November 2020

Forward Looking Statements and Non-GAAP Measures In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, the degree and nature of our competition, legislative and regulatory changes, including changes to the Internal Revenue Code of 1986, as amended (the “Code”), and related rules, regulations and interpretations governing the taxation of REITs; and limitations imposed on our business and our ability to satisfy complex rules in order for us to qualify as a REIT for federal income tax purposes. These and other risk factors are more fully discussed in the company's filings with the Securities and Exchange Commission. EBITDA is defined as net income (loss) before interest expense and amortization of loan costs, depreciation and amortization, income taxes, equity in (earnings) loss of unconsolidated entity and after the Company’s portion of EBITDA of OpenKey. In addition, we excluded impairment on real estate, (gain) loss on insurance settlement and disposition of assets and Company’s portion of EBITDAre of OpenKey from EBITDA to calculate EBITDA for real estate, or EBITDAre, as defined by NAREIT. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price or debt amount. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net operating income is the property's Hotel EBITDA minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC or in the appendix to this presentation. The calculation of implied equity value is derived from an estimated blended capitalization rate (“Cap Rate”) for the entire portfolio using the capitalization rate method. The estimated Cap Rate is based on recent Cap Rates of publically traded peers involving a similar blend of asset types found in the portfolio, which is then applied to Net Operating Income (“NOI”) of the company’s assets to calculate a Total Enterprise Value (“TEV”) of the company. From the TEV, we deduct debt and preferred equity and then add back working capital to derive an equity value. The capitalization rate method is one of several valuation methods for estimating asset value and implied equity value. Among the limitations of using the capitalization rate method for determining an implied equity value are that it does not take into account the potential change or variability in future cash flows, potential significant future capital expenditures, the intended hold period of the asset, or a change in the future risk profile of an asset. This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Braemar Hotels & Resorts Inc. or any of its respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security. Our business has been and will continue to be materially adversely affected by the impact of, and the public perception of a risk of, a pandemic disease. In December 2019, a novel strain of coronavirus (COVID-19) was identified in Wuhan, China, which has subsequently spread to other regions of the world, and has resulted in increased travel restrictions and extended shutdown of certain businesses in affected regions, including in nearly every state in the United States. Since late February, we have experienced a significant decline in occupancy and RevPAR and we expect the significant occupancy and RevPAR reduction associated with the novel coronavirus (COVID-19) to likely continue as we are recording significant reservation cancellations as well as a significant reduction in new reservations relative to prior expectations. The continued outbreak of the virus in the U.S. has and will likely continue to further reduce travel and demand at our hotels. The prolonged occurrence of the virus has resulted in health or other government authorities imposing widespread restrictions on travel or other market impacts. The hotel industry and our portfolio have and we expect will continue to experience the postponement or cancellation of a significant number of business conferences and similar events. At this time those restrictions are very fluid and evolving. We have been and will continue to be negatively impacted by those restrictions. Given that the type, degree and length of such restrictions are not known at this time, we cannot predict the overall impact of such restrictions on us or the overall economic environment. In addition, even after the restrictions are lifted, the propensity of people to travel and for businesses to hold conferences will likely remain below historical levels for an additional period of time that is difficult to predict. We may also face increased risk of litigation if we have guests or employees who become ill due to COVID-19. As such, the impact these restrictions may have on our financial position, operating results and liquidity cannot be reasonably estimated at this time, but the impact will likely be material. Additionally, the public perception of a risk of a pandemic or media coverage of these diseases, or public perception of health risks linked to perceived regional food and beverage safety has materially further adversely affected us by reducing demand for our hotels. Currently, no vaccines have been developed, and there can be no assurance that an effective vaccine can be discovered in time to protect against a potential pandemic. These events have resulted in a sustained, significant drop in demand for our hotels and could have a material adverse effect on us. Prior to investing in Braemar, potential investors should carefully review Braemar’s periodic filings with the Securities and Exchange Commission, including, but not limited to, Braemar’s most current Form 10-K, Form 10-Q and Form 8-K’s, including the risk factors included therein. Company Presentation | November 2020 2

Management Team RICHARD J. STOCKTON DERIC S. EUBANKS, CFA JEREMY J. WELTER Chief Executive Officer & Chief Financial Officer Chief Operating Officer President . 23 years of hospitality . 20 years of hospitality . 15 years of hospitality experience experience experience . 4 years with the Company . 17 years with the Company . 10 years with the Company (5 years with the Company’s . 15 years with Morgan Stanley . 3 years with ClubCorp predecessor) Cornell School of Hotel CFA charterholder . . . 5 years with Stephens Administration BS . Southern Methodist University Investment Bank . University of Pennsylvania BBA . Oklahoma State University BS MBA Company Presentation | November 2020 3

Post COVID-19 Strategic Initiatives Conserve Liquidity Manage the Balance Sheet Return to Profitability Grow the Portfolio The Ritz-Carlton Sarasota Sarasota, FL Company Presentation | November 2020 4

