- SAIC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Science Applications International (SAIC) 8-KRegulation FD Disclosure

Filed: 11 Sep 13, 12:00am

Investor Day Presentation September 11, 2013 |

SAIC.com © SAIC. All rights reserved. V127 12noon Forward-Looking Statements Certain statements in this presentation contain or are based on "forward-looking" information within the meaning of the Private Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by words such as "expects," "intends," "plans," "anticipates," "believes," "estimates,“ and similar words or phrases. Forward-looking statements in this presentation include, among others: our intent to separate into two independent publicly traded companies as a result of the proposed spin-off; revenue, growth and cost-efficiency expectations for the two independent companies following the spin-off; the expectation that the spin-off will be tax-free; statements regarding the resources, potential, priorities, competitive positioning and opportunities for the independent companies following the spin-off; expectations about future dividends and the timing of the proposed transaction. These statements reflect our belief and assumptions as to future events that may not prove to be accurate. Actual performance and results may differ materially from the forward-looking statements made in this presentation depending on a variety of factors, including, but not limited to: failure to obtain necessary regulatory approvals or to satisfy any of the other conditions to the proposed spin-off; adverse effects on the market price of our common stock and on our operating results because of a failure to complete the proposed spin-off; failure to realize the expected benefits of the proposed spin-off; negative effects of announcement or consummation of the proposed spin-off on the market price of the company’s common stock; significant transaction costs and/or unknown liabilities; general economic and business conditions that affect the companies in connection with the proposed spin-off; unanticipated expenses such as litigation or legal settlement expenses; changes in capital market conditions that may affect proposed debt financing; the impact of the proposed spin-off on the Company’s or the newly formed company’s employees, customers and suppliers; disruption to business operations as a result of the proposed transaction; the inability to retain key personnel; and the inability of the companies to operate independently following the spin-off. The proposed spin-off will be subject to customary regulatory approvals, the receipt of a tax opinion from counsel, the execution of intercompany agreements, finalization of the capital structure of the two corporations, final approval of the SAIC board and other customary matters. These are only some of the factors that may affect the forward-looking statements contained in this presentation. For further information concerning risks and uncertainties associated with our business, please refer to the filings we make from time to time on behalf of SAIC,Inc. and SAIC Gemini Inc. with the U.S. Securities and Exchange Commission (SEC), including the "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Legal Proceedings" sections of the Registration Statement on Form 10 of SAIC Gemini, Inc., and any amendment thereto, which may be viewed or obtained through the SEC’s website, www.sec.gov. All information in this presentation is as of September 4, 2013. The Company expressly disclaims any duty to update the forward-looking statement provided in this presentation to reflect subsequent events, actual results or changes in the Company's expectations. The Company also disclaims any duty to comment upon or correct information that may be contained in reports published by investment analysts or others. 2 |

SAIC.com © SAIC. All rights reserved. SAIC Investor Day – Wednesday, September 11 Start Stop Duration (mins) Topic 1:30 1:35 5 Opening Remarks and Introductions: Paul Levi, Investor Relations & Treasurer 1:35 2:15 40 Introduction and Company Overview: Tony Moraco, Chief Executive Officer (CEO) 2:15 2:45 30 Enterprise Information Technology & Technical and Engineering: Nazzic Keene, Sector President 2:45 3:00 15 Break 3:00 3:30 30 Financial Highlights: John Hartley, (CFO) 3:30 3:45 15 Closing Remarks: Tony Moraco, (CEO) 3:45 4:30 45 Questions and Answers: Tony Moraco, Nazzic Keene, and John Hartley 3 |

SAIC.com © SAIC. All rights reserved. V127 12noon Transaction Overview • On September 27, 2013, the Parent (to be renamed Leidos Holdings, Inc.) plans to spin-off the technical engineering and enterprise information technology business • The IRS issued a favorable ruling as to the tax-free nature of the transaction Distributing Company SAIC, Inc (NYSE: SAI) changing to --- Leidos Holdings, Inc. (NYSE: LDOS) Distributed Company Science Applications International Corporation Ticker SAIC Exchange NYSE Distribution Ratio One share of SAIC for each 7 shares of SAI Expected SAIC Shares Outstanding ~ 49 million Dividend Policy SAIC currently intends to pay an initial dividend of $0.28 (1) per quarter on its common stock Capital Structure $226 million Cash $200 million Revolving Credit Facility $500 million Term Loan • Expected Key Dates - When-Issued Trading Begins: September 16, 2013 - Distribution Date: September 27, 2013 (11:59 PM/ET) - Distribution Record Date: September 19, 2013 - Regular Way Trading Begins: September 30, 2013 4 (1) Dividend adjusted for share distribution ratio |

Company Overview Chief Executive Officer – Tony Moraco |

SAIC Overview • Leading technology integrator specializing in technical engineering and enterprise IT services to the U.S. Government • Long term mission service delivery and customer relationships • 40+ year history of successful performance • Significant scale and diversified contract base, over $4.0 billion in annual revenues • Highly skilled workforce of about 14,000 employees • Strong and predictable cash flow • Experienced management team of proven industry leaders 6 SAIC.com © SAIC. All rights reserved. V127 12noon |

SAIC.com © SAIC. All rights reserved. V127 12noon $37B Army Federal Civilian Total US Government SAIC Addressable Prior to Split ~$160B New Unconstrained Addressable ~$25B Customer Addressable Spend Navy/Marine Corps $30B DoD Agencies / Defense Logistics $35B $60B Spin Enables Access to a Larger Federal Market SAIC Addressable After Split ~$185B 7 $23B Air Force |

