REGISTRATION NO. 333 -_________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

eBULLION, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 5050 | 46-2323674 | ||

(State or jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

eBullion, Inc

80 Broad Street, 5th Floor

New York, New York 10004

Telephone (212) 8377858

(Address and telephone number of principal executive offices and principal place of business)

Hank Gracin, Esq.

Leslie Marlow, Esq.

Gracin & Marlow, LLP

The Chrysler Building

405 Lexington Avenue, 26th Floor

New York, New York 10174

Telephone (212) 907-6457

(Name, address and telephone number of agent for service)

Approximate Date of Proposed Sale to the Public: From time to time after the date this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 424, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | x |

| (Do not check if a smaller reporting company) | |||

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered (1) | Proposed Maximum Offering Price Per Share (2) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee (3) | ||||||||||||

| Shares of common stock, par value $0.0001 | 500,000 | $ | 0.50 | $ | 250,000 | $ | 34.10 | |||||||||

| Total shares being registered | 500,000 | $ | 250,000 | $ | 34.10 | |||||||||||

(1) In accordance with Rule 416(a), the registrant is also registering hereunder an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions.

(2) Estimated in accordance with Rule 457(c) of the Securities Act of 1933 solely for the purpose of computing the amount of the registration fee based on the recent sales of unregistered securities in April 2013.

(3) Calculated under Section 6(b) of the Securities Act of 1933 as 0.00013640 of the aggregate offering price.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

THE INFORMATION CONTAINED IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS DECLARED EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED APRIL 18, 2013

PRELIMINARY PROSPECTUS

eBULLION, INC.

500,000 SHARES OF COMMON STOCK

This prospectus relates to the resale and other disposition from time to time of up to 500,000 shares of our common stock by the selling stockholders identified under the section entitled “Selling Stockholders” on page 29. The shares of common stock offered consist of 500,000 shares of our common stock. We issued all of the issued securities described above in private placement transactions completed prior to the filing of this registration statement.

The shares included in this prospectus may be reoffered and sold directly by the selling stockholders in accordance with one or more of the methods described in the plan of distribution, which begins on page 30 of this prospectus. We are not selling any shares of our common stock in this offering and therefore we will not receive any proceeds from the sales by the selling stockholders. Instead, the shares may be offered and sold from time to time by the selling shareholders at a fixed price of $0.50 per share until the shares are quoted, if ever, on the OTC Bulletin Board or another exchange and thereafter at prevailing market prices or privately negotiated prices. We may receive proceeds from any exercise of outstanding warrants if and when such warrants are exercised for cash.

Our common stock does not presently trade on any exchange or electronic medium. Although we hope to be quoted on the OTC Bulletin Board, no assurance can be given that our common stock will be quoted on the OTC Bulletin Board or any other quotation service.

We are an “emerging growth company” within the meaning of the recently enacted Jumpstart Our Business Startups Act and will be subject to reduced public company reporting requirements.

Investing in the Company’s securities involves a high degree of risk. You should carefully consider the risks and uncertainties described under the heading “Risk Factors” which begin on page 4 of this prospectus before making a decision whether to purchase our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ____________, 2013.

| Page | |

| PROSPECTUS SUMMARY | 1 |

| RISK FACTORS | 4 |

| USE OF PROCEEDS | 13 |

| BUSINESS | 13 |

| DETERMINATION OF OFFERING PRICE | 23 |

| DILUTION | 23 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION | 23 |

| DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS | 25 |

| EXECUTIVE COMPENSATION | 26 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 27 |

| SELLING STOCKHOLDERS | 28 |

| PLAN OF DISTRIBUTION | 30 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 31 |

| DESCRIPTION OF SECURITIES | 32 |

| EXPERTS | 32 |

| DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES | 32 |

| LEGAL MATTERS | 33 |

| WHERE YOU CAN FIND MORE INFORMATION | 33 |

| PART II | II-1 |

You should rely only on the information that we have provided in this prospectus. We have not authorized anyone to provide you with different information and you must not rely on any unauthorized information or representation. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. This document may only be used where it is legal to sell these securities. You should assume that the information appearing in this prospectus is accurate only as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus, or any sale of our common stock. Our business, financial condition and results of operations may have changed since the date on the front of this prospectus. We urge you to carefully read this prospectus before deciding whether to invest in any of the common stock being offered.

The following summary highlights material contained in this prospectus. This summary does not contain all the information you should consider before investing in our securities. Before making an investment decision, you should read the entire prospectus carefully, including the "Risk Factors" section, the financial statements and the notes to the financial statements that appear elsewhere in this prospectus. References to the “Company”, “we,” “us,” and “our” are references to the combined business of eBullion, Inc, a Delaware corporation and its wholly owned subsidiary, Man Loong Bullion Company Limited, (“Man Loong”) a Hong Kong limited liability company.

Business Overview

ITEM 1. BUSINESS

Business Overview

Since April 3, 2013, through our subsidiary Man Loong Bullion Company Limited, a Hong Kong limited liability company (“Man Loong”), we have been engaged in the precious metals trading business, providing precious metals spot contract trading services to clients for gold and silver trading, via a 24-hour electronic trading platform located in Hong Kong which Man Loong licenses from True Technology, a company organized under the laws of Hong Kong (“True Technology”), owned by one of our executive officers and one of our directors . In facilitating trades of these precious metals, Man Loong acts in its capacity as an officially designated electronics trading member of the Chinese Gold and Silver Exchange Society (“CGSE”), a self-regulatory organization registered in Hong Kong which acts as an exchange for the trading of gold and silver. Man Loong holds a Type AA License with the CGSE, which authorizes it to engage in the electronic trading of Kilo Gold and Loco London Gold and Silver on behalf of its clients. The electronic trading platform that Man Loong licenses from True Technology provides customers with CGSE price quotations on gold and silver spot contracts, on a Loco London basis, as well as information updates on the gold and silver market, based on an evaluation of third-party market pricing sources such as Reuters or Bloomberg. Man Loong’s client base is primarily in Hong Kong, where it has one office and maintains its trading platforms, and in China, where it works through various independent sales agents.

Man Loong’s membership in the CGSE allows it to facilitate trades on behalf of non-members who execute trades to buy and/or sell gold and/or silver without Man Loong being required to become a counterparty to the trade or to purchase or sell any gold or silver being traded as a principal. Man Loong receives a brokerage commission ranging from $20 to $40 per trade regardless of the purchase price paid or received for the gold or silver traded through our electronic platform and ots clients assume the sole responsibility for settlement of the purchase price of the gold or silver traded and for any gain or loss recognized on those trades. All of Man Loong’s revenue is derived from the commissions it receives on each trade for which it facilitates placement on the market.

