- MUSA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Murphy USA (MUSA) DEF 14ADefinitive proxy

Filed: 19 Mar 15, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Murphy USA Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Notice of 2015

Annual Meeting

of Stockholders

and Proxy

Statement

YOUR VOTE IS IMPORTANT

DRIVEN TO PERFORM

R. Madison Murphy Chairman of the Board of Directors |  |

March 19, 2015

Dear Shareholder:

The board of directors and management cordially invite you to attend Murphy USA’s annual meeting of shareholders to be held at 1:00 p.m., Central Time, on Wednesday, May 6, 2015, at the South Arkansas Arts Center, 110 East 5th Street, El Dorado, Arkansas 71730. The formal notice of the annual meeting of shareholders and proxy statement are attached.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. Therefore, we urge you to promptly vote and submit your proxy via the Internet, by phone, or by signing, dating, and returning the enclosed proxy card. If you attend the Annual Meeting, you can vote in person, even if you have previously submitted your proxy.

On behalf of the Board of Directors, we would like to express our appreciation for your continued investment in Murphy USA. We look forward to greeting as many of you as possible.

Sincerely,

Murphy USA Inc. | 200 E. Peach St. | El Dorado, AR 71730 | 870-875-7600 | corporate.murphyusa.com | NYSE: MUSA

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

Notice of Annual Meeting

Wednesday, May 6, 2015 1:00 p.m. Central Time | South Arkansas Arts Center 110 East 5th Street, El Dorado, Arkansas, 71730 | Record Date The close of business March 10, 2015 |

The Annual Meeting of Stockholders of Murphy USA Inc. (the “Company”) will be held at the South Arkansas Arts Center, 110 East 5th Street, El Dorado, Arkansas, 71730, on Wednesday, May 6, 2015, at 1:00 p.m., Central Time, for the following purposes:

| 1. | Election of three Class II directors whose current terms expire on the date of the 2015 Annual Meeting; |

| 2. | Approval of executive compensation on an advisory, non-binding basis; |

| 3. | Ratification of the action of the Audit Committee of the Board of Directors in appointing KPMG LLP as the Company’s independent registered public accounting firm for fiscal 2015; and |

| 4. | Such other business as may properly come before the meeting. |

Only stockholders of record at the close of business on March 10, 2015, the record date fixed by the Board of Directors of the Company, will be entitled to notice of and to vote at the meeting or any adjournment thereof. A list of all stockholders entitled to vote is on file at the office of the Company, 200 Peach Street, El Dorado, Arkansas 71730.

Cast Your Vote Right Away

It is very important that you vote. Please cast your vote right away on all of the proposals listed above to ensure that your shares are represented. For specific instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials (Notice) you received in the mail or, if you requested to receive printed proxy materials, on your enclosed proxy card.

Notice and Access

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 6, 2015:

The Notice of 2015 Annual Meeting, 2015 Proxy Statement and 2014 Annual Report on Form 10-K are available, free of charge, at www.proxyvote.com.

This year, we will be furnishing proxy materials over the Internet to a number of our stockholders under the U.S. Securities and Exchange Commission’s notice and access rules. Many of our stockholders will receive a Notice of Internet Availability of Proxy Materials (the “Notice”) in the mail instead of a paper copy of this Proxy Statement, a proxy card or voting instruction card and our 2014 Annual Report. We believe that this process will reduce the environmental impact of our Annual Meeting as well as reduce the costs of printing and distributing our proxy materials. The Notice will instruct you as to how you may access and review all of the proxy materials on the internet.

All stockholders who do not receive a Notice will receive a paper copy of the proxy materials by mail, unless they have previously elected to receive proxy materials by email. We remind stockholders who receive a Notice that the Notice is not itself a proxy card and should not be returned with voting instructions. The Notice only presents an overview of the more complete proxy materials. Shareholders should review the proxy materials before voting.

The Notice contains instructions on how to access our proxy materials and vote over the Internet at www.proxyvote.com and how stockholders can receive a paper copy of our proxy materials, including this Proxy Statement, a proxy card or voting instruction card and our 2014 Annual Report. At www.proxyvote.com stockholders can also request to receive future proxy materials in printed form by mail or electronically by email.

By the Order of the Board of Directors

John A. Moore

Secretary

El Dorado, Arkansas

March 19, 2015

MURPHY USA INC. 1

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

Review, Approval or Ratification of Transactions with Related Persons | 11 | |||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

The Compensation Process | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

Potential Payments Upon Termination or Termination in Connection with a Change in Control | 29 | |||

Proposal 2 – Approval of Executive Compensation on an Advisory, Non-Binding Basis | 31 | |||

| 32 | ||||

2 MURPHY USA INC.

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

Table of Contents(continued)

| 32 | ||||

Electronic Availability of Proxy Materials for 2015 Annual Meeting | 33 | |||

| 33 | ||||

This proxy statement is issued by Murphy USA Inc. in connection with the 2015 Annual Meeting of Stockholders scheduled for May 6, 2015. This proxy statement and accompanying proxy card are first being made available to stockholders on or about March 19, 2015.

MURPHY USA INC. 3

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

The solicitation of the enclosed proxy is made on behalf of the Board of Directors of Murphy USA Inc. (the “Board”) for use at the Annual Meeting of Stockholders to be held on May 6, 2015. It is expected that the Notice of Internet Availability of Proxy Materials will be mailed to stockholders beginning on or about March 19, 2015.

The complete mailing address of the Company’s principal executive office is 200 Peach Street, El Dorado, Arkansas 71730.

References in this Proxy Statement to “we,” “us,” “our,” “the Company” and “Murphy USA” refer to Murphy USA Inc. and its consolidated subsidiaries.

Quorum Requirement

A quorum of stockholders is necessary to hold a valid meeting. The presence, in person or by proxy, of the holders of a majority of the total voting power of all outstanding securities of the Company entitled to vote at a meeting of stockholders shall constitute a quorum. Abstentions and “broker non-votes” are counted as present for establishing a quorum. A “broker non-vote” occurs on a proposal when shares held by brokers or nominees as to which instructions have not been received from the beneficial owners or persons entitled to vote and that the broker or nominee does not have discretionary power to vote on a non-routine matter.

Vote Necessary to Approve Proposals

General

Votes cast by proxy or in person at the meeting will be counted by the persons appointed by the Company to act as Judges of Election for the meeting. The Judges of Election will treat shares represented by proxies that reflect abstentions as shares that are present and entitled to vote for purposes of determining the outcome of any other business submitted at the meeting to the stockholders for a vote.

Your proxy will be voted at the meeting, unless you (i) revoke it at any time before the vote by filing a revocation with the Secretary of the Company, (ii) duly execute a proxy card bearing a later date, or (iii) appear at the meeting and vote in person. Proxies returned to the Company, votes cast other than in person and written revocations will be disqualified if received after commencement of the meeting. If you elect to vote your proxy by telephone or internet as described in the telephone/internet voting instructions on your proxy card, the Company will vote your shares as you direct. Your telephone/internet vote authorizes the named proxies to vote your shares in the same manner as if you had marked, signed and returned your proxy card.

Proposal 1 – Election of Three Class II Directors Whose Current Terms Expire on the Date of the 2015 Annual Meeting

The Class II directors shall be elected by a plurality of the votes cast at the Annual Meeting so long as a quorum is present. Under this stan-

dard, you may either vote in favor of all Class II directors, or withhold on all Class II directors or a particular Class II director. If you do not vote at all, you will have no impact on the calculation of “votes cast.” “Broker non-votes” will not count as a vote cast and will likewise have no effect. Unless specification to the contrary is made, the shares represented by the enclosed proxy will be voted FOR all the director nominees.

