Filed Pursuant to Rule 424(b)(3)

Registration No. 333-189256

Prospectus

Catalent Pharma Solutions, Inc.

Offer to Exchange

$350,000,000 aggregate principal amount of 7.875% Senior Notes due 2018, which have been registered under the Securities Act of 1933, for any and all outstanding 7.875% Senior Notes due 2018.

The exchange notes will be fully and unconditionally guaranteed on an unsecured basis by certain of our domestic subsidiaries.

The Exchange Offer:

| • | | We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradable. |

| • | | You may withdraw tenders of outstanding notes at any time prior to the expiration date of the exchange offer. |

| • | | The exchange offer expires at 11:59 p.m., New York City time, on July 24, 2013, unless extended. We do not currently intend to extend the expiration date. |

| • | | The exchange of outstanding notes for exchange notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes. |

| • | | We will not receive any proceeds from the exchange offer. |

The Exchange Notes:

| • | | The exchange notes are being offered in order to satisfy certain of our obligations under the registration rights agreement entered into in connection with the private offering of the outstanding notes. |

| • | | The terms of the exchange notes to be issued in the exchange offer are substantially identical to the outstanding notes, except that the exchange notes will be freely tradable. |

Resales of the Exchange Notes:

| • | | The exchange notes may be sold in the over-the-counter-market, in negotiated transactions or through a combination of such methods. |

See “Risk Factors” beginning on page 16 for a discussion of certain risks that you should consider before participating in the exchange offer.

Each broker-dealer that receives exchange notes for its own account in the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of those exchange notes. The letter of transmittal states that by so acknowledging and delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act of 1933.

This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for outstanding notes where such outstanding notes were acquired by such broker-dealer as a result of market-making activities or other trading activities.

We have agreed that, for a period of 90 days after the consummation of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the exchange notes to be distributed in the exchange offer or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 26, 2013.

TABLE OF CONTENTS

We have not authorized any dealer, salesperson or other person to give any information or represent anything to you other than the information contained in this prospectus. You must not rely on unauthorized information or representations.

This prospectus does not offer to sell nor ask for offers to buy any of the securities in any jurisdiction where it is unlawful, where the person making the offer is not qualified to do so, or to any person who cannot legally be offered the securities. The information in this prospectus is current only as of the date on its cover, and may change after that date.

INDUSTRY AND MARKET INFORMATION

The market data and other statistical information used throughout this prospectus are based on our good faith estimates, which are derived from our review of internal surveys, as well as synthesis and analysis prepared, based on or derived from independent industry publications, government publications, reports by market research firms or other published independent sources. These publications and surveys generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. While we believe these sources are reliable, we have not verified the research by any independent source.

i

SUMMARY

This summary does not contain all of the information that you should consider before investing in the exchange notes. You should read the entire prospectus carefully, including the matters discussed under the captions “Risk Factors” and “Unaudited Pro Forma Financial Information” and in the financial statements and related notes included elsewhere in this prospectus. As used herein, unless the context indicates or otherwise requires, the terms “we,” “us,” “our,” “Catalent,” “the Company,” and the “Successor” refer to Catalent Pharma Solutions, Inc. and its consolidated subsidiaries. The “Issuer” refers to Catalent Pharma Solutions, Inc., the issuer of the outstanding notes and the exchange notes. In this prospectus, when we refer to our fiscal years, we say “fiscal” and the year number, as in “fiscal 2012,” which refers to our fiscal year ended June 30, 2012.

Our Company

We are the leading global provider of development solutions and advanced delivery technologies for drugs, biologics and consumer health products. Through our extensive capabilities and deep expertise in product development, we help our customers bring more products to market, faster. Our advanced delivery technology platforms, the broadest and most diverse combination of intellectual property and proven formulation, manufacturing and regulatory expertise available to the industry, enable our customers to introduce more products and better treatments to the market. Across both development and delivery, our commitment to reliably supply our customers’ needs serves as the foundation for the value we provide. We operate through four businesses: Development & Clinical Services, Softgel Technologies, Modified Release Technologies, and Medication Delivery Solutions. We believe that through our prior and ongoing investments in growth-enabling capacity and capabilities, our entry into new markets, our ongoing focus on operational and quality excellence, our innovation activities, the sales of existing customer products, and the introduction of new customer products, we will continue to benefit from attractive margins in and realize the growth potential from these areas.

We have extensive relationships with industry-leading customers. In fiscal 2012, we did business with 83 of the top 100 global pharmaceutical marketers, and 41 of the top 50 biotechnology marketers. Selected key customers include Pfizer, Johnson & Johnson, GlaxoSmithKline, Eli Lilly, Merck, Novartis and Roche. We have many long-standing relationships with our customers, particularly in advanced delivery technologies, where a prescription pharmaceutical product relationship will often last for nearly two decades, extending from mid-clinical development through the end of the product’s life cycle. We serve customers who require innovative product development, superior quality, advanced manufacturing and skilled technical services to support their development and marketed product needs.

We believe our customers value us because our depth of development solutions and advanced delivery technologies, consistent and reliable supply, geographic reach, and substantial expertise enable us to create a broad range of business and product solutions that can be customized to fit their individual needs. The aim of our offerings is to allow our customers to bring more products to market, and develop and market differentiated new products that improve patient outcomes. We believe our leading market position, significant global scale, and diversity of customers, offerings, regulatory categories, products, and geographies reduce our exposure to potential strategic and product shifts within the industry.

1

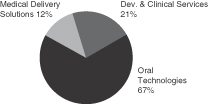

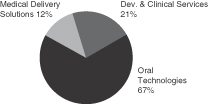

In fiscal 2012, our revenues were $1,694.8 million.

Revenue by Segment (1)

Year Ended June 30, 2012

| | | | | | |

Segment | | Offerings and Services | | Fiscal 2012 Revenue (in millions)(1) | |

Oral Technologies | | Formulation, development and manufacturing of prescription and consumer health products using our proprietary softgel, LiquiGel®, Vegicaps® and Zydis® technologies; our recently licensed development stage OptiDose™ and Lyopan™ technologies; as well as other proprietary and conventional oral drug delivery technologies. | | $ | 1,220.2 | |

| | |

Development & Clinical Services | | Manufacturing, packaging, storage, distribution and inventory management for global clinical trials of drugs and biologics; analytical and bioanalytical development and testing; scientific and regulatory consulting services; development services and clinical manufacturing for conventional oral dose forms; and development and manufacturing of products. | | $ | 268.3 | |

| | |

Medication Delivery Solutions | | Formulation, development, and manufacturing for prefilled syringes and other injectable formats; blow- fill-seal unit dose development and manufacturing; and biologic cell line development and manufacturing, including our GPEx® protein expression technology. | | $ | 223.9 | |

| (1) | Pro forma to give effect to the CTS Acquisition (as defined below) as if it had occurred on July 1, 2011; figures exclude intersegment revenue and discontinued operations. |

Our history of innovation in the advanced delivery of pharmaceutical products formed the foundation of our market-leading business. We have a track record of nearly eight decades of oral dose form innovation, since we first transformed the softgel manufacturing process in the 1930s. We launched the oral dissolving tablet category by commercializing our Zydis® technology in the 1980s and, in 2001, introduced an advanced softgel capsule shell, VegiCaps® Soft capsules. Our GPEx® cell line technology for biologics can help bring innovator, bio-similar and bio-better products to the market more rapidly. Today we employ more than 1,000 scientists and technicians and hold approximately 1,400 patents and patent applications in advanced delivery, drug and biologics formulation and manufacturing. We apply this portfolio to actively support current and future revenue generation, and we may receive license and exclusivity fees and/or royalties for certain technologies.

