Filed Pursuant to Rule 424(b)(3)

Registration Nos. 333-187931

through 333-187931-01

PROSPECTUS

Truven Health Analytics Inc.

Offer to Exchange

$327,150,000 aggregate principal amount of 10.625% Senior Notes due 2020

that have been registered under the Securities Act of 1933

for any and all outstanding unregistered 10.625% Senior Notes due 2020

Offer for any and all outstanding 10.625% Senior Notes due 2020, in the aggregate principal amount of $327,150,000 (which we refer to as the “Old Notes”) that were issued in a private offering on June 6, 2012, in exchange for up to $327,150,000 in aggregate principal amount of 10.625% Senior Notes due 2020, which have been registered under the Securities Act of 1933, as amended (which we refer to as the “Exchange Notes” and, together with the Old Notes, the “Notes”). We are offering to exchange the Exchange Notes for the Old Notes to satisfy our obligations contained in the registration rights agreement that we entered into in connection with the issuance of the Old Notes. We will not receive any proceeds from the exchange offer, and issuance of the Exchange Notes will not result in any increase in our outstanding debt.

Terms of the Exchange Offer

| | • | | Expires 5:00 p.m., New York City time, July 26, 2013, unless extended. |

| | • | | You may withdraw tendered outstanding Old Notes any time before the expiration or termination of the exchange offer. |

| | • | | Not subject to any condition other than that the exchange offer does not violate applicable law or any applicable interpretation of the staff of the Securities and Exchange Commission and customary conditions. |

| | • | | We can amend or terminate the exchange offer. |

| | • | | We will not receive any proceeds from the exchange offer. |

| | • | | The exchange of Old Notes for Exchange Notes will not be a taxable event for United States federal income tax purposes. See “Material United States Federal Income Tax Considerations.” |

Terms of the Exchange Notes

| | • | | The Exchange Notes will be general senior unsecured obligations and will rank equally in right of payment with all of our existing and future indebtedness that is not expressly subordinated thereto, senior in right of payment to any existing and future indebtedness that is expressly subordinated in right of payment thereto and effectively junior to our existing and future secured indebtedness, including our existing senior secured credit facility, to the extent of the value of the collateral securing such indebtedness. |

| | • | | The Exchange Notes will be fully, jointly, severally and unconditionally guaranteed on a senior unsecured basis by Truven Holding Corp., our parent company, and our wholly-owned direct and indirect subsidiaries that guarantee any of our other indebtedness or the indebtedness of any other guarantor, all of which we refer to in this prospectus as the “Guarantors.” |

| | • | | The Exchange Notes will mature on June 1, 2020. |

| | • | | The Exchange Notes will accrue interest at a rate per annum equal to 10.625% and will be payable semi-annually on each June 1 and December 1. |

| | • | | We may redeem the Exchange Notes in whole or in part from time to time. See “Description of Exchange Notes.” |

| | • | | If we experience certain changes of control, we must offer to purchase the Exchange Notes at 101% of their aggregate principal amount, plus accrued and unpaid interest and Additional Interest, if any. |

| | • | | The terms of the Exchange Notes are substantially identical to those of the outstanding Old Notes, except the transfer restrictions and certain registration rights and additional interest provisions relating to the Old Notes do not apply to the Exchange Notes. |

We are an “emerging growth company” under applicable Securities and Exchange Commission rules and will be subject to reduced public company reporting requirements.

For a discussion of the specific risks that you should consider before tendering your outstanding Old Notes in the exchange offer, see “Risk Factors” in this prospectus.

There is no established trading market for the Old Notes or the Exchange Notes. We do not intend to list the Exchange Notes on any securities exchange or seek approval for quotation through any automated trading system.

Each broker-dealer that receives Exchange Notes for its own account pursuant to the exchange offer in exchange for Old Notes that were acquired as a result of market-making activities or other trading activities must acknowledge that it will deliver a prospectus (or, to the extent permitted by law, make available a prospectus to purchasers) in connection with any resales of the Exchange Notes. A broker-dealer may use this prospectus, as supplemented or amended, in connection with resales of any Exchange Notes acquired in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 26, 2013

TABLE OF CONTENTS

Each broker-dealer that receives Exchange Notes for its own account pursuant to the exchange offer in exchange for Old Notes that were acquired as a result of market-making activities or other trading activities must acknowledge that it will deliver a prospectus (or, to the extent permitted by law, make available a prospectus to purchasers) in connection with any resale of such Exchange Notes. By so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”). A broker-dealer who acquired Old Notes as a result of market-making or other trading activities may use this prospectus, as supplemented or amended from time to time, in connection with resales of the Exchange Notes. We have agreed that, for a period of up to 180 days after the date the exchange offer registration statement becomes effective, we will make this prospectus, as amended or supplemented, available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy securities other than those specifically offered hereby or an offer to sell any securities offered hereby in any jurisdiction where, or to any person whom, it is unlawful to make such offer or solicitation. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or issuing of the Exchange Notes.

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E in the Securities Exchange Act of 1934 (the “Exchange Act”), including statements that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results. These forward-looking statements identify prospective information and can generally be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “seeks,” “projects,” “intends,” “plans,” “may,” “will” or “should” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this prospectus and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which we operate.

Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. By their nature, forward-looking statements involve risks, uncertainties and changes in circumstance that are difficult to predict, because they relate to events and depend on circumstances that may or may not occur in the future. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. The matters referred to in the forward-looking statements contained in this prospectus may not in fact occur. We caution you therefore against relying on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include regional, national or global political, economic, business, competitive, market and regulatory conditions and the following:

| | • | | We are highly dependent on customers and, in many cases, their insurance carriers, as well as third-party vendors, to supply us with data necessary for the delivery of our solutions and services and any deterioration in our key sources of data would adversely affect our business. |

| | • | | We receive, process, store, use and transmit individually identifiable health information and other sensitive data, which subjects us to governmental regulation and other legal obligations related to privacy and security, and any actual or perceived failure to comply with such obligations could harm our business. |

| | • | | If our security measures are breached, or if the systems our customers use to gain access to our solutions are compromised, customers may curtail their use of our offerings or stop their use of our offerings entirely. |

| | • | | Failure of our customers to obtain proper permissions or provide us with accurate and appropriate data may result in claims against us or may limit or prevent our use of data, which could harm our business. |

| | • | | Certain of our activities present the potential for identity theft or similar illegal behavior by our employees or contractors with respect to third parties. |

| | • | | Government regulation creates risks and challenges with respect to our compliance efforts and our business strategies. |

| | • | | Customer contracts with governmental agencies, or which are funded by government programs, impose strict compliance burdens on us, may give rise to conflicts with some of our other important businesses, and are subject to termination and delays in funding. |

| | • | | Inaccuracies in the solutions and services that we deliver to our customers could have an adverse effect on our reputation and business and expose us to liability. |

| | • | | Failures, delays, or interruptions in the operation of our computer and communications systems or the failure to implement system enhancements may harm our business. |

| | • | | If we are unable to retain our existing customers, our business, financial condition and results of operations could suffer. |

ii

| | • | | A prolonged economic downturn could have a material adverse effect on our business, financial condition and results of operations. |

| | • | | Content innovation and technological developments could render our solutions and services obsolete or uncompetitive and we may not be able to develop new content innovations and technology necessary for our business to remain competitive, or to do so efficiently. |

| | • | | Our business is subject to significant or potentially significant competition that is likely to intensify in the future. |

| | • | | Our business could be harmed if we are no longer able to license or integrate third party technologies, or to the extent any problems arise with the functionality or successful integration of any software or other technologies licensed to us by third party vendors. |

| | • | | Client procurement strategies could put additional pressure on the pricing of our information services, thereby leading to decreased earnings. |

| | • | | The protection of our intellectual property requires substantial resources. |