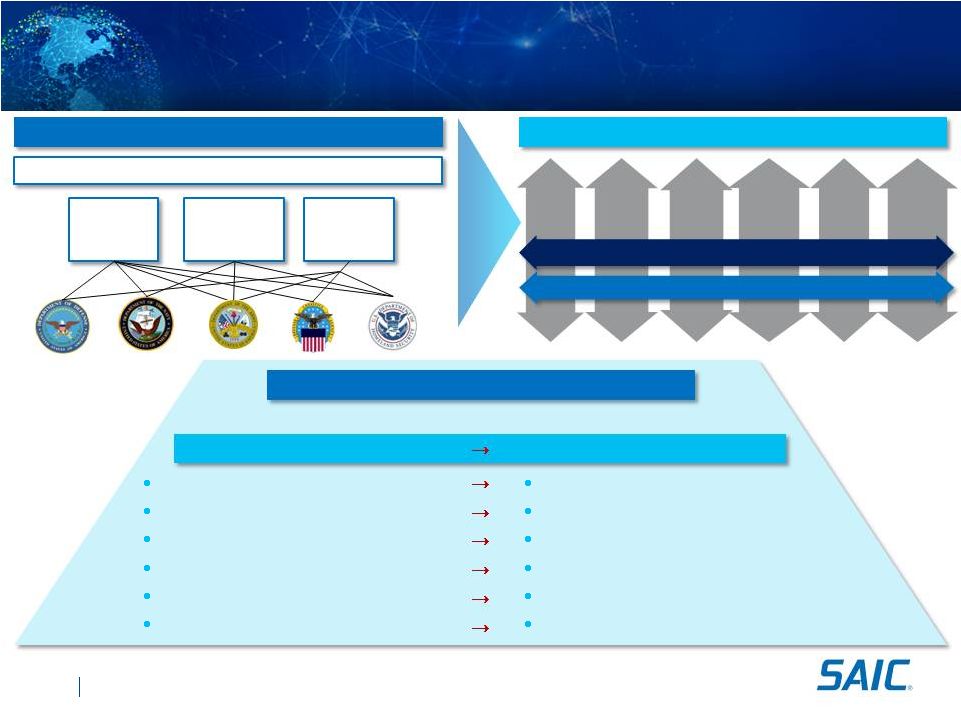

SAIC.com © SAIC. All rights reserved. V127 12noon Enterprise Transformation to Create a Highly Aligned Organization Historical SAIC, Inc. Structure New SAIC Structure Corporate Defense Solutions Group Intelligence Surveillance Reconnaissance Group Health, Energy & Civil Solutions Group Continuing Themes World-class Delivery Ethical Culture Enterprise entrepreneurship Customer / portfolio management Organizational alignment Market segment focused Enhanced utilization and resource deployment Selling enterprise capabilities Individual entrepreneurship Independent contract management Silo organization structure Diverse industries Ad Hoc resource deployment Business Unit focused selling Present Themes New Themes Army / Air Force State &, Local, Commercial Navy / Marine Corps Defense Logistics Agency DoD Agencies Commands Federal Civilian Enterprise IT Services Technical & Engineering Services Customer Affinity 8 |

SAIC.com © SAIC. All rights reserved. V127 12noon Investment Highlights Focused on serving our customers leveraging both deep mission domain knowledge and the breadth of enabling IT solutions Strategic alignment with the enduring mission needs of our customers Long term relationships with all key customers, with several individual contracts over 20 years Enduring Customer Relationships And Mission-Orientation Technical Experts Led by Experienced Management Tailored Operational Model and Competitive Structure 66% of our employees deployed at customer sites Over 65% of workforce hold a security clearance; 32% of workforce have a technical degree Executive team members average over 25 years of industry experience Effective account management and service lines for critical mission delivery Optimized corporate center leveraging shared services for efficient pricing structures Execute enterprise best practices to include CMMI certification Solid Financial Position Recurring revenue base with margin expansion potential Strong cash flow generation and balance sheet strength Flexibility of pursuing capital deployment alternatives Full Lifecycle Offerings End-to-end offerings support entire mission and enterprise lifecycles Services include design, development, integration, training, and sustainment Leadership position built upon differentiated offerings such as Supply Chain Management, Hardware Integration, and Global Network Integration Significant Scale and Diversified Contract Base One of the largest pure play technical services providers to the U.S. Government Over 1,500 active contracts and task orders Prime contractor on 91% of select premier contract vehicles across the federal government 9 |

SAIC.com © SAIC. All rights reserved. V127 12noon Mission-Oriented Services Promote Enduring Revenue 10 |

Enduring Customer Relationships 11 Customer Army/Air Force Navy/ Marine Corps Defense Logistics Agency DoD Agencies & Commands Federal Civilian State, Local and Commercial Relationship Strength 30+ years 30+ years 30+ years 30+ years 20+ years 20+ years Top Customers and Commands Aviation & Missile Life Cycle Management Command Program Exec. Office for Simulation, Training, & Instrumentation Mission & Installation Contract Command Air Force 754th Electronics Systems Group Research, Development & Engineering Command Space & Naval Warfare Systems Command U.S. Fleet Forces Command Naval Surface Warfare Center Crane Division Defense Logistics Agency Troop Support Defense Logistics Agency Land and Maritime U.S. Central Command Defense Information Systems Agency Missile Defense Agency Defense Threat Reduction Agency Washington Headquarters Services Department of Homeland Security National Aeronautics and Space Administration Department of State Department of Agriculture State of California Toyota Hawaii City of San Diego Sample Contract Values / Lengths $820M / 3 years $670M / 5 years $433M / 5 years $667M / 3 years $245M / 5 years $2.3B / 10 years $1.4B / 10 years $1.1B / 7 years $345M / 4 years $255M / 5 years $4.0B / 10 years $3.0B / 5 years $2.6B / 10 years $150M / 5 years $100M / 5 years $43M / 5 years SAIC.com © SAIC. All rights reserved. V127 12noon |