2

In recent years we have continued to expand our advanced delivery technology portfolio. In fiscal 2011, we acquired a novel molecular optimization platform, OptiForm™ from GlaxoSmithKline, providing drug developers a new way to identify the best form of a molecule to take forward into development. In 2011, we also in-licensed a development stage oral dissolving tablet alternative, LyoPan™, which we are progressing towards commercialization. In fiscal 2012, we licensed the novel OptiDose™ controlled release technology from Sanwa Kagaku Kenkyusho Co., Ltd., a commercially successful platform which enables novel modified release options for oral solid dose forms. We also launched OptiMelt™ hot melt technology capabilities enabling new dose form options, based on growth investments in capabilities and capital assets, and in April 2012 entered into a broad collaboration with BASF in this area. We also have formed active partnerships to extend our technology reach, including collaborations with Bend Research for multiparticulate oral controlled-release products and with Toyobo Biologics Inc. related to GPEx® and biologics manufacturing, and have active collaborations with research universities around the world. We believe our own internal innovation activities, supplemented by current and future external partnerships and collaborations, will continue to strengthen and extend our leadership position in the industry for delivery of drugs, biologics and consumer health products.

We created our Development & Clinical Services business in fiscal 2010 which unified all of our existing development activities, to address the needs of our pharmaceutical and biotechnology customers for solutions to increasingly complex product development challenges. We have continued to invest to expand the capabilities and capacity of our development solutions, including substantial expansions of cold-chain capabilities for clinical supplies. In fiscal 2012, we substantially expanded the scale of this business with the CTS Acquisition.

On February 17, 2012, we closed our acquisition of Aptuit’s Clinical Trial Supplies (“CTS”) business for approximately $400 million (the “CTS Acquisition”). The acquisition substantially expands our business, transforming us into the second largest global provider of clinical supply solutions, and enhances our leading global position in development solutions and advanced delivery technologies for drugs, biologics and consumer health products.

The Aptuit CTS business was a leading supplier of clinical trial materials and logistics to the global biopharmaceutical industry. It operated in two segments: Clinical Packaging and Logistics (“CP&L”) and Pharma Development and Manufacturing (“PDM”) business. CP&L packaged, stored and coordinated the distribution of drugs for use in clinical trials. PDM provided drug formulation, analytical testing, and small scale manufacturing services. The business has been integrated into our Development and Clinical Services business.

History

Catalent was formed in April 2007, when we were acquired by affiliates of The Blackstone Group (“Blackstone”). Prior to that, we formed the core of the Pharmaceutical Technologies and Services (“PTS”) segment of Cardinal Health, Inc. (“Cardinal”). PTS was in turn created by Cardinal through a series of acquisitions, with the intent of creating the world’s leading outsourcing provider of specialized, market-leading solutions to the global pharmaceutical and biotechnology industry. In 1998, R.P. Scherer Corporation, the market leader in advanced oral drug delivery technologies, was acquired by Cardinal. In 1999, Cardinal acquired Automated Liquid Packaging, Inc., the market leader in blow-fill-seal technology for respiratory treatments, ophthalmics, and other areas. In 2001, Cardinal purchased International Processing Corporation, a provider of oral solid dose forms. In 2002, PTS entered the fee-for-service development solutions market with the acquisition of Magellan Labs, a leader in the provision of analytical sciences services to the U.S. pharmaceuticals industry. Finally, in 2003, Cardinal acquired Intercare Group PLC, through which we expanded our European injectable manufacturing network. During the period from 1996 through 2006, we also made other selective acquisitions of businesses, facilities and technologies in all segments, including our legacy pharmaceutical packaging segment.

Subsequent to our 2007 acquisition, we have regularly reviewed our portfolio of offerings and operations in the context of our strategic growth plan. As a result of those ongoing assessments, since 2007 we have sold five

3

businesses, including two injectable vial facilities in the U.S., a French oral dose facility, a printed components business (with four facilities), and, in fiscal 2012, our North American commercial packaging business. Concurrent with the sale of the North American commercial packaging business, the Packaging Services segment ceased to be a reportable segment within continuing operations. In addition, the Sterile Technologies segment has been renamed Medication Delivery Solutions. We have also consolidated operations at two other facilities into the remaining facility network since our acquisition by Blackstone.

Our Sponsor

Investment funds associated with or advised by The Blackstone Group (the “Sponsor”) currently control, through Phoenix Charter LLC, approximately 87% of our voting membership interests. As used herein, the term “Investors” refers to our Sponsor together with the other investors in BHP PTS Holdings LLC, the investment entity formed by the Investors in connection with their investment in Phoenix Charter LLC.

Company Information

Catalent Pharma Solutions, Inc. is a Delaware corporation. Our principal executive offices are located at 14 Schoolhouse Road, Somerset, New Jersey, 08873, and our telephone number there is (732) 537-6200.

4

THE EXCHANGE OFFER

On September 18, 2012, we completed the private offering of the outstanding notes. In this prospectus, the term “outstanding notes” refers to the 7.875% Senior Notes due 2018 and the term “exchange notes” refers to the 7.875% Senior Notes due 2018, as registered under the Securities Act of 1933, as amended (the “Securities Act”); the term “notes” refers to the outstanding notes and the exchange notes.

General | In connection with the private offering of the outstanding notes, we entered into a registration rights agreement with Morgan Stanley & Co. LLC, Deutsche Bank Securities Inc., Goldman, Sachs & Co., Jefferies & Company, Inc. and J.P. Morgan Securities LLC (collectively, the “initial purchasers”), the initial purchasers of the outstanding notes in which we and the guarantors agreed, among other things, to use commercially reasonable efforts to deliver this prospectus to you and to complete the exchange offer within 360 days after the date of original issuance of the outstanding notes. |

| | You are entitled to exchange in the exchange offer your outstanding notes for exchange notes which are identical in all material respects to the outstanding notes except: |

| | • | | the exchange notes have been registered under the Securities Act; |

| | • | | the exchange notes are not entitled to any registration rights which are applicable to the outstanding notes under the registration rights agreement; and |

| | • | | certain additional interest rate provisions of the registration rights agreement are no longer applicable. |

The Exchange Offer | We are offering to exchange up to $350,000,000 aggregate principal amount of our 7.875% Senior Notes due 2018, which have been registered under the Securities Act, for any and all of our outstanding 7.875% Senior Notes due 2018. |

| | You may only exchange outstanding notes in denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

| | Subject to the satisfaction or waiver of specified conditions, we will exchange the exchange notes for all outstanding notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer. We will cause the exchange to be effected promptly after the expiration of the exchange offer. |

| | Upon completion of the exchange offer, there may be no market for the outstanding notes and you may have difficulty selling them. |

