- BHR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Braemar Hotels & Resorts (BHR) DEF 14ADefinitive proxy

Filed: 23 May 18, 12:59pm

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Braemar Hotels & Resorts Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

2018 Proxy Statement

Annual Meeting of Stockholders

Tuesday, July 3, 2018

9:00 a.m., Central Time

Dallas/Fort Worth Airport Marriott

8440 Freeport Pkwy

Irving, Texas 75063

May 23, 2018

Dear Stockholders of Braemar Hotels & Resorts Inc.:

On behalf of the Board of Directors of Braemar Hotels & Resorts Inc., I cordially invite you to attend the 2018 annual meeting of stockholders of your company, which will be held at 9:00 a.m., Central time, on Tuesday, July 3, 2018, at the Dallas/Fort Worth Airport Marriott, which is located at 8440 Airport Freeway in Irving, Texas.

In 2017, we committed to focus on investing solely in the luxury chain scale segment. As part of this refined strategy, in 2017 and early 2018, we completed the acquisition of the Park Hyatt Beaver Creek Resort & Spa in Beaver Creek, Colorado, the Hotel Yountville in Yountville, California and the Ritz-Carlton Sarasota in Sarasota, Florida. We also sold the Marriott Plano Legacy Town Center in Plano, Texas and signed a definitive agreement to sell the Renaissance Tampa in Tampa, Florida, in order to dispose non-core assets that no longer fit our strategy. Further, we began repositioning the two other assets we identified as non-core—the Courtyard Philadelphia Downtown and the Courtyard San Francisco Downtown—by reaching an agreement to convert and upbrand both of those hotels to Autograph Collection properties. We now have the highest RevPAR in the lodging REIT sector and the highest quality hotel portfolio available to public market REIT investors.

In 2017, we completed public offerings of both our common stock as well as our convertible preferred stock, raising approximately $105 million in net proceeds used to grow the Company. We also took advantage of favorable credit markets, financing and re-financing certain of our hotels opportunistically to lower our interest expense and extend debt maturities. In January 2017, we increased our quarterly cash dividend by 33%, from $0.12 per diluted share to $0.16 per diluted share. In December 2017, we provided our 2018 dividend guidance, and during 2018 we expect to distribute a quarterly cash dividend of $0.16 per common share, subject to quarterly Board approval. This equates to an annual rate of $0.64 per diluted share, representing a 6.1% yield based on the closing stock price on May 18, 2018.

Also, in early 2018 we introduced our new name (Braemar Hotels & Resorts Inc.) and branding to further establish our identity in the capital markets.

Our business is managed with the oversight and direction of our Board of Directors, which regularly considers the optimal strategy for the strategic advancement and growth of our Company and the long-term interests of our stockholders. When making decisions, our Board of Directors considers the views of our stockholders. To understand our stockholders' views about our Company, our management team conducts outreach and engagement with our stockholders throughout the year and regularly provides our Board with management's summaries of stockholder feedback. In our latest effort to promote transparency and accountability, we have redesigned our proxy statement for 2018 to make the information in it more accessible to, and understandable by, investors.

We encourage you to review the proxy statement and to return your proxy card as soon as possible so that your shares will be represented at the meeting.

Thank you.

Sincerely,

![]()

Monty J. Bennett

Founder and Chairman of the Board

Notice of 2018 Annual Meeting of Stockholders

| Meeting Date: | Tuesday, July 3, 2018 | |

Meeting Time: | 9:00 a.m., Central time | |

Location: | Dallas/Fort Worth Airport Marriott 8440 Freeport Pkwy Irving, Texas 75063 |

You may vote at the 2018 annual meeting of stockholders the shares of common stock of which you were a holder of record at the close of business on May 15, 2018.

Review your proxy statement and vote in one of the four ways:

| By order of the Board of Directors, | ||

Deric S. Eubanks, Chief Financial Officer |

14185 Dallas Parkway, Suite 1100

Dallas, Texas 75254

May 23, 2018

SUMMARY | 1 | |||

Annual Meeting of Stockholders | 1 | |||

Voting Matters | 2 | |||

Board Nominees | 2 | |||

Summary of Director Diversity and Experience | 3 | |||

Corporate Governance Highlights | 3 | |||

PROPOSAL NUMBER ONE—ELECTION OF DIRECTORS | 6 | |||

Nominees for Election as Directors | 7 | |||

Summary of Director Qualifications, Skills, Attributes and Experience | 13 | |||

CORPORATE GOVERNANCE | 14 | |||

Code of Business Conduct and Ethics | 14 | |||

Board Leadership Structure | 14 | |||

Board Role | 15 | |||

Strategy | 15 | |||

Risk Oversight | 16 | |||

Succession Planning | 16 | |||

Board Refreshment | 16 | |||

Director Nomination Procedures by the Company | 16 | |||

Stockholder and Interested Party Communication with Our Board of Directors | 18 | |||

Director Orientation and Continuing Education | 18 | |||

Director Retirement Policy | 19 | |||

BOARD OF DIRECTORS AND COMMITTEES | 20 | |||

Board Member Independence | 20 | |||

Board Committees and Meetings | 21 | |||

Director Compensation | 24 | |||

Compensation Committee Interlocks and Insider Participation | 25 | |||

Attendance at Annual Meeting of Stockholders | 26 | |||

EXECUTIVE OFFICERS AND COMPENSATION | 27 | |||

Executive Officers | 27 | |||

Executive Compensation | 29 | |||

Summary Compensation Table | 33 | |||

Outstanding Equity Awards at Fiscal Year End Table | 35 | |||

Potential Payments Upon Termination of Employment or Change of Control | 37 | |||

PROPOSAL NUMBER TWO—RATIFICATION OF THE APPOINTMENT OF BDO USA, LLP AS OUR INDEPENDENT AUDITORS | 39 | |||

Audit Committee Report | 39 | |||

Auditor Fees | 40 | |||

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS | 42 | |||

Security Ownership of Management, Directors and Director Nominees | 42 | |||

Security Ownership of Certain Beneficial Owners | 43 | |||

Section 16(a) Beneficial Ownership Reporting Compliance | 44 | |||

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS | 45 | |||

Conflict of Interest Policies | 45 | |||

Our Relationship and Agreements with Ashford Inc. | 46 | |||

Advisor Interest in Certain Entities | 47 | |||

Our Relationship and Agreements with Remington | 48 | |||

Our Relationship and Agreements with Ashford Trust | 48 | |||

OTHER PROPOSALS | 50 |

i

GENERAL INFORMATION | 51 | |||

Solicitation of Proxies | 51 | |||

Electronic Availability of Proxy Materials | 51 | |||

Voting Securities | 51 | |||

Voting | 51 | |||

Counting of Votes | 52 | |||

Right to Revoke Proxy | 52 | |||

Multiple Stockholders Sharing the Same Address | 53 | |||

Annual Report | 53 | |||

Other Matters | 53 | |||

About this Proxy Statement | 53 | |||

ADDITIONAL INFORMATION | 54 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2018 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 3, 2018.

The Company's Proxy Statement for the 2018 Annual Meeting of Stockholders, the Annual Report to Stockholders for the fiscal year ended December 31, 2017, including the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2017, as amended, are available at www.bhrreit.com by clicking "INVESTOR," then "Financial Reports & SEC Filings," and then "Annual Meeting Material."

ii

This summary highlights selected information contained in this proxy statement, but it does not contain all the information you should consider in determining how to vote your shares of our common stock at the 2018 annual meeting of stockholders of the Company. We urge you to read the entire proxy statement before you vote. This proxy statement was first mailed to stockholders on or about May 23, 2018.

We are providing these proxy materials in connection with the solicitation by the Board of Directors of Braemar Hotels & Resorts Inc. of proxies to be voted at our 2018 annual meeting of stockholders.

In this proxy statement:

Ashford Inc. and Ashford LLC together serve as our external advisor. In this proxy statement, we refer to Ashford Inc. and Ashford LLC collectively as our "advisor."