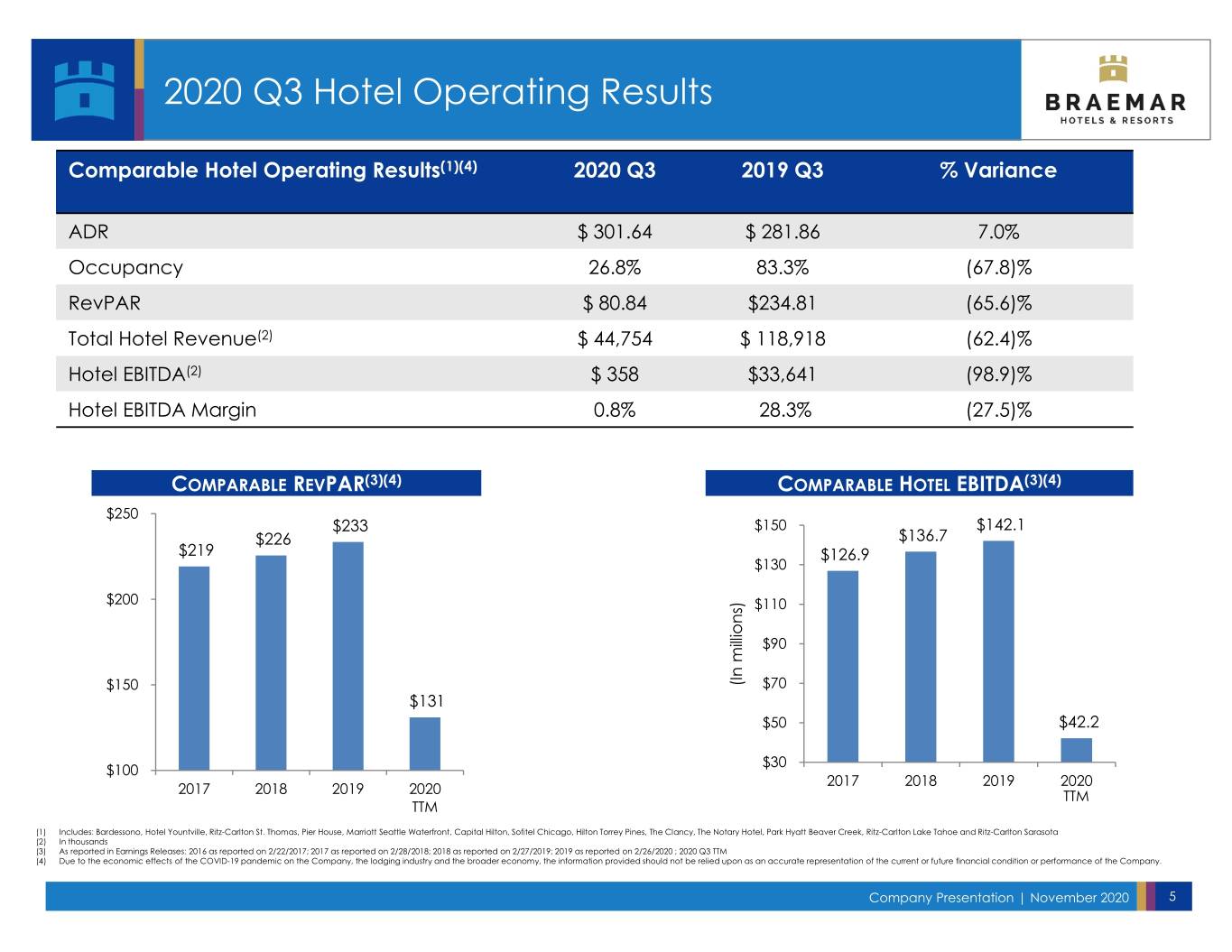

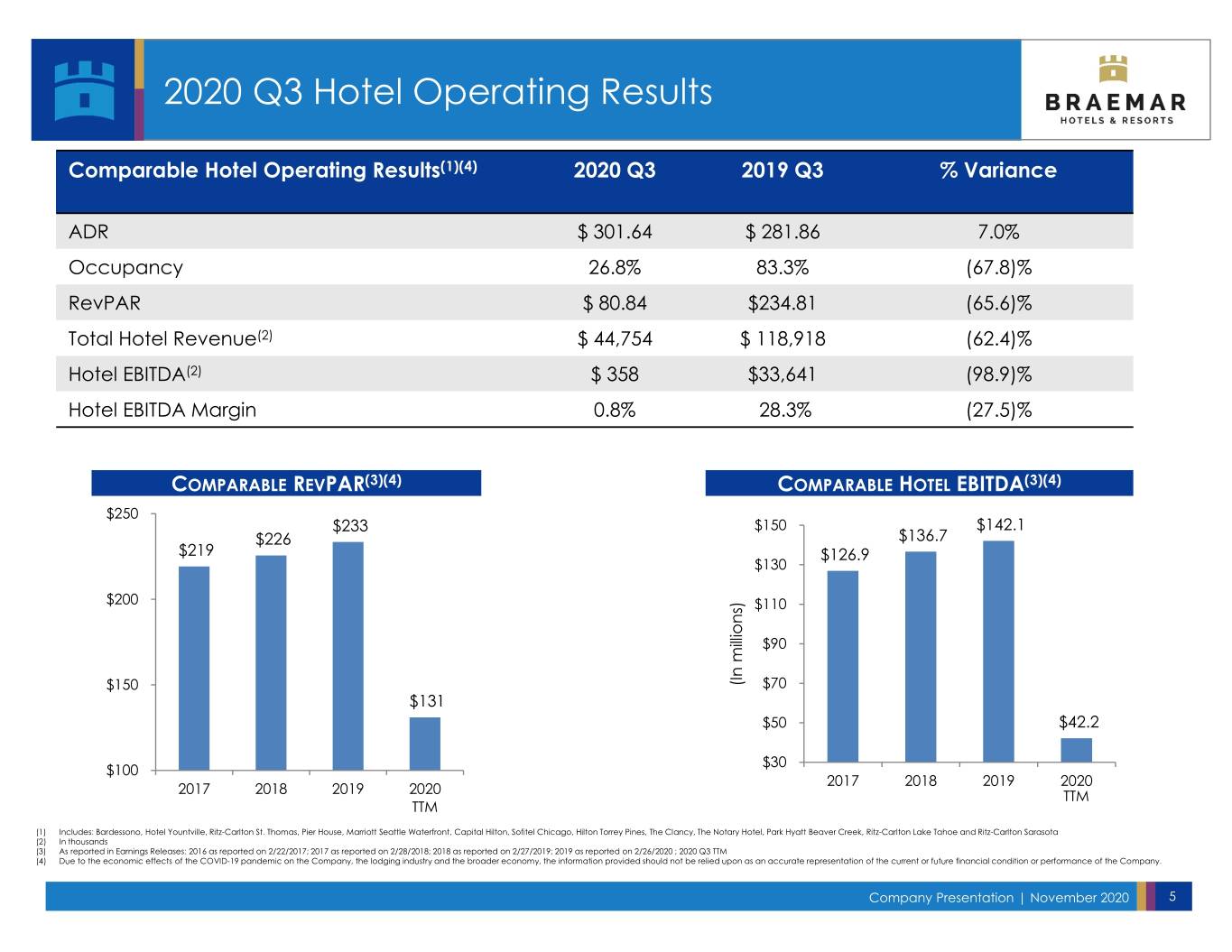

2020 Q3 Hotel Operating Results Comparable Hotel Operating Results(1)(4) 2020 Q3 2019 Q3 % Variance ADR $ 301.64 $ 281.86 7.0% Occupancy 26.8% 83.3% (67.8)% RevPAR $ 80.84 $234.81 (65.6)% Total Hotel Revenue(2) $ 44,754 $ 118,918 (62.4)% Hotel EBITDA(2) $ 358 $33,641 (98.9)% Hotel EBITDA Margin 0.8% 28.3% (27.5)% COMPARABLE REVPAR(3)(4) COMPARABLE HOTEL EBITDA(3)(4) $250 $233 $150 $142.1 $226 $136.7 $219 $126.9 $130 $200 $110 $90 $150 millions) (In $70 $131 $50 $42.2 $30 $100 2017 2018 2019 2020 2017 2018 2019 2020 TTM TTM (1) Includes: Bardessono, Hotel Yountville, Ritz-Carlton St. Thomas, Pier House, Marriott Seattle Waterfront, Capital Hilton, Sofitel Chicago, Hilton Torrey Pines, The Clancy, The Notary Hotel, Park Hyatt Beaver Creek, Ritz-Carlton Lake Tahoe and Ritz-Carlton Sarasota (2) In thousands (3) As reported in Earnings Releases: 2016 as reported on 2/22/2017; 2017 as reported on 2/28/2018; 2018 as reported on 2/27/2019; 2019 as reported on 2/26/2020 ; 2020 Q3 TTM (4) Due to the economic effects of the COVID-19 pandemic on the Company, the lodging industry and the broader economy, the information provided should not be relied upon as an accurate representation of the current or future financial condition or performance of the Company. Company Presentation | November 2020 5