5

Resales | Based on interpretations by the staff of the Securities and Exchange Commission (the “SEC”) set forth in no-action letters issued to third parties referred to below, we believe that you may resell or otherwise transfer exchange notes issued in the exchange offer without complying with the registration and prospectus delivery provisions of the Securities Act, if: |

| | • | | you are not our “affiliate” within the meaning of Rule 405 under the Securities Act; |

| | • | | you are acquiring the exchange notes in the ordinary course of your business; and |

| | • | | you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes. |

| | If you are our affiliate, or are engaging in, or intend to engage in, or have any arrangement or understanding with any person to participate in, a distribution of the exchange notes, or are not acquiring the exchange notes in the ordinary course of your business: |

| | (1) | you cannot rely on the position of the staff of the SEC enunciated inMorgan Stanley & Co. Incorporated(available June 5, 1991),Exxon Capital Holdings Corporation(available May 13, 1988), as interpreted in the SEC’s letter toShearman & Sterling(dated July 2, 1993), or similar no-action letters; |

| | (2) | in the absence of an exception from the position of the SEC stated in (1) above, you must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale or other transfer of the exchange notes. |

| | If you are a broker-dealer and receive exchange notes for your own account in exchange for outstanding notes that you acquired as a result of market-making activities or other trading activities, you must acknowledge that you will deliver this prospectus in connection with any resale of the exchange notes. See “Plan of Distribution.” |

Expiration Date | The exchange offer will expire at 11:59 p.m., New York City time, on July 24, 2013, unless extended by us. We do not currently intend to extend the expiration date. |

Withdrawal | You may withdraw the tender of your outstanding notes at any time prior to the expiration of the exchange offer. We will return to you any of your outstanding notes that are not accepted for any reason for exchange, without expense to you, promptly after the expiration or termination of the exchange offer. |

Interest on the Exchange Notes and the Outstanding Notes | Each exchange note will bear interest at the rate per annum set forth on the cover page of this prospectus from the most recent date to |

6

| | which interest has been paid on the outstanding notes. The interest on the notes is payable semi-annually on each April 15 and October 15, beginning on April 15, 2013. No interest will be paid on outstanding notes following their acceptance for exchange. |

Conditions to the Exchange Offer | The exchange offer is subject to customary conditions, which we may assert or waive. See “The Exchange Offer—Conditions to the Exchange Offer.” |

Procedures for Tendering Outstanding Notes | If you wish to participate in the exchange offer, you must complete, sign and date the accompanying letter of transmittal, or a facsimile of the letter of transmittal, according to the instructions contained in this prospectus and the letter of transmittal. You must then mail or otherwise deliver the letter of transmittal, or a facsimile of the letter of transmittal, together with the outstanding notes and any other required documents, to the exchange agent at the address set forth on the cover page of the letter of transmittal. |

| | If you hold outstanding notes through The Depository Trust Company (“DTC”) and wish to participate in the exchange offer, you must comply with the Automated Tender Offer Program procedures of DTC, by which you will agree to be bound by the letter of transmittal, and in that case, you need not execute and deliver a letter of transmittal. |

| | By signing, or agreeing to be bound by, the letter of transmittal, you will represent to us that, among other things: |

| | • | | you are not our “affiliate” within the meaning of Rule 405 under the Securities Act; |

| | • | | you are acquiring the exchange notes in the ordinary course of your business; |

| | • | | you are not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes; and |

| | • | | if you are a broker-dealer that will receive exchange notes for your own account in exchange for outstanding notes that you acquired as a result of market-making or other trading activities, that you will deliver a prospectus, as required by law, in connection with any resale or other transfer of such exchange notes. |

| | If you are our affiliate, or are engaging in, or intend to engage in, or have any arrangement or understanding with any person to participate in, a distribution of the exchange notes, or are not acquiring the exchange notes in the ordinary course of your business, you cannot rely on the applicable positions and interpretations of the staff of the SEC and you must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale or other transfer of the exchange notes. |

7

Special Procedures for Beneficial Owners | If you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender those outstanding notes in the exchange offer, you should contact the registered holder promptly and instruct the registered holder to tender those outstanding notes on your behalf. |

Guaranteed Delivery Procedures | If you wish to tender your outstanding notes and your outstanding notes are not immediately available or you cannot deliver your outstanding notes, the letter of transmittal and any other documents required by the letter of transmittal, or you cannot comply with the applicable procedures under DTC’s Automated Tender Offer Program for transfer of book-entry interests, prior to the expiration date, then you must tender your outstanding notes according to the guaranteed delivery procedures set forth in this prospectus under “The Exchange Offer—Guaranteed Delivery Procedures.” |

Effect on Holders of Outstanding Notes | In connection with the sale of the outstanding notes, we entered into a registration rights agreement with the initial purchasers of the outstanding notes that grants the holders of outstanding notes registration rights. As a result of the making of, and upon acceptance for exchange of all validly tendered outstanding notes pursuant to the terms of the exchange offer, we will have fulfilled a covenant under the registration rights agreement. Accordingly, there will be no increase in the interest rate on the outstanding notes under the circumstances described in the registration rights agreement assuming the exchange offer is consummated on or before September 13, 2013. If you do not tender your outstanding notes in the exchange offer, you will continue to be entitled to all the rights and limitations applicable to the outstanding notes as set forth in the indenture, except we will not have any further obligation to you to provide for the registration of the outstanding notes under the registration rights agreement, except in limited circumstances. |

| | To the extent that outstanding notes are tendered and accepted in the exchange offer, the trading market for outstanding notes could be adversely affected. |

Consequences of Failure to Exchange | All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we do not currently anticipate that we will register the outstanding notes under the Securities Act. |

8

Certain U.S. Federal Income and Estate Tax Consequences | The exchange of outstanding notes in the exchange offer will not be a taxable event for United States federal income tax purposes. See “Certain U.S. Federal Income and Estate Tax Consequences—Exchange Offer.” |

Use of Proceeds | We will not receive any cash proceeds from the issuance of the exchange notes pursuant to the exchange offer. In consideration for issuing the exchange notes as contemplated in this prospectus, we will receive in exchange a like principal amount of outstanding notes, the terms of which are identical in all material respects to the exchange notes. The outstanding notes surrendered in exchange for the exchange notes will be retired and cancelled and cannot be reissued. Accordingly, the issuance of the exchange notes will not result in any change in our capitalization. |

Exchange Agent | The Bank of New York Mellon, whose address and telephone number are set forth in the section captioned “The Exchange Offer—Exchange Agent” of this prospectus, is the exchange agent for the exchange offer. |

9

SUMMARY OF THE TERMS OF THE EXCHANGE NOTES

The terms of the exchange notes are identical in all material respects to the terms of the outstanding notes, except that the exchange notes will not contain terms with respect to transfer restrictions or additional interest upon a failure to fulfill certain of our obligations under the registration rights agreement. The exchange notes will evidence the same debt as the outstanding notes. The exchange notes will be governed by the same indenture under which the outstanding notes were issued and the exchange notes and the outstanding notes will constitute a single class for all purposes under the indenture. For more detailed description of the notes, see “Description of the Notes.”

