Exhibit 99.1

Investor and analyst call Acquisition of Epizyme, Inc. 27 June 2022

Disclaimer and safe harbor—This presentation includes only summary information and does not purport to be comprehensive. Forward-looking statements, targets and estimates contained herein are for illustrative purposes only and are based on management’s current views and assumptions. Such statements involve known and unknown risks and uncertainties that may cause actual results, performance or events to differ materially from those anticipated in the summary information. Actual results may depart significantly from these targets given the occurrence of certain risks and uncertainties, notably given that a new medicine can appear to be promising at a preparatory stage of development or after clinical trials but never be launched on the market or be launched on the market but fail to sell notably for regulatory or competitive reasons. Ipsen must deal with or may have to deal with competition from generic medicines that may result in market-share losses, which could affect its level of growth in sales or profitability. The Company expressly disclaims any obligation or undertaking to update or revise any forward-looking statements, targets or estimates contained in this presentation to reflect any change in events, conditions, assumptions or circumstances on which any such statements are based, unless so required by applicable law.—All medicine names listed in this document are either licensed to Ipsen or are registered trademarks of Ipsen or its partners.—The implementation of the strategy has to be submitted to the relevant staff representation authorities in each country concerned, in compliance with the specific procedures, terms and conditions set forth by each national legislation.—In those countries in which public or private-health cover is provided, Ipsen is dependent on prices set for medicines, pricing and reimbursement-regime reforms and is vulnerable to the potential withdrawal of certain medicines from the list of reimbursable medicines by governments, and the relevant regulatory authorities in its locations. In light of the economic impact caused by the COVID-19 pandemic, there could be increased pressure on the pharmaceutical industry to lower medicine prices.—Ipsen operates in certain geographical regions whose governmental finances, local currencies or inflation rates could erode the local competitiveness of Ipsen’s medicines relative to competitors operating in local currency, and/or could be detrimental to Ipsen’s margins in those regions where Ipsen’s sales are billed in local currencies.—In a number of countries, Ipsen markets its medicines via distributors or agents; some of these partners’ financial strengths could be impacted by changing economic or market conditions, including impacts of the COVID-19 pandemic, potentially subjecting Ipsen to difficulties in recovering its receivables. Furthermore, in certain countries whose financial equilibrium is threatened by changing economic or market conditions, including impacts of the COVID-19 pandemic, and where Ipsen sells its medicines directly to hospitals, Ipsen could be forced to lengthen its payment terms or could experience difficulties in recovering its receivables in full.—Ipsen also faces various risks and uncertainties inherent to its activities identified under the caption ‘Risk Factors’ in the Company’s Universal Registration Document.—All of the above risks could affect Ipsen’s future ability to achieve its financial targets, which were set assuming reasonable macroeconomic conditions based on the information available today. 2

Speakers David Loew Howard Mayer Aymeric Le Chatelier Chief Executive Officer Head of Research and Development Chief Financial Officer 3

Agenda 1 Strategic rationale 2 The science: Tazverik® 3 Commercial opportunity 4 Financials 5 Questions 4

Strategic rationale David Loew

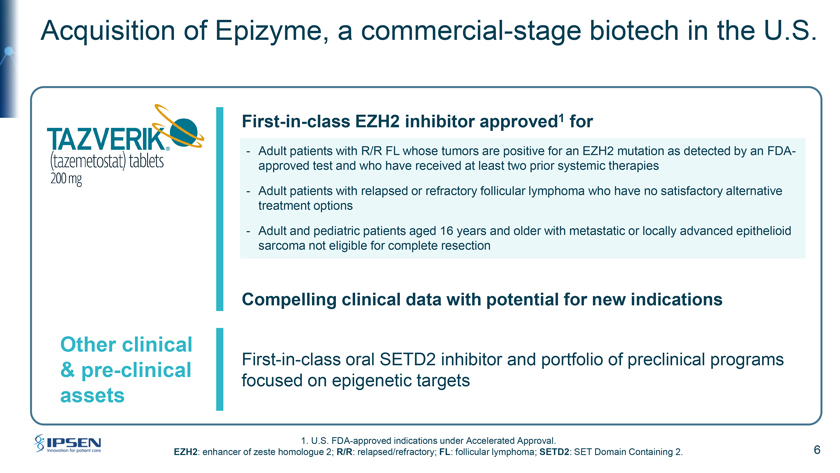

Acquisition of Epizyme, a commercial-stage biotech in the U.S. First-in-class EZH2 inhibitor approved1 for - Adult patients with R/R FL whose tumors are positive for an EZH2 mutation as detected by an FDA-approved test and who have received at least two prior systemic therapies—Adult patients with relapsed or refractory follicular lymphoma who have no satisfactory alternative treatment options—Adult and pediatric patients aged 16 years and older with metastatic or locally advanced epithelioid sarcoma not eligible for complete resection Compelling clinical data with potential for new indications Other clinical First-in-class oral SETD2 inhibitor and portfolio of preclinical programs & pre-clinical focused on epigenetic targets assets 1. U.S. FDA-approved indications under Accelerated Approval. EZH2: enhancer of zeste homologue 2; R/R: relapsed/refractory; FL: follicular lymphoma; SETD2: SET Domain Containing 2. 6

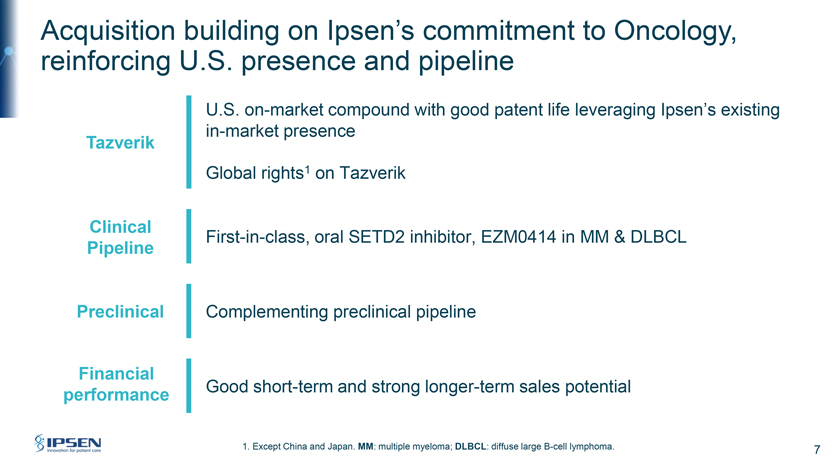

Acquisition building on Ipsen’s commitment to Oncology, reinforcing U.S. presence and pipeline U.S. on-market compound with good patent life leveraging Ipsen’s existing in-market presence Tazverik Global rights1 on Tazverik Clinical First-in-class, oral SETD2 inhibitor, EZM0414 in MM & DLBCL Pipeline Preclinical Complementing preclinical pipeline Financial Good short-term and strong longer-term sales potential performance 1. Except China and Japan. MM: multiple myeloma; DLBCL: diffuse large B-cell lymphoma. 7

The science: Tazverik Howard Mayer 8

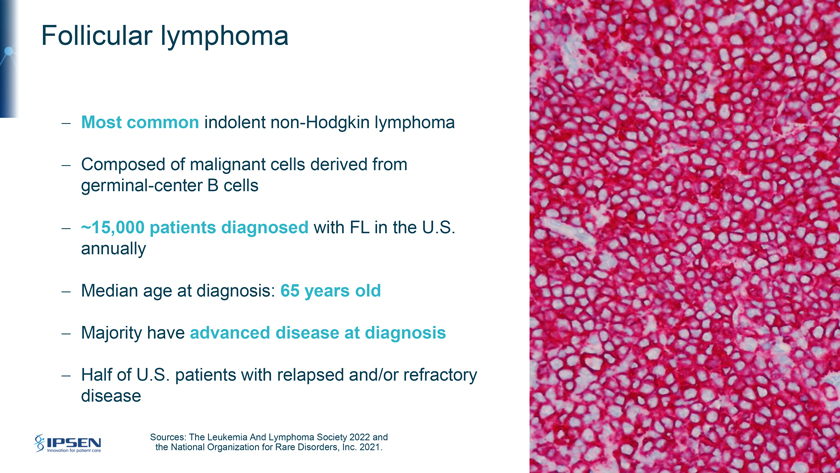

Follicular lymphoma—Most common indolent non-Hodgkin lymphoma—Composed of malignant cells derived from germinal-center B cells—~15,000 patients diagnosed with FL in the U.S. annually—Median age at diagnosis: 65 years old - Majority have advanced disease at diagnosis - Half of U.S. patients with relapsed and/or refractory disease Sources: The Leukemia And Lymphoma Society 2022 and the National Organization for Rare Disorders, Inc. 2021.