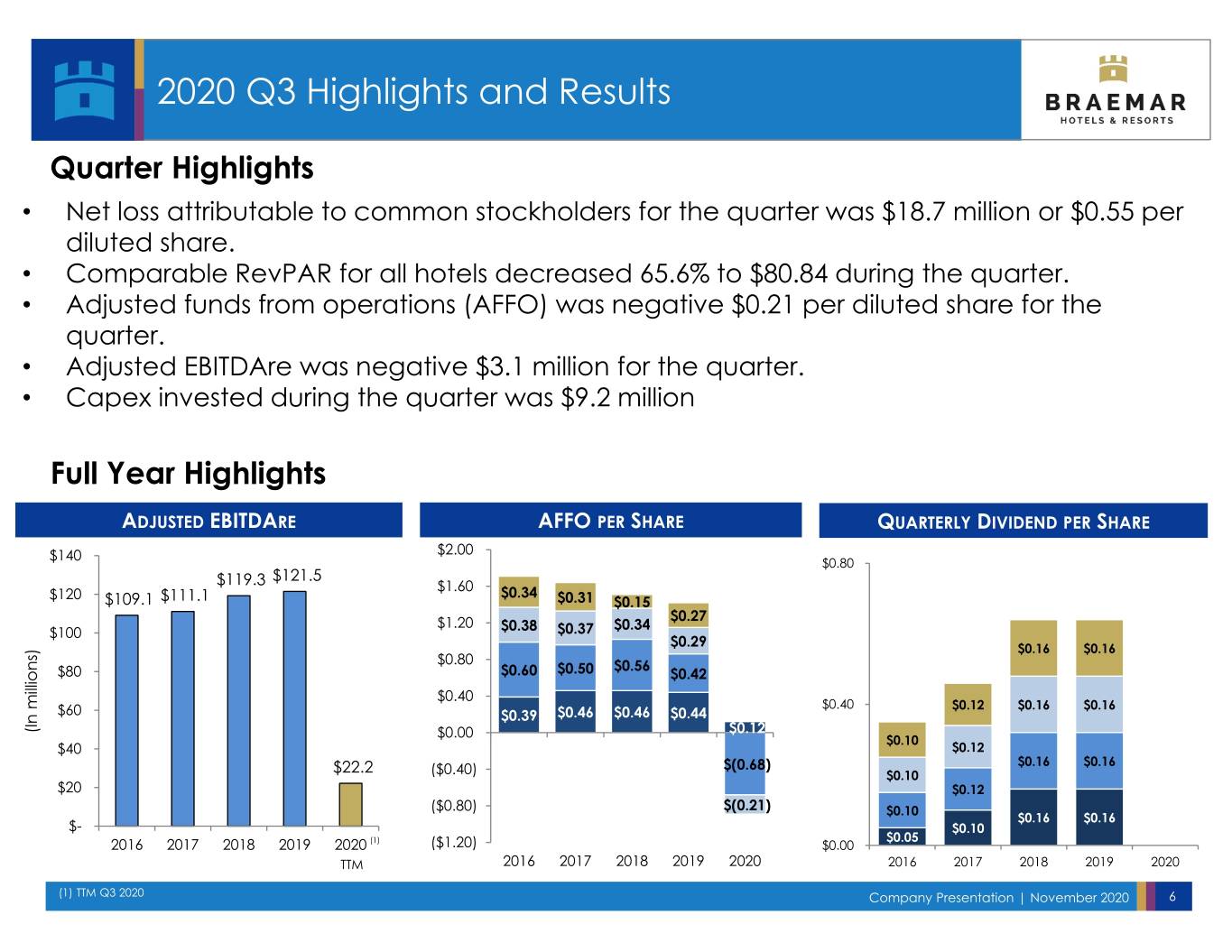

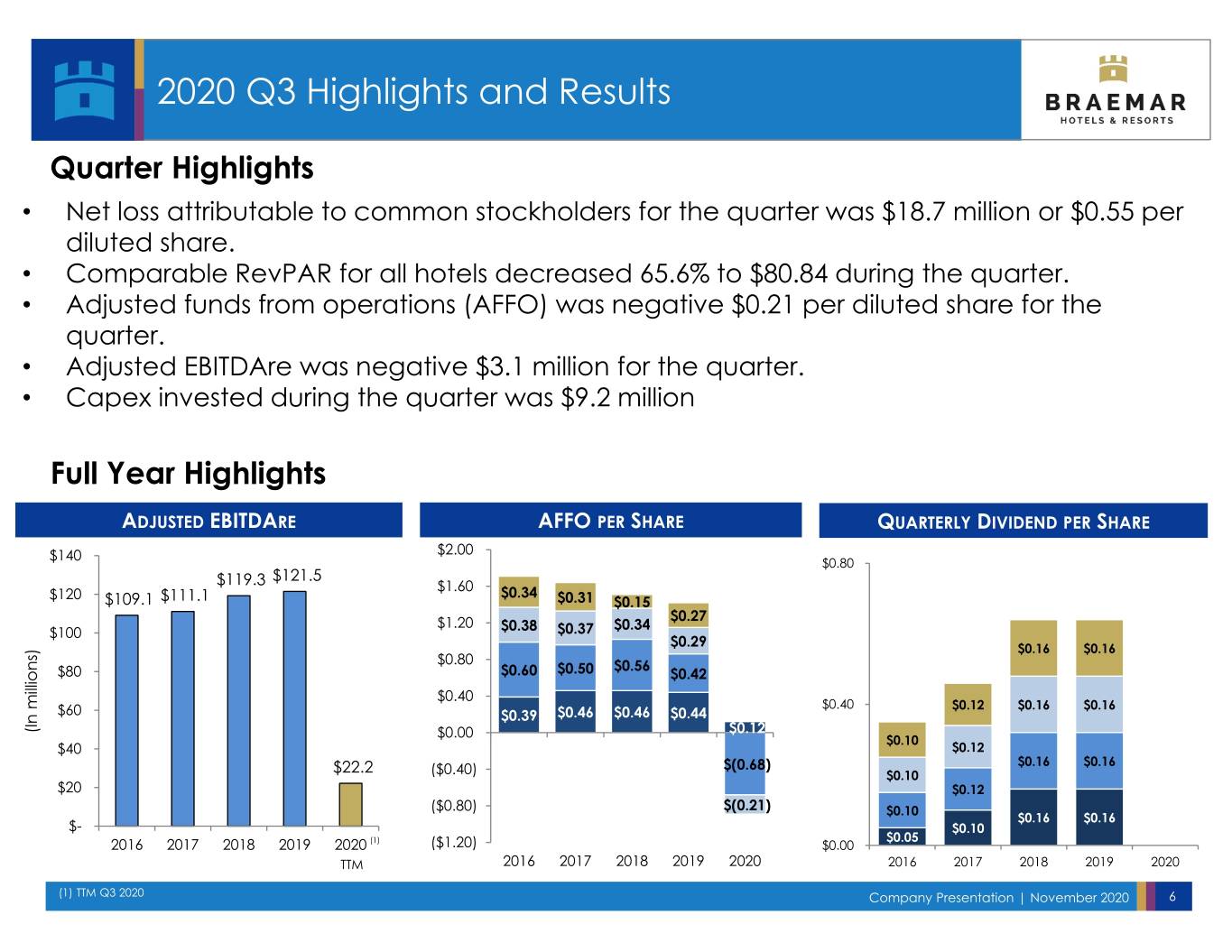

2020 Q3 Highlights and Results Quarter Highlights • Net loss attributable to common stockholders for the quarter was $18.7 million or $0.55 per diluted share. • Comparable RevPAR for all hotels decreased 65.6% to $80.84 during the quarter. • Adjusted funds from operations (AFFO) was negative $0.21 per diluted share for the quarter. • Adjusted EBITDAre was negative $3.1 million for the quarter. • Capex invested during the quarter was $9.2 million Full Year Highlights ADJUSTED EBITDARE AFFO PER SHARE QUARTERLY DIVIDEND PER SHARE $140 $2.00 $0.80 $121.5 $119.3 $1.60 $120 $0.34 $109.1 $111.1 $0.31 $0.15 $0.27 $1.20 $0.38 $0.34 $100 $0.37 $0.29 $0.16 $0.16 $0.80 $0.56 $80 $0.60 $0.50 $0.42 $0.40 $0.40 $0.12 $0.16 $0.16 $60 $0.39 $0.46 $0.46 $0.44 (In millions) (In $0.00 $0.12 $0.10 $40 $0.12 $22.2 $(0.68) $0.16 $0.16 ($0.40) $0.10 $20 $0.12 ($0.80) $(0.21) $0.10 $0.16 $0.16 $- $0.10 $0.05 2016 2017 2018 2019 2020 (1) ($1.20) $0.00 TTM 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 (1) TTM Q3 2020 Company Presentation | November 2020 6

High Quality Assets Situated in High Barriers to Entry Leisure and Urban Markets Hotel Yountville The Ritz-Carlton Lake Tahoe Marriott Seattle Waterfront Sofitel Chicago Magnificent Mile The Notary Hotel Yountville, CA Truckee, CA Seattle, WA Chicago, IL Philadelphia, PA Bardessono Hotel & Spa Capital Hilton Yountville, CA Washington, D.C. The Clancy San Francisco, CA The Ritz-Carlton Sarasota Sarasota, FL Pier House Resort Key West, FL Hilton La Jolla Torrey Pines Park Hyatt Beaver Creek Pier House Resort & Spa The Ritz-Carlton St. Thomas La Jolla, CA Beaver Creek, CO Key West, FL St. Thomas, USVI Company Presentation | November 2020 7

Portfolio Detail Portfolio Status Q3 2020 Core Assets Location Market Type Number of Rooms Occ% ADR RevPAR Bardessono Napa Valley, CA Drive-to Leisure 65 51.5% $879.12 $452.50 Ritz-Carlton Lake Tahoe Truckee, CA Drive-to Leisure 170 58.8% $457.60 $268.91 Hotel Yountville Napa Valley, CA Drive-to Leisure 80 35.7% $624.27 $222.99 Ritz-Carlton St. Thomas St. Thomas, USVI Fly-to Leisure 180 39.6% $556.10 $219.95 Ritz-Carlton Sarasota Sarasota, FL Drive-to Leisure 266 55.0% $350.45 $192.64 Pier House Key West, FL Drive-to Leisure 142 57.0% $321.12 $182.88 Park Hyatt Beaver Creek Beaver Creek, CO Drive-to Leisure 190 34.7% $277.89 $96.54 Hilton Torrey Pines La Jolla, CA Drive-to Leisure 394 48.5% $143.02 $69.32 Sofitel Chicago Magnificent Mile Chicago, IL Urban 415 29.4% $151.79 $44.69 Marriott Seattle Waterfront Seattle, WA Urban 361 16.3% $195.33 $31.81 The Notary Hotel Philadelphia, PA Urban 499 14.1% $167.61 $23.69 Capital Hilton Washington, D.C. Urban 550 5.2% $124.81 $6.53 The Clancy San Francisco, CA Urban 410 -- -- $0.02 Total Portfolio 3,722 26.8% $301.64 $80.84 Company Presentation | November 2020 8

EBITDA Contribution by Brand and Class 2020 Q3 TTM Hotel EBITDA by Brand(1) 2020 Q3 TTM Hotel EBITDA by Class(1) 75% 100% Ritz-Carlton Luxury 50% 80% 50% 80% Independent Park Hyatt 60% 25% Marriott/ 25% 12% Autograph Hilton 10% 10% 40% Upper Upscale 0% 20% 20% Sofitel -8% -25% 0% 2020 Q3 TTM Room Revenue(1) 2020 Q3 TTM Rooms Revenue by Location(1) 1% 23% 38% Transient Urban Group Resort Contract 62% 76% (1) Comparable TTM as of 09/30/2020, see appendix for a reconciliation of TTM hotel net income (loss) to hotel TTM EBITDA Company Presentation | November 2020 9

