SETTLEMENT AGREEMENT

This Settlement Agreement (hereinafter “Agreement”) dated September 30, 2019 is entered into by and between Southwest Capital Funding, Ltd. A Texas Limited Partnership (“Southwest”) and Greenway Technologies, Inc. f/k/a UMED Holdings Inc. (“Greenway”) (Southwest and Greenway are referred to individually as a “Party” and collectively herein as the “Parties”).

RECITALS:

WHEREAS, Southwest and Greenway are parties to a lawsuit pending in Hawaii, cause no. 16-1-0342, in the Circuit Court of the Third Circuit, State of Hawaii, styledSouthwest Capital Funding, Ltd. v. Mamaki Tea, Inc., et. al. (the “Lawsuit”).

WHEREAS, without admission, including liability, and to avoid the time, cost and uncertainty of continued litigation, Southwest and Greenway, for sufficient consideration, including the mutual covenants in this agreement, intend to fully and finally compromise and settle all claims between them to the date of this agreement, all as more particularly hereinafter8 provided.

NOW THEREFORE, for the consideration stated herein and the mutual promises and agreements set forth herein, the Parties hereby agree as follows:

A.SETTLEMENT

| 1. | The Parties agree to the entry of a Stipulated Judgment in the Lawsuit, with Southwest awarded judgment against Greenway in the amount of $740,000.00, in the form attached hereto as Exhibit A. |

| 2. | Greenway agrees to provide Southwest a Promissory Note in the amount of $525,000.00, providing for a three-year term, at 7.7% simple interest-only payable semi-annually, with interest due calculated on a 365-day year, default interest at 18%, with the principal amount due at maturity. A copy of the Promissory Note is attached hereto as Exhibit B. |

| 3. | Greenway agrees to issue and deliver to Southwest 1,000,000 shares of Rule 144 restricted Class A common stock valued at $0.05 per share ($50,000.00 – Income to Southwest/Expense to GWTI), such restrictive legend providing no longer than the statutory six (6) months restrictions. However, provided there is no default on the Promissory Note, Southwest agrees to not sell any stock for at least one year from the date of this Agreement. An event of default under this Settlement Agreement shall be created and exist in the event that Greenway no longer has any securities registered pursuant to Section 12(a) of the Securities Exchange Act of 1934, as amended. |

| 4. | Southwest agrees to not domesticate, abstract, execute, and/or otherwise attempt to enforce the Stipulated Judgment until such time as Greenway fails to make a payment on the Promissory Note as the same shall become due and payable, and Southwest gives written notice of such default to Greenway and/or their counsel, and such failure continues unremedied for five business days thereafter. In all events, Greenway is entitled to a credit against the Stipulated Judgment for any payment made towards the Promissory Note and a $50,000 credit for the stock delivered pursuant to paragraph 3. |

| SETTLEMENT AGREEMENT – Page 1 |

| 5. | Upon receipt of payment of all amounts due under the Promissory Note, Southwest agrees to release Greenway from all obligations arising under the Stipulated Judgment and to execute and deliver to Greenway a Release of Judgment. |

B.RELEASE

| 1. | For the consideration stated herein, and except for the Stipulated Judgment and the obligations undertaken by the parties in this Settlement Agreement and Promissory Note, Southwest, for itself, its officers, shareholders, directors, agents, assigns, successors, and representatives, hereby releases all claims of whatever nature, known or unknown, which it may have against Greenway, its officers, shareholders, directors, agents, assigns, successors, and representatives, which claims arise from occurrences to the date of this agreement, including without limitation, the suit described herein |

| 2. | For the consideration stated herein, Greenway for itself, its officers, shareholders, directors, agents, assigns, successors, and representatives, hereby releases all claims of whatever nature, known or unknown, which it may have against Southwest, its officers, shareholders, directors, agents, assigns, successors, and representatives, which claims arise from occurrences to the date of this agreement, including without limitation, the suit described herein. |