Issuer | Catalent Pharma Solutions, Inc., a Delaware corporation. |

Notes Offered | $350,000,000 aggregate principal amount of 7.875% Senior Notes due 2018. |

Maturity Date | October 15, 2018. |

Interest | The notes bear interest at 7.875% per annum. |

Interest Payment Dates | Interest on the notes is paid semi-annually in arrears on each April 15 and October 15, beginning on April 15, 2013. Interest on the notes accrues from the date of issuance. |

Optional Redemption | We may redeem some or all of the notes at any time at the redemption prices listed under “Description of the Notes—Optional Redemption,” plus accrued and unpaid interest to the redemption date. |

Change of Control | Upon a change of control, as defined under the section titled “Description of the Notes,” we will be required to make an offer to purchase the notes then outstanding at a purchase price equal to 101% of their principal amounts, plus accrued interest to the date of repurchase. We may not have sufficient funds available at the time of a change of control to repurchase the notes. |

Guarantees | The notes are guaranteed on a senior unsecured basis, jointly and severally, by all of our wholly-owned U.S. subsidiaries (excluding our Puerto Rico subsidiaries) that guarantee our senior secured credit facilities. |

Ranking | The notes are our unsecured senior obligations. Accordingly, the notes: |

| | • | | rank equally in right of payment with all of our existing and future unsubordinated indebtedness; |

| | • | | rank senior in right of payment to all of our existing and future indebtedness that expressly provides for its subordination to the notes; |

| | • | | are structurally subordinated to all of the existing and future indebtedness of our subsidiaries that are not guarantors; and |

10

| | • | | are effectively subordinated to all of our existing and future secured indebtedness to the extent of the value of the assets securing such indebtedness. |

| | The guarantees are unsecured senior obligations of the guarantors. Accordingly, the guarantees: |

| | • | | rank equally in right of payment with all existing and future unsubordinated indebtedness of the guarantors; |

| | • | | rank senior in right of payment to all existing and future indebtedness of the guarantors that expressly provides for its subordination to the guarantees; |

| | • | | are effectively subordinated to all existing and future secured indebtedness of the guarantors to the extent of the value of the assets securing such indebtedness. |

| | As of March 31, 2013, we had (1) $1,703.1 million (dollar equivalent) of secured indebtedness; (2) $2,320.4 million (dollar equivalent) of senior indebtedness (which includes our secured indebtedness); and (3) $277.2 million (dollar equivalent) of senior subordinated indebtedness. In addition, we had an additional $185.1 million of unutilized capacity and $15.2 million of outstanding letters of credit under our revolving credit facility. |

Certain Covenants | The terms of the notes, among other things, limit our ability and the ability of our restricted subsidiaries to: |

| | • | | incur additional indebtedness and issue certain preferred stock; |

| | • | | pay certain dividends and make distributions in respect of capital stock; |

| | • | | place limitations on distributions from restricted subsidiaries; |

| | • | | guarantee certain indebtedness; |

| | • | | sell or exchange assets; |

| | • | | enter into transactions with affiliates; |

| | • | | create certain liens; and |

| | • | | consolidate, merge or transfer all or substantially all of our assets and the assets of our subsidiaries on a consolidated basis. |

| | These covenants are subject to a number of important qualifications and exceptions. See “Description of the Notes.” |

Use of Proceeds | We will not receive any cash proceeds from the exchange offer. |

Certain ERISA Considerations | The notes may, subject to certain restrictions described in “Certain ERISA Considerations” herein, be sold and transferred to ERISA Plans. Prospective investors should carefully consider the matters discussed under the caption “Notice to Investors” herein. |

11

Trading | The exchange notes will generally be freely transferable (subject to certain restrictions discussed in “The Exchange Offer”) but will be a new issue of securities for which there will not initially be a market. Accordingly, there can be no assurance as to the development or liquidity of any market for the exchange notes. The initial purchasers in the private offering of the outstanding notes have advised us that they currently intend to make a market in the exchange notes, as permitted by applicable laws and regulations. However, they are not obligated to do so and may discontinue any such market making activities at any time without notice. |

RISK FACTORS

See “Risk Factors” for a description of the risks you should consider before deciding to participate in the exchange offer.

12

SUMMARY HISTORICAL FINANCIAL INFORMATION

The following table presents our summary historical financial information as of the dates and for the periods presented. The summary historical financial information as of June 30, 2011 and 2012 and for the fiscal years ended June 30, 2010, 2011 and 2012 has been derived from our audited consolidated financial statements included elsewhere in this prospectus.

The summary financial data as of March 31, 2013 and for the nine months ended March 31, 2012 and 2013 have been derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. The unaudited financial data presented have been prepared on a basis consistent with our audited consolidated financial statements. In the opinion of management, such unaudited financial data reflect all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of the results for those periods.

You should read this information together with the information included under the headings “Risk Factors” and our historical consolidated financial statements and related notes included elsewhere in this prospectus.

Our unaudited financial statements have been prepared on a basis consistent with our audited annual financial statements. In the opinion of management, such unaudited financial information reflects all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of the results for those periods. The results for any interim period are not necessarily indicative of the results that may be expected for a full fiscal year.

13

| | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Years Ended June 30, | | | Nine Months Ended

March 31, | |

| | | 2010 | | | 2011 | | | 2012 | | | 2012 | | | 2013 | |

| | | | | | (Unaudited) | |

| | | (in millions, except as noted) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net revenue | | $ | 1,480.4 | | | $ | 1,531.8 | | | $ | 1,694.8 | | | $ | 1,216.5 | | | $ | 1,295.1 | |

Cost of products sold | | | 1,039.5 | | | | 1,029.7 | | | | 1,136.2 | | | | 823.4 | | | | 900.2 | |

Selling, general and administrative expense | | | 270.1 | | | | 288.3 | | | | 348.1 | | | | 242.3 | | | | 251.7 | |

Impairment charges and (gain)/loss on sale of assets(1) | | | 214.8 | | | | 3.6 | | | | 1.8 | | | | (1.4 | ) | | | 4.6 | |

Restructuring and other | | | 17.7 | | | | 12.5 | | | | 19.5 | | | | 12.6 | | | | 12.7 | |

Property and casualty (gain)/losses, net(2) | | | — | | | | 11.6 | | | | (8.8 | ) | | | (10.5 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Operating earnings/(loss) | | | (61.7 | ) | | | 186.1 | | | | 198.0 | | | | 150.1 | | | | 125.9 | |

Interest expense, net | | | 161.0 | | | | 165.5 | | | | 183.2 | | | | 131.2 | | | | 160.7 | |

Other (income)/expense, net | | | (7.3 | ) | | | 26.0 | | | | (3.8 | ) | | | (3.1 | ) | | | 20.3 | |

| | | | | | | | | | | | | | | | | | | | |

Earnings/(loss) from continuing operations before income taxes | | | (215.4 | ) | | | (5.4 | ) | | | 18.6 | | | | 22.0 | | | | (55.1 | ) |

Income tax expense/(benefit) | | | 21.9 | | | | 23.7 | | | | 16.5 | | | | 19.0 | | | | 5.9 | |

| | | | | | | | | | | | | | | | | | | | |

Earnings/(loss) from continuing operations | | | (237.3 | ) | | | (29.1 | ) | | | 2.1 | | | | 3.0 | | | | (61.0 | ) |

Earnings/(loss) from discontinued operations, net of tax | | | (49.7 | ) | | | (21.0 | ) | | | (41.3 | ) | | | (4.0 | ) | | | (4.9 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net earnings/(loss) | | | (287.0 | ) | | | (50.1 | ) | | | (39.2 | ) | | | (1.0 | ) | | | (65.9 | ) |

Net earnings/(loss) attributable to noncontrolling interest, net of tax(3) | | | 2.6 | | | | 3.9 | | | | 1.2 | | | | 1.2 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net earnings/(loss) attributable to Catalent | | $ | (289.6 | ) | | $ | (54.0 | ) | | $ | (40.4 | ) | | $ | (2.2 | ) | | $ | (65.9 | ) |

| | | | | | | | | | | | | | | | | | | | |

Statement of Cash Flow Data: | | | | | | | | | | | | | | | | | | | | |

Net cash provided by (used in) continuing operations: | | | | | | | | | | | | | | | | | | | | |

