Filing - Institute of Kings and Priests, Inc. (IKP)

Form 10

April 23, 2013

___________________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

100 F Street NE, Washington, D.C. 20549-1090

FORM 10

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Institute of Kings and Priests, Inc.

(a Wisconsin corporation)

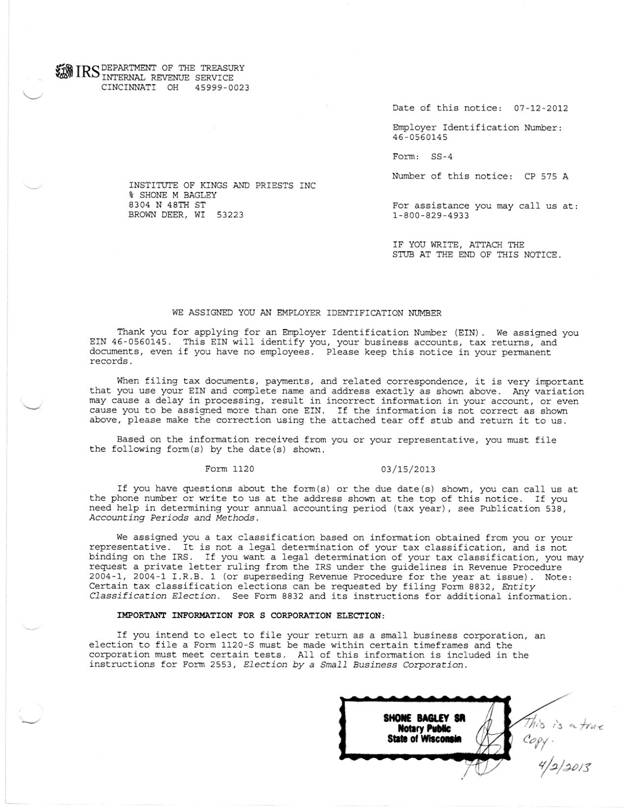

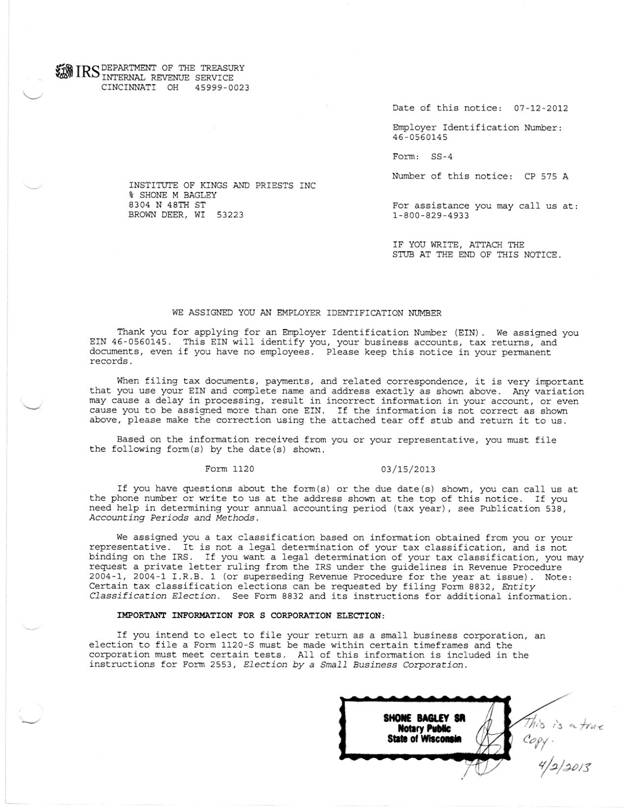

I.R.S. Employer Identification Number:46-0560145

12201 West Burleigh Street Suite 14

Wauwatosa, WI 53222

Email: ikpsed@yahoo.com

Phone: (414) 699-1962

Fax: (414) 744-3333

------------------------------------------------------------

(Address and telephone number of Registrant’s principal executive offices)

Securities to be registered pursuant to Section 12(b) of the Act:

3,000,000 Common Stock, fifty cents ($.50) per value

(Title of each class)

OTC Bulletin Board (OTCBB)

(Name of each exchange on which to be registered)

Securities to be registered pursuant to Section 12(g) of the Act:

None at this time

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Exchange Act.

Large accelerated filer___ Accelerated filer___

Non-accelerated filer___(Do not check if a smaller reporting company)

Smaller reporting company _x__

Table of Contents

Item 1. Business ----------------------------------------------------------------------- 3

Our Mission------------------------------------ 3

Our Goals ---------------------------------------3

Our Business -----------------------------------3

Business History -------------------------------4

Item 1A. Risk Factor ----------------------------------------------------------------4

Item 2. Financial Information ------------------------------------------------------4

1. Limit or Acquisition Activities ------------4

2. Plan of Operation ----------------------------4

3. Executive Compensation -------------------5

4, Summary Compensation Table ------------5

5. Director's Compensation --------------------5

Item 3. Properties --------------------------------------------------------------------5

Item 4. Security Ownerships -------------------------------------------------------6

Item 5. Directors and Executive Officers -----------------------------------------6

Item 6. Executive Compensation -------------------------------------------------- 8

Item 7. Certain Relationships and Related Transactions,

and Director Independence -----------------------------------------------9

Item 8. Legal Proceeding ------------------------------------------------------------9

Item 9. Market Price of and Dividends --------------------------------------------9

Item 10. Recent Sales of Unregistered Securities --------------------------------9

Item 11. Description of registrant's Securities to be registered -----------------9

1. Common Stock --------------------------------9

2. Cash Dividends --------------------------------10

3. Reports ------------------------------------------10

4. Stock Transfer Agent -------------------------10

Item 12. Indemnification of Directors and Officers -----------------------------10

Item 13. Financial Statements and Supplementary Data ------------------------12

EX 99 (1-5)

Item 14. Change in and Disagreements with Accountants on Accounting

and Financial Disclosure --------------------------------------------------12

Item 15. Financial Statements and Exhibits ---------------------------------------12

EX 3a - Articles of Incorporation

EX 3b - By-laws

EX 4 - Instruments defining the rights of security holders

EX 9 - Voting Trust Agreement

EX 10 - Material Contracts

EX 11 - Statement re computation of per share earnings

EX 12 - Statements re computation of ratios

EX 24 - Power of Attorney

EX 99 - Financial Statements

Signature Page --------------------------------------------------------------------------13

INFORMATION REQUIRED IN REGISTRATION STATEMENT

Item 1. Business

Our Mission

The mission of this Company is to seek especially hopeful students of all backgrounds and to coach them, through mental discipline and social understanding, to develop their intellectual, ethical, civic, and creative abilities to the fullest. The aim of our educational program is the cultivation of citizens with a rich awareness of “self” that leads and serves in every province of human activity.

Our Goals

The following serve as specific goals of this company:

· Recruit, support, and retain a diverse faculty and staff capable of providing the highest quality learning experiences to our students.

· Offer high quality innovative programs that engage and challenge students and stimulate critical exchange of ideas.

· Develop and align standards and assessments that aid the recruitment, retention and graduation of students capable of being esteemed professionals.

· Promote interdisciplinary and interagency collaboration on advocacy efforts and other change strategies that can enhance individuals, organizations and communities.

· Participate and excel in actions that earn state and national recognition for this company.

Our Business

Institute of Kings and Priests, Inc. (IKP) is engaged in the provision of diversified education solutions for individuals who do not excel in the typical public or charter school environment. IKP operates in three Business segments:

1. School Learning Solutions

Our school learning solutions are comprised of advanced studies of Math, English and Science. Each student will learn at their own speed of understanding without the peer-pressure of other students. With the help of technology, IKP's students will be given a reading/visual/video-based CD containing 9th - 12th grade Math, English and Science studies that will lead each student to their highest ability at their own pace.

At the same time, Monday through Friday IKP's teachers will teach each student specific skill instruction such as Divinity, Business, Medical (EMS), and Government so that each students’ studies will apply the specifics of Math, English and Science so the students can see the relationship within Math, English and Science to that life skill.

After the second year of attendance, the students will receive their High School Diploma. Surpassing the State requirement of 21 course credits, through our program and within two years, our students will receive 37 course credits, 6 certifications of completions and skill knowledge that cannot be replaced.

2. Bachelor's Degree Program

An advantage with IKP is our higher education program that can lead a student up to a Bachelor's Degree, which provides students with an undergraduate education within the four years of high School. IKP has a goal to encompass higher education, business and professional development as an offering to students after graduating their second year of High School. Earning a Bachelor's Degree is an inexpensive way for our students to receive a higher education without accumulating a large amount of debt. It is also possible for them to find a high-paying job in specific career fields once they graduate IKP's school. As a result, at the end of IKP's students four years attendance, the students will have a Bachelor's Degree, ready for the work force, ready for society.

3. Business Sponsorship

IKP will allow each student within the "business course" a chance to pitch their business idea. If theBoard of Business Development agrees, they (we) will invest at the same time guide that student to a successful business. Once the Business become successful or sustaining, IKP will "bow out" to let that student be one of the great CEO's.

The other part of IKP Business Sponsorship is how we will hire some students who complete the "Stock/Option course" and prove a degree of understanding, for a chance for IKP to oversee the students to take some of the company's money and invest it.

Parents will pay a tuition along with the tuition assistance from the State of Wisconsin starting 2014-2015 school year; this will enlist and sustain their child(ren) within IKP. IKP truly believes that parents should invest in their children and in addition, we have a volunteer program for the parents to be involved with teachers and other programs that will inform the parents every step of the way. We believe that as the child invest in their selves also each parent must invest in their child(ren). We must start to grow the parents and the students together to truly turn our community around.

