Company Presentation – January 2016

2 In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our competition. These and other risk factors are more fully discussed in the Company's filings with the Securities and Exchange Commission. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC. This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Hospitality Prime, Inc. or any of its respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security. Safe Harbor

Ashford Hospitality Prime Vision Well defined strategy investing in luxury hotels in gateway and resort markets 3 Bardessono Hotel & Spa Yountville, CA Pier House Resort Key West, FL Chicago Sofitel WaterTower Chicago, IL Grow platform through accretive acquisitions of high quality assets Maintain highly- aligned management team and organizational structure Simple and straightforward investment profile Grow organically through strong revenue initiatives Maintain conservative capital structure with target Net Debt / EBITDA of 5.0x or less Continue to take steps to improve shareholder value and increase total shareholder return

Maximizing Shareholder Value Consistently committed to maximizing shareholder value including the following initiatives: Doubled common dividend to $0.10 per share in Q2 2015 $65 million convertible preferred equity raise at $18.90 conversion price Accretive acquisition of the luxury Bardessono Hotel & Spa in Q3 2015 with use of "key-money" from Ashford, Inc. Accretive acquisition of the luxury resort Ritz-Carlton St. Thomas in Q4 2015 at 7.2x TTM EBITDA and 10% TTM NOI cap rate Best in class asset management team with strong history of organic value creation Review of strategic alternatives to improve shareholder value 4

Strategic Alternatives Update In August, the Company announced a plan to explore a full range of strategic alternatives including a possible sale of the Company Independent directors engaged Deutsche Bank as advisors Board is discussing all possible strategic alternatives to maximize value for shareholders No timetable has been set on finalizing any strategic alternative decision 5

Recent Developments 6 Acquisition of the Bardessono Hotel & issuance of convertible preferred equity Very high quality asset in high demand market with high barriers to entry Enabled us to grow the portfolio without raising dilutive equity Amendments to Advisory Agreement with Ashford, Inc. Receive key money ($2 million thus far) Termination right without fee upon Advisor CoC Shorten initial term of agreement Reduction in base fee amount Purchase of approximately 175,000 shares of Ashford, Inc. common stock Executed strategic goal of increased alignment for AHP AHP shareholders will participate in the economics of the Advisor Opportunistic transaction given growth profile Belief in long-term value of AINC Termination fee clarification Acquisition of The Ritz-Carlton St. Thomas luxury resort Very high quality asset in high demand market with high barriers to entry Accretive growth of the portfolio consistent with luxury hotel strategy Attractive purchase metrics for this type of high quality asset