All Other Proposals

For Proposals 2 and 3, the affirmative vote of a majority of the shares of our capital stock present in person or represented by proxy at the Annual Meeting and entitled to vote is required for approval. You may vote “for,” “against” or “abstain” on these matters. If you vote to “abstain,” it will have the same effect as a vote “against.” “Broker non-votes” are not counted as shares present or represented and voting and have no effect on the vote. Unless specification to the contrary is made, the shares represented by the enclosed proxy will be voted FOR the approval of the compensation of the Named Executive Officers, as disclosed in this proxy statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission (on an advisory, non-binding basis) and FOR approval of the action of the Audit Committee of the Board of Directors in appointing KPMG LLP as the Company’s independent registered public accounting firm for 2015.

Broker Voting

If your shares are held in the name of a bank, broker or other holder of record (a “nominee”), you will receive instructions from the nominee that you must follow in order for your shares to be voted. Certain of these institutions offer telephone and Internet voting. Under current New York Stock Exchange (“NYSE”) rules, the proposal to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the current fiscal year should be considered a routine matter. However, for purposes of determining the outcome of any non-routine matter as to which the broker does not have discretionary authority to vote, those shares will be treated as not present and not entitled to vote with respect to that matter. Notably, Proposals 1 and 2 should be considered non-routine matters and your broker is not permitted to vote your shares without your instructions and such uninstructed shares are considered “broker non-votes.”

On March 10, 2015, the record date for the meeting, the Company had 45,538,520 shares of common stock outstanding, all of one class and each share having one vote with respect to all matters to be voted on at the meeting. Information as to common stock ownership of certain beneficial owners and management is set forth in the tables under “Security Ownership of Certain Beneficial Owners” and “Security Ownership of Directors and Management” included on page 14 in this Proxy Statement.

4 MURPHY USA INC.

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

Proposal 1 – Election of Three Class II Directors Whose Current Terms Expire on the Date of the Annual Meeting

The Board recognizes that it is important for the Company’s directors to possess a diverse array of backgrounds and skills, whether in terms of executive management leadership, public company experience or educational achievement. When considering new candidates, the Nominating and Governance Committee, with input from the Board, will seek to ensure the Board reflects a range of talents, ages, skills, diversity and expertise, particularly in the areas of accounting and finance, management, government/regulation, leadership and convenience store and other retail-related industries, sufficient to provide sound and prudent guidance with respect to our operations and interests. In addition, although it does not have a separate policy with respect to diversity, the Nominating and Governance Committee considers the issue of diversity among the factors used to identify nominees for directors. The goal is to assemble and maintain a Board comprised of individuals that not only possess a high level of business acumen, but who also demonstrate a commitment to the Company’s Code of Business Conduct and Ethics in carrying out the Board’s responsibilities with respect to oversight of the Company’s operations.

The Company’s Corporate Governance Guidelines provide that directors should not be nominated for election to the Board after their 76th birthday, although the full Board may nominate candidates older than 76 under special circumstances.

To the extent authorized by the proxies, the shares represented by the proxies will be voted in favor of the election of the three nominees for director whose names are set forth below. If for any reason any of these nominees is not a candidate when the election occurs, the shares represented by such proxies will be voted for the election of the other nominees named and may be voted for any substituted nominees or the board size may be reduced.

All directors, other than Mr. Clyde (our President and Chief Executive Officer), have been deemed independent by the Board based on the rules of the NYSE and the standards of independence included in the

Company’s Corporate Governance Guidelines. As part of its independence recommendation to the Board, the Nominating and Governance Committee at its February meeting considered familial relationships of certain directors (Mr. Murphy is a first cousin of Mr. Deming and Rev. Keller).

Mr. Murphy became the Non-Executive Chairman of the Board in connection with the spin-off of the Company from Murphy Oil Corporation (the “Spin-Off”), which was completed on August 30, 2013. As an independent chairman, he leads our regularly scheduled meetings of independent directors, held without the presence of Company management. Such meetings are scheduled to occur at four Board meetings each year.

Stockholders and other interested parties may send communications to the Board, specified individual directors and the independent directors as a group c/o the Secretary, Murphy USA Inc., 200 Peach Street, El Dorado, AR 71730-5836. All such communications will be kept confidential and forwarded to the specified director(s). Items that are unrelated to a director’s duties and responsibilities as a Board member, such as junk mail, may be excluded by the Secretary. The names of the nominees and certain information as to them, are as follows:

Our Board is divided into three classes serving staggered three-year terms. Messrs. Holliger and Keyes and Ms. Landen, who are Class II directors, are nominated for re-election at this Annual Meeting of Stockholders. Class III and Class I directors will serve until our annual meetings of stockholders in 2016 and 2017, respectively. At each annual meeting of stockholders, directors will be elected for three-year terms to succeed the class of directors whose terms have expired. This section details the name, age, class, qualifications and committee memberships of our directors as of the 2015 Annual Meeting of Stockholders.

The following Class II directors are nominated for re-election at this Annual Meeting of Stockholders.

Fred L. Holliger

| Chairman and CEO of Giant Industries (a NYSE petroleum refining and retail convenience store company) from 2002 to 2007; Independent consultant to Western Refining Company (a NYSE crude oil refiner and marketer) from 2007 through June 2012

Qualifications: Mr. Holliger spent his entire 36-year career in the petroleum industry in a variety of engineering, marketing, supply and general management positions. His long career in the oil and gas industry, along with his leadership experience, allow him to provide valuable insight to our Board.

Board Committees: Executive Compensation Committee and Nominating and Governance Committee

Age: 67

Director since: August 2013 | |

MURPHY USA INC. 5

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

Proposal 1 – Election of Three Class II Directors Whose Current Terms Expire on the Date of the Annual Meeting(continued)

James W. Keyes

| Chairman and Chief Executive Officer of Wild Oats LLC (a NASDAQ operator of natural foods stores), since January 2012; Chairman and Chief Executive Officer of Blockbuster (a provider of home movie and video game rental services) from 2007 to 2011; Chief Executive Officer of 7-Eleven Inc. from 2000 to 2005

Qualifications: Mr. Keyes’ experience running large companies, and specifically 7-Eleven (a major retail gasoline chain), along with his leadership on the successful sale of Blockbuster’s assets to Dish Networks through its restructuring process, provide invaluable business and industry expertise to our Board.

Board Committees: Audit Committee and Executive Compensation Committee

Age: 60

Director since: August 2013 | |

Diane N. Landen

| Owner and President of Vantage Communications, Inc. (private company in investment management, communications, and broadcast property ownership); Vice Chairman and Executive Vice President of Noalmark Broadcasting Corporation (a private radio and media company); Partner at Munoco Company L.C. (a private oil and gas exploration and production company); Secretary and Director of Loutre Land and Timber Company (a private natural resources company), and serves on its Executive and Nominating Committees

Qualifications: Ms. Landen has over 20 years’ experience in investment management, communications, and broadcast property ownership. She has, through her involvement in these many and varied business ventures, developed a broad range of experience in operating successful companies, allowing her to make significant contributions to our Board.

Board Committees: Audit Committee and Nominating and Governance Committee

Age: 54

Director since: August 2013 | |

The following Class III and Class I directors are not up for re-election at this Annual Meeting of Stockholders. Class III directors will be up for election at our annual meeting in 2016 and Class I directors will be up for election at our annual meeting in 2017.

Class III Directors (terms expiring at the 2016 Annual Meeting)

Robert A. Hermes

| Director of Murphy Oil from 1999 through 2014, member of the Executive Committee, Nominating & Governance Committee and Environmental, Health & Safety Committee; retired in 2014; Chairman of the Board of Purvin & Gertz, Inc. (an international energy consulting firm); retired in 2005

Qualifications: Dr. Hermes has broad experience in economic and technical aspects of petroleum refining, crude oil pricing, oil logistics, petroleum marketing, and interfuel competition. He also brings to the Board expertise in strategic planning and feasibility studies. As former Chairman of the Board of Purvin & Gertz, Inc., Dr. Hermes has a strong background as an advisor on energy policy, which enables him to provide valuable advice to our Board.

