JANUARY 17, 2018 Exhibit 99.1

Safe Harbor / Forward-Looking Statements This presentation contains certain forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended, based on our current expectations, estimates and projections about our operations, industry, financial condition, performance, results of operations, and liquidity. Statements containing words such as “may,” “believe,” “anticipate,” “expect,” “intend,” “plan,” “project,” “projections,” “business outlook,” “estimate,” or similar expressions constitute forward-looking statements. These forward-looking statements include, but are not limited to, statements about the Company’s strategies and future financial performance; expectations about future business plans, prospective performance and opportunities, including revenues; segment metrics; customer acquisition and retention; operating expenses; market trends, including those in the markets in which the Company competes; liquidity; cash flows and uses of cash; capital expenditures; the Company’s ability to invest in initiatives; the Company’s products and services; pricing; marketing plans; and competition. Potential factors that could affect these forward-looking statements include, among others, the factors disclosed in the Company’s most recent Annual Report on Form 10-K and the Company’s other filings with the Securities and Exchange Commission (www.sec.gov), including, without limitation, information under the captions “Management's Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors.” Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management's analysis only as of the date hereof. Any such forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties that may cause actual performance and results to differ materially from those predicted. Reported results should not be considered an indication of future performance. Except as required by law, we undertake no obligation to publicly release the results of any revision or update to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. In addition, the Company may not provide guidance of the type provided under Financial Outlook for 2018 or elsewhere in this presentation in the future. FTD reserves all rights to our trademarks, trade names and service marks, regardless of the manner in which we refer to them in this presentation. All other trademarks, trade names and service marks appearing in this presentation are the property of their respective owners. 2

Introduction to FTD The Industry As We See It Recent FTD Performance Our Strategic Plan Q&A Agenda

Introduction to FTD The Industry As We See It Recent FTD Performance Our Strategic Plan Q&A Agenda

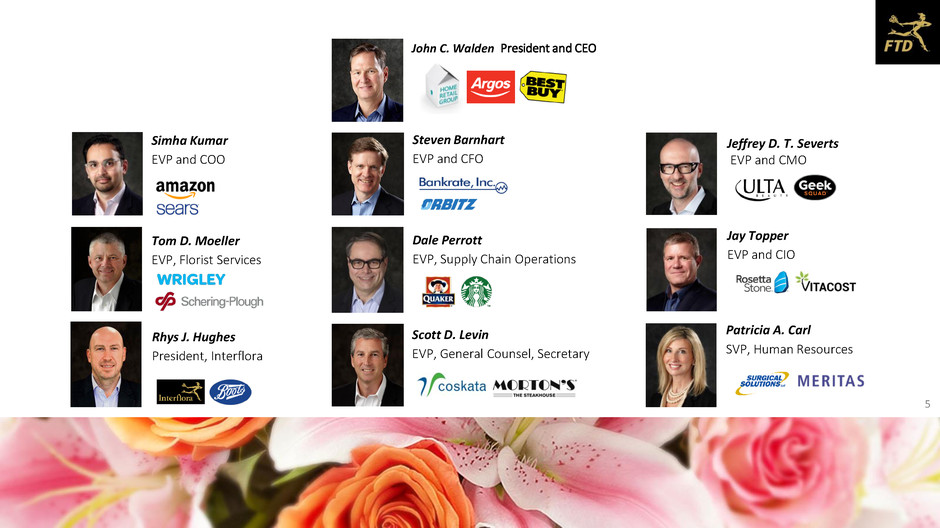

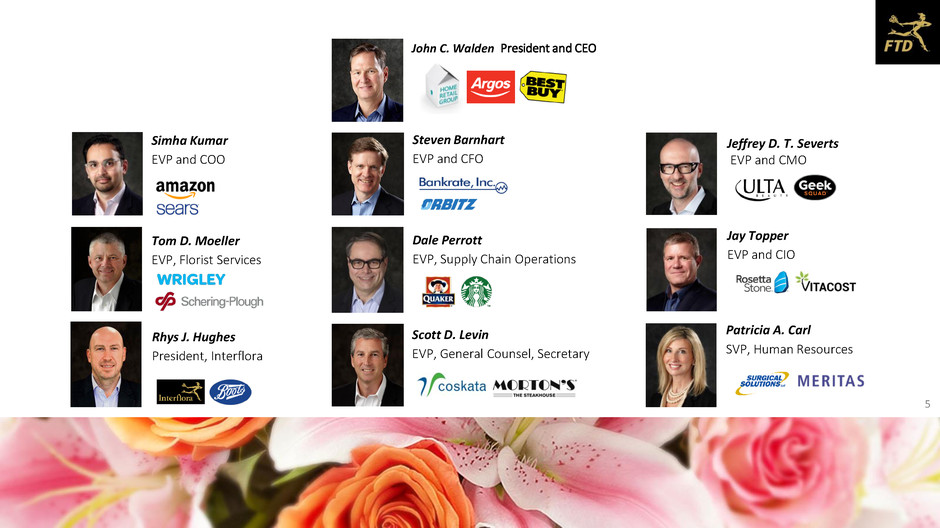

John C. Walden President and CEO Rhys J. Hughes President, Interflora Simha Kumar EVP and COO Tom D. Moeller EVP, Florist Services Steven Barnhart EVP and CFO Scott D. Levin EVP, General Counsel, Secretary Dale Perrott EVP, Supply Chain Operations Patricia A. Carl SVP, Human Resources Jay Topper EVP and CIO Jeffrey D. T. Severts EVP and CMO 5

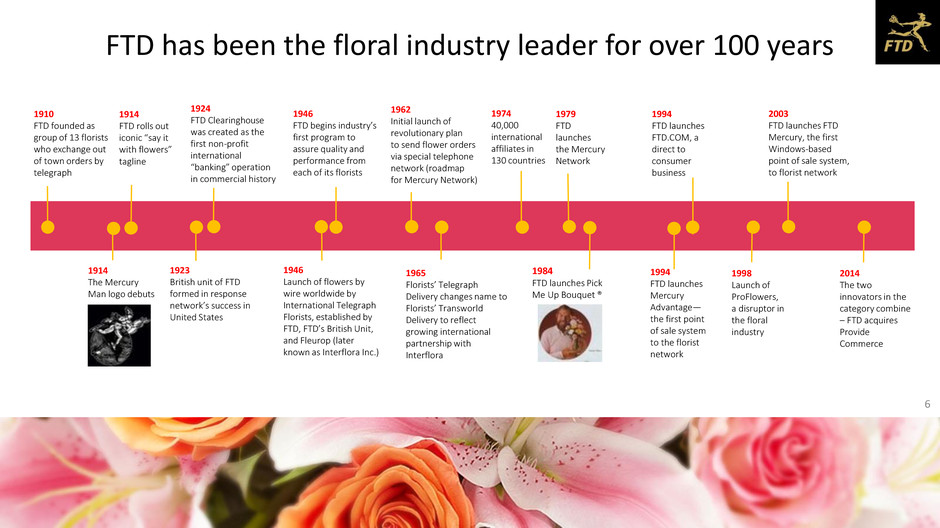

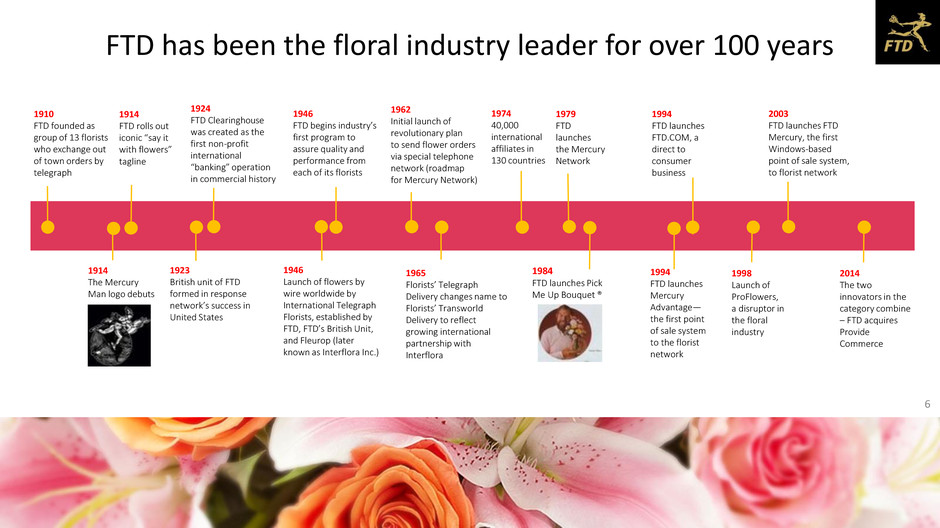

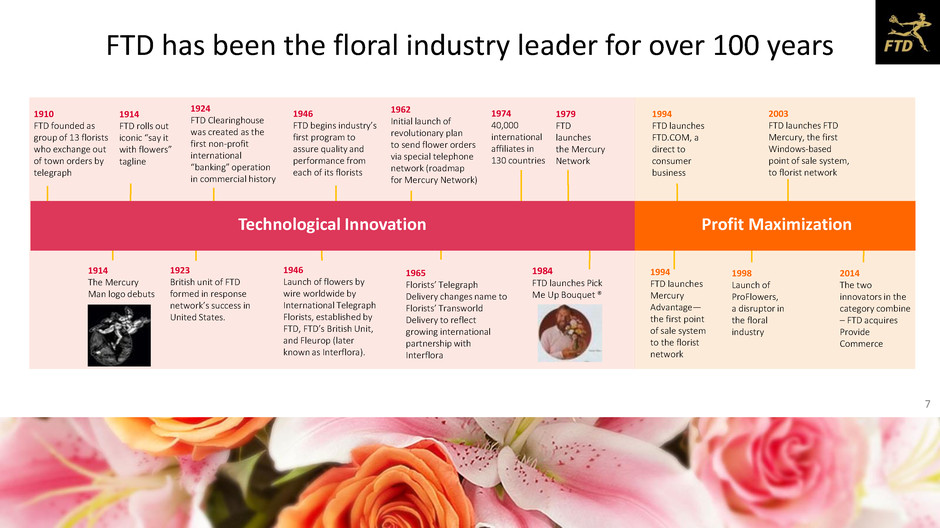

FTD has been the floral industry leader for over 100 years 1984 FTD launches Pick Me Up Bouquet ® 1979 FTD launches the Mercury Network 2003 FTD launches FTD Mercury, the first Windows-based point of sale system, to florist network 1924 FTD Clearinghouse was created as the first non-profit international “banking” operation in commercial history 2014 The two innovators in the category combine – FTD acquires Provide Commerce 1914 The Mercury Man logo debuts 1910 FTD founded as group of 13 florists who exchange out of town orders by telegraph 1914 FTD rolls out iconic “say it with flowers” tagline 1923 British unit of FTD formed in response network’s success in United States 1946 FTD begins industry’s first program to assure quality and performance from each of its florists 1946 Launch of flowers by wire worldwide by International Telegraph Florists, established by FTD, FTD’s British Unit, and Fleurop (later known as Interflora Inc.) 1962 Initial launch of revolutionary plan to send flower orders via special telephone network (roadmap for Mercury Network) 1974 40,000 international affiliates in 130 countries 1965 Florists’ Telegraph Delivery changes name to Florists’ Transworld Delivery to reflect growing international partnership with Interflora 1994 FTD launches FTD.COM, a direct to consumer business 1998 Launch of ProFlowers, a disruptor in the floral industry 1994 FTD launches Mercury Advantage— the first point of sale system to the florist network 6

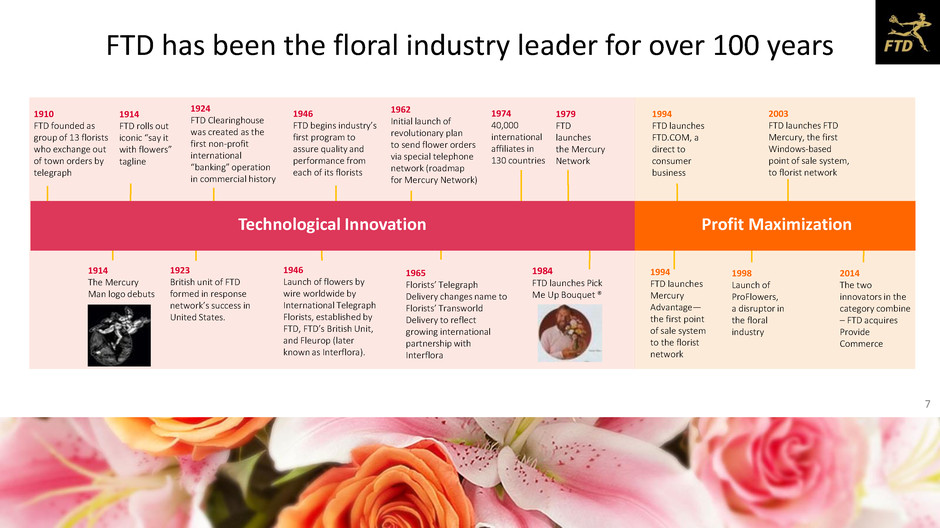

FTD has been the floral industry leader for over 100 years 1984 FTD launches Pick Me Up Bouquet ® 1979 FTD launches the Mercury Network 1994 FTD launches FTD.COM, a direct to consumer business 2003 FTD launches FTD Mercury, the first Windows-based point of sale system, to florist network 1994 FTD launches Mercury Advantage— the first point of sale system to the florist network 1924 FTD Clearinghouse was created as the first non-profit international “banking” operation in commercial history 2014 The two innovators in the category combine – FTD acquires Provide Commerce 1998 Launch of ProFlowers, a disruptor in the floral industry 1914 The Mercury Man logo debuts 1910 FTD founded as group of 13 florists who exchange out of town orders by telegraph 1914 FTD rolls out iconic “say it with flowers” tagline 1923 British unit of FTD formed in response network’s success in United States. 1946 FTD begins industry’s first program to assure quality and performance from each of its florists 1946 Launch of flowers by wire worldwide by International Telegraph Florists, established by FTD, FTD’s British Unit, and Fleurop (later known as Interflora). 1962 Initial launch of revolutionary plan to send flower orders via special telephone network (roadmap for Mercury Network) 1974 40,000 international affiliates in 130 countries 1965 Florists’ Telegraph Delivery changes name to Florists’ Transworld Delivery to reflect growing international partnership with Interflora Technological Innovation Profit Maximization 7