For our fiscal years ended March 31, 2011 and 2012, Man Loong’s revenue was approximately $2.6 million and $2.0 million, respectively, and its net income was $1.2 million and $0.25 million, respectively. For the nine months ended December 31, 2012 and 2011, Man Loong’s revenue was $858,434 and $1,751,153, respectively and it had a net loss of ($453,127) for the nine months ended December 31, 2012 and net income of $421,474 for the nine months ended December 31, 2011.

Our principal offices are located at 80 Broad Street, New York, New York 10004, (212) 837-7858. Man Loong currently has 1 office in Hong Kong. Man Loong’s principal executive offices are located at 8/F, Tower 5, China Hong Kong City, 33 Canton Road, Tsim Sha Tsui, Hong Kong. The telephone number at Man Loong’s principal executive office is +852-2155-3999. All Man Loong’s transactions and the technologies, including the servers that carry out these transactions, are all executed and located in Hong Kong.

Our Corporate History and Background

We were incorporated under the laws of the State of Delaware on January 28, 2013. We were initially formed to develop software for use in on-line trading of gold and silver contracts. Since the acquisition of Man Loong, our business development focus has been, and we expect will continue to be, solely on increasing Man Loong’s market share for the on-line trading of gold and silver spot contracts within the Hong Kong market while developing a business model for the on-line trading of gold and silver spot contracts by Man Loong in the People’s Republic of China.

Acquisition of Man Loong On April 3, 2013, we entered into a Contribution Agreement with the shareholders of Man Loong, whereby we acquired 100% of the issued and outstanding capital stock of Man Loong from its stockholders, in exchange for 50,760,000 newly issued shares of our common stock, par value $0.0001. After the transaction, Man Loong became our wholly owned subsidiary.

1

As a result of the acquisition, we have assumed the business and operations of Man Loong. Man Loong, which was incorporated in 1974 in Hong Kong and was re-registered in 2009 under Hong Kong law as a limited liability company, was organized to facilitate the trading of precious metals spot contracts. Man Loong initially provided an electronic trading platform that offered one-stop electronic trading in Hong Kong, and in 2010, expanded its services to include the trading for its clients and not as principal, of gold and silver spot contracts in China. Man Loong currently has one office in Hong Kong and several independent agents that it engages in China.

The acquisition of Man Loong was treated for accounting purposes as a reverse merger with eBullion acquiring 100% of the outstanding common stock of Man Loong in exchange for 50,760,000 newly issued shares of our common stock, par value $.0001. Unless the context suggests otherwise, when we refer in this prospectus to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Man Loong. For accounting purposes, the reverse merger of eBullion, Inc. with Man Loong has been treated as a recapitalization with no adjustment to the historical book and tax basis of either companies’ assets or liabilities.

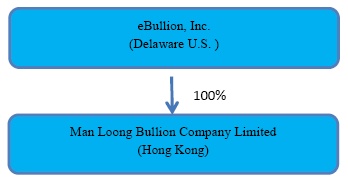

Our Corporate Structure Our primary business operations are conducted through our Hong Kong operating subsidiary, Man Loong. For ease of reference, below is a chart that presents our current corporate structure.

Our principal executive offices are located at 80 Broad Street, New York, New York 10004 and Man Loong’s principal offices are located at 8/F, Tower 5, China Hong Kong City, 33 Canton Road, Tsim Sha Tsui, Hong Kong. The telephone number at our principal executive offices is (212) 837-7858 and Man Loong’s principal executive office is +852-2155-3999. All our transactions and the technologies, including the servers that carry out these transactions, are all executed and located in Hong Kong.

2

The Offering

Shares of our common stock offered for re-sale by the Selling Stockholders pursuant to this prospectus | 500,000 | |

| Common stock currently outstanding | 51,260,000 | |

| Proceeds to the Company | We will not receive any proceeds from the resale or other disposition of the shares covered by this prospectus by any Selling Stockholder. | |

| Risk Factors | There are significant risks involved in investing in our Company. For a discussion of risk factors you should consider before buying our common stock see “Risk Factors” beginning on page 3 |

3

Investment in our common stock involves a high degree of risk. You should carefully consider the risks described below together with all of the other information included herein before making an investment decision. If any of the following risks actually occur, our business, financial condition or results of operations could suffer. In that case, the market price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

Restricted access to Man Loong’s website, could lead to significant operating disruptions, a negative customer experience or the loss of customers or potential customers.

If any enterprises or professional organizations, including governmental agencies, blocked access to Man Loong’s website or the Internet generally for a number of reasons including due to security or confidentiality concerns or regulatory reasons, or if any government of any jurisdiction in which we or Man Loong are considered to be carrying on business in may block or suspend internet transmission capabilities, Man Loong’s business would experience significant operating disruptions because our revenues are primarily generated through the commissions Man Loong receives for the trades facilitated through its electronic trading platform through the Internet and Man Loong’s website. If these entities were to block or limit access to Man Loong’s website or adopt policies restricting its customers from providing it with accurate and up-to-date information, the value of Man Loong’s electronic trading platform could be negatively impacted, which could adversely affect its ability to retain and attract customers.

Our revenue is based upon Man Loong’s trade commissions which are themselves influenced by trading volume and volatility and economic conditions that are beyond our control.

Any volatility in the global financial markets has a direct impact on Man Loong’s commissions and therefore its revenue. Many countries have recently experienced recessionary conditions. Our revenue is influenced by the general level of trading activity in the gold and silver market since all of our revenue is derived from the commission Man Loong receives on each trade that it facilitates. Our revenue and operating results may vary significantly from period to period primarily due to movements and trends in the world’s currency markets, volatility in the market price of gold and silver and fluctuations in trading levels. Recently, Man Loong has experienced greater trade volume and it has generally experienced greater trading volume in periods of volatile markets as during such periods there tends to be increased trading. In the event Man Loong experiences lower levels of volatility, trading volume will typically decrease and therefore Man Loong’s commission revenue will likely be negatively affected. Like other financial services firms, our business and profitability and Man Loongs are directly affected by elements that are beyond our and its control, such as economic and political conditions, broad trends in business and finance, changes in the volume of transactions, changes in supply and demand for precious metals, movements in currency exchange rates, changes in the financial strength of market participants, legislative and regulatory changes, changes in the markets in which such transactions occur, changes in how such transactions are processed and disruptions due to terrorism, war or extreme weather events. Any one or more of these factors, or other factors, may adversely affect our business and results of operations and cash flows. As a result, period-to-period comparisons of our operating results may not be meaningful and our future operating results may be subject to significant fluctuations or declines.

