Exhibit 3.61

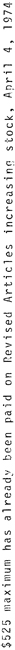

REVISED ARTICLES OF INCORPORATION

of

LeGRAND JOHNSON ENTERPRISES, INC.

now known as

LeGRAND JOHNSON CONSTRUCTION CO.

FIRST: These Revised Articles of Incorporation supersede the original Articles of Incorporation and all amendments thereto. The name of the corporation is LeGRAND JOHNSON CONSTRUCTION CO.

SECOND: The period of duration of this corporation shall be perpetual.

THIRD: The pursuits and business for which this corporation is formed are:

(a) To engage in the general finance business and the furnishing of capital and loans to industrial, agricultural and other financial ventures; to engage in the general business of construction, building and repair in all of its branches; and to engage in the business of manufacturing and fabricating and the furnishing of materials, services, labor and equipment; or a combination of any, or all, under contract or otherwise.

(b) To buy, sell, hold, encumber, contract, trade and otherwise deal in all and every kind of materials, patent rights, processes, lands and interests therein and all other kinds of property or rights.

(c) To furnish under contract or otherwise all manner of services, equipment and labor.

(d) To build, construct, repair, alter, establish, hold, invest, buy, sell, own and otherwise deal in improvements, subdivisions, projects, buildings, homes, business properties and all other improvements and lands, for its own account or otherwise.

(e) To carry on and conduct a general engineering and contracting business, including therein the designing, constructing, enlarging, repairing, remodeling or otherwise engaging in any work upon buildings, roads, highways, public works, manufacturing plants, bridges, piers, docks, mines, shafts, wells, pipelines, water works, dams, reservoirs, railroads, railway structures and all concrete, iron, steel, wood, masonry and earth constructions, and to make, extend and receive any contracts, or assignments of contracts therefor, or relating thereto, or connected therewith, and to manufacture and furnish the building materials and supplies connected therewith.

(f) To prospect and explore for, mine, quarry, excavate and bore for sand, gravel, silica rock, silica sand, clay, lime, limestone, volcanic ash and other materials and substances; to manufacture the same into brick, block, tile, cement, concrete and other manufactured products; to sell such materials in crude or manufactured form; and, to the extent required in such business, to locate, purchase, sell, lease and otherwise acquire and dispose of mines and mining property.

1.

(g) To purchase, lease and otherwise acquire, hold, operate, mortgage, convey and otherwise dispose of all kinds of property, both real and personal, both in the State of Utah and in all other states, territories and dependencies of the United States; to purchase the good will, business and all other property of any individual, firm or corporation as a going concern and to assume all its debts, contracts and obligations, provided said business is authorized by the powers herein conferred.

(h) To own and acquire, raise or produce or purchase or manufacture any and all kinds of real or personal property of whatsoever kind or nature to be used in connection with or for any of the purposes of this corporation. To purchase, rent, lease or otherwise acquire the ownership of, or the use of lands or goods of every kind and nature wheresoever the same may be found for the business of this corporation.

(i) To lend or advance money or to invest money in any corporation, business, association or individual wherever situated or located, with or without security as directed or authorized by the Board of Directors of this corporation.

(j) To borrow money in the purchase or acquisition of property, business, rights or franchises or for additional working capital or for any other object in or about its business or affairs and without limit as to amount; to incur debts and to raise, borrow and secure the payment of money in any lawful manner, including the issue and sale or other disposition of bonds, warrants, debentures, obligations, negotiable and transferable instruments and evidences of indebtedness of all kinds whether secured by mortgage, pledge, deed of trust or otherwise.

(k) To enter into, make and perform and carry out contracts of every sort and kind with any person, firm, association or corporation, municipality, body politic, country, territory, state, government or colony or dependency thereof and without limit as to amount; to draw, make, accept, endorse, discount, execute and issue promissory notes, drafts, bills of exchange, warrants, bonds, debentures and other negotiable or transferable instruments or evidences of indebtedness, whether secured by mortgage or otherwise, so far as may be permitted by the laws of the State of Utah.

