Exhibit 99.2 June 2019 Minnetonka Medical Center Minnetonka, MN SUPPLEMENTAL OPERATING & FINANCIAL INFORMATION SECOND QUARTER 2019 PHYSICIANS REALTY TRUST NYSE: DOC Springwoods MOB Spring, TX

TABLE OF CONTENTS COMPANY OVERVIEW ABOUT PHYSICIANS REALTY TRUST 4 SECOND QUARTER HIGHLIGHTS 6 FINANCIAL HIGHLIGHTS 7 FINANCIAL INFORMATION RECONCILIATION OF NON-GAAP MEASURES: FUNDS FROM OPERATIONS (FFO), NORMALIZED FUNDS FROM OPERATIONS (NORMALIZED FFO), AND NORMALIZED FUNDS AVAILABLE FOR DISTRIBUTION (NORMALIZED FAD) 8 RECONCILIATION OF NON-GAAP MEASURES: NET OPERATING INCOME AND ADJUSTED EBITDAre 9 MARKET CAPITALIZATION AND DEBT SUMMARY 10 FINANCIAL STATISTICS AND COVENANT PERFORMANCE 11 MOB SAME-STORE PORTFOLIO PERFORMANCE AND TENANT OCCUPANCY 12 INVESTMENT ACTIVITY AND CONSTRUCTION LOAN SUMMARY 13 PORTFOLIO GEOGRAPHIC DISTRIBUTION 14 PORTFOLIO DIVERSIFICATION 15 LEASING RELATIONSHIPS AND EXPIRATION SCHEDULE 16 CONSOLIDATED BALANCE SHEETS 17 CONSOLIDATED STATEMENTS OF INCOME 18 REPORTING DEFINITIONS 19 2

FORWARD-LOOKING STATEMENTS Certain statements made in this supplemental information package constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)). In particular, statements pertaining to our capital resources, portfolio performance and results of operations contain forward-looking statements. Likewise, our pro forma financial statements and our statements regarding anticipated market conditions are forward-looking statements. You can identify forward-looking statements by the use of forward-looking terminology such as "believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” "outlook," "continue," "projects," “pro forma,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans, expectations or intentions. Forward-looking statements reflect the views of our management regarding current expectations and projections about future events and are based on currently available information. These forward-looking statements are not guarantees of future performance and involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods which may be incorrect or imprecise and we may not be able to realize them. While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes after the date of this supplemental information package, except as required by applicable law. You should not place undue reliance on any forward-looking statements that are based on information currently available to us or the third parties making the forward-looking statements. For a discussion of factors that could impact our future results, performance or transactions, see Part I, Item 1A (Risk Factors) of our Annual Report on Form 10- K for the fiscal year ended December 31, 2018. NON-GAAP FINANCIAL MEASURES This presentation includes Adjusted EBITDAre, EBITDAR, Net Operating Income (or NOI), Cash NOI, MOB Same-Store Cash NOI, Funds From Operations (or FFO), Normalized FFO, and Normalized Funds Available For Distribution (or FAD), which are non-GAAP financial measures. For purposes of the Securities and Exchange Commission’s (“SEC”) Regulation G, a non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable financial measure calculated and presented in accordance with GAAP in the statement of operations, balance sheet or statement of cash flows (or equivalent statements) of the company, or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable financial measure so calculated and presented. As used in this presentation, GAAP refers to generally accepted accounting principles in the United States of America. Our use of the non-GAAP financial measure terms herein may not be comparable to that of other real estate investment trusts. Pursuant to the requirements of Regulation G, we have provided reconciliations of the non-GAAP financial measures to the most directly comparable GAAP financial measures. ADDITIONAL INFORMATION The information in this supplemental information package should be read in conjunction with the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, earnings press release dated August 7, 2019, and other information filed with, or furnished to, the SEC. You can access the Company’s reports and amendments to those reports filed or furnished to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act in the “Investor Relations” section on the Company’s website (www.docreit.com) under the tab “SEC Filings” as soon as reasonably practicable after they are filed with, or furnished to, the SEC. The information on or connected to the Company’s website is not, and shall not be deemed to be, a part of, or incorporated into this supplemental information package. You also can review these SEC filings and other information by accessing the SEC’s website at http://www.sec.gov. 3

ABOUT PHYSICIANS REALTY TRUST Physicians Realty Trust (NYSE:DOC) (the “Trust,” the “Company,” “DOC,” “we,” “our” and “us”) is a self-managed healthcare real estate company organized in 2013 to acquire, selectively develop, own, and manage healthcare properties that are leased to physicians, hospitals, and healthcare delivery systems. We invest in real estate that is integral to providing high quality healthcare services. Our properties typically are on a campus with a hospital or other healthcare facilities or strategically located and affiliated with a hospital or other healthcare facilities. Our management team has significant public healthcare REIT experience and long established relationships with physicians, hospitals, and healthcare delivery system decision makers that we believe will provide quality investment opportunities to generate attractive risk-adjusted returns to our shareholders. We are a Maryland real estate investment trust and elected to be taxed as a REIT for U.S. federal income tax purposes. We conduct our business through an UPREIT structure in which our properties are owned by Physicians Realty L.P., a Delaware limited partnership (the “operating partnership”), directly or through limited partnerships, limited liability companies, or other subsidiaries. We are the sole general partner of the operating partnership and, as of June 30, 2019, owned approximately 97.1% of the partnership interests in the operating partnership (“OP Units”). COMPANY SNAPSHOT As of June 30, 2019 Gross real estate investments (thousands) $ 4,445,963 Total healthcare properties (1) 252 % Leased (1) 96.0% Total portfolio gross leasable area (sq. ft.) (1) 13,641,585 % of GLA on-campus / affiliated (1) 89% Average remaining lease term for all buildings (years) (1) 7.5 Cash and cash equivalents (thousands) $ 6,883 Total debt to firm value 31.5% Weighted average interest rate per annum on consolidated debt 3.8% Equity market cap (thousands) $ 3,231,899 Quarterly dividend $ 0.23 Quarter end stock price $ 17.44 Dividend yield 5.28% Common shares outstanding 185,315,334 OP Units outstanding and not owned by DOC 5,497,445 Total firm value (thousands) $ 4,898,053 (1) Excludes the Company's corporate office building. 4

ABOUT PHYSICIANS REALTY TRUST (CONTINUED) BOARD OF TRUSTEES Tommy G. Thompson John T. Thomas Chairman President Chief Executive Officer Stanton D. Anderson Mark A. Baumgartner Albert C. Black Compensation Committee Chair Audit Committee Chair Nominating and Corporate Governance Committee Chair William A. Ebinger, M.D. Pamela J. Kessler Richard A. Weiss Trustee Trustee Finance and Investment Committee Chair MANAGEMENT TEAM John T. Thomas Jeffrey N. Theiler President Executive Vice President Chief Executive Officer Chief Financial Officer D. Deeni Taylor Mark D. Theine John W. Lucey Executive Vice President Executive Vice President Chief Accounting and Chief Investment Officer Asset & Investment Management Administrative Officer Bradley D. Page Daniel M. Klein Laurie P. Becker Senior Vice President Senior Vice President Senior Vice President General Counsel Deputy Chief Investment Officer Controller LOCATION AND CONTACT INFORMATION Corporate Headquarters Independent Registered Corporate and REIT Tax Counsel 309 N. Water Street, Suite 500 Public Accounting Firm Baker & McKenzie LLP Milwaukee, WI 53202 Ernst & Young Richard Lipton, Partner (414) 367-5600 Chicago, IL 60606 Chicago, IL 60601 (312) 879-2000 (312) 861-8000 COVERING ANALYSTS J. Dennerlein - Bank of America Merrill Lynch J. Sadler - Keybanc Capital Markets Inc. J. Kim - BMO Capital Markets Corp. V. Malhotra - Morgan Stanley M. Gorman - BTIG J. Hughes - Raymond James Financial Inc. D. Bernstein - Capital One Securities M. Carroll - RBC Capital Markets LLC N. Joseph - Citi D. Babin - Robert W. Baird & Co. C. Kucera - FBR Capital C. Vanacore - Stifel P. Martin - JMP Securities M. Lewis - SunTrust Robinson Humphrey The equity analysts listed above are those analysts that have published research material on the Company and are listed as covering the Company. Please note that any opinions, estimates, or forecasts regarding the Company's performance made by the analysts listed above do not represent the opinions, estimates, or forecasts of the Company or its management. The Company does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations made by any of such analysts. Interested persons may obtain copies of analysts' reports on their own, as we do not distribute these reports. Several of these firms may, from time to time, own our stock and/or hold other long or short positions on our stock, and may provide compensated services to us. 5

SECOND QUARTER 2019 HIGHLIGHTS OPERATING HIGHLIGHTS • Second quarter 2019 total revenue of $94.9 million, down 11% compared to the prior year period • Second quarter 2019 rental revenue of $68.3 million, down 15% compared to the prior year period • Generated quarterly net income per share of $0.04 on a fully diluted basis • Generated second quarter normalized funds from operations (Normalized FFO) before rental revenue and straight-line receivable write-offs of $49.4 million or $0.26 per share and OP Unit on a fully diluted basis. Related to the Company’s adoption of ASC 842, the Company recognized certain write-offs during the quarter due to recent developments at the Company’s LifeCare LTACH facilities and former Foundation El Paso Surgical Hospital. Non-cash straight-line receivable write-offs totaled $6.5 million ($0.034 per share and OP unit) and cash revenue impacts totaled $2.9 million ($0.015 per share and OP unit). Inclusive of these write-offs, Normalized FFO was $40.0 million or $0.21 per share and OP unit. • Second Quarter MOB Same-Store Net Operating Income (Cash NOI) growth was 3.5% year-over-year. • Declared quarterly dividend of $0.23 per share for the second quarter • 96.0% of portfolio square footage leased as of June 30, 2019 COMPANY ANNOUNCEMENTS • May 30, 2019: Provided an update regarding the Company's financial exposure to LifeCare Holdings, LLC, which along with several related entities, filed for Chapter 11 Bankruptcy on May 6, 2019. • June 21, 2019: Announced that our Board of Trustees authorized and declared a cash distribution of $0.23 per common share and OP Unit for the quarterly period ended June 30, 2019. The distribution was paid on July 18, 2019 to common shareholders and OP Unit holders of record as of the close of business on July 3, 2019. SECOND QUARTER INVESTMENT ACTIVITY SUBSEQUENT EVENTS • Doctors United ASC, Pasadena, TX • Rockwall II MOB, Rockwall, TX • Sacred Heart ASC Construction Loan, Pensacola, FL • Shadeland Portfolio (2 Properties), Indianapolis, IN • Atlanta Condominium Investments, Atlanta, GA • Various Loan Transactions Westgate MOB CHI Midlands One Professional Center Glendale, AZ Papillion, NE 6

