Bank of America Global Real Estate Conference September 2014 Exhibit 99.1

Forward Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We caution investors that any forward-looking statements presented herein are based on management’s beliefs and assumptions and information currently available to management. Such statements are subject to risks, uncertainties and assumptions and may be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. These risks and uncertainties include, without limitation: general risks affecting the real estate industry (including, without limitation, the market value of our properties, the inability to enter into or renew leases at favorable rates, portfolio occupancy varying from our expectations, dependence on tenants’ financial condition, and competition from other developers, owners and operators of real estate); risks associated with the disruption of credit markets or a global economic slowdown; risks associated with the potential loss of key personnel (most importantly, members of senior management); risks associated with our failure to maintain our status as a REIT under the Internal Revenue Code of 1986, as amended; possible adverse changes in tax and environmental laws; and potential liability for uninsured losses and environmental contamination. The risks described above are not exhaustive, and additional factors could adversely affect our business and financial performance, including those discussed in our annual report on Form 10-K for the year ended December 31, 2013, and subsequent filings with the Securities and Exchange Commission. We expressly disclaim any responsibility to update forward-looking statements, whether as a result of new information, future events or otherwise. Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97

“Pure-Play” Southern California Industrial Expert With High Quality Infill Properties Investment Highlights Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 Industrial Market With Significant Consolidation Opportunity Significant External Growth Prospects Through Proprietary Deal Sourcing Capabilities Demonstrated Growth and Performance Since IPO Capital Structure Poised to Support Future Growth Led by Experienced Management Team with Vertically Integrated Platform Opportunity to Grow Rents and Occupancy in both Existing Portfolio and Recent and Future Acquisitions 2

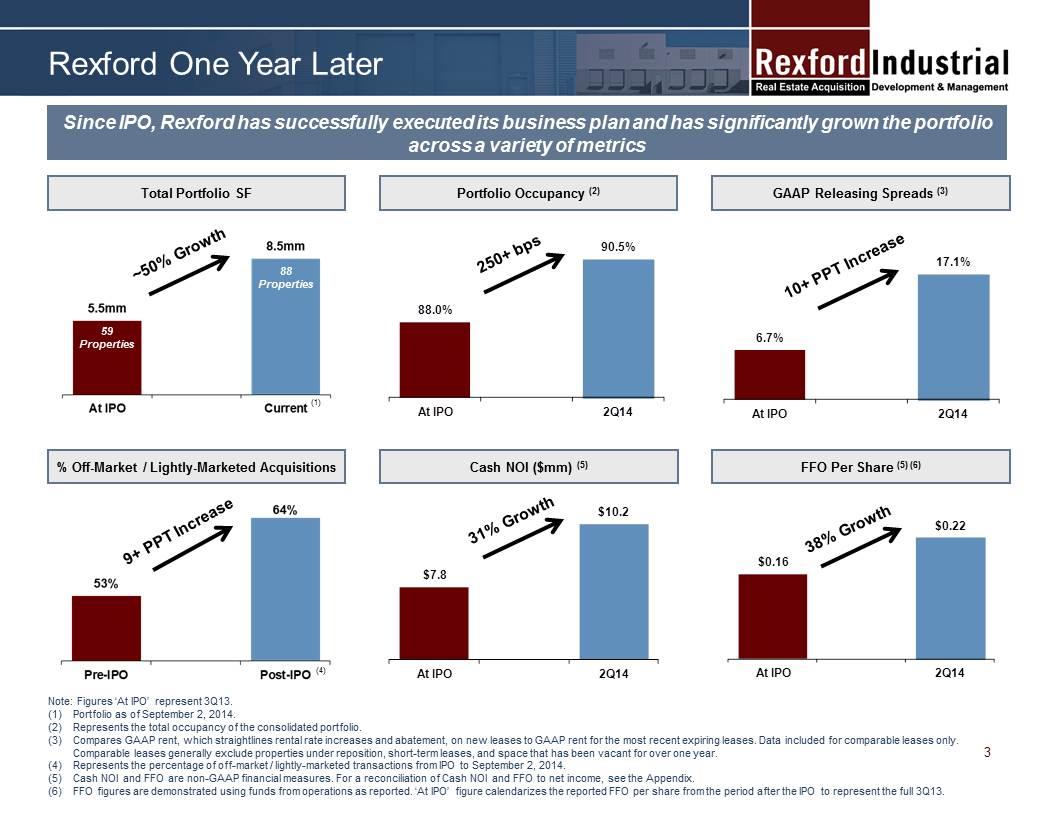

Portfolio Occupancy (2) GAAP Releasing Spreads (3) Cash NOI ($mm) (5) Note: Figures ‘At IPO’ represent 3Q13. Portfolio as of September 2, 2014. Represents the total occupancy of the consolidated portfolio. Compares GAAP rent, which straightlines rental rate increases and abatement, on new leases to GAAP rent for the most recent expiring leases. Data included for comparable leases only. Comparable leases generally exclude properties under reposition, short-term leases, and space that has been vacant for over one year. Represents the percentage of off-market / lightly-marketed transactions from IPO to September 2, 2014. Cash NOI and FFO are non-GAAP financial measures. For a reconciliation of Cash NOI and FFO to net income, see the Appendix. FFO figures are demonstrated using funds from operations as reported. ‘At IPO’ figure calendarizes the reported FFO per share from the period after the IPO to represent the full 3Q13. FFO Per Share (5) (6) Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 Total Portfolio SF % Off-Market / Lightly-Marketed Acquisitions ~50% Growth (4) Since IPO, Rexford has successfully executed its business plan and has significantly grown the portfolio across a variety of metrics 250+ bps 10+ PPT Increase 9+ PPT Increase 31% Growth 38% Growth 59 Properties 88 Properties (1) 3 Rexford One Year Later

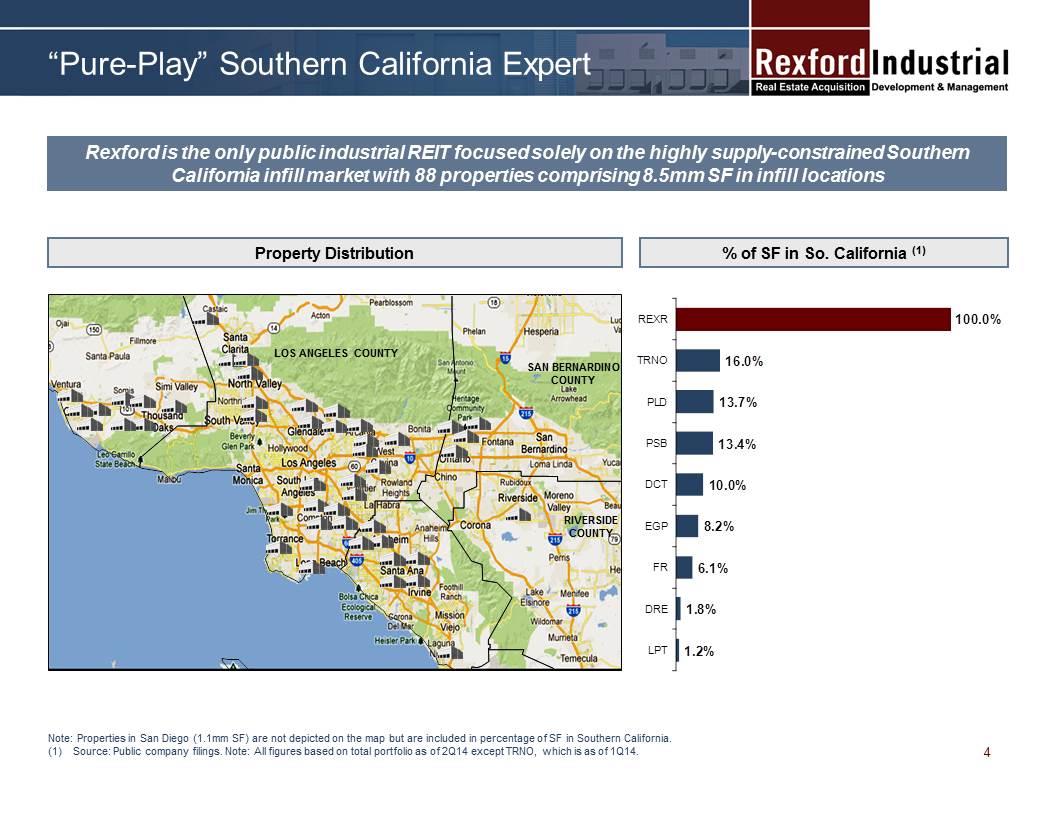

“Pure-Play” Southern California Expert Note: Properties in San Diego (1.1mm SF) are not depicted on the map but are included in percentage of SF in Southern California. Source: Public company filings. Note: All figures based on total portfolio as of 2Q14 except TRNO, which is as of 1Q14. Rexford is the only public industrial REIT focused solely on the highly supply-constrained Southern California infill market with 88 properties comprising 8.5mm SF in infill locations Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 % of SF in So. California (1) Property Distribution 4 SAN BERNARDINO COUNTY LOS ANGELES COUNTY RIVERSIDE COUNTY