(1) To endorse, guarantee and secure the payment and satisfaction of the bonds, coupons, mortgages, deeds of trust, debentures, securities, obligations, evidences of indebtedness and shares of the capital stock of other corporations and also to guarantee the payment or satisfaction of the dividends on shares of the capital stock of other corporations as far as and to the extent that the same may be permissible by the laws relating to domestic corporations of the State of Utah.

(m) To purchase and otherwise acquire any and all letters patent and similar rights guaranteed by the United States or any other country or government, licenses and the like, or any other interests therein or any inventions which may seem capable of being used for or in connection with any of the objects or purposes of said corporation and to use, develop, sell and grant licenses in respect to or other interest in the same and otherwise turn the same to account.

(n) To purchase, sell, acquire or otherwise become interested in any stocks, bonds, mortgages, debentures, notes, commercial paper, subscription warrants, voting trust certificates

2.

and other securities, choses in action, evidences of indebtedness or other obligations of any nature, whether of domestic or foreign corporation or other body politic or of domestic or foreign corporation, associations, firms, syndicates or individuals by purchase, investment, underwriting, by original subscription, participation in syndicates with others or otherwise and irrespective of whether or not such securities are fully paid or subject to further payment either with a view to investment or for resale or for any other legal and lawful purpose.

(o) To organize or cause to be organized under the laws of the State of Utah, or any other state, district, territory, province or government, a corporation or corporations for the purpose of accomplishing any or all of the objects for which this corporation is organized and to dissolve, wind up, liquidate, merge or consolidate any such corporation or corporations or to cause the same to be dissolved, wound up, liquidated, merged or consolidated.

(p) To do each and all things herein set forth to the same extent and as fully as natural persons might do or could do in the State of Utah, or in any other state, country or place.

(q) In general, but in connection with the foregoing, said corporation shall have and exercise all the powers conferred by the laws of the State of Utah, upon business corporations, it being hereby expressly provided that the foregoing enumeration of specific powers shall not be held to limit or restrict in any manner such general powers.

FOURTH: The said corporation is organized in the City of Logan, County of Cache, State of Utah. Its principal place of business shall be located in Logan, Utah.

FIFTH: The capital stock of the corporation shall be divided into two classes as follows:

(a)Common shares. The aggregate number of common shares which the corporation has authority to issue is 500,000 shares having a par value of one dollar ($1.00) each.

(b)Preferred shares. The aggregate number of preferred shares which the corporation has authority to issue is 1,100,000 shares having a par value of one dollar ($1.00) each.

(c)Preferences, limitations and relative rights. Except to the extent otherwise provided by law, the preferences, limitations and relative rights of the common shares and of the preferred shares shall be as follows:

(1)Voting. Subject to the provisions of the bylaws of the corporation relating to the fixing of a record date, the holders of common shares shall be entitled to one (1) vote for each common share so held for the election of directors and for all other purposes. The holders of preferred shares shall have no voting rights.

(2)Dividends. The holders of preferred shares shall be entitled to receive, when and as declared by the Board of Directors, out of funds legally available for the

3.

purpose, cumulative dividends at, but not exceeding the rate of, eight (8%) per cent of the par value per annum, payable in cash semi-annually on the first day of May and the first day of November in each year after issue. After the requirements with respect to the dividends on the preferred shares have been met, the holders of common shares shall be entitled to receive dividends out of funds legally available for the purpose when, as and if declared from time to time by the Board of Directors.

(3)Voluntary or involuntary liquidation. In the event of voluntary or involuntary liquidation, the holders of preferred shares shall be entitled to receive an amount equal to the par value thereof, such amount to be paid in cash, to the extent thereof, and next from properties in kind, at the fair market value thereof, plus all arrearages of unpaid cumulative dividends, before any payment or distribution may be made to the holders of the common shares. Common shares shall be entitled to receive all other cash and properties upon voluntary or involuntary liquidation.

