UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22911

Reality Shares ETF Trust

(Exact name of registrant as specified in charter)

402 West Broadway, Suite 2800

San Diego, CA 92101

(Address of principal executive offices) (Zip code)

Eric R. Ervin

c/o Reality Shares Advisors, LLC

402 West Broadway, Suite 2800

San Diego, CA 92101

(Name and address of agent for service)

Registrant’s telephone number, including area code: (619) 487-1445

Date of fiscal year end: October 31

Date of reporting period: October 31, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Reality Shares DIVS ETF

Ticker: DIVY

Annual Report

October 31, 2015

The financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

Not FDIC Insured • No Bank Guarantee • May Lose Value

ALPS Distributors, Inc., distributor.

Table of Contents

Letter to Shareholders (Unaudited)

December 2015

Dear Shareholder:

Stock, bond, currency and commodity markets in 2015 have all been characterized by high volatility and sometimes dramatic directional swings as investors grappled with mixed economic indicators in the U.S., struggling economies in Europe, and weakness in China and other emerging economies. But the question weighing most heavily on investors’ minds was when the U.S. Federal Reserve would raise its benchmark Fed Funds rate. For seven years, the Fed Funds Rate and other benchmark rates have hovered near historic lows – and in some cases have been even negative. This phenomenon has had a profound effect on some investor’s behavior, as indicated by investors shifting their money into potentially riskier investments in search of higher yields and better returns, and then likely monitoring the timing of a Fed rate increase so they could maximize returns without suffering downside risk.

This trend may also have been exacerbated by the proliferation of index investing, in both “beta1” and “smart beta2” forms. According to the ICI Factbook, more than 20% of U.S. equity investor assets are now invested in index funds that track broad market averages, which means that when investors buy or sell, they are increasingly buying and selling the same stocks at the same time. We believe this trend will favor a more differentiated investment approach that incorporates alternative asset classes and more targeted and rigorous securities selection. Using dividends as a driver of investment returns and as an alternative to a portfolio of equity securities is a principal investment thesis3 underlying the Reality Shares DIVS ETF (DIVY).

While high-dividend stocks as a whole fared poorly, dividend payments themselves – from which DIVY seeks to derive its performance return – proved robust in 2015. Forecasts for S&P 500 dividend growth began the year in excess of 10%, but extreme financial challenges in the energy sector led to several significant dividend cuts. So while S&P 500 dividends are likely to fall short of a record fifth consecutive year of double-digit growth, they are still well ahead of their 10-year average of 6.9%. Through October 31, S&P 500 dividends were already up 7.1%, and the third quarter of 2015 marked the sixth consecutive quarter of record dividend payments.

Notably this year, after passing the latest round of Federal Reserve stress tests, certain of the largest banks in the financial sector received approval to re-establish or increase the amount of cash available to return to shareowners. Subsequent dividend actions by several large dividend payers led the sector back as once again the largest contributor to S&P 500 dividends. Additionally, the dividend programs at Apple and Exxon each surpassed a record $12 billion. Corporate cash balances are near record levels, giving boards the flexibility to return more cash to shareholders. So in spite of the volatility in the stock market, the potential for above-average dividend growth is still strong.

Eric R. Ervin President and C.E.O. Reality Shares, Inc.

| 1 | Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. |

| 2 | Smart Beta defines a set of investment strategies that seeks to capture investment factors or market inefficiencies based on a series of alternative index construction rules. |

| 3 | The Investment Objective of the Reality Shares DIVS ETF seeks to produce long-term capital appreciation. The Principal Investment Strategy is designed to provide exposure to the aggregate value of ordinary dividends expected to be paid on a portfolio of large capitalization equity securities listed for trading in the U.S., Europe and Japan. Please see the prospectus for a full description of DIVY’s principal investment strategies. |

| | | | |

| Reality Shares DIVS ETF | | | 1 | |

Management Discussion of Fund Performance (Unaudited)

October 31, 2015

Reality Shares DIVS ETF (DIVY)

Launched on December 18, 2014, the Reality Shares DIVS ETF (DIVY) is a first-of-its-kind exchange-traded fund that offers investors a new way to approach dividend investing by providing access to the potential future dividend growth of the largest companies in the U.S. without exposure to the volatility of their underlying stock prices. By isolating the expected dividend values of large cap securities, DIVY seeks to provide investors a number of potential benefits including portfolio diversification, risk mitigation, and lower volatility.

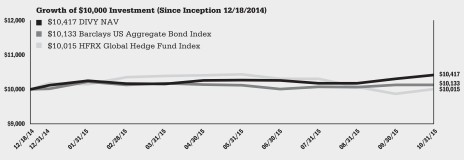

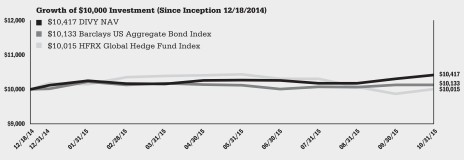

DIVY is designed as an alternative to bonds and stocks during volatile markets. Since its inception on December 18, 2014 to October 31, 2015, DIVY returned 4.17% by NAV compared to a 1.33% gain for the Barclays U.S. Aggregate Bond Index1 and 0.15% for the HFRX Global Hedge Fund Index2. DIVY also is designed to seek returns with lower volatility and a lower correlation to stock market price fluctuations, and we believe it has been successful in achieving those goals.

The market price of DIVY has had a correlation to the S&P 500 index3 of just -0.10 since its inception, and its annualized price volatility of 10.30% was approximately 33% lower than that of the S&P 500 index for the period. From peak to trough, the maximum draw-down (measuring the percentage drop in cumulative return from a previously reached high) for DIVY’s NAV was -2.57%, compared to -11.13% for the S&P 500 Total Return Index4 as a proxy for the broad equity market.

| | |

| Fund Performance History (%) | | Total Return

As of October 31, 2015 |

| | | Since Inception

(December 18, 2014) |

Fund | | |

NAV Return | | 4.17% |

Market Price | | 3.74% |

Index | | |

Barclays US Aggregate Bond Index | | 1.33% |

HFRX Global Hedge Fund Index | | 0.15% |

| | |

| 2 | | Reality Shares DIVS ETF |

Management Discussion of Fund Performance (concluded)

| 1 | Barclays U.S. Aggregate Bond Index measures the performance of the total U.S. investment-grade bond market. The index includes investment-grade U.S. Treasury bonds, government-related bonds, corporate bonds, mortgage-backed pass-through securities, commercial mortgage-backed securities and asset-backed securities that are publicly offered for sale in the United States. |

| 2 | HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

| 3 | The S&P 500® Index is a broad-based, unmanaged American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ. The S&P 500 was developed and continues to be maintained by Standard & Poor’s Financial Services LLC, and is considered to be a bellwether for the US economy. |

| 4 | The S&P 500 Total Return Index is a broad stock market index based on the market capitalization of 500 large companies having common stock listed on the NYSE or NASDAQ, where any cash distributions, such as dividends, are reinvested back into the index. The S&P 500 was developed and continues to be maintained by Standard & Poor’s Financial Services LLC, and is considered to be a bellwether for the US economy. |

Disclosures:

The views in this letter were those of the Fund manager as of the publication of the report and may not necessarily reflect his views on the date this letter is first published or anytime thereafter. These views are intended to assist shareholders in understanding the Fund’s present investment methodology and do not constitute investment advice.