SAIC.com © SAIC. All rights reserved. V127 12noon Full Lifecycle Services & Solutions 12 Mission & SETA Hardware Integration Training & Simulation Logistics & Supply Chain Network Integration Software Integration Emerging IT Solutions IT Managed Services SAIC Services & Solutions DESIGN Engineering & Analysis BUILD Develop & Integrate SUPPORT Operations & Maintenance |

SAIC.com © SAIC. All rights reserved. V127 12noon Significant Scale and Diversified Contract Base Contract Type Contract Concentration Revenue Mix Balanced Distribution of Revenue Sources Scalable Prime Contracts 91% SAIC Prime Contracts Over 1,500 Active Contracts and Task Orders Over $7B in Backlog Time & Materials 29% (1) (1) Includes fixed-price-level-of-effort. ID/IQ vs. Non-ID/IQ Strong ID/IQ Contract Win Rate Generally a Top 5 Task Order Awardee on Multi-Award ID/IQ’s Cost Reimbursable 38% Fixed Price 33% Materials 20% Subcontractors 38% Top 5 Contracts 35% Top 6 – 10 Contracts 11% Other Contracts 54% ID/IQ 86% Non-ID/IQ 14% Value Add Labor 42% 13 |

SAIC.com © SAIC. All rights reserved. SAIC Competitive Landscape 14 OEM Defense Contractors Pure Play SETA & Government Services Diversified IT Services SAIC competes effectively across this landscape |

SAIC.com © SAIC. All rights reserved. V127 12noon Customers SAIC Market Position Offerings Network Integration Software Integration IT Managed Services Emerging IT Mission & SETA Hardware Integration Training & Simulation Logistics & Supply Chain Grow Protect/Expand Benefits Addressable Market $24B $60B $32B $3B $30B $60B Operating Model to Drive Growth 15 |

SAIC.com © SAIC. All rights reserved. V127 12noon Workforce with Technical Expertise • About 14,000 employees • 66% of employees deployed at customer sites • Over 65% of employees hold a security clearance • Large percentage of workforce with higher education • Veterans account for approximately 25% of our workforce • Key certifications in critical technologies across Microsoft, Cisco and VMware Mission & SETA 21% Hardware Integration 14% Training & Simulation 9% Logistics & Supply Chain 10% Network Integration 7% Software Integration 15% IT Managed Services 19% Emerging IT Solutions 5% Employee Demographics Distributed Employee Base 16 |

SAIC.com © SAIC. All rights reserved. Experienced Leadership Team Deborah L. James President, Technical and Engineering Sector Brian F. Keenan Executive Vice President Human Capital Officer Executive Vice President, SAIC Communications & Gov’t Affairs Senior Vice President, SAIC Business Unit General Manager Former Assistant Secretary of Defense for Reserve Affairs, Department of Defense Senior Vice President, SAIC Corp Strategy and Planning Prior to SAIC, Senior Vice President and General Manager, CGI, U.S. Enterprise Markets Communications and IT industry experience after graduating from the University of Arizona Executive Vice President of SAIC Human Resources Prior to SAIC, spent more than 15 years at Mobil and ExxonMobil in HR leadership roles Served seven years in the U.S. Army Nazzic S. Keene President, Enterprise IT Sector Former Acting President of SAIC’s Defense Solutions Group Led U.S. Navy and Marine Corps marketing efforts for SAIC’s Systems Engineering Group 21 years various assignments with U.S. Army Corps of Engineers Thomas G. Baybrook Chief of Administration and Operations Senior Vice President and SAIC Corporate Controller Joined SAIC in 2001 as Vice President and Director of Accounting Operations Before joining SAIC, spent 12 years with Deloitte LLP John R. Hartley Chief Financial Officer Laura K. Kennedy Senior Vice President and Chief Ethics Officer Prior to SAIC, served as Vice President for Global Compliance at Honeywell International Prior to Honeywell, spent 21 years in legal private practice, specializing in the areas of government contracts and international trade compliance Prior to SAIC, served as General Counsel for MWH Global, SRA International and Raytheon Missile Systems Prior business law experience with Sidley Austin and Perkins Coie in telecommunications and aerospace industries Mark D. Schultz Executive Vice President General Counsel 17 Thomas E. Wofford Senior Vice President, Internal Audit Prior to SAIC, served as Director of Global Audit for General Electric’s Energy Division Prior internal audit experience with Dresser, Inc., Trinity Industries, and E-Systems, Inc. Also served as Manager of Finance, Controller, and CFO with E-Systems subsidiaries Anthony J. Moraco Chief Executive Officer President, SAIC Government Solutions Group President, SAIC Intelligence, Surveillance, and Reconnaissance Group Executive Vice President, SAIC Corporate Operations (1) Nominated to become Secretary of the U.S. Air Force (1) |