(4)Redemption. The preferred shares shall be subject to redemption in whole or from time to time in part at the option of the corporation, according to the following schedule:

| Redemption Price | ||

one year after issue | Par plus 10% of par | |

two years after issue | Par plus 9% of par | |

three years after issue | Par plus 8% of par | |

four years after issue | Par plus 7% of par | |

five years after issue | Par plus 6% of par | |

six years after issue | Par plus 5% of par | |

seven years after issue | Par plus 4% of par | |

eight years after issue | Par plus 3% of par | |

nine years after issue | Par plus 2% of par | |

ten years after issue | Par plus 1% of par | |

eleven years after issue and thereafter | Par | |

In addition to amounts determined under the foregoing schedule, the holder of a preferred share being redeemed shall be entitled to receive all arrearages of unpaid cumulative cash dividends, if any, to the date of redemption fixed in the notice of redemption. At least thirty (30) days’ prior written notice shall be given to the holder of record of the shares to be called for redemption by mailing said notice to each holder of preferred shares to be redeemed at the last address as shown on the corporate records. Said notice shall specify the redemption price and the place at which and the date on which the preferred shares called for redemption will be redeemed and shall specify the preferred shares called for redemption. If less than all of the outstanding preferred shares are to be redeemed, the preferred shares to be redeemed shall be chosen by lot or pro rata, as the Board of Directors may determine. On and after the date fixed for redemption, all such shares called for redemption shall no longer be deemed to be outstanding and the holders thereof shall have no further rights in respect thereto, or in respect to the corporation, its assets or business, except the right to receive the redemption price plus dividend arrearages, if any, without interest.

4.

Notwithstanding any other provision hereof or rule of law to the contrary, and without the giving of any notice of redemption as described above, one or more preferred shares included in a deceased holder’s estate for federal estate tax purposes (or one or more preferred shares issued as a stock dividend in respect of common shares, which common shares were included in a deceased holder’s estate for federal estate tax purposes) may, at the option of the corporation, be redeemed at any time after such inclusion, by certificate number without any obligation to redeem any other preferred shares (or to determine by lot which preferred shares are to be redeemed) at the par value thereof plus arrearages of unpaid cumulative cash dividends, if any, to the date of actual redemption, so long as the total of amounts so distributed in redemption of such shares of (or attributed to) such deceased holder does not exceed the sum of

A. the estate, inheritance, legacy and succession taxes (including any interest collected as part of such taxes) imposed because of such decedent’s death, and

B. the amount of funeral and administration expenses allowable as deductions to the estate under Section 2053 of the Internal Revenue Code

as provided in Section 303 of the Internal Revenue Code, as amended from time to time.

From time to time the common shares and the preferred shares may be issued in such amounts and in such manner and for such consideration (or as a stock dividend) as may be determined by the Board of Directors and as may be permitted by law.

SIXTH: The Board of Directors shall consist of not less than three (3) nor more than seven (7), and said directors shall choose from amongst their members the following officers: President, Vice President, Treasurer and Secretary.

SEVENTH: The term of office of said officers and directors shall be one (1) year, and they shall hold office until their successor shall have been duly elected and qualified or unless they resign or are removed as herein provided, or as provided by law.

EIGHTH: To be eligible as an officer or director of said corporation, a person must be the owner of at least one (1) share of the corporate stock thereof.

5.

NINTH: A majority of the members of the Board of Directors shall be necessary to, and shall constitute a quorum and shall be authorized to transact the business and exercise all of the corporate powers of the corporation.

TENTH: The regular annual meeting of the holders of common shares of said corporation for the election of officers and directors shall be on the second Monday in June of each year, commencing with the year 1955, at the principal place of business of said corporation which shall be in Logan City, Utah. Notice of such meeting shall be given by ordinary mail and notice by publication shall not be necessary.

ELEVENTH: Special meetings of stockholders may be called and held upon notice signed by the President or any two directors and transmitted by ordinary mail, and publication of such notice shall not be necessary.