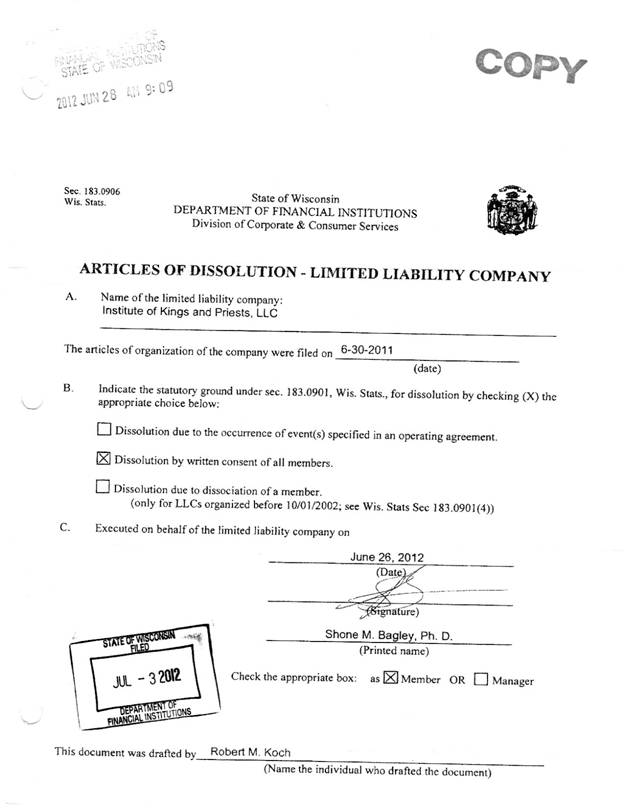

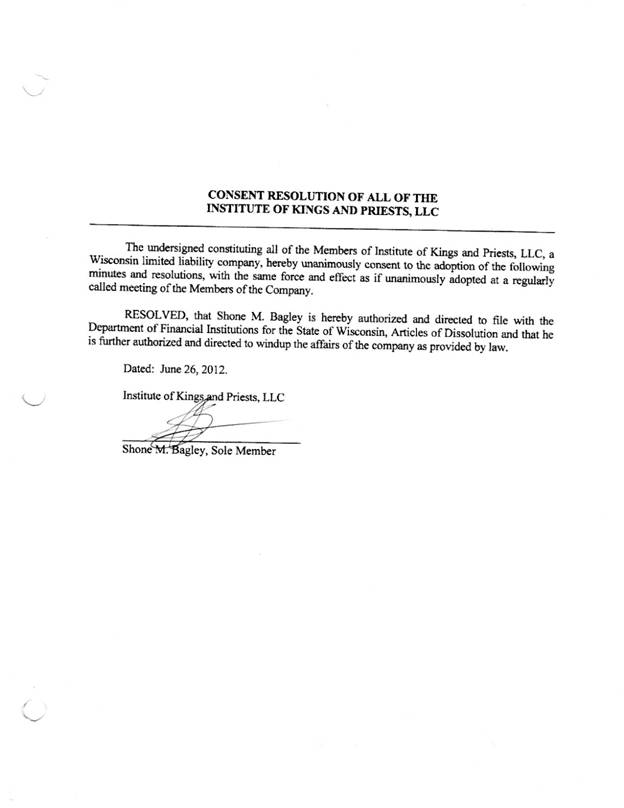

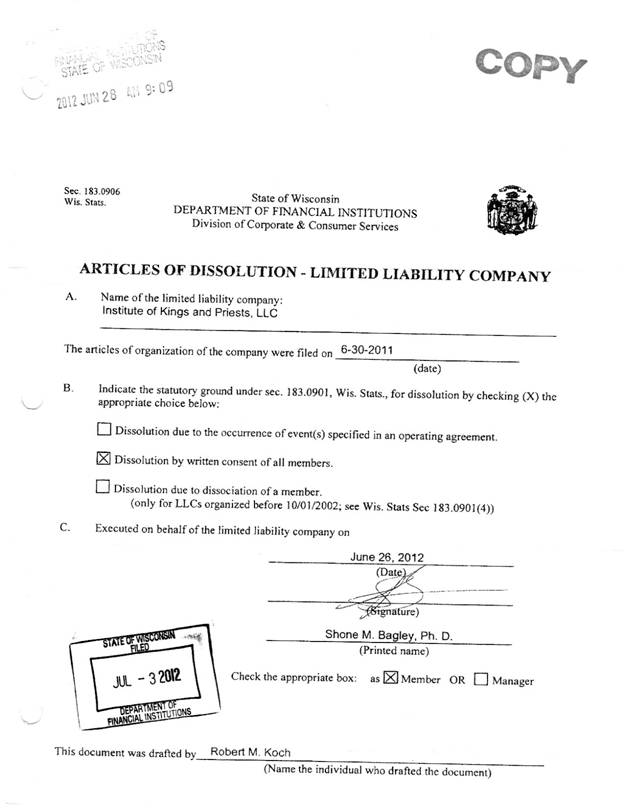

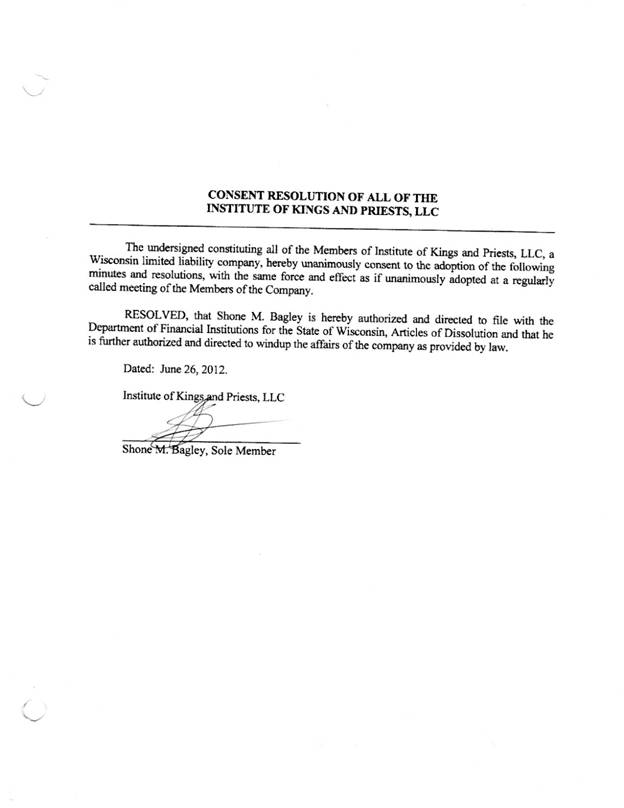

Business History

In 2009 Institute of Kings and Priests were initiated as a seminary school. IKP grew into a limited liability company in June 2011 and open our doors to the High School level. The company grew again, dissolved in June 2012, and immediately incorporated as a "C" corporation in July 2012. Early operations are consisted with today's operation of education.

Item 1A. Risk Factors

Some discussions in this registration statement may contain forward-looking statements that involve risks and uncertainties. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this registration statement. Such factors include, but are not limited to, those discussed in Item 15. Financial EX99 (1-5), as well as those discussed elsewhere. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to possible future events.

Item 2. Financial Information

1. LIMIT OUR ACQUISITION ACTIVITY WHICH MAY RESULT IN A LOSS OF YOUR INVESTMENT

Because we are small and do not have much capital, we must limit our acquisition activity. As such we may not be able to lease the properties as we would like, hire new staff, build the classrooms to a higher standard. In that event, another profitable year may go unrevealed. Without producing the right standard and climate for the State, students, and staff, we cannot generate revenues and you will lose your investment.

2. PLAN OF OPERATION

We are a start-up company, just past the exploration stage of our company and have not yet generated revenue from our business operations. We can continue as an on-going business for the next twelve months due to Board and Officer of the company the willingness to commit to loan us money for our operations. Our only other source for cash at this time is investments by others in this Offering.

In 2014-2015 school year, we anticipate we will be approved to receive State assistance through the “Wisconsin Charter Program,” the sum of $9,000.00 per student, at the High School Level. We also anticipate enrollment of our High School student count to reach over 150 students the same years. We must raise capital to implement and ready our project for the 2014-2015 school years. The minimum amount of 1,000,000 shares of this offering will allow us to operate and prepare for the August 2014school year. The more capital we raise, the more this company will be ready to serve our students, their parents, and the community.

We calculated that we will need to raise the minimum amount in this offering of $500,000 in order to acquire:

1. Building - to house 250 students

2. Hire new instructors

3. Prep all classrooms with the necessary equipment

4. Market and promote for the 150 - 250 students

IKP have targeted for our first location the city of Milwaukee, WI. We believe if we can help the lower income population be more part of the community by helping existing businesses, starting their own business, and participate in the local government to grow the community we all can benefit from. IKP have been approached and is considering other states to branch out to within three to five years.

IKP's plan of operation for the twelve months following the date of this listing is to raise funds from the offering, secure a lease on a property, complete the re-work of classes, hiring of new employees and finalize the production program before the 2014-2015 school year starts while also instructing our new students starting August 2013-2014 school year.

3. EXECUTIVE COMPENSATION

Our current officers and Board Members receive no compensation. The current Board of Directors is comprised of Dr. Shone Bagley, Sr. and Mr. Todd Poston.