| | • | | Third parties may claim that we are infringing their intellectual property, and we could suffer significant litigation or licensing expenses or be prevented from selling certain solutions. |

| | • | | We are, and may become, involved in litigation that could harm the value of our business. |

| | • | | Our success depends in part on our ability to identify, recruit and retain skilled management, including our executive officers, and technical personnel. If we fail to recruit and retain suitable candidates or if our relationship with our employees changes or deteriorates, there could be an adverse effect on our business. |

| | • | | Following the completion of the exchange offer, we will be subject to SEC reporting requirements for which our accounting and other management systems and resources may not be adequately prepared. |

| | • | | We may incur increased ongoing costs as a result of being obligated to file reports with the SEC and our management will be required to devote substantial time to new compliance initiatives. |

| | • | | Failure to successfully complete or integrate acquisitions into our existing operations could have an adverse impact on our business, financial condition and results of operations. |

| | • | | We may experience difficulties operating as a standalone company. |

| | • | | To the extent the availability of free or relatively inexpensive information increases, the demand for some of our solutions may decrease. |

| | • | | Our foreign operations expose us to political, economic, regulatory and other risks, which could adversely impact our financial results. |

| | • | | As an “emerging growth company” under the JOBS Act, we are permitted to, and intend to, rely on exemptions from some disclosure requirements. |

| | • | | Our Predecessor’s historical financial information may not be representative of our results as a standalone company or indicative of our future financial performance. |

| | • | | Rebranding may have an adverse impact on our business. |

| | • | | Following the consummation of the Transactions, we no longer receive financial support from Thomson Reuters or have access to its assets or borrowing power. We may not be able to raise additional funds when needed for our business or to exploit opportunities. |

| | • | | Following the consummation of the Transactions, we are controlled by the Sponsor, whose interest as equity holder may conflict with yours as a creditor. |

iii

| | • | | If we do not remediate material weaknesses in our internal control over financial reporting or are unable to implement and maintain effective internal control over financial reporting in the future, the accuracy and timeliness of our financial reporting may be adversely affected. |

| | • | | Other factors that are described in “Risk Factors” in this prospectus. |

The preceding factors should not be construed as exhaustive and should be read with the other cautionary statements in this prospectus. Any forward-looking statement made by us in this prospectus speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Although we base these forward-looking statements on assumptions that we believe are reasonable when made, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this prospectus. In addition, even if our results of operations, financial condition and liquidity, and the development of the industry in which we operate, are consistent with the forward-looking statements contained in this prospectus, those results or developments may not be indicative of results or developments in subsequent periods.

Given these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. Any forward-looking statements that we make in this prospectus speak only as of the date of those statements, and we undertake no obligation to update those statements or to publicly announce the results of any revisions to any of those statements to reflect future events or developments, except as may be required by law. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

MARKET, RANKING, INDUSTRY DATA AND FORECASTS

This prospectus includes market share, ranking, industry data and forecasts that we obtained from industry publications, surveys, public filings and internal company sources. As noted in this prospectus, the Centers for Medicare and Medicaid Services (“CMS”), the Kaiser Family Foundation, Atlantic Information Services, Inc., Health Affairs, the Office of the National Coordinator for Health Information Technology, the Healthcare Financial Management Association, Med Ad News and Billian Publishing were the primary sources for third-party industry data and forecasts. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of such information. We have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Statements as to our market position and ranking are based on market data currently available to us, management’s estimates and assumptions we have made regarding the size of our markets within our industry. While we are not aware of any misstatements regarding our industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk factors” in this prospectus. We cannot guarantee the accuracy or completeness of such information contained in this prospectus.

TRADEMARKS, SERVICE MARKS AND COPYRIGHTS

We own or have rights to trademarks, service marks or trade names that we use in connection with the operation of our business. In addition, our names, logos and website names and addresses are our service marks or trademarks. Other trademarks, service marks and trade names appearing in this prospectus are the property of

iv

their respective owners. Some of the trademarks we own or have the right to use include Advantage Suite, MarketScan, CareDiscovery, 100 Top Hospitals and Micromedex. We also own or have the rights to copyrights that protect the content of our products. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this prospectus are listed without the©,® andTM symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

BASIS OF PRESENTATION

Unless otherwise indicated or the context otherwise requires, references in this prospectus to:

| | • | | the term “Holdings LLC” refer to VCPH Holdings LLC, a Delaware limited liability company; |

| | • | | the term “Truven Holding” refer to Truven Holding Corp., a Delaware corporation that is directly owned by Holdings LLC; |

| | • | | the term “TRHI” refer to Thomson Reuters (Healthcare) Inc., a Delaware corporation, which, upon consummation of the Merger, became a direct wholly-owned subsidiary of VCPH Holding Corp. (now known as Truven Holding) and subsequently changed its name to Truven Health Analytics Inc.; |

| | • | | the terms “Thomson Reuters Healthcare” and “our Predecessor” refer to TRHI, together with certain other assets and liabilities of the Thomson Reuters Healthcare business prior to and including the date of the closing of the Acquisition on June 6, 2012; |

| | • | | the term “Wolverine” refer to Wolverine Healthcare Analytics, Inc., a Delaware corporation and an affiliate of The Veritas Capital Fund IV, L.P., a private equity fund managed by Veritas Capital, which was formed on May 16, 2012 as a direct wholly-owned subsidiary of VCPH Holding Corp. (now known as Truven Holding) and, upon consummation of the Acquisition, merged with and into TRHI, with TRHI surviving the Merger as a direct wholly-owned subsidiary of VCPH Holding Corp. (now known as Truven Holding) and subsequently changing its name to Truven Health Analytics Inc.; |

| | • | | the terms “Truven” and the “Issuer” refer to Truven Health Analytics Inc., a Delaware corporation and a direct wholly-owned subsidiary of Truven Holding; |

| | • | | the terms “our company,” “us,” “we” and “our” refer to Truven Holding and Truven, together with their subsidiaries; |

| | • | | the term “Acquisition” refer to the acquisition by Wolverine of 100% of the equity interests of TRHI and certain assets and liabilities of the Thomson Reuters Healthcare business, pursuant to the Stock and Asset Purchase Agreement, dated as of April 23, 2012, which VCPH Holding Corp. (now known as Truven Holding) entered into with the Stock Seller and the Asset Seller and subsequently assigned to Wolverine on May 24, 2012, and which closed on June 6, 2012; |

| | • | | the term “Merger” refer to the merger upon the closing of the Acquisition, whereby Wolverine (which was formed solely for the purpose of completing the Acquisition) merged with and into TRHI, with TRHI surviving the Merger as a direct wholly-owned subsidiary of VCPH Holding Corp. (now known as Truven Holding) and subsequently changing its name to Truven Health Analytics Inc.; |

| | • | | the term “Stock Seller” refer to Thomson Reuters U.S. Inc.; |

| | • | | the term “initial purchasers” refer to the initial purchasers of the Old Notes; |

| | • | | the terms “Sponsor” and “Veritas Capital” refer to Veritas Capital Fund Management, L.L.C.; |

| | • | | the term “Asset Seller” refer to Thomson Reuters Global Resources; |

| | • | | the terms “Thomson Reuters” and the “Predecessor Parent” refer to Thomson Reuters Corporation; |

v

| | • | | the term “Stock and Asset Purchase Agreement” refer to the Stock and Asset Purchase Agreement among VCPH Holding Corp., the Stock Seller and the Asset Seller, dated as of April 23, 2012, which VCPH Holding Corp. assigned to Wolverine on May 24, 2012; |

| | • | | the term “Predecessor period” refer to all periods prior to and including the date of the closing of the Acquisition on June 6, 2012; and |

| | • | | the term “Successor period” refer to all periods from inception of Truven Holding (April 20, 2012 onwards), which includes all periods of Truven after the closing of the Acquisition on June 6, 2012, and references to the term “Successor” refer to Truven Holding, on a consolidated basis with its subsidiaries. |

In connection with the Merger, Truven succeeded to the obligations of Wolverine under the credit agreement that governs our Senior Credit Facility and under the indenture that governs the Notes.

