Filed Pursuant to Rule 424(b)(3)

Registration No. 333-193480

STRATEGIC STORAGE GROWTH TRUST, INC.

SUPPLEMENT NO. 3 DATED AUGUST 19, 2016

TO THE PROSPECTUS DATED APRIL 11, 2016

This document supplements, and should be read in conjunction with, the prospectus of Strategic Storage Growth Trust, Inc. dated April 11, 2016, Supplement No. 1 dated May 19, 2016 and Supplement No. 2 dated June 17, 2016. Unless otherwise defined in this supplement, capitalized terms used in this supplement shall have the same meanings as set forth in the prospectus.

The purpose of this supplement is to disclose:

| | • | | an update on the status of our public offering; |

| | • | | a revision to our state-specific suitability standards; |

| | • | | updates to our risk factors; |

| | • | | information regarding our share redemption program; |

| | • | | information regarding related party fees and expenses; |

| | • | | an update regarding the third quarter cash distribution declaration; |

| | • | | our distribution declaration history; |

| | • | | selected quarterly financial data; |

| | • | | an update regarding when we cease paying stockholder servicing fees; |

| | • | | an update regarding the redemption of Preferred Units in our operating partnership; |

| | • | | an update to the “Volume Discounts” section of our prospectus; |

| | • | | an update to the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of the prospectus to include information for the six months ended June 30, 2016; |

| | • | | our unaudited consolidated financial statements as of and for the six months ended June 30, 2016; and |

| | • | | a revised subscription agreement. |

Status of Our Offering

On June 17, 2013, we commenced a private offering of up to $109.5 million in shares of our common stock to accredited investors only pursuant to a confidential private placement memorandum. On May 23, 2014, we reached the minimum offering amount of $1.0 million in sales of shares in our private offering and we commenced operations. On January 16, 2015, we terminated the private offering of which we raised a total of $7.8 million. On January 20, 2015, our public offering was declared effective. Effective September 28, 2015, we reallocated shares in our primary offering to consist of the following: up to $500 million in Class A shares and up to $500 million in Class T shares. As of August 8, 2016, we had received gross offering proceeds of approximately $41.8 million from the sale of approximately 4.1 million Class A shares and approximately $3.3 million from the sale of approximately 0.3 million Class T shares in our initial public offering. As of August 8, 2016, approximately $1.05 billion in shares remained available for sale to the public under our initial public offering, including shares available under our distribution reinvestment plan.

1

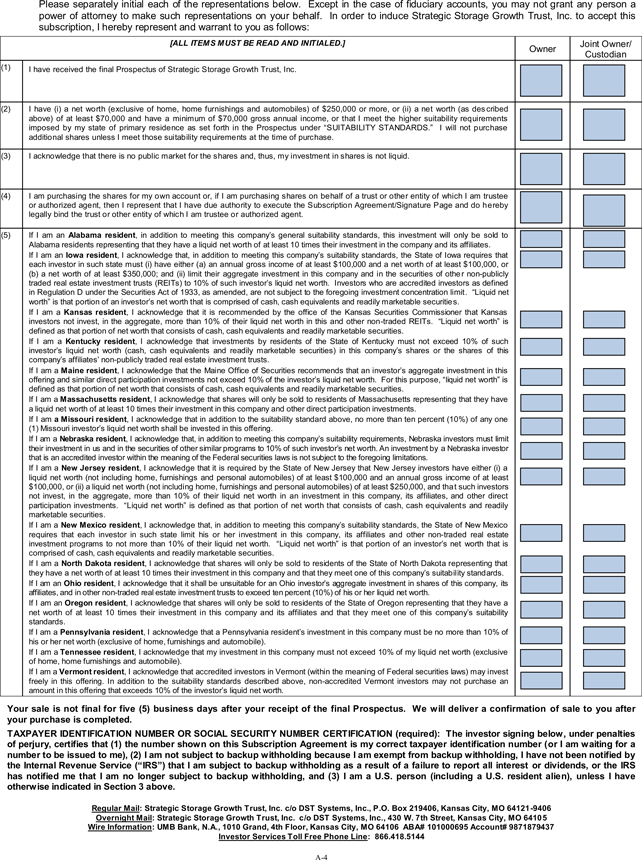

Suitability Standards

The state-specific suitability standard for the State of Iowa contained in the “Suitability Standards” section immediately behind the cover page of our prospectus is hereby deleted and replaced with the following:

| | • | | For Iowa Residents - Iowa investors must (i) have either (a) an annual gross income of at least $100,000 and net worth of at least $100,000, or (b) a net worth of at least $350,000; and (ii) limit their aggregate investment in this offering and in the securities of other non-publicly traded real estate investment trusts (REITs) to 10% of such investors liquid net worth. Investors who are accredited investors as defined in Regulation D under the Securities Act of 1933, as amended, are not subject to the foregoing investment concentration limit. |

Updates to Our Risk Factors

The second risk factor on the cover page of our prospectus is hereby replaced with the following:

| | • | | We have paid distributions from sources other than our cash flows from operations, including from the net proceeds of this offering. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions. From commencement of paying cash distributions in November 2015 through June 30, 2016, the payment of distributions has been paid from offering proceeds. Until we generate cash flows sufficient to pay distributions to you, we may pay distributions from the net proceeds of this offering or from borrowings in anticipation of future cash flows. |

The third risk factor under the “Summary Risk Factors” subsection under the “Prospectus Summary” section of our prospectus is hereby replaced with the following:

| | • | | We have paid, and may continue to pay, distributions from sources other than cash flow from operations; therefore, we will have fewer funds available for the acquisition of properties, and our stockholders’ overall return may be reduced. From commencement of paying cash distributions in November 2015 through June 30, 2016, the payment of distributions has been paid from offering proceeds. |

The risk factor under “Risks Related to this Offering and an Investment in Strategic Storage Growth Trust, Inc.” titled, “We have paid, and may continue to pay, distributions from sources other than cash flow from operations; therefore, we will have fewer funds available for the acquisition of properties, and our stockholders’ overall return may be reduced” is hereby deleted and replaced with the following:

We have paid, and may continue to pay, distributions from sources other than cash flow from operations; therefore, we will have fewer funds available for the acquisition of properties, and our stockholders’ overall return may be reduced.

In the event we do not have enough cash from operations to fund our distributions, we may borrow, issue additional securities, or sell assets in order to fund the distributions or make the distributions out of net proceeds from our offering. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions. From commencement of paying cash distributions in November 2015 through June 30, 2016, the payment of cash distributions has been paid from offering proceeds. If we continue to pay distributions from sources other than cash flow from operations, we will have fewer funds available for acquiring properties, which may reduce our stockholders’ overall returns. Additionally, to the extent distributions exceed cash flow from operations, a stockholder’s basis in our stock may be reduced and, to the extent distributions exceed a stockholder’s basis, the stockholder may recognize a capital gain.

Share Redemption Program Information

Through June 30, 2016, we had not received any requests for redemptions.

2

Related Party Fees and Expenses

The following table summarizes related party costs incurred and paid by us for the year ended December 31, 2015 and the six months ended June 30, 2016, as well as any related amounts payable as of December 31, 2015 and June 30, 2016:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, 2015 | | | Six Months Ended June 30, 2016 | |

| | | Incurred | | | Paid | | | Payable | | | Incurred | | | Paid | | | Payable | |

Expensed | | | | | | | | | | | | | | | | | | | | | | | | |

Operating expenses (including organizational costs) | | $ | 774,212 | | | $ | 748,513 | | | $ | 25,699 | | | $ | 352,131 | | | $ | 118,121 | | | $ | 259,709 | |

Asset management fees | | | 180,060 | | | | 216,308 | | | | — | | | | 198,121 | | | | 193,298 | | | | 4,823 | |

Property management fees(1) | | | 378,190 | | | | 446,336 | | | | — | | | | 265,991 | | | | 265,991 | