INVESTOR UPDATE

April 30, 2019

Dear Fellow Shareholders:

On behalf of the Board of Directors and the management team of Virginia National Bankshares Corporation (the Company or VABK), we are pleased to provide our view of the banking industry and regulatory environment, along with an update on our performance for the year ended December 31, 2018.

We were thrilled to celebrate the 20th Anniversary of Virginia National Bank (the Bank or VNB), the Company’s subsidiary, on July 29, 2018. Our employees and board members enjoyed a company party at our headquarters located in Charlottesville. Several staff members hired in the first year of our company continue to be employed to this day. As you can see from the many photos included in this letter, community involvement is very important to our Company. Our staff and customers attend fundraising events sponsored by our Bank, and many of our employees are on local non-profit boards to help create a stronger impact on the communities we serve. | |

|

The banking environment of 2018 presented constant change. Bank mergers and acquisitions, specifically in the community bank sector, continued at a rapid, but predictable pace. De novo bank formations were almost nonexistent due to the current regulatory and capital requirements, as well as the difficulty in achieving profitability. Our high-performing Bank ended 2018 with record earnings, Return on Average Assets (ROAA) and efficiency ratio.

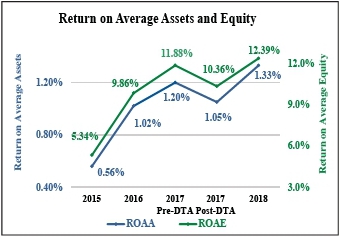

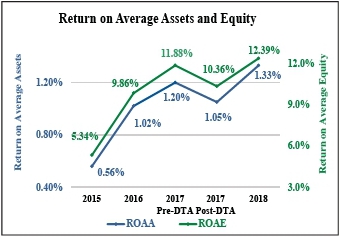

The Bank again surpassed its ROAA goal by finishing 2018 at 1.38%. Based on the Bank’s strong performance and VNB Wealth’s contribution, consolidated VABK also increased its ROAA to 1.33%. Our Company’s efficiency ratio improved again due to technology efficiencies in the operational areas of the Bank, as well as the continued savings from our renegotiated core technology contract.

We experienced a year of net loan growth of $8.4 million. In 2018, we also remained competitive in our markets, increased our deposits, and maintained our low cost of funds. We are elated with our Company’s success in 2018!

The national social issues we addressed were health care costs, the decreasing financial knowledge among high school students, and the lack of individuals wanting to become commercial lenders. The Company absorbed the increased employee health care costs, raising its contribution from 45% four years ago to 59% in 2018, and we are committed to contributing more over the next two years.

In addition, to address the limited financial knowledge among high school students, we began the Financial Career & Leadership Academy (FCLA) program. Every Monday and Wednesday evening we take high school students through courses, such as financial management, interest rate calculations, tax preparation, understanding cash flow and investing. We hope the word spreads on this program and that many high school students choose to participate in this program.

Investor Update

April 30, 2019

In 2018, we completed the plans for launching a commercial lender sixty-hour college course certification. The purpose of this certification is two-fold—to attract adults that want a career change and to also create a program that employees can use as a path for promotion. As of March 2019, two individuals have completed the program and two more will start in May. We hope to share the program with other banks in the future so that the national commercial lender problem can be solved. We want to assure our shareholders, employees and customers that we are a community bank that intends to remain focused on performance, take care of our high-performing employees, and deliver convenient and secure financial services. Please enjoy reading the following information about our financial results. | | Linda Hitchings, Tara Harrison, Mark Meulenberg, and Gina Bayes attended the Charlottesville Free Clinic’s annual benefit concert featuring Brandi Carlile |

Congratulations to UVA! April 8, 2019 was a big day for all in Charlottesville, home of the University of Virginia. We were glued to our TVs as the Cavaliers moved through the Sweet 16 to the Final Four and on to become the national basketball champions! | | Erica Burkholder, Brittany Wood, William DeMaio, and Sean Deighan at VNB’s Barracks Road office showed their team spirit for UVA’s national championship men’s basketball game |

James Pierce, Jack Horn, Glenn Rust, and Sandra Thomas pictured as Glenn Rust receives the Virginia/DC Board Member of the Year award with Boys and Girls Clubs of America | | Pantops office staff: Andrea Foster, Callie Morris, Kelly Robey, Tessie Bishop, Jordan Pierson, and Leslie Snoddy |