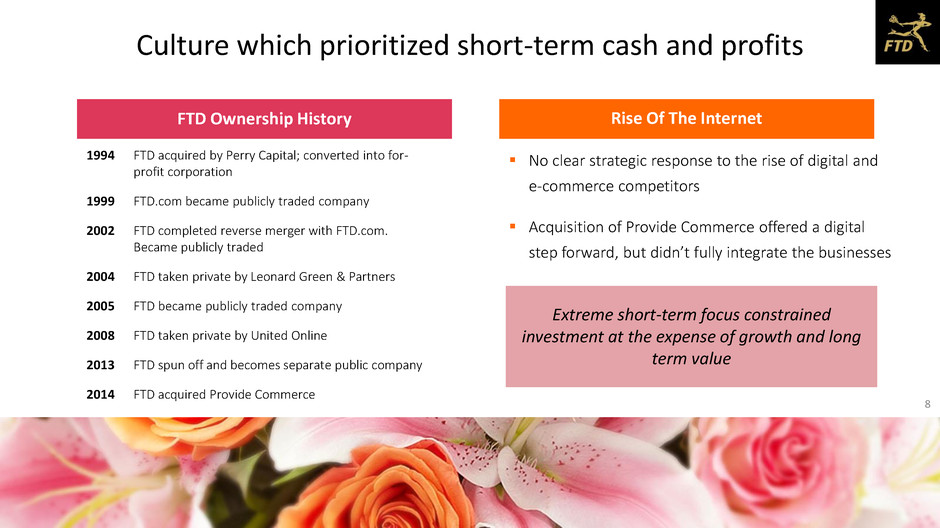

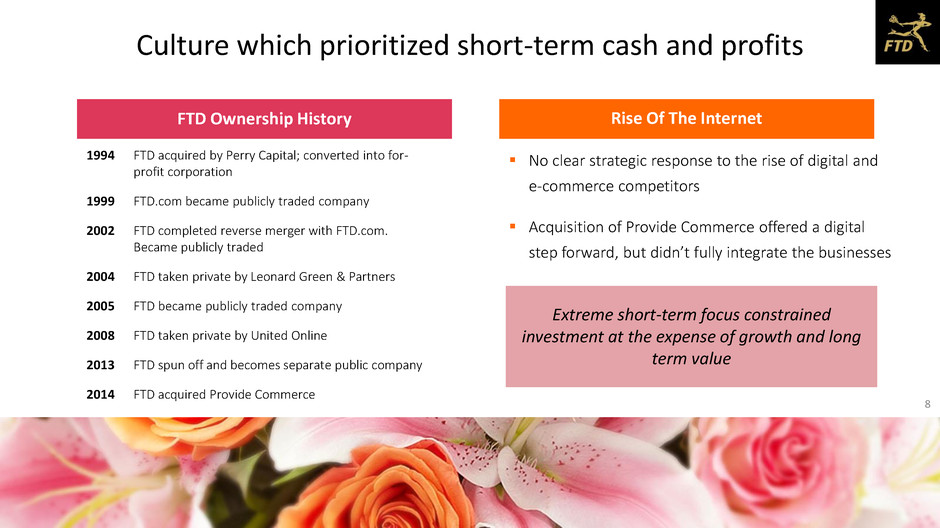

Culture which prioritized short-term cash and profits 1994 FTD acquired by Perry Capital; converted into for- profit corporation 1999 FTD.com became publicly traded company 2002 FTD completed reverse merger with FTD.com. Became publicly traded 2004 FTD taken private by Leonard Green & Partners 2005 FTD became publicly traded company 2008 FTD taken private by United Online 2013 FTD spun off and becomes separate public company 2014 FTD acquired Provide Commerce No clear strategic response to the rise of digital and e-commerce competitors Acquisition of Provide Commerce offered a digital step forward, but didn’t fully integrate the businesses FTD Ownership History Rise Of The Internet Extreme short-term focus constrained investment at the expense of growth and long term value 8

In spite of recent challenges, FTD remains strong with both an obligation and a commitment to regain its leadership We are the world’s largest floral gifting company We have over 10,000 florist locations across North America 7 out of 10 Americans recognize the Mercury Man logo Interflora is the dominant florist network in the U.K. with leading brand awareness Our network extends to over 125 countries We deliver joy through the magic of flowers an average of every 4 seconds of every day 9

This video describes the history of FTD, including florists making arrangements and customers receiving flowers. The transcript of the video is below and to view the video please visit the “Investor Relations” section of the FTD’s website at www.ftdcompanies.com. Female voiceover: We are the world’s largest floral company. Grown from industry leading innovation. From pioneering same day flower delivery anywhere in the country, to more recently disrupting the category with boxed flowers sent directly to consumer’s homes. Innovation is the core of who we are and what we do. It drove us to create the first national network of florists that grew to be the global network we know today. It put us at the forefront of digital retail with the launch of the FTD Mercury Network, and it inspired us to start selling flowers online nearly twenty-five years ago when Amazon was still a small bookstore. This continual drive to innovate is what established FTD as the unchallenged category leader, but with FTD’s conversion to a for-profit company that title began to wither away. We stopped building for the long run, we stopped investing in ourselves, our florists and our customers. We stopped innovating, but we can reclaim our rightful place as the best floral company in the world. We have so much to work with—a brand and mark that’s recognized by seven out of ten Americans, a century of heritage and knowhow about flowers, and the chance, every four seconds of every day to deliver joy to someone through the magic of flowers. We are ready to transform this industry, again. VIDEO

Agenda Introduction to FTD The Industry As We See It Recent FTD Performance Our Strategic Plan Q&A

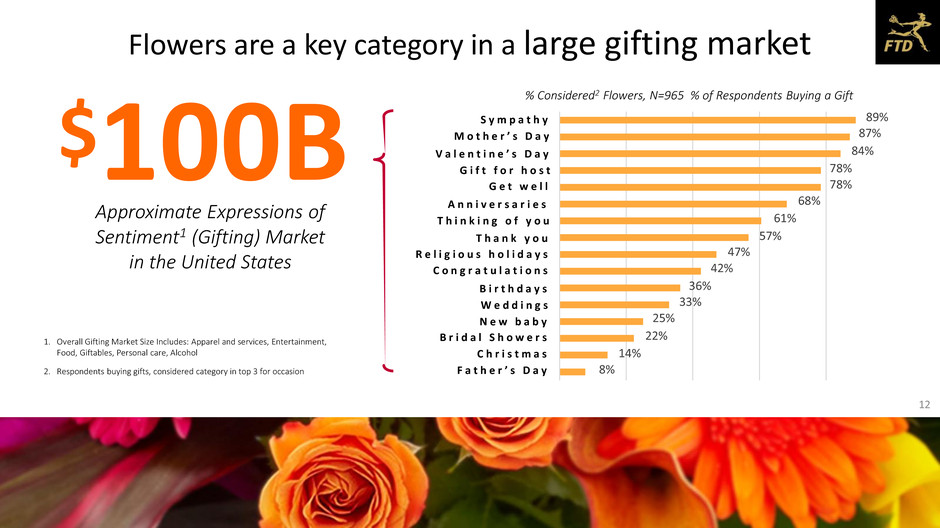

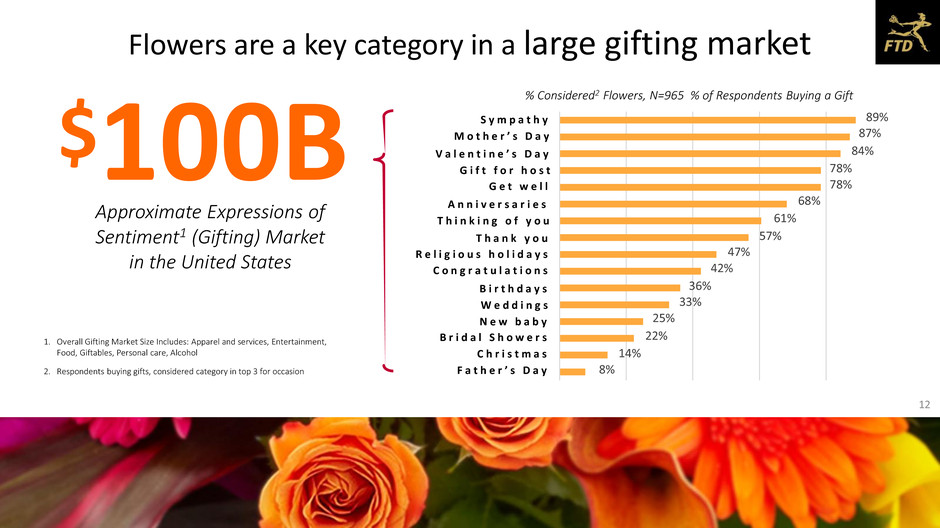

Flowers are a key category in a large gifting market % Considered2 Flowers, N=965 % of Respondents Buying a Gift 89% 87% 84% 78% 78% 68% 61% 57% 47% 42% 36% 33% 25% 22% 14% 8% A n n i v e r s a r i e s T h a n k y o u G i f t f o r h o s t V a l e n t i n e ’ s D a y F a t h e r ’ s D a y B r i d a l S h o w e r s C h r i s t m a s N e w b a b y W e d d i n g s B i r t h d a y s R e l i g i o u s h o l i d a y s T h i n k i n g o f y o u C o n g r a t u l a t i o n s G e t w e l l M o t h e r ’ s D a y S y m p a t h y$100B Approximate Expressions of Sentiment1 (Gifting) Market in the United States 1. Overall Gifting Market Size Includes: Apparel and services, Entertainment, Food, Giftables, Personal care, Alcohol 2. Respondents buying gifts, considered category in top 3 for occasion 12

All of the categories we compete in are large and robust F l o r a l G i f t i n g P e r s o n a l i z e d M e r c h a n d i s e G o u r m e t F o o d s Market Size, 2017-2020F ($B, % CAGR) 10.8 12.7 2020F2017 +5.6% 5.7 ~9% 2020F 7.3 2017 15.6 17.3+3.4% 2020F2017 Market Size, 2017-2020F ($B, % CAGR)Market Size, 2017-2020F ($B, % CAGR) Source: IBISWorld, Prince & Prince, OC&C analysis 13

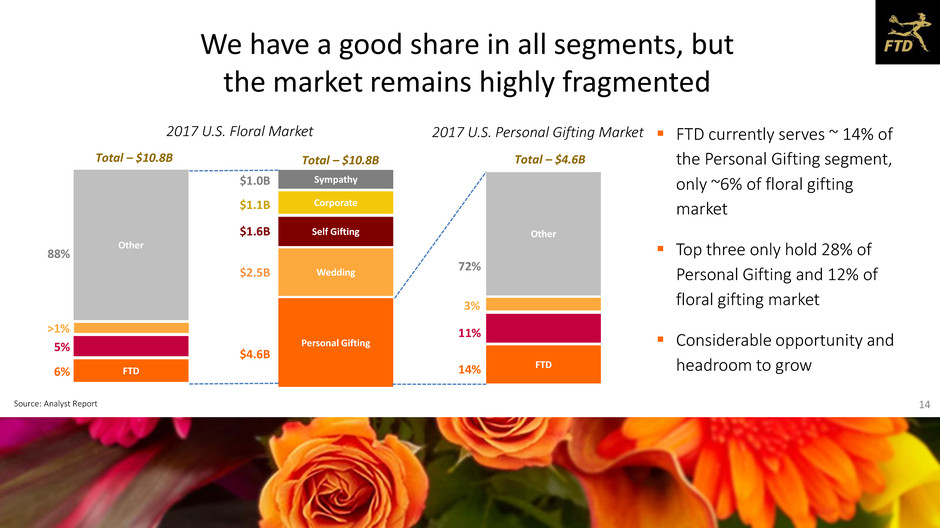

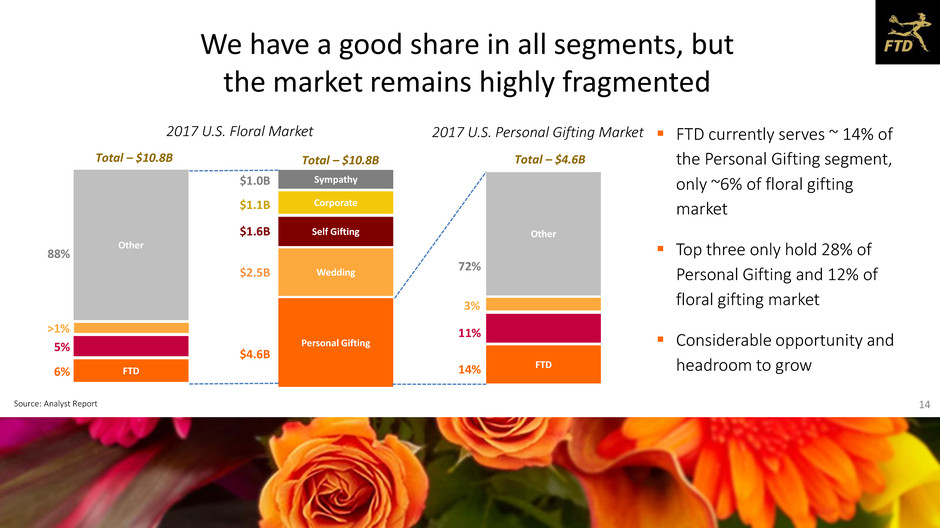

We have a good share in all segments, but the market remains highly fragmented 2017 U.S. Floral Market $1.1B $1.0B $2.5B $4.6B $1.6B FTD currently serves ~ 14% of the Personal Gifting segment, only ~6% of floral gifting market Top three only hold 28% of Personal Gifting and 12% of floral gifting market Considerable opportunity and headroom to grow Self Gifting Personal Gifting Wedding Sympathy Corporate 88% 5% 6% FTD Other Total – $10.8B Total – $10.8B 2017 U.S. Personal Gifting Market FTD Other Total – $4.6B 72% 11% 14% >1% 3% Source: Analyst Report 14