Competitive trading systems could force Man Loong to reduce its commissions and negatively impact revenue.

Any increased competition to Man Loong’s platform through the development of faster execution programs could reduce the volume of trades or force Man Loong to reduce its commission on each trade. In addition, new and enhanced alternative trading systems have emerged as an option for individual and institutional investors to carry out proprietary trades, which could result in reduced commissions.

A substantial portion of our revenue and operating profits is derived from Man Loong’s role as a service provider. In its role as a service provider, Man Loong derives a fixed amount of commission from each trade that we facilitate.

Man Loong may also experience reduced trade volumes from competition from computer-generated buy and sell programs and other technological advances and regulatory changes in the precious metals market that may continue to tighten spreads on precious metals transactions. In addition, new and enhanced alternative trading systems have emerged as an option for individual and institutional investors to avoid directing their trades through retail trade facilitators, which could result in reduced revenue derived from our precious metal trade facilitation business. Man Loong may also face price competition from its competitors.

Man Loong may be exposed to unidentified or unexpected risks if its risk management policies and procedures are not effective.

Man Loong relies on a combination of technical and human controls and supervision to protect it against certain risks. However, its risk-management methods may be subject to error and failure and therefore may not adequately prevent losses due to technical errors if its testing and quality control practices are not effective in preventing software or hardware failures. Although Man Loong has risk-management policies, control systems and compliance manuals set in place, we cannot guarantee adherence to such policies, systems, and manuals by our staff. Its policies, procedures and practices used to identify, monitor and control a variety of risks, including risks related to human error, hardware and software errors, market movements, fraud and money-laundering, are established and reviewed by its management. Under certain circumstances Man Loong may elect to adjust its risk-management policies to allow for an increase in risk tolerance, which could expose it to the risk of greater losses. To deal with and to manage its risks, Man Loong’s approach is discretionary by nature and are considered on a case by case basis and developed internally. Man Loong hasobserved historical market behavior and also involve reliance on standard industry practices. These methods may not adequately prevent losses. These methods may not protect Man Loong against all risks or may protect us less than anticipated, in which case our business, financial condition and results of operations and cash flows may be materially adversely affected.

4

We do not own the trading platform upon which our business operates and if the license was terminated our business would experience significant operating disruptions.

Man Loong licenses the software that is utilized to run its electronic trading platform from True Technology, an entity owned by our Chief Executive Officer and one of our directors and shareholders pursuant to the terms of a license agreement that can be terminated upon our breach of the terms of the agreement. Although we believe that alternative software programs are available or could be developed by other third parties or eventually by Man Loong in house, the development of any such programs would be costly and may not be available in a timely manner. The termination of the license agreement would likely result in suspension of Man Loong’s internet transmission capabilities and its business would experience significant operating disruptions if the license agreement were terminated.

Man Loong also relies on True Technology’s computer systems or third-party service and software providers, including trading platforms, back-office systems, internet service providers and communications facilities. In these third-party services, deterioration in their performance or quality, could adversely affect Man Loong’s business. If Man Loong’s arrangement with any third party is terminated, it may not be able to find an alternative systems or a services provider on a timely basis or on commercially reasonable terms. This could have a material adverse effect on our business, financial condition and results of operations and cash flows.

Our business is substantially dependent upon our licensed trading platform. Any disruption or corruption of the trading platform or our inability to maintain technological superiority in our industry could have a material adverse effect on our business, financial condition and results of operations and cash flows.

Our business is substantially dependent upon Man Loong’s licensed electronic trading platform, which Man Loong relies upon to accurately and timely receive and process internal and external data. If the trading platform were to fail to function properly for any reason, Man Loong could suffer from trade errors and therefore it would be forced to suspend operations until such time as the disruptions were fixed. Man Loong’s ability to facilitate transactions successfully and provide high quality customer service depends on the efficient and uninterrupted operation of its computer and communications hardware and software systems. Computer systems are vulnerable to damage or interruption from human error, natural disasters, power loss, telecommunication failures, break-ins, sabotage, computer viruses, intentional acts of vandalism, computer denial-of-service attacks and other similar events. If Man Loong’s systems fail to perform, it could experience periodic interruptions and disruptions in operations, slower response times or decreased customer satisfaction.

In order to remain competitive, Man Loong’s electronic trading platform is under continuous development and redesign. However, with any newly developed technology Man Loong runs the ongoing risk that failures may occur and result in service interruptions or other negative consequences such as slower quote aggregation, slower trade execution, erroneous trades, or mistaken risk-management information.

We believe Man Loong’s technology has provided Man Loong with a competitive advantage relative to many of its competitors. If its competitors develop more advanced technologies, it may be required to devote substantial resources to the development of more advanced technology to remain competitive. The gold and silver market is characterized by rapidly changing technology, evolving industry standards and changing trading systems, practices and techniques. Man Loong may not be able to keep up with these rapid changes in the future, develop new technology, realize a return on amounts invested in developing new technologies or remain competitive in the future.

Man Loong’s systems have in the past experienced disruptions in operations, which it believes will continue to occur from time to time. As of the date hereof, we have not been notified of any claim against Man Loong alleging harm caused to third parties by this disruption and its customers have continued to actively place precious metals trading orders through their respective trading accounts. However, we can provide no assurance that we will not receive any claims in the future in connection with this disruption.

To mitigate the risk of trading disruptions, Man Loong has a mirror server setup in a secured server room in its headquarters office in Hong Kong. The mirror server has the same trading software installed as the production server. If there are any network problems with the production server, the network connection will be switched to mirror server to minimize, if not avoid entirely any downtime of the trading systems. In addition, Man Loong has two IT specialists and one operations manager to continuously monitor the server status and ensure the resumption of operations should it ever become necessary.

5

Man Loong’s IT department is working with IT security consultants to strengthen and protect its network from intentional attacks. Man Loong has also established a separate department to monitor its networks and to identify and minimize human errors, such as clerical mistakes and incorrectly placed trades, as well as intentional misconduct, such as unauthorized trading, mischief and fraud. Furthermore, Man Loong seeks to mitigate the impact of any operational issues by maintaining insurance coverage for various contingencies. Despite any precautions it may take, any systems failure that causes an interruption in its services or decreases the responsiveness of its services could, among other consequences, impair its reputation, damage its brand name and materially adversely affect its and our business, financial condition and results of operations and cash flows.

Due to the fact that Man Loong’s cost structure is largely fixed, it may not be able to respond to changes in revenue.

A substantial portion of Man Loong’s expenses are fixed expenses for which it has payment commitments regardless of its revenue. These expenses include office lease costs, computer hardware and software, hosting facilities and security and staffing costs. If demand for Man Loong’s services declines and, as a result, its revenues decline, it may not be able to adjust its cost structure on a timely basis and its profitability may be materially adversely affected.

