our users continuously organize our institutional content by adding it to family trees, in turn making relevant content easier to find by other users. We believe the value of our content therefore increases as our user network grows.

Market Leading Technology Platform, Enabling a Compelling User Experience

We have invested over $370 million in technology and development since 2004 to build our market-leading, proprietary, scalable technology platform and enhance the user experience. Our services allow subscribers to discover, preserve and share their family history by accessing content collections, building family trees, collaborating with other users of the community and sharing their discoveries with friends and relatives. For example, in 2013, we launched the Story View product experience to our users which enables users to create a highly shareable narrative around a person in their family tree. We believe these technologies provide a significant competitive advantage.

Our platform is designed to make searching easier for our subscribers. Our search solution focuses on structured and semi-structured records rather than free text search and automatically corrects for incomplete information and incorporates name, date and location proximity algorithms. In addition, our revolutionary “hinting” tool uses record matching algorithms to push new discoveries to subscribers without any additional research on their part. Our proprietary search engine, which enables this hinting functionality, performs tens of millions of searches per day.

We have developed and released mobile applications for both the iOS and Android-based platforms to provide a simple way to get started in family history and to help existing users continue their research and share with others in a more social manner. As of June 30, 2013, our mobile application has been downloaded over 8.5 million times and was a top grossing app in its category in the Apple App Store. These technologies enhance the user experience by enabling our subscribers to engage in or continue their research regardless of location.

Large Base of Long-Tenured and Predictable Subscribers

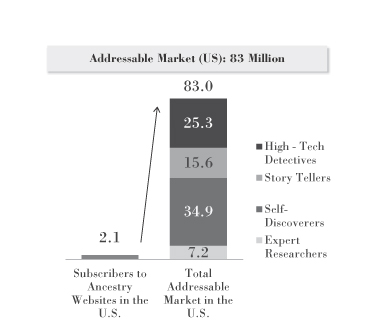

We have built what we believe is the world’s largest online community of people interested in their family histories and believe that this network is valuable to our subscribers. Our subscribers range from the most committed family historians to those taking their first steps towards satisfying a simple curiosity about their family story. From 2004 to 2012, our subscriber base has grown at a 16% compound annual growth rate (“CAGR”), and as of June 30, 2013, we had approximately 2.1 million global subscribers to Ancestry.com branded websites. Total subscribers across all websites, including Ancestry.com branded websites, Archives.com, Fold3.com and Newspapers.com, were approximately 2.7 million as of June 30, 2013. We believe we have a highly engaged subscriber base. The average survival rates of our subscribers to Ancestry.com branded websites, which are the rates at which initial subscribers remain subscribers over a period of time, from the original subscription date are approximately as follows: (a) 38% to 48% after one year; (b) 27% to 36% after two years; (c) 26% to 32% after three years; and (d) 26% to 28% after four years. Further, lifetime revenue from subscribers to Ancestry.com branded websites, which is the revenue received from a subscriber over a four-year period after becoming a subscriber, has remained steady over the last two years ranging from $310 to $340 per subscriber. Subscribers stay with our service for many reasons, including a compelling desire to discover new content. In addition, our proprietary hinting service keeps users engaged by using algorithms to search our ever-growing content collection for records related to subscriber family trees and then pushing relevant materials to each subscriber.

Predictable and Steady Growth from Increasing Scale and a More Tenured Subscriber Base

We have converted these subscriber trends into consistently strong revenue and adjusted EBITDA. Our revenue and adjusted EBITDA have grown each year since 2004, even during a difficult macroeconomic