Page 2

Investor Update

April 30, 2019

VIRGINIA NATIONAL BANKSHARES CORPORATION

STOCK AND CAPITAL PERFORMANCE |

| 2018 was a record year, not only for our Company, but for our shareholders as well. We increased the quarterly dividend to shareholders for the sixth consecutive year. Since the Company declared its first cash dividend in the amount of $0.05 per share during the second quarter of 2013, the quarterly dividend has increased 500% to $0.30 per share. Cash dividends declared per share increased 70% from 2017 to 2018, based on the decision by the Board of Directors to increase the cash dividend to $0.30 per share in the second quarter of 2018. Also in 2018, the Company issued a 5% stock dividend to further enhance shareholder value. The stock dividend was paid prior to and in addition to the regular quarterly cash dividend, further enhancing the value of the cash dividend for shareholders. | | |

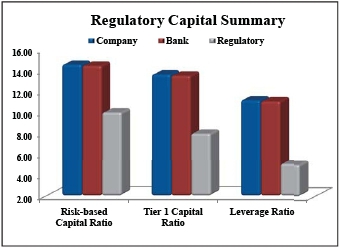

| | The Company and the Bank continue to be well-capitalized based on regulatory guidelines. The Company’s Tier 1 capital ratio was 13.58% at December 31, 2018, while its risk-based capital and leverage ratios were 14.52% and 11.14%, respectively. The Bank’s Tier 1 capital ratio was 13.47% at December 31, 2018, with risk-based capital and leverage ratios of 14.41% and 11.05%, respectively. The common equity Tier 1 ratios for the Company and the Bank equal the Tier 1 capital ratios for each. Minimum regulatory guidelines for well-capitalized banks are 10.0% for risk-based capital, 8.0% for Tier 1 capital, 6.5% for common equity Tier 1, and 5.0% for leverage ratios. Our strong capital position allows us to continue to increase shareholder return. |

Washington Nationals’ baseball star Ryan Zimmerman and Tim Sims at the annual ziMS Foundation bowling event to support research andfind a cure for MS | | Kelly Potter presenting trophy at the Montpelier Hunt Races |

Page 3

Investor Update

April 30, 2019

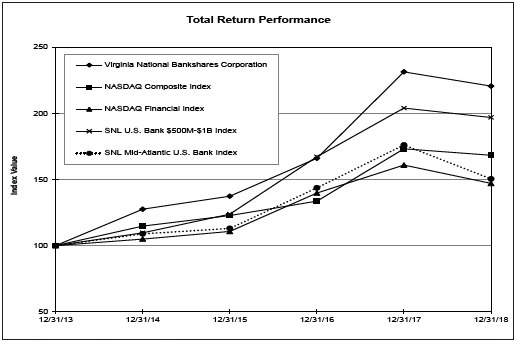

Source: S&P Global Market Intelligence

© 2019 |

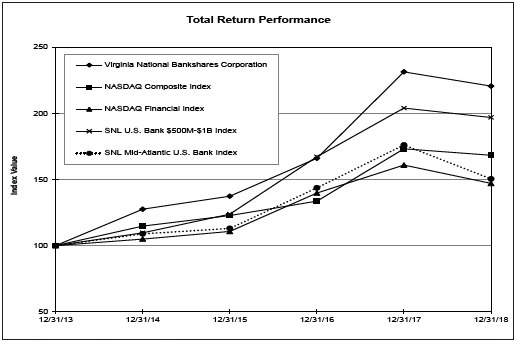

The equity markets witnessed significant volatility in the fourth quarter of 2018. Bank stocks were no exception, underperforming the broader market after reaching interim highs in mid-September of 2018. According to investment banking firm D.A. Davidson, 78% of publicly-traded banks hit their 52-week low in the fourth quarter of 2018 and 39% hit their lowest level in the last two years. Our stock price per share decreased only 12% from $39.00 at December 31, 2017 to $34.51 at December 31, 2018. However, our five-year growth was significant. The above graph compares the cumulative total shareholder return of VABK common stock to several indices. The graph assumes that $100 was invested on December 31, 2013 in the Company’s common stock and in each of the indices, and that dividends were reinvested. If you had invested $10,000 on December 31, 2013 and reinvested dividends, the stock would be worth over $22,000 at December 31, 2018, compared to less than $20,000 for each of the comparative indices noted below.