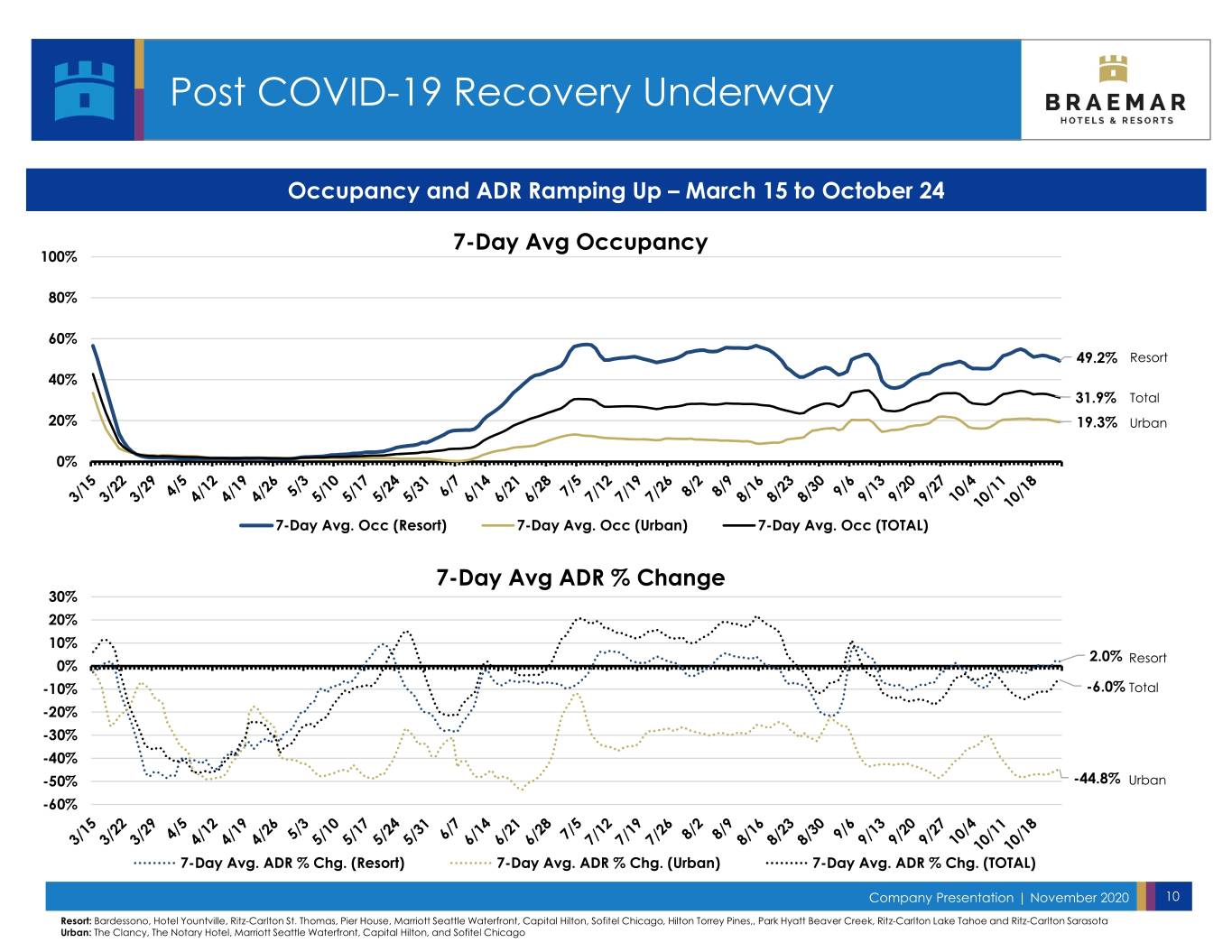

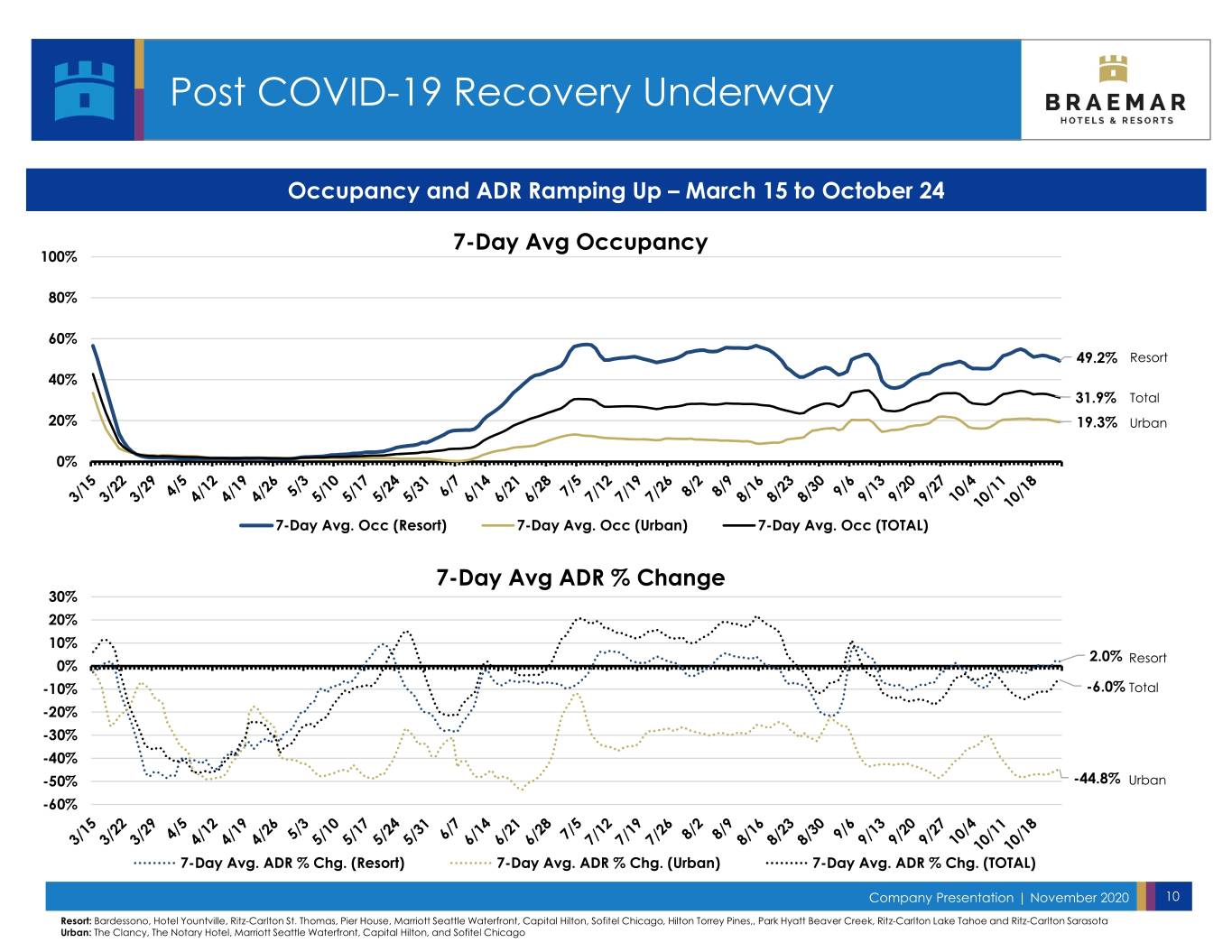

Post COVID-19 Recovery Underway Occupancy and ADR Ramping Up – March 15 to October 24 7-Day Avg Occupancy 100% 80% 60% 49.2% Resort 40% 31.9% Total 20% 19.3% Urban 0% 7-Day Avg. Occ (Resort) 7-Day Avg. Occ (Urban) 7-Day Avg. Occ (TOTAL) 7-Day Avg ADR % Change 30% 20% 10% 2.0% Resort 0% -10% -6.0% Total -20% -30% -40% -50% -44.8% Urban -60% 7-Day Avg. ADR % Chg. (Resort) 7-Day Avg. ADR % Chg. (Urban) 7-Day Avg. ADR % Chg. (TOTAL) Company Presentation | November 2020 10 Resort: Bardessono, Hotel Yountville, Ritz-Carlton St. Thomas, Pier House, Marriott Seattle Waterfront, Capital Hilton, Sofitel Chicago, Hilton Torrey Pines,, Park Hyatt Beaver Creek, Ritz-Carlton Lake Tahoe and Ritz-Carlton Sarasota Urban: The Clancy, The Notary Hotel, Marriott Seattle Waterfront, Capital Hilton, and Sofitel Chicago