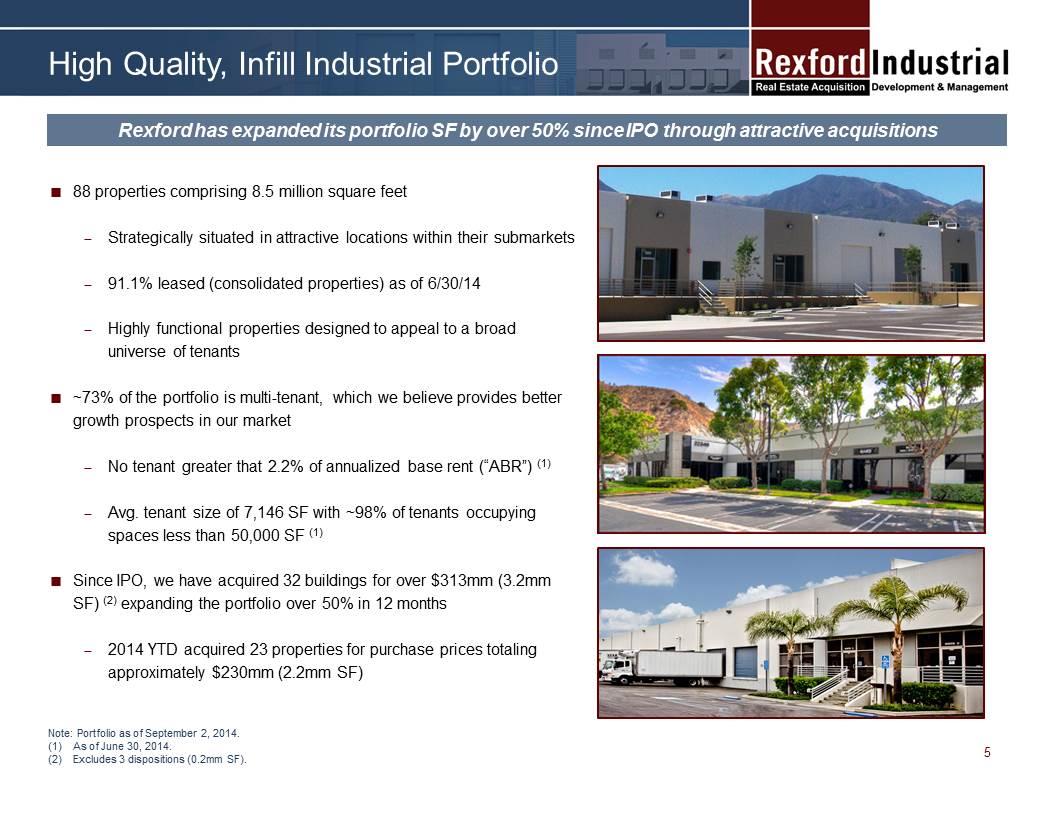

High Quality, Infill Industrial Portfolio 88 properties comprising 8.5 million square feet Strategically situated in attractive locations within their submarkets 91.1% leased (consolidated properties) as of 6/30/14 Highly functional properties designed to appeal to a broad universe of tenants ~73% of the portfolio is multi-tenant, which we believe provides better growth prospects in our market No tenant greater that 2.2% of annualized base rent (“ABR”) (1) Avg. tenant size of 7,146 SF with ~98% of tenants occupying spaces less than 50,000 SF (1) Since IPO, we have acquired 32 buildings for over $313mm (3.2mm SF) (2) expanding the portfolio over 50% in 12 months 2014 YTD acquired 23 properties for purchase prices totaling approximately $230mm (2.2mm SF) Note: Portfolio as of September 2, 2014. As of June 30, 2014. Excludes 3 dispositions (0.2mm SF). Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 Rexford has expanded its portfolio SF by over 50% since IPO through attractive acquisitions 5

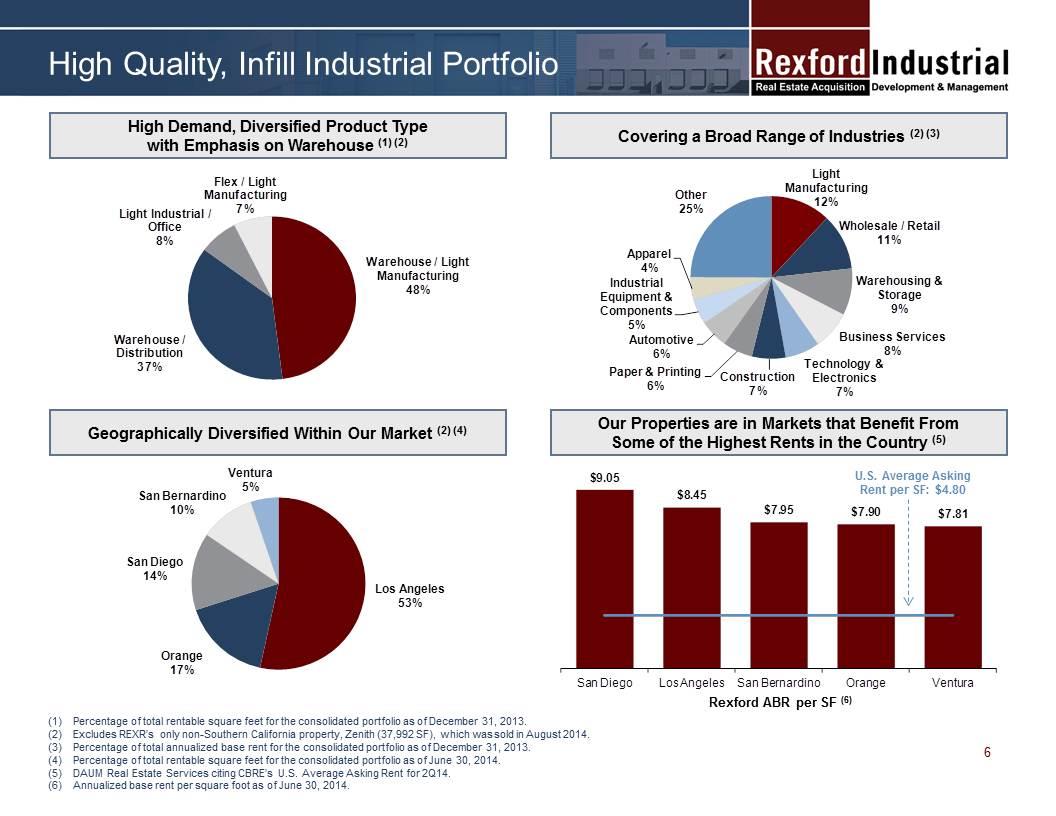

High Quality, Infill Industrial Portfolio Covering a Broad Range of Industries (2) (3) High Demand, Diversified Product Type with Emphasis on Warehouse (1) (2) Percentage of total rentable square feet for the consolidated portfolio as of December 31, 2013. Excludes REXR’s only non-Southern California property, Zenith (37,992 SF), which was sold in August 2014. Percentage of total annualized base rent for the consolidated portfolio as of December 31, 2013. Percentage of total rentable square feet for the consolidated portfolio as of June 30, 2014. DAUM Real Estate Services citing CBRE’s U.S. Average Asking Rent for 2Q14. Annualized base rent per square foot as of June 30, 2014. Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 U.S. Average Asking Rent per SF: $4.80 Rexford ABR per SF (6) Our Properties are in Markets that Benefit From Some of the Highest Rents in the Country (5) Geographically Diversified Within Our Market (2) (4) 6

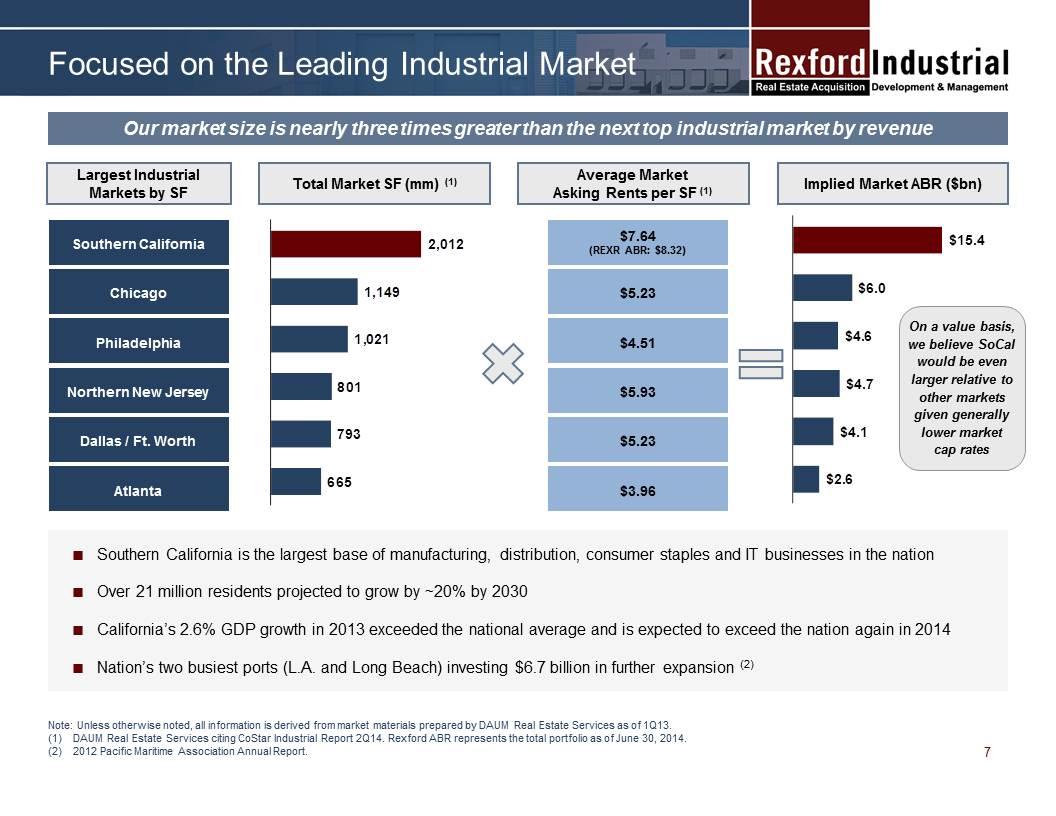

Philadelphia Northern New Jersey Focused on the Leading Industrial Market Total Market SF (mm) (1) Average Market Asking Rents per SF (1) Implied Market ABR ($bn) Southern California Chicago Dallas / Ft. Worth Atlanta Southern California is the largest base of manufacturing, distribution, consumer staples and IT businesses in the nation Over 21 million residents projected to grow by ~20% by 2030 California’s 2.6% GDP growth in 2013 exceeded the national average and is expected to exceed the nation again in 2014 Nation’s two busiest ports (L.A. and Long Beach) investing $6.7 billion in further expansion (2) Largest Industrial Markets by SF Our market size is nearly three times greater than the next top industrial market by revenue $4.51 $5.93 $7.64 (REXR ABR: $8.32) $5.23 $5.23 $3.96 Note: Unless otherwise noted, all information is derived from market materials prepared by DAUM Real Estate Services as of 1Q13. DAUM Real Estate Services citing CoStar Industrial Report 2Q14. Rexford ABR represents the total portfolio as of June 30, 2014. 2012 Pacific Maritime Association Annual Report. Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 On a value basis, we believe SoCal would be even larger relative to other markets given generally lower market cap rates 7

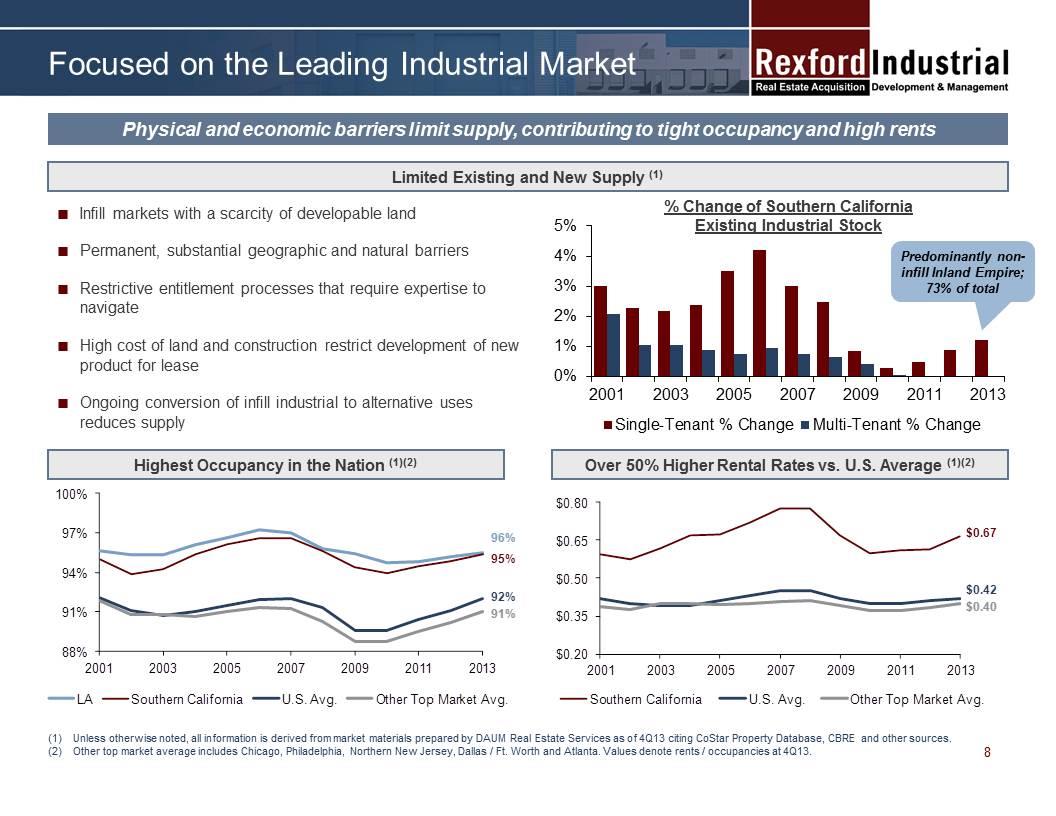

Focused on the Leading Industrial Market Unless otherwise noted, all information is derived from market materials prepared by DAUM Real Estate Services as of 4Q13 citing CoStar Property Database, CBRE and other sources. Other top market average includes Chicago, Philadelphia, Northern New Jersey, Dallas / Ft. Worth and Atlanta. Values denote rents / occupancies at 4Q13. Physical and economic barriers limit supply, contributing to tight occupancy and high rents Highest Occupancy in the Nation (1)(2) Over 50% Higher Rental Rates vs. U.S. Average (1)(2) Limited Existing and New Supply (1) Infill markets with a scarcity of developable land Permanent, substantial geographic and natural barriers Restrictive entitlement processes that require expertise to navigate High cost of land and construction restrict development of new product for lease Ongoing conversion of infill industrial to alternative uses reduces supply % Change of Southern California Existing Industrial Stock Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 Predominantly non-infill Inland Empire; 73% of total 8

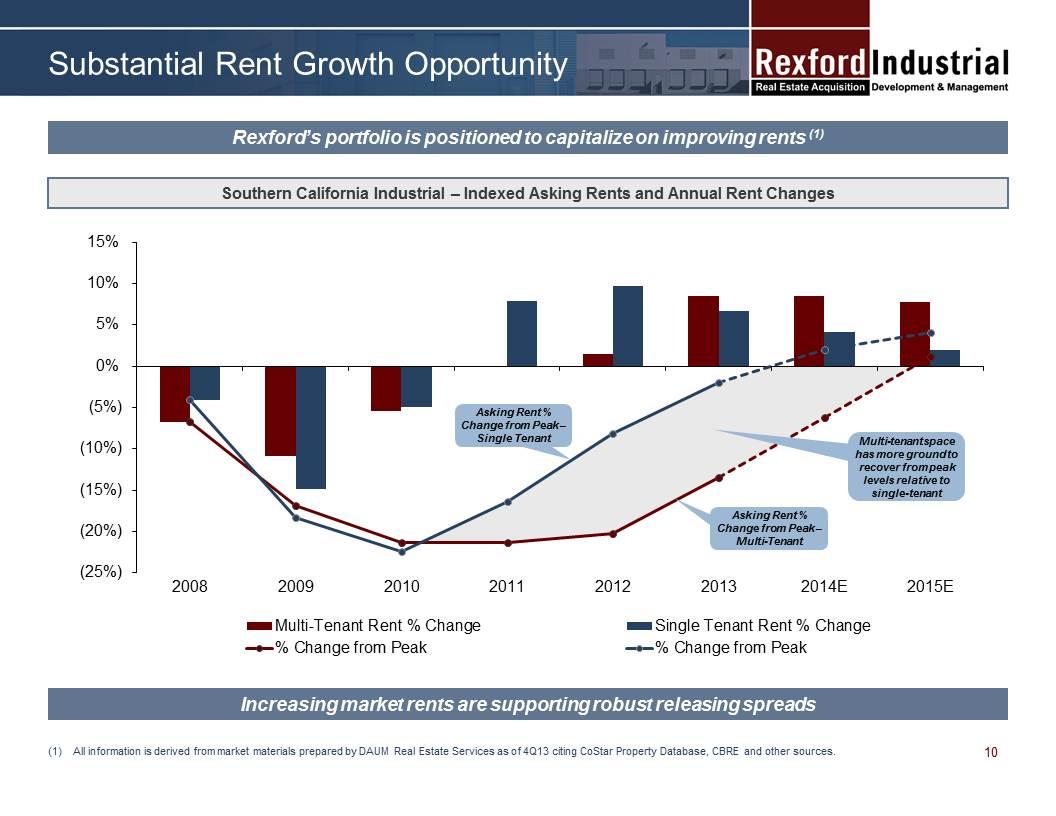

Proven Avenues Of Accretive Growth Significant upside in multi-tenant rental rates which have lagged the broader market recovery Internal Growth External Growth Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 Proprietary Deal Sourcing Select Redevelopment Drive Rents Industry Consolidation Increase Occupancy Increased cash flow by leasing vacant space Substantial consolidation opportunity in the large, highly-fragmented Southern California market Local sharpshooter with favorable access to on- and off-market / lightly-marketed investment opportunities In-house capability to improve and reposition space to deliver high quality and functional product in the market Highlights 17% GAAP releasing spreads (2Q 2014) 250bps increase in portfolio occupancy since IPO 50+% increase in portfolio (3.2mm SF) since IPO ~64% of transactions completed off-market / lightly-marketed since IPO 1.1mm SF acquired with value-add play since IPO Demonstrated by… From IPO to 2Q14, Rexford has grown quarterly Cash NOI by 31% and FFO per Share by 38% (1) Figures ‘At IPO’ calendarizes reported figures from the period after the IPO to represent the full 3Q13. 9

All information is derived from market materials prepared by DAUM Real Estate Services as of 4Q13 citing CoStar Property Database, CBRE and other sources. Substantial Rent Growth Opportunity Rexford’s portfolio is positioned to capitalize on improving rents (1) Southern California Industrial – Indexed Asking Rents and Annual Rent Changes Increasing market rents are supporting robust releasing spreads Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 Asking Rent % Change from Peak – Multi-Tenant Asking Rent % Change from Peak – Single Tenant Multi-tenant space has more ground to recover from peak levels relative to single-tenant 10