Glenn Rust, Linda Hitchings, Tim Sims, and Kelly Potter receiving sponsorship recognition from Ethan Long, Executive Director at the Virginia Institute of Autism | | Alan Williams, Ashley Carter, Kevin Baugher, Amanda Litchfield, Michelle Warwick, and Tara Harrison participated in the Charlottesville-Albemarle SPCA’s annual Bow-Wow-Walk fundraiser |

Page 4

Investor Update

April 30, 2019

COMPARATIVE EARNINGS DATA |

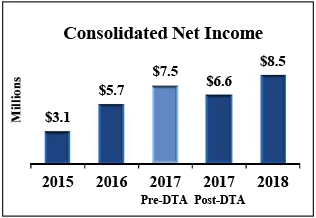

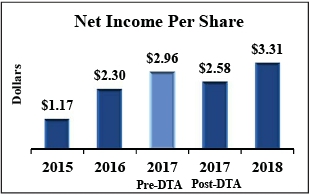

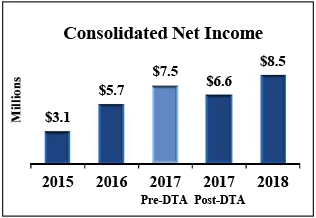

| The Company’s net income improved 29% to $8.5 million, or $3.31 per diluted share, for the year ended December 31, 2018, from $6.6 million, or $2.58 per diluted share (adjusted for the 5% stock dividend effective April 13, 2018) for the year ended December 31, 2017. Net income for 2017 was reduced by $963 thousand due to the re-measurement of, and adjustment to, deferred tax assets (DTA) as a result of the enactment of the Tax Cuts and Jobs Act (Tax Reform) in December 2017. This DTA adjustment represented the impact of reducing the federal tax rate applicable to the Company’s DTAs to 21% in 2018 from 34% previously. | |  |

| | | |

Prior periods have been adjusted for 5% stock dividend effective April 2018. | | There were two primary components contributing to the increase in net income year-over-year. First, provision for income taxes decreased $2.3 million, due to the reduced tax rate as noted above. Second, net interest income rose $1.5 million, primarily due to the increase in yield in all major loan categories and elevated average balances within our commercial and real estate loan portfolios. These favorable variances were offset by: $1.5 million increase in provision for loan losses, $350 thousand decrease in noninterest income, and $132 thousand increase in noninterest expense. |

| | |

| For the year ended December 31, 2018, the Company’s ROAA and ROAE were 1.33% and 12.39%, respectively. The Bank’s ROAA reached a record level of 1.38%. The Bank’s ROAE also reached a record level of 13.16%. Based on each of these metrics, we outperformed most of our national peers with ROAA and ROAE averages of 1.26% and 11.33%, respectively. We also compared favorably to similarly-sized Virginia peers whose ROAA average was 0.91% and ROAE average was 8.37% for the same period. Peers are defined as all commercial banks with assets of $100 million to $1 billion. In fact, the Bank placed in the top five of all Virginia banks. | |  |

