Free Writing Prospectus Filed Pursuant to Rule 433

File No. 333-177891-04

Free Writing Prospectus

Structural and Collateral Term Sheet

$876,739,752

(Approximate Aggregate Cut-off Date Balance of Mortgage Pool)

$710,778,000

(Approximate Aggregate Principal Balance of Offered Certificates)

WFRBS Commercial Mortgage Trust 2013-C13

as Issuing Entity

RBS Commercial Funding Inc.

as Depositor

Wells Fargo Bank, National Association

The Royal Bank of Scotland

Liberty Island Group I LLC

NCB, FSB

Basis Real Estate Capital II, LLC

C-III Commercial Mortgage LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2013-C13

April 12, 2013

| | |

| RBS | | WELLS FARGO SECURITIES |

Co-Lead Manager and Co-Bookrunner | | Co-Lead Manager and Co-Bookrunner |

Citigroup

Co-Manager

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-177891) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-866-884-2071 (8 a.m. – 5 p.m. EST) or by emailing rbscmbs@rbs.com.

Nothing in this document constitutes an offer to sell or a solicitation to buy securities in any jurisdiction where such offer, solicitation or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of RBS Securities Inc. (“RBSSI”), Wells Fargo Securities, LLC (“WFS”), Citigroup Global Markets Inc. or any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

RBS is a trade name for the investment banking business of RBSSI. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by RBSSI and their securities affiliates. Lending, derivatives and other commercial banking activities are performed by The Royal Bank of Scotland plc and their banking affiliates. RBSSI is a member of SIPC, FINRA and the NYSE.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including Wells Fargo Securities, LLC, a member of FINRA, NYSE, NFA and SIPC, Wells Fargo Institutional Securities, LLC, a member of FINRA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC and Wells Fargo Bank, N.A.

IRS CIRCULAR 230 NOTICE

THIS TERM SHEET IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, FOR THE PURPOSE OF AVOIDING U.S. FEDERAL, STATE OR LOCAL TAX PENALTIES. THIS TERM SHEET IS WRITTEN AND PROVIDED BY THE DEPOSITOR IN CONNECTION WITH THE PROMOTION OR MARKETING BY THE DEPOSITOR AND THE CO-LEAD BOOKRUNNING MANAGERS OF THE TRANSACTION OR MATTERS ADDRESSED HEREIN. INVESTORS SHOULD SEEK ADVICE BASED ON THEIR PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The offered certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. Prospective investors should understand that, when considering the purchase of the offered certificates, a contract of sale will come into being no sooner than the date on which the relevant class of certificates has been priced and the underwriters have confirmed the allocation of certificates to be made to investors; any “indications of interest” expressed by any prospective investor, and any “soft circles” generated by the underwriters, will not create binding contractual obligations for such prospective investors, on the one hand, or the underwriters, the depositor or any of their respective agents or affiliates, on the other hand.

As a result of the foregoing, a prospective investor may commit to purchase certificates that have characteristics that may change, and each prospective investor is advised that all or a portion of the certificates referred to in these materials may be issued that differ from the characteristics described in these materials. The underwriters’ obligation to sell certificates to any prospective investor is conditioned on the certificates and the transaction having the characteristics described in these materials. If the underwriters determine that a condition is not satisfied in any material respect, such prospective investor will be notified, and neither the depositor nor the underwriters will have any obligation to such prospective investor to deliver any portion of the offered certificates which such prospective investor has committed to purchase, and there will be no liability between the underwriters, the depositor or any of their respective agents or affiliates, on the one hand, and such prospective investor, on the other hand, as a consequence of the non-delivery.

Each prospective investor has requested that the underwriters provide to such prospective investor information in connection with such prospective investor’s consideration of the purchase of the certificates described in these materials. These materials are being provided to each prospective investor for informative purposes only in response to such prospective investor’s specific request. The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of, or attached to, any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

| | |

| WFRBS Commercial Mortgage Trust 2013-C13 | | Issue Characteristics |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class | | Expected Ratings (Fitch/Moody’s)(1) | | Approximate

Initial Certificate

Principal Balance

or Notional

Amount(2) | | | Approx.

Initial Credit

Support(3) | | | Pass-Through

Rate

Description | | | Weighted

Average

Life

(Years)(4) | | | Expected

Principal

Window(4) | | | Certificate

Principal to

Value Ratio(5) | | | Certificate

Principal

U/W NOI

Debt Yield(6) | |

| | Offered Certificates | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A-1 | | AAA(sf)/Aaa(sf) | | $ | 56,222,000 | | | | 30.000 | % | | | | (7) | | | 2.66 | | | | 06/13 – 03/18 | | | | 31.0 | % | | | 19.4 | % |

A-2 | | AAA(sf)/Aaa(sf) | | $ | 79,549,000 | | | | 30.000 | % | | | | (7) | | | 4.86 | | | | 03/18 – 04/18 | | | | 31.0 | % | | | 19.4 | % |

A-3 | | AAA(sf)/Aaa(sf) | | $ | 125,000,000 | | | | 30.000 | % | | | | (7) | | | 9.85 | | | | 02/23 – 03/23 | | | | 31.0 | % | | | 19.4 | % |

A-4 | | AAA(sf)/Aaa(sf) | | $ | 206,479,000 | | | | 30.000 | % | | | | (7) | | | 9.93 | | | | 03/23 – 04/23 | | | | 31.0 | % | | | 19.4 | % |

A-SB | | AAA(sf)/Aaa(sf) | | $ | 71,467,000 | | | | 30.000 | % | | | | (7) | | | 7.43 | | | | 04/18 – 02/23 | | | | 31.0 | % | | | 19.4 | % |

A-S | | AAA(sf)/Aaa(sf) | | $ | 90,962,000 | | | | 19.625 | % | | | | (7) | | | 9.93 | | | | 04/23 – 04/23 | | | | 35.6 | % | | | 16.9 | % |

B | | AA-(sf)/Aa3(sf) | | $ | 51,509,000 | | | | 13.750 | % | | | | (7) | | | 9.98 | | | | 04/23 – 05/23 | | | | 38.2 | % | | | 15.7 | % |

C | | A-(sf)/A3(sf) | | $ | 29,590,000 | | | | 10.375 | % | | | | (7) | | | 10.02 | | | | 05/23 – 05/23 | | | | 39.7 | % | | | 15.1 | % |

| | | | | | | | |

| | Non-Offered Certificates | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

A-3FL(8) | | AAA(sf)/Aaa(sf)(9) | | $ | 75,000,000 | (8) | | | 30.000 | % | | | Libor Plus | (10) | | | 9.85 | | | | 02/23 – 03/23 | | | | 31.0 | % | | | 19.4 | % |

A-3FX(8) | | AAA(sf)/Aaa(sf) | | $ | 0 | (8) | | | 30.000 | % | | | | (7) | | | 9.85 | | | | 02/23 – 03/23 | | | | 31.0 | % | | | 19.4 | % |

X-A | | AAA(sf)/Aaa(sf) | | $ | 704,679,000 | (11) | | | N/A | | | | Variable | (12) | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

X-B | | A-(sf)/A2(sf) | | $ | 81,099,000 | (13) | | | N/A | | | | Variable | (14) | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

X-C | | NR/NR | | $ | 42,741,751 | (15) | | | N/A | | | | Variable | (16) | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

D | | BBB-(sf)/Baa3(sf) | | $ | 32,877,000 | | | | 6.625 | % | | | | (7) | | | 10.02 | | | | 05/23 – 05/23 | | | | 41.3 | % | | | 14.5 | % |

E | | BB(sf)/Ba2(sf) | | $ | 15,343,000 | | | | 4.875 | % | | | | (7) | | | 10.02 | | | | 05/23 – 05/23 | | | | 42.1 | % | | | 14.3 | % |

F | | B(sf)/B2(sf) | | $ | 16,439,000 | | | | 3.000 | % | | | | (7) | | | 10.02 | | | | 05/23 – 05/23 | | | | 42.9 | % | | | 14.0 | % |

G | | NR/NR | | $ | 26,302,751 | | | | 0.000 | % | | | | (7) | | | 10.02 | | | | 05/23 – 05/23 | | | | 44.2 | % | | | 13.6 | % |

Notes:

| (1) | The expected ratings presented are those of Fitch, Inc. (“Fitch”), and Moody’s Investors Service, Inc. (“Moody’s”), which the depositor hired to rate the rated offered certificates. One or more other nationally recognized statistical ratings organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act or otherwise to rate or provide market reports and/or published commentary related to the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the offered certificates. See “Risk Factors – Risks Related to the Offered Certificates – Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May be Downgraded” in the free writing prospectus, dated April 12, 2013 (the “Free Writing Prospectus”). |

| (2) | The principal balances and notional amounts set forth in the table are approximate. The actual initial principal balances and notional amounts may be larger or smaller depending on the aggregate cut-off date principal balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date principal balance may be as much as 5% larger or smaller than the amount presented in the Free Writing Prospectus. |

| (3) | The approximate initial credit support with respect to the Class A-1, A-2, A-3, A-3FL, A-3FX, A-4 and A-SB Certificates represents the approximate credit enhancement for the Class A-1, A-2, A-3, A-3FL, A-3FX, A-4 and A-SB Certificates in the aggregate. No class of Certificates will provide any credit support to the Class A-3FL Certificates for any failure by the swap counterparty to make the payment under the related swap contract. |

| (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described on Annex D to the Free Writing Prospectus. |

| (5) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2, A-3, A-3FL, A-3FX, A-4, A-SB, X-A, X-B and X-C Certificates) is calculated by dividing the aggregate principal balance of such class of certificates and all classes of certificates (other than Class X-A, X-B and X-C Certificates) senior to such class by the aggregate appraised value of $1,981,663,318 (calculated as described in the Free Writing Prospectus) of the mortgaged properties securing the mortgage loans (excluding, with respect to the 301 South College Street loan combination, a pro rata portion of the related appraised value allocated to the related companion loan based on its cut-off date principal balance). The Certificate Principal to Value Ratios for each of the Class A-1, A-2, A-3, A-3FL, A-3FX, A-4 and A-SB Certificates are calculated by dividing the aggregate principal balance of the Class A-1, A-2, A-3, A-3FL, A-3FX, A-4 and A-SB Certificates by such aggregate appraised value (excluding, with respect to the 301 South College Street loan combination, a pro rata portion of the related appraised value allocated to the related companion loan based on its cut-off date principal balance). However, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan (unless such mortgage loans are cross-collateralized and the cross-collateralization remains in effect). |

| (6) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2, A-3, A-3FL, A-3FX, A-4, A-SB, X-A, X-B and X-C Certificates) is calculated by dividing the underwritten net operating income (which excludes, with respect to the 301 South College Street loan combination, a pro rata portion of the related underwritten net operating income allocated to the related companion loan based on its cut-off date principal balance) for the mortgage pool of $118,877,341 (calculated as described in the Free Writing Prospectus) by the aggregate principal balance of such class of certificates and all classes of certificates (other than Class X-A, X-B and X-C Certificates) senior to such class of certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-2, A-3, A-3FL, A-3FX, A-4 and A-SB Certificates is calculated by dividing such mortgage pool underwritten net operating income (which excludes, with respect to the 301 South College Street loan combination, a pro rata portion of the related underwritten net operating income allocated to the related companion loan based on its cut-off date principal balance) by the aggregate principal balance of the Class A-1, A-2, A-3, A-3FL, A-3FX, A-4 and A-SB Certificates. However, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan (unless such mortgage loans are cross-collateralized and the cross-collateralization remains in effect). |

| (7) | The pass-through rates for the Class A-1, A-2, A-3, A-3FX, A-4, A-SB, A-S, B, C, D, E, F and G Certificates and the Class A-3FX Regular Interest in each case will be one of the following: (i) a fixed rate per annum, (ii) the WAC Rate (as defined in the Free Writing Prospectus) for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the WAC Rate for the related distribution date or (iv) a variable rate per annum equal to the WAC Rate for the related distribution date minus a specified percentage. |

| (8) | The Class A-3FL Certificates will evidence a beneficial interest in a grantor trust that includes the Class A-3FX Regular Interest and an interest rate swap contract. Under certain circumstances, holders of the Class A-3FL Certificates may exchange all or a portion of their certificates for a like principal amount of Class A-3FX Certificates having the same pass-through rate as the Class A-3FX Regular Interest. The aggregate principal balance of the Class A-3FL Certificates may be adjusted from time to time as a result of such an exchange. The aggregate principal balance of the Class A-3FX Certificates and Class A-3FL Certificates will at all times equal the principal balance of the Class A-3FX Regular Interest. The principal balance of the Class A-3FX Certificates will initially be $0. |

| (9) | The ratings assigned to the Class A-3FL Certificates reflect only the receipt of interest up to the fixed rate of interest at a rate equal to the applicable pass-through rate for the Class A-3FX Regular Interest. The ratings of Fitch, Inc. and Moody’s Investors Service, Inc. do not address any shortfalls or delays in payment that investors in the Class A-3FL Certificates may experience as a result of the conversion of the pass-through rate on the Class A-3FX Regular |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| | |

| WFRBS Commercial Mortgage Trust 2013-C13 | | Issue Characteristics |

| | Interest from a fixed interest rate to a floating interest rate. |

| (10) | The pass-through rate on the Class A-3FL Certificates will be a perannumrate equal to LIBOR plus a specified percentage; provided, however, that under certain circumstances, the pass-through rate on the Class A-3FL Certificates may convert to the pass-through rate applicable to the Class A-3FX Regular Interest. The initial LIBOR rate will be determined two LIBOR business days prior to the Closing Date, and subsequent LIBOR rates for the Class A-3FL Certificates will be determined two LIBOR business days before the start of the related interest accrual period. |

| (11) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate principal balance of the Class A-1, A-2, A-3, A-4, A-SB and A-S Certificates and the Class A-3FX Regular Interest outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. |

| (12) | The pass-through rate for the Class X-A Certificates for any distribution date will be a perannumrate equal to the excess, if any, of (a) the WAC Rate for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2, A-3, A-4, A-SB and A-S Certificates and the Class A- 3FX Regular Interest for the related distribution date, weighted on the basis of their respective aggregate principal balances outstanding immediately prior to that distribution date. |

| (13) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate principal balance of the Class B and C Certificates outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. |

| (14) | The pass-through rate for the Class X-B Certificates for any distribution date will be a perannumrate equal to the excess, if any, of (a) the WAC Rate for the related distribution date, over (b) the weighted average of the pass-through rates on the Class B and C Certificates for the related distribution date, weighted on the basis of their respective aggregate principal balances outstanding immediately prior to that distribution date. |

| (15) | The Class X-C Certificates are notional amount certificates. The Notional Amount of the Class X-C Certificates will be equal to the aggregate principal balance of the Class F and G Certificates outstanding from time to time. The Class X-C Certificates will not be entitled to distributions of principal. |

| (16) | The pass-through rate for the Class X-C Certificates for any distribution date will be a perannumrate equal to the excess, if any, of (a) the WAC Rate for the related distribution date, over (b) the weighted average of the pass-through rates on the Class F and G Certificates for the related distribution date, weighted on the basis of their respective aggregate principal balances outstanding immediately prior to that distribution date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| | |

| WFRBS Commercial Mortgage Trust 2013-C13 | | Issue Characteristics |

| II. | Transaction Highlights |

Mortgage Loan Sellers:

| | | | | | | | | | | | | | | | |

Mortgage Loan Seller | | Number of

Mortgage

Loans | | | Number of

Mortgaged

Properties | | | Aggregate Cut-off

Date Balance | | | % of Cut-off

Date Pool

Balance | |

Wells Fargo Bank, National Association | | | 37 | | | | 53 | | | $ | 533,017,079 | | | | 60.8 | % |