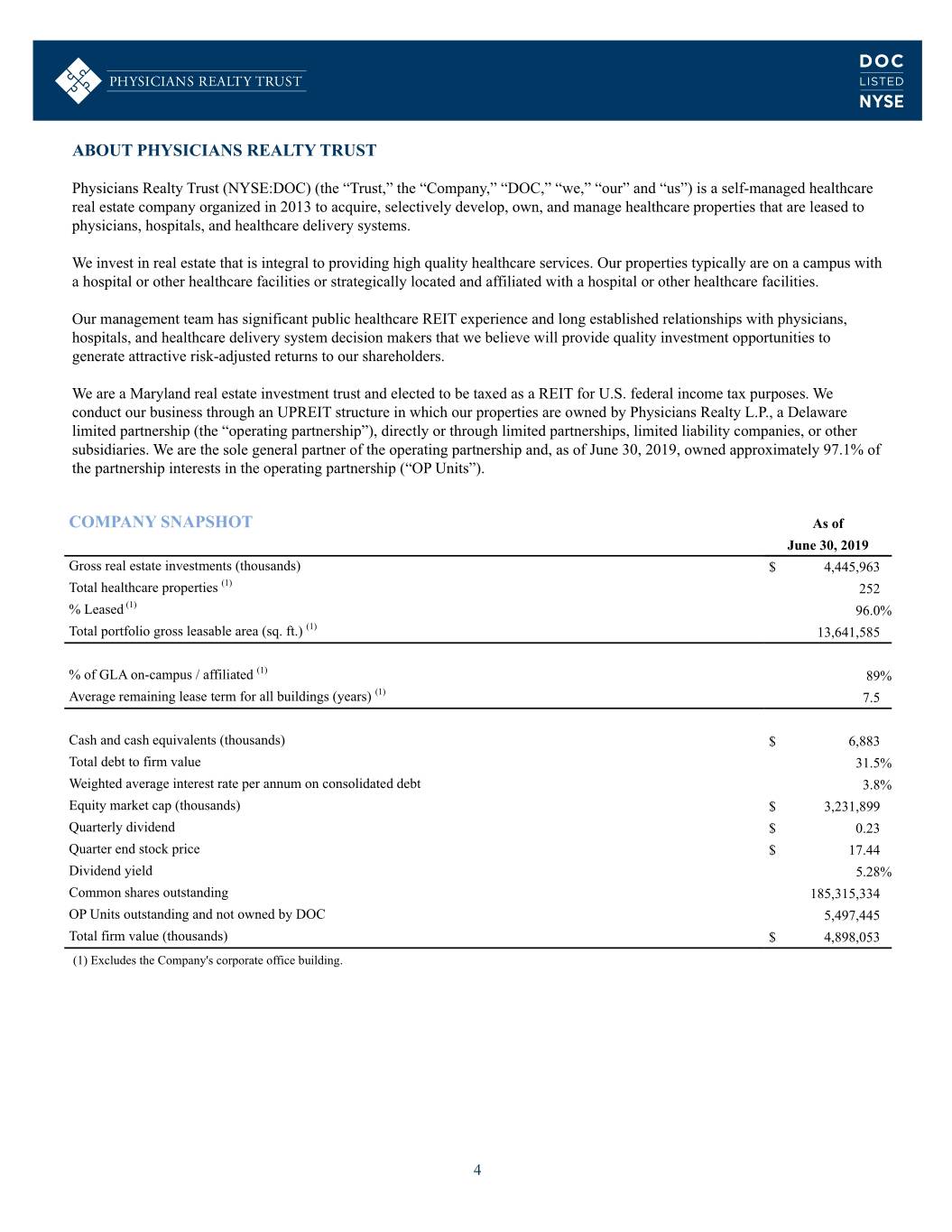

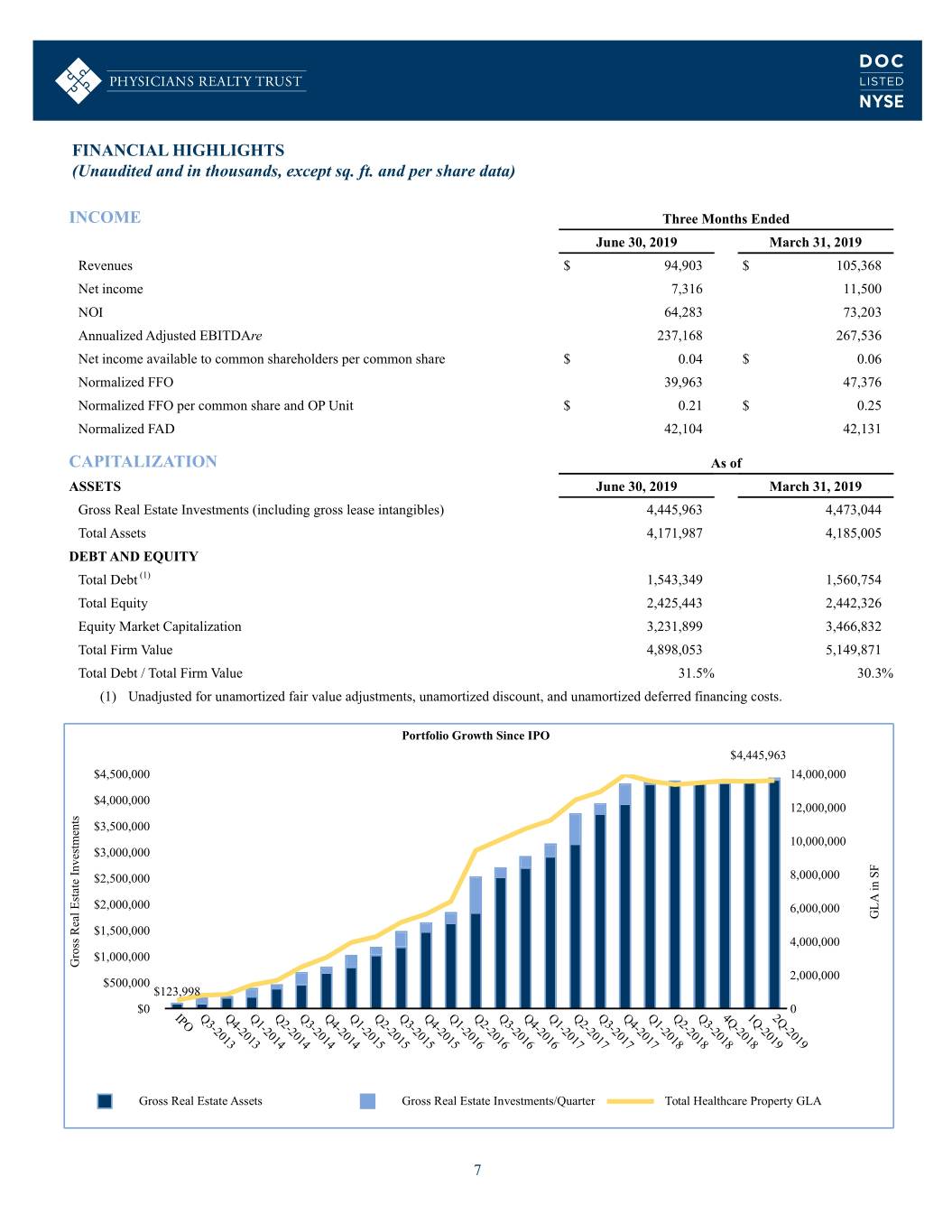

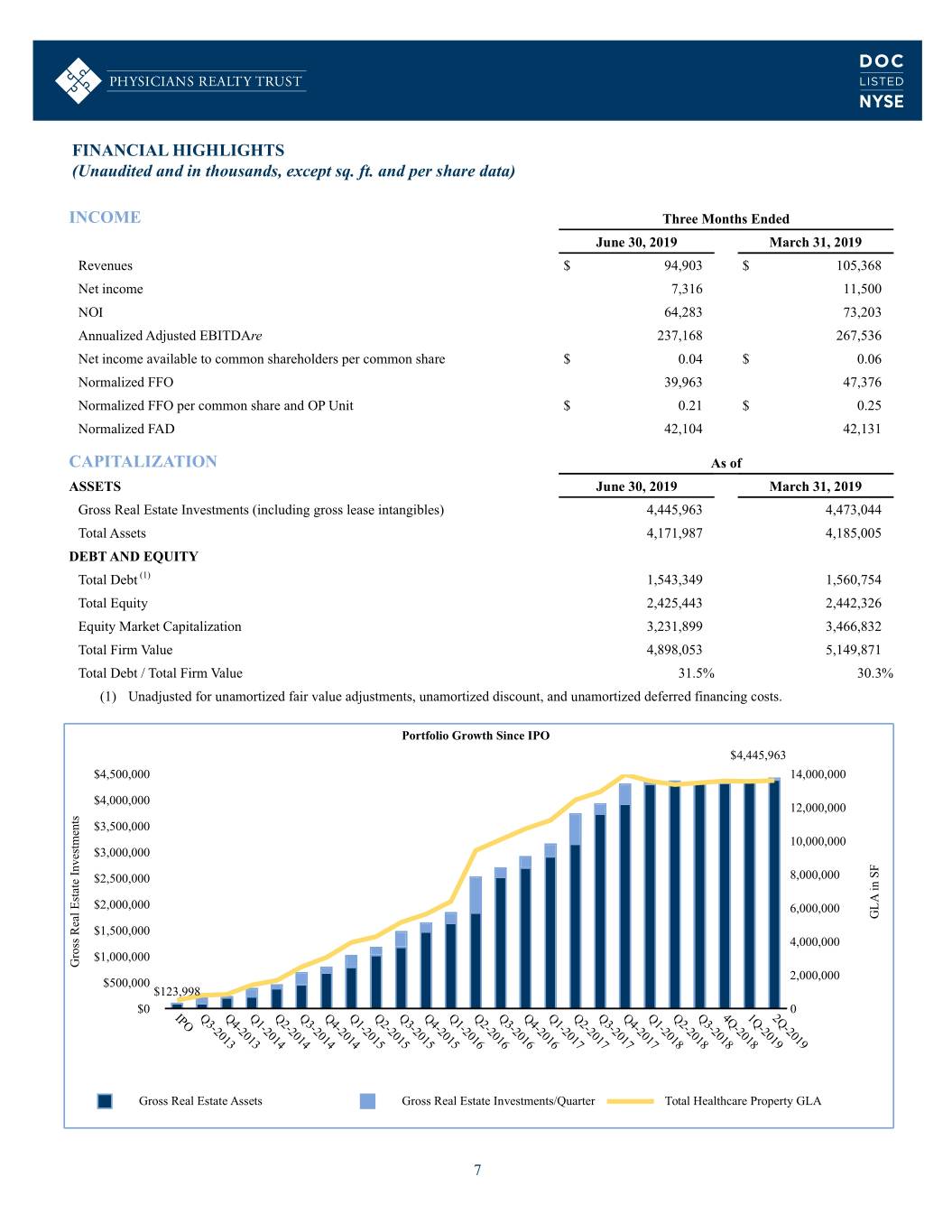

FINANCIAL HIGHLIGHTS (Unaudited and in thousands, except sq. ft. and per share data) INCOME Three Months Ended June 30, 2019 March 31, 2019 Revenues $ 94,903 $ 105,368 Net income 7,316 11,500 NOI 64,283 73,203 Annualized Adjusted EBITDAre 237,168 267,536 Net income available to common shareholders per common share $ 0.04 $ 0.06 Normalized FFO 39,963 47,376 Normalized FFO per common share and OP Unit $ 0.21 $ 0.25 Normalized FAD 42,104 42,131 CAPITALIZATION As of ASSETS June 30, 2019 March 31, 2019 Gross Real Estate Investments (including gross lease intangibles) 4,445,963 4,473,044 Total Assets 4,171,987 4,185,005 DEBT AND EQUITY Total Debt (1) 1,543,349 1,560,754 Total Equity 2,425,443 2,442,326 Equity Market Capitalization 3,231,899 3,466,832 Total Firm Value 4,898,053 5,149,871 Total Debt / Total Firm Value 31.5% 30.3% (1) Unadjusted for unamortized fair value adjustments, unamortized discount, and unamortized deferred financing costs. Portfolio Growth Since IPO $4,445,963 $4,500,000 14,000,000 $4,000,000 12,000,000 s t n $3,500,000 e m 10,000,000 t s $3,000,000 e v F n I 8,000,000 S e $2,500,000 n t i a t s A E $2,000,000 6,000,000 L l G a e R $1,500,000 s s 4,000,000 o r $1,000,000 G 2,000,000 $500,000 $123,998 $0 0 IP Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q 4Q 1Q 2Q O 3- 4- 1- 2- 3- 4- 1- 2- 3- 4- 1- 2- 3- 4- 1- 2- 3- 4- 1- 2- 3- - - - 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 13 13 14 14 14 14 15 15 15 15 16 16 16 16 17 17 17 17 18 18 18 18 19 19 Gross Real Estate Assets Gross Real Estate Investments/Quarter Total Healthcare Property GLA 7

RECONCILIATION OF NON-GAAP MEASURES: FUNDS FROM OPERATIONS (FFO), NORMALIZED FUNDS FROM OPERATIONS (NORMALIZED FFO) AND NORMALIZED FUNDS AVAILABLE FOR DISTRIBUTION (NORMALIZED FAD) (Unaudited and in thousands, except share and per share data) Three Months Ended Six Months Ended June 30, 2019 June 30, 2019 Net income $ 7,316 $ 18,816 Net income attributable to NCI - partially owned properties (136) (274) Preferred distributions (294) (578) Depreciation and amortization expense 36,194 72,553 Depreciation and amortization expense - partially owned properties (70) (144) Gain on the sale of investment properties (3,033) (3,033) FFO applicable to common shares and OP Units $ 39,977 $ 87,340 Net change in fair value of derivative (14) (1) Normalized FFO applicable to common shares and OP Units $ 39,963 $ 87,339 Net income available to common shareholders per common share and OP Unit $ 0.04 $ 0.09 FFO per common share and OP Unit $ 0.21 $ 0.46 Normalized FFO per common share and OP Unit $ 0.21 $ 0.46 Normalized FFO applicable to common shares and OP Units $ 39,963 $ 87,339 Non-cash share compensation expense 2,685 5,338 Straight-line rent adjustments 1,961 (2,801) Amortization of acquired above/below market leases/assumed debt 825 1,643 Amortization of lease inducements 337 680 Amortization of deferred financing costs 599 1,206 TI/LC and recurring capital expenditures (4,266) (9,170) Normalized FAD applicable to common shares and OP Units $ 42,104 $ 84,235 Weighted average number of common shares and OP Units outstanding 190,815,892 189,699,284 8

RECONCILIATION OF NON-GAAP MEASURES: NET OPERATING INCOME AND ADJUSTED EBITDAre (Unaudited and in thousands) Three Months Ended Six Months Ended NET OPERATING INCOME June 30, 2019 June 30, 2019 Net income $ 7,316 $ 18,816 General and administrative 7,676 16,648 Depreciation and amortization expense 36,285 72,734 Interest expense 16,053 32,322 Net change in fair value of derivative (14) (1) Gain on the sale of investment properties (3,033) (3,033) NOI $ 64,283 $ 137,486 NOI $ 64,283 $ 137,486 Straight-line rent adjustments 1,961 (2,801) Amortization of acquired above/below market leases 856 1,674 Amortization of lease inducements 337 680 Cash NOI $ 67,437 $ 137,039 Three Months Ended Six Months Ended ADJUSTED EBITDAre June 30, 2019 June 30, 2019 Net income $ 7,316 $ 18,816 Depreciation and amortization 36,285 72,734 Interest expense 16,053 32,322 Gain on the sale of investment properties (3,033) (3,033) EBITDAre $ 56,621 $ 120,839 Non-cash share compensation expense 2,685 5,338 Net non-cash changes in fair value (14) (1) Adjusted EBITDAre $ 59,292 $ 126,176 Adjusted EBITDAre Annualized(1) $ 237,168 $ 252,352 (1) Amounts are annualized and actual results may differ significantly from the annualized amounts shown. 9