Annual Meeting of Stockholders

Time and Date | Record Date | |

|---|---|---|

| 9:00 a.m., Central time, July 3, 2018 | May 15, 2018 |

Place | Number of Common Shares Eligible to Vote at the Annual Meeting as of the Record Date | |||

|---|---|---|---|---|

| Dallas/Fort Worth Airport Marriott | 32,505,238 | |||

| 8440 Freeport Pkwy Irving, Texas 75063 | ||||

1

Matter | Board Recommendation | Page Reference (for more detail) | ||||

|---|---|---|---|---|---|---|

| Election of Directors | ü For each director nominee | 6 | ||||

Ratification of Appointment of BDO USA, LLP | ü For | 39 | ||||

The following table provides summary information about each director nominee. All directors of the Company are elected annually by a majority of the votes cast at the Company's annual meeting of stockholders.

| | | | Committee Memberships* | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Director Since | | Other U.S. Public Company Boards | |||||||||||

Name; Age | Principal Occupation | A | C | NCG | RPT | |||||||||

| Monty J. Bennett, 53 | 2013 | Chairman and CEO of Ashford Inc.; Chairman of Ashford Trust; CEO of Remington | Ashford Inc., Ashford Trust | |||||||||||

Stefani D. Carter, 40 | 2013 | Senior Counsel at the law firm of Estes Thorne & Carr PLLC | ||||||||||||

Kenneth H. Fearn, 52 | 2016 | Founder and Managing Partner of Integrated Capital LLC | F | |||||||||||

Curtis B. McWilliams, 62 (L) | 2013 | Retired President and CEO of CNL Real Estate Advisors, Inc. | F | Ardmore Shipping Corporation | ||||||||||

Matthew D. Rinaldi, 42 | 2013 | General Counsel of Qantas Healthcare Management, LLC and its affiliated medical facilities; elected representative of Texas House District 115 | ||||||||||||

Abteen Vaziri, 39 | 2017 | Director at Greystone & Co. | ||||||||||||

| * | A: | Audit Committee | ||

| NCG: | Nominating and Corporate Governance Committee | |||

| C: | Compensation Committee | |||

| RPT: | Related Party Transactions Committee | |||

| L: | Lead Director | |||

| F: | Audit Committee financial expert |

2

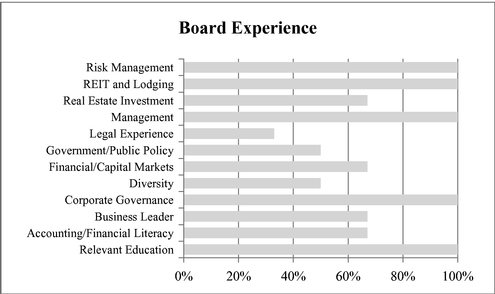

Summary of Director Diversity and Experience

Our Board embodies a broad and diverse set of experiences, qualifications, attributes and skills. Below is a brief summary of some of the attributes, skills and experience of our director nominees. For a more complete description of each director nominee's qualifications, please see their biographies starting on page 7.

Corporate Governance Highlights

We are committed to the values of effective corporate governance and high ethical standards. Our Board believes that these values are conducive to the strong performance of the Company and creating long-term stockholder value. Our governance framework gives our independent directors the structure necessary to provide oversight, direction, advice and counsel to the management of the Company. This framework is described in more detail in our Corporate Governance Guidelines and codes of conduct, which can be found in the governance documents section of our website at www.bhrreit.com. As reflected below, in recent years, we have made a number of improvements to our corporate governance framework.

Recent Developments in 2016 and 2017 | • Adopted a majority voting standard for uncontested director elections and a plurality voting standard for contested director elections | |

• Separated the roles of Chairman and CEO | ||

• Prohibited share recycling with respect to share forfeitures, stock options and stock appreciation rights under our stock plan by executives and directors | ||

• Implemented a mandatory equity award retention period for executives and directors | ||

• Adopted a proxy access resolution which would enable a stockholder, or a group of not more than 20 stockholders, who have continuously owned 3% or more of the Company's common stock for a minimum of three years to include nominees in our proxy materials for the greater of two directors or 20% of our Board |

3

• Redesigned our proxy statement to be more readable and useful for stockholders | ||

Board Independence | • All directors except our Chairman are independent | |

Board Committees | • Four Board committees: | |

• Audit Committee | ||

• Compensation Committee | ||

• Nominating and Corporate Governance Committee | ||

• Related Party Transactions Committee | ||

• All committees composed entirely of independent directors | ||

• Two Audit Committee members are "financial experts" | ||

Leadership Structure | • Chairman of the Board separate from CEO | |

• Independent and empowered Lead Director with broadly defined authority and responsibilities | ||

Risk Oversight | • Regular Board review of enterprise risk management and related policies, processes and controls | |

• Board committees exercise oversight of risk for matters within their purview | ||

Open Communication | • We encourage open communication and strong working relationships among the Lead Director, Chairman, CEO and other directors and officers | |

• Our directors have direct access to management and employees | ||

Stock Ownership | • Mandatory stock ownership and equity award retention guidelines for directors and executives | |

• our directors are required to own our common stock in excess of 3x the annual Board retainer fee | ||

• our CEO is required to own our common stock in excess of 6x his annual base salary | ||

• our President (if not the CEO) is required to own our common stock in excess of 4x his annual base salary | ||

• our other executive officers are required to own our common stock in excess of 3x his annual base salary | ||

• our directors and executive officers are required to retain at least 50% of the after-tax stock awards until the required ownership levels described above have been met | ||

• Comprehensive insider trading policy | ||

• Prohibitions on hedging and pledging transactions | ||

Accountability to Stockholders | • Directors elected by majority vote in uncontested director elections • We have a non-classified Board and elect every director annually |

4

• We have adopted proxy access (stockholders may include nominees in our proxy materials) | ||

• We do not have a stockholder rights plan | ||

• We have opted out of the Maryland Business Combination Act and Maryland Control Share Acquisition Act (which had provided certain takeover defenses) | ||

• We have not elected to be subject to the provisions of the Maryland Unsolicited Takeover Act which would have permitted our Board to classify itself without a stockholder vote | ||

• Stockholders holding a stated percentage of our outstanding voting shares may call special meetings of stockholders | ||

• Board receives quarterly updates from management interaction with stockholders and prospective investors | ||

Board Practices | • Robust annual Board and committee self-evaluation process | |

• Mandatory director retirement at age 70 unless waived by the Board | ||

• Balanced and diverse Board composition | ||

• Limits on outside public company board service | ||

Conflicts of Interest | • Matters relating to our advisor or any other related party are subject to the approval of independent directors |

5

PROPOSAL NUMBER ONE—ELECTION OF DIRECTORS

All of our directors are elected annually by our stockholders. Our Nominating and Corporate Governance Committee has recommended, and our Board has nominated, for re-election all six persons currently serving as directors of the Company. Each of the persons nominated as director who receives a majority vote at the Annual Meeting will serve until the next annual meeting of stockholders and until his or her successor is duly elected and qualified.

Although six individuals have been nominated as candidates for election as directors of the Company at the Annual Meeting, in accordance with the Company's bylaws our Board has set the size of our Board as eight directors. Our settlement agreement, dated February 16, 2017, with Sessa Capital (Master), L.P., Sessa Capital GP, LLC, Sessa Capital IM, L.P., Sessa Capital IM GP, LLC, and John Petry ("Sessa Capital") provided that two designees of Sessa Capital would be appointed or elected to our Board. The designees of Sessa Capital, Mr. Daniel B. Silvers and Mr. Lawrence A. Cunningham, were elected as directors of the Company at our annual meeting of stockholders held on June 9, 2017. The Sessa Capital settlement agreement required the designees of Sessa Capital elected as directors of the Company to enter into a confidentiality agreement with the Company that is similar in all material respects to the confidentiality agreement executed by the Company's other directors. Messrs. Silvers and Cunningham each refused to enter into such a confidentiality agreement with the Company. Following receipt of notice from the Company that he was in violation of our Corporate Governance Guidelines, which specifically require all directors to enter into the confidentiality agreement approved by our Nominating and Corporate Governance Committee and the Board, which notice further stated that Mr. Silvers' and Mr. Cunningham's refusal to enter into the confidentiality agreement constituted a breach of the Sessa Capital settlement agreement, each of Mr. Silvers and Mr. Cunningham resigned as a director of the Company on July 6, 2017. As of the date of this proxy statement, the Company had not received any notice from Sessa Capital regarding the designation of any other individuals for election or for appointment as directors of the Company.