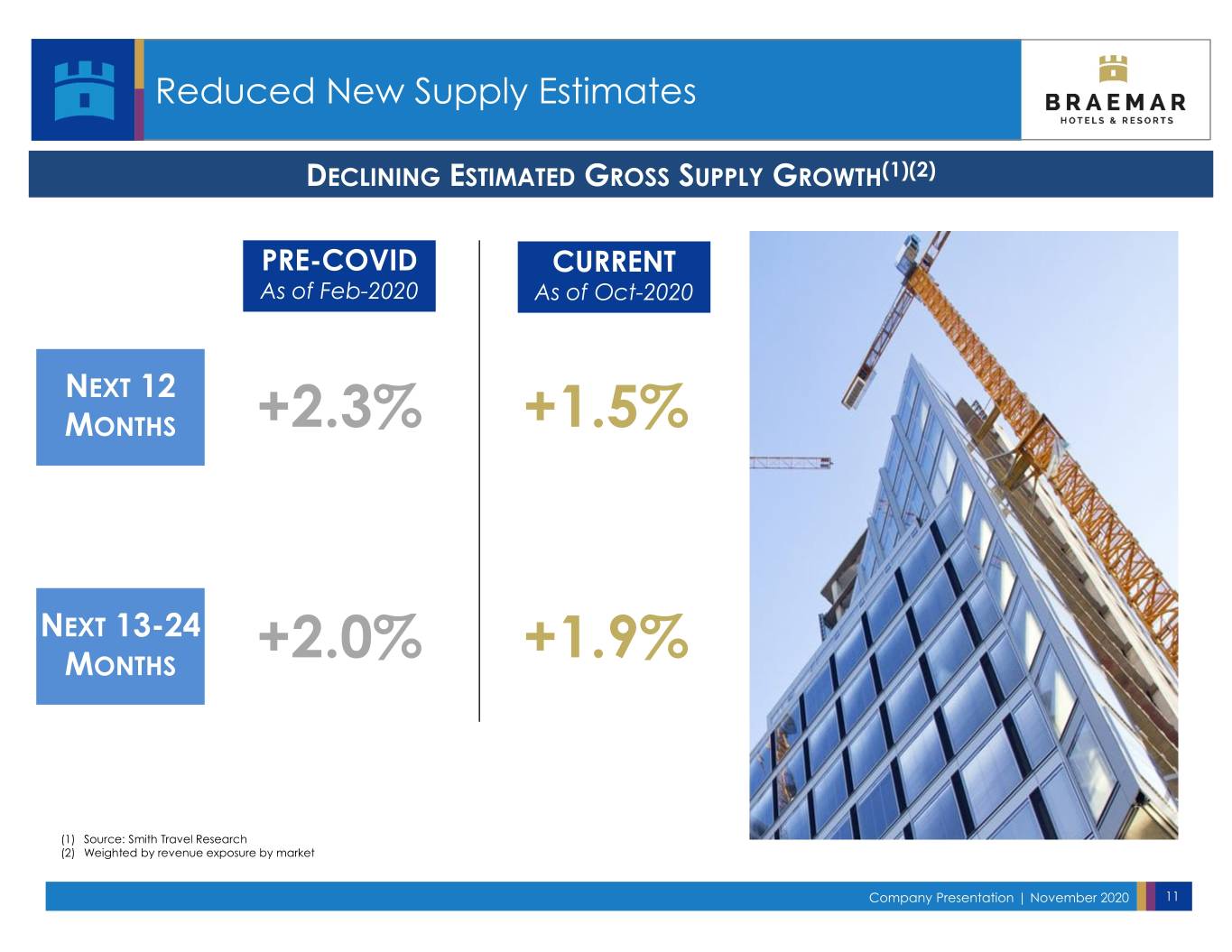

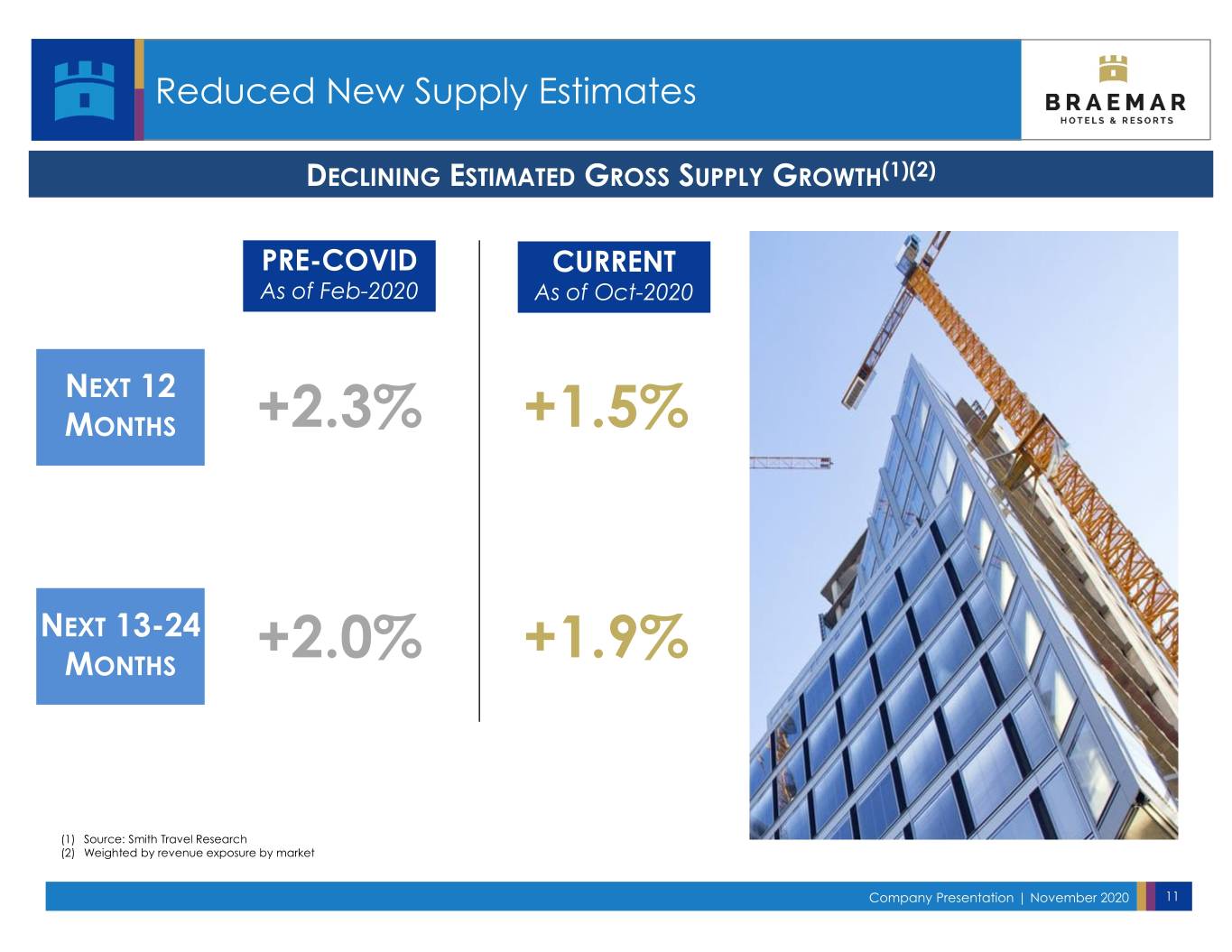

Reduced New Supply Estimates DECLINING ESTIMATED GROSS SUPPLY GROWTH(1)(2) PRE-COVID CURRENT As of Feb-2020 As of Oct-2020 NEXT 12 MONTHS +2.3% +1.5% NEXT 13-24 MONTHS +2.0% +1.9% (1) Source: Smith Travel Research (2) Weighted by revenue exposure by market Company Presentation | November 2020 11

Current Liquidity(1) CASH POSITION CASH & CASH EQUIVALENTS $88.2M RESTRICTED CASH $34.7M TOTAL CASH $122.9M MONTHLY CASH UTILIZATION 73% 44% PROPERTY CASH CAD AFFO BURN ~$0M PAYOUT RATIO(3) PAYOUT RATIO(1)(3) INTEREST EXPENSE, G&A, AND ADVISORY FEES $5M Company Presentation | November 2020 12 (1) As of 09/30/20

Leverage Strategy Well Designed to Handle Pandemic Impact Target Leverage Overview Gross Hold 10% of Gross Debt Balance as cash on Assets the balance sheet Non-recourse debt lowers risk profile 45% Floating-rate debt provides a natural hedge to hotel cash flows and maximizes flexibility in all economic environments Net Debt Proactive strategy to opportunistically refinance loans and extend maturities Long-standing lender relationships 1 The use of debtGross potentially Assets increases BHR’s returns, Net Debtas well as the risk associated with the investment Company Presentation | November 2020 13