4. SUMMARY COMPENSATION TABLE

Change in

Pension

Value and

Non-Equity Nonqualified

Incentive Deferred All

Name and Plan Compen- Other

Principal Stock Option Compen- sation Compen-

Position Year Salary Bonus Awards Awards sation Earnings sation Totals

----------------------------------------------------------------------------------------------------------------------------

Bagley, 2012 0 0 0 0 0 0 0 0

Shone

President,

Secretary,

CEO, Director

Poston, 2012 0 0 0 0 0 0 0 0

Todd

Treasurer,

CFO, Director

5. Director Compensation

There are no current employment agreements between the company and its executive officer.

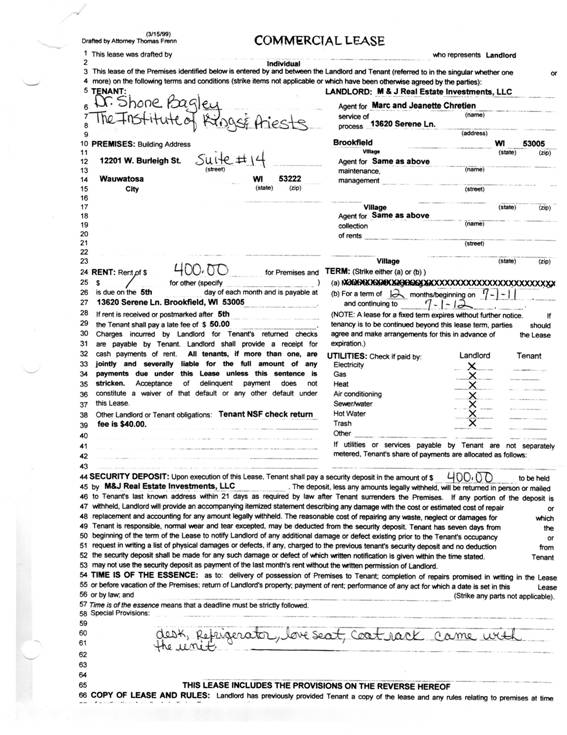

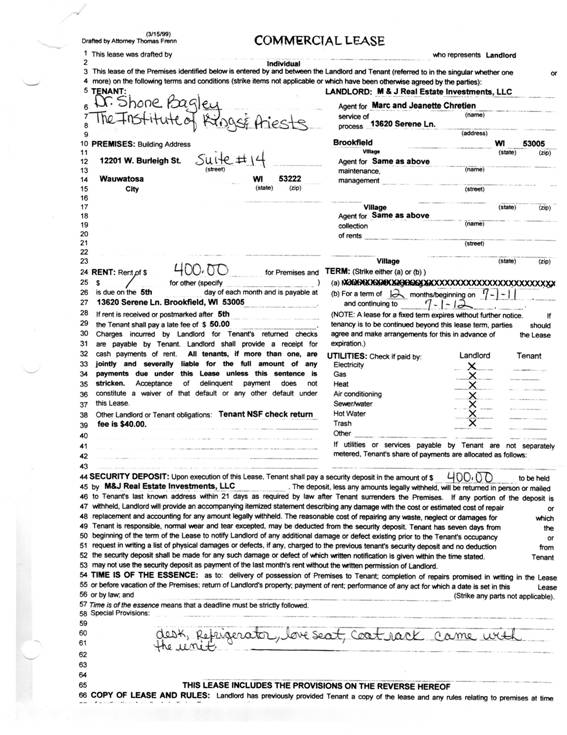

Item 3. Properties

No such property is not held in fee or is held subject to any major encumbrance. We lease shared office facilities at Suite 14 West Burleigh Street, Wauwatosa, WI 53222. The facilities include answering, fax services, reception area, and shared office, boardroom facilities and classroom. Other support services are available on a pay for use basis. We pay approximately $400 US per month and the office arrangement is on a written month-to-month basis - see Exhibit 10. There is no lease or rental agreement for the space.

Item 4. Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding our common stock beneficially owned on the date of this filing

Name and Address Amount and Nature

Of Beneficial of Beneficial Percent of

Owner (1) and (2) Ownership (1) and (2) Class

--------------------------- -------------------------------- ----------------

Shone Bagley, Sr.

8304 N. 48th Street 5,000,000 - Founder 55%

Brown Deer, WI 53223 CEO/Secretary/Director

Todd Poston

6842 South Parkedge Cir 120,000 - CFO 1.33%

Franklin, WI 53132 Treasurer / Director

_________________________________________________________________________

All others as a group 5,000- Advisory only less than 0.001%

(1) The persons named above, who are the only officers, directors and principal shareholders, may be deemed to be parents and promoters, within the meaning of such terms under the Securities Act of 1933, by virtue of their direct securities holdings. These persons are the only promoters.

(2) In general, a person is considered a beneficial owner of a security if that person has or shares the power to vote or direct the voting of such security, or the power to dispose of such security. A person is also considered to be a beneficial owner of any securities of which the person has the right to acquire beneficial ownership within (60) days.

(3)

(i) have equal ratable rights to dividends from funds legally available therefore, when, as and if declared by the Board of Directors of the Company;

(ii) are entitled to share ratably in all of the assets of the Company available for distribution to holders of common stock upon liquidation, dissolution or winding up of

the affairs of the Company;

(iii) do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights applicable thereto; and

(iv) are entitled to one non-cumulative vote per share on all matters on which stockholders may vote.

All shares of common stock now outstanding are fully paid for and non-assessable and all shares of common stock which are the subject of this Offering, when issued, will be fully paid for and non-assessable. Please refer to the Company's Articles of Incorporation, Bylaws and the applicable statutes of the State of Wisconsin for a more complete description of the rights and liabilities of holders of the Company's securities.

There are currently no options, warrants, rights or other securities conversion privileges granted to our officers, directors or beneficial owners and no plans to issue any such rights in the future.

Item 5. Directors and Executive Officers

The following table sets forth the names, ages, and positions of the executive officers and directors.

Directors are elected at the annual meeting of stockholders and serve for one year or until their successors are elected and qualify.

The Board of Directors elects officers and their terms of office are, except to the extent governed by employment contract, at the discretion of the Board of Directors.

Name Age Position (s)

--------------------------------- ----------- ----------------------------

Dr. Shone Bagley, Sr. 42 President, Chief Executive Officer,

Secretary, and Director

Todd Poston 53 Chief Financial Officer,

Treasurer, and Director

Dr. Shone Bagley, Sr., named above, have held the offices/positions since inception (July 2012)

and both are expected to hold said offices/positions until the next annual meeting of stockholders.

Background of Officers and Directors are as follows:

(a) Dr. Shone Bagley, Sr.

Business:

2009 - Started: Institute of Kings and Priests - Seminary

2012 - Incorporated “Institute of Kings and Priests, Inc.” / adding High School

Military Service:

8 years of Military Service --- Honorably Discharged 2009

-- 2 years Air Force

-- 6 years Army

Associate Pastor:

2000 - 2004 Wilson Grove MB Church

2003 - 2005 Union Hill MB Church

2007 - 2009 New Popular Grove Independent Methodist Church

2000 - Certificate of License

2009 - Ordination – by: Southern Baptist Association

Education:

2006 - Bachelor of Christian Counseling - Sacramento Theological Bible College

2008 - Masters of Christian Counseling - New Foundation Theological Seminary

2011 - Doctoral in Divinity & Philosophy - New Foundation Theological Seminary

Publications:

2006 - A Message from a God Fearer --- sold +/- 12,000 books

2010 - God is at hand - Killing Willie Lynch Spirit --- sold +/-23,000 books

2012 - Promise --- released September 2012

Professional Affiliations:

2008- Member with American Association of Christian Counselors

2009- Member with Society for Christian Psychology

(b) Mr. Todd Poston

Chief Financial Officer

Institute of Kings and Priests, Inc.

Dec. 2012– Present Wauwatosa, WI

This start-up company is engaged in the provision of diversified education solutions to

late-term high school students seeking to earn a high school diploma and an Bachelor degree

in a vocational endeavor. This part time position is responsible for financial affairs,

including managing accounting activities, planning and financial reporting.

Writer

Sales Automation Support, Inc.

Privately Held; 11-50 employees; Writing and Editing industry

February 2012– February 2012 (1 month)New Berlin, WI

Wrote curriculum for two subjects of a 30-part Veteran's Administration course on starting a

business; subjects were Basics of Organization Design, and Legal Representation and Accountants.

Project Manager, Collections Outsourcing

xpedx

Public Company; 5001-10,000 employees; IP; Paper & Forest Products industry

August 2009– June 2011 (1 year 11 months)Guatemala City, Guatemala

Implemented third-party collection outsourcing from decentralized U.S.-based collectors to

centralized Guatemala-based collectors.

Group Credit Manager

xpedx

Public Company; 5001-10,000 employees; IP; Paper & Forest Products industry

January 2006– July 2009 (3 years 7 months)Milwaukee, WI

Led a team of credit managers and collectors charged with managing a $45 mil accounts receivable portfolio.

Group Controller

xpedx

Public Company; 5001-10,000 employees; IP; Paper & Forest Products industry

July 1993– December 2005 (12 years 6 months)Milwaukee, WI

Responsible for financial reporting, financial analysis, internal controls, credit oversight,

budgeting and capital requests for a group with $485 mil annual sales with 420 employees and nine locations.

Controller, Accounting Manager, Systems Manager, Financial Analyst, other

Leslie Paper

August 1975– June 1993 (17 years 11 months)Minneapolis, MN

At a privately owned regional wholesale distributor with $390 mil annual sales, 400 employees and 13 locations,

roles included responsibility for monthly and year-end closes, account reconciliations, external audits, income tax

accruals and estimated tax payments, contributions to an Employee Stock Ownership Plan, 401k discrimination

testing, payroll oversight, third-party information services provider oversight, cash management, sales and use

tax returns and property tax renditions.