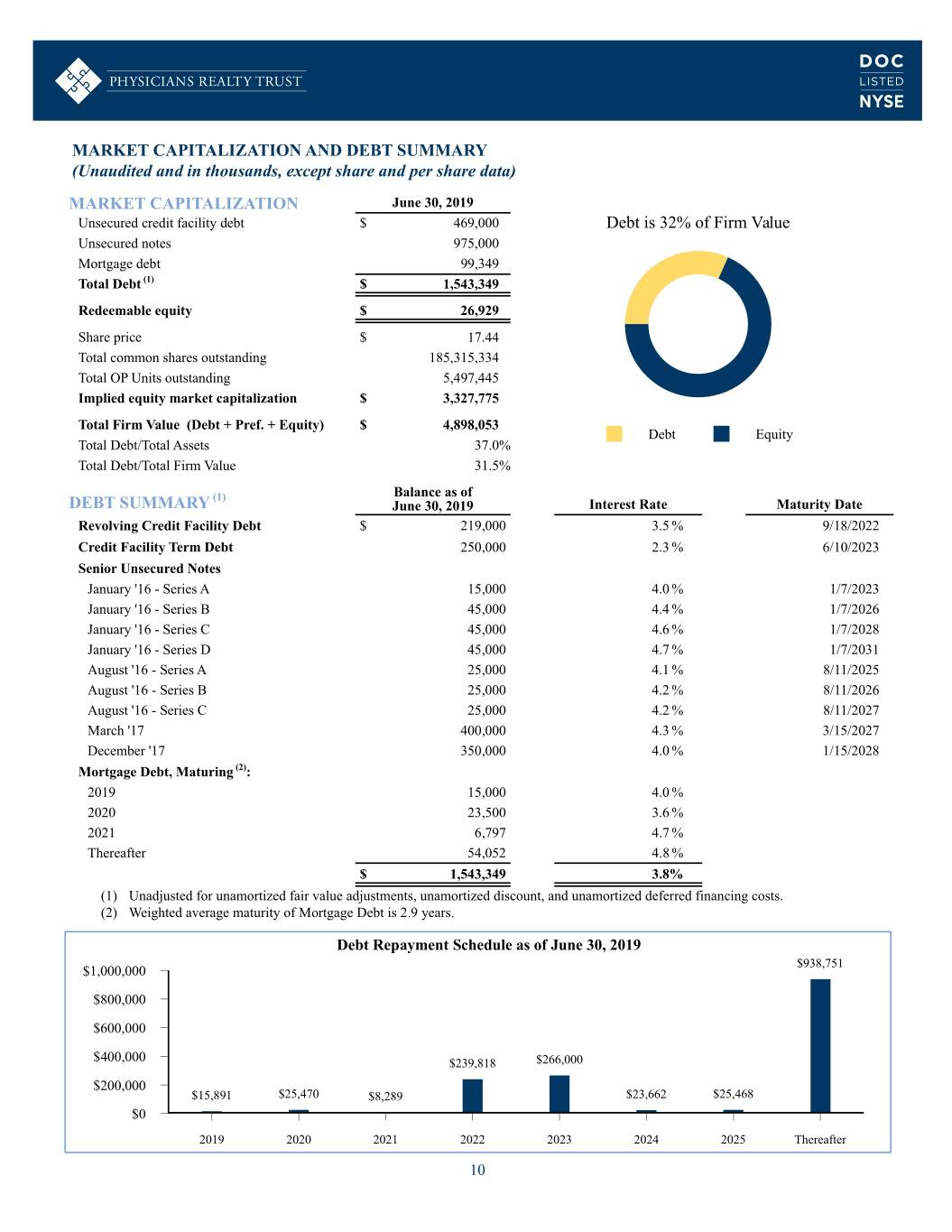

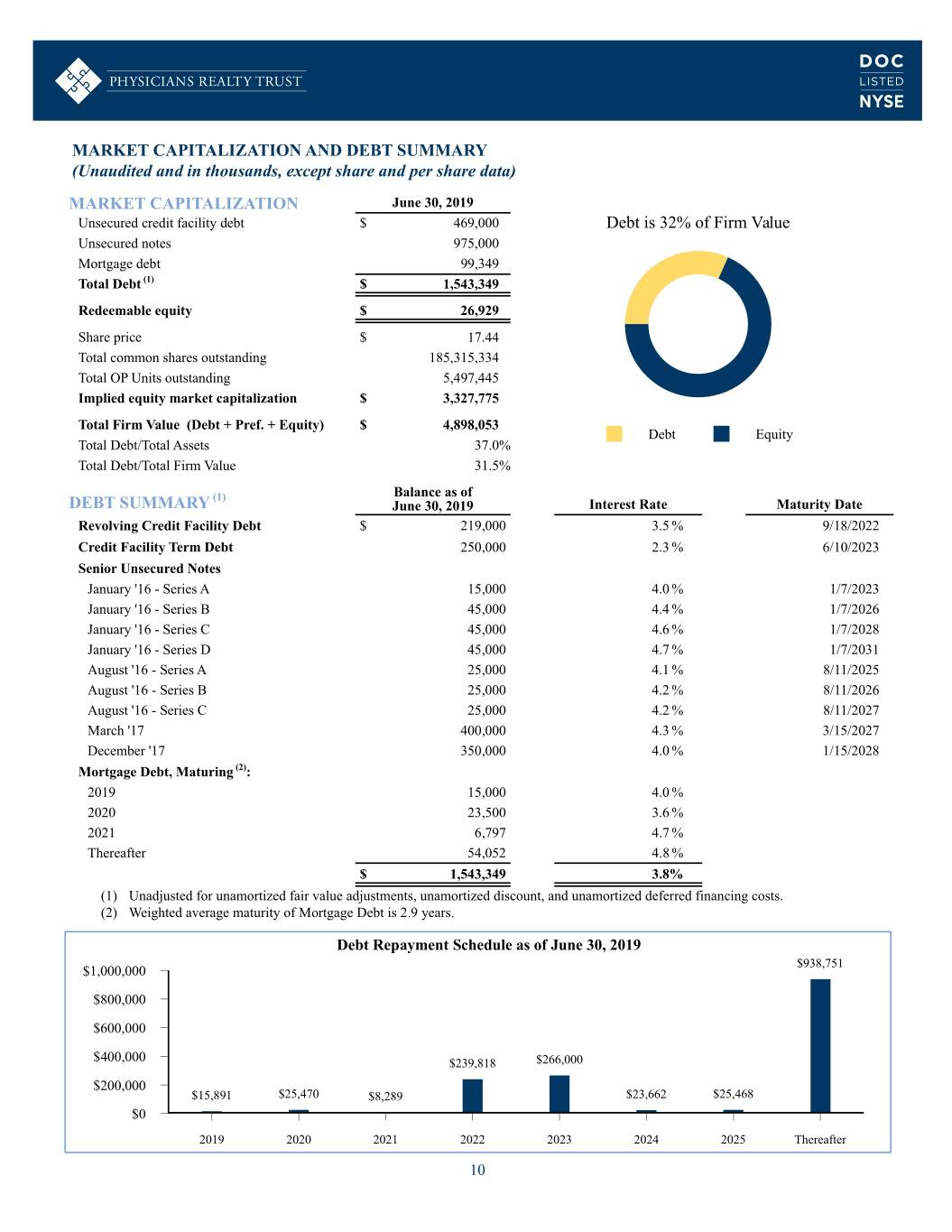

MARKET CAPITALIZATION AND DEBT SUMMARY (Unaudited and in thousands, except share and per share data) MARKET CAPITALIZATION June 30, 2019 Unsecured credit facility debt $ 469,000 Debt is 32% of Firm Value Unsecured notes 975,000 Mortgage debt 99,349 Total Debt (1) $ 1,543,349 Redeemable equity $ 26,929 Share price $ 17.44 Total common shares outstanding 185,315,334 Total OP Units outstanding 5,497,445 Implied equity market capitalization $ 3,327,775 Total Firm Value (Debt + Pref. + Equity) $ 4,898,053 Debt Equity Total Debt/Total Assets 37.0% Total Debt/Total Firm Value 31.5% (1) Balance as of DEBT SUMMARY June 30, 2019 Interest Rate Maturity Date Revolving Credit Facility Debt $ 219,000 3.5 % 9/18/2022 Credit Facility Term Debt 250,000 2.3 % 6/10/2023 Senior Unsecured Notes January '16 - Series A 15,000 4.0 % 1/7/2023 January '16 - Series B 45,000 4.4 % 1/7/2026 January '16 - Series C 45,000 4.6 % 1/7/2028 January '16 - Series D 45,000 4.7 % 1/7/2031 August '16 - Series A 25,000 4.1 % 8/11/2025 August '16 - Series B 25,000 4.2 % 8/11/2026 August '16 - Series C 25,000 4.2 % 8/11/2027 March '17 400,000 4.3 % 3/15/2027 December '17 350,000 4.0 % 1/15/2028 Mortgage Debt, Maturing (2): 2019 15,000 4.0 % 2020 23,500 3.6 % 2021 6,797 4.7 % Thereafter 54,052 4.8 % $ 1,543,349 3.8% (1) Unadjusted for unamortized fair value adjustments, unamortized discount, and unamortized deferred financing costs. (2) Weighted average maturity of Mortgage Debt is 2.9 years. Debt Repayment Schedule as of June 30, 2019 $938,751 $1,000,000 $800,000 $600,000 $400,000 $239,818 $266,000 $200,000 $15,891 $25,470 $8,289 $23,662 $25,468 $0 2019 2020 2021 2022 2023 2024 2025 Thereafter 10

FINANCIAL STATISTICS AND COVENANT PERFORMANCE (Unaudited and in thousands, except share and per share data) Quarter Ended June 30, 2019 Annualized dividend rate (1) $ 0.92 Price per share (2) $ 17.44 Annualized Dividend Yield 5.28% Total debt (3) $ 1,543,349 Net debt (less cash) 1,536,466 Adjusted EBITDAre (annualized)* 237,168 Net Debt / Adjusted EBITDAre Ratio 6.48x Adjusted EBITDAre (annualized)* $ 237,168 Cash interest expense (annualized)* 61,880 Interest Coverage Ratio 3.83x Total interest expense $ 16,053 Capitalized interest 147 Secured debt principal amortization 404 Total fixed charges $ 16,604 Adjusted EBITDAre 59,292 Adjusted EBITDAre / Fixed Charge Coverage Ratio 3.57x Implied equity market cap $ 3,327,775 Redeemable equity 26,929 Total debt (3) 1,543,349 Total Firm Value 4,898,053 Total debt (3) $ 1,543,349 Total assets 4,171,987 Total Debt / Total Assets 37.0% Total Debt / Total Firm Value 31.5% Weighted average common shares 185,239,471 Weighted average OP Units not owned by DOC 5,478,242 Dilutive effect of unvested restricted common shares and share units 98,179 Weighted Average Common Shares and OP Units - Diluted 190,815,892 COVENANT PERFORMANCE Required June 30, 2019 Total Leverage Ratio ≤ 60.0% 35.3% Total Secured Leverage Ratio ≤ 40.0% 2.3% Maintenance of Unencumbered Assets ≥ 1.5x 2.9x Consolidated Debt Service (Trailing Four Quarters) ≥ 1.5x 4.0x (1) Annualized rate based on $0.23 quarterly dividend for the quarter ending June 30, 2019. Actual dividend amounts will be determined by the Trust's board of trustees based on a variety of factors. (2) Closing common share price of $17.44 as of June 28, 2019. (3) Unadjusted for unamortized fair value adjustments, unamortized discount, and unamortized deferred financing costs. * Amounts are annualized and actual results may differ significantly from the annualized amounts shown. 11