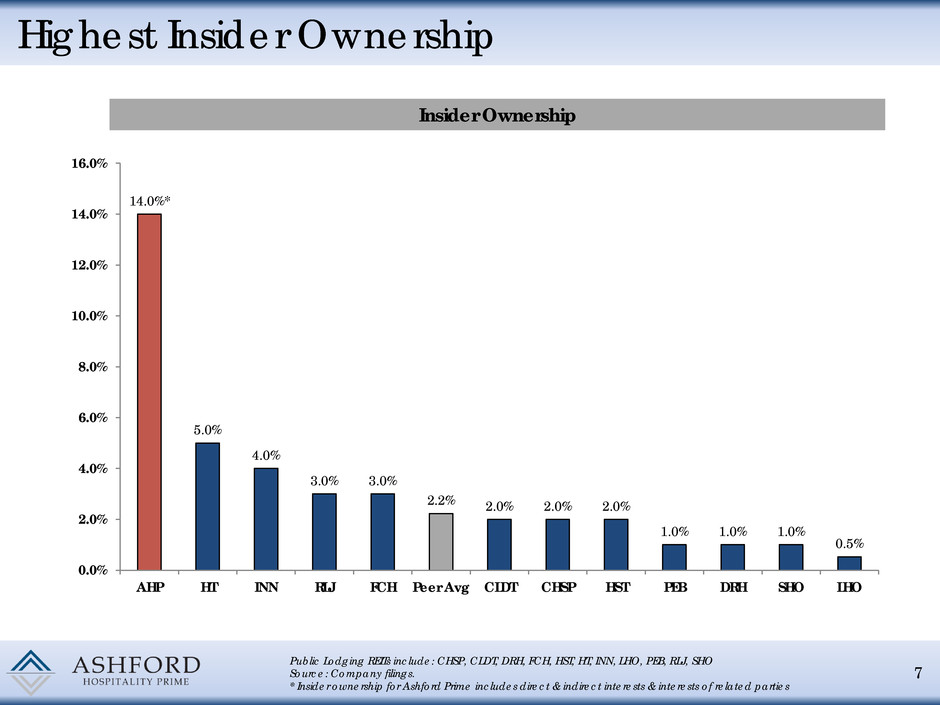

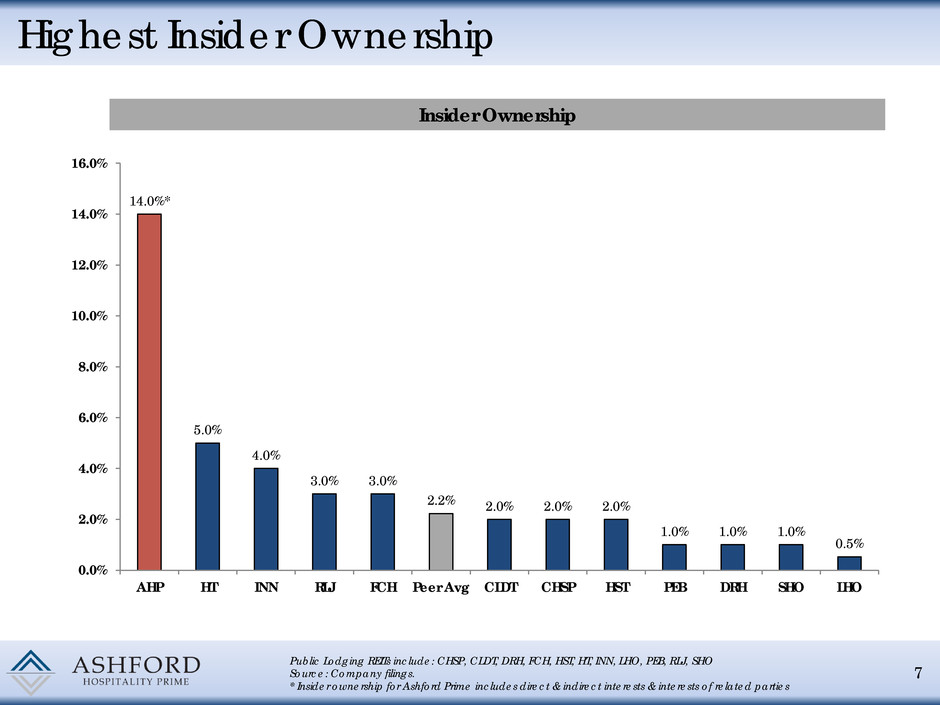

Highest Insider Ownership 7 Public Lodging REITs include: CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHO Source: Company filings. * Insider ownership for Ashford Prime includes direct & indirect interests & interests of related parties Insider Ownership 14.0%* 5.0% 4.0% 3.0% 3.0% 2.2% 2.0% 2.0% 2.0% 1.0% 1.0% 1.0% 0.5% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% AHP HT INN RLJ FCH Peer Avg CLDT CHSP HST PEB DRH SHO LHO

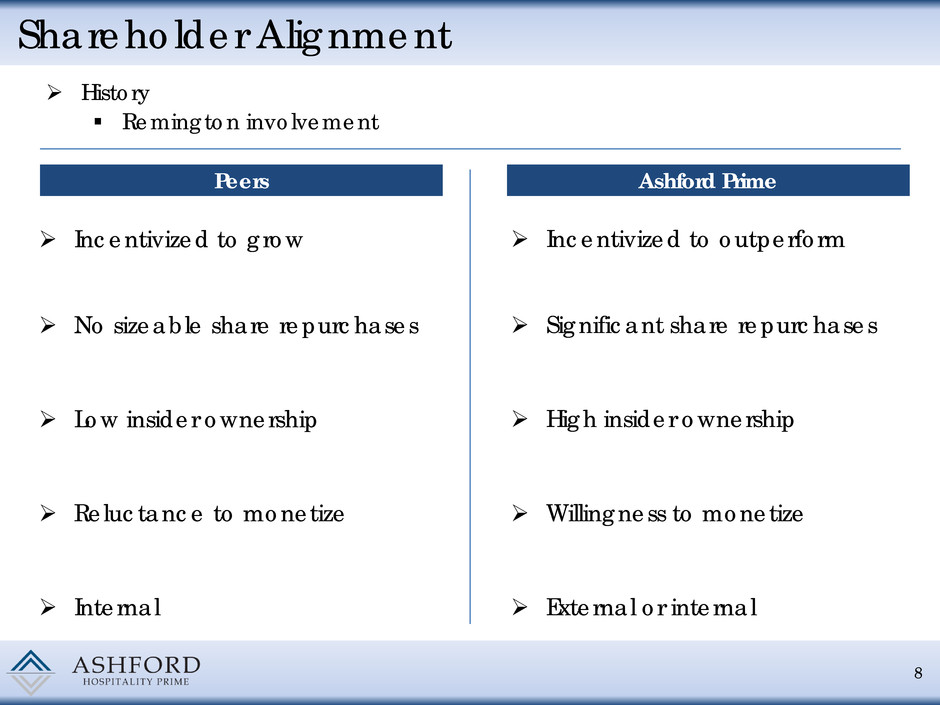

Shareholder Alignment 8 Peers Ashford Prime Incentivized to grow No sizeable share repurchases Low insider ownership Reluctance to monetize Internal Incentivized to outperform Significant share repurchases High insider ownership Willingness to monetize External or internal History Remington involvement

