- NWHM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

New Home (NWHM) CORRESPCorrespondence with SEC

Filed: 16 Jul 13, 12:00am

| SIDLEY AUSTIN LLP 787 SEVENTH AVENUE (212) 839 5300 (212) 839 5599 FAX | BEIJING BOSTON BRUSSELS CHICAGO DALLAS FRANKFURT GENEVA | HONG KONG HOUSTON LONDON LOS ANGELES NEW YORK PALO ALTO SAN FRANCISCO | SHANGHAI SINGAPORE SYDNEY TOKYO WASHINGTON, D.C. | ||||||

| jcummins@sidley.com (212) 839-5374 | FOUNDED 1866 | |||||||||

July 16, 2013

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, DC 20549

Attn: Jay Ingram

Alfred Pavot

Tracey Smith

Asia Timmons-Pierce

| Re: | The New Home Company LLC | |

| Amendment No. 4 to the Registration Statement on Form S-1 | ||

| CIK No. 0001574596 |

Ladies and Gentlemen:

The New Home Company LLC (to be converted into a Delaware corporation prior to the completion of the offering to which the Registration Statement referred to below relates) (the “Company”) has today electronically transmitted, pursuant to Regulation S-T, Amendment No. 4 (“Amendment No. 4”) to the Registration Statement on Form S-1 (including exhibits thereto) of the Company (the “Registration Statement”) for filing under the Securities Act of 1933, as amended (the “Securities Act”). On behalf of the Company, we hereby respond to the comments of the staff (the “Staff”) of the Division of Corporation Finance of the Securities and Exchange Commission (the “Commission”) in a letter dated July 15, 2013 from Mr. Jay Ingram, Legal Branch Chief. For your convenience, the Staff’s comments are included in this letter and are followed by the applicable responses. We will also provide courtesy copies of Amendment No. 4 to the Registration Statement, as filed and marked to indicate the changes made from the filing of Amendment No. 3 to the Registration Statement with the Commission on July 11, 2013.

S-1/A#4 Draft

Management’s Discussion and Analysis of Financial Conditions and Results of Operation, page 61

Securities and Exchange Commission

Division of Corporation Finance

July 16, 2013

Page 2

| 1. | We note that you expect to recognize $2.7 million of stock compensation expense for the issuance of stock-based compensation in connection with your initial public offering, which is 59.6% of pro forma loss from operations for fiscal year 2012. Please expand your overview section to notify investors that you will be issuing stock-based compensation in connection with your initial public offering and subsequently in connection with your 2013 Long-Term Incentive Plan. Please also disclose the amount of compensation expense you expect to recognize for each year in which the stock-based compensation vests. |

Response: The requested changes have been made to pages 61 and 62.

Unaudited Pro Forma Consolidated Financial Statements, page F-2

Pro Forma Consolidated Balance Sheet, page F-3

| 2. | We note from your disclosures on pages 51 and 54 that you may increase or decrease the number of shares you will offer in your initial public offering. As such, please provide the disclosures required by Article 11-02(b)(8) of Regulation S-X for the different results that may occur. |

Response: The disclosures on pages 51, 53 and 54 indicating that the Company may increase or decrease the number of shares it will offer in the initial public offering have been deleted, and, as a result, the Company respectfully submits that disclosures pursuant to Article 11-02(b)(8) of Regulation S-X are not relevant.

| 3. | We note that the executive management team’s ownership interest will increase from 25% to 40.3% subsequent to the conversion of the registrant from an LLC to a Delaware corporation. We further note that you have not recognized an expense within retained earnings and did not disclose that this expense has been excluded from pro forma net loss before nonrecurring items. Please tell us what consideration you have given to recognizing the increase in ownership interest as compensation expense for the executive management team as a result of the conversion to a corporation. Please refer to Article 11-02(b)(5) of Regulation S-X for guidance regarding nonrecurring items. Further, we note your disclosure that the allocation of the aggregate 9,690,387 shares of common stock your current members will receive in connection with the conversion from an LLC to a Delaware corporation is variable depending on the initial public offering price. Please include a sensitivity analysis of the impact of a change in the initial public offering price in accordance with Article 11-02(b)(8) of Regulation S-X. |

Securities and Exchange Commission

Division of Corporation Finance

July 16, 2013

Page 3

We respectfully submit to the Staff that the increase in percentage ownership held by the executive management team subsequent to the conversion of the Company from a limited liability company to a corporation is directly attributable to the equity interest held by the executive management team in the Company through TNHC Partners LLC (“TNHCP”). This increase in percentage ownership is not attributable to their respective employment with the Company. Accordingly, the change in percentage ownership held by the executive management team does not have an impact on the pro forma results reported. This conclusion is supported by the Company’s analysis, which analysis is set forth in the memorandum attached as Exhibit A to this response letter. Based upon such analysis, the Company believes that the following key terms support its conclusion that the interests held by members of the executive management team in TNHCP is equity and should not be treated as compensation:

| • | The legal form of the equity interest issued to TNHCP is identical to the equity interest issued to the other members of the Company. |

| • | TNHCP has representation on the board of the Company equal to its economic interest. |

| • | The total amount of capital contributed by TNHCP was proportionate to its capital interest. |

| • | The economic allocation to TNHCP equity interests is not subordinated to the economic interests of other equity members nor is it tied to performance of a subset of the Company’s assets. |

| • | There is no vesting requirement for the TNHCP equity interests nor is it tied to the employment agreements of the respective executive officers. |

| • | Termination of employment by the Company, or by a respective executive officer, has no impact on the respective equity interests of the executive officers. For example, the CEO of the Company can choose to end his employment with the Company, or the Company may terminate its employment with the CEO, and the CEO would still retain his equity interest in TNHCP. |

As a result of the foregoing, a sensitivity analysis has not been included, as such an analysis would be predicated on the treatment of the foregoing as compensation. However, separately, we note that a sensitivity analysis has been included on page 185 of the Registration Statement. The correspondence submitted to the Staff in our letter dated July 11, 2013 illustrates that the number of shares to be received by our executive management team and the institutional investors, respectively, does not change from the low to the high end of the price range set forth on the cover page of the prospectus.

Pro Forma Consolidated Statements of Operations, page F-4

| 4. | We note that you have included the number of shares to be issued in this offering within pro forma shares outstanding for purposes of calculating pro forma loss per share. We further note that you will be using the proceeds from this offering for general corporate purposes (e.g., development of lots, home construction and other related purposes). In accordance with Article 11-02(b)(7) of Regulation S-X, please remove the shares offered in connection with your initial public offering from the earnings (loss) per share presentation. |

Response: The requested change has been made, and disclosure has been added in the new footnote 7, in accordance with the Staff’s comment.

Securities and Exchange Commission

Division of Corporation Finance

July 16, 2013

Page 4

Notes to Pro Forma Financial Statements, page F-6

| 5. | Please expand footnote (4) to provide investors with the specific calculations of the adjustment for the 92,220 restricted stock units by the corresponding vesting period of one to five years and the options for 541,111 shares of your common stock by the corresponding vesting period of one to five years. Please refer to Article 11-02(b)(6) of Regulation S-X for guidance. Please disclose the amount of unrecognized compensation expense that will be recognized over the remaining vesting periods. |

Response: The requested changes have been made on page F-6.

15. Unaudited Pro Forma Income (Loss) per Share, page F-31

| 6. | Please provide us with your calculations of the weighted-average shares for the conversion of members’ equity into shares of common stock of 9,690,387 for each period presented. |

Response: The calculations of the weighted-average shares for the conversion of members’ equity into shares of common stock are set forth on Exhibit B hereto. Please note that the Company has presented the calculations for the predecessor separately.

| 7. | Please expand your calculation to include the periods August 18, 2010 through December 31, 2010, and January 1, 2010 through August 17, 2010, as reference in your footnote disclosure. |

Response: The requested changes have been made on pages F-9 and F-32.

16. Subsequent Events, page F-32

| 8. | Please provide the disclosure required by ASC 855-10-50-1 for both your annual and interim periods presented. |

Response: The requested changes have been made on pages F-32 and F-43.

* * * * *

Securities and Exchange Commission

Division of Corporation Finance

July 16, 2013

Page 5

In addition to the foregoing, we are providing, as Exhibit C hereto, an updated version of the JBREC report submitted supplementally to the Staff with our letter dated June 14, 2013 in response to Comment No. 7 of the Staff’s letter dated May 15, 2013. In addition, we are also providing, as Exhibit D hereto, Amendment No. 1 to the Supplement to the Amended and Restated Limited Liability Company Agreement previously provided supplementally to the Staff with our letter dated June 26, 2013.