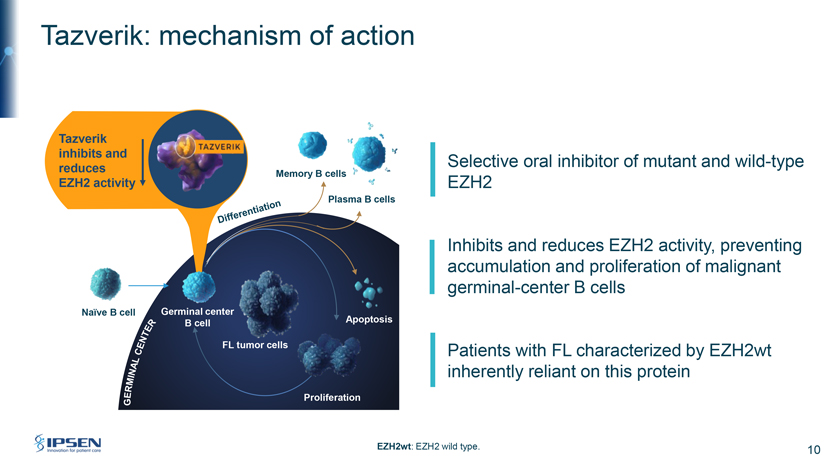

Tazverik: mechanism of action Tazverik inhibits and Selective oral inhibitor of mutant and wild-type reduces Memory B cell EZH2 activity EZH2 Plasma B cells Inhibits and reduces EZH2 activity, preventing accumulation and proliferation of malignant germinal-center B cells Naïve B cell Germinal center B cell Apoptosis FL Patients with FL characterized by EZH2wt inherently reliant on this protein Proliferation EZH2wt: EZH2 wild type. 10

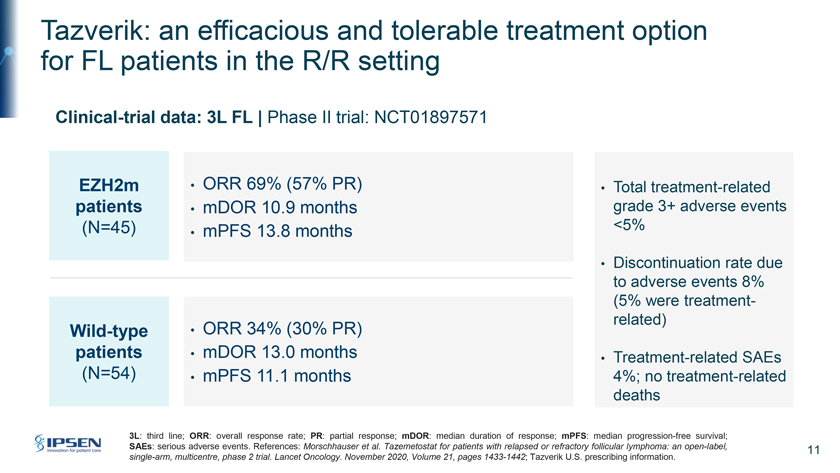

Tazverik: an efficacious and tolerable treatment option for FL patients in the R/R setting Clinical-trial data: 3L FL | Phase II trial: NCT01897571 EZH2m • ORR 69% (57% PR) • Total treatment-related patients • mDOR 10.9 months grade 3+ adverse events (N=45) . <5% • mPFS 13 8 months • Discontinuation rate due to adverse events 8% (5% were treatment-related) Wild-type • ORR 34% (30% PR) patients • mDOR 13.0 months • Treatment-related SAEs (N=54) • mPFS 11.1 months? 4%; no treatment-related deaths 3L: third line; ORR: overall response rate; PR: partial response; mDOR: median duration of response; mPFS: median progression-free survival; SAEs: serious adverse events. References: Morschhauser et al. Tazemetostat for patients with relapsed or refractory follicular lymphoma: an open-label, 11 single-arm, multicentre, phase 2 trial. Lancet Oncology. November 2020, Volume 21, pages 1433-1442; Tazverik U.S. prescribing information.