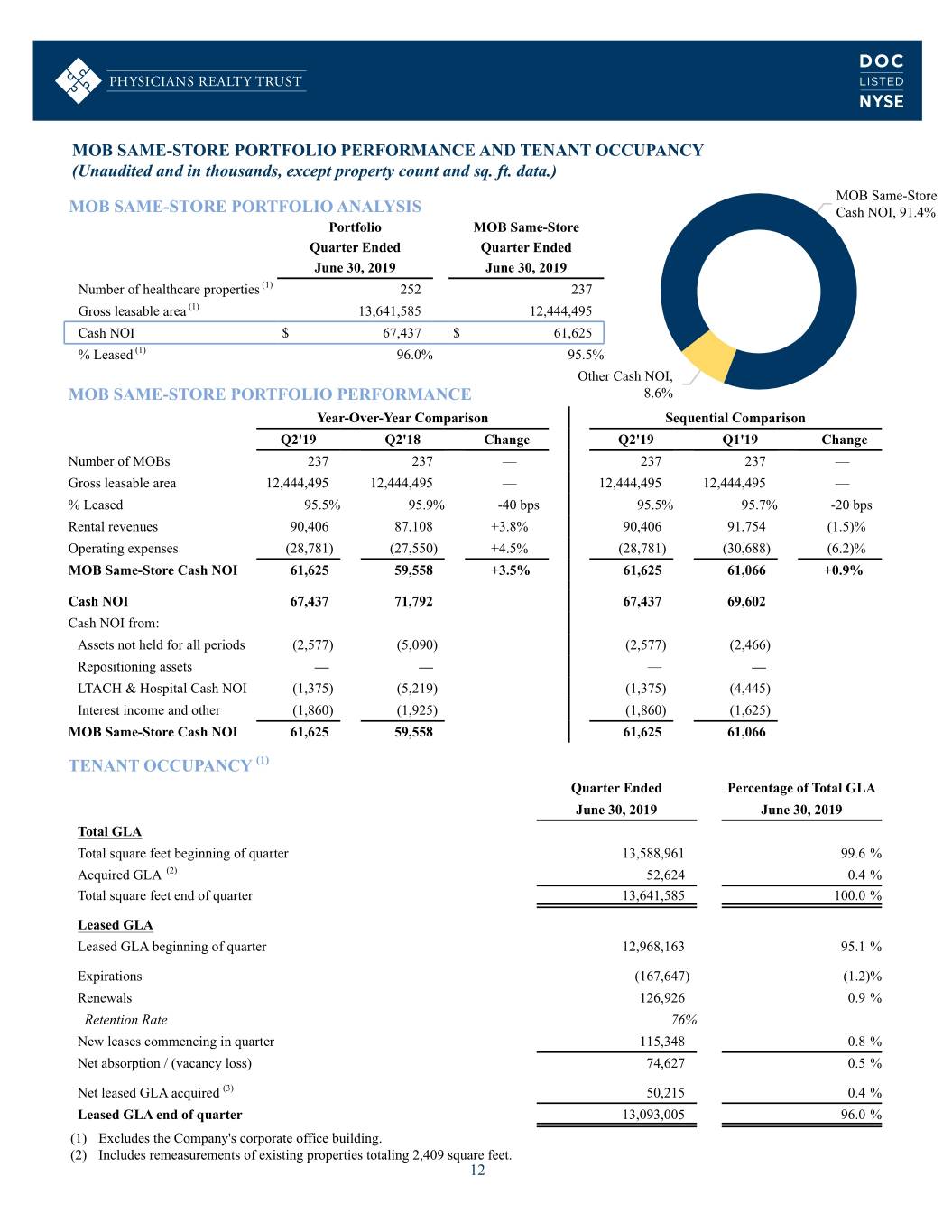

MOB SAME-STORE PORTFOLIO PERFORMANCE AND TENANT OCCUPANCY (Unaudited and in thousands, except property count and sq. ft. data.) MOB Same-Store MOB SAME-STORE PORTFOLIO ANALYSIS Cash NOI, 91.4% Portfolio MOB Same-Store Quarter Ended Quarter Ended June 30, 2019 June 30, 2019 Number of healthcare properties (1) 252 237 Gross leasable area (1) 13,641,585 12,444,495 Cash NOI $ 67,437 $ 61,625 % Leased (1) 96.0% 95.5% Other Cash NOI, MOB SAME-STORE PORTFOLIO PERFORMANCE 8.6% Year-Over-Year Comparison Sequential Comparison Q2'19 Q2'18 Change Q2'19 Q1'19 Change Number of MOBs 237 237 — 237 237 — Gross leasable area 12,444,495 12,444,495 — 12,444,495 12,444,495 — % Leased 95.5% 95.9% -40 bps 95.5% 95.7% -20 bps Rental revenues 90,406 87,108 +3.8% 90,406 91,754 (1.5)% Operating expenses (28,781) (27,550) +4.5% (28,781) (30,688) (6.2)% MOB Same-Store Cash NOI 61,625 59,558 +3.5% 61,625 61,066 +0.9% Cash NOI 67,437 71,792 67,437 69,602 Cash NOI from: Assets not held for all periods (2,577) (5,090) (2,577) (2,466) Repositioning assets — — — — LTACH & Hospital Cash NOI (1,375) (5,219) (1,375) (4,445) Interest income and other (1,860) (1,925) (1,860) (1,625) MOB Same-Store Cash NOI 61,625 59,558 61,625 61,066 TENANT OCCUPANCY (1) Quarter Ended Percentage of Total GLA June 30, 2019 June 30, 2019 Total GLA Total square feet beginning of quarter 13,588,961 99.6 % Acquired GLA (2) 52,624 0.4 % Total square feet end of quarter 13,641,585 100.0 % Leased GLA Leased GLA beginning of quarter 12,968,163 95.1 % Expirations (167,647) (1.2)% Renewals 126,926 0.9 % Retention Rate 76% New leases commencing in quarter 115,348 0.8 % Net absorption / (vacancy loss) 74,627 0.5 % Net leased GLA acquired (3) 50,215 0.4 % Leased GLA end of quarter 13,093,005 96.0 % (1) Excludes the Company's corporate office building. (2) Includes remeasurements of existing properties totaling 2,409 square feet. 12

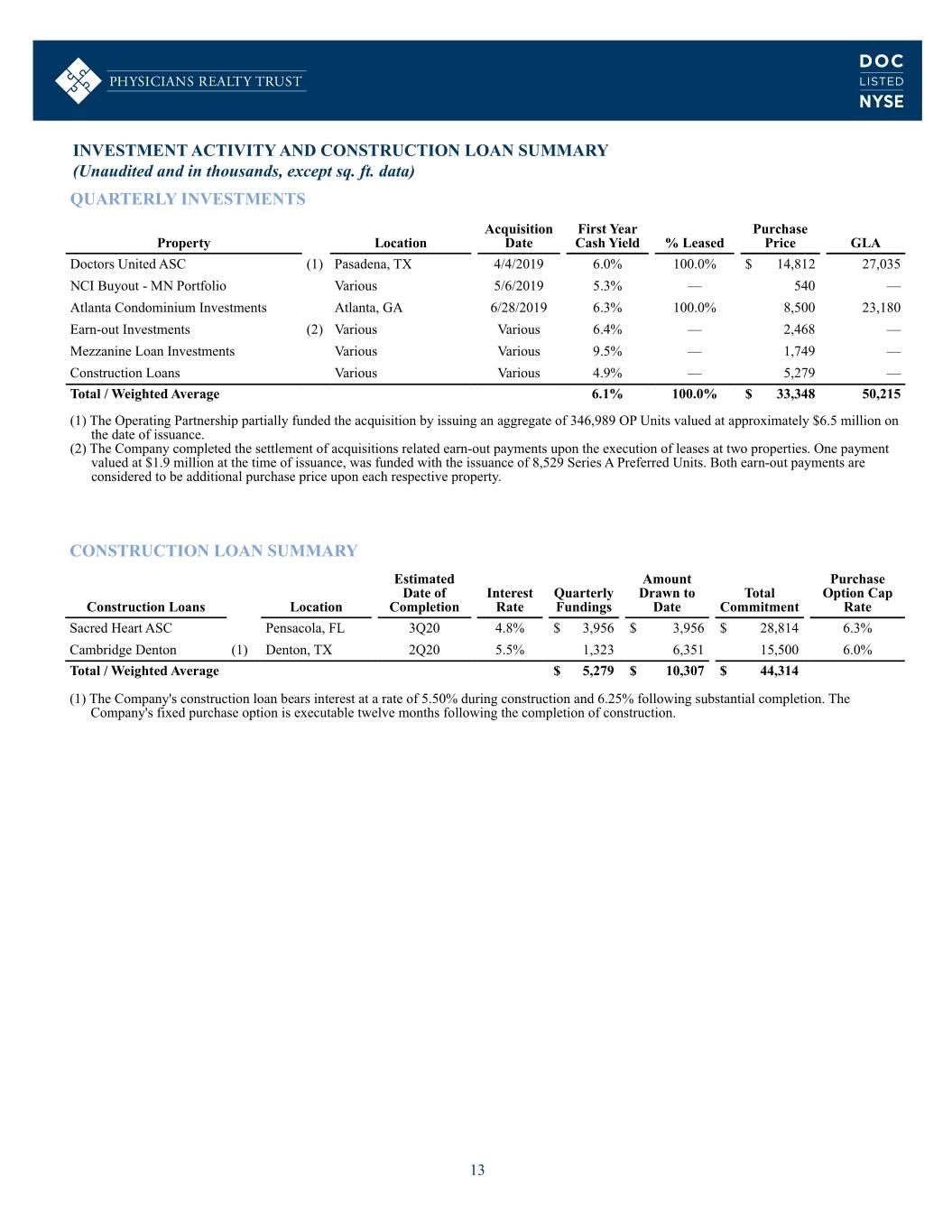

INVESTMENT ACTIVITY AND CONSTRUCTION LOAN SUMMARY (Unaudited and in thousands, except sq. ft. data) QUARTERLY INVESTMENTS Acquisition First Year Purchase Property Location Date Cash Yield % Leased Price GLA Doctors United ASC (1) Pasadena, TX 4/4/2019 6.0% 100.0% $ 14,812 27,035 NCI Buyout - MN Portfolio Various 5/6/2019 5.3% — 540 — Atlanta Condominium Investments Atlanta, GA 6/28/2019 6.3% 100.0% 8,500 23,180 Earn-out Investments (2) Various Various 6.4% — 2,468 — Mezzanine Loan Investments Various Various 9.5% — 1,749 — Construction Loans Various Various 4.9% — 5,279 — Total / Weighted Average 6.1% 100.0% $ 33,348 50,215 (1) The Operating Partnership partially funded the acquisition by issuing an aggregate of 346,989 OP Units valued at approximately $6.5 million on the date of issuance. (2) The Company completed the settlement of acquisitions related earn-out payments upon the execution of leases at two properties. One payment valued at $1.9 million at the time of issuance, was funded with the issuance of 8,529 Series A Preferred Units. Both earn-out payments are considered to be additional purchase price upon each respective property. CONSTRUCTION LOAN SUMMARY Estimated Amount Purchase Date of Interest Quarterly Drawn to Total Option Cap Construction Loans Location Completion Rate Fundings Date Commitment Rate Sacred Heart ASC Pensacola, FL 3Q20 4.8% $ 3,956 $ 3,956 $ 28,814 6.3% Cambridge Denton (1) Denton, TX 2Q20 5.5% 1,323 6,351 15,500 6.0% Total / Weighted Average $ 5,279 $ 10,307 $ 44,314 (1) The Company's construction loan bears interest at a rate of 5.50% during construction and 6.25% following substantial completion. The Company's fixed purchase option is executable twelve months following the completion of construction. 13