Page 5

Investor Update

April 30, 2019

VIRGINIA NATIONAL BANK

NET INTEREST INCOME, MARGINS AND YIELDS |

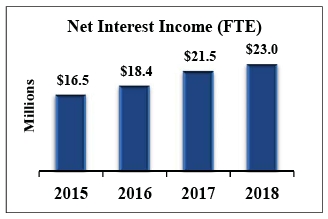

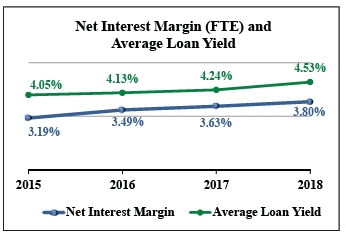

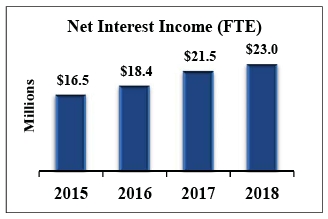

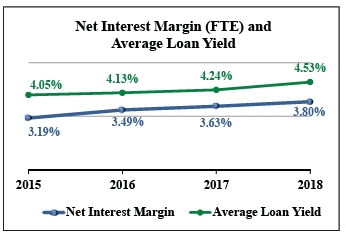

| | Net interest income fully tax equivalent (FTE) of $23.0 million for 2018 was an improvement of $1.5 million, or 6.8%, over 2017. The net interest margin of the Bank continued to improve year-over-year as a result of increased loan yield and an improved mix of earning assets. We realized a net interest margin (FTE) of 3.80% in 2018, which was 17 basis points (bps) higher than 2017. Our average loan yield of 4.53% for 2018 was 29 bps higher than the loan yield realized in 2017 of 4.24%. The average balance for loans as a percentage of earnings assets for 2018 improved to 87% from 83% the prior year. Average earning assets increased $13 million in 2018 compared to 2017, and average loan balances increased $36 million over the same period. |

| | |

| Net interest margin will be impacted by future changes in short- and long-term interest rates, as well as the influence of the competitive environment. Although the Bank’s cost of funds increased, averaging 46 bps for 2018 compared to 21 bps in 2017, we remained strong compared to the average for national and Virginia peers of 67 bps and 59 bps, respectively. A continuing driver of the Company’s low cost of funds is the Company’s level of non-interest bearing demand deposits and low costs of deposit accounts, which represented 81% of total deposits as of December 31, 2018. | |  |

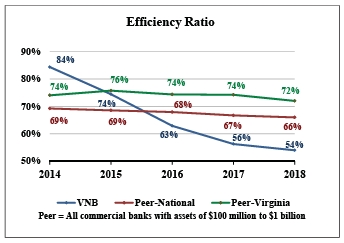

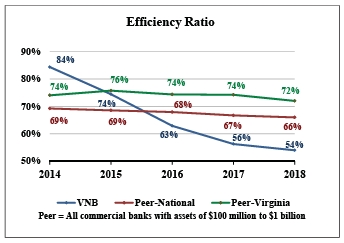

| One of the key ratios we closely monitor is the efficiency ratio, which measures the cost to produce one dollar of revenue. A lower ratio is an indicator of greater operational efficiency. We have experienced a positive trend over the last four years in our efficiency ratio due to higher yielding assets, cost containment, and expense reduction strategies. This trend is shown in the graph, which uses the efficiency ratio as calculated by the FDIC. | |  |

Page 6

Investor Update

April 30, 2019

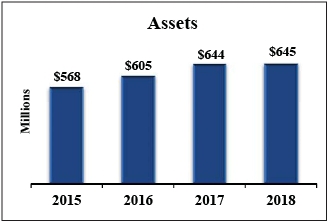

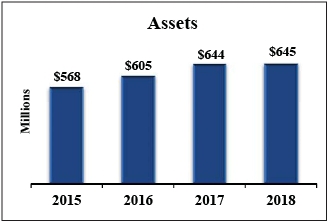

| Our focus in 2018 was on right-sizing the balance sheet with an effective mix of earning assets and liabilities, rather than necessarily growing the balance sheet. The Bank’s highest yielding asset category of loans constituted 87% of average assets during 2018. With the purchase of a $19 million adjustable rate mortgage loan portfolio in December, non-organic loan balances increased to $117 million, or 22%, of the total loan portfolio as of December 31, 2018, compared to $101 million, or 19%, as of December 31, 2017. We continued our success of self-funding by increasing deposits to $574 million, or 5%, while maintaining a low cost of funds of 46 bps for 2018. We eliminated all borrowing balances by the end of December 31, 2018, including repurchase agreements, contrasting from a borrowing balance of $34 million as of December 31, 2017, in an effort to keep cost of funds low. | |  |

| | | |

Loans are presented on a gross basis. | |  Low-cost deposits include demand, savings and money market accounts. |

Elizabeth Canfield, Michelle Warwick, Gina Bayes, Tim Sims, John Acchione, and Scott Waskey pictured with former Pittsburgh Steeler, Heath Miller, and UVA’s championship men’s basketball coach, Tony Bennett, at Big Brothers Big Sisters of Central Virginia’s fundraiser |