Data in this prospectus presented on a pro forma basis gives pro forma effect to the Transactions, as set forth under the heading “The Transactions.” See “Unaudited pro forma combined financial information” for an explanation of the pro forma adjustments contained in the unaudited pro forma combined financial information.

PRESENTATION OF FINANCIAL INFORMATION

As more fully described in this prospectus, on April 23, 2012, VCPH Holding Corp. (now known as Truven Holding) entered into a Stock and Asset Purchase Agreement with the Stock Seller and the Asset Seller, which VCPH Holding Corp. assigned to Wolverine on May 24, 2012. Pursuant to the Stock and Asset Purchase Agreement, Wolverine acquired 100% of the equity interests of TRHI and certain assets and liabilities of the Thomson Reuters Healthcare business. Following the Merger, these assets and liabilities are now held by Truven (formerly TRHI), which remains a direct wholly-owned subsidiary of Truven Holding, which was formed on April 20, 2012 by Veritas Capital for the purpose of consummating the Acquisition and has had no operations from inception. In this prospectus, we refer to this acquisition as the “Acquisition.” Our Predecessor’s financial statements included in this prospectus have been prepared on a carve-out basis using the historical basis of Thomson Reuters in the assets and liabilities, the historical results of the operations of the Thomson Reuters Healthcare business and the fiscal year end of Thomson Reuters of December 31 of each year. Our Predecessor’s combined financial statements have been derived from the consolidated financial statements and accounting records of Thomson Reuters, principally from statements and records representing the Thomson Reuters Healthcare business when it was operated as a division of Thomson Reuters. The Successor’s audited consolidated financial statements for the period from inception of Truven Holding (April 20, 2012 onwards) represent the consolidated financial position of Truven Holding and its subsidiaries, which includes all periods of Truven after the closing of the Acquisition on June 6, 2012. Both our Predecessor’s and Successor’s financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”). References in this prospectus to “fiscal year” or “fiscal” refer to our fiscal year ending on December 31 in each calendar year.

EMERGING GROWTH COMPANY STATUS

We are an “emerging growth company” as defined in the recently enacted Jumpstart Our Business Startups Act (“JOBS Act”), and we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies.” See “Risk Factors—Risks related to our business—As an “emerging growth company” under the JOBS Act, we are permitted to, and intend to, rely on exemptions from some disclosure requirements.”

vi

Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We could remain an “emerging growth company” until the earliest of: (i) the last day of the fiscal year during which we had total annual gross revenues of $1 billion or more; (ii) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement; (iii) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt; or (iv) the date on which we are deemed a “large accelerated issuer” as defined under the federal securities laws.

vii

SUMMARY

This summary highlights certain information about our business and about this exchange offer. This is a summary of information contained elsewhere in this prospectus, is not complete and does not contain all of the information that may be important to you. For a more complete understanding of our business and this exchange offer, you should read this entire prospectus, including the section entitled “Risk Factors,” along with our financial statements and the related notes included elsewhere in this prospectus.

Company overview

We provide healthcare data and analytics solutions and services to key constituents in the U.S. healthcare system, including federal government agencies, state government agencies, employers and health plans, hospitals, clinicians and pharmaceutical companies. We are one of the largest independent healthcare data and analytics solutions and services providers. In a changing healthcare environment with increasing pressures for lower costs and higher performance, our solutions and services empower our customers to make decisions to improve the cost, performance and quality of healthcare through data and data analytics.

We integrate our significant content assets with expert designed methodologies and analytics into solution platforms that are designed to help our clients make better decisions, analyze data more effectively and deliver healthcare more efficiently and with higher quality.

Our solutions address various areas of industry needs, including:

| | • | | Cost and risk management |

| | • | | Clinical and operational performance improvement |

Business overview

We create value for our clients by integrating and leveraging our extensive content assets with our deep industry domain expertise and analytics. We deploy these capabilities across solution and service platforms that meet the needs of different industry customer channels.

Our technology and data operations have been built over 30 years to harmonize disparate data streams through our rigorous and efficient data processing capacity. We process updates on a daily basis for databases with over 500 terabytes of data containing 40 billion data records on 170 million de-identified patient lives and review over 500,000 articles from over 10,000 journals every year. We continually refresh and transform this large and complex quantity of data into coherent and actionable information that enables our downstream analytics.

The major solution platforms and services we provide for our clients include population health and cost analysis solutions; hospital performance management solutions; patient care solutions; research solutions; and payment integrity and compliance solutions. In each solution area, we augment our value proposition with highly tailored services offered either as an integral part of a recurring contract or as a separate but often repeated service engagement.

Our Segments

We operate and manage our business under three reportable segments. Each segment offers distinct integrated products and services related to data analytics and solution platforms to customers or groups of similar customers

1

that are subject to different pricing, process and marketing strategies. The Company’s business segments, which primarily operate in the United States, are as follows:

Payer – The Payer segment provides information and solutions to various customer channels, such as employers/health plans, pharmaceutical companies, federal government, and state government, to improve the cost and quality of healthcare. These solutions focus on care and risk management, which enhance benefit design, medical cost trend management, disease management, network design and quality management processes in healthcare payer and purchasing organizations.

Hospitals – The Hospitals segment provides data, analytics, solutions and value added services to healthcare providers. These solutions benchmark customer data and evaluate the customer’s performance against peer organizations. Typical benchmarks include costs, operational efficiencies, clinical performance and re-admissions.

Clinicians – The Clinicians segment delivers high value content, solutions and sophisticated decision support tools primarily to hospitals and health systems for use by nurses, physicians and pharmacists. These solutions and tools are aimed at improving patient care, reducing medication errors and enhancing disease and condition management.

Our competitive strengths

We believe we are distinguished by the following competitive strengths:

| | • | | A leading independent healthcare data and analytics solutions and services provider |

| | • | | Significant barriers to entry as a result of our difficult to replicate data assets coupled with 30 years of experience and domain expertise |

| | • | | High revenue visibility and cash flow generation driven by a subscription-based business model |

| | • | | Diversified, blue chip customer base |

| | • | | Experienced management team with long company tenure |

Our business strategy

Our strategy is to grow our business as a leading provider of healthcare data and analytics to our customer channels within our segments by expanding and deepening our client relationships and expanding our products and services offerings.

The Transactions

Stock and Asset Purchase Agreement

On April 23, 2012, VCPH Holding Corp. (now known as Truven Holding) entered into the Stock and Asset Purchase Agreement with the Stock Seller and the Asset Seller, which VCPH Holding Corp. assigned to Wolverine on May 24, 2012. Pursuant to the Stock and Asset Purchase Agreement, Wolverine acquired 100% of the equity interests of Thomson Reuters (Healthcare) Inc. and certain other assets and liabilities of the Thomson Reuters Healthcare business. Following the Merger, these assets and liabilities acquired are now held by Truven (formerly TRHI), which remains a direct wholly-owned subsidiary of Truven Holding. The acquired assets include certain intellectual property, causes of action and claims and other incidental assets. The acquired liabilities include certain claims and legal proceedings, compensation and benefits and other liabilities in existence at the closing of the Acquisition. There were no pre-closing or post-closing purchase price adjustments.

2

Merger

Upon the closing of the Acquisition, Wolverine merged with and into TRHI, with TRHI surviving the Merger as a direct wholly-owned subsidiary of VCPH Holding Corp. (now known as Truven Holding). TRHI subsequently changed its name to Truven Health Analytics Inc. In this prospectus, we refer to this merger as the “Merger.” In connection with the Merger, Truven (formerly TRHI) succeeded to the obligations of Wolverine under the credit agreement that governs the Senior Credit Facility (as defined below) and under the indenture that governs the Notes.