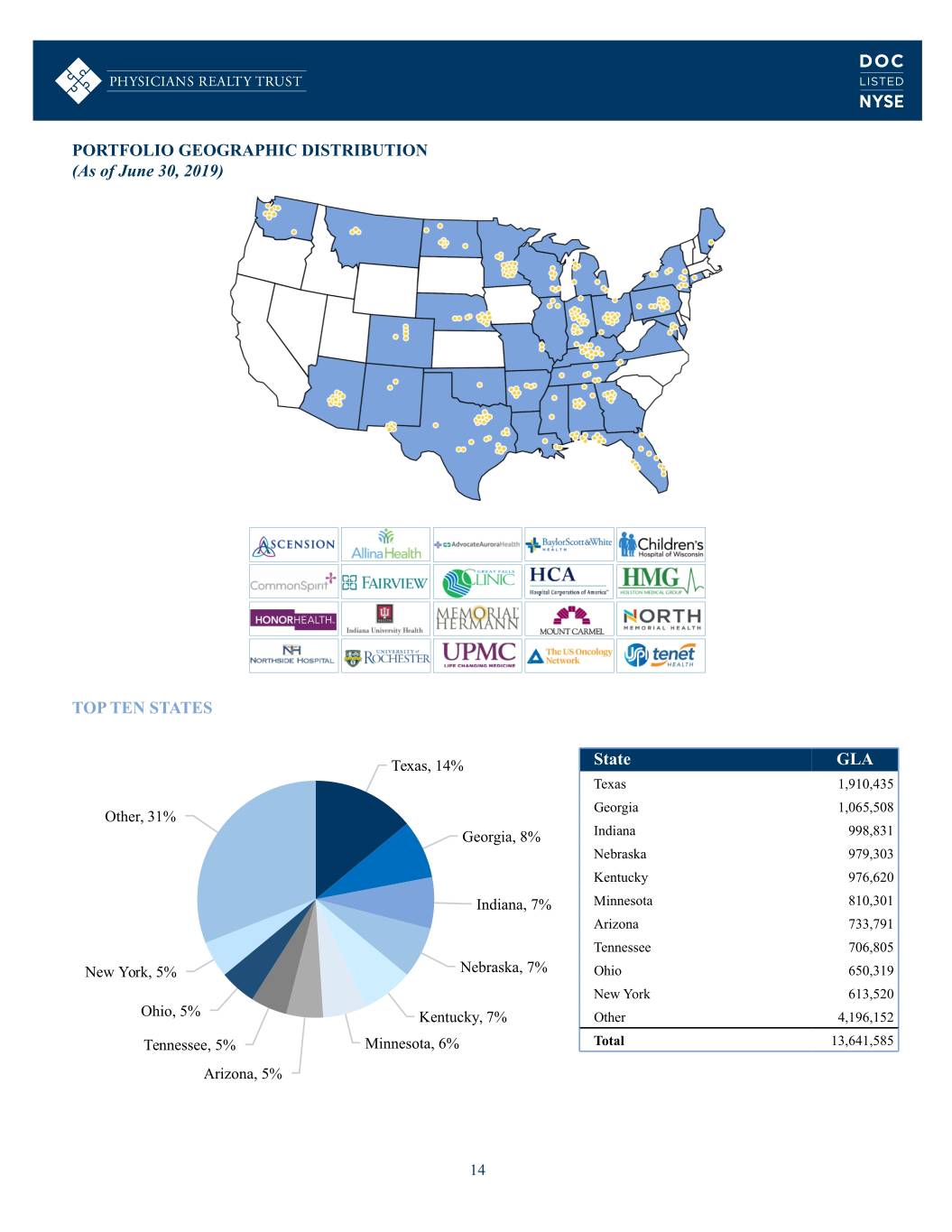

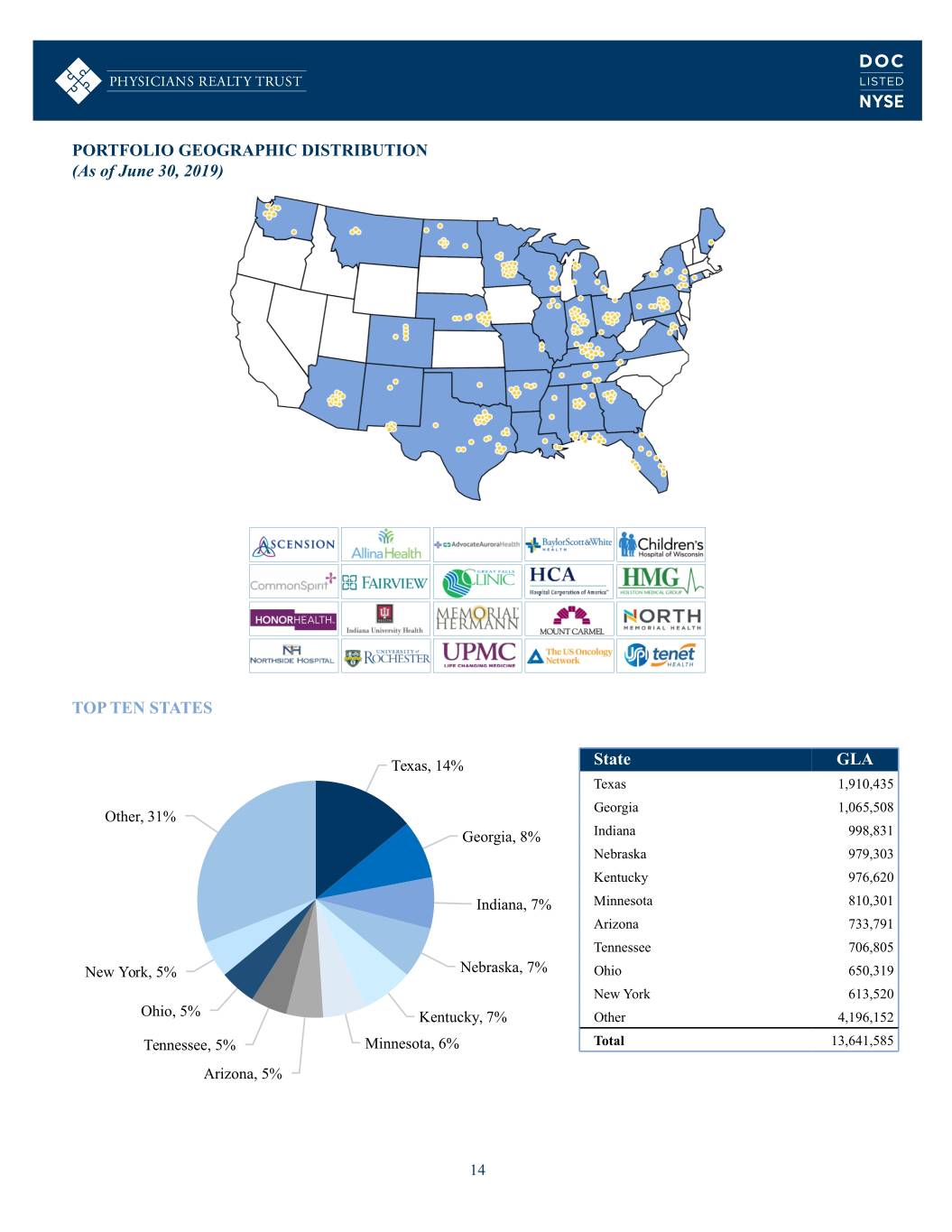

PORTFOLIO GEOGRAPHIC DISTRIBUTION (As of June 30, 2019) TOP TEN STATES Texas, 14% State GLA Texas 1,910,435 Georgia 1,065,508 Other, 31% Georgia, 8% Indiana 998,831 Nebraska 979,303 Kentucky 976,620 Indiana, 7% Minnesota 810,301 Arizona 733,791 Tennessee 706,805 New York, 5% Nebraska, 7% Ohio 650,319 New York 613,520 Ohio, 5% Kentucky, 7% Other 4,196,152 Tennessee, 5% Minnesota, 6% Total 13,641,585 Arizona, 5% 14

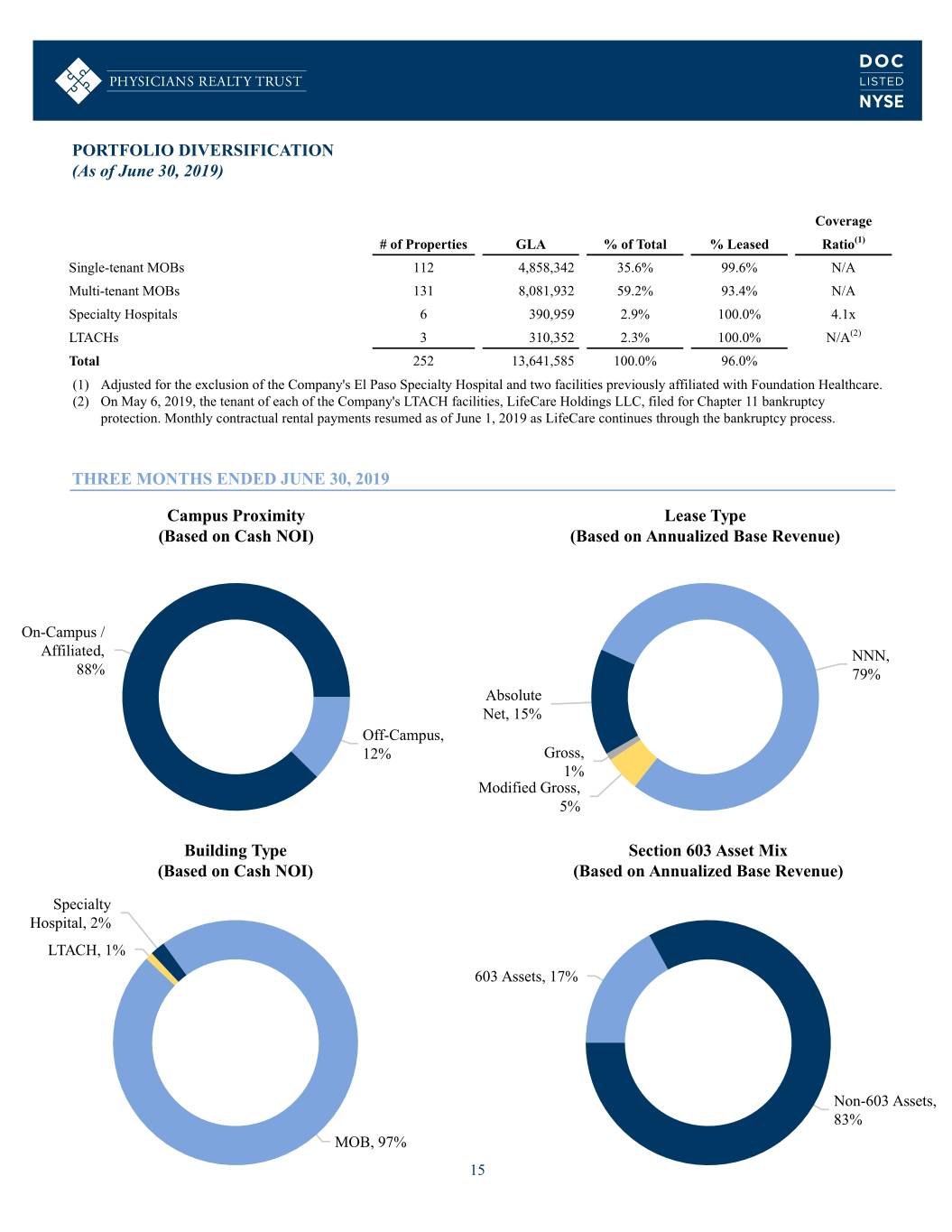

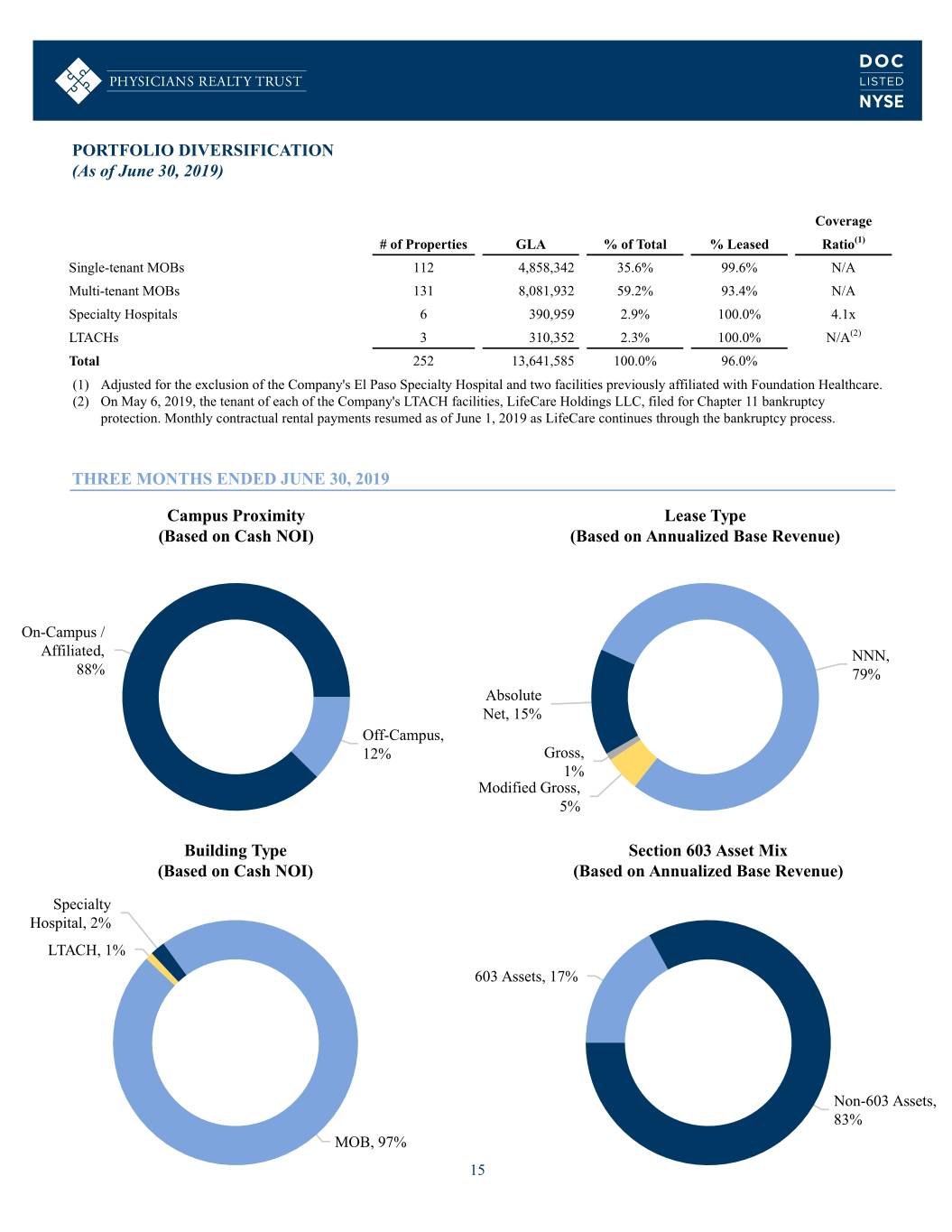

PORTFOLIO DIVERSIFICATION (As of June 30, 2019) Coverage # of Properties GLA % of Total % Leased Ratio(1) Single-tenant MOBs 112 4,858,342 35.6% 99.6% N/A Multi-tenant MOBs 131 8,081,932 59.2% 93.4% N/A Specialty Hospitals 6 390,959 2.9% 100.0% 4.1x LTACHs 3 310,352 2.3% 100.0% N/A(2) Total 252 13,641,585 100.0% 96.0% (1) Adjusted for the exclusion of the Company's El Paso Specialty Hospital and two facilities previously affiliated with Foundation Healthcare. (2) On May 6, 2019, the tenant of each of the Company's LTACH facilities, LifeCare Holdings LLC, filed for Chapter 11 bankruptcy protection. Monthly contractual rental payments resumed as of June 1, 2019 as LifeCare continues through the bankruptcy process. THREE MONTHS ENDED JUNE 30, 2019 Campus Proximity Lease Type (Based on Cash NOI) (Based on Annualized Base Revenue) On-Campus / Affiliated, NNN, 88% 79% Absolute Net, 15% Off-Campus, 12% Gross, 1% Modified Gross, 5% Building Type Section 603 Asset Mix (Based on Cash NOI) (Based on Annualized Base Revenue) Specialty Hospital, 2% LTACH, 1% 603 Assets, 17% Non-603 Assets, 83% MOB, 97% 15

