- EPZM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Epizyme (EPZM) DEF 14ADefinitive proxy

Filed: 30 Mar 22, 7:53am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

EPIZYME, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

EPIZYME, INC.

400 Technology Square, 4th Floor

Cambridge, Massachusetts 02139

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

To be held on May 17, 2022

You are cordially invited to attend the 2022 Annual Meeting of Stockholders, or the Annual Meeting, of Epizyme, Inc., which is scheduled to be held on Tuesday, May 17, 2022 at 10:00 a.m. Eastern time. The Annual Meeting will be held via the Internet this year, at a virtual web conference at meetnow.global/MM2596W.

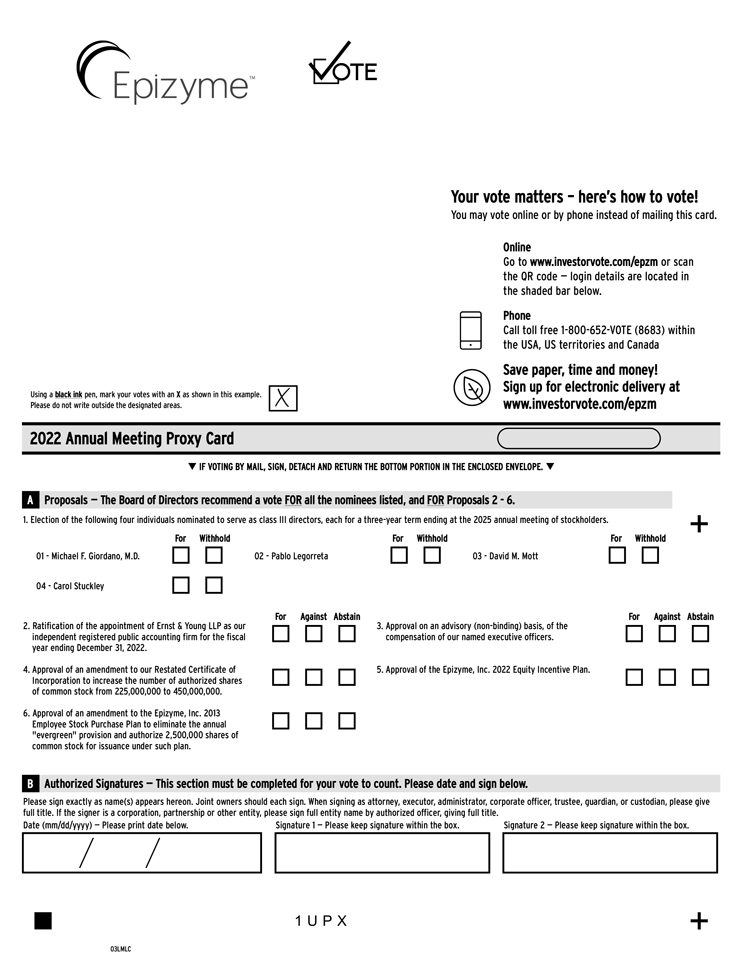

Only stockholders who owned common stock at the close of business on March 22, 2022 can vote at the Annual Meeting or any adjournment that may take place. At the Annual Meeting, the stockholders will consider and vote on the following matters:

| 1. | Election of four class III directors to our board of directors, each to serve until the 2025 annual meeting of stockholders; |

| 2. | Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; |

| 3. | Approval on an advisory (non-binding) basis, of the compensation of our named executive officers; |

| 4. | Approval of an amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 225,000,000 to 450,000,000; |

| 5. | Approval of the Epizyme, Inc. 2022 Equity Incentive Plan; |

| 6. | Approval of an amendment to the Epizyme, Inc. 2013 Employee Stock Purchase Plan to eliminate the annual “evergreen” provision and authorize 2,500,000 shares of common stock for issuance under such plan; and |

| 7. | Transaction of any other business properly brought before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

You can find more information, including the nominees for director, in the proxy statement for the Annual Meeting, which is available for viewing, printing and downloading at http://www.edocumentview.com/epzm. The board of directors recommends that you vote in favor of each of proposals one through six as outlined in the attached proxy statement.

Instead of mailing a paper copy of our proxy materials to all of our stockholders, we are providing access to our proxy materials over the Internet under the U.S. Securities and Exchange Commission’s “notice and access” rules. As a result, we are sending to our stockholders a Notice of Internet Availability of Proxy Materials, or the Notice, instead of a paper copy of this proxy statement and our Annual Report to Stockholders for the fiscal year ended December 31, 2021, or the 2021 Annual Report. We plan to mail the Notice on or about March 30, 2022. The Notice contains instructions on how to access our proxy materials over the Internet. The Notice also contains instructions on how each of our stockholders can receive a paper copy of our proxy materials, including the proxy statement, our 2021 Annual Report, and a form of proxy card.

We cordially invite all stockholders to attend the Annual Meeting online. Holders of our common stock as of the close of business on March 22, 2022, the record date for the Annual Meeting, are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement of the Annual Meeting. Whether or not you expect to attend the Annual Meeting online, please vote your shares to ensure your representation and the presence of a quorum at the Annual Meeting. If you are a holder of our common stock as of the close of business on the record date, you may vote your shares on the Internet by visiting https://www.investorvote.com/epzm, by telephone by calling 1-800-652-VOTE (8683) and following the recorded instructions or by completing, signing, dating, and returning a proxy card. Your vote is important regardless of the number of shares you own. If you mail your proxy card or vote by telephone or the Internet and then decide to attend the Annual Meeting online to vote your shares during the meeting, you may still do so. Your proxy is revocable in accordance with the procedures set forth in the proxy statement.

If your shares are held in “street name,” that is, held for your account by a broker or other nominee, you will receive instructions from the holder of record that you must follow for your shares to be voted.

Our Annual Meeting will be a “virtual meeting” of stockholders this year, which will be conducted exclusively via the Internet as a virtual web conference. There will not be a physical meeting location, and stockholders will not be able to attend the Annual Meeting in person. This means that you can attend the Annual Meeting online, vote your shares during the online meeting and submit questions during the online meeting by visiting meetnow.global/MM2596W. We believe that hosting a “virtual meeting” will enable greater stockholder attendance and participation from any location around the world.

A complete list of registered stockholders will be available to holders of our common stock as of the close of business on the record date of March 22, 2022 during the Annual Meeting for examination at

meetnow.global/MM2596W.

| By order of the Board of Directors, |

| /s/ Grant Bogle |

| Grant Bogle |

| President and Chief Executive Officer |

Cambridge, Massachusetts

March 30, 2022

Epizyme, Inc.

Proxy Statement

| Page | ||||

| 1 | ||||

| 2 | ||||

| 8 | ||||

| 15 | ||||

| 17 | ||||

| 26 | ||||

| 60 | ||||

| 61 | ||||

Proposal No. 5: Approval of the Epizyme, Inc. 2022 Equity Incentive Plan | 63 | |||

| 77 | ||||

| 82 | ||||

| 85 | ||||

| 88 | ||||

| 88 | ||||

| 89 | ||||

| 89 | ||||

| 90 | ||||

Unless otherwise stated or the context indicates otherwise, all references in this proxy statement to “Epizyme,” “Epizyme, Inc.,” “we,” “us,” “our,” “our company,” “the Company” and similar references refer to Epizyme, Inc. and its wholly owned subsidiary, Epizyme Securities Corporation; all references herein to “TAZVERIK® (tazemetostat),” “TAZVERIK®” and “TAZVERIK” refer to tazemetostat in the context of the commercially-available product for which we received accelerated approval from the United States Food and Drug Administration, or FDA, in January 2020 for epithelioid sarcoma, or ES, and in June 2020 for follicular lymphoma, or FL; and all references herein to “tazemetostat” refer to tazemetostat in the context of the product candidate for which we are exploring further applications and indications. Epizyme® and TAZVERIK® are registered trademarks of Epizyme, Inc. in the United States and other countries. Epizyme, Inc. has also submitted trademark applications for Epizyme™ and TAZVERIK™ in other countries. All other trademarks, service marks or other tradenames appearing in this proxy statement are the property of their respective owners.