Item 6. Executive Compensation

The officers and directors do not presently receive any cash or non-cash compensation for their services and there

are currently no plans to implement any such compensation. They are, however, reimbursed for any out-of-pocket

expenses incurred on our behalf.

___________________________________________

Summary Compensation Table

___________________________________________

Annual Compensation Long-Term Comp.

Name and Other

Position(s) Year Salary/ Bonus Comp. Annual Awards Payouts

-------------------------------------------------------------------------------------------------------------------------------------

Shone Bagley, Sr. 2012-13 None None None None

President, CEO,

Secretary , and Director

Todd Poston 2012-13 None None None None

CFO, Treasure, and

Director

The officers and directors are not currently party to any employment agreements and we do not presently have any pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, it may adopt such plans in the future. There are presently no personal benefits available to directors, officers or employees.

Item 7. Certain Relationships and Related Transactions,

and Director Independence

We do not have any related transactions at this time and have not yet formulated a policy for the resolution of any related transaction conflicts, should they arise.

Item 8. Legal Proceedings

To the best of our Management's knowledge, there are no material legal proceedings filed or threatened against us.

Item 9. Market Price of and Dividends on the Registrant’s

Common Equity and Related Stockholder Matters

As of the date of this filing, there are three (3) shareholders of record, holding a total of shares of 5,125,000 of the company's Common Stock. The company's stock is not listed for quotation; total of 5,120,000 shares are held by our officers and directors, all of which shall be restricted securities, as that term is defined in Rule 144 of the Rules and Regulations of the Securities and Exchange Commission, promulgated under the Act.

A total of 3,000,000 of our common shares shall be sold in a public offering registered in the State of Wisconsin, and are unrestricted securities and may be publicly sold at any time, without restriction upon the completion of the S-1 with the SEC, which will make this company a 1934 Exchange Act Reporting company.

There are currently no outstanding options, warrants to purchase or securities convertible into, our common or preferred stock.

Item 10. Recent Sales of Unregistered Securities

On July 04, 2012, a total of 5,000,000 shares of Common Stock were issued to Dr. Shone Bagley, Sr. the founder of the company and on December 10, 2012, a total of 120,000 shares of Common Stock were issued to Mr. Poston in exchange for organizational services in the amount of $125,000 U.S., or $1.00 per share.

Both of such shares are restricted securities, as that term is defined by the Securities Act of 1933. This transaction was conducted in reliance upon an exemption from registration provided under Section 4(2) of the Securities Act of 1933, based upon the fact that the sales were made to the officers and directors only in transactions not involving a public offering. The shareholders is our officers and directors who had access to all of the information which would be required to be included in a registration statement. Each of the shareholders were sophisticated investors who had the ability to bear the economic risk of the loss of their investment and there was no general solicitation or advertising associated with the sales.

Item 11. Description of Registrant’s Securities to be Registered

As of the date of this filing, there were 5,125,000 shares of Common Stock issued and outstanding, which are held by three (3) stockholders of record; 2- officers and directors and 1- advisory board member.

1. Common Stock

The company authorized capital stock consists of 3,000,000 shares of Common Stock, par value $.50 per share. The holders of Common Stock

(i) have equal ratable rights to dividends from funds legally available therefore, when, as and if declared by the Board of Directors;

(ii) are entitled to share ratably in all of the assets for distribution to holders of Common Stock upon

liquidation, dissolution or winding up of our business affairs;

(iii) do not have preemptive, subscription or conversion rights, and there are no redemption or sinking

fund provisions or rights applicable thereto; and

(iv) are entitled to one non-cumulative vote per share on all matters on which stockholders may vote.

There are no provisions in the articles of incorporation or bylaws that would delay, defer or prevent a

change in control of our company or a change in type of business.

2. Cash Dividends

As of the date of this registration statement, we had not paid any cash dividends to stockholders. The declaration of any future cash dividend will be at the discretion of the Board of Directors and will depend upon the earnings, if any, capital requirements and our financial position, general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, into the business.

3. Reports

We will furnish audited annual financial reports to all of our stockholders, certified by our independent

accountants, and will furnish unaudited quarterly financial reports, reviewed by the independent accountants.

4. Stock Transfer Agent

Upon acceptance of the S-1 from the SEC our stock transfer agent will be Globex Transfer, LLC, 780 Deltona Blvd., Suite 202, Deltona, FL 32725, Telephone (813) 344-4490 ext 258, an independent stock transfer agency.

Item 12. Indemnification of Directors and Officers

Section 180.0850, 180.851, 180.0852 of the CHAPTER 180 BUSINESS CORPORATIONS provides that each corporation shall have the following powers and within Article 12 of our By-Laws, we:

180.0850 Definitions applicable to indemnification and insurance provisions. In ss. 180.0850 to 180.0859:

(1) "Corporation" means a domestic corporation and any domestic or foreign predecessor of a domestic corporation where the predecessor corporation's existence ceased upon the consummation of a merger or other transaction.

(2) "Director or officer" of a corporation means any of the following:

(a) An individual who is or was a director or officer of the corporation.

(b) An individual who, while a director or officer of the corporation, is or was serving at the corporation's request as a director, officer, partner, trustee, member of any governing or decision-making committee, manager, employee or agent of another corporation or foreign corporation, limited liability company, partnership, joint venture, trust or other enterprise.

(c) An individual who, while a director or officer of the corporation, is or was serving an employee benefit plan because his or her duties to the corporation also impose duties on, or otherwise involve services by, the person to the plan or to participants in or beneficiaries of the plan.

(d) Unless the context requires otherwise, the estate or personal representative of a director or officer.

(3) "Expenses" include fees, costs, charges, disbursements, attorney fees and any other expenses incurred in connection with a proceeding.

(4) "Liability" includes the obligation to pay a judgment, settlement, forfeiture, or fine, including an excise tax assessed with respect to an employee benefit plan, plus costs, fees, and surcharges imposed under ch. 814, and reasonable expenses.

(5) "Party" includes an individual who was or is, or who is threatened to be made, a named defendant or respondent in a proceeding.

(6) "Proceeding" means any threatened, pending or completed civil, criminal, administrative or investigative action, suit, arbitration or other proceeding, whether formal or informal, which involves foreign, federal, state or local law and which is brought by or in the right of the corporation or by any other person.

History: 1989 a. 303; 1993 a. 112; 2003 a. 139.

180.0851 Mandatory indemnification.

(1) A corporation shall indemnify a director or officer, to the extent that he or she has been successful on the merits or otherwise in the defense of a proceeding, for all reasonable expenses incurred in the proceeding if the director or officer was a party because he or she is a director or officer of the corporation.

(2)

(a) In cases not included under sub. (1), a corporation shall indemnify a director or officer against liability incurred by the director or officer in a proceeding to which the director or officer was a party because he or she is a director or officer of the corporation, unless liability was incurred because the director or officer breached or failed to perform a duty that he or she owes to the corporation and the breach or failure to perform constitutes any of the following:

1. A willful failure to deal fairly with the corporation or its shareholders in connection with a

matter in which the director or officer has a material conflict of interest.

2. A violation of the criminal law, unless the director or officer had reasonable cause to

believe that his or her conduct was lawful or no reasonable cause to believe that his or her conduct was unlawful.

3. A transaction from which the director or officer derived an improper personal profit.

4. Willful misconduct.

(b) Determination of whether indemnification is required under this subsection shall be made under s. 180.0855.

(c) The termination of a proceeding by judgment, order, settlement or conviction, or upon a plea of no

contest or an equivalent plea, does not, by itself, create a presumption that indemnification of the director or officer is not required under this subsection.

(3) A director or officer who seeks indemnification under this section shall make a written request to the corporation.

(4)

(a) Indemnification under this section is not required to the extent limited by the articles of incorporation under s. 180.0852.

(b) Indemnification under this section is not required if the director or officer has previously

received indemnification or allowance of expenses from any person, including the corporation, in connection with the same proceeding.

History: 1989 a. 303.

Indemnification under this section is not self-executing. Certain formalities are required that prevent

after-the-fact justification for taking corporate funds for personal use. Without these formalities, an officer could direct the corporation to pay funds for his own defense and only later assert that he or shehad been indemnified by the corporation. Ehlinger v. Hauser, 2010 WI 54, 325 Wis. 2d 287, 785 N.W.2d 328, 07-0477.

180.0852 180.0852 Corporation may limit indemnification.

A corporation's articles of incorporation may limit its obligation to indemnify under s. 180.0851.

Any provision of the articles of incorporation relating to a corporation's power or obligation to indemnify that was in existence on June 13, 1987, does not constitute a limitation on the corporation's obligation to indemnify under s. 180.0851. A limitation under this section applies if the first alleged act or omission of a director or officer for which indemnification is sought occurred while the limitation was in effect.

History: 1989 a. 303.

Item 13. Financial Statements and Supplementary Data

EX 99:

1) Balance Sheet

2) P/L Statement

3) Income Statement

4) Compensation Schedule

5) Enrollment Schedule

These documents does not reflect in 2014-2015 school year, we anticipate we will be approved to receive State assistance through the “Wisconsin Charter Program,” the sum of $9,000.00 per student, at the High School Level. We also anticipate enrollment of our High School student count to reach over 150 students the same years.

Item 14. Changes in and Disagreements with Accountants on

Accounting and Financial Disclosure.

1. Not Applicable

2. Controls and Procedures

The Company, under the supervision and with the participation of the Chief Executive Officer and the Chief Financial Officer, evaluated the effectiveness of the design and operation of the Company’s ‘‘disclosure controls and procedures’’ (as defined in Rule 13a-15(e) under the Securities Exchange Act of 1934, as amended (the ‘‘Exchange Act’’)) as of the end of the period covered by this report and based on that evaluation, the Chief Executive Officer and the Chief Financial Officer concluded that the Company’s disclosure controls and procedures were effective as of December 31, 2012.