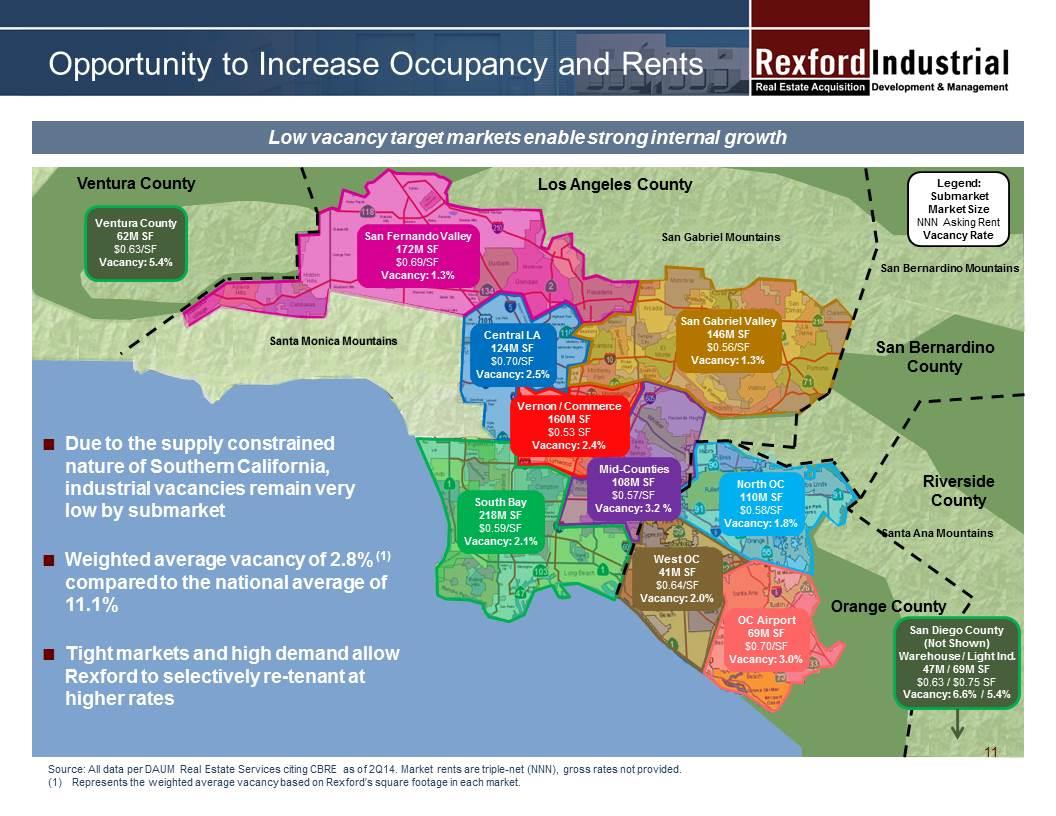

Opportunity to Increase Occupancy and Rents Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 Source: All data per DAUM Real Estate Services citing CBRE as of 2Q14. Market rents are triple-net (NNN), gross rates not provided. Represents the weighted average vacancy based on Rexford’s square footage in each market. San Fernando Valley 172M SF $0.69/SF Vacancy: 1.3% San Gabriel Valley 146M SF $0.56/SF Vacancy: 1.3% Central LA 124M SF $0.70/SF Vacancy: 2.5% South Bay 218M SF $0.59/SF Vacancy: 2.1% Vernon / Commerce 160M SF $0.53 SF Vacancy: 2.4% North OC 110M SF $0.58/SF Vacancy: 1.8% West OC 41M SF $0.64/SF Vacancy: 2.0% OC Airport 69M SF $0.70/SF Vacancy: 3.0% Ventura County Los Angeles County San Gabriel Mountains San Bernardino Mountains San Bernardino County Riverside County Orange County Santa Ana Mountains Santa Monica Mountains Ventura County 62M SF $0.63/SF Vacancy: 5.4% San Diego County (Not Shown) Warehouse / Light Ind. 47M / 69M SF $0.63 / $0.75 SF Vacancy: 6.6% / 5.4% Due to the supply constrained nature of Southern California, industrial vacancies remain very low by submarket Weighted average vacancy of 2.8% (1) compared to the national average of 11.1% Tight markets and high demand allow Rexford to selectively re-tenant at higher rates Mid-Counties 108M SF $0.57/SF Vacancy: 3.2 % Santa Monica Mountains Low vacancy target markets enable strong internal growth Legend: Submarket Market Size NNN Asking Rent Vacancy Rate 11

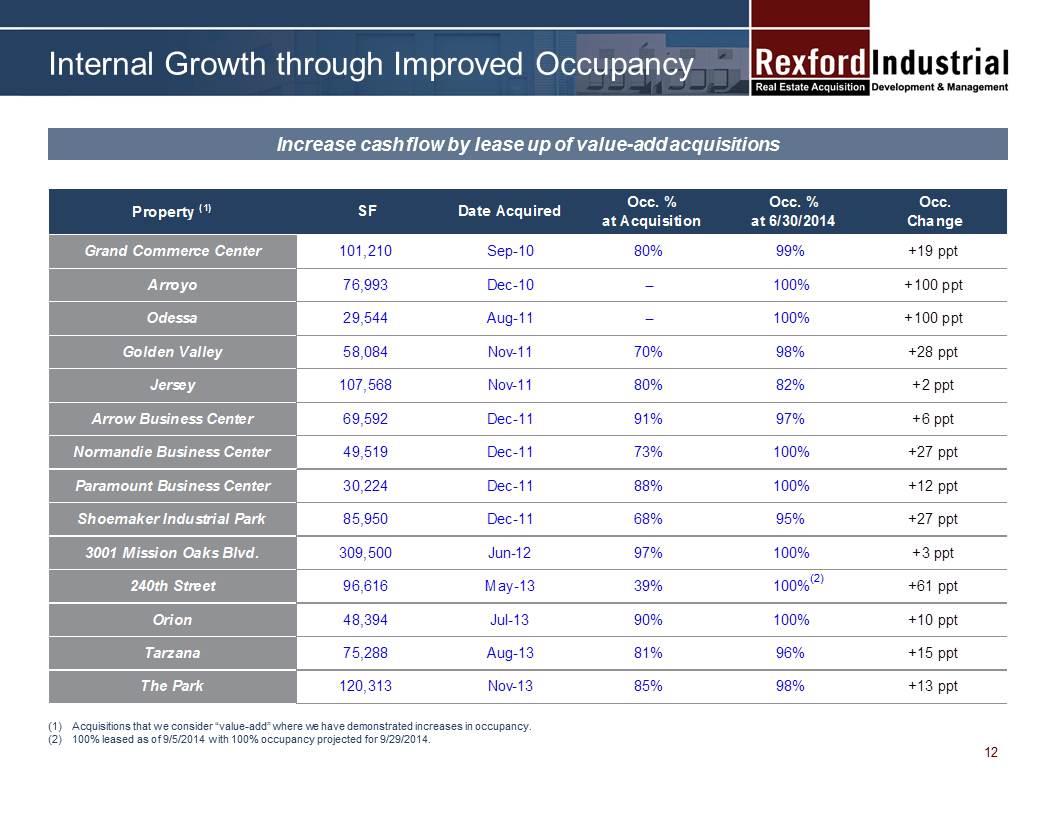

Internal Growth through Improved Occupancy Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 Acquisitions that we consider “value-add” where we have demonstrated increases in occupancy. 100% leased as of 9/5/2014 with 100% occupancy projected for 9/29/2014. Increase cash flow by lease up of value-add acquisitions 12 (2)

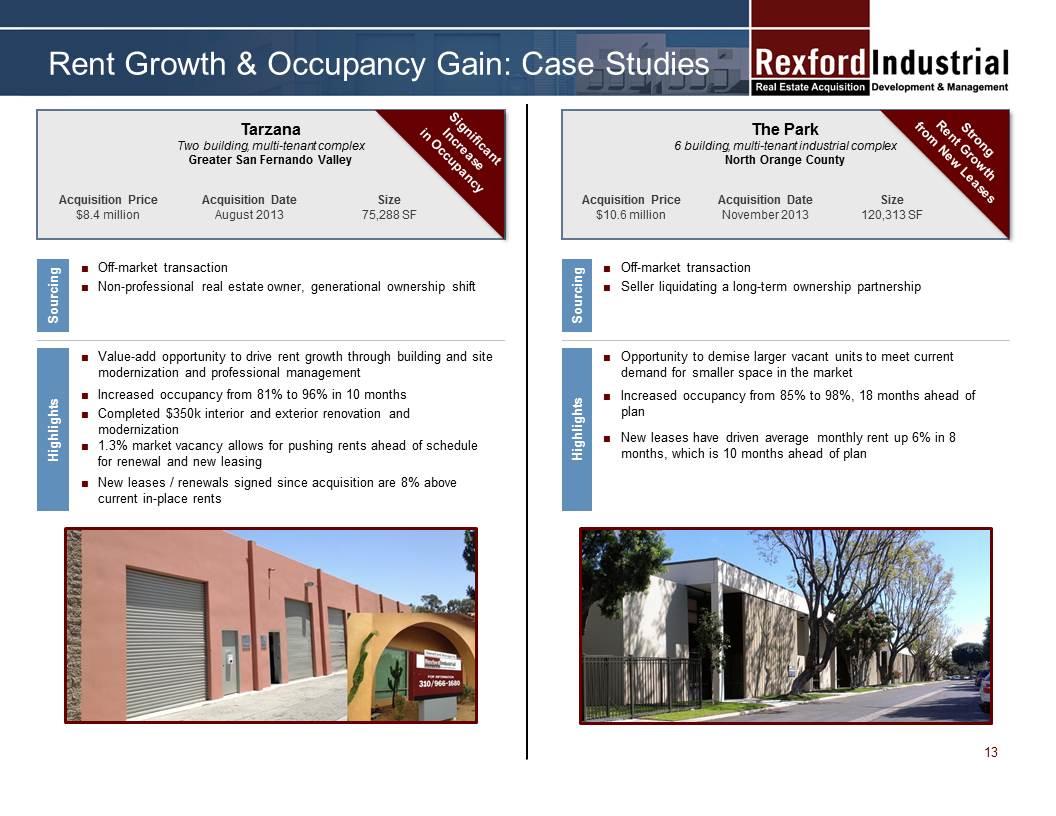

The Park 6 building, multi-tenant industrial complex North Orange County Rent Growth & Occupancy Gain: Case Studies Strong Rent Growth from New Leases Tarzana Two building, multi-tenant complex Greater San Fernando Valley Significant Increase in Occupancy Acquisition Price $8.4 million Acquisition Date August 2013 Size 75,288 SF Acquisition Price $10.6 million Acquisition Date November 2013 Size 120,313 SF Sourcing ■ Off-market transaction ■ Non-professional real estate owner, generational ownership shift Highlights ■ Value-add opportunity to drive rent growth through building and site modernization and professional management ■ Increased occupancy from 81% to 96% in 10 months ■ Completed $350k interior and exterior renovation and modernization ■ 1.3% market vacancy allows for pushing rents ahead of schedule for renewal and new leasing ■ New leases / renewals signed since acquisition are 8% above current in-place rents Sourcing ■ Off-market transaction ■ Seller liquidating a long-term ownership partnership Highlights ■ Opportunity to demise larger vacant units to meet current demand for smaller space in the market ■ Increased occupancy from 85% to 98%, 18 months ahead of plan ■ New leases have driven average monthly rent up 6% in 8 months, which is 10 months ahead of plan 13 Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97