EPIZYME, INC.

400 Technology Square, 4th Floor

Cambridge, Massachusetts 02139

617-229-5872

FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

to be held on May 17, 2022

This proxy statement contains information about the Annual Meeting of Stockholders of Epizyme, Inc., or the Annual Meeting, to be held on Tuesday, May 17, 2022 at 10:00 a.m. Eastern time. The Annual Meeting will be held via the Internet this year, as a virtual web conference at meetnow.global/MM2596W. The board of directors of Epizyme is using this proxy statement to solicit proxies for use at the Annual Meeting.

All properly submitted proxies will be voted in accordance with the instructions contained in those proxies. If no instructions are specified, the proxies will be voted in accordance with the recommendation of our board of directors with respect to each of the matters set forth in the accompanying Notice of Meeting. If you are a stockholder as of the close of business on the record date, you may change your vote or revoke your proxy at any time before it is exercised at the meeting by giving our corporate Secretary written notice to that effect.

Instead of mailing a paper copy of our proxy materials to all of our stockholders, we are providing access to our proxy materials over the Internet under the U.S. Securities and Exchange Commission’s “notice and access” rules. As a result, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials, or Notice, instead of a paper copy of this proxy statement and our Annual Report to Stockholders for the fiscal year ended December 31, 2021, or the 2021 Annual Report. We plan to send the Notice on or about March 30, 2022, and it contains instructions on how to access those documents over the Internet. The Notice also contains instructions on how each of our stockholders can receive a paper copy of our proxy materials, including this proxy statement, our 2021 Annual Report, and a form of proxy card.

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting of Stockholders to be Held on May 17, 2022:

This proxy statement and our 2021 Annual Report are

available for viewing, printing and downloading at http://www.edocumentview.com/epzm.

A copy of our annual report on Form 10-K for the fiscal year ended December 31, 2021, as filed with the U.S. Securities and Exchange Commission, or SEC, except for exhibits, will be furnished without charge to any stockholder upon written request to Epizyme, Inc. 400 Technology Square, 4th Floor, Cambridge, Massachusetts 02139. This proxy statement and our annual report on Form 10-K for the fiscal year ended December 31, 2021 are also available on the SEC’s website at http://www.sec.gov.

1

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Purpose of the Annual Meeting

At the Annual Meeting, our stockholders will consider and vote on the following matters:

| 1. | Election of four class III directors to our board of directors, each to serve until the 2025 annual meeting of stockholders; |

| 2. | Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; |

| 3. | Approval, on an advisory (non-binding) basis, of the compensation of our named executive officers; |

| 4. | Approval of an amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 225,000,000 to 450,000,000; |

| 5. | Approval of the Epizyme, Inc. 2022 Equity Incentive Plan; |

| 6. | Approval of an amendment to the Epizyme, Inc. 2013 Employee Stock Purchase Plan to eliminate the annual evergreen provision and authorize 2,500,000 shares of common stock for issuance under such plan; and |

| 7. | Transaction of any other business properly brought before the Annual Meeting or any adjournment or postponement thereof. |

As of the date of this proxy statement, we are not aware of any business to come before the meeting other than the first six items noted above.

Board of Directors Recommendation

Our board of directors unanimously recommends that you vote:

FOR the election of the four nominees to serve as class III directors on our board of directors for a three-year term;

FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022;

FOR the approval, on an advisory (non-binding) basis, of the compensation of our named executive officers;

FOR the approval of an amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 225,000,000 to 450,000,000;

FOR the approval of the Epizyme, Inc. 2022 Equity Incentive Plan; and

FOR the approval of an amendment to the Epizyme, Inc. 2013 Employee Stock Purchase Plan to eliminate the annual evergreen provision and authorize 2,500,000 shares of common stock for issuance under such plan.

Availability of Proxy Materials

The proxy materials, including this proxy statement, a proxy card and our 2021 Annual Report are available for viewing, printing and downloading on the Internet at http://www.edocumentview.com/epzm.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on the record date of March 22, 2022, are entitled to receive notice of the Annual Meeting and to vote the shares of our common stock that they held on that date. As of

2

March 22, 2022, there were 164,790,509 shares of common stock issued and outstanding. Each share of common stock is entitled to one vote on each matter properly brought before the Annual Meeting.

Difference between a “stockholder of record” and a beneficial owner of shares held in “street name”

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Computershare, then you are considered a “stockholder of record” of those shares. You may vote your shares by proxy prior to the Annual Meeting by following the instructions contained in the Notice and in the section titled “How do I vote at the Annual Meeting” on page 4 of this proxy statement.

Beneficial Owners of Shares Held in Street Name. If your shares are held in a brokerage account or by a bank, trust or other nominee or custodian, then you are considered the beneficial owner of those shares, which are held in “street name.” The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct that organization as to how to vote the shares held in your account by following the instructions contained on the voting instruction card provided to you by that organization.

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

We are pleased to comply with the SEC rules that allow companies to distribute their proxy materials over the Internet under the “notice and access” approach. As a result, on or about March 30, 2022, we plan to send our stockholders and beneficial owners a copy of the Notice instead of paper copies of this proxy statement, our proxy card, and our 2021 Annual Report. Detailed instructions on how to access these materials via the Internet may be found in the Notice. The Notice also contains instructions on how each of our stockholders can receive a paper copy of our proxy materials, including the proxy statement, our 2021 Annual Report, and a form of proxy card. This proxy statement and our 2021 Annual Report are available for viewing, printing and downloading on the Internet at http://www.edocumentview.com/epzm.

Why is the Annual Meeting a virtual, online meeting?

Our Annual Meeting will be a virtual meeting of stockholders this year where stockholders will participate by accessing a website using the Internet. There will not be a physical meeting location. We believe that hosting a virtual meeting will facilitate stockholder attendance and participation at our Annual Meeting by enabling stockholders to participate remotely from any location around the world. We have designed the virtual annual meeting to provide the same rights and opportunities to participate as stockholders would have at an in-person meeting, including the right to vote and ask questions through the virtual meeting platform.

How do I virtually attend the Annual Meeting?

We will host the Annual Meeting live online via webcast. You may attend the Annual Meeting live online by visiting meetnow.global/MM2596W. The webcast will start at 10:00 a.m. Eastern time on Tuesday, May 17, 2022. You are entitled to participate in the Annual Meeting only if you were a stockholder as of the close of business on the record date of March 22, 2022, or if you hold a valid proxy for the Annual Meeting.

If you are a stockholder of record, then you do not need to register to virtually attend the Annual Meeting. Please follow the instructions on the Notice or proxy card that you received. You will need the control number included on your proxy card in order to be able to enter the Annual Meeting online. To participate in the Annual Meeting, you will need to review the information included on your Notice, on your proxy card or in the instructions that accompanied your proxy materials. The online meeting will begin promptly at 10:00 a.m., Eastern time. We encourage you to access the meeting prior to the start time to leave ample time for the online check-in proceedings.

3

If you hold your shares in “street name” you must register in advance to virtually attend the Annual Meeting. To register to virtually attend the Annual Meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your Epizyme, Inc. holdings along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received by Computershare no later than 5:00 p.m., Eastern Time, on May 12, 2022. You will receive a confirmation of your registration by email after we receive your registration materials. Requests for registration should be directed to Computershare as follows:

By E-mail: Forward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com

By Mail:

Computershare

Epizyme, Inc. Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

How do I submit a question at the Annual Meeting?