SAIC.com © SAIC. All rights reserved. SAIC Board of Directors 18 Thomas F. Frist, III * Director since September 2009 Edward J. Sanderson, Jr. (Chairman) * Director since October 2002 Jere A. Drummond * Director since July 2003 Steven R. Shane John J. Hamre * Director since June 2005 Anthony J. Moraco Chief Executive Officer of Science Applications International Corporation Robert A. Bedingfield * Historical SAIC, Inc. board member (1) Nominated to become Director of the National Science Foundation Executive Vice President of Oracle (Retired) President of Unisys Worldwide Services Partner at both McKinsey & Company and Accenture (formerly Andersen Consulting) President of Purdue University (Retired) Chancellor at the University of California, Riverside Chief Scientist of the National Aeronautics and Space Administration Principal of Frist Capital, LLC Co-Managed FS Partners, L.L.C. President, SAIC Government Solutions Group President, SAIC Intelligence, Surveillance, and Reconnaissance Group Executive Vice President, SAIC Corporate Operations Global Coordinating Partner at Ernst & Young LLP (Retired) Aerospace & Defense Practice Leader at Ernst & Young Trustee of the University of Maryland at College Park Board of Trustees since 2000 Vice Chairman of BellSouth Corporation (Retired) President and Chief Executive Officer of BellSouth Communications Group President and Chief Executive Officer of BellSouth Telecommunications, Inc President and CEO of the Center for Strategic & International Studies Served as Deputy Secretary of Defense Partner at Accenture plc (Retired) Managed Accenture’s US Federal, State and Local, Canada Federal and Canadian Provincial businesses Provided advisory services to the executive level at Fannie Mae and other clients * (1) France A. Córdova Director since February 2008 |

SAIC.com © SAIC. All rights reserved. V127 12noon Internal Transformation Enterprise Investments Tailored Offerings Key Investment Areas Business Development Capabilities Efficient corporate center structure designed to the new company’s business model Operating model implementation – Focuses customer account management – Optimizes resource deployments Pipeline expansion from OCI elimination Prioritized investment for Bid and Proposal in each Customer Group Leverage broad prime contract vehicle base Investments in workforce subject matter expertise Investments in differentiated offerings in each service line Technology re-use of proven offerings for tailored solutions Develop strategic partnerships to enhance capabilities Expanded Market Share Reinvesting in our enterprise drives shareholder value 19 Key Investments |

SAIC.com © SAIC. All rights reserved. V127 12noon Strong Revenue Base With Margin Expansion Predictable Cash Generator Capital Deployment Consistency Strong Financial Position Large, recurring revenue base; $4B+ “renewed” company with significant scale and market position Revenue base provides significant investment capacity Margin opportunities in leaner, focused organization CASH FLOW REVENUE & MARGIN CAPITAL DEPLOYMENT Predictable free cash flow to support capital deployment Balance sheet strength with firepower for future growth Disciplined philosophy in deploying capital for shareholder value Direct return to shareholders of excess cash 20 |

Performance Strategy Summary • Protect - Excellent contract execution - Retain incumbent positions • Expand customers - Leverage existing service line portfolio to existing customers • Grow - Strategic targeting of new customers for our mature capabilities - Utilize differentiated offerings Strategically aligned enterprise investments to expand offerings Grow into Market Adjacencies Expand with Current Customers Protect Our Base SAIC.com © SAIC. All rights reserved. V127 12noon our revenue base current offerings to current into “white space” 21 |

Sector Overviews Sector President – Nazzic Keene |

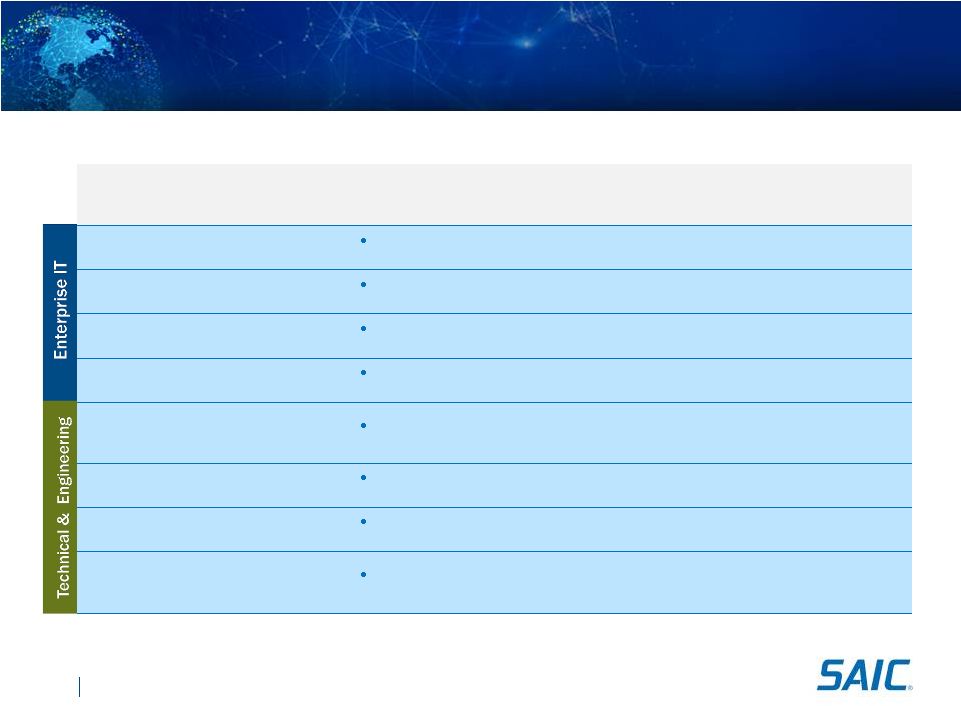

Sector Overviews • Deliver proven full systems lifecycle Information technology solutions and services – Design, development, deployment, management, operations, and security • Deliver mission critical technology solutions solving most complex customer IT challenges • Leverage technology to significantly reduce our customers operating costs while improving their mission support • Provide mission focused full life-cycle technical, engineering, and professional services – Customer affinity coupled with technical expertise – Cost-effective solutions through enabling technologies, tailored toolsets, and innovative methodologies • Specialize in weapons system engineering, logistics and supply chain management, ground vehicle integration, system upgrade and maintenance, training and simulation, and program support services Intersection of mission and technology for dependable and reliable service delivery 23 Enterprise Information Technology Technical and Engineering SAIC.com © SAIC. All rights reserved. |