The Royal Bank of Scotland(1) | | | 10 | | | | 10 | | | | 121,327,252 | | | | 13.8 | |

Liberty Island Group I LLC | | | 8 | | | | 8 | | | | 79,693,825 | | | | 9.1 | |

NCB, FSB | | | 21 | | | | 21 | | | | 60,560,290 | | | | 6.9 | |

Basis Real Estate Capital II, LLC | �� | | 8 | | | | 8 | | | | 43,252,366 | | | | 4.9 | |

C-III Commercial Mortgage LLC | | | 11 | | | | 13 | | | | 38,888,939 | | | | 4.4 | |

| | | | | | | | | | | | | | | | |

Total | | | 95 | | | | 113 | | | $ | 876,739,752 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | |

| (1) | The mortgage loan seller referred to herein as The Royal Bank of Scotland is comprised of two affiliated companies: The Royal Bank of Scotland plc and RBS Financial Products Inc. With respect to the mortgage loans being sold for deposit into the trust by The Royal Bank of Scotland: (a) 9 mortgage loans, having an aggregate cut-off date principal balance of $112,327,252 and representing approximately 12.8% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, were originated, and are being sold to the issuing entity, only by The Royal Bank of Scotland plc, and (b) 1 mortgage loan, having an aggregate cut-off date principal balance of $9,000,000 and representing approximately 1.0% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, was originated, and is being sold to the issuing entity, only by RBS Financial Products Inc. |

Loan Pool:

| | | | |

Cut-off Date Balance: | | $ | 876,739,752 | |

Number of Mortgage Loans: | | | 95 | |

Average Cut-off Date Balance per Mortgage Loan: | | $ | 9,228,839 | |

Number of Mortgaged Properties: | | | 113 | |

Average Cut-off Date Balance per Mortgaged Property(1): | | $ | 7,758,759 | |

Weighted Average Mortgage Interest Rate: | | | 4.179 | % |

Ten Largest Mortgage Loans as % of Cut-off Date Pool Balance: | | | 44.7 | % |

Weighted Average Original Term to Maturity or ARD (months): | | | 114 | |

Weighted Average Remaining Term to Maturity or ARD (months): | | | 113 | |

Weighted Average Original Amortization Term (months)(2): | | | 345 | |

Weighted Average Remaining Amortization Term (months)(2): | | | 345 | |

Weighted Average Seasoning (months): | | | 1 | |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| | | | |

Weighted Average U/W Net Cash Flow DSCR(1): | | | 2.34x | |

Weighted Average U/W Net Operating Income Debt Yield Ratio(1): | | | 13.5 | % |

Weighted Average Cut-off Date Loan-to-Value Ratio(1): | | | 59.1 | % |

Weighted Average Balloon or ARD Loan-to-Value Ratio(1): | | | 49.8 | % |

% of Mortgage Loans with Additional Subordinate Debt(2): | | | 5.8 | % |

% of Mortgage Loans with Single Tenants(3): | | | 8.6 | % |

| (1) | With respect to 301 South College Street, loan-to-value ratio, debt service coverage ratio, debt yield and cut-off date balance per square foot calculations include the relatedpari passucompanion loan (unless otherwise stated) in total debt. The information for each mortgaged property that relates to a mortgage loan that is cross-collateralized with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio, debt yield or cut-off date balance per square foot for each such mortgaged property is based upon the ratio, yield or balance (as applicable) for the aggregate indebtedness evidenced by all loans in the group. On an individual basis, without regard to the cross-collateralization feature, any mortgaged property securing a mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. Information for each residential cooperative mortgage loan is calculated using underwritten net cash flow for the related residential cooperative property which is the projected net cash flow reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to value ratio information for each residential cooperative mortgage loan is based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative. See Annex A to the Free Writing Prospectus. Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. |

| (2) | Seventeen (17) of the mortgage loans, each of which are secured by residential cooperative properties, currently have in place subordinate secured lines of credit to the related mortgage borrowers that permit future advances (such loans, collectively, the “Subordinate Coop LOCs”). The percentage figure expressed as “% of Mortgage loans with Additional Subordinate Debt” is determined as a percentage of cut-off date principal balance and does not take into account future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the Pooling and Servicing Agreement. See “Description of the Mortgage Pool – Subordinate and/or Other Financing” and “ – Additional Debt Financing for Mortgage Loans Secured by Residential Cooperatives” in the Free Writing Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single-tenant properties with different tenants at such properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

| | |

| WFRBS Commercial Mortgage Trust 2013-C13 | | Issue Characteristics |

Loan Structural Features:

Amortization:Based on the Cut-off Date Pool Balance, 86.2% of the mortgage pool (87 mortgage loans) has scheduled amortization, as follows:

54.1% (73 mortgage loans) requires amortization during the entire loan term

32.0% (13 mortgage loans) provides for an interest-only period followed by an amortization period

0.7% (1 mortgage loan) requires amortization during the entire loan initial term followed by hyper-amortization thereafter

Interest-Only: Based on the Cut-off Date Pool Balance, 13.8% of the mortgage pool (8 mortgage loans) provides for interest-only payments during the entire loan term. The Weighted Average Cut-off Date Loan-to-Value Ratio and Weighted Average U/W Net Cash Flow DSCR for those mortgage loans is 46.8% and 4.46x, respectively.

Hard Lockboxes: Based on the Cut-off Date Pool Balance, 37.1% of the mortgage pool (17 mortgage loans) has hard lockboxes in place.

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| | | | |

Real Estate Taxes: | | | 82.0 | % of the pool |

Insurance Premiums: | | | 41.5 | % of the pool |

Capital Replacements: | | | 79.0 | % of the pool |

TI/LC: | | | 55.4 | % of the pool(1) |

| (1) | The percentage of Cut-off Date Balance for loans with TI/LC reserves is based on the aggregate principal balance allocable to office, retail, mixed use and industrial properties. |

Call Protection/Defeasance: Based on the Cut-off Date Pool Balance, the mortgage pool has the following call protection and defeasance features:

74.2% of the mortgage pool (67 mortgage loans) features a lockout period, then defeasance only until an open period

9.7% of the mortgage pool (1 mortgage loan) features a lockout period, then defeasance or the greater of a prepayment premium or yield maintenance until an open period

9.2% of the mortgage pool (6 mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance until an open period

6.9% of the mortgage pool (21 mortgage loans) features no lockout period, but requires the greater of a prepayment premium or yield maintenance for a period, then a prepayment premium until an open period

Please refer to Annex A to the Free Writing Prospectus for further description of individual loan call protection.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

| | |

| WFRBS Commercial Mortgage Trust 2013-C13 | | Issue Characteristics |

| | | | |

III. | | Issue Characteristics | | |

| | |

| | Securities Offered: | | $710,778,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of eight classes (Classes A-1, A-2, A-3, A-4, A-SB, A-S, B and C), which are offered pursuant to a registration statement filed with the SEC. |

| | |

| | Mortgage Loan Sellers: | | Wells Fargo Bank, National Association (“WFB”); The Royal Bank of Scotland (“RBS”); Liberty Island Group I LLC (“LIG I”); NCB, FSB; Basis Real Estate Capital II, LLC (“Basis”) and C-III Commercial Mortgage LLC (“CIIICM”) |

| | |

| | Co-lead Bookrunning Managers: | | RBS Securities Inc. and Wells Fargo Securities, LLC |

| | |

| | Co-Manager: | | Citigroup Global Markets Inc. |

| | |

| | Rating Agencies: | | Fitch, Inc. and Moody’s Investors Service, Inc. |

| | |

| | Master Servicers: | | Wells Fargo Bank, National Association and NCB, FSB |

| | |

| | Special Servicers: | | LNR Partners, LLC and NCB, FSB |

| | |

| | Certificate Administrator: | | Wells Fargo Bank, National Association |

| | |

| | Trustee: | | U.S. Bank National Association |

| | |

| | Trust Advisor: | | Trimont Real Estate Advisors, Inc. |

| | |

| | Cut-off Date: | | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in May 2013 (or, in the case of any mortgage loan that has its first due date in June 2013, the date that would have been its due date in May 2013 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| | |

| | Expected Closing Date: | | On or about May 9, 2013. |

| | |

| | Determination Dates: | | The 11th day of each month (or if that day is not a business day, the next succeeding business day), commencing in June 2013. |

| | |

| | Distribution Dates: | | The fourth business day following the Determination Date in each month, commencing in June 2013. |

| | |

| | Rated Final Distribution Date: | | The Distribution Date in May 2045. |

| | |

| | Interest Accrual Period: | | With respect to any Distribution Date, the calendar month preceding the month in which such Distribution Date occurs. |

| | |

| | Day Count: | | The Offered Certificates will accrue interest on a 30/360 basis. |

| | |

| | Minimum Denominations: | | $10,000 for each Class of Offered Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

| | |

| | Clean-up Call: | | 1% |

| | |

| | Delivery: | | DTC, Euroclear and Clearstream Banking |

| | |

| | ERISA/SMMEA Status: | | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. |

| | |

| | Risk Factors: | | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE FREE WRITING PROSPECTUS. |

| | |

| | Bond Analytics Information: | | The Certificate Administrator will be authorized to make distribution date settlements, CREFC reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg Financial Markets L.P., Trepp LLC, Intex Solutions, Inc., Markit Group Limited, Interactive Data Corp. and BlackRock Financial Management Inc. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| | |

| WFRBS Commercial Mortgage Trust 2013-C13 | | Characteristics of the Mortgage Pool |

| IV. | Characteristics of the Mortgage Pool(1) |

| A. | Ten Largest Mortgage Loans |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mortgage

Loan

Seller | | Mortgage Loan Name | | City | | State | | Number of

Mortgage

Loans /

Mortgaged

Properties | | Mortgage

Loan Cut-

off Date

Balance ($) | | | % of Cut-

off Date

Pool

Balance

(%) | | | Property

Type | | Number of

SF, Rooms

or Pads | | | Cut-off Date

Balance Per

SF, Room or

Pad($) | | | Cut-off Date

LTV Ratio

(%) | | | Balloon or

ARD LTV

Ratio (%) | | | U/W NCF

DSCR (x) | | | U/W NOI

Debt Yield

(%) | |

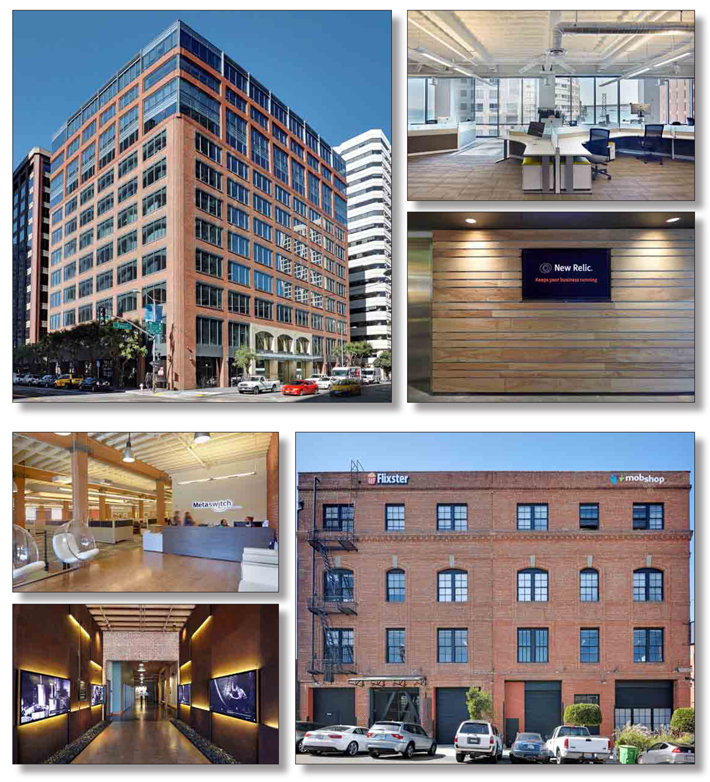

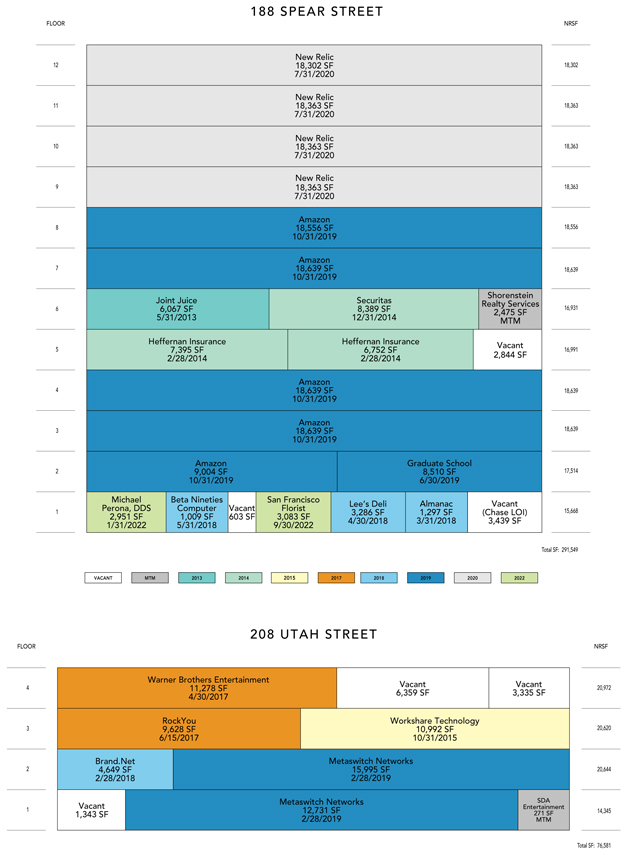

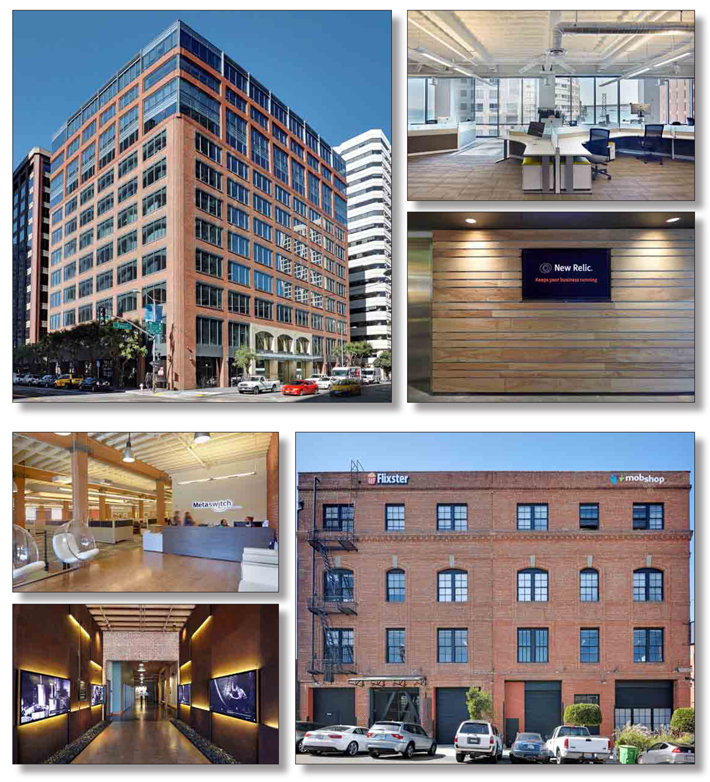

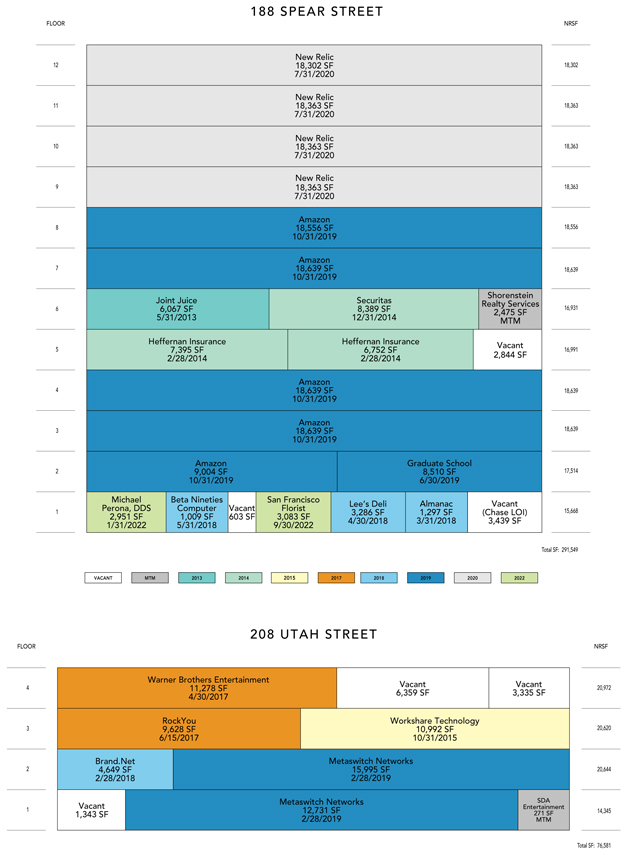

WFB | | 188 Spear Street and 208 Utah Street | | San Francisco | | CA | | 1 / 2 | | $ | 87,000,000 | | | | 9.9 | % | | Office | | | 291,549 | | | $ | 298 | | | | 57.0 | % | | | 47.7 | % | | | 1.61x | | | | 9.7 | % |

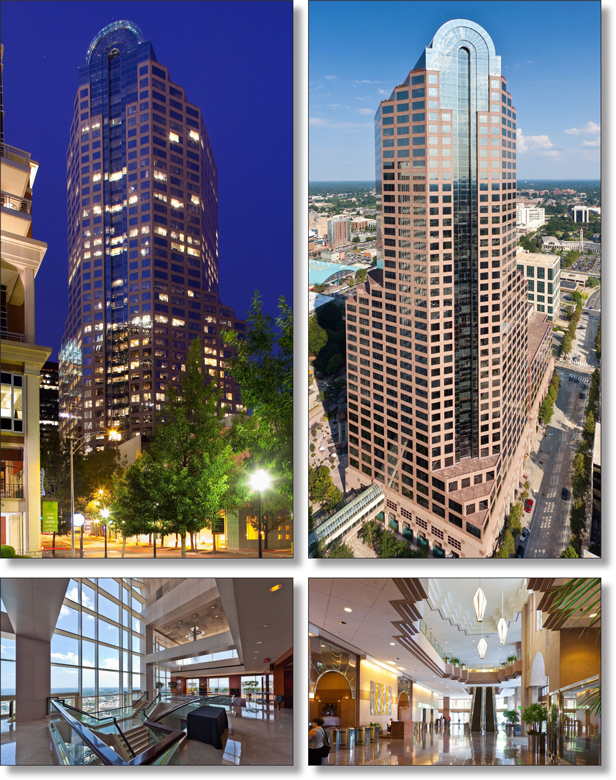

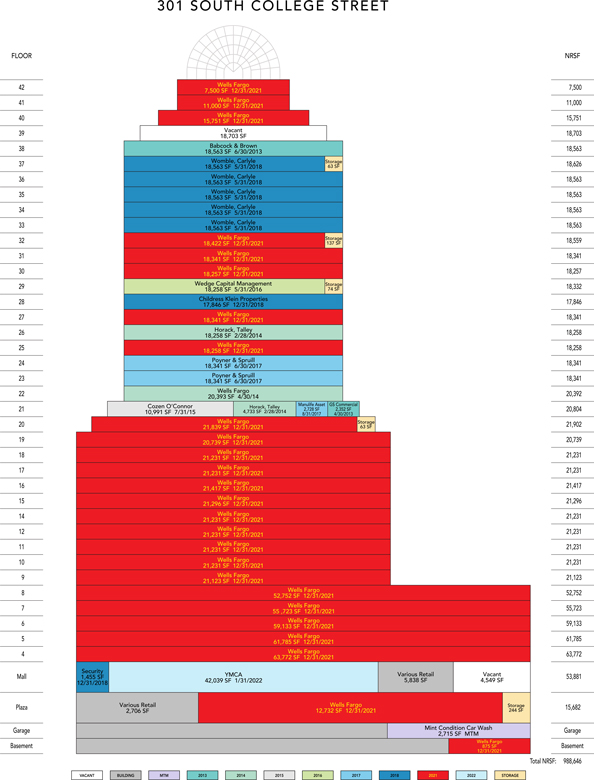

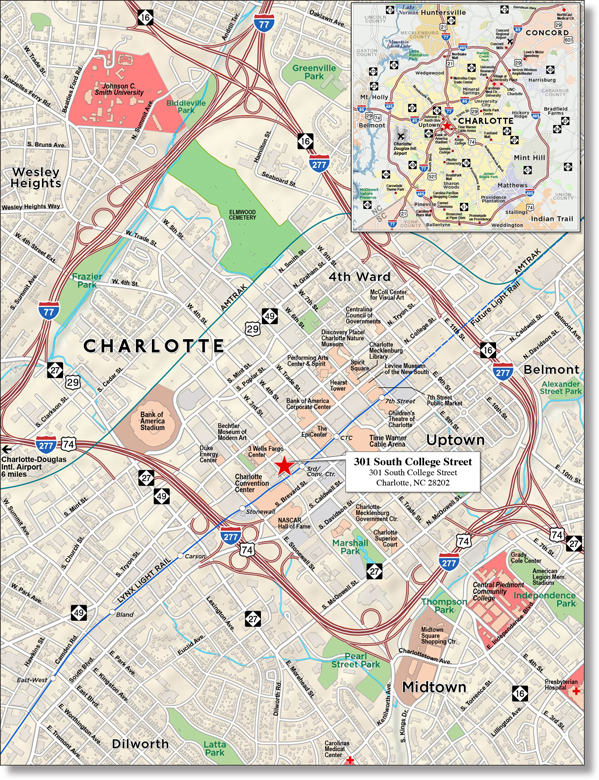

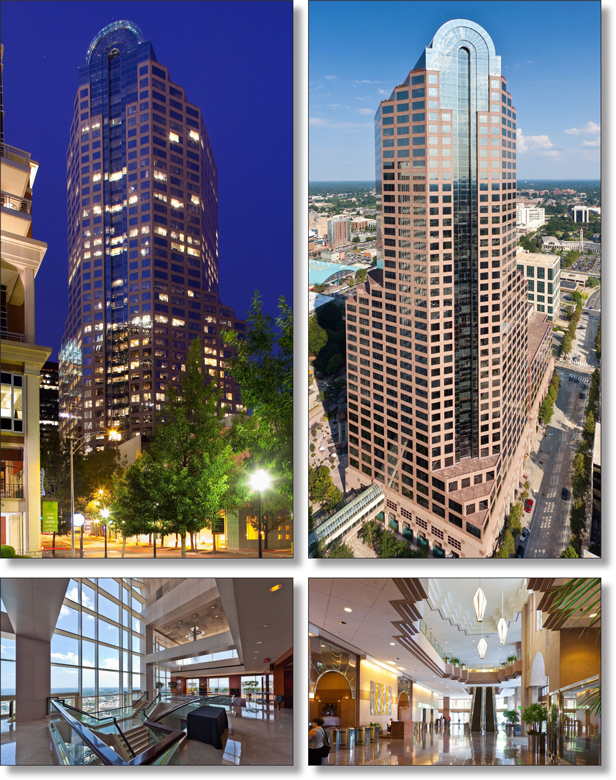

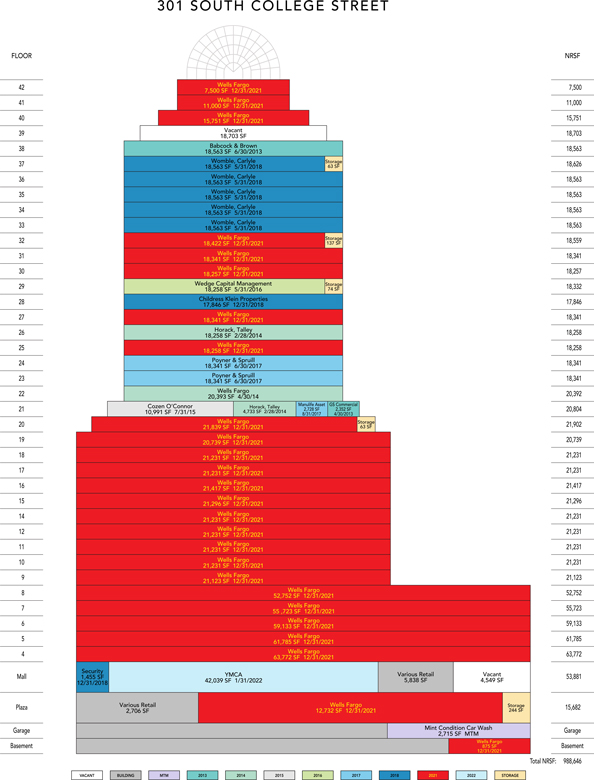

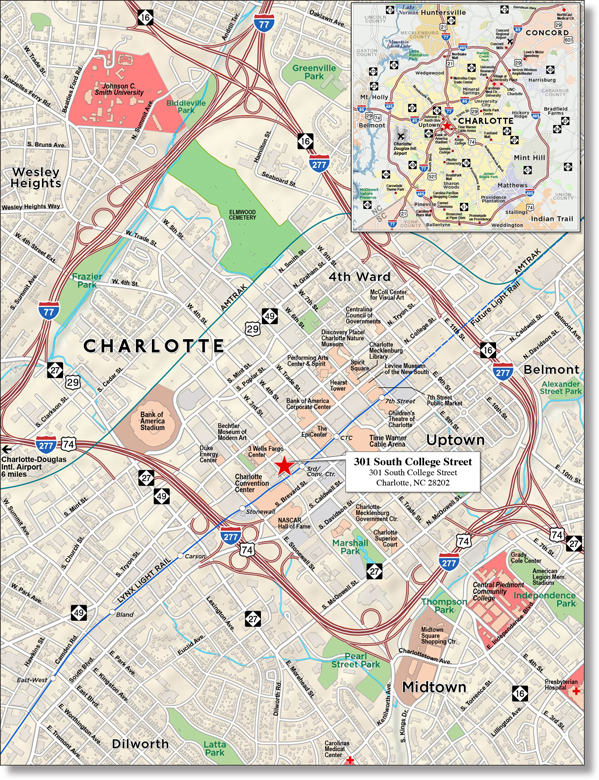

WFB | | 301 South College Street | | Charlotte | | NC | | 1 / 1 | | | 85,000,000 | | | | 9.7 | | | Office | | | 988,646 | | | | 177 | | | | 70.0 | | | | 63.5 | | | | 1.80 | | | | 10.6 | |