Thank you for your responsiveness in providing the comments in your letter dated July 15, 2013. We believe that the proposed modifications to the Registration Statement are responsive to such comments. The Company seeks to commence printing preliminary prospectuses and the marketing roadshow of its offering as soon as practicable. Please direct any further communications relating to this filing to the undersigned at (212) 839-5374.

| Very truly yours, |

| /s/ J. Gerard Cummins |

| J. Gerard Cummins |

| cc: | H. Lawrence Webb |

Edward F. Petrosky

Casey T. Fleck

Julian Kleindorfer

Exhibit A

[See attached]

Date: | July 16, 2013 | |

To: | Wayne Stelmar and The New Home Company LLC files | |

| cc: Peter Zofrea, EY Coordinating Partner | ||

From: | Mike Cunningham | |

Compensation Expense

Background

The New Home Company LLC (the “Company”), a Delaware limited liability company, and its subsidiaries are primarily engaged in all aspects of residential real estate development, including acquiring land and designing, constructing and selling homes located in California. The Company was formed with an effective date of August 26, 2009. The Company was capitalized through cash contributions by its sole member and holding company, TNHC Partners LLC (“TNHCP”) with the following structure:

| Pre – Transaction | ||||||||||||

Investor | Capital % | Economic % | Voting % | |||||||||

TNHCP | 100.0 | % | 100.0 | % | 100.0 | % | ||||||

TOTAL | 100.0 | % | 100.0 | % | 100.0 | % | ||||||

TNHCP is comprised of four individual equity holders, each of who are also executive officers of the Company.

Page 1 of 5

Effective August 18, 2010, the Company amended and restated its operating agreement (the “Agreement”) and concurrently admitted Watt/TNHC LLC (“Watt”) and IHP Capital Partners VI, LLC (“IHP”) as members. Watt and IHP each contributed cash of $6,000,000 in exchange for 33.33%, or 66.67% in total, of the outstanding capital interest, and 25% each, or 50% in total, of the outstanding economic/voting interest. The following was the structure of the Company:

| Pre – Transaction | Post – Transaction with Watt and IHP | |||||||||||||||||||||||

Investor | Capital % | Economic % | Voting % | Capital % | Economic % | Voting % | ||||||||||||||||||

TNHCP | 100.0 | % | 100.0 | % | 100.0 | % | 33.33 | % | 50.00 | % | 50.0 | % | ||||||||||||

IHP | — | — | — | 33.33 | % | 25.00 | % | 25.0 | % | |||||||||||||||

Watt | — | — | — | 33.33 | % | 25.00 | % | 25.0 | % | |||||||||||||||

TOTAL | 100.0 | % | 100.0 | % | 100.0 | % | 100.00 | % | 100.00 | % | 100.0 | % | ||||||||||||

Effective January 2011, the Company admitted TCN/TNHC LP (“Tricon”) as a member of the Company for a contribution of $6,600,000. As a result of this transaction, capital percentages were adjusted as following:

| Pre –Transaction with Tricon | Post – Transaction with Tricon | |||||||||||||||||||||||

Investor | Capital % | Economic % | Voting % | Capital % | Economic % | Voting % | ||||||||||||||||||

TNHCP | 33.33 | % | 50.0 | % | 50.0 | % | 25.00 | % | 50.0 | % | 50.0 | % | ||||||||||||

IHP | 33.33 | % | 25.0 | % | 25.0 | % | 25.00 | % | 16.67 | % | 16.67 | % | ||||||||||||

Watt | 33.33 | % | 25.0 | % | 25.0 | % | 25.00 | % | 16.67 | % | 16.67 | % | ||||||||||||

Tricon | — | — | — | 25.00 | % | 16.67 | % | 16.67 | % | |||||||||||||||

TOTAL | 100.0 | % | 100.0 | % | 100.0 | % | 100.00 | % | 100.0 | % | 100.0 | % | ||||||||||||

TNHCP, Watt, IHP, and Tricon are collectively referred to herein as the “Members”.

In accordance with Section 7 of the Agreement, distributions shall first be made to all Members pro rata in proportion to their unreturned capital commitments and then to all Members pro rata in proportion to their economic interest.

Page 2 of 5

Issues:

| 1) | TNHCP has a disproportionate economic interest when compared to its capital interest. Since the equity holders of TNHCP are also executive officers of the Company, should the Company recognize any compensation expense related to the disproportionate economic interest? |

Authoritative Guidance

Accounting Standards Codification 718, Share Based Payment, (“ASC 718”)

Ernst & Young Financial Reporting Developments (“FRD”) – Share Based Payment

Conclusion

Based on a review of the Company’s operating agreement and the employment agreements for the executive officers of the Company, who are also equity owners of TNHCP, we conclude that all economic allocations would be driven by equity ownership and are not related to employment. Accordingly, the Company should not recognize any compensation expense specific to the economic allocation of profits in accordance with the Agreement.

Reasons for Conclusions:

Response to Issue 1:

The CEO, CFO, COO, and CIO of the Company are also the equity holders of TNHCP, which owns a 25% capital interest and 50% economic interest in the Company. The above mentioned executive officers together own 100% of TNHCP.

ASC 718 defines share based compensation as awards issued to employees for services they provide to a company. The definition of shares includes instruments that represent a legal equity interest in a partnership, limited liability partnership, or limited liability company. Section S2.1.5.6 of EY FRD provides the following general factors to consider in determining whether the individual is a partner versus an employee:

| a. | Form of ownership — if the individual has made a contribution and signed a partnership agreement that will provide for an allocation in the profits and losses along with distributions, and the individual receives a K-1 for tax purposes, the arrangement may be more akin to a partner arrangement. Alternatively, employee classification may be appropriate if the individual’s amount of ownership is determined based upon providing a service or meeting a particular performance condition where the failure to meet either of these requirements will result in the partnership interest ceasing to exist. |

Page 3 of 5

| b. | Governance of the partnership — if the individual is part of a visible group that is known to have ultimate authority on the enterprise’s direction, then this is a general indicator of a partner. |

| c. | Funding participation — a partner is generally required to provide a fixed dollar amount based upon its percentage of ownership when capital is needed. |

In his 11 December 2006 speech at the 2006 AICPA National Conference on Current SEC and PCAOB Developments, Joseph Ucuzoglu, Professional Accounting Fellow, Office of the Chief Accountant, U.S. Securities and Exchange Commission, stated, “When making this [partner vs. employee] determination, all relevant features of the special class must be considered. There are no bright lines or litmus tests. When few if any assets underlie the special class, or the holder’s claim to those assets is heavily subordinated, the arrangement often has characteristics of a performance bonus or profit-sharing arrangement. Instruments that provide the holder with substantive voting rights and pari passu dividend rights are at times indicative of an equity interest. Consideration should also be given to any investment required, and any put and call rights that may limit the employee’s downside risk or provide for cash settlement.”

Based on a review of the Company’s operating agreement, we noted the following:

| • | The legal form of the equity interest issued to TNHCP is identical to those issued to the other equity Members of the Company. |

| • | TNHCP receives a K-1 from the Company for tax purposes. |

| • | TNHCP has representation on the board of the Company equal to its economic interest. |

| • | Terms of equity participation features such as capital and voting rights, distribution rights and liquidation rights are consistent amongst the Members. |

| • | The total amount of capital contribution by TNHCP was in pro-rata shares of its capital interest. |

| • | The economic allocation to TNHCP equity interests is not subordinated to the economic interests of other equity Members nor is it tied to performance to a subset of the Company assets. |

| • | TNHCP does not have any preferred transferability of its equity interest when compared to other equity partners. |

| • | There is no vesting requirement for the TNHCP equity interests nor is it tied to the employment agreements of the respective executive officers. |

Page 4 of 5

| • | Termination of employment by the Company, or by a respective executive officer, has no impact on their respective equity interest. For example, the CEO of the Company can choose to end his employment with the Company, or the Company may terminate the CEO, and the CEO would still retain his equity interest in TNHCP. |

| • | There are no put/call or other repurchase features attached specifically to TNHCP’s equity interest. IHP is the only investor whose shares do not contain transfer restrictions, but once IHP exercises its right to transfer shares without receiving the approval of other Members, the other Members’ shares become unrestricted. There is a call option at any time within three months after the occurrence of a Board of Managers Impasse or an Event of Default that allows the other Members to purchase the Member’s interests in the Company who had the impasse or default. This provision applies to all Members of the Company. |

Based on the above, we conclude that the economic allocation to TNHCP is identifiable with its equity interest and is not related to the employment of the Company’s executive officers.

Page 5 of 5

Exhibit B

[See attached]

The New Home Company Predecessor

Weighted Average Shares Outstanding Calculation

Period | Contributions | Conversion Ratio | Common Outstanding | Weighted Shares Outstanding @ 8/17/10 | ||||||||||||

9/17/2009 | (100,000 | ) | 0.1615 | 16,151 | 16,151 | |||||||||||

10/13/2009 | (100,000 | ) | 0.1615 | 16,151 | 16,151 | |||||||||||

10/22/2009 | (250,000 | ) | 0.1615 | 40,377 | 40,377 | |||||||||||

11/10/2009 | (100,000 | ) | 0.1615 | 16,151 | 16,151 | |||||||||||

11/24/2009 | (50,000 | ) | 0.1615 | 8,075 | 8,075 | |||||||||||

12/4/2009 | (100,000 | ) | 0.1615 | 16,151 | 16,151 | |||||||||||

12/14/2009 | (220,000 | ) | 0.1615 | 35,531 | 35,531 | |||||||||||

12/22/2009 | (5,060,000 | ) | 0.1615 | 817,223 | 817,223 | |||||||||||

12/31/2009 | 40,000 | 0.1615 | (6,460 | ) | (6,460 | ) | ||||||||||

|

| |||||||||||||||

Total | 959,348 | |||||||||||||||

|

| |||||||||||||||

The New Home Company LLC

Weighted Average Shares Outstanding Calculation

Period | Contributions | Conversion Ratio | Common Outstanding | Weighted Shares Outstanding at 12/31/10 | Weighted Shares Outstanding at 12/31/11 | Weighted Shares Outstanding at 12/31/12 | Weighted Shares Outstanding at 3/31/12 | Weighted Shares Outstanding at 3/31/13 | ||||||||||||||||||||||||

8/18/2010 | (11,940,000 | ) | 0.1615 | 1,928,387 | 1,928,387 | 1,928,387 | 1,928,387 | 1,928,387 | 1,928,387 | |||||||||||||||||||||||

9/15/2010 | (3,260,000 | ) | 0.1615 | 526,511 | 417,309 | 526,511 | 526,511 | 526,511 | 526,511 | |||||||||||||||||||||||

10/15/2010 | (2,800,000 | ) | 0.1615 | 452,218 | 257,932 | 452,218 | 452,218 | 452,218 | 452,218 | |||||||||||||||||||||||

12/15/2010 | (1,800,000 | ) | 0.1615 | 290,712 | 34,455 | 290,712 | 290,712 | 290,712 | 290,712 | |||||||||||||||||||||||

1/15/2011 | (2,600,000 | ) | 0.1615 | 419,917 | — | 402,660 | 419,917 | 419,917 | 419,917 | |||||||||||||||||||||||

5/15/2011 | (800,000 | ) | 0.1615 | 129,205 | — | 81,417 | 129,205 | 129,205 | 129,205 | |||||||||||||||||||||||

6/15/2011 | (800,000 | ) | 0.1615 | 129,205 | — | 70,443 | 129,205 | 129,205 | 129,205 | |||||||||||||||||||||||

9/15/2011 | (4,800,000 | ) | 0.1615 | 775,231 | — | 227,259 | 775,231 | 775,231 | 775,231 | |||||||||||||||||||||||

12/15/2011 | (1,000,000 | ) | 0.1615 | 161,506 | — | 7,080 | 161,506 | 161,506 | 161,506 | |||||||||||||||||||||||

4/15/2012 | (2,000,000 | ) | 0.1615 | 323,013 | — | — | 230,091 | — | 323,013 | |||||||||||||||||||||||

5/15/2012 | (5,000,000 | ) | 0.1615 | 807,532 | — | — | 508,856 | — | 807,532 | |||||||||||||||||||||||

6/15/2012 | (800,000 | ) | 0.1615 | 129,205 | — | — | 70,443 | — | 129,205 | |||||||||||||||||||||||

9/15/2012 | (800,000 | ) | 0.1615 | 129,205 | — | — | 37,877 | — | 129,205 | |||||||||||||||||||||||

2/15/2013 | (2,000,000 | ) | 0.1615 | 323,013 | — | — | — | — | 157,917 | |||||||||||||||||||||||

3/15/2013 | (9,600,000 | ) | 0.1615 | 1,550,462 | — | — | — | — | 275,638 | |||||||||||||||||||||||

4/15/2013 | (10,000,000 | ) | 0.1615 | 1,615,065 | — | — | — | — | — | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Total | (60,000,000 | ) | 9,690,387 | 2,638,082 | 3,986,687 | 5,660,159 | 4,812,892 | 6,635,403 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Exhibit C

[See attached]

Housiing Marrkett Overrviiew July 2013 Trusted Analysis for Executive Decisions Headquarters 16485 Laguna Canyon Road, Suite 130 Irvine, CA 92618 Tel: 949-870-1200 www.realestateconsulting.com Offices Irvine San Diego Sacramento Texas Florida New England Contact Information Don Walker Chris Porter President Manager (858) 558-8384 x154 (949) 870-1218 dwalker@realestateconsulting.com cporter@realestateconsulting.com John Burns Real Estate Consulting

Unless otherwise indicated, market data is derived from a market study prepared for us in connection with this offering by John Burns Real Estate Consulting, LLC (“JBREC”) based on the most recent data available as of July 2013. Founded in 2001, JBREC is an independent research provider and consulting firm focused on the housing industry. The following information contains forward-looking statements which are subject to uncertainty and you should review “Cautionary Note Concerning Forward-Looking Statements.”

This Market Opportunity section provides a review of the following:

Overview

| • | National Housing Market |

Selected Housing Markets

| • | Orange County |

| • | San Diego County |

| • | Ventura County |

| • | Los Angeles County |

| • | San Francisco Metropolitan Division |

| • | San Jose Metropolitan Statistical Area |

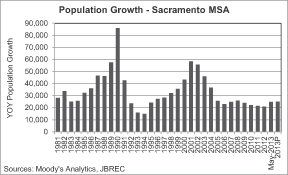

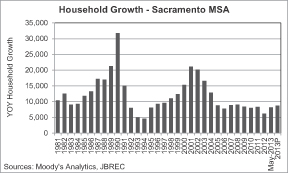

| • | Sacramento Metropolitan Statistical Area |

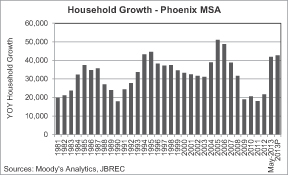

| • | Phoenix Metropolitan Statistical Area |

National Housing Market

The U.S. housing market continues to improve from the cyclical low points reached during the 2008 to 2009 national recession. Between the 2005 market peak and 2011, new single-family housing sales declined 76%, according to data compiled by the U.S. Census Bureau, and median home prices declined 34%, as measured by the S&P Case-Shiller Index. In 2011, early signs of a recovery began to materialize in many markets around the country as a result of an improving macroeconomic backdrop and favorable housing affordability. In the twelve months ended May 31, 2013, homebuilding permits increased 36% and the annual median single-family existing home price increased 11% year-over-year. Growth in new home sales has outpaced growth in existing home sales over the same period, increasing 29% versus 13% for existing homes, which rose, in part, due to foreclosure-related sales.

Historically, strong housing markets have been associated with very favorable affordability, a healthy domestic economy, positive demographic trends such as population growth and household formation, low mortgage rates, increases in renters that qualify as homebuyers, and locally based dynamics such as housing demand relative to housing supply. Many markets across the U.S. are exhibiting most of these positive characteristics. Relative to long-term historical averages, the U.S. economy is creating more jobs than homebuilding permits issued, the inventory of resale and new unsold homes is well below average, and affordability is near its best level in more than 30 years, as measured by the ratio of homeownership costs to household income.

Despite recent momentum, the U.S. housing market has not fully recovered from the 2008 to 2009 recession as mortgage underwriting standards have tightened and the number of delinquent homes remains elevated relative to historical averages. Additionally, real estate is a local industry and not all markets exhibit the same trends.