Board Committees: Executive Committee and Nominating and Governance Committee

Age: 75

Director since: August 2013 | |

6 MURPHY USA INC.

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

Proposal 1 – Election of Three Class II Directors Whose Current Terms Expire on the Date of the Annual Meeting(continued)

R. Madison Murphy

| Director of Murphy Oil since 1993 and serves on its Executive Committee and as Chair of its Audit Committee; Chairman of the Board of Murphy Oil from 1994 to 2004 and Chief Financial Officer of Murphy Oil from 1992 to 1994; Managing Member, Murphy Family Management, LLC (manages investments, farm, timber and real estate) since 1998; Director of Deltic Timber Corporation (a NYSE natural resources / timberland company) since 1996

Qualifications: Mr. Murphy served as Chairman of the Board of Murphy Oil from 1994 to 2004. This background, along with his current membership on the Board of Directors of Deltic Timber Corporation and Murphy Oil and his past membership on the Board of Directors of BancorpSouth, Inc. (a NYSE bank holding company), brings to the Board invaluable corporate leadership and financial expertise.

Board Committees: Executive Committee and ex-officio of all Committees

Age: 57

Director since: August 2013 | |

R. Andrew Clyde

| President and Chief Executive Officer of Murphy USA since August 2013; Partner (global energy practice), Booz & Company (and prior to August 2008, Booz Allen Hamilton) (a global management and strategy consulting firm) from 2000 to 2013, where he held leadership roles as North American Energy Practice Leader and Dallas office Managing Partner and served on the firm’s board Nominating Committee

Qualifications: As CEO, Mr. Clyde successfully led the Spin-Off of Murphy USA and established it as a standalone company. He has led the development and execution of Murphy USA’s strategy for the past two years. At Booz & Company, Mr. Clyde spent 20 years working with downstream energy and retail clients on strategy, organization and performance improvement engagements.

Board Committees: Executive Committee

Age: 51

Director since: August 2013 | |

The Reverend Dr. Christoph Keller, III

| Director of Deltic Timber Corporation (a NYSE natural resources / timberland company) since 1996, a member of its Executive Compensation Committee and Chair of the Nominating and Corporate Governance Committee;Co-Manager of Keller Enterprises, L.L.C. (a firm with farming operations and real estate and venture capital investments) from 1998 to 2008, also as a past director and current Chairman of its Executive Compensation Committee; Episcopal priest since 1982; Boards of the General Theological Seminary of the Episcopal Church in New York and Episcopal Collegiate School in Little Rock; interim Dean of Trinity Episcopal Cathedral in Little Rock

Qualifications: Rev. Keller’s board level experience on both public and private companies, particularly his past experience on Deltic Timber’s board as it spun-off from Murphy Oil and transitioned to a public company, enables him to make valuable contributions to our Board.

Board Committees: Executive Compensation Committee and Nominating and Governance Committee

Age: 60

Director since: August 2013 | |

Class I Directors (terms expiring at the 2017 Annual Meeting)

Claiborne P. Deming

| Chairman of the Board of Murphy Oil since March 2012, also Chairman of its Executive Committee; President and Chief Executive Officer of Murphy Oil from October, 1994 through December, 2008; retired June 2009

Qualifications: Mr. Deming’s previous experience as President and Chief Executive Officer of Murphy Oil gives him insight into the Company’s challenges, opportunities and operations. Among other qualifications, Mr. Deming brings to the Board executive leadership skills and over 30 years’ experience in the oil and gas industry.

Board Committees: Executive Committee and Executive Compensation Committee

Age: 60

Director since: August 2013 | |

MURPHY USA INC. 7

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

Proposal 1 – Election of Three Class II Directors Whose Current Terms Expire on the Date of the Annual Meeting(continued)

Thomas M. Gattle, Jr.

| Chairman of the Board, President and Chief Executive Officer of TerralRiver Service, Inc. (a private company operating fertilizer terminals, boats and barges) since 1992; Director of American Plant Food (a private manufacturer of fertilizers); owned and operated several businesses including Terral Barge Line, which operated the Lake Providence and Madison Ports on the Mississippi River from 1980-1992 and Great River Grain from 1980-1990, which owned and operated grain elevators on the lower Mississippi River

Qualifications: Mr. Gattle’s many years of experience as a successful company owner and executive officer will allow him to provide significant input to our Board on both financial and operational matters.

Board Committees: Audit Committee and Nominating and Governance Committee

Age: 63

Director since: August 2013 | |

Jack T. Taylor

| Director of Genesis Energy LP since 2013 (a NYSE midstream energy master limited partnership) and serves as a member of the Audit; and Governance, Compensation and Business Development Committees; Director of Sempra Energy (a NYSE Fortune 500 energy services company) since February 2013 and serves as a member of the Audit; and Environmental, Health, Safety and Technology; Chief Operating Officer-Americas and Executive Vice Chair of U.S. Operations for KPMG LLP from 2005 to 2010

Qualifications: Mr. Taylor has extensive experience with financial and public accounting issues as well as a deep knowledge of the energy industry. He spent over 35 years as a public accountant at KPMG LLP, many of which he worked in a leadership capacity. He is a National Association of Corporate Directors Board Leadership Fellow. This experience with financial and public accounting issues, together with his executive experience and knowledge of the energy industry, make him a valuable addition to our Board.

Board Committees: Audit Committee

Age: 63

Director since: August 2013 | |

THE BOARD RECOMMENDS A VOTE “FOR” THE CLASS III DIRECTORS NOMINATED BY THE BOARD.

8 MURPHY USA INC.

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

The positions of Chairman of the Board and Chief Executive Officer of Murphy USA are held by two individuals. Mr. Murphy serves as our Chairman of the Board as a non-executive and independent director. Mr. Clyde serves as our President and Chief Executive Officer, and also serves as a director. Along with Mr. Murphy and Mr. Clyde, other directors bring different perspectives and roles to the Company’s management, oversight and strategic development. The Company’s directors bring experience and expertise from both inside and outside the Company and industry, while the President and Chief Executive Officer is most familiar with the Company’s business and industry, most involved in the Company’s day-to-day operations, and most capable of leading the execution of the Company’s strategy. The Board believes that having separate roles of Chairman and President and Chief Executive Officer is in the best interest of stockholders because it facilitates independent oversight of management.

Our Company’s management is responsible for the day-to-day management of risks to the Company. The Board of Directors has broad oversight responsibility for our risk management programs.

The Board of Directors exercises risk management oversight and control both directly and indirectly, the latter through various board committees as discussed below. The Board of Directors regularly reviews information regarding the Company’s credit, liquidity and operations, including the risks associated with each. The Executive Compensation Committee is responsible for overseeing the management of risks relating to the Company’s executive compensation plans and arrangements. The Audit Committee is responsible for oversight of financial risks and the ethical conduct of the Company’s business, including the steps the Company has taken to monitor and mitigate these risks. The Nominating and Governance Committee, in its role of reviewing and maintaining the Company’s Corporate Governance Guidelines, manages risks associated with the independence of the Board and potential conflicts of interest. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports and by the President and Chief Executive Officer about the known risks to the strategy and the business.

Our Board of Directors has established several standing committees in connection with the discharge of its responsibilities. The following table presents the standing committees of the Board and the current membership of such committees and the number of times each such committee met in 2014.

| Nominee / Director | Audit | Executive | Executive Compensation | Nominating and Governance | ||||||||||||

R. Madison Murphy | X | 2 | X | 1 | X | 2 | X | 2 | ||||||||

R. Andrew Clyde | X | |||||||||||||||

Claiborne P. Deming | X | X | 1 | |||||||||||||

Thomas M. Gattle, Jr. | X | X | ||||||||||||||

Robert A. Hermes | X | X | 1 | |||||||||||||

Fred L. Holliger | X | X | ||||||||||||||

Christoph Keller, III | X | X | ||||||||||||||

James W. Keyes | X | X | ||||||||||||||

Diane N. Landen | X | X | ||||||||||||||

Jack T. Taylor | X | 1 | ||||||||||||||

Number of meetings in 2014 | 7 | 7 | 2 | 2 | ||||||||||||

| 1 | Committee Chairman. |

| 2 | Ex-Officio. |

Audit Committee – The Audit Committee has the sole authority to appoint or replace the Company’s independent registered public accounting firm, which reports directly to the Audit Committee. The Audit Committee also assists the Board with its oversight of the integrity of the Company’s financial statements, the independent registered public accounting firm’s qualifications, independence and performance, the performance of the Company’s internal audit function, the compliance by the Company with legal and regulatory requirements, and the review of programs related to compliance with the Company’s Code of Business Conduct and Ethics. The Audit Committee meets with representatives of the independent registered public accounting firm and with members of the internal Auditing Department for these purposes. The Board has designated Mr. Taylor as its “Audit Committee Financial Expert” as defined in Item 407 of Regulation S-K. All of the members of the Audit Committee, including Mr. Taylor, are independent under the rules of the NYSE and the Company’s independence standards.

Executive Committee – The Executive Committee is vested with the authority to exercise certain functions of the board when the board is not in session. The Executive Committee is also in charge of all general administrative affairs of the Company, subject to any limitations prescribed by the board.

Executive Compensation Committee – The Executive Compensation Committee oversees the compensation of the Company’s executives and directors and administers the Company’s annual incentive compensation plan, the long-term incentive plan and the stock plan for non-employee directors.

The Executive Compensation Committee consists entirely of independent directors, each of whom meets the NYSE listing

MURPHY USA INC. 9

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

Board and Governance Matters(continued)

independence standards and our Company’s independence standards. See “Compensation Discussion and Analysis” for additional information about the Executive Compensation Committee. In carrying out its duties, the Executive Compensation Committee will have direct access to outside advisors, independent compensation consultants and others to assist them.

Compensation Committee Interlocks and Insider Participation

During 2014, Messrs. Deming, Holliger, Keller, Keyes and Murphy served as the members of the Compensation Committee. No person who served as a member of the Executive Compensation Committee was, during 2014, an officer or employee of us or any of our subsidiaries, or had any relationship requiring disclosure in this proxy statement. None of our executive officers served as a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire Board of Directors) or director of another entity, one of whose executive officers served as a member of our Board of Directors.

Nominating and Governance Committee – The Nominating and Governance Committee identifies and recommends potential director candidates, makes annual independence recommendations as to each director, recommends appointments to Board committees, oversees evaluation of the Board’s performance and reviews and assesses the Corporate Governance Guidelines of the Company. Information regarding the process for evaluating and selecting potential director candidates, including those recommended by stockholders, is set out in the Company’s Corporate Governance Guidelines. Stockholders desiring to recommend director candidates for consideration by the Nominating and Governance Committee will be able to address their recommendations to: Nominating and Governance Committee of the Board of Directors, c/o Secretary, Murphy USA, 200 Peach Street, P.O. Box 7300, El Dorado, Arkansas 71731-7300. As a matter of policy, director candidates recommended by stockholders will be evaluated on the same basis as candidates recommended by the directors, executive search firms or other sources. The Corporate Governance Guidelines also provide a mechanism by which stockholders may send communications to directors. See Proposal 1 for further detail. The Nominating and Governance Committee consists entirely of independent directors, each of whom meets the NYSE listing independence standards and the Company’s independence standards.

Charters for the Audit, Executive, Executive Compensation, Nominating and Governance Committees, along with the Corporate Governance Guidelines and the Code of Ethics and Business Conduct, are available on the Company’s Web site, http://ir.corporate.murphyusa.com.

During fiscal 2014, there were five meetings of the Board. All nominees’ attendance exceeded 75% of the total number of meetings of the Board and committees on which they served. As set forth in the Company’s Corporate Governance Guidelines, all Board members are expected to attend the Annual Meeting of Stockholders, and all did so in 2014.

Directors who are employees of Murphy USA do not receive compensation for their services on the Board. Our Board of Directors determines annual retainers and other compensation for non-employee directors. The primary elements of our non-employee director compensation program include a combination of cash and equity.

In 2014, the cash component consisted of:

| • | Annual retainer: $40,000 |

| • | Chairman of the Board: $115,000 |

| • | Audit Committee Chairman: $15,000 |

| • | Executive Compensation Committee Chairman: $12,500 |

| • | Chair of each other Committee: $10,000 |

| • | Board and Committee meeting fees: $2,000 each |

All retainers are paid quarterly. The Company also reimburses directors for travel, lodging, and other related expenses they incur in attending Board and committee meetings.

In addition to the cash component, the non-employee directors also receive an annual grant of time-based restricted stock units which vest after three years. Each non-employee director received a restricted stock unit grant with a target value of at $100,000 on February 12, 2014.

10 MURPHY USA INC.

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

Board and Governance Matters(continued)

Further information regarding non-employee director compensation is set forth in the following table.

2014 Director Compensation Table

| Name | Fees Earned or Paid in Cash(1) ($) | Stock Awards(2) ($) | All Other Compensation(3) ($) | Total ($) | ||||||||||||

R. Madison Murphy | 201,000 | 97,402 | 25,000 | 323,402 | ||||||||||||

Claiborne P. Deming | 78,500 | 97,402 | — | 175,902 | ||||||||||||

Thomas M. Gattle, Jr. | 66,000 | 97,402 | — | 163,402 | ||||||||||||

Robert A. Hermes | 78,000 | 97,402 | 3,500 | 178,902 | ||||||||||||

Fred L. Holliger | 58,000 | 97,402 | — | 155,402 | ||||||||||||

Christoph Keller, III | 58,000 | 97,402 | — | 155,402 | ||||||||||||

James W. Keyes | 68,000 | 97,402 | — | 165,402 | ||||||||||||

Diane N. Landen | 68,000 | 97,402 | — | 165,402 | ||||||||||||

Jack T. Taylor | 79,000 | 97,402 | 25,000 | 201,402 | ||||||||||||

| (1) | The amounts shown reflect the cash retainers and meeting fees paid during the fiscal year ended December 31, 2014. |

| (2) | The amounts shown reflect the aggregate grant date fair value, as computed in accordance with FASB ASC Topic 718 regarding stock compensation for restricted stock unit awards granted to the non-employee directors in 2014. The aggregate number of restricted stock unit awards held as of December 31, 2014 was 5,650 for each director. |

| (3) | The amounts shown represent contributions made on behalf of Mr. Murphy, Dr. Hermes and Mr. Taylor to charitable organizations under our matching gifts program. |

The column above showing “All Other Compensation” represents the incremental cost of matching gifts. The non-employee directors are eligible to participate in our matching gift program on the same terms as Murphy USA employees. Under this program, an eligible person’s total gifts of up to $12,500 per calendar year will qualify. The Company will contribute to qualified educational institutions and hospitals in an amount equal to twice the amount contributed by the eligible person. The Company will contribute to qualified welfare and cultural organizations an amount equal to the contribution made by the eligible person.