Our revenue is dependent upon Man Loong’s ability to attract and retain the agents with whom its customers have accounts.

Our revenue is dependent upon Man Loong’s ability to retain and attract agents. Man Loong’s customer base is primarily comprised of agents which have been retained by individual customers who generally trade in gold and silver spot contracts. Although Man Loong offer products and tailored services designed to educate, support and retain its agents’ customers, its efforts to attract new agents, and those agents’ ability to attract new customers or reduce the attrition rate of its existing agents and their customers may not be successful. If Man Loong is unable to maintain or increase its agent retention rates or generate a substantial number of new agents in a cost-effective manner, its business, financial condition and results of operations and cash flows would likely be adversely affected. During the prior year, Man Loong’s loss of two agents resulted in a substantial decrease in its revenue. Although Man Loong has spent significant financial resources on support services for agents and their customers, marketing expenses and related expenses and plan to continue to do so, these efforts may not be cost-effective at attracting new agents and customers. In particular, we believe that costs for customer support services and rates for desirable advertising and marketing placements, including online, search engine, print and television advertising, are likely to increase in the foreseeable future, and Man Loong may be disadvantaged relative to its larger competitors in its ability to expand or maintain its customer support capabilities, and advertising and marketing commitments.

Any future expansion or acquisitions may result in significant transaction expenses, integration and consolidation risks and risks associated with entering new markets, and we may be unable to profitably operate our consolidated company.

Our growth strategy includes the penetration of new markets in the future. Any future markets that we enter may result in significant transaction expenses and present new risks associated with entering additional markets or offering new products and integrating the acquired companies. We may not have sufficient management, financial and other resources to integrate our operations in the new markets with our current operations and we may be unable to profitably operate our expanded company. Additionally, any new businesses that we may acquire, once integrated with our existing operations, may not produce expected or intended results.

Some of the new markets may be in emerging growth countries. To compete successfully in these emerging markets, we must continue to design, develop, and sell new and enhanced precious metals electronic trading programs and services that are culturally acceptable to these emerging markets. Any emerging market that we attempt to penetrate will have risks of potential entrenched local competition, higher credit risks, cultural differences, less developed and established local financial and banking infrastructure, reduced protection of intellectual rights, inability to enforce contracts in some jurisdictions, difficulties and costs associated with staffing and managing foreign operations, including reliance on newly hired local personnel, currency and tax laws that may prevent or restrict the transfer of capital and profits among our various operations around the world; and time zone, language and cultural differences among personnel in different areas of the world. We may also have difficulty in complying with the diverse regulatory requirements of multiple jurisdictions, which may be more burdensome, not clearly defined, and subject to unexpected changes, potentially exposing us to significant compliance costs and regulatory penalties

Our Hong Kong operating subsidiary, Man Loong, facilitates the trading of gold and silver spot contracts in Hong Kong and China. Spot contracts in gold and silver are not and may not be offered in the U.S. by us, including by our non-U.S. subsidiary, and are not eligible for resale to U.S. residents. They are not currently registered with the U.S. Securities and Exchange Commission or any other U.S. regulators.

Man Loong may be unable to respond to customers’ demands for new services and products and our business, financial condition and results of operations and cash flows may be materially adversely affected.

Man Loong’s customers may demand new services provided by Man Loong’s electronic trading platform. If Man Loongs fails to identify these demands from customers or update our services accordingly, any new services and products provided by its competitors may render its existing services and products less competitive. Man Loong is currently dependent upon a third party for the development of enhancements to its trading platform. The software developer is not our employee and we cannot control the timing or amount of resources they devote to our programs. Our future success will depend, in part, on Man Loong’s ability to respond to customers’ demands for new services and products on a timely and cost-effective basis and to adapt to address the increasingly sophisticated requirements and varied needs of our customers and prospective customers. We may not be successful in developing, introducing or marketing new services and products. In addition, Man Loong’s new service and product enhancements may not achieve market acceptance. Any failure on our part or Man Loong’s to anticipate or respond adequately to customer requirements, or any significant delays in the development, introduction or availability of new services, products or service or product enhancements could have a material adverse effect on our business, financial condition and results of operations and cash flows.

6

We depend on our key personnel, the loss of whom would impair our ability to compete.

We and Man Loong are highly dependent on the employment services of Kee Yuen Choi, our Chief Executive Officer. The loss of Mr. Choi’s services could adversely affect us. We and Man Loong are also dependent on the other members of our management. The loss of the service of any of these persons could seriously harm our product development and commercialization efforts. In addition, research, product development and commercialization will require additional skilled personnel in areas such as software and electronic technical support, customer support and marketing and retention of personnel, particularly for employees with technical expertise, is uncertain. If we are unable to hire, train and retain a sufficient number of qualified employees, our ability to conduct and expand our business could be seriously reduced. The inability to retain and hire qualified personnel could also hinder the planned expansion of our business and may result in us relocating some or all of our operations.

Our Chief Executive Officer beneficially owns and controls a substantial portion of our outstanding common stock, which may limit your ability and the ability of our other stockholders, whether acting alone or together, to propose or direct the management or overall direction of our Company.

Mr. Choi, as our Chief Executive Officer and Chairman of our Board of Directors, and through his control of approximately 50% of our outstanding Common Stock, controls the Company and important matters relating to us. As a result of his positions and his control of our common stock, Mr. Choi controls the outcome of all matters submitted to our shareholders for approval, including the election of our directors, our business strategy and our day-to-day operations. In addition, Mr. Choi’s ownership of our Common Stock and control of the Company could discourage the acquisition of our Common Stock by potential investors and could have an anti-takeover effect, preventing a change in control of the Company and possibly depressing the trading price of our Common Stock. There can be no assurance that conflicts of interest will not arise with respect to Mr. Choi’s ownership and control of the Company or that any conflicts will be resolved in a manner favorable to the other shareholders of the Company.

Man Loong’s operations will be dependent upon its ability to protect our intellectual property, which could be costly.

Our success will depend in part upon protecting any technology we or Man Loong uses or may develop from infringement, misappropriation, duplication and discovery, and avoiding infringement and misappropriation of third party rights. We intend to rely, in part, on a combination of patent and contract law to protect such technology in the United States and abroad. However, we or our licensor may in the future need to initiate lawsuits to protect or enforce our patents, which would be expensive and, if we or they lose, may cause us to lose some of our intellectual property rights, which would reduce our ability to compete in the market.

