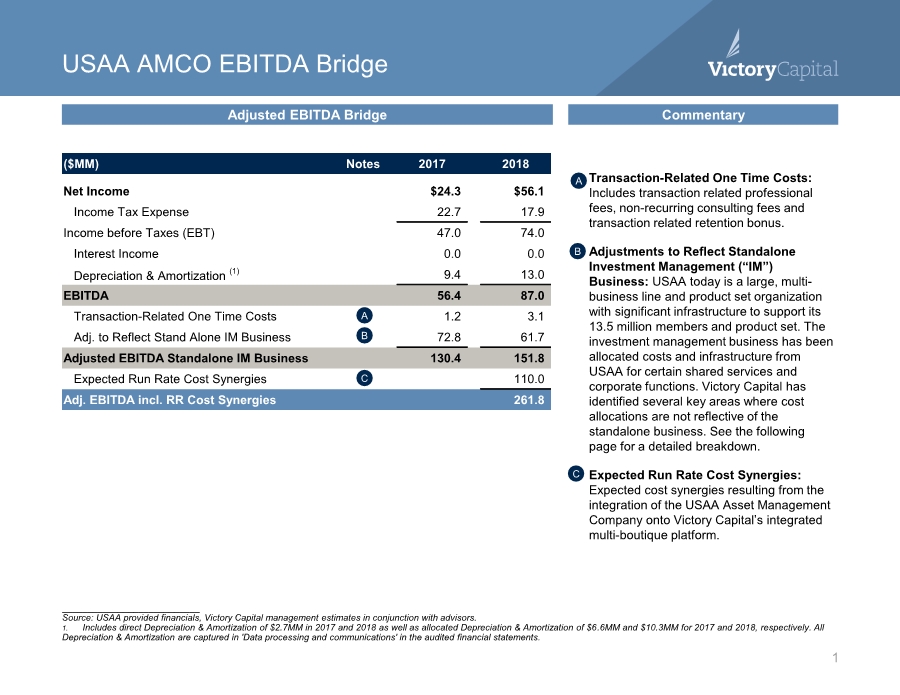

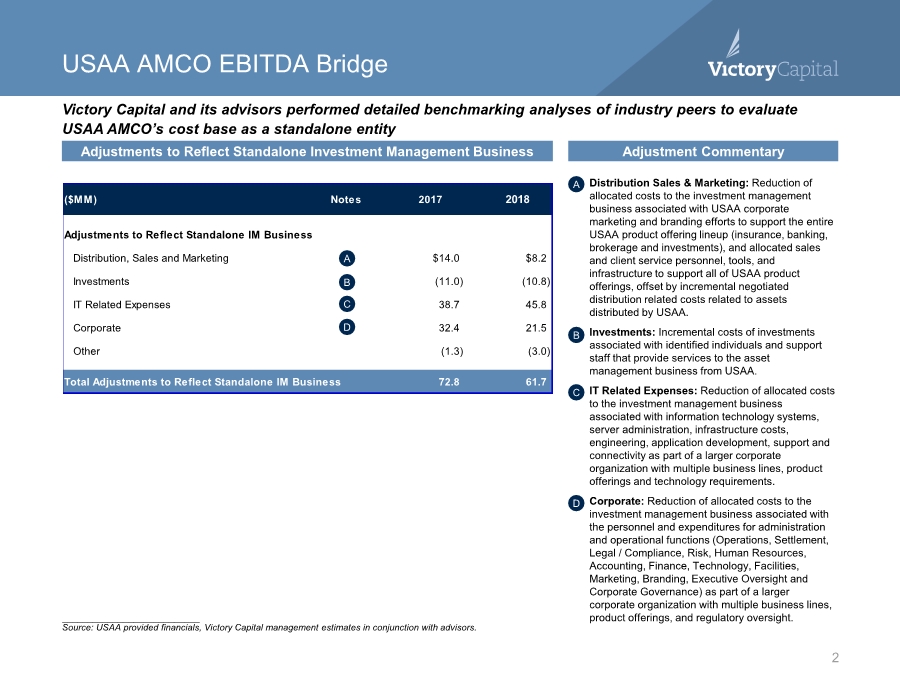

| ($MM) Notes 2017 2018 Adjustments to Reflect Standalone IM Business Distribution, Sales and Marketing 1 $14.0 $8.2 Investments 2 (11.0) (10.8) IT Related Expenses 3 38.7 45.8 Corporate 4 32.4 21.5 Other (1.3) (3.0) Total Adjustments to Reflect Standalone IM Business 72.8 61.7 ◼ Distribution Sales & Marketing: Reduction of allocated costs to the investment management business associated with USAA corporate marketing and branding efforts to support the entire USAA product offering lineup (insurance, banking, brokerage and investments), and allocated sales and client service personnel, tools, and infrastructure to support all of USAA product offerings, offset by incremental negotiated distribution related costs related to assets distributed by USAA. ◼ Investments: Incremental costs of investments associated with identified individuals and support staff that provide services to the asset management business from USAA. ◼ IT Related Expenses: Reduction of allocated costs to the investment management business associated with information technology systems, server administration, infrastructure costs, engineering, application development, support and connectivity as part of a larger corporate organization with multiple business lines, product offerings and technology requirements. ◼ Corporate: Reduction of allocated costs to the investment management business associated with the personnel and expenditures for administration and operational functions (Operations, Settlement, Legal / Compliance, Risk, Human Resources, Accounting, Finance, Technology, Facilities, Marketing, Branding, Executive Oversight and Corporate Governance) as part of a larger corporate organization with multiple business lines, product offerings, and regulatory oversight. Adjustment Commentary Adjustments to Reflect Standalone Investment Management Business B C A A B C USAA AMCO EBITDA Bridge ___________________________ Source: USAA provided financials, Victory Capital management estimates in conjunction with advisors. D D Victory Capital and its advisors performed detailed benchmarking analyses of industry peers to evaluate USAA AMCO’s cost base as a standalone entity 2 |