- VCTR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

Victory Capital (VCTR) DEFA14AAdditional proxy soliciting materials

Filed: 9 Jul 24, 4:53pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to §240.14a-12 |

Victory Capital Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Victory Capital Holdings, Inc. held a conference call on July 9, 2024 announcing that it has entered into definitive agreements with Amundi whereby Amundi’s U.S. business (formerly Pioneer Investments) will be combined into Victory. Below is a copy of the transcript of the conference call as well as the related investor presentation. The transcript has been edited to correct erroneous transcriptions and garbled statements.

Amundi Definitive Agreement Conference Call Script

Live Call: Monday, July 9, 2024, 7:00 am CT

Operator:

Good morning and welcome to the Victory Capital Conference Call. All callers are in a listen-only mode. Following the Company's prepared remarks there will be a question-and-answer session.

I will now turn the call over to Mr. Matthew Dennis, Chief of Staff and Director of Investor Relations. Please go ahead, Mr. Dennis…

Matt Dennis:

Thank you, and good morning. Welcome to Victory Capital’s conference call to discuss the signing of the Definitive Agreement between Victory Capital and Amundi.

Statements made on this conference call that are not historical facts are forward looking statements and speak only as of today’s date and involve a number of risks and uncertainties that could cause actual results to differ materially from these statements. Victory Capital assumes no duty and does not undertake any obligation to update any forward-looking statements.

Please refer to our press release that was issued early this morning as well as our recent SEC filings including Forms 10-K and 10-Q, for additional risk factors that could cause our actual results to differ materially from our forward-looking statements, all of which can be found on our website at ir.vcm.com

Furthermore, please note that the ultimate completion of a transaction remains subject to certain closing conditions as well as regulatory approvals.

With that, it is now my pleasure to turn the call over to David Brown, Chairman and CEO, David…

Dave Brown:

Thank you, Matt. Good morning, and welcome to Victory Capital’s conference call to announce the signing of a definitive agreement with Amundi. I am joined today by Michael Policarpo, our President, Chief Financial and Administrative Officer, as well as Matt Dennis, our Chief of Staff and Director of Investor Relations.

Following our brief prepared remarks, Mike, Matt, and I will be available to take your questions.

The presentation begins on slide 3.