Stock Ownership Guidelines

The Board of Directors has also established stock ownership guidelines for non-employee directors of the Company. Directors are expected to achieve ownership of at least three times the annual cash retainer within five years of service. A director may not pledge Company securities either by purchasing Company securities on margin or holding Company securities in a margin account, until he or she has achieved the applicable stock ownership target specified in the guidelines above. These guidelines are designed to ensure that directors display confidence in the Company through the ownership of a significant amount of our stock. At December 31, 2014, all of our Directors had met or were on track to comply with these stock ownership guidelines within the applicable five-year period.

Review, Approval or Ratification of Transactions with Related Persons

The Nominating and Governance Committee reviews ordinary course of business transactions with firms associated with directors and nominees for director. The Company’s management also monitors such transactions on an ongoing basis. Executive officers and directors are governed by the Company’s written Code of Business Conduct and Ethics, which provides that waivers may only be granted by

the Board of Directors or a Board committee and must be promptly disclosed to stockholders. No such waivers were granted nor applied for in fiscal 2014. The Company’s Corporate Governance Guidelines require that all directors recuse themselves from any discussion or decision affecting their personal, business or professional interests.

In connection with the Company’s December 31, 2014 consolidated financial statements, the Audit Committee reviewed and discussed the audited financial statements with management and the specific disclosures contained in the Company’s Form 10-K for the year ended December 31, 2014, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, discussed with KPMG LLP the matters required to be discussed by the communications pursuant to applicable auditing standards, and independence standards, and considered the compatibility of non-audit services with KPMG LLP’s independence. The Audit Committee has received the written disclosures and the letter from KPMG LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence, and has discussed with that firm its independence from Murphy USA. The Committee met seven times in 2014.

Based on these reviews and discussions, the Audit Committee recommended to the Board that the Company’s audited consolidated financial statements be included in its Annual Report on Form 10-K for the year ended December 31, 2014.

Audit Committee

Jack T. Taylor (Chairman)

James W. Keyes

Diane N. Landen

Thomas M. Gattle, Jr.

R. Madison Murphy

MURPHY USA INC. 11

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

Ownership of Murphy USA Common Stock

Security Ownership Of Certain Beneficial Owners

The following are known to the Company to be the beneficial owners of more than five percent of the Company’s common stock (as of the most recent date of such stockholder’s Schedule 13G filing for Murphy USA with the SEC):

| Name and address of beneficial owner | Amount and nature of beneficial ownership(1) | Percentage | ||||||

FMR LLC. 245 Summer Street Boston, MA 02210(2) | 5,415,737 | 11.8 | % | |||||

The Vanguard Group. 100 Vanguard Blvd. Malvern, PA 19355(3) | 3,583,411 | 7.8 | % | |||||

BlackRock, Inc. 40 East 52nd Street New York, NY 10022(4) | 3,473,878 | 7.6 | % | |||||

| (1) | Includes common stock for which the indicated owner has sole or shared voting or investment power and is based on the indicated owner’s Schedule 13G filing for Murphy USA for the period ended December 31, 2014. |

| (2) | A parent holding company or control person of the entities holding Murphy USA shares in accordance with Rule 13d-1(b)(1)(ii)(G). Total includes 42,609 shares with sole voting power, 0 shares with shared voting power, 5,415,737 shares with sole dispositive power and 0 shares with shared dispositive power. |

| (3) | An investment adviser in accordance with Rule 13d-1(b)(1)(ii)(E). Total includes 29,119 shares with sole voting power, 0 shares with shared voting power, 3,557,992 shares with sole dispositive power and 25,419 shares with shared dispositive power. |

| (4) | A parent holding company or control person of the entities holding Murphy USA shares in accordance with Rule 13d-1(b)(1)(ii)(G). Total includes 3,272,007 shares with sole voting power, 0 shares with shared voting power, 3,473,878 shares with sole dispositive power and 0 shares with shared dispositive power. |

Security Ownership of Directors and Management

The following table sets forth information, as of the record date, concerning the number of shares of Common Stock of the Company beneficially owned by all directors and nominees, each of the Named Executive Officers (as hereinafter defined), and directors and executive officers as a group.

| Name | Personal with Full Voting and Investment Power(1)(2) | Personal as Beneficiary of Trusts | Voting and Investment Power Only | Options Exercisable Within 60 Days | Total | Percent of Outstanding (if greater than one percent) | ||||||||||||||||||

Claiborne P. Deming | 227,564 | 394,884 | 52,430 | (3) | — | 674,878 | 1.48 | % | ||||||||||||||||

Thomas M. Gattle, Jr. | 2,095 | — | — | — | 2,095 | (4) | ||||||||||||||||||

Robert A. Hermes | 6,817 | — | — | — | 6,817 | (4) | ||||||||||||||||||

Fred L. Holliger | 1,000 | — | — | — | 1,000 | (4) | ||||||||||||||||||

Christoph Keller, III | 32,673 | 119,517 | (5) | 290,571 | (6) | — | 442,761 | (4) | ||||||||||||||||

James W. Keyes | — | — | — | — | — | (4) | ||||||||||||||||||

Diane N. Landen(7) | 31,871 | 42,632 | 60,976 | (8) | — | 135,479 | (4) | |||||||||||||||||

R. Madison Murphy | 250,065 | 308,179 | 713,610 | (9) | — | 1,271,854 | 2.79 | % | ||||||||||||||||

Jack T. Taylor | 5,000 | — | — | — | 5,000 | (4) | ||||||||||||||||||

R. Andrew Clyde | 11,000 | — | — | 59,249 | 70,249 | (4) | ||||||||||||||||||

Mindy K. West | 13,126 | — | — | — | 13,126 | (4) | ||||||||||||||||||

John A. Moore | 4,995 | — | — | — | 4,995 | (4) | ||||||||||||||||||

Jeffrey A. Goodwin | 2,309 | — | — | — | 2,309 | (4) | ||||||||||||||||||

Marn K. Cheng | 1,812 | — | — | — | 1,812 | (4) | ||||||||||||||||||

John C. Rudolfs | 592 | — | — | — | 592 | (4) | ||||||||||||||||||

Directors and executive officers as a group (17 persons) | 594,278 | 865,212 | 1,117,587 | 59,249 | 2,636,326 | 5.79 | % | |||||||||||||||||

| (1) | Includes Murphy USA (“MUSA”) Savings (401(k)) Plan shares in the following amounts: Ms. West—278 qualified shares; Mr. Moore—647 qualified shares; Mr. Cheng—664 qualified shares. |

| (2) | Includes shares held by spouse and other household members as follows: Mr. Deming—11,732 shares held by spouse; Mr. Gattle—100 shares owned jointly with spouse; Dr. Hermes—6,817 shares held jointly with spouse; Mr. Holliger—1,000 shares owned jointly with spouse; Rev. Keller—22,543 shares held by spouse or owned jointly with spouse and other household members; Ms. Landen—2,043 shares owned jointly with spouse and children; Mr. Murphy—57,905 shares held by spouse; Mr. Goodwin—1,837 shares of common stock owned jointly with spouse or other household members. |

| (3) | Includes 52,430 shares held in trust for children. |

| (4) | Less than 1%. |

| (5) | Includes 119,517 shares of common stock held by trusts for which Rev. Keller is the income beneficiary and trustee. |

| (6) | Includes 290,571 shares of common stock held by trusts for the benefit of others for which Rev. Keller is the trustee. |

| (7) | An estate in which Ms. Landen is co-executor has pledged 53,395 shares of common stock as required under certain existing loan agreements. |

12 MURPHY USA INC.

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

Ownership of Murphy USA Common Stock(continued)

| (8) | Includes (i) 53,395 shares of common stock owned as the executor of estate of another individual, and (ii) 7,581 shares of common stock held by trusts for which Ms. Landen is the trustee. |

| (9) | Includes (i) 235,766 shares held by trusts for the benefit of others for which Mr. Murphy is trustee or co-trustee, (ii) 166,844 shares held by a private foundation of which Mr. Murphy is President for which beneficial ownership is expressly disclaimed, (iii) 36,000 shares held in trust for children, and (iv) 275,000 shares held by a limited partnership that is controlled by a limited liability company of which Mr. Murphy is a member. Mr. Murphy has beneficial interest in 56,426 of these shares. Mr. Murphy’s wife has a beneficial interest in 306 shares, for which beneficial ownership is expressly disclaimed. |

Section 16(a) Beneficial Ownership Reporting Compliance

Based upon a review of the copies of reports filed by the Company’s directors and executive officers pursuant to Section 16(a) of the Securities Exchange Act of 1934, and on representations from such reporting persons, the Company believes that all such persons complied with all applicable filing requirements during fiscal 2014.

