TRANSFORMATIONAL ENTRY INTO THE PERMIAN BASIN Encana Corporation Doug Suttles President & CEO September 29, 2014

Athlon Energy – The Best of the Permian Transformative Acquisition in World Class Basin • $7.1B acquisition of Athlon Energy Inc. – $5.93B cash plus assumption of $1.15B of long - term debt – Midland Basin pure play, headquartered in Fort Worth, TX – Expected to close by year - end 2014 • ~3.0 billion Boe resource potential (net) • ~ 5,000 potential gross Hz well locations • 140,000 net acres, ~ 90% WI – Midland, Martin & other (66,000 net acres) – Howard (57,500 net acres) – Glasscock (16,500 net acres) – ~70% land held by production • ~ 30,000 boe /d current production – ~60% oil, ~20% NGL, ~20% natural gas • Strongly accretive, accelerates portfolio transition 2

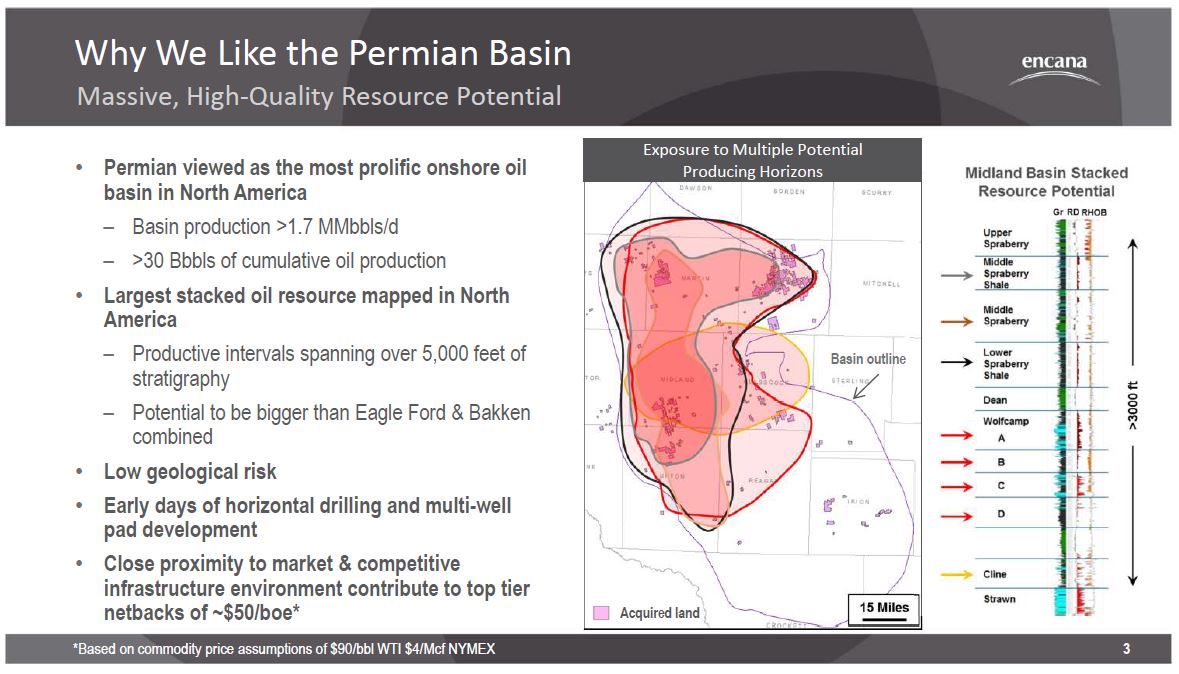

• Permian viewed as the most prolific onshore oil basin in North America – Basin production >1.7 MMbbls /d – > 30 Bbbls of cumulative oil production • Largest stacked oil resource mapped in North America – Productive intervals spanning over 5,000 feet of stratigraphy – Potential to be bigger than Eagle Ford & Bakken combined • Low geological risk • Early days of horizontal drilling and multi - well pad development • Close proximity to market & competitive infrastructure environment contribute to top tier netbacks of ~$50/ boe * Why We Like the Permian Basin Massive, High - Quality Resource Potential Exposure to M ultiple P otential Producing H orizons 3 *Based on commodity price assumptions of $90/ bbl WTI $4/Mcf NYMEX Acquired land Basin outline