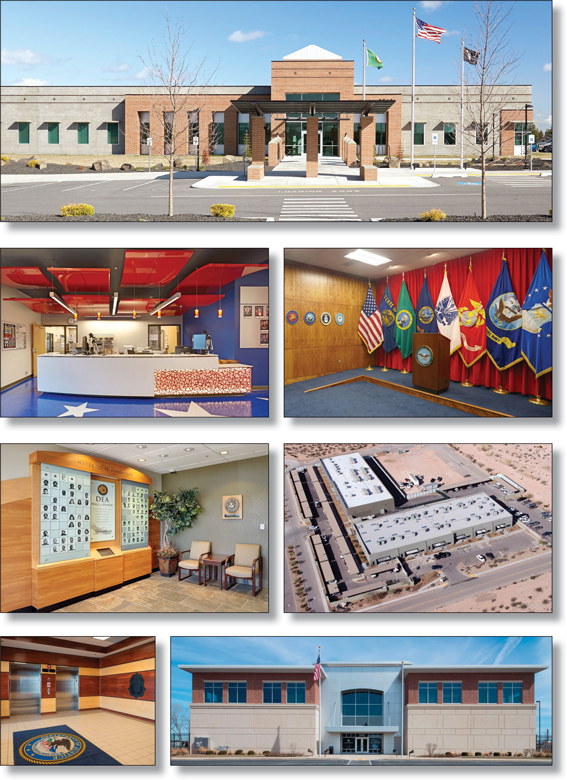

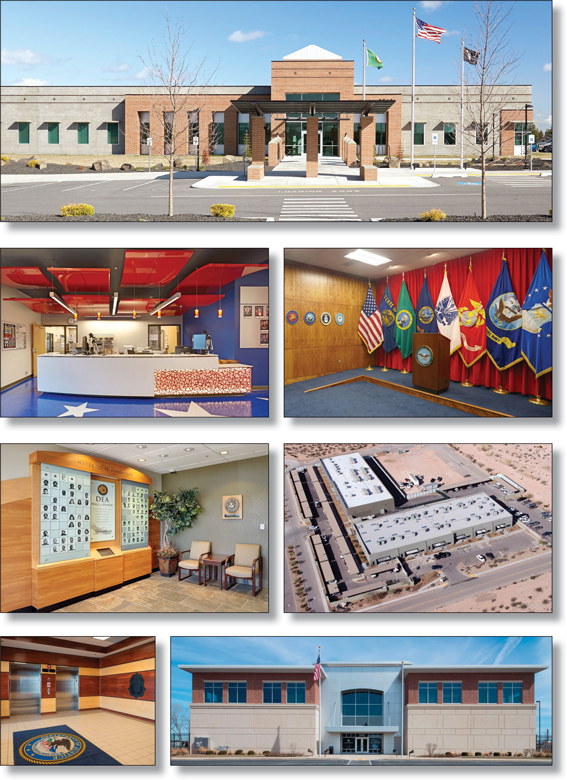

WFB | | GSA Portfolio | | Various | | Various | | 1 / 14 | | | 50,000,000 | | | | 5.7 | | | Various | | | 341,412 | | | | 146 | | | | 52.7 | | | | 52.7 | | | | 2.51 | | | | 11.7 | |

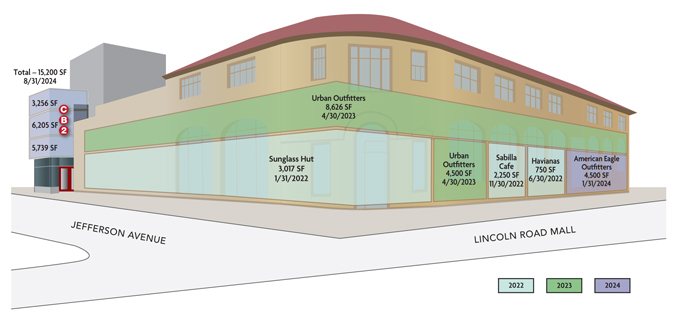

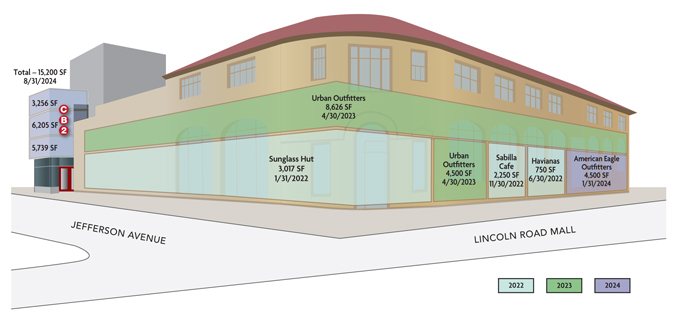

WFB | | 825-845 Lincoln Road | | Miami Beach | | FL | | 1 / 1 | | | 30,000,000 | | | | 3.4 | | | Retail | | | 38,843 | | | | 772 | | | | 45.3 | | | | 45.3 | | | | 2.97 | | | | 12.5 | |

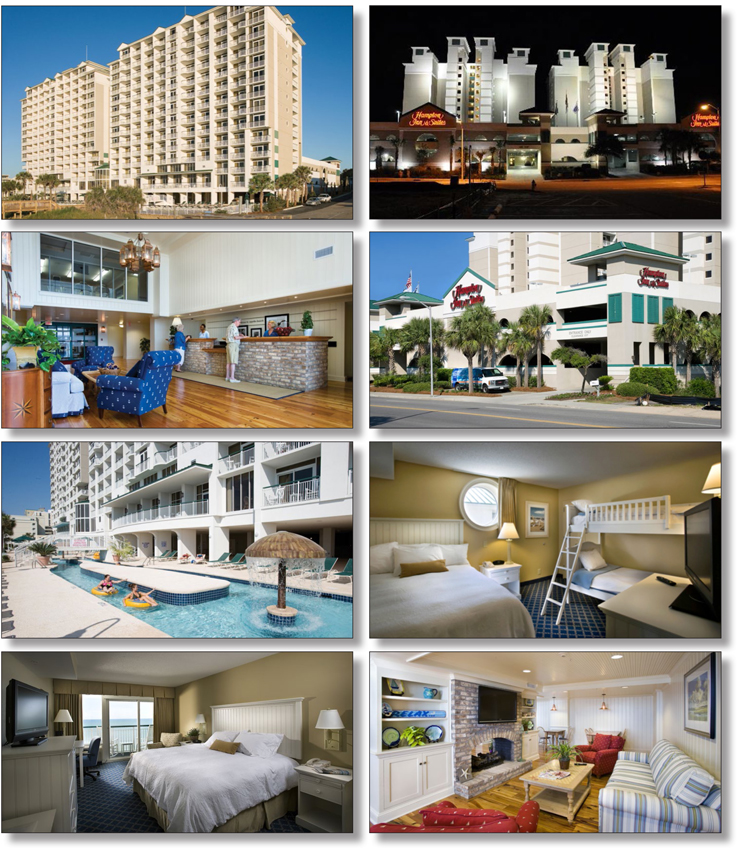

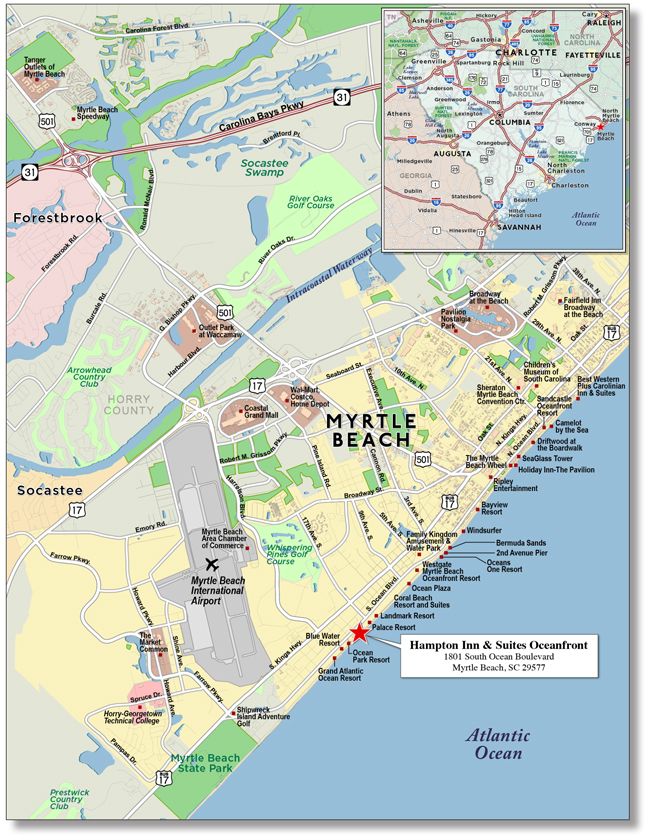

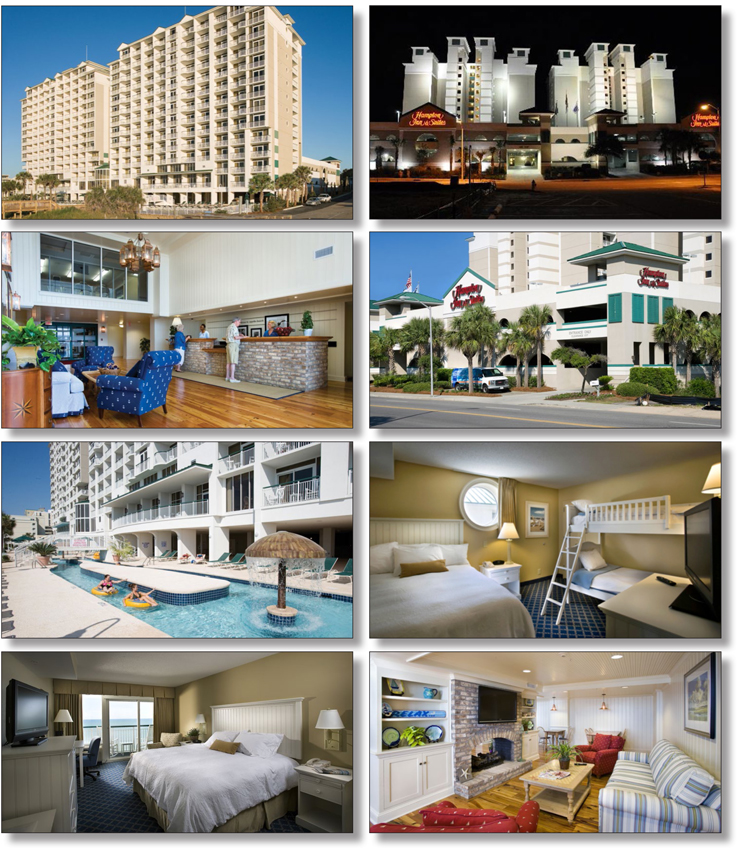

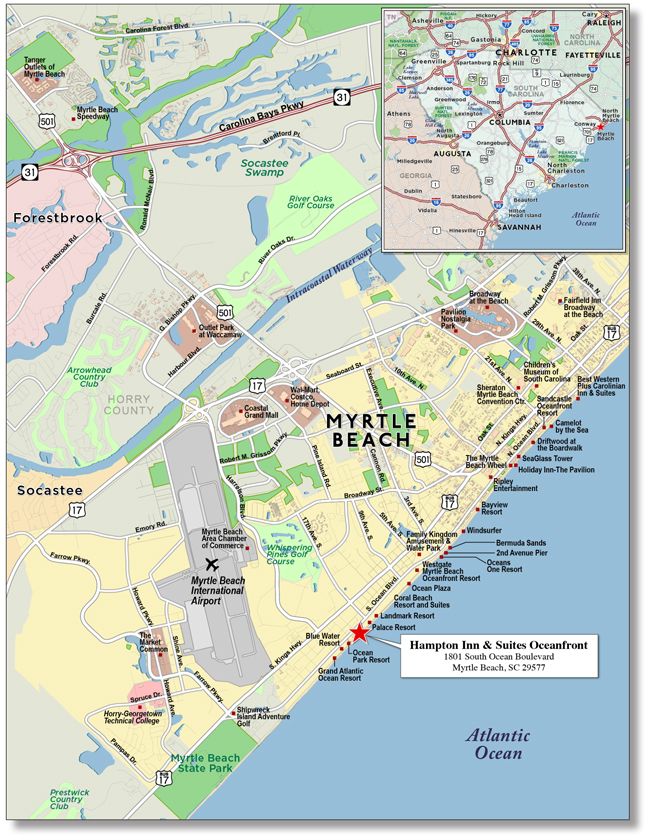

RBS | | Hampton Inn & Suites Oceanfront | | Myrtle Beach | | SC | | 1 / 1 | | | 29,947,006 | | | | 3.4 | | | Hospitality | | | 227 | | | | 131,925 | | | | 63.7 | | | | 47.1 | | | | 1.56 | | | | 12.0 | |