You will be able to submit your questions prior to and during the Annual Meeting by visiting

meetnow.global/MM2596W.

How do I vote at the Annual Meeting?

If you are a stockholder of record, you can vote your shares in one of two ways: either by proxy or if you attend the Annual Meeting online, during the Annual Meeting. If you choose to vote by proxy, you may do so by telephone, via the Internet or by mail. Each of these methods is explained below.

| • | By Telephone. You may transmit your proxy over the phone by calling 1-800-652-VOTE (8683) and following the instructions provided in the Notice and on the proxy card. |

| • | Via the Internet. You may transmit your proxy via the Internet prior to the Annual Meeting by following the instructions provided in the Notice and on the proxy card. |

| • | By Mail. If you requested printed copies of proxy materials, you can vote by mailing your proxy card as described in the proxy materials. |

| • | Online during the Annual Meeting. You may vote your shares online while virtually attending the Annual Meeting by visiting meetnow.global/MM2596W. You will need your control number included on your proxy card in order to be able to vote during the Annual Meeting. Even if you plan to attend the Annual Meeting online, we urge you to vote your shares by proxy in advance of the Annual Meeting so that if you should become unable to attend the Annual Meeting online your shares will be voted as directed by you. |

Telephone and Internet voting for stockholders of record will be available until 1:00 am Eastern time on May 17, 2022, and mailed proxy cards must be received by May 16, 2022 in order to be counted at the Annual Meeting. If the Annual Meeting is adjourned or postponed, these deadlines may be extended.

If you are the beneficial owner of shares held in “street name” and you wish to vote online during the Annual Meeting, you must obtain a legal proxy from the organization that holds your shares and demonstrate proof of beneficial ownership to virtually attend the Annual Meeting. The voting deadlines and availability of telephone and Internet voting for beneficial owners of shares held in “street name” will depend on the voting processes of the organization that holds your shares. Therefore, we urge you to carefully review and follow the voting instruction card and any other materials that you receive from that organization.

4

Can I vote my shares by filling out and returning the Notice of Internet Availability of Proxy Materials?

No. The Notice contains instructions on how to vote via the Internet, by telephone, by requesting and returning a paper proxy card by mail, or by virtually attending the Annual Meeting and voting during the Annual Meeting.

What constitutes a quorum?

A quorum of stockholders is necessary to hold a valid meeting. Our amended and restated by-laws provide that a quorum will exist if stockholders holding a majority of the shares of stock issued and outstanding and entitled to vote are present at the meeting in person or by proxy. Shares present virtually during the Annual Meeting will be considered shares of common stock represented in person at the meeting. If a quorum is not present, the meeting may be adjourned until a quorum is obtained.

Abstentions and broker non-votes count as present for establishing a quorum but will not be counted as votes cast. Broker non-votes occur when your broker or other nominee submits a proxy for your shares (because the broker or other nominee has received instructions from you on one or more proposals, but not all proposals, or has not received instructions from you but is entitled to vote on a particular “discretionary” matter) but does not indicate a vote for a particular proposal because the broker or other nominee either does not have the authority to vote on that proposal and has not received voting instructions from you or has discretionary authority but chooses not to exercise it.

May I see a list of stockholders entitled to vote as of the record date for the Annual Meeting?

A complete list of registered stockholders will be available to stockholders of record during the Annual Meeting for examination at meetnow.global/MM2596W.

Ballot Measures Considered “Discretionary” and “Non-Discretionary”

The election of directors (Proposal No. 1) is considered a non-discretionary matter under applicable rules. A broker or other nominee cannot vote without instructions on non-discretionary matters, and therefore there may be broker non-votes on Proposal No. 1.

The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal No. 2) is considered a discretionary matter under applicable rules. A broker or other nominee may generally exercise discretionary authority and vote on discretionary matters. If they exercise this discretionary authority, no broker non-votes are expected to occur in connection with Proposal No. 2. If a broker or other nominee does not exercise this discretionary authority and does not have instructions from you, then broker non-votes would occur in connection with Proposal No. 2.

The approval, on an advisory (non-binding) basis, of the compensation of our named executive officers (Proposal No. 3) is considered a non-discretionary matter under applicable rules. A broker or other nominee cannot vote without instructions on non-discretionary matters, and therefore there may be broker non-votes on Proposal No. 3.

The approval of an amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of common stock (Proposal No. 4) is considered a discretionary matter under applicable rules. A broker or other nominee may generally exercise discretionary authority and vote on discretionary matters. If they exercise this discretionary authority, no broker non-votes are expected to occur in connection with Proposal No. 4. If a broker or other nominee does not exercise this discretionary authority and does not have instructions from you, then broker non-votes would occur in connection with Proposal No. 4.

5

The approval of the Epizyme, Inc. 2022 Equity Incentive Plan (Proposal No. 5) is considered a non-discretionary matter under applicable rules. A broker or other nominee cannot vote without instructions on non-discretionary matters, and therefore there may be broker non-votes on Proposal No. 5.

The approval of an amendment to the Epizyme, Inc. 2013 Employee Stock Purchase Plan to eliminate the annual evergreen provision and authorize 2,500,000 shares of common stock for issuance under such plan (Proposal No. 6) is considered a non-discretionary matter under applicable rules. A broker or other nominee cannot vote without instructions on non-discretionary matters, and therefore there may be broker non-votes on Proposal No. 6.

Votes Required to (1) Elect a Director, (2) Ratify Appointment of Ernst & Young LLP, (3) Approve the Advisory Vote on Executive Officer Compensation, (4) Approve an Amendment to our Restated Certificate of Incorporation, (5) Approve the Epizyme, Inc. 2022 Equity Incentive Plan, and (6) Approve an Amendment to the Epizyme, Inc. 2013 Employee Stock Purchase Plan:

To be elected, a director must receive a plurality of the votes cast by stockholders entitled to vote at the Annual Meeting (Proposal No. 1).

The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm (Proposal No. 2), the approval of the advisory vote on executive compensation (Proposal No. 3), the approval of the Epizyme, Inc. 2022 Equity Incentive Plan (Proposal No. 5), and the approval of the amendment to the Epizyme, Inc. 2013 Employee Stock Purchase Plan (Proposal No. 6) each require the affirmative vote of a majority of the shares of common stock present or represented by proxy and voted “for” or “against” such matter.

Shares which abstain and broker non-votes will not be counted as votes in favor of, or with respect to, these proposals and will also not be counted as votes cast. Accordingly, abstentions and broker non-votes will have no effect on the outcome of Proposals No. 1, No. 2, No. 3, No. 5 and No. 6.

The amendment of our Restated Certificate of Incorporation to increase the number of authorized shares of common stock (Proposal No. 4) requires the affirmative vote of stockholders holding a majority of the shares of our common stock issued and outstanding and entitled to vote at the Annual Meeting. Because Proposal No. 4 requires the affirmative vote of the holders of a majority of the shares of our common stock issued and outstanding and entitled to vote at the Annual Meeting, abstentions and broker non-votes will have the same effect as a vote “AGAINST” Proposal No. 4.

Method of Counting Votes

Each holder of common stock is entitled to one vote at the Annual Meeting on each matter to come before the Annual Meeting, including the election of directors, for each share held by such stockholder as of the record date. Votes cast virtually during the Annual Meeting or by proxy by mail, via the Internet prior to the Annual Meeting or by telephone will be tabulated by the inspector of election appointed for the Annual Meeting, who will also determine whether a quorum is present.