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.realityshares.com. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The estimated operating expense ratio as disclosed in the most recent prospectus dated December 15, 2014 (supplemented September 16, 2015), was 0.85%.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares. An investor cannot invest directly in an index.

A fund’s per share net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing fund shares. The NAV return is based on the NAV of a fund and the market return is based on the market price per share of a fund. The price used to calculate market return (“Market Price”) is determined by using the mean of the bid and offer on the primary stock exchange on which the shares of the fund is listed for trading when the fund’s NAV is calculated at market close. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the fund at Market Price and NAV, respectively.

The Fund does not generate dividend income, and is not appropriate for investors seeking dividend income.

The Fund is newly organized and the Adviser has not previously managed an ETF registered under the 1940 Act.

Investing involves risks, including possible loss of principal. Past performance does not guarantee future results. There is no assurance the stated objective(s) will be met. Not FDIC insured. See the section “Principal Risks” in the prospectus for important risk disclosures. Investments in swaps, options, forward contracts and futures contracts are subject to a number of risks, including correlation risk, interest rate risk, market risk, leverage risk, and liquidity risk. Each of these risks could cause DIVY to vary from its stated objective, could cause DIVY to lose money and may have a negative impact on the value of your investment.

| | | | |

| Reality Shares DIVS ETF | | | 3 | |

Shareholder Expense Example (Unaudited)

October 2015

As a shareholder of the Reality Shares DIVS ETF (the “Fund”), you incur two types of costs: (1) transaction costs, including brokerage commissions paid on purchase and sales of fund shares, and (2) ongoing costs, including management fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The actual and hypothetical expense example below is based on an investment of $1,000 held for the entire six-month period from May 1, 2015 to October 31, 2015.

Actual expenses

The first line under the Fund in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for the Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line under the Fund in the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

5/01/2015 | | | Ending

Account Value

10/31/2015 | | | Annualized

Expense Ratio

for the

Period | | | Expenses Paid

During

Period(1) | |

Reality Shares DIVS ETF | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,015.30 | | | | 0.85 | % | | $ | 4.32 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.92 | | | | 0.85 | % | | $ | 4.33 | |

| (1) | Hypothetical Expenses Paid are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| | |

| 4 | | Reality Shares DIVS ETF |

Schedule of Investments

Reality Shares DIVS ETF

October 31, 2015

| | | | | | | | |

| | | Shares | | | Value | |

Money Market – 99.5% | | | | | | | | |

Goldman Sachs Financial Square Money Market Fund, Institutional Shares, 0.15%(a)

(Cost $29,914,119) | | | 29,914,119 | | | $ | 29,914,119 | |

| | | | | | | | |

Total Investments – 99.5% | | | | | | | | |

(Cost $29,914,119) | | | | | | | 29,914,119 | |

Other Assets in Excess of Liabilities – 0.5% | | | | 139,351 | |

| | | | | | | | |

Net Assets – 100.0% | | | | | | $ | 30,053,470 | |

| (a) | Rate shown reflects the 7-day yield at October 31, 2015. |

Dividend swap baskets outstanding at October 31, 2015:

| | | | | | | | | | |

| Underlying Index | | Expiration

Date | | Notional

Amount

Long (Short) | | | Unrealized

Appreciation

(Depreciation) | |

S&P 500 | | 12/31/2016 | | $ | (5,988,675 | ) | | $ | (39,425 | ) |

S&P 500 | | 12/31/2017 | | | (11,766,750 | ) | | | (87,750 | ) |

S&P 500 | | 12/31/2018 | | | (11,992,250 | ) | | | (134,750 | ) |

| | | | | | | | | $ | (261,925 | ) |

Cash was pledged to the broker for swap positions in the amount of $420,000.

BNP Paribas acts as counterparty to the dividend swap baskets listed above. The Fund will either pay the actual aggregate dividend value and receive the expected dividend value (long), or pay the expected dividend value and receive the actual aggregate dividend value (short).

The following table summarizes valuation of the Fund’s investments under the fair value hierarchy levels as of October 31, 2015:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Valuation Inputs | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | |

Money Market Fund | | $ | 29,914,119 | | | $ | — | | | $ | — | | | $ | 29,914,119 | |

Total Assets | | $ | 29,914,119 | | | $ | — | | | $ | — | | | $ | 29,914,119 | |

Liabilities | | | | | | | | | | | | | | | | |

Other Financial Instruments* | | $ | — | | | $ | (261,925 | ) | | $ | — | | | $ | (261,925 | ) |

Total Liabilities | | $ | — | | | $ | (261,925 | ) | | $ | — | | | $ | (261,925 | ) |

Total | | $ | 29,914,119 | | | $ | (261,925 | ) | | $ | — | | | $ | 29,652,194 | |

| * | Other financial instruments include dividend swap baskets. Dividend swap baskets are presented at net unrealized appreciation (depreciation). |

During the period ended October 31, 2015, there were no transfers between Level 1 and Level 2. It is the Fund’s policy to recognize transfers into and out of all levels at the beginning of the reporting period.

The Fund did not hold any Level 3 securities for the period ended October 31, 2015.

The accompanying notes are an integral part of these financial statements.

| | | | |

| Reality Shares DIVS ETF | | | 5 | |

Statement of Assets and Liabilities

Reality Shares DIVS ETF

October 31, 2015

| | | | |

Assets: | | | | |

| |

Investments, at fair value (cost: $29,914,119) | | $ | 29,914,119 | |

| |

Receivables | | | | |

| |

Receivable from broker | | | 420,000 | |

| |

Dividend receivable | | | 3,077 | |

Total Assets | | | 30,337,196 | |

Liabilities: | | | | |

| |

Payables | | | | |

| |

Advisory fees (Note 4) | | | 21,801 | |

| |

Unrealized depreciation on swaps (Note 7) | | | 261,925 | |

Total Liabilities | | | 283,726 | |

Net Assets | | $ | 30,053,470 | |

Net Assets Consist of: | | | | |

| |

Paid-in capital | | $ | 29,553,091 | |

| |

Undistributed net investment income | | | — | |

| |

Accumulated net realized gain on investments, futures and written options | | | 762,304 | |

| |

Net unrealized depreciation on swaps | | | (261,925 | ) |

Net Assets | | $ | 30,053,470 | |

Shares outstanding (unlimited number of shares of beneficial interest authorized, no par value) | | | 1,254,348 | |

Net Asset Value, per share | | $ | 23.96 | |

The accompanying notes are an integral part of these financial statements.

| | |

| 6 | | Reality Shares DIVS ETF |

Statement of Operations

Reality Shares DIVS ETF

For the period December 18, 2014 (commencement of operations) to October 31, 2015.