98

The U.S. housing market is in the beginning of phase three of a three-phase supply-constrained housing recovery, as described below:

| • | Phase 1—job growth begins. |

| • | Phase2—price appreciation occurs among low-priced homes in foreclosure, increasing resale prices to the point that purchasing a new home provides a good value compared to purchasing an existing home. Reduced resale inventory and great affordability are fueling a surge in demand for new homes in this recovery. |

| • | Phase 3—strong demand and limited supply lead to considerable price appreciation in land-constrained markets, and a resurgence in construction activity in markets with sufficient land supplies. Price appreciation allows discretionary buyers to sell their existing homes and potentially purchase a new home. |

While conditions are improving rapidly, significant future growth is required to return to pre-recession housing market conditions.

| • | Construction starts, as measured by the U.S. Census Bureau through May 2013, are at 1,020,000 units per year. This represents 53% of a recovery to a level of 1.5 million annual starts, which is comparable to housing starts in the year 2000, a period that is reflective of a more stable market. Permits issued through May 2013 are more than twice the level of the low of 478,000 annual starts in April 2009. |

| • | Existing home sales, as measured by the National Association of Realtors, are at 4,970,000 annualized transactions through May 2013, which is in line with what JBREC estimates to be a stable level based on a ratio of existing home sales activity per household during the late 1980s and 1990s, when the housing market was in a more balanced environment and many economic variables were near historical averages. Existing home sales had fallen to an annualized rate of 3,300,000 transactions in July 2010. |

| • | New home sales are at 476,000 annualized transactions through May 2013, as measured by the U.S. Census Bureau, representing 30% of a recovery to a level of 800,000 annual transactions, which JBREC estimates to be a stable level based on new home sales activity during the late 1990s, when the housing market was in a more balanced environment and many economic variables were near historical averages. New home sales had fallen to 273,000 annualized transactions in February 2011. |

| • | Home affordability for the nation reached its most favorable levels during the housing downturn as prices and mortgage rates declined. A combination of rising prices and mortgage rates is likely to increase the cost of housing relative to incomes for U.S. homebuyers over the next five years, bringing affordability measures closer to the historical median level measured from 1981 to 2012. |

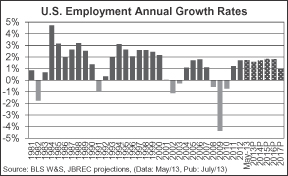

Demand. Job growth is the most important factor for a healthy housing market. While year-over-year job growth is once again positive after significant losses from 2008 through 2010, recent growth has moderated amidst fiscal uncertainty. Additionally, the rate of job growth in economic recoveries has slowed over the last 30 years, primarily as a result of the aging U.S. labor force, productivity improvements and globalization. JBREC assumes that job growth will grow at a 1.6% compound annual rate from 2013 through 2017, ramping up in 2015 and 2016, and slowing in 2017. |  | |

| By the end of 2014, the economy is expected to have recovered all of the 7.7 million jobs lost between 2008 and 2010. | ||

99

The average employment growth to homebuilding permit ratio for the country was 2.3 as of May 31, 2013. A balanced ratio in a stable market is 1.2 to 1.3. This ratio has been above a stable market ratio for several quarters, due to a rise in employment growth coupled with historically low homebuilding permit levels. Eventually, the relative excess job growth to homebuilding permit growth should lead to improving consumer confidence and new home sales, which will drive increased construction activity.

Household formations are expected to average 1.36 million per year through 2017, based on population growth that averages 0.9% per year and headship rates (which is the percentage of people in an age group that head a household) that return to levels that are more consistent with historical trends by 2025. The reduction in headship rates for nearly all age groups from 2000 to 2010 was caused primarily by the economic distress in the late 2000s. Immigration is expected to add to the household and population growth as well, occurring at approximately 0.3% per year, and mostly concentrated in the 20 to 40 year old demographic.

A lack of inventory is limiting sales activity in the existing home market, but sales are expected to grow through 2016, in part, due to continued investor activity. After decreasing to 4.1 million transactions in 2008 from a peak of nearly 7.1 million transactions three years prior, existing home sales transactions are currently at 4.97 million, hampered by a large decrease in the supply of homes on the market. JBREC forecasts that sales will rise to 5.5 million transactions in 2016, which would be slightly higher than the sales activity in 2001, and will decline in 2017 when mortgage rates are assumed to exceed 5.5% and the economy is assumed to slow. The share of sales that were for investment purposes rose to 30% in the first quarter of 2013, which was the highest rate on record. An elevated share of distressed sales is expected to keep investor activity above normal levels in the near term. Many investors are converting distressed inventory to rentals for a long-term hold, which is aiding the recovery process as they are removing marginal inventory that otherwise depresses prices.

The projected slow but steady job growth should support absorption of the rising new home supply, which is coming off historical lows. New home sales transactions reached a trough in 2011 at 273,000 homes sold, and are forecasted to rise steadily to 810,400 sales in 2016—a level last reached in pre-boom 1997 and slightly higher than 2007. The new home market currently has only 161,000 units of completed supply, which is near the lowest level in more than 30 years, and JBREC expects construction levels to increase as the price of housing rebounds.

Supply. JBREC is forecasting measurable improvement in new residential construction activity. Activity should steadily increase through 2016 at a rate that slightly exceeds the recovery in past regional downturns, such as what happened in Houston in the late-1980s and Southern California in the late-1990s. With prices rising, and certain submarkets stabilized, homebuilder demand for lots is increasing substantially.

Very little entitlement processing took place during the housing correction, so the supply of finished, or even |

| |

| approved lots, is very tight today. There will be a lag in the delivery of new lot supply, especially in markets with a prolonged approvals process, such as California. In many metro areas, lot prices are quickly approaching peak values as demand exceeds supply. | ||

100

The number of existing homes available for sale (not including “shadow inventory,” which is the number of homes with a mortgage that are in some form of distress but that are not currently for sale) continues its general downward trend after peaking in 2007. As of May 31, 2013, there were 5.1 months of inventory supply on the market, which is well below the peak level and below the average of 7.2 months of supply over the past 30 years.

The excess of vacant homes in the United States has been entirely cleared over the last year, according to JBREC. The vacant housing inventory had accumulated during the correction as investors and second-home buyers purchased homes for profit and personal use, and again as the severe recession significantly reduced household formations. Household growth has outpaced construction and housing vacancy has stabilized nationally, although this varies by local market.

While the number of homes entering the foreclosure process is declining, the overall volume is still quite high relative to historical levels. Approximately 10.8% of all mortgages are delinquent as of the first quarter of 2013—nearly twice the pre-2008 level. The shadow inventory is still substantial. This supply is likely to be sold or liquidated over the next several years. JBREC believes that banks will dispose of many of these distressed loans through either short sales or foreclosures and will do so at a moderate rate so as to limit the downward pressure on home prices resulting from the liquidation. One risk is that banks change their philosophy and decide to dispose of these distressed loans at a more rapid pace.

The media has made much of the distress in the market, focusing on the homes that are in some form of delinquency or foreclosure. However, only 9% of the total housing units in the United States have some sort of distress; the remaining 91% do not, as estimated by JBREC.

Affordability. Affordability in the existing home market is at historically favorable levels nationally, looking back over the last 30 years. The ratio of annual housing costs (which are mortgage payments plus a portion of the down payment) for the median-priced resale home to the median household income is near an all-time low, dating back to 1981. Due to rising mortgage rates coupled with expected home price appreciation, affordability conditions nationally are expected to weaken gradually in the coming years, reaching their historical median levels in 2016. While affordability conditions vary by market, most markets have experienced their most favorable historical affordability during this cycle.

Home values are trending up, and the combination of low mortgage rates, a declining percentage of distressed sales, and low inventory levels are expected to drive rising home values. JBREC estimates national home values appreciated by approximately 5.2% during the twelve months ended May 31, 2013, and forecasts national appreciation of 9.1% in 2013 and 7.6% in 2014, slowing to 0.8% by 2017. Many factors can influence this outlook. Purchases by the Federal Reserve of mortgage-backed securities cause JBREC to believe that the Federal Reserve would like to see home prices rise. |

|

Increasing home price appreciation will be supported by low mortgage rates, which remain historically favorable and are expected to remain low in the near term due to low inflation and global economic uncertainty.

101

JBREC assumes that average 30-year fixed mortgage rates will rise gradually to 5.7% by 2017, as increasing inflation and an improving economy drive rates higher after this period of very low inflation. This assumption has a very high level of risk as interest rates can change quickly.