Revoking a Proxy; Changing Your Vote

If you are a stockholder of record, you may revoke your proxy before the vote is taken at the Annual Meeting:

| • | by submitting a new proxy with a later date before the applicable deadline either signed and returned by mail or transmitted using the telephone or Internet voting procedures described in the “How do I vote at the Annual Meeting” section above; |

| • | by voting virtually during the Annual Meeting; or |

| • | by filing a written revocation with our corporate Secretary. |

6

If your shares are held in “street name,” you may submit new voting instructions by contacting your broker or other organization holding your account. You may also vote virtually during the Annual Meeting, which will have the effect of revoking any previously submitted voting instructions, if you obtain a legal proxy from the organization that holds your shares as described in the “How do I vote at the Annual Meeting” section above.

Your virtual attendance at the Annual Meeting will not automatically revoke your proxy.

Costs of Proxy Solicitation

We will bear the costs of soliciting proxies. Our directors, officers and regular employees, without additional remuneration, may solicit proxies by mail, telephone, facsimile, email, personal interviews and other means.

Voting Results

We plan to announce preliminary voting results at the Annual Meeting and will publish final results in a Current Report on Form 8-K to be filed with the SEC within four business days following the Annual Meeting.

7

ELECTION OF FOUR CLASS III DIRECTORS

Our board of directors currently consists of ten members, eight of whom are “independent directors” under applicable Nasdaq rules. In accordance with the terms of our certificate of incorporation and amended and restated by-laws, our board of directors is divided into three classes (class I, class II and class III), with members of each class serving staggered three-year terms. The members of the classes are divided as follows:

| • | the class I directors are Kenneth Bate, Roy A. Beveridge, M.D., and Victoria Richon, Ph.D., and their term expires at the annual meeting of stockholders to be held in 2023; |

| • | the class II directors are Grant Bogle, Kevin T. Conroy, and Carl Goldfischer, M.D., and their term expires at the annual meeting of stockholders to be held in 2024; and |

| • | the class III directors are Michael F. Giordano, M.D., Pablo Legorreta, David M. Mott, and Carol Stuckley, and their term expires at the Annual Meeting. |

Upon the expiration of the term of a class of directors, directors in that class will be eligible to be elected for a new three-year term at the annual meeting of stockholders in the year in which their term expires.

Our certificate of incorporation and amended and restated by-laws provide that the authorized number of directors may be changed only by resolution of our board of directors. Our certificate of incorporation and by-laws also provide that our directors may be removed only for cause by the affirmative vote of the holders of at least 75% of the votes that all our stockholders would be entitled to cast in an annual election of directors, and that any vacancy on our board of directors, including a vacancy resulting from an enlargement of our board of directors, may be filled only by vote of a majority of our directors then in office.

Based upon the recommendation of our nominating and corporate governance committee, our board of directors has nominated Michael F. Giordano, M.D., Pablo Legorreta, David M. Mott, and Carol Stuckley for election as class III directors at the Annual Meeting. Each of the nominees is presently a director, and each has indicated a willingness to continue to serve as director, if elected. If a nominee becomes unable or unwilling to serve, however, the proxies may be voted for substitute nominees selected by our board of directors.

Skills, Experience and Commitment to Diversity

Our priority in selection of board members is identification of members who will further the interests of our stockholders through their established record of professional accomplishment, the ability to contribute positively to the collaborative culture among board members, knowledge of our business and understanding of the competitive landscape. Although we have no formal policy regarding board diversity, our board of directors recognizes the importance and the value of diversity and seeks directors with varying professional backgrounds and other differentiating personal characteristics who combine a broad spectrum of experience and expertise with a reputation for integrity.

In 2021, we added two new independent directors with the appointments of Roy A. Beveridge, M.D., and Carol Stuckley to our board of directors in November 2021, and our board of directors now includes four diverse directors, with two of our directors identifying as women, one identifying as Hispanic/Latinx and one identifying as LGBTQ+.

8

Board Diversity Matrix

In accordance with Nasdaq’s recently-adopted board diversity listing standards, we are also disclosing aggregated statistical information about the members of our board directors as voluntarily identified to us by each of our directors.

Board Diversity Matrix (As of March 1, 2022) | ||||||||||||||

| Total Number of Directors: | 10 | |||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||

| Part I: Gender Identity | ||||||||||||||

Directors | 2 | 8 | — | — | ||||||||||

| Part II: Demographic Background | ||||||||||||||

African American or Black | — | — | — | — | ||||||||||

Alaskan Native or Native American | — | — | — | — | ||||||||||

Asian | — | — | — | — | ||||||||||

Hispanic or Latinx | — | 1 | — | — | ||||||||||

Native Hawaiian or Pacific Islander | — | — | — | — | ||||||||||

White | 2 | 7 | — | — | ||||||||||

Two or More Races or Ethnicities | — | — | — | — | ||||||||||

LGBTQ+ | 1 | |||||||||||||

|

|

|

|

|

|

| ||||||||

Did Not Disclose Demographic Background | — | |||||||||||||

Nominees for Election as Class III Directors

Biographical information as of March 1, 2022, including principal occupation and business experience during the last five years, for our nominees for election as class III directors at our Annual Meeting is set forth below.

Class III Directors (Term Expires at Annual Meeting)

| Age | ||||

| Michael F. Giordano, M.D. has served as a director since March 2018. Dr. Giordano served as a clinical advisor and Chief Medical Officer to us from December 2017 to August 2018. From 1999 to 2017, Dr. Giordano worked at Bristol-Myers Squibb, or BMS, most recently serving as senior vice president and head of development, oncology and immuno-oncology from February 2012 to February 2017. From 1990 to 1999, he served as assistant professor of medicine and founding director of the Cornell Clinical Trials Unit, a National Institutes of Health and Industry-supported AIDS clinical trials center at New York Hospital-Cornell University Medical Center. Since January 2018, Dr. Giordano has served on the board of directors of RAPT Therapeutics, Inc., a publicly traded clinical-stage, immunology-based biopharmaceutical company and since September 2018, he has served on the board of directors of Achilles Therapeutics plc, a publicly traded biopharmaceutical company. He earned his M.D. and completed his residency and fellowship training at NewYork-Presbyterian/Weill Cornell Medical Center, and received his B.A. in natural sciences from The Johns Hopkins University. We believe that Dr. Giordano’s extensive experience in oncology and immuno-oncology at BMS, as well as his experience as a clinical advisor to us, provide him with the qualifications and skills to serve as a director of our company. | 64 | |||

9

| Age | ||

| Pablo Legorreta has served as a director since November 2019. Since 1996, Mr. Legorreta is the founder and chief executive officer of Royalty Pharma plc, a life sciences investment company that went public in June 2020. Mr. Legorreta also serves as chairman of the board of directors of Royalty Pharma plc. Mr. Legorreta was elected as a director under the terms of our purchase agreement dated November 4, 2019 with a subsidiary of Royalty Pharma. Royalty Pharma beneficially owns more than 20% of our voting securities. Mr. Legorreta is also a co-founder of Pharmakon Advisors, LP, an affiliate of the lenders under our loan agreement dated November 4, 2019. Mr. Legorreta has over 20 years of experience investing in pharmaceutical royalties and building and managing a leading life sciences investment company. Prior to founding Royalty Pharma in 1996, Mr. Legorreta was an investment banker at Lazard Frères in Paris and New York. Mr. Legorreta serves on the Board of Governors of the New York Academy of Sciences, as well as the Boards of Trustees of Rockefeller University, Brown University, the Hospital for Special Surgery, Pasteur Foundation (the U.S. affiliate of the French Institut Pasteur), Open Medical Institute and Park Avenue Armory. Mr. Legorreta is the founder and chairman of Alianza Médica para la Salud, a non-profit dedicated to enhancing the quality of health care in Latin America by providing doctors and healthcare providers with continued education opportunities. Mr. Legorreta has a degree in industrial engineering from Universidad Iberoamericana in Mexico City. We believe that Mr. Legorreta’s experience in investing in pharmaceutical royalties and managing a growing life sciences investment company, as well as significant background in investment banking and debt financing provide him with the qualifications and skills to serve as a director of our company. | 58 | |