MURPHY USA INC. 13

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

DISCUSSION AND ANALYSIS

The following Compensation Discussion and Analysis provides an overview of the compensation provided to our CEO, CFO, and three other most highly compensated executive officers for the year ended December 31, 2014:

| Name | Title | |

R. Andrew Clyde | President & CEO | |

Mindy K. West | EVP, CFO, & Treasurer | |

John A. Moore | SVP, General Counsel & Corporate Secretary | |

Jeffrey A. Goodwin | SVP, Retail Operations | |

Marn K. Cheng | SVP, Retail Operations Support |

In addition, we will address the compensation of John C. Rudolfs who served as our EVP, Marketing until May 21, 2014 and who would have been among our most highly compensated executive officers in 2014, other than our CEO and CFO, had he served as an executive officer of Murphy USA at the end of 2014. Mr. Rudolfs received severance benefits upon his departure, which are more fully described in the “Other Policies – Severance and Change in Control Protection” section included on page 22 in this Proxy Statement.

The six individuals above are collectively referred to herein as our “Named Executive Officers” or “NEOs”.

To further illustrate the concepts in this Compensation Discussion and Analysis, we have included charts and tables where we believe appropriate to enhance our stockholders’ understanding of the compensation of our NEOs. This Compensation Discussion and Analysis should be read in conjunction with this tabular information beginning on page 16 in this Proxy Statement.

Murphy USA operates the nation’s fourth largest convenience store chain, with 1,263 locations in 23 states as of December 31, 2014, most of which are in close proximity to Walmart stores. We believe our proximity to Walmart stores generates significant traffic to our retail stations while our competitively priced gasoline and convenience offerings appeal to our shared customers. We began our relationship with Walmart in 1996 and, in December 2012, we signed a new agreement that allows us to build approximately 200 new sites at Walmart locations over the next few years.

We operate our retail gasoline stations with a strong emphasis on fuel sales complemented by a focused convenience offering that allows for a smaller store footprint than many of our competitors. Almost all of our new stations are standardized 208 or 1,200 square foot stores and the majority of our stores are located on Company-owned property and do not incur any rent expense. This combination of a focused convenience offering and standardized smaller footprint stores allows us to achieve lower overhead and labor costs compared to our competitors with a larger store format.

Highlights of the Company during fiscal year 2014 include the following:

| • | Completed our first full year as a standalone company |

| • | Completed a $50 million share repurchase program and announced a $250 million share repurchase program that extends until December 31, 2015 |

| • | Added 60 new retail sites to our portfolio |

| • | Made investments in the Hereford ethanol plant to improve efficiency and yield |

| • | Repaid the outstanding balance on our $150 million term loan more than two years prior to maturity |

| • | Extended the maturity of our credit facility by one year and modified several restrictive covenants |

Executive Compensation Philosophy and Objectives

The Executive Compensation Committee (the “Committee”) bases its executive compensation decisions on principles designed to align the interests of our executives with those of our stockholders. The Committee believes compensation should provide a direct link with the Company’s values, objectives, business strategies, and financial results. In order to motivate, attract, and retain key executives who are critical to its long-term success, the Company aims to provide pay packages that are competitive with others in the retail industry. In addition, the Company believes that executives should be rewarded for both the short and long-term success of the Company and, conversely, be subject to a degree of downside risk in the event that the Company does not achieve its performance objectives.

14 MURPHY USA INC.

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

Compensation Discussion And Analysis(continued)

Pay for Performance

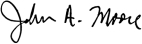

The Committee believes our compensation programs provide for a strong “pay for performance” linkage between the compensation provided to our CEO and the Company’s performance relative to its peers. Since our Spin-Off on August 30, 2013, our annualized total shareholder return (“TSR”) has been 60%. We significantly outpaced the median TSR of our peer group (discussed in the “Role of Market Data” section included on page 18 in this Proxy Statement) as well as the S&P 500 Index both in 2014 and during the 16 months since the Spin-Off.

2014 “Say-on-Pay” Vote Result

The Committee carefully considered the results of our first Say-on-Pay vote on NEO compensation in May 2014, in which more than 96 percent voted for the compensation of our NEOs as described in our 2014 Proxy Statement. The Committee interpreted this level of support as affirmation by stockholders of the design and overall execution of our programs.

Compensation Design Principles and Governance Practices

The Committee intends for its compensation design principles to protect and promote our shareholders’ interests. We believe our compensation programs are consistent with best practices for sound corporate governance.

We Do

| ü | Pay for performance |

| ü | Perform an annual compensation risk assessment |

| ü | Utilize an independent compensation consultant |

| ü | Provide modest perquisites |

| ü | Maintain share ownership guidelines and restrict pledging |

| ü | Prohibit hedging transactions by executives |

| ü | Include “clawbacks” in our annual and long-term incentive plans |

We Do Not

| û | Maintain employment contracts |

| û | Maintain separate change in control (“CIC”) agreements other than with the CEO |

| û | Provide tax gross ups on perquisites or CIC benefits |

| û | Allow repricing of underwater options |

| û | Allow current payment of dividends or dividend equivalents on unearned long-term incentives |

The Committee has responsibility for discharging the Board of Directors’ responsibilities with respect to compensation of the Company’s executives. In particular, the Committee annually reviews and approves corporate goals and objectives relevant to CEO compensation, evaluates the CEO’s performance in light of those goals and objectives, and determines and approves the CEO’s compensation based on this evaluation. In doing so, the Committee reviews all elements of the CEO’s compensation. The Committee also approves non-

CEO executive compensation, approves and administers incentive compensation and equity-based plans, and monitors compliance of directors and executive officers with Company stock ownership requirements. Pursuant to its charter, the Committee has the sole authority to retain and terminate compensation consultants as well as internal and external legal, accounting and other advisors, including sole authority to approve the advisors’ fees and other engagement terms. For additional information on the responsibilities of the Committee, see the “Committees—Executive Compensation Committee” section included on page 23 in this Proxy Statement.

MURPHY USA INC. 15

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

Compensation Discussion And Analysis(continued)

The Committee adopted a peer group for purposes of reviewing and approving 2014 compensation. Due to the relatively small number of publicly-traded retail convenience store competitors, the group was broadened to include other companies in similar industries with which Murphy USA competes for executive talent in order to create a sufficient sample of companies against which compensation can be compared. The peer group was developed based on certain attributes including:

| • | Industry Sector: Direct motor fuel and convenience retailers, retailers exposed to vehicle miles traveled, and other small box common goods retailers (e.g., quick serve restaurants) |

| • | Scale of Operation: Revenue, non-fuel revenue, earnings before interest, taxes, depreciation, and amortization, market capitalization, number of employees, and store count |

| • | Method of Operation: Company-operated sites and direct-owned real estate |

The peer group consists of the following companies:

• Alimentation Couche-Tard • Advance Auto Parts • AutoZone • Bob Evans Farms • Casey’s General Stores • Chipotle Mexican Group | • Cracker Barrel • CST Brands • Foot Locker • GameStop • Monro Muffler Brake • O’Reilly Automotive |

• The Pantry • Pier 1 Imports • Susser Holdings1 | • TravelCenters of America • Vitamin Shoppe |

In addition to comparator company information, the Committee uses several industry compensation surveys to determine competitive market pay levels for the NEOs.