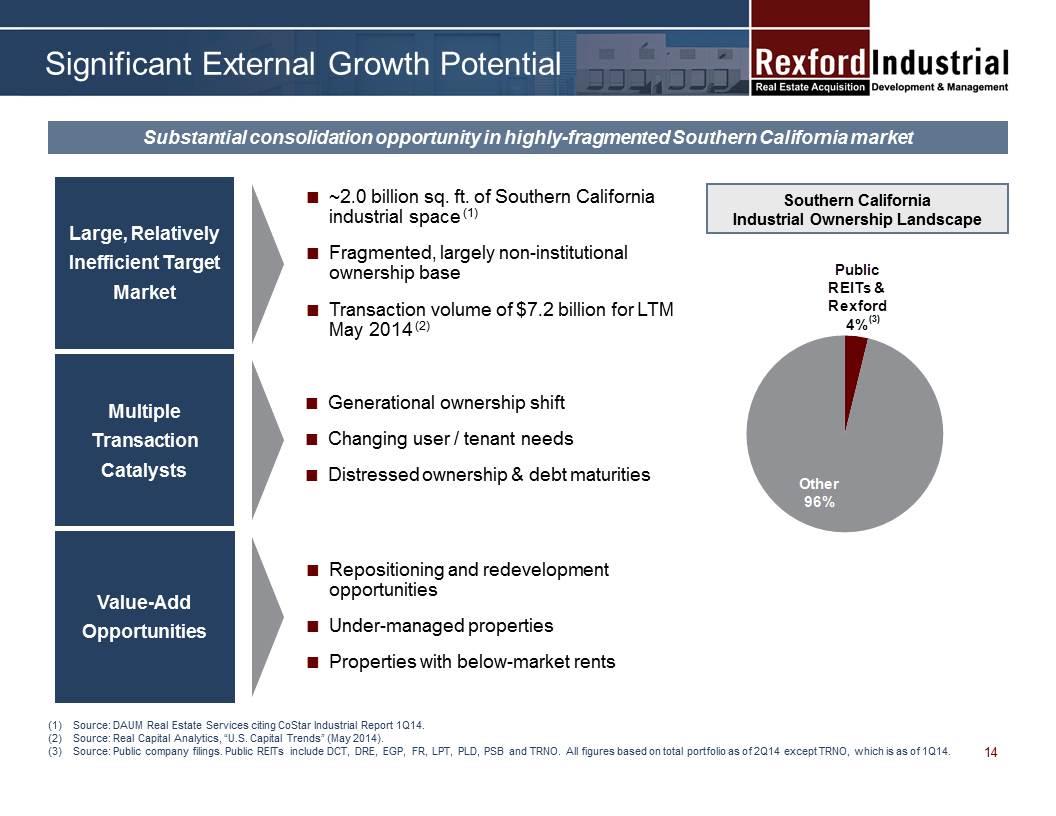

Significant External Growth Potential Source: DAUM Real Estate Services citing CoStar Industrial Report 1Q14. Source: Real Capital Analytics, “U.S. Capital Trends” (May 2014). Source: Public company filings. Public REITs include DCT, DRE, EGP, FR, LPT, PLD, PSB and TRNO. All figures based on total portfolio as of 2Q14 except TRNO, which is as of 1Q14. Substantial consolidation opportunity in highly-fragmented Southern California market ~2.0 billion sq. ft. of Southern California industrial space (1) Fragmented, largely non-institutional ownership base Transaction volume of $7.2 billion for LTM May 2014 (2) Large, Relatively Inefficient Target Market Generational ownership shift Changing user / tenant needs Distressed ownership & debt maturities Multiple Transaction Catalysts Repositioning and redevelopment opportunities Under-managed properties Properties with below-market rents Value-Add Opportunities Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 Southern California Industrial Ownership Landscape 14 (3)

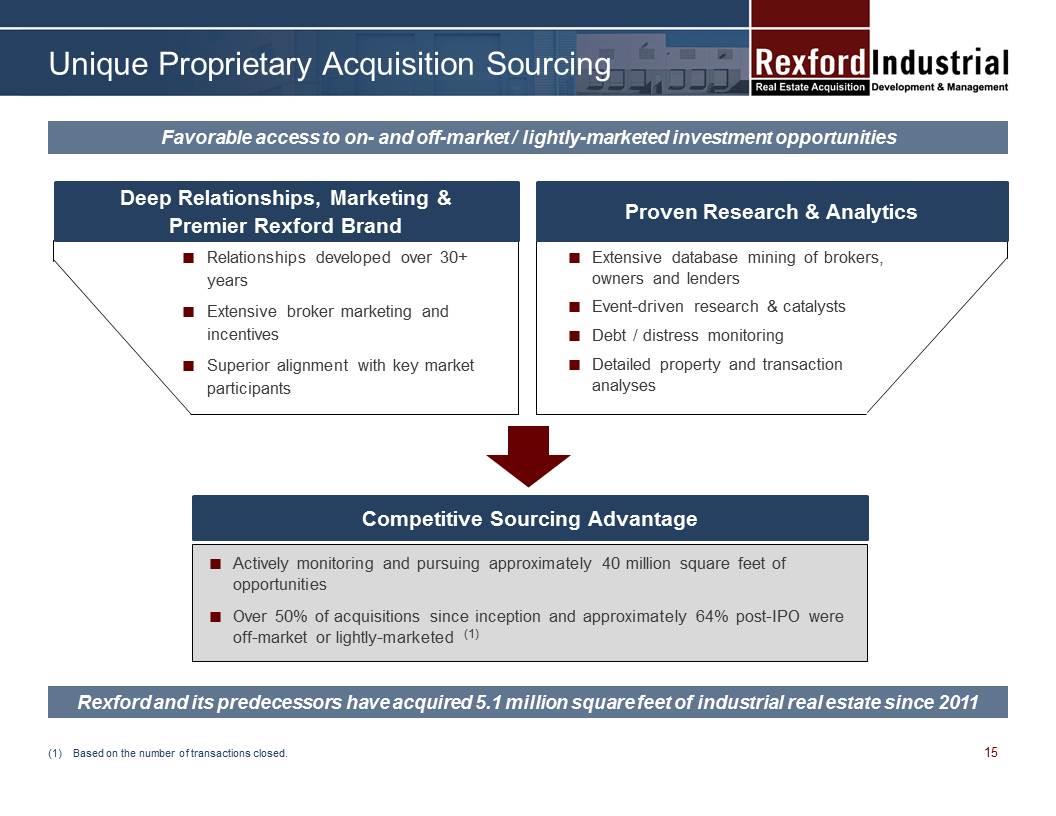

Actively monitoring and pursuing approximately 40 million square feet of opportunities Over 50% of acquisitions since inception and approximately 64% post-IPO were off-market or lightly-marketed (1) Relationships developed over 30+ years Extensive broker marketing and incentives Superior alignment with key market participants Extensive database mining of brokers, owners and lenders Event-driven research & catalysts Debt / distress monitoring Detailed property and transaction analyses Favorable access to on- and off-market / lightly-marketed investment opportunities Rexford and its predecessors have acquired 5.1 million square feet of industrial real estate since 2011 Deep Relationships, Marketing & Premier Rexford Brand Proven Research & Analytics Competitive Sourcing Advantage Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 Unique Proprietary Acquisition Sourcing Based on the number of transactions closed. 15

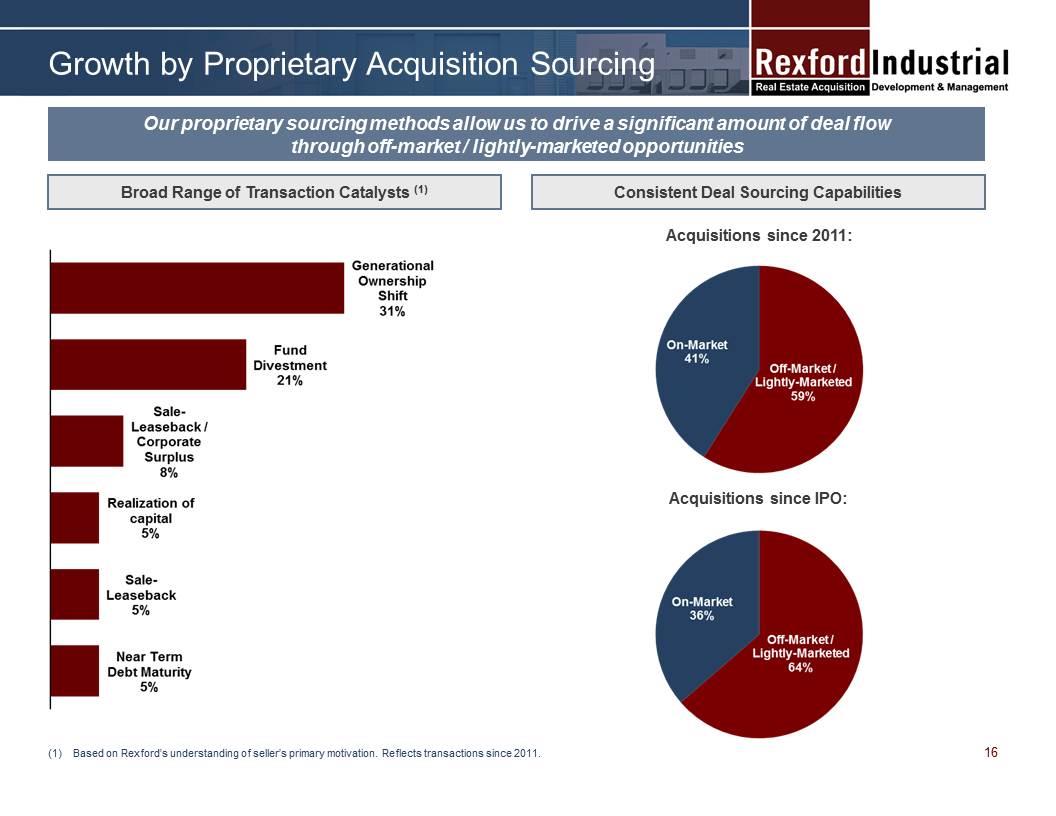

Growth by Proprietary Acquisition Sourcing Based on Rexford’s understanding of seller’s primary motivation. Reflects transactions since 2011. Broad Range of Transaction Catalysts (1) Consistent Deal Sourcing Capabilities Acquisitions since IPO: Our proprietary sourcing methods allow us to drive a significant amount of deal flow through off-market / lightly-marketed opportunities Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 Acquisitions since 2011: 16

