Exhibit 99.2

| INVESTOR UPDATE

(Number 26 in the Series) |

May 6, 2015

Dear Fellow Shareholders:

On behalf of the Board of Directors and the management team of Virginia National Bankshares Corporation (the Company), I am pleased to provide an update on the Company’s performance for the year ending December 31, 2014.

The after-shock of the recession changed community banking dynamics and financials forever. That is not my opinion, but the opinion of others. There is no doubt many of the metrics are forever changed, but it doesn’t mean the changes are bad; the industry has just changed. Most would find it difficult to believe in 1970 there were over 23,000 financial institutions and the average asset size was $25 million. Even harder to grasp is most of these banks were at a 1% Return on Assets (ROA). A big bank was considered to have $1 billion in assets and a mega bank holding company several billion. Five recessions, hundreds of technology improvements and regulatory changes later, we now have around 6,400 FDIC insured financial institutions. A big bank now has $200 billion in assets and a mega bank holding company has a trillion dollars in assets. My point in sharing these facts with you is there have always been major changes and adjustments in the financial world. It takes time to adjust and sometimes is just too easy to concentrate on the negativity of change. Many of the changes are positive. Banks are safer, better capitalized, more efficient, and offer more consumer and commercial choices than ever before. So how is the Company doing?

VNBTrust, which operates under the trade name VNB Wealth Management, completed the last phase of its transition from 2013 by moving clients to a new system and growing Assets Under Management. By consolidating to one location, the VNB Wealth Management team is now integrated with the management team of Virginia National Bank (the Bank) and is very active in our markets. The team is adding new clients and is poised to purchase a book of business later in 2015. After the last two years of transition, the VNB Wealth Management team gladly welcomes the opportunity to grow the business.

The Bank grew deposits and loans and continued to reduce overhead, streamline operations, and flatten our management layers. We also raised fees across the board, something not done in over eight years. The Bank’s margins contracted, but it is clear stabilization has occurred.

What is left? First, we need to concentrate on loan growth. In late 2014, we saw payoffs decline, a trend we expect to continue. We expanded our loan offerings and are now extremely competitive in our markets. We entered the Warrenton market last year and loan production results are excellent. Additionally, we sought out other loan opportunities to supplement organic growth while at the same time ensuring our asset quality remains sound. We expect our loan growth initiative, coupled with our ongoing analysis of expenses, to restore the Company’s growth in earnings.

Completed Initiatives.The following strategies were successfully completed in 2014:

| ● | Mortgage Division – The Bank hired a mortgage lender and established relationships with several correspondent banks to facilitate the origination and sale of loans on the secondary market. This initiative is contributing to non-interest income, as well as increasing the volume of loans held in our portfolio. |

| ● | Debit Card Security – The Bank implemented a new monitoring system to protect our customers and reduce overall exposure to fraud. |

| ● | Fee Increases – The Bank raised fees to better align with costs, and yet remain at or below our peers. |

| ● | Merchant Card Services – We partnered with a new vendor to enhance our services, add value to our clients, and increase non-interest income. |

| ● | Cash Dividend – The Company increased the quarterly cash dividend by 50%. |

| ● | VNB Wealth Management – We completed a system conversion to better serve our clients. |

| ● | New Market – The Bank hired a commercial lender to open an office in Warrenton. |

Investor Update

Page 2

New Initiatives.We initiated the following strategies in 2014:

| ● | Capital Allocation – The Board approved a stock repurchase plan as part of our overall capital strategy. Purchases may be made when deemed advantageous compared to other alternatives. |

| ● | Return on Assets – In 2014, the Bank embarked upon a strategy to increase our return on assets, with an objective of achieving 1% by fiscal year end 2016. We plan to achieve this goal through: |

| ○ | An increase in non-interest income through further expansion of our Mortgage Division, annual review of service charges, leasing excess office space, and exploration of referral arrangements and of other lines of business. |

| ○ | Organic loan growth, supplemented by loan purchase transactions, both packaged or through participation interests, which will serve to diversify our existing loan portfolio. |

| ○ | Management of expenses – Personnel expenses represent the Bank’s largest non-interest expense; as such, we continually evaluate employee headcount to streamline operations and maximize the efficiency of staff. Additionally, on an ongoing basis, we assess real estate leases for termination or renegotiation. |