| | | | |

Investment Income: | | | | |

| |

Dividend income | | $ | 4,174 | |

Expenses: | | | | |

| |

Advisory fees (Note 4) | | | 165,321 | |

Net Investment loss | | | (161,147 | ) |

Realized and Unrealized Gain (Loss): | | | | |

| |

Net realized gain (loss) on: | | | | |

| |

Investments | | | (64,070,933 | ) |

| |

Futures | | | (4,929,283 | ) |

| |

Written options | | | 69,923,667 | |

Net realized gain | | | 923,451 | |

Net Change in Unrealized Depreciation on: | | | | |

| |

Swaps | | | (261,925 | ) |

Net change in unrealized depreciation | | | (261,925 | ) |

Net realized and unrealized gain | | | 661,526 | |

Increase in net assets resulting from operations | | $ | 500,379 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| Reality Shares DIVS ETF | | | 7 | |

Statement of Change in Net Assets

Reality Shares DIVS ETF

For the period December 18, 2014 (commencement of operations) to October 31, 2015.

| | | | |

Increase (Decrease) in Net Assets Resulting from Operations: | | | | |

| |

Net investment loss | | $ | (161,147 | ) |

| |

Net realized gain on investments, futures and written options | | | 923,451 | |

| |

Net change in unrealized depreciation | | | (261,925 | ) |

Net increase in net assets resulting from operations | | | 500,379 | |

Shareholder Transactions: | | | | |

| |

Proceeds from shares sold | | | 33,588,764 | |

| |

Cost of shares redeemed | | | (4,135,673 | ) |

Net increase in net assets resulting from shareholder transactions | | | 29,453,091 | |

Increase in net assets | | | 29,953,470 | |

Net Assets: | | | | |

| |

Beginning of period | | | 100,000 | |

| |

End of period | | $ | 30,053,470 | |

Undistributed net investment income | | $ | — | |

Changes in Shares Outstanding: | | | | |

| |

Shares outstanding, beginning of period | | | 4,348 | |

| |

Shares sold | | | 1,425,000 | |

| |

Shares redeemed | | | (175,000 | ) |

Shares outstanding, end of period | | | 1,254,348 | |

The accompanying notes are an integral part of these financial statements.

| | |

| 8 | | Reality Shares DIVS ETF |

Financial Highlights

Reality Shares DIVS ETF

For the period December 18, 2014 (commencement of operations) to October 31, 2015.

| | | | |

| Per Share Operational Performance: | | | |

Net asset value, beginning of period | | $ | 23.00 | |

Investment operations: | | | | |

Net investment loss1 | | | (0.17 | ) |

Net realized and unrealized gain | | | 1.13 | |

Total from investment operations | | | 0.96 | |

Net asset value, end of period | | $ | 23.96 | |

| |

Total Return at Net Asset Value2 | | | 4.17 | % |

Net assets, end of period (000’s) omitted | | $ | 30,053 | |

Ratios/Supplemental Data: | | | | |

Ratio to average net assets of: | | | | |

Expenses | | | 0.85 | %3 |

Net investment loss | | | (0.82 | )%3 |

Portfolio turnover rate4 | | | 1,475 | % |

| 1 | Based on average daily shares outstanding. |

| 2 | Periods less than one year are not annualized. |

| 4 | Portfolio turnover rate excludes securities received or delivered in-kind and is not annualized for periods of less than one year. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| Reality Shares DIVS ETF | | | 9 | |

Notes to Financial Statements

For the period ended October 31, 2015

1. ORGANIZATION

Reality Shares DIVS ETF (the “Fund”) is a series of the Reality Shares ETF Trust (the “Trust”) which was organized as a Delaware statutory trust on March 26, 2013. The Fund is a non-diversified, open-end management investment company Trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund commenced operations on December 18, 2014.

The shares of the Fund are listed and traded on the NYSE Arca, Inc. and other secondary markets. The market price of the Fund may be below, at, or above the net asset value (“NAV”) of the Fund. The Fund issues and redeems shares at NAV only in aggregated lots of 25,000 shares or more (each, a “Creation Unit”). Because non-exchange traded instruments and certain listed derivatives are not currently eligible for in-kind transfer, they will be substituted with cash in the purchase or redemption of Creation Units of the Fund. Specifically, the Fund will not accept (or offer) swaps, exchange-traded options, over-the-counter (“OTC”) options, exchange-traded futures, or forward contracts in the creation or redemption of its shares. As a practical matter, only institutions or large investors purchase or redeem Creation Units. Except when aggregated in Creation Units, shares of the Fund are not redeemable securities.

The Fund’s principal investment strategy is designed to provide exposure to the aggregate value of ordinary dividends expected to be paid on a portfolio of large capitalization equity securities listed for trading in the U.S., Europe and Japan (“Large Cap Securities”). These are sometimes referred to as the “expected dividend values” of the Large Cap Securities. Reality Shares Advisors, LLC (the “Adviser”), the Fund’s investment adviser, believes expected dividend values generally correspond to the aggregate value of actual dividend payments on the Large Cap Securities. Unlike more traditional products, the Fund does not seek to produce returns based on appreciation in the stock market price of Large Cap Securities. Instead, the Fund seeks to produce returns based primarily on increases in the expected dividend values of Large Cap Securities. The Fund uses a variety of investment strategies to achieve this objective. Under normal circumstances, the Fund generally invests in a combination of swaps, listed option contracts, futures and forwards on indexes of Large Cap Securities (“Large Cap Securities Indexes”) or exchange traded funds (“ETFs”) designed to track Large Cap Securities Indexes (“Large Cap Securities ETFs”).

2. SIGNIFICANT ACCOUNTING POLICIES

These financial statements are prepared in conformity with U.S. generally accepted accounting principles (“GAAP”), which require management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and reported amounts of increases and decreases in the net assets from operations during the reporting period. Actual results could differ from those estimates.

The Fund is an investment company and follows the accounting and reporting guidance with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 946, Financial Services – Investment Companies.

The following is a summary of significant accounting policies followed by the Fund in its preparation of its financial statements:

Investment Transactions and Investment Income: Investment transactions are recorded on the trade date. Realized gains and losses on sales of investment securities are calculated using specific identification basis. Dividend income, if any, is recorded on the ex-dividend date or, in the case of foreign securities, as soon as the Fund is informed of the ex-dividend dates. Interest income, including accretion of discounts and amortization of premiums, is recorded on the accrual basis.

Cash and Cash Equivalents: Cash and cash equivalents include funds from time to time deposited with financial institutions and short-term, liquid investments in a money market fund. Cash and cash equivalents are carried at cost which approximates fair value.

Dividend Distributions: Distributions to shareholders from investment income and capital gains are recorded on the ex-dividend date and are determined in accordance with federal income tax regulations, which may differ from GAAP.

Receivable from broker: Receivable from broker represents deposits with brokers which is used as collateral pledged to brokers for swap contracts.

Swaps: Changes in the underlying value of the swap contracts are recorded as unrealized appreciation or depreciation on swaps.

Written Options: Premiums received from options written are recorded as liabilities. The liabilities are subsequently adjusted to reflect the current value of the options written. Premiums received from writing options which expire are treated as realized gains. Premiums received from writing options which are exercised or are closed are added to or offset against the proceeds or amount paid on the transactions to determine the net realized gain or loss.