• Value driven, pure - play producer with top - tier margins – High performing team with track record of growing value • Assembled large contiguous acreage blocks in core of basin – Highly conducive to further down - spacing – Heavily weighted to liquids (~ 80% of production) • Ideal assets to leverage Encana’s proven resource play hub (RPH*) expertise – Shift from vertical to horizontal development a game changer for Athlon assets – Proven success in analogous resource plays • Assets expected to become self - funding in 2016 • Accretive to CFPS growth and accelerates Encana’s portfolio transition Why We Like Athlon Tremendous Running Room in the Core of the Midland Basin 15 Miles Athlon Well - Positioned R elative to Highest I ndustry 24 hr Test R ates Acquired land 4 Source: ITG Investment Research *Resource P lay Hub: Encana’s development model using repeatable, transferable operations techniques to reduce costs and improve safety a nd environmental performance.

Enhancing and Accelerating Value Leveraging Our Strengths to Add V alue in the Permian • Hitting the ground running in 2015: – At least $1B capital program – Initiate pad drilling program – Ramp horizontal rig fleet from current 4 to 7 by year - end 2015 – 6 - 8 vertical rigs to continue land retention program and delineation – 2015F production: ~50,000 boe /d • Leverage demonstrated RPH* track record to improve EURs and costs • Recent well results indicate core of play extends into Howard County – Tubb 39 #5H (100% WI): 30 - day IP of 1,594 boe /d, 73% oil, 6,705’ lateral • Upside through further down - spacing – Encana plan based on average 80 acre spacing – Industry currently testing further down - spacing • 10+ years of drilling inventory provides significant running room – ~5,000 potential horizontal wells Athlon Well - Positioned R elative to P roducing H orizons 5 *Resource P lay Hub: Encana’s development model using repeatable, transferable operations techniques to reduce costs and improve safety a nd environmental performance. Acquired land Basin Outline