Base salaries and total target direct compensation for the Company’s NEOs were compared to the median of the market data to determine whether the Company’s compensation practices were in alignment. When making compensation-related decisions, the Committee aims to set compensation levels for executive officers based on a deliberate review of market competition for a particular position as well as each individual’s possession of a unique skill or knowledge set, proven leadership capabilities or experience, and Company performance. Based on such factors, the Committee may determine with respect to one or more individuals that it is appropriate for compensation to meet, exceed, or fall below the median of the market data for a particular compensation element or total compensation.

Role of the CEO in Compensation Decisions

The CEO periodically reviews the performance of each of the NEOs, excluding himself, develops preliminary recommendations regarding salary adjustments and annual and long-term award amounts, and provides these recommendations to the Committee. The Committee can exercise its discretion in modifying any recommendations and makes the final decisions.

Our compensation program is comprised of three key components, each designed to be market-competitive and to help attract, motivate, retain, and reward our NEOs.

| Element | Key Characteristics | Objectives | ||

| Base Salary | • Fixed minimum level of compensation | • To reward the executive for day-to-day execution of primary duties and responsibilities | ||

• Reviewed annually and adjusted if and when appropriate | • To provide a foundation level of compensation upon which incentive opportunities can be added to provide the motivation to deliver superior performance | |||

| Annual Incentives | • Variable cash compensation component | • To motivate and reward NEOs for achieving annual business goals | ||

• Performance-based award opportunity based on annual operational and individual performance | • To align the interests of participants with the interests of stockholders | |||

• Intended to encourage responsible risk taking and accountability | ||||

| Long-term Incentives | • Variable equity-based compensation component | • To align executives’ interests with the interests of stockholders | ||

• Performance-based award opportunity based on long-term performance | • To reinforce the critical objective of building stockholder value over the long term • To focus management attention upon the execution of the long-term business strategy |

| 1 | On August 29, 2014, Susser Holdings and Energy Transfer Partners, L.P. announced the completion of their merger, making Susser a subsidiary of Energy Transfer Partners. Accordingly, Susser Holdings was removed from the peer group at that time. |

16 MURPHY USA INC.

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

Compensation Discussion And Analysis(continued)

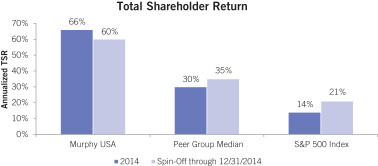

The majority of our NEO compensation is performance-based and is issued in the form of both short- and long-term incentives. Individuals in a position to influence the growth of stockholder wealth have larger portions of their total compensation delivered in the form of equity-based long-term incentives. The target mix of the compensation program elements for the CEO and other NEOs is shown in the following chart which outlines the size, in percentage terms, of each element of target compensation.

A. Base Salary

Base salary is designed to provide a competitive fixed rate of pay recognizing each employee’s different level of responsibility and performance. In setting base salary levels for NEOs, the Committee considers competitive market data in addition to other factors such as duties and responsibilities, experience, individual performance, retention concerns, internal equity considerations, Company performance, general economic conditions, and marketplace compensation trends.

Base salaries are reviewed annually. In 2014, the Committee increased base salaries awarded to each NEO to bring salaries closer to competitive market levels for similar positions. The following table shows the base salaries for each of the NEOs effective February 1, 2014:

| Name | Title | 2013 Pre-Spin Salary ($) | 2013 Post-Spin Salary ($) | 2014 Salary ($) | Adjustment for 2014 (%) | |||||||||||||

R. Andrew Clyde | President & CEO | 750,000 | 750,000 | 825,000 | 10.0 | |||||||||||||

Mindy K. West | EVP, CFO, & Treasurer | 350,000 | 450,000 | 470,000 | 4.4 | |||||||||||||

John A. Moore | SVP, General Counsel & Corporate Secretary | 296,500 | 365,000 | 384,000 | 5.2 | |||||||||||||

Jeffrey A. Goodwin | SVP, Retail Operations | 260,000 | 320,000 | 332,500 | 3.9 | |||||||||||||

Marn K. Cheng(1) | SVP, Retail Operations Support | — | — | 324,500 | — | |||||||||||||

John C. Rudolfs | Former EVP, Marketing | 330,720 | 400,000 | 417,500 | 4.4 | |||||||||||||

| (1) | Mr. Cheng was not a Named Executive Officer before 2014 and, therefore, his compensation is not disclosed for prior years. |

B. Annual Incentive Plan

We provide annual incentives to our executive officers through our stockholder-approved Murphy USA Inc. 2013 Annual Incentive Plan, as amended and restated effective as of February 12, 2014 (the “AIP”). The primary objective of the AIP is to align corporate and individual goals with stockholder interests and Company strategy and

to reward employees for their performance relative to those goals. Murphy USA targets the median of competitive market pay levels for annual target incentive compensation. Executives have the opportunity to be compensated above the median of market pay levels when Murphy USA performs above market based on established performance measures.

MURPHY USA INC. 17

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

Compensation Discussion And Analysis(continued)

Bonus opportunities under the AIP are communicated as a target percentage of annualized base salary. The Committee reviews market data annually with respect to competitive pay levels and sets specific

bonus opportunities for each of our NEOs. The following table shows the target bonuses as a percentage of salary in effect for each of the NEOs in 2014:

| Name | Title | Target Bonus as a % of Salary | ||||

R. Andrew Clyde | President & CEO | 100 | % | |||

Mindy K. West | EVP, CFO, & Treasurer | 75 | % | |||

John A. Moore | SVP, General Counsel & Corporate Secretary | 60 | % | |||

Jeffrey A. Goodwin | SVP, Retail Operations | 60 | % | |||

Marn K. Cheng | SVP, Retail Operations Support | 55 | % | |||

John C. Rudolfs | Former EVP, Marketing | 65 | % | |||

Corporate Performance

For 2014, the AIP metrics for Murphy USA employees included return on average capital employed (“ROACE”), profitability as measured by both fuel and merchandise gross margins, and total recordable incident rate. The Committee believes these metrics in combination reflect the key goals and objectives for the Company for 2014. The

following table summarizes the performance metrics and corresponding weightings used in determining annual incentive award payouts for Murphy USA employees and the weighted performance scores for each based on actual performance during 2014:

| Metric | Weighting (%) | Threshold (50% | Target (100% | Maximum (200% | Actual | Payout (%) | Weighted Performance Score (%) | |||||||||||||||||||||

ROACE (%) | 30 | 7.2 | 9.0 | 12.6 | 17.2 | 200.0 | 60.0 | |||||||||||||||||||||

Fuel Gross Margin ($000s) (average per store month) | 30 | 30.0 | 32.5 | 37.5 | 42.9 | 200.0 | 60.0 | |||||||||||||||||||||

Merchandise Gross Margin ($000s) (average per store month) | 30 | 19.3 | 19.7 | 20.4 | 20.6 | 200.0 | 60.0 | |||||||||||||||||||||

Total Recordable Incident Rate | 10 | 1.17 | 1.10 | 1.03 | 1.07 | 142.9 | 14.3 | |||||||||||||||||||||

Total | 100 | 194.3 | ||||||||||||||||||||||||||

| 1 | ROACE is computed by dividing the Company’s earnings before interest and taxes, as adjusted from time-to-time for certain unusual and nonrecurring gains or losses by the sum of (a) the average of the Company’s beginning and ending balance of property, plant, and equipment during the respective year and (b) the average of the Company’s beginning and ending net working capital position during the respective year; excludes impact of Hereford ethanol facility. |

18 MURPHY USA INC.

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

Compensation Discussion And Analysis(continued)

Under the terms of the AIP, achievement of 100% of the target for any metric results in the payment of 100% of target for that metric. Achievement of the minimum level of the performance range results in the payment of 50% of target and achievement of the maximum level of performance results in the payment of 200% of target. No awards relative to a given metric are payable if performance for that metric falls below the minimum. Results between points are interpolated.