C.REPRESENTATIONS AND WARRANTIES

| 1. | As a material inducement to the Parties’ entry into this agreement, each Party unconditionally represents that at the signing of this agreement and delivery of any documents hereunder: |

| i. | such Party has the right and power to enter into this agreement; |

| ii. | this agreement and all other agreements delivered in connection with this agreement have been or will be duly executed by and delivered by such Party and are valid and binding agreements of such Party enforceable against such Party in accordance with their respective terms; |

| iii. | execution and delivery of this agreement and all other documents delivered in connection herewith will not conflict with or result in a breach of any of the terms, conditions, or provisions of or constitute a default under any other agreement or instrument to which such Party is a Party or by which such Party is bound or by any law, statute, regulation, rule, order, writ, injunction, or decree of any governmental instrumentality or court; |

| SETTLEMENT AGREEMENT – Page 2 |

| iv. | such Party, as such Party’s interest may appear, has complete and unrestricted power to sell, transfer, assign, and deliver to the other the interests and release under this and other documents delivered hereunder; and |

| v. | such Party is the owner and holder of all claims and causes of action released in paragraph 3 and has not previously assigned, in whole or in part (by operation of law or otherwise) any such claims or interests. |

| 2. | The Parties shall hold each other harmless and indemnify each of them and their officers, directors, shareholders, agents, assigns, heirs, successors, and representatives from liability and loss from, and the cost of defense (including without limitation, reasonable attorneys’ and accountants’ fees) of claims arising from breach, failure or falsity of representations and warranties in this agreement, or from the claims of third parties brought over one of the Parties against another. |

D.GENERAL CONDITIONS

| 1. | This agreement shall be governed and construed in accordance with the laws of the State of Texas, enforcement of which by suit on claims arising from breach, failure, or falsity of representations and warranties as provided for herein shall entitle the successful party to reasonable and necessary attorneys’ fees, and is payable and performable in Dallas County, Texas. |

| 2. | The obligations of the Parties under this agreement shall survive the execution and delivery of this agreement. |

| 3. | This agreement is binding on and inures to the benefit of the parties hereto and their respective heirs, successors, and assigns. |

| 4. | The Parties shall execute any additional documents that are reasonably necessary to effectuate or evidence the terms of this agreement. |

| 5. | The provisions of this Settlement Agreement comprise all the terms, conditions, agreements, and representations of the parties hereto respecting the subject matter of this Settlement Agreement which can be modified or amended only in writing signed by the parties. The Parties represent and acknowledge that each does not rely, has not relied upon, and expressly disclaims any reliance upon any representation by a party, written or oral, except as expressly set forth herein. |

| 6. | This agreement may be executed and evidenced in multiple counterparts. |

| SETTLEMENT AGREEMENT – Page 3 |

E.NOTICES

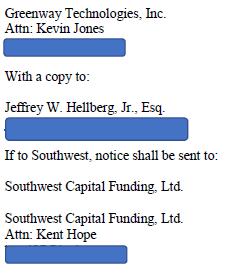

Any notice or payment required to be given under this agreement shall be made by electronic mail to the following addresses:

If to Greenway, notice shall be sent to:

SIGNED as of the date first noted above.

| Southwest Capital Funding, Ltd. | Greenway Technologies, Inc. f/k/a UMED Holdings Inc. | |||

| /s/ S. Kent Hope | /s/? Ransom B. Jones | |||

| By | S. Kent Hope | By | Ransom Jones | |

| Its: | Manager | Its: | Chief Financial Officer | |

| SETTLEMENT AGREEMENT – Page 4 |

EXHIBIT A TO SETTLEMENT AGREEMENT

[Stipulated Judgement approved as to form and when fully executed to be inserted here]

| Carlsmith Ball LLP | ||

Tom E. Roesser ASBTower, Suite 2100 1001 Bishop Street Honolulu, HI 96813 Tel No. 808.523.2500 Fax No. 808.523.0842

| 3241 | |

Katherine A. Garson 121 Waianuenue Avenue P.O. Box 686 Hilo, HI 96721-0686 Tel No. 808.935.6644 Fax No. 808.935.7975 | 5748 |

Attorneys for Plaintiff SOUTHWEST CAPITAL FUNDING, LTD. |

IN THE CIRCUIT COURT OF THE THIRD CIRCUIT

STATE OF HAWAI’I

SOUTHWEST CAPITAL FUNDING, LTD., a Texas limited partnership,

Plaintiff,

vs.

MAMAKI TEA, INC., a Nevada corporation, MAMAKI OF HAWAII, INC., a Nevada corporation, TIMOTHY ANDREW BENKO a.k.a. TIMOTHY A. BENKO, MARY ROBERTA CAPONE a.k.a. MARY R. CAPONE a.k.a. MARY T. CAPONE, BANK OF AMERICA, N.A., a national association, ROBERT R. ROMER, JOE LACOSTE, CURT BORMAN, UMED HOLDINGS, INC., a Texas corporation, and DOE INDIVIDUALS 1-50, and DOE ENTITIES 1-50, | CIVIL NO. 16-1-0342 (Foreclosure)

STIPULATED JUDGMENT; ORDER

No Trial Date Set

[caption continued on next page] |

Defendants.

| |

MAMAKI TEA, INC., a Nevada corporation; MAMAKI TEA OF HAWAII, INC., a Nevada corporation, and CURT BORMAN,

Counterclaimants and Crossclaimants,

vs.