SAIC.com © SAIC. All rights reserved. Top Contracts & Programs 24 Customer / Program Scope Period of Performance (POP) Total Contract Value U.S. Army/ITES-2S Supports IT services including data centers and software development 2006 – 2016 $1.5B State Dept / Vanguard Provides enterprise-wide IT network infrastructure services 2011 – 2021 $2.6B NASA / NICS Manages communication services for all 80,000 network users 2011 – 2021 $1.3B DHS / EAGLE Provides infrastructure engineering, O&M, and software development services 2006 – 2013 $1.2B U.S. Army Aviation and Missile Command Expedited Professional & Engineering Support Services Engineering and software support for aerospace systems 2005 - 2013 $3B Defense Logistics Agency Tires Successor Initiative Supply chain management services for military tires 2005 - 2013 $3B U.S. Navy Network Integration Engineering Facility C4I services for Navy's premier C4ISR System Center lab 2011 –2018 $1.2B National Aeronautics and Space Administration JSC Safety and Mission Assurance Engineering Contract Safety and mission assurance engineering support services 2013 - 2018 $200M |

Service Offerings |

Network Integration Software Integration IT Managed Services Emerging IT Solutions • Design and integration for Wide Area Networks and Local Area Networks • IP telephony integration • Network security • Resiliency and redundancy • Certification and accreditation • Software application development and maintenance • Rapid legacy system modernization • Service-oriented architecture design • Mobile application development and management, application stores • ERP integration • Mobility • Data center management • Operation and cloud migration • Network engineering • Disaster recovery • Managed mobile and tactical infrastructure solutions • Cloud and virtualized computing infrastructure • Big data and data analytics • Software defined networks • Business transformation • Cyber security Enterprise Information Technology Offerings 26 SAIC.com © SAIC. All rights reserved. |

SAIC.com © SAIC. All rights reserved. Technical and Engineering Offerings Mission & SETA Hardware Integration Training & Simulation Logistics & Supply Chain • Mission support including base security and mission engineering • SETA support including high-end engineering support, assistance & advisory services, C4 systems, R&D support • Program Support: Program management • In-service engineering support • C5ISR system integration services • Force protection systems • Training and mission rehearsal planning and management • Scenario development • Live, virtual, and constructive training • Simulation training aids and products • Process improvement • Supply chain management • Stock management support • Material acquisition • Demand forecasting • Distribution • Sustaining engineering • Marine engineering • R&D support 27 |

SAIC.com © SAIC. All rights reserved. • Contract Name: Integrated Communications Services • Customer: National Aeronautics and Space Administration • POP: 6/2011 - 5/2021 • Contract Value: $1.3 Billion Network Integration NASA Integrated Communications Services Providing two thirds of the agency’s IT infrastructure, we enhance the user experience for more than 60,000 NASA professionals at locations worldwide Contract Details SAIC Offerings 28 • Consolidates and manages Wide Area Networks and Local Area Networks and provides a single, global point of contact for every NASA center – Manage NASA’s Global Network connecting numerous countries, including Russia, Australia, Germany, Canada, Spain, Argentina, France, and Chile – 500+ point to point dedicated circuits – 35,000+ switch voice circuits – Satellite services for each center – 3 Wide Area Networks: Mission, Corporate, and Research – 50+ LANs (including international connectivity) – 80,000 network users – 156,000 devices connected – 200 connections to universities and partners |

SAIC.com © SAIC. All rights reserved. • Contract Name: Vanguard 2.2.1 • Customer: Department of State • POP: 2/2011 – 2/2021 • Contract Value: $2.6 Billion Maintain and enhance enterprise-wide IT network and services infrastructure for Department of State Bureau of Information Resource Management IT Managed Services – Support 105,000 users at 385 DoS sites worldwide including classified environments – 24/7/365 technical Tier II and Tier III support – 2,000+ servers – 5,000 Blackberries / 5,000 network devices Network Integration – 40,000+ phone lines, including POTS and secure – 500+ point to point direct circuits; 250+ VPNs – 50+ satellite and microwave circuits – 10+ connections to other government agencies Software Integration – ~40 active Development, Modernization, and Enhancement (DME) projects to expand system capabilities and services – IT transformation projects to extend the Foreign Affairs Network in support of other agencies Department of State Vanguard 2.2.1 Developing a new partnership by providing a broad spectrum of IT, network, and software services in support of U.S. diplomats around the globe Contract Details SAIC Offerings 29 |

SAIC.com © SAIC. All rights reserved. V118_15AUG_3PM AMCOM Express BPA • Contract Name: AMCOM Express BPA • Customer: U.S. Army • POP: 2/2005 – 2/2015 • Contract Value: $3.0 Billion Partner with customers to apply broad-based mission, platform, and technical knowledge to serve unique needs Contract Details SAIC Offerings 30 Mission & SETA Training & Simulation Software Integration • C4ISR/Cyber analysis and test • Air worthiness analysis for all special operations helicopters, Army airplanes and unmanned aircraft systems (UAS/Drones) • Corrosion prevention and control for aviation and missile weapons systems • Develop and integrate advanced technologies during entire life cycle of supported systems • Trained over 20,000 students in basic skills and digital master gunner courses • Serious gaming solutions • Maintain and operate UAS simulations in support of live, virtual and constructive simulation events • Lifecycle SW support for over 200 projects in the • aviation, UAS, missiles, mission command, and force protection domains |