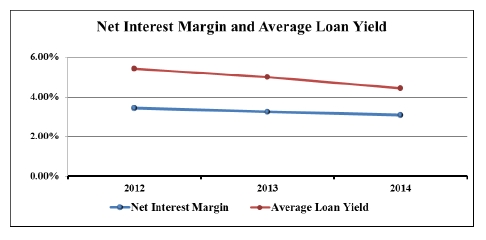

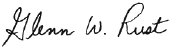

Margins and Yields – Bank Only.The following graph shows a decline in net interest margin and average loan yield. We continue to experience increased competition in our markets, which has forced us to aggressively price new loans and re-price existing loans. We anticipated the Federal Reserve would increase rates modestly late in the year, reducing the pressure on net interest margin; however, this did not occur. Our strategy continues to be originating high quality loans, which requires competitive pricing. This has resulted in erosion to both yield and margin in this low interest rate environment.

Loan growth for 2014 was 4.2%; however, a significant portion occurred in the fourth quarter. Consequently, the full impact was not realized in the year’s net interest income. Fortunately, we are seeing very positive signs in our market that small to mid-tier businesses are borrowing again. While margins may not improve in the near term, we expect further loan growth in 2015, which should improve the overall yield on our earning assets.

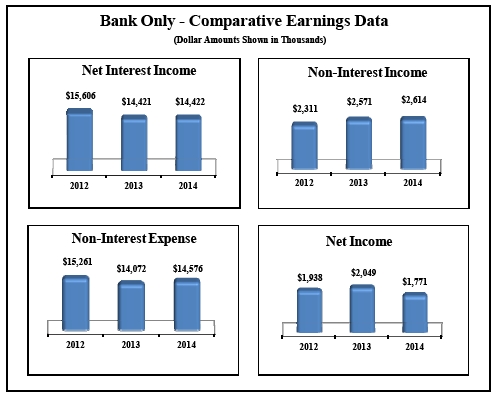

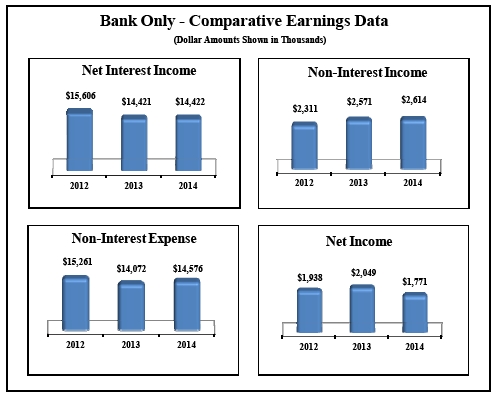

Comparative Earnings Data – Bank Only.Net income fell short of our expectations, decreasing by $278 thousand over 2013. The reason for the decline in net income was twofold. First, we experienced large early loan payoffs in the second and third quarters, as well as loan growth occurring later in the year than anticipated. As stated earlier, our margin and yield declined during the same time period as we competed for high quality loans. Second, non-interest expense, particularly salaries, grew as we made key hires necessary for future growth. Further expense reductions have occurred in the first quarter of 2015, which should positively impact the bottom line this year.

While non-interest income increased slightly over 2013, the full impact of fee increases implemented late in 2014 was not realized. The challenges for 2015 are a bit different than those in 2014 and we will focus more on loan production rather than non-interest income or expense reductions. Nonetheless, we will continue to carefully control expenses and evaluate fees. To further our success in loan production, we will continue to evaluate the competition on a regular basis, setting rates and terms accordingly. As has always been our practice, we will pursue new relationships through our community partnerships, hosting special events for existing clients and prospects, and promoting brand awareness. Although we did not see loan growth until the latter part of the year, our strategy of maintaining and establishing relationships is generating many opportunities to bid onloan packages. These opportunities are coming from new relationships established over the past three years as well as long-term relationships.