On September 5, 2017, our Board appointed Mr. Abteen Vaziri as a director of the Company, which appointment became effective on October 1, 2017. In addition, on September 5, 2017, our Board accepted Ms. Sarah Zubiate Darrouzet's resignation from the Board, which resignation became effective October 1, 2017.

Under the terms of our bylaws, in uncontested elections of directors of our Company, a nominee is elected as a director by the affirmative vote of a majority of the votes cast in the election for that nominee (with abstentions and broker nonvotes not counted as a vote cast either for or against that director's election), at the meeting of stockholders at which such election occurs. Under our Corporate Governance Guidelines, if an incumbent director who is a nominee for reelection does not receive the affirmative vote of the holders of a majority of the shares of common stock so voted for such nominee, such incumbent director must promptly tender his or her resignation as a director, for consideration by the Nominating and Corporate Governance Committee of the Board and ultimate decision by the Board. The Nominating and Corporate Governance Committee will promptly consider any such tendered resignation and will make a recommendation to the Board as to whether such tendered resignation should be accepted or rejected, or whether other action should be taken with respect to such offer to resign. Any incumbent director whose tendered resignation is under consideration may not participate in any deliberation or vote of the Nominating and Corporate Governance Committee or the Board regarding such tendered resignation. The Nominating and Corporate Governance Committee and the Board may consider any factors they deem relevant in deciding whether to accept, reject or take other action with respect to any such tendered resignation. Within ninety (90) days after the date on which certification of the stockholder vote on the election of directors is made, the Board will publicly disclose its decision and rationale regarding whether to accept, reject or take other action with respect to the tendered resignation. If any incumbent director's tendered resignation is not accepted by

6

the Board, such director will continue to serve until the next annual meeting of stockholders and until his or her successor is elected and qualified or his or her earlier death or resignation.

Set forth below are the names, principal occupations, committee memberships, ages, directorships held with other companies, and other biographical data for each of the six nominees for director, as well as the month and year each nominee first began his or her service on the Board. For a discussion of such person's beneficial ownership of our common stock, see the "Security Ownership of Management and Certain Beneficial Owners" section of this proxy statement.

If any nominee becomes unable to stand for election as a director, an event that the Board does not presently expect, the Board reserves the right to nominate substitute nominees prior to the Annual Meeting. In such a case, the Company will file an amended proxy statement that will identify the substitute nominees, disclose whether such nominees have consented to being named in such revised proxy statement and to serve, if elected, and include such other disclosure relating to such nominees as may be required under the Securities Exchange Act of 1934, as amended (the "Exchange Act").

The Board unanimously recommends a vote FOR all nominees.

Nominees for Election as Directors

| Monty J. Bennett Age 53 Chairman since 2013

| Mr. Monty Bennett has served as Chairman of the Board of Directors since April 2013, and also served as Chief Executive Officer of the Company from April 2013 to November 2016. He has served as the Chief Executive Officer and Chairman of the board of directors of Ashford Inc. since November 2014. Mr. Bennett has also served on Ashford Trust's board of directors since May 2003 and served as its Chief Executive Officer from that time until February 2017. Effective in January 2013, Mr. Bennett was appointed as the Chairman of the board of directors of Ashford Trust. Prior to January 2009, Mr. Bennett served as Ashford Trust's President. Mr. Bennett also serves as the Chairman of Ashford Investment Management, LLC ("AIM"), an investment fund platform and an indirect subsidiary of Ashford Inc., and as Chief Executive Officer of Remington Holdings, LP. Mr. Bennett joined Remington Hotel Corporation in 1992 and has served in several key positions, such as President, Executive Vice President, Director of Information Systems, General Manager and Operations Director. Mr. Bennett holds a Master's degree in Business Administration from the S.C. Johnson Graduate School of Management at Cornell University and a Bachelor of Science degree with distinction from the Cornell School of Hotel Administration. He is a life member of the Cornell Hotel Society. He has over 20 years of experience in the hotel industry and has experience in virtually all aspects of the hospitality industry, including hotel ownership, finance, operations, development, asset management and project management. He is a member of the American Hotel & Lodging Association's Industry Real Estate Finance Advisory Council, and is on the Advisory Editorial Board for GlobalHotelNetwork.com. He is also a member of the CEO Leadership Council for Fix the Debt, a non-partisan group dedicated to reducing the nation's federal debt level and on the advisory Board of Texans for Education Reform. Formerly, Mr. Bennett was a member of Marriott's Owner Advisory Council and Hilton's Embassy Suites Franchise Advisory Council. |

7

| Mr. Bennett is a frequent speaker and panelist for various hotel development and industry conferences, including the NYU Lodging Conference and the Americas Lodging Investment Summit conferences. Mr. Bennett received the Top-Performing CEO Award from HVS for 2011. This award is presented each year to the Chief Executive Officer in the hospitality industry who offers the best value to stockholders based on HVS's pay-for-performance model. The model compares financial results relative to Chief Executive Officer compensation, as well as stock appreciation, company growth and increases in EBITDA. | ||

Experience, Qualifications, Attributes and Skills: Mr. Bennett's extensive industry experience as well as the strong and consistent leadership qualities he has displayed in his role as Chairman, his prior role as the Chief Executive Officer of the Company and his experience with, and knowledge of, the Company and its operations gained in those roles and in his role as Chairman and Chief Executive Officer of Ashford Inc. and his prior role as Chief Executive Office and currently as Chairman of Ashford Trust are vital qualifications and skills that make him uniquely qualified to serve as a director of the Company and as the Chairman of the Board. | ||

| Stefani D. Carter Age 40 Director since 2013 Independent Committees: • Nominating and Corporate Governance (chair) • Compensation • Related Party Transactions

| Ms. Carter has served as a member of the Board since November 2013. She currently serves as chair of our Nominating and Corporate Governance Committee and as a member of our Compensation Committee and our Related Party Transactions Committee. Ms. Carter has been a practicing attorney since 2005, specializing in civil litigation, contractual disputes and providing general counsel and advice to small businesses and individuals. Ms. Carter serves as Senior Counsel at the law firm of Estes Thorne & Carr PLLC, a position she has held since November 2017. From 2011 to November 2017, Ms. Carter served as a principal at the law firm of Stefani Carter & Associates, LLC. In addition, Ms. Carter served as an elected representative of Texas House District 102 in the Texas House of Representatives (the "Texas House") between 2011 and 2015, serving as a member on several Texas House committees, including the Committee on Appropriations, the Energy Resources Committee, and the Select Committee on Criminal Procedure Reform during that period. Ms. Carter also served as a member and Vice-Chair of the Texas House Committee on Criminal Jurisprudence during that period. From 2008 to 2011, Ms. Carter was employed as an associate attorney at the law firm of Sayles Werbner and from 2007 to 2008 was a prosecutor in the Collin County District Attorney's Office. Prior to joining the Collin County District Attorney's Office, Ms. Carter was an associate attorney at Vinson & Elkins from 2005 to 2007. Ms. Carter has a Juris Doctor from Harvard Law School, a Master's in Public Policy from Harvard University's John F. Kennedy School of Government and a Bachelor of Arts in Government and a Bachelor of Journalism in News/Public Affairs from The University of Texas at Austin. |

