Filed pursuant to Rule 424(b)(3)

Registration No. 333-207537

PROSPECTUS SUPPLEMENT NO. 2

(to Prospectus dated April 5, 2016)

ATLAS GROWTH PARTNERS, L.P.

Common Units Representing Limited Partner Interests

Minimum Offering: 100,000 Class A Common Units and Class T Common Units

Maximum Offering: 100,000,000 Class A Common Units and Class T Common Units

Warrants to Purchase Post-Listing Common Units Representing Limited Partner Interests

Distribution Reinvestment Plan: up to 21,505,376 Class A Common Units

Post-Listing Common Units Underlying the Warrants and to be Issued Upon Automatic Conversion of Class A and

Class T Common Units

This prospectus supplement is being filed to provide updates regarding our affiliate, Atlas Resource Partners, L.P., and to update and supplement information contained in the prospectus dated April 5, 2016 and prospectus supplement no. 1 dated May 16, 2016. The information contained herein supplements the disclosure under the headings “Suitability Standards,” “Summary,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business and Properties” and “Management.”

This prospectus supplement updates and supplements the information in the prospectus and is not complete without, and may not be delivered or utilized except in combination with, the prospectus, including any other amendments or supplements thereto. This prospectus supplement should be read in conjunction with the prospectus and if there is any inconsistency between the information in the prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Investing in our common units involves a high degree of risk. Before subscribing for common units you should carefully read the discussion of material risks of investing in our common units in “Suitability Standards” on page iii and in “Risk Factors” on page 28 of the prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is July 25, 2016

PROSPECTUS UPDATES

SUMMARY; MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION; BUSINESS AND PROPERTIES

The following disclosure is hereby inserted into the following locations in the Prospectus: (a) under the new subheading labeled“—Recent Developments” at the end of the section entitled “Summary—Our Operations” at the bottom of page 7 of the prospectus; (b) under the new subheading “—ARP Reorganization” at the end of the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operation—Recent Developments” on page 123 of the prospectus; and (c) under the new subheading “—ARP Reorganization” at the end of the section entitled “Business and Properties—Our Relationship with ATLS and ARP” on page 151 of the prospectus.

On July 25, 2016, Atlas Growth Partners, L.P.’s (“AGP”) affiliate, Atlas Resource Partners, L.P. (“ARP”), entered into a Restructuring Support Agreement (defined below) with its lenders for a prepackaged restructuring that will reduce debt on its balance sheet and position ARP for the future. Atlas Growth Partners and Atlas Resource Partners are affiliates through the ownership by their common parent, Atlas Energy Group, LLC (“ATLS”). The ARP Restructuring (defined below) is expected to be completed within approximately 30 days, after which ARP should emerge as a new publicly traded company, backed by its stakeholders, committed to investing capital to develop its exploration and production assets, as well as its tax-advantaged drilling partnership program.

AGP is not a party to the Restructuring Support Agreement, and the ARP Restructuring does not impact AGP.

The ARP Restructuring is not expected to impact ATLS or its ownership interest in AGP, including ATLS’s control of our general partner, Atlas Growth Partners GP, LLC. The debt structure of ATLS was recently modified, and ATLS will not be a party to the ARP Restructuring. ATLS remains controlled by the same ownership group and management team and thus, we expect that the ARP Restructuring will have no material impact on the ability of management to operate AGP or the other ATLS businesses.

The description of the ARP Restructuring below relates solely to the Restructuring Support Agreement and its expected impacts on ARP.

ARP Restructuring

On July 25, 2016, ARP, certain of its subsidiaries (collectively with ARP, the “Atlas Restructuring Parties”) and ATLS, as ARP’s general partner, solely with respect to certain sections thereof, entered into a Restructuring Support Agreement (the “Restructuring Support Agreement”) with (i) lenders holding 100% of ARP’s senior secured revolving credit facility (the “First Lien Lenders”), (ii) lenders holding 100% of ARP’s second lien term loan (the “Second Lien Lenders”) and (iii) holders (the “Consenting Noteholders” and, collectively with the ARP First Lien Lenders and the ARP Second Lien Lenders, and their respective successors or permitted assigns that become party to the Restructuring Support Agreement, the “Restructuring Support Parties”) of approximately 80% of the aggregate principal amount outstanding of the 7.75% Senior Notes due 2021 (the “7.75% Notes”) of ARP’s subsidiaries, Atlas Resource Partners Holdings, LLC and Atlas Resource Finance Corporation (together, the “Issuers”), and 9.25% Senior Notes due 2021 (together with the 7.75% Notes, the “Notes”) of the Issuers. Under the Restructuring Support Agreement, the Restructuring Support Parties have agreed, subject to certain terms and conditions, to support a restructuring of the Atlas Restructuring Parties (the “ARP Restructuring”) pursuant to a pre-packaged plan of reorganization (the “Plan”) to be filed in cases commenced under chapter 11 of the United States Bankruptcy Code (“Chapter 11”).