Investor Update

Page 3

Our new commercial lender in Warrenton and our new mortgage lender in Charlottesville were immediately productive and brought in substantial relationships as well. I am also excited about the volume of loans in our pipeline. If it continues to be as strong as it was in the fourth quarter of 2014 and the first quarter of 2015, we should see a positive and immediate shift in our balance sheet as well as earnings.

Balance Sheet.The Company achieved growth in all categories shown in the following graphs. The only real surprise was the large increase in deposits. In last year’s shareholder letter, I predicted deposits would actually decrease as the economy stabilized and customers would move money back into investment portfolios, which is a continuation of what happened in 2013. The reason for the increase was simple; several clients sold portions of their businesses and were temporarily holding large deposits at the Bank. We expect these deposits will be withdrawn by the end of 2015 and our deposit growth will return to normal.

During 2014, deleveraging continued on the loan side with $51 million of loan prepayments, primarily occurring in the second and third quarters. Once again small business owners seemed reluctant to borrow due to the uncertainty of the economy, yet we managed to end the year at $313 million in loans. While waiting for loan demand to return in our markets, we purchased participation interests in several Shared National Credits. To align with our philosophy of superior credit quality, we set parameters for this portfolio to ensure the total does not exceed certain limits of risk-based capital. We also limited our exposure per borrower and industry to eliminate concentrations within this portfolio. In addition, we are pursuing the purchase of a guaranteed student loan portfolio. We view this purchasing strategy as a temporary measure that will not only diversify earnings but also efficiently deploy capital.

Investor Update

Page 4

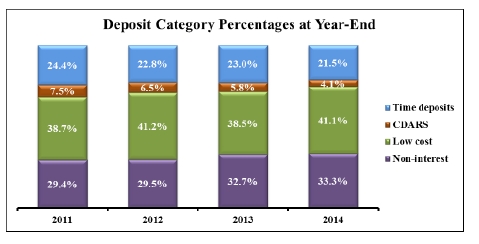

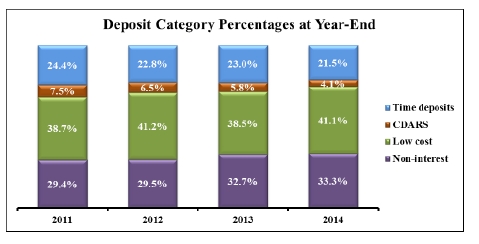

Deposit Composition.Notwithstanding the economic challenges of past years, we again increased our low cost and non-interest bearing deposits in 2014. Since its inception, one of the Bank’s tenets is to be a “self-funding” financial institution, which means funding loans with deposits. Due to the recession, loan demand has declined, causing the value of deposits to diminish. Unlike other banks, the Bank continued to focus on relationships that brought us both loans and deposits, knowing loan demand would return.

The Bank’s average loan-to-deposit ratio was 66.2% in 2014. In 2007, the Bank’s ratio was significantly higher at 89.3%. While our ratio has fallen, this does not mean the Bank is struggling. The sluggish economy is one reason for the decline, as loan demand has waned. A compounding factor is the flood of low cost and non-interest bearing deposits we have received since the beginning of the recession, as clients looked for a safe harbor. This growth has allowed us to maintain one of the lowest cost of funds in the country. In normal times, this will enable us to generate a healthy net interest margin.

Investor Update

Page 5

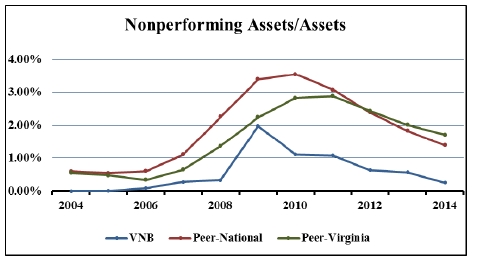

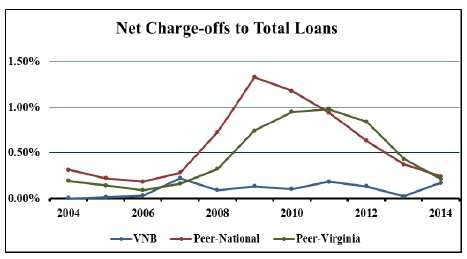

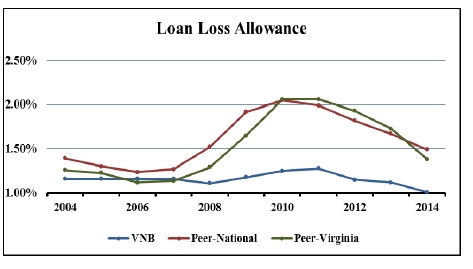

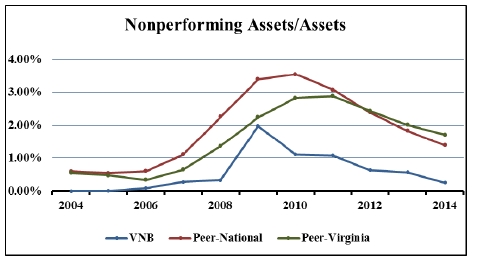

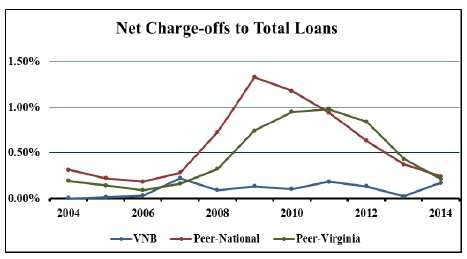

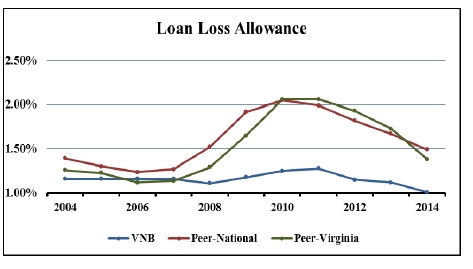

Credit Quality.During the pre-recession years, the Bank and its peers benefited from a robust economy. However, since the start of the recession in 2007, the benefits of our disciplined approach to lending and our superior credit quality are illustrated in the graphs below. These actions permitted us to remain profitable during a difficult period.

In 2014, our level of nonperforming assets continued to decline and remained well below our peer groups. Although charge-offs increased slightly in 2014, we were 19.1% and 29.1% below our state and national peer groups, respectively. At year-end 2014, the Bank’s Loan Loss Allowance of 1.01% dropped to its lowest level in 10 years, which is a tribute to the Bank’s credit culture. Had our allowance been at the Virginia peer group level of 1.38%, the Bank’s net income would have been $1.2 million less. The combination of our low levels of nonperforming assets, modest charge-offs, and relatively low loan loss allowance is the primary reason we remained profitable every quarter throughout the recession. I expect by 2016, the metrics of our peer groups will improve and the gap will narrow. It is important to note that in 2004-2006 (the good times), the difference between VNB and peers is small and seemingly unimportant. In 2007-2013, that small difference became a significant and costly difference for our peers. As we grow our loan portfolio in the recovering economy, we will continue to focus on adding high quality loans to the portfolio.

Investor Update

Page 6

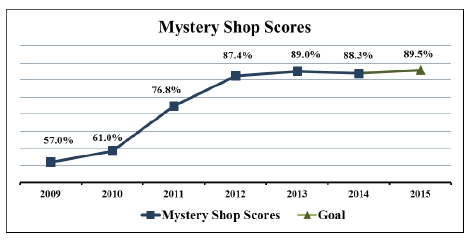

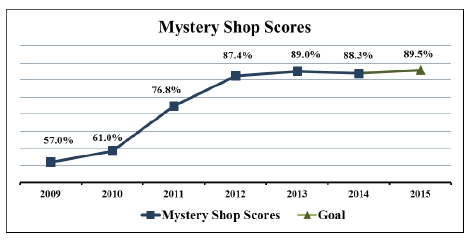

Retail Strategy. The Bank’s retail strategy was launched in 2010 after we discovered three metrics that needed improvement. First, our shop scores were below expectations. Second, we were not focused on generating non-interest income. Last, the efficiency ratio in our offices was unacceptably high and unhealthy for the Bank. We appointed a Director of Retail Banking, whose mission was to review our products and services, examine transaction counts, and implement new technologies. This led to the reduction of several unprofitable services and in headcount. Additionally, we added a mortgage lender in 2014 to contribute to non-interest income.

It is important to note throughout the distraction of eliminating services, introducing new ones, and reducing headcount, the retail group also embarked on a new training program with the goal of creating a more knowledgeable, service-oriented team. The success of this training is measured quarterly. As evidenced by the graph below, these efforts have been successful. It was very difficult to move the needle from a score of 61% in 2010 to a score of 88% in 2014. It should be noted the negligible reduction in scores during 2014 was due to the introduction of more challenging subject matter and the increase of cross-sell metrics. Future fluctuations are expected as we continue to raise the bar. We are very proud of all our employees, and special recognition is given to this group for all they have achieved.

Investor Update

Page 7

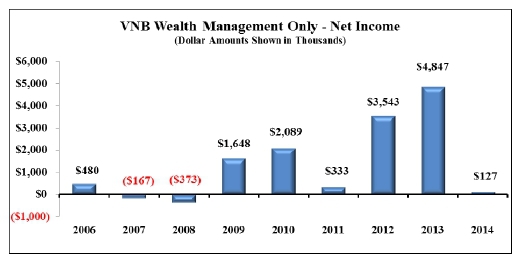

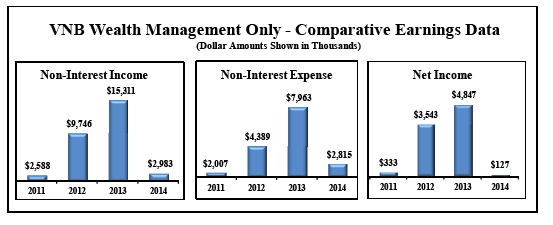

VNB Wealth Management. I am very pleased with the results of VNB Wealth Management. Assets Under Management (AUM) finished well ahead of expectations by the end of 2014, following the sale of Swift Run Capital Management, LLC and subsequent transfers of AUM. Seldom does a group of professionals come together and accomplish as much as this team has in a short period of time. They completed a system conversion, revamped marketing materials, created an impressive investment product line, designed and moved into a new location, added new clients, and remained profitable. In 2015, they can now focus on growing the business, and I know they are up to the task.

In last year’s shareholder letter, I reminded everyone VNB Wealth Management has two primary sources of revenue:

| ● | Management fees – Derived from its AUM. |

| ● | Incentive income – Based on the investment returns generated on its performance-based AUM. |

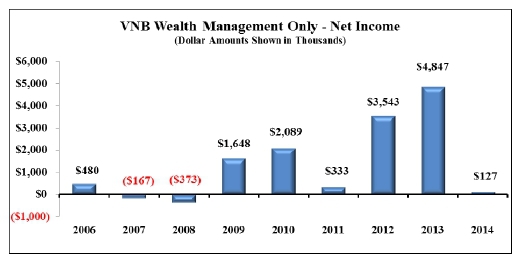

In any given year, revenues are driven by the combination of these income streams. When AUM levels remain stable, management fees are reasonably predictable, while incentive income is inherently both volatile and unpredictable. The graph below shows the volatility of incentive fee income. A net loss will result when fixed expenses exceed management fees and performance fees are non-existent. This occurred in 2007 and 2008. Future losses can be avoided by adding management fee-only clients, which adds stability and predictability to our revenue streams and allows a predictable offset against expenses. Conversely, the results in 2012 and 2013 illustrate the higher revenue that may be earned from volatile and unpredictable performance fees. I believe a mix of revenues is preferable to ensure there are sufficient fixed fees to offset expenses and provide some baseline of profitability, with a possibility for higher earnings in some years.