SAIC.com © SAIC. All rights reserved. Department of Transportation Expanding in the Federal Aviation Administration Network Integration X Software Integration X IT Managed Services Emerging IIT Solutions X Mission & SETA Hardware Integration X X X Logistics & Supply Chain X X Training and Simulation X X X X X 31 Protect/Expand X Network Integration X X X X X X Software Integration X X X X IT Managed Services X X X X X X X X X Emerging IIT Solutions X X X X X X X Mission & SETA X X X X X X Hardware Integration Logistics & Supply Chain X X X X X X Training and Simulation X X X X X X X Full Portfolio Pipeline ITSS-SD $150M 2013 FCS $110M 2013 AIMM S2 $30M 2013 CSMC $60M 2014 IT Infr $100M 2014 NG Init’s $110M 2014 Flight Svcs $400M 2014 SE2020 SB $35M 2014 ATCOTS $200M 2014 NAVTAC $200M 2015 NextGen Inititives $107M ATO-T Eng $70M ATO-T C&F $32M Volpe TMIS $150M ETASS- SB $60M ITSS $156M Current Contracts ($575M) • Systems Acquisition Support • Concept Development • Requirements Definition • Prototype Development • Safety Engineering • Testing • Air Traffic Control • Telecom, Wireless services • Flight and Aviation Information to Airlines or General Aviation • Infrastructure Support • Outsourced Service: Training, Helpdesk, Cloud • Management, Cloud solutions, IT application to support non-NAS functions Current Contracts Opportunities FY2012 FAA Addressable Market $3B Grow X New focus area for SAIC Traditional market space for SAIC SAIC Market Position Enterprise IT Technical Services |

SAIC.com © SAIC. All rights reserved. Stable and Predictable Revenue Incremental Revenue & Profit Accelerated Profitable Growth Integrated Growth Strategy Recognized and valued by our customers as trusted and highly capable partner dedicated to their mission success – Dedicated client management team – Flawless execution of proven services and solutions Maximize position in mission critical areas – Global network integration – Combat & weapon systems engineering, integration, and modernization – Supply chain management including prime vendor maintenance & repair operations 32 EXPAND PROTECT GROW Leveraging our strong 40+ year SAIC heritage while thoughtfully investing in the future to retain our competitive advantage – Expand market position in existing clients by selling the full enterprise Growth Opportunities in – Cloud – migration and brokerage Solutions – Mobility systems integration – “Government side” engineering and technical support – Hardware integration, integrated training, and logistics services Well positioned for future growth selling proven, market leading solutions into adjacent markets • – Next generation enterprise networks & unified communications – ITaaS Platform – all IT as a service – Managed services, outsourced solutions – Enterprise IT and technical and engineering services (e.g. Air Force) – Technical services expansion/OCI uplift (e.g NAVAIR/NAVSEA) |

Our Model Will Drive Operational Excellence & Growth • Building on our 40+ year history of serving our customers • Dedicated account management teams of experienced senior executives • Improved customer relationships through focused account management • More effectively sell and deliver the entire range of SAIC’s services and solutions to all customers, both current and new 33 Services and Solutions Functional Alignment • Enhanced, innovative capabilities and solutions through service group alignment and focus on best-in-class • Through enterprise-wide resource planning, easier, quicker access to the right resources at the right time, wherever in SAIC they reside • Leverage enterprise-wide skills and expertise for program needs and issue resolution • A highly competitive cost structure to bid and win more profitable work • Optimized services across the company to maintain competitive rates that help stretch customer budgets Customer Centric SAIC.com © SAIC. All rights reserved. One ‘connected’ team focused on enterprise goals and aligned on company success |

Financial Overview Chief Financial Officer – John R. Hartley |

SAIC.com © SAIC. All rights reserved. V127 12noon Financial Objectives Post Spin • Low single digit revenue growth in challenging market – Considering revenue base of approximately $4 Billion • Incremental operating margin improvement – Indirect cost structure efficiency, increased value added content, and solid program execution • Efficient free cash flow in excess of net income • Effective and disciplined capital deployment – Deploying cash in excess of minimum operating needs Strong Cash Flows Disciplined Capital Deployment Margin Performance Solid Financial Position 35 SAIC’s financial objectives designed to grow shareholder value |

SAIC.com © SAIC. All rights reserved. V127 12noon SAIC – Creating Shareholder Value Organizational alignment Value Proposition Principles: Say what we do Do what we say Transparency of mission Make our value proposition clear 36 Grow shareholder value through delivery of return on investment • Understood and executed at every level of the enterprise • Explicit and disciplined in how we deliver value • Tangible metrics that measure our progress • Well aligned incentives that drive behavior throughout the enterprise • Transparency with investors to provide visibility into business |

