- BHR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

SC 13D/A Filing

Braemar Hotels & Resorts (BHR) SC 13D/AAshford Hospitality Prime, Inc.

Filed: 11 Dec 15, 12:00am

Exhibit 1

SESSA CAPITAL

1350 Avenue of the Americas, Suite 3110

New York, NY 10019

212-257-4410

December 10, 2015

Board of Directors

c/o Mr. Curtis B. McWilliams, Lead Director

Ashford Hospitality Prime, Inc.

14185 Dallas Parkway, Suite 1100

Dallas, TX 75254

Members of the Ashford Hospitality Prime Board of Directors,

Sessa Capital is the third largest holder of Ashford Hospitality Prime, holding 8.2% of the common shares. We appreciated the opportunity to attend your investor day on October 20th and meet with members of the management team after the event.

We eagerly await a conclusion to the company’s strategic alternatives process. We were quite disappointed, however, to read in your third quarter press release that the Independent Directors are only “in the beginning stage” of the strategic review. This disclosure, coming more than two months after your initiation of the process is unacceptable, and we fear indicates a lack of urgency. We question whether the Board’s pace is due to the conflicts of interest inherent in the Ashford structure or intentional foot-dragging by Directors not fully committed to value maximization for outside shareholders, but in either case we urge you to move ahead without further delay. Investors have been patient with Ashford Prime, but the value destruction, measured by stock market return over any meaningful period,* exhausts such patience.

We were further troubled by management’s disclosure at the investor day that the fee for terminating the current advisory agreement with Ashford Inc. could be as large as $4-5 per share. How can a Board of Directors hand over 1/3 of a company’s current market capitalization to an affiliate of the Chairman in any scenario? Even more troubling is the fact that the Board recently approved amendments to the advisory agreement to apply the termination fee to an even wider, overly broad range of actions, such as director elections and asset dispositions. A core principle of corporate governance is the right of shareholders to a free and fair election of Directors. Your decision to apply the termination fee to the election of certain Directors (but not incumbents) is self-entrenching, coercive and strips shareholders of their most fundamental voting right. Quite simply, Directors who agreed to the fee and its application have uniquely disqualified themselves as shareholder representatives.

| * | From the first day of trading following the spin-off to the close of trading on the day preceding the announcement that the company would explore strategic alternatives, AHP declined approximately 42%. In this same period the Dow Jones US Hotel & Lodging REITs Index was up approximately 7%. |

Board of Directors

c/o Mr. Curtis B. McWilliams, Lead Director

Page 2

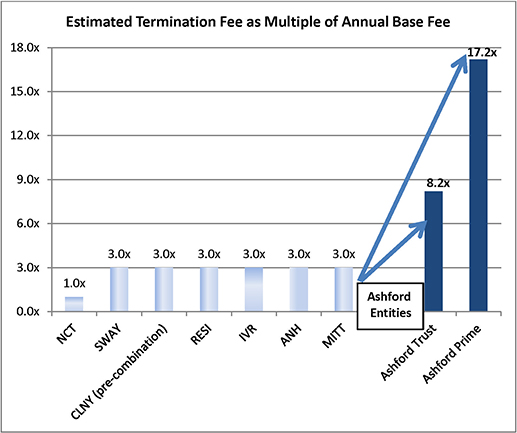

Not only is the termination fee overbroad and unjustly applied, it is also unreasonably high. The termination fee, at the midpoint of management’s estimate, is at least17.2 times the company’s annualized base advisory fee paid to Ashford Inc.; a customary fee in the industry would be less than 1/5 that amount. If management’s numbers are correct, the company would likely pay more to terminate the advisory agreement than it would pay in base fees for the remainder of the agreement’sentire 10 year term based on the company’s current market capitalization.

The below table shows the degree to which this fee is an outlier versus several other REITs with termination fees:

Market peers include selected externally managed REITs; multiples reflect estimates based on publicly available disclosures. Ashford Prime’s termination fee is assumed to be $148m, based on the midpoint of management’s $4-5 per share range. Ashford Trust’s fee is assumed to be $286m, based on the midpoint of management’s $2-3 per share range. From this chart we excluded RMR, CommonWealth REIT’s former manager, that was removed by shareholder action following underperformance and claims of conflicts of interest. By our estimates, even RMR’s termination fees are substantially lower as a multiple of annual fees.

As a starting point to a serious strategic review process, we urge the Board to fix the termination fee. We fear potential credible strategic partners may avoid participation in a process in which the existing termination fee could tilt the playing field significantly in favor of affiliated insiders over other potential participants, to the disadvantage of Ashford Prime shareholders.

We are also concerned that the result of the strategic review process may be pre-ordained. Recently, it came to our attention that Ashford Inc.’s preliminary merger proxy states that, among other things, Ashford’s management expects “acquisitions by Ashford Trust and Ashford Prime” to more than double Remington’s revenues over the next four years. If accurate, this disclosure, along with the recent expansion of the portfolio with Ashford Prime’s Ritz-Carlton St. Thomas purchase, point to a management vision inconsistent with maximizing shareholder value for Ashford Prime shareholders.

Our desire is not to be forced into further action, and we hope that decisive action by the Independent Directors, with a fair outcome for all, will render any further action on our part unnecessary. We continue to be concerned about conflicts of interest. Our trust and confidence in the current Directors have been shaken by questionable decisions that have burdened the company since the spinoff.

Board of Directors

c/o Mr. Curtis B. McWilliams, Lead Director

Page 3

We will continue to closely monitor actions relating to the Board’s review of strategic alternatives and corporate governance developments in the hope and expectation that the Board will address shareholder concerns. We will not hesitate to protect our rights and those of all shareholders if necessary.

Sincerely,

John Petry

| cc: | Monty J. Bennett, Chief Executive Officer and Chairman |

| David A. Brooks, Chief Operating Officer, General Counsel and Corporate Secretary |