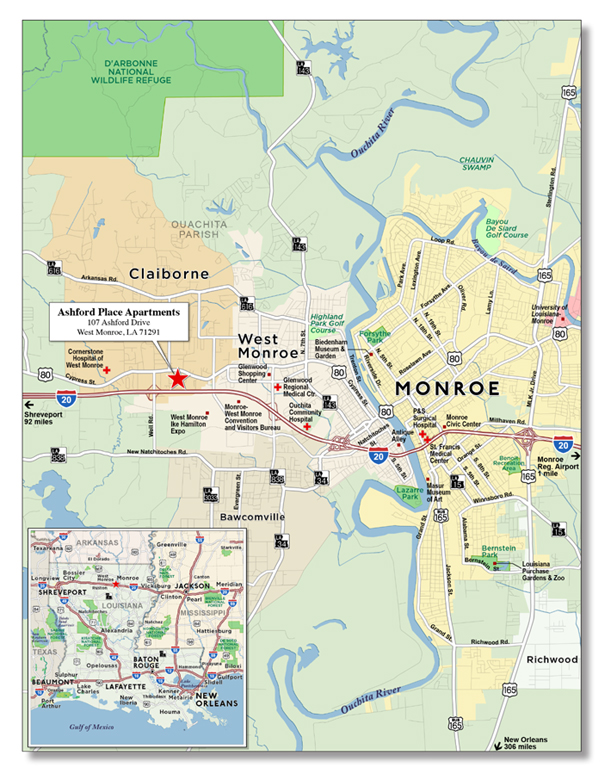

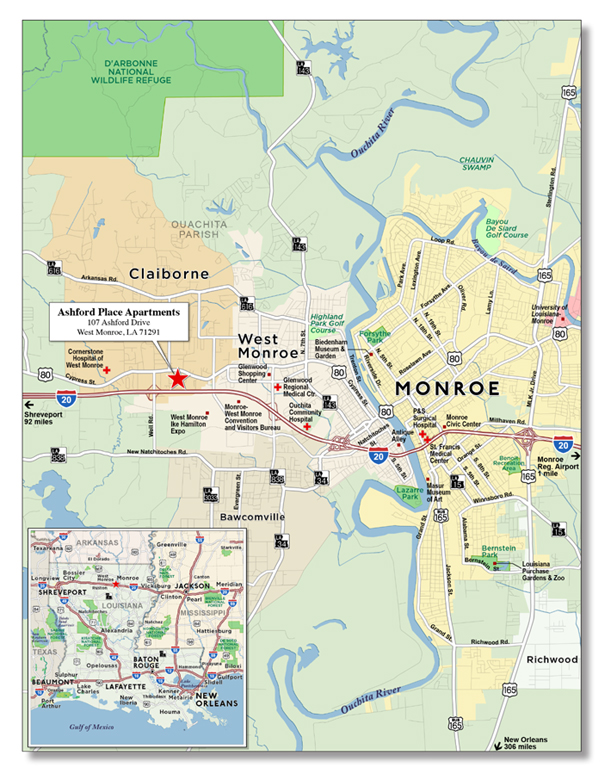

RBS | | Ashford Place Apartments | | West Monroe | | LA | | 1 / 1 | | | 24,575,000 | | | | 2.8 | | | Multifamily | | | 338 | | | | 72,707 | | | | 74.5 | | | | 62.2 | | | | 1.55 | | | | 9.4 | |

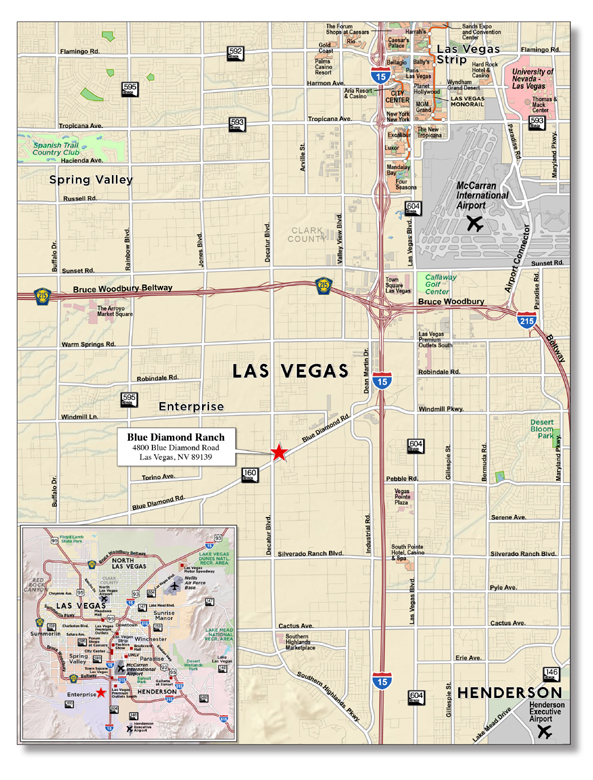

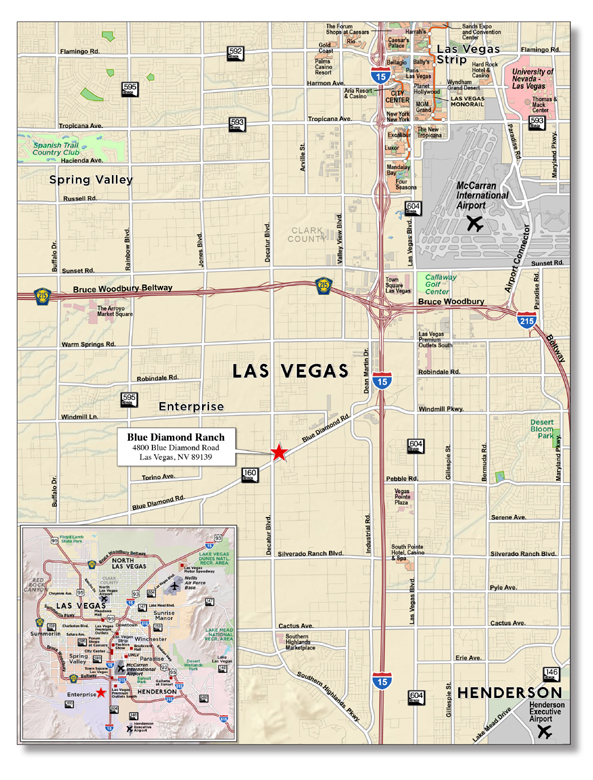

LIG I | | Blue Diamond Ranch | | Las Vegas | | NV | | 1 / 1 | | | 22,970,041 | | | | 2.6 | | | Retail | | | 104,450 | | | | 220 | | | | 59.6 | | | | 48.3 | | | | 1.56 | | | | 10.0 | |

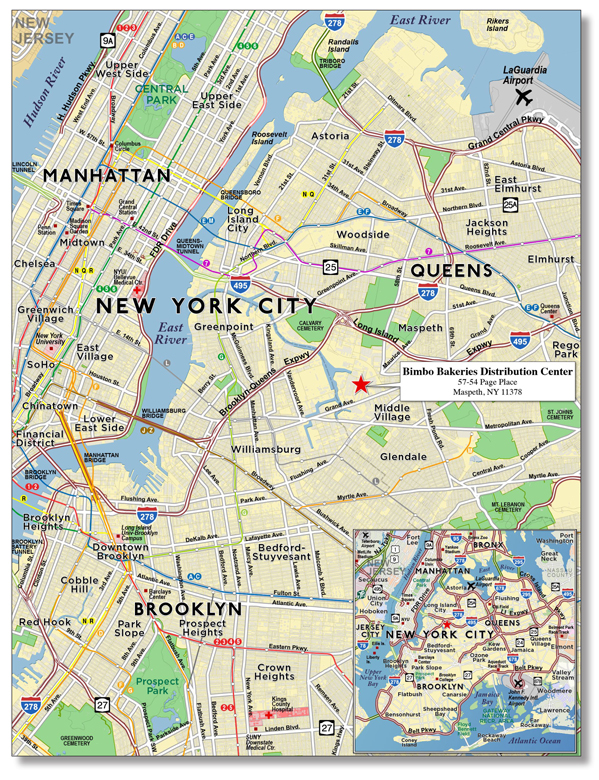

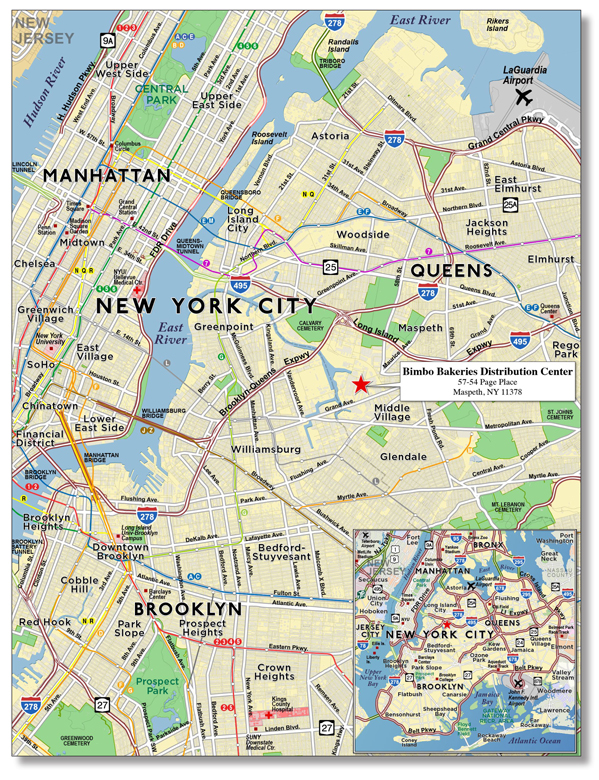

WFB | | Bimbo Bakeries Distribution Center | | Maspeth | | NY | | 1 / 1 | | | 22,500,000 | | | | 2.6 | | | Industrial | | | 56,966 | | | | 395 | | | | 57.7 | | | | 57.7 | | | | 2.72 | | | | 10.6 | |

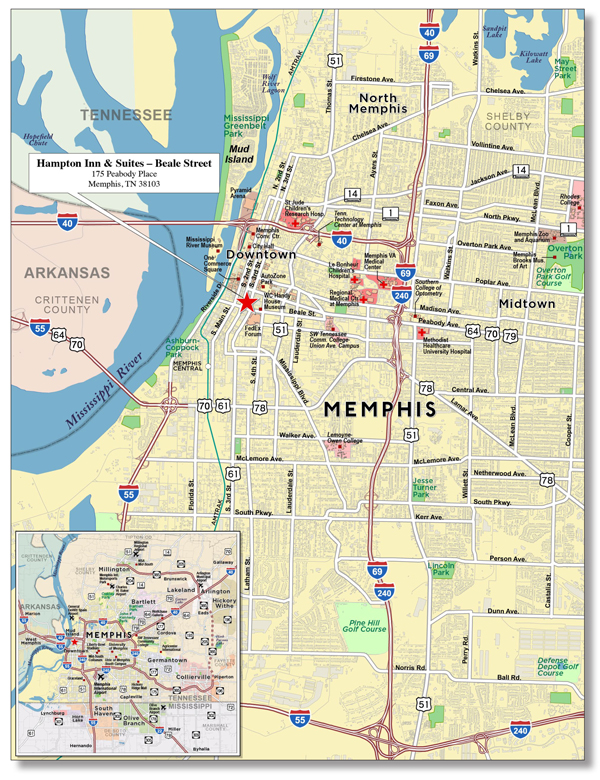

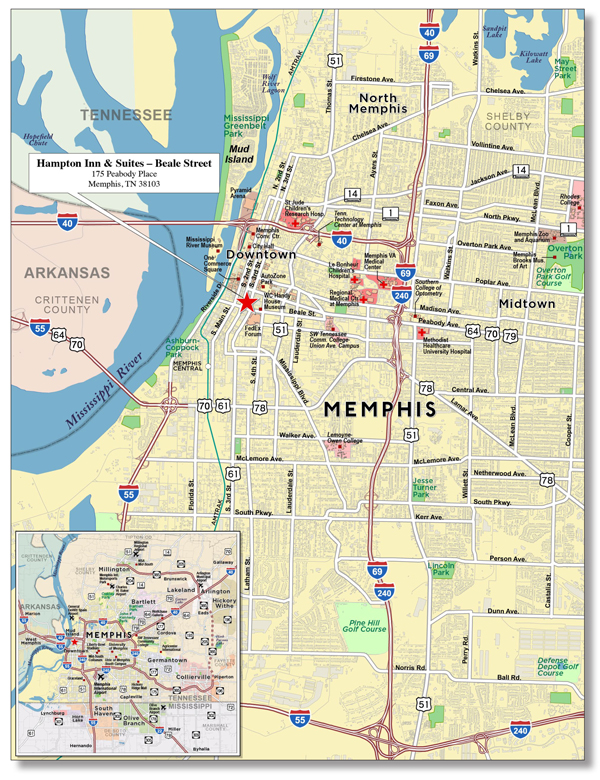

WFB | | Hampton Inn & Suites – Beale Street | | Memphis | | TN | | 1 / 1 | | | 22,415,761 | | | | 2.6 | | | Hospitality | | | 144 | | | | 155,665 | | | | 67.9 | | | | 59.6 | | | | 1.78 | | | | 12.6 | |