8

| Experience, Qualifications, Attributes and Skills: Ms. Carter brings her extensive legal experience in advising and counseling clients in civil litigation and contractual disputes, as well as her many experiences as an elected official, to the Board. In addition, Ms. Carter brings her experience with, and knowledge of, the Company and its operations gained as a director of the Company since November 2013 to her role as a director of the Company. | ||

| Kenneth H. Fearn Age 52 Director since 2016 Independent Audit Committee Financial Expert Committees: • Related Party Transactions (chair) • Audit • Compensation

| Mr. Fearn has served as a member of the Board since August 2016. He currently serves as chair of our Related Party Transactions Committee and as a member on our Audit Committee and Compensation Committee. Mr. Fearn is Founder and Managing Partner of Integrated Capital LLC, a private equity real estate firm with a focus on hospitality assets in markets across the United States. Prior to founding Integrated Capital in 2004, Mr. Fearn was Managing Director and Chief Financial Officer of Maritz, Wolff & Co., a private equity firm engaged in real estate acquisition and development from 1995 to 2004. Maritz, Wolff & Co. managed three private equity investment funds totaling approximately $500 million focused on acquiring luxury hotels and resorts. Prior to his tenure at Maritz, Wolff & Co., from 1993 to 1995, Mr. Fearn was with McKinsey & Company, a strategy management consulting firm, resident in the Los Angeles office, where he worked with Fortune 200 companies to address issues of profitability and develop business strategies. Prior to McKinsey & Company, he worked at JP Morgan & Company where he was involved with corporate merger and acquisition assignments. Mr. Fearn received a Bachelor of Arts in Political Science from the University of California, Berkeley and a Master of Business Administration from the Harvard University Graduate School of Business. Mr. Fearn has served on the Marriott International Owner Advisory Board since 2006 and is an Entrepreneur in Residence at the Leland C. and Mary M. Pillsbury Institute for Hospitality Entrepreneurship at Cornell University. He also previously served as Chairman of the Board of Commissioners of the Community Redevelopment Agency of the City of Los Angeles as well as our Board of Directors of the Los Angeles Area Chamber of Commerce, where he was a member of the Executive Committee and the Finance Committee from 2005-2014. Experience, Qualifications, Attributes and Skills: Mr. Fearn brings over 21 years of real estate and hospitality experience to the Board. During his career at Maritz, Wolff & Co. and later at Integrated Capital, he was involved in the acquisition of approximately $2 billion in hospitality assets and secured in excess of $2.5 billion in debt financing for hospitality asset acquisitions. His extensive contacts in the hospitality and commercial real estate lending industries are beneficial in his service on the Board. |

9

| Curtis B. McWilliams Age 62 Director since 2013 Independent Lead Director Audit Committee Financial Expert Committee: • Audit (chair)

| Mr. McWilliams has served as a member of the Board since November 2013 and currently serves as our Lead Director and as chair of our Audit Committee. He also serves as a director of Ardmore Shipping Corporation, an NYSE-listed company. Mr. McWilliams retired from his position as President and Chief Executive Officer of CNL Real Estate Advisors, Inc. in 2010 after serving in such role since 2007. CNL Real Estate Advisors, Inc. provides advisory services relating to commercial real estate acquisitions and asset management and structures strategic relationships with U.S. and international real estate owners and operators for investments in commercial properties across a wide variety of sectors. From 1997 to 2007, Mr. McWilliams also served as the President and Chief Executive Officer, as well as serving as a director from 2005 to 2007, of Trustreet Properties, Inc., which under his leadership became the then-largest publicly-traded restaurant REIT with over $3.0 billion in assets. Mr. McWilliams has approximately 13 years of experience with REITs and, during his career at CNL Real Estate Advisors, Inc., helped launch and then served as the President of two REIT joint ventures between CNL and Macquarie Capital and the external advisor for both such REITs. Mr. McWilliams previously served on the Board of Directors and as the Audit Committee Chairman of CNL Bank, a state bank in the State of Florida, from 1999 to 2004. Mr. McWilliams also has approximately 13 years of investment banking experience at Merrill Lynch & Co., where he started as an associate and later served for several years as a Managing Director. Mr. McWilliams has a Master's in Business with a Concentration in Finance from the University of Chicago Graduate School of Business and a Bachelor of Science in Engineering in Chemical Engineering from Princeton University. Experience, Qualifications, Attributes and Skills: Mr. McWilliams brings his business and management experience gained while serving as President and Chief Executive Officer of two different companies, including one NYSE-listed REIT, as well as his investment banking experience and his experience as a public company director and Audit Committee Chairman, to the Board. In addition, Mr. McWilliams brings his experience with, and knowledge of, the Company and its operations gained as a director of the Company since November 2013 to his role as a director of the Company. |

10

| Matthew D. Rinaldi Age 42 Director since 2013 Independent Committees: • Compensation (chair) • Nominating and Corporate Governance • Related Party Transactions

| Mr. Rinaldi has served as a member of the Board since November 2013 and currently serves as chair of our Compensation Committee and as a member of our Nominating and Corporate Governance Committee and our Related Party Transactions Committee. Mr. Rinaldi is a licensed attorney whose practice has focused on representing businesses in a broad range of complex commercial litigation and appellate matters, including securities class action lawsuits, director and officer liability, real estate, antitrust, insurance and intellectual property litigation. Mr. Rinaldi is the General Counsel of Qantas Healthcare Management, LLC and its affiliated medical facilities, a position he has held since June 2017. Mr. Rinaldi served as Senior Counsel with the law firm of Dykema from July 2014 through June 2017. Mr. Rinaldi also serves as an elected representative of Texas House District 115 in the Texas House since 2014. Previously, Mr. Rinaldi practiced law as a solo practitioner from November 2013 to July 2014 and served as counsel with the law firm of Miller, Egan, Molter & Nelson, LLP from 2009 to November 2013. Prior to joining Miller, Egan, Molter & Nelson, LLP, Mr. Rinaldi was an associate attorney at the law firm of K&L Gates LLP from 2006 to 2009 and an associate attorney at the law firm of Gibson, Dunn and Crutcher, LLP from 2001 to 2006, where he defended corporate officers and accounting firms in securities class action lawsuits and assisted with SEC compliance issues. Mr. Rinaldi has extensive experience in federal, state and appellate courts and has represented and counseled a broad spectrum of clients, including Fortune 500 companies, "Big Four" accounting firms and insurance companies, as well as small businesses and individuals. Mr. Rinaldi has a Juris Doctor,cum laude, from Boston University and a Bachelor of Business Administration in Economics,cum laude, from James Madison University. Experience, Qualifications, Attributes and Skills: Mr. Rinaldi brings his extensive legal experience advising and counseling corporate officers of public companies and independent auditors in matters involving SEC compliance, director and officer liability and suits brought by stockholders and bondholders, as well as his experience in real estate, employment, insurance and intellectual property-related legal matters, to the Board. In addition, Mr. Rinaldi brings his experience with, and knowledge of, the Company and its operations gained as a director of the Company since November 2013 to his role as a director of the Company. |

11

| Abteen Vaziri Age 39 Director since 2017 Independent Committees: • Audit • Nominating and Corporate Governance

| Mr. Vaziri has served as a member of the Board since October 2017. He currently serves as a member of our Audit Committee and our Nominating and Corporate Governance Committee. Mr. Vaziri has worked in all aspects of evaluating hotel assets, from evaluating investments in the hospitality, gaming, and lodging industries to analyzing the development of hotels, the evaluation of hotel F&B operations and analyzing and executing traditional and EB-5 hotel financings. Mr. Vaziri currently serves as a director at Greystone & Co, an institutional real estate lender, where Mr. Vaziri has helped build Greystone's EB-5 real estate financing platform. Mr. Vaziri earned a Bachelor of Science in Computer Science at the University of Texas at Dallas and a Masters of Business Administration in Finance from the Cox School of Business at Southern Methodist University. Mr. Vaziri is also a Juris Doctor candidate at Fordham University with a concentration in Finance and Business Law, expecting to graduate in May 2018. Experience, Qualifications, Attributes and Skills: Mr. Vaziri brings his familiarity with the hotel industry, his real estate experience, and his experience as a director of an institutional real estate lender to the Board. He also has significant experience in strategic planning, accounting, finance and risk management. |