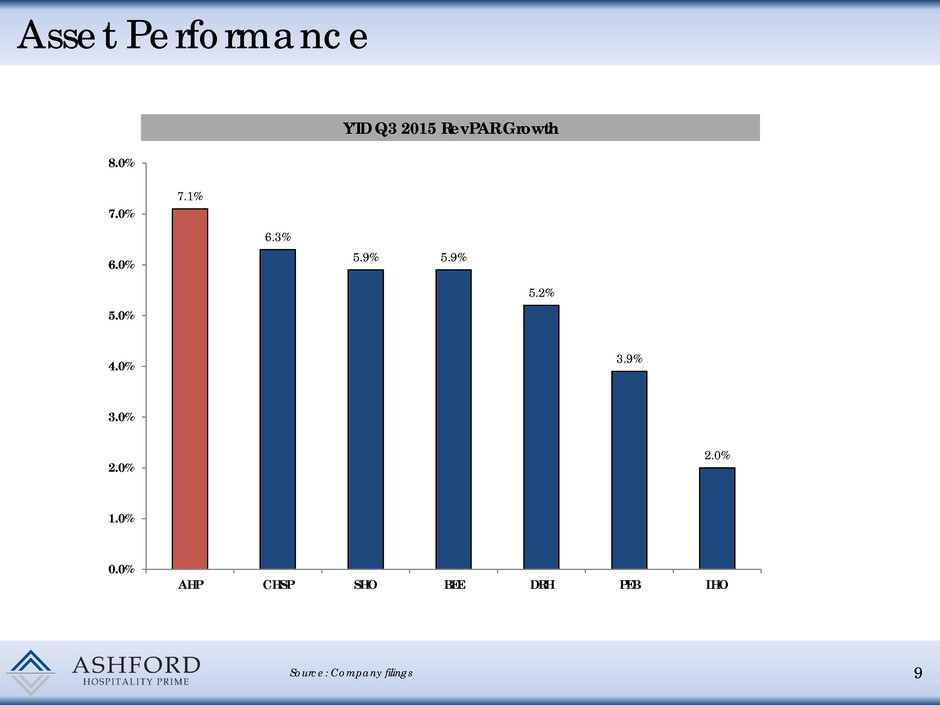

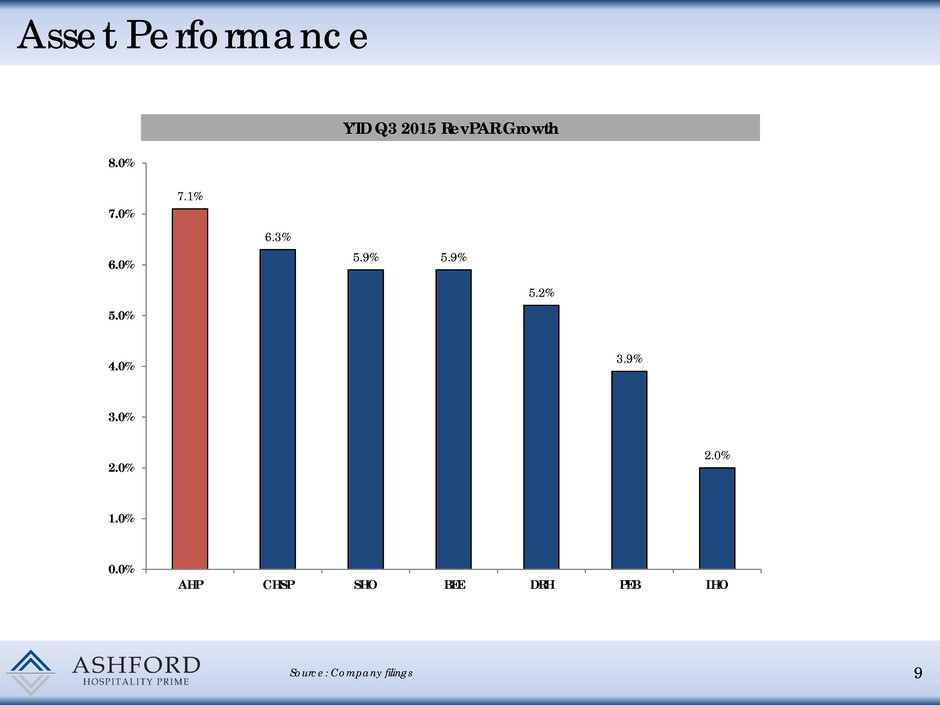

Asset Performance 9 Source: Company filings YTD Q3 2015 RevPAR Growth 7.1% 6.3% 5.9% 5.9% 5.2% 3.9% 2.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% AHP CHSP SHO BEE DRH PEB LHO