Individual Performance

In addition to the corporate performance component, the AIP permits the Committee to exercise negative discretion to reduce an NEO’s award based on the Committee’s subjective review of his/her performance relative to successful achievement of goals, business plan execution, and other qualitative results. We believe that it is important to include this component in our AIP in order to take into account NEO performance that, in the Committee’s opinion, justify a reduction in the amount otherwise payable to an NEO based on objective corporate performance. Overall, amounts earned under the AIP cannot exceed more than 200% of target. In 2014, the Committee believed that our NEOs’ outstanding individual performance was appropriately reflected in our corporate performance results. Thus, in general, the Committee opted not to make significant negative adjustments to the awards earned by our NEOs and payable under the AIP based on our corporate performance.

Overall Performance and Payouts

After certifying the results relative to our performance metrics and considering each individual’s contributions throughout the year, the Committee approved the following payments for our NEOs for 2014:

| Name | Actual Bonus ($) | |||

R. Andrew Clyde | 1,600,000 | |||

Mindy K. West | 682,479 | |||

John A. Moore | 445,821 | |||

Jeffrey A. Goodwin | 386,414 | |||

Marn K. Cheng | 345,486 | |||

John C. Rudolfs | 203,746 | (1) | ||

| (1) | Prorated for portion of the year served. |

C. Long-term Incentive Compensation

We provide share-based, long-term compensation to our executive officers through our stockholder-approved Murphy USA Inc. 2013 Long-Term Incentive Plan, as amended and restated effective as of February 12, 2014 (the “LTIP”). Long-term incentive levels for Murphy USA’s officers are targeted at the median of competitive market pay levels. The plan provides for a variety of stock and share-based awards, including stock options and restricted stock units (“RSUs”),

each of which vests over a period determined by the Committee, as well as performance stock units (“PSUs”) that are earned based on the Company’s achievement of two equally-weighted objective performance goals. We believe that these awards create a powerful link between the creation of stockholder value and executive pay delivered. In addition, we believe that the balance between absolute performance alignment through stock options and the ROACE-based PSUs, and the relative performance objectives underscored by the PSUs earned based on the Company’s TSR as compared to its peers, is appropriate. In order for executives to fully realize their targeted opportunities, Murphy USA must both successfully achieve its long-term goals and outperform its peers.

Stock Options

In 2014, stock options comprised 25% of each NEO’s annual equity award. Stock options provide a direct link between executive officer compensation and the value delivered to shareholders. The Committee believes that stock options are inherently performance-based, as option holders only realize benefits if the value of our stock increases following the date of grant. All grants of options will vest in two equal installments on the second and third anniversaries of the grant date, and unless otherwise forfeited or exercised, expire seven years from the date of the grant.

Restricted Stock Units

In 2014, RSUs comprised 25% of each NEO’s annual equity award. The Committee believes that RSUs are an important part of the compensation program for NEOs as they (i) drive behaviors to create value for shareholders by linking executive compensation to stock price performance, (ii) encourage retention, and (iii) result in actual share ownership (thereby supporting the Company’s stock ownership guidelines). All grants of RSUs will cliff-vest on the third anniversary of the grant date (unless otherwise forfeited due to termination) and are delivered to the NEOs in the form of unrestricted shares of common stock.

Performance Stock Units

In 2014, PSUs comprised 50% of each NEO’s annual equity award. The Committee believes that PSUs serve as a complement to stock options and RSUs. Our PSUs benchmark Murphy USA performance relative to two equally-weighted metrics, ROACE and TSR relative to our peer group, with payouts at the threshold level of performance equal to 50% of target and maximum payouts capped at 200% of target. The Committee believes the PSU program does not encourage excessive or inappropriate risk-taking, as it caps the maximum payout at 200% of target. PSUs are designed to pay 100% of target at the end of the three-year performance cycle if target levels of performance are achieved. Payment, if earned, is made in unrestricted shares of common stock at the end of the three-year performance period once performance results have been approved by the Committee.

MURPHY USA INC. 19

| 2015 NOTICE OF MEETING AND PROXY STATEMENT |

Compensation Discussion And Analysis(continued)

Vesting for 50% of the PSUs will be based on MUSA’s TSR performance between 2014 and 2016 relative to the Company’s peer group, with payouts at the threshold level of performance equal to 50% of target and maximum payouts capped at 200% of target. The Committee considers relative TSR an appropriate metric as it aligns the pay for our officers to the appreciation (or reduction) our shareholders receive in their investment in Murphy USA. TSR achievement and corresponding payout levels are as follows:

| Achievement Level | Percentile Rank Relative to Peers | Payout % of Target(1) | ||||||

Maximum | ³75 | th | 200 | % | ||||

Target | 50 | th | 100 | % | ||||

Threshold | 25 | th | 50 | % | ||||

Below Threshold | <25 | th | 0 | % | ||||

| (1) | Payout will be interpolated on a linear basis for performance between levels of achievement |

Vesting for the remaining 50% of the PSUs will be based on MUSA’s three-year average ROACE performance between 2014 and 2016 as compared to the Company’s three-year ROACE targets set by the Committee at the beginning of the performance period, with payouts at the threshold level of performance equal to 50% of target and maximum payouts capped at 200% of target.

D. Employee Benefits and Perquisites

Murphy USA’s executives are provided usual and customary employee benefits available to all employees (except certain hourly retail employees). These include qualified defined contribution (Savings) plan (401(k)), health insurance, life insurance, accidental death and dismemberment insurance, medical/dental insurance, vision insurance, and long-term disability insurance.

The purpose of the Savings Plan, a tax-qualified defined contribution retirement plan, for employees of Murphy USA is to provide retirement and incidental benefits for all employees who participate. All employees are allowed to contribute on a pre-tax basis up to 25 percent of their eligible pay. The Company matching contributions are limited to dollar for dollar on the first six percent. Participating employees are immediately vested in all employee and Company matching contributions.

Murphy USA provides a Supplemental Executive Retirement Plan (“Murphy USA SERP”), an unfunded, nonqualified defined contribution plan to eligible executives including the NEOs. The Murphy USA SERP is intended to restore to certain highly-compensated individuals qualified defined contribution (Savings and profit-sharing) plan benefits restricted under the Internal Revenue Code of 1986 (the “IRC”).

Murphy USA offers limited perquisites to our NEOs consistent with our peer group. The Board of Directors has authorized up to 50 hours annually of personal use of Company aircraft for our CEO as part of his total compensation package. The value of such personal use is

periodically reported to the Committee and will be reported as taxable income to the CEO with no income tax assistance or gross-ups provided by the Company.

Reportable values for these programs based on the incremental costs to the Company are included in the “All Other Compensation” column of the 2014 Summary Compensation Table included on page 25 in this Proxy Statement.

Severance and Change in Control Protection

The Company has not entered into any employment, CIC or termination agreements with its NEOs other than with the CEO, which was inherited by Murphy USA in connection with the Spin-Off from prior parent Murphy Oil.

Mr. Rudolfs resigned on May 21, 2014. In consideration of a release of claims against the Company and agreement to certain restrictive covenants, Mr. Rudolfs will receive a cash payment of $417,500, payable in four equal quarterly installments, a lump sum cash payment of $120,000, and a pro-rata portion of his 2014 award under the AIP calculated based on actual performance, paid at the time awards are normally paid under the Plan.