Page 7

Investor Update

April 30, 2019

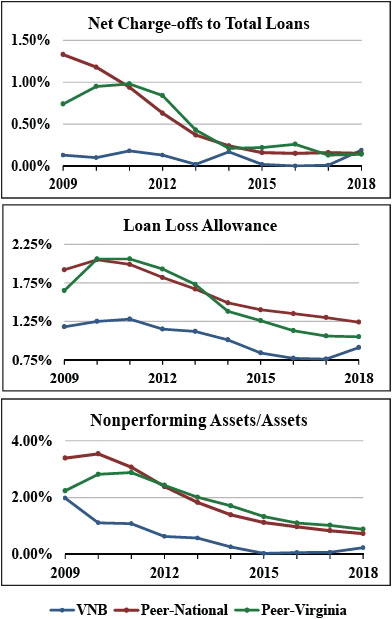

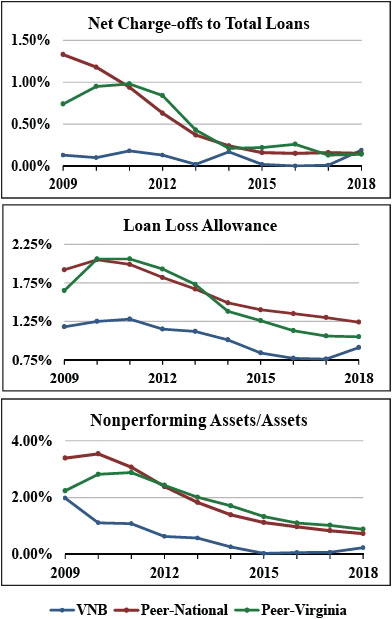

The Bank’s objective is to maintain the historically strong credit quality of the loan portfolio by maintaining rigorous underwriting standards. In June of 2018, the Bank was notified that the company which issued surety bonds on its student loan portfolio had been placed into liquidation due to insolvency. The surety bonds terminated one month later. Claims have been filed for loans that were 120 or more past due as of the termination date, and such loans were placed on non-accrual. Student loans that have or will become 120 days or more past due after the termination date are classified as charge-offs, which has increased our charge-offs to a level more in line with our peers. The loss of such surety bonds also negatively impacted our allowance for loan loss and nonperforming asset balances.

The Company fully anticipates that it will receive payment of over $400 thousand on claims made through the liquidation process. In addition, the Company has contracted with a third party to proactively manage the collections of past due student loans, which is fully ramped up; this third party has extensive experience and specializes in this type of asset management.

The credit quality of the remainder of the Bank’s loan portfolio remains strong. The Bank’s allowance for loan losses as a percentage of total assets of 0.91% compared favorably to its national and state peers whose allowance for loan losses averaged 1.29% and 1.05%, respectively, as of December 31, 2018.

Peer = All commercial banks with assets of $100 million to $1 billion

|

Downtown office staff: Marissa Welch, Maury Early, Virginia Dansey, Pat

Morris, and Kathryn Morris |

Page 8

Investor Update

April 30, 2019

During 2018, the Company completed the reorganization and new area buildout of its VNB Wealth lines of business. The Company formed Masonry Capital Management, LLC (“Masonry Capital”), a registered investment adviser (RIA), to allow the Company to offer its investment strategy to a wider range of clients. Also in 2018, the Company eliminated the VNBTrust charter and merged it into the Bank. The Company now has three distinct wealth management lines of business and four sources of revenue. The three business lines are:

| ● | Masonry Capital – investment management services for managed accounts employing a value-based, catalyst-driven investment strategy |

| ● | VNB Trust & Estate Services – investment management, wealth advisory and trust and estate administration services |

| ● | VNB Investment Services – investment advisory, brokerage, annuity and insurance services and products |

The four sources of revenue are:

| ● | Royalty and revenue sharing arrangement on both fixed and incentive fees |

| ● | Advisory and brokerage revenue from the investment services group |

| ● | Management and trust service fees which are derived from Assets Under Management (AUM) |

| ● | Incentive income which is based on the investment returns generated on performance-based AUM |

| VIRGINIA NATIONAL | | VIRGINIA NATIONAL BANK | | VIRGINIA NATIONAL BANK |

| BANKSHARES CORPORATION | | TRUST & ESTATE SERVICES | | INVESTMENT SERVICES |

| MASONRY CAPITAL | | | | |

| MANAGEMENT, LLC | | | | |

| |  | |  |

| Mark A. Meulenberg | | Wendy Watson Stone | | Todd Sturman, CFP, AIF |

| Chief Investment Officer | | Senior Fiduciary & Trust Officer | | Wealth Advisor |