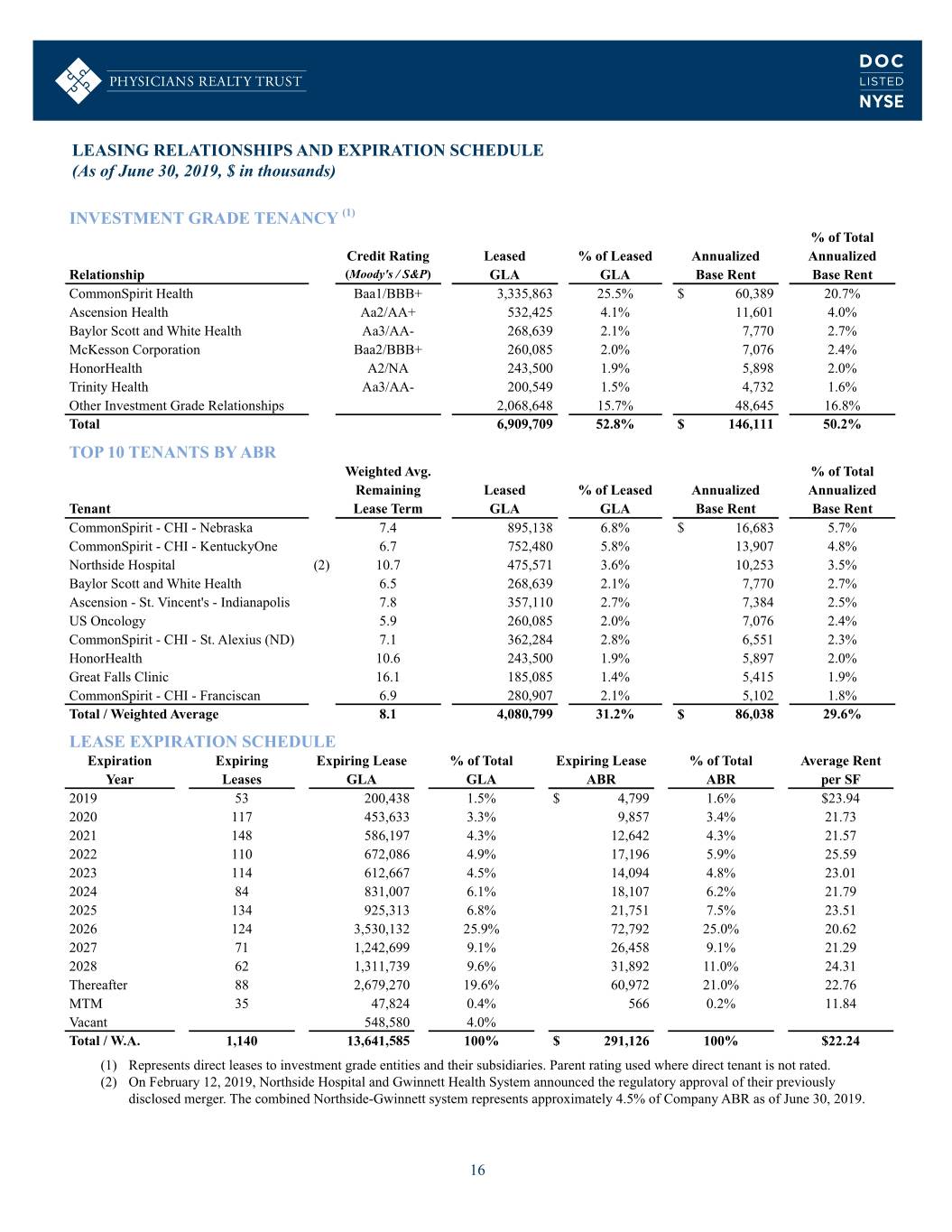

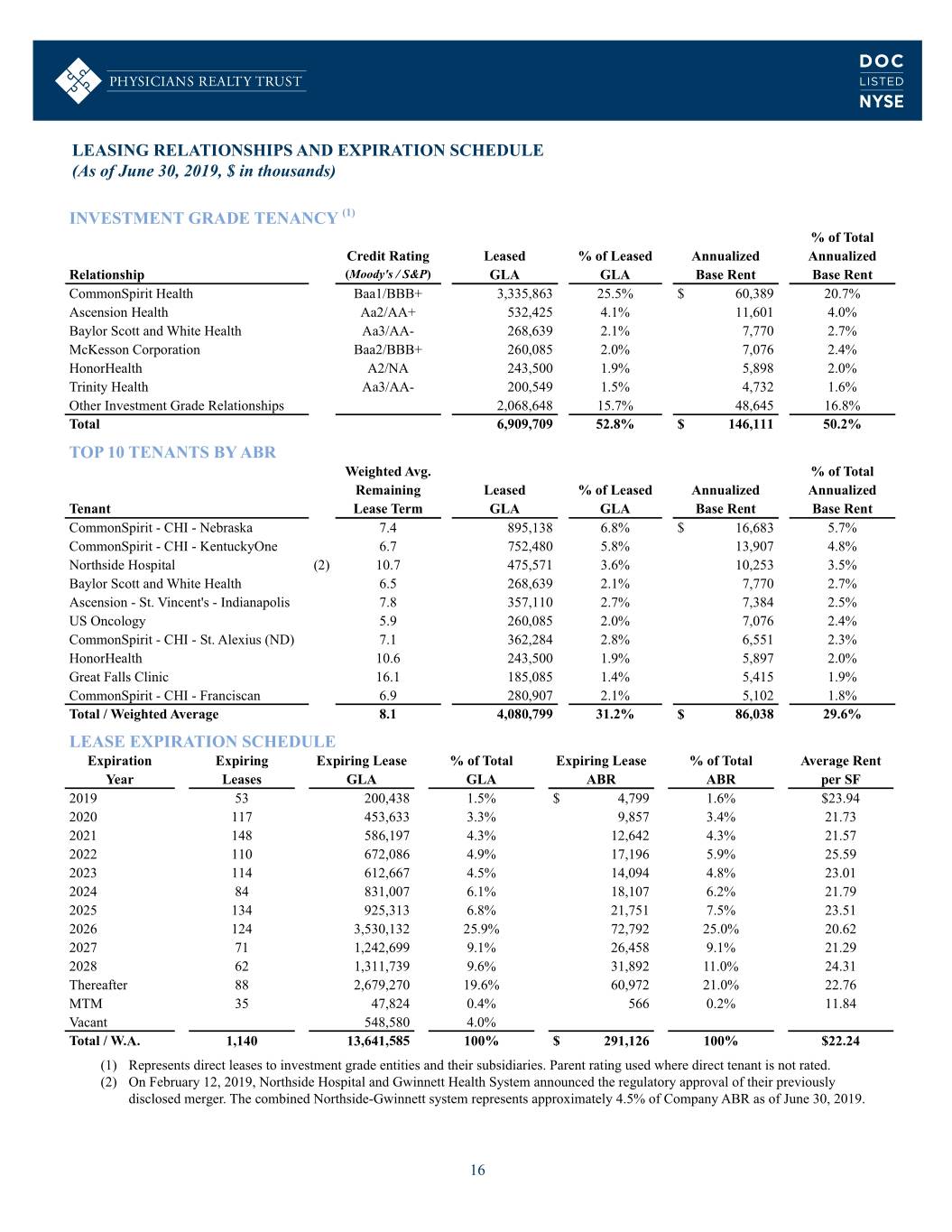

LEASING RELATIONSHIPS AND EXPIRATION SCHEDULE (As of June 30, 2019, $ in thousands) INVESTMENT GRADE TENANCY (1) % of Total Credit Rating Leased % of Leased Annualized Annualized Relationship (Moody's / S&P) GLA GLA Base Rent Base Rent CommonSpirit Health Baa1/BBB+ 3,335,863 25.5% $ 60,389 20.7% Ascension Health Aa2/AA+ 532,425 4.1% 11,601 4.0% Baylor Scott and White Health Aa3/AA- 268,639 2.1% 7,770 2.7% McKesson Corporation Baa2/BBB+ 260,085 2.0% 7,076 2.4% HonorHealth A2/NA 243,500 1.9% 5,898 2.0% Trinity Health Aa3/AA- 200,549 1.5% 4,732 1.6% Other Investment Grade Relationships 2,068,648 15.7% 48,645 16.8% Total 6,909,709 52.8% $ 146,111 50.2% TOP 10 TENANTS BY ABR Weighted Avg. % of Total Remaining Leased % of Leased Annualized Annualized Tenant Lease Term GLA GLA Base Rent Base Rent CommonSpirit - CHI - Nebraska 7.4 895,138 6.8% $ 16,683 5.7% CommonSpirit - CHI - KentuckyOne 6.7 752,480 5.8% 13,907 4.8% Northside Hospital (2) 10.7 475,571 3.6% 10,253 3.5% Baylor Scott and White Health 6.5 268,639 2.1% 7,770 2.7% Ascension - St. Vincent's - Indianapolis 7.8 357,110 2.7% 7,384 2.5% US Oncology 5.9 260,085 2.0% 7,076 2.4% CommonSpirit - CHI - St. Alexius (ND) 7.1 362,284 2.8% 6,551 2.3% HonorHealth 10.6 243,500 1.9% 5,897 2.0% Great Falls Clinic 16.1 185,085 1.4% 5,415 1.9% CommonSpirit - CHI - Franciscan 6.9 280,907 2.1% 5,102 1.8% Total / Weighted Average 8.1 4,080,799 31.2% $ 86,038 29.6% LEASE EXPIRATION SCHEDULE Expiration Expiring Expiring Lease % of Total Expiring Lease % of Total Average Rent Year Leases GLA GLA ABR ABR per SF 2019 53 200,438 1.5% $ 4,799 1.6% $23.94 2020 117 453,633 3.3% 9,857 3.4% 21.73 2021 148 586,197 4.3% 12,642 4.3% 21.57 2022 110 672,086 4.9% 17,196 5.9% 25.59 2023 114 612,667 4.5% 14,094 4.8% 23.01 2024 84 831,007 6.1% 18,107 6.2% 21.79 2025 134 925,313 6.8% 21,751 7.5% 23.51 2026 124 3,530,132 25.9% 72,792 25.0% 20.62 2027 71 1,242,699 9.1% 26,458 9.1% 21.29 2028 62 1,311,739 9.6% 31,892 11.0% 24.31 Thereafter 88 2,679,270 19.6% 60,972 21.0% 22.76 MTM 35 47,824 0.4% 566 0.2% 11.84 Vacant 548,580 4.0% Total / W.A. 1,140 13,641,585 100% $ 291,126 100% $22.24 (1) Represents direct leases to investment grade entities and their subsidiaries. Parent rating used where direct tenant is not rated. (2) On February 12, 2019, Northside Hospital and Gwinnett Health System announced the regulatory approval of their previously disclosed merger. The combined Northside-Gwinnett system represents approximately 4.5% of Company ABR as of June 30, 2019. 16