Item 15. Exhibits.

EX 3a - Articles of Incorporation

EX 3b - By-laws

EX 4 - Instruments defining the rights of security holders

EX 9 - Voting Trust Agreement

EX 10 - Material Contracts

EX 11 - Statement re computation of per share earnings

EX 12 - Statements re computation of ratios

EX 24 - Power of Attorney

Item 15a. Exhibits Not Applicable

EX 2 - Plan of acquisition, reorganization, arrangement, liquidation or succession

EX 16 - Letter re change in certifying accountant

EX 21 - Subsidiaries of the registrant

SIGNATURES

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized.

By: ___/s/ SHONE M BAGLEY SR______________ Date:4/23/2013

(Signature)

Shone Bagley, Sr. President / CEO / Director

(Registrant) title

Item 15: EX-4 Instrument Defining the Rights of Security Holders

Description: Instrument Defining the Rights of Security holders.

The following instrument defines the rights of Institute of Kings and Priests, Inc. ("Company") Shareholders.

1. Dividend Rights

All common shares outstanding have equal rights and full entitlement to receive pro rata distribution of any earnings declared payable by the Company as dividends. The rights of common shareholders of the Company to receive payment of any earnings which are declared as dividends by the Company are subordinate to the rights of preferred shareholders of the Company.

2. Voting Rights

Each one (1) share of the Company's common stock is entitled one (1) vote as to the selection of the Company's directors and other important Company matters.

The Company's Preferred class B shares do not have any cumulative voting rights.

3. Liquidation Rights

In the event that the Company is liquidated, the claims of secured and unsecured creditors and owners of bonds and preferred stock take precedence over the claims of common shareholders.

4. Preemption Rights

The Company's common shares to be registered are not entitled to any preemptive rights regarding the issuance of additional common shares.

5. Alienability of Securities

There are no restrictions on the alienability of the Company's common shares to be registered.

6. Discriminating Against Existing or Prospective Shareholders

The Company's common shares to be registered do not have any provision which discriminates against any existing or prospective shareholder as a result of any shareholder owning a substantial amount of securities.

7. Modification of Shareholders Rights

The rights of the Company's common shareholders may be modified by a 66 2/3 percent vote of all said shareholder's shares outstanding, voting as a class.

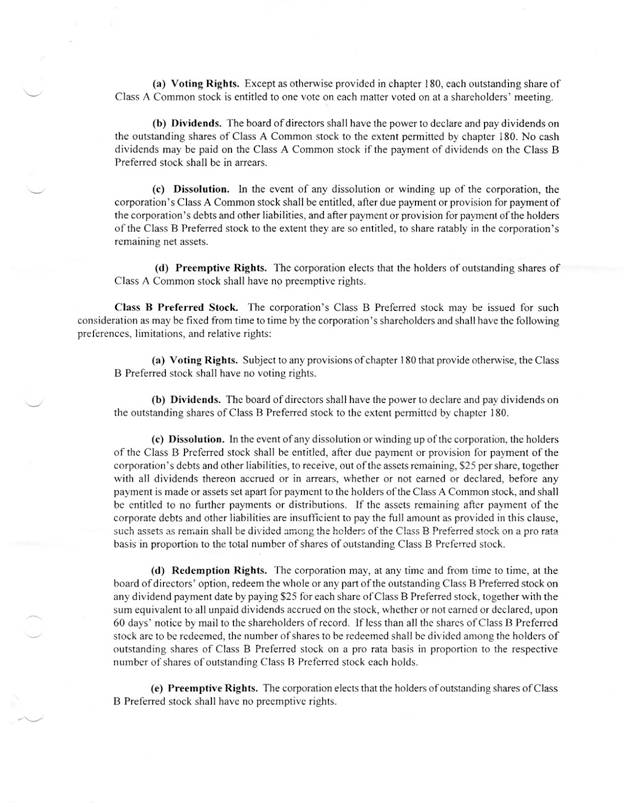

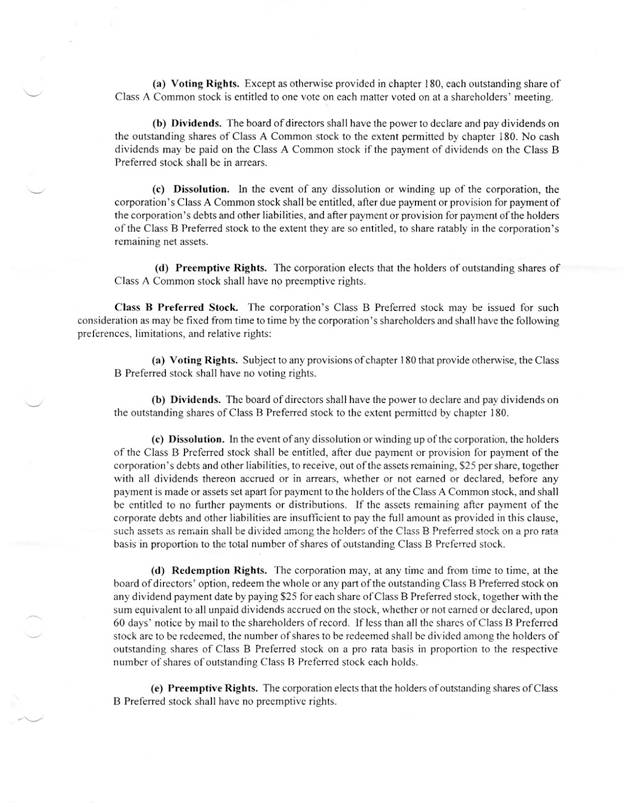

8. Preferred Stock

The Company is registering its preferred stock outstanding. The Company has 1,000,000 shares of class B; $25.00; cumulative preferred stock outstanding as of March 30,2013. Said preferred shares are outstanding

pursuant to an exemption from the requirements of registration under Rule 230.504 of Regulation D under the Securities Act of 1933, as amended.

9. Preference as to dividends

a) (a)The $25.00, cumulative preferred stock shall rank senior to all other classes of the Company's capital stock with respect to dividends and as to rights upon liquidation, winding up or dissolution of the Company. As long as any shares of the $25.00, cumulative preferred stock remain outstanding, the Company will not be entitled to authorize or issue any other class of securities that are senior to or on parity with the $25.00, cumulative preferred stock with respect to dividends or on liquidation, winding up or dissolution, without the approval of holders of at least 66 2/3% of the $25.00, cumulative preferred stock .

b) Holders of shares of the $25.00, cumulative preferred stock will not be entitled to vote with the holders of the Company's common stock. Holders of the $25.00, cumulative preferred stock have no cumulative voting rights or preemptive or other rights to subscribe for shares.

c) If at any time the equivalent of six quarterly dividend payments on the $25.00, cumulative preferred stock are in arrears and unpaid, the holders of the $25.00, cumulative preferred stock shall be entitled to vote with the Company's common stock holders. Additionally, the number of members of the Board of Directors of the Company shall be increased by one and the holders of the $25.00, cumulative preferred stock shall have the exclusive right, voting separately as a class, to elect one director of the Company such director to be in addition to the number of directors constituting the Company's Board of Directors immediately prior to the accrual of the right.

d) Such voting right will continue until all dividends accumulated and payable on that stock have been paid in full, at which time such voting right of the holders of the $25.00, cumulative preferred stock shall terminate, subject to re-vesting in the event of a subsequent, similar arrearage. Upon any termination of such voting right, the term of office of the director elected by the holders of the $25.00, cumulative preferred stock voting separately as a class will terminate.

e) The approval of the holders of at least 66 2/3% of the shares of $25.00, cumulative preferred stock then outstanding, voting as a class, will be required to

a. create, authorize or issue any capital stock of the Company ranking, either as to payment of dividends or upon liquidation, dissolution or winding up of the Company, on a parity or senior to the $25.00, cumulative preferred stock ; or

b. change the attributes of the $25.00, cumulative preferred stock in any material respect prejudicial to the holders of the $25.00, cumulative preferred stock.

The preferred shares outstanding are entitled to the following rights:

a) Dividend Rights

The holders of the $25.00, cumulative preferred stock are entitled to receive out of funds of the Company legally available thereof, dividends at an annual rate of $0.07250 per share, payable quarterly in arrears in four equal installments of $0.018125 per share on the 15th day of March, June, September and December in each year. Dividends on the $25.00, cumulative preferred stock will accrue and cumulate from the date of first issuance and will be paid to holders of record of the $25.00, cumulative preferred stock as they appear on the books of the Company as of the close of business on any record date for payment of dividends. The record dates for payment of dividends shall be the last day of February, May, August and November in each year which immediately precedes each respective dividend payment date. The amount payable for the dividend period for any other period less than a full quarterly dividend period will be computed on the basis of a 365-day year. The initial dividend will accrue from the date of issuance of the units which consist of the $25.00, cumulative preferred stock and will be payable 90 days from the date the units which consist of the $25.00, cumulative preferred stock are issued. Accumulation of dividends will not bear interest.

So long as the $25.00, cumulative preferred stock are outstanding, the Company may not declare or pay any dividend on the common stock or other capital stock unless the full cumulative dividends on the $25.00, cumulative preferred stock have been paid in full or contemporaneously are declared and paid in full through the last dividend payment date.

b) Warrants and Rights

Each of the Company's 3,000,000 shares of class A; $.50 common stock outstanding is paired together with 1/10th warrant and is outstanding as a unit. Each one (1) warrant purchases ten (10) shares of common stock at $.50 per share.

Said warrants shall have a perpetual life until that time in which the Common Stock of the Company is registered for public sale with the Securities and Exchange Commission pursuant to the Securities Act of 1933 ("Act") or the Exchange Act of 1934 ("Exchange Act"). After such time that the Company's registration statement for the public sale of its Common Stock becomes effective, the warrants herein offered shall no longer have a perpetual life. Instead, said warrants shall have a life of 30 days. Said 30 days shall commence and take effect and be counted from the date that the Company's registration statement for the public sale of its common stock becomes effective under the ("Act") or ("Exchange Act") unless such time period is extended or waived by a vote of the Company's Board of Directors.

c) Governing Law

This Supplemental Indenture shall be governed by, and construed in accordance with, the laws of the State of Wisconsin.

d) Severability Clause

In case any provision in this, Instrument Defining the Rights of Security holders, shall be invalid, illegal or unenforceable, the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired thereby and such provision shall be ineffective only to the extent of such invalidity, illegality or unenforceability.

e) Counterparts

The parties hereto may sign one or more copies of this, Instrument Defining the Rights of Security holders, in counterparts, all of which together shall constitute one and the same agreement.

f) Trustee

The Trustee makes no representations as to the validity or sufficiency of this Instrument Defining the Rights of Security holders. The recitals and statements herein are deemed to be those of the Company, the Existing Guarantor and the New Guarantor and not of the Trustee.

------------------------------------------------------------------------

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed as of the date first above written.

Institute of Kings and Priests, Inc.

By: /s/ SHONE M BAGLEY SR

Name: Shone Bagley, Sr.

Title: President, CEO, and Secretary

Address: 12201 West Burleigh Street Suite 14 Wauwatosa, WI 53223

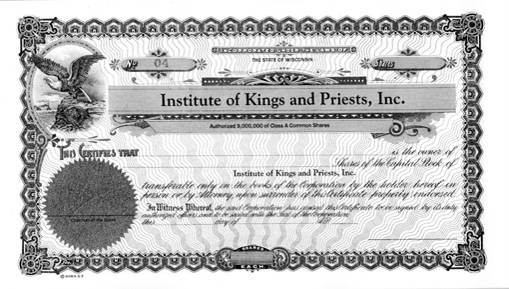

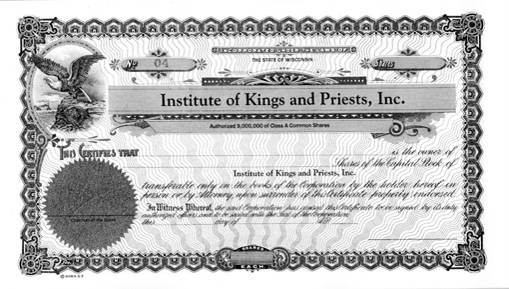

Item 15: EX-9 Voting Trust Agreement plus Specimen of Stock Certificate

THIS AGREEMENT made as of the ____ day of ___________________, 20____.

A M O N G:

________Shone Bagley, Sr._____(5,000,000)____ Investor 1 (___56____ %),

________Todd Poston_________(120,000)______ Investor 2 (___1.33___ %),

__________open___________________________ Investor 3 (____0____ %),

and so on to include all the shareholders of the Class A shares investment round(hereinafter collectively referred to as the “Shareholders”)

- and –

_______________________________________________________ Nominee for Voting Trustee,

(hereinafter referred to as the “Voting Trustee”)

W I T N E S S E T H:

WHEREAS the Shareholders are the registered and beneficial owners of 5,120,000(total number of shares of the Shareholders) Class A Shares and in the capital of Institute of Kings and Priests, Inc. (the “Company”), a company formed under the laws within the State of Wisconsin, have entered into an voting Trust Agreement;

WHEREAS, pursuant to the terms of this Agreement, giving Voting Trustee the

right to acquire _______________________ shares of the common stock, par value $.50 per share on the terms and subject to the conditions thereof;

AND WHEREAS, the certificates for shares, common Stocks issued to Voting Trustee shall be endorsed as follows:

The shares represented by this certificate are subject to restrictions imposed by the federal Securities Act of 1933, as amended and applicable state securities laws. The shares may not be sold or transferred in the absence of registration or an exemption therefrom under such Securities Act of 1933 and such applicable state securities laws.

AND WHEREAS the Shareholders have agreed to appoint the Voting Trustee as the

Shareholders’ voting trustee on the terms and conditions hereinafter contained; NOW THEREFORE in consideration of the foregoing and mutual covenants and agreements contained herein, the parties agree as follows:

1. Appointment of the Voting Trustee: The Shareholders shall appoint the Voting Trustee in respect of the Shares.

a. The Shareholders shall endorse, assign, and deliver to the Trustee the certificates representing the shares of stock owned by them respectively, and shall do all things necessary for the transfer of their respective shares to the Trustee on the books of the Corporation.

b. Non-Withdrawal of Shares: No party to this Agreement may withdraw his shares from this Voting Trust without the prior written consent of all parties hereto.

2. Acknowledgement by Shareholders: Each Security holder does hereby

acknowledge to and with the Voting Trustee that such Security holder now has full right, power and authority to execute, deliver and perform this agreement and for greater certainty and without limitation, that such Security holder has not previously entered into any agreement or arrangement, oral or written, with respect to the voting of the Shares.

3. Acceptance by the Voting Trustee: The Voting Trustee hereby accepts its appointment as voting trustee.

4. Term of Agreement:

a. The term of this Agreement shall be in effect until the execution of an agreement in writing by the Voting Trustee and the Shareholders terminating this Agreement.

b. This trust shall continue for ___2___ years from the date hereof, and shall then terminate, provided, however,

c. that the Shareholder of the shares of stock subject to this agreement may at any time terminate this trust by resolution adopted at a meeting of the trust certificate holders called by any one of them, upon notice of __15_____ days, stating the purpose of such meeting, in writing, mailed to the trust certificate holders at their respective addresses as they appear in the records of the Trustee.

d. Upon the termination of the trust, the Trustee shall, upon the surrender of the trust certificates by the respective holders thereof, assign and transfer to them the number of shares of stock thereby represented.

5. Exercise of Voting Rights:

a. Until the termination of this Agreement in accordance with the provisions hereof, the Voting Trustee shall, in respect of the Shares, exclusively possess and be entitled, in person, by proxy or by attorney, in its sole discretion to exercise all the rights of voting appertaining to the Shares and all rights in connection with the initiation, taking part in and consenting to any action as shareholders of the Company.

b. In furtherance of the foregoing, the Shareholders shall from time to time and at times during the term of this Agreement may elect do whatever may be requested by the Voting Trustee, including the execution and delivery of appropriate instruments of proxy, to enable or facilitate the exercise of any and all such rights by or on behalf of the Voting Trustee.

6. Right to Receive Dividends and Distributions: Save as herein specifically provided, each of the Shareholders shall be entitled to receive any and all dividends and distributions on and in respect of the Shares to which they would otherwise be entitled.

7. Applicability of Agreement: The Shareholders agree that the provisions of this Agreement relating to the deposit of proxies with respect to the voting rights attaching to the Shares shall apply mutatis mutandis to:

· any shares or securities of the Company into which such Shares may be converted, changed, reclassified, re-divided, re-designated, subdivided or consolidated;

· any shares or securities which are received by the Shareholders as a stock dividend or distribution payable in shares or securities of the Company which entitle the holder thereof to vote at any meeting of the shareholders of the Company; and

· any shares or securities of the Company or of any successor or continuing company to the Company which may be received by the Shareholders on a reorganization, amalgamation, consolidation or merger, statutory or otherwise.

8. Protection of the Voting Trustee:

a. By way of supplement to the provisions of law or of any statute for the time being in effect relating to trustees, it is agreed that:

· the Voting Trustee shall not incur any liability or responsibility by reason of any error of law or mistake or any matter or thing done or omitted to be done under or in relation to this Agreement except for its wilful and wrongful neglect or default; and

· the Voting Trustee may, in relation to this Agreement, act on the opinion or advice of or opinion obtained from any lawyer, broker or other expert and shall not be responsible for any loss occasioned by so acting, and shall incur no liability or responsibility for deciding in good faith not to act upon any such opinion or advice.

9. Acts of the Voting Trustee, the Trustees and General Limitation of Liability:

a. For greater certainty, where any reference is made herein to an act to be performed or which may not be performed by the Voting Trustee, such reference shall be construed and applied for all purposes as if it referred to an act to be performed or which may not be performed by the trustees of the Voting Trustee (the “Trustees”) on behalf of the Voting Trustee or by some other person duly authorized to do so by the Trustees or pursuant to the provisions hereof, and where reference is made herein to actions, rights or obligations of the Trustees, such reference shall be construed and applied for all purposes to refer to actions, rights or obligations of the Trustees in their capacity as Trustees, and not in their other capacities, unless the context otherwise requires.

b. The parties hereto acknowledge that the Trustees are entering into this Agreement solely in their capacity as trustees, on behalf of the Voting Trustee. The Trustees shall not be subject to any personal liability for any debts, liabilities, obligations, claims, demands, judgments, costs, charges or expenses against or with respect to the Voting Trustee arising out of anything done or permitted or omitted to be done in respect of the execution of the duties of the office of Trustee for or in respect to the affairs of the Voting Trustee. No property or assets of the Trustees, owned in their personal capacity or otherwise, will be subject to any levy, execution or other enforcement procedure with regard to any of the Voting Trustee’s obligations hereunder or under any other related agreements. No recourse may be had or taken, directly or indirectly, against the Trustees in their personal capacity or against any incorporator shareholder, director, officer, employee or agent of the Trustees or any successor of the Trustees. The Voting Trustee shall be solely liable therefore and resort shall be had solely to the assets of the Voting Trustee for payment or performance thereof.