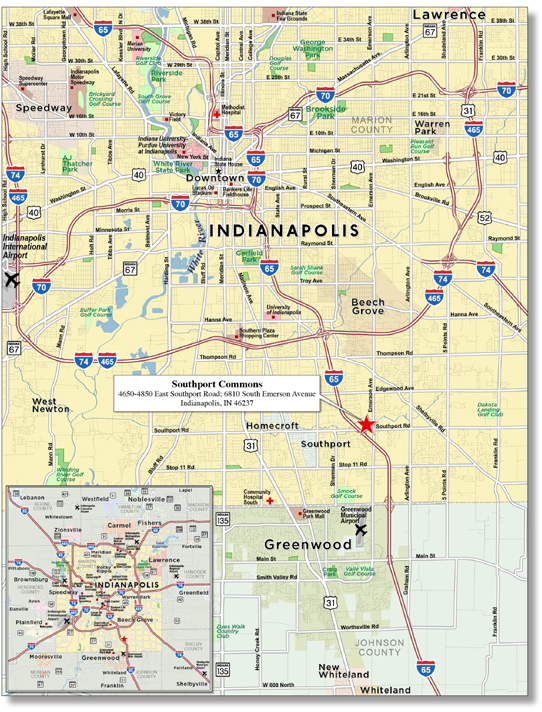

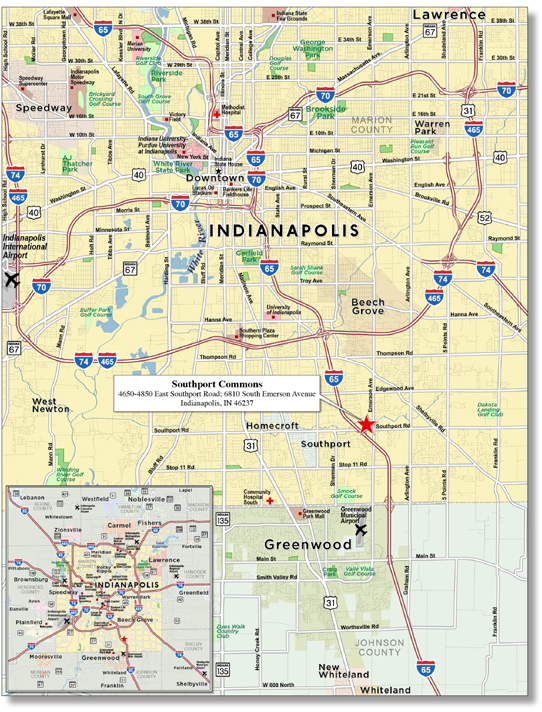

WFB | | Southport Commons | | Indianapolis | | IN | | 1 / 1 | | | 17,118,390 | | | | 2.0 | | | Retail | | | 200,056 | | | | 86 | | | | 71.9 | | | | 52.6 | | | | 1.44 | | | | 10.5 | |

Top Three Total/Weighted Average | | 3 / 17 | | $ | 222,000,000 | | | | 25.3 | % | | | | | | | | | | | | | 61.0 | % | | | 54.9 | % | | | 1.89x | | | | 10.5 | % |

Top Five Total/Weighted Average | | 5 / 19 | | $ | 281,947,006 | | | | 32.2 | % | | | | | | | | | | | | | 59.6 | % | | | 53.0 | % | | | 1.97x | | | | 10.9 | % |

Top Ten Total/Weighted Average | | 10 / 24 | | $ | 391,526,199 | | | | 44.7 | % | | | | | | | | | | | | | 61.5 | % | | | 54.0 | % | | | 1.93x | | | | 10.8 | % |

Non-Top Ten Total/Weighted Average | | 85 / 89 | | $ | 485,213,553 | | | | 55.3 | % | | | | | | | | | | | | | 57.2 | % | | | 46.4 | % | | | 2.67x | | | | 15.8 | % |

| (1) | With respect to 301 South College Street, Cut-off Date Balance per square foot, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan (unless otherwise stated) in total debt. |

| B. | Summary ofPari Passu Split Loan Structures |

| | | | | | | | | | | | | | | | | | |

Property Name | | Mortgage Loan

Seller | | Related Notes in

Loan Group

(Original Balance) | | | Holder of Note | | | Whether Note is

Lead Servicing for

the Entire Loan

Combination | | | Current Master Servicer Under Related

Securitization PSA | | Current Special Servicer Under Related

Securitization PSA |

301 South College Street | | WFB | | $ | 85,000,000 | | | | WFRBS 2013-C13 | | | | No | | | Wells Fargo Bank, National Association | | LNR Partners, LLC |

| | WFB | | $ | 90,000,000 | | | | | (1) | | | | (2) | | TBD | | TBD |

| (1) | The relatedpari passu companion loan is currently held by the mortgage loan seller for the mortgage loan included in the WFRBS 2013-C13 trust. |

| (2) | The 301 South College Street loan combination will be serviced under the WFRBS 2013-C13 pooling and servicing agreement until the securitization of the relatedpari passu companion loan, after which such loan combination will be serviced under the pooling and servicing agreement related to the securitization of thatpari passu companion loan. The master servicer and special servicer under the latter pooling and servicing agreement will be identified in a notice, report or statement to holders of the WFRBS 2013-C13 certificates after the securitization of the 301 South College Streetpari passu companion loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| | |

| WFRBS Commercial Mortgage Trust 2013-C13 | | Characteristics of the Mortgage Pool |

| C. | Previous Securitization History(1) |

| | | | | | | | | | | | | | | | | | | | | | |

Loan No. | | | Mortgage

Loan Seller | | Mortgage Loan or

Mortgaged Property Name | | City | | State | | Property Type | | Mortgage Loan

or Mortgaged

Property Cut-off

Date Balance ($) | | | % of Cut-off

Date Pool

Balance (%) | | | Previous

Securitization |

| | 4 | | | WFB | | 825-845 Lincoln Road | | Miami Beach | | FL | | Retail | | $ | 30,000,000 | | | | 3.4 | % | | WBCMT 2003-C5 |

| | 10 | | | WFB | | Southport Commons | | Indianapolis | | IN | | Retail | | | 17,118,390 | | | | 2.0 | | | GCCFC 2003-C1 |

| | 11 | | | WFB | | Merrick Commons | | Merrick | | NY | | Retail | | | 16,474,928 | | | | 1.9 | | | GECMC 2002-3A |

| | 16 | | | RBS | | Water Tower | | Portland | | OR | | Mixed Use | | | 12,583,305 | | | | 1.4 | | | MLMT 2004-BPC1 |

| | 19 | | | WFB | | Simi Valley Promenade | | Simi Valley | | CA | | Retail | | | 11,834,395 | | | | 1.3 | | | LBUBS 2004-C4 |

| | 21 | | | RBS | | Garwood Plaza | | Garwood | | NJ | | Retail | | | 11,600,000 | | | | 1.3 | | | JPMCC 2003-CB7; JPMCC 2003-LN1 |

| | 25 | | | CIIICM | | Bit O Home MHC | | Santa Ana | | CA | | Manufactured

Housing Community | | | 4,644,128 | | | | 0.5 | | | WBCMT 2003-C5 |

| | 26 | | | CIIICM | | Liberty MHC | | Santa Ana | | CA | | Manufactured

Housing Community | | | 4,644,128 | | | | 0.5 | | | WBCMT 2003-C5 |

| | 38 | | | CIIICM | | Buckhorn Ranch Estates MHC | | Des Plaines | | IL | | Manufactured

Housing Community | | | 6,991,112 | | | | 0.8 | | | JPMCC 2003-PM1A |

| | 42 | | | NCB, FSB | | 1523 Central Park Avenue Owners, Inc. | | Yonkers | | NY | | Multifamily | | | 6,519,382 | | | | 0.7 | | | MSC 2005 IQ-9 |

| | 52 | | | NCB, FSB | | Kensington Gate Owners Incorporated | | Great Neck | | NY | | Multifamily | | | 5,265,000 | | | | 0.6 | | | MSC 2005 IQ-9 |

| | 60 | | | NCB, FSB | | 21 N. Chatsworth Owners Corp. | | Larchmont | | NY | | Multifamily | | | 4,093,997 | | | | 0.5 | | | CSFB 2003-C3 |

| | 66 | | | NCB, FSB | | 2035 Central Park Ave. Owners Corp. | | Yonkers | | NY | | Multifamily | | | 3,244,691 | | | | 0.4 | | | CSFB 2004-C4 |

| | 67 | | | NCB, FSB | | 632 Palmer Road Owners, Inc. | | Yonkers | | NY | | Multifamily | | | 3,094,950 | | | | 0.4 | | | CSFB 2004-C4 |

| | 69 | | | CIIICM | | Country Breeze MHC | | Yuma | | AZ | | Manufactured

Housing Community | | | 3,015,832 | | | | 0.3 | | | CSFB 2003-C3 |

| | 70 | | | NCB, FSB | | Caribbean House, Inc. | | Edgewater | | NJ | | Multifamily | | | 2,991,594 | | | | 0.3 | | | CSFB 2003-C3 |

| | 71 | | | NCB, FSB | | 325 House Inc. | | New York | | NY | | Multifamily | | | 2,845,623 | | | | 0.3 | | | CSFB 2004-C4 |

| | 72 | | | NCB, FSB | | Mutual Housing Association, Inc. | | Bronx | | NY | | Multifamily | | | 2,796,762 | | | | 0.3 | | | CSFB 2004-C4 |

| | 73 | | | NCB, FSB | | Georgian House Owners Corp. | | Kew Gardens | | NY | | Multifamily | | | 2,795,857 | | | | 0.3 | | | CSFB 2003-C3 |

| | 80 | | | WFB | | Shreveport Plaza | | Shreveport | | LA | | Retail | | | 2,294,595 | | | | 0.3 | | | GECMC 2003-C1 |

| | 83 | | | NCB, FSB | | 51 West 81stStreet Corp. | | New York | | NY | | Multifamily | | | 2,000,000 | | | | 0.2 | | | CSFB 2004-C4 |

| | 84 | | | NCB, FSB | | 110-34 73rdOwners Corp. | | Forest Hills | | NY | | Multifamily | | | 1,897,253 | | | | 0.2 | | | MSC 2005 IQ-9 |

| | 87 | | | CIIICM | | Coachella MHC | | Coachella | | CA | | Manufactured

Housing Community | | | 1,647,116 | | | | 0.2 | | | WBCMT 2003-C5 |

| | 89 | | | NCB, FSB | | Claridge Apartment Corporation | | Great Neck | | NY | | Multifamily | | | 1,593,608 | | | | 0.2 | | | MSC 2003 IQ-6 |

| | 90 | | | NCB, FSB | | Fountain Gardens Owners Corp. | | Bronx | | NY | | Multifamily | | | 1,547,525 | | | | 0.2 | | | CSFB 2004-C1 |

| | 94 | | | NCB, FSB | | 120-10-12 85thAve. Owners Corp. | | Kew Gardens | | NY | | Multifamily | | | 1,248,240 | | | | 0.1 | | | MSC 2005 IQ-9 |

| | | | | | | | | | | | | | | | | | | | | | |

| | Total | | | | | | | | | | | | | $ | 164,782,411 | | | | 18.8 | % | | |

| | | | | | | | | | | | | | | | | | | | | | |

| (1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While the above mortgage loans may have been securitized multiple times in prior transactions, mortgage loans are only listed in the above chart if the mortgage loan paid off a mortgage loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

| | |

| WFRBS Commercial Mortgage Trust 2013-C13 | | Characteristics of the Mortgage Pool |

| D. | Mortgage Loans with Scheduled Balloon Payments and Related Classes |

Class A-2(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loan

No. | | Mortgage

Loan

Seller | | Mortgage Loan Name | | State | | Property

Type | | Mortgage

Loan Cut-

off Date

Balance ($) | | | % of

Cut-off

Date

Pool

Balance

(%) | | | Mortgage

Loan

Balance at

Maturity

($) | | | % of

Class A-2

Certificate

Principal

Balance

(%)(2) | | | SF/

Rooms/

Pads | | | Loan

per SF/

Room/

Pad ($) | | | U/W

NCF

DSCR

(x) | | | U/W

NOI

Debt

Yield

(%) | | | Cut-off

Date

LTV

Ratio

(%) | | | Balloon

LTV

Ratio

(%) | | | Rem.

IO

Period

(mos.) | | | Rem.