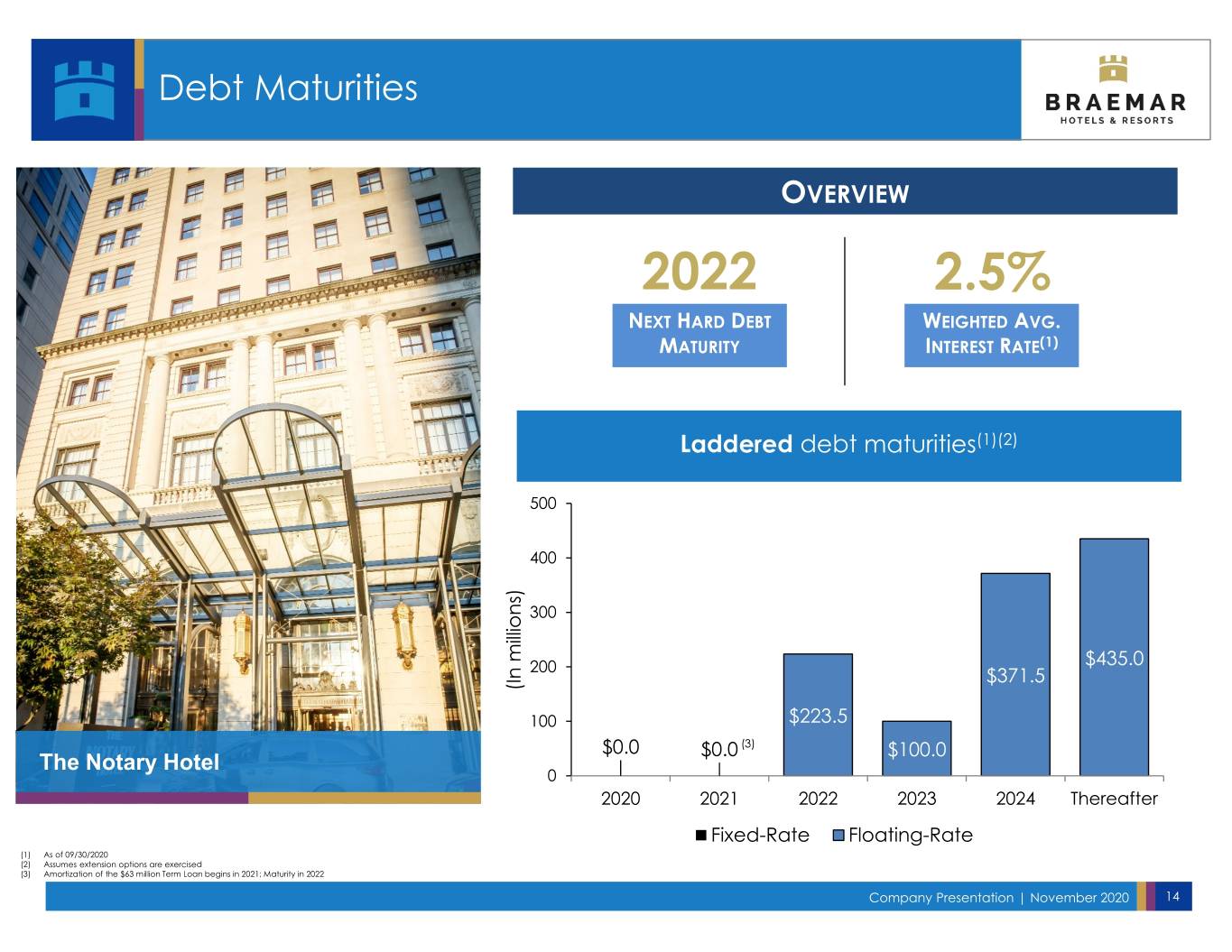

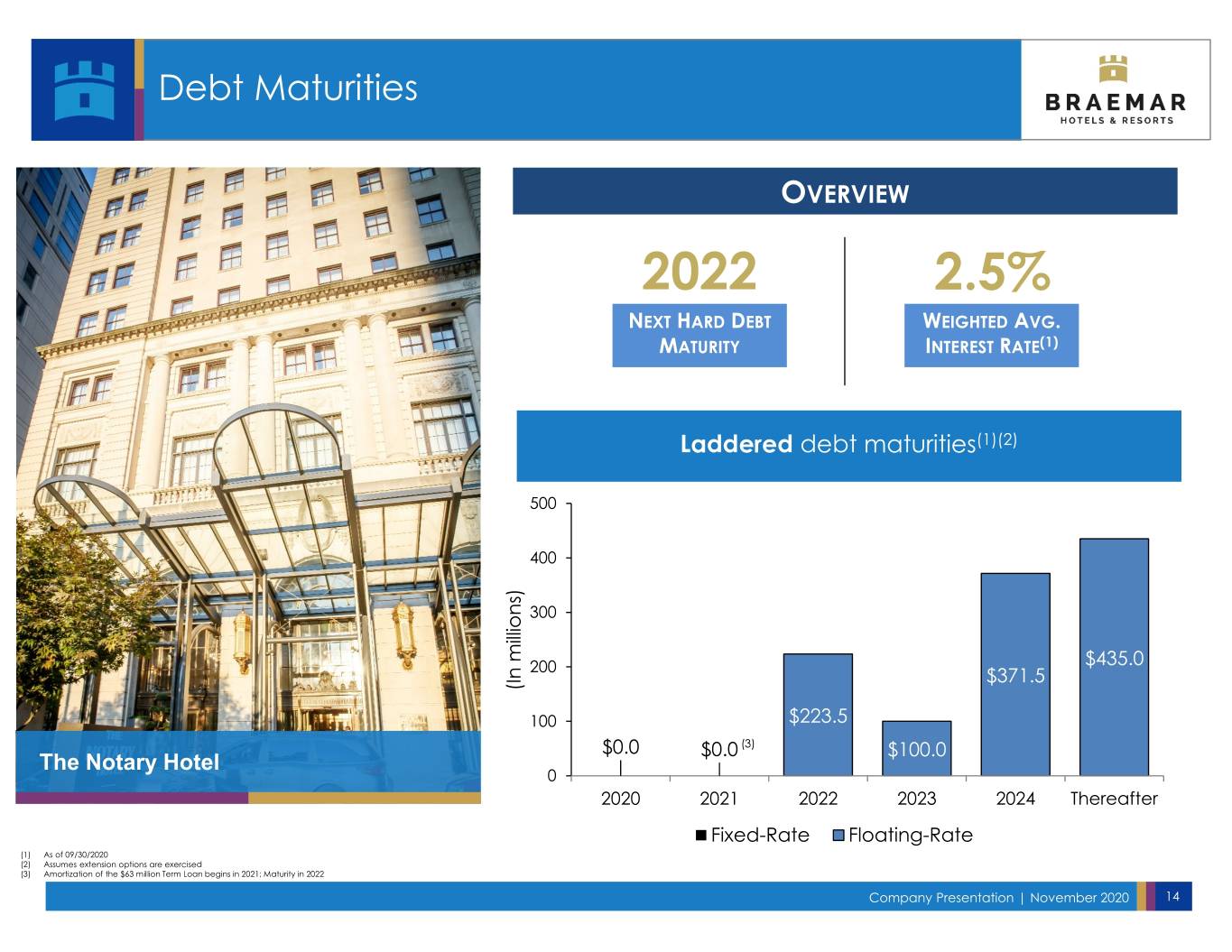

Debt Maturities OVERVIEW 2022 2.5% NEXT HARD DEBT WEIGHTED AVG. MATURITY INTEREST RATE(1) Laddered debt maturities(1)(2) 500 400 300 $435.0 200 $371.5 (In millions) 100 $223.5 $0.0 $0.0 (3) $100.0 The Notary Hotel 0 2020 2021 2022 2023 2024 Thereafter Fixed-Rate Floating-Rate (1) As of 09/30/2020 (2) Assumes extension options are exercised (3) Amortization of the $63 million Term Loan begins in 2021; Maturity in 2022 Company Presentation | November 2020 14

Portfolio Well Positioned for Ramp Up Strategic Initiatives Position Braemar for Ramp Up in 2021 Beach Improvement Villa Construction Completed 2019 Completed 2019 Ritz-Carlton Sarasota Bardessono Hotel & Spa Autograph Conversion Hurricane Recovery Completed 2019 Completed 2019 Ritz-Carlton St. The Notary Hotel Thomas Lobby Renovation Autograph Conversion Completed 2019 Completed Q3 2020 Park Hyatt Beaver Creek The Clancy Company Presentation | November 2020 15

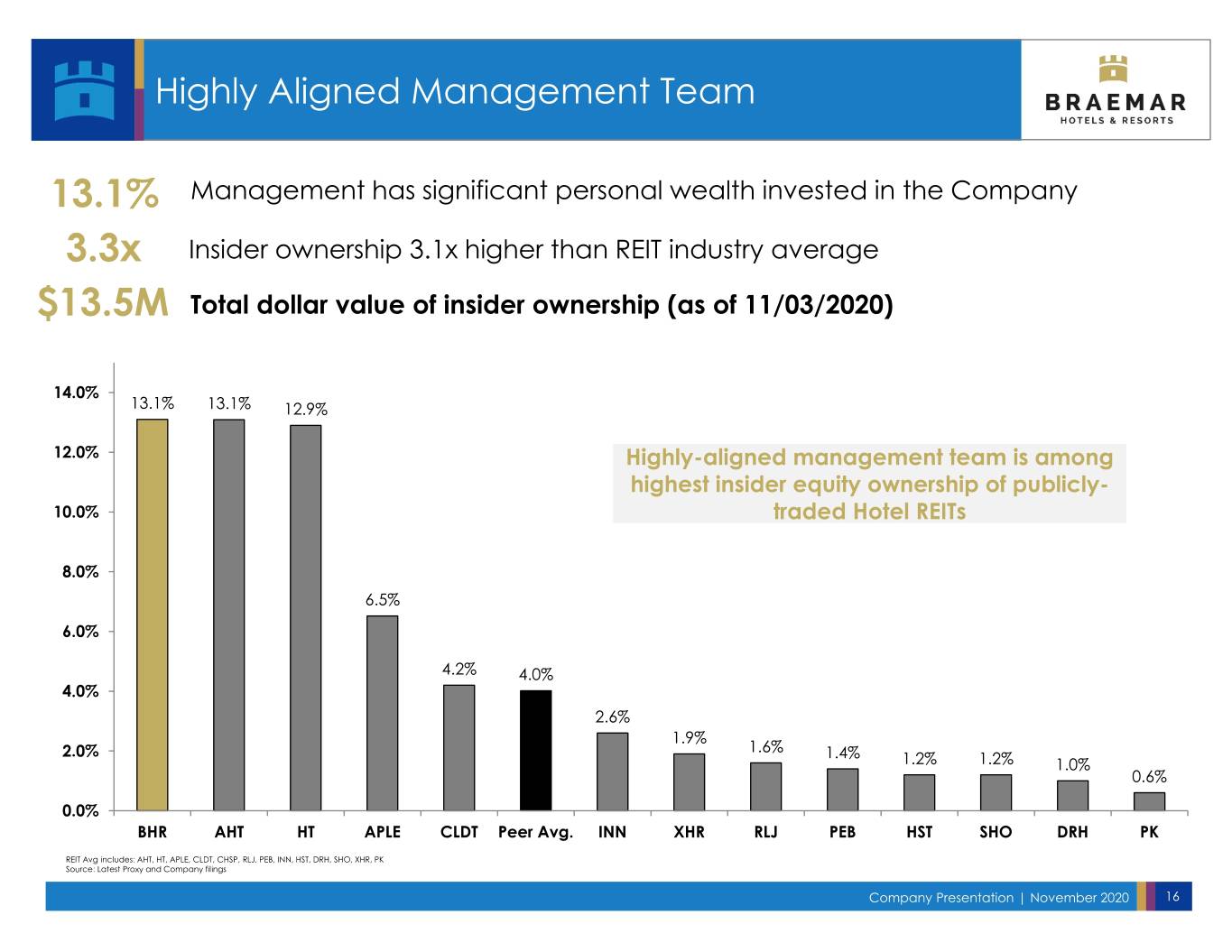

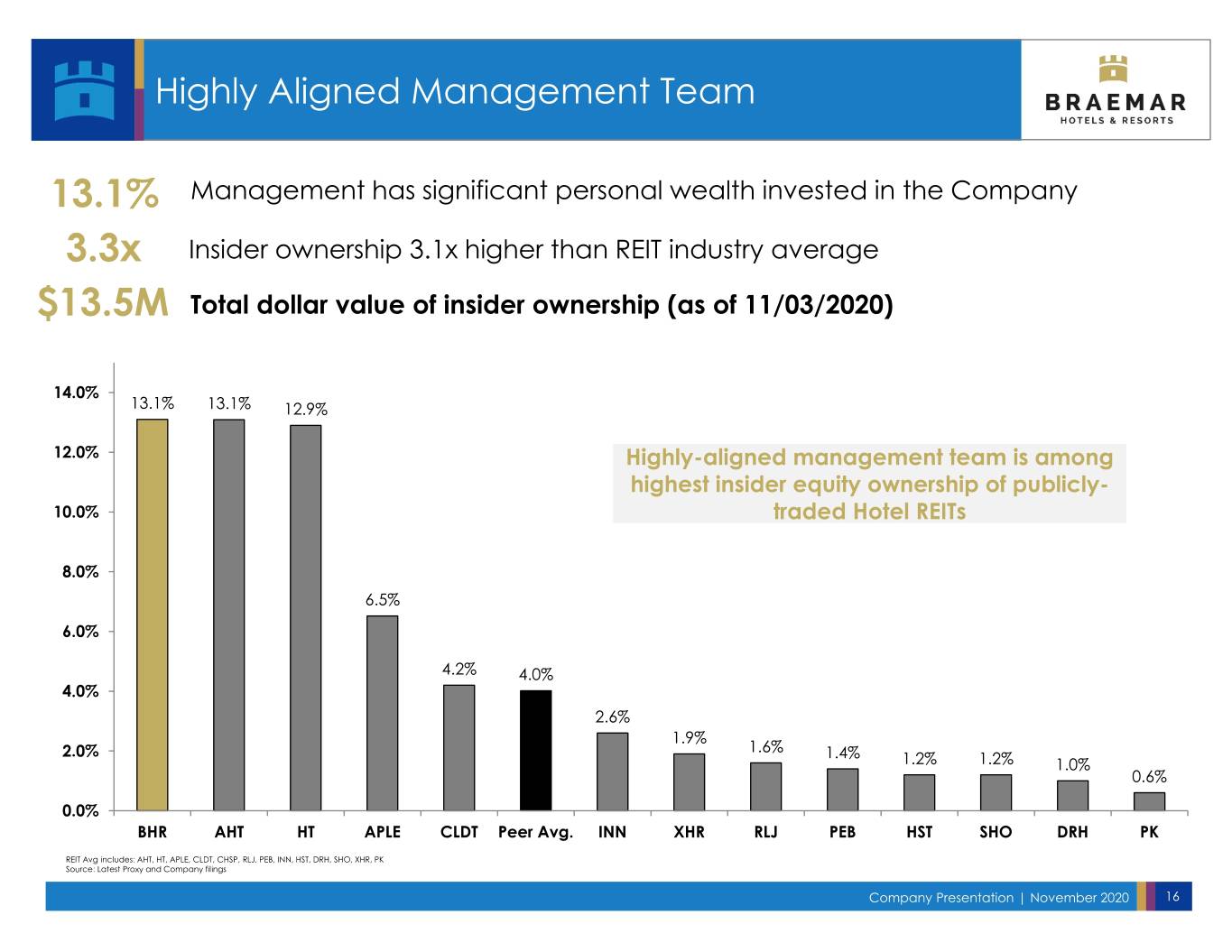

Highly Aligned Management Team 13.1% Management has significant personal wealth invested in the Company 3.3x Insider ownership 3.1x higher than REIT industry average $13.5M Total dollar value of insider ownership (as of 11/03/2020) 14.0% 13.1% 13.1% 12.9% 12.0% Highly-aligned management team is among highest insider equity ownership of publicly- 10.0% traded Hotel REITs 8.0% 6.5% 6.0% 4.2% 4.0% 4.0% 2.6% 1.9% 2.0% 1.6% 1.4% 1.2% 1.2% 1.0% 0.6% 0.0% BHR AHT HT APLE CLDT Peer Avg. INN XHR RLJ PEB HST SHO DRH PK REIT Avg includes: AHT, HT, APLE, CLDT, CHSP, RLJ, PEB, INN, HST, DRH, SHO, XHR, PK Source: Latest Proxy and Company filings Company Presentation | November 2020 16

Key Takeaways Conserve Liquidity Manage the Balance Sheet Return to Profitability Grow the Portfolio The Ritz-Carlton Sarasota Sarasota, FL Company Presentation | November 2020 17

Appendix

Reconciliation of Net Income (Loss) to Comparable Hotel EBITDA In thousands Three Months Ended Three Months Ended Three Months Ended Three Months Ended TTM Ended September 30, 2020 June 30, 2020 March 31, 2020 December 31, 2019 September 30, 2020 Net income (loss) $ (10,815) $ (38,076) $ (1,459) $ 31,806 $ (18,544) Non-property adjustments (10,149) 813 - (26,320) (35,656) Interest income (10) (18) (62) (69) (159) Interest expense 2,463 4,570 4,906 5,210 17,149 Amortization of loan cost 297 287 282 309 1,175 Depreciation and amortization 18,507 18,553 18,338 18,310 73,708 Income tax expense (benefit) 8 (804) 335 (173) (634) Non-hotel EBITDA ownership expense 57 (1,129) 4,970 1,277 5,175 Hotel EBITDA including amounts attributable to noncontrolling interest 358 (15,804) 27,310 30,350 42,214 Less: EBITDA adjustments attributable to consolidated noncontrolling interest 338 1,084 (957) (1,520) (1,055) Hotel EBITDA attributable to the Company and OP unitholders $ 696 $ (14,720) $ 26,353 $ 28,830 $ 41,159 Non-comparable adjustments - - - (44) (44) Comparable hotel EBITDA $ 358 $ (15,804) $ 27,310 $ 30,306 $ 42,170 Three Months Ended September 30, 2019 Net income (loss) $ 9,410 Non-property adjustments 1,441 Interest income (79) Interest expense 4,829 Amortization of loan cost 229 Depreciation and amortization 16,831 Income tax expense (benefit) (78) Non-hotel EBITDA ownership expense 1,048 Hotel EBITDA including amounts attributable to noncontrolling interest 33,631 Less: EBITDA adjustments attributable to consolidated noncontrolling interest (1,545) Hotel EBITDA attributable to the Company and OP unitholders $ 32,086 Non-comparable adjustments 10 Comparable hotel EBITDA $ 33,641 Company Presentation | November 2020 19