Financing

We financed the Acquisition and paid related costs and expenses associated with the Acquisition and the financing as follows:

| | • | | $464.4 million in common equity contributed by entities affiliated with the Sponsor and certain co-investors; |

| | • | | $527.6 million principal amount of borrowings under the Term Loan Facility described below; and |

| | • | | $327.2 million principal amount of Old Notes. |

In connection with the offering of the Old Notes and the Acquisition, we and VCPH Holding Corp. (now known as Truven Holding) entered into a senior secured credit facility (the “Senior Credit Facility”) with JPMorgan Chase Bank, N.A., as administrative agent, J.P. Morgan Securities LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated, Morgan Stanley Senior Funding, Inc. and UBS Securities LLC as arrangers and the several lenders party thereto. As amended on April 26, 2013, the Senior Credit Facility consists of (i) a $535.0 million term loan facility with a seven-year maturity (the “Term Loan Facility”) and (ii) a $50.0 million revolving credit facility with a five-year maturity (the “Revolving Credit Facility”). See “The Transactions” for further information regarding the Transactions, and see “Description of Senior Credit Facility” for a description of the Senior Credit Facility.

We refer to the Acquisition and the related transactions, including the Merger, the offer and sale of the Old Notes, the borrowings under our Senior Credit Facility and the equity investments described above as the “Transactions.” All references to “the closing of the Acquisition” and to “the closing of the Transactions” refer to the closing of the Acquisition and the related transactions on June 6, 2012.

3

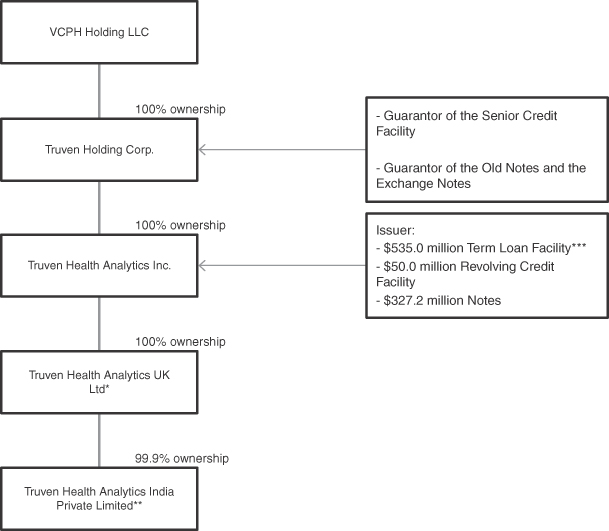

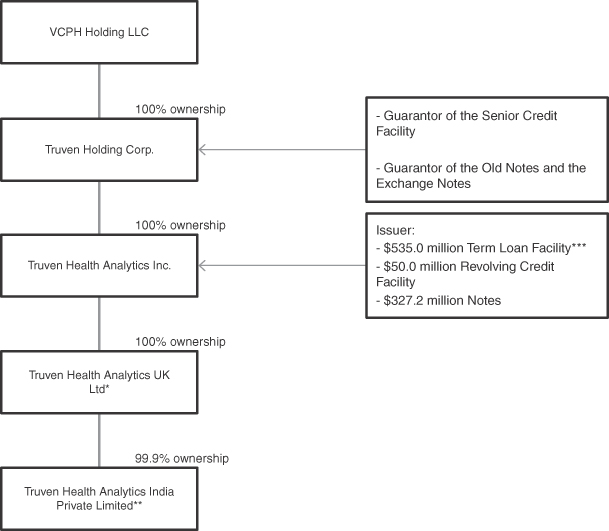

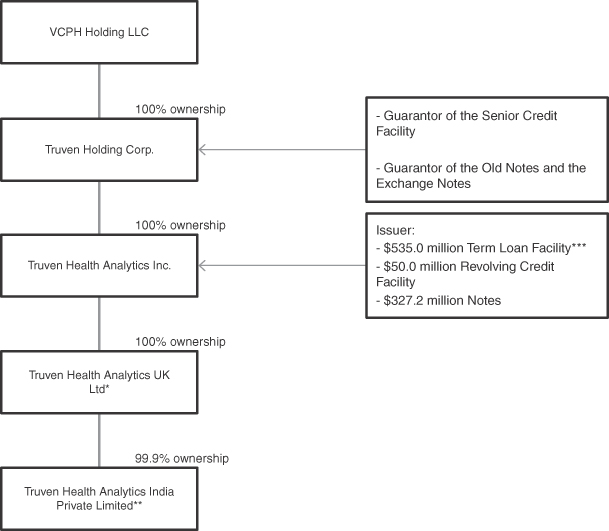

Corporate structure

The chart below illustrates our basic corporate and debt structure.

| * | 66% of issued shares (66 shares) have been pledged to JPMorgan Chase Bank, N.A. as Administrative Agent under the Senior Credit Facility. |

| ** | 0.1% (or 10 shares) owned by Drushanthi Ganeshan, a Director employee. |

| *** | As amended on April 26, 2013. |

4

Equity sponsor

Veritas Capital is a leading private equity firm that specializes in making investments in companies that provide products and services to government and commercial customers around the world, including healthcare, technology, education, energy, defense, infrastructure, national security and aerospace. Veritas Capital, through its private equity funds, has made 21 platform investments. In addition to Truven, Veritas Capital’s current portfolio companies include Aeroflex Incorporated, CRGT, Inc., Excelitas Technologies Corp., KeyPoint Government Solutions, Inc., The SI Organization, Inc. and CPI International, Inc.

Corporate history and information

As the healthcare business unit of Thomson Reuters, our Predecessor, Thomson Reuters Healthcare was managed both separately and in conjunction with the Thomson Reuters Scientific segment during the 10 years preceding the Acquisition. Effective June 30, 2011 following the announcement by Thomson Reuters of its intention to dispose of the Thomson Reuters Healthcare business, until the closing of the Acquisition on June 6, 2012, it operated as a separate unit within Thomson Reuters. Veritas Capital announced that its newly formed subsidiary, VCPH Holding Corp. (now known as Truven Holding), had entered into an agreement to acquire 100% of the equity interests of TRHI and certain assets and liabilities of Thomson Reuters Healthcare on April 23, 2012. VCPH Holding Corp. assigned the agreement to Wolverine on May 24, 2012. Upon closing of the Acquisition, Wolverine merged with and into TRHI, with TRHI surviving the Merger as a direct wholly-owned subsidiary of VCPH Holding Corp. (now known as Truven Holding). TRHI subsequently changed its name to Truven Health Analytics Inc.

Truven Health Analytics Inc. is a Delaware corporation. Our principal executive offices are located at 777 E. Eisenhower Parkway, Ann Arbor, Michigan 48108. Our telephone number at that address is (734) 913-3000. Our corporate website address is www.truvenhealth.com. The website and the information contained on the website do not constitute a part of this prospectus. You should rely only on the information contained in this prospectus.

We operate in a competitive and rapidly changing environment. You should consider carefully all of the information contained in this prospectus and, in particular, you should evaluate the specific risk factors set forth in the “Risk Factors” section of this prospectus, which describes the risk factors related to the exchange offer and our business and organization structure in evaluating the exchange offer and making a decision whether to participate.

The Exchange Offer

On June 6, 2012, we sold, through a private placement exempt from the registration requirements of the Securities Act, $327,150,000 of our 10.625% Senior Notes due 2020, all of which are eligible to be exchanged for Exchange Notes. We refer to these notes as “Old Notes” in this prospectus.

