CERTAIN PORTIONS OF THIS LETTER HAVE BEEN REDACTED AND ARE THE SUBJECT OF A CONFIDENTIAL TREATMENT REQUEST PURSUANT TO SECURITIES AND EXCHANGE COMMISSION RULE 83.

REDACTED PORTIONS ARE MARKED WITH [*****] AND HAVE BEEN SUBMITTED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION.

October 26, 2018

Via EDGAR

Ms. Jennifer Thompson

Accounting Branch Chief

Office of Consumer Products

Securities and Exchange Commission

Division of Corporation Finance

100 F Street N.E.

Washington, D.C. 20549

|

| |

| Re: | FTD Companies, Inc. Form 10-K for Fiscal Year Ended December 31, 2017 Filed April 2, 2018 Form 10-Q for the Quarterly Period Ended June 30, 2018 Filed August 9, 2018 File No. 001-35901 |

Dear Ms. Thompson:

On behalf of FTD Companies, Inc. (the “Company”), we submit this letter in response to comments from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”), received by letter dated September 27, 2018 (the “Comment Letter”), relating to the above referenced filings. The headings and numbered paragraphs of this letter correspond to the headings and paragraph numbers contained in the Comment Letter and, to facilitate your review, we have reproduced the text of the Staff’s comments in italics below.

Form 10-K for the Fiscal Year Ended December 31, 2017

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Year Ended December 31, 2017 compared to Year Ended December 31, 2016, page 41

| |

| 1. | We note you present certain results from your International segment on a constant currency basis. Please revise your disclosure to clarify that presenting results on a constant currency basis is a non-GAAP presentation in accordance with Item 10(e)(1)(ii)(e) of Regulation S-K. |

CONFIDENTIAL TREATMENT REQUESTED BY FTD COMPANIES, INC. - FTD 0001

Securities and Exchange Commission

Re: FTD Companies 2017 Form 10-K and June 30, 2018 10-Q

October 26, 2018

Page 2

The Company acknowledges the Staff’s comment and will revise its disclosure in future filings to clarify that presenting results on a constant currency basis is a non-GAAP presentation in accordance with Item 10(e)(1)(ii)(e) of Regulation S-K. The Company will also continue to provide the nearest GAAP measure and disclosure of the reason management believes presenting results in constant currency provides useful information to investors.

Critical Accounting Policies, Estimates, and Assumptions

Goodwill, Indefinite-Lived Intangible Assets, and Long-Lived Asset, page 55

| |

| 2. | We note that you performed goodwill impairment assessments as of September 30, 2017, December 31, 2017, and June 30, 2018 using a combination of the income, cost, and market valuation methodologies which led to material goodwill impairment charges. Please address the following comments: |

| |

| • | Please tell us what, if any, cautionary disclosures regarding the potential for a material goodwill impairment charge you provided in filings prior to your third quarter Form 10-Q ended September 30, 2017. In this regard, we did not observe any update to your critical accounting policies in the second quarter Form 10-Q ended June 30, 2017. To the extent prior disclosures were not provided, please explain why. |

The Company respectfully acknowledges the Staff's comment and concerns regarding cautionary disclosures for potential material goodwill impairment charges.

The Company advises the Staff that for the 2016 annual goodwill impairment assessment, the fair values of all reporting units other than the ProFlowers/Gourmet Foods (PF/GF) reporting unit significantly exceeded their respective carrying values. Therefore, the goodwill of each of these reporting units was determined not to be impaired. The carrying value of the PF/GF reporting unit exceeded its fair value and an impairment charge of $84 million was recorded. In the Annual Report on Form 10-K for the fiscal year ended December 31, 2016 (“2016 Form 10-K”), the Company’s critical accounting policy related to goodwill and indefinite-lived trade names included disclosure (pg. 55 of the 2016 Form 10-K) that, although we believed the assumptions and rates used in our impairment assessments were reasonable, they are judgmental, and variations to any assumptions could result in materially different calculations of fair value. We also disclosed several key factors that could create variances in the estimated fair value of the reporting units: fluctuations in (1) forecasted order volumes and average order values, which can be driven by multiple external factors affecting demand, including macroeconomic factors, competitive dynamics, and changes in consumer preferences; (2) marketing costs to generate orders; (3) product and fulfillment costs; (4) operational efficiency; and (5) equity valuations of peer companies. On a year-to-date basis through June 30, 2017, factors (1) through (4) were not materially (i.e. less than 10%) off plan and we were not aware of any significant