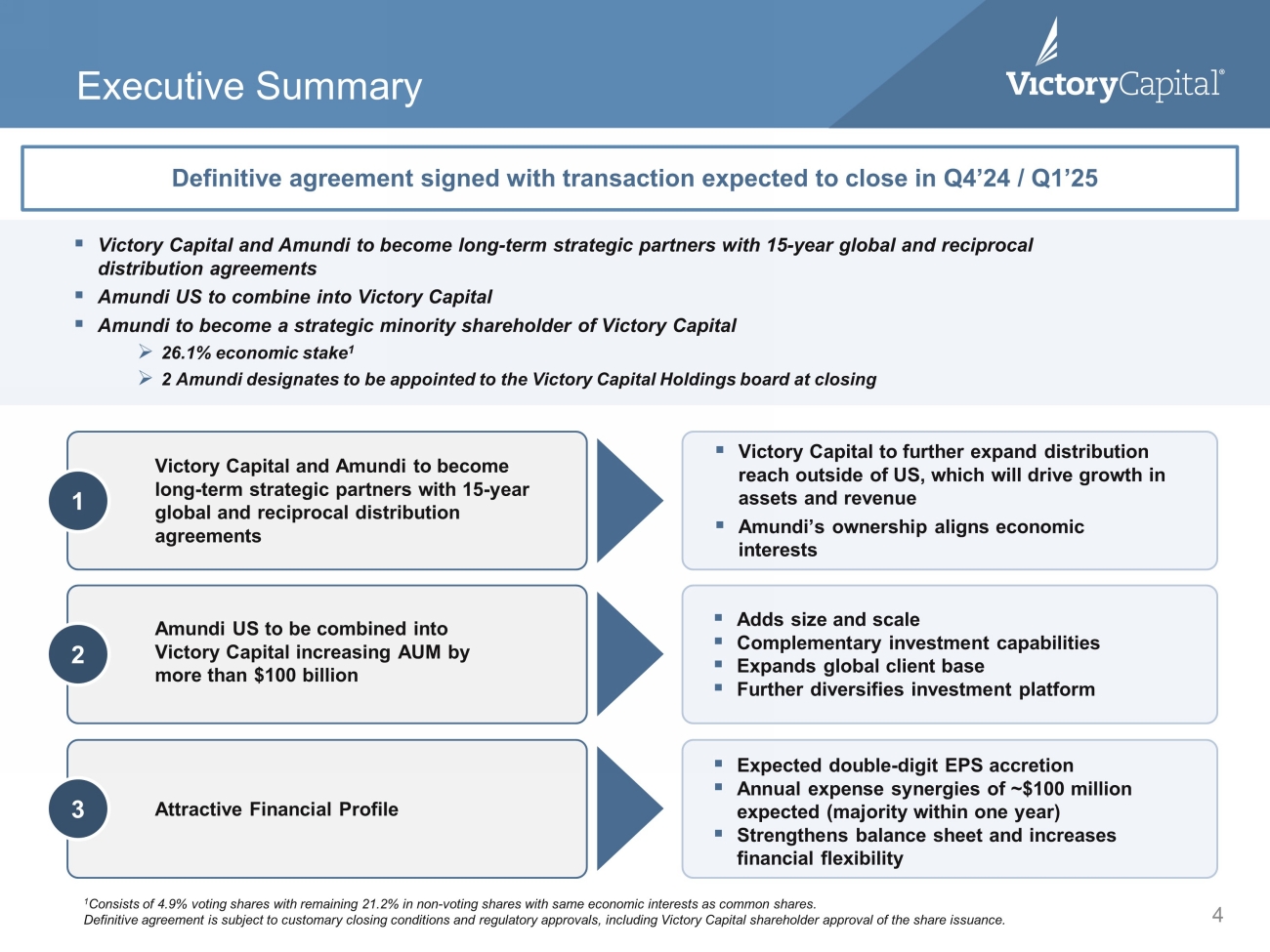

On April 16th, we disclosed our Memorandum of Understanding for plans to enter into a strategic and multi-dimensional transaction with Amundi that would positively evolve our company in a number of ways. As we mentioned in the press release that was issued early this morning, there are no material differences in what we envisioned and memorialized in the Memorandum of Understanding and what is in the definitive agreement.

- 2 -

Over the past few months, we have worked diligently to get to the signing of the definitive agreement. We are excited to say that we have completed this phase of the transaction on plan and, beginning today, we turn our attention to closing, which we expect will occur in either late 2024 or early 2025.

As we engaged with the Amundi leadership team to forge the formal agreement, we were consistently impressed by our shared values and client focus. This gives us a great deal of comfort as we move ahead with what is going to be a very long-term relationship.

This transaction is anticipated to generate significant value creation and serve as a catalyst for profitable growth and higher cashflow moving forward. I believe we will look back on 2024 as an important milestone in our Company’s growth trajectory.

Expanding our distribution reach outside of the US market through Amundi’s strong distribution network and JV partners will greatly accelerate the globalization of our firm. In addition, it immediately diversifies our client base with an increased international presence, as more than a third of Amundi US’s AUM is currently from non-US clients.

Victory Capital will become the exclusive provider of US-manufactured active asset management products for Amundi’s distribution outside of the US. This opens a large and robust international distribution channel for our products to reach clients around the world through Amundi’s global distribution network, which has a local presence in 35 countries and 1,000 third-party distributors reaching more than 100 million retail clients, and more than 1,500 institutional clients. Moreover, Victory Capital will be the exclusive distributor of Amundi products in the U.S. which will give us access to additional products for our current and future clients.

A second significant aspect of the transaction is the combination of Amundi’s US business into Victory Capital in exchange for voting rights of 4.9% and a total economic interest of 26.1% in Victory Capital. Amundi’s stake in our firm closely aligns our respective economic interests and sets the foundation for success on the reciprocal distribution agreements.

The addition of their US business adds what will be our largest investment franchise and significantly enhances the size and scale of our overall business by adding more than $100 billion of AUM with very competitive long-term investment performance. It will broaden our investment capabilities through the addition of complementary U.S. fixed income, equity, and multi-asset strategies.

While the transaction is strategically beneficial, it is also accretive to earnings and will strengthen our balance sheet. The combination of the Amundi US business onto our platform aligns very well with our proven M&A history and playbook. We anticipate low double-digit EPS accretion by the end of the first full year of ownership. In addition, since we are not using cash or debt as consideration, the incremental earnings will significantly reduce our leverage ratio and provide significant additional strategic and capital flexibility. This will allow us to continue re-investing in our business to drive organic growth. It will also provide us with more financial wherewithal as we pursue future acquisition prospects and increase the return of capital to shareholders.

- 3 -

Following closing, we will have an even larger and more robust US distribution capability. This, combined with our exclusive access to one of the largest and most effective international distribution networks in the industry, will position us even more attractively as the acquirer of choice for high-performing investment organizations.

We are confident in our ability to realize meaningful synergies from this transaction, and we are maintaining our prior guidance of approximately $100 million in expense synergies with most of that being generated from vendor consolidations, improved economies of scale, and elimination of redundancies. We expect the expense synergies to be fully realized within two years with most achieved within the first year. We have not included any revenue synergies in our guidance at this point.

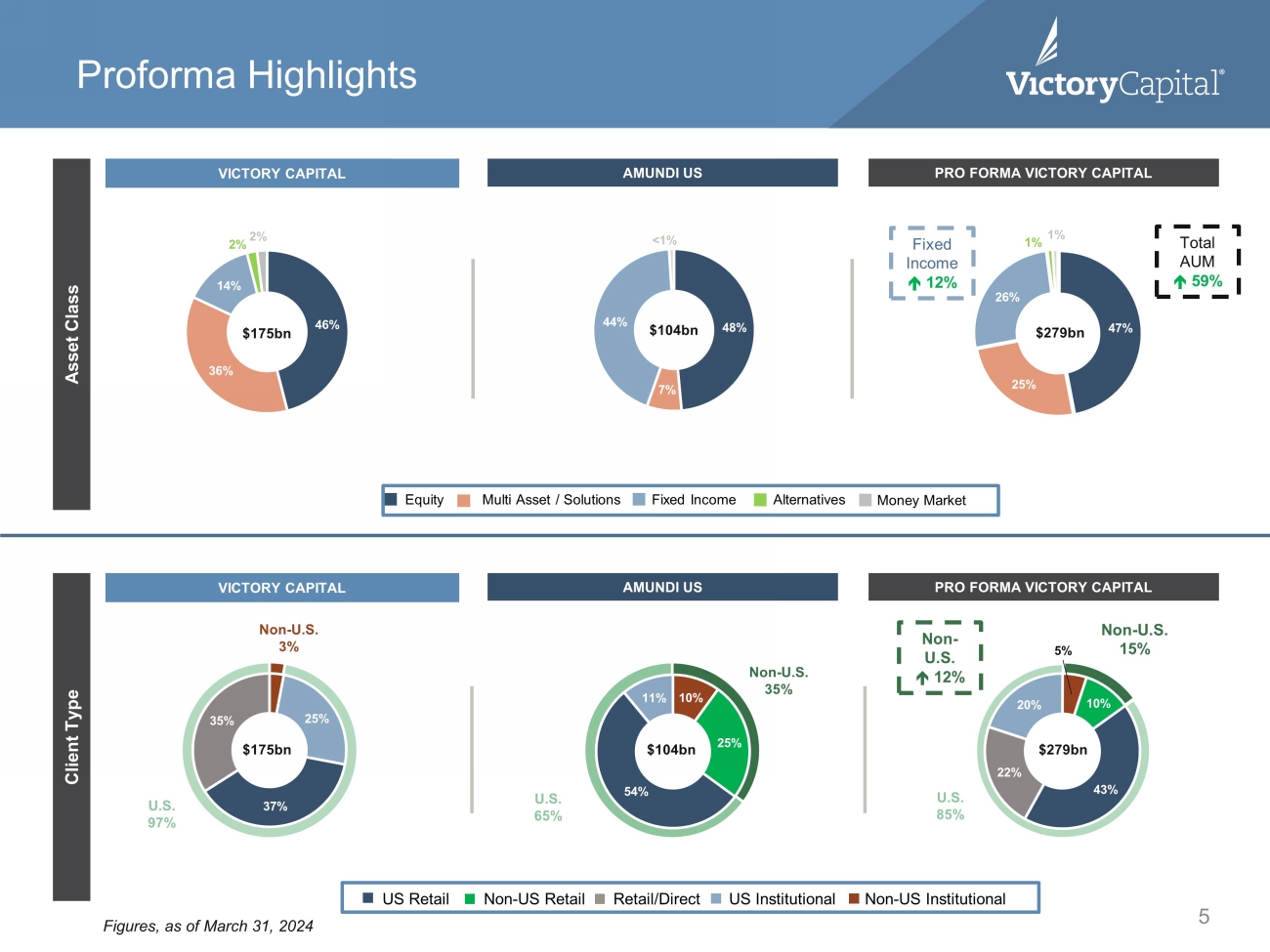

On slide 4, you can see that when the transaction closes it will meaningfully diversify our asset class mix.