Term to

Maturity

(mos.) | |

| 9 | | WFB | | Hampton Inn & Suites – Beale Street | | TN | | Hospitality | | $ | 22,415,761 | | | | 2.6 | % | | $ | 19,692,550 | | | | 24.8 | % | | | 144 | | | $ | 155,665 | | | | 1.78x | | | | 12.6 | % | | | 67.9 | % | | | 59.6 | % | | | 0 | | | | 58 | |

| 13 | | WFB | | The Henry – Autograph Collection by Marriott | | MI | | Hospitality | | | 14,472,723 | | | | 1.7 | | | | 12,727,684 | | | | 16.0 | | | | 308 | | | | 46,989 | | | | 2.00 | | | | 17.6 | | | | 39.9 | | | | 35.1 | | | | 0 | | | | 59 | |

| 15 | | WFB | | Hampton Inn & Suites – Atlanta | | GA | | Hospitality | | | 13,600,000 | | | | 1.6 | | | | 12,280,293 | | | | 15.4 | | | | 119 | | | | 114,286 | | | | 1.78 | | | | 12.8 | | | | 67.0 | | | | 60.5 | | | | 10 | | | | 58 | |

| 23 | | WFB | | Hilton Garden Inn – Baton Rouge | | LA | | Hospitality | | | 9,800,000 | | | | 1.1 | | | | 8,849,035 | | | | 11.1 | | | | 131 | | | | 74,809 | | | | 1.77 | | | | 13.0 | | | | 63.2 | | | | 57.1 | | | | 10 | | | | 58 | |

| 24 | | WFB | | Hampton Inn – Birmingham | | AL | | Hospitality | | | 9,400,000 | | | | 1.1 | | | | 8,487,849 | | | | 10.7 | | | | 133 | | | | 70,677 | | | | 1.75 | | | | 12.6 | | | | 65.8 | | | | 59.5 | | | | 10 | | | | 58 | |

| 27 | | WFB | | Hampton Inn & Suites – Legacy Park | | TX | | Hospitality | | | 9,200,000 | | | | 1.0 | | | | 8,307,257 | | | | 10.4 | | | | 105 | | | | 87,619 | | | | 1.74 | | | | 12.5 | | | | 68.1 | | | | 61.5 | | | | 10 | | | | 58 | |

| 34 | | LIG I | | Sheridan Building | | PA | | Office | | | 7,479,751 | | | | 0.9 | | | | 6,822,883 | | | | 8.6 | | | | 97,456 | | | | 77 | | | | 1.62 | | | | 11.8 | | | | 69.3 | | | | 63.2 | | | | 0 | | | | 58 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total/Weighted Average | | | | | | $ | 86,368,235 | | | | 9.9 | % | | $ | 77,167,551 | | | | 97.0 | % | | | | | | | | | | | 1.79x | | | | 13.4 | % | | | 62.4 | % | | | 55.9 | % | | | 5 | | | | 58 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | The table above presents the mortgage loans whose balloon payments would be applied to pay down the principal balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Free Writing Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each class of Certificates, including the Class A-2 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. |

| (2) | Reflects the percentage of the Mortgage Loan Balance at Maturity divided by the initial Class A-2 Certificate Principal Balance. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

| | |

| WFRBS Commercial Mortgage Trust 2013-C13 | | Characteristics of the Mortgage Pool |

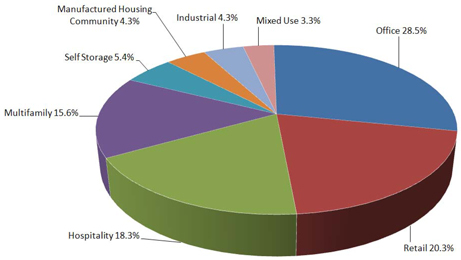

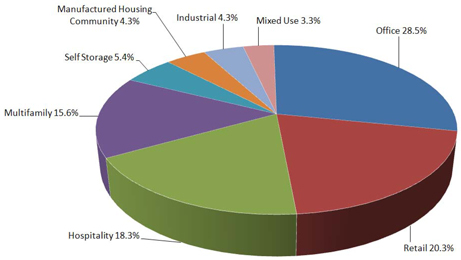

| E. | Property Type Distribution(1) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Property Type | | Number of

Mortgaged

Properties | | | Aggregate

Cut-off

Date

Balance

($) | | | % of

Cut-off

Date

Balance

(%) | | | Weighted

Average

Cut-off

Date

LTV

Ratio

(%) | | | Weighted

Average

Balloon or

ARD LTV

Ratio

(%) | | | Weighted

Average

U/W NCF

DSCR (x) | | | Weighted

Average

U/W NOI

Debt

Yield

(%) | | | Weighted

Average

U/W NCF

Debt

Yield

(%) | | | Weighted

Average

Mortgage

Rate

(%) | |

Office | | | 22 | | | $ | 249,616,614 | | | | 28.5 | % | | | 62.5 | % | | | 55.5 | % | | | 1.83x | | | | 10.6 | % | | | 9.8 | % | | | 3.955 | % |

CBD | | | 4 | | | | 179,479,751 | | | | 20.5 | | | | 63.7 | | | | 55.8 | | | | 1.70 | | | | 10.2 | | | | 9.5 | | | | 3.842 | |

Suburban | | | 17 | | | | 67,589,718 | | | | 7.7 | | | | 59.4 | | | | 54.5 | | | | 2.20 | | | | 11.5 | | | | 10.3 | | | | 4.201 | |

Medical | | | 1 | | | | 2,547,145 | | | | 0.3 | | | | 64.5 | | | | 53.7 | | | | 1.60 | | | | 12.4 | | | | 10.8 | | | | 5.380 | |

Retail | | | 16 | | | | 178,067,400 | | | | 20.3 | | | | 62.5 | | | | 51.3 | | | | 1.79 | | | | 10.6 | | | | 9.9 | | | | 4.277 | |

Anchored | | | 9 | | | | 115,576,602 | | | | 13.2 | | | | 65.6 | | | | 52.0 | | | | 1.56 | | | | 10.3 | | | | 9.4 | | | | 4.288 | |

Unanchored | | | 1 | | | | 30,000,000 | | | | 3.4 | | | | 45.3 | | | | 45.3 | | | | 2.97 | | | | 12.5 | | | | 12.0 | | | | 3.990 | |

Shadow Anchored(2) | | | 5 | | | | 29,700,401 | | | | 3.4 | | | | 67.5 | | | | 55.2 | | | | 1.53 | | | | 10.2 | | | | 9.4 | | | | 4.444 | |

Single Tenant | | | 1 | | | | 2,790,397 | | | | 0.3 | | | | 64.9 | | | | 48.8 | | | | 1.42 | | | | 10.5 | | | | 10.1 | | | | 5.130 | |

Hospitality | | | 14 | | | | 160,657,431 | | | | 18.3 | | | | 62.8 | | | | 50.8 | | | | 1.76 | | | | 13.5 | | | | 11.8 | | | | 4.424 | |

Limited Service | | | 9 | | | | 115,940,206 | | | | 13.2 | | | | 65.6 | | | | 53.3 | | | | 1.69 | | | | 12.5 | | | | 11.1 | | | | 4.395 | |

Full Service | | | 3 | | | | 31,160,964 | | | | 3.6 | | | | 52.5 | | | | 44.8 | | | | 1.85 | | | | 15.0 | | | | 12.1 | | | | 4.344 | |

Extended Stay | | | 2 | | | | 13,556,261 | | | | 1.5 | | | | 63.1 | | | | 43.5 | | | | 2.19 | | | | 18.1 | | | | 16.4 | | | | 4.855 | |

Multifamily | | | 30 | | | | 136,518,405 | | | | 15.6 | | | | 42.2 | | | | 34.6 | | | | 5.05 | | | | 25.6 | | | | 25.2 | | | | 4.045 | |

Garden | | | 8 | | | | 69,981,455 | | | | 8.0 | | | | 64.0 | | | | 52.2 | | | | 1.82 | | | | 11.2 | | | | 10.6 | | | | 4.129 | |

Cooperative | | | 21 | | | | 60,560,290 | | | | 6.9 | | | | 15.0 | | | | 12.8 | | | | 9.13 | | | | 43.6 | | | | 43.6 | | | | 3.872 | |

High Rise | | | 1 | | | | 5,976,660 | | | | 0.7 | | | | 61.6 | | | | 50.5 | | | | 1.39 | | | | 9.8 | | | | 8.8 | | | | 4.800 | |

Self Storage | | | 12 | | | | 47,243,236 | | | | 5.4 | | | | 60.0 | | | | 48.3 | | | | 1.70 | | | | 10.8 | | | | 10.5 | | | | 4.497 | |

Self Storage | | | 12 | | | | 47,243,236 | | | | 5.4 | | | | 60.0 | | | | 48.3 | | | | 1.70 | | | | 10.8 | | | | 10.5 | | | | 4.497 | |

Manufactured Housing Community | | | 11 | | | | 37,917,594 | | | | 4.3 | | | | 58.9 | | | | 47.3 | | | | 1.89 | | | | 11.9 | | | | 11.7 | | | | 4.520 | |

Manufactured Housing Community | | | 11 | | | | 37,917,594 | | | | 4.3 | | | | 58.9 | | | | 47.3 | | | | 1.89 | | | | 11.9 | | | | 11.7 | | | | 4.520 | |

Industrial | | | 4 | | | | 37,900,000 | | | | 4.3 | | | | 62.7 | | | | 56.7 | | | | 2.33 | | | | 10.6 | | | | 10.3 | | | | 3.820 | |

Warehouse | | | 4 | | | | 37,900,000 | | | | 4.3 | | | | 62.7 | | | | 56.7 | | | | 2.33 | | | | 10.6 | | | | 10.3 | | | | 3.820 | |

Mixed Use | | | 4 | | | | 28,819,072 | | | | 3.3 | | | | 61.3 | | | | 53.9 | | | | 2.04 | | | | 11.2 | | | | 10.0 | | | | 4.289 | |

Office/Retail | | | 3 | | | | 22,219,072 | | | | 2.5 | | | | 63.9 | | | | 54.2 | | | | 1.91 | | | | 11.1 | | | | 9.8 | | | | 4.331 | |

Office/Industrial | | | 1 | | | | 6,600,000 | | | | 0.8 | | | | 52.7 | | | | 52.7 | | | | 2.51 | | | | 11.7 | | | | 10.6 | | | | 4.150 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Average | | | 113 | | | $ | 876,739,752 | | | | 100.0 | % | | | 59.1 | % | | | 49.8 | % | | | 2.34x | | | | 13.5 | % | | | 12.7 | % | | | 4.179 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate), and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio or debt yield for each such mortgaged property is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group. On an individual basis, without regard to the cross-collateralization feature, any mortgaged property securing a mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio or debt yield for each such mortgaged property are calculated using underwritten net cash flow for the related residential cooperative property which is the projected net cash flow reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative. Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. With respect to 301 South College Street, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passucompanion loan (unless otherwise stated) in total debt. |

| (2) | A mortgaged property is classified as shadow anchored if it is located in close proximity to an anchored retail property. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

| | |

| WFRBS Commercial Mortgage Trust 2013-C13 | | Characteristics of the Mortgage Pool |

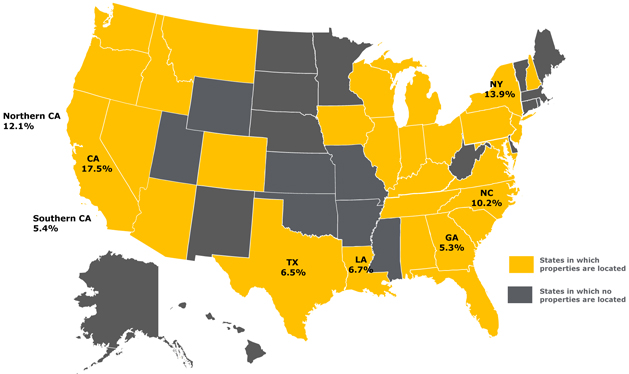

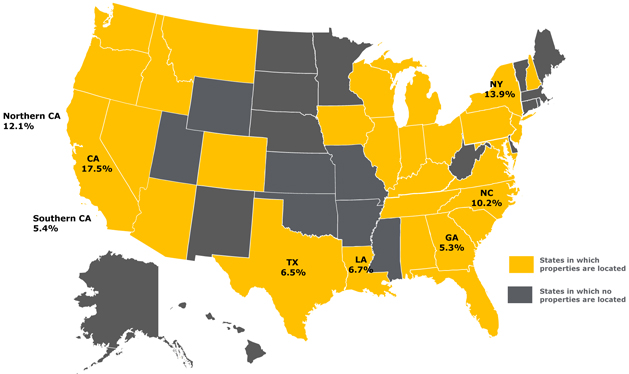

| F. | Geographic Distribution(1)(2) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Location(3) | | Number of

Mortgaged

Properties | | | Aggregate

Cut-off

Date

Balance ($) | | | % of

Cut-off

Date

Balance | | | Weighted

Average

Cut-off

Date LTV

Ratio (%) | | | Weighted

Average

Balloon or

ARD LTV

Ratio (%) | | | Weighted

Average

U/W NCF

DSCR (x) | | | Weighted

Average

U/W NOI

Debt

Yield (%) | | | Weighted

Average

U/W NCF

Debt

Yield (%) | | | Weighted

Average

Mortgage

Rate (%) | |

California | | | 15 | | | $ | 153,563,410 | | | | 17.5 | % | | | 58.9 | % | | | 48.4 | % | | | 1.65x | | | | 10.2 | % | | | 9.6 | % | | | 4.010 | % |

Northern | | | 6 | | | | 106,193,219 | | | | 12.1 | | | | 59.0 | | | | 48.6 | | | | 1.63 | | | | 9.9 | | | | 9.1 | | | | 3.765 | |

Southern | | | 9 | | | | 47,370,191 | | | | 5.4 | | | | 58.7 | | | | 47.8 | | | | 1.70 | | | | 10.9 | | | | 10.5 | | | | 4.558 | |

New York | | | 27 | | | | 121,752,152 | | | | 13.9 | | | | 36.5 | | | | 32.2 | | | | 5.63 | | | | 27.1 | | | | 26.8 | | | | 3.962 | |

North Carolina | | | 2 | | | | 89,800,000 | | | | 10.2 | | | | 69.1 | | | | 62.9 | | | | 1.84 | | | | 10.7 | | | | 10.2 | | | | 3.946 | |

Louisiana | | | 7 | | | | 58,899,595 | | | | 6.7 | | | | 68.0 | | | | 58.2 | | | | 1.74 | | | | 10.9 | | | | 10.1 | | | | 4.205 | |

Texas | | | 10 | | | | 57,284,591 | | | | 6.5 | | | | 66.3 | | | | 53.9 | | | | 1.85 | | | | 13.0 | | | | 11.7 | | | | 4.412 | |

Georgia | | | 4 | | | | 46,050,000 | | | | 5.3 | | | | 66.9 | | | | 53.7 | | | | 1.73 | | | | 12.3 | | | | 10.9 | | | | 4.250 | |