TWELFTH: At all meetings of stockholders a majority of the outstanding common stock of said corporation shall constitute a quorum and each share of common stock shall be entitled to one vote; proxies may be given and the holder thereof shall be entitled to vote said common stock the same as if the owner were personally present.

THIRTEENTH: Any officer or director may resign by giving ten (10) days’ notice in writing, to the President or Secretary or Treasurer, and any officer or director may be removed at any regular or special meeting of the stockholders called and held for that purpose, and any vacancy caused by death, resignation or removal may be filled at any meeting of the stockholders.

6.

FOURTEENTH: The Board of Directors shall have power to adopt By-laws for the government and control of the corporation.

FIFTEENTH: The private property of the stockholders of said corporation shall not be liable for the debts or obligations thereof.

SIXTEENTH: The capital stock of said corporation, common as well as preferred, shall be non-assessable for any purpose whatsoever.

IN WITNESS WHEREOF, we have hereunto set our hands at Logan City, Utah, this 28th day of December, 1973.

| LeGRAND JOHNSON CONSTRUCTION CO. | ||

| By | /s/ Max L. Johnson | |

| ||

| President | ||

| By | /s/ Larry L. Jardine | |

| ||

| Secretary-Treasurer | ||

| STATE OF UTAH | ) | |||||

| ) | ||||||

| COUNTY OF SALT LAKE | ) | ss. |

I, KEITH JAY HOLDSWORTH, a Notary Public, DO HEREBY CERTIFY that on this 28th day of December, 1973, personally appeared before me Max L. Johnson who, being by me first duly sworn, declared that he is the President of LeGrand Johnson Construction Co. and that he signed the foregoing document as President of the corporation, and that the statements therein contained are true; and that on this 28th day of December, 1973, personally appeared before me Larry L. Jardine who, being by me first duly sworn, declared that he is the Secretary-Treasurer of LeGrand Johnson Construction Co. and that he signed the foregoing document as Secretary-Treasurer of the corporation and that the statements contained therein are true.

| /s/ Keith Jay Holdsworth | |

| ||

Notary Public Residing in Salt Lake County My Commission Expires: Feb 18, 1975 |

7. Revised Articles

ARTICLES OF AMENDMENT

LeGRAND JOHNSON CONSTRUCTION CO. | ||||

| These Articles of Amendment are made by LeGrand Johnson Construction Co., a Utah corporation, pursuant to section 16-10-57 of the Utah Business Corporation Act, and in accordance with the provisions of such section the following information is set forth:

(a) The name of the corporation is LeGrand Johnson Construction Co.

(b) The Board of Directors of such Company has approved and the shareholders of such Company have adopted the following amendments:

1. Article FIFTH of the Revised Articles of Incorporation of such Company shall be revised to read as follows:

FIFTH: The capital stock of the corporation shall be divided into three classes as follows:

(a)Voting Common shares. The aggregate number of voting common shares which the corporation has authority to issue is 500,000 shares having a par value of one dollar ($1.00) each.

(b)Nonvoting Common shares. The aggregate number of nonvoting common shares which the corporation has authority to issue is 1,000,000 shares having a par value of one dollar ($1.00) each.

(c)Preferred shares. The aggregate number of preferred shares which the corporation has authority to issue is 1,600,000 shares having a par value of one dollar ($1.00) each.

(d)Preferences, limitations and relative rights. Except to the extent otherwise provided by law, the preferences, limitations and relative rights of the common shares and of the preferred shares shall be as follows:

(1)Voting. Subject to the provisions of the bylaws of the corporation relating to the fixing of a record date, the holders of voting common shares shall be entitled to one (1) vote for each voting share so held for the election of directors and for all other purposes. The holders of nonvoting common and preferred shares shall have no voting rights, except to the extent otherwise provided by the laws of the State of Utah. Except with respect to such voting differences each share of nonvoting common stock shall have all of the rights, powers, privileges and immunities of each share of voting common stock. |

(2)Dividends. The holders of preferred shares shall be entitled to receive, when and as declared by the Board of Directors, out of funds legally available for the purpose, cumulative dividends at, but not exceeding the rate of, eight (8%) per cent of the par value per annum, payable in cash semi-annually on the first day of May and the first day of November in each year after issue. After the requirements with respect to the dividends on the preferred shares have been met, the holders of common shares shall be entitled to receive dividends out of funds legally available for the purpose when, as and if declared from time to time by the Board of Directors.