CONFIDENTIAL TREATMENT REQUESTED BY FTD COMPANIES, INC. - FTD 0002

Securities and Exchange Commission

Re: FTD Companies 2017 Form 10-K and June 30, 2018 10-Q

October 26, 2018

Page 3

changes in equity valuations of peer companies. As a result, we did not include any further disclosure in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2017.

During the third quarter of 2017, the Company experienced a sustained decline in its market capitalization. As such, the Company determined that a triggering event had occurred that required an interim impairment assessment for all of its reporting units, intangible assets, and other long-lived assets. The Company performed a quantitative interim impairment assessment. At that time, the Company was in the process of undergoing an in-depth strategic review of all its businesses. The financial projections that were utilized in the interim impairment assessment reflected the initial estimates of the financial impacts of the proposed initiatives resulting from the strategic review. The long-term outlook for the Florist, Consumer and PF/GF reporting units was based on the anticipated success of the strategic initiatives.

In the Quarterly Report on Form 10-Q for the quarter ended September 30, 2017, the Company updated its critical accounting policy related to goodwill and indefinite-lived intangibles to include disclosures related to the interim impairment assessment performed during that quarter. The Company also included disclosure related to the significant strategic review the Company was in the process of completing and the uncertainties regarding the related impact on financial performance and the potential for future impairments if the estimates and assumptions made proved not to have been accurate predictions of the future, if the projections of future cash flows and financial performance were not achieved, or if the Company’s market capitalization declined further. The Company disclosed that it was not possible at that time to determine if any such additional future impairment charges would result, or if they did, whether such charges would be material.

The Company will continue to provide cautionary disclosures in our future filings regarding the risks of any potential events or circumstances, such as, among others, a further decline in our market capitalization, which could result in potential future goodwill and other indefinite and long-lived asset impairment charges.

| |

| • | We note your disclosure at December 31, 2017 that the fair value of your Personal Creations reporting unit “reasonably” exceeded its carrying value. Please tell us what you meant by reasonably exceeded and the percentage by which the fair value of the Personal Creations reporting unit exceeded its carrying value at December 31, 2017. Please further explain the factors that led to the reduction of the fair value of the Personal Creations reporting unit such that you recognized an impairment charge in the second quarter of fiscal 2018. |

In the 2017 annual impairment assessment, based on a combination of the market and income approaches, the Personal Creations reporting unit’s estimated fair value was [*****], which exceeded its carrying value by 12.2%. We considered a 12.2% margin

[*****] Information omitted and provided under separate cover to the Staff pursuant to Rule 83.

CONFIDENTIAL TREATMENT REQUESTED BY FTD COMPANIES, INC. – FTD 0003

Securities and Exchange Commission

Re: FTD Companies 2017 Form 10-K and June 30, 2018 10-Q

October 26, 2018

Page 4

to be a reasonable margin. In January 2018, the Company shared its strategic plan with investors. One strategic priority identified by the Company was the exploration of strategic options for Personal Creations, including a potential sale of the business.

[*****] In the interim impairment assessment for the second quarter of 2018, the discount rate utilized in the discounted cash flow valuation of the Personal Creations business was increased due to [*****] the increased risk of the Company’s business overall, as evidenced by the 30% decline in market capitalization since the 2017 annual impairment assessment. These factors led to the reduction in fair value of the Personal Creations reporting unit, such that the Company recognized an impairment charge related to the goodwill of that reporting unit in the second quarter of 2018.

| |

| • | We note that you recorded impairment charges for the ProFlowers/Gourmet Foods and the Consumer reporting units, which you now refer to as FTD.com, in the third and fourth quarters of fiscal 2017 and the second quarter of fiscal 2018. Summarize for us the changes in circumstances and/or assumptions that led to the multiple impairment charges at these reporting units over a relatively short period of time. If you utilized multiple valuation approaches in determining fair value for these two reporting units, please tell us the relative weighting assigned to each method and how you determined the weighting was appropriate. Also, tell us whether the weighting changed or remained the same at each assessment date, and your basis for any change. |

As previously noted, during the third quarter of 2017, due to a sustained decline in the Company’s market capitalization, the Company determined that a triggering event had occurred that required an interim impairment assessment. Between late 2016 and the third quarter of 2017, the Company experienced significant turnover in executive management. The former President and Chief Executive Officer and two Chief Financial Officers left the company and were replaced and a Chief Operating Officer and Chief Marketing Officer were hired. During the third quarter of 2017, the Company was in the process of undergoing an in-depth strategic review of all its businesses. The financial projections that were utilized in the interim impairment assessment reflected the initial estimates of the financial impacts of the proposed initiatives resulting from the strategic review. The long-term outlook for the Florist, Consumer, and PF/GF reporting units was based on the anticipated success of the initiatives.

During the fourth quarter of 2017, the Company changed its annual goodwill impairment testing date from October 1 to November 30 to align more closely with the Company’s annual budgeting and long-range planning process. During such quarter, after review by senior management and the Board of Directors, the Company revised and refined the strategic initiatives and also revised its long-term financial projections accordingly. Some of the revisions to the initiatives were significant, resulting in increased risk and corresponding increases to the discount rates utilized to determine

the fair values of the reporting units. In addition, between the third and fourth quarters of 2017, the Company experienced a further decline in its market capitalization. The

[*****] Information omitted and provided under separate cover to the Staff pursuant to Rule 83.

CONFIDENTIAL TREATMENT REQUESTED BY FTD COMPANIES, INC. – FTD 0004

Securities and Exchange Commission

Re: FTD Companies 2017 Form 10-K and June 30, 2018 10-Q

October 26, 2018

Page 5

market capitalization at November 30, 2017 was approximately half what it was at September 30, 2017. The decline in market capitalization was an indication that the market was assigning more risk to the Company, further suggesting that increases in the

discount rates were dictated.

During the second quarter of 2018, the business results of all reporting units other than the International reporting unit were below forecast. We reduced our guidance for the remainder of 2018, due to the business results to date and our expectations of continued challenges for the balance of the year. In addition, during the quarter, the Board of Directors initiated a review of strategic alternatives focused on maximizing stockholder value. The strategic alternatives expected to be considered include, but are not limited to, a sale or merger of the Company, continuing to pursue value-enhancing initiatives as a standalone company, capital structure optimization that may involve potential financings, or the sale or other disposition of certain businesses or assets. We also announced that John Walden, our then current President and Chief Executive Officer, had stepped down and had been replaced, on an interim basis, by Scott Levin, then our Executive Vice President, General Counsel and Secretary. In conjunction with the review of strategic alternatives, we also announced a corporate restructuring and cost savings plan which included the departure of our then current Chief Operating Officer and Chief Marketing Officer and a significant number of other employees. As a result of the shortfalls in current year results, the initiation of the corporate restructuring and cost savings plan and the review of strategic alternatives, we again revised our long-term projections. Such revisions included delays in implementation and/or realization of savings associated with certain of the strategic initiatives that had been planned as part of the 2017 strategic plan.

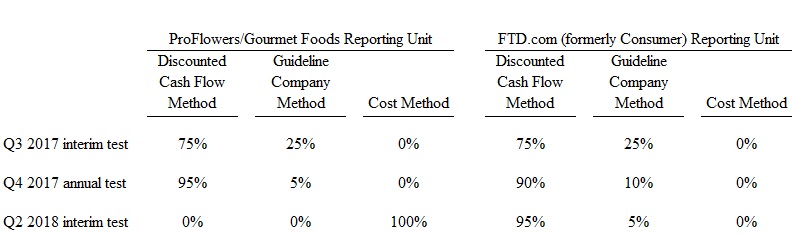

The valuation methods utilized in the interim and annual impairment assessments and their relative weightings were as follows:

In calculating the fair value of the reporting units for the third quarter 2017 interim impairment assessment, we used a combination of the income (discounted cash flow) approach and the market (guideline company) approach valuation methodologies. The weightings assigned to each approach were based on our consideration of the various approaches and the reliability of inputs. As the companies utilized in the market approach are not directly comparable to the Company’s reporting units, and generally, there is a lack of pure-play publicly traded guideline companies that are directly

CONFIDENTIAL TREATMENT REQUESTED BY FTD COMPANIES, INC. - FTD 0005

Securities and Exchange Commission

Re: FTD Companies 2017 Form 10-K and June 30, 2018 10-Q

October 26, 2018

Page 6

comparable to the operations of the reporting units, we determined that the income approach should be more heavily weighted than the market approach. The weightings

used in the third quarter 2017 interim impairment assessment were consistent with the

weightings used in the prior year assessment.

In the annual impairment assessment performed in the fourth quarter of 2017, in conjunction with the revisions to the Company’s projections to reflect the updated

expected financial impacts of the strategic initiatives, the weightings assigned to each valuation method were also readdressed and revised. As noted previously, the long term outlook for the Consumer and PF/GF reporting units was dependent on the success of the initiatives, the benefits of which were not expected to begin to be fully realized until 2021. Therefore, the 2017 and 2018 financial metrics used in the market approach, especially EBITDA, did not represent long-term, normalized financial metrics and we concluded that the income approach was a better estimate of value for these reporting units. Therefore, we reconsidered the weightings to the various approaches and concluded that the weighting applied to the income approach should be higher than the weighting utilized in the prior quarter. We continued to apply a small weighting to the market approach as in valuation it is generally accepted that more than one approach should be used and the valuations under the different approaches should result in reasonably similar value.

For the second quarter 2018 interim assessment, we again reassessed the weightings and concluded that the income approach was a better indication of value so applied a higher weighting than in prior assessments for the FTD.com (previously Consumer) reporting unit. For the PF/GF reporting unit, we utilized the cost approach as explained further in the response to the next question.

It should be noted that the indications of value under the different approaches utilized did not vary greatly. Therefore, the change in weightings did not have a material impact on the valuations. If the weightings had remained 75% income approach and 25% market approach, the impact to the fourth quarter 2017 impairments would have been an increase to the Consumer impairment of $0.5 million and a decrease to the PF/GF impairment of $1.2 million (i.e. a net decrease in impairment charges of $0.7 million). The impact to the second quarter 2018 impairments would have been a decrease in the Consumer impairment of $0.3 million and no change to the PF/GF impairment as the remaining goodwill of that reporting unit was fully impaired under all methods.

| |

| • | We note that in the second quarter of 2018 you state that you used the cost approach to calculate the fair value of the reporting unit for the ProFlowers/Gourmet Foods reporting unit although prior to that time you had used a combination of the market and income approaches. Please specifically address why you changed to the cost approach and why you believe that it provides the highest indication of value for that reporting unit. |

CONFIDENTIAL TREATMENT REQUESTED BY FTD COMPANIES, INC. - FTD 0006

Securities and Exchange Commission

Re: FTD Companies 2017 Form 10-K and June 30, 2018 10-Q

October 26, 2018

Page 7

For the second quarter 2018 interim assessment, the indicated fair value of the PF/GF reporting unit utilizing the income approach was [*****]. The indicated fair value utilizing the cost approach was [*****]. The market approach was not utilized as [*****] it was not considered necessary to utilize multiple approaches. Also, for the

same reason as noted in the previous response, the financial metrics under the market approach would not represent normalized financial metrics and the adjustments that would be required to utilize that approach would diminish the value of using it. In addition, utilization of the cost approach is a generally accepted valuation method when the valuation is either negative or the value of the net assets/liabilities exceeds

the expected present value of the economic returns.

| |

| • | Given the multiple impairment charges you recognized, tell us how you considered disclosing a sensitivity analysis that demonstrates how changes in the key assumptions that you disclose would impact your estimate of the fair value of each reporting unit. Please refer to Section V of SEC Release No. 33-8350. |

The Company respectfully advises the Staff that the Company has considered the Commission’s guidance in Section V of SEC Release N. 33-8350 to disclose a sensitivity analysis of the key assumptions underlying the impairment assessment. The Company believes the qualitative disclosures provided in its Quarterly Reports on Form 10-Q, including the disclosure discussed above, enable the reader to understand the key assumptions utilized in the assessment and that significant changes in those assumptions could result in future impairments that could be material.

The Company recognizes that a quantitative sensitivity analysis requires management to assess estimates and judgments for numerous key assumptions, such as discount rates, growth rates, cash flow projections and terminal growth rates. As the assumptions utilized to determine the fair value of a reporting unit are very interrelated, particularly in periods for which significant business changes are forecast, a change in one assumption often requires changes in other assumptions to maintain logically consistent results. Therefore, we could not assess the change in just one assumption without taking into consideration other assumptions that would need to change as well. For example, if the assumptions related to revenue growth are decreased, the level of risk in the projections would need to be reconsidered as well to determine whether a change to the discount rates is warranted. Other assumptions may also need to be revised to ensure that the relationship between the results of the different valuation approaches and also the company’s market capitalization are still aligned. With each impairment assessment, we reconcile the total fair value of the reporting units to the Company’s market capitalization as a means of confirming that the fair values derived are reasonable compared to the value the market is assigning to the overall business.

[*****] Information omitted and provided under separate cover to the Staff pursuant to Rule 83.

CONFIDENTIAL TREATMENT REQUESTED BY FTD COMPANIES, INC. – FTD 0007

Securities and Exchange Commission

Re: FTD Companies 2017 Form 10-K and June 30, 2018 10-Q

October 26, 2018

Page 8

A quantitative sensitivity analysis needs to consider numerous assumptions, which may have complex and unpredictable interactions, comprehensively. Section V of SEC Release 33-8350 requires companies to provide quantitative as well as qualitative disclosure when quantitative information is reasonably available and will provide material information for investors. The Company believes that the preparation of a meaningful and reasonable quantitative sensitivity analysis for the impairment testing was, in this situation, impractical due to the numerous scenarios that could be considered and may have resulted in disclosure that could be confusing to the reader.

As noted in an earlier response, in the third quarter of 2017, the Company updated its critical accounting policy related to goodwill and indefinite-lived intangibles to

include disclosure related to the significant strategic review the Company was in the process of completing and the uncertainties regarding the related impact on financial performance and the potential for future impairments if the estimates and assumptions made proved not to have been accurate predictions of the future, if the projections of future cash flows and financial performance were not achieved, or if the Company’s market capitalization declined further. We will continue to provide cautionary disclosures in our future filings regarding the risks of any potential events or circumstances, such as, among others, a further decline in the Company’s market capitalization that could result in potential future goodwill and other indefinite and long-lived asset impairment charges.

| |

| 3. | We note you have indefinite-lived trade names and trademarks totaling $112.5 million and $91.3 million as of December 31, 2017 and June 30, 2018, respectively. In the third and fourth quarters of fiscal 2017, and the second quarter of fiscal 2018, you recorded pre-tax impairment charges of $13.1 million, $25.2 million, and $20.4 million, respectively. Please tell us about your evaluation of the remaining useful life of trade names and trademarks as of December 31, 2017 and June 30, 2018 to determine whether events and circumstances continue to support an indefinite useful life. Refer to ASC 350- 30-35-16. |

The Company’s indefinite-lived trade names are the FTD and Interflora trade names, both of which are supported by the iconic Mercury Man logo. FTD was formed in 1910 as the world’s first flowers‑by‑wire service and in 1914 adopted the Mercury Man as its official logo. In 1923, Florists’ Telegraph Delivery Association launched in the U.K. and in the 1950’s, the name ‘Interflora’, which is one of the most recognized brands in the U.K. and the Republic of Ireland, was adopted.