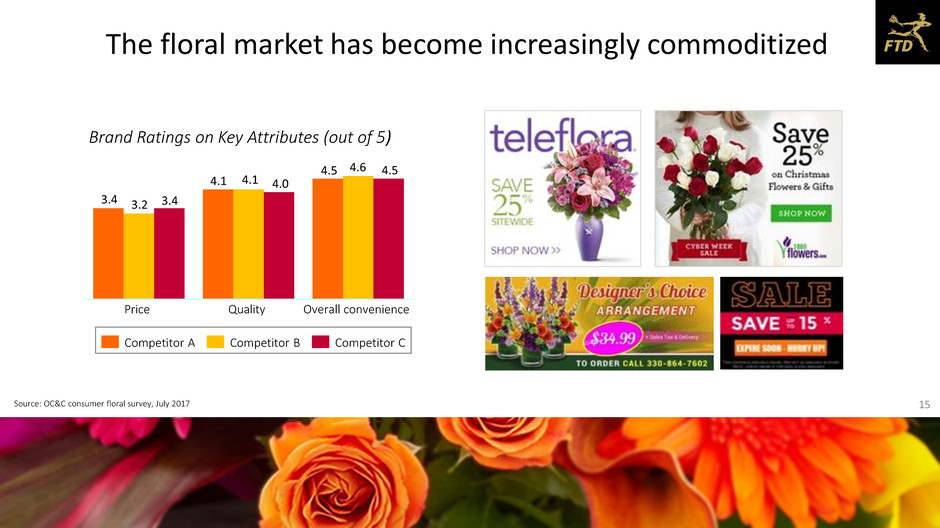

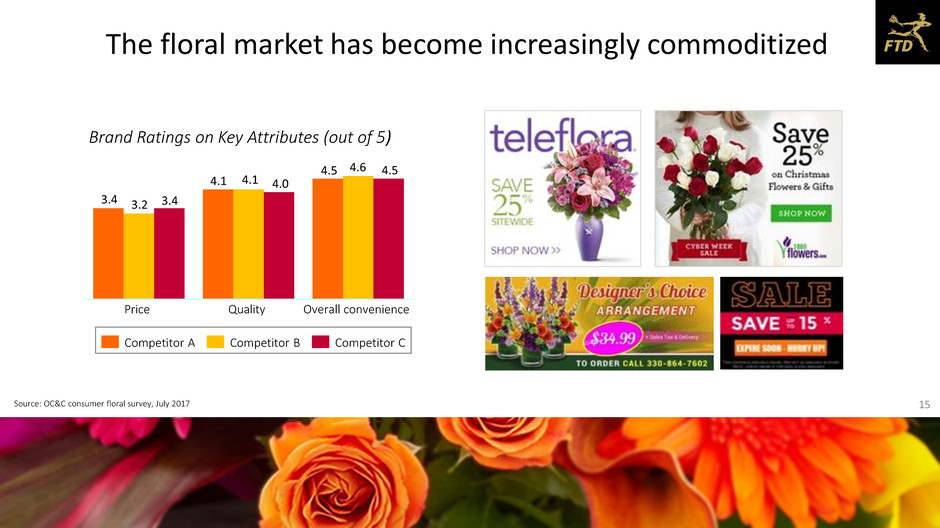

3.4 4.1 4.5 3.2 4.1 3.4 4.0 4.5 The floral market has become increasingly commoditized Overall convenienceQualityPrice Competitor B Competitor CCompetitor A Brand Ratings on Key Attributes (out of 5) 4.6 Source: OC&C consumer floral survey, July 2017 15

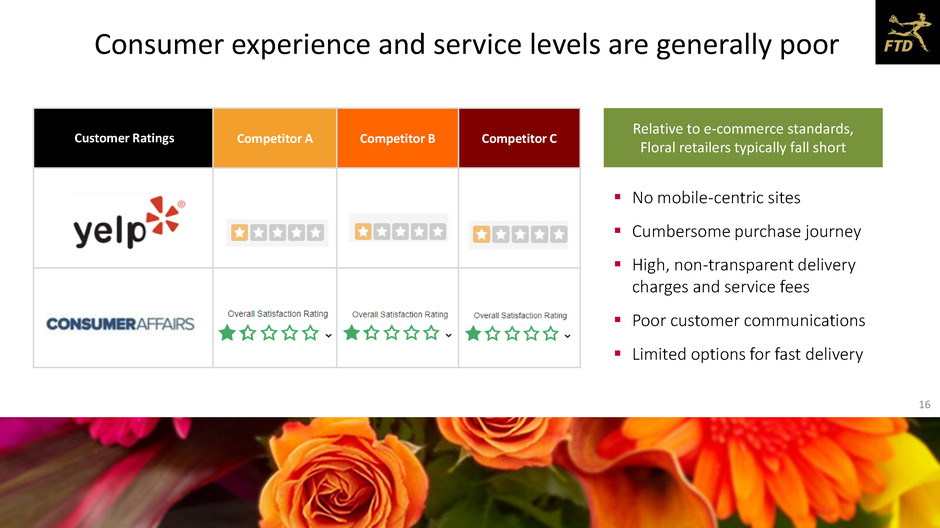

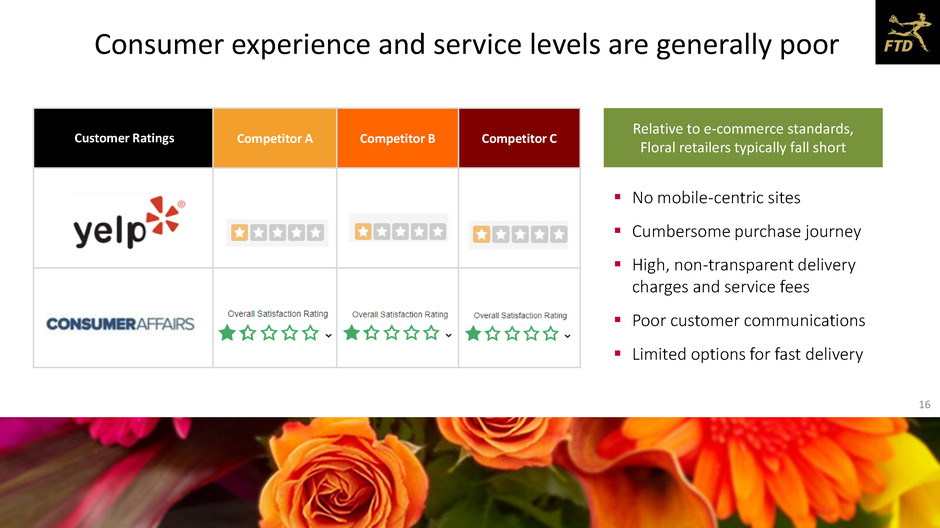

Consumer experience and service levels are generally poor Competitor A Competitor B Competitor CCustomer Ratings Relative to e-commerce standards, Floral retailers typically fall short No mobile-centric sites Cumbersome purchase journey High, non-transparent delivery charges and service fees Poor customer communications Limited options for fast delivery 16

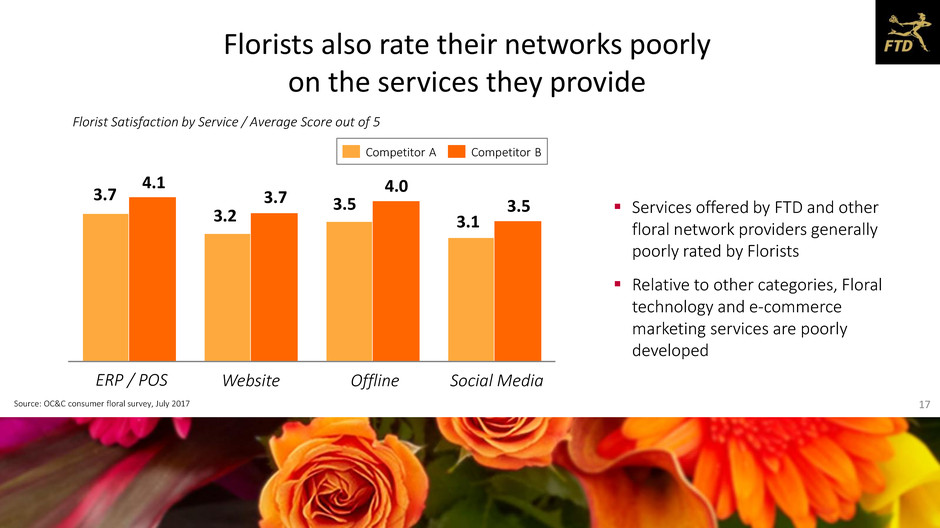

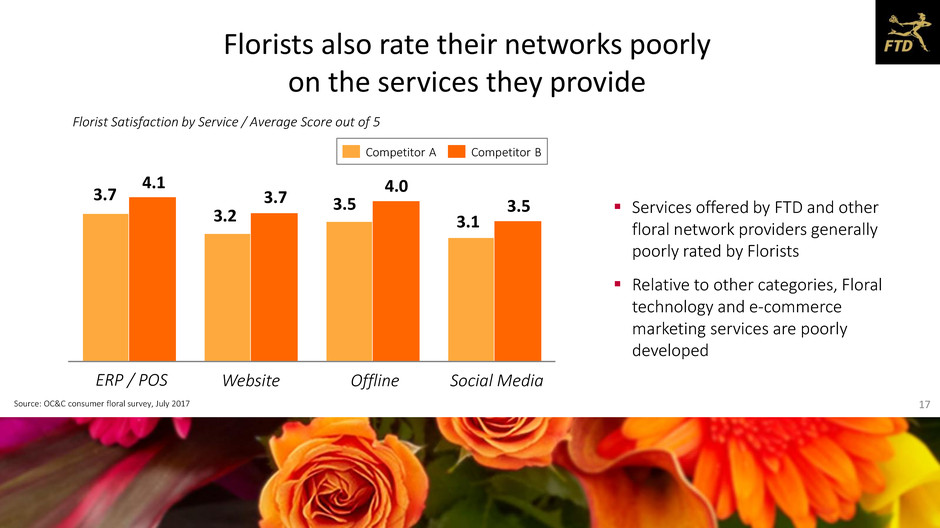

3.7 3.2 3.5 3.1 3.7 4.0 3.5 Website Social MediaOfflineERP / POS Florist Satisfaction by Service / Average Score out of 5 Competitor BCompetitor A Florists also rate their networks poorly on the services they provide Services offered by FTD and other floral network providers generally poorly rated by Florists Relative to other categories, Floral technology and e-commerce marketing services are poorly developed 4.1 Source: OC&C consumer floral survey, July 2017 17

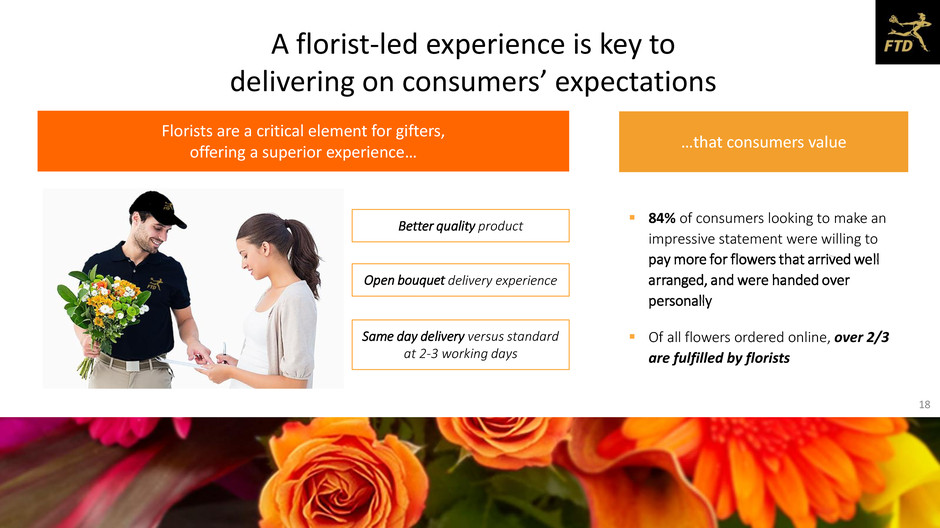

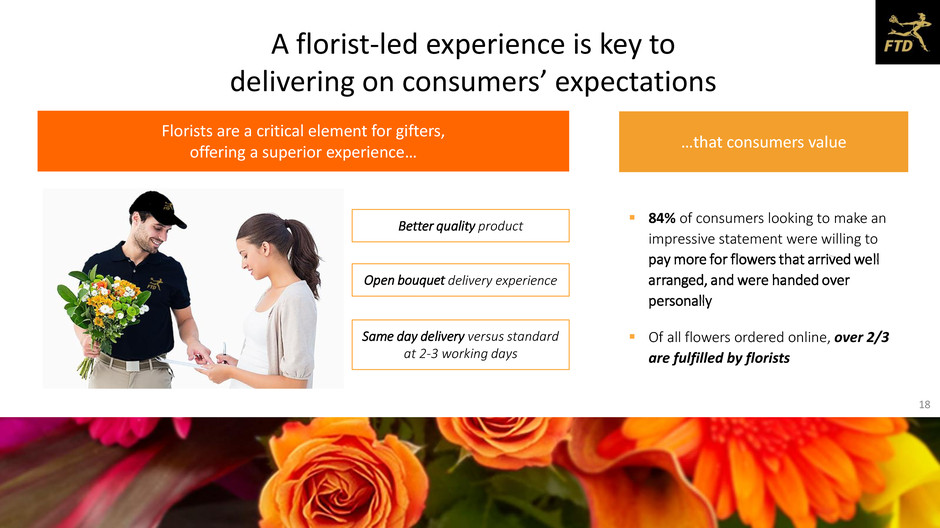

A florist-led experience is key to delivering on consumers’ expectations …that consumers value Florists are a critical element for gifters, offering a superior experience… Better quality product 84% of consumers looking to make an impressive statement were willing to pay more for flowers that arrived well arranged, and were handed over personally Of all flowers ordered online, over 2/3 are fulfilled by florists Open bouquet delivery experience Same day delivery versus standard at 2-3 working days 18