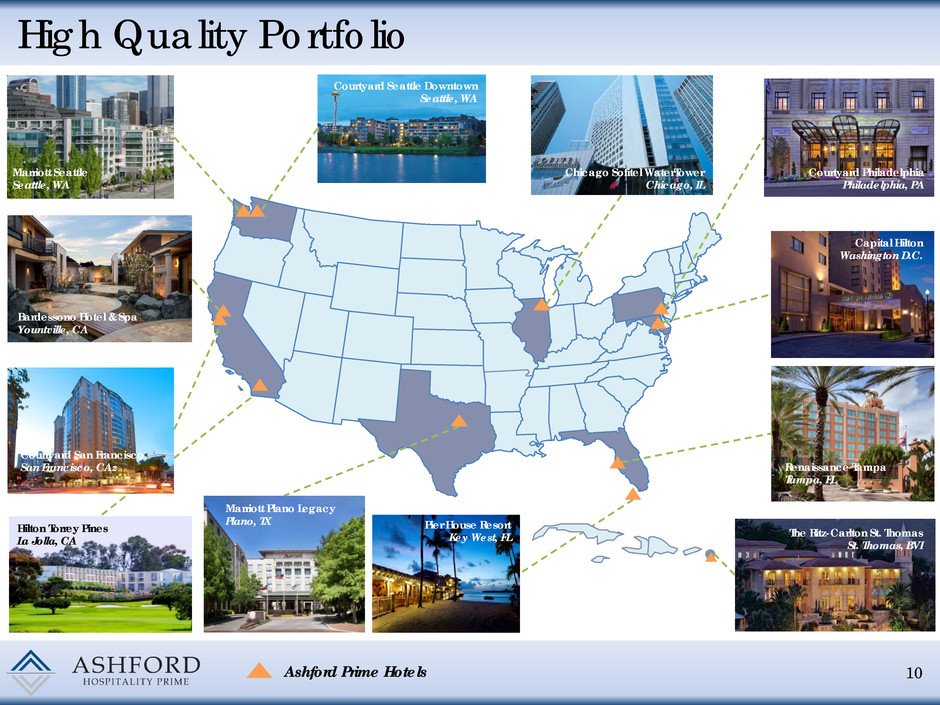

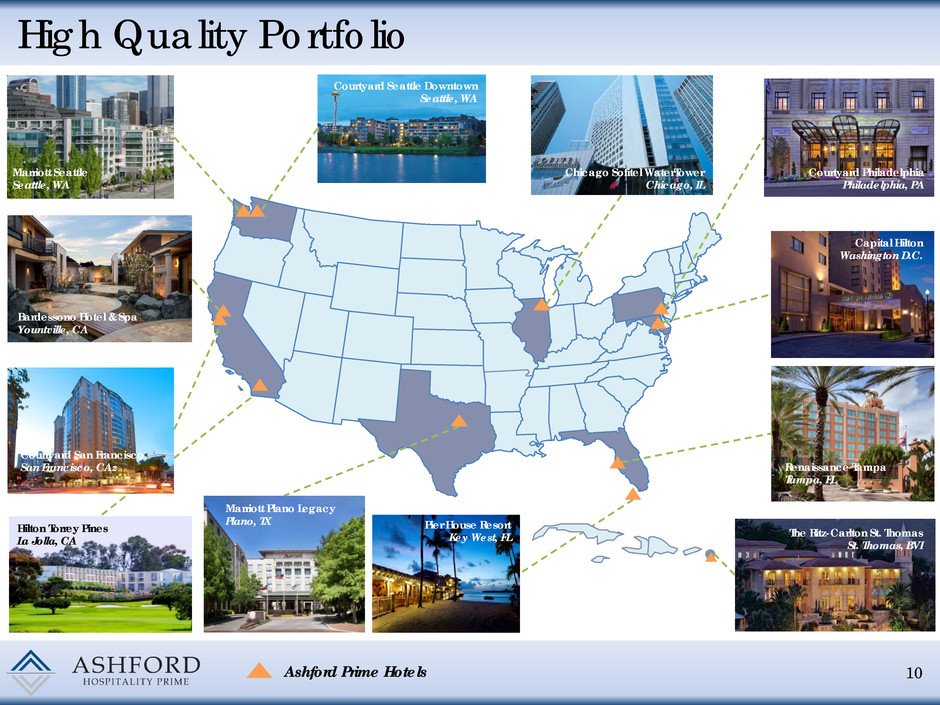

High Quality Portfolio 10 Ashford Prime Hotels Courtyard Seattle Downtown Seattle, WA Marriott Seattle Seattle, WA Hilton Torrey Pines La Jolla, CA Bardessono Hotel & Spa Yountville, CA Pier House Resort Key West, FL Renaissance Tampa Tampa, FL Chicago Sofitel WaterTower Chicago, IL Courtyard Philadelphia Philadelphia, PA Capital Hilton Washington D.C. Courtyard San Francisco San Francisco, CAz Renaissance Tampa Tampa, FL Courtyard Philadelphia Philadelphia, PA apital Hilton ashington . . Marriott Plano Legacy Plano, TX The Ritz-Carlton St. Thomas St. Thomas, BVI