There is a strong case for solid price appreciation:

| • | Demand—demand is growing much faster than the new home supply being added to the market, which is helping to reduce the excess existing supply in the market. With a lower level of excess supply, prices will rise as there will be multiple buyers for every house on the market for sale. |

| • | Affordability—the most favorable affordability in decades will make it easier for buyers to pay higher prices for homes. |

| • | Investment—hard assets, such as real estate, are broadly considered an inflation hedge, and many investors will focus on inflation once the current deflation concerns subside. International investors sense a fantastic opportunity to buy U.S. real estate, partially thanks to favorable exchange rates. Also, large institutional investors as well as local investment groups see a great opportunity to buy homes at below replacement cost or below the historical price/income ratio, and have been driving prices up. |

The Bear Case. While the fundamentals are in place for a recovery in the housing market, there are a number of factors that are slowing the recovery, including the following.

| • | The market is experiencing a low level of activity from entry-level buyers due to a lack of savings, challenges with back-end debt-to-income ratios and credit, and uncertainty about the housing market and the economy. |

| • | A low level of home purchases by current homeowners is occurring due to the high loan-to-value ratios of many existing homeowners. |

| • | The economy could still experience slow and volatile growth in the years to come, and even a recession. Recessions caused by excess leverage, such as the recent recession, usually resolve over many years and the path is typically very volatile. |

| • | A large number of mortgaged homes will continue to go through the foreclosure process and will be sold under duress. |

| • | Mortgage rates could rise. |

| • | The implementation of qualified mortgage and qualified residential mortgage rules proposed in the Dodd Frank Wall Street Reform and Consumer Protection Act could make mortgages more difficult to obtain. The recent qualified mortgage definition recommended a 43% backend debt-to-income ratio, which is generally more accommodative than the early 1990s. |

| • | Development and building costs are rising, which could negatively impact homebuilder margins. |

In addition, the government deficit is substantial, and the United States will be subject to further credit rating downgrades until political leadership develops and executes a plan to address the deficit. A lack of fiscal accountability could cause U.S. economic problems for years to come.

Conclusion. In summary, housing is a risky asset class, but JBREC believes the outlook for the housing market is very favorable as a result of several factors, including the following:

| • | Demand is strong.The number of adults finding employment is exceeding new home supply by a ratio of 2.3 to 1. |

| • | Supply is low.Resale inventory is well below the historical average months of supply, new home inventory is near an all-time low, and new construction is well below historical averages. |

| • | Affordability is historically favorable.With mortgage rates at 4.5% as of early July 2013, and home prices in many markets back to levels last seen in 2003-2004, homeownership is an attractive financial option. |

102

JBREC forecasts that the excesses of the recent downturn will clear and that home prices and construction will increase for the foreseeable future.

The following table provides a summary of actual economic data and estimates, forecasts and projections for the eight primary markets for the most recent data available as of July 2013.

| Forecasted 2013 Home Value Appreciation(1) | Data: Twelve months ended May 31, 2013 | |||||||||||||||||||

Market | Job Growth | Permits | Job Growth / Permit Ratio | Months of Resale Supply(2) | ||||||||||||||||

Orange County | 13.7 | % | 24,500 | 6,662 | 3.7 | 2.3 | ||||||||||||||

San Diego | 13.78 | % | 20,300 | 6,720 | 3.0 | 2.5 | ||||||||||||||

Ventura | 13.5 | % | 4,300 | 614 | 7.0 | 2.8 | ||||||||||||||

Los Angeles | 9.0 | % | 44,100 | 11,960 | 3.7 | 2.8 | ||||||||||||||

San Francisco | 14.4 | % | 25,300 | 6,099 | 4.1 | 2.8 | ||||||||||||||

San Jose | 15.9 | % | 26,400 | 6,201 | 4.3 | 2.2 | ||||||||||||||

Sacramento | 16.5 | % | 7,100 | 4,123 | 1.7 | 1.2 | ||||||||||||||

Phoenix | 19.6 | % | 47,200 | 17,563 | 2.7 | 2.7 | ||||||||||||||

| (1) | This information is contained in the market study provided to us by JBREC and is based upon various assumptions and forward-looking estimates. Actual results may differ materially from this forecast. |

| (2) | Estimated months of supply as of May 31, 2013. |

103

Orange County, CA Housing Market Overview

Orange County, California, also referred to as the Santa Ana-Anaheim-Irvine metropolitan division, is a part of a single MSA which consists of Los Angeles and Orange Counties together. Orange County has over 3.1 million people and 1.0 million households, making it the third-most populous county in California. Considered to be a set of suburban commuter cities several decades ago, Orange County now has its own vibrant economy and employment centers, and stands on its own identity as a mature community and culture independent of the larger Los Angeles County to its north. Because of its coastal location and its status as a thriving employment center, Orange County is a “first choice” region for housing within the greater Southern California real estate market.

| ||

The housing fundamentals of Orange County have shown considerable improvement in recent years, which is a positive sign for home price appreciation in this market, indicating a recovery from the recession of the last few years. The John Burns Real Estate Consulting Housing Cycle Risk Index measures the health of the housing market based on the performance of 24 market fundamentals in relation to their own history, and has historically been a one- to three-year leading indicator for home price appreciation. The improvement in the overall fundamentals is the result of improving job growth, low supply, good affordability, and the turning of the business cycle. The affordability fundamentals are good, with prices having bottomed at levels last seen in 2003 and 2004, at the same time that low mortgage rates are at 4.5% as of early July 2013. The combination of prices being below peak and historically low mortgage rates continue to provide a good buying opportunity.

There are 1.4 million non-farm payroll jobs in Orange County, and employment growth has been positive since 2011 after job losses in 2007 through 2010. The metro area lost 165,200 jobs (10.9%) from the 2006 peak before adding a combined 75,200 jobs (5.6% growth) from 2011 through May 2013. JBREC expects employment growth of 30,000 jobs (2.1%) in 2013.

Although the area is famous for its vacation destinations such as Disneyland and Knott’s Berry Farm, employment in Orange County is distributed over many industries and sectors. The largest employment sector is the high-paying Professional Business Services (18.0% of jobs) sector, followed by the Trade, Transportation & Utilities (17.1%) sector. Leisure and Hospitality (13.1%), Educational and Health Services |

| |

| (11.8%), Manufacturing (11.1%) and Government (10.7%) follow in size. While Disney is indeed the county’s largest employer, the next three places are held by the University of California, Irvine; St. Joseph’s Health; and Boeing. The headquarters of several Fortune 500 companies are in Orange County, including Ingram Micro and First American in Santa Ana, Western Digital in Lake Forest, and Pacific Life in Newport Beach. The city of Irvine is the home of Allergan, Broadcom, Standard Pacific and Gateway. The Asian-based automobile and electronics companies Mazda, Toshiba, Toyota, Samsung, Kia, Mitsubishi and Hyundai all have regional or national headquarters in Orange County. | ||

104

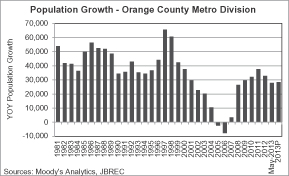

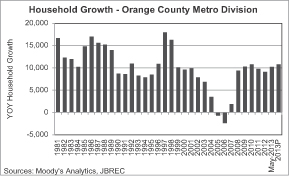

While Orange County lost 0.4% of its population in 2005 and 2006, it has gained population every year since then, adding a total of 186,600 people (6.4%) from 2007 through May 2013. JBREC assumes population growth of 28,400 people (0.9% growth) and household growth of 10,800 (1.1% growth) in 2013.

|  |

As of May 2013, the median household income in Orange County was $71,803, having peaked in 2008 at $76,181. Notably, Orange County median household income is well above the corresponding figure of $53,728 for Los Angeles County, showing the prevalence of higher-income jobs, many of them professional, in Orange County. JBREC expects income growth will be relatively flat for Orange County in 2013.

Existing home sales in Orange County are rising after dipping in 2011. In the twelve months ended May 31, 2013, existing home sales for the area increased to 34,768, up 48% from the trough of 2007. Existing home sales levels are still well below the peak level of 52,000 in 2003. Home prices have increased sharply in Orange County. The median existing single-family detached home price declined 31% between 2007 and 2009, due in part to a shift in sales activity away from the higher price points and a loss in value. The strength of the Orange County economy is seen in the fact that this decline was less than the corresponding drop of 41% in Los Angeles County. As of May 2013, the median price for existing single-family detached homes was $600,000, up from $495,000 in May 2012 and above the 2004 median price level of $570,000, but still below the median price for 2005.