The risks and uncertainties that we face with respect to our patents and other proprietary rights include the following:

| ● | the pending patent applications we have filed or to which we have exclusive rights may not result in issued patents or may take longer than we expect to result in issued patents; |

| ● | the claims of any patents which are issued may not provide meaningful protection; |

| ● | we may not be able to develop additional proprietary technologies that are patentable; |

| ● | the patents licensed or issued to us or our customers may not provide a competitive advantage; |

| ● | other companies may challenge patents licensed or issued to us or our customers; |

| ● | patents issued to other companies may harm our ability to do business; |

| ● | other companies may independently develop similar or alternative technologies or duplicate our technologies; and |

| ● | other companies may design around the technologies we have licensed or developed. |

There can be no assurance that any of our patent applications or licensed patent applications will issue or that any patents that may issue will be valid and enforceable. We may not be successful in securing or maintaining proprietary patent protection for our products and technologies that we develop or license. In addition, our competitors may develop products similar to ours using methods and technologies that are beyond the scope of our intellectual property protection, which could reduce our anticipated sales. While some of our products have proprietary patent protection, a challenge to these patents can subject us to expensive litigation. Litigation concerning patents, other forms of intellectual property, and proprietary technology is becoming more widespread and can be protracted and expensive and distract management and other personnel from performing their duties.

7

We also rely upon trade secrets, unpatented proprietary know-how, and continuing technological innovation to develop a competitive position. If these measures do not protect our rights, third parties could use our technology, and our ability to compete in the market would be reduced. In addition, employees, consultants and others who participate in the development of our products may breach their agreements with us regarding our intellectual property, and we may not have adequate remedies for the breach. We also may not be able to effectively protect our intellectual property rights in some foreign countries and our trade secrets may become known through other means not currently foreseen by us. We cannot assure you that others will not independently develop substantially equivalent proprietary technology and techniques or otherwise gain access to our trade secrets and technology, or that we can adequately protect our trade secrets and technology.

Additionally, in order to protect or enforce our patent rights, we may initiate patent litigation against third parties, such as infringement suits or interference proceedings. Litigation may be necessary to:

| ● | assert claims of infringement; |

| ● | enforce our patents; |

| ● | protect our trade secrets or know-how; or |

| ● | determine the enforceability, scope and validity of the proprietary rights of others. |

Lawsuits could be expensive, take significant time and divert management’s attention from other business concerns. They would put our licensed patents at risk of being invalidated or interpreted narrowly and our patent applications at risk of not issuing. We may also provoke third parties to assert claims against us. Patent law relating to the scope of claims in the technology fields in which we operate is still evolving and, consequently, patent positions in our industry are generally uncertain. If initiated, we cannot assure you that we would prevail in any of these suits or that the damages or other remedies awarded, if any, would be commercially valuable. During the course of these suits, there could be public announcements of the results of hearings, motions and other interim proceedings or developments in the litigation. If securities analysts or investors were to perceive any of these results to be negative, our stock price could decline.

We may incur substantial liabilities and may be required to limit commercialization of our electronic trading platform in response to product liability lawsuits.

We or Man Loong could be the subject of complaints or litigation from customers alleging product quality or operational concerns. Litigation or adverse publicity resulting from these allegations could materially and adversely affect our business, regardless of whether the allegations are valid or whether we are liable. Neither we nor Man Loong currently have product liability insurance coverage, and even if there was such coverage, there would be no assurance that such coverage would be sufficient to properly protect us. Further, claims of this type, whether substantiated or not, may divert our financial and management resources from revenue generating activities and the business operation.

We are an “emerging growth company,” and any decision on our part to comply with certain reduced disclosure requirements applicable to emerging growth companies could make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act enacted in April 2012, and, for as long as we continue to be an emerging growth company, we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We could remain an emerging growth company until the earliest of : (i) the last day of the fiscal year in which we have total annual gross revenues of $1 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of our first sale of common equity securities pursuant to an effective registration statement; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer. We cannot predict if investors will find our common stock less attractive if we choose to rely on these exemptions. If some investors find our common stock less attractive as a result of any choices to reduce future disclosure, there may be a less active trading market for our common stock and our stock price may be more volatile.

Under Section 107(b) of the Jumpstart Our Business Startups Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

8

As a result of our becoming a public company, we will become subject to additional reporting and corporate governance requirements that will require additional management time, resources and expense.

In connection with this filing, we will become obligated to file with the U.S. Securities and Exchange Commission annual and quarterly information and other reports that are specified in the U.S. Securities Exchange Act of 1934. We will also become subject to other reporting and corporate governance requirements under the Sarbanes-Oxley Act of 2002, as amended, and the rules and regulations promulgated thereunder, all of which will impose significant compliance and reporting obligations upon us.

Our internal controls over financial reporting may not be effective and our independent registered public accounting firm may not be able to certify as to their effectiveness, which could have a significant and adverse effect on our business and reputation.

As a newly public reporting company, we will be in a continuing process of developing, establishing, and maintaining internal controls and procedures that will allow our management to report on, and our independent registered public accounting firm to attest to, our internal controls over financial reporting if and when required to do so under Section 404 of the Sarbanes-Oxley Act of 2002. Our independent registered public accounting firm is not required to attest to the effectiveness of our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act until the later of the year following our first annual report required to be filed with the SEC, or the date we are no longer an emerging growth company. Our management will be required to report on our internal controls over financial reporting under Section 404 commencing in fiscal year 2015. If we fail to achieve and maintain the adequacy of our internal controls, we would not be able to conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404. At such time, our independent registered public accounting firm may issue a report that is adverse in the event it is not satisfied with the level at which our controls are documented, designed or operating. Moreover, our testing, or the subsequent testing by our independent registered public accounting firm, that must be performed may reveal other material weaknesses or that the material weaknesses described above have not been fully remediated. If we do not remediate the material weaknesses described above, or if other material weaknesses are identified or we are not able to comply with the requirements of Section 404 in a timely manner, our reported financial results could be materially misstated or could subsequently require restatement, we could receive an adverse opinion regarding our internal controls over financial reporting from our independent registered public accounting firm and we could be subject to investigations or sanctions by regulatory authorities, which would require additional financial and management resources, and the market price of our stock could decline.

Future sales of our common stock by our existing shareholders could cause our stock price to decline.

The Company will have a significant number of restricted shares that will become eligible for sale shortly after this registration statement is declared effective. We currently have 51,260,000 shares of our common stock outstanding, all of which are restricted securities. Of such amount, the shares being registered herein will be eligible for sale immediately upon the effectiveness of this registration statement. All of the remaining shares will be eligible for resale under Rule 144 within ninety days of us being a reporting company under Section 13 or 15 of the Securities Exchange Act of 1934 (the “Exchange Act”), subject to certain restrictions. It is conceivable that following the holding period, many shareholders may wish to sell some or all of their shares. If our shareholders sell substantial amounts of our common stock in the public market at the same time, the market price of our common stock could decrease significantly due to an imbalance in the supply and demand of our common stock. Even if they do not actually sell the stock, the perception in the public market that our shareholders might sell significant shares of our common stock could also depress the market price of our common stock.