| David M. Mott has served as a director since December 2009 and as Chairman of our board of directors since April 2016. Mr. Mott has been a private investor through Mott Family Capital since February 2020. Mr. Mott previously served as a general partner of New Enterprise Associates, Inc., an investment firm focused on venture capital and growth equity investments, from September 2008 to February 2020, where he led the healthcare investing practice. From 1992 until 2008, Mr. Mott worked at MedImmune, Inc., or MedImmune, a biotechnology company and subsidiary of AstraZeneca Plc, or AstraZeneca, and served in numerous roles during his tenure, including most recently as Chief Executive Officer from October 2000 to July 2008. During that time, Mr. Mott also served as Executive Vice President of AstraZeneca from June 2007 to July 2008 following AstraZeneca’s acquisition of MedImmune in June 2007. Mr. Mott also serves on the board of directors of the following publicly traded life sciences companies: Adaptimmune Therapeutics plc, a clinical-stage biopharmaceutical company, as a director since February 2015 and as chairman since January 2017; Ardelyx, Inc., a biopharmaceutical company, as a director since March 2009 and as chairman since March 2014; IMARA Inc., a clinical-stage biotechnology company, as a director since January 2016 and as chairman since April 2016; Mersana Therapeutics, Inc., a clinical-stage biopharmaceutical company, as a director and as chairman since July 2012; and Novavax, Inc., a late-stage biotechnology company, as a director since June 2020. Mr. Mott also previously served on the board of directors of Tesaro, Inc., or Tesaro, as a director from May 2010 and as chairman from July 2011 until its sale to GlaxoSmithKline plc in January 2019 and Nightstar Therapeutics plc, a clinical-stage gene therapy company, as a director from August 2015 until its sale to Biogen in June 2019. Mr. Mott received a B.A. from Dartmouth College. We believe that Mr. Mott’s extensive experience in the life sciences industry as a senior executive and venture capitalist, as well as his service and experience on the boards of directors of other life sciences companies, provide him with the qualifications and skills to serve as a director of our company. | 56 | |

10

| Age | ||

| Carol Stuckley, M.B.A. has served as a director since November 2021. Since July 2019, Ms. Stuckley has served as an independent financial consultant in the healthcare and pharmaceutical sectors. From June 2015 to July 2019, Ms. Stuckley served as Chief Financial Officer and Senior Vice President at Healthcare Payment Specialists, LLC (acquired by TransUnion). Prior roles include Vice President, Finance North America at Galderma Laboratories, L.P. (acquired by Nestle Skin Health), and a variety of global financial roles of increasing responsibility during her more than 22 years at Pfizer, Inc., most recently as Vice President, Assistant Treasurer and Corporate Officer. Since May 2021, she has served on the board of directors of Centessa Pharmaceuticals plc, a publicly traded clinical-stage pharmaceutical company, and from June 2017 to August 2021 she served on the board of directors of Ipsen S.A., a publicly traded, French pharmaceutical company. Ms. Stuckley earned a B.A. in Economics and French from the University of Delaware, as well as an M.B.A. in International Business and Finance and an M.A. in Economics from the Fox Business School at Temple University. We believe that Ms. Stuckley’s significant experience leading the financial aspects of large global healthcare companies, her experience as an executive and her service on the board of directors of publicly held companies provide her with the qualifications and skills to serve as a director of our company. | 66 |

The proxies will be voted in favor of the nominees unless a contrary specification is made in the proxy. The nominees have consented to serve as our directors if elected. However, if any nominee is unable for any reason to serve as a director, proxies may be voted for one or more substitute(s) who will be designated by our board of directors.

Board of Directors Recommendation

OUR BOARD OF DIRECTORS RECOMMENDS VOTING “FOR” THE ELECTION OF EACH OF MICHAEL F. GIORDANO, M.D., PABLO LEGORRETA, DAVID M. MOTT, AND CAROL STUCKLEY AS CLASS III DIRECTORS, EACH FOR A THREE-YEAR TERM ENDING AT THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD IN 2025.

Directors Continuing in Office

Biographical information as of March 1, 2022, including principal occupation and business experience during the last five years, for our directors continuing in office after the Annual Meeting is set forth below.

Class I Directors (Term Expires at 2023 Annual Meeting)

| Age | ||

| Kenneth Bate has served as a director since December 2014. Mr. Bate served as an independent consultant in the biotechnology field from 2012 until 2017. From 2009 to 2012, Mr. Bate served as President and Chief Executive Officer of Archemix, Inc., or Archemix, a privately-held biotechnology company. Prior to Archemix, from 2006 to 2009, Mr. Bate served in various positions at NitroMed, Inc., a pharmaceutical company, most recently as President and Chief Executive Officer. From 2002 to 2005, Mr. Bate served as Chief Financial Officer of Millennium Pharmaceuticals, where he headed the commercial organization. Prior to joining Millennium Pharmaceuticals, Mr. Bate co-founded JSB Partners, LLC, a banking and advisory services firm for biopharmaceutical and life sciences companies. From 1990 to 1996, he was with Biogen Inc., a biotechnology company, first as their Chief Financial Officer, and then as head of the commercial organization. Mr. Bate serves on the board of directors of the following publicly traded biopharmaceutical companies: AVEO Pharmaceuticals, Inc., since December 2007; Astria Therapeutics, Inc. (formerly known as Catabasis Pharmaceuticals, Inc.), since January 2014, as co-chair from February 2016 to February 2019 and as chair since February 2019; Madrigal Pharmaceuticals, Inc., since July 2016; and Genocea Biosciences, Inc., as a director since September 2014 and as chair since December 2018. Mr. Bate received his B.A. in chemistry from Williams College and his M.B.A. from the Wharton School | 71 |

11

| of the University of Pennsylvania. We believe that Mr. Bate’s extensive financial and leadership experience, his experience as an executive and his service on the board of directors of numerous public and privately held companies provide him with the qualifications and skills to serve as a director of our company. | ||

| Age | ||

| Roy A. Beveridge, M.D. has served as a director since November 2021. Mr. Beveridge is a medical oncologist who has been in practice for more than 30 years during which time he has treated hundreds of lymphoma and myeloma patients. He has led large integrated provider networks and has deep expertise in healthcare policy and reimbursement. He is currently a Strategy and Policy Consultant at Avalere Health, a healthcare consulting firm, where he has worked since February 2020. From May 2019 to July 2020, Dr. Beveridge served as a Consultant to Humana Inc. and from May 2019 to February 2020 he served as Interim President of Conviva Physician Group, a wholly-owned subsidiary of Humana. From May 2013 to June 2019, he served as Humana’s Chief Medical Officer where he led clinical policy, population health and clinical quality initiatives. Prior to this Dr. Beveridge held a similar role for US Oncology, Inc., which was acquired by McKesson Specialty Health, where he focused on research, quality, data science, clinical pathways and payer initiatives. Much of his recent work has focused on social determinants of health and improving the health of underserved populations. He has published more than 200 papers in various professional and scientific journals. Dr. Beveridge has a B.A. in Biology from the Johns Hopkins University and an M.D. from Cornell University. He also received internal medicine training at the University of Chicago and completed an oncology fellowship at Johns Hopkins. We believe that Dr. Beveridge’s experience as a practicing clinical oncologist and researcher and his executive leadership roles in the healthcare industry provide him with the qualifications and skills to serve as a director of our company. | 64 | |

| Victoria Richon, Ph.D. has served as a director since September 2019. Dr. Richon serves as R&D Advisor to the board of directors and Chair of the scientific advisory board of Ribon Therapeutics Inc., a biotechnology company, or Ribon, a role she has held since February 2022. Previously, Dr. Richon served as President and as a member of the board of directors of Ribon from November 2015 to February 2022, and also served as chief executive officer from January 2017 to February 2022. Prior to becoming Ribon’s chief executive officer, Dr. Richon also served as the Ribon’s chief scientific officer from November 2015 to January 2017. Prior to joining Ribon, Dr. Richon was Vice President, Global Head of Oncology Research and Translational Medicine at Sanofi Oncology from November 2012 to October 2015. Dr. Richon previously served as our Vice President of Biological Sciences from October 2008 to November 2012. Dr. Richon received her Ph.D. in biochemistry at the University of Nebraska Medical Center and a B.A. in chemistry at the University of Vermont. We believe that Dr. Richon’s extensive experience in the pharmaceutical industry, her experience as an executive, and her expertise in oncology clinical development provide her with the qualifications and skills to serve as a director of our company. | 62 | |