(3)Voluntary or involuntary liquidation. In the event of voluntary or involuntary liquidation, the holders of preferred shares shall be entitled to receive an amount equal to the par value thereof, such amount to be paid in cash, to the extent thereof, and next from properties in kind, at the fair market value thereof, plus all arrearages of unpaid cumulative dividends, before any payment or distribution may be made to the holders of the common shares. Common shares shall be entitled to receive all other cash and properties upon voluntary or involuntary liquidation.

(4)Redemption. The preferred shares shall be subject to redemption in whole or from time to time in part at the option of the corporation, according to the following schedule:

| Redemption Price | ||

One year after issue | Par plus 10% of par | |

Two years after issue | Par plus 9% of par | |

Three years after issue | Par plus 8% of par | |

Four years after issue | Par plus 7% of par | |

Five years after issue | Par plus 6% of par | |

Six years after issue | Par plus 5% of par | |

Seven years after issue | Par plus 4% of par | |

Eight years after issue | Par plus 3% of par | |

Nine years after issue | Par plus 2% of par | |

Ten years after issue | Par plus 1% of par | |

Eleven years after issue and thereafter | Par | |

In addition to amounts determined under the foregoing schedule, the holder of a preferred share being redeemed shall be entitled to receive all arrearages of unpaid cumulative cash dividends, if any, to the date of redemption fixed in the notice of redemption. At least thirty (30) days’ prior written notice shall be given to the holder of record of the shares to be called for redemption by mailing said notice to each holder of preferred shares to be redeemed at the last address as shown on the corporate records. Said notice shall specify the redemption price and the

- 2 -

place at which and the date on which the preferred shares called for redemption will be redeemed and shall specify the preferred shares called for redemption. If less than all of the outstanding preferred shares are to be redeemed, the preferred shares to be redeemed shall be chosen by lot or pro rata, as the Board of Directors may determine. On and after the date fixed for redemption, all such shares called for redemption shall no longer be deemed to be outstanding and the holders thereof shall have no further rights in respect thereto, or in respect to the corporation, its assets or business, except the right to receive the redemption price plus dividend arrearages, if any, without interest.

Notwithstanding any other provision hereof or rule of law to the contrary, and without the giving of any notice of redemption as described above, one or more preferred shares included in a deceased holder’s estate for federal estate tax purposes (or one or more preferred shares issued as a stock dividend in respect of common shares, which common shares were included in a deceased holder’s estate for federal estate tax purposes) may, at the option of the corporation, be redeemed at any time after such inclusion, by certificate number without any obligation to redeem any other preferred shares (or to determine by lot which preferred shares are to be redeemed) at the par value thereof plus arrearages of unpaid cumulative cash dividends, if any, to the date of actual redemption, so long as the total of amounts so distributed in redemption of such shares of (or attributed to) such deceased holder does not exceed the sum of

A. the estate, inheritance, legacy and succession taxes (including any interest collected as part of such taxes) imposed because of such decedent’s death, and

B. the amount of funeral and administration expenses allowable as deductions to the estate under section 2053 of the Internal Revenue Code as provided in section 303 of the Internal Revenue Code, as amended from time to time.

From time to time the common shares and the preferred shares my be issued in such amounts and in such manner and for such consideration (or as a stock dividend) as may be determined by the Board of Directors and as may be permitted by law.

- 3 -

2. Article TENTH of the Revised Articles of Incorporation of such Company shall be revised to read as follows:

TENTH: The regular annual meeting of the holders of voting common shares of said corporation for the election of officers and directors shall be on the second Monday in June of each year, commencing with the year 1955, at the principal place of business of said corporation which shall be in Logan City, Utah. Notice of such meeting shall be given by ordinary mail and notice by publication shall not be necessary.