Portfolio Overview 11 (1) As of September 30, 2015 (2) Wells Fargo Securities Research; Lodging: TripAdvisor Rankings (September 4, 2015) Note: Hotel EBITDA in thousands High quality portfolio with total ADR and RevPAR of $226 and $187, respectively for the TTM period High performing portfolio with total occupancy of 82% High market share portfolio with a total RevPAR index of 111% Geographically diversified portfolio located in strong markets Highest TripAdvisor ranking among publicly-traded Hotel REITs(2) Acquired the luxury resort Ritz-Carlton St. Thomas in December 2015 with TTM November 2015 RevPAR, ADR, and Occupancy of $441, $556, and 79%, respectively Number of TTM TTM TTM TTM Hotel % of RevPAR Location Rooms ADR(1) Occ. (1) RevPAR(1) EBITDA(1) Total Index(1) Courtyard Philadelphia Downtown Philadelphia, PA 499 $174 82% $143 $12,232 10.7% 118% Mariott Plano Legacy Dallas, TX 404 $190 71% $135 $11,076 9.7% 136% Courytard San Francisco Downtown San Francisco, CA 405 $266 92% $244 $13,807 12.1% 106% Courtyard Seattle Downtown Seattle, WA 250 $194 79% $154 $6,492 5.7% 110% Marriott Seattle Waterfront Seattle, WA 358 $254 81% $206 $14,242 12.5% 114% Renaissance Tampa Tampa, FL 293 $171 79% $135 $5,670 5.0% 125% Capital Hilton Washington D.C. 550 $221 86% $190 $15,812 13.9% 111% Hilton Torrey Pines La Jolla, CA 394 $188 86% $161 $12,360 10.8% 105% Chicago Sofitel Water Tower Chicago, IL 415 $226 80% $182 $9,166 8.0% 96% Pier House Key West, FL 142 $392 89% $351 $9,578 8.4% 103% Bardessono Napa Valley, CA 62 $708 79% $556 $3,672 3.2% 106% Total Portfolio 3,772 $226 82% $187 $114,107 100.0% 111%

Investment Strategy 12 Luxury hotels Gateway and resort markets Disciplined capital allocation Lower leverage Investment Strategy Competitive Advantage Material impact of one acquisition to portfolio given size Market knowledge given existing presence across all Ashford companies Opportunity for best in class Remington property management Closing capability, speed, and industry relationships Proven track record of value creating transactions