Pursuant to the Restructuring Support Agreement, ARP expects to commence a solicitation of votes for the Plan on July 25, 2016 and expects to commence the Chapter 11 cases on or before July 27, 2016.

ARP expects its oil and gas properties to continue operating in the ordinary course throughout the ARP Restructuring. Pursuant to the Plan, the business assets and operations of the Partnership will vest in a new limited liability company, which will be classified as a corporation for U.S. federal income tax purposes (“New Holdco”). Under the Plan, all suppliers, vendors, employees, royalty owners, trade partners and landlords will be unimpaired by the ARP Restructuring and will be satisfied in full in the ordinary course of business, and the Atlas Restructuring Parties’ existing trade contracts and terms will be maintained. The ARP Restructuring, including as a result of ARP monetizing certain hedges to pay down borrowings outstanding under its revolving credit facility, will result in a reduction of the Atlas Restructuring Parties’ existing debt by approximately $900 million and the elimination of approximately $80 million of annual debt service obligations.

In particular, under the Plan, on the Plan’s effective date (the “Plan Effective Date”), the First Lien Lenders will receive cash payment of all obligations owed to them by ARP pursuant to the revolving credit facility (other than $440 million of principal and face amount of letters of credit) and become lenders under an exit facility credit agreement (the “First Lien Exit Facility”), composed of a $410 million conforming reserve-based tranche and a $30 million non-conforming tranche. The non-conforming tranche will mature on May 1, 2017 and the conforming reserve-based tranche will mature on August 23, 2019.

In addition, ARP will enter into a new second lien credit agreement (the “Second Lien Exit Facility” and, together with the First Lien Exit Facility, the “Exit Facilities”). The Second Lien Lenders will receive a pro rata share of the Second Lien Exit Facility, which will have an aggregate principal amount of $250 million, plus the amounts resulting from the accrual of PIK interest on the principal amount of $250 million from the commencement of the Chapter 11 cases, with interest expense paid partially in cash and partially in-kind for a period before returning to all cash interest. In addition to the Second Lien Exit Facility, the Second Lien Lenders will receive a pro rata share of 10% of the common equity interests of New HoldCo, subject to dilution by a management incentive plan.

Holders of the Notes, in exchange for 100% of the $668 million aggregate principal amount of Notes outstanding plus accrued but unpaid interests as of the commencement of the chapter 11 cases, will receive, on the Plan Effective Date, 90% of the common equity interests of New HoldCo as of the Plan Effective Date, subject to dilution by a management incentive plan.

Under the Plan, the holders of ARP’s limited partnership units will receive no recovery. On the Plan Effective Date, all preferred limited partnership units and common limited partnership units of ARP will be cancelled without the receipt of any consideration.

Under the Plan, on the Plan Effective Date, a wholly owned subsidiary of ATLS (“ARP Mgt LLC”) will receive a preferred share of New HoldCo. The preferred share will entitle ARP Mgt LLC to receive 2% of the economics of New HoldCo (subject to dilution if catch-up contributions are not made with respect to future equity issuances, other than pursuant to a management incentive plan) and certain other rights as provided for in the Restructuring Support Agreement. For so long as ARP Mgt LLC holds such preferred share, a majority of the board of directors of New HoldCo will be appointed by certain current affiliates of ATLS. New HoldCo will have a continuing right to purchase the preferred share at fair market value, subject to the approval of 67% of the outstanding common shares not held by ARP Mgt LLC or its affiliates.

The Restructuring Support Agreement may be terminated upon the occurrence of certain events, including the failure to meet specified milestones related to filing, confirmation and consummation of the Plan, among other requirements, and in the event of certain breaches by the parties under the Restructuring Support Agreement. There can be no assurance that the ARP Restructuring will be consummated.

ARP NYSE Delisting

On July 12, 2016, ARP was notified by the New York Stock Exchange (the “NYSE”) that the NYSE will commence proceedings to delist ARP’s common units (the “ARP Common Units”) from the NYSE as a result of ARP’s failure to comply with the continued listing standard set forth in Section 802.01C of the NYSE Listed Company Manual to maintain an average closing price of not less than $1.00 over a consecutive 30 trading day period. ARP’s two preferred unit classes, 8.625% Class D Cumulative Redeemable Perpetual Preferred Units and 10.75% Class E Cumulative Redeemable Perpetual Preferred Units (collectively, the “Preferred Units”), will also be delisted.

The ARP Common Units and Preferred Units began trading on the OTCQX Market on Wednesday, July 13, 2016, with the symbol “ARPJ” for the ARP Common Units, “ARPJP” for the Class D Preferred Units and “ARPJN” for the Class E Preferred Units.

SUITABILITY STANDARDS

The following disclosure is hereby added to the disclosure in “—General Suitability Requirements for Purchasers of Common Units Representing Limited Partner Interests” on page iv of the prospectus:

Arkansas Residents: In addition to meeting the general suitability standards stated above, you may not invest more than 10% of your liquid net worth in Atlas Growth Partners, L.P. and in other similar direct participation programs.