Simultaneously with the private placement, we entered into a Registration Rights Agreement, dated June 6, 2012 (the “Registration Rights Agreement”), with the initial purchasers of the Old Notes. Under the Registration Rights Agreement, we are required to use commercially reasonable efforts to file a registration statement with the Securities and Exchange Commission (the “SEC”) enabling the holders of the Old Notes to exchange their Old Notes for Exchange Notes with identical terms, other than with respect to limitations on transfer and registration rights, and use commercially reasonable efforts to complete the exchange offer not later than 60 days after the date on which the exchange offer registration statement is declared effective by the SEC. You may exchange your Old Notes for Exchange Notes in this exchange offer. You should read the discussion under the headings “—Summary of Exchange Offer,” “The Exchange Offer” and “Description of Exchange Notes” for further information regarding the Exchange Notes.

5

We did not file the exchange offer registration statement for the Old Notes by March 3, 2013 and consequently have been required to pay additional interest on the Old Notes beginning on March 4, 2013, pursuant to the Registration Rights Agreement. We paid a total of $197,653 in additional interest on the June 1, 2013 interest payment date. Once the exchange offer is completed, the interest rate on any remaining outstanding Old Notes and the new Exchange Notes will revert to 10.625%.

We did not register the Old Notes under the Securities Act or any state securities law, nor do we intend to after the exchange offer. As a result, the Old Notes may only be transferred in limited circumstances under the securities laws. If the holders of the Old Notes do not exchange their Old Notes in the exchange offer, they lose their right to have the Old Notes registered under the Securities Act, subject to some exceptions. Anyone who still holds Old Notes after the exchange offer may be unable to resell their Old Notes.

Securities Offered | $327,150,000 aggregate principal amount of 10.625% Senior Notes due 2020. |

Exchange Offer | We are offering to exchange the Old Notes for a like principal amount at maturity of the Exchange Notes. Old Notes may be exchanged only in minimum denominations of $2,000 and any integral multiple of $1,000 in excess thereof. This exchange offer is being made pursuant to the Registration Rights Agreement, which grants the initial purchasers and any subsequent holders of the Old Notes certain exchange and registration rights. This exchange offer is intended to satisfy those exchange and registration rights with respect to the Old Notes. After the exchange offer is complete, you will no longer be entitled to any exchange or registration rights with respect to your Old Notes, subject to some exceptions. |

| | The form and terms of the Exchange Notes are the same as the form and terms of the outstanding Old Notes except that: |

| | • | | the Exchange Notes will be registered under the Securities Act and will not have any legends restricting their transfer; |

| | • | | the Exchange Notes will bear a different CUSIP number than the Old Notes; |

| | • | | the Exchange Notes will not contain the registration rights and additional interest provisions contained in the outstanding Old Notes; and |

| | • | | interest on the Exchange Notes will accrue from the last interest date on which interest was paid on the Old Notes. |

| | The Exchange Notes will evidence the same debt as the Old Notes and will be entitled to the benefits of the same indenture that governs the Old Notes. |

Expiration Date; Withdrawal of Tender | The exchange offer will expire 5:00 p.m., New York City time, on July 26, 2013, or a later time if we choose to extend the exchange offer in our sole and absolute discretion. You may withdraw your tender of Old Notes at any time prior to 5:00 p.m., New York City time, on the expiration date. All outstanding Old Notes that are |

6

| | validly tendered and not validly withdrawn will be exchanged. Any Old Notes not accepted by us for exchange for any reason will be returned to you at our expense as promptly as possible after the expiration or termination of the exchange offer. |

Resales | We believe that you can offer for resale, resell and otherwise transfer the Exchange Notes without complying with the registration and prospectus delivery requirements of the Securities Act so long as: |

| | • | | you acquire the Exchange Notes in the ordinary course of business; |

| | • | | you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in the distribution of the Exchange Notes; |

| | • | | you are not an “affiliate” of ours, as defined in Rule 405 under the Securities Act; and |

| | • | | you are not a broker-dealer. |

| | If any of these conditions is not satisfied and you transfer any Exchange Notes without delivering a proper prospectus or without qualifying for a registration exemption, you may incur liability under the Securities Act. We do not assume, or indemnify you against, any such liability. |

| | Each broker-dealer acquiring Exchange Notes for its own account in exchange for Old Notes, which it acquired through market-making activities or other trading activities, must acknowledge that it will deliver a proper prospectus (or, to the extent permitted by law, make available a prospectus to purchasers) meeting the requirements of the Securities Act in connection with any resale of the Exchange Notes. A broker-dealer may use this prospectus, as supplemented or amended, in connection with resales of Exchange Notes acquired in the exchange offer. |

Conditions to the Exchange Offer | Our obligation to accept for exchange, or to issue the Exchange Notes in exchange for, any Old Notes is subject to certain customary conditions, including our determination that the exchange offer does not violate any law, statute, rule, regulation or interpretation by the Staff of the SEC or any regulatory authority or other foreign, federal, state or local government agency or court of competent jurisdiction, some of which may be waived by us. We currently expect that each of the conditions will be satisfied and that no waivers will be necessary. See “The Exchange Offer—Conditions on the Exchange Offer.” |

Procedures for Tendering Old Notes held in the Form of Book-Entry Interests | The Old Notes were issued as global book-entry notes and were deposited upon issuance with The Bank of New York Mellon Trust Company, N.A., as custodian for the global securities representing the |

7

| | uncertificated depositary interests in those outstanding Old Notes, which represent a 100% interest in those Old Notes, to The Depository Trust Company (“DTC”). Beneficial interests in the outstanding Old Notes, which are held by direct or indirect participants in DTC, are shown on, and transfers of the Old Notes can only be made through, records maintained in book-entry form by DTC. |

| | You may tender your outstanding Old Notes by instructing your broker or bank where you keep the Old Notes to tender them on your behalf. In some cases you may be asked to submit the letter of transmittal that may accompany this prospectus. By tendering your Old Notes you will be deemed to have acknowledged and agreed to be bound by the terms set forth under “The Exchange Offer.” Your outstanding Old Notes must be tendered in minimum denominations of $2,000 and any integral multiple of $1,000 in excess thereof. |

| | In order for your tender to be considered valid, the exchange agent must receive a confirmation of book-entry transfer of your outstanding Old Notes into the exchange agent’s account at DTC, under the procedure described in this prospectus under the heading “The Exchange Offer,” on or before 5:00 p.m., New York City time, on the expiration date of the exchange offer. |

United States Federal Income Tax Considerations | The exchange offer will not result in any income, gain or loss to the holders of Old Notes or to us for United States federal income tax purposes. See “Material United States Federal Income Tax Considerations.” |

Use of Proceeds | We will not receive any proceeds from the issuance of the Exchange Notes in the exchange offer. |

Exchange Agent | The Bank of New York Mellon Trust Company, N.A. is serving as the exchange agent for the exchange offer. |

Shelf Registration Statement | In limited circumstances, holders of Old Notes may require us to register their Old Notes under a shelf registration statement. |

Consequences of Not Exchanging Old Notes

If you do not exchange your Old Notes in the exchange offer, your Old Notes will continue to be subject to the restrictions on transfer currently applicable to the Old Notes. In general, you may offer or sell your Old Notes only:

| | • | | if they are registered under the Securities Act and applicable state securities laws; |

| | • | | if they are offered or sold under an exemption from registration under the Securities Act and applicable state securities laws; or |

| | • | | if they are offered or sold in a transaction not subject to the Securities Act and applicable state securities laws. |

8

We do not currently intend to register the Old Notes under the Securities Act. Under some circumstances, however, holders of the Old Notes, including holders whose Old Notes are ineligible to be exchanged in the exchange offer, may require us to file, and to cause to become effective, a shelf registration statement covering resales of Old Notes by these holders. For more information regarding the consequences of not tendering your Old Notes and our obligation to file a shelf registration statement, see “The Exchange Offer—Consequences of Failure to Exchange” and “The Exchange Offer—Shelf Registration.”