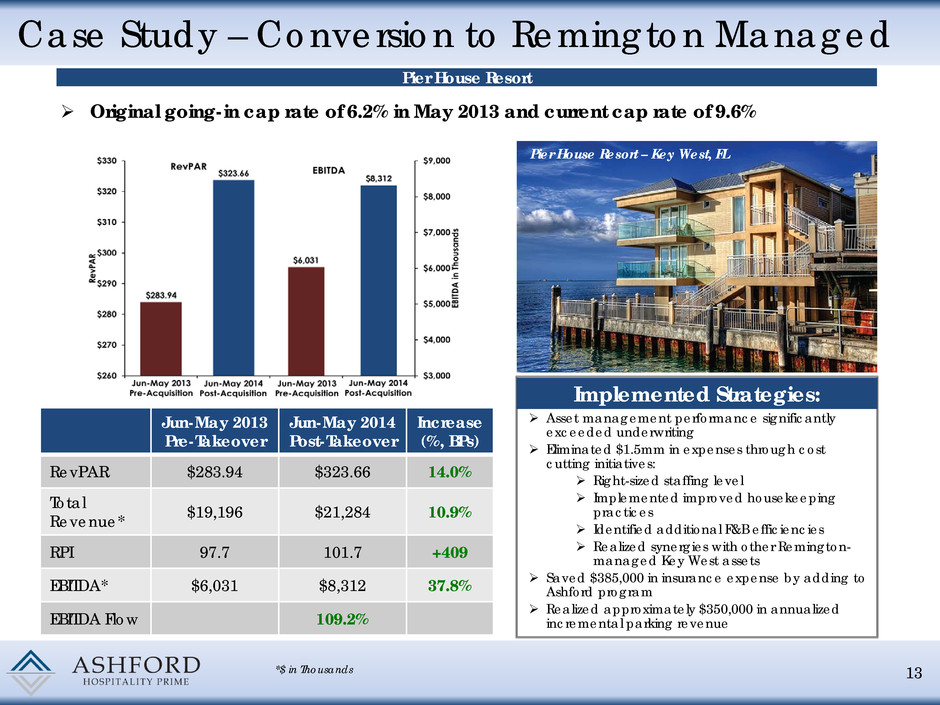

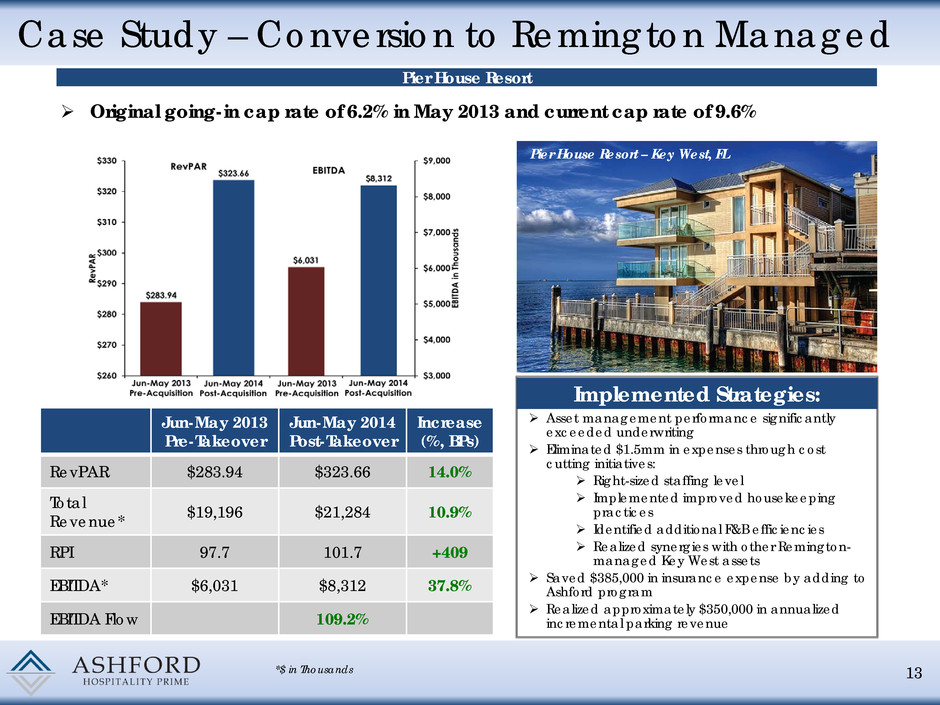

Case Study – Conversion to Remington Managed 13 Asset management performance significantly exceeded underwriting Eliminated $1.5mm in expenses through cost cutting initiatives: Right-sized staffing level Implemented improved housekeeping practices Identified additional F&B efficiencies Realized synergies with other Remington- managed Key West assets Saved $385,000 in insurance expense by adding to Ashford program Realized approximately $350,000 in annualized incremental parking revenue Implemented Strategies: Pier House Resort – Key West, FL Pier House Resort Jun-May 2013 Pre-Takeover Jun-May 2014 Post-Takeover Increase (%, BPs) RevPAR $283.94 $323.66 14.0% Total Revenue* $19,196 $21,284 10.9% RPI 97.7 101.7 +409 EBITDA* $6,031 $8,312 37.8% EBITDA Flow 109.2% *$ in Thousands Original going-in cap rate of 6.2% in May 2013 and current cap rate of 9.6%