New home sales activity for the twelve months ended May 31, 2013 has risen from the trough levels of 2009, but remains low for this market. New home sales transactions totaled 2,531 for the twelve months ended May 31, 2013, well below the peak of 6,436 in 2003. JBREC expects the new home sales volume to increase to 3,000 transactions in 2013. The median new home price is once again rising after declining from the peak level in 2005. As of May 2013, the median new home price was $694,250, which is up 14.8% from May 2012, but still down slightly from its top of $706,500 in 2005. The median new home price can be heavily influenced by the mix of home types being sold at any given time, and should not be relied upon as the only indicator of market trends. |

| |

105

Home values in Orange County are poised for continued positive growth in 2013, according to JBREC. The Burns Home Value Index provides an estimate of home value trends in an MSA, based on an “electronic appraisal” of every home in the market, rather than just the small sample of homes that are actually transacting. JBREC forecasts home values to rise by 13.7% in 2013, after rising 13.3% during the twelve months ended May 31, 2013.

Homebuilding permit activity in Orange County continues to increase from its lowest levels in decades, with the mix of permits issued gradually moving toward multi-family housing as the county “fills up” and available land slowly decreases. While JBREC forecasts that much of the growth in the housing inventory in 2013 will be for multifamily units, single-family construction is also expected to rebound from trough levels during the downturn in housing. Single-family homebuilding permits had fallen to 1,330 units in 2008, but rose to 3,123 over the twelve months ended May 31, 2013. Multifamily permits totaled 3,539 over the twelve months ended May 31, 2013 and are projected to rise to 4,500 in 2013. The potential exists for a significant increase in homebuilding permit activity in Orange County over the next decade due to a number of large, restructured investments such as: Heritage Fields at the former El Toro Marine Corps Air Station; the former Tustin Marine Corps Air Station; Baker Ranch; Rancho Mission Viejo; and the Irvine Ranch.

The demand being generated for housing is greater than the new supply being added to the market, with job growth in 2012 nearly five times the number of homebuilding permits issued in that same time. The employment growth to homebuilding permit ratio as of May 2013 was 3.7 and that ratio is expected to remain relatively steady for 2013 due to strong job growth.

Resale listings in Orange County are low, which could lead to more competitiveness and increasing prices in the resale market. Through May 2013, the county had 6,550 homes listed on the market, which represented a 23% decline from one year prior and a 46% drop from 2010. By comparison, listings exceeded 17,000 homes on the market in some months of 2007. The level of listings as of May 2013 translates to a very low 2.3 months of supply, based on existing home |

| |

| sales activity over the most recent twelve months. A 6.0 month supply is considered equilibrium for most markets. The May 2013 inventory level is well below the peak level of 8.9 months of supply in 2008. | ||

106

Pre-foreclosure notices are declining in Orange County, which is a positive sign for home prices, as pre-foreclosure notices are an indicator of future distress. In the twelve months ended March 31, 2013, approximately 10,200 notices were issued, representing a 41% decline from one year prior and a 68% decline from the peak in 2009.

While the number of homes falling into pre-foreclosure is declining, there is a moderate level of potential distressed homes that are not yet on the market and may limit upward movement for home prices. JBREC estimated the shadow inventory as of March 31, 2013 at 15,400, or about 5.0 months of supply. The shadow inventory is approximately two times the very low level of listings that are on the market. JBREC believes that most shadow inventory homes will gradually become distressed sales over the next few years, and the pace of distressed sales will be slow enough that home prices will not be significantly negatively affected.

When comparing the monthly costs of owning the median-priced home with the median household income, |

| |

| affordability conditions are slightly better than the historical median affordability conditions in the Orange County metro division. JBREC’s Affordability Index takes into consideration the change in mortgage rates over time in its estimate of the ownership costs, which can significantly impact the monthly payment. JBREC forecasts affordability conditions in Orange County will weaken further in 2013 as home prices and mortgage rates are expected to rise. | ||

In summary, the housing fundamentals in Orange County are solid. Job growth is positive for housing demand in this market, particularly as job growth outpaces the supply of new homes being added to the market. Low levels of existing home listings are creating a more competitive resale market, which should influence future home price appreciation. Prices are at low levels not seen since 2004, in a time when mortgage rates are also low. The combination of relatively low prices and low mortgage rates in a county of high-income jobs suggests a continued rebound in the form of rising construction activity and home prices.

107

San Diego, CA Housing Market Overview

The San Diego-Carlsbad-San Marcos, California MSA consists of San Diego County. San Diego is the second-most populous county in the State of California, with over 3.2 million people and more than 1.1 million households, which is slightly larger than neighboring Orange County. The coastal county is known for its defense/military bases, high-tech industry, and tourism, as well as manufacturing and research. The majority of demand for housing is generated by growth in the region’s diverse economy, but San Diego has also attracted certain affluent second-home buyers and retirees for quality of life reasons. | ||

The housing fundamentals in San Diego are improving, which is a positive sign for price appreciation in this market. The John Burns Real Estate Consulting Housing Cycle Risk Index measures the health of the housing market based on the performance of 24 market fundamentals in relation to their own history, and has historically been a one- to three-year leading indicator for home price appreciation. The overall housing market fundamentals grade has improved since 2008, as the demand, supply and affordability fundamentals have all improved in this market. The risk of a substantial oversupply of residential lots and homes in this MSA are reduced relative to most other markets in the country due to a very difficult entitlement process in which it can take several years to convert a raw property into entitled and finished residential lots.

San Diego has a payroll employment level of nearly 1.3 million workers, and job growth has returning to the market after witnessing a decrease in employment of 6.6% between 2008 and 2010. On a percentage basis, the San Diego metro area witnessed the smallest decrease in employment of the Southern California metro areas. The metro area has added 59,800 jobs (4.9% growth) since 2011, and JBREC assumes job growth of 25,000 (2.0%) in 2013.

Defense/military has a large presence in San Diego’s employment, including the largest naval fleet in the world. The county is also home to a large number of research and manufacturing businesses, particularly in the wireless and biotechnology sectors, and is home to two Fortune 500 companies (Qualcomm and Sempra Energy). The Government sector is the county’s |

| |

| largest, accounting for 18.1% of employment, The Professional and Business Services sector is nearly equal in size, accounting for 17.2% of jobs, and is generally considered to be a high-income employment sector. The Trade, Transportation and Utilities sector comprises 16.1% of employment. Compared to the nation, San Diego has a higher concentration of jobs in the Professional and Business Services, Leisure and Hospitality, and Government sectors. | ||

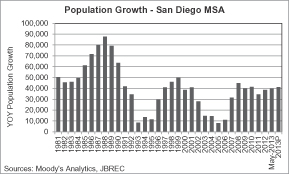

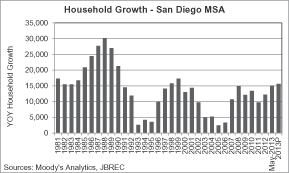

Population and household growth in San Diego have rebounded after slowing in the early- to mid-2000s. From 2008 to 2012, population growth averaged 39,900 people (1.3%) per year and household growth averaged

108

12,500 (1.2%) per year. JBREC assumes population growth of 41,300 people (1.3% growth) and household growth of 15,600 households (1.4% growth) in 2013.

|  |

As of May 2013, the median household income in San Diego was $60,709, which is higher than the national average. After peaking above $63,500 in 2008, the median household income in San Diego declined in 2009 and 2010. JBREC assumes income levels will remain relatively flat in 2013.

San Diego’s existing home sales are improving. In the twelve months ended May 31, 2013, sales had reached 39,655 transactions, representing an increase of more than 48% from the 2007 market trough of 26,715. The federal and state tax credits, as well as increased levels of distressed sales, helped to boost sales in 2008 and 2009. Sales slowed in 2010 and 2011 as the tax credits began to expire and the number of homes on the market began to decline, but sales are rising once again. Resale prices had witnessed strong appreciation from the late 1990s through 2005, but remained essentially flat in 2006 and decreased from 2007 through 2009. The median price in San Diego declined 38% from the peak in 2005 to the trough in 2009, due in part to a shift in sales activity away from the higher price points and a loss in value. Home prices are now rising rapidly.

San Diego’s new home sales activity is steadily increasing from trough levels in 2011, but the increase is expected to accelerate as both demand and supply return to the market. New home sales totaled 3,581 in the twelve months ended May 31, 2013, and JBREC forecasts 3,500 transactions in 2013, which is still low in comparison to historical levels for this market. The median new home price was the highest it had ever been in May 2013 at $495,000. However, new home prices should not be relied upon as the only indicator of market trends, as they can be heavily influenced by the mix of home types being sold at any given time. Resale home prices are a better indication of market trends. |

| |

109

Home values in the San Diego MSA are rebounding, and are poised for continued positive growth in 2013, according to the Burns Home Value Index. The index shows that San Diego home values appreciated 14.0% during the twelve months ended May 31, 2103, following six years of declining values from 2006 through 2011. JBREC forecasts home values to rise 13.7% in 2013.