12

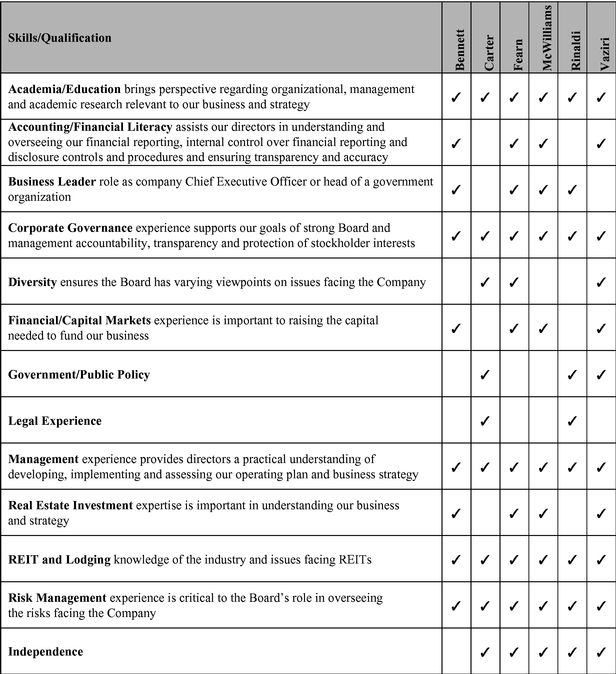

Summary of Director Qualifications, Skills, Attributes and Experience

Our Nominating and Corporate Governance Committee and the full Board believe a complementary mix of diverse qualifications, skills, attributes, and experiences will best serve the Company and its stockholders. The summary of our directors' qualifications, skills, attributes and experiences that appears below, and the related narrative for each director nominee appearing in the directors' biographies above, notes some of the specific experience, qualifications, attributes, and skills for each director that the Board considers important in determining that each nominee should serve on the Board in light of the Company's business, structure, and strategic direction. The absence of a checkmark for a particular skill does not mean the director in question is unable to contribute to the decision-making process in that area.

13

The Board is committed to corporate governance practices that promote the long-term interests of our stockholders. The Board regularly reviews developments in corporate governance and updates the Company's corporate governance framework, including its corporate governance policies and guidelines, as it deems necessary and appropriate. Our policies and practices reflect corporate governance initiatives that comply with the listing requirements of the NYSE and the corporate governance requirements of the Sarbanes-Oxley Act of 2002. We maintain a corporate governance section on our website, which includes key information about our corporate governance initiatives including our Corporate Governance Guidelines, charters for the committees of the Board, our Code of Business Conduct and Ethics and our Code of Ethics for the Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer. The corporate governance section can be found on our website atwww.bhrreit.com by clicking "INVESTOR" and then "CORPORATE GOVERNANCE."

Code of Business Conduct and Ethics

Our Code of Business Conduct and Ethics applies to our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer, as well as our other officers and our directors and to Ashford Inc.'s and Ashford LLC's personnel when such individuals are acting for us or on our behalf. Among other matters, our Code of Business Conduct and Ethics is designed to deter wrongdoing and to promote:

Any waiver of the Code of Business Conduct and Ethics for our officers or directors may be made only by the Board or one of the Board committees and will be promptly disclosed if and to the extent required by law or stock exchange regulations.

The Board regularly considers the optimal leadership structure for the Company and its stockholders. In making decisions related to our leadership structure, the Board considers many factors, including the specific needs of the Company in light of its current strategic initiatives and the best interests of stockholders.

Mr. Monty J. Bennett served as Chairman of the Board as well as our Chief Executive Officer from November 2013 until November 14, 2016, when the Board decided to separate those roles and appointed Mr. Richard J. Stockton to serve as our Chief Executive Officer. Mr. Bennett has continued to serve as Chairman of the Board since that time.

To further minimize the potential for future conflicts of interest, our bylaws and our Corporate Governance Guidelines. as well as the NYSE rules applicable to its listed companies, require that the Board must maintain a majority of independent directors at all times, and our Corporate Governance Guidelines require that if the Chairman of the Board is not an independent director, at least two-thirds of the directors must be independent. Currently, all of our directors other than Mr. Bennett are independent directors. The Board must also comply with each of our conflict of interest policies

14

discussed in "Certain Relationships and Related Party Transactions—Conflict of Interest Policy." Our bylaw provisions, governance policies and conflicts of interest policies are designed to provide a strong and independent Board and ensure independent director input and control over matters involving potential conflicts of interest.

Under our Corporate Governance Guidelines, in 2017, the Board re-appointed Mr. Curtis B. McWilliams to serve as the lead independent director for a one-year term. The lead director has the following duties and responsibilities:

The Board believes that our leadership structure provides a very well-functioning and effective balance between strong company leadership and appropriate safeguards and oversight by independent directors.

Subject to the advisory agreement entered into by the Company, Ashford Inc., Braemar Hospitality Limited Partnership and Ashford LLC, as amended from time to time (the "advisory agreement"), the business and affairs of the Company are managed by or under the direction of the Board in accordance with Maryland law. The Board provides direction to, and oversight of, management of the Company. In addition, the Board establishes the strategic direction of the Company and oversees the performance of the Company's business, management and the employees of our advisor who provide services to the Company. Subject to the Board's supervision, our advisor is responsible for the day-to-day operations of the Company and to make available sufficient experience and appropriate personnel to serve as executive officers of the Company. The management of the Company is responsible for presenting business objectives, opportunities and/or strategic plans to our Board for review and approval and for implementing the Company's strategic direction and the Board's directives.

Strategy

The Board recognizes the importance of ensuring that our overall business strategy is designed to create long-term value for our stockholders and maintains an active oversight role in formulating, planning and implementing the Company's strategy. The Board regularly considers the progress of, and challenges to, the Company's strategy and related risks throughout the year. At each regularly-scheduled Board meeting, the management and the Board discuss strategic and other significant business developments since the last meeting and the Board considers, recommends and approves changes in strategies for the Company.

15

Risk Oversight

Our full Board has ultimate responsibility for risk oversight, but the committees of our Board help oversee risk in areas over which they have responsibility. The Board does not view risk in isolation. Risks are considered in virtually every business decision and as part of the Company's business strategy. The Board and the Board committees receive regular updates related to various risks for both our Company and our industry. The Audit Committee regularly receives and discusses reports from members of management who are involved in the risk assessment and risk management functions of our Company. The Compensation Committee annually reviews the overall structure of our equity compensation programs to ensure that those programs do not encourage executives to take unnecessary or excessive risks.

Succession Planning

The Board, acting through the Nominating and Corporate Governance Committee, has reviewed and concurred in a management succession plan, developed by our advisor in consultation with the Chairman, to ensure continuity in senior management. This plan, on which the Chief Executive Officer is to report from time to time, addresses:

The plan also includes an assessment of senior management experience, performance, skills and planned career paths.

In addition to ensuring the Board reflects an appropriate mix of experiences, qualifications, attributes and skills, the Nominating and Corporate Governance Committee also focuses on director succession and tenure. For example, our bylaws provide that individuals who would be 70 years of age at the time of their election may not serve on our Board unless the Board waives such limitation. Upon attaining age 70 while serving as a director of the Company and annually thereafter, an individual must tender a letter of proposed retirement from our Board effective at the expiration of such individual's current term, and our Board may accept the retirement of the director or request such director to continue to serve as a director. Over the last two years, our Board has undergone significant refreshment, resulting in lower average tenure, younger average age, and broadened diversity of background.