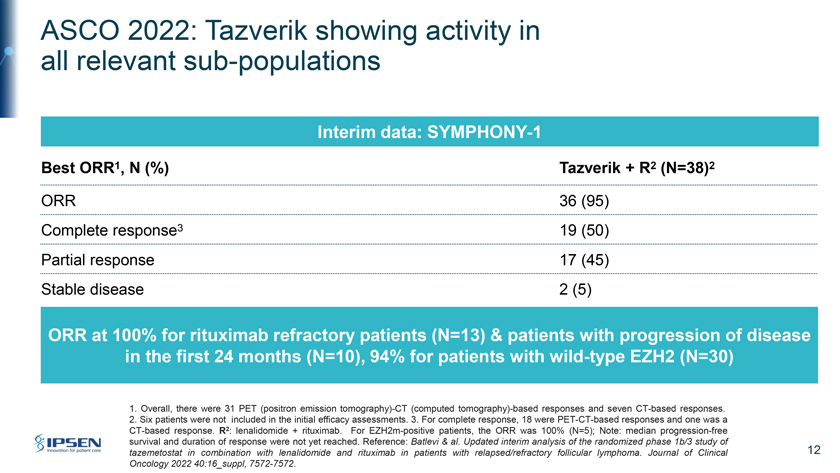

ASCO 2022: Tazverik showing activity in all relevant sub-populations Interim data: SYMPHONY-1 Best ORR1, N (%) Tazverik + R2 (N=38)2 ORR 36 (95) Complete response3 19 (50) Partial response 17 (45) Stable disease 2 (5) ORR at 100% for rituximab refractory patients (N=13) & patients with progression of disease in the first 24 months (N=10), 94% for patients with wild-type EZH2 (N=30) 1. Overall, there were 31 PET (positron emission tomography)-CT (computed tomography)-based responses and seven CT-based responses. 2. Six patients were not included in the initial efficacy assessments. 3. For complete response, 18 were PET-CT-based responses and one was a CT-based response. R2: lenalidomide + rituximab. For EZH2m-positive patients, the ORR was 100% (N=5); Note: median progression-free survival and duration of response were not yet reached. Reference: Batlevi & al. Updated interim analysis of the randomized phase 1b/3 study of tazemetostat in combination with lenalidomide and rituximab in patients with relapsed/refractory follicular lymphoma. Journal of Clinical 12 Oncology 2022 40:16_suppl, 7572-7572.

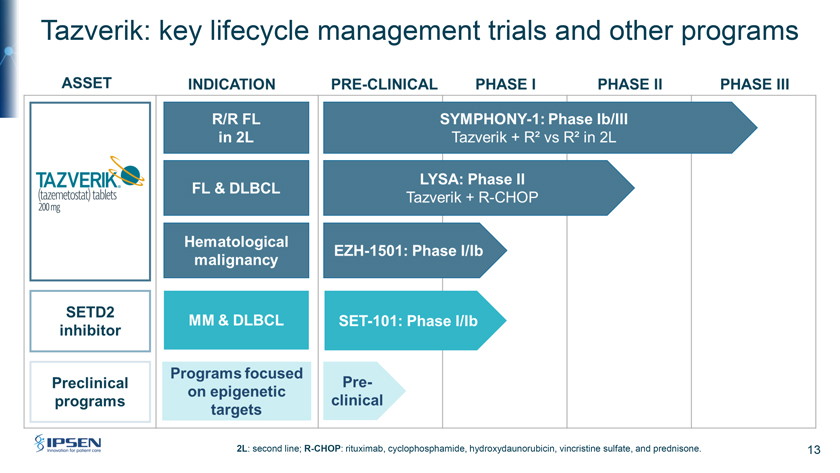

Tazverik: key lifecycle management trials and other programs 2L: second line; R-CHOP: rituximab, cyclophosphamide, hydroxydaunorubicin, vincristine sulfate, and prednisone. 13

Commercial opportunity David Loew

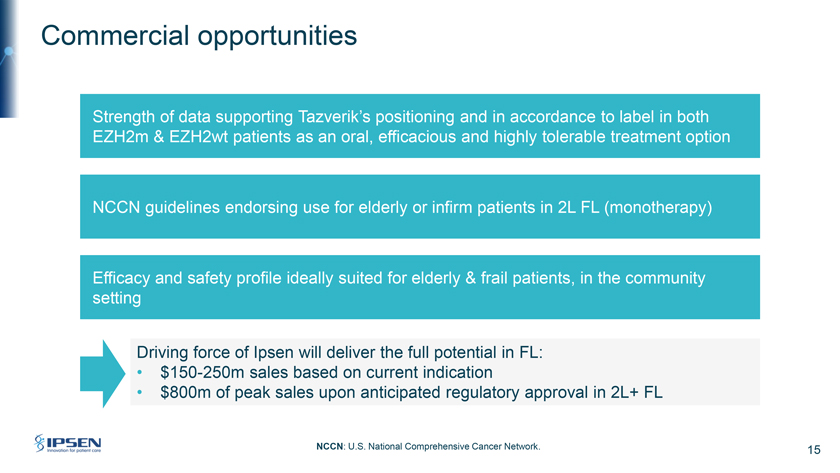

Commercial opportunities Strength of data supporting Tazverik’s positioning and in accordance to label in both EZH2m & EZH2wt patients as an oral, efficacious and highly tolerable treatment option NCCN guidelines endorsing use for elderly or infirm patients in 2L FL (monotherapy) Efficacy and safety profile ideally suited for elderly & frail patients, in the community setting Driving force of Ipsen will deliver the full potential in FL: • $150-250m sales based on current indication • $800m of peak sales upon anticipated regulatory approval in 2L+ FL NCCN: U.S. National Comprehensive Cancer Network. 15