Purchased Options: Changes in value of purchased options are reported as part of change in unrealized gain (loss) on investments in the Statement of Operations. When the purchased option expires, is terminated or is sold, the Fund will record a gain or loss, which is reported as part of realized gain (loss) on investments in the Statement of Operations.

| | |

| 10 | | Reality Shares DIVS ETF |

Notes to Financial Statements (continued)

In the normal course of business, the Fund enters into contracts that contain a variety of representations that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund and/or its affiliates that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

3. SECURITIES VALUATION

Investment Valuation: The Fund calculates its NAV each day the New York Stock Exchange (the “NYSE”) is open for trading as of the close of regular trading on the NYSE, normally 4:00 p.m. Eastern time (the “NAV Calculation Time”). In calculating a Fund’s NAV, Fund investments generally are valued using market valuations. A market valuation generally means a valuation (i) obtained from an exchange or a major market-maker (or dealer), (ii) based on a price quotation or other equivalent indication of value supplied by an exchange, or a major market-maker (or dealer) or (iii) based on amortized cost. Short-term debt securities with remaining maturities of sixty (60) days or less are valued on the basis of amortized cost, provided such amount approximates fair value. In general, the Trust values exchange-listed option contracts based on the last reported sales price or the midpoint of the bid /ask spread for individual exchange-listed option contracts up until 4:15 p.m. Eastern time, the normal close of the Chicago Board Options Exchange, as reported by the Options Price Reporting Authority (“OPRA” and “OPRA Prices”). The Fund compares these OPRA Prices to the best bid/ask quotes received from independent broker-dealers and independent pricing services on the option combinations held by the Fund. When the OPRA Prices are within the option combination best bid/ask quotes, the OPRA Prices are used to value the option contracts held by the Fund. When the OPRA Prices fall outside of the option combination best bid/ask quotes, the Fund’s procedures, in general, provide for the option combinations held by the Fund to be priced based on the average of the best bid and best offer indicated by the dealer quotes, as well as other observable market inputs. The Trust generally values exchange-listed futures at the settlement price determined by the applicable exchange. Non-exchange-traded derivatives, including OTC options, swap transactions and forward transactions, are normally valued on the basis of quotations or equivalent indication of value supplied by an independent pricing service or major market-makers or dealers. Swaps cleared through a central clearing house, if any, normally are valued at the settlement price established each day by the board of exchange on which they are traded. The Trust may use various third-party pricing services, or discontinue the use of any third-party pricing service, as determined by the Trust’s Board of Trustees from time to time.

The Fund values its investments at fair value pursuant to procedures adopted by the Board of Trustees if (1) market quotations are not readily available or deemed not to reflect fair value or (2) the Adviser believes that the values available are unreliable. Under supervision of the Board of Trustees, the Adviser formed a Fair Value Pricing Committee (the “Committee”) to perform certain functions as they relate to the administration and oversight of the Fund’s valuation procedures. Under these procedures, the Committee convenes on a regular and ad-hoc basis to review such securities and considers a number of factors, including valuation methodologies and significant unobservable inputs, when arriving at fair value.

In certain instances, such as when reliable market valuations are not readily available or are not deemed to reflect current market values, the Fund’s investments will be fair valued in accordance with the Fund’s pricing policy and procedures. Securities that are valued using “fair value” pricing may include, but are not limited to, securities for which there are no current market quotations or whose issuer is in default or bankruptcy, securities subject to corporate actions (such as mergers or reorganizations), securities subject to non-U.S. investment limits or currency controls, and securities affected by “significant events.” An example of a significant event is an event occurring after the close of the market in which a security trades but before a Fund’s next NAV Calculation Time that may materially affect the value of a Fund’s investment (e.g., government action, natural disaster, or significant market fluctuation). Price movements in U.S. markets that are deemed to affect the value of foreign securities, or reflect changes to the value of such securities, also may cause securities to be “fair valued.”

When fair-value pricing is employed, the prices of securities used by the Fund to calculate its NAV may differ from quoted or published prices for the same securities.

Fair Valuation Measurement: The Financial Accounting Standards Board established a framework for measuring fair value in accordance with GAAP. Under Fair Value Measurements and Disclosures, various inputs are used in determining the value of the Fund’s investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The three Levels of inputs of the fair value hierarchy are defined as follows:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument in an inactive market, prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

| | | | |

| Reality Shares DIVS ETF | | | 11 | |

Notes to Financial Statements (continued)

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

4. INVESTMENT MANAGEMENT AND OTHER AGREEMENTS

Unitary Fee: Subject to the supervision of the Board of Trustee, the Adviser is responsible for managing the investment activities of the Fund and the Fund’s business affairs and other administrative matters. For its services, the Fund pays the Adviser an annual rate of 0.85% of the Fund’s average daily net assets. Such fee is accrued daily and paid monthly. Under the Investment Advisory Agreement for the Fund, the Advisor has agreed to pay generally all expenses of the Fund.

Distribution and Service Fees: ALPS Distributors, Inc. (the “Distributor”) serves as the Fund’s Distributor. The Distributor will not distribute shares in less than Creation Units, as defined in Note 5, and does not maintain a secondary market in shares. The shares are expected to be traded in the secondary market.

No distribution fees are currently paid by the Fund and there are no current plans to impose a fee.

Administrator, Custodian, Accounting Agent and Transfer Agent Services: The Bank of New York Mellon (in each capacity, the “Administrator”, “Custodian,” “Accounting Agent” or “Transfer Agent”) serves as the Fund’s Administrator, Custodian, Accounting Agent and Transfer Agent pursuant to the Fund Administration and Accounting Agreement. The Bank of New York Mellon is a subsidiary of The Bank of New York Mellon Corporation, a financial holding company.

5. CREATION AND REDEMPTION TRANSACTIONS

Creation Units of the Fund are issued and redeemed generally in exchange for cash payment. In each instance of such cash creations or redemptions, the Trust may impose transaction fees based on transaction expenses related to the particular exchange that will be higher than the transaction fees associated with in-kind purchase or redemptions.

Only “Authorized Participants” who have entered into contractual arrangements with the Distributor may purchase or redeem shares directly from the Fund. An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company (“DTC”) participant and, in each case, must have executed a Participant Agreement with the Distributor. Most retail investors will not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, they will be unable to purchase or redeem the shares directly from the Fund. Rather, most retail investors will purchase shares in the secondary market with the assistance of a broker and will be subject to customary brokerage commissions or fees.

6. PURCHASES AND SALES OF SECURITIES

For the period ended October 31, 2015, purchases and sales of investments, other than short-term securities, were $383,501,200 and $393,516,946, respectively.

7. DERIVATIVE INSTRUMENTS

Swaps: A swap agreement is an agreement between two parties pursuant to which the parties exchange payments at specified dates on the basis of a specified notional amount, with the payments calculated by reference to specified securities, indexes, reference rates or other instruments. Most swap agreements provide that when the period payment dates for both parties are the same, the payments are made on a net basis (i.e., the two payment streams are netted out, with only the net amount paid by one party to the other). The Fund’s obligations or rights under a swap agreement entered into on a net basis will generally be equal only to the net amount to be paid or received under the agreement, based on the relative values of the notional positions held by each counterparty. Swap agreements are not entered into or traded on exchanges and there is no central clearing or guaranty function for total return swaps. Therefore, swaps are subject to credit risk or the risk of default or non-performance by the counterparty. Swaps could result in losses if interest rate or credit quality changes are not correctly anticipated by the Fund. Such loss could be in excess of the related amounts reflected in the Fund’s Statement of Assets and Liabilities.