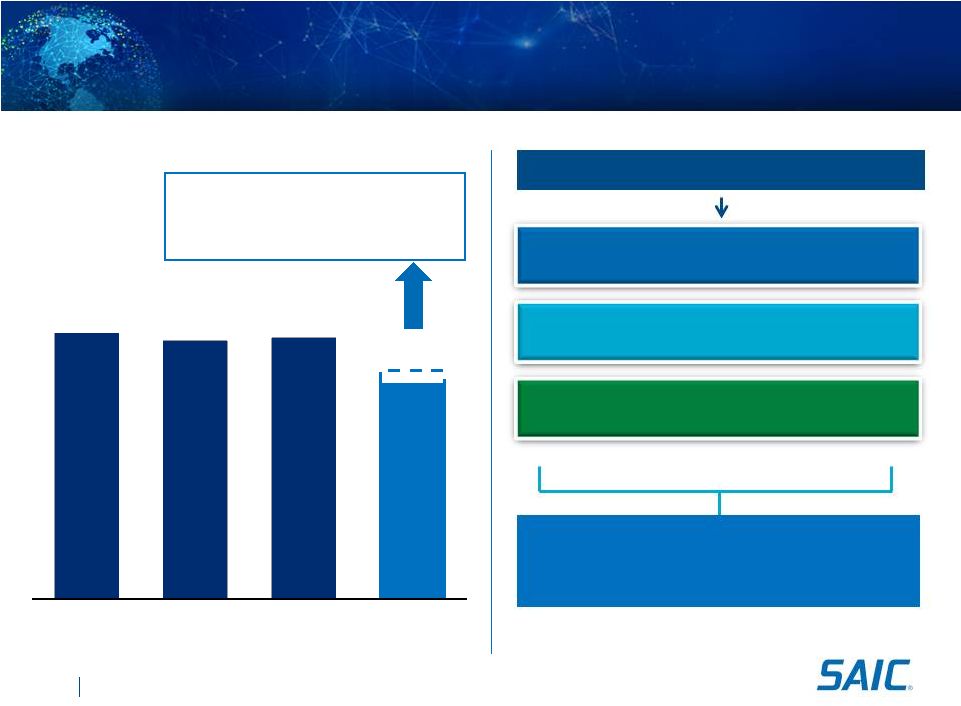

SAIC.com © SAIC. All rights reserved. V127 12noon Financial Performance Revenues (1) ($ in millions) $3,850 $4,767 $4,637 $4,690 $4,100 FY 2011 FY 2012 FY 2013 FY 2014E • ~$400M loss of DGS contract • ~$100M OCO drawdown • ~$125M Sequestration/budget pressures (1) Excludes revenues performed by parent. 37 Revenue Drivers Stable and Diversified Base Expand Existing Customer Grow Underserved Agencies Revenue Performance Solid Book-to-Bill and Backlog |

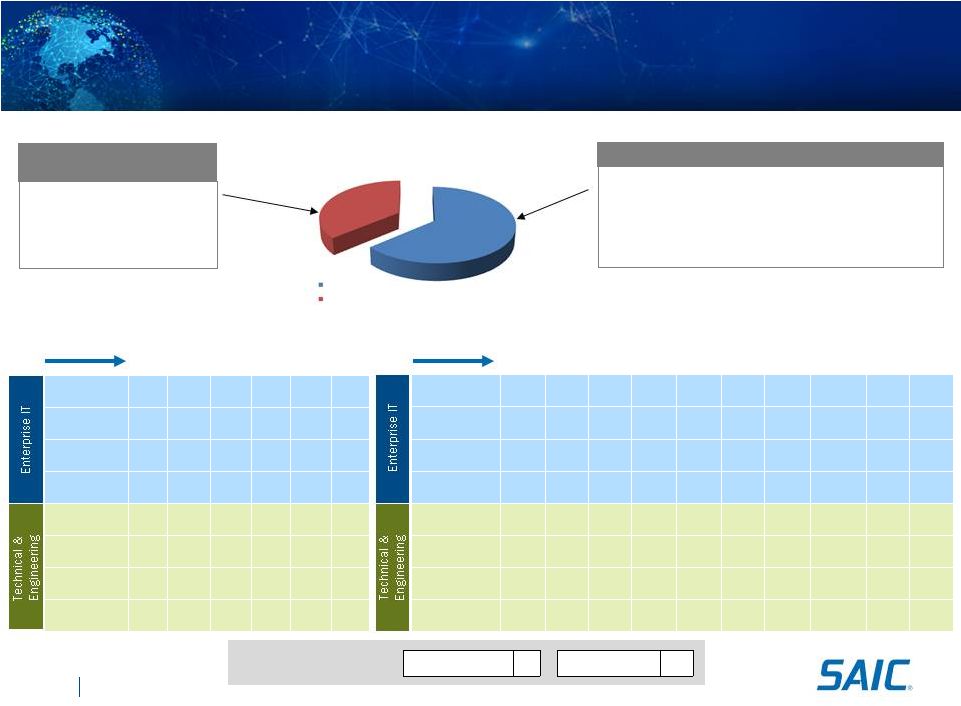

SAIC.com © SAIC. All rights reserved. V127 12noon Aligned with Performance Measures Army / Air Force State, Local and Commercial Navy / Marine Corps Defense Logistics Agency DoD Agencies & Commands Federal Civilian Customer Organization Revenue Offerings Network Integration Software Integration IT Managed Services Emerging IT Solutions Mission & SETA Hardware Integration Training & Simulation Logistics & Supply Chain Benefits Service Organization Revenue 38 Incentive Structure Aligned with Operational Priorities |

SAIC.com © SAIC. All rights reserved. V127 12noon Backlog Historical Backlog ($ in millions) 39 • Continued increase in ID/IQ contracts • Award delays continuing • Growth in pending awards Book to Bill Ratio (1) H1 FY 2014 book to bill ratio. (1) 2,144 2,056 1,953 1,664 6,204 6,655 5,811 5,209 $8,348 $8,711 $7,764 $6,873 FY 2011 FY 2012 FY 2013 Q2 FY 2014 Funded Backlog Negotiated Unfunded Backlog -- 1.1x 0.8x 0.6x |

