | | | | 1.24 | | | | 1.58 | |

| | | | |

| Total from investment operations | | | 0.47 | | | | (0.60) | | | | 1.28 | | | | 1.67 | |

| |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | 0.00 | | | | (0.08) | | | | (0.02) | | | | (0.04) | |

| Distributions from net realized gain | | | 0.00 | | | | 0.00 | | | | (0.04) | | | | (0.04) | |

| | | | |

| Total dividends and/or distributions to shareholders | | | 0.00 | | | | (0.08) | | | | (0.06) | | | | (0.08) | |

| |

| Net asset value, end of period | | $ | 12.60 | | | $ | 12.13 | | | $ | 12.81 | | | $ | 11.59 | |

| | | | |

|

| |

| Total Return, at Net Asset Value4 | | | 3.87% | | | | (4.72)% | | | | 11.05% | | | | 16.76% | |

|

| |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 64,333 | | | $ | 59,422 | | | $ | 47,128 | | | $ | 432 | |

| |

| Average net assets (in thousands) | | $ | 64,638 | | | $ | 54,043 | | | $ | 6,437 | | | $ | 358 | |

| |

| Ratios to average net assets:5 | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.49% | | | | 0.76% | | | | 0.33% | | | | 0.89% | |

| Expenses excluding specific expenses listed below | | | 0.98% | | | | 1.00% | | | | 1.01% | | | | 1.33% | |

| Interest and fees from borrowings | | | 0.00%6 | | | | 0.00%6 | | | | 0.00% | | | | 0.00% | |

| | | | |

| Total expenses7 | | | 0.98% | | | | 1.00% | | | | 1.01% | | | | 1.33% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.90% | | | | 0.90% | | | | 0.88% | | | | 0.90% | |

| |

| Portfolio turnover rate | | | 30% | | | | 53% | | | | 55% | | | | 52% | |

1. Represents the last business day of the Fund’s reporting period.

2. For the period from May 17, 2013 (commencement of operations) to April 30, 2014.

3. Per share amounts calculated based on the average shares outstanding during the period.

4. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

5. Annualized for periods less than one full year.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| Six Months Ended October 31, 2016 | | | 0.98% | | | |

| Year Ended April 29, 2016 | | | 1.00% | | | |

| Year Ended April 30, 2015 | | | 1.01% | | | |

| Period Ended April 30, 2014 | | | 1.33% | | | |

See accompanying Notes to Financial Statements.

|

| 23 OPPENHEIMER MAIN STREET SMALL CAP FUND |

NOTES TO FINANCIAL STATEMENTS October 31, 2016 Unaudited

1. Organization

Oppenheimer Main Street Small Cap Fund (the “Fund”) is registered under the Investment Company Act of 1940 (“1940 Act”), as amended, as a diversified open-end management investment company. The Fund’s investment objective is to seek capital appreciation. The Fund’s investment adviser is OFI Global Asset Management, Inc. (“OFI Global” or the “Manager”), a wholly-owned subsidiary of OppenheimerFunds, Inc. (“OFI” or the “Sub-Adviser”). The Manager has entered into a sub-advisory agreement with OFI.

The Fund offers Class A, Class C, Class I, Class R and Class Y shares. As of July 1, 2014, Class N shares were renamed Class R shares. Class N shares subject to a contingent deferred sales charge (“CDSC”) on July 1, 2014, continue to be subject to a CDSC after the shares were renamed. Purchases of Class R shares occurring on or after July 1, 2014, are not subject to a CDSC upon redemption. Class A shares are sold at their offering price, which is normally net asset value plus a front-end sales charge. Class C and Class R shares are sold without a front-end sales charge but may be subject to a CDSC. Class R shares are sold only through retirement plans. Retirement plans that offer Class R shares may impose charges on those accounts. Class I and Class Y shares are sold to certain institutional investors or intermediaries without either a front-end sales charge or a CDSC, however, the intermediaries may impose charges on their accountholders who beneficially own Class I and Class Y shares. All classes of shares have identical rights and voting privileges with respect to the Fund in general and exclusive voting rights on matters that affect that class alone. Earnings, net assets and net asset value per share may differ due to each class having its own expenses, such as transfer and shareholder servicing agent fees and shareholder communications, directly attributable to that class. Class A, C and R shares have separate distribution and/or service plans under which they pay fees. Class I and Class Y shares do not pay such fees.

The following is a summary of significant accounting policies followed in the Fund’s preparation of financial statements in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

2. Significant Accounting Policies

Security Valuation. All investments in securities are recorded at their estimated fair value, as described in Note 3.