When the Fund has an unrealized loss on a swap agreement, the Fund has instructed the custodian to pledge cash or liquid securities as collateral with a value at least equal to the amount of the unrealized loss. Collateral pledges are monitored and subsequently adjusted if and when the swap valuations fluctuate.

Pursuant to documentation governing the Fund’s swap transactions between the Fund and its counterparties, BNP Paribas, the counterparty has the right to terminate the swaps early in the event that the net assets of the Fund decline below specific levels set

| | |

| 12 | | Reality Shares DIVS ETF |

Notes to Financial Statements (continued)

forth in the documentation (“net asset contingent features”). In the event of early termination, the counterparty may require the Fund to pay or receive a settlement amount in connection with the terminated swap transaction. As of October 31, 2015, the Fund has not triggered the conditions under such documentation that will give the counterparty the right to call for an early termination. As of such date, the settlement value of these contracts was approximately equal to the fair value of such contracts.

The Fund entered into dividend swaps in order to gain exposure to changes in the expected dividend value of the Large Cap Securities. Dividend swaps are over-the-counter derivative contracts that allow investors exposure to the actual dividend value that will be paid by the constituents of an index over a period of time. In a typical dividend swap transaction, the buyer and seller agree at inception to the aggregate value of dividends they expect to be paid on the index constituents over the life of the contract – the expected dividend value. At maturity of the contract, the buyer pays this amount to the seller and receives the aggregate value of actual dividends paid on the index constituents – the actual dividend value. During the life of the dividend swap, the contract is valued on the current expected dividend value of the index for the specific maturity. As the contract approaches maturity, the expected dividend value will change primarily based on information about actual dividends until final settlement of the contract where expected dividend value and actual dividend value converge.

For the period ended October 31, 2015, the monthly average net notional value of dividend swap baskets held by the Fund was $(5,408,668).

Option Contracts: An option contract is a financial contract in which the purchaser of the contract has the right, but not the obligation, to buy (call) or sell (put) a financial asset, such as an index or ETF, at an agreed-upon price, known as the “strike price,” during a specific time period or on a specific exercise date. The seller of an option contract has a corresponding obligation to sell or buy, as applicable, the financial asset at the strike price during the option period or on the exercise date. A put option gives the purchaser of the option the right to sell, and the issuer of the option the obligation to buy, the underlying asset during the option period. A call option gives the purchaser of the option the right to buy, and the seller of the option the obligation to sell, the underlying asset during the option period.

During the period, the Fund purchased a series of option contracts that, when combined together, are designed to eliminate the effect of changes in the trading prices of the Large Cap Securities and the effect of interest rate changes on the prices of the option contracts. As a result, the value of the Fund’s options portfolio is designed to change based primarily on changes in the expected dividend values reflected in the options’ prices.

Risks may arise from a possible lack of liquid secondary market for an option. The maximum exposure to loss for any purchased option is limited to the premium initially paid for the option. Written uncovered call options subject the Fund to unlimited risk of loss. Written covered call options limit the upside potential of a security above the strike price. Put options written subject the Fund to risk of loss if the value of the security declines below the exercise price minus the put premium.

By writing a covered call option, the Fund, in exchange for the premium, foregoes the opportunity for capital appreciation above the exercise price should the market of the price of the underlying security increase. By writing a put option, the Fund, in exchange for the premium, accepts the risk of having to purchase a security at an exercise price that is above the current price. Changes in value of written options are reported as change in unrealized gain (loss) on written options in the Statement of Operations. When the written option expires, is terminated or is sold, the Fund will record a gain or loss, which is reported as realized gain (loss) on written options in the Statement of Operations.

Transactions in written options during the period ended October 31, 2015, were as follows:

| | | | | | | | |

| | | Contracts | | | Premiums

Received | |

Options outstanding, at beginning of period | | | — | | | $ | — | |

Options written | | | 17,050 | | | | 305,215,475 | |

Options closed | | | (17,050 | ) | | | (305,215,475 | ) |

Options expired | | | — | | | | — | |

Options outstanding, at end of period | | | — | | | $ | — | |

For the period ended October 31, 2015, the monthly average value of options contracts purchased was $138,132,034.

Futures Contracts: During the period, the Fund invested in futures contracts in order to hedge its investments against fluctuations in value caused by changes in prevailing interest rates or market conditions. A futures contract is an agreement between two parties to buy and sell a specific amount of a commodity, security or financial instrument including an index of stocks at a set price on a future date.

| | | | |

| Reality Shares DIVS ETF | | | 13 | |

Notes to Financial Statements (continued)

Upon entering into a futures contract, the Fund is required to deposit with a broker an amount (initial margin) equal to a percentage of the purchase price indicated by the futures contract. Subsequent payments, which are dependent on the daily fluctuations in the value of the underlying instrument, are made or received by the Fund each day (daily variation margin) and are recorded as unrealized gains or losses until the contracts are closed. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the proceeds from (or cost of) the closing transactions and the Fund’s cost basis in the contract. The realized gain or loss and change in unrealized gain or loss is reflected in the Statement of Operations.

The risks associated with futures contracts include (i) the risk that the counterparty to a contract may not fulfill its contractual obligations; (ii) the risk of mispricing or improper valuation; (iii) the risk of an illiquid secondary market; and (iv) the risk that changes in the value of the investment may not correlate perfectly with the underlying asset, rate or index.

Futures expose the Fund to risks in excess of the amounts recorded in the Statement of Assets and Liabilities. The Fund’s maximum risk of loss due to counterparty credit risk is equal to the margin posted by the Fund to the broker plus any gains or minus any losses on the outstanding futures contracts.

For the period ended October 31, 2015, the monthly average notional of futures contracts held by the Fund was $(901,475,025).

FASB ASC 815, “Derivatives and Hedging” (“ASC 815”), is applicable to all entities that issue or hold derivative instruments. ASC 815 requires qualitative disclosures about objectives and strategies for using derivatives and distinguishes between instruments used to manage risk and those used for other purposes.

The effect of derivatives on the Fund’s Statement of Assets and Liabilities at October 31, 2015:

| | | | | | | | |

| Location | | Equity Contracts | | | Total | |

Liability Derivatives: | | | | | | | | |

Unrealized Depreciation on Swaps | | $ | 261,925 | | | $ | 261,925 | |

Total Gross Amount of Liability | | $ | 261,925 | | | $ | 261,925 | |

The effect of derivatives on the Fund’s Statement of Operations for the period ended October 31, 2015:

| | | | | | | | | | | | |

| Location | | Equity Contracts | | | Interest Rate Contracts | | | Total | |

Net Realized Gain (Loss) on: | | | | | | | | | | | | |

Futures | | $ | — | | | $ | (4,929,283 | ) | | $ | (4,929,283 | ) |

Options Purchased | | | (64,070,933 | ) | | | — | | | | (64,070,933 | ) |

Options Written | | | 69,923,667 | | | | — | | | | 69,923,667 | |

Total Net Realized Gain (Loss) | | $ | 5,852,734 | | | $ | (4,929,283 | ) | | $ | 923,451 | |

Net Change in Unrealized Gain (Loss) on: | | | | | | | | | | | | |

Swaps | | $ | (261,925 | ) | | $ | — | | | $ | (261,925 | ) |

Total Net Change in Unrealized Gain (Loss) | | $ | (261,925 | ) | | $ | — | | | $ | (261,925 | ) |

In order to better define its contractual rights and to secure rights that will help the Fund mitigate its counterparty risk, the Fund may enter into an International Swaps and Derivatives Association, Inc. Master Agreement (“ISDA Master Agreement”) or similar agreement with its counterparties. An ISDA Master Agreement is a bilateral agreement between the Fund and a counterparty that governs OTC derivatives, including forward contracts, and typically contains, among other things, collateral posting terms, netting and rights of set-off provisions in the event of a default and/or termination event. Under an ISDA Master Agreement, the Fund may, under certain circumstances, offset with the counterparty certain derivative financial instruments’ payables and receivables to create a single net payment.