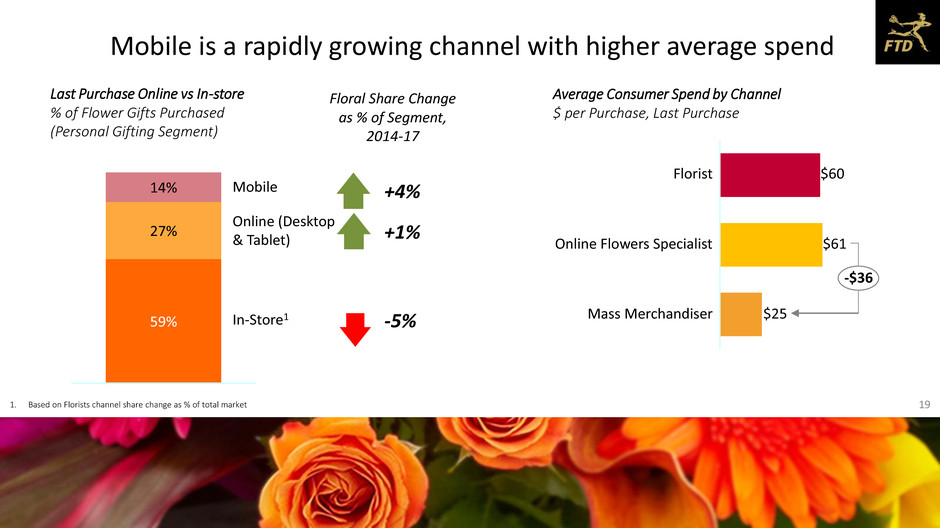

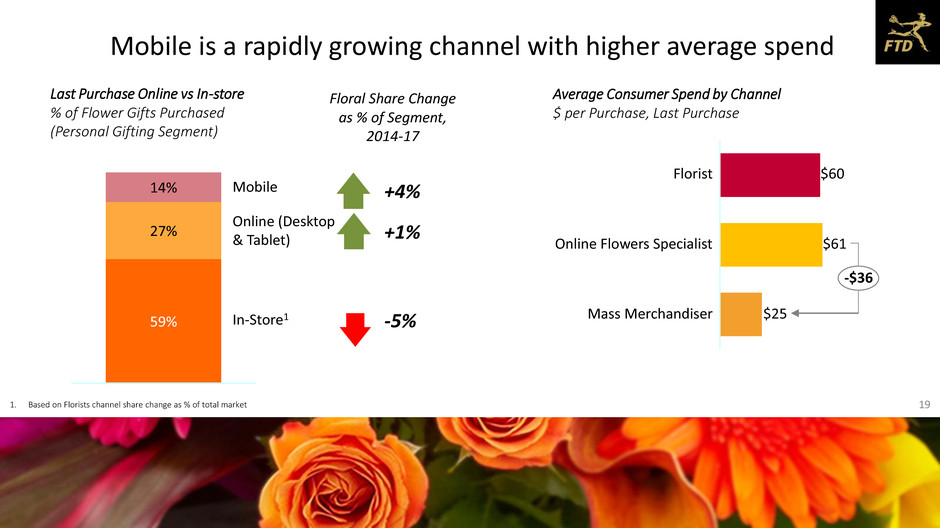

Mobile is a rapidly growing channel with higher average spend Last Purchase Online vs In-store % of Flower Gifts Purchased (Personal Gifting Segment) 59% 27% 14% Online (Desktop & Tablet) Mobile In-Store1 Average Consumer Spend by Channel $ per Purchase, Last Purchase -$36 Mass Merchandiser $25 Online Flowers Specialist $61 Florist $60 +4% -5% Floral Share Change as % of Segment, 2014-17 +1% 1. Based on Florists channel share change as % of total market 19

The floral market offers significant growth opportunity and is ripe for disruption The Opportunities Are Significant The Industry Is Ripe For Disruption Commoditized product offering with little brand differentiation Poor service standards Price and promotion led with little emotional connection Florists rate their networks poorly No disruptors of scale today The market for floral gifting is large, growing and fragmented among many small competitors Only ~40% of all floral personal gifting is bought online, with a high average spend Consumers are willing to pay more for florist prepared and delivered products 20

Agenda Introduction to FTD The Industry As We See It Recent FTD Performance Our Strategic Plan Q&A

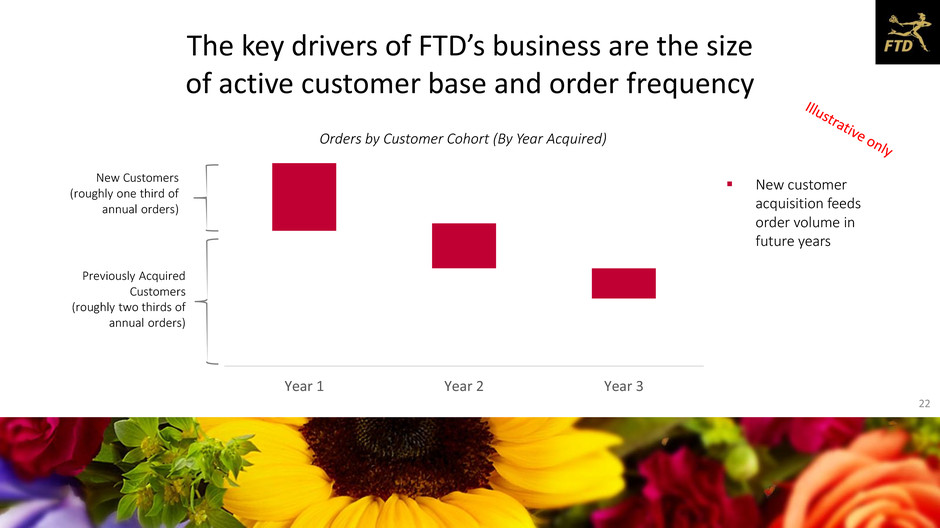

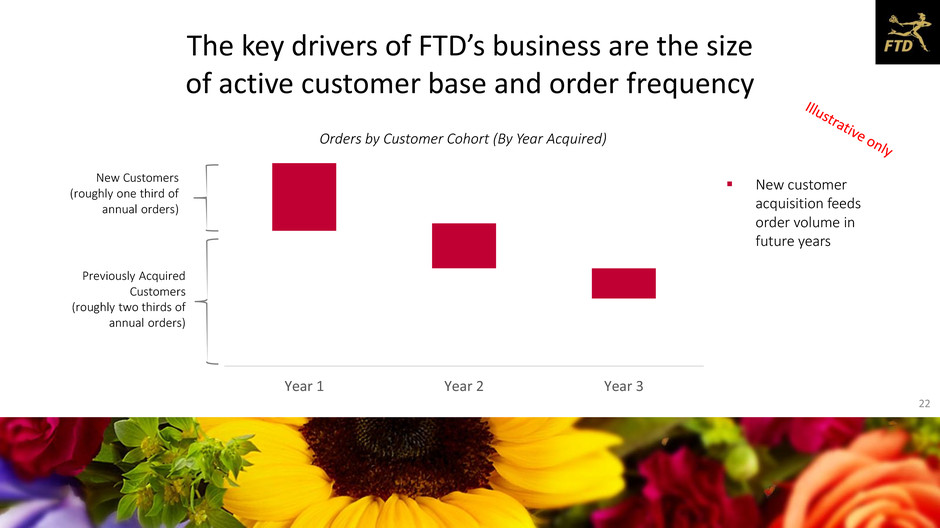

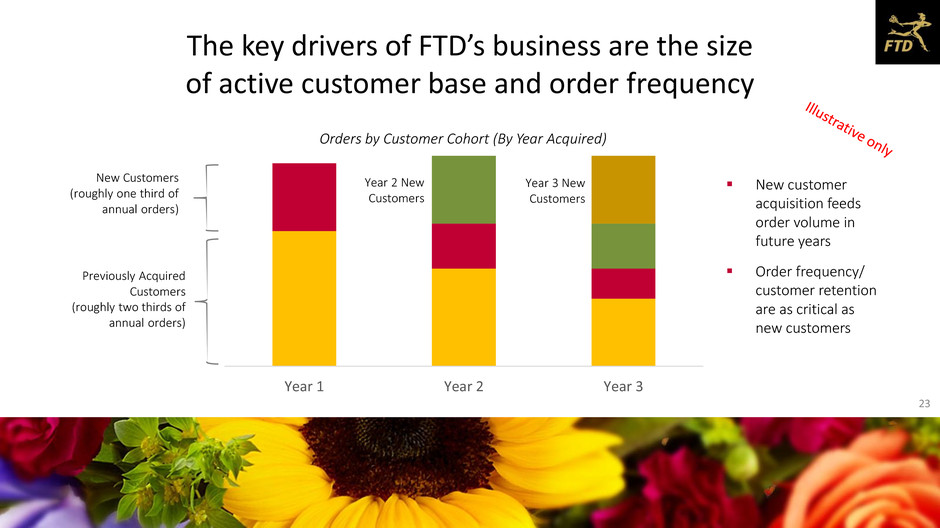

Year 1 Year 2 Year 3 New Customers (roughly one third of annual orders) Orders by Customer Cohort (By Year Acquired) Previously Acquired Customers (roughly two thirds of annual orders) New customer acquisition feeds order volume in future years The key drivers of FTD’s business are the size of active customer base and order frequency 22

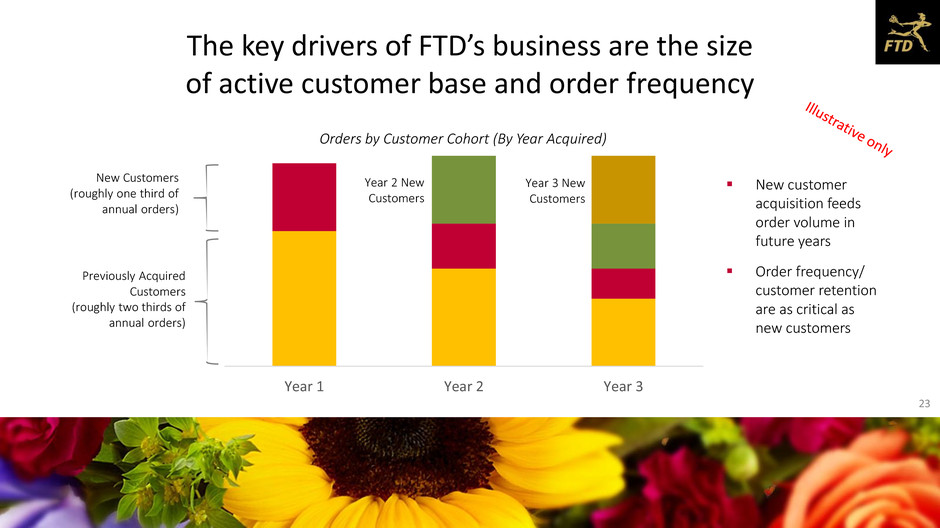

The key drivers of FTD’s business are the size of active customer base and order frequency Year 1 Year 2 Year 3 Year 2 New Customers Year 3 New Customers New customer acquisition feeds order volume in future years Order frequency/ customer retention are as critical as new customers New Customers (roughly one third of annual orders) Previously Acquired Customers (roughly two thirds of annual orders) Orders by Customer Cohort (By Year Acquired) 23

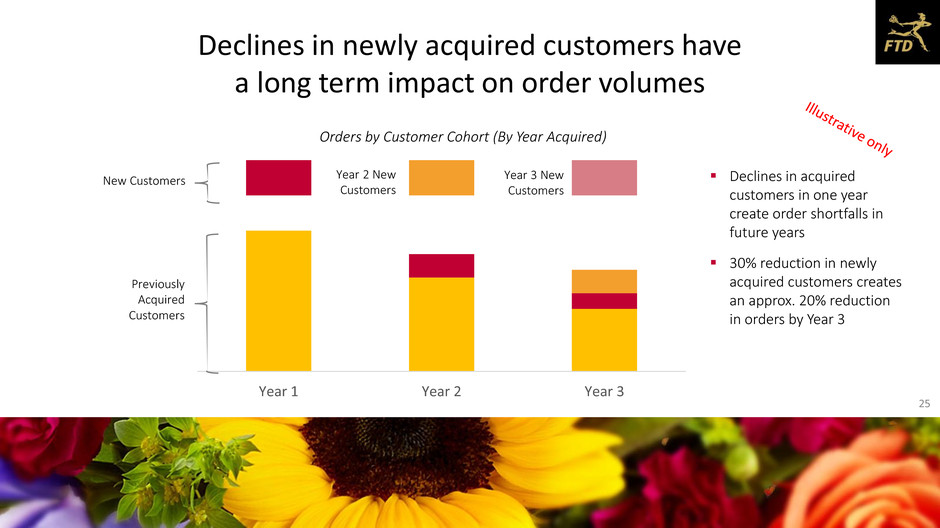

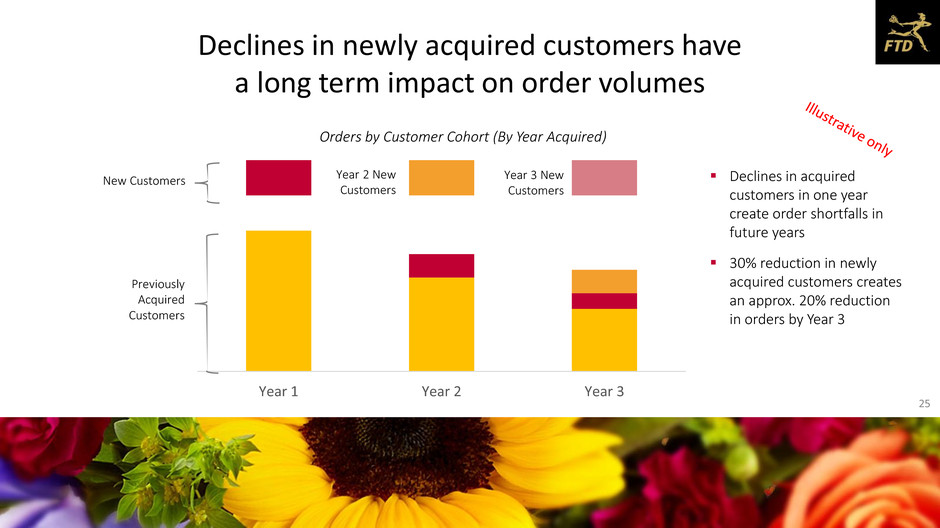

Declines in newly acquired customers have a long term impact on order volumes Previously Acquired Customers Year 1 Year 2 Year 3 Year 2 New Customers Year 3 New Customers Orders by Customer Cohort (By Year Acquired) New Customers 24

Previously Acquired Customers Year 1 Year 2 Year 3 Year 2 New Customers Year 3 New Customers Declines in acquired customers in one year create order shortfalls in future years 30% reduction in newly acquired customers creates an approx. 20% reduction in orders by Year 3 Orders by Customer Cohort (By Year Acquired) New Customers Declines in newly acquired customers have a long term impact on order volumes 25