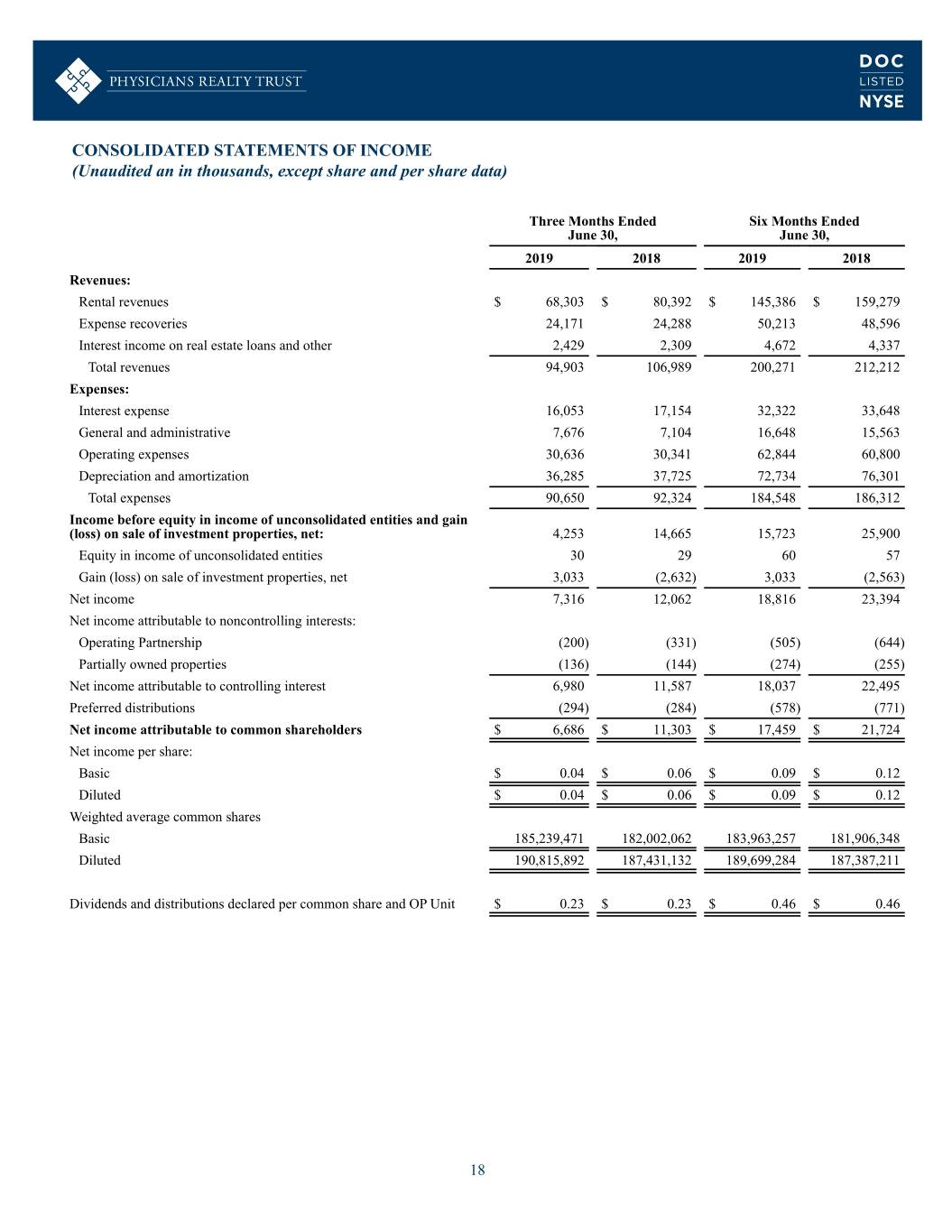

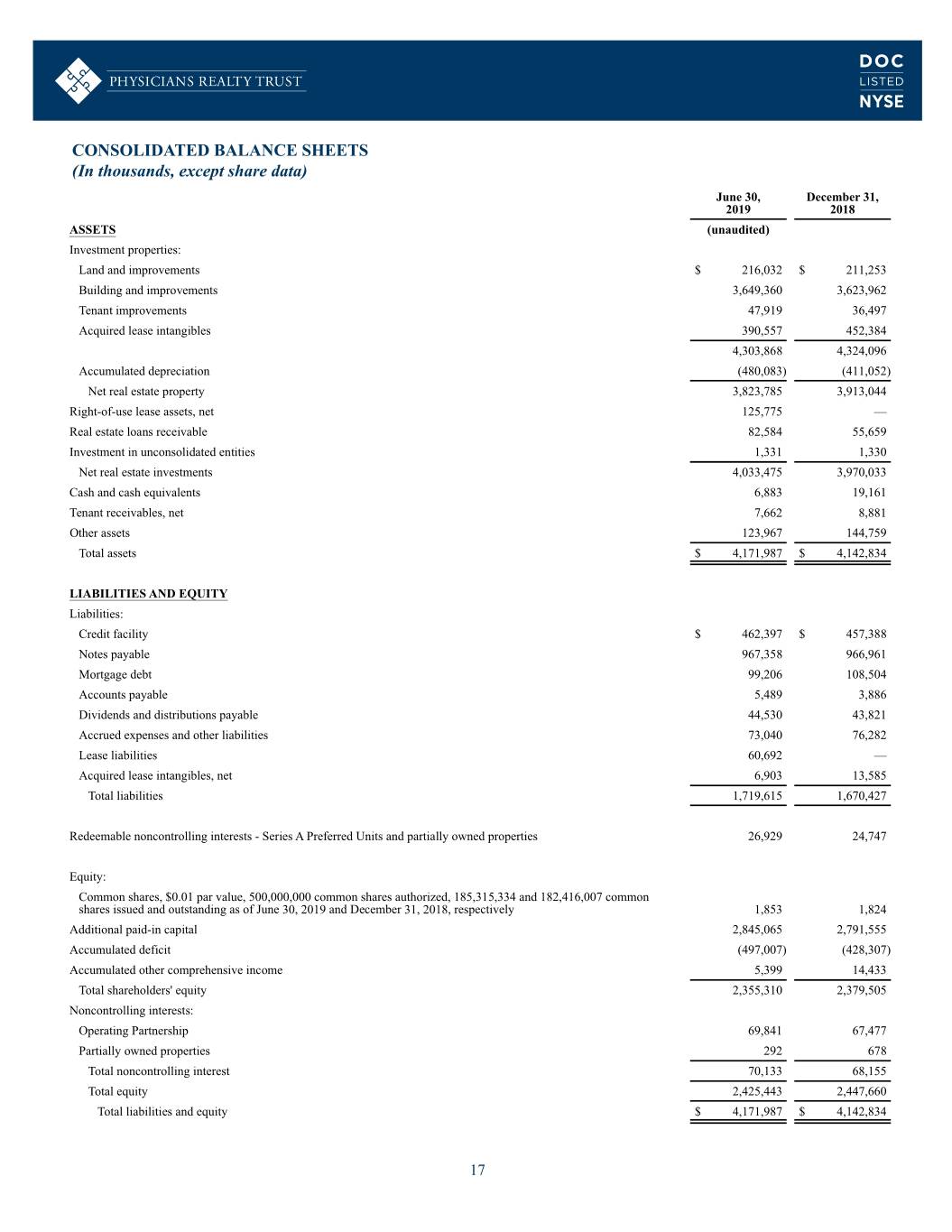

CONSOLIDATED BALANCE SHEETS (In thousands, except share data) June 30, December 31, 2019 2018 ASSETS (unaudited) Investment properties: Land and improvements $ 216,032 $ 211,253 Building and improvements 3,649,360 3,623,962 Tenant improvements 47,919 36,497 Acquired lease intangibles 390,557 452,384 4,303,868 4,324,096 Accumulated depreciation (480,083) (411,052) Net real estate property 3,823,785 3,913,044 Right-of-use lease assets, net 125,775 — Real estate loans receivable 82,584 55,659 Investment in unconsolidated entities 1,331 1,330 Net real estate investments 4,033,475 3,970,033 Cash and cash equivalents 6,883 19,161 Tenant receivables, net 7,662 8,881 Other assets 123,967 144,759 Total assets $ 4,171,987 $ 4,142,834 LIABILITIES AND EQUITY Liabilities: Credit facility $ 462,397 $ 457,388 Notes payable 967,358 966,961 Mortgage debt 99,206 108,504 Accounts payable 5,489 3,886 Dividends and distributions payable 44,530 43,821 Accrued expenses and other liabilities 73,040 76,282 Lease liabilities 60,692 — Acquired lease intangibles, net 6,903 13,585 Total liabilities 1,719,615 1,670,427 Redeemable noncontrolling interests - Series A Preferred Units and partially owned properties 26,929 24,747 Equity: Common shares, $0.01 par value, 500,000,000 common shares authorized, 185,315,334 and 182,416,007 common shares issued and outstanding as of June 30, 2019 and December 31, 2018, respectively 1,853 1,824 Additional paid-in capital 2,845,065 2,791,555 Accumulated deficit (497,007) (428,307) Accumulated other comprehensive income 5,399 14,433 Total shareholders' equity 2,355,310 2,379,505 Noncontrolling interests: Operating Partnership 69,841 67,477 Partially owned properties 292 678 Total noncontrolling interest 70,133 68,155 Total equity 2,425,443 2,447,660 Total liabilities and equity $ 4,171,987 $ 4,142,834 17