Collateral requirements generally differ by type of derivative. Collateral terms are contract-specific for OTC derivatives (e.g. foreign exchange contracts, options and certain swaps). Generally, for transactions traded under an ISDA Master Agreement, the collateral requirements are typically calculated by netting the marked to market amount for each transaction under such agreement and comparing that amount to the value of any collateral currently pledged by the Fund and the counterparty. Generally, the amount of collateral due from or to a counterparty must exceed a minimum transfer amount threshold before a transfer is required to be made. To the extent amounts due to the Fund from its derivatives counterparties are not fully collateralized, contractually or otherwise, the Fund bears the risk of loss from counterparty non-performance.

For financial reporting purposes, the Fund does not offset assets and liabilities subject to a master netting arrangements or similar agreements in the Statement of Assets and Liabilities. Therefore all qualified transactions are presented on a gross basis in the Statement of Assets and Liabilities. As of October 31, 2015, the Fund has transactions subject to enforceable master netting agreements. A reconciliation of the gross amount on the Statement of Assets and Liabilities to the net amounts, including collateral exposure, included in the following table:

| | |

| 14 | | Reality Shares DIVS ETF |

Notes to Financial Statements (continued)

Liabilities:

| | | | | | | | | | | | | | | | | | | | | | |

| Amounts Not Offset in the Statement of Assets and Liabilities | |

| Description | | Counterparty | | Gross Amounts of

Liabilities Offset in the

Statement of Assets

and Liabilities | | | Financial Instruments

Available for Offset | | | Financial

Instruments

Collateral

Pledged | | | Cash Collateral

Pledged | | | Net Amount

Due from

Counterparty | |

Unrealized Appreciation (Depreciation) on Dividend Swap Baskets | | BNP Paribas | | $ | (261,925 | ) | | $ | — | | | $ | — | | | $ | 261,925 | | | $ | — | |

Total | | | | $ | (261,925 | ) | | $ | — | | | $ | — | | | $ | 261,925 | | | $ | — | |

8. PRINCIPAL RISKS

In the normal course of business, the Fund trades financial instruments and enters into financial transactions where risk of potential loss exists due to such things as changes in the market (market risk) or failure or inability of the other party to a transaction to perform (credit and counterparty risk). Some principal risk factors affecting your investments in the Fund are set forth below:

Dividend Payout Risk: The success of the Fund’s investment strategy is highly dependent on the expected dividend values reflected in the prices of the Fund’s portfolio holdings. The value of an investment in the Fund will decrease, and you could lose money, if the expected dividend values reflected in the prices of the Fund’s portfolio holdings decrease. This generally will occur if the value of actual dividends paid by the counterparty to the swap contract on the Large Cap Securities goes down. The value of actual dividends paid on the Large Cap Securities and expected dividend values reflected in the prices of the Fund’s portfolio holdings may be lower for a variety of reasons, including an actual or potential decline in the health of the overall economy, lower corporate earnings levels, changes to corporate dividend policies, fluctuating interest rates and other factors. Each of these factors could have a negative impact on the value of the actual dividend payments on the Large Cap Securities and the expected dividend values reflected in the prices of the Fund’s portfolio holdings and could have a negative impact on Fund returns. Further, the expected dividend value reflected in the price of an instrument held by the Fund reflects only ordinary dividends and does not reflect the issuance of special dividends. Therefore, the value of your investment in the Fund is not expected to increase in response to the issuance of any special dividends paid on the Large Cap Securities.

Dividend Isolation Strategy Risk: Unlike more traditional funds, the Fund does not seek investment returns based on increases in the secondary market trading price of their portfolio holdings over short or long periods of time. Instead, the Fund seeks to produce investment returns based on strategies designed to provide exposure to the expected dividend values reflected in the prices of their portfolio holdings. The value of an investment in the Fund is generally expected to increase as the expected dividend values reflected in the prices of its portfolio holdings goes up. The value of an investment in the Fund is generally expected to decrease as the expected dividend values reflected in the prices of its portfolio holdings goes down. The value of an investment in the Fund is not intended to track the price returns of the securities underlying its portfolio holdings or general equity market returns. There can be no guarantee that the Fund’s investment strategies will be successful or that this strategy will produce positive investment returns.

Liquidity Risk: Liquidity risk is the risk that certain instruments may be difficult or impossible to buy or sell at the time and the price that the Fund would like. The Fund may have to lower the price, sell other securities instead or forego an investment opportunity, any of which could have a negative effect on Fund management or performance. With respect to options, shorter-dated options (i.e., options exercisable in the near future) may be more liquid than longer-dated options (i.e., options exercisable at a later date). There can be no guarantee that the trading markets of the Fund’s portfolio holdings that trade on an exchange will be liquid at all times.

Market Risk: Market risk is the risk that the market price of a security may move up and down, sometimes rapidly and unpredictably. The market prices of the Fund’s portfolio holdings are influenced by many factors. Although the Fund seeks to limit the influence of all such factors other than the expected dividend value reflected in the prices of its portfolio holdings, there can be no guarantees these strategies will be successful. As a result, the performance of the Fund could vary from its stated objective and you could lose money.

Non-Correlation Risk: The Fund is not designed to produce investment returns based on the stock market price of the Large Cap Securities. This means that the returns on your Fund investment are not intended to correlate to the stock market returns of the Large Cap Securities or equity securities in general. The value of your Fund investment may go down when the stock market return of the Large Cap Securities or equity securities in general are up.

Counterparty Risk: The Fund is exposed to counterparty risk, or the risk that an institution or other entity with which the Fund has unsettled or open transactions will default. The potential loss to the Fund could exceed the value of the financial assets recorded in the Fund’s financial statements. Financial assets, which potentially expose the Fund to counterparty risk, consist principally of cash due from counterparties and investments. The Adviser seeks to minimize the Fund’s counterparty risk by performing reviews of each counterparty and by minimizing concentration of counterparty risk by undertaking transactions with multiple customers and counterparties on recognized and reputable exchanges. Delivery of securities sold is only made once the Fund has received payment. Payment is made on a purchase once the securities have been delivered by the counterparty. The trade will fail if either party fails to meet its obligation.

| | | | |

| Reality Shares DIVS ETF | | | 15 | |

Notes to Financial Statements (concluded)

The Fund’s prospectus contains additional information about the principal risks of investing in the Fund.