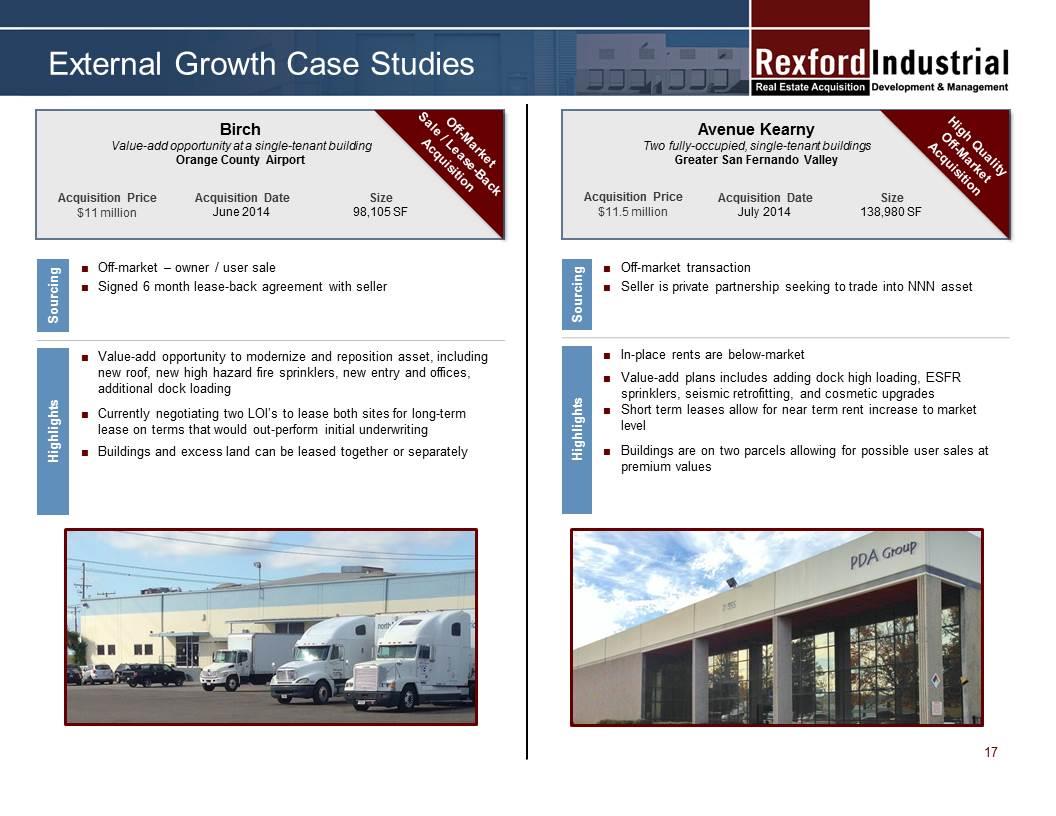

External Growth Case Studies Significant Increase in Occupancy Birch Value-add opportunity at a single-tenant building Orange County Airport Avenue Kearny Two fully-occupied, single-tenant buildings Greater San Fernando Valley High Quality Off-Market Acquisition Off-Market Sale / Lease-Back Acquisition Acquisition Price $11 million Acquisition Date June 2014 Size 98,105 SF Acquisition Price $11.5 million Acquisition Date July 2014 Size 138,980 SF Sourcing ■ Off-market – owner / user sale ■ Signed 6 month lease-back agreement with seller Highlights ■ Value-add opportunity to modernize and reposition asset, including new roof, new high hazard fire sprinklers, new entry and offices, additional dock loading ■ Currently negotiating two LOI’s to lease both sites for long-term lease on terms that would out-perform initial underwriting ■ Buildings and excess land can be leased together or separately Sourcing ■ Off-market transaction ■ Seller is private partnership seeking to trade into NNN asset Highlights ■ In-place rents are below-market ■ Value-add plans includes adding dock high loading, ESFR sprinklers, seismic retrofitting, and cosmetic upgrades ■ Short term leases allow for near term rent increase to market level ■ Buildings are on two parcels allowing for possible user sales at premium values 17 Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97

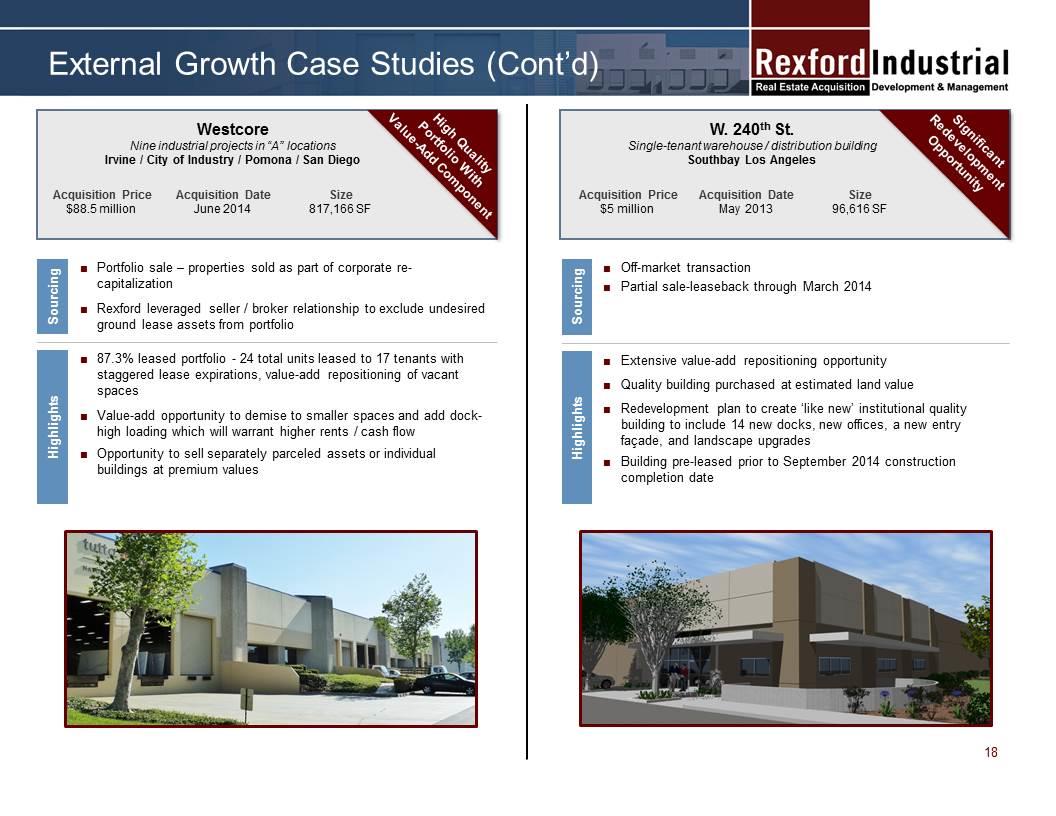

Westcore Nine industrial projects in “A” locations Irvine / City of Industry / Pomona / San Diego External Growth Case Studies (Cont’d) W. 240th St. Single-tenant warehouse / distribution building Southbay Los Angeles High Quality Portfolio With Value-Add Component Significant Redevelopment Opportunity Acquisition Price $88.5 million Acquisition Date June 2014 Size 817,166 SF Acquisition Price $5 million Acquisition Date May 2013 Size 96,616 SF Sourcing ■ Portfolio sale – properties sold as part of corporate re-capitalization ■ Rexford leveraged seller / broker relationship to exclude undesired ground lease assets from portfolio Highlights ■ 87.3% leased portfolio - 24 total units leased to 17 tenants with staggered lease expirations, value-add repositioning of vacant spaces ■ Value-add opportunity to demise to smaller spaces and add dock-high loading which will warrant higher rents / cash flow ■ Opportunity to sell separately parceled assets or individual buildings at premium values Sourcing ■ Off-market transaction ■ Partial sale-leaseback through March 2014 Highlights ■ Extensive value-add repositioning opportunity ■ Quality building purchased at estimated land value ■ Redevelopment plan to create ‘like new’ institutional quality building to include 14 new docks, new offices, a new entry façade, and landscape upgrades ■ Building pre-leased prior to September 2014 construction completion date 18 Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97

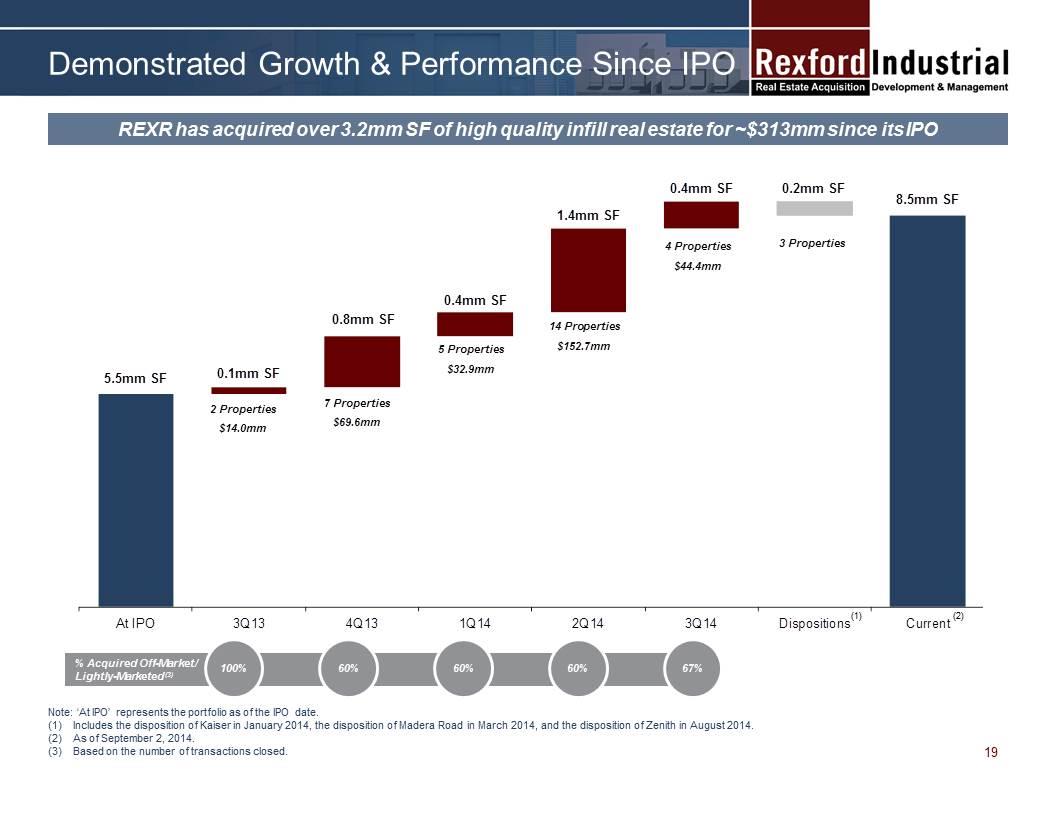

REXR has acquired over 3.2mm SF of high quality infill real estate for ~$313mm since its IPO Note: ‘At IPO’ represents the portfolio as of the IPO date. Includes the disposition of Kaiser in January 2014, the disposition of Madera Road in March 2014, and the disposition of Zenith in August 2014. As of September 2, 2014. Based on the number of transactions closed. % Acquired Off-Market / Lightly-Marketed (3) 100% 60% 60% 60% 67% (1) (2) 19 Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 Demonstrated Growth & Performance Since IPO