Director Nomination Procedures by the Company

The Nominating and Corporate Governance Committee recommends qualified candidates for Board membership based on the following criteria:

16

In connection with the selection of nominees for director, consideration will also be given to the Board's desire for an overall balance of diversity, including diversity in professional background, experience and perspective. The Board, taking into consideration the recommendations of the Nominating and Corporate Governance Committee, is responsible for selecting the director nominees for election by the stockholders and for appointing directors to the Board between annual meetings to fill vacancies, with primary emphasis on the criteria set forth above. The Board and the Nominating and Governance Committee assess the effectiveness of the Board's diversity efforts as part of the annual Board evaluation process.

Stockholder Nominations and Recommendations

Our bylaws permit stockholders to nominate candidates for election as directors of the Company at an annual meeting of stockholders. Stockholders wishing to nominate director candidates can do so by providing a written notice to Corporate Secretary, Braemar Hotels & Resorts Inc., 14185 Dallas Parkway, Suite 1100, Dallas, Texas 75254. Stockholder nomination notices and the accompanying certificate, as described below, must be received by the Corporate Secretary not earlier than January 22, 2019 and not later than 5:00 p.m., Eastern time, on February 21, 2019 for the nominated individuals to be considered for candidacy at the 2019 annual meeting of stockholders. Such nomination notices must include all information regarding the proposed nominee that would be required to be disclosed in connection with the solicitation of proxies for the election of the proposed nominee as a director in an election contest pursuant to the SEC's proxy rules under the Exchange Act, as well as certain other information regarding the proposed nominee, the stockholder nominating such proposed nominee and certain persons associated with such stockholder, and must be accompanied by a certificate of the nominating stockholder as to certain matters, all as prescribed in the Company's bylaws. A detailed description of the information required to be included in such notice and the accompanying certificate is included in the Company's bylaws. You may contact the Corporate Secretary at the address above to obtain a copy of the relevant bylaw provisions regarding the requirements for making stockholder nominations. Failure of the notice and certificate to comply fully with the requirements of the Company's bylaws in such regard will result in the stockholder nomination being invalid and the election of the proposed nominee as a director of the Company not being voted on at the pertinent annual meeting of stockholders.

Stockholders may recommend director candidates for consideration by the Nominating and Corporate Governance Committee. Any such recommendation must include verification of the stockholder status of the person submitting the recommendation and the nominee's name and qualifications, attributes, skills and experiences for Board membership. Stockholder recommendations may be submitted by writing to Corporate Secretary, Braemar Hotels & Resorts Inc., 14185 Dallas Parkway, Suite 1100, Dallas, Texas 75254 and must be received not earlier than January 22, 2019 and not later than 5:00 p.m., Eastern time, on February 21, 2019 for the recommended individual to be considered for nomination for election as a director of the Company at the 2019 annual meeting of stockholders. The Nominating and Corporate Governance Committee expects to use a similar process to evaluate candidates recommended by stockholders as the one it uses to evaluate candidates otherwise identified by the committee.

Since August 3, 2016, our bylaws have provided that if a holder or a group of up to 20 holders having held at least 3% of the Company's common stock outstanding as of the most recent date for which such amount has been given in any filing by the Company with the SEC prior to the submission of the nomination notice, as described below, continuously for a period of at least three consecutive years immediately preceding the submission of the nomination notice may nominate an individual for election at any annual meeting of stockholders in accordance with such bylaw provision and the Company will include such nominated individual in the Company's proxy statement for that annual meeting and on the Company's form of proxy and the ballot for that annual meeting as a nominee for

17

election as a director of the Company at an annual meeting. The Company will not, however, be required to include in its proxy statement or on its proxy card or a ballot more stockholder nominees under this provision of the bylaws than the greater of (i) two nominees and (ii) that number of nominees equaling 20% of the total number of directors of the Company on the last day of which a nomination notice under such provision may be submitted to the Company (rounded down to the nearest whole number). Our bylaws set forth procedures for choosing among stockholder nominees if the number of stockholder nominees validly nominated under such provision of the bylaws exceeds the maximum number of nominees as described above. The nomination notices nominating stockholder nominees must contain all information regarding the proposed nominee that would be required to be disclosed in connection with the solicitation of proxies for the election of the proposed nominee as a director in an election contest pursuant to the SEC's proxy rules under the Exchange Act, as well as certain other information regarding the proposed nominee, the stockholder or stockholders nominating such proposed nominee and certain persons associated with such persons and contain certain representations and warranties of such stockholder or stockholders in a nominating group, all as set forth in the Company's bylaws, and be accompanied by written agreements of the nominating stockholder or stockholders and the stockholder nominee containing provisions as prescribed by the Company's bylaws. The Company's bylaws describe in detail the information required to be included, and the representations and warranties to be made, in such nomination notice and the provisions to be contained in the accompanying agreements. In addition, a stockholder or the stockholders in a group proposing to nominate an individual to stand for election pursuant to this bylaw provision must file a Schedule 14N with the SEC in accordance with the SEC's proxy rules. Stockholder nomination notices and the accompanying agreements must be received by the Corporate Secretary, Braemar Hotels & Resorts Inc., 14185 Dallas Parkway, Suite 1100, Dallas, Texas 75254, not earlier than January 22, 2019 and not later than 5:00 p.m., Eastern time, on February 21, 2019 for the nominated individuals to be eligible for inclusion in the Company's proxy statement and on its proxy card and the ballot for the 2019 annual meeting of stockholders. You may contact the Corporate Secretary at the address above to obtain a copy of the relevant bylaw provisions regarding the requirements for making stockholder nominations. Failure of a nomination notice and the accompanying agreements to comply fully, or of a relevant party to otherwise comply fully, with the applicable requirements of the Company's bylaws will result in the stockholder nomination being invalid and the proposed nominee not being to be eligible for inclusion in the Company's proxy statement and on its proxy card and the ballot for the 2019 annual meeting of stockholders.

Stockholder and Interested Party Communication with Our Board of Directors

Stockholders and other interested parties who wish to contact any of our directors either individually or as a group may do so by writing to them c/o the Corporate Secretary, Braemar Hotels & Resorts Inc., 14185 Dallas Parkway, Suite 1100, Dallas, Texas 75254. Stockholders' and other interested parties' letters are screened by Company personnel based on criteria established and maintained by our Nominating and Corporate Governance Committee, which includes filtering out improper or irrelevant topics such as solicitations.

Director Orientation and Continuing Education

The Board and senior management conduct a comprehensive orientation process for new directors to become familiar with our vision, strategic direction, core values, including ethics, financial matters, corporate governance policies and practices and other key policies and practices through a review of background material and meetings with senior management. The Board also recognizes the importance of continuing education for directors and is committed to providing education opportunities in order to improve both the Board's and its committees' performance. Senior management will assist in identifying and advising our directors about opportunities for continuing education, including conferences provided by independent third parties.

18

Upon attaining the age of 70 and annually thereafter, as well as when a director's principal occupation or business association changes substantially from the position he or she held when originally invited to join the Board, a director will tender a letter of proposed retirement or resignation, as applicable, from the Board to the chairperson of our Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee will review the director's continuation on the Board, and recommend to the Board whether, in light of all the circumstances, the Board should accept such proposed resignation or request that the director continue to serve.

19

BOARD OF DIRECTORS AND COMMITTEES

Our business is managed through the oversight and direction of the Board. Members of the Board are kept informed of our business through discussions with the Chairman of the Board, Chief Executive Officer, Lead Director and other officers, by reviewing materials provided to them and by participating in meetings of the Board and its committees.

The Board has retained Ashford Inc. and Ashford LLC to manage our operations and asset manage our portfolio of hotels, subject to the Board's oversight and supervision and the terms and conditions of the advisory agreement. Because of the conflicts of interest created by the relationships among us, Ashford Trust, Ashford Inc. and any other related party, and each of their respective affiliates, many of the responsibilities of the Board have been delegated to our independent directors, as discussed below and under "Certain Relationships and Related Party Transactions—Conflict of Interest Policies."