9. FEDERAL INCOME TAX

The Fund intends to qualify as a regulated investment company by complying with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, by distributing substantially all of its net investment income and net realized capital gains to shareholders. Dividends and/or distributions, if any, are paid to shareholders invested in the Fund on the applicable record date, at least annually. Net realized capital gains, if any, will be distributed by the Fund at least annually. The amount of dividends distributions from net investment income and net realized capital gains are determined in accordance with Federal income tax regulations, which may differ from GAAP.

Management evaluates the Fund’s tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. Management has analyzed the Fund’s tax positions taken on federal, state and local income tax returns for all open tax years (for up to three tax years), and has concluded that no provisions for federal, state and local income tax are required in the Fund’s financial statements. The Fund’s federal, state and local income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state and local departments of revenue.

At October 31, 2015, the cost of investments on a tax basis was as follows:

| | | | | | | | | | | | |

| Cost | | Gross

Unrealized

Appreciation | | | Gross

Unrealized

Depreciation | | | Net Unrealized

Appreciation/

Depreciation | |

$29,914,119 | | $ | — | | | $ | — | | | $ | — | |

The differences between book and tax basis cost of investments and net unrealized appreciation (depreciation) are primarily attributable to wash sale loss deferrals and nontaxable distributions from regulated investment companies.

At October 31, 2015, the components of undistributed or accumulated earnings/loss on a tax-basis were as follows:

| | | | | | | | | | | | |

Undistributed

Ordinary

Income | | Undistributed

Long-term Capital

Gains | | | Net Unrealized

Depreciation | | | Total

Accumulated

Earnings | |

$208,233 | | $ | 554,071 | | | $ | (261,925 | ) | | $ | 500,379 | |

Certain late year ordinary income losses within the taxable year can be deemed to arise on the first business day of the Fund’s next taxable year. At October 31, 2015, the Fund had no loss deferrals.

For financial reporting purposes, capital accounts are adjusted to reflect the tax character of permanent book/tax differences. Reclassifications are primarily due to the tax treatment of Net Operating Losses.

At October 31, 2015, the effect of permanent book/tax reclassifications resulted in increases (decreases) to the components of net assets as follows:

| | | | | | | | |

Undistributed

Net Investment

Income | | Accumulated

Capital

and Other

Losses | | | Paid-in

Capital | |

$161,147 | | $ | (161,147 | ) | | $ | — | |

10. SUBSEQUENT EVENTS

In preparing these financial statements, the Fund’s management has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. No notable events have occurred between period end and the issuance of the financial statements.

| | |

| 16 | | Reality Shares DIVS ETF |

Report of Independent Registered Public Accounting Firm

To Board of Trustees and Shareholders of Reality Shares ETF Trust:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Reality Shares ETF Trust (comprising the Reality Shares DIVS ETF Fund (the “Fund”)) as of October 31, 2015, and the related statement of operations, statement of changes in net assets and the financial highlights for the period December 18, 2014 (commencement of operations) through October 31, 2015. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and the financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2015, by correspondence with the custodian and brokers. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Reality Shares DIVS ETF Fund of Reality Shares ETF Trust at October 31, 2015, and the results of its operations, the changes in its net assets and its financial highlights for the period December 18, 2014 (commencement of operations) through October 31, 2015 in conformity with U.S. generally accepted accounting principles.

Los Angeles, California

December 11, 2015

| | | | |

| Reality Shares DIVS ETF | | | 17 | |

Board of Trustees and Officers (Unaudited)

The business of the Trust is managed under the direction of the Trust’s Board of Trustees. The Board elects the officers of the Trust who are responsible for administering the Trust’s day-to-day operations. Each Trustee serves until his her successor is duly elected or appointed and qualified.

The name, year of birth, address and principal occupations during the past five years for each Trustee and Officer of the Trust is set forth below, along with the public directorships held by the Trustees.

Interested Trustees

| | | | | | | | |

| Name, Address(1) and Age | | Position with

Trust and Length

of Term(2) | | Principal Occupations

in the Past 5 Years | | Number of Portfolios in

Fund Complex(3)

Overseen by Trustee | | Other Directorships Held

in the Past 5 Years |

Eric Ervin(4) (Born: 1976) | | Trustee (since 2014) | | President, CEO and Co-Founder of Reality Shares, Inc. (October 2011 – present); Vice President, Morgan Stanley Smith Barney (June 2009 – October 2011) | | 6 | | None |

Michael S. Rosen(4) (Born: 1961) | | Trustee (since 2014) | | Context Capital Management, LLC, Co-Founder and CEO (2001 – present) | | 6 | | None |

Independent Trustees | | | | | | | | |

Christopher Nero (Born: 1967) | | Trustee (since 2014) | | True North Advisory Group (business consulting firm), CEO (January 2012 – present); Deutsche Bank AFS, Managing Director and Global Head (January 2008 – March 2011) | | 6 | | None |

Nathaniel R. Singer (Born: 1961) | | Trustee (since 2014) | | Swap Financial Group, Financial Adviser (January 2008 – present) | | 6 | | Municipal

Securities

Rulemaking

Board |

Justin Ferayorni, CFA (Born: 1973) | | Trustee (since 2015) | | Founder, Chief Executive Officer and Chief Investment Officer of Tamarack Capital Management, LLC (2005 – present) | | 6 | | None |

| (1) | Unless otherwise noted, the business address of each Trustee is 402 West Broadway, Suite 2800, San Diego, California 92101. |

| (2) | Each Trustee shall serve until death, resignation or removal. |

| (3) | The term “Fund Complex” refers to the Reality Shares ETF Trust. |

| (4) | Messrs. Ervin and Rosen may be deemed to be “interested” persons of the Fund, as that term is defined in the 1940 Act, by virtue of their affiliation with the Adviser and/or its affiliates. |

Trust Officers

| | | | |

| Name, Address(1) and Age | | Position with Trust and Length of Term(2) | | Principal Occupations in Past 5 Years |

Eric Ervin (Born: 1976) | | President (since 2014) | | President, CEO and Co-Founder of Reality Shares, Inc. (October 2011 – present); Vice President, Morgan Stanley Smith Barney (June 2009 – October 2011) |

Tom Trivella (Born: 1958) | | Treasurer (since 2014) | | Chief Operating Officer of Reality Shares, Inc. (October 2013 – present); Chief Operating Officer, Citadel Securities LLC (June 2010 – August 2012); Chief Operating Officer, ICAP Corporates LLC (July 2008 – May 2010) |

Ryan Ballantyne (Born: 1971) | | Secretary (since 2014) | | Executive Vice President – Sales and Trading of Reality Shares, Inc. (September 2012 – present); Managing Director, Miller Tabak & Co., LLC (April 2007 – August 2012) |

Ted J. Uhl (Born: 1975) | | Chief Compliance Officer (since 2014) | | Deputy Chief Compliance Officer of ALPS (June 2010 – Present); Senior Risk Manager for ALPS (October 2006 – June 2010). |

| (1) | The business address of Messrs. Ervin, Trivella and Ballantyne is 402 West Broadway, Suite 2800, San Diego, California 92101. The business address of Mr. Uhl is 1290 Broadway, Suite 1100, Denver, CO 80203. |

| (2) | Each officer shall serve until death, resignation or removal. |

The Fund’s Statement of Additional Information (“SAI”) has additional information about the Fund’s Trustees and Officers and is available without charge upon request. Contact your financial representative for a free prospectus or SAI.

| | |

| 18 | | Reality Shares DIVS ETF |

Board Considerations in Approving the Investment Advisory Agreement for the Fund (Unaudited)

The Board of Trustees (the Board”) of Reality Shares ETF Trust (the “Trust”), including the Trustees who are not “interested persons,” as defined by the Investment Company Act of 1940, of the Trust (“Independent Trustees”), attended an in-person meeting held on January 8, 2014 (the “Meeting”), called for the purpose of, among other things, the consideration of, and voting on, the approval of the investment advisory agreement (the “Investment Advisory Agreement”) between the Trust and Reality Shares Advisors, LLC (the “Advisor”) applicable to the Reality Shares DIVS ETF, a new series of the Trust (the “Fund”). The Board unanimously approved the Investment Advisory Agreement based on the Board’s review of qualitative and quantitative information provided by the Advisor.