In accordance with ASC 350-30-35-16, we evaluate the fair value of our FTD and Interflora trade names annually, or more frequently if events or circumstances indicate that a

triggering event may have occurred, to determine whether events or circumstances have occurred which may require a reconsideration of the established indefinite useful life. There are no legal, regulatory, contractual, competitive, economic, or other factors that limit the useful life of the trade names and logo to the FTD.com, Florist and Interflora reporting units. We continue to project significant positive cash flows from the reporting units that

CONFIDENTIAL TREATMENT REQUESTED BY FTD COMPANIES, INC. - FTD 0008

Securities and Exchange Commission

Re: FTD Companies 2017 Form 10-K and June 30, 2018 10-Q

October 26, 2018

Page 9

utilize these trade names and logo. Although the U.S. business results over the past few years have declined, which has resulted in impairments of the FTD trade name, FTD fully intends to utilize both the FTD and Interflora trade names (as well as the Mercury Man logo) indefinitely.

In accordance with ASC 350-30-35-16, the Company will continue to assess the indefinite-lived trade names for potential impairment on an annual basis or more often if events or circumstances indicate that a triggering event may have occurred and will continue to assess each reporting period whether an indefinite useful life is appropriate.

Income Taxes, page 58

| |

| 4. | Please consider expanding your disclosure to provide a more comprehensive discussion and analysis of the specific positive and negative evidence you considered in determining the realizability of the material components of your deferred tax assets. In this regard, we note the Company is in a cumulative three year net loss position at the end of fiscal 2017. Please tell us how you concluded that no significant valuation allowance was needed. |

In evaluating the Company’s ability to recover its deferred tax assets, the Company considers all available positive and negative evidence, as appropriate, including its operating results, ongoing tax planning and forecasts of future taxable income on a jurisdiction by jurisdiction basis.

The Company’s U.S. businesses were in a cumulative three year net loss position, adjusted for permanent items, at the end of fiscal 2017. Such cumulative losses are negative evidence that was considered with respect to the need for a valuation allowance.

Given the cumulative losses in the U.S. businesses, in assessing the realizability of the U.S. deferred tax assets, we did not consider future taxable income exclusive of reversing temporary differences and carryforwards nor did we consider tax planning strategies related to those businesses. We did consider the future reversal of existing taxable temporary differences as positive evidence that was considered in assessing the need for a valuation allowance. At December 31, 2017, the U.S. businesses had a net deferred tax liability recorded (excluding those related to indefinite-lived intangibles). Based on a scheduling analysis, the deferred tax liabilities will be reversed over the next twelve years and create taxable income that will exceed the deductions created by the reversal of the deferred tax assets. We believe that this presents sufficient positive evidence to overcome the negative evidence presented by the cumulative net losses. We intend to revise our disclosures in future filings to provide more discussion regarding the evidence considered in assessing the realizability of the significant components of our deferred tax assets.

CONFIDENTIAL TREATMENT REQUESTED BY FTD COMPANIES, INC. - FTD 0009

Securities and Exchange Commission

Re: FTD Companies 2017 Form 10-K and June 30, 2018 10-Q

October 26, 2018

Page 10

Item 9A Controls and Procedures, page 60

| |

| 5. | We note the material weakness related to the control over the review of inputs used in the determination of the reporting unit carrying values that you identified subsequent to the original September 30, 2017 Form 10-Q filing. Explain to us the facts and circumstances that lead to the identification of this material weakness. Additionally, tell us in more detail the changes you made to your controls and procedures to remediate this material weakness. Lastly, tell us how you were able to remediate this material weakness by year end fiscal 2017 especially since your amended Form 10-Q for the quarter ended September 30, 2017 was not filed until February 26, 2018. |

After filing the Form 10-Q for the quarter ended September 30, 2017, we determined that there was a material calculation error in the determination of the goodwill impairment charges which required us to restate the September 30, 2017 financial statements. The material error was caused by a transposition error in a spreadsheet.