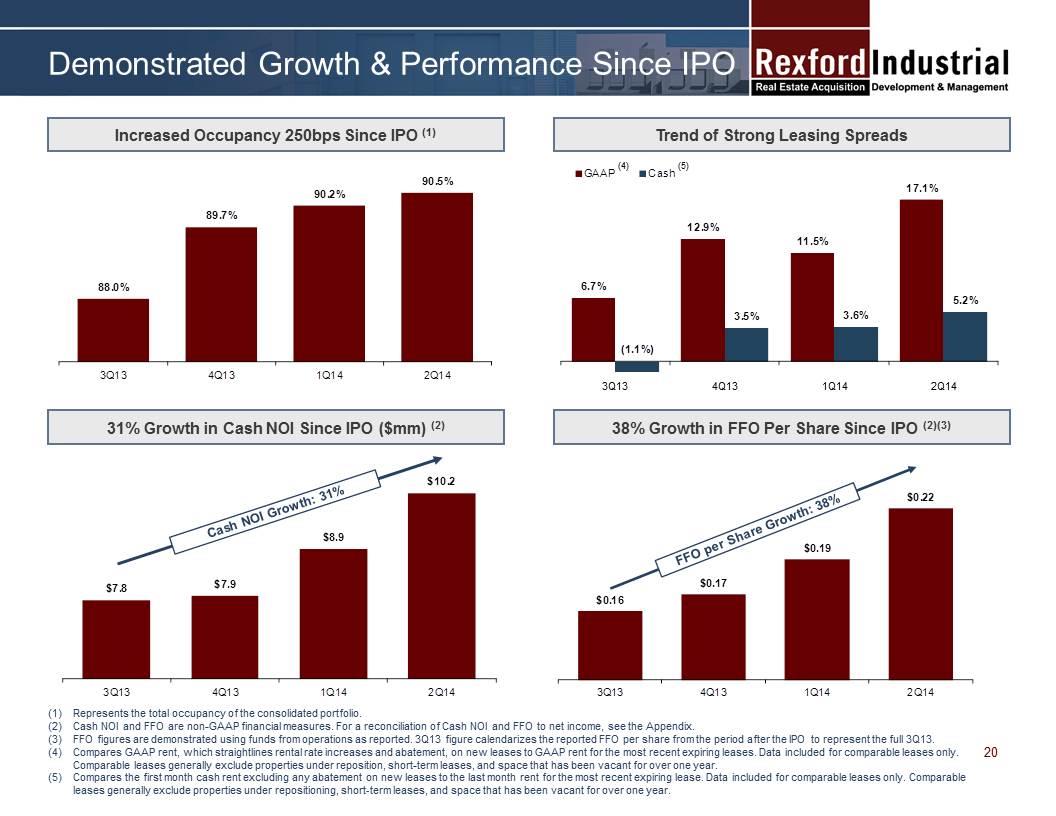

Increased Occupancy 250bps Since IPO (1) Trend of Strong Leasing Spreads 31% Growth in Cash NOI Since IPO ($mm) (2) Represents the total occupancy of the consolidated portfolio. Cash NOI and FFO are non-GAAP financial measures. For a reconciliation of Cash NOI and FFO to net income, see the Appendix. FFO figures are demonstrated using funds from operations as reported. 3Q13 figure calendarizes the reported FFO per share from the period after the IPO to represent the full 3Q13. Compares GAAP rent, which straightlines rental rate increases and abatement, on new leases to GAAP rent for the most recent expiring leases. Data included for comparable leases only. Comparable leases generally exclude properties under reposition, short-term leases, and space that has been vacant for over one year. Compares the first month cash rent excluding any abatement on new leases to the last month rent for the most recent expiring lease. Data included for comparable leases only. Comparable leases generally exclude properties under repositioning, short‐term leases, and space that has been vacant for over one year. 38% Growth in FFO Per Share Since IPO (2)(3) Cash NOI Growth: 31% FFO per Share Growth: 38% 3Q13 4Q13 1Q14 2Q14 (4) (5) 20 Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 Demonstrated Growth & Performance Since IPO

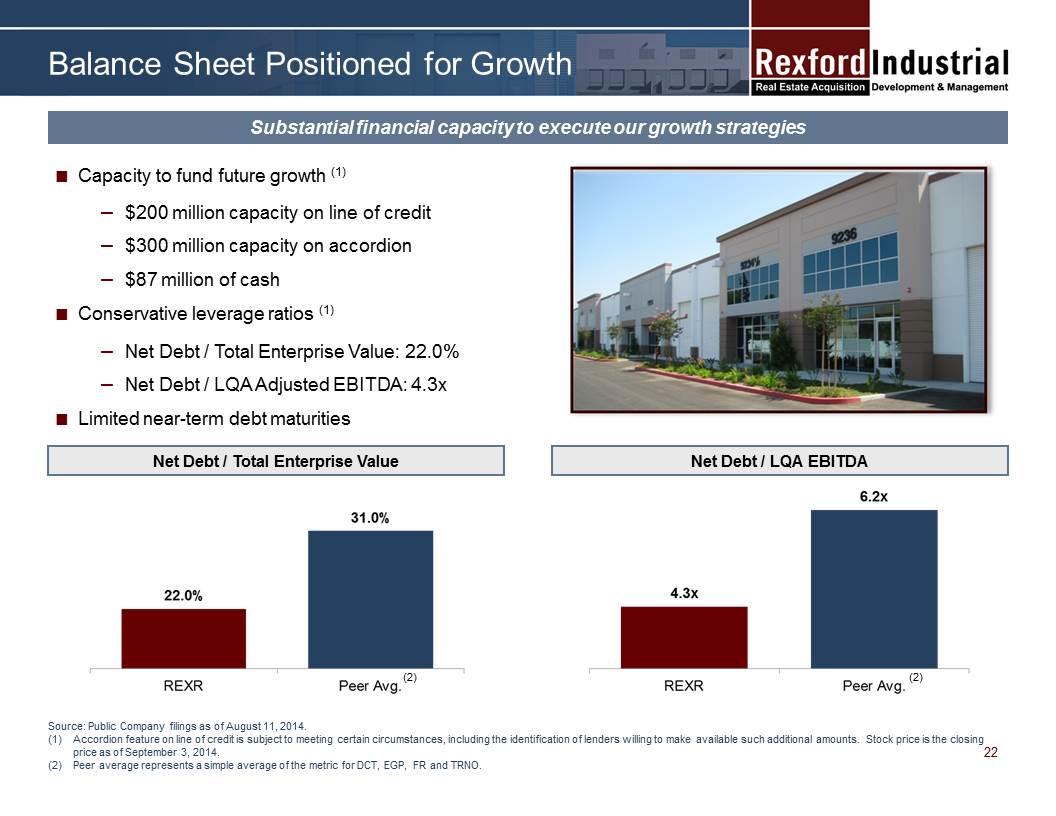

Source: Public Company filings as of August 11, 2014. Accordion feature on line of credit is subject to meeting certain circumstances, including the identification of lenders willing to make available such additional amounts. Stock price is the closing price as of September 3, 2014. Peer average represents a simple average of the metric for DCT, EGP, FR and TRNO. Capacity to fund future growth (1) $200 million capacity on line of credit $300 million capacity on accordion $87 million of cash Conservative leverage ratios (1) Net Debt / Total Enterprise Value: 22.0% Net Debt / LQA Adjusted EBITDA: 4.3x Limited near-term debt maturities (2) Net Debt / Total Enterprise Value Net Debt / LQA EBITDA Balance Sheet Positioned for Growth (2) Substantial financial capacity to execute our growth strategies 22 Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97

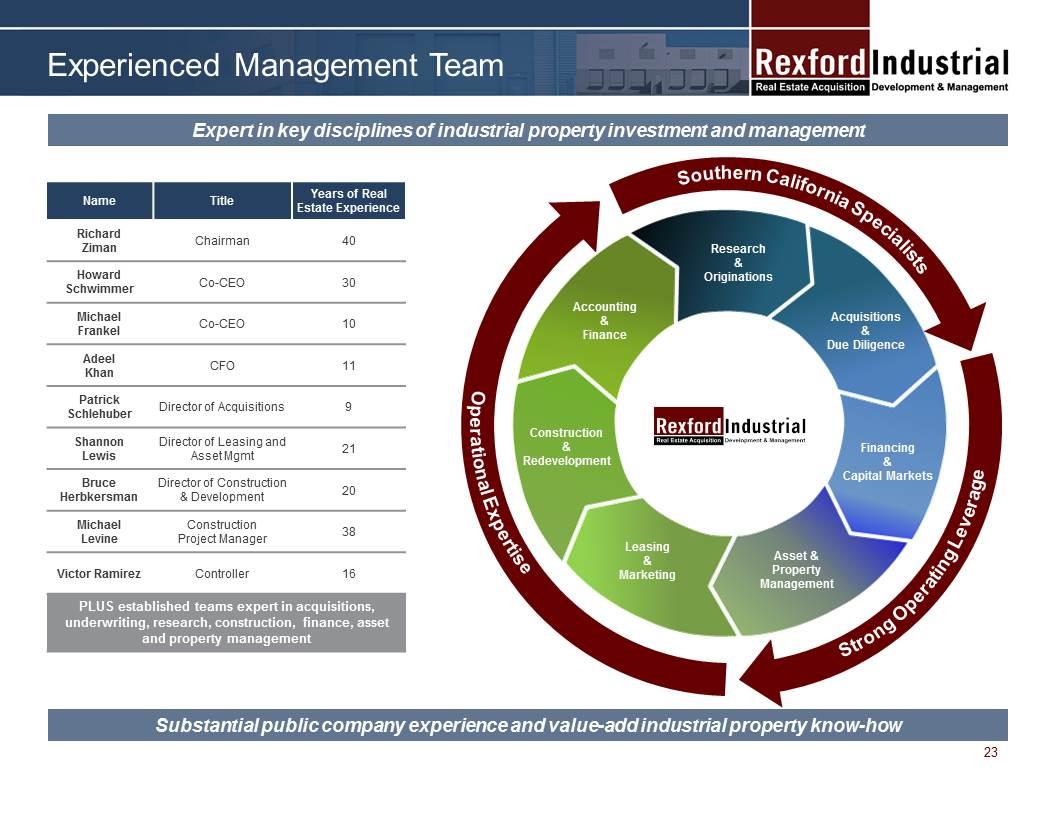

Experienced Management Team Expert in key disciplines of industrial property investment and management Name Title Years of Real Estate Experience Richard Ziman Chairman 40 Howard Schwimmer Co-CEO 30 Michael Frankel Co-CEO 10 Adeel Khan CFO 11 Patrick Schlehuber Director of Acquisitions 9 Shannon Lewis Director of Leasing and Asset Mgmt 21 Bruce Herbkersman Director of Construction & Development 20 Michael Levine Construction Project Manager 38 Victor Ramirez Controller 16 PLUS established teams expert in acquisitions, underwriting, research, construction, finance, asset and property management Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 Substantial public company experience and value-add industrial property know-how Research & Originations Acquisitions & Due Diligence Accounting & Finance Construction & Redevelopment Leasing & Marketing Financing & Capital Markets Asset & Property Management Operational Expertise Southern California Specialists Strong Operating Leverage 23