Class II Directors (Term Expires at 2024 Annual Meeting)

| Age | ||

| Grant Bogle has served as a director since September 2019 and our President and Chief Executive Officer since August 2021. Mr. Bogle served as Senior Vice President and Chief Commercial Officer for Tesaro, a biopharmaceutical company, from July 2015 to June 2019. Prior to joining Tesaro, Mr. Bogle served as Senior Vice President, Pharmaceutical and Biotech Solutions at McKesson Specialty Health (formerly U.S. Oncology) from July 2007 to June 2015. Previously, he was Senior Vice President of Sales and Marketing for Millennium Pharmaceuticals. Mr. Bogle holds a B.A. in economics from Dartmouth College, an M.B.A. from Columbia University and is a Senior Fellow of the Advanced Leadership Initiative at Harvard University. We believe that Mr. Bogle’s extensive experience in the commercialization, sales, marketing and distribution of biopharmaceutical products and his experience as an executive provide him with the qualifications and skills to serve as a director of our company. | 64 |

12

| Age | ||

| Kevin T. Conroy has served as a director since February 2017. Mr. Conroy is currently the President, Chief Executive Officer and chairman of the board of directors of Exact Sciences Corporation, or Exact Sciences, a publicly traded molecular diagnostics company. Mr. Conroy has served as chairman of the board of directors of Exact Sciences since March 2014, as President and Chief Executive Officer since March 2009 and as a director since March 2009. Prior to joining Exact Sciences, Mr. Conroy served in multiple executive leadership positions at Third Wave Technologies, or Third Wave, a molecular diagnostic testing company, including President and Chief Executive Officer from December 2005 until the acquisition of Third Wave by Hologic, Inc. in July 2008. He joined Third Wave in July 2004 and served as General Counsel from October 2004 until December 2005. Prior to Third Wave, Mr. Conroy served as Intellectual Property Counsel at GE Healthcare, a medical imaging and diagnostics company and a division of General Electric Company. Before joining GE Healthcare, Mr. Conroy was the chief operating officer of two early-stage, venture-backed technology companies. Prior to that, he was an intellectual property litigator at McDermott Will & Emery and Pattishall, McAuliffe, Newbury, Hilliard and Geraldson, where he was a partner. Since April 2019, Mr. Conroy has served on the board of directors of Adaptive Biotechnologies Corporation, a publicly traded commercial-stage biotechnology company. Mr. Conroy previously served on the board of directors of Arya Sciences Acquisition Corp., a publicly traded special purpose acquisition company sponsored by an affiliate of Perceptive Advisors LLC, from July 2018 to July 2020. From February 2021 to September 2021, Mr. Conroy served on the board of directors of CM Life Sciences II Inc., a public special purpose acquisition company completed a business combination with SomaLogic, Inc, or SomaLogic, in September 2021. He served on the board of directors of SomaLogic from September 2021 to November 2021. Mr. Conroy received a B.S. in electrical engineering from Michigan State University and a J.D. from the University of Michigan Law School. We believe that Mr. Conroy’s extensive executive experience in the life sciences industry and his service on the board of directors of a life sciences company provide him with the qualifications and skills to serve as a director of our company. | 56 | |

| Carl Goldfischer, M.D. has served as a director since September 2009. Dr. Goldfischer has served as an Investment Partner, Managing Director, member of the board of directors and member of the executive committee of Bay City Capital LLC, or Bay City Capital, a life sciences investment firm, since January 2000. Prior to joining Bay City Capital, Dr. Goldfischer was Chief Financial Officer of ImClone Systems Incorporated, a biopharmaceutical company. Since January 2020, Dr. Goldfischer has served on the board of directors of Galecto, Inc., a publicly traded clinical-stage biotechnology company and since January 2016, Dr. Goldfischer has served on the board of directors of IMARA Inc., a publicly traded clinical-stage biotechnology company. He previously served on the board of directors of EnteroMedics Inc., now ReShape Lifesciences Inc., a publicly traded medical device company, from 2004 to September 2017. Dr. Goldfischer received a B.A. from Sarah Lawrence College and an M.D. with honors in Scientific Research from Albert Einstein College of Medicine. We believe that Dr. Goldfischer’s extensive finance and investment experience, his experience as an executive and his service on the board of directors of numerous public and privately held companies provide him with the qualifications and skills to serve as a director of our company. | 63 | |

| There are no family relationships between or among any of our directors or executive officers. The principal occupation and employment during the past five years of each of our directors was carried on, in each case except as specifically identified above, with a corporation or organization that is not a parent, subsidiary or other affiliate of us. There is no arrangement or understanding between any of our directors and any other person or persons pursuant to which he or she is to be selected as a director. Mr. Legorreta was elected to our board under the terms of our purchase agreement dated November 4, 2019 with RPI Finance Trust, an affiliate of Royalty Pharma. | ||

There are no material legal proceedings to which any of our directors is a party adverse to us or any of our subsidiaries or in which any such person has a material interest adverse to us or any of our subsidiaries.

13

Executive Officers Who Are Not Directors

Biographical information as of March 1, 2022 for our executive officers who are not directors is listed below.

| Age | ||

| Dr. Shefali Agarwal has served as our Executive Vice President, Chief Medical and Development Officer since February 2021 and served as our Chief Medical Officer from June 2018 to February 2021. Prior to joining us, Dr. Agarwal held leadership positions across medical research, clinical development, clinical operations and medical affairs. She most recently served as chief medical officer at SQZ Biotechnologies Company, or SQZ Biotech, a biotechnology company developing cell therapies for patients with a wide range of diseases, from July 2017 to May 2018 and as a non-executive advisor from May 2018 to July 2018, where she built and led the clinical development organization, which included clinical research operations and the regulatory function. Before SQZ Biotech, Dr. Agarwal also held leadership positions at Curis, Inc. a biotechnology company developing therapeutics for the treatment of cancer, from July 2016 to July 2017 and Tesaro from July 2013 to July 2017. Dr. Agarwal also held positions of increasing responsibility at AVEO Pharmaceuticals, Inc., a biopharmaceutical company, from December 2011 to July 2013, Covidien, a medical devices and health care products company, from April 2010 to December 2011, and Pfizer Inc., a pharmaceutical company with a wide range of treatments, from June 2005 to April 2010. She has served as a member of the board of directors of Gritstone bio, Inc., a publicly traded clinical-stage biotechnology company, since June 2021; Fate Therapeutics, Inc., a publicly traded clinical-stage biopharmaceutical company, since July 2019; and Onxeo SA, a publicly traded clinical-stage biopharmaceutical company, since April 2021. Dr. Agarwal received her MBBS medical degree from Karnataka University’s Mahadevappa Rampure Medical School in India, Master’s Degree in Public Health from Johns Hopkins University, where she led clinical research in the Department of Anesthesiology and Critical Care Medicine, and a Master of Science degree in Business from the University of Baltimore’s Merrick School of Business. | 48 | |

| Jeffery L. Kutok, M.D., Ph.D., has served as our Chief Scientific Officer since April 2020. Dr. Kutok previously served as Chief Scientific Officer of Infinity Pharmaceuticals, Inc., or Infinity, a biotechnology company that develops cancer medication, from February 2017 to March 2020. Dr. Kutok previously served as Infinity’s Vice President of Biology and Translational Science from August 2013 to February 2017, and in other roles with increasing responsibility from January 2011 to August 2013. Prior to joining Infinity, Dr. Kutok was an associate professor of pathology at Harvard Medical School and Brigham and Women’s Hospital. Dr. Kutok’s laboratory focused on translational medicine research and biomarker identification in cancer, and he is an author on over 200 journal articles, reviews and book chapters. Dr. Kutok is board certified in Anatomic Pathology and Hematology and had clinical duties in Hematopathology and Molecular Diagnostics at Brigham and Women’s Hospital. Dr. Kutok received his B.S. in biology and his M.D., Ph.D. in medicine and molecular pathology from the State University of New York at Stony Brook. He was also a post-doctoral fellow at Harvard University in the laboratory of Dr. Gary Gilliland, M.D., Ph.D. | 55 | |