Operating activities | | $ | 231.5 | | | $ | 111.6 | | | $ | 87.7 | | | $ | 81.9 | | | $ | 84.4 | |

Investing activities | | | (70.2 | ) | | | (83.3 | ) | | | (538.2 | ) | | | (507.4 | ) | | | (84.5 | ) |

Financing activities | | | (56.7 | ) | | | (26.1 | ) | | | 352.9 | | | | 361.4 | | | | (51.4 | ) |

| | | | | |

Balance Sheet Data (at period end): | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | | | | | $ | 205.1 | | | $ | 139.0 | | | $ | 135.9 | | | $ | 87.5 | |

Total assets | | | | | | | 2,831.2 | | | | 3,139.0 | | | | 3,229.2 | | | | 3,021.3 | |

Total debt, including current portion of long-term debt and other short-term borrowing | | | | | | | 2,346.6 | | | | 2,683.5 | | | | 2,728.7 | | | | 2,675.2 | |

Total liabilities | | | | | | | 3,041.1 | | | | 3,489.7 | | | | 3,502.5 | | | | 3,438.7 | |

Total shareholders’ equity (deficit) | | | | | | $ | (209.9 | ) | | $ | (350.7 | ) | | $ | (273.3 | ) | | $ | (417.4 | ) |

| | | | | |

Other Financial Data: | | | | | | | | | | | | | | | | | | | | |

Capital expenditures | | | 70.5 | | | | 87.3 | | | | 104.2 | | | | 67.6 | | | | 84.8 | |

Cash interest expense | | | 98.6 | | | | 157.6 | | | | 172.4 | | | | 101.0 | | | | 132.4 | |

| (1) | Impairment charges and (gain)/loss on sale of assets recorded during fiscal 2010 were primarily related to goodwill and long-lived asset impairment charges impacting our Packaging Services and Sterile Technologies segments. |

| (2) | In March 2011, a U.K. based packaging facility was damaged by fire. See Note 14 to our audited consolidated financial statements incorporated herein by reference for additional information. |

| (3) | Noncontrolling interest, net of tax expense/(benefit), relates to the minority share purchase of our majority-owned softgel joint venture in Germany. In February 2012, we purchased the minority interest and the operations are now wholly owned by us. |

14

During the first quarter of fiscal 2013, the Company adopted an accounting standard which eliminated the option to present the components of other comprehensive income as part of the statement of changes in stockholders’ equity, which was the presentation used in the Company’s 2012 Annual Report on Form 10-K. The adopted accounting standard requires the presentation of the components of net income, other comprehensive income and total comprehensive income in either one continuous statement or two separate consecutive statements. The components of other comprehensive (loss) income and total comprehensive income (loss) for the years ended June 30, 2012, 2011 and 2010 are presented below (in millions).

| | | | | | | | | | | | |

| (in millions) | | Year Ended

June 30, 2010 | | | Year Ended

June 30, 2011 | | | Year Ended

June 30, 2012 | |

Net earnings/(loss) | | $ | (287.0 | ) | | $ | (50.1 | ) | | $ | (39.2 | ) |

Other comprehensive income/(loss), net of tax | | | | | | | | | | | | |

Foreign currency translation adjustments | | | (21.5 | ) | | | 62.0 | | | | (27.3 | ) |

Defined benefit pension plan, net | | | (6.8 | ) | | | 23.1 | | | | (29.6 | ) |

Distribution related to noncontrolling interest | | | (1.7 | ) | | | (2.6 | ) | | | — | |

Deferred compensation/(benefit) | | | (0.3 | ) | | | 0.9 | | | | 0.1 | |

Earnings/(loss) on derivatives for the period | | | (29.9 | ) | | | 12.5 | | | | 15.2 | |

| | | | | | | | | | | | |

Other comprehensive income/(loss), net of tax | | | (60.2 | ) | | | 95.9 | | | | (41.6 | ) |

Comprehensive earnings/(loss) | | | (347.2 | ) | | | 45.8 | | | | (80.8 | ) |

Comprehensive income/(loss) attributable to noncontrolling interest | | | (4.6 | ) | | | 5.3 | | | | (1.9 | ) |

Comprehensive earnings/(loss) attributable to Catalent | | $ | (342.6 | ) | | $ | 40.5 | | | $ | (78.9 | ) |

15

RISK FACTORS

Any investment in the notes involves a high degree of risk. You should consider carefully the following information about these risks, together with the other information contained in this prospectus, before participating in the exchange offer. If any of the following risks actually occur, our business, financial condition, operating results or cash flow could be materially and adversely affected. Additional risks or uncertainties not presently known to us, or that we currently believe are immaterial, may also impair our business operations. We cannot assure you that any of the events discussed in the risk factors below will not occur and if such events do occur, you may lose all or part of your original investment in the notes.

Risks Related to the Exchange Offer

There may be adverse consequences if you do not exchange your outstanding notes.

If you do not exchange your outstanding notes for exchange notes in the exchange offer, then you will continue to be subject to the transfer restrictions on the outstanding notes as set forth in the offering memorandum distributed in connection with the private offering of the outstanding notes. In general, the outstanding notes may not be offered or sold unless they are registered or exempt from registration under the Securities Act and applicable state securities laws. Except as required by the registration rights agreement, we do not intend to register resales of the outstanding notes under the Securities Act. You should refer to “Summary—The Exchange Offer” and “The Exchange Offer” for information about how to tender your outstanding notes.

The tender of outstanding notes under the exchange offer will reduce the outstanding amount of the outstanding notes, which may have an adverse effect upon and increase the volatility of, the market price of the outstanding notes due to reduction in liquidity.

Your ability to transfer the exchange notes may be limited by the absence of an active trading market, and there is no assurance that any active trading market will develop for the exchange notes.

The exchange notes are new issues of securities for which there is no established public market. The initial purchasers in the private offering of the outstanding notes have advised us that they currently intend to make a market in the exchange notes as permitted by applicable laws and regulations; however, the initial purchasers are not obligated to make a market in any of the exchange notes, and they may discontinue their market-making activities at any time without notice. Therefore, an active market for any of the exchange notes may not develop or, if developed, it may not continue. The liquidity of any market for the exchange notes will depend upon the number of holders of the exchange notes, our performance, the market for similar securities, the interest of securities dealers in making a market in the exchange notes and other factors. A liquid trading market may not develop for the exchange notes or any series of notes. If a market develops, the exchange notes could trade at prices that may be lower than the initial offering price of the exchange notes. If an active market does not develop or is not maintained, the price and liquidity of the exchange notes may be adversely affected. Historically, the market for non-investment grade debt has been subject to disruptions that have caused substantial volatility in the prices of securities similar to the notes. The market, if any, for any of the exchange notes may not be free from similar disruptions and any such disruptions may adversely affect the prices at which you may sell your exchange notes. In addition, subsequent to their initial issuance, the exchange notes may trade at a discount from their initial offering price, depending upon prevailing interest rates, the market for similar notes, our performance and other factors.

16

Risks Related to Our Indebtedness

Our substantial leverage could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or in our industry, expose us to interest rate risk to the extent of our variable rate debt and prevent us from meeting our obligations under the notes.