10 Amendment:

a. This agreement may not be amended except by instrument in writing executed by all the parties hereto.

b. In the event that the holder of any trust certificate shall desire to sell or pledge his beneficial interest in the shares of stock represented thereby, he shall first give to the Trustee notice in writing of such desire, and the Trustee shall have the right to purchase the trust certificates at the book value of the stock represented by such certificates at the time of such purchase.

c. If the Trustee shall exercise such option to purchase, he/she shall hold the beneficial interest thereof for the benefit of all the remaining trust certificate holders who shall, upon ___30_____ days’ notice given by the Trustee before exercising such option, contribute their respective proportionate share of the purchase money to be paid by the Trustee.

d. In the event that the Trustee shall not exercise such option to purchase the subscriber's interest, and only in that event, the holder of such trust certificate shall have the right to sell the same without restriction

11 Governing Law: This Agreement is made pursuant to and shall be governed by and construed in accordance with the laws within the State of Wisconsin.

12 Assignment & Successors:

a. This Agreement shall [not] be assignable by the parties hereto and shall enure to the benefit of and be binding upon the parties hereto and their respective heirs, executors, administrators, legal personal representative, successors [and assigns] and upon any trusteeor receiver in bankruptcy or upon any other trustee or appointee or their successors or assigns upon whom shall devolve by operation of law or otherwise, any interest or claim in and to the property of or the interest herein of any party.

b. In the event of any trustee dying, resigning, refusing, or becoming unable to act, the surviving or other Trustee, if any, shall appoint a trustee or trustees to fill the vacancy or vacancies, and any person so appointed shall thereupon be vested with all the duties, powers, and authority of a trustee as if originally named herein.

13 Counterparts: This agreement may be executed in one or more counterparts by original or telefacsimile signature, each of which when executed shall be deemed to be an original and such counterparts shall together constitute one and the same instrument.

14 Entire Agreement: This agreement sets forth the entire agreement and understanding of the parties to this agreement with respect to the subject matter hereof.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement

the day and year first above written.

Institute of Kings and Priest, INC.

(1 )By:___________________________ (2) By:_____________________________

(print) (print)

Name:_________________________ Name: __________________________

(sign) (sign)

Title:________________________ Title:__________________________

(3) By:___________________________ (4) By:_____________________________

(print) (print)

Name:_________________________ Name: __________________________

(sign) (sign)

Title:________________________ Title:__________________________

By:________________________________ ____________________________________

Voting Trustee (print) (sign)

Address: __________________________________________________________

Email: __________________________ Phone #: ________________________

Specimen of Stock Certificate

SPECIMEN

SPECIMEN

Item 15: EX-10 Material Contracts

Item 13. Financial Statements and Supplementary Data

1) Balance Sheet

This document does not reflect in 2014-2015 school year, we anticipate approval to receive State assistance through the “Wisconsin Charter Program,” the sum of $9,000.00 per student, at the High School Level. We also anticipate enrollment of our High School student count to reach over 150 students the same years.

| | Y-3 Ended | Y-4 Ended | Y-5 Ended | Y-6 Ended | Y-7 Ended |

| | 12/31/2012 | 12/31/2013 | 12/31/2014 | 12/31/2015 | 12/31/2016 |

| | | | | | |

CASH | | | | | |

Beginning balance | $ - | $ 531 | $ 440,391 | $ 211,796 | $ 135,091 |

Stock sales | $ 28,575 | $ 515,600 | $ - | $ - | $ - |

Stock redemptions | $ (500) | $ - | $ - | $ - | $ - |

Dividends | $ - | $ - | $ - | $ - | $ - |

Operations | $ (32,882) | $ (71,902) | $(194,695) | $ (46,105) | $413,876 |

Depletion | $15,900 | $ - | $10,050 | $18,900 | $ 15,600 |

Capital expenses | $ (15,900) | $ - | $ (42,450) | $ (49,500) | $ - |

Banking change of balance | $ 5,338 | $ (3,838) | $ (1,500) | $ - | $ - |

Changes in other | $ (5,338) | $ (21,000) | $ (3,000) | $ - | $ - |

Ending balance | $531 | $440,391 | $211,796 | $135,091 | $ 564,567 |

| | | | | | |

NET FIXED ASSETS | | | | | |

Beginning balance | $5,299 | $ - | $ - | $32,400 | $63,000 |

Increase | $15,900 | $ - | $42,450 | $49,500 | $ - |

Depletion | $15,900 | $ - | $10,050 | $ 18,900 | $15,600 |

Ending balance | $ - | $ - | $ 32,400 | $63,000 | $47,400 |

| | | | | | |

TOTAL ASSETS | $ 531 | $ 440,391 | $244,196 | $ 198,091 | $611,967 |

| | | | | | |

LIABILITIES | | | | | |

Accrued payables beginning balance | $4,896 | $5,338 | $1,500 | $ - | $ - |

Increase | $ 5,338 | $6,000 | $ 3,000 | $ - | $ - |

Payments | $ - | $ 9,838 | $ 4,500 | $ - | $ - |

Ending balance | $ 5,338 | $1,500 | $ - | $ - | $ - |

| | | | | | |

LINE OF CREDIT | | | | | |

Line of credit beginning balance | $ - | $ - | $ 0 | $ 0 | $ 0 |

Additional funds | $ - | $15,000 | $ - | $ - | $ - |

Interest accrued | $ - | $ 680 | $ 0 | $ 0 | $ 0 |

Interest rate | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% |

| | | | | | |

Payment of funds | $ - | $15,000 | $ - | $ - | $ - |

Payment of accrued interest | $ - | $ 680 | $ 0 | $ 0 | $ 0 |

Ending line of credit | $ - | $ 0 | $ 0 | $ 0 | $ 0 |

| | | | | | |

| | | | | | |

PAID-IN CAPITAL | | | | | |

Beginning balance | $ - | $28,075 | $543,675 | $543,675 | $543,675 |

Change in paid-in capital | $28,075 | $515,600 | $ - | $ - | $ - |

Ending balance | $28,075 | $543,675 | $543,675 | $543,675 | $543,675 |

RETAINED EARNINGS | | | | | |

Beginning balance | $ - | $ (32,882) | $(104,784) | $(299,479) | $(345,584) |

Earnings/ (loss) | $ (32,882) | $ (71,902) | $ (194,695) | $ (46,105) | $413,876 |

Total | $ (32,882) | $(104,784) | $(299,479) | $(345,584) | $ 68,292 |

ACCUMULATED DIVIDENDS PAID | | | | | |

Beginning balance | $ - | $ - | $ - | $ - | $ - |

Dividends (prior month end) | $ - | $ - | $ - | $ - | $ - |

Total | $ - | $ - | $ - | $ - | $ - |

Total equity | $ (4,807) | $438,891 | $244,196 | $198,091 | $611,967 |

| | | | | | |

LIABILITIES AND EQUITY | $ 531 | $440,391 | $244,196 | $198,091 | $611,967 |

| | | | | | |

BOOK VALUE PER SHARE | | | | | |

Stock class A | $ (1.07) | $ 0.80 | $ 0.42 | $ 0.33 | $ 1.13 |

Item 13. Financial Statements and Supplementary Data

Item 13. Financial Statements and Supplementary Data

2) P/L Statement

This document does not reflect in 2014-2015 school year, we anticipate approval to receive State assistance through the “Wisconsin Charter Program,” the sum of $9,000.00 per student, at the High School Level. We also anticipate enrollment of our High School student count to reach over 150 students the same years.

| | Y-3 Ended | Y-4 Ended | Y-5 Ended | Y-6 Ended | Y-7 Ended | Y-8 Ended |

| | 12/31/2012 | 12/31/2013 | 12/31/2014 | 12/31/2015 | 12/31/2016 | 12/31/2017 |

| | | | | | | |

Total receipts | $ - | $9,715 | $186,175 | $743,500 | 1,538,250 | $2,203,250 |

| | | | | | | |

Number of students | 5 | 4 | 28 | 102 | 198 | 271 |

| | | | | | | |

Number of paid employees | | | | | | |

Executives | - | 1 | 1 | 2 | 2 | 2 |

DEANs | - | - | 3 | 8 | 13 | 16 |

Support and other | - | 0 | 1 | 1 | 1 | 1 |

Total | - | 1 | 5 | 10 | 16 | 19 |

| | | | | | | |

Expenses | | | | | | |

Total employee salaries and benefits | $ - | $50,087 | $207,530 | $490,325 | $779,362 | $948,815 |

Building square footage | 250 | 500 | 7,750 | 15,000 | 15,000 | $ 15,000 |

Square footage per student | 200 | 130 | 278 | 148 | 76 | 55 |

Cost per square foot/mo | $ - | $12.00 | $12.00 | $12.00 | $12.00 | $12.00 |

Total building rental | $2,085 | $6,000 | $93,000 | $180,000 | $180,000 | $180,000 |

Advertising and promotional | $3,650 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 |

Bank fees and other | $67 | $120 | $120 | $120 | $120 | $120 |

Facilities | | | | | | |

Depreciation | $ - | $ - | $3,600 | $11,400 | $15,600 | $15,600 |

Section 179 depletion | $15,900 | $ - | $ 6,450 | $ 7,500 | $ - | $6,800 |

General liability insurance | $ 250 | $350 | $3,350 | $8,650 | $13,400 | $16,000 |