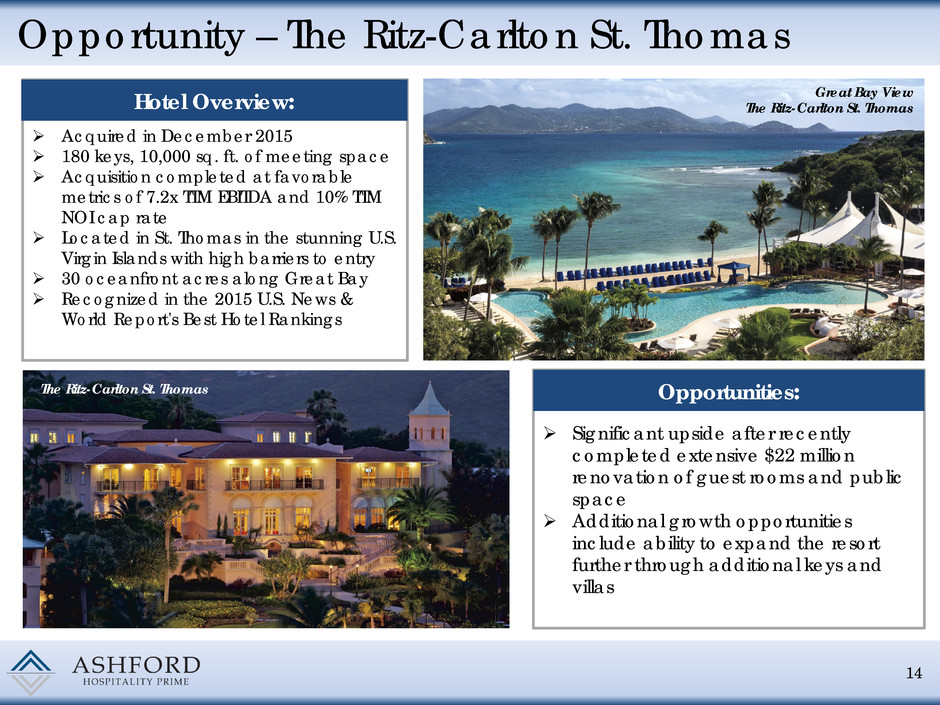

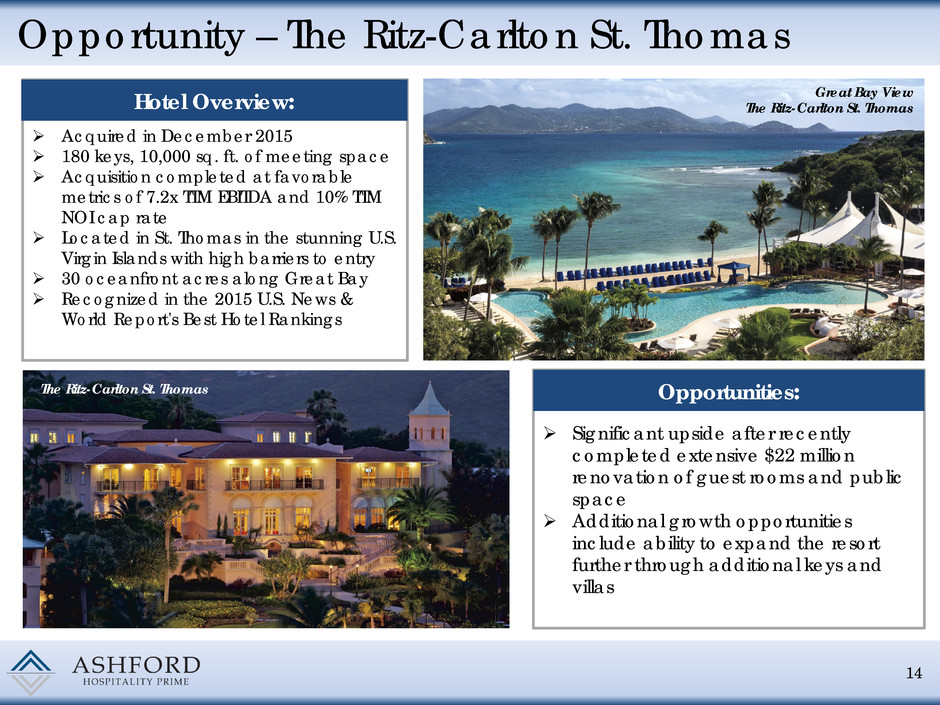

Opportunity – The Ritz-Carlton St. Thomas 14 The Ritz-Carlton St. Thomas Acquired in December 2015 180 keys, 10,000 sq. ft. of meeting space Acquisition completed at favorable metrics of 7.2x TTM EBITDA and 10% TTM NOI cap rate Located in St. Thomas in the stunning U.S. Virgin Islands with high barriers to entry 30 oceanfront acres along Great Bay Recognized in the 2015 U.S. News & World Report's Best Hotel Rankings Hotel Overview: Significant upside after recently completed extensive $22 million renovation of guest rooms and public space Additional growth opportunities include ability to expand the resort further through additional keys and villas Opportunities: Great Bay View The Ritz-Carlton St. Thomas

Capital Structure and Net Working Capital Conservative leverage in line with platform strategy Targeted Net Debt / EBITDA of 5.0x All debt is non-recourse, property level mortgage debt Targeted cash balance of 25% to 30% of market capitalization Maintain excess cash balance to capitalize on opportunities Hedge unfavorable economic shocks Dry powder to execute opportunistic acquisitions 15 As of September 30, 2015 (1) Adjusted for acquisition of The Ritz-Carlton St. Thomas and financing of the Bardessono Hotel (2) At market value as of January 11, 2016 Total Enterprise Value Net Working Capital Figures in millions except per share values Stock Price (As of January 11, 2016) $12.66 Fully Diluted Shares Outstanding 32.8 Equity Value $415.8 Plus: Convertible Preferred Equity 65.0 Plus: Debt(1) 793.3 Total Market Capitalization $1,274.2 Less: Net Working Capital(1) (174.1) Total Enterprise Value $1,100.1 Cash & Cash Equivalents(1) $100.4 Restricted Cash 30.6 Investment in AIM REHE, LP 47.1 Accounts Receivable, net 12.8 Prepaid Expenses 3.6 Due From Affiliates, net (0.8) Due from Third Party Hotel Managers 7.7 Investment in Ashford Inc. (2) 10.7 Total Current Assets $212.0 Accounts Payable, net & Accrued Expenses $34.6 Dividends Payable 3.3 Total Current Liabilities $37.9 Net Working Capital $174.1

$406.3 $8.1 $80.0 $152.0 $196.0 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 $400.0 $450.0 2016 2017 2018 2019 2020 Thereafter Fixed-Rate Floating-Rate Debt Maturities and Leverage Target leverage: Net Debt / EBITDA < 5.0x Maintain mix of fixed and floating rate debt Ladder maturities Exclusive use of property-level, non-recourse debt 16 As of September 30, 2015 (1) Assumes extension options are exercised Note: Adjusted for acquisition of The Ritz-Carlton St. Thomas and financing of the Bardessono Hotel. All debt yield statistics are based on EBITDA to principal. Debt Maturity Schedule (mm)(1) Debt Yield: 15.6% Debt Yield: N/A Debt Yield: 11.5% Debt Yield: 14.6% Debt Yield: 14.4%