During the year ended December 31, 2017, the Board held 14 regular meetings and held two executive sessions of our non-management directors. The non-management directors must hold at least two regularly scheduled meetings per year without management present. All of our incumbent directors standing for re-election attended, in person or by telephone, at least 75 percent of all meetings of the Board and committees on which such director served, held during the period for which such person was a director or was a member of such committees, as applicable, in 2017.

The Board determines the independence of our directors in accordance with our Corporate Governance Guidelines and Section 303A.02 of the NYSE Listed Company Manual, which requires an affirmative determination by our Board that the director has no material relationship with us that would impair his or her independence. In addition, Section 303A.02(b) of the NYSE Listed Company Manual sets forth certain tests that, if any of them is met by a director automatically disqualifies that director from being independent from management of our Company. Moreover, our Corporate Governance Guidelines provide that if any director receives more than $120,000 per year in compensation from the Company, exclusive of director and committee fees, he or she will not be considered independent. The full text of our Board's Corporate Governance Guidelines can be found in the Investor Relations section of our website atwww.bhrreit.com by clicking "INVESTOR," then "CORPORATE GOVERNANCE."

Following deliberations, the Board has affirmatively determined that, with the exception of Mr. Monty J. Bennett, our Chairman, each nominee for election as a director of the Company is independent of Braemar and its management and has been such during his or her term as a director commencing with the annual meeting of stockholders of the Company held on June 9, 2017, in each case, under the standards set forth in our Corporate Governance Guidelines and the NYSE Listed Company Manual, and our Board has been since that date and is comprised of a majority of independent directors, as required by Section 303A.01 of the NYSE Listed Company Manual. Any reference to an independent director herein means such director satisfies both the standards set forth in our Corporate Governance Guidelines and the NYSE independence tests.

In addition, each current member of our Audit Committee and our Compensation Committee has been determined by the Board to be independent and to have been independent at all pertinent times under the heightened independence standards applicable to members of audit committees of board of directors and to members of compensation committees of board of directors of companies with equity securities listed for trading on the NYSE and under the rules of the SEC under the Exchange Act and that each nominee for election as a director of the Company at the Annual Meeting is independent under those standards.

20

In making the independence determinations with respect to our current directors, the Board examined all relationships between each of our directors or their affiliates and Braemar or its affiliates. The Board determined that none of these transactions impaired the independence of the directors involved.

Historically, the standing committees of the Board have been the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. In 2016, the Board added the Related Party Transactions Committee as a standing committee of the Board. Each of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee is governed by a written charter that has been approved by the Board. A copy of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee charters can be found in the Investor Relations section of our website atwww.bhrreit.com by clicking "INVESTOR" and then "CORPORATE GOVERNANCE." The committee members of each active committee and a description of the principal responsibilities of each such committee follows:

| | Audit | Compensation | Nominating and Corporate Governance | Related Party Transactions | ||||

|---|---|---|---|---|---|---|---|---|

| Stefani D. Carter | X | Chair | X | |||||

Kenneth H. Fearn | X | X | Chair | |||||

Curtis B. McWilliams | Chair | |||||||

Matthew D. Rinaldi | Chair | X | X | |||||

Abteen Vaziri | X | X |

Audit Committee

Current Members: | Curtis B. McWilliams (chair), Kenneth H. Fearn and Abteen Vaziri | |

Independence | All of the members of the Audit Committee have been determined by our Board to be independent at all pertinent times, including under the heightened independence standards for members of audit committees of boards of directors. | |

Number of Meetings in 2017: | 5 | |

Key Responsibilities | • Assist the Board in overseeing (i) our accounting and financial reporting processes; (ii) the integrity and audits of our financial statements; (iii) our compliance with legal and regulatory requirements; (iv) adequacy of our internal control over financial reporting; (v) the qualifications and independence of our independent auditors; (vi) the performance of our internal and independent auditors; and (vii) our processes to manage business, financial and cybersecurity risk; | |

• has sole authority to appoint or replace our independent auditors; | ||

• has sole authority to approve in advance all audit and non-audit engagement fees, scope of the audit and terms with our independent auditors; |

21

• monitor compliance of our employees with our standards of business conduct and conflict of interest policies; | ||

• meet at least quarterly with our senior executive officers, internal audit staff and our independent auditors in separate executive sessions; | ||

• recommend to the Board whether the Company's financial statements should be included in the Annual Report on Form 10-K; and | ||

• prepare the Audit Committee report that the SEC rules and regulations require to be included in the Company's annual proxy statement. |

Each of Mr. McWilliams and Mr. Fearn qualifies as an "audit committee financial expert," as defined by the applicable rules and regulations of the Exchange Act. All of the members of our Audit Committee on and after January 1, 2017 are "financially literate" under the NYSE listing standards.

Compensation Committee

Current Members: | Matthew D. Rinaldi (chair), Stefani D. Carter and Kenneth H. Fearn | |

Independence | All of the members of the Compensation Committee have been determined by our Board to be independent at all pertinent times, including under the heightened standards for members of the compensation committees of boards of directors. | |

Number of Meetings in 2017: | 4 | |

Key Responsibilities | • Evaluate the performance of our officers; | |

• review and approve the officer compensation plans, policies and programs; | ||

• evaluate the performance of our advisor; | ||

• review the compensation and fees payable to Ashford Inc. under the advisory agreement; | ||

• annually review the compensation paid to non-employee directors for service on the Board and make recommendations to the Board regarding any proposed adjustments to such compensation; | ||

• prepare Compensation Committee reports; and | ||

• administer the Company's equity incentive plan. |

The Compensation Committee has the authority to retain and terminate any compensation consultant to assist it in the evaluation of officer compensation, or to delegate its duties and responsibilities to one or more subcommittees as it deems appropriate. In 2017, the Compensation Committee retained Gressle & McGinley LLC as its independent compensation consultant. Gressle & McGinley LLC provided competitive market data to support the Compensation Committee's decisions on the value of equity to be awarded to our named executive officers. Gressle & McGinley LLC has not performed any other services for the Company and performed its services only on behalf of, and at the direction of, the Compensation Committee. Our Compensation Committee reviewed the independence of Gressle & McGinley LLC in light of SEC rules and NYSE listing standards regarding

22

compensation consultant independence and has affirmatively concluded that Gressle & McGinley LLC is independent from management of the Company and has no conflicts of interest relating to its engagement by our Compensation Committee. Messrs. W. Michael Murphy and Andrew L. Strong were members of the Compensation Committee from January 1, 2017 through June 9, 2017. They did not stand for reelection as a director of the Company at the annual meeting of stockholders of the Company held on June 9, 2017.