Directors insurance | $ - | $1,200 | $2,400 | $2,400 | $2,400 | $2,400 |

Repairs | $ - | $ - | $ - | $ - | $ - | $ - |

Telephone and internet | $162 | $480 | $1,320 | $2,160 | $2,160 | $2,160 |

Utilities | $ - | $ - | $31,500 | $67,500 | $76,500 | $85,500 |

Meals and food supplies | $729 | $2,300 | $ 3,000 | $3,000 | $3,000 | $3,000 |

Memberships and events | $ 969 | $ - | $750 | $750 | $750 | $750 |

Office supplies | $3,696 | $4,600 | $6,000 | $6,000 | $6,000 | $ 6,000 |

Private vehicle mileage, etc. | $1,710 | $6,000 | $3,500 | $ - | $ - | $ - |

Professional accounting services | $500 | $300 | $900 | $1,800 | $1,800 | $1,800 |

Professional legal services | $1,880 | $4,000 | $11,200 | $1,500 | $1,500 | $1,500 |

Professional background checking | $ - | $ 500 | $1,250 | $1,500 | $1,250 | $500 |

Other | $1,284 | $ - | $ - | $ - | $ - | $ - |

Stock registration fees per share | | | | | | |

Stock registration expense | $ - | $ - | $ - | $ - | $ - | $ - |

Total expenses | $32,882 | $80,937 | $380,870 | $789,605 | $1,088,842 | $1,275,945 |

| | | | | | | |

EBIT | $ (32,882) | $ (71,222) | $(194,695) | $ (46,105) | $449,408 | $927,305 |

| | | | | | | |

Interest | $ - | $ 680 | $ 0 | $ 0 | $ 0 | $ 0 |

Taxes | $ - | $ - | $ - | $ - | $35,531 | $315,284 |

Net earnings | $ (32,882) | $ (71,902) | $(194,695) | $ (46,105) | $413,876 | $612,021 |

Item 13. Financial Statements and Supplementary Data

3) Income Statement

This document does not reflect in 2014-2015 school year, we anticipate approval to receive State assistance through the “Wisconsin Charter Program,” the sum of $9,000.00 per student, at the High School Level. We also anticipate enrollment of our High School student count to reach over 150 students the same years.

| | | |

In whole dollars | | | For the twelve months ended December 31, 2012 |

Net Sales | | | | 50 |

Bad debt expense | | | | 50 |

Gross margin | | | | 0 |

Operating expenses: | | | | |

Advertising | | | | 3,650 |

Facilities | | | | 2,498 |

Depreciation | | | | 530 |

Meals and food supplies | | | | 728 |

Membership dues | | | | 969 |

Office supplies | | | | 6,342 |

Travel | | | | 1,710 |

Professional services | | | | 2,948 |

Total operating expenses | | | | 19,375 |

Operating (loss) | | | | ( 19,375) |

Other income/ (expense): | | | | |

Amortization | | | | ( 7,954) |

Miscellaneous | | | | ( 784) |

Total other income/ (expense) | | | | ( 8,738) |

EBIT | | | | ( 28,113) |

| | | | |

Item 13. Financial Statements and Supplementary Data

4) Compensation Schedule

This document does not reflect in 2014-2015 school year, we anticipate approval to receive State assistance through the “Wisconsin Charter Program,” the sum of $9,000.00 per student, at the High School Level. We also anticipate enrollment of our High School student count to reach over 150 students the same years.

| | Y-3 Ended | Y-4 Ended | Y-5 Ended | Y-6 Ended | Y-7 Ended | Y-8 Ended |

| | 12/31/2012 | 12/31/2013 | 12/31/2014 | 12/31/2015 | 12/31/2016 | 12/31/2017 |

| | | | | | | |

CEO | | | | | | |

Number | - | - | - | 0.50 | 1.00 | 1.00 |

Annual salary | $120,000 | $120,000 | $120,000 | $120,000 | $120,000 | $120,000 |

Salary | $ - | $ - | $ - | $ 60,000 | $120,000 | $120,000 |

401k cost | 4.8% | 4.8% | 4.8% | 4.8% | 4.8% | 4.8% |

Total 401k cost | $ - | $ - | $ - | $2,880 | $5,760 | $5,760 |

| | | | | | | |

CFO | | | | | | |

Number | - | 0.50 | 1.00 | 1.00 | 1.00 | 1.00 |

Annual salary | $ 75,000 | $ 75,000 | $ 75,000 | $ 75,000 | $75,000 | $ 75,000 |

Salary | $ - | $37,500 | $75,000 | $75,000 | $75,000 | $75,000 |

401k cost | 4.8% | 4.8% | 4.8% | 4.8% | 4.8% | 4.8% |

Total 401k cost | - | $1,800 | $3,600 | $3,600 | $3,600 | $3,600 |

| | | | | | | |

DEANs | | | | | | |

High school teachers number | - | - | 2.00 | 5.50 | 7.00 | 7.00 |

Ratio students/teacher | - | - | 5.31 | 12.80 | 14.29 | 14.29 |

Associate program teachers number | - | - | 0.50 | 2.00 | 5.50 | 9.00 |

Ratio students/teacher | - | - | 4.17 | 13.61 | 18.44 | 18.96 |

Annual high school teacher | $30,000 | $30,000 | $31,200 | $32,448 | $33,746 | $35,096 |

Annual associate teacher | $29,700 | $29,700 | $30,888 | $32,124 | $33,408 | $34,745 |

Teacher salaries | $ | $ - | $80,958 | $249,181 | $430,038 | $570,236 |

401k cost | 4.0% | 4.0% | 4.0% | 4.0% | 4.0% | 4.0% |

Total 401k cost | $ - | $ - | $3,238 | $9,967 | $17,202 | $22,809 |

| | | | | | | |

Secretary | | | | | | |

Number | - | 0.42 | 1.00 | 1.00 | 1.00 | 1.00 |

Hours per day | - | 1.67 | 5.67 | 8.00 | 8.00 | 8.00 |

Cost per hour | $ - | $ - | $10.75 | $11.50 | $12.00 | $12.50 |

Secretary wages | $ - | $4,333 | $15,838 | $23,920 | $24,960 | $26,000 |

401k cost | 4.0% | 4.0% | 4.0% | 4.0% | 4.0% | 4.0% |

Total 401k cost | $ - | $173 | $634 | $957 | $998 | $1,040 |

| | | | | | | |

Total Staff Compensation | | | | | | |

Total 401k cost | $ - | $1,973 | $7,472 | $17,404 | $27,560 | $33,209 |

FICA @ 7.65% | $ - | $3,200 | $13,142 | $31,220 | $49,725 | $60,530 |

FUTA per year | $120 | $120 | $120 | $120 | $120 | $120 |

SUTA per year | $240 | $240 | $240 | $240 | $240 | $240 |

Total unemployment taxes | $ - | $330 | $1,620 | $3,600 | $5,580 | $6,840 |

Insurance cost per month | $250 | $250 | $250 | $250 | $250 | $250 |

Total insurance cost | $ - | $2,750 | $13,500 | $30,000 | $46,500 | $57,000 |

| | | | | | | |

| | | | | | | |

Total compensation | $ - | $50,087 | 207,530 | $490,325 | $779,362 | $948,815 |

Item 13. Financial Statements and Supplementary Data

5) Enrollment Schedule

This document does not reflect in 2014-2015 school year, we anticipate approval to receive State assistance through the “Wisconsin Charter Program,” the sum of $9,000.00 per student, at the High School Level. We also anticipate enrollment of our High School student count to reach over 150 students the same years.

| | Y-3 Ended | Y-4 Ended | Y-5 Ended | Y-6 Ended | Y-7 Ended | Y-8 Ended |

| | 12/31/2012 | 12/31/2013 | 12/31/2014 | 12/31/2015 | 12/31/2016 | 12/31/2017 |

| | | | | | | |

Enrollment | | | | | | |

Home schooling | - | - | - | - | - | - |

High school | | | | | | |

Enrollment | 3 | 5 | 50 | 100 | 100 | 100 |

In attendance | 1 | 4 | 24 | 71 | 100 | 100 |

Graduation | - | 3 | 5 | 50 | 100 | 100 |

Associate | | | | | | |

Enrollment | - | - | 10 | 50 | 100 | 100 |

In attendance | - | - | 4 | 31 | 98 | 171 |

Graduation | - | - | - | - | 10 | 50 |

Total | 1 | 4 | 28 | 102 | 198 | 271 |

| | | | | | | |

Application fees | | | | | | |

All students | $ 45.83 | $ 50.00 | $ 50.00 | $ 50.00 | $ 50.00 | $ 50.00 |

Tuition/month | | | | | | |

Home schooling | $ - | $ - | $ - | $ - | $ - | $ - |

High school | $ - | $ 165.00 | $ 415.42 | $ 535.00 | $ 535.00 | $ 535.00 |

Associate | $ - | $ 375.00 | $ 750.00 | $ 750.00 | $ 750.00 | $ 750.00 |

Graduation fees | | | | | | |

High school | $ - | $ 37.50 | $ 75.00 | $ 75.00 | $ 75.00 | $ 75.00 |

Associate | $ - | $ 62.50 | $ 125.00 | $ 125.00 | $ 125.00 | $ 125.00 |

| | | | | | | |

TOTAL RECEIPTS | | | | | | |

Fees | $ - | $ 475 | $ 3,375 | $ 11,250 | $ 18,750 | $ 23,750 |

Home schooling tuition | $ - | $ - | $ - | $ - | $ - | $ - |

High school tuition | $ - | $ 9,240 | $ 145,300 | $ 454,750 | $ 642,000 | $ 642,000 |

Associate tuition | $ - | $ - | $ 37,500 | $ 277,500 | $ 877,500 | $ 1,537,500 |

Total receipts | $ - | $ 9,715 | $ 186,175 | $ 743,500 | $ 1,538,250 | $ 2,203,250 |