We will increase our proportion of fixed income, which is an asset class we are very bullish on, for the long term. We will also see an immediate increase in our non-US AUM, with 15% of proforma assets projected to be from clients outside of the US. Additionally, under the global distribution agreement we would expect that proportion to grow in the future. Amundi US has the infrastructure already in place to facilitate distribution throughout the Amundi global network and through their joint ventures around the world. Therefore, we will not need to start from scratch and look forward to broadening and increasing the US-manufactured product range being sold and serviced by this extensive distribution complex.

Lastly, we have updated our deal timeline. There remain several key milestones between today and closing, including consent from the Amundi US clients, regulatory approvals, and VCTR shareholder approval for the share issuance.

In parallel, we will be developing integration plans that ensure no disruptions to the investment teams and client experience.

With that, we will now take your questions.

Questions and Answers

Operator:

We are now opening the floor for question-and-answer session. Our first question comes from Adam Beatty from UBS. Your line is now open.

Adam Beatty:

Oh, thank you and good morning.

I agree with the comments definitely around the potential for international distribution and the numbers there are pretty hefty, pretty compelling. Just want to get some color, if I could around the first steps toward integrating legacy Victory's products into Amundi's distribution and also maybe a bit on the nature of the distribution partnerships that Amundi has. Thank you.

David Brown:

Sure. Good morning.

- 4 -

First, I think it's important to understand that, you know, today the Amundi US business is distributing their own products internationally through the Amundi distribution system. So the infrastructure is set up already. Our plans are to plug into that infrastructure to invest in that infrastructure, provide additional products into that infrastructure so it can be distributed throughout the world through Amundi's distribution system. One of the real advantages of this transaction is it brings a broader set of manufacturing out of the US to the Amundi distribution system and to the Amundi's clients outside of the US, which they desire to have a wider and deeper US manufacturing capability.

So, we'll fill that. that'll be the first step. During the announce and close, we'll work with the Amundi US team to see how we can accelerate what they're doing, enhance what they're doing, and then work with our team to see how we can plug in most efficiently. I think it's really important to note that all of the guidance we've given so far has all really been around expense synergies. We've not included in any of the guidance, any revenue synergies or eventually do that and we do see that there will be a significant amount of revenue synergies for us going forward when we think about this long-term relationship.

Adam Beatty: Excellent. Appreciate that.

Just a quick follow up. You mentioned maybe doing some investment into the distribution network. Just wondering what kinds of investment you're contemplating. Thanks.

David Brown:

You know, we'll work with the Amundi US team. My hope is that we can invest in areas with people, technology and getting more efficient and effective. All of that investment is really netted into our expense synergies. So when we talk about the guidance of a $100 million, that's net of investment. So that includes the investment piece. But we'll work with the Amundi US team to see where they best think that that, you know, money can be invested to accelerate distribution, to make it more effective, to make it more efficient and really set it up for the next decade or so.

Adam Beatty:

Got it. Thank you.

Appreciate the call and the questions. Thanks.

Operator:

As of right now, we don't have any questions left in the queue. I'd like to thank everyone for attending today's call. We hope that you find it useful. Have a wonderful day and stay safe.

***

- 5 -

Forward-Looking Statements

This communication may contain forward-looking statements within the meaning of applicable U.S. federal and non-U.S. securities laws. These statements may include, without limitation, any statements preceded by, followed by or including words such as “target,” “believe,” “expect,” “aim,” “intend,” “may,” “anticipate,” “assume,” “budget,” “continue,” “estimate,” “future,” “objective,” “outlook,” “plan,” “potential,” “predict,” “project,” “will,” “can have,” “likely,” “should,” “would,” “could” and other words and terms of similar meaning or the negative thereof and include, but are not limited to, statements regarding the proposed transaction and the outlook for Victory Capital’s or Amundi’s future business and financial performance. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors beyond Victory Capital’s and Amundi’s control and could cause Victory Capital’s and Amundi’s actual results, performance or achievements to be materially different from the expected results, performance or achievements expressed or implied by such forward-looking statements.