Nominating and Corporate Governance Committee

Current Members: | Stefani D. Carter (chair), Matthew D. Rinaldi and Abteen Vaziri | |

Independence | All of the members of the Nominating and Corporate Governance Committee have been determined by the Board to be independent at all pertinent times. | |

Number of Meetings in 2017: | 10 | |

Key Responsibilities | • Identify individuals qualified to become members of the Board; | |

• recommend to the Board the director nominees for election at the next annual meeting of stockholders; | ||

• identify and recommend candidates to fill vacancies on the Board occurring between annual stockholder meetings; | ||

• recommend to the Board director nominees for each committee of the Board; | ||

• develop and recommend to the Board our Corporate Governance Guidelines and periodically review and update such Corporate Governance Guidelines as well as the charters of each committee of the Board; | ||

• perform a leadership role in shaping in our corporate governance; and | ||

• oversee an evaluation of Board, its committees and executive management. |

Related Party Transactions Committee

Members: | Kenneth H. Fearn (chair), Stefani D. Carter and Matthew D. Rinaldi | |

Number of Meetings in 2017 | 5 | |

Key Responsibilities | • Review any transaction in which our officers, directors, Ashford Inc. or Ashford Trust or their officers, directors or respective affiliates have an interest, including our advisor or any other related party and their respective affiliates, before recommending approval by a majority of our independent directors. The Related Party Transactions Committee can deny a new proposed transaction or recommend for approval to the independent directors. Also, the Related Party Transactions Committee periodically reviews and reports to independent directors on past approved related party transactions. |

23

Each of our non-employee directors is paid an annual base cash retainer of $55,000. The lead independent director is paid an additional annual cash retainer of $25,000, the chairman of our Audit Committee is paid an additional annual retainer of $25,000, each member of our Audit Committee other than the chairman is paid an additional annual retainer of $5,000, the chairman of our Compensation Committee is paid an additional annual retainer of $15,000, the chairman of our Nominating and Corporate Governance Committee is paid an additional annual retainer of $10,000, the chairman of our Related Party Transactions Committee is paid an additional annual retainer of $15,000 and each member of our Related Party Transactions Committee other than the chairman is paid an additional annual retainer of $10,000. Each non-employee director is also paid a fee of $2,000 for each Board or committee meeting that he or she attends in person, except that the chairman of each committee is paid a fee of $3,000 for each committee meeting that he or she attends. Each non-employee director is also paid a fee of $500 for each Board or committee meeting that he or she attends via teleconference. Non-employee directors may also be paid additional cash retainers from time to time for service on special committees. Officers receive no additional cash compensation for serving on the Board. In addition, we reimburse all directors for reasonable out-of-pocket expenses incurred in connection with their services on the Board.

In addition, on the date of the first meeting of the Board of Directors following each annual meeting of stockholders at which a non-employee director is initially elected or re-elected to our Board of Directors, each non-employee director receives a grant of shares of our common stock or, at the election of each director, long-term incentive partnership units ("LTIP units") in Braemar Hospitality Operating Partnership ("Braemar OP"), which are issued under our 2013 Equity Incentive Plan and are fully vested immediately. In accordance with this policy, we granted 3,200 shares of fully vested common stock to each of our non-employee directors in June 2017, except for Mr. Vaziri, to whom we granted 2,133 shares of fully vested common stock in October 2017 in connection with his appointment to our Board, which number of shares reflects the pro-rated awards based on Mr. Vaziri's service on our Board for only part of 2017. In addition, we granted 800 shares of the Company's restricted stock to Messrs. Cunningham and Silvers in March 2017 and 267 shares of the Company's restricted stock to Ms. Darrouzet in April 2017 in connection with their appointments to our Board, which numbers of shares reflect the pro-rated awards for their services on the Board prior to the Company's 2017 annual meeting of stockholders. Ms. Carter and Ms. Darrouzet elected to receive 3,200 fully vested LTIP units in June 2017. These vested LTIP units, upon achieving parity with the common units of our operating partnership, are convertible into common partnership units at the option of the grantee. Common partnership units are redeemable for cash or, at our option, convertible into shares of our common stock based on a one-for-one basis.

Each member of our Board must hold an amount of common stock having a value in excess of three times his annual Board retainer fee (excluding any portion of the retainer fee representing additional compensation for being a committee chairman). In addition, in August 2016, our Board of Directors adopted and approved an amendment to our bylaws by which each director is required to retain at least 50% of the after-tax shares received in connection with any awards granted under any of the Company's equity plans until such time that such director has met his required ownership level.

Mr. Monty J. Bennett, Chairman of the Board, is an employee of our advisor and receives equity awards under our 2013 Equity Incentive Plan in such capacity. However, Mr. Bennett does not receive any compensation for serving as a director or as the Chairman of the Board. With respect to 2017, he received equity compensation in the amount of approximately $1.7 million as an employee of our advisor for his services to Braemar.

24

The following table summarizes the compensation paid by us to our non-employee directors for their services as a director for the fiscal year ended December 31, 2017:

Name | Fees Earned or Paid in Cash(1) | Stock Awards(2) | Total | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Lawrence A. Cunningham(3) | $ | 21,681 | $ | 40,936 | $ | 62,617 | ||||

Stefani D. Carter | 122,434 | 31,936 | 154,370 | |||||||

Sarah Darrouzet(4) | 30,813 | 34,865 | 65,678 | |||||||

Kenneth H. Fearn | 143,948 | 32,096 | 176,044 | |||||||

Curtis B. McWilliams | 201,264 | 32,096 | 233,360 | |||||||

Matthew D. Rinaldi | 113,382 | 32,096 | 145,478 | |||||||

Daniel B. Silvers(3) | 34,931 | 40,936 | 75,867 | |||||||

Michael Murphy(5) | 70,000 | — | 70,000 | |||||||

Andrew Strong(5) | 77,000 | — | 77,000 | |||||||

Abteen Vaziri(6) | 35,500 | 20,264 | 55,764 | |||||||

Compensation Committee Interlocks and Insider Participation

During 2017, Ms. Carter and Messrs. Fearn, Murphy, Rinaldi and Strong served on our Compensation Committee. Each of those persons was or is an independent director throughout the period for which they served or have served on our Compensation Committee during 2017 and thereafter. None of these directors was, is or has ever been an officer or employee of our Company. None of our executive officers serves, or during 2017 served, as (i) a member of a Compensation Committee (or Board committee performing equivalent functions) of any entity, one of whose executive officers served as a director on our Board or as a member of our Compensation Committee, or (ii) a director of another entity, one of whose executive officers served or serves on our Compensation Committee. No member of our Compensation Committee has or had in 2017 any relationship with the Company requiring disclosure as a related party transaction under "Certain Relationships and Related Party Transactions."

25

Attendance at Annual Meeting of Stockholders

In keeping with our corporate governance principles, directors are expected to attend the annual meeting of stockholders in person. All persons who were directors at the time of our 2017 annual meeting of stockholders attended our annual meeting in person or by telephone.

26

EXECUTIVE OFFICERS AND COMPENSATION

The following table shows the names and ages of our current executive officers and the positions held by each individual. The executive officers named below were appointed to those positions by the Board and serve in such positions at the pleasure of the Board. A description of the business experience of each for the past five years follows the table.

| | Age | Title | |||

|---|---|---|---|---|---|

| Richard J. Stockton | 47 | Chief Executive Officer and President | |||

| Deric S. Eubanks | 42 | Chief Financial Officer and Treasurer | |||

| J. Robison Hays, III | 40 | Chief Strategy Officer | |||

| Jeremy Welter | 41 | Chief Operating Officer | |||

| Mark L. Nunneley | 60 | Chief Accounting Officer | |||

| Richard J. Stockton Chief Executive Officer and President Age 47 Executive since 2016

| Mr. Stockton has served as our Chief Executive Officer since November 2016 and as our President as April 2017. Mr. Stockton brings a wealth of real estate experience and accomplishments to Braemar. Prior to joining our Company, Mr. Stockton served as Global Chief Operating Officer for Real Estate at CarVal Investors, a subsidiary of Cargill Inc. with approximately $1 billion in real estate investments in the United States, Canada, United Kingdom and France, beginning in August 2015. He spent over 15 years at Morgan Stanley in real estate investment banking where he rose from Associate to Managing Director and regional group head. At Morgan Stanley, he was head of EMEA Real Estate Banking in London, executing business across Europe, the Middle East, and Africa. He was also appointed co-head of the Asia Pacific Real Estate Banking Group, where he was responsible for a team across Hong Kong, Singapore, Sydney and Mumbai. He left Morgan Stanley in 2013 to become President & CEO-Americas for OUE Limited, a publicly listed Singaporean property company with over $5 billion in assets from February 2013 to March 2015. Mr. Stockton received a Masters of Business Administration degree in Finance and Real Estate from The Wharton School, University of Pennsylvania, and a Bachelor of Science degree from Cornell University, School of Hotel Administration. |

27

Deric S. Eubanks Chief Financial Officer and Treasurer Age 42 Executive since 2014