The principal occupation and employment during the past five years of each of our executive officers was carried on, in each case except as specifically identified above, with a corporation or organization that is not a parent, subsidiary or other affiliate of us. There is no arrangement or understanding between any of our executive officers and any other person or persons pursuant to which he or she was or is to be selected as an executive officer.

There are no material legal proceedings to which any of our executive officers is a party adverse to us or any of our subsidiaries or in which any such person has a material interest adverse to us or any of our subsidiaries.

14

RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP

AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE

FISCAL YEAR ENDING DECEMBER 31, 2022

Our stockholders are being asked to ratify the appointment by the audit committee of the board of directors of Ernst & Young LLP as our independent registered public accounting firm. Ernst & Young LLP has served as our independent registered public accounting firm since 2009.

The audit committee is solely responsible for appointing our independent registered public accounting firm for the fiscal year ending December 31, 2022. Stockholder approval is not required to appoint Ernst & Young LLP as our independent registered public accounting firm. However, the board of directors believes that submitting the appointment of Ernst & Young LLP to the stockholders for ratification is consistent with good corporate governance. If the stockholders do not ratify this appointment, the audit committee will reconsider whether to retain Ernst & Young LLP. If the appointment of Ernst & Young LLP is ratified, the audit committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time it decides that such a change would be in the best interest of our company and our stockholders.

A representative of Ernst & Young LLP is expected to attend the virtual Annual Meeting and will have an opportunity to make a statement if he or she desires to do so and to respond to appropriate questions from our stockholders.

We incurred the following fees from Ernst & Young LLP for the audit of the consolidated financial statements and for other services provided during the years ended December 31, 2021 and 2020.

| 2021 | 2020 | |||||||

Audit fees (1) | $ | 1,635,000 | $ | 1,443,000 | ||||

Audit-related fees | — | — | ||||||

Tax fees | — | — | ||||||

All other fees | — | — | ||||||

|

|

|

| |||||

Total fees | $ | 1,635,000 | $ | 1,443,000 | ||||

|

|

|

| |||||

| (1) | Audit fees consist of fees for the audit of our annual financial statements, the review of the interim financial statements included in our quarterly reports on Form 10-Q, and other professional services provided in connection with any registration statements filed with the SEC. |

Audit Committee Pre-Approval Policy and Procedures

Our audit committee has adopted policies and procedures relating to the approval of all audit and non-audit services that are to be performed by our independent registered public accounting firm. This policy provides that we will not engage our independent registered public accounting firm to render audit or non-audit services unless the service is specifically approved in advance by our audit committee or the engagement is entered into pursuant to the pre-approval procedure described below.

From time to time, our audit committee may pre-approve specified types of services that are expected to be provided to us by our independent registered public accounting firm during the next 12 months. Any such pre-approval is detailed as to the particular service or type of services to be provided and is also generally subject to a maximum dollar amount.

During our 2021 and 2020 fiscal years, no services were provided to us by Ernst & Young LLP other than in accordance with the pre-approval policies and procedures described above.

15

Board of Directors Recommendation

OUR BOARD OF DIRECTORS RECOMMENDS VOTING “FOR” PROPOSAL NO. 2 TO RATIFY THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

16

Director Nomination Process

Our nominating and corporate governance committee is responsible for identifying individuals qualified to serve as directors, consistent with criteria approved by our board, and recommending the persons to be nominated for election as directors, except where we are legally required by contract, law or otherwise to provide third parties with the right to nominate director candidates.

The process followed by our nominating and corporate governance committee to identify and evaluate director candidates includes requests to board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the committee and our board. While there are no specific minimum qualifications for a committee-recommended nominee to our board of directors, the qualifications, qualities and skills that our nominating and corporate governance committee believes must be met by a committee-recommended nominee for a position on our board of directors are as follows:

| • | Nominees should have a reputation for integrity, honesty and adherence to high ethical standards. |

| • | Nominees should have demonstrated business acumen, experience and ability to exercise sound judgments in matters that relate to our current and long-term objectives and should be willing and able to contribute positively to our decision-making process. |

| • | Nominees should have a commitment to understand our company and our industry and to regularly attend and participate in meetings of our board of directors and its committees. |

| • | Nominees should have the interest and ability to understand the sometimes conflicting interests of our various constituencies, which include stockholders, employees, customers, governmental units, creditors and the general public, and to act in the interests of all stockholders. |

| • | Nominees should not have, nor appear to have, a conflict of interest that would impair the nominee’s ability to represent the interests of all of our stockholders and to fulfill the responsibilities of a director. |

| • | Nominees shall not be discriminated against on the basis of race, religion, national origin, sex, sexual orientation, disability or any other basis proscribed by law. Our nominating and corporate governance committee does not have a formal diversity policy, but believes that our board, taken as a whole, should embody a diverse set of skills, experiences and backgrounds. In this regard, the nominating and corporate governance committee also takes into consideration the diversity (for example, with respect to gender, race and national origin) of our board members. The nominating and corporate governance committee does not make any particular weighting of diversity or any other characteristic in evaluating nominees and directors. |

| • | Nominees should typically be able to serve for at least three years before reaching the age of 75. |

Stockholders may recommend individuals to the nominating and corporate governance committee for consideration as potential director candidates. Any such proposals should be submitted to our corporate Secretary at our principal executive offices and should include appropriate biographical and background material to allow the nominating and corporate governance committee to properly evaluate the potential director candidate; such proposal submission should also include the number of shares of our stock beneficially owned by the stockholder proposing the candidate. The specific requirements for the information that is required to be provided for such recommendations to be considered are specified in our amended and restated by-laws and must be received by us no later than the date referenced below under the heading “Stockholder Proposals.” Assuming that biographical and background material has been provided on a timely basis, any recommendations received from stockholders will be evaluated in the same manner as potential nominees proposed by the nominating and corporate governance committee. If our board of directors decides to nominate a stockholder-recommended candidate and recommends his or her election, then his or her name will be included on our proxy card for the next annual meeting of stockholders.

17

Director Independence

Applicable Nasdaq rules require a majority of a listed company’s board of directors to be comprised of independent directors within one year of listing.

In addition, the Nasdaq rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent and that audit committee members also satisfy independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act and that compensation committee members satisfy independence criteria set forth in Rule 10C-1 under the Exchange Act. Under applicable Nasdaq rules, a director will only qualify as an “independent director” if, in the opinion of the listed company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

In order to be considered independent for purposes of Rule 10A-3 under the Exchange Act, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee, accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries or otherwise be an affiliated person of the listed company or any of its subsidiaries.