Page 9

Investor Update

April 30, 2019

| CRITICAL ISSUES FOR FUTURE SUCCESS |

The top opportunities and challenges for the Company in 2019 are as follows:

| ● | VNB Wealth - Now that the reorganization is complete we must once again turn our attention to growing the customer base as well as acquiring other RIAs or individuals that will help increase profitability. Lastly, final negotiations with software vendors in 2019 will reduce non-interest expense. |

| ● | Loan Growth - We will continue recruiting talented commercial bankers in new markets and adjusting our loan terms to meet market demands. |

| ● | Acquisition Strategy - We are increasing the capacity of our infrastructure and technology division so that when an acquisition presents itself we are ready to handle the extra load. |

| ● | New Banking Platforms - In 2019 we will be implementing software to handle CECL, as well as moving our retail division to a mobile tablet servicing platform. Both of these major software changes are underway and will be fully deployed in 2019 and 2020. |

The Company has an unwavering commitment to delivering long-term value to our shareholders. We will continue to seek opportunities to reduce expenses, embrace technology, and create new ways to generate earnings. Our progress in 2018 demonstrates we are dedicated to these actions, and we are confident in our ability to thrive and prosper for years to come.

Your confidence and support are sincerely appreciated. Should you have any questions, please do not hesitate to call us at (434) 817-8649.

Sincerely,

|  |

| Glenn W. Rust | Tara Y. Harrison |

| President & Chief Executive Officer | Chief Financial Officer & Executive Vice President |

Forward-Looking Statements; Other Information:Statements in this letter which express or imply a view about the objectives and future performance of the Virginia National Bankshares Corporation are “forward-looking statements.” Such statements are often characterized by use of qualified words such as “expect,” “believe,” “estimate,” “project,” “anticipate,” “intend,” “will,” “should,” or words of similar meaning or other statements concerning the opinions or judgment of the Company and its management about future events. While Company management believes such statements to be reasonable, future events and predictions are subject to circumstances that are not within the control of the Company and its management, and actual events in the future may be substantially different from those expressed in this letter. The Company’s past results are not necessarily indicative of future performance. Factors that could cause future performance to differ from past performance or anticipated performance could include, but are not limited to, changes in national and local economies, employment or market conditions; changes in interest rates, deposits, loan demand and asset quality; competition; changes in banking regulations and accounting principles or guidelines; and performance of assets under management. These statements speak only as of the date made, and the Company does not undertake to update them to reflect changes or events that may occur later. Information based on other sources is believed by management of the Company to be reliable, but has not been independently verified. For more information about the Company’s 2018 performance, please refer to the Company’s audited consolidated financial statements in its Annual Report on Form 10-K for the year ended December 31, 2018 filed with the Securities and Exchange Commission on March 15, 2019.

Page 10

| Virginia National Bankshares | | VNB Trust & Estate Services | | VNB Wealth Management |

| Corporation Headquarters | | 112 Third Street, SE | | 404 People Place |

| 404 People Place | | Charlottesville, VA 22902 | | Charlottesville, VA 22911 |

| Charlottesville, VA 22911 | | | | |

| VIRGINIA NATIONAL BANK |

| BRANCH LOCATIONS |

| |  | |  |

| 29 North | | Pantops | | Barracks Road |

| 1580 Seminole Trail | | 404 People Place | | 1900 Arlington Boulevard |

| Charlottesville, VA 22901 | | Charlottesville, VA 22911 | | Charlottesville, VA 22903 |

| | | | | |

| | | | | |

| |  | |  |

| Downtown Mall | | Downtown Drive-Thru | | Creekside |

| 222 East Main Street | | 301 East Water Street | | 3119 Valley Avenue |

| Charlottesville, VA 22902 | | Charlottesville, VA 22902 | | Winchester, VA 22601 |

| VIRGINIA NATIONAL BANKSHARES CORPORATION |

| BOARD MEMBERS |

| Listed Alphabetically |

| |

| H.K. Benham, III |

| Not pictured |

| |  | |  |

| William D. Dittmar, Jr. | | Steven W. Blaine | | James T. Holland |

| Chairman | | | | |

|  |  |  |

| Linda M. Houston | Susan King Payne | Gregory L. Wells | Bryan D. Wright |

| VIRGINIA NATIONAL BANKSHARES CORPORATION |

| EXECUTIVE OFFICERS |

|

Donna S. Shewmake

General Counsel, Executive Vice President & Corporate Secretary | | Glenn W. Rust