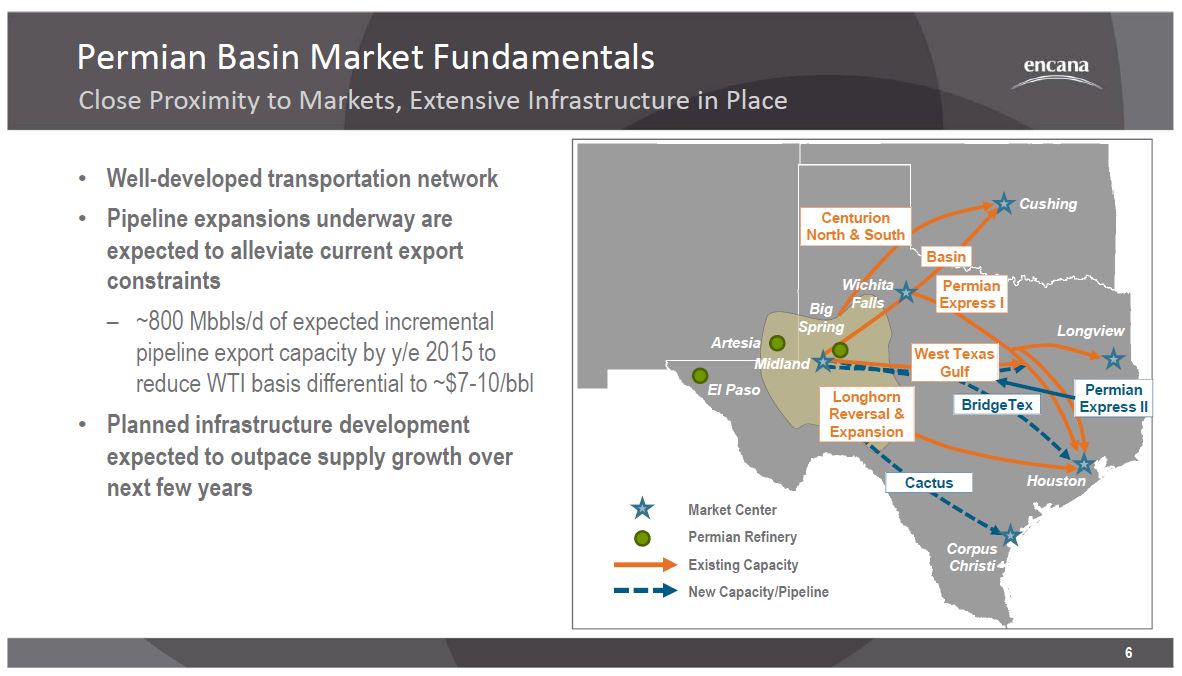

El Paso Midland Artesia Big Spring Centurion North & South Basin Cactus Longhorn Reversal & Expansion Permian Express I BridgeTex West Texas Gulf Cushing Wichita Falls Longview Houston Permian Express II Corpus Christi Permian Basin Market Fundamentals Close Proximity to Markets, Extensive Infrastructure in Place • Well - developed transportation network • P ipeline expansions underway are expected to alleviate current export constraints – ~800 Mbbls/d of expected incremental pipeline export capacity by y/e 2015 to reduce WTI basis differential to ~$7 - 10/bbl • Planned infrastructure development expected to outpace supply growth over next few years Market Center Permian Refinery Existing Capacity New Capacity/Pipeline 6

Permian Assets - Five Year Outlook Delivering Significant High Margin Growth 0 50 100 150 200 250 2015F 2017F 2019F Net Production ( Mboe /d) Permian Net Production 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 2015F 2017F 2019F Operating Cash Flow ($MM) Permian Pre - Tax Operating Cash Flow • Strong operating cash flow growth – ~$50.00/ boe netback at $90/ bbl WTI, $4/Mcf NYMEX – Expected to be self - funding by 2016 • Meaningful growth in production volumes – Forecast anticipates Permian production averaging 200 - 250 Mboe /d by 2019 – Significant additional upside given possible 5,000 Hz well locations • Opportunities for additional upside – Type curve and capital efficiency improvements – F urther accelerate development – Down - spacing and additional horizons beyond the Spraberry and Wolfcamp 7 *Based on commodity price assumptions of $90/ bbl WTI $4/Mcf NYMEX

Consistent with Vision, Strategy & Goal Transaction Accelerates Key Targets VISION: Leading North American oil and gas resource play company • Acquisition in core of North America’s largest unconventional oil play • A ccelerates rebalancing of portfolio by two years • Investment opportunities for 10+ years STRATEGY: Disciplined focus on generating profitable growth • Acquiring premium netback production • Lower margin mature natural gas being replaced with higher margin oil and NGLs • Opportunity to enhance value through application of Encana’s operational expertise GOAL: Growing shareholder value • Accretive to cash flow per share • Expected to be self funding in 2016 • Effective deployment of cash balance Delivering on our 2017 targets today 8

TOP TIER RESOURCE • Multiple stacked productive oil horizons • 10+ year inventory • ~80% liquids OPERATIONAL EXCELLENCE • Early stages of horizontal drilling & pad development • Optimize development with RPH* model Leveraging our Winning Core Competencies Why This Asset is a Great Fit for Encana BALANCE SHEET STRENGTH MARKET FUNDAMENTALS • Established infrastructure in close proximity to markets • Planned capacity additions to support growth in Midland basin CAPITAL ALLOCATION • Adds 7 th growth play to portfolio • Acquisition funded largely with cash • Expected to be self funding in 2016 9 *Resource P lay Hub: Encana’s development model using repeatable, transferable operations techniques to reduce costs and improve safety a nd environmental performance.

$0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 Dispositions Acquisitions $MM ~3x Margin ~$20/ Boe netback margin Focused on Value vs. Volumes Proceeds from 2014 asset sales plus balance sheet cash redeployed into liquids - rich assets at almost 3x margin High - graded portfolio into premium margin production 2014 Transactions High - Grade Asset Base Portfolio Transition Accelerated by A&D Activity Replaced lower margin natural gas production with higher margin l iquids production ~$55/ Boe netback margin Other Bighorn PrairieSky IPO + Secondary East Texas Jonah Eagle Ford Permian 10 Cash* *2013 year - end cash less May 2014 $1 billion debt repayment

Focused on Growing Value Growth Assets Deliver Superior Margin PRODUCTION TIME ~$8.00/ Boe ~$40.00/ Boe in 2015 previously ~$25.00/ Boe Replacing lower margin production with higher margin production from Encana’s growth assets 2015F Pre - hedge upstream operating cash flow/ Boe GROWTH ASSET PRODUCTION BASE PRODUCTION Portfolio Transition Increases Margin Contribution From Growth Assets 11