This restatement resulted in the identification of a material weakness in internal control over financial reporting. The material weakness related to our control over the review of inputs used in the determination of the reporting unit carrying values that allowed a material error to occur that was not detected on a timely basis. Our control related to the review of the balance sheet allocation when performing a goodwill impairment assessment was not operating effectively as of September 30, 2017. The balance sheet allocation was prepared by the Director of Accounting and then reviewed by the Assistant Controller. The error was eventually identified when the VP, Corporate Controller performed a separate review. While the VP, Corporate Controller’s review of the balance sheet allocation worksheet identified the misstatement, the identification was not timely as it occurred after the filing of the Quarterly Report on Form 10-Q for the quarter ended September 30, 2017.

Under the oversight of senior management and the audit committee, the following changes were implemented to remediate the underlying cause of the material weakness: (1) improvement of control procedures to ensure sufficient detailed review of the inputs utilized in the determination of the reporting unit carrying values for the testing of goodwill for impairment, and (2) improvement of documentation of review procedures performed in relation to testing of goodwill for impairment. Specifically, the control was revised to include additional management review of the inputs utilized to determine the carrying value of each reporting unit, including review of the allocation methodologies utilized to allocate certain balance sheet accounts. The allocation methodologies are reviewed for reasonableness based on the balance being allocated and for consistency with the prior year/period. If the allocation methodology has been changed for the current assessment, finance

management reviews the rationale for the change. In addition, a checklist of control procedures related to the impairment assessment is completed and reviewed by the VP, Corporate Controller to ensure that the control is appropriately performed on a timely basis.

CONFIDENTIAL TREATMENT REQUESTED BY FTD COMPANIES, INC. - FTD 00010

Securities and Exchange Commission

Re: FTD Companies 2017 Form 10-K and June 30, 2018 10-Q

October 26, 2018

Page 11

The control related to the impairment assessment is an annual control that happened to operate twice during 2017 because of the interim impairment assessment required as of September 30, 2017. The control related to the interim assessment failed, as the error occurred in connection with the September 30, 2017 impairment assessment. We revised the control and remediated the material weakness with the annual impairment assessment, which was performed in the fourth quarter of 2017 reporting period and the results of which were disclosed in our Annual Report on Form 10-K for the fiscal year ended December 31, 2017. The control related to the annual assessment operated effectively.

Form 10-Q for the Quarterly Period Ended June 30, 2018

Management’s Discussion and Anal ysis of Fin anc ial Condition and Results of Oper ations

Liquidity and Capital Resources

Credit Agreement, page 37

| |

| 6. | We note that your amended credit facility entered into on May 31, 2018 revised the consolidated net leverage ratio and fixed charge coverage ratio covenants for each quarterly period through the September 19, 2019 maturity date. Tell us your consideration of disclosing the actual and required ratios as of each reporting date for any material debt covenants for which it is reasonably likely that you will not be able to meet or which could impact your ability to obtain additional debt or equity financing to a material extent. See Sections I.D and IV.C of the SEC Release No. 33-8350. |

The Company respectfully advises the Staff that the Company has considered the Commission’s guidance in Sections I.D and IV. C of SEC Release N. 33-8350 (the “Release”) and believes that the disclosure provided in the Going Concern section of Note 1 (which is referenced in the Liquidity and Capital Resources section of the MD&A) adequately addresses the disclosure required by such guidance.