President & Chief Executive Officer | | Tara Y. Harrison

Chief Financial Officer & Executive Vice President | | Virginia R. Bayes

Chief Credit Officer & Executive Vice President |

| | | | | |

| Glenn W. Rust | | Adam T. Perry | |

| President & Chief Executive Officer | | Chief Technology Officer | |

| | |

| Virginia R. Bayes | | Larry K. Pitchford | |

| Chief Credit Officer | | Human Resources Director | |

| | |

| Tara Y. Harrison | | Donna G. Shewmake | |

| Chief Financial Officer | | General Counsel | |

| | |

| Linda W. Hitchings | | Wendy Watson Stone | |

| Senior Lending Officer | | Senior Fiduciary & Trust Officer, | |

| | | VNB Trust & Estate Services | |

| Mark A. Meulenberg | | | |

| Chief Investment Officer, | | Alan R. Williams | |

| VNB Wealth Management | | Director of Retail Banking | |

| | | | | |

| VIRGINIA NATIONAL BANKSHARES CORPORATION |

ORGANIZATIONAL INFORMATION

Virginia National Bankshares Corporation (Company), headquartered in Charlottesville, Virginia, became a bank holding company in 2013 following reorganization of Virginia National Bank (Bank) into a holding company form of ownership. When the reorganization became effective on December 16, 2013, the Bank became the wholly-owned subsidiary of the Company. Investment management and trust services are offered under the trade name of VNB Wealth Management. For more information, visit www.vnbwealth.com.

Virginia National Bank offers a full range of banking and related financial services to locally owned businesses and individuals through its five banking offices located in Central Virginia and online at www.vnb.com. Four of the offices are located in Charlottesville/Albemarle County and one is located in Winchester. The Bank received its federal banking charter from the Office of the Comptroller of the Currency on July 29, 1998. Virginia National Bank is a member of the Federal Reserve System and is an Equal Housing Lender whose deposits are insured by the Federal Deposit Insurance Corporation.

SHAREHOLDER INFORMATION

The Company’s common stock is quoted on the OTC Market Group’s OTCQX marketplace under the symbol VABK. Analysts, investors, the press and others seeking financial information about Virginia National Bankshares Corporation should contact Tara Y. Harrison, Chief Financial Officer and Executive Vice President, (434) 817-8587, at the Corporate Offices located at 404 People Place, Charlottesville, Virginia 22911.

ANNUAL MEETING

The 2019 Virginia National Bankshares Corporation Annual Shareholders Meeting will be held at 10:00 a.m. EST, Friday, June 14, 2019 at the Omni Hotel Charlottesville, 212 Ridge McIntire Road, Charlottesville, Virginia 22903.

| INDEPENDENT AUDITORS |

| Yount, Hyde & Barbour, P.C. |

| 50 South Cameron Street |

| P.O. Box 2560 |

| Winchester, VA 22601 |

| (540) 662-3417 |

| www.yhbcpa.com |

| |

| REGISTRAR & TRANSFER AGENT |

| American Stock Transfer & Trust Co. |

| 6201 15th Avenue |

| Brooklyn, NY 11219 |

| (800) 937-5449 |

| www.astfinancial.com |

| |

| WEBSITE ADDRESSES |

| www.vnb.com |

| www.vnbwealth.com |

| www.vnbcorp.com |

VISION

Be the industry leading organization built on trust, collaboration and open communication.

MISSION

We have an unwavering commitment to invest in the long-term financial health and stability of individuals, businesses, and charitable organizations. We leverage individuality and knowledge to deliver caring and innovative solutions to our customers. We embrace diversity and provide growth and enrichment opportunities for customers, employees, and shareholders.

It’s all about people … and always will be.

WEBSITE:vnb.com |PHONE:877.817.8621 |FAX:434.817.8624

MAILING:Post Office Box 2853 | Charlottesville, VA 22902-2853

DELIVERIES:404 People Place | Charlottesville, VA 22911