SOUTHWEST CAPITAL FUNDING, LTD., and UMED HOLDINGS, INC.,

Counterclaim Defendants and Crossclaim Defendants.

| |

MAMAKI TEA, INC., a Nevada corporation, MAMAKI OF HAWAII, INC., a Nevada corporation and CURT BORMAN,

Third-Party Plaintiffs,

vs.

TERRY BRAUDRICK and TERRY CHESNUT aka TERRY CHESTNUT,

Third-Party Defendants.

| |

TERRY BRAUDRICK,

Third-Party Defendant/ Counterclaimant/Third-Party Plaintiff,

vs.

MAMAKI TEA, INC., a Nevada corporation, MAMAKI OF HAWAII, INC., a Nevada corporation, and CURT BORMAN,

Counterclaim Defendants,

and

MAMAKI TEA & EXTRACT, INC., a Nevada corporation, HAWAII BEVERAGES, INC., a Nevada corporation and DOES 1-100,

Third-Party Defendants.

|

STIPULATED JUDGMENT

IT IS HEREBY STIPULATED by and between Plaintiff SOUTHWEST CAPITAL FUNDING, LTD. (“Southwest”) and Defendant UMED HOLDINGS, INC. in Civil No. 16-1-0342, and pursuant to Hawai’i Rules of Civil Procedure Rule 54, that final judgment be entered against Defendant UMED HOLDINGS, INC. as follows:

1. Judgment is entered in favor of Southwest and against Defendant UMED Holdings, Inc., now known as Greenway Technologies, Inc., in the amount of SEVEN HUNDRED FORTY THOUSAND AND NO/100 DOLLARS ($740,000.00) (the “Judgment Amount”).

2. Southwest is also awarded post-judgment interest on the Judgment Amount at the statutory rate of ten percent (10%) per annum from and after the date of the Court’s approval and entry of this Final Judgment.

3. This Court shall retain jurisdiction in this matter to resolve any dispute arising from this Stipulated Judgment, and shall have the discretion to award reasonable attorneys’ fees and costs against the non-prevailing party in any such dispute.

4. This Stipulated Judgment may be executed in counterparts, each of which constitutes an original and all of which constitute one and the same agreement.

DATED: Hilo, Hawai’i, _________________________.

TOM E. ROESSER KATHERINE A. GARSON | |

Attorneys for Plaintiff SOUTHWEST CAPITAL FUNDING, LTD. | |

Attorneys for Defendant Greenway Technologies, Inc. f/k/a UMED Holdings, Inc. |

APPROVED AND SO ORDERED:

JUDGE OF THE ABOVE-ENTITLED COURT

SOUTHWEST CAPITAL FUNDING, LTD. v. MAMAKI TEA, INC., et al., Civil No. 16-1-0342, Circuit Court of the Third Circuit, STIPULATED JUDGMENT; ORDER

| 2 |

EXHIBIT B TO SETTLEMENT AGREEMENT

[Promissory Note approved as to form and when fully executed to be inserted here]

PROMISSORY NOTE

$525,000.00

| STATE OF TEXAS | § | |

| § | ||

| COUNTY OF DALLAS | § |

September 26, 2019

FOR VALUE RECEIVED, the undersigned,Greenway Technologies, Inc. f/k/a UMED Holdings Inc. (“Maker”), unconditionally promises to pay to the order ofSouthwest Capital Funding, Ltd. (“Holder”) the principal sum of Five Hundred and Twenty Five Thousand Dollars ($525,000.00), with interest at the rate of 7.7% per annum (calculated on the basis of a 365 day year) on the unpaid principal balance (the “Applicable Rate”). Principal and interest under this note (the “Note”) are due and payable as follows:

Semi-annual payments of accrued interest shall be due and payable on February 15 and August 15 of each year, with the first such installment due on February 15, 2020. All principal and any accrued and unpaid interest shall be due and payable on August 15, 2022 (the “Maturity Date”)

At the option of the holder of this Note, the entire principal balance and accrued interest owing hereon shall at once become due and payable, without notice or demand, upon the occurrence at any time of any of the following events (“Events of Default”):

| (1) | failure to make prompt payment of any interest hereon when due; | |

| (2) | the termination, dissolution or cessation of the business, or | |

| (3) | the bankruptcy or insolvency of, the assignment for the benefit of creditors by, or an appointment of a receiver for, any of the property of any party liable for the payment hereof, whether as maker, endorser, guarantor, surety or otherwise. |

The failure to exercise the option to accelerate the maturity hereof upon the happening of any one or more of the Events of Default specified herein shall not constitute a waiver of the right of the holder hereof to exercise the same or any other option at that time or at any subsequent time with respect to such uncured default or any other event of uncured default hereunder or under any instrument securing, governing or evidencing the loan evidenced hereby. The remedies of the holder hereof, as provided herein and in any instrument securing, governing or evidencing the loan evidenced hereby, shall be cumulative and concurrent and may be pursued separately, successively or together, as often as occasion therefor shall arise, at the sole discretion of the holder hereof. The acceptance by the holder hereof of any payment hereon which is less than payment in full of all amounts due and payable at the time of such payment shall not constitute a waiver of the rights of the holder hereof to exercise the foregoing option or any other option granted to the holder hereof in this Note or in any other instrument securing, governing or evidencing the loan evidenced hereby, at that time or at any subsequent time, or nullify any prior exercise of any such option.

After an Event of Default or after the maturity hereof, the principal hereof and past-due interest hereon shall bear interest at eighteen percent (18%) per annum.

Except as otherwise expressly provided herein, the undersigned and all other parties now or hereafter liable for the payment hereof, whether as endorser, guarantor, surety, or otherwise, severally waive demand, presentment, notice of dishonor, notice of intention to accelerate the indebtedness evidenced hereby, notice of the acceleration of the indebtedness evidenced hereby, diligence in collecting, grace, notice and protest, and consent to all extensions which from time to time may be granted by the holder hereof and to all partial payments hereon, whether before or after the maturity hereof.

If this Note is not paid when due, whether at the maturity hereof or by acceleration, or if this Note is collected through a bankruptcy, probate or other court, whether before or after the maturity hereof, the undersigned agrees to pay all costs of collection, including but not limited to reasonable attorneys’ fees, incurred by the holder hereof.

All agreements between the undersigned and the holder hereof, whether now existing or hereafter arising and whether written or oral, are hereby limited so that in no contingency, whether by reason of acceleration of the maturity hereof or otherwise, shall the interest contracted for, charged, received, paid or agreed to be paid to the holder hereof, exceed the maximum amount permissible under applicable law. If, from any circumstance whatsoever, interest would otherwise be payable to the holder hereof in excess of the maximum lawful amount, the interest payable to the holder hereof shall be reduced to the maximum amount permitted under applicable law; and if from any circumstance the holder hereof shall ever receive anything of value deemed interest by applicable law in excess of the maximum lawful amount, an amount equal to any excessive interest shall be applied to the reduction of the principal hereof and not to the payment of interest, or if such excessive interest exceeds the unpaid balance of principal hereof, such excess shall be refunded to the undersigned. All interest paid or agreed to be paid to the holder hereof shall, to the extent permitted by applicable law, be amortized, prorated, allocated, and spread throughout the full period until payment in full of the principal so that the interest hereon for such full period shall not exceed the maximum amount permitted by applicable law. This paragraph shall control all agreements between the undersigned and the holder hereof.

This Note may be prepaid, in whole or in part, at any time and from time to time, without premium, penalty, or notice. Except as otherwise specified herein, any prepayment hereon shall be applied first to accrued interest then due hereon and next to the last maturing installment of principal due hereunder.

Any notice or other communication required or permitted hereby, or convenient to the holder, shall be deemed delivered when deposited (a) in a receptacle of the United States Postal Service, as registered or certified mail, return receipt requested, postage prepaid, or (b) with an expedited courier service, fees prepaid and addressed to the undersigned at its address.

All obligations, covenants, and terms of payment are expressly performable solely in Dallas County, Texas. The substantive laws of the State of Texas shall govern the validity, construction, enforcement, and interpretation of this Note. In the event of a dispute involving this Note, the undersigned irrevocably agrees that venue for such dispute shall lie in any court of competent jurisdiction in Dallas County, Texas.

Executed the date first above written.

| Maker: | |

| Greenway Technologies, Inc. | |

| f/k/a UMED Holdings Inc. |

| /s/ Ransom B. Jones | ||

| By: | Ransom Jones | |

| Its: | Chief Financial Officer | |