Other States(4) | | | 48 | | | | 349,390,004 | | | | 39.9 | | | | 60.8 | | | | 50.6 | | | | 1.88 | | | | 11.7 | | | | 10.6 | | | | 4.337 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Average | | | 113 | | | $ | 876,739,752 | | | | 100.0 | % | | | 59.1 | % | | | 49.8 | % | | | 2.34x | | | | 13.5 | % | | | 12.7 | % | | | 4.179 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | The Mortgaged Properties are located in 29 states. |

| (2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate), and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio or debt yield for each such mortgaged property is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group. On an individual basis, without regard to the cross-collateralization feature, any mortgaged property securing a mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio or debt yield for each such mortgaged property are calculated using underwritten net cash flow for the related residential cooperative property which is the projected net cash flow reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative. Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. With respect to 301 South College Street, loan-to-value ratio, debt service coverage ratio, debt yield and cut-off date balance per square foot calculations include the relatedpari passucompanion loan (unless otherwise stated) in total debt. |

| (3) | For purposes of determining whether a mortgaged property is in Northern California or Southern California, Northern California includes areas with zip codes above 93600 and Southern California includes areas with zip codes of 93600 and below. |

| (4) | Includes 23 other states. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

| | |

| WFRBS Commercial Mortgage Trust 2013-C13 | | Characteristics of the Mortgage Pool |

| G. | Characteristics of the Mortgage Pool(1) |

CUT-OFF DATE BALANCE

| | | | | | | | | | | | |

Range of Cut-off Date Balances ($) | | Number

of

Mortgage

Loans | | | Aggregate

Cut-off

Date

Balance ($) | | | % of

Cut-off

Date

Balance | |

850,000 – 1,000,000 | | | 1 | | | $ | 850,000 | | | | 0.1 | % |

1,000,001 – 2,000,000 | | | 12 | | | | 19,488,785 | | | | 2.2 | |

2,000,001 – 3,000,000 | | | 13 | | | | 33,697,643 | | | | 3.8 | |

3,000,001 – 4,000,000 | | | 9 | | | | 30,481,203 | | | | 3.5 | |

4,000,001 – 5,000,000 | | | 10 | | | | 44,858,086 | | | | 5.1 | |

5,000,001 – 6,000,000 | | | 7 | | | | 39,800,930 | | | | 4.5 | |

6,000,001 – 7,000,000 | | | 8 | | | | 52,571,269 | | | | 6.0 | |

7,000,001 – 8,000,000 | | | 7 | | | | 52,897,727 | | | | 6.0 | |

8,000,001 – 9,000,000 | | | 3 | | | | 25,867,674 | | | | 3.0 | |

9,000,001 – 10,000,000 | | | 4 | | | | 38,384,885 | | | | 4.4 | |

10,000,001 – 15,000,000 | | | 9 | | | | 114,440,423 | | | | 13.1 | |

15,000,001 – 20,000,000 | | | 3 | | | | 48,993,319 | | | | 5.6 | |

20,000,001 – 30,000,000 | | | 6 | | | | 152,407,808 | | | | 17.4 | |

30,000,001 – 50,000,000 | | | 1 | | | | 50,000,000 | | | | 5.7 | |

50,000,001 – 87,000,000 | | | 2 | | | | 172,000,000 | | | | 19.6 | |

| | | | | | | | | | | | |

Total: | | | 95 | | | $ | 876,739,752 | | | | 100.0 | % |

| | | | | | | | | | | | |

Average: | | $ | 9,228,839 | | | | | | | | | |

| | | | | | | | | | | | |

UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO

| | | | | | | | | | | | |

Range of U/W NOI DSCRs (x) | | Number

of

Mortgage

Loans | | | Aggregate

Cut-off

Date

Balance ($) | | | % of

Cut-off

Date

Balance | |

1.34 – 1.40 | | | 1 | | | $ | 11,600,000 | | | | 1.3 | % |

1.41 – 1.50 | | | 1 | | | | 2,790,397 | | | | 0.3 | |

1.51 – 1.60 | | | 8 | | | | 65,076,890 | | | | 7.4 | |

1.61 – 1.70 | | | 9 | | | | 87,305,628 | | | | 10.0 | |

1.71 – 1.80 | | | 11 | | | | 179,807,844 | | | | 20.5 | |

1.81 – 1.90 | | | 11 | | | | 149,715,932 | | | | 17.1 | |

1.91 – 2.00 | | | 15 | | | | 123,079,371 | | | | 14.0 | |

2.01 – 2.25 | | | 8 | | | | 45,505,386 | | | | 5.2 | |

2.26 – 2.50 | | | 3 | | | | 19,909,885 | | | | 2.3 | |

2.51 – 2.75 | | | 3 | | | | 38,619,839 | | | | 4.4 | |

2.76 – 3.00 | | | 1 | | | | 50,000,000 | | | | 5.7 | |

3.01 – 3.50 | | | 6 | | | | 55,523,956 | | | | 6.3 | |

3.51 – 32.64 | | | 18 | | | | 47,804,624 | | | | 5.5 | |

| | | | | | | | | | | | |

Total: | | | 95 | | | $ | 876,739,752 | | | | 100.0 | % |

| | | | | | | | | | | | |

Weighted Average: | | | 2.48x | | | | | | | | | |

| | | | | | | | | | | | |

UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO

| | | | | | | | | | | | |

Range of U/W NCF DSCRs (x) | | Number

of

Mortgage

Loans | | | Aggregate

Cut-off

Date

Balance ($) | | | % of

Cut-off

Date

Balance | |

1.21 – 1.30 | | | 1 | | | $ | 11,600,000 | | | | 1.3 | % |

1.31 – 1.40 | | | 2 | | | | 13,926,660 | | | | 1.6 | |

1.41 – 1.50 | | | 6 | | | | 55,408,976 | | | | 6.3 | |

1.51 – 1.60 | | | 12 | | | | 135,574,377 | | | | 15.5 | |

1.61 – 1.70 | | | 16 | | | | 179,105,657 | | | | 20.4 | |

1.71 – 1.80 | | | 14 | | | | 205,436,885 | | | | 23.4 | |

1.81 – 1.90 | | | 6 | | | | 36,694,950 | | | | 4.2 | |

1.91 – 2.00 | | | 4 | | | | 22,081,033 | | | | 2.5 | |

2.01 – 2.25 | | | 5 | | | | 25,125,635 | | | | 2.9 | |

2.26 – 2.50 | | | 2 | | | | 14,309,885 | | | | 1.6 | |

2.51 – 2.75 | | | 3 | | | | 74,147,116 | | | | 8.5 | |

2.76 – 3.00 | | | 3 | | | | 42,768,289 | | | | 4.9 | |

3.01 – 3.50 | | | 3 | | | | 12,755,667 | | | | 1.5 | |

3.51 – 32.64 | | | 18 | | | | 47,804,624 | | | | 5.5 | |

| | | | | | | | | | | | |

Total: | | | 95 | | | $ | 876,739,752 | | | | 100.0 | % |

| | | | | | | | | | | | |

Weighted Average: | | | 2.34x | | | | | | | | | |

| | | | | | | | | | | | |

LOAN PURPOSE

| | | | | | | | | | | | |

Loan Purpose | | Number

of

Mortgage

Loans | | | Aggregate

Cut-off

Date

Balance ($) | | | % of

Cut-off

Date

Balance | |

Refinance | | | 78 | | | $ | 623,409,817 | | | | 71.1 | % |

Acquisition | | | 16 | | | | 250,272,287 | | | | 28.5 | |

Various | | | 1 | | | | 3,057,648 | | | | 0.3 | |

| | | | | | | | | | | | |

Total: | | | 95 | | | $ | 876,739,752 | | | | 100.0 | % |

| | | | | | | | | | | | |

MORTGAGE RATE

| | | | | | | | | | | | |

Range of Mortgage Rates (%) | | Number

of

Mortgage

Loans | | | Aggregate

Cut-off

Date

Balance ($) | | | % of

Cut-off

Date

Balance | |

3.640 – 3.750 | | | 6 | | | $ | 120,695,806 | | | | 13.8 | % |

3.751 – 4.000 | | | 24 | | | | 228,339,386 | | | | 26.0 | |

4.001 – 4.250 | | | 17 | | | | 216,545,228 | | | | 24.7 | |

4.251 – 4.500 | | | 15 | | | | 124,987,964 | | | | 14.3 | |

4.501 – 4.750 | | | 21 | | | | 132,807,291 | | | | 15.1 | |

4.751 – 5.000 | | | 9 | | | | 46,553,831 | | | | 5.3 | |

5.001 – 5.250 | | | 1 | | | | 2,790,397 | | | | 0.3 | |

5.251 – 5.500 | | | 2 | | | | 4,019,848 | | | | 0.5 | |

| | | | | | | | | | | | |

Total: | | | 95 | | | $ | 876,739,752 | | | | 100.0 | % |

| | | | | | | | | | | | |

Weighted Average: | | | 4.179 | % | | | | | | | | |

| | | | | | | | | | | | |

UNDERWRITTEN NOI DEBT YIELD

| | | | | | | | | | | | |

Range of U/W NOI Debt Yields (%) | | Number

of

Mortgage

Loans | | | Aggregate

Cut-off

Date

Balance ($) | | | % of

Cut-off

Date

Balance | |

7.8 – 8.9 | | | 1 | | | $ | 11,600,000 | | | | 1.3 | % |

9.0 – 9.9 | | | 8 | | | | 157,418,543 | | | | 18.0 | |

10.0 – 10.9 | | | 21 | | | | 278,516,040 | | | | 31.8 | |

11.0 – 11.9 | | | 11 | | | | 102,834,816 | | | | 11.7 | |

12.0 – 12.9 | | | 22 | | | | 197,495,290 | | | | 22.5 | |

13.0 – 13.9 | | | 6 | | | | 39,253,942 | | | | 4.5 | |

14.0 – 14.9 | | | 1 | | | | 5,000,000 | | | | 0.6 | |

15.0 – 15.9 | | | 1 | | | | 3,244,691 | | | | 0.4 | |

16.0 – 16.9 | | | 2 | | | | 7,992,085 | | | | 0.9 | |

17.0 – 17.9 | | | 1 | | | | 14,472,723 | | | | 1.7 | |

18.0 – 19.9 | | | 2 | | | | 4,638,709 | | | | 0.5 | |

20.0 – 132.4 | | | 19 | | | | 54,272,912 | | | | 6.2 | |

| | | | | | | | | | | | |

Total: | | | 95 | | | $ | 876,739,752 | | | | 100.0 | % |

| | | | | | | | | | | | |

Weighted Average: | | | 13.5 | % | | | | | | | | |

| | | | | | | | | | | | |

UNDERWRITTEN NCF DEBT YIELD

| | | | | | | | | | | | |

Range of U/W NCF Debt Yields

(%) | | Number

of

Mortgage

Loans | | | Aggregate

Cut-off

Date

Balance ($) | | | % of

Cut-off

Date

Balance | |

7.6 – 7.9 | | | 1 | | | $ | 11,600,000 | | | | 1.3 | % |

8.0 – 8.9 | | | 5 | | | | 121,998,792 | | | | 13.9 | |

9.0 – 9.9 | | | 16 | | | | 161,700,781 | | | | 18.4 | |

10.0 – 10.9 | | | 18 | | | | 273,619,598 | | | | 31.2 | |

11.0 – 11.9 | | | 23 | | | | 166,047,098 | | | | 18.9 | |

12.0 – 12.9 | | | 6 | | | | 53,808,307 | | | | 6.1 | |

13.0 – 13.9 | | | 2 | | | | 17,816,780 | | | | 2.0 | |

15.0 – 15.9 | | | 2 | | | | 4,717,394 | | | | 0.5 | |

16.0 – 16.9 | | | 1 | | | | 6,519,382 | | | | 0.7 | |

18.0 – 19.9 | | | 2 | | | | 4,638,709 | | | | 0.5 | |

20.0 – 132.4 | | | 19 | | | | 54,272,912 | | | | 6.2 | |

| | | | | | | | | | | | |

Total: | | | 95 | | | $ | 876,739,752 | | | | 100.0 | % |

| | | | | | | | | | | | |

Weighted Average: | | | 12.7 | % | | | | | | | | |

| | | | | | | | | | | | |

| (1) | Information regarding mortgage loans that are cross-collateralized with other mortgage loans is based upon the individual loan balances, except that the applicable loan-to value ratio, debt service coverage ratio or debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group. On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio or debt yield for each such mortgaged property are calculated using underwritten net cash flow for the related residential cooperative property which is the projected net cash flow reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative. Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. With respect to 301 South College Street loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan (unless otherwise stated) in total debt. |

13

| | |

| WFRBS Commercial Mortgage Trust 2013-C13 | | Characteristics of the Mortgage Pool |

ORIGINAL TERM TO MATURITY OR ARD

| | | | | | | | | | | | |

Range of Original Terms to

Maturity or ARD (months) | | Number

of

Mortgage

Loans | | | Aggregate

Cut-off Date

Balance ($) | | | % of

Cut-off

Date

Balance | |

60 | | | 7 | | | $ | 86,368,235 | | | | 9.9 | % |

120 | | | 88 | | | | 790,371,517 | | | | 90.1 | |

| | | | | | | | | | | | |

Total: | | | 95 | | | $ | 876,739,752 | | | | 100.0 | % |

| | | | | | | | | | | | |

Weighted Average: | | | 114 months | | | | | | | | | |

REMAINING TERM TO MATURITY OR ARD

| | | | | | | | | | | | |

Range of Remaining Terms to

Maturity or ARD (months) | | Number

of

Mortgage

Loans | | | Aggregate

Cut-off Date

Balance ($) | | | % of

Cut-off

Date

Balance | |

58 – 60 | | | 7 | | | $ | 86,368,235 | | | | 9.9 | % |

85 – 120 | | | 88 | | | | 790,371,517 | | | | 90.1 | |

| | | | | | | | | | | | |