A decline in the price of shares of our common stock might impede our ability to raise capital through the issuance of additional shares of our common stock or other equity securities, and may cause you to lose part or all of your investment in our shares of common stock.

Shareholders purchasing shares in this offering do not have pre-emptive rights, which will cause them to experience dilution if we issue additional securities.

At any time or times after this offering, we may issue and sell additional shares of our authorized but previously unissued shares of common stock, preferred stock, or common stock warrants on such terms and conditions as our Board of Directors, in its sole discretion, may determine without consent of our shareholders. Our shareholders do not have pre-emptive rights to acquire additional shares should we in the future issue or sell additional securities. Thus, we are not required to offer any existing shareholder the right to purchase his or her pro rata portion of any future issuance of securities and, therefore, upon the issuance of any additional securities by us hereafter, our shareholders will not be able to maintain their then existing pro rata ownership in our outstanding shares of common stock, preferred stock, or common stock warrants without additional purchases of securities at the price then set internally by us.

9

In the event of a breach of law by us or a breach of a contractual obligation our shareholders will have little or no recourse because all of our assets, as well as our officers and directors, are located in Hong Kong.

Investors in our Company will have little recourse in the event of a breach of law or contractual obligation that has an adverse effect upon our operations because of the inherent difficulties in enforcing their rights since all of our assets are located in Hong Kong. Inasmuch as our officers and directors reside outside of the United States, investors located in the United States may have difficulty enforcing their rights against such person if he were to breach his duties. In addition, it may not be possible to effect service of process in Hong Kong and uncertainty exists as to whether the courts in Hong Kong would recognize or enforce judgments of U.S. courts obtained against our officers and directors predicated on the civil liability provisions of the securities laws of the U.S. or any state thereof, or to be competent to hear original actions brought in Hong Kong against us or such person predicated upon the securities laws of the United States or any state thereof.

We do not expect to pay dividends on our common stock in the foreseeable future.

Although Man Loong has paid dividends to its private stockholders in the past, we do not expect to pay dividends on common stock for the foreseeable future, and we may never pay dividends. Consequently, the only opportunity for investors to achieve a return on their investment may be if a trading market develops and investors are able to sell their shares for a profit or if our business is sold at a price that enables investors to recognize a profit. We currently intend to retain any future earnings to support the development and expansion of our business and do not anticipate paying cash dividends for the foreseeable future. Our payment of any future dividends will be at the discretion of our Board of Directors after taking into account various factors, including but not limited to our financial condition, operating results, cash needs, growth plans and the terms of any credit agreements that we may be a party to at the time. In addition, our ability to pay dividends on our common stock may be limited by state law. Accordingly, we cannot assure investors any return on their investment, other than in connection with a sale of their shares or a sale of our business. At the present time there is a limited trading market for our shares. Therefore, holders of our securities may be unable to sell them. We cannot assure investors that an active trading market will develop or that any third party will offer to purchase our business on acceptable terms and at a price that would enable our investors to recognize a profit.

Our lack of an independent audit committee and audit committee financial expert at this time may hinder our board of directors’ effectiveness in fulfilling the functions of the audit committee without undue influence from management and until we establish such committee will prevent us from obtaining a listing on a national securities exchange.

Although our common stock is not listed on any national securities exchange, for purposes of independence we use the definition of independence applied by NASDAQ. Currently, we have no independent audit committee. Our full board of directors functions as our audit committee and is comprised of five directors, three of whom are considered to be "independent" in accordance with the requirements set forth in NASDAQ Listing Rule 5605(a)(2). An independent audit committee plays a crucial role in the corporate governance process, assessing our Company's processes relating to our risks and control environment, overseeing financial reporting, and evaluating internal and independent audit processes. The lack of an independent audit committee may prevent the board of directors from being independent from management in its judgments and decisions and its ability to pursue the responsibilities of an audit committee without undue influence. We may have difficulty attracting and retaining directors with the requisite qualifications. If we are unable to attract and retain qualified, independent directors, the management of our business could be compromised.. An independent audit committee is required for listing on any national securities exchange, therefore until such time as we have an independent audit committee we will be ineligible for listing on any national securities exchange.

Our board of directors acts as our compensation committee, which presents the risk that compensation and benefits paid to those executive officers who are board members and other officers may not be commensurate with our financial performance.

A compensation committee consisting of independent directors is a safeguard against self-dealing by company executives. Our board of directors acts as the compensation committee and determines the compensation and benefits of our executive officers, administers our employee stock and benefit plans, and reviews policies relating to the compensation and benefits of our employees. Our lack of an independent compensation committee presents the risk that our executive officer on the board may have influence over his personal compensation and benefits levels that may not be commensurate with our financial performance.

Limitations on director and officer liability and indemnification of our Company’s officers and directors by us may discourage stockholders from bringing suit against an officer or director.

Our Company’s certificate of incorporation and bylaws provide, with certain exceptions as permitted by governing state law, that a director or officer shall not be personally liable to us or our stockholders for breach of fiduciary duty as a director or officer, except for acts or omissions which involve intentional misconduct, fraud or knowing violation of law, or unlawful payments of dividends. These provisions may discourage stockholders from bringing suit against a director or officer for breach of fiduciary duty and may reduce the likelihood of derivative litigation brought by stockholders on our behalf against a director or officer.

10

We are responsible for the indemnification of our officers and directors.

Should our officers and/or directors require us to contribute to their defense, we may be required to spend significant amounts of our capital. Our certificate of incorporation and bylaws also provide for the indemnification of our directors, officers, employees, and agents, under certain circumstances, against attorney's fees and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities on behalf of our Company. This indemnification policy could result in substantial expenditures, which we may be unable to recoup. If these expenditures are significant, or involve issues which result in significant liability for our key personnel, we may be unable to continue operating as a going concern.

Our common stock may be thinly traded, so you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise money or otherwise desire to liquidate your shares.