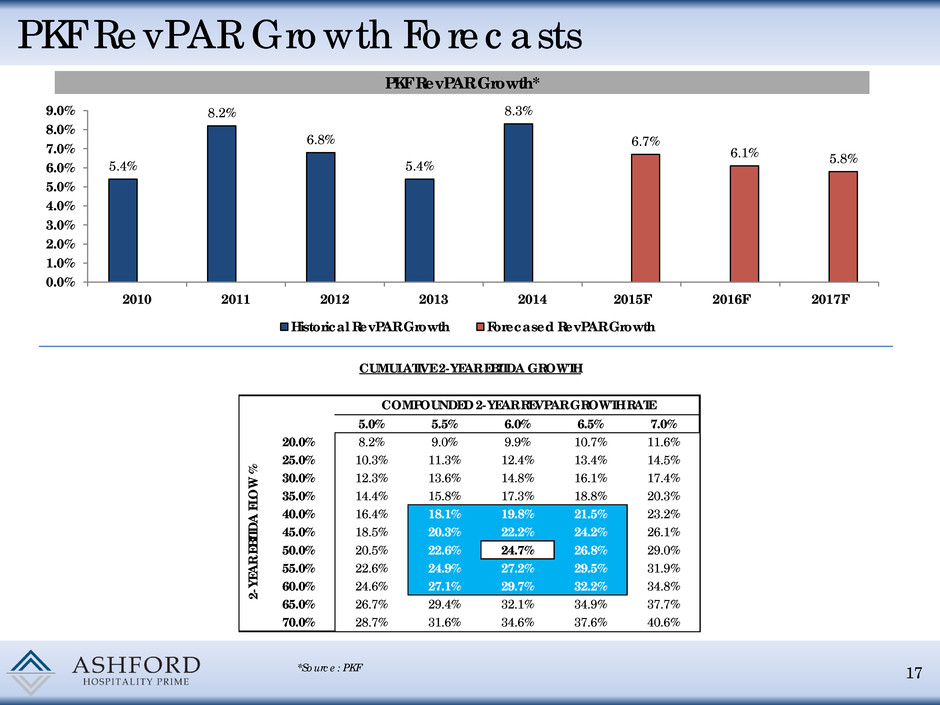

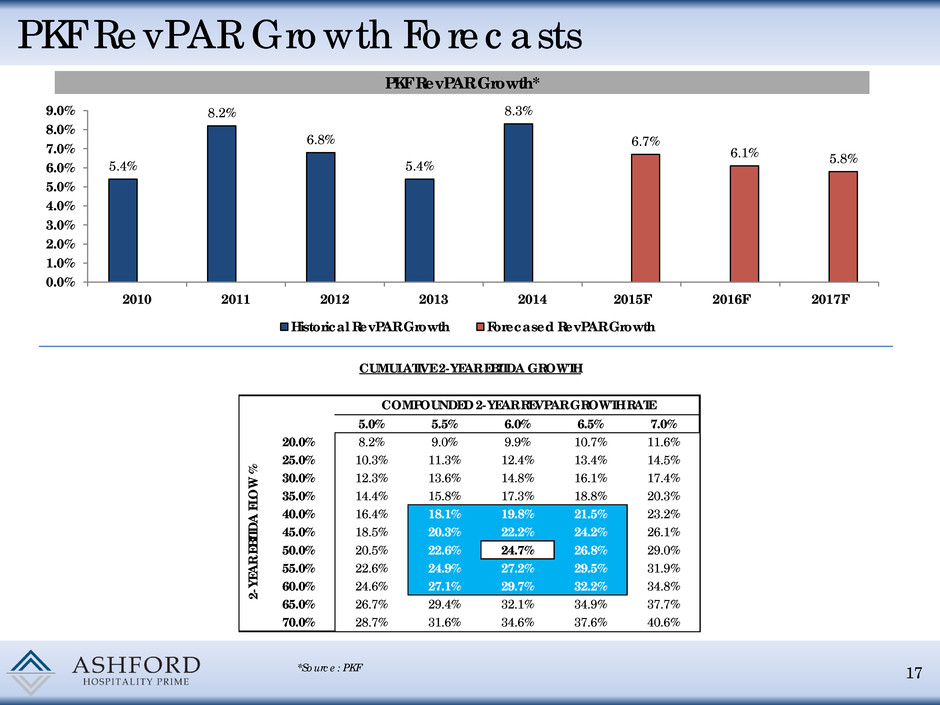

PKF RevPAR Growth Forecasts 17 PKF RevPAR Growth* *Source: PKF 5.4% 8.2% 6.8% 5.4% 8.3% 6.7% 6.1% 5.8% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 2010 2011 2012 2013 2014 2015F 2016F 2017F Historical RevPAR Growth Forecased RevPAR Growth COMPOUNDED 2-YEAR REVPAR GROWTH RATE 24.5% 5.0% 5.5% 6.0% 6.5% 7.0% 20.0% 8.2% 9.0% 9.9% 10.7% 11.6% 25.0% 10.3% 11.3% 12.4% 13.4% 14.5% 30.0% 12.3% 13.6% 14.8% 16.1% 17.4% 35.0% 14.4% 15.8% 17.3% 18.8% 20.3% 40.0% 16.4% 18.1% 19.8% 21.5% 23.2% 45.0% 18.5% 20.3% 22.2% 24.2% 26.1% 50.0% 20.5% 22.6% 24.7% 26.8% 29.0% 55.0% 22.6% 24.9% 27.2% 29.5% 31.9% 60.0% 24.6% 27.1% 29.7% 32.2% 34.8% 65.0% 26.7% 29.4% 32.1% 34.9% 37.7% 70.0% 28.7% 31.6% 34.6% 37.6% 40.6% 2- YE A R EB IT D A F LO W % CUMULATIVE 2-YEAR EBITDA GROWTH

Key Takeaways 18 High quality portfolio Simple, focused strategy on luxury hotels Focus on increasing shareholder value with review of strategic alternatives Strong industry fundamentals Strong management team with a long track record of creating shareholder value Highly-aligned platform through management structure and high insider ownership

Company Presentation – January 2016