Prior to reaching the conclusion to approve the Investment Advisory Agreement, the Independent Trustees requested and obtained from the Advisor such information as the Independent Trustees deemed reasonably necessary to evaluate the Investment Advisory Agreement. In addition, the Board received a memorandum from fund counsel regarding the responsibilities of the Board with respect to the approval of investment advisory agreements and reviewed such memorandum during the Meeting and also participated in question and answer sessions with representatives of the Advisor. Prior to the Meeting, the Board obtained and reviewed a wide variety of information, including certain comparative information regarding the Fund’s proposed fees and expenses relative to the fees and expenses of other comparable funds. The Independent Trustees carefully evaluated this information, met in executive session outside the presence of Fund management, and were advised by independent legal counsel with respect to their deliberations.

At the Meeting, the Board, including the Independent Trustees, evaluated a number of factors, including among others: (a) the nature, extent and quality of the investment advisory and other services to be provided by the Advisor; (b) the Advisor’s investment management personnel; (c) the Advisor’s operations and financial condition and certain potential risks associated with the Advisor being a newly formed investment adviser; (d) hypothetical backtested performance data of the Advisor’s investment strategy proposed to be used to manage the Fund’s assets, including the methodology and assumptions used in connection with preparing the data; (e) a comparison of the Fund’s projected advisory fees to the advisory fees charged to comparable funds; (f) the Fund’s expected overall fees and operating expenses compared with those of similar funds; (g) the Advisor’s compliance processes and systems; (h) the Advisor’s compliance policies and procedures; and (i) the Advisor’s reputation, expertise and resources in the financial markets. In its deliberations, the Trustees did not identify any single piece of information that was all-important or controlling, noting that each Trustee could attribute different weights to the various factors considered.

Based on the Board’s deliberations at the Meeting, the Board, including all of the Independent Trustees, unanimously: (a) concluded that the terms of the Investment Advisory Agreement are fair and reasonable; (b) concluded that the Advisor’s fees are reasonable in light of the services that it will provide to the Fund; and (c) agreed to approve the Investment Advisory Agreement based upon the following considerations, among others:

| | • | | Nature, Extent and Quality of Services Provided by the Advisor. The Board reviewed the scope of services to be provided by the Advisor under the Investment Advisory Agreement and determined that the Advisor was capable of providing high quality advisory services to the Fund, as indicated by the firm’s management capabilities, the professional qualifications and experience of its portfolio managers, and its investment and management oversight processes. Based on the foregoing, the Trustees determined that the approval of the Investment Advisory Agreement would enable shareholders of the Fund to receive high quality services at a cost that was appropriate and reasonable. |

| | • | | Fund Expenses and Performance of the Fund and the Advisor. As the Fund had not yet commenced operations, the Board was not able to review the Fund’s performance. However, the Board considered hypothetical backtested performance data of the Advisor’s strategy proposed to be used to manage the Fund’s assets. Such data included the hypothetical performance of the strategy over one-, three-, five-, seven- and ten-year periods compared to the performance of certain indexes. Representatives of the Advisor also discussed with the Board the methodology and relevant assumptions used to determine the performance data. The Board also reviewed statistical information provided by the Advisor regarding the Fund’s proposed expense ratio. The Advisor prepared a report to help the Board compare the Fund’s fees and expenses to those of comparable funds in the Fund’s peer groups, as determined by the Advisor. In the report, the Fund’s proposed expense ratio was compared to those of other funds with shared key characteristics (e.g., asset size, investment strategy and portfolio investments) determined by the Advisor to comprise the Fund’s applicable peer groups. The Advisor discussed, and the Board considered, the methodology that the Advisor used to determine the Fund’s peer groups. The Board also considered the Advisor’s representation that it found the peer groups that it compiled to be appropriate. Based on the foregoing, the Board determined that the proposed advisory fee to be paid by the Fund is reasonable in relation to the nature and quality of the services to be provided by the Advisor. |

| | • | | Costs of Services Provided to the Fund and Profits Realized by the Advisor. The Board noted that the Advisor had contractually agreed to pay all operating expenses of the Fund, including the cost of transfer agency, custody, fund administration, legal, audit and other services, except interest, taxes, brokerage commissions and other expenses connected with the execution of portfolio transactions, distribution fees, and extraordinary expenses. On that basis, the |

| | | | |

| Reality Shares DIVS ETF | | | 19 | |

Board Considerations in Approving the Investment Advisory Agreement for the Fund (concluded)

| | Board concluded that the cost of services to the Fund was reasonable. With respect to the Advisor’s profitability, the Board concluded that it was too early to predict the profitability of the Fund to the Advisor, but noted that they would monitor the Advisor’s profitability with respect to the Fund after the Fund commenced operations. |

| | • | | Economies of Scale. The Board noted that because the Fund had not yet commenced operations, there were as of now, no economies of scale to share with shareholders. The Board noted that it intends to continue monitoring the existence of economies of scale as the Fund grows in size. |

On the basis of the information provided to it in advance of the Meeting and its evaluation of that information, as well as additional information provided by the Advisor in response to the Trustees’ questions during the Meeting, the Board, including the Independent Trustees, concluded that the terms of the Investment Advisory Agreement were reasonable, and that approval of the Investment Advisory Agreement was in the best interests of the Fund and its shareholders.

| | |

| 20 | | Reality Shares DIVS ETF |

Supplemental Information (Unaudited)

Proxy Voting Policies, Procedures and Record

A description of the Trust’s proxy voting policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, and each Fund’s proxy voting record for the most recent twelve-month period ended June 30 is available, without charge upon request, by calling (888) 854-8181. This information is also available on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

Shareholder Reports and Quarterly Portfolio Disclosure

The Reality Shares DIVS ETF files its complete schedule of portfolio holdings with the SEC for its first and third quarters on Form N-Q. Copies of the filings are available on the SEC’s website at http://www.sec.gov. You can also obtain copies of Form N-Q by (i) visiting the SEC’s Public Reference Room in Washington, DC (information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330); (ii) sending your request and a duplicating fee to the SEC’s Public Reference Room, Washington, DC 20549-0102; or (iii) sending your request electronically to the following email box address: <publicinfo@sec.gov>.

Premium/Discount Information