Prior to this offering, you could not buy or sell our common stock publicly. We cannot predict the extent to which investors’ interests will lead to an active trading market for our common stock or whether the market price of our common stock will be volatile following this offering. If an active trading market does not develop, investors may have difficulty selling any of our common stock that they buy. There may be limited market activity in our stock and we are likely to be too small to attract the interest of many brokerage firms and analysts. We cannot give you any assurance that a public trading market for our common stock will develop or be sustained. If we trade on OTC markets, the trading volume we will develop may be limited by the fact that many major institutional investment funds, including mutual funds as well as individual investors, follow a policy of not investing in OTC stocks and certain major brokerage firms restrict their brokers from recommending OTC stocks because they are considered speculative, volatile, thinly traded and the market price of the common stock may not accurately reflect the underlying value of our Company. The market price of our common stock could be subject to wide fluctuations in response to quarterly variations in our revenues and operating expenses, announcements of new products or services by us, significant sales of our common stock, including “short” sales, the operating and stock price performance of other companies that investors may deem comparable to us, and news reports relating to trends in our markets or general economic conditions.

The application of the “penny stock” rules to our common stock could limit the trading and liquidity of the common stock, adversely affect the market price of our common stock and increase your transaction costs to sell those shares.

As long as the trading price of our common stock is below $5 per share, the open-market trading of our common stock will be subject to the “penny stock” rules, unless we otherwise qualify for an exemption from the “penny stock” definition. The “penny stock” rules impose additional sales practice requirements on certain broker-dealers who sell securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 together with their spouse). These regulations, if they apply, require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the associated risks. Under these regulations, certain brokers who recommend such securities to persons other than established customers or certain accredited investors must make a special written suitability determination regarding such a purchaser and receive such purchaser’s written agreement to a transaction prior to sale. These regulations may have the effect of limiting the trading activity of our common stock, reducing the liquidity of an investment in our common stock and increasing the transaction costs for sales and purchases of our common stock as compared to other securities. The stock market in general and the market prices for penny stock companies in particular, have experienced volatility that often has been unrelated to the operating performance of such companies. These broad market and industry fluctuations may adversely affect the price of our stock, regardless of our operating performance. Stockholders should be aware that, according to Securities and Exchange Commission (“SEC”) Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include: (i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (iii) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (iv) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. The occurrence of these patterns or practices could increase the volatility of our share price.

We may not be able to attract the attention of major brokerage firms, which could have a material adverse impact on the market value of our common stock.

The trading market for our common stock will rely in part on the research and reports that equity research analysts publish about us and our business. We do not control these analysts. However, security analysts of major brokerage firms may not provide coverage of our common stock since there is no incentive to brokerage firms to recommend the purchase of our common stock, which may adversely affect the market price of our common stock. If equity research analysts do provide research coverage of our common stock, the price of our common stock could decline if one or more of these analysts downgrade our common stock or if they issue other unfavorable commentary about us or our business. If one or more of these analysts ceases coverage of our company, we could lose visibility in the market, which in turn could cause our stock price to decline.

11

RISKS RELATED TO REGULATION

Litigation and regulatory investigations may result in significant financial losses and harm to our reputation.

We face significant risk of litigation, regulatory investigations and similar actions in the ordinary course of our business, including the risk of lawsuits and other legal actions relating to unauthorized transactions, error transactions, breach of data privacy laws, breach of fiduciary or other duties. Any such action may include claims for substantial or unspecified compensatory damages, as well as civil, regulatory or criminal proceedings against our directors, officers or employees, and the probability and amount of liability, if any, any remain unknown for significant periods of time. We may be also subject to various regulatory inquiries, such as information requests and book and records examinations, from regulators and other authorities in the geographical markets in which we operate.

A substantial liability arising from a law suit judgment or a significant regulatory action against us or a disruption in our business arising from adverse adjudications in proceedings against our directors, officers or employees could have a material adverse effect on our business, financial condition and results or operations. Moreover, even if we ultimately prevail in the litigation, regulatory action or investigation, we could suffer significant harm to our reputation, which could materially affect our prospects and future growth, including our ability to attract new customers, retain current customers and recruit and retain employees and agents.

Compliance with rules and regulations in our geographical markets could have a material adverse effect on our business, financial condition and results of operation.

As a data user we and Man Loong are prohibited from doing or engaging in any practice that contravenes the data privacy laws, rules and regulations that regulate the use of customer data in the markets in which we or Man Loong are engaged. In Hong Kong, Man Loong is governed by the Personal Data (Privacy) Ordinance (Chapter 486 of the Laws of Hong Kong) Compliance with these laws, rules and regulations may restrict Man Loong’sbusiness activities, require us to incur increased expenses and devote considerable time to compliance efforts.

In addition, we or Man Loong may also be required to qualify to do business in certain foreign countries where we have customers residing. We and Man Loong are required to comply with the laws and regulations of each country in which we conduct business, including laws and regulations currently in place or which may be enacted related to Internet services available to their citizens from service providers located elsewhere. Any failure to develop effective compliance and reporting systems could result in regulatory penalties in the applicable jurisdiction, which could have a material adverse effect on our business, financial condition and results of operations and cash flows.

Presently all transactions for spot contracts on gold and silver are executed and completed over Man Loong’selectronic trading platform or telephone transaction system located in Hong Kong although its customers may not reside in Hong Kong. Agents and their customers may access Man Loong’s electronic trading platform via the Internet from anywhere in the world, but all instructions are first communicated to Man Loong and then the resulting trade is executed in Hong Kong. The acceptance of a customer order by Internet in a jurisdiction other than Hong Kong may require Man Loong to comply with the laws of that jurisdiction and failure to comply may have a material negative impact on our financial condition and business results.

Without local PRC registration, licensing or authorization, we may be subject to possible enforcement action and sanction for our operations in the PRC if our operations are deemed to have violated PRC regulations.

When permitted, we promote our services to customers outside of Hong Kong, including to customers in China where our industry is regulated. The regulatory rules and procedures for engaging in our business in China are complex and are not as clear as those in many other jurisdictions and so we have not sought licensing from PRC government authorities to conduct business operations in China. We do work with third party agents to promote and introduce our services to individuals and businesses in China and we accept them as customers via our website. Our PRC legal counsel has advised us that our activities in China are in compliance with PRC law because such activities are purely promotional and never involve the conduct of any business transactions in China. We cannot assure you that PRC rules and regulations will not change such that we can no longer engage in such promotional activities or offer our precious metals trading services to PRC residents online. In such case, we may be subject to fines, penalties, or sanctions or may be required to cease such offerings to PRC residents all together. These restrictions may limit our ability to increase revenues and would have a material adverse effect on our results of operations.

12

If Man Loong were to fail to comply with the requirements of the CGSE (Chinese Gold & Silver Exchange Society), Man Loong could lose our ability to process client trades, which would have an adverse material effect on our revenues, business and financial condition.