“Pure-Play” Southern California Industrial Expert With High Quality Infill Properties Investment Highlights Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 Industrial Market With Significant Consolidation Opportunity Significant External Growth Prospects Through Proprietary Deal Sourcing Capabilities Demonstrated Growth and Performance Since IPO Capital Structure Poised to Support Future Growth Led by Experienced Management Team with Vertically Integrated Platform Opportunity to Grow Rents and Occupancy in both Existing Portfolio and Recent and Future Acquisitions 24

Appendix Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97

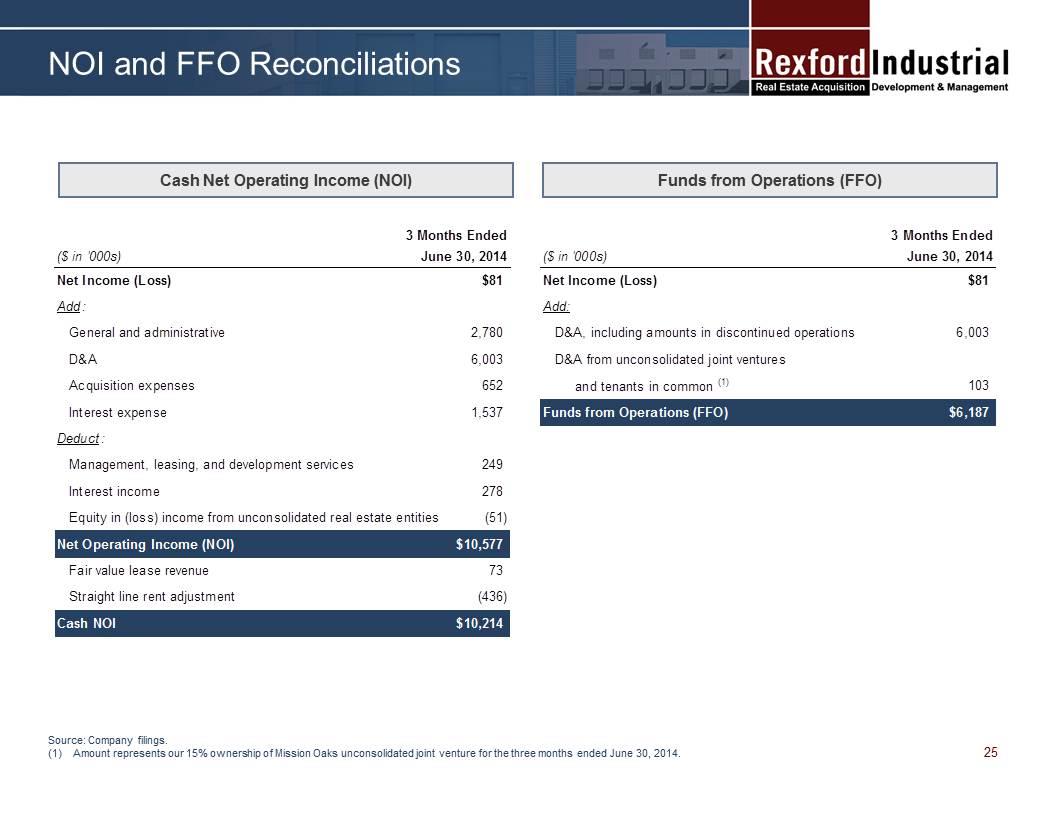

NOI and FFO Reconciliations Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 25 Cash Net Operating Income (NOI) Funds from Operations (FFO) Source: Company filings. Amount represents our 15% ownership of Mission Oaks unconsolidated joint venture for the three months ended June 30, 2014.

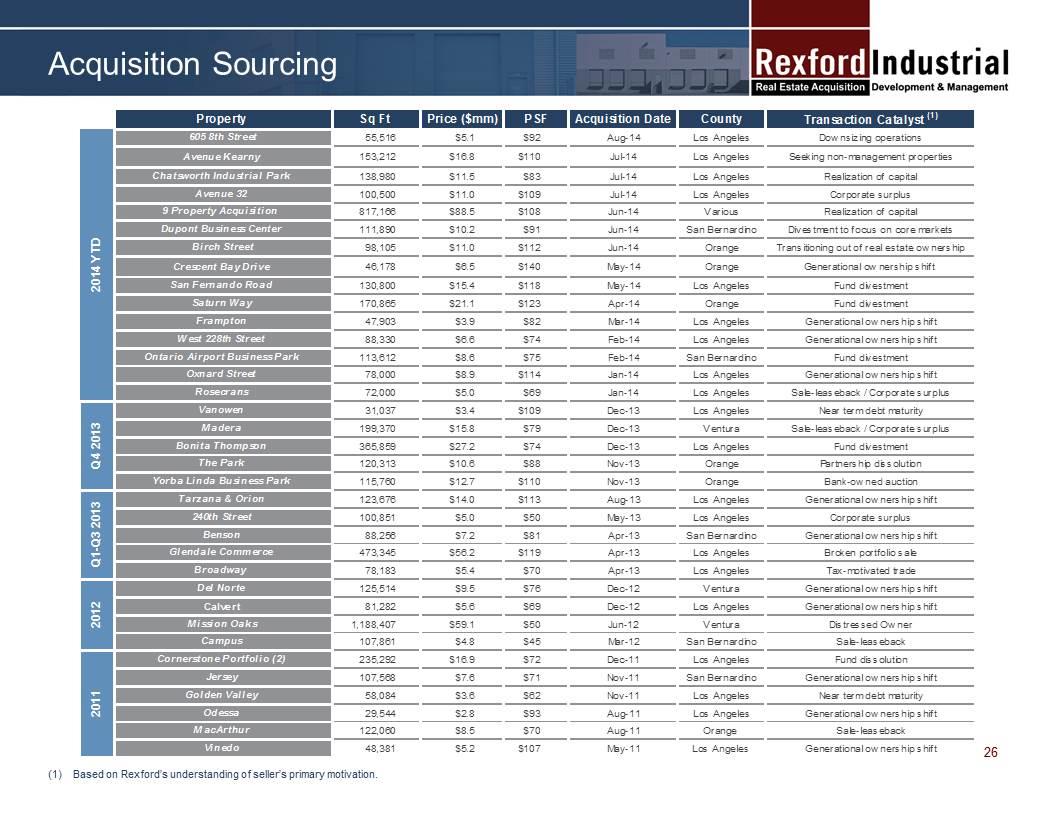

Acquisition Sourcing Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 Based on Rexford’s understanding of seller’s primary motivation. 26

Definitions / Discussion of Non-GAAP Financial Measures Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97 Annualized Base Rent: Calculated for each lease as the latest monthly contracted base rent per the terms of such lease multiplied by 12. Excludes billboard and antenna revenue and rent abatements. Cash NOI: Cash basis NOI is a non-GAAP measure, which we calculate by adding or subtracting from NOI i) fair value lease revenue and ii) straight-line rent adjustment. We use Cash NOI, together with NOI, as a supplemental performance measure. Cash NOI should not be used as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs. Cash NOI should not be used as a substitute for cash flow from operating activities computed in accordance with GAAP. We use Cash NOI to help evaluate the performance of the Company as a whole, as well as the performance of our Same Property Portfolio. Funds from Operations (FFO): We calculate FFO before non-controlling interest in accordance with the standards established by the National Association of Real Estate Investment Trusts (“NAREIT”). FFO represents net income (loss) (computed in accordance with GAAP), excluding gains (or losses) from sales of depreciable operating property, real estate related depreciation and amortization (excluding amortization of deferred financing costs) and after adjustments for unconsolidated partnerships and joint ventures. Management uses FFO as a supplemental performance measure because, in excluding real estate related depreciation and amortization, gains and losses from property dispositions, other than temporary impairments of unconsolidated real estate entities, and impairment on our investment in real estate, it provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We also believe that, as a widely recognized measure of performance used by other REITs, FFO may be used by investors as a basis to compare our operating performance with that of other REITs. However, because FFO excludes depreciation and amortization and captures neither the changes in the value of our properties that result from use or market conditions nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of our properties, all of which have real economic effects and could materially impact our results from operations, the utility of FFO as a measure of our performance is limited. Other equity REITs may not calculate or interpret FFO in accordance with the NAREIT definition as we do, and, accordingly, our FFO may not be comparable to such other REITs’ FFO. FFO should not be used as a measure of our liquidity, and is not indicative of funds available for our cash needs, including our ability to pay dividends. Net Operating Income (NOI): Includes the revenue and expense directly attributable to our real estate properties calculated in accordance with GAAP. Calculated as total revenue from real estate operations including i) rental revenues ii) tenant reimbursements, and iii) other income less property expenses and other property expenses (before interest expense, depreciation and amortization). We use NOI as a supplemental performance measure because, in excluding real estate depreciation and amortization expense and gains (or losses) from property dispositions, it provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We also believe that NOI will be useful to investors as a basis to compare our operating performance with that of other REITs. However, because NOI excludes depreciation and amortization expense and captures neither the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of our properties (all of which have real economic effect and could materially impact our results from operations), the utility of NOI as a measure of our performance is limited. Other equity REITs may not calculate NOI in a similar manner and, accordingly, our NOI may not be comparable to such other REITs’ NOI. Accordingly, NOI should be considered only as a supplement to net income as a measure of our performance. NOI should not be used as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs. NOI should not be used as a substitute for cash flow from operating activities in accordance with GAAP. We use NOI to help evaluate the performance of the Company as a whole, as well as the performance of our Same Property Portfolio. 27

Color Scheme 255 204 102 97 143 187 169 134 68 233 233 233 145 146 150 102 0 0 37 64 97