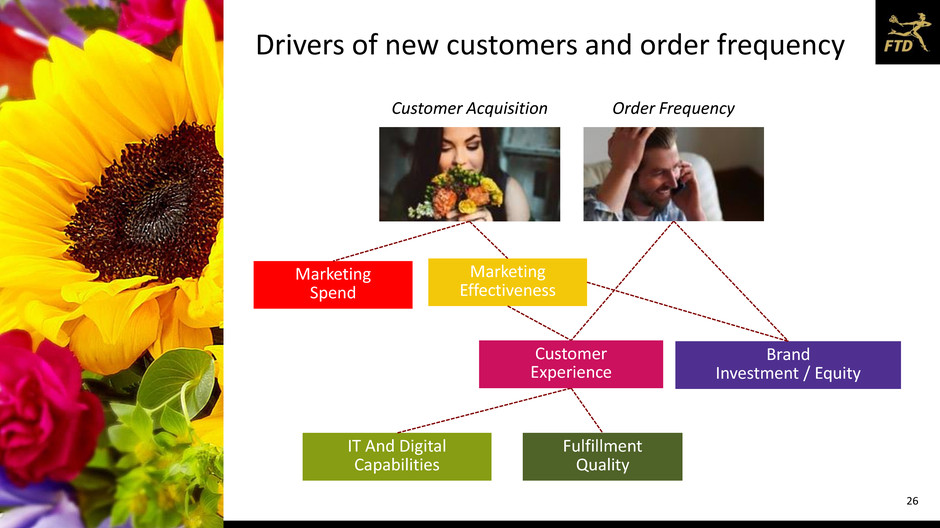

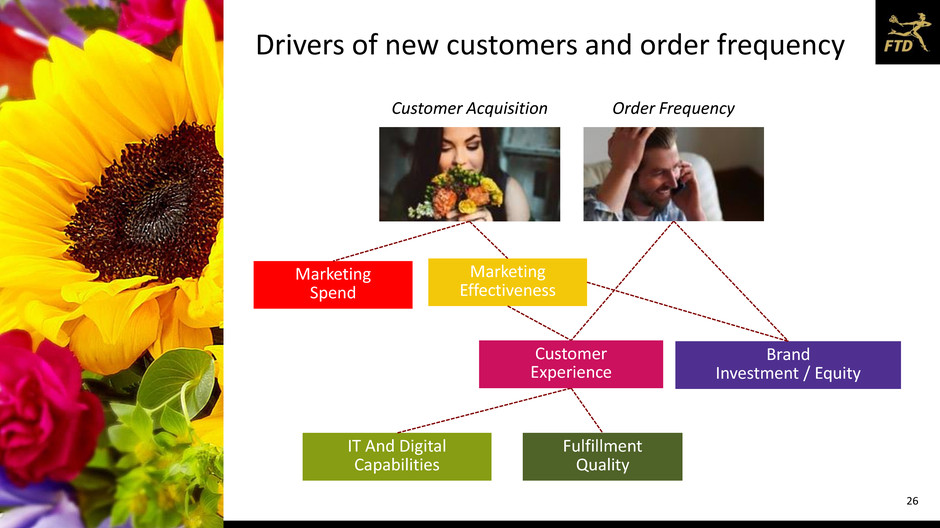

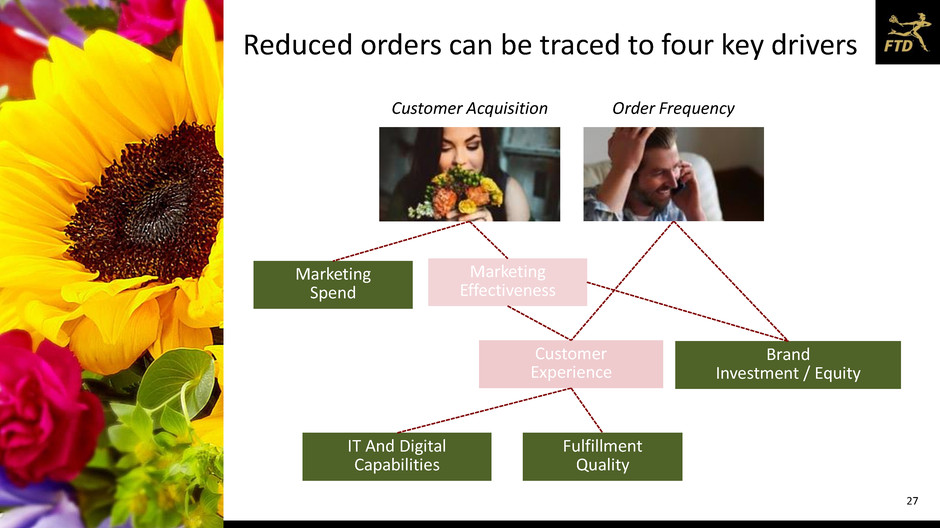

26 Marketing Spend Marketing Effectiveness Brand Investment / Equity IT And Digital Capabilities Fulfillment Quality Drivers of new customers and order frequency Order FrequencyCustomer Acquisition Customer Experience

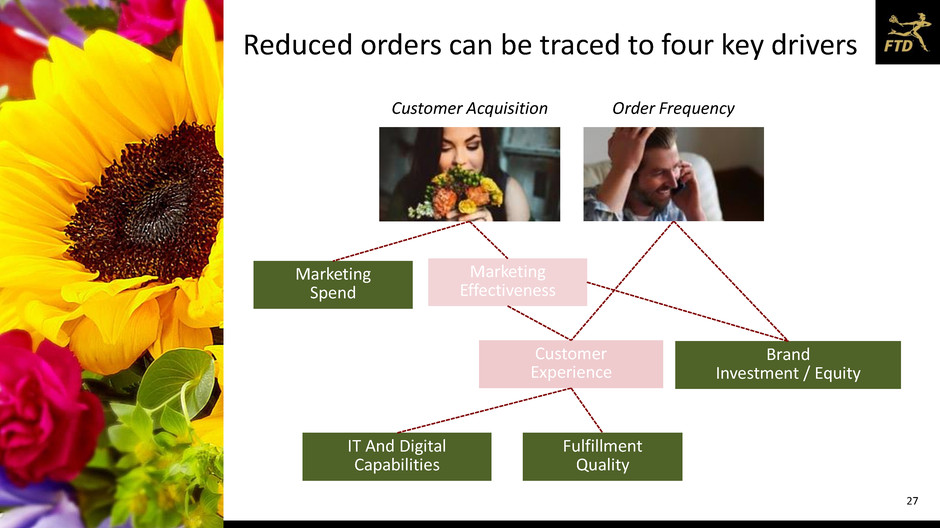

27 Marketing Spend Marketing Effectiveness Brand Investment / Equity IT And Digital Capabilities Fulfillment Quality Reduced orders can be traced to four key drivers Order FrequencyCustomer Acquisition Customer Experience

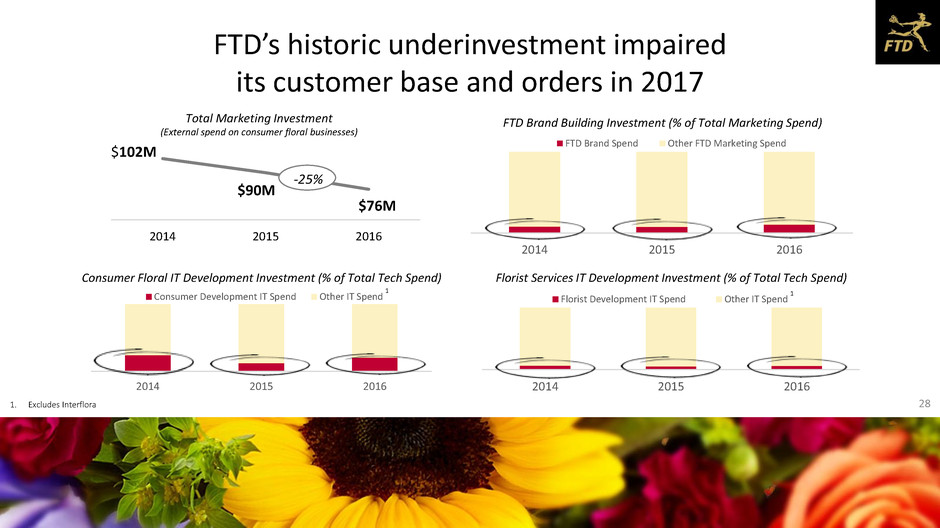

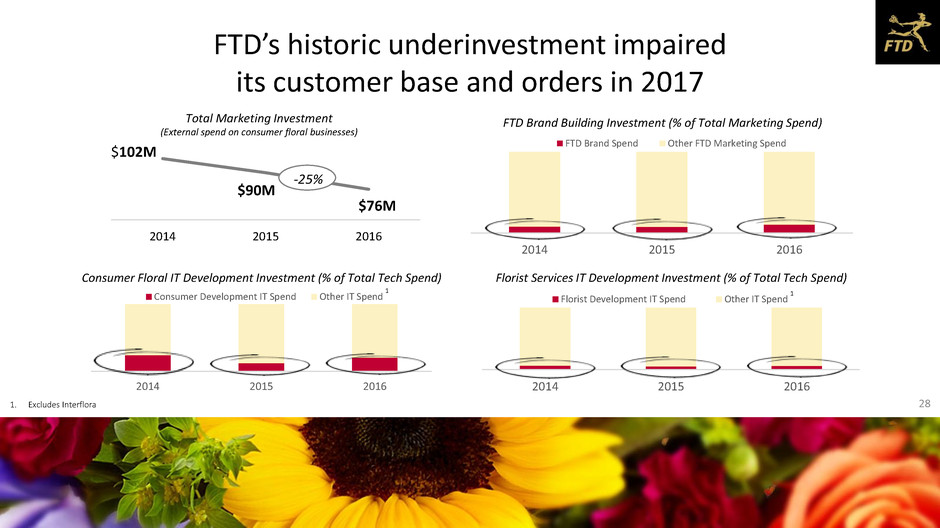

FTD’s historic underinvestment impaired its customer base and orders in 2017 2014 2015 2016 Total Marketing Investment (External spend on consumer floral businesses) Consumer Floral IT Development Investment (% of Total Tech Spend) Florist Services IT Development Investment (% of Total Tech Spend) $102M $76M 2014 2015 2016 Consumer Development IT Spend Other IT Spend FTD Brand Building Investment (% of Total Marketing Spend) 2014 2015 2016 FTD Brand Spend Other FTD Marketing Spend -25% 2014 2015 2016 Florist Development IT Spend Other IT Spend $90M 1 1 1. Excludes Interflora 28

Against a challenging backdrop, FTD established an ambitious agenda for 2017 Manage through performance headwinds and undertake “no regrets” improvements Create a leadership and organizational foundation for the business Complete a comprehensive strategic review and strategic plan 29

Performance and “no regrets” improvements Tested Innovative Marketing Approaches Leveraged Data and Analytics Enhanced Customer Experience Improved Supply Chain Used machine learning to drive creative execution Conducted micro- targeted paid search campaigns Reduced assortment complexity Instituted data-driven discipline to business Instituted closed loop NPS program globally Established consumer friendly “No Hassle” policy Significantly increased network berry capacity (e.g. Lincoln and NJ facilities) Led industry-wide corrugated sourcing program to reduce cost across full value chain 30

Significant improvements to our leadership team and organizational foundation Upgraded key executive roles New, improved leadership for Floral businesses Created and filled 24 new leadership positions in Technology Upgraded our entire Supply Chain leadership team Leadership Team Reorganized into a ‘one organization’ model with an enterprise mindset Created enterprise functions to leverage expertise and enable integration Began establishing new cultural expectations New company headquarters in downtown Chicago Innovation mindset Organizational Foundation WORKING TOGETHER AS ONE FTD LEAD WITH POSITIVE ENERGY AND URGENCY CUSTOMERS & MEMBERS COME FIRST WINNING THROUGH INNOVATION 31

Comprehensive strategic development process Robust understanding of the facts: markets, competitors, customers, florist members, economics Benchmarks from world-class companies beyond our industry Answered big strategic questions: How we can win, in what categories, etc. Designed our future business Developed the plans to achieve the strategies Financial plan and business case Operational plans M a y J u n J u l A u g S e p O c t N o v Diagnosis Strategic Planning Operational Planning 32

BREAK

Introduction to FTD The Industry As We See It Recent FTD Performance Our Strategic Plan Q&A Agenda

Reclaim our heritage as the world’s floral innovator and leader, creating products, brands, and technology- driven services our customers love Our Vision 35

Our Five-Year Strategic Plan will achieve this vision and drive significant shareholder value AEBITDA2Revenue ~$1.1B1 $1.5B+ +36% +66% 2 0 1 7 2 0 2 2 2 0 1 7 2 0 2 2 $81.2M1 $135M+ 1. Represents the mid-point of the guidance provided in November 2017. Actual financial results for 2017 are not yet available. 2. Adjusted EBITDA is a non-GAAP measure. See appendix for definitions of non-GAAP measures. 36

Our Strategic Plan has four key components Consumer Focus Florist Partners Supply Chain Efficiency Non-Floral Rebuild a strong, disruptive brand to earn the trust and win the hearts of consumers Recreate a network of strong partnerships with the world’s best florists Provide high quality product at low cost with market leading fulfillment options Extend our floral advantage into complementary non-floral categories 37

Our Strategic Plan has four key components Consumer Focus: Rebuild a strong, disruptive brand to earn the trust and win the hearts of consumers Florist Partners: Recreate a network of strong partnerships with the world’s best florists Supply Chain Efficiency: Provide high quality product at low cost with market leading fulfillment options Non-Floral: Extend our floral advantage into complementary non-floral categories 38

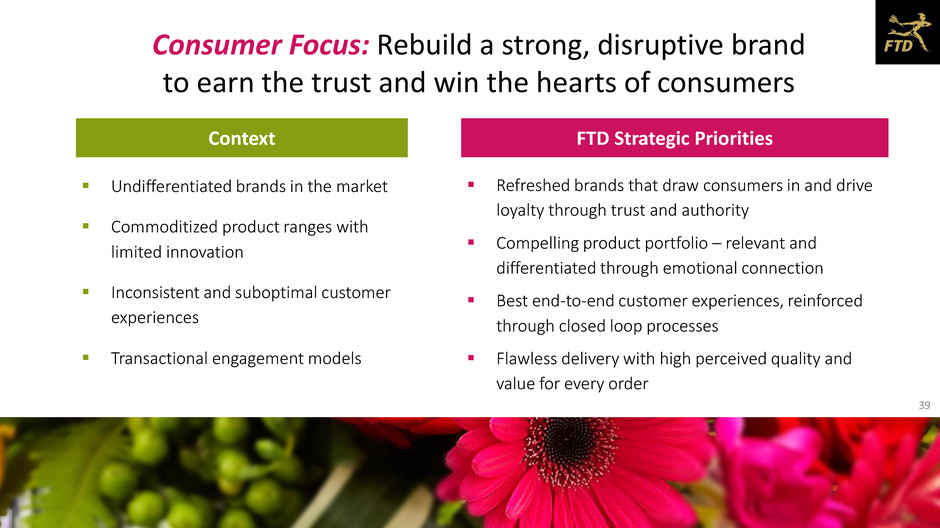

Consumer Focus: Rebuild a strong, disruptive brand to earn the trust and win the hearts of consumers . Undifferentiated brands in the market Commoditized product ranges with limited innovation Inconsistent and suboptimal customer experiences Transactional engagement models Refreshed brands that draw consumers in and drive loyalty through trust and authority Compelling product portfolio – relevant and differentiated through emotional connection Best end-to-end customer experiences, reinforced through closed loop processes Flawless delivery with high perceived quality and value for every order FTD Strategic PrioritiesContext 39