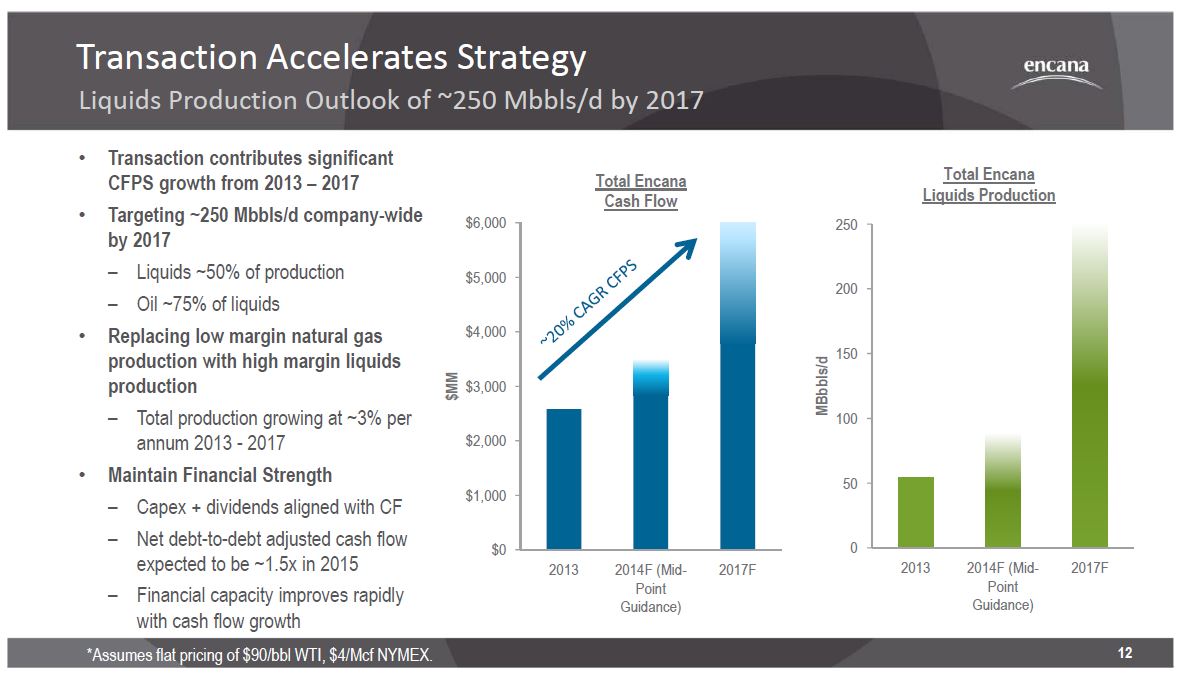

*Assumes flat pricing of $90/ bbl WTI, $4/Mcf NYMEX. Transaction Accelerates Strategy Liquids Production Outlook of ~250 Mbbls/d by 2017 12 • Transaction contributes significant CFPS growth from 2013 – 2017 • Targeting ~250 Mbbls/d company - wide by 2017 – Liquids ~50% of production – Oil ~75% of liquids • Replacing low margin natural gas production with high margin liquids production – Total production growing at ~3% per annum 2013 - 2017 • Maintain Financial Strength – Capex + dividends aligned with CF – Net debt - to - debt adjusted cash flow expected to be ~1.5x in 2015 – Financial capacity improves rapidly with cash flow growth 0 50 100 150 200 250 2013 2014F (Mid- Point Guidance) 2017F MBbbls /d Total Encana Liquids Production $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 2013 2014F (Mid- Point Guidance) 2017F $MM Total Encana Cash Flow

Acquisition Aligned With Scorecard Delivering on t he Plan Operational Excellence Mega oil play in early days of horizontal and multi - well pad development Tremendous opportunity to enhance and accelerate value by applying our technical expertise Demonstrated track record of unconventional resource play development Balance Sheet Strength Funded with expected cash at closing plus assumed senior unsecured debt Expect to end Q3 with ~$7.0B cash & cash equivalents Net debt - to - debt adjusted cash flow expected to be ~1.5x in 2015 Expect to maintain investment grade credit rating Portfolio Transition Expect original 2017 target of 75% of operating cash flow from liquids to be achieved in 2015 Adds 10+ years drilling inventory in premier North American oil basin Replaces lower margin mature natural gas with higher margin liquids production 13

Scorecard - 12 Month Highlights Exceeding Expectations Operational Excellence Base production outperforming initial forecast Growth plays meeting/exceeding type curve expectations ~50% liquids growth H12014 vs. H12013 1H14 $100 million costs savings from organizational realignment and operating efficiencies Balance Sheet Strength Maintained investment grade credit rating Debt reduced by $1B with no further maturities until 2017 Expect to end Q3 with ~$ 7.0B cash & cash equivalents Capex + dividends aligned with cash flow Portfolio Transition Major shift in capital allocation to growth plays Completed $2.9B Eagle Ford acquisition to add 6th growth play Advanced non - core asset sales of ~$4.0B net proceeds Unlocked $3.7 billion of value with PrairieSky IPO and Sell - Down 14

Leading North American Resource Play Company Robust Portfolio with Visible Long Term Growth Options • Positions in the heart of the top 2 Canadian resource plays (Montney and Duvernay) and top 2 U.S. resource plays (Eagle Ford and Permian) • Permian an ideal fit for Encana machine – High - quality stacked potential Huge inventory Ideal for RPH • Asset base now repositioned - 2+ years ahead of target – Permian acquisition significantly accelerates portfolio transition – ~35% of total production from liquids in 2015 (~75% oil) – ~45 – 50% of total production from liquids in 2017 vs. 10% in 2013 – ~80% of 2017 production from growth assets vs. 25% in 2013 – Natural gas optionality maintained • Transaction accretive to former +10% CFPS CAGR metric – Lower margin mature natural gas replaced with higher margin liquids production – Now targeting ~20% CFPS CAGR 2013 – 2017 • Financial strength intact 15 Eagle Ford Oil Permian Oil Montney Liquids rich Duvernay High value condensate DJ Basin Oil/liquids rich San Juan Oil Tuscaloosa Marine Shale Oil Natural gas o ptionality

Disciplined Focus on Profitable Growth VISION: Leading North American oil and gas resource play company • High quality rocks • Scale and running room • Operational excellence • Portfolio optionality STRATEGY: Disciplined focus on generating profitable growth • Capital allocated to high return and scalable assets • Acceleration of oil/liquids growth • Reduce cost structures and drive efficiency improvements GOAL: Growing shareholder value • Sustainable business model through commodity cycle • Cash flow per share growth • Investment grade credit rating • Dividend paying* • Unlocking value from massive resource base *Dividends are subject to the discretion of the Board of Directors. 16

Disclaimer The tender offer (the “Offer”) described in this presentation has not yet commenced, and this presentation is neither an offer to purchase nor a solicitation of an offer to sell any shares of the common stock of Athlon Energy Inc. (“Athlon”) or any other securities. On the commencement date of the Offer, a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related docum ent s, will be filed with the United States Securities and Exchange Commission (the “SEC”) by Encana Corporation (“Encana” or the “Company”) and a Solicitation/Recommendation Statement on Schedule 14D - 9 will be filed with the SEC by Athlon. The offer to purchase shares of Athlon will only be made pursuant to the offer to purchase, the letter of transmittal and related documents filed with such Schedule TO. INVESTOR S A ND SECURITY HOLDERS ARE URGED TO READ BOTH THE TENDER OFFER STATEMENT AND THE SOLICITATION/RECOMMENDATION STATEMENT REGARDING THE OFFER, AS THEY MAY BE AMENDED FROM TIME TO TIME, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of these statements (when available) and ot her documents filed with the SEC at the website maintained by the SEC at www.sec.gov or by directing such requests to the Informa tio n Agent for the Offer, which will be named in the tender offer statement .

Future Oriented Information In the interests of providing Encana shareholders and potential investors with information regarding Encana, including management’s assessment of Encana’s and its subsidiaries’ future plans and operations, certain statements contained in this presentation are forward - looking statements or information within the meaning of applicable securities legislation, collectively referred to herein as “f orward - looking statements.” Forward - looking statements in this presentation include, but are not limited to: achieving the compa ny’s expectations through 2017 and beyond; the successful execution and acceleration of the company’s strategy; the company’s commitment to gro win g long term shareholder value through a disciplined focus on generating profitable growth; the company’s vision of becoming t he leading north American oil and gas resource play company with scale and running room and replace lower margin mature natural gas with hi gher margin liquids production; the company’s focus on value instead of production volumes; the company’s plan unlock value f rom its resource base and its continued focused investment on a limited number of oil and liquids - rich plays; the accelerated rebalancin g of the company’s portfolio by two years; the anticipated purchase price for Athlon; the massive running room of the Athlon lands (the “Lands”), including the resource potential and high - margin liquids production; expected resource potential and well inventories, including locations and production from each well; anticipated development on the Lands; the expectation that the transaction will add immediate production and will add 10 years of drilling inventory in the Permian Basin; anticipated drilling and number of rigs on the Lands by year - end 2015; proposed pipeline expansions and infrastructure development; the expected growth and total production from the Lands through to 2019 and beyond; expected premium netbacks and the expectation that the Lands will be a strong source of cash flow for many years; the successful implementation of the comp any ’s resource play hub expertise on the Lands and the expectation that the assets will be self - funding in 2016; the company’s plan to invest at least $1 billion in the Lands in 2015; anticipated cash flow, including free cash flow positive in 2016; anticipated production to 2019; the expected closi ng date of the Athlon transaction and the expectation that closing conditions will be satisfied and regulatory approvals will be obtained; the company’s expectation to achieve its 2017 target of operating cash flow from production in 2015; expected compound annual growth rate of cash flow per share through to 2017; the company’s expectation to continue to successfully execute on its strategy, maintain operational excellence, balance sheet strength and be well positio ned for further success; the company’s plans to reduce costs, improve efficiencies, strengthen cash flow and maximize margins; th e company’s focus on operational excellence and leveraging technology and technical expertise across the business and optimizing operations on bot h base and core growth assets; anticipated oil, natural gas and NGLs prices to 2017 and beyond; anticipated dividends and mai nta ining an investment grade credit rating; and anticipated cash and cash equivalents. Readers are cautioned not to place undue reliance on forward - looking statements, as there can be no assurance that the plans, intentions or expectations upon which they are based will occur. By their nature, forward - looking statements involve numerous assumptions, known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the predictions , f orecasts, projections and other forward - looking statements will not occur, which may cause the company’s actual performance and financial results in future periods to differ materially from any estimates or projections of future performance or results expressed or implied b y s uch forward - looking statements. These assumptions, risks and uncertainties include, among other things: volatility of, and assum ptions regarding natural gas and liquids prices, including substantial or extended decline of the same and their adverse effect on the company ’s operations and financial condition and the value and amount of its reserves; assumptions based upon the company’s current gui dan ce; fluctuations in currency and interest rates; risk that the company may not conclude divestitures of certain assets or other transactions o r r eceive amounts contemplated under the transaction agreements (such transactions may include third - party capital investments, far m - outs or partnerships, which Encana may refer to from time to time as “partnerships” or “joint ventures” and the funds received in res pec t thereof which Encana may refer to from time to time as “proceeds”, “deferred purchase price” and/or “carry capital”, regard les s of the legal form) as a result of various conditions not being met; product supply and demand; market competition; risks inherent in the company ’s and its subsidiaries’ marketing operations, including credit risks; imprecision of reserves estimates and estimates of recove rab le quantities of natural gas and liquids from resource plays and other sources not currently classified as proved, probable or possible reserv es or economic contingent resources, including future net revenue estimates; marketing margins; potential disruption or unexpected technical difficulties in developing new facilities; unexpected cost increases or technical difficulties in constructing or modifying p roc essing facilities; risks associated with technology; the company’s ability to acquire or find additional reserves; hedging activities resulting in realized and unrealized losses; business interruption and casualty losses; risk of the company not operating all of its properties and ass ets ; counterparty risk; risk of downgrade in credit rating and its adverse effects; liability for indemnification obligations to th ird parties; variability of dividends to be paid; its ability to generate sufficient cash flow from operations to meet its current and future obligations ; i ts ability to access external sources of debt and equity capital; the timing and the costs of well and pipeline construction; th e company’s ability to secure adequate product transportation; changes in royalty, tax, environmental, greenhouse gas, carbon, accounting and other laws or re gulations or the interpretations of such laws or regulations; political and economic conditions in the countries in which the co mpany operates; terrorist threats; risks associated with existing and potential future lawsuits and regulatory actions made against the compa ny; risk arising from price basis differential; risk arising from inability to enter into attractive hedges to protect the compan y’ s capital program; and other risks and uncertainties described from time to time in the reports and filings made with securities regulatory authorities by En cana. There can be no assurance that the transaction will be completed . C ompletion of the transaction is subject to a number of risks and uncertainties, including that at least a majority of the outstanding Athlon shares have tendered to the Offer, that the waiting period under the U.S. Har t - Scott - Rodino Act has expired or been terminated, and other customary conditions. Although Encana believes that the expectations represented by such forward - looking statements are reasonable, there can be no assurance that such expectations wil l prove to be correct. Readers are cautioned that the foregoing list of important factors is not exhaustive. In addition, ass ump tions relating to such forward - looking statements generally include Encana’s current expectations and projections made in light of, and generally consistent with, its historical experience and its perce pt ion of historical trends, including the conversion of resources into reserves and production as well as expectations regarding rates of advancement and innovation, generally consistent with and informed by its past exp eri ence, all of which are subject to the risk factors identified elsewhere in this presentation . Assumptions with respect to forward - looking information regarding expanding Encana's oil and NGLs production and extraction volumes are based on existing expansion of natural gas processing facilities in areas wh ere Encana operates and the continued expansion and development of oil and NGL production from existing properties within its asset portfolio. Forward - looking information respecting anticipated 2014 cash flow for Encana is based upon, among other things, achieving average production for 2014 of between 2.40 Bcf /d and 2.50 Bcf /d of natural gas and 86,000 bbls /d to 91,000 bbls /d of liquids, commodity prices for natural gas and liquids based on NYMEX $4.50 per MMBtu and WTI of $98 per bbl , an estimated U.S./Canadian dollar foreign exchange rate of $0.90 and a weighted average number of outstanding shares for Encana of approximately 741 million. Furthermore , the forward - looking statements contained in this presentation are made as of the date hereof and, except as required by law, E ncana undertakes no obligation to update publicly or revise any forward - looking statements, whether as a result of new information, future events or otherwise. The forward - looking statements c ontained in this presentation are expressly qualified by this cautionary statement.

Advisory Regarding Reserves Data & Other Oil & Gas Information Disclosure Protocols National Instrument (“NI”) 51 - 101 of the Canadian Securities Administrators imposes oil and gas disclosure standards for Canadia n public companies such as Encana engaged in oil and gas activities. Encana complies with the NI 51 - 101 annual disclosure requir ements in its annual information form, most recently dated February 20, 2014 (“AIF”). The Canadian protocol disclosure is contained in Appendix A and under “Narrative Description of the Business” in the AIF. Encana has obtained an exemption dated January 4, 2011 from cer ta in requirements of NI 51 - 101 to permit it to provide certain disclosure prepared in accordance with U.S. disclosure requirements, in addition to the Canad ian protocol disclosure. That disclosure is primarily set forth in Appendix D of the AIF . Reserves are the estimated remaining quantities of oil and natural gas and related substances anticipated to be recoverable from known ac cumulations, from a given date forward, based on: analysis of drilling, geological, geophysical and engineering data, the use of established technology, and specified economic conditions, which are generally accepted as being reasonable. Proved reserves are those re ser ves which can be estimated with a high degree of certainty to be recoverable. It is likely that the actual remaining quantit ies recovered will exceed the estimated proved reserves. Probable reserves are those additional reserves that are less certain to be recovered than proved re serves. It is equally likely that the actual remaining quantities recovered will be greater or less than the sum of the esti mat ed proved plus probable reserves. Possible reserves are those additional reserves that are less certain to be recovered than probable reserves. It is unlikely tha t the actual remaining quantities recovered will exceed the sum of the estimated proved plus probable plus possible reserves . The estimates of economic contingent resources contained in this presentation are based on definitions contained in the Canad ian Oil and Gas Evaluation Handbook (“COGEH”). Contingent resources do not constitute, and should not be confused with, reserves. C ontingent resources are defined as those quantities of petroleum estimated, on a given date, to be potentially recoverable from known accumulations u sin g established technology or technology under development, but which are not currently considered to be commercially recoverab le due to one or more contingencies. Economic contingent resources are those contingent resources that are currently economically recoverable. In e xam ining economic viability, the same fiscal conditions have been applied as in the estimation of reserves. There is a range of unc ertainty of estimated recoverable volumes. A low estimate is considered to be a conservative estimate of the quantity that will actually be recover ed. It is likely that the actual remaining quantities recovered will exceed the low estimate, which under probabilistic methodolo gy reflects a 90 percent confidence level. A best estimate is considered to be a realistic estimate of the quantity that will actually be recovered. It is equall y l ikely that the actual remaining quantities recovered will be greater or less than the best estimate, which under probabilisti c m ethodology reflects a 50 percent confidence level. A high estimate is considered to be an optimistic estimate. It is unlikely that the actual remaining quantities recove red will exceed the high estimate, which under probabilistic methodology reflects a 10 percent confidence level. There is no certainty that it will be commercially viable to produce any portion of the volumes currently classified as economic co nti ngent resources. The primary contingencies which currently prevent the classification of Encana's disclosed economic contingent resources as reserves include the lack of a reasonable expectation that all internal and external approvals will be forthcoming and the lack of a d ocu mented intent to develop the resources within a reasonable time frame. Other commercial considerations that may preclude the cla ssification of contingent resources as reserves include factors such as legal, environmental, political and regulatory matters or a lack of markets. The estimates of various classes of reserves (proved, probable, possible) and of contingent resources (low, best, high) in this p res entation represent arithmetic sums of multiple estimates of such classes for different properties, which statistical principl es indicate may be misleading as to volumes that may actually be recovered. Readers should give attention to the estimates of individual classes of reserves and con tingent resources and appreciate the differing probabilities of recovery associated with each class. Encana uses the terms resource play, total petroleum initially - in - place, natural gas - in - place, and crude oil - in - place. Resource play is a term used by Encana to describe an accumulation of hydrocarbons known to exist over a large areal expanse and/or th ick vertical section, which when compared to a conventional play, typically has a lower geological and/or commercial development risk and lower average declin e r ate. Total petroleum initially - in - place (“PIIP”) is defined by the Society of Petroleum Engineers - Petroleum Resources Manageme nt System (“SPE - PRMS”) as that quantity of petroleum that is estimated to exist originally in naturally occurring accumulations. It includes that qu ant ity of petroleum that is estimated, as of a given date, to be contained in known accumulations prior to production plus those es timated quantities in accumulations yet to be discovered (equivalent to “total resources”). Natural gas - in - place (“NGIP”) and crude oil - in - place (“COIP”) are defined in the same manner, with the substitution of “natural gas” and “crude oil” where appropriate for the word “petroleum”. As used b y Encana, estimated ultimate recovery (“EUR”) has the meaning set out jointly by the Society of Petroleum Engineers and World Petroleum Congress in the ye ar 2000, being those quantities of petroleum which are estimated, on a given date, to be potentially recoverable from an accumul ati on, plus those quantities already produced therefrom. In this presentation, Encana has provided information with respect to certain of its plays and emerging opportunities which i s “ analogous information” as defined in NI 51 - 101. This analogous information includes estimates of PIIP, NGIP, COIP or EUR, all a s defined in the COGEH or by the SPE - PRMS, and/or production type curves. This analogous information is presented on a basin, sub - basin or area basis utiliz ing data derived from Encana's internal sources, as well as from a variety of publicly available information sources which are predominantly independent in nature. Some of this data may not have been prepared by qualified reserves evaluators or auditors and the preparation of any est imates may not be in strict accordance with COGEH. Regardless, estimates by engineering and geo - technical practitioners may vary and the differences may be significant. Encana believes that the provision of this analogous information is relevant to Encana's oil and gas activities, given its acreage position and operations (either ongoing or planned) in the areas in question. Due to the early life nature of the various emerging plays discussed in this document, PIIP is the most relevant specific ass ign able category of estimated resources. Estimates by engineering and geo - technical practitioners may vary and the differences may be significant. There is no certainty that it will be commercially viable to produce any portion of the estimated PIIP. There is also no certainty that i t w ill be commercially viable to produce any portion of the estimated NGIP, COIP or EUR. 30 - day IP and short - term rates are not necessarily indicative of long - term performance or of ultimate recovery. In this presentation, certain oil and NGLs volumes have been converted to cubic feet equivalent ( cfe ) on the basis of one barrel ( bbl ) to six thousand cubic feet (Mcf). Cfe may be misleading, particularly if used in isolation. A conversion ratio of one bbl to six Mcf is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent value equivalency at the well hea d. Given that the value ratio based on the current price of oil as compared to natural gas is significantly different from the e ner gy equivalency of 6:1, utilizing a conversion on a 6:1 basis may be misleading as an indication of value. For convenience, references in this presentation to “Encana”, the “Company”, “we”, “us” and “our” may, where applicable, refe r o nly to or include any relevant direct and indirect subsidiary corporations and partnerships (“Subsidiaries”) of Encana Corpor ati on, and the assets, activities and initiatives of such Subsidiaries.

Investor Relations Contacts Brian Dutton | Director, Investor Relations 403.645.2285 | brian.dutton@encana.com Patti Posadowski | Senior Advisor, Investor Relations 403.645.2252 | patti.posadowski@encana.com encana.com 20