We are highly leveraged. As of March 31, 2013, we had (1) $2,320.4 million (dollar equivalent) of senior indebtedness; and (2) $277.2 million (dollar equivalent) of senior subordinated indebtedness. In addition, we had an additional $185.1 million of unutilized capacity and $15.2 million of outstanding letters of credit under our revolving credit facility.

Our high degree of leverage could have important consequences for us, including:

| | • | | increasing our vulnerability to adverse economic, industry or competitive developments; |

| | • | | exposing us to the risk of increased interest rates because certain of our borrowings, including borrowings under our senior secured credit facilities, are at variable rates of interest; |

| | • | | exposing us to the risk of fluctuations in exchange rates because certain of our borrowings, including certain of our senior secured term loan facilities and the Senior Subordinated Notes, are denominated in euros; |

| | • | | making it more difficult for us to satisfy our obligations with respect to our indebtedness, including the notes, and any failure to comply with the obligations of any of our debt instruments, including restrictive covenants and borrowing conditions, could result in an event of default under the indenture governing the notes and the agreements governing such other indebtedness; |

| | • | | restricting us from making strategic acquisitions or causing us to make non-strategic divestitures; |

| | • | | limiting our ability to obtain additional financing for working capital, capital expenditures, product development, debt service requirements, acquisitions and general corporate or other purposes; and |

| | • | | limiting our flexibility in planning for, or reacting to, changes in our business or market conditions and placing us at a competitive disadvantage compared to our competitors who are less highly leveraged and who, therefore, may be able to take advantage of opportunities that our leverage prevents us from exploiting. |

Our total interest expense, net was $183.2 million, $165.5 million, $161.0 million and $160.7 million for fiscal years 2012, 2011 and 2010 and the nine months ended March 31, 2013, respectively. After taking into consideration our ratio of fixed-to-floating rate debt, including our senior unsecured term loan entered into on April 29, 2013, a 100 basis point increase in such rates would increase our annual interest expense by approximately $12 million.

Despite our high indebtedness level, we and our subsidiaries will still be able to incur significant additional amounts of debt, which could further exacerbate the risks associated with our substantial indebtedness.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future. Although the indenture that governs the notes, the indentures governing our other notes and the senior secured credit facilities contain restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of significant qualifications and exceptions and, under certain circumstances, the amount of indebtedness that could be incurred in compliance with these restrictions could be substantial. We have approximately $185 million available to us for borrowing, subject to certain conditions, from our $200.3 million revolving credit facility. If new debt is added to our subsidiaries’ existing debt levels, the risks associated with debt we currently face would increase.

17

Our debt agreements contain restrictions that limit our flexibility in operating our business.

The indenture that governs the notes, our credit facilities and the indentures governing our other notes contain various covenants that limit our ability to engage in specified types of transactions. These covenants limit our ability and the ability of our restricted subsidiaries to, among other things:

| | • | | incur additional indebtedness and issue certain preferred stock; |

| | • | | pay certain dividends on, repurchase or make distributions in respect of capital stock or make other restricted payments; |

| | • | | place limitations on distributions from restricted subsidiaries; |

| | • | | issue or sell capital stock of restricted subsidiaries; |

| | • | | guarantee certain indebtedness; |

| | • | | make certain investments; |

| | • | | sell or exchange assets; |

| | • | | enter into transactions with affiliates; |

| | • | | create certain liens; and |

| | • | | consolidate, merge or transfer all or substantially all of our assets and the assets of our subsidiaries on a consolidated basis. |

A breach of any of these covenants could result in a default under one or more of these agreements, including as a result of cross default provisions, and, in the case of the revolving credit facility, permit the lenders to cease making loans to us. Upon the occurrence of an event of default under the senior secured credit facilities, the lenders could elect to declare all amounts outstanding under the senior secured credit facilities to be immediately due and payable and to terminate all commitments to extend further credit. Such actions by those lenders could cause cross defaults under our other indebtedness. If we were unable to repay those amounts, the lenders under the senior secured credit facilities could proceed against the collateral granted to them to secure that indebtedness. We pledged a significant portion of our assets as collateral under the senior secured credit facilities. If the lenders under the senior secured credit facilities accelerate the repayment of borrowings, we may not have sufficient assets to repay the senior secured credit facilities as well as our unsecured indebtedness, including the notes. In addition, our senior secured credit facilities include other and more restrictive covenants and restrict our ability to prepay our other indebtedness, including the notes. Our ability to comply with these covenants may be affected by events beyond our control.

We utilize derivative financial instruments to reduce our exposure to market risks from changes in interest rates on our variable rate indebtedness and we are exposed to risks related to counterparty credit worthiness or non-performance of these instruments.

We enter into pay-fixed interest rate swaps to limit our exposure to changes in variable interest rates. Such instruments may result in economic losses should exchange rates decline to a point lower than our fixed rate commitments. We are exposed to credit-related losses which could impact the results of operations in the event of fluctuations in the fair value of the interest rate swaps due to a change in the credit worthiness or non-performance by the counterparties to the interest rate swaps.

Risks Related to Our Business

We participate in a highly competitive market and increased competition may adversely affect our business.

We operate in a market that is highly competitive. We compete on several fronts, both domestically and internationally, including competing with other companies that provide similar offerings to pharmaceutical,

18

biotechnology and consumer health companies based in North America, Latin America, Europe and the Asia-Pacific region. We also may compete with the internal operations of those pharmaceutical, biotechnology and consumer health manufacturers that choose to source these offerings internally, where possible.

We face material competition in each of our markets. Competition is driven by proprietary technologies and know-how, capabilities, consistency of operational performance, quality, price, value and speed. Some competitors may have greater financial, research and development, operational and marketing resources than we do. Competition may also increase as additional companies enter our markets or use their existing resources to compete directly with ours. Expanded competition from companies in low-cost jurisdictions, such as India and China, may in the future impact our results of operations or limit our growth. Greater financial, research and development, operational and marketing resources may allow our competitors to respond more quickly with new, alternative or emerging technologies. Changes in the nature or extent of our customer requirements may render our offerings obsolete or non-competitive and could adversely affect our results of operations and financial condition.

The demand for our offerings depends in part on our customers’ research and development and the clinical and market success of their products. Our business, financial condition and results of operations may be harmed if our customers spend less on or are less successful in these activities.

Our customers are engaged in research, development, production and marketing of pharmaceutical, biotechnology and consumer health products. The amount of customer spending on research, development, production and marketing, as well as the outcomes of such research, development, and marketing activities, have a large impact on our sales and profitability, particularly the amount our customers choose to spend on our offerings. Our customers determine the amounts that they will spend based upon, among other things, available resources and their need to develop new products, which, in turn, is dependent upon a number of factors, including their competitors’ research, development and production initiatives, and the anticipated market uptake, clinical and reimbursement scenarios for specific products and therapeutic areas. In addition, consolidation in the industries in which our customers operate may have an impact on such spending as customers integrate acquired operations, including research and development departments and their budgets. Our customers finance their research and development spending from private and public sources. A reduction in spending by our customers could have a material adverse effect on our business, financial condition and results of operations. If our customers are not successful in attaining or retaining product sales due to market conditions, reimbursement issues or other factors, our results of operations may be materially impacted.

We are subject to product and other liability risks that could adversely affect our results of operations, financial condition, liquidity and cash flows.