In the Going Concern section of Note 1 included in the Notes to our Condensed Consolidated Financial Statements in the Form 10-Q for the quarter ended June 30, 2018, we disclosed the key terms of the Third Amendment to the Credit Agreement, including that the consolidated net leverage ratio and fixed charge coverage ratio covenants were revised for each quarterly period through the maturity date of the Amended Credit Agreement. The revised ratios required per the covenants for each future quarter were

disclosed in the Company’s Current Report on Form 8-K, filed on June 1, 2018. We disclosed that the Company was in compliance with the revised covenants as of June 30, 2018. Additionally, the Going Concern section of Note 1 includes the following disclosure:

CONFIDENTIAL TREATMENT REQUESTED BY FTD COMPANIES, INC. - FTD 00011

Securities and Exchange Commission

Re: FTD Companies 2017 Form 10-K and June 30, 2018 10-Q

October 26, 2018

Page 12

| |

| • | The Company’s ability to continue as a going concern is dependent on the Company generating profitable operating results and continuing to be in compliance with the revised covenants under the Amended Credit Agreement or refinancing, repaying or obtaining new financing prior to the maturity date of the Amended Credit Agreement in September 2019. |

| |

| • | The Board of Directors initiated a review of strategic alternatives for the business including, but not limited to, a sale or merger of the Company, continuing to pursue value-enhancing initiatives as a standalone company, capital structure optimization that may involve potential financings, or the sale or other disposition of certain businesses or assets and a corporate restructuring and cost savings plan. |

| |

| • | Notwithstanding the initiatives noted above, based on then-year-to-date results and the outlook for the remainder of the term of the Amended Credit Agreement, the consolidated net leverage ratio and fixed charge coverage ratio may exceed and fall below, respectively, the ratios required during the remainder of the term of the Amended Credit Agreement and that, if that were to be the case and we were unable to obtain waivers or amendments from our lenders, we do not expect the Company would be able to repay all of the outstanding indebtedness if the |

lenders were to accelerate payment.

| |

| • | There can be no assurance that the strategic alternatives review noted above will result in any particular strategic alternative or strategic transaction or that the Company will be able to refinance its outstanding indebtedness or obtain alternative financing on acceptable terms, when required or if at all. If the Company is not successful in its initiatives, the Company may be forced to limit its business activities or be unable to continue as a going concern, which would have a material adverse effect on its results of operations and financial condition. |

Further, the Company included revisions to its risk factors in its latest Quarterly Report on Form 10-Q for the quarter ended June 30, 2018, noting the risks and uncertainties that impact the ability of the Company to continue as a going concern. In light of these disclosures, the Company believes that it has provided investors with disclosure that adequately addresses the Commission’s guidance in Sections I.D and IV. C of the Release. The Company will continue to consider the Commission’s guidance in Sections I.D and IV. C of the Release, and evaluate whether additional disclosure is necessary in future filings, taking into account any further amendments to the Amended Credit Agreement.

[Signature page follows]

CONFIDENTIAL TREATMENT REQUESTED BY FTD COMPANIES, INC. - FTD 00012

Securities and Exchange Commission

Re: FTD Companies 2017 Form 10-K and June 30, 2018 10-Q

October 26, 2018

Page 13

***

Should any member of the Staff have any questions or comments concerning this filing or the materials submitted herewith, or desire any further information or clarification in respect of the responses herein, please do not hesitate to contact me at (630) 724-6237.

|

| | |

| | Sincerely, |

| | |

| | FTD COMPANIES, INC. |

| | |

| | By: | /s/ Steven D. Barnhart |

| | Steven D. Barnhart |

| | Executive Vice President and |

| | Chief Financial Officer |

cc: Robert Babula, Staff Accountant (Securities and Exchange Commission)

Elizabeth Sellers, Staff Accountant (Securities and Exchange Commission)

Scott D. Levin, Interim President and Chief Executive Officer and General Counsel

Edward B. Winslow, Jones Day

CONFIDENTIAL TREATMENT REQUESTED BY FTD COMPANIES, INC. - FTD 00013