3. Article TWELFTH of the Revised Articles of Incorporation of such Company shall be revised to read as follows:

TWELFTH: At all meetings of stockholders a majority of the outstanding voting common stock of said corporation shall constitute a quorum and each share of voting common stock shall be entitled to one vote; proxies may be given and the holder thereof shall be entitled to vote said common stock the same as if the owner were personally present.

(c) The date of adoption of the said amendments by the shareholders of the Company was June 28, 1976.

(d) The number of common shares (the only shares of the Company having general voting rights) outstanding was 250,923 and each of said shares was entitled to vote on said amendment. No other class of shares was entitled to vote thereon as a class.

(e) 250,923 common shares voted in favor of said amendment and no common shares voted against said amendment.

(f) The amendment does not effect a change in the amount of the stated capital of the corporation.

IN WITNESS WHEREOF these Articles of Amendment have been duly executed this 28th day of June, 1976, on behalf of LeGrand Johnson Construction Co. by its duly authorized officers.

| LeGRAND JOHNSON CONSTRUCTION CO. | ||

| By | /s/ Max L. Johnson | |

| ||

| Max L. Johnson, President | ||

| By | /s/ Larry L. Jardine | |

| ||

| Larry L. Jardine, Secretary | ||

- 4 -

| STATE OF UTAH | ) | |||

| ) | ss. | |||

| COUNTY OF CACHE | ) |

I, Beverly M. Ross, a Notary Public do hereby certify that on the 28 day of June, 1976, personally appeared before me Max L. Johnson, who, being by me duly sworn, declared that he is the President of LeGrand Johnson Construction Co. and that he signed the foregoing document as President of the corporation, and that the statements contained therein are true.

| /s/ Beverly M. Ross | ||

| NOTARY PUBLIC | ||

| Residing in: | Logan, Utah | |

| My Commission Expires: |

4-19-80 |

- 5 -

| ARTICLES OF AMENDMENT LeGRAND JOHNSON CONSTRUCTION CO. |  |

These Articles of Amendment are made by LeGrand Johnson Construction Co., a Utah Corporation, pursuant to Section 16-10-57 of the Utah Business Corporation Act, and in accordance with the provisions of such section the following information is set forth:

(a) The name of the Corporation is LeGrand Johnson Construction Co.

(b) The Board of Directors of such Company has approved and the shareholders of such Company have adopted the following amendment:

Article FIFTH of the Revised Articles of Incorporation of such Company shall be revised to read as follows:

FIFTH: The capital stock of the corporation shall be divided into four classes as follows:

(a)Voting Common Shares. The aggregate number of voting common shares which the corporation has authority to issue is 1,000,000 shares having a par value of one dollar ($1.00) each.

(b)Nonvoting Common Shares. The aggregate number of nonvoting common shares which the corporation has authority to issue is 1,000,000 shares having a par value of one dollar ($1.00) each.

(c)Class A Preferred Shares. The aggregate number of class A preferred shares which the corporation has authority to issue is 1,600,000 shares having a par value of one dollar ($1.00) each.

(d)Class B Preferred Shares. The aggregate number of class B preferred shares which the corporation has authority to issue is 10,000,000 shares having a par value of one dollar ($1.00) each.

(e)Preferences, Limitations and Relative Rights. Except to the extent otherwise provided by law, the preferences, limitations and relative rights of the common shares (voting and nonvoting) and of the preferred shares (class A and class B) shall be as follows:

(1)Voting. The holders of voting common shares shall be entitled to one (1) vote for each voting share so held for the election of directors and for all other purposes. Except to the extent otherwise provided by the laws of the State of Utah, (i) the holders of nonvoting common stock shall have no voting rights; (ii) the holders of class A preferred stock shall have no voting rights; and (iii) the holders of class B preferred stock shall have no voting rights except to the extent that the corporation is in arrears eight (8) consecutive semi-annual dividends in respect

of outstanding class B preferred or arrearages thereon remain unpaid aggregating twelve (12) semi-annual dividends in a total of ten (10) years or less. Except with respect to such voting differences each share of nonvoting common stock shall have all of the rights, powers, privileges, and immunities of each share of voting common stock and each share of class B preferred stock shall have all of the rights, powers, privileges and immunities of each share of class A preferred stock, except to the extent specifically provided herein.

(2)Dividends. The holders of preferred shares (class A and class B) shall be entitled to receive, when and as declared by the Board of Directors, out of funds legally available for the purpose, cumulative dividends at, but not exceeding the rate of, eight (8%) percent of the par value per annum, payable in cash semi-annually on the first day of May and the first day of November in each year after issue. Dividends shall be paid when and as declared by the Board of Directors from funds legally available for the purpose with the following priorities: (i) class A preferred shares to the extent of unpaid arrearages, (ii) class B preferred shares to the extent of unpaid arrearages, and (iii) common shares (voting and nonvoting).

(3)Voluntary or involuntary liquidation. In the event of voluntary or involuntary liquidation, the holders of preferred shares (class A and class B) shall be entitled to receive an amount equal to the par value thereof, such amount to be paid in cash, to the extent thereof, and next from properties in kind, at the fair market value thereof, plus all arrearages of unpaid cumulative dividends, before any payment or distribution may be made to the holders of the common shares (voting and nonvoting). Common shares (voting and nonvoting) pro rata shall be entitled to receive all other cash and properties upon voluntary or involuntary liquidation.

(4)Redemption. The preferred shares (class A and class B) shall be subject to redemption in whole or from time to time in part at the option of the corporation, according to the following schedule:

CLASS A SHARES

| Redemption Price | ||

One year after issue | Par plus 10% of par | |

Two years after issue | Par plus 9% of par | |

Three years after issue | Par plus 8% of par | |

Four years after issue | Par plus 7% of par | |

Five years after issue | Par plus 6% of par | |

Six years after issue | Par plus 5% of par | |

Seven years after issue | Par plus 4% of par | |

Eight years after issue | Par plus 3% of par | |

Nine years after issue | Par plus 2% of par | |

Ten years after issue | Par plus 1% of par | |

Eleven years after issue and thereafter | Par | |

-2-

CLASS B SHARES

| Redemption Price | ||

Anytime after issue | Par plus 5% of Par | |

In addition to amounts determined under the foregoing schedule, the holder of a preferred share (class A or class B) being redeemed shall be entitled to receive all arrearages of unpaid cumulative cash dividends, if any, to the date of redemption fixed in the notice of redemption. At least thirty (30) days’ prior written notice shall be given to the holder of record of the shares to be called for redemption by mailing said notice to each holder of preferred shares (class A or class B) to be redeemed at the last address as shown on the corporate records. Said notice shall specify the redemption price and the place at which and the date on which the preferred shares (class A or class B) called for redemption will be redeemed and shall specify the preferred shares (class A or class B) called for redemption. If less than all of the outstanding preferred shares (class A or class B) are to be redeemed, the preferred shares (class A or class B) to be redeemed shall be chosen by lot or pro rata, as the Board of Directors may determine. On and after the date fixed for redemption, all such shares called for redemption shall no longer be deemed to be outstanding and the holders thereof shall have no further rights in respect thereto, or in respect to the corporation, its assets or business, except the right to receive the redemption price plus dividend arrearages, if any, without interest.