In addition, in affirmatively determining the independence of any director who will serve on a company’s compensation committee, Rule 10C-1 under the Exchange Act requires that a company’s board of directors must consider all factors specifically relevant to determining whether a director has a relationship to such company which is material to that director’s ability to be independent from management in connection with the duties of a compensation committee member, including: the source of compensation to the director, including any consulting, advisory or other compensatory fee paid by such company to the director, and whether the director is affiliated with the company or any of its subsidiaries or affiliates.

In March 2022, our board of directors undertook a review of the composition of our board of directors and the independence of each director. Based upon business and personal information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our board of directors determined that each of our directors, with the exceptions of Mr. Bogle and Mr. Legorreta, are “independent directors” as defined under applicable Nasdaq rules. In making such determination, our board of directors considered the relationships that each such director has with our company and all other facts and circumstances that our board of directors deemed relevant in determining his or her independence, including the beneficial ownership of our capital stock by each director. Mr. Bogle is not an independent director under these rules because he is currently serving as our president and chief executive officer. Mr. Legorreta is not an independent director under these rules because of our transactions with RPI Finance Trust, Pharmakon Advisors, LP and RP Management, LLC.

Board Committees

Our board of directors has established an audit committee, an organizational health and compensation committee, or compensation committee, and a nominating and corporate governance committee. Each of the audit committee, compensation committee and nominating and corporate governance committee operates under a charter, and each such committee reviews its respective charter at least annually. A current copy of the charter for each of the audit committee, compensation committee and the nominating and corporate governance committee is posted on the corporate governance section of the “Investor Center” on our website, which is located at http://www.epizyme.com.

18

Audit Committee

The members of our audit committee are Dr. Goldfischer, Mr. Bate, Mr. Conroy and Ms. Stuckley. Dr. Goldfischer is chair of the audit committee. Our audit committee met four times during 2021. Our audit committee’s responsibilities include:

| • | appointing, approving the compensation of, and assessing the independence of our independent registered public accounting firm; |

| • | overseeing the work of our independent registered public accounting firm, including through the receipt and consideration of reports from that firm; |

| • | reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements and related disclosures; |

| • | monitoring our internal control over financial reporting, disclosure controls and procedures and code of conduct; |

| • | overseeing our internal audit function, if any; |

| • | discussing our risk management policies; |

| • | establishing procedures for the receipt and retention of accounting-related complaints and concerns; |

| • | meeting independently with our internal audit staff, if any, our independent registered public accounting firm and management; |

| • | reviewing and approving or ratifying any related person transactions; and |

| • | preparing the audit committee report required by SEC rules. |

All audit and non-audit services, other than de minimis non-audit services, to be provided to us by our independent registered public accounting firm must be approved in advance by our audit committee.

Our board of directors has determined that Dr. Goldfischer, Mr. Bate, and Ms. Stuckley are each an “audit committee financial expert” as defined in applicable SEC rules. We believe that the composition of our audit committee meets the requirements for independence under current Nasdaq and SEC rules and regulations.

Organizational Health and Compensation Committee

The members of our organizational health and compensation committee, or compensation committee, are Mr. Mott, Mr. Bate, and Dr. Beveridge. Mr. Mott is chair of the compensation committee. Grant Bogle served as a member of our compensation committee until his appointment as our President and Chief Executive Officer, effective August 2021, and Dr. Andrew Allen served as a member of our compensation committee until his resignation from our board of directors, effective November 2021. Our compensation committee met seven times during 2021. Our compensation committee’s responsibilities include:

| • | reviewing and approving, or making recommendations to our board of directors with respect to, our chief executive officer’s compensation; |

| • | reviewing and approving, or making recommendations to our board of directors with respect to, the compensation of our other executive officers; |

| • | overseeing the evaluations of our senior executives; |

| • | reviewing and making recommendations to our board of directors with respect to management succession planning; |

| • | reviewing and discussing with management the Company’s organizational health, leadership development programs, and processes and programs designed to attract, motivate, develop and retain employees, which may include areas relating to hiring, retention, and promotion and to diversity, equity, and inclusion; |

19

| • | identifying and discussing with management opportunities for improvement in the Company’s organizational health, including periodically updating and/or making recommendations to our board of directors regarding programs and strategies for sustainable organizational health; |

| • | overseeing and administering our cash and equity incentive plans; |

| • | reviewing and making recommendations to our board of directors with respect to director compensation; |

| • | reviewing and discussing annually with management our “Compensation Discussion and Analysis” disclosure; and |

| • | preparing the compensation committee report if and to the extent then required by SEC rules. |

Our compensation committee may delegate to one or more executive officers the power to grant options or other stock awards pursuant to our incentive plans to employees of the company who are not executive officers or senior vice presidents.

We believe that the composition of our compensation committee meets the requirements for independence under current Nasdaq and SEC rules and regulations.

Compensation Committee Interlocks and Insider Participation

As described above, during 2021, the members of our compensation committee included Mr. Mott, Mr. Bate, Dr. Beveridge, Mr. Bogle, and Dr. Allen. None of the current or former members of our compensation committee is an officer or employee of our company, nor have they ever been an officer or employee of our company. None of our executive officers has served as a director or member of the compensation committee (or other committee serving an equivalent function) of any other entity whose executive officers currently serve as one of our directors or a member of the compensation committee. During 2021, Shefali Agarwal, who is one of our executive officers, served on the compensation committee of Gritstone bio, Inc., or Gritstone bio. Dr. Allen, a former director and member of our compensation committee, is the President and Chief Executive Officer of Gritstone bio.

Nominating and Corporate Governance Committee

The members of our nominating and corporate governance committee are Dr. Goldfischer, Mr. Conroy and Dr. Richon. Dr. Goldfischer is chair of the nominating and corporate governance committee. Our nominating and corporate governance committee met two times during 2021. Our nominating and corporate governance committee’s responsibilities include:

| • | identifying individuals qualified to become members of our board of directors; |

| • | recommending to our board of directors the persons to be nominated for election as directors and to each of our board’s committees; |

| • | developing, reviewing and recommending proposed updates to our board of directors of our board’s corporate governance guidelines; and |

| • | overseeing an annual evaluation of our board of directors. |

We believe that the composition of our nominating and corporate governance committee meets the requirements for independence under current Nasdaq and SEC rules and regulations.

Board and Committee Meetings Attendance

Our board of directors recognizes the importance of director attendance at board and committee meetings. The full board of directors met eight times during 2021. During 2021, each member of the board of directors, other

20

than Mr. Legorreta, attended in person or participated in 75% or more of the aggregate of (i) the total number of meetings of the board of directors (held during the period for which such person has been a director) and (ii) the total number of meetings held by all committees of the board of directors on which such person served (during the periods that such person served).

During 2021, Mr. Legorreta attended five of the eight meetings of our board of directors, and two of the three meetings that Mr. Legorreta was unable to attend were due to extenuating circumstances related to an illness of an immediate family member.

Director Attendance at Annual Meeting of Stockholders

Directors are responsible for attending the annual meeting of stockholders. Seven members of our board of directors attended the 2021 annual meeting of stockholders.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A current copy of the code of business conduct and ethics is posted on the corporate governance section of the “Investor Center” on our website, which is located at http://www.epizyme.com. If we make any substantive amendments to, or grant any waivers from, the code of business conduct and ethics for any officer or director, we will disclose the nature of such amendment or waiver on our website or in a current report on Form 8-K.

Corporate Governance Guidelines

Our board of directors has adopted corporate governance guidelines to assist in the exercise of its duties and responsibilities and to serve the best interests of our company and our stockholders. The guidelines provide that:

| • | the principal responsibility of our board of directors is to oversee the management of our company; |

| • | a majority of the members of our board of directors must be independent directors; |

| • | the independent directors meet in executive session at least twice a year; |

| • | directors have full and free access to management and, as necessary, independent advisors; and |