We are subject to significant product liability and other liability risks that are inherent in the design, development, manufacture and marketing of our offerings. We may be named as a defendant in product liability lawsuits, which may allege that our offerings have resulted or could result in an unsafe condition or injury to consumers. Such lawsuits could be costly to defend and could result in reduced sales, significant liabilities and diversion of management’s time, attention and resources. Even claims without merit could subject us to adverse publicity and require us to incur significant legal fees.

Furthermore, product liability claims and lawsuits, regardless of their ultimate outcome, could have a material adverse effect on our business operations, financial condition and reputation and on our ability to attract and retain customers. We have historically sought to manage this risk through the combination of product liability insurance and contractual indemnities and liability limitations in our agreements with customers and vendors. The availability of product liability insurance for companies in the pharmaceutical industry is generally more limited than insurance available to companies in other industries. Insurance carriers providing product liability insurance to those in the pharmaceutical and biotechnology industries generally limit the amount of available policy limits, require larger self-insured retentions and exclude coverage for certain products and claims. There can be no assurance that a successful product liability claim or other liability claim would be

19

adequately covered by our applicable insurance policies or by any applicable contractual indemnity or liability limitations. In addition, as we seek to expand our participation in marketed products through royalty and profit sharing arrangements, our ability to contractually limit our liability may be restricted.

Failure to comply with existing and future regulatory requirements could adversely affect our results of operations and financial condition.

The healthcare industry is highly regulated. We are subject to various local, state, federal, foreign and transnational laws and regulations, which include the operating and security standards of the Drug Enforcement Administration (“DEA”), the U.S. Food and Drug Administration (“FDA”), various state boards of pharmacy, state health departments, the United States Department of Health and Human Services (“DHHS”), the EU member states and other comparable agencies and, in the future, any changes to such laws and regulations could adversely affect us. In particular, we are subject to laws and regulations concerning good manufacturing practices and drug safety. Our subsidiaries may be required to register for permits and/or licenses with, and may be required to comply with the laws and regulations of the DEA, the FDA, DHHS, foreign agencies including the European Medicines Agency (“EMA”), and other various state boards of pharmacy, state health departments and/or comparable state agencies as well as certain accrediting bodies depending upon the type of operations and location of product distribution, manufacturing and sale.

The manufacture, distribution and marketing of our offerings for use in our customers’ products are subject to extensive ongoing regulation by the FDA, the DEA, the EMA, and other equivalent local, state, federal and foreign regulatory authorities. Failure by us or by our customers to comply with the requirements of these regulatory authorities could result in warning letters, product recalls or seizures, monetary sanctions, injunctions to halt manufacture and distribution, restrictions on our operations, civil or criminal sanctions, or withdrawal of existing or denial of pending approvals, including those relating to products or facilities. In addition, such a failure could expose us to contractual or product liability claims as well as contractual claims from our customers, including claims for reimbursement for lost or damaged active pharmaceutical ingredients, the cost of which could be significant.

In addition, any new offerings or products must undergo lengthy and rigorous clinical testing and other extensive, costly and time-consuming procedures mandated by the FDA, the EMA and other equivalent local, state, federal and foreign regulatory authorities. We or our customers may elect to delay or cancel anticipated regulatory submissions for current or proposed new products for any number of reasons.

Although we believe that we are in compliance in all material respects with applicable laws and regulations, there can be no assurance that a regulatory agency or tribunal would not reach a different conclusion concerning the compliance of our operations with applicable laws and regulations. In addition, there can be no assurance that we will be able to maintain or renew existing permits, licenses or any other regulatory approvals or obtain, without significant delay, future permits, licenses or other approvals needed for the operation of our businesses. Any noncompliance by us with applicable laws and regulations or the failure to maintain, renew or obtain necessary permits and licenses could have an adverse effect on our results of operations and financial condition.

Failure to provide quality offerings to our customers could have an adverse effect on our business and subject us to regulatory actions and costly litigation.

Our results depend on our ability to execute and improve when necessary our quality management strategy and systems, and effectively train and maintain our employee base with respect to quality management. Quality management plays an essential role in determining and meeting customer requirements, preventing defects and improving our offerings. While we have a network of quality systems throughout our business units and facilities which relate to the design, formulation, development, manufacturing, packaging, sterilization, handling, distribution and labeling of our customers’ products which use our offerings, quality and safety issues may occur with respect to any of our offerings. A quality or safety issue could have an adverse effect on our business, financial condition and results of operations and may subject us to regulatory actions, including product recalls, product seizures, injunctions to halt manufacture and distribution, restrictions on our operations, or civil

20

sanctions, including monetary sanctions and criminal actions. In addition, such an issue could subject us to costly litigation, including claims from our customers for reimbursement for the cost of lost or damaged active pharmaceutical ingredients, the cost of which could be significant.

The services and offerings we provide are highly exacting and complex, and if we encounter problems providing the services or support required, our business could suffer.

The offerings we provide are highly exacting and complex, particularly in our Medication Delivery Solutions segment, due in part to strict regulatory requirements. From time to time, problems may arise in connection with facility operations or during preparation or provision of an offering, in both cases for a variety of reasons including, but not limited to, equipment malfunction, sterility variances or failures, failure to follow specific protocols and procedures, problems with raw materials, environmental factors and damage to, or loss of, manufacturing operations due to fire, flood or similar causes. Such problems could affect production of a particular batch or series of batches, requiring the destruction of product, or could halt facility production altogether. This could, among other things, lead to increased costs, lost revenue, damage to customer relations, reimbursement to customers for lost active pharmaceutical ingredients, time and expense spent investigating the cause and, depending on the cause, similar losses with respect to other batches or products. Production problems in our drug and biologic manufacturing operations could be particularly significant because the cost of raw materials is often higher than in our other businesses. If problems are not discovered before the product is released to the market, recall and product liability costs may also be incurred. In addition, such risks may be greater at facilities that are new or going through significant expansion.

Our global operations are subject to a number of economic, political and regulatory risks.

We conduct our operations in various regions of the world, including North America, South America, Europe and the Asia-Pacific region. Global economic and regulatory developments affect businesses such as ours in many ways. Our operations are subject to the effects of global competition, including potential competition from manufacturers in low-cost jurisdictions such as China. Local jurisdiction risks include regulatory risks arising from local laws. Our global operations are also affected by local economic environments, including inflation and recession. Political changes, some of which may be disruptive, can interfere with our supply chain and customers and some or all of our activities in a particular location. While some of these risks can be hedged using derivatives or other financial instruments and some are insurable, such attempts to mitigate these risks are costly and not always successful. Also, fluctuations in foreign currency exchange rates can impact our consolidated financial results.

If we do not enhance our existing or introduce new technology or service offerings in a timely manner, our offerings may become obsolete over time, customers may not buy our offerings and our revenue and profitability may decline.

The healthcare industry is characterized by rapid technological change. Demand for our offerings may change in ways we may not anticipate because of such evolving industry standards as well as a result of evolving customer needs that are increasingly sophisticated and varied and the introduction by others of new offerings and technologies that provide alternatives to our offerings. Several of our higher margin offerings are based on proprietary technologies. The patents for these technologies will ultimately expire, and these offerings may become subject to competition. Without the timely introduction of enhanced or new offerings, our offerings may become obsolete over time, in which case our revenue and operating results would suffer. For example, if we are unable to respond to changes in the nature or extent of the technological or other needs of our pharmaceutical customers through enhancing our offerings, our competition may develop offering portfolios that are more competitive than ours and we could find it more difficult to renew or expand existing agreements or obtain new agreements. Innovations directed at continuing to offer enhanced or new offerings generally will require a substantial investment before we can determine their commercial viability, and we may not have the financial resources necessary to fund these innovations.

21

The success of enhanced or new offerings will depend on several factors, including our ability to:

| | • | | properly anticipate and satisfy customer needs, including increasing demand for lower cost products; |

| | • | | enhance, innovate, develop and manufacture new offerings in an economical and timely manner; |

| | • | | differentiate our offerings from competitors’ offerings; |

| | • | | achieve positive clinical outcomes for our customers’ new products; |

| | • | | meet safety requirements and other regulatory requirements of government agencies; |

| | • | | obtain valid and enforceable intellectual property rights; and |

| | • | | avoid infringing the proprietary rights of third parties. |

Even if we succeed in creating enhanced or new offerings from these innovations, they may still fail to result in commercially successful offerings or may not produce revenue in excess of the costs of development, and they may be quickly rendered obsolete by changing customer preferences or the introduction by our competitors of offerings embodying new technologies or features. Finally, innovations may not be accepted quickly in the marketplace because of, among other things, entrenched patterns of clinical practice, the need for regulatory clearance and uncertainty over third-party reimbursement.

We and our customers depend on patents, copyrights, trademarks and other forms of intellectual property protections, however, these protections may not be adequate.

We rely on a combination of know-how, trade secrets, patents, copyrights and trademarks and other intellectual property laws, nondisclosure and other contractual provisions and technical measures to protect a number of our offerings and intangible assets. These proprietary rights are important to our ongoing operations. There can be no assurance that these protections will prove meaningful against competitive offerings or otherwise be commercially valuable or that we will be successful in obtaining additional intellectual property or enforcing our intellectual property rights against unauthorized users. Our exclusive rights under certain of our offerings are protected by patents, some of which are subject to expire in the near term. When patents covering an offering expire, loss of exclusivity may occur and this may force us to compete with third parties, thereby affecting our revenue and profitability. We do not currently expect any material loss of revenue to occur as a result of the expiration of any patent.

Our proprietary rights may be invalidated, circumvented or challenged. We have in the past been subject to patent oppositions before the European Patent Office and we may in the future be subject to patent oppositions in Europe or other jurisdictions in which we hold patent rights. In addition, in the future, we may need to take legal actions to enforce our intellectual property rights, to protect our trade secrets or to determine the validity and scope of the proprietary rights of others. The outcome of any such legal action may be unfavorable to us.

These legal actions regardless of outcome might result in substantial costs and diversion of resources and management attention. Although we use reasonable efforts to protect our proprietary and confidential information, there can be no assurance that our confidentiality and non-disclosure agreements will not be breached, our trade secrets will not otherwise become known by competitors or that we will have adequate remedies in the event of unauthorized use or disclosure of proprietary information. Even if the validity and enforceability of our intellectual property is upheld, a court might construe our intellectual property not to cover the alleged infringement. In addition, intellectual property enforcement may be unavailable in some foreign countries. There can be no assurance that our competitors will not independently develop technologies that are substantially equivalent or superior to our technology or that third parties will not design around our patent claims to produce competitive offerings. The use of our technology or similar technology by others could reduce or eliminate any competitive advantage we have developed, cause us to lose sales or otherwise harm our business.

22

We have applied in the United States and certain foreign countries for registration of a number of trademarks, service marks and patents, some of which have been registered or issued, and also claim common law rights in various trademarks and service marks. In the past, third parties have opposed our applications to register intellectual property and there can be no assurance that they will not do so in the future. It is possible that in some cases we may be unable to obtain the registrations for trademarks, service marks and patents for which we have applied and a failure to obtain trademark and patent registrations in the United States or other countries could limit our ability to protect our trademarks and proprietary technologies and impede our marketing efforts in those jurisdictions.

Our use of certain intellectual property rights is also subject to license agreements with third parties for certain patents, software and information technology systems and proprietary technologies. If these license agreements were terminated for any reason, it could result in the loss of our rights to this intellectual property, our operations may be materially adversely affected and we may be unable to commercialize certain offerings.

In addition, many of our branded pharmaceutical customers rely on patents to protect their products from generic competition. Because incentives exist in some countries, including the United States, for generic pharmaceutical companies to challenge these patents, pharmaceutical and biotechnology companies are under the ongoing threat of a challenge to their patents. If our customers’ patents were successfully challenged and as a result subjected to generic competition, the market for our customers’ products could be significantly impacted, which could have an adverse effect on our results of operations and financial condition.

Our future results of operations are subject to fluctuations in the costs, availability, and suitability of the components of the products we manufacture, including active pharmaceutical ingredients, excipients, purchased components, and raw materials.

We depend on various active pharmaceutical ingredients, components, compounds, raw materials, and energy supplied primarily by others for our offerings. This includes, but is not limited to, gelatin, starch, iota carrageenan, petroleum-based products and resin. Also, frequently our customers provide their active pharmaceutical or biologic ingredient for formulation or incorporation in the finished product. It is possible that any of our or our customer supplier relationships could be interrupted due to natural disasters, international supply disruptions caused by pandemics, geopolitical issues or other events or could be terminated in the future.

For example, gelatin is a key component in our Oral Technologies segment. The supply of gelatin is obtained from a limited number of sources. In addition, much of the gelatin we use is bovine-derived. Past concerns of contamination from Bovine Spongiform Encephalopathy (“BSE”) have narrowed the number of possible sources of particular types of gelatin. If there were a future disruption in the supply of gelatin from any one or more key suppliers, we may not be able to obtain an alternative supply from our other suppliers. If future restrictions were to emerge on the use of bovine-derived gelatin due to concerns of contamination from BSE, any such restriction could hinder our ability to timely supply our customers with products and the use of alternative non-bovine-derived gelatin could be subject to lengthy formulation, testing and regulatory approval.

Any sustained interruption in our receipt of adequate supplies could have an adverse effect on us. In addition, while we have processes intended to reduce volatility in component and material pricing, we may not be able to successfully manage price fluctuations and future price fluctuations or shortages may have an adverse effect on our results of operations.

Changes in healthcare reimbursement in the United States or internationally could adversely affect our results of operations and financial condition.

The healthcare industry has changed significantly over time, and we expect the industry to continue to evolve. Some of these changes, such as ongoing healthcare reform, adverse changes in government or private funding of healthcare products and services, legislation or regulations governing the patient access to care and privacy, or the delivery or pricing of pharmaceuticals and healthcare services or mandated benefits, may cause

23

healthcare industry participants to change the amount of our offerings they purchase or the price they are willing to pay for our offerings. Changes in the healthcare industry’s pricing, selling, inventory, distribution or supply policies or practices could also significantly reduce our revenue and results of operations. Particularly, volatility in individual product demand may result from changes in public or private payer reimbursement or coverage.

Fluctuations in the exchange rate of the U.S. dollar and other foreign currencies could have a material adverse effect on our financial performance and results of operations.

As a company with many international entities, certain revenues, costs, assets and liabilities, including a portion of our senior secured credit facilities and the senior subordinated notes, are denominated in currencies other than the U.S. dollar. As a result, changes in the exchange rates of these currencies or any other applicable currencies to the U.S. dollar will affect our revenues, earnings and cash flows and could result in unrealized and realized exchange losses despite any efforts we may undertake to manage or mitigate our exposure to foreign currency fluctuations.

Tax legislation initiatives or challenges to our tax positions could adversely affect our results of operations and financial condition.