Homebuilding permit activity in San Diego is rising from its lowest levels in decades, but for the twelve months ended May 31, 2013 levels were approximately one-third of the highest level during the early 2000s. The trough of the market for construction activity occurred in 2009 at just under 3,000 total homebuilding permits, which was less than 7% of the peak permit level in the county in 1986. During the twelve months ended May 31, 2013, San Diego issued 6,720 homebuilding permits, which is much lower than the demand generated by the recent improvement in employment growth. Over the 30-year period from 1983 through May 2013, 52% of the homebuilding permits issued were for single-family homes. During the twelve months ended May 31, 2013, 37% of the homebuilding permits issued were for single-family homes. This shift is due to a lack of land zoned for traditional single-family detached homes and a resulting increase in the share of infill, attached housing.

The demand being generated for housing is greater than the new supply being added to the market, with job growth in the twelve months ended May 31, 2013 higher than the number of homebuilding permits issued in that same time. The employment growth to homebuilding permit ratio was 3.0 in May 2013, as compared to the 1.3 average employment growth to homebuilding permit ratio for the market from 1981 through 2012, and is expected to remain high in 2013.

Resale listings in San Diego are low, causing the resale market to become more competitive and leading to increases in prices. As of May 2013, San Diego had 8,120 homes listed on the market, which represented a decline of 27% from the prior year. In late 2006 and again in late 2007, listings surpassed 22,000 homes on the market. The level of listings as of May 2013 equated to 2.5 months of supply, based on existing home sales activity over the prior twelve months. This represents a significant decrease from the more than nine months of supply in 2008. |

| |

110

In addition to the decline in listings, pre-foreclosure notices have been trending downward, which is a positive sign for home prices in the San Diego market. Pre-foreclosure notices are an indicator of future home sales that will be distressed sales. In the twelve months ended March 31, 2013, just over 12,000 pre-foreclosure notices had been issued, representing a 38% decline from the prior year and a 69% decline from the peak in 2009.

While the level of future distressed home sales is generally declining, there remains a moderate level of distressed homes that are not yet on the market that will act to limit rapid appreciation of home prices. As of March 31, 2013, the shadow inventory amounted to an estimated 17,900 homes, or 5.0 months of supply. This is approximately two times the level of listings that were on the market at that time. JBREC believes that most shadow inventory homes in San Diego will gradually become distressed sales over the next few years, and the pace of distressed sales will be slow enough that home prices will not be significantly negatively affected. |

| |

When comparing the monthly costs of owning the median-priced home with the median household income, through May 31, 2013, affordability in San Diego is better than the area’s historical median dating back to 1981. Affordability conditions are expected to worsen in 2013 as home prices and mortgage rates are expected to rise. | ||

In summary, San Diego’s housing fundamentals are solid. Job growth exceeds the area’s new construction levels, and listings are low. As the fundamentals that drive the San Diego housing market reflect a more stable environment, the market is on track to return to solid price appreciation and rising construction.

111

Ventura, CA Housing Market Overview

The Ventura MSA, also referred to as the Oxnard-Thousand Oaks-Ventura MSA, consists of Ventura County. The county is home to nearly 844,000 people and more than 278,000 households. The coastal county has a rich history, while simultaneously providing amenities found in much more urban settings. Although Ventura lives in the large shadow of Los Angeles County to the south, it has a vibrant economy in its own right, and household income levels are significantly higher than surrounding metros. Limited land supply and a tough land planning and approval environment will continue to restrict the supply of new homes over the next few years.

The housing fundamentals in Ventura are improving, which is a positive sign for home price appreciation in this market, indicating a recovery from the recession of the last few years. The improvement in the overall fundamentals is the result of improving job growth, low supply and excellent affordability. In particular, the supply fundamentals stand out, given the very low levels of homebuilding permit activity and resale listings. The combination of prices being below peak and low mortgage rates provide a historic buying opportunity, which makes for good affordability conditions.

There are nearly 284,000 non-farm payroll jobs in Ventura County, and employment growth has been positive since 2011 after job losses that lasted from 2007 through 2010. The metro area lost 25,000 jobs (8.4%) from the 2006 peak before adding 10,900 jobs (4.0% growth) in 2011 through May 2013. JBREC assumes employment growth rising to 5,000 jobs added in 2013.

The largest employment sector is Trade, Transportation and Utilities (19.4% of jobs), followed by the Government (15.8%) sector. The high-paying Professional Business Services sector comprises an additional 12.8% of jobs in the MSA, which is lower than the national average for this sector. The Fortune 500 pharmaceutical company Amgen is headquartered in Thousand Oaks. |

|

112

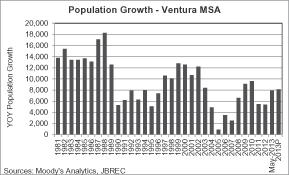

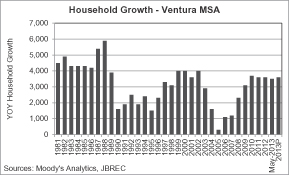

The Ventura MSA showed a slowing in population growth and household growth in the mid-2000s, but has rebounded, adding an estimated 7,900 people and 3,500 households during the twelve months ended May 31, 2013. JBREC assumes population growth of approximately 8,100 people (1.0% growth) and household growth of approximately 3,600 (1.3% growth) in 2013.

|  |

As of May 2013, the median household income in Ventura County was $72,803, having peaked in 2008 at $76,888. Notably, Ventura’s median household income is well above the median income for Los Angeles County, showing the prevalence of higher-income jobs, many of them professional, in Ventura County. JBREC assumes median incomes will remain relatively flat for Ventura in 2013.

Existing home sales in Ventura are rising rapidly after remaining relatively flat in 2011. In the twelve months ended May 31, 2013, existing home sales for the area increased to 9,805, up 32% from the trough of 2007. Existing home sales levels during the twelve months ended May 31, 2013 were still well below the recent peak level of 16,153 in 2003. Home prices are starting to turn around in Ventura. The median existing single-family detached home price declined 38% between 2007 and 2009, due in part to a shift in sales activity away from the higher price points and a loss in value. Although substantial, this decline was slightly less than the corresponding drop of 41% in Los Angeles County. As of May 2013, the median price for existing single-family detached home prices was $460,000, up from $406,250 in May 2012 and slightly above the 2003 median price level of $403,000.

New home sales activity for the twelve months ended May 31, 2013 has risen from the trough levels of 2011, but remains very low for this market. New home sales transactions totaled 427 for the twelve months ended May 31, 2013, well below the peak of 2,965 in 2000. JBREC expects the new home sales volume to increase to 600 transactions in 2013. The median new home price is once again starting to increase after declining from the peak level in 2005. As of May 2013, the median new home price was $412,000, which is up 8% from May 2012, but still down 41% from its top |

| |

| of $699,000 in 2005. The median new home price can be heavily influenced by the mix of home types being sold at any given time, and should not be relied upon as the only indicator of market trends. | ||

113

Home values in Ventura are poised for continued positive growth in 2013, according to JBREC. JBREC forecasts home values to rise by 13.5% in 2013, after rising 13.6% during the twelve months ended May 31, 2013.

Homebuilding permit activity in Ventura is starting to pick up, but remains at very low levels. While JBREC forecasts that much of the growth in the housing inventory in 2013 will be for multifamily units, single-family construction is also expected to rebound steadily. Single-family homebuilding permits had fallen to 204 units in 2009, but rose to 305 over the twelve months ended May 31, 2013. Single-family homebuilding permits are expected to account for roughly 45% of the total residential construction activity in 2013, rising to 390 permits. In contrast, multifamily permits totaled 309 during the twelve months ended May 31, 2013 and are projected to rise to 480 in 2013. Limited available land will keep construction activity well below what was seen over the last few decades.

The demand being generated for housing is greater than the new supply being added to the market, with job growth in the twelve months ended May 31, 2013 approximately seven times the number of homebuilding permits issued in that same time; the employment growth to homebuilding permit ratio for the twelve months ended May 31, 2013 was 7.0. That ratio is expected to remain high in 2013, due to improving job growth and low permit levels.