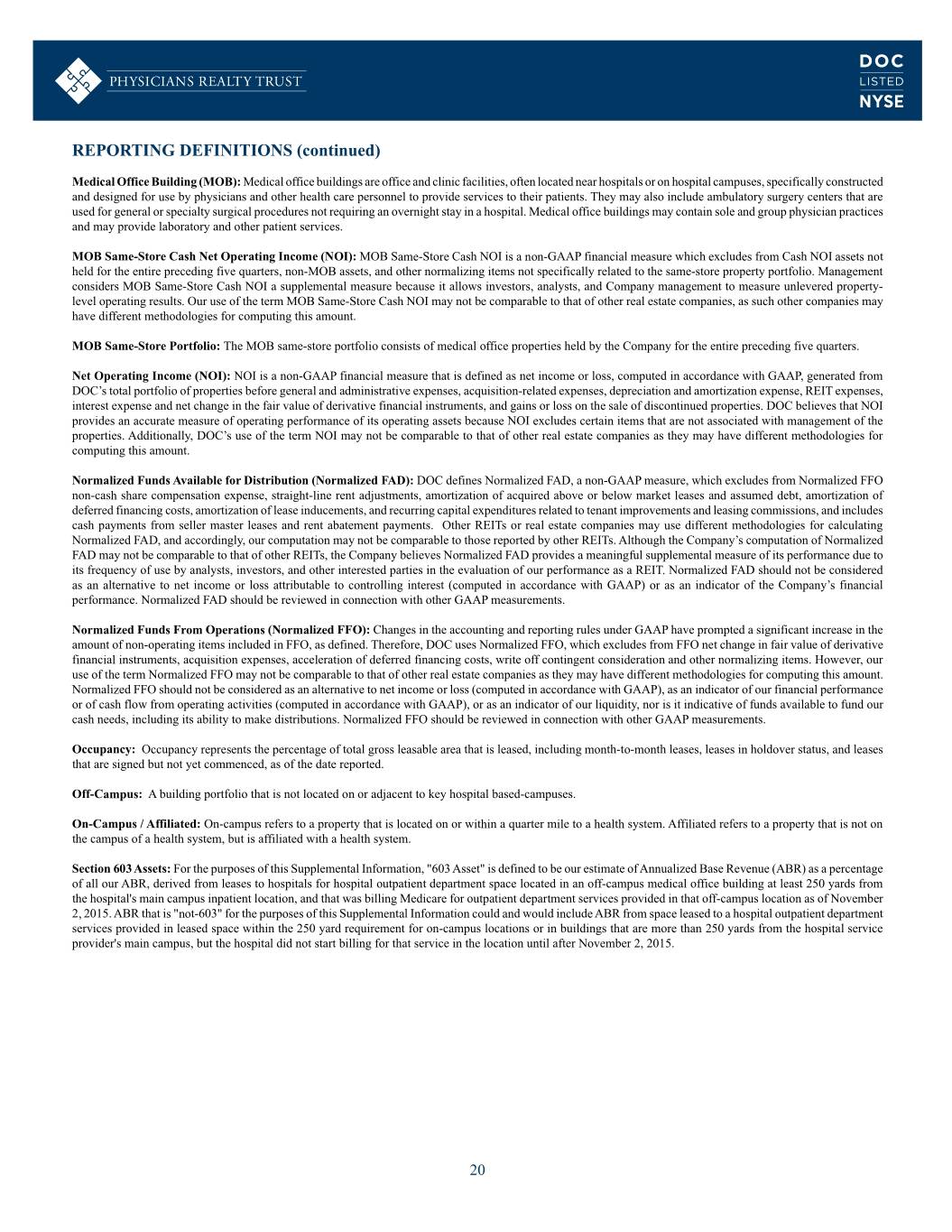

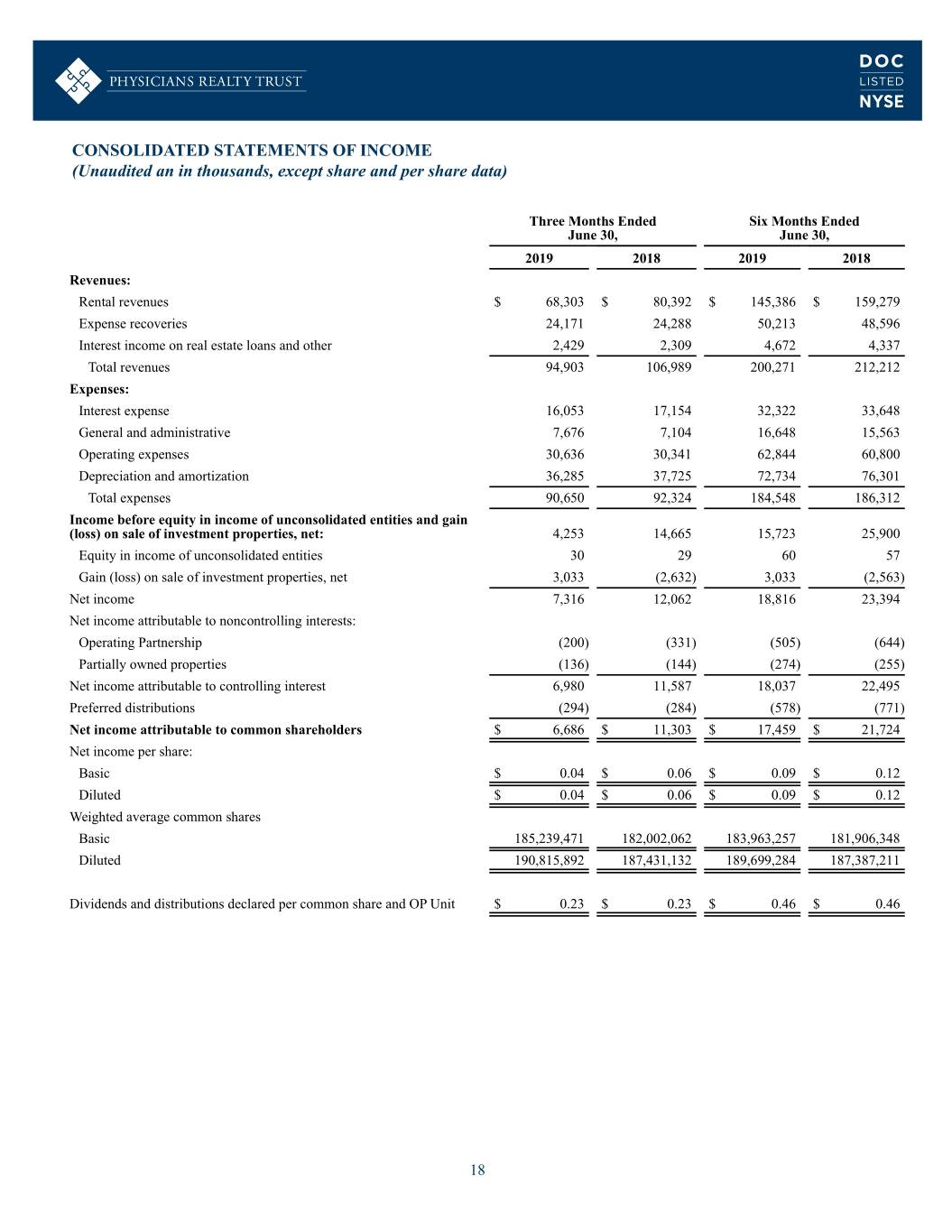

CONSOLIDATED STATEMENTS OF INCOME (Unaudited an in thousands, except share and per share data) Three Months Ended Six Months Ended June 30, June 30, 2019 2018 2019 2018 Revenues: Rental revenues $ 68,303 $ 80,392 $ 145,386 $ 159,279 Expense recoveries 24,171 24,288 50,213 48,596 Interest income on real estate loans and other 2,429 2,309 4,672 4,337 Total revenues 94,903 106,989 200,271 212,212 Expenses: Interest expense 16,053 17,154 32,322 33,648 General and administrative 7,676 7,104 16,648 15,563 Operating expenses 30,636 30,341 62,844 60,800 Depreciation and amortization 36,285 37,725 72,734 76,301 Total expenses 90,650 92,324 184,548 186,312 Income before equity in income of unconsolidated entities and gain (loss) on sale of investment properties, net: 4,253 14,665 15,723 25,900 Equity in income of unconsolidated entities 30 29 60 57 Gain (loss) on sale of investment properties, net 3,033 (2,632) 3,033 (2,563) Net income 7,316 12,062 18,816 23,394 Net income attributable to noncontrolling interests: Operating Partnership (200) (331) (505) (644) Partially owned properties (136) (144) (274) (255) Net income attributable to controlling interest 6,980 11,587 18,037 22,495 Preferred distributions (294) (284) (578) (771) Net income attributable to common shareholders $ 6,686 $ 11,303 $ 17,459 $ 21,724 Net income per share: Basic $ 0.04 $ 0.06 $ 0.09 $ 0.12 Diluted $ 0.04 $ 0.06 $ 0.09 $ 0.12 Weighted average common shares Basic 185,239,471 182,002,062 183,963,257 181,906,348 Diluted 190,815,892 187,431,132 189,699,284 187,387,211 Dividends and distributions declared per common share and OP Unit $ 0.23 $ 0.23 $ 0.46 $ 0.46 18

REPORTING DEFINITIONS Adjusted Earnings Before Interest Taxes, Depreciation and Amortization for Real Estate (Adjusted EBITDAre): We define Adjusted EBITDAre for DOC as EBITDAre, computed in accordance with standards established by the National Association of Real Estate Investment Trusts (“NAREIT”), plus acquisition-related expenses, non-cash compensation, and other non-recurring items. We consider Adjusted EBITDAre an important measure because it provides additional information to allow management, investors, and our current and potential creditors to evaluate and compare our core operating results and our ability to service debt. Annualized Base Rent (ABR): Annualized base rent is calculated by multiplying reported base rent for June 2019 by 12 (but excluding the impact of concessions and straight-line rent). Cash Net Operating Income (NOI): Cash NOI is a non-GAAP financial measure which excludes from NOI straight-line rent adjustments, amortization of acquired below and above market leases and other non-cash and normalizing items. Other non-cash and normalizing items include items such as the amortization of lease inducements, and payment received from a seller master lease. DOC believes that Cash NOI provides an accurate measure of the operating performance of its operating assets because it excludes certain items that are not associated with management of the properties. Additionally, DOC believes that Cash NOI is a widely accepted measure of comparative operating performance in the real estate community. However, DOC’s use of the term Cash NOI may not be comparable to that of other real estate companies as such other companies may have different methodologies for computing this amount. Coverage Ratio: Reflects the ratio of full-year EBITDAR to rent of indicated properties. Coverage ratios are calculated one quarter in arrears, beginning the first full quarter after acquisition, for all properties the company has owned for fifteen months. Management fee is standardized to 4% of revenues for LTACHs. Earnings Before Interest Taxes, Depreciation, Amortization and Rent (EBITDAR): We define EBITDAR for DOC as net (loss) income computed in accordance with GAAP plus depreciation, amortization, interest expense and net change in the fair value of derivative financial instruments, net (loss) included from discontinued operations, stock based compensation, acquisition-related expenses and lease expense. We consider EBITDAR an important measure because it provides additional information to allow management, investors, and our current and potential creditors to evaluate and compare our tenants ability to fund their rent obligations. Earnings Before Interest Taxes, Depreciation and Amortization for Real Estate (EBITDAre): In 2017, NAREIT issued a white paper defining EBITDA for real estate as net income or loss computed in accordance with GAAP plus interest expense, income tax expense, depreciation and amortization expense, impairment, gains or losses from the sale of real estate; and the proportionate share of joint venture depreciation, amortization and other adjustments. We adopted the use of EBITDAre in the first quarter of 2018. Funds From Operations (FFO): Funds from operations, or FFO, is a widely recognized measure of REIT performance. We believe that information regarding FFO is helpful to shareholders and potential investors because it facilitates an understanding of the operating performance of our properties without giving effect to real estate depreciation and amortization, which assumes that the value of real estate assets diminishes ratably over time. We calculate FFO in accordance with standards established by NAREIT. NAREIT defines FFO as net income or loss (computed in accordance with GAAP) before noncontrolling interests of holders of OP units, excluding preferred distributions, gains (or losses) on sales of depreciable operating property, impairment write-downs on depreciable assets, plus real estate related depreciation and amortization (excluding amortization of deferred financing costs). Our FFO computation may not be comparable to FFO reported by other REITs that do not compute FFO in accordance with NAREIT definition or that interpret the NAREIT definition differently than we do. The GAAP measure that we believe to be most directly comparable to FFO, net income, includes depreciation and amortization expenses, gains or losses on property sales, impairments and noncontrolling interests. In computing FFO, we eliminate these items because, in our view, they are not indicative of the results from the operations of our properties. To facilitate a clear understanding of our historical operating results, FFO should be examined in conjunction with net income (determined in accordance with GAAP) as presented in our financial statements. FFO does not represent cash generated from operating activities in accordance with GAAP, should not be considered to be an alternative to net income or loss (determined in accordance with GAAP) as a measure of our liquidity and is not indicative of funds available for our cash needs, including our ability to make cash distributions to shareholders. Gross Leasable Area (GLA): Gross leasable area (in square feet). Gross Real Estate Investments: Based on acquisition price (and includes lease intangibles). Health System: We define an entity to be a health system if each of the following criteria are met: 1) the entity provides inpatient or outpatient services in the primary course of business; 2) services are provided at more than one campus or site of care; and 3) if the entity only provides outpatient services, they must employ a minimum of 50 physicians. Health System-Affiliated: Properties are considered affiliated with a health system if one or more of the following conditions are met: 1) the land parcel is contained within the physical boundaries of a hospital campus; 2) the land parcel is located adjacent to the campus; 3) the building is physically connected to the hospital regardless of the land ownership structure; 4) a ground lease is maintained with a health system entity; 5) a master lease is maintained with a health system entity; 6) significant square footage is leased to a health system entity; 7) the property includes an ambulatory surgery center with a hospital ownership interest; or 8) a significant square footage is leased to a physician group that is either employed, directly or indirectly by a health system, or has a significant clinical and financial affiliation with the health system. Hospitals: Hospitals refer to specialty surgical hospitals. These hospitals provide a wide range of inpatient and outpatient services, including but not limited to, surgery and clinical laboratories. LTACHs: Long-term acute care hospitals (LTACH) provide inpatient services for patients with complex medical conditions who require more sensitive care, monitoring or emergency support than that available in most skilled nursing facilities. 19

REPORTING DEFINITIONS (continued) Medical Office Building (MOB): Medical office buildings are office and clinic facilities, often located near hospitals or on hospital campuses, specifically constructed and designed for use by physicians and other health care personnel to provide services to their patients. They may also include ambulatory surgery centers that are used for general or specialty surgical procedures not requiring an overnight stay in a hospital. Medical office buildings may contain sole and group physician practices and may provide laboratory and other patient services. MOB Same-Store Cash Net Operating Income (NOI): MOB Same-Store Cash NOI is a non-GAAP financial measure which excludes from Cash NOI assets not held for the entire preceding five quarters, non-MOB assets, and other normalizing items not specifically related to the same-store property portfolio. Management considers MOB Same-Store Cash NOI a supplemental measure because it allows investors, analysts, and Company management to measure unlevered property- level operating results. Our use of the term MOB Same-Store Cash NOI may not be comparable to that of other real estate companies, as such other companies may have different methodologies for computing this amount. MOB Same-Store Portfolio: The MOB same-store portfolio consists of medical office properties held by the Company for the entire preceding five quarters. Net Operating Income (NOI): NOI is a non-GAAP financial measure that is defined as net income or loss, computed in accordance with GAAP, generated from DOC’s total portfolio of properties before general and administrative expenses, acquisition-related expenses, depreciation and amortization expense, REIT expenses, interest expense and net change in the fair value of derivative financial instruments, and gains or loss on the sale of discontinued properties. DOC believes that NOI provides an accurate measure of operating performance of its operating assets because NOI excludes certain items that are not associated with management of the properties. Additionally, DOC’s use of the term NOI may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount. Normalized Funds Available for Distribution (Normalized FAD): DOC defines Normalized FAD, a non-GAAP measure, which excludes from Normalized FFO non-cash share compensation expense, straight-line rent adjustments, amortization of acquired above or below market leases and assumed debt, amortization of deferred financing costs, amortization of lease inducements, and recurring capital expenditures related to tenant improvements and leasing commissions, and includes cash payments from seller master leases and rent abatement payments. Other REITs or real estate companies may use different methodologies for calculating Normalized FAD, and accordingly, our computation may not be comparable to those reported by other REITs. Although the Company’s computation of Normalized FAD may not be comparable to that of other REITs, the Company believes Normalized FAD provides a meaningful supplemental measure of its performance due to its frequency of use by analysts, investors, and other interested parties in the evaluation of our performance as a REIT. Normalized FAD should not be considered as an alternative to net income or loss attributable to controlling interest (computed in accordance with GAAP) or as an indicator of the Company’s financial performance. Normalized FAD should be reviewed in connection with other GAAP measurements. Normalized Funds From Operations (Normalized FFO): Changes in the accounting and reporting rules under GAAP have prompted a significant increase in the amount of non-operating items included in FFO, as defined. Therefore, DOC uses Normalized FFO, which excludes from FFO net change in fair value of derivative financial instruments, acquisition expenses, acceleration of deferred financing costs, write off contingent consideration and other normalizing items. However, our use of the term Normalized FFO may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount. Normalized FFO should not be considered as an alternative to net income or loss (computed in accordance with GAAP), as an indicator of our financial performance or of cash flow from operating activities (computed in accordance with GAAP), or as an indicator of our liquidity, nor is it indicative of funds available to fund our cash needs, including its ability to make distributions. Normalized FFO should be reviewed in connection with other GAAP measurements. Occupancy: Occupancy represents the percentage of total gross leasable area that is leased, including month-to-month leases, leases in holdover status, and leases that are signed but not yet commenced, as of the date reported. Off-Campus: A building portfolio that is not located on or adjacent to key hospital based-campuses. On-Campus / Affiliated: On-campus refers to a property that is located on or within a quarter mile to a health system. Affiliated refers to a property that is not on the campus of a health system, but is affiliated with a health system. Section 603 Assets: For the purposes of this Supplemental Information, "603 Asset" is defined to be our estimate of Annualized Base Revenue (ABR) as a percentage of all our ABR, derived from leases to hospitals for hospital outpatient department space located in an off-campus medical office building at least 250 yards from the hospital's main campus inpatient location, and that was billing Medicare for outpatient department services provided in that off-campus location as of November 2, 2015. ABR that is "not-603" for the purposes of this Supplemental Information could and would include ABR from space leased to a hospital outpatient department services provided in leased space within the 250 yard requirement for on-campus locations or in buildings that are more than 250 yards from the hospital service provider's main campus, but the hospital did not start billing for that service in the location until after November 2, 2015. 20