SUMMARY

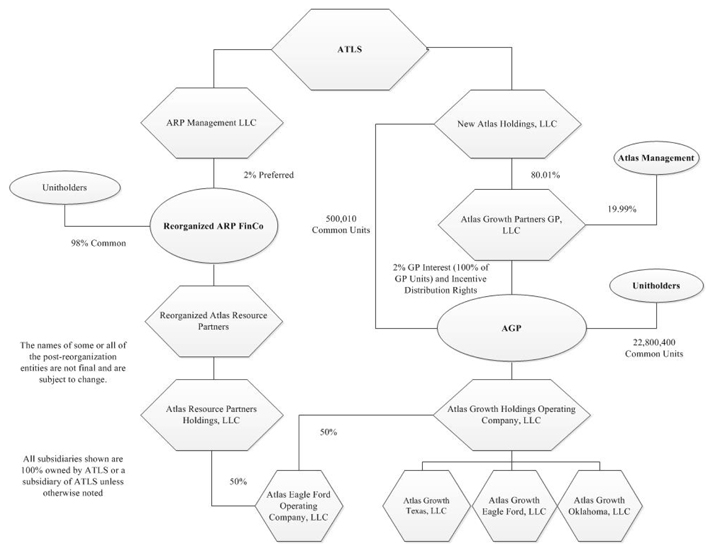

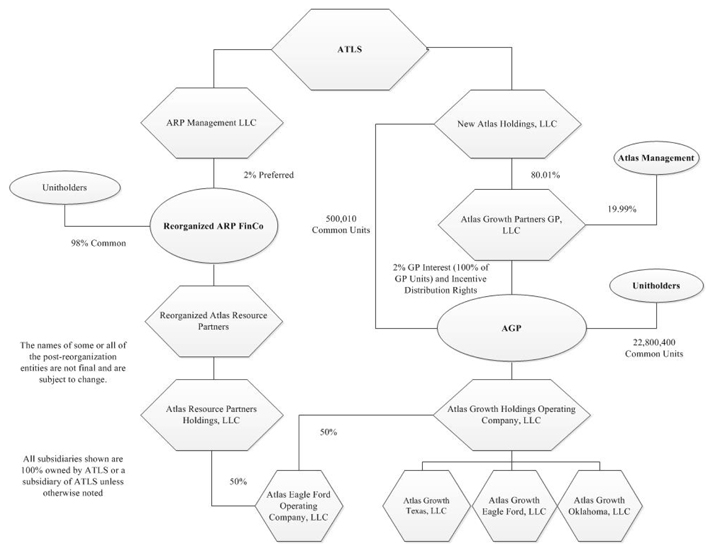

The following disclosure is hereby added to the disclosure in “—Our Ownership Structure” on page 9 of the prospectus:

The following chart shows the ownership structure of the various entities that are affiliated with us, our general partner and our respective affiliates as expected following the consummation of the ARP Restructuring.

BUSINESS AND PROPERTIES

The following disclosure replaces “Business and Properties—Employees” beginning on page 170 of the prospectus:

We have no officers, directors, or employees. Instead, our general partner will manage our day-to-day affairs and all aspects of our oil and gas operations. As of July 22, 2016, ATLS had 403 employees. Please read “Management” for more information.

MANAGEMENT

The Management section of the prospectus is amended as follows:

Brad Eubanks, Vice President of Land, and William A. Ulrich, Vice President of Corporate Development, are no longer employees of the general partner or any of its affiliates.

Frank Rotunda, age 65, has been the Senior Director of Land with management responsibilities for all of Atlas’s land functions since June 2016. Previously, he served as Regional Land Director – Western Division beginning in April 2015 following a role as Regional Land Director – Eastern Division beginning in January 2012. Prior to joining Atlas, Mr. Rotunda served as Director of Business Development – Appalachian for EXCO Resources. Mr. Rotunda began his career in 1978 with Quaker State Oil Refining Corporation and has served in a number of management positions for several oil and gas companies, with responsibilities including leasing and drilling programs, acquisitions and divestitures and general land administration.

Betsy Toney, age 31, has been the Vice President of Corporate Development of our general partner since July 2016. In addition, she has served as Vice President of Finance for our general partner, ATLS and ARP since October 2015. Previously, she served as a director of Corporate Development beginning in January 2014 following a role as an associate in Corporate Development in Strategy beginning in August 2012. Prior to joining Atlas, Ms. Toney served as a member of the investment team at Quantum Energy Partners and as an investment banker with JP Morgan Chase and Greenhill & Co.

GLOSSARY

The Glossary section of the prospectus is revised as follows: (a) the definition of “ARP” on page 278 of the prospectus is revised and replaces by the following definition; and (b) the definition of “General Partner” is hereby added at the beginning of page 280 of the prospectus:

ARP—Atlas Resource Partners, L.P., an affiliate of Atlas Energy Group, LLC.

General Partner—Our general partner is Atlas Growth Partners GP, LLC, an affiliate of Atlas Energy Group, LLC.