Although it is not possible to identify all such risks and factors, they include, among others, the following: risks that conditions to closing will fail to be satisfied and that the transaction will fail to close on the anticipated timeline, if at all; risks associated with the expected benefits, or impact on the Victory Capital’s and Amundi’s respective businesses, of the proposed transaction, including the ability to achieve any expected synergies; and other risks and factors relating to Victory Capital’s and Amundi’s respective businesses contained in their respective public filings.

Important Additional Information and Where to Find It

This communication is being issued in connection with the proposed acquisition of Amundi Holdings US, Inc. (“Amundi US”) by the Company. In connection with the transaction, the Company intends to file a proxy statement and certain other documents regarding the transaction with the SEC. The definitive version of the proxy statement (if and when available) will be mailed to the Company’s stockholders.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS CONTEMPLATED BY THE CONTRIBUTION AGREEMENT AND RELATED MATTERS.

Investors and security holders may obtain, free of charge, copies of the proxy statement (when it is available) and other documents that are filed or will be filed with the SEC by the Company through the website maintained by the SEC at www.sec.gov or the Investor Relations portion of the Company’s website at https://ir.vcm.com.

Participants in the Solicitation

The Company and certain of its directors, executive officers and other employees may be deemed to be “participants” in the solicitation of proxies from the Company’s stockholders with respect to the special meeting of stockholders that will be held to consider and vote upon the approval of the share issuance in connection with the proposed acquisition of Amundi US by the Company. Additional information regarding the identity of the participants, and their respective direct and indirect interests in the transaction, by security holdings or otherwise, will be set forth in the proxy statement and other materials to be filed with the SEC in connection with the transaction (if and when they become available). Information relating to the Company’s executive officers and directors can also be found in the Company’s proxy statement for its 2024 annual meeting of stockholders, which was filed with the SEC on March 28, 2024. Investors and security holders may obtain free copies of these documents using the sources indicated above.

- 6 -

Victory Capital and Amundi Execute Definitive Agreement to Become Strategic Partners July 9, 2024

2 This presentation may contain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1 995. These statements may include, without limitation, any statements preceded by, followed by or including words such as “target,” “believe,” “expect, ” “ aim,” “intend,” “may,” “anticipate,” “assume,” “budget,” “continue,” “estimate,” “future,” “objective,” “outlook,” “plan,” “potential,” “predict,” “project,” “wil l,” “can have,” “likely,” “should,” “would,” “could” and other words and terms of similar meaning or the negative thereof. Such forward - looking statements involve known and unknown risks, uncertainties and other important factors beyond the control of Victory Capital (the “Company”) such as continued geopolitical uncertainty including the conflicts in Ukraine and Israel and its effect on our business, operations and financial results going forward, as discussed in Victory Capital’s filings with th e S EC, that could cause Victory Capital’s actual results, performance or achievements to be materially different from the expected results, performance or achievements ex pressed or implied by such forward - looking statements. Although it is not possible to identify all such risks and factors, they include, among others, risks that the conditions to clo sing will be satisfied and the transaction will close on the anticipated timeline, if at all; risks associated with expected benefits, or impact on our business, of the pr oposed transaction, including our ability to achieve any expected synergies; reductions in AUM based on investment performance, client withdrawals, difficult market co ndi tions and other factors such as a pandemic; the nature of the Company’s contracts and investment advisory agreements; the Company’s ability to maintain histo ric al returns and sustain its historical growth; the Company’s dependence on third parties to market its strategies and provide products or services for th e o peration of its business; the Company’s ability to retain key investment professionals or members of its senior management team; the Company’s reliance on the technology systems supporting its operations; the Company’s ability to successfully acquire and integrate new companies; the concentration of th e C ompany’s investments in long - only small - and mid - cap equity and U.S. clients; risks and uncertainties associated with non - U.S. investments; the Company’s eff orts to establish and develop new teams and strategies; the ability of the Company’s investment teams to identify appropriate investment opportunities; the Com pan y’s ability to limit employee misconduct; the Company’s ability to meet the guidelines set by its clients; the Company’s exposure to potential litigation ( inc luding administrative or tax proceedings) or regulatory actions; the Company’s ability to implement effective information and cyber security policies, pro ced ures and capabilities; the Company’s substantial indebtedness; the potential impairment of the Company’s goodwill and intangible assets; disruption to t he operations of third parties whose functions are integral to the Company’s ETF platform; the Company’s determination that Victory Capital is not required to reg ist er as an "investment company" under the Investment Company Act of 1940; the fluctuation of the Company’s expenses; the Company’s ability to respond to rece nt trends in the investment management industry; the level of regulation on investment management firms and the Company’s ability to respond to regulator y d evelopments; the competitiveness of the investment management industry; the level of control over the Company retained by Crestview GP; and ot her risks and factors listed under "Risk Factors" and elsewhere in the Company’s filings with the SEC. Such forward - looking statements are based on numerous assumptions regarding Victory Capital’s present and future business strate gies and the environment in which it will operate in the future. Any forward - looking statement made in this press release speaks only as of the date hereof. Except as required by law, Victory Capital assumes no obligation to update these forward - looking statements, or to update the reasons actual results could differ m aterially from those anticipated in the forward - looking statements, even if new information becomes available in the future. Forward Looking Statements