Description of Exchange Notes

Issuer | Truven Health Analytics Inc., a Delaware corporation |

Securities offered | $327,150,000 aggregate principal amount of 10.625% Senior Notes due 2020. |

Maturity date | June 1, 2020. |

Interest rate | 10.625% per year. |

Interest payment dates | June 1 and December 1, commencing December 1, 2012. Interest will accrue from the last interest date on which interest was paid on the Old Notes. |

Optional redemption | The Exchange Notes will be redeemable at our option, in whole or in part, at any time on or after June 1, 2016, at the redemption prices set forth in this prospectus, together with accrued and unpaid interest thereon, to but excluding the date of redemption. |

| | At any time prior to June 1, 2015, we may redeem up to 35% of the aggregate principal amount of the Exchange Notes with the cash proceeds of certain equity offerings at a redemption price of 110.625% of the aggregate principal amount of the Exchange Notes, together with accrued and unpaid interest thereon, to but excluding the date of redemption, subject to certain conditions. |

| | At any time prior to June 1, 2016, we may also redeem some or all of the Exchange Notes at a redemption price equal to 100% of the principal amount of the Exchange Notes redeemed, together with accrued and unpaid interest, to but excluding the date of redemption, plus a “make-whole premium.” |

Change of control offer | Upon the occurrence of specific kinds of changes of control, we will make an offer to repurchase all of the Exchange Notes at 101% of the aggregate principal amount thereof, together with accrued and unpaid interest, to, but excluding, the repurchase date. See “Description of exchange notes—Repurchase at the option of holders—Change of control.” |

Asset disposition offer | Certain asset dispositions will be triggering events that may require us to use the proceeds from those asset dispositions to make an offer to purchase the Exchange Notes (and potentially other indebtedness that ispari passu with the Exchange Notes) at 100% of their principal amount, together with accrued and unpaid interest, to the date fixed |

9

| | for the closing of such offer if such proceeds are not otherwise used within a specified period to reduce or repay certain indebtedness (with a corresponding reduction in commitment, if applicable), to make certain capital expenditures, or to invest in capital assets related to our business or capital stock of a restricted subsidiary (as defined under the heading “Description of exchange notes.”) See “Description of exchange notes—Repurchase at the option of holders—Asset sales.” |

Guarantees | The Exchange Notes will be fully and unconditionally guaranteed, jointly and severally, on a senior unsecured basis by Truven Holding and each of our wholly-owned direct and indirect subsidiaries that is a borrower under or that guarantees our obligations under our Senior Credit Facility or that guarantees our indebtedness or indebtedness of any other guarantor (collectively, the “guarantors”). Under certain circumstances, the subsidiary guarantors may be released from their guarantees without the consent of the holders of the Exchange Notes. See “Description of exchange notes—Guarantees.” |

| | As of March 31, 2013, our non-guarantor subsidiaries represented less than 3% of our operating revenues, net income and total assets. |

Ranking | The Exchange Notes and the guarantees will be our and the guarantors’ general senior unsecured obligations and will: |

| | • | | rank senior in right of payment to all of our and the guarantors’ existing and future subordinated indebtedness; |

| | • | | rank equally in right of payment with all of our and the guarantors’ existing and future senior indebtedness (including the Senior Credit Facility); |

| | • | | be effectively subordinated to any of our and the guarantors’ existing and future secured debt (including the Senior Credit Facility), to the extent of the value of the assets securing such debt; and |

| | • | | be structurally subordinated to all of the existing and future liabilities (including trade payables) of any of our subsidiaries that does not guarantee the Exchange Notes. |

Covenants | We will issue the Exchange Notes under the indenture with The Bank of New York Mellon Trust Company, N.A., as trustee. The indenture, among other things, limits our ability and the ability of restricted subsidiaries to: |

| | • | | incur additional indebtedness and guarantee indebtedness; |

| | • | | pay dividends or make other distributions in respect of, or repurchase or redeem, our capital stock; |

| | • | | prepay, redeem or repurchase certain debt; |

| | • | | issue certain preferred stock or similar equity securities; |

| | • | | make loans, investments and acquisitions; |

10

| | • | | sell or otherwise dispose of assets; |

| | • | | enter into transactions with affiliates; |

| | • | | enter into agreements restricting any restricted subsidiaries’ ability to pay dividends; and |

| | • | | consolidate, merge or sell all or substantially all of our assets. |

| | These covenants will be subject to a number of important exceptions and qualifications. For more details, see “Description of Exchange Notes.” |

No established trading market | The Exchange Notes are new issues of securities with no established trading market. We do not intend to apply for the Exchange Notes to be listed on any securities exchange or included in any automated quotation system. We cannot assure you that a liquid market for the Exchange Notes will develop or be maintained. |

Use of proceeds | We will not receive any proceeds from the issuance of the Exchange Notes pursuant to the exchange offer. |

Risk factors | In evaluating an investment in the Exchange Notes, prospective investors should carefully consider, along with the other information in this prospectus, the specific factors set forth under “Risk Factors” for risks involved with an investment in the Exchange Notes. |

11

Summary historical financial and other data

The following table sets forth our summary historical financial and other data for the periods and at the dates indicated:

The termPredecessor periodrefers to all periods related to the Thomson Reuters Healthcare business (the Predecessor) prior to and including the date of the closing of the Acquisition on June 6, 2012. We have derived the statement of operations and cash flow data for the fiscal years ended December 31, 2011 and 2010 and for the period from January 1 to June 6, 2012, and the balance sheet data as of December 31, 2011 from our Predecessor’s audited combined financial statements included elsewhere in this prospectus. The balance sheet data as of December 31, 2010 has been derived from our Predecessor’s audited combined financial statements not included in this prospectus. We have derived the statement of operations and cash flow data for the three month period ended March 31, 2012 and the balance sheet data as of March 31, 2012 from our unaudited interim condensed consolidated and combined financial statements as of March 31, 2013, included elsewhere in this prospectus.

The term Successor periodrefers to all periods from inception of Truven Holding (April 20, 2012 onwards), which includes all periods of Truven after the closing of the Acquisition on June 6, 2012. Following the Acquisition and the related Merger, Truven (formerly TRHI) owns certain other assets and liabilities of the Thomson Reuters Healthcare business and is a direct wholly-owned subsidiary of Truven Holding (the Successor). We have derived the balance sheet data as of December 31, 2012 and the statement of operations and cash flow data for the period from April 20, 2012 to December 31, 2012 from Successor’s audited consolidated financial statements included elsewhere in this prospectus, which represent the consolidated financial position of Truven Holding and its subsidiaries. We have derived the statement of comprehensive income (loss) and cash flow data for the three month period ended March 31, 2013 and the balance sheet data as of March 31, 2013 from our unaudited interim condensed consolidated and combined financial statements as of March 31, 2013, included elsewhere in this prospectus, which represent the consolidated results of operations and financial position of Truven Holding and its subsidiaries as of March 31, 2013. The summary historical financial and other data included below and elsewhere in this prospectus are not necessarily indicative of future results. The summary financial data presented below has been derived from financial statements that have been prepared in accordance with GAAP and should be read with the information included under the headings “Risk Factors,” “Capitalization,” “Unaudited pro forma combined financial information,” “Management’s discussion and analysis of financial condition and results of operations” and with our audited consolidated and combined financial statements as of December 31, 2012, and unaudited interim condensed consolidated and combined financial statements as of March 31, 2013 and the related notes thereto, included elsewhere in this prospectus.