Reinforce FTD as our flagship brand across the portfolio 40

Improve our end-to-end customer experience Launch a new mobile-first redesign of our mobile and web experiences Refresh the look and feel of our brands Reimagine our assortment by pairing design-led and data-driven approaches Implement 100% digitally-driven customer service (consumer and florist) Commit to flawless execution through expanded fulfillment options, transparency and assurance of quality 41

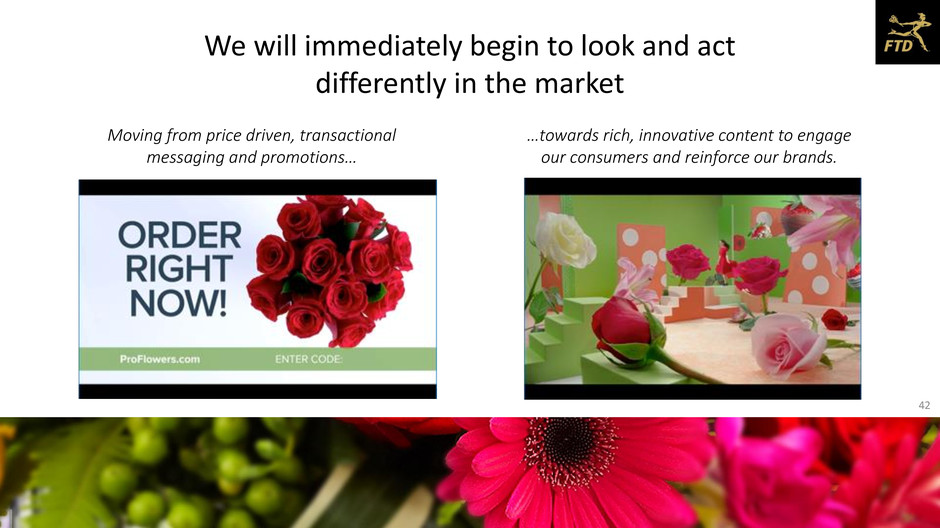

We will immediately begin to look and act differently in the market Moving from price driven, transactional messaging and promotions… …towards rich, innovative content to engage our consumers and reinforce our brands. 42

2017 Video This video is a 2017 ProFlowers® Valentine’s Day commercial. The transcript of the video is below and to view the video please visit the “Investor Relations” section of the FTD’s website at www.ftdcompanies.com. Male Announcer Voice Over: Are you ready for Valentine’s Day? Male Actor 1: Simple rule for Valentine’s Day, you can never lose with roses. Male Actor 2: ProFlowers® always look great, which hello, makes you look great. Male Actor 3: I save time, I same money and my wife loves them. Male Announcer Voice Over: Go to ProFlowers.com right now and you’ll get one dozen red roses, plus a vase and a box of gourmet chocolates starting at $29.99. Just tap on the mic in the upper right corner and enter code. That’s promo code. Two minutes is all it takes to choose your flowers, pick your vase and send them on their way. All of our flowers come with a seven-day freshness guarantee or your money back. Order right now and for $9.99 more we’ll double the roses. Yep, twenty-four red roses with the vase, plus the gourmet chocolates starting at $39.99. Female Actress: I love them. I hope he does this every year. Male Actor 1: I’m telling you ProFlowers® is a win-win, every time. Male Actor 3: Every time. Male Actor 2: Every time. Male Announcer Voice Over: Go to Proflowers.com right now, click on the blue mic and enter promo code. Order now for Valentine’s Day delivery.

2018 Video This video is a 2018 ProFlowers® Valentine’s Day commercial. The transcript of the video is below and to view the video please visit the “Investor Relations” section of the FTD’s website at www.ftdcompanies.com. Male Actor: Valentine’s Day, huh? You’re probably planning to think outside the box. My advice? Don’t. This Valentine’s Day, think inside the box. Male Announcer Voiceover: Make a big impression this Valentine’s Day. Introducing the perfectly paired collection from ProFlowers® and Shari’s Berries®. Male Actor: You’re welcome.

Our Strategic Plan has four key components Consumer Focus: Rebuild a strong, disruptive brand to earn the trust and win the hearts of consumers Florist Partners: Recreate a network of strong partnerships with the world’s best florists Supply Chain Efficiency: Provide high quality product at low cost with market leading fulfillment options Non-Floral: Extend our floral advantage into complementary non-floral categories 45

Florist Partners: Recreate a network of strong partnerships with the world’s best florists High florist failure rates and encroaching supermarket and online competition Antiquated tools and technology services which don’t address florist needs Florist networks exacerbating florist challenges through service complexity Limited perceived value in florist networks Intuitive, value-added technology and support to holistically strengthen florists’ businesses Simplified ways of working to reduce cost and increase profits for florists and FTD Strong, trusted FTD brand to drive customer engagement and order volume FTD and Interflora preferred partners for the best florists FTD Strategic PrioritiesContext 46

Invest in technology and service initiatives to strengthen our partner florists’ businesses Improved internal florist operations and profitability Improved marketing effectiveness and commercial reach for florists Enhanced customer service, support processes and tools, simplified ways of working 47

Our Strategic Plan has four key components Consumer Focus: Rebuild a strong, disruptive brand to earn the trust and win the hearts of consumers Florist Partners: Recreate a network of strong partnerships with the world’s best florists Supply Chain Efficiency: Provide high quality product at low cost with market leading fulfillment options Non-Floral: Extend our floral advantage into complementary non-floral categories 48

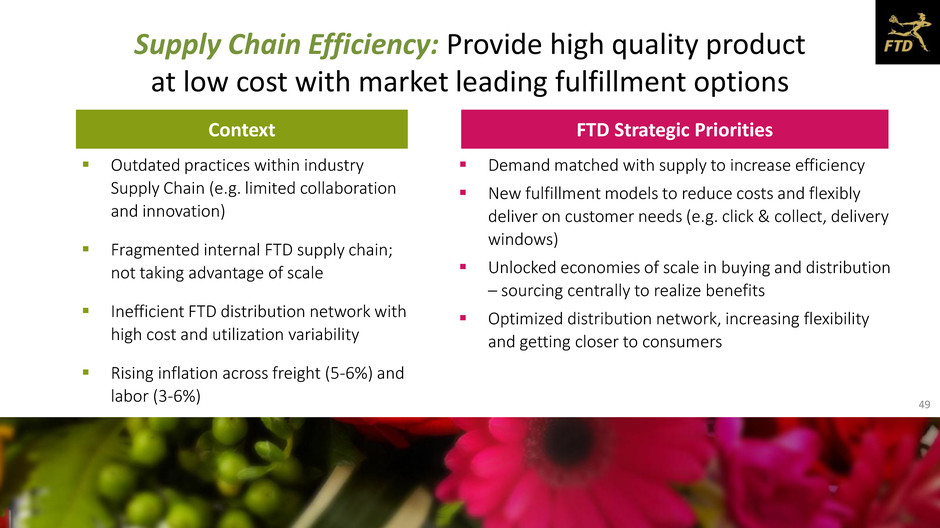

Supply Chain Efficiency: Provide high quality product at low cost with market leading fulfillment options Outdated practices within industry Supply Chain (e.g. limited collaboration and innovation) Fragmented internal FTD supply chain; not taking advantage of scale Inefficient FTD distribution network with high cost and utilization variability Rising inflation across freight (5-6%) and labor (3-6%) Demand matched with supply to increase efficiency New fulfillment models to reduce costs and flexibly deliver on customer needs (e.g. click & collect, delivery windows) Unlocked economies of scale in buying and distribution – sourcing centrally to realize benefits Optimized distribution network, increasing flexibility and getting closer to consumers FTD Strategic PrioritiesContext 49

Capture unrealized synergies and operate more effectively Unified and coordinated sourcing across the enterprise Shared distribution, logistics, and contracts Improved network utilization both on and off peak Increased collaboration with floral supply partners 50

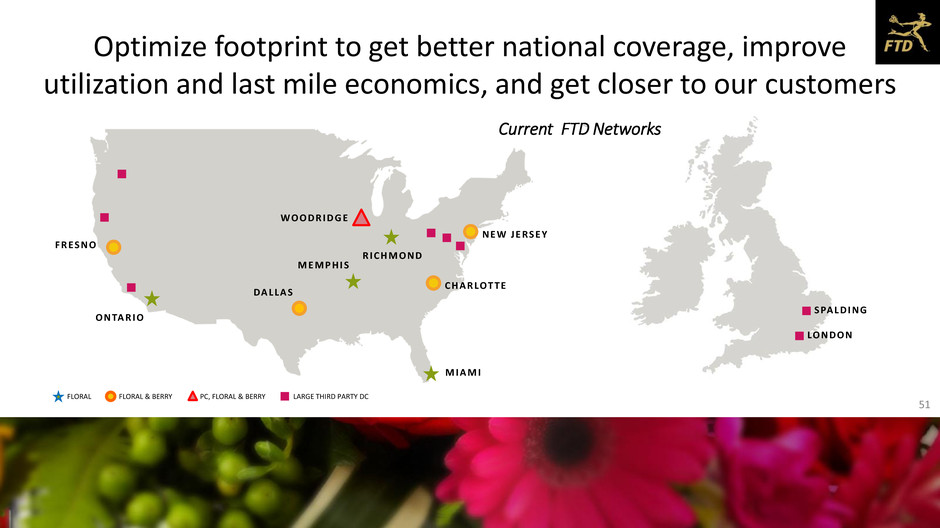

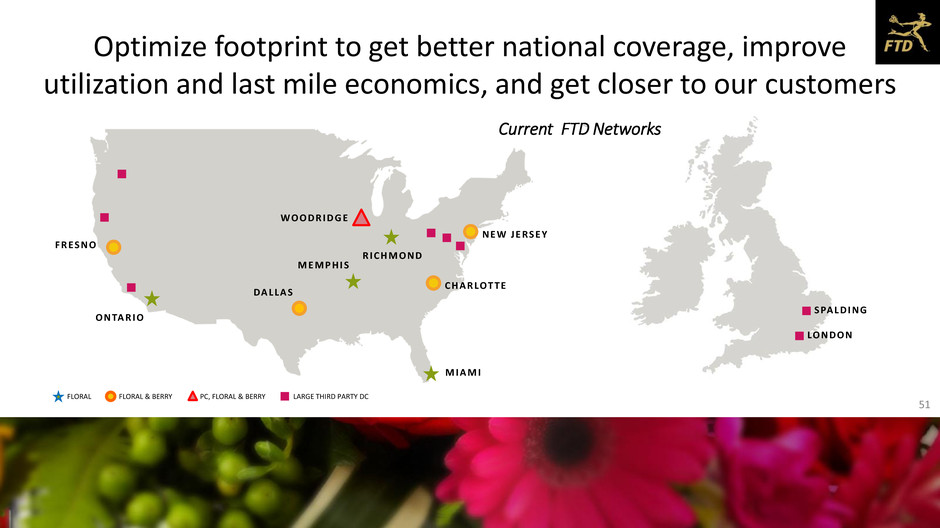

FLORAL & BERRY PC, FLORAL & BERRY LARGE THIRD PARTY DCFLORAL Optimize footprint to get better national coverage, improve utilization and last mile economics, and get closer to our customers O N TA R I O F R ES N O M I A M I N E W J E RS E Y DA LLA S M E M P H I S WO O D R I D G E CH A R LOT T E R I CH M O N D LO N D O N S PA LD I N G Current FTD Networks 51

Our Strategic Plan has four key components Consumer Focus: Rebuild a strong, disruptive brand to earn the trust and win the hearts of consumers Florist Partners: Recreate a network of strong partnerships with the world’s best florists Supply Chain Efficiency: Provide high quality product at low cost with market leading fulfillment options Non-Floral: Extend our floral advantage into complementary non-floral categories 52

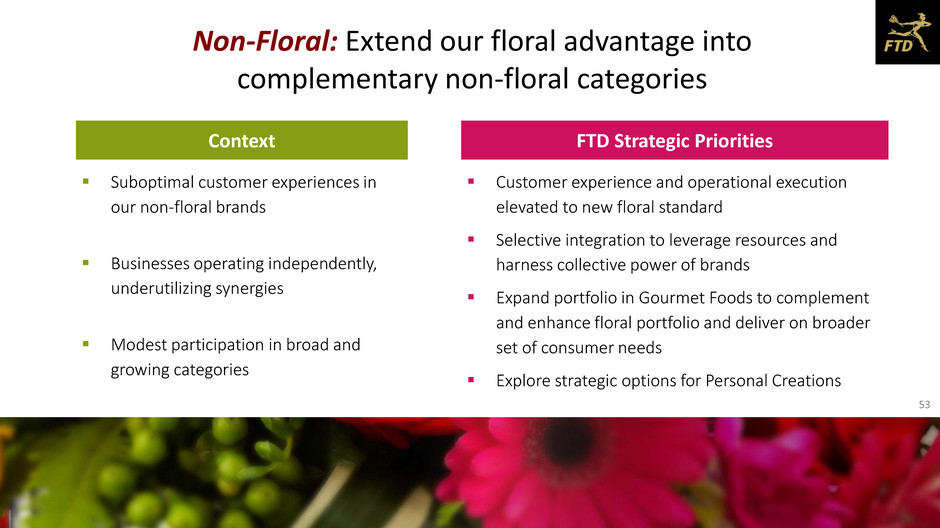

Non-Floral: Extend our floral advantage into complementary non-floral categories Suboptimal customer experiences in our non-floral brands Businesses operating independently, underutilizing synergies Modest participation in broad and growing categories Customer experience and operational execution elevated to new floral standard Selective integration to leverage resources and harness collective power of brands Expand portfolio in Gourmet Foods to complement and enhance floral portfolio and deliver on broader set of consumer needs Explore strategic options for Personal Creations FTD Strategic PrioritiesContext 53