3 This communication is being issued in connection with the proposed acquisition of Amundi Holdings US, Inc . (“ Amundi US ”) by the Company . In connection with the transaction, the Company intends to file a proxy statement and certain other documents regarding the transaction with the SEC . The definitive version of the proxy statement (if and when available) will be mailed to the Company’s stockholders . INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS CONTEMPLATED BY THE CONTRIBUTION AGREEMENT AND RELATED MATTERS . Investors and security holders may obtain, free of charge, copies of the proxy statement (when it is available) and other documents that are filed or will be filed with the SEC by the Company through the website maintained by the SEC at www . sec . gov or the Investor Relations portion of the Company’s website at https : //ir . vcm . com . Participants in the Solicitation The Company and certain of its directors, executive officers and other employees may be deemed to be “participants” in the solicitation of proxies from the Company’s stockholders with respect to the special meeting of stockholders that will be held to consider and vote upon the approval of the share issuance in connection with the proposed acquisition of Amundi US by the Company . Additional information regarding the identity of the participants, and their respective direct and indirect interests in the transaction, by security holdings or otherwise, will be set forth in the proxy statement and other materials to be filed with the SEC in connection with the transaction (if and when they become available) . Information relating to the Company’s executive officers and directors can also be found in the Company’s proxy statement for its 2024 annual meeting of stockholders, which was filed with the SEC on March 28 , 2024 . Investors and security holders may obtain free copies of these documents using the sources indicated above . Important Additional Information and Where to Find It

Executive Summary 4 ▪ Victory Capital and Amundi to become long - term strategic partners with 15 - year global and reciprocal distribution agreements ▪ Amundi US to combine into Victory Capital ▪ Amundi to become a strategic minority shareholder of Victory Capital » 26.1% economic stake 1 » 2 Amundi designates to be appointed to the Victory Capital Holdings board at closing Victory Capital and Amundi to become long - term strategic partners with 15 - year global and reciprocal distribution agreements Amundi US to be combined into Victory Capital increasing AUM by more than $100 billion Attractive Financial Profile ▪ Victory Capital to further expand distribution reach outside of US, which will drive growth in assets and revenue ▪ Amundi’s ownership aligns economic interests ▪ Adds size and scale ▪ Complementary investment capabilities ▪ Expands global client base ▪ Further diversifies investment platform ▪ Expected double - digit EPS accretion ▪ Annual expense synergies of ~$100 million expected (majority within one year) ▪ Strengthens balance sheet and increases financial flexibility 1 2 3 Definitive agreement signed with transaction expected to close in Q4’24 / Q1’25 1 Consists of 4.9% voting shares with remaining 21.2% in non - voting shares with same economic interests as common shares . Definitive agreement is subject to customary closing conditions and regulatory approvals, including Victory Capital sharehold er approval of the share issuance.

U.S. 65% Non - U.S. 35% 10% 25% 54% 11% 22% 20% 5% 10% 43% 48% 7% 44% <1% 46% 36% 14% 2% 2% 25% 37% 35% Client Type Proforma Highlights 5 Asset Class 47% 25% 26% 1% 1% $104bn $104bn $279bn $175bn $279bn U.S. 97% Non - U.S. 15% U.S. 85% Non - U.S. 3% $175bn Equity Fixed Income Multi Asset / Solutions Alternatives Money Market Fixed Income 12% Non - U.S. 12% AMUNDI US VICTORY CAPITAL PRO FORMA VICTORY CAPITAL AMUNDI US VICTORY CAPITAL PRO FORMA VICTORY CAPITAL Total AUM 59% Figures, as of March 31, 2024 US Retail Retail/Direct Non - US Institutional US Institutional Non - US Retail