Man Loong must comply with the minimum working capital and other requirements of the CGSE to continue our present business operations as an officially designated electronics trading member of the CGSE, a self-regulatory organization registered in Hong Kong. If we were to fall out of compliance with the CGSE’s requirements for its members, Man Loong could lose its ability to facilitate any trades of gold, silver and other precious metals for clients, and potentially lose its membership in the CGSE, all of which would have an adverse material effect on our revenues, business and financial condition. The constitution of the CGSE requires its members to have a minimum working capital, defined as cash plus precious metals, of approximately $193,000 and minimum required assets of $643,000. The CGSE also requires its members to submit a quarterly liquidity capital report, in order to ensure that the bank balances exceed or equal the balance of customer deposits, as well as comply with a code of conduct which is established by CGSE. As of March 31, 2012 and 2011, Man Loong was in compliance with these requirements, with $1.7 million and $.2 million in cash, respectively, and $2.2 million and $2.3 million, respectively, in total assets.

Our growth may be limited by various restrictions and we remain at risk that we may be required to cease operations if we become subject to regulation by local government bodies.

We currently have only a limited presence in a number of significant markets and may not be able to gain a significant presence there unless and until regulatory barriers to international firms in certain of those markets are modified. Consequently, we cannot assure you that our international expansion will continue and that we will be able to develop our business in emerging markets as we currently plan. Furthermore, we may be subject to possible enforcement action and sanction if we are determined to have previously offered, or currently offer, our services in violation of local government’s regulations. In these circumstances, we are exposed to sanction by local enforcement agencies and our contracts with customers may be unenforceable. We may also be required to cease the conduct of our business with customers in the relevant jurisdiction and/or we may determine that compliance with the regulatory requirements for continuance of the business is too onerous to justify making the necessary changes to continue that business.

Procedures and requirements of the patriot act may expose us to significant costs or penalties.

As participants in the financial services industry, we are, and our subsidiaries are, subject to laws and regulations, including the Patriot Act of 2001, that require that we know our customers and monitor transactions for suspicious financial activities. The cost of complying with the Patriot Act and related laws and regulations is significant. We face the risk that our policies, procedures, technology and personnel directed toward complying with the Patriot Act are insufficient and that we could be subject to significant criminal and civil penalties due to noncompliance. Such penalties could have a material adverse effect on our business, financial condition and results of operations and cash flows. In addition, as an online financial services provider with customers worldwide, we may face particular difficulties in identifying our customers and monitoring their activities.

We will not receive any proceeds from the sale of the common stock by the Selling Stockholders pursuant to this prospectus. All proceeds from the sale of the shares will be for the account of the Selling Stock holders.

History

Since April 3, 2013, through our subsidiary, Man Loong, we have been engaged in the precious metals trading business, providing precious metals spot contract to clients for gold and silver trading, via a 24-hour electronic trading platform which we license from True Technology located in Hong Kong. In facilitating trades of these precious metals, Man Loong acts in its capacity as an officially designated electronics trading member of the Chinese Gold and Silver Exchange Society, or the “CGSE”, in Hong Kong. Man Loong holds a Type AA License which authorizes us to engage in the electronic trading of Kilo Gold and Loco London Gold and Silver. The electronic trading platform that Man Loong licenses from True Technology provides its customers with CGSE price quotations on gold and silver spot contracts, on a Loco London basis, as well as information updates on the gold and silver market, based on an evaluation of third-party market pricing sources such as Reuters or Bloomberg. Man Loong’s client base is primarily in Hong Kong where it has one office and maintain its trading platforms and in China where it works through various independent sales agents.

13

Man Loong’s membership in the CGSE allows it to facilitate trades on behalf of nonmembers who executes trades to buy and/or sell gold and/or silver spot contracts without its being required to become a counterparty to the trade or to purchase or sell any gold or silver being traded as a principal. Man Loong receives a brokerage commission per trade ranging from $20 to $40 regardless of the purchase price paid or received for the gold or silver traded and its clients assume the sole responsibility for settlement of the purchase price of the gold or silver traded and for any resulting gain or loss recognized on those trades. Substantially all of Man Loong’s revenue is derived from the commission it receives on each trade executed through our electronic trade platform or telephone transaction system.

For our fiscal years ended March 31, 2011 and 2012, Man Loong’s revenue was approximately $2.6 million and $2.0 million, respectively and Man Loong’s net income was $1.2 million and $0.25 million, respectively. For the nine months ended December 31, 2012 and 2011, Man Loong’s revenue was $858,434 and $1,751,153, respectively and it had a net loss of ($453,127) for the nine months ended December 31, 2012 and net income of $421,474 for the nine months ended December 31, 2011.

Our principal executive offices are located at 80 Broad Street, New York, New York 10004. The telephone number at our principal executive offices is (212) 837-7858. Man Loong’s principal offices are located at 8/F, Tower 5, China Hong Kong City, 33 Canton Road, Tsim Sha Tsui, Hong Kong. The telephone number at Man Loong’s principal executive office is +852-2155-3999. All Man Loong’s transactions and the technologies, including the servers that carry out these transactions, are all executed and located in Hong Kong.

Our Corporate History and Background

We were incorporated under the laws of the State of Delaware on January 28, 2013. We were initially formed to develop software for use in on-line trading of gold and silver contracts. Since the acquisition of Man Loong, our business development focus has been, and will continue to be, solely on increasing Man Loong’s market share for the on-line trading of gold and silver spot contracts within the Hong Kong market while developing Man Loong’s business model for the on-line trading of gold and silver spot contracts by Man Loong in the People’s Republic of China.

Acquisition of Man Loong

On April 3, 2013, we entered into a Contribution Agreement with the shareholders of Man Loong, whereby we acquired 100% of the issued and outstanding capital stock of Man Loong from its shareholders, in exchange for 50,760,000 newly issued shares of our common stock, par value $0.0001. After the transaction Man Loong became our wholly owned subsidiary.

As a result of the acquisition, we have assumed the business and operations of Man Loong Man Loong Bullion which was incorporated in 1974 in Hong Kong and was re-registered in 2009 under Hong Kong law as a limited liability company, to facilitate the trading of precious metals spot contracts. Man Loong initially provided an electronic trading platform that offered one-stop electronic trading in Hong Kong, and expanded its services in 2010 to include the trading for its clients, and not as principal, of gold and silver spot contracts in China.

The acquisition of Man Loong for accounting purposes was treated as a reverse merger, with eBullion acquiring 100% of the outstanding common stock of Man Loong in exchange for 50,7600,000 newly issued shares of our common stock, par value $.0001. Unless the context suggests otherwise, when we refer in this prospectus to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Man Loong Bullion For accounting purposes, the reverse merger of eBullion, Inc. (Delaware U.S.) with Man Loong Bullion has been treated as a recapitalization with no adjustment to the historical book and tax basis of either companies’ assets and liabilities.