Notwithstanding any other provision hereof or rule of law to the contrary, and without the giving of any notice of redemption as described above, one or more preferred shares (class A or class B) included in a deceased holder’s estate for federal estate tax purposes (or one or more preferred shares (class A or class B) issued as a stock dividend in respect of common shares (voting and nonvoting) which common shares (voting and nonvoting) were included in a deceased holder’s estate for federal estate tax purposes) may, at the option of the corporation, be redeemed at any time after such inclusion, by certificate number without any obligation to redeem any other preferred shares (class A or class B) (or to determine by lot which preferred shares (class A or class B) are to be redeemed) at the par value thereof plus arrearages of unpaid cumulative cash dividends, if any, to the date of actual

-3-

redemption, so long as the total of amounts so distributed in redemption of such shares of (or attributed to) such deceased holder does not exceed the sum of

A. the estate, inheritance, legacy and succession taxes (including any interest collected as part of such taxes) imposed because of such decedent’s death, and

B. the amount of funeral and administration expenses allowable as deductions to the estate under section 2053 of the Internal Revenue Code as provided in section 303 of the Internal Revenue Code, as amended from time to time.

From time to time the common shares (voting and nonvoting) and the preferred shares (class A and class B) may be issued in such amounts and in such manner and for such consideration (or as a stock dividend) as may be determined by the Board of Directors and as may be permitted by law.

(c) The date of adoption of the Amendment by the shareholders of the Company was August 11, 1980.

(d) The Company presently has the following shares outstanding: 250,923 shares of voting common stock, 501,846 shares of nonvoting common stock and 114,514 shares of preferred stock. Because the proposed amendment would affect a reclassification of the preferred stock, the holders of the preferred stock are entitled to vote as a class under U.C.A. §16-10-56. Because the “amendment is part of a recapitalization by which the holders of nonvoting common shares will be requested to exchange their shares, the holders of the nonvoting common shares also voted as a class on the amendment.

(e) 250,923 common shares voted in favor of the amendment and no common shares voted against said amendment. 501,846 nonvoting common shares voted in favor of the amendment and no nonvoting common shares voted against said amendment. 114,514 preferred shares voted in favor of such amendment and no preferred shares voted against said amendment.

(f) The amendment does not effect a change in the amount of the stated capital of the corporation.

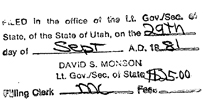

IN WITNESS WHEREOF these Articles of Amendment have been duly executed this 4th day of September, 1981, in behalf of LeGrand Johnson Construction Co. by its duly authorized officers.

| LeGRAND JOHNSON CONSTRUCTION CO. | ||

By | /s/ Max L. Johnson | |

| ||

| Max L. Johnson, President | ||

| By | /s/ Larry L. Jardine | |

| ||

| , Secretary | ||

-4-

STATE OF UTAH | ) | |||

| ) | ss. | |||

COUNTY OF CACHE | ) |

I, Keith Jay Holdsworth, a Notary Public do hereby certify that on the 4th day of September, 1981, personally appeared before me Max L. Johnson, who, being by me duly sworn, declared that he is the President of LeGrand Johnson Construction Co. and that he signed the foregoing document as President of the Corporation, and that the statements contained therein are true.

| /s/ Keith Jay Holdsworth |

| Notary Public |

| Residing in: Salt Lake County, Utah |

| My Commission Expires: |

Feb 18, 1983 |

|

-5-

| ||||||||

|

| |||||||

Articles of Amendment LeGrand Johnson Construction Co. | ||||||||

These Articles of Amendment are made by LeGrand Johnson Construction Co., a Utah corporation (the “Corporation”), pursuant to Section 16-10a-1003 of the Utah Revised Business Corporation Act:

1. The name of the Corporation is LeGrand Johnson Construction Co.

2. The Board of Directors and all of the shareholders of the Corporation have approved and adopted the following amendments:

Article Sixth is hereby replaced in its entirety as follows:

Sixth: The Board of Directors shall consist of such number of directors as set forth in the Bylaws.

Article Eighth is hereby replaced in its entirety as follows:

Eighth: Each director and officer must be an individual at least eighteen years old.

3. The number of shares of common voting stock outstanding was 378,573 and all 378,573 shares were entitled to vote upon, approved and adopted the foregoing amendments on August 17, 2015. No other class of shares was entitled to vote.

|  | |||||||

| By: | /s/ Janice J. Sackett | |||||||

| Janice Sackett, President | ||||||||