12

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Predecessor | | | | | Successor | | | Predecessor | | | | | Successor | |

(Dollars In thousands) | | Year ended

December 31,

2010 | | | Year ended

December 31,

2011 | | | Period

from

January 1

to

June 6, | | | | | Period from

inception

(April 20,

2012) to

December 31,

2012

(Successor) | | | Three

months

ended

March 31,

2012 | | | | | Three

months

ended

March 31,

2013 | |

| | | (unaudited) | | | (unaudited) | | | | | (unaudited) | | | (unaudited) | | | | | (unaudited) | |

Statement of operations data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues, net | | $ | 450,008 | | | $ | 483,207 | | | $ | 208,998 | | | | | $ | 241,786 | | | $ | 120,148 | | | | | $ | 112,890 | |

Cost of revenues, excluding depreciation and amortization(a) | | | (226,176 | ) | | | (238,291 | ) | | | (108,760 | ) | | | | | (137,063 | ) | | | (62,316 | ) | | | | | (65,340 | ) |

Selling and marketing, excluding depreciation and amortization(b) | | | (55,148 | ) | | | (53,991 | ) | | | (25,559 | ) | | | | | (30,482 | ) | | | (14,314 | ) | | | | | (13,115 | ) |

General and administrative, excluding depreciation and amortization(c) | | | (40,715 | ) | | | (53,008 | ) | | | (30,821 | ) | | | | | (18,013 | ) | | | (14,394 | ) | | | | | (11,134 | ) |

Allocation of costs from Predecessor Parent and affiliates(d) | | | (33,358 | ) | | | (34,496 | ) | | | (10,003 | ) | | | | | — | | | | (7,453 | ) | | | | | — | |

Depreciation | | | (13,418 | ) | | | (14,851 | ) | | | (6,805 | ) | | | | | (6,700 | ) | | | (3,552 | ) | | | | | (4,580 | ) |

Amortization of developed technology and content | | | (23,660 | ) | | | (24,208 | ) | | | (12,460 | ) | | | | | (15,470 | ) | | | (5,873 | ) | | | | | (7,718 | ) |

Amortization of other identifiable intangible assets(e) | | | (20,112 | ) | | | (19,691 | ) | | | (8,226 | ) | | | | | (19,527 | ) | | | (4,765 | ) | | | | | (8,615 | ) |

Other operating expenses(f) | | | (1,995 | ) | | | (20,002 | ) | | | (18,803 | ) | | | | | (49,622 | ) | | | (7,003 | ) | | | | | (12,865 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total operating costs and expenses | | | (414,582 | ) | | | (458,538 | ) | | | (221,437 | ) | | | | | (276,877 | ) | | | (119,670 | ) | | | | | (123,367 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating (loss) income | | | 35,426 | | | | 24,669 | | | | (12,439 | ) | | | | | (35,091 | ) | | | 478 | | | | | | (10,477 | ) |

Interest income from Predecessor Parent(g) | | | 156 | | | | 134 | | | | — | | | | | | — | | | | (2 | ) | | | | | — | |

Net interest income (expense)(h) | | | 60 | | | | (63 | ) | | | 3 | | | | | | (49,014 | ) | | | 46 | | | | | | (17,567 | ) |

Unrealized foreign exchange loss | | | | | | | | | | | | | | | | | | | | | — | | | | | | (12 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) Income before income taxes | | | 35,642 | | | | 24,740 | | | | (12,436 | ) | | | | | (84,105 | ) | | | 522 | | | | | | (28,056 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Benefit from (Provision for) income taxes | | | (13,989 | ) | | | (9,859 | ) | | | 4,803 | | | | | | 29,993 | | | | (229 | ) | | | | | 10,426 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income | | $ | 21,653 | | | $ | 14,881 | | | $ | (7,633 | ) | | | | $ | (54,112 | ) | | $ | 293 | | | | | $ | (17,630 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash flow data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net cash provided by operating activities | | $ | 97,684 | | | $ | 85,017 | | | $ | 17,806 | | | | | $ | 27,352 | | | | 14,520 | | | | | | 17,268 | |

Net cash used in investing activities | | | (43,925 | ) | | | (40,521 | ) | | | (10,285 | ) | | | | | (1,281,130 | ) | | | (9,513 | ) | | | | | (19,378 | ) |

Net cash provided by (used in) financing activities | | | (55,227 | ) | | | (44,659 | ) | | | (7,513 | ) | | | | | 1,277,125 | | | | (5,004 | ) | | | | | 631 | |

Other financial data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital expenditures(i) | | | (40,058 | ) | | | (40,521 | ) | | | (10,285 | ) | | | | | (31,270 | ) | | | (9,513 | ) | | | | | (19,378 | ) |

Ratio of earnings to fixed charges(j) | | | 14.4x | | | | 11.1x | | | | — | | | | | | — | | | | 1.8x | | | | | | — | |

| | | | | | | | | | | | | | | | | | |

| | | Predecessor | | | | | Successor | | | Successor | |

| | | As of December 31, | | | | | As of December 31, | | | As of March 31, | |

| | | 2010 | | | 2011 | | | | | 2012 | | | 2013 | |

| | | (unaudited) | | | | | (unaudited) | | | (unaudited) | |

Balance sheet data (at end of period): | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 233 | | | $ | 70 | | | | | $ | 23,347 | | | $ | 21,836 | |

Working capital deficit(k) | | | (75,444 | ) | | | (75,481 | ) | | | | | (86,036 | ) | | | (110,455 | ) |

Total assets | | | 800,611 | | | | 590,875 | | | | | | 1,597,082 | | | | 1,566,784 | |

Long-term debt, net of original issue discount(l) | | | — | | | | — | | | | | | 837,972 | | | | 837,194 | |

Total equity | | | 568,089 | | | | 354,299 | | | | | | 419,252 | | | | 404,907 | |

13

| (a) | Includes all personnel and other costs of revenue, including but not limited to, client support, client operations, product management, royalties, allocation of technology support costs administered by Thomson Reuters relating to market data and professional service costs. |

| (b) | Includes all personnel and other costs related to sales and marketing, including but not limited to, sales and marketing staff, commissions and marketing events. |

| (c) | Includes all personnel and other costs related to general administration as well as costs shared across the organization, including but not limited to technology, finance and strategy. |

| (d) | As described in Note 18 to the financial statements for the 2012 periods and Note 8 to the unaudited interim condensed consolidated and combined financial statements as of March 31, 2013, included elsewhere in this prospectus, our Predecessor historically engaged in related party transactions with Thomson Reuters relative to certain support services, including among others, finance, accounting, treasury, tax, transaction processing, information technology, legal, human resources, payroll, insurance and real estate management. |

| (e) | Includes amortization of definite-lived trade names, database content, publishing rights and acquired customer relationship assets. |

| (f) | Includes related disposal costs incurred as part of the Acquisition process (comprised of audit services, accounting and consulting services and legal fees), severance and retention bonuses relating to the Acquisition, costs relating to other acquisition activities in the Predecessor period (such as legal fees and due diligence costs) and other costs which represent severance, consulting expenses and technology expenses as part of certain restructuring activities. Refer to Note 14 to the financial statements for the 2012 periods and Note 5 to the unaudited interim condensed consolidated and combined financial statements as of March 31, 2013, included elsewhere in this prospectus. |

| (g) | Prior to the Acquisition, certain of our Predecessor’s cash management transactions with Thomson Reuters were subject to written loan agreements specifying repayment terms and interest payments, under which Thomson Reuters was required to pay interest to our Predecessor equal to the average monthly rate earned by Thomson Reuters on its cash investments held with its primary U.S. banker. Interest on these notes is reflected in “Interest income from Predecessor Parent” in our Predecessor’s combined statement of operations. These loan agreements were satisfied upon completion of the Acquisition. |

| (h) | Interest earned or incurred related to third-party transactions. |

| (i) | Includes capitalized software and capitalized hardware, other equipment related costs, as well as other property costs. |

| (j) | For purposes of determining the ratio of earnings to fixed charges, earnings are defined as earnings (loss) from continuing operations before income taxes, plus fixed charges. The term “fixed charges” means the sum of the following: (i) interest expensed and capitalized, (ii) amortized premiums, discounts and capitalized expenses related to indebtedness, (iii) an estimate of the interest within rental expense, and (iv) loss on early extinguishment of debt representing write-off of unamortized debt issue cost, original issue discount and call premium fees. The ratio of earnings to fixed charges is computed by dividing earnings (loss) from operations plus fixed charges by fixed charges. |

| (k) | Working capital is defined as current assets excluding cash and cash equivalents minus current liabilities. |

| (l) | Total debt includes current and non-current portion, net of original issue discount of $13.6 million and $14.2��million as of March 31, 2013 and December 31, 2012, respectively. |

14

RISK FACTORS

You should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to participate in the exchange offer. The risks and uncertainties described below are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of those risks actually occurs, our business, financial condition and results of operations would suffer. In such case, you may lose all or part of your original investment. The risks discussed below also include forward-looking statements, and our actual results may differ substantially from those discussed or implied in these forward-looking statements. See “Cautionary Statement Regarding Forward-Looking Statements” in this prospectus.