Investor Update

Page 8

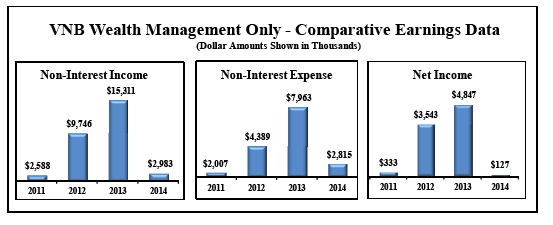

The following graphs illustrate not only the volatility of performance fees, but their direct effect on non-interest expense. Prior to 2014, incentive compensation was generally based on the level of performance fees earned; as non-interest income increased, so did non-interest expense. In 2014, we restructured our compensation arrangements to separate incentive compensation paid by VNB Wealth Management from the performance fees earned.

VNB Wealth Management’s Future Challenges.What are the additional future challenges ahead for this group? There is the current debate that active investing is a thing of the past. If one has been watching the flow of money pouring into passively managed funds, you might agree active investing will disappear. I always find it interesting these types of actions come during bull markets when people start believing investing is easy. They have surely forgotten about the years 2007 through 2009. Going further back in time, investors with short memories must not remember 2000 or 2002. Those were painful years. Do I believe we will have new clients coming to us and our business model is one that can grow? Yes! There is no use debating the pros and cons in this letter; we will know in the next two years whether I am right or wrong by the number of AUM we add.

Conclusion.The top challenges and opportunities for the Company in 2015 are as follows:

| ● | VNB Wealth Management – Focus on the addition of new clients and AUM in all our markets. This type of growth will positively impact non-interest income. |

| ● | Loan Growth – Continue to introduce competitive loan products in response to market demands. |

| ● | Expense Reductions – Streamline operational efficiencies. |

| ● | Capital Allocation – Effectively deploy excess capital. |

| ● | Technology – Implement technologies that protect our customers, the Company, and help contain future non-interest expense. |

Last year, I stated community banks will survive, but only if they become more efficient, more competitive, reduce expenses, embrace technology, and either find or create new ways to generate earnings. They must also be more involved in their communities than larger banks. Our actions in 2014 demonstrate we are doing all these things. The Company remained financially sound, profitable, and grew its customer base.

Your confidence and support are sincerely appreciated. If you have any questions, please do not hesitate to call me at 434-817-8649.

Sincerely,

Glenn W. Rust

President & CEO

Forward-Looking Statements; Other Information:Statements in this letter which express or imply a view about the objectives and future performance of the Virginia National Bankshares Corporation are “forward-looking statements.” Such statements are often

Investor Update

Page 9

characterized by use of qualified words such as “expect,” “believe,” “estimate,” “project,” “anticipate,” “intend,” “will,” or words of similar meaning or other statements concerning the opinions or judgment of the Company and its management about future events.While Company management believes such statements to be reasonable, future events and predictions are subject to circumstances that are not within the control of the Company and its management, and actual events in the future may be substantially different from those expressed in this letter. The Company’s past results are not necessarily indicative of future performance. Factors that could cause future performance to differ from past performance or anticipated performance could include, but are not limited to, changes in national and local economies, employment or market conditions; changes in interest rates, deposits, loan demand and asset quality; competition; changes in banking regulations and accounting principles or guidelines; and performance of assets under management. These statements speak only as of the date made, and the Company does not undertake to update them to reflect changes or events that may occur later. Information based on other sources is believed by management of the Company to be reliable, but has not been independently verified. For more information about the Company’s 2014 performance, please refer to the Company’s audited consolidated financial statements in its Annual Report on Form 10-K for the year ended December 31, 2014 with the Securities and Exchange Commission on March 30, 2015.