SAIC.com © SAIC. All rights reserved. V127 12noon Financial Performance (1) Excludes $28 million of separation transaction expenses in FY 2013. FY14 will also reflect separation transaction expenses. Operating Income Drivers 40 Operating Income Improvement $0 $100 $200 $300 $400 FY 2011 FY 2012 FY 2013 4% 5% 6% 7% 8% $329 $299 $309 6.9% 6.4% 6.6% Operating Income Operating Income % Reduce indirect cost Increase value add base Leverage scale Strong Program Execution (1) Operating Income (Excluding Separation Expenses) ($ in millions) |

SAIC.com © SAIC. All rights reserved. V127 12noon Operating Income Drivers Current Current Current Current Future Future Future Future 41 • Corporate organization designed for entire organization • Significant Group indirect infrastructure • Incentives motivate subcontract activities • Value added base decreasing (currently only 42% of revenue) Costs structure motivates lowering contract fees to be competitive Decentralized business models with reactive program management approach Indirect cost structure efficiency Vigilance about removing unnecessary costs Manage unallowable and unbillable costs Incentives aligned to motivate SAIC content and collaboration Explicit about capabilities we provide and what we partner for Value added base increasing Bid more contract fee with competitive cost structure and differentiated solutions Capability alignment promotes proactive program management approach Improve fee performance on all programs Continue to make our customers successful Cost Optimization Increase Value Added Base Leverage Scale Program Execution Success Indicator Bid fee versus actual fee performance Success Indicator Fee performance by service offering Success Indicator Percentage of value add versus subcontract labor by capability Success Indicator Best in class indirect rates versus peers |

SAIC.com © SAIC. All rights reserved. V127 12noon Near-Term Cost Optimization Opportunities Organizational Simplification Facility Rationalization Benefit Alignment Strategic Sourcing Current Current Current Current Separate support functions across the organization Complicated structure Redundant internal processes 118 locations occupying ~3.2 million square feet Common across entire enterprise Limited use of competitive benefit packages Separate vendor relationships among segments Future Future Future Future Centralize shared services infrastructure with efficient support model Discontinue certain internal processes for more efficient client service Close about 50 sites and reduce about 20 sites (~1.1 million square feet) Benefits better aligned to market Disciplined utilization of competitive benefit packages Centralize strategic sourcing function Negotiate more effectively with vendors by leveraging buying power 42 |

Multiple of Net Income 1.3x 1.7x 1.5x Historical Operating Cash Flow ($ in millions) $261 $303 $280 FY 2011 FY 2012 FY 2013 • Operating cash flow generation of greater than 1.0x of net income on long term basis • Capital expenditures are expected to be less than 1% of total revenues • FY14 cash flow negatively impacted by cancellation of governments accelerated payment program (~$30M) • Ample flexibility to pursue capital deployment alternatives $208 $182 $182 FY 2011 FY 2012 FY 2013 Historical Net Income ($ in millions) Historical Net Income and Cash Flow Generation FY13 includes separation transaction expenses net of tax SAIC.com © SAIC. All rights reserved. V127 12noon 43 |

SAIC.com © SAIC. All rights reserved. V127 12noon Capital Structure Overview Capitalization ($ in millions) Debt Maturity Profile ($ in millions) $138M 44 (1) Undrawn, 5-year $200 million Senior Unsecured Revolving Credit Facility. (2) EBITDA excludes Gemini transaction/separation expenses. -- $13 $31 $44 $50 $362 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 $500M Term Loan at Spin 5/3/2013 Pro Forma Cash $226 New Revolving Credit Facility -- New Term Loan Facility (Fixed Rate with Interest Rate Swap) $500 Capital Lease Obligations & Notes Payable 3 Total Debt $503 Total Book Equity 384 Total Capitalization $887 Credit Statistics Total Debt / FY 2014 EBITDA Less than 2.0x (1) |

SAIC.com © SAIC. All rights reserved. V127 12noon SAIC FY14 Guidance • Revenue $3.85 Billion to $4.10 Billion • Diluted Earnings Per Share (1) (2) $0.34 to $0.38 • Operating Cash Flow Equal to or Greater Than $125 Million (1) Based upon SAIC, Inc. average effective share count of 343 Million at September 4, 2013, includes estimated transaction expenses of $35M net of taxes. (2) After adjustment for the distribution in the spin transaction ratio of one (1) SAIC share for every seven (7) SAI owned, Diluted Earnings Per Share guidance will be $2.38 to $2.66, as adjusted. 45 |

SAIC.com © SAIC. All rights reserved. V127 12noon Long Term Financial Targets FY14 to FY16 Annual Organic Revenue Growth Low single-digit growth Target Operating Margin (for 3 to 5 years) Year-over-Year Increase Tax Rate 35% to 40% range Maximize cash flow generation, free cash flow to exceed net income Deploy excess cash for shareholder value creation 46 |

SAIC.com © SAIC. All rights reserved. V127 12noon Capital Allocation Priorities • Dividend – Maintain relative portion of historical SAIC, Inc. • Debt Reduction – Not intended in excess of required amortization • Capital Deployment– For shareholder value creation 47 Capital deployment in excess of minimum operating cash level current dividend |

Closing Remarks Chief Executive Officer – Tony Moraco |

SAIC.com © SAIC. All rights reserved. V127 12noon Investment Highlights Enduring Customer Relationships and Mission-Orientation Technical Experts Led by Experienced Management Tailored Operational Model and Competitive Structure Solid Financial Position Full Lifecycle Offerings Significant Scale and Diversified Contract Base 49 |

|