Risks related to the exchange offer and the Exchange Notes

Holders of Old Notes who fail to exchange their Old Notes in the exchange offer will continue to be subject to restrictions on transfer.

If you do not exchange your Old Notes for Exchange Notes in the exchange offer, you will continue to be subject to the restrictions on transfer applicable to the Old Notes. The restrictions on transfer of your Old Notes arise because we issued the Old Notes under exemptions from, or in transactions not subject to, the registration requirements of the Securities Act and applicable state securities laws. In general, you may only offer or sell the Old Notes if they are registered under the Securities Act and applicable state securities laws, or are offered and sold under an exemption from these requirements. We do not plan to register the Old Notes under the Securities Act. In addition, if there are only a small number of Old Notes outstanding, there may not be a very liquid market in those Old Notes. There may be few investors that will purchase unregistered securities in which there is not a liquid market. For further information regarding the consequences of not tendering your Old Notes in the exchange offer, see the discussion below under the caption “The Exchange Offer—Consequences of Failure to Exchange.”

If an active trading market does not develop for the Exchange Notes, you may not be able to resell them.

The Exchange Notes are a new issue of securities. We do not intend to apply to list the Exchange Notes on any securities exchange or to arrange for quotation on any automated dealer quotation systems. There is no established public trading market for the Exchange Notes, and an active trading market may not develop. If no active trading market develops, you may not be able to resell your Exchange Notes at their fair market value or at all. Future trading prices of the Exchange Notes will depend on many factors, including, among other things, prevailing interest rates, our operating results and financial condition, the number of holders of Exchange Notes and the market for similar securities. We cannot assure you that the market, if any, for the Exchange Notes will be free from disruptions or that any such disruptions may not adversely affect the prices at which you may sell your Exchange Notes.

The market price of the Exchange Notes may be volatile, which could affect the value of your investment.

It is impossible to predict whether the price of the Exchange Notes will rise or fall. Trading prices of the Exchange Notes will be influenced by our operating results and prospects and by economic, financial, regulatory and other factors. General market conditions, including the level of, and fluctuations in, the prices of high yield notes, will also have an impact.

You must comply with the exchange offer procedures in order to receive new, freely tradable Exchange Notes.

Delivery of Exchange Notes in exchange for Old Notes tendered and accepted for exchange pursuant to the exchange offer will be made only after timely receipt by the exchange agent of book-entry transfer of Old Notes into the exchange agent’s account at DTC, as depositary, including an Agent’s Message (as defined herein). We are not required to notify you of defects or irregularities in tenders of Old Notes for exchange. Old Notes that are

15

not tendered or that are tendered but we do not accept for exchange will, following consummation of the exchange offer, continue to be subject to the existing transfer restrictions under the Securities Act and, upon consummation of the exchange offer, certain registration and other rights under the Registration Rights Agreement will terminate. See “The Exchange Offer—Procedures for Tendering Old Notes Through Brokers and Banks” and “The Exchange Offer—Consequences of Failure to Exchange.”

Some holders who exchange their Old Notes may be deemed to be underwriters, and these holders will be required to comply with the registration and prospectus delivery requirements in connection with any resale transaction.

If you exchange your Old Notes in the exchange offer for the purpose of participating in a distribution of the Exchange Notes, you may be deemed to have received restricted securities and, if so, will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction.

Based on interpretations by the SEC in no-action letters, we believe, with respect to Exchange Notes issued in the exchange offer, that holders who:

| | • | | are not “affiliates” of ours within the meaning of Rule 405 under the Securities Act; |

| | • | | acquire their Exchange Notes in the ordinary course of business; |

| | • | | do not engage in, intend to engage in, or have arrangements to participate in a distribution (within the meaning of the Securities Act) of the Exchange Notes; and |

| | • | | are not broker-dealers, |

do not have to comply with the registration and prospectus delivery requirements of the Securities Act.

Holders described in the preceding sentence must tell us in writing at our request that they meet these criteria. Holders that do not meet these criteria could not rely on interpretations of the SEC in no-action letters, and will have to register the Exchange Notes they receive in the exchange offer and deliver a prospectus for them. In addition, holders that are broker-dealers may be deemed “underwriters” within the meaning of the Securities Act in connection with any resale of Exchange Notes acquired in the exchange offer. Holders that are broker-dealers that receive Exchange Notes for their own account in exchange for Old Notes that were acquired as a result of market-making activities or other trading activities must acknowledge that they will deliver a prospectus (or, to the extent permitted by law, make available a prospectus to purchasers) in connection with any resale of Exchange Notes they acquire in the exchange offer.

Our substantial indebtedness could adversely affect our financial condition and prevent us from fulfilling our obligations under the Exchange Notes.

As of March 31, 2013, our total principal indebtedness was approximately $850.8 million and we have undrawn availability under the Revolving Credit Facility of approximately $49.7 million (after giving effect to approximately $0.3 million of outstanding letters of credit, which, while not drawn, reduce the available balance under the Revolving Credit Facility). Of this total amount, approximately $523.7 million is secured indebtedness under our Senior Credit Facility (excluding approximately $0.3 million represented by letters of credit under the Revolving Credit Facility), to which the Exchange Notes are effectively subordinated to the extent of the value of the assets securing such indebtedness. We may also request incremental increases in commitments under the Senior Credit Facility in an aggregate principal amount up to (x) $75.0 million plus (y) up to an additional $75.0 million if the consolidated senior secured leverage ratio is less than or equal to 4.0:1.0, subject to certain conditions.

Subject to the limits contained in the credit agreement that governs our Senior Credit Facility, the indenture that governs the Notes and our other debt instruments, we may be able to incur substantial additional debt from time to time to finance working capital, capital expenditures, investments or acquisitions, or for other purposes. If we

16

do so, the risks related to our high level of debt could intensify. Specifically, our high level of debt could have important consequences to the holders of the Exchange Notes, including the following:

| | • | | making it more difficult for us to satisfy our obligations with respect to the Exchange Notes and our other debt; |

| | • | | limiting our ability to obtain additional financing to fund future working capital, capital expenditures, acquisitions or other general corporate requirements; |

| | • | | requiring a substantial portion of our cash flows to be dedicated to debt service payments instead of other purposes, thereby reducing the amount of cash flows available for working capital, capital expenditures, acquisitions and other general corporate purposes; |

| | • | | increasing our vulnerability to general adverse economic and industry conditions; |

| | • | | exposing us to the risk of increased interest rates as certain of our borrowings, including borrowings under our Senior Credit Facility, are at variable rates of interest; |

| | • | | limiting our flexibility in planning for and reacting to changes in the industry in which we compete; |

| | • | | placing us at a disadvantage compared to other, less leveraged competitors; and |

| | • | | increasing our cost of borrowing. |

In addition, the indenture that governs the Notes and the credit agreement that governs our Senior Credit Facility contain restrictive covenants that limit our ability to engage in activities that may be in our long term best interest. Our failure to comply with those covenants could result in an event of default which, if not cured or waived, could result in the acceleration of all our debt.