Financials Aymeric Le Chatelier

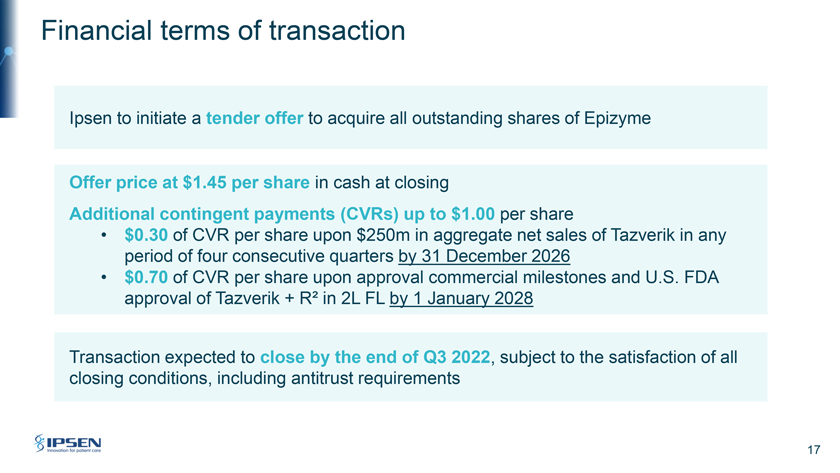

Financial terms of transaction Ipsen to initiate a tender offer to acquire all outstanding shares of Epizyme Offer price at $1.45 per share in cash at closing Additional contingent payments (CVRs) up to $1.00 per share • $0.30 of CVR per share upon $250m in aggregate net sales of Tazverik in any period of four consecutive quarters by 31 December 2026 • $0.70 of CVR per share upon approval commercial milestones and U.S. FDA approval of Tazverik + R² in 2L FL by 1 January 2028 Transaction expected to close by the end of Q3 2022, subject to the satisfaction of all closing conditions, including antitrust requirements 17

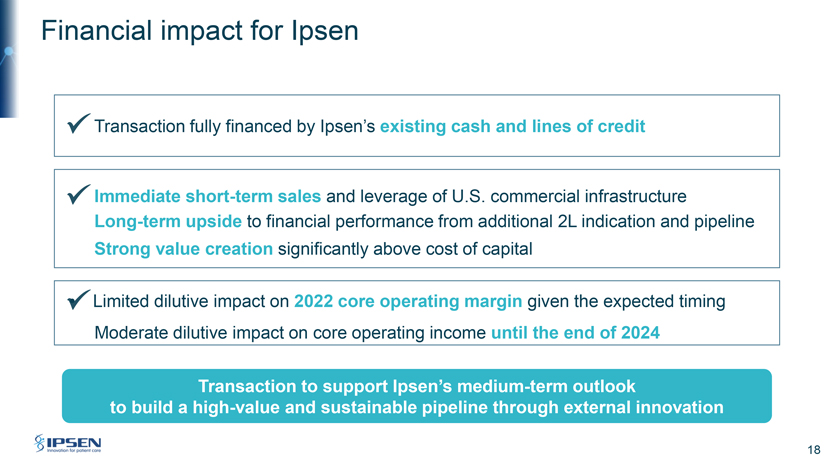

Financial impact for Ipsen Transaction fully financed by Ipsen’s existing cash and lines of credit Immediate short-term sales and leverage of U.S. commercial infrastructure Long-term upside to financial performance from additional 2L indication and pipeline Strong value creation significantly above cost of capital • Limited dilutive impact on 2022 core operating margin given the expected timing Moderate dilutive impact on core operating income until the end of 2024 Transaction to support Ipsen’s medium-term outlook to build a high-value and sustainable pipeline through external innovation 18

Summary David Loew

Summary Strengthening Ipsen’s oncology portfolio Focus and pipeline A winning strategy Providing commercial opportunities across the short and long term, focused on Tazverik Ipsen to continue its external-innovation strategy as a key platform for growth 20

Questions

Craig Marks Vice President, Investor Relations +44 7564 349 193 craig.marks@ipsen.com Adrien Dupin de Saint-Cyr Investor Relations Manager +33 6 64 26 17 49 adrien.dupin.de.saint.cyr@ipsen.com 22

THANK YOU

Follow us www.ipsen.com