Resale listings in Ventura are low, which could lead to more competitiveness and increasing prices in the resale market. As of May 2013, the county had 2,303 homes listed on the market, which represented a 31% decline from one year prior and a 55% drop from 2010. By comparison, listings exceeded 7,000 homes on the market in some months of 2007. The level of listings as of May 31, 2013 translates to a very low 2.8 months of supply, based on existing home sales activity. A 6.0 month supply is considered equilibrium for most markets. The May 2013 inventory level is well below the peak level of 11.8 months of supply in 2008. |

|

114

Pre-foreclosure notices are declining in Ventura, which is a positive sign for home prices, as pre-foreclosure notices are an indicator of future distress. In the twelve months ended March 31, 2013, approximately 3,500 notices were issued, representing a 38% decline from one year prior and a 61% decline from the peak in 2009.

While the number of homes falling into pre-foreclosure is declining, there is a moderate level of potential distressed homes that are not yet on the market and may limit upward movement for home prices. As of March 31, 2013, JBREC estimated the shadow inventory at 5,300, or about 5.0 months of supply. The shadow inventory is nearly two times the very low level of listings that were on the market at that time. JBREC believes that most shadow inventory homes will gradually become distressed sales over the next few years, and the pace of distressed sales will be slow enough that home prices will not be significantly negatively affected.

When comparing the monthly costs of owning the median-priced home with the median household income, |

| |

affordability conditions are better than the historical median affordability conditions in Ventura. JBREC forecasts affordability conditions in Ventura will weaken in 2013 as home prices and mortgage rates are expected to rise.

In summary, the housing fundamentals in Ventura are improving steadily. Job growth is positive for housing demand in this market, particularly as job growth outpaces the supply of new homes being added to the market. Low levels of existing home listings are creating a more competitive resale market, which should influence future home price appreciation. Prices are still at relatively low levels in a time when mortgage rates are also low. The combination of low prices and low mortgage rates in a county of high-income jobs suggests a rebound in the form of rising construction activity and home prices. | ||

115

Los Angeles, CA Housing Market Overview

The Los Angeles metropolitan division is a part of a single MSA which consists of Los Angeles and Orange Counties together; the Los Angeles division represents Los Angeles County only. This county has over 10.0 million people and 3.3 million households, making it the most populous county in the entire nation as well as in California, representing slightly less than 30% of the state population and about 3% of the population of the entire nation. Owing to its size, this market has a wide diversity of submarkets and demographics, which make it critical for builders and developers to understand the local consumer. A large percentage of new homebuilding activity will likely occur in either infill locations close to job growth or in more distant areas where land is available for traditional single-family detached home development.

| ||

The housing fundamentals of Los Angeles County have shown considerable improvement in recent years, which is a positive sign for home price appreciation in this market, indicating a recovery from the recession of the last few years. The improvement in the overall fundamentals is the result of improving job growth and declining distressed sales, crossed with low construction levels in the recession. The affordability fundamentals are excellent, with prices on average having fallen to levels consistent with prices in 2003 at the same time that mortgage rates are at a low level, around 4.5% as of early July. The current affordability conditions continue to provide a good buying opportunity.

There are more than 3.9 million non-farm payroll jobs in Los Angeles County, and employment growth is once again positive after job losses in 2008 through 2010. The metro area lost 349,700 jobs (8.5%) from the 2007 peak before adding 141,500 jobs (3.8% growth) from 2011 through May 2013. The recent recession resulted in fewer losses than the 433,900 jobs lost in the downturn of 1991 through 1994, which had fallen upon a smaller population. JBREC assumes employment growth of 70,000 jobs in 2013.

Although the area is famous for its entertainment industry, employment in Los Angeles County is distributed over many industries and sectors. The largest employment sector is Trade, Transportation and Utilities (19.2% of jobs), followed by the high-paying Professional and Business Services (14.9%), Government (14.4%), and Educational and Health Services (14.3%). Los Angeles County is home to such Fortune 500 companies as Walt Disney, DirecTV, Occidental Petroleum and Edison International, as well as the U.S headquarters for automobile companies |

| |

| Toyota, Honda and Isuzu. The city and county governments are also major employers, as is the educational system. The ports of Los Angeles and Long Beach handle one-fourth of all container traffic coming into the United States, making the complex the largest port in the country and the third-largest in the world. | ||

116

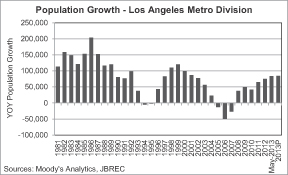

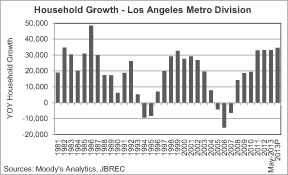

Los Angeles County lost a little less than one percent of its population in the three years from 2005 through 2007, but has added 341,500 people from 2008 through May 2013 (3.5% cumulative growth). JBREC assumes population growth of approximately 84,500 people (0.8% growth) and household growth of approximately 34,500 households (1.0% growth) in 2013.

|  |

As of May 2013, the median household income in Los Angeles County was $53,728, having declined modestly since 2008 when it peaked at $55,537. JBREC assumes the median income will be flat in 2013.

Existing home sales in Los Angeles County are rising vigorously after declining in 2010 and 2011. In the twelve months ended May 31, 2013, existing home sales for the area increased to 82,089, up 40% from the trough of the market in 2008. Existing home sales levels for the twelve months ended May 31, 2013 were still well below the peak levels that topped 127,000 transactions in both 2003 and 2004. Home prices have turned around in Los Angeles County. In a classic business cycle, the median existing single-family detached home price declined by 44% between 2007 and 2009, representing the withdrawal of generous lending that had made high prices possible and led to many distressed sales. As of May 2013, the median price for existing single-family detached home prices was $420,000, up from $326,000 in May 2012 and above the 2004 median price level of $410,000.

New home sales activity for the twelve months ended May 31, 2013 rose from trough levels in 2011, but remains very low in comparison to history in this market. New home sales transactions totaled 4,323 for the twelve months ended May 31, 2013, up from 3,822 in 2011, but still well short of the peak at 12,370 in 2006. The median new home price is once again rising after declining from the peak level in 2007. As of May 2013 the median new home price was $450,000, down 10.5% from its peak of $502,867 in 2007. The median new home price can be heavily influenced by the mix of home types being sold at any given time in this broad region. As a result, resale home prices are a better indication of market trends. |

|

117

Home values in Los Angeles County are poised for continued positive growth in 2013, according to the Burns Home Value Index. JBREC forecasts home values to rise by 9.0% in 2013, after growing 8.2% during the twelve months ended May 2013.

While the mix of new housing construction in this county has historically been a fairly balanced split between attached homes and single-family detached homes, the market is becoming a more attached-dominated market as the availability of land for detached housing is diminished. JBREC forecasts that much of the growth in the housing in 2013 will be for multifamily units, but single-family construction is also expected to rebound from trough levels during the downturn in housing. Single-family homebuilding permits had fallen to 2,268 units in 2009 as construction slowed, but rose to 3,007 over the twelve months ended May 31, 2013. Single-family homebuilding permits are expected to account for approximately one-fourth of the total residential construction activity in 2013, rising to 3,360 permits. In contrast, multi-family permits totaled 8,953 during the twelve months ended May 31, 2013 and are projected to rise to 11,000 in 2013.

The demand being generated for housing is greater than the new supply being added to the market, with job growth in the twelve months ended May 31, 2013 nearly four times the number of homebuilding permits issued in that same time; the employment growth to homebuilding permit ratio through May 2013 was 3.7. This ratio is expected to remain high in 2013, owing to relatively strong job growth and low permit levels.

Resale listings in Los Angeles County are very low, which could lead to more competitiveness and increasing prices in the resale market. As of May 2013, the county had 19,100 homes listed on the market, which represented a 28% decline from one year prior and an almost 50% drop from 2010. By comparison, listings exceeded 50,000 homes on the market in much of 2007 and 2008. The level of listings as of May 2013 translates to a very low 2.8 months of supply, based on existing home sales activity over the most recent twelve months. A 6.0 month supply is considered equilibrium for most markets. The May 2013 inventory level is well below the level of more than 11 to 12 months of supply in 2008, when listings had peaked. |

|

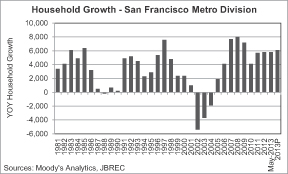

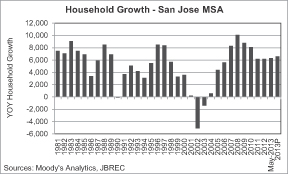

118