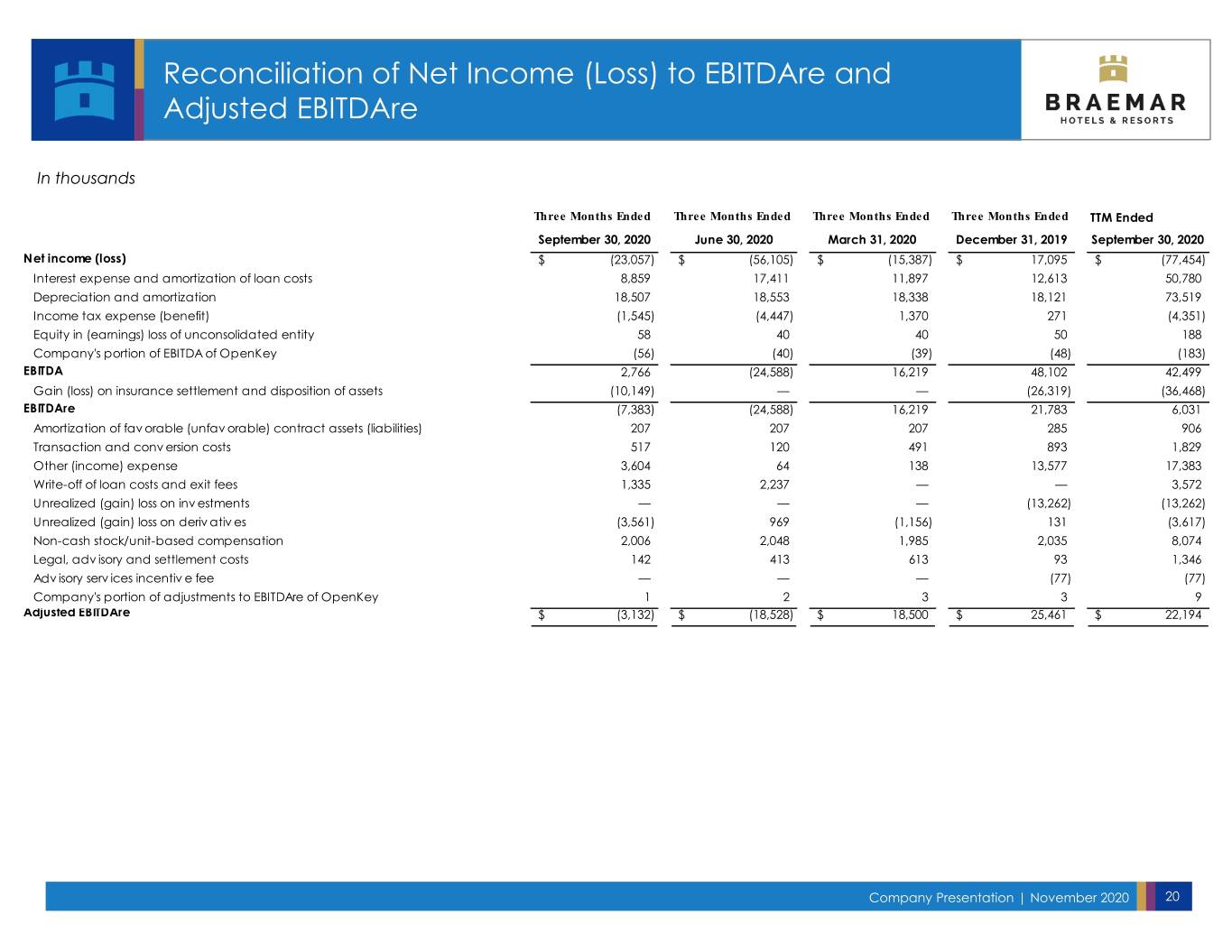

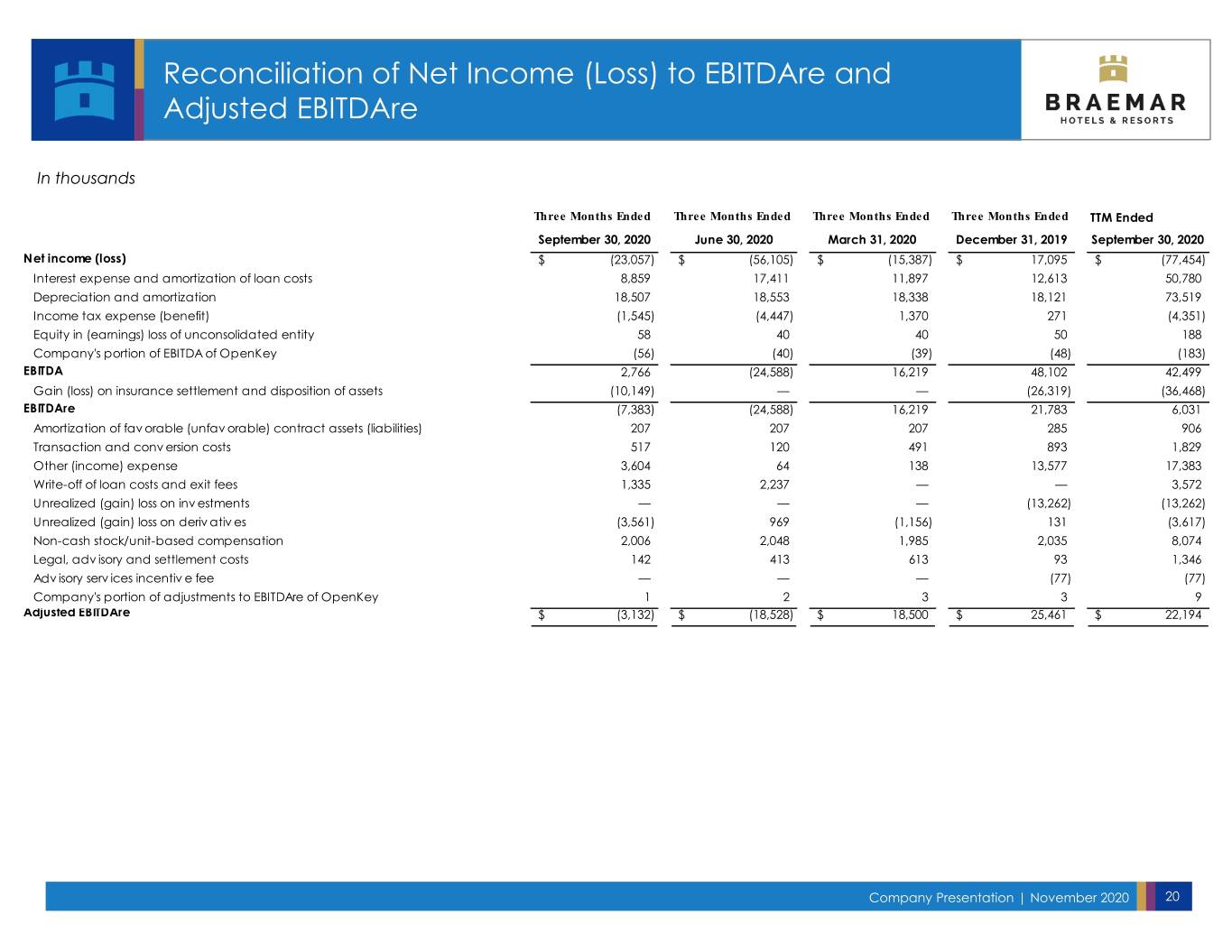

Reconciliation of Net Income (Loss) to EBITDAre and Adjusted EBITDAre In thousands Three Months Ended Three Months Ended Three Months Ended Three Months Ended TTM Ended September 30, 2020 June 30, 2020 March 31, 2020 December 31, 2019 September 30, 2020 Net income (loss) $ (23,057) $ (56,105) $ (15,387) $ 17,095 $ ( 77,454) Interest expense and amortization of loan costs 8,859 17,411 11,897 12,613 50,780 Depreciation and amortization 18,507 18,553 18,338 18,121 73,519 Income tax expense (benefit) (1,545) (4,447) 1,370 271 (4,351) Equity in (earnings) loss of unconsolidated entity 58 40 40 50 188 Company's portion of EBITDA of OpenKey (56) (40) (39) (48) (183) EBITDA 2,766 (24,588) 16,219 48,102 42,499 Gain (loss) on insurance settlement and disposition of assets (10,149) ——(26,319) (36,468) EBITDAre (7,383) (24,588) 16,219 21,783 6,031 Amortization of fav orable (unfav orable) contract assets (liabilities) 207 207 207 285 906 Transaction and conv ersion costs 517 120 491 893 1,829 Other (income) expense 3,604 64 138 13,577 17,383 Write-off of loan costs and exit fees 1,335 2,237 — — 3,572 Unrealized (gain) loss on inv estments ———(13,262) (13,262) Unrealized (gain) loss on deriv ativ es (3,561) 969 (1,156) 131 (3,617) Non-cash stock/unit-based compensation 2,006 2,048 1,985 2,035 8,074 Legal, adv isory and settlement costs 142 413 613 93 1,346 Adv isory serv ices incentiv e fee ———(77) (77) Company's portion of adjustments to EBITDAre of OpenKey 12339 Adjusted EBITDAre $ (3,132) $ (18,528) $ 18,500 $ 25,461 $ 22,194 Company Presentation | November 2020 20

Reconciliation of Net Income (Loss) to Adjusted FFO In thousands Three Months Ended Three Months Ended Three Months Ended Three Months Ended TTM Ended September 30, 2020 June 30, 2020 March 31, 2020 December 31, 2019 September 30, 2020 Net income (loss) $ (23,057) $ (56,105) $ (15,387) $ 17,095 $ (77,454) (Income) loss from consolidated entities attributable to noncontrolling interest 1,999 2,404 572 (282) 4,693 Net (income) loss attributable to redeemable noncontrolling interests in operating partnership 2,381 5,770 1,885 (1,563) 8,473 Preferred div idends (2,554) (2,555) (2,555) (2,545) (10,209) Net income (loss) attributable to common stockholders (21,231) (50,486) (15,485) 12,705 (74,497) Depreciation and amortization on real estate 17,791 17,792 17,559 17,324 70,466 Net income (loss) attributable to redeemable noncontrolling interests in operating partnership (2,381) (5,770) (1,885) 1,563 (8,473) Equity in (earnings) loss of unconsolidated entities 58 40 40 50 188 (Gain) loss on insurance settlement and dispostion of assets (10,149) - - (26,319) (36,468) Company's portion of FFO of OpenKey (57) (40) (40) (50) (187) FFO available to common stockholders and OP unitholders (15,969) (38,464) 189 5,273 (48,971) Series B Cumulative Convertible Preferred Stock dividends 1,729 1,730 1,730 1,720 6,909 Transaction and conversion costs 517 120 491 893 1,829 Other (income) expense 3,604 64 138 13,577 17,383 Interest expense accretion on refundable membership club deposits 201 202 213 213 829 Write-off of loan costs and exit fees 1,335 2,237 - - 3,572 Amortization of loan costs 670 928 1,053 1,076 3,727 Unrealized (gain) loss on investments - - - (13,262) (13,262) Unrealized (gain) loss on deriv atives (3,561) 969 (1,156) 131 (3,617) Non-cash stock/unit-based compensation 2,006 2,048 1,985 2,035 8,074 Legal, advisory and settlement costs 142 413 613 93 1,346 Advisory services incentive fee - - - (77) (77) Company's portion of adjustments to FFO of OpenKey 1 2 3 4 10 Adjusted FFO available to the common stockholders and OP unitholders $ (9,325) $ (29,751) $ 5,259 $ 11,676 $ (22,248) Company Presentation | November 2020 21

Indebtedness In thousands (1) LIBOR rates were 0.148% and 1.763% at September 30, 2020 and December 31, 2019, respectively. (2) Base Rate, as defined in the secured term loan agreement, is the greater of (i) the prime rate set by Bank of America, or (ii) federal funds rate + 0.5%, or (iii) LIBOR + 1.0%. (3) Effective June 8, 2020, we amended our secured revolving credit facility totaling $75 million, which was the total borrowing capacity. In conjunction with the amendment, we repaid $10 million of principal and converted the facility to a term loan with a principal balance of $65 million. The amended term loan is interest only until March 2021 and bears interest at a rate of Base Rate + 1.25% - 2.50% or LIBOR + 2.25% - 3.5%, with a LIBOR floor of 0.50%. (4) This mortgage loan has three one-year extension options, subject to satisfaction of certain conditions, of which the second was exercised in April 2020. (5) Effective June 9, 2020, we executed a FF&E accommodation agreement for this mortgage loan. Terms of the agreement included lender-held reserves were made available to fund property-level operating expenses and monthly FF&E escrow deposits (6) The interest rate spread on this mortgage loan changed from 4.95% as of December 31, 2019, to 3.95% as of March 31, 2020, based on an appraisal received in accordance with the August 5, 2019 loan amendment. This mortgage loan has a LIBOR floor of 1.00%. This mortgage loan has three one-year extension options, subject to satisfaction of certain conditions. (7) Effective May 1, 2020, we executed a forbearance agreement for this mortgage loan. Terms of the agreement included adding a LIBOR floor of 0.25%; deferral of interest payments for three months with the option to extend the interest payment deferral an additional three months, which was exercised in August 2020, with all deferred payments due at maturity; lenderheld reserves were made available to fund property-level operating expenses; and monthly FF&E escrow deposits were waived through December 2020. (8) Effective September 24, 2020, we executed a forbearance agreement for this mortgage loan. Terms of the agreement included deferral of interest payments for six months, lender-held reserves were made available to fund property-level operating expenses, and monthly FF&E escrow deposits were waived through December 2020. In conjunction with the forbearance agreement, deferred interest payments of $2.2 million were capitalized into the principal balance and are to be repaid in 12 monthly installments beginning January 2021. Company Presentation | November 2020 22