Foreign Currency Translation. The Fund’s accounting records are maintained in U.S. dollars. The values of securities denominated in foreign currencies and amounts related to the purchase and sale of foreign securities and foreign investment income are translated into U.S. dollars as of the close of the New York Stock Exchange (the “Exchange”), normally 4:00 P.M. Eastern time, on each day the Exchange is open for trading. Foreign exchange rates may be valued primarily using a reliable bank, dealer or service authorized by the Board of Trustees.

Reported net realized gains and losses from foreign currency transactions arise from sales of portfolio securities, sales and maturities of short-term securities, sales of foreign currencies, exchange rate fluctuations between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding

|

| 24 OPPENHEIMER MAIN STREET SMALL CAP FUND |

2. Significant Accounting Policies (Continued)

taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized appreciation and depreciation on the translation of assets and liabilities denominated in foreign currencies arise from changes in the values of assets and liabilities, including investments in securities at fiscal period end, resulting from changes in exchange rates.

The effect of changes in foreign currency exchange rates on investments is separately identified from the fluctuations arising from changes in market values of securities held and reported with all other foreign currency gains and losses in the Fund’s Statement of Operations.

Allocation of Income, Expenses, Gains and Losses. Income, expenses (other than those attributable to a specific class), gains and losses are allocated on a daily basis to each class of shares based upon the relative proportion of net assets represented by such class. Operating expenses directly attributable to a specific class are charged against the operations of that class.

Dividends and Distributions to Shareholders. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations and may differ from U.S. GAAP, are recorded on the ex-dividend date. Income and capital gain distributions, if any, are declared and paid annually or at other times as deemed necessary by the Manager.

The tax character of distributions is determined as of the Fund’s fiscal year end. Therefore, a portion of the Fund’s distributions made to shareholders prior to the Fund’s fiscal year end may ultimately be categorized as a tax return of capital.

Investment Income. Dividend income is recorded on the ex-dividend date or upon ex-dividend notification in the case of certain foreign dividends where the ex-dividend date may have passed. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income is recognized on an accrual basis. Discount and premium, which are included in interest income on the Statement of Operations, are amortized or accreted daily.

Return of Capital Estimates. Distributions received from the Fund’s investments in Master Limited Partnerships (MLPs) and Real Estate Investments Trusts (REITs), generally are comprised of income and return of capital. The Fund records investment income and return of capital based on estimates. Such estimates are based on historical information available from each MLP, REIT and other industry sources. These estimates may subsequently be revised based on information received from MLPs and REITs after their tax reporting periods are concluded.

Custodian Fees. “Custodian fees and expenses” in the Statement of Operations may include interest expense incurred by the Fund on any cash overdrafts of its custodian account during the period. Such cash overdrafts may result from the effects of failed trades in portfolio

|

| 25 OPPENHEIMER MAIN STREET SMALL CAP FUND |

NOTES TO FINANCIAL STATEMENTS Unaudited / Continued

2. Significant Accounting Policies (Continued)

securities and from cash outflows resulting from unanticipated shareholder redemption activity. The Fund pays interest to its custodian on such cash overdrafts, to the extent they are not offset by positive cash balances maintained by the Fund, at a rate equal to the Federal Funds Rate plus 0.50%. The “Reduction to custodian expenses” line item, if applicable, represents earnings on cash balances maintained by the Fund during the period. Such interest expense and other custodian fees may be paid with these earnings.

Security Transactions. Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Indemnifications. The Fund’s organizational documents provide current and former Trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Federal Taxes. The Fund intends to comply with provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its investment company taxable income to shareholders. Therefore, no federal income or excise tax provision is required. The Fund files income tax returns in U.S. federal and applicable state jurisdictions. The statute of limitations on the Fund’s tax return filings generally remains open for the three preceding fiscal reporting period ends. The Fund has analyzed its tax positions for the fiscal year ended April 29, 2016, including open tax years, and does not believe there are any uncertain tax positions requiring recognition in the Fund’s financial statements.

During the fiscal year ended April 29, 2016, the Fund did not utilize any capital loss carryforward to offset capital gains realized in that fiscal year. Details of the fiscal year ended April 29, 2016 capital loss carryforwards are included in the table below. Capital loss carryforwards with no expiration, if any, must be utilized prior to those with expiration dates. Capital losses with no expiration will be carried forward to future years if not offset by gains.

| | | | |

| Expiring | |

No expiration | | $ | 25,450,099 | |

At period end, it is estimated that the capital loss carryforwards would be $20,063,565 which will not expire. The estimated capital loss carryforward represents the carryforward as of the end of the last fiscal year, increased or decreased by capital losses or gains realized in the first six months of the current fiscal year. During the reporting period, it is estimated that the Fund will utilize $5,386,534 of capital loss carryforward to offset realized capital gains.

Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of dividends and distributions made during the fiscal year from net investment income or net realized gains are determined in accordance with federal

|

| 26 OPPENHEIMER MAIN STREET SMALL CAP FUND |

2. Significant Accounting Policies (Continued)

income tax requirements, which may differ from the character of net investment income or net realized gains presented in those financial statements in accordance with U.S. GAAP. Also, due to timing of dividends and distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or net realized gain was recorded by the Fund.

The aggregate cost of securities and other investments and the composition of unrealized appreciation and depreciation of securities and other investments for federal income tax purposes at period end are noted in the following table. The primary difference between book and tax appreciation or depreciation of securities and other investments, if applicable, is attributable to the tax deferral of losses or tax realization of financial statement unrealized gain or loss.

| | | | |

| Federal tax cost of securities | | $ | 414,936,477 | |

| | | | |

| Gross unrealized appreciation | | $ | 50,008,458 | |

| Gross unrealized depreciation | | | (20,243,942) | |

| | | | |

| Net unrealized appreciation | | $ | 29,764,516 | |

| | | | |

Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

3. Securities Valuation

The Fund calculates the net asset value of its shares as of 4:00 P.M. Eastern time, on each day the New York Stock Exchange (the “Exchange”) is open for trading, except in the case of a scheduled early closing of the Exchange, in which case the Fund will calculate net asset value of the shares as of the scheduled early closing time of the Exchange.

The Fund’s Board has adopted procedures for the valuation of the Fund’s securities and has delegated the day-to-day responsibility for valuation determinations under those procedures to the Manager. The Manager has established a Valuation Committee which is responsible for determining a “fair valuation” for any security for which market quotations are not “readily available.” The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

Valuation Methods and Inputs

Securities are valued using unadjusted quoted market prices, when available, as supplied primarily by third party pricing services or dealers.

The following methodologies are used to determine the market value or the fair value of the types of securities described below:

Securities traded on a registered U.S. securities exchange (including exchange-traded derivatives other than futures and futures options) are valued based on the last sale price

|

| 27 OPPENHEIMER MAIN STREET SMALL CAP FUND |

NOTES TO FINANCIAL STATEMENTS Unaudited / Continued

3. Securities Valuation (Continued)

of the security reported on the principal exchange on which it is traded, prior to the time when the Fund’s assets are valued. In the absence of a sale, the security is valued at the mean between the bid and asked price on the principal exchange or, if not available from the principal exchange, obtained from two dealers. If bid and asked prices are not available from either the exchange or two dealers, the security is valued by using one of the following methodologies (listed in order of priority): (1) a bid from the principal exchange, (2) the mean between the bid and asked price as provided by a single dealer, or (3) a bid from a single dealer. A security of a foreign issuer traded on a foreign exchange, but not listed on a registered U.S. securities exchange, is valued based on the last sale price on the principal exchange on which the security is traded, as identified by the third party pricing service used by the Manager, prior to the time when the Fund’s assets are valued. If the last sale price is unavailable, the security is valued at the most recent official closing price on the principal exchange on which it is traded. If the last sales price or official closing price for a foreign security is not available, the security is valued at the mean between the bid and asked price per the exchange or, if not available from the exchange, obtained from two dealers. If bid and asked prices are not available from either the exchange or two dealers, the security is valued by using one of the following methodologies (listed in order of priority): (1) a bid from the exchange, (2) the mean between the bid and asked price as provided by a single dealer, or (3) a bid from a single dealer.

Shares of a registered investment company that are not traded on an exchange are valued at that investment company’s net asset value per share.

Corporate and government debt securities (of U.S. or foreign issuers) and municipal debt securities, event-linked bonds, loans, mortgage-backed securities, collateralized mortgage obligations, and asset-backed securities are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing services or broker-dealers who may use matrix pricing methods to determine the evaluated prices.

Short-term money market type debt securities with a remaining maturity of sixty days or less are valued at cost adjusted by the amortization of discount or premium to maturity (amortized cost), which approximates market value. Short-term debt securities with a remaining maturity in excess of sixty days are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing services or broker-dealers.

A description of the standard inputs that may generally be considered by the third party pricing vendors in determining their evaluated prices is provided below.

| | |

| Security Type | | Standard inputs generally considered by third-party pricing vendors |

| Corporate debt, government debt, municipal, mortgage- backed and asset-backed securities | | Reported trade data, broker-dealer price quotations, benchmark yields, issuer spreads on comparable securities, the credit quality, yield, maturity, and other appropriate factors. |

| Loans | | Information obtained from market participants regarding reported trade data and broker-dealer price quotations. |

| Event-linked bonds | | Information obtained from market participants regarding reported trade data and broker-dealer price quotations. |

|

| 28 OPPENHEIMER MAIN STREET SMALL CAP FUND |

3. Securities Valuation (Continued)