Improve Shari’s Berries to leverage our floral capabilities and deliver a powerful proposition to our customers Deliver Operating Improvements Integrate with Floral Business Introduce Shari’s Gourmet 54

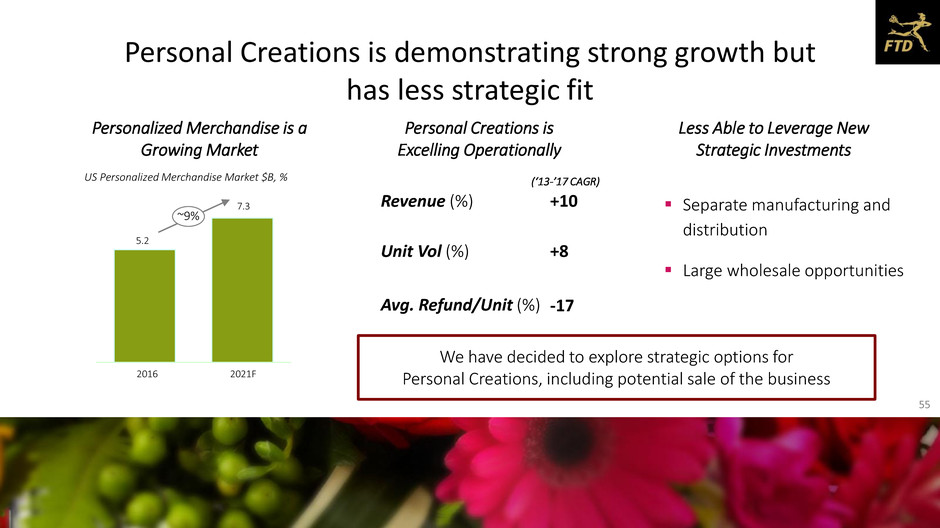

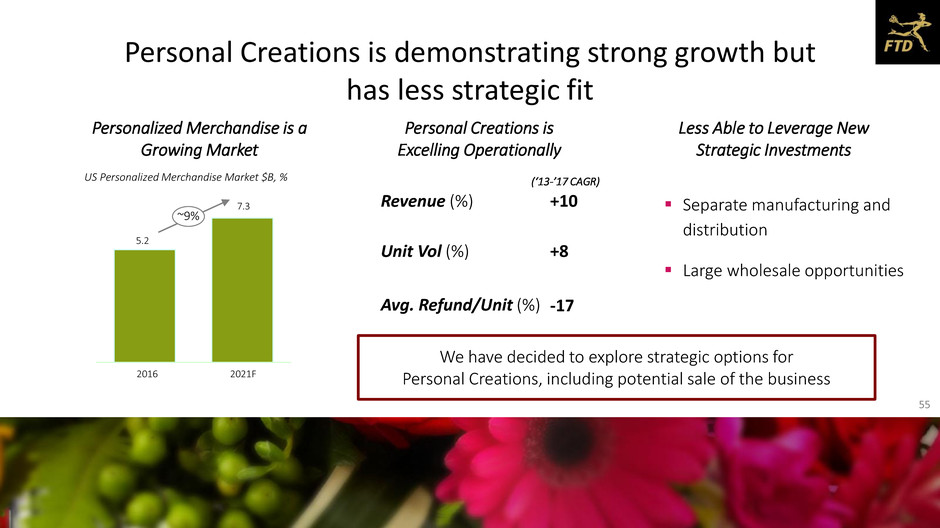

Personal Creations is demonstrating strong growth but has less strategic fit US Personalized Merchandise Market $B, % 7.3 5.2 2016 ~9% 2021F Less Able to Leverage New Strategic Investments Personalized Merchandise is a Growing Market Separate manufacturing and distribution Large wholesale opportunities Personal Creations is Excelling Operationally Revenue (%) Unit Vol (%) Avg. Refund/Unit (%) +10 +8 -17 We have decided to explore strategic options for Personal Creations, including potential sale of the business (‘13-’17 CAGR) 55

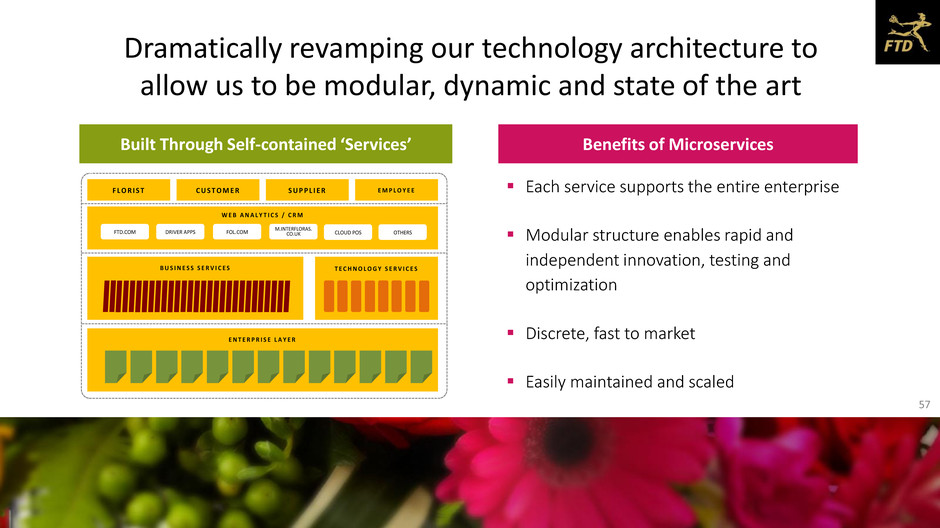

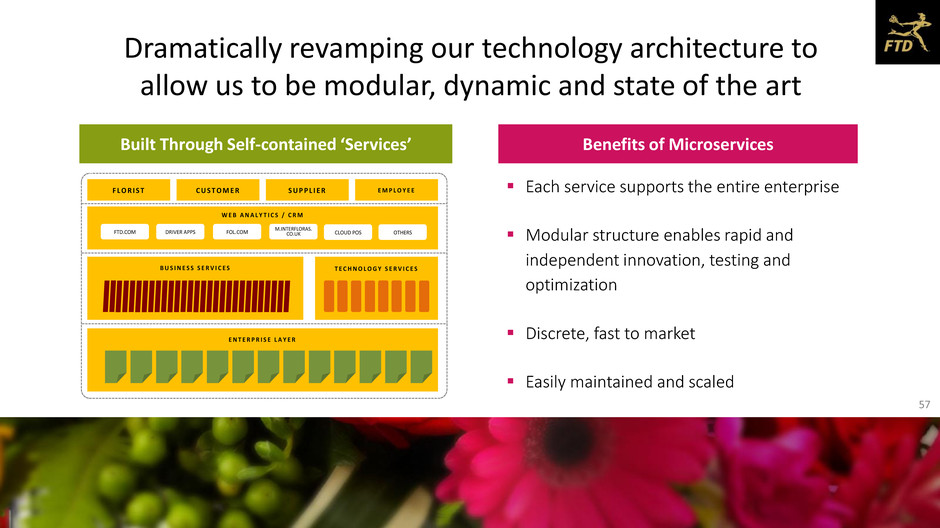

New technologies are central to our strategy FTD Strategic PrioritiesContext Legacy technology across consumer and florist businesses Multiple platforms leading to fragmented resources and subscale support Limited focus on customer experience and member needs Insufficient resources for new development agenda Single platform with Microservices supporting entire ecosystem Best in class capabilities and spend leveraged efficiently across a unified system Agile product teams and closed loop processes for continuous improvement Mobile-first solutions for customer and member applications 56

Dramatically revamping our technology architecture to allow us to be modular, dynamic and state of the art Benefits of MicroservicesBuilt Through Self-contained ‘Services’ Each service supports the entire enterprise Modular structure enables rapid and independent innovation, testing and optimization Discrete, fast to market Easily maintained and scaled F LOR I S T CUSTOMER SUPPL I ER EMP LOY E E BU S I N E S S S E R V I C E S EN T E R P R I S E L A Y E R WEB ANA L Y T I C S / C RM FTD.COM DRIVER APPS FOL.COM M.INTERFLORAS. CO.UK CLOUD POS OTHERS T E C HNO LOGY S E R V I C E S 57

Consumer Focus Florist Partners Supply Chain Efficiency Non-Floral Collectively, our Strategic Plan unlocks a singular, advantaged strategy and realizes a new vision 58

Our Strategic Plan delivers value and growth over three phases Reset Reinvent Grow Year 1 to 3 Year 2 to 4 Year 3 to 5 Create commercial foundations for re-energized growth within our businesses Improve customer experience and offer Leverage scale benefits Deliver compelling propositions to win share Redesign way we structure and operate our Floral business to create competitive advantage Reboot relationships with florists Build and exploit competitive advantages by unifying our businesses around a vision of “expressions of sentiment” Consider international expansion to build a global Floral business 59

Our Strategic Plan will create significant long term shareholder value Revenue of $1.5B+ and growing Adjusted EBITDA1 exceeding $135M and growing, with margin percentage in the high single digits Free cash flow1 exceeding $100M and growing By 2022, our goal is to have built a company with 1. Adjusted EBITDA and Free Cash Flow are non-GAAP measures. See Appendix for definitions of non-GAAP measures. 60

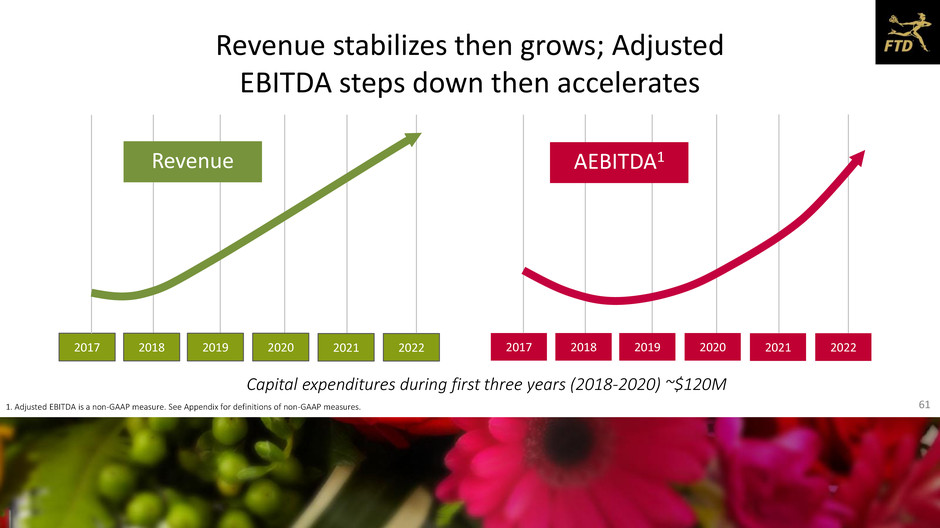

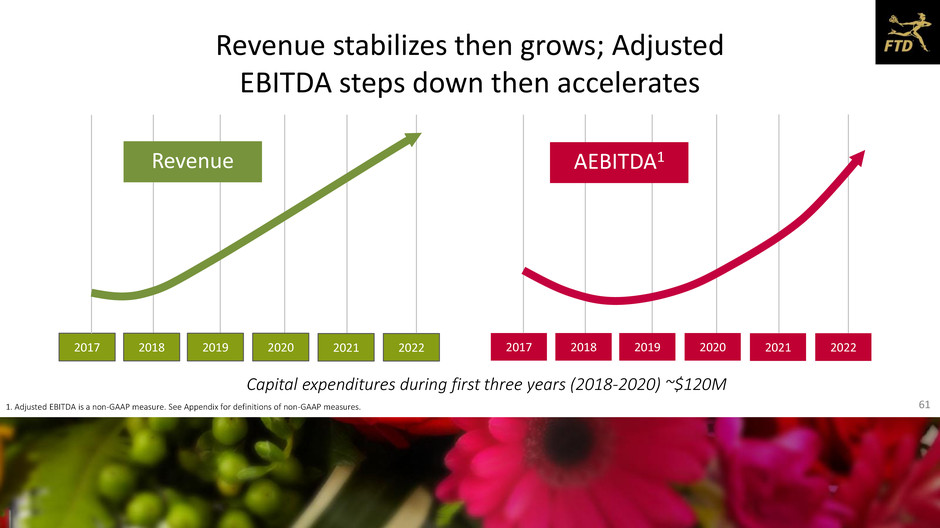

Revenue stabilizes then grows; Adjusted EBITDA steps down then accelerates 2017 2018 2019 2020 2021 2022 2017 2018 2019 2020 2021 2022 Revenue AEBITDA1 1. Adjusted EBITDA is a non-GAAP measure. See Appendix for definitions of non-GAAP measures. Capital expenditures during first three years (2018-2020) ~$120M 61

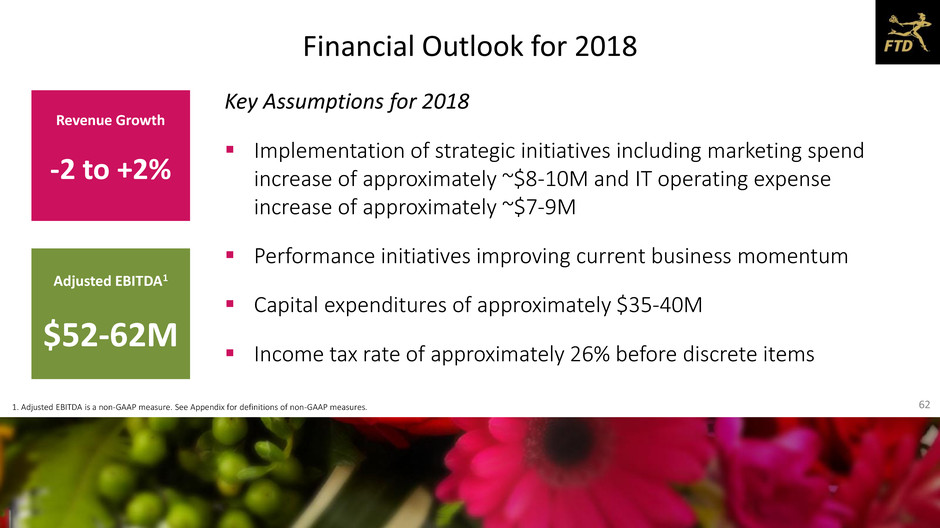

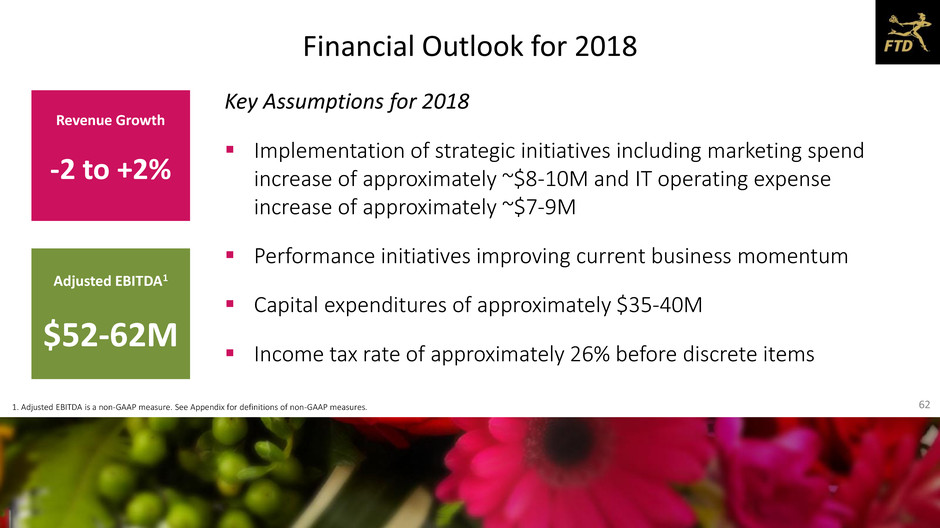

Key Assumptions for 2018 Implementation of strategic initiatives including marketing spend increase of approximately ~$8-10M and IT operating expense increase of approximately ~$7-9M Performance initiatives improving current business momentum Capital expenditures of approximately $35-40M Income tax rate of approximately 26% before discrete items Revenue Growth Adjusted EBITDA1 $52-62M -2 to +2% Financial Outlook for 2018 1. Adjusted EBITDA is a non-GAAP measure. See Appendix for definitions of non-GAAP measures. 62

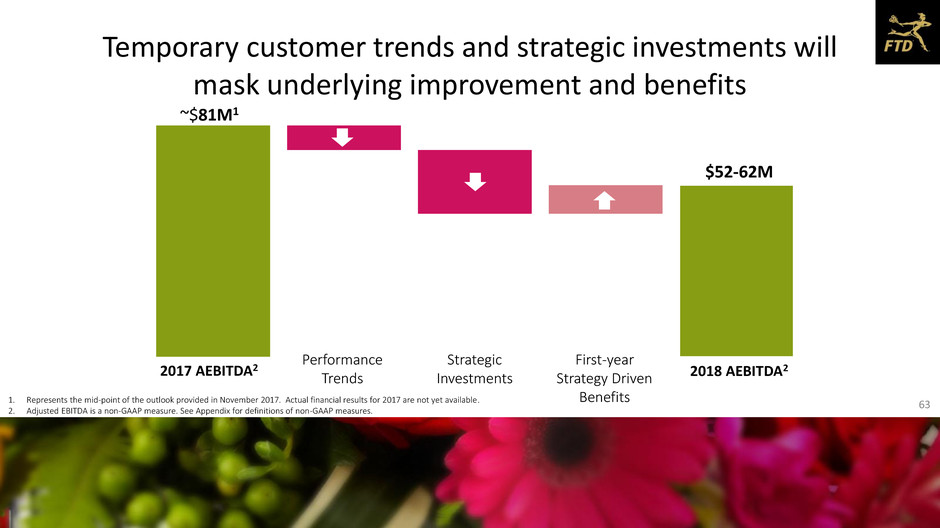

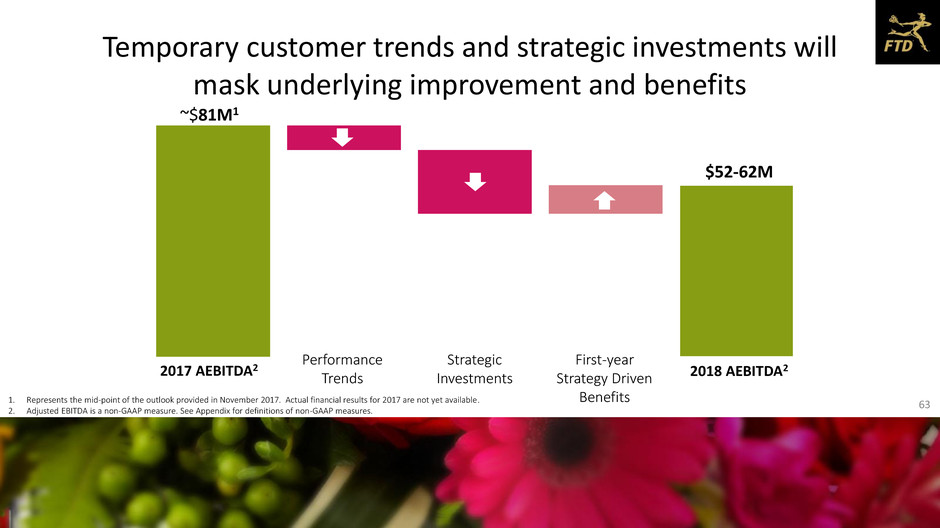

Temporary customer trends and strategic investments will mask underlying improvement and benefits 2017 AEBITDA2 2018 AEBITDA2 Performance Trends Strategic Investments First-year Strategy Driven Benefits $52-62M ~$81M1 1. Represents the mid-point of the outlook provided in November 2017. Actual financial results for 2017 are not yet available. 2. Adjusted EBITDA is a non-GAAP measure. See Appendix for definitions of non-GAAP measures. 63

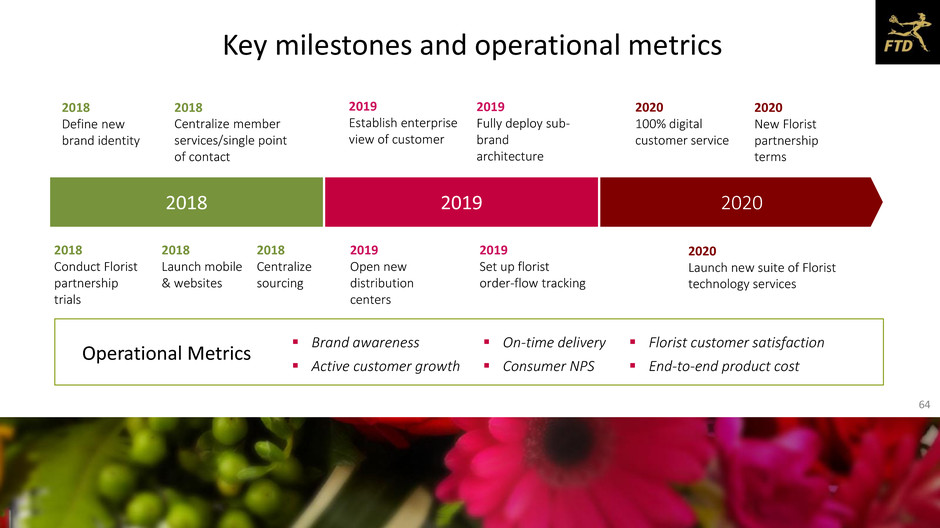

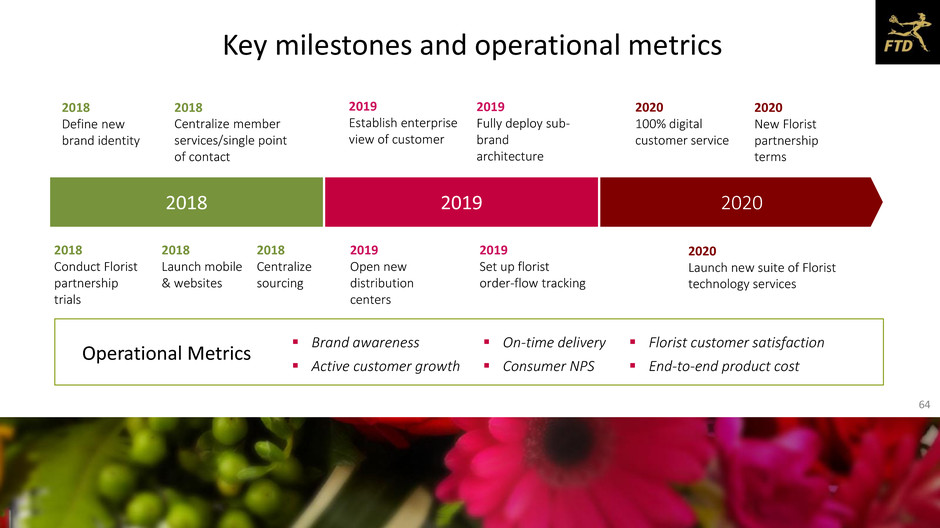

2020 Key milestones and operational metrics Operational Metrics Brand awareness Active customer growth On-time delivery Consumer NPS 2018 Define new brand identity 2018 Centralize member services/single point of contact 2018 Conduct Florist partnership trials 2018 Launch mobile & websites 2019 Establish enterprise view of customer 2019 Open new distribution centers 2020 100% digital customer service 2020 Launch new suite of Florist technology services 2018 Centralize sourcing 2019 Fully deploy sub- brand architecture 2020 New Florist partnership terms 2019 Set up florist order-flow tracking 2018 2019 Florist customer satisfaction End-to-end product cost 64

FTD has a clear and compelling investment thesis Markets are large, growing and ripe for disruption Root causes of performance issues are fixable and being addressed E-commerce model is profitable and resilient Management team is accomplished and committed Strategic plan will drive superior equity returns 65

VIDEO Female voiceover: At FTD we’re ready to reclaim our title as the best floral company in the world. The opportunity is there. The market is fragmented. Florists are looking for a new kind of partnership and consumers are yearning for more. With over one-hundred years of expertise and innovation, we’re prime to transform an industry again. We’ll renew our commitment to the largest network of global florists, and dedicate ourselves to delivering flawless customer service. We’ll reinvent the floral supply chain to reduce cost and better meet the market needs. We’ll update our website and introduce a new, customized mobile experience. We’ll move from price and occasion based gifting, to establishing new gifting occasions driven by flowers and emotions. And we’ll inspire consumers with new and unexpected ways to choose the perfect bouquet for all of life’s moments. At FTD, we know flowers. We know each one has its own unique meaning and they can speak for us when words fail. They provide the warm moments in a world lost in cold communication. Flowers can say so much more. It’s time to reintroduce the world to all that FTD can do. Let’s reclaim our title as the leader of the flower industry, and set the stage for another one-hundred years of innovation and success. This video describes FTD’s heritage and opportunity. The transcript of the video is below and to view the video please visit the “Investor Relations” section of the FTD’s website at www.ftdcompanies.com.

BREAK

Agenda Introduction to FTD The Industry As We See It Recent FTD Performance Our Strategic Plan Q&A

JANUARY 17, 2018

APPENDIX

71 Non-GAAP Measures Adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA” or “AEBITA”). The Company defines Adjusted EBITDA as net income / (loss) before net interest expense, provision / (benefit) for income taxes, depreciation, amortization, stock-based compensation, transaction-related costs, litigation and dispute settlement charges and gains, restructuring and other exit costs, and impairment of goodwill and intangible assets. Litigation and dispute settlement charges and gains include estimated losses for which the Company has established a reserve, as well as actual settlements, judgments, fines, penalties, assessments or other resolutions against, or in favor of, the Company related to litigation, arbitration, investigations, disputes, or similar matters. Insurance recoveries received by the Company related to such matters are also included in these adjustments. Transaction-related costs are certain expense items resulting from actual or potential transactions such as business combinations, mergers, acquisitions, dispositions, spin-offs, financing transactions, and other strategic transactions, including, without limitation, (i) transaction-related bonuses and (ii) expenses for advisors and representatives such as investment bankers, consultants, attorneys, and accounting firms. Transaction- related costs may also include, without limitation, transition and integration costs such as retention bonuses and acquisition-related milestone payments to acquired employees, in addition to consulting, compensation, and other incremental costs directly associated with integration projects. The Company's definition of Adjusted EBITDA may be modified from time to time. Management believes that because Adjusted EBITDA excludes (i) certain non-cash expenses (such as depreciation, amortization, and stock-based compensation) and (ii) expenses that are not reflective of the Company's core operations, this measure provides investors with additional useful information to measure the Company's financial performance, particularly with respect to changes in performance from period to period. Management uses Adjusted EBITDA to measure the Company's performance. The Adjusted EBITDA metric also is used as a performance measure under the Company's senior secured credit facility and includes adjustments such as the items defined above and other further adjustments, which are defined in the senior secured credit facility. The Company also uses this measure as a basis in determining certain incentive compensation targets for certain members of the Company's management

72 Non-GAAP Measures (cont’d) Adjusted EBITDA is not determined in accordance with GAAP and should be considered in addition to, not as a substitute for or superior to, financial measures determined in accordance with GAAP. A limitation associated with the use of Adjusted EBITDA is that it does not reflect the periodic costs of certain tangible and intangible assets used in generating revenues in the Company's business. Management evaluates the costs of such tangible and intangible assets through other financial activities such as evaluations of capital expenditures and purchase accounting. An additional limitation associated with this measure is that it does not include stock-based compensation expenses related to the Company's workforce. A further limitation associated with the use of this measure is that it does not reflect expenses or gains that are not considered reflective of the Company's core operations. Management compensates for this limitation by providing supplemental information about such charges, gains and costs within its financial press releases and SEC filings, when applicable. An additional limitation associated with the use of this measure is that the term "Adjusted EBITDA" does not have a standardized meaning. Therefore, other companies may use the same or a similarly named measure but exclude different items or use different computations, which may not provide investors a comparable view of the Company's performance in relation to other companies. Management generally compensates for this limitation by presenting the most comparable GAAP measure, net income, directly ahead of Adjusted EBITDA in financial press releases. In addition, many of the adjustments to the Company's GAAP financial measures reflect the exclusion of items that are recurring in nature and will be reflected in the Company's financial results for the foreseeable future. Free Cash Flow. The Company defines Free Cash Flow as net cash provided by operating activities less capital expenditures, plus cash paid for transaction-related costs, cash paid or received for litigation and dispute settlement charges and gains, and cash paid for restructuring and other exit costs. With respect to FTD’s business outlook and projections, a reconciliation of net income to Adjusted EBITDA is not provided because the Company cannot, without unreasonable effort, estimate or predict with reasonable certainty various components of net income, including acquisition or disposition related costs, and discrete tax items, which components could significantly impact that financial measure. A reconciliation of Free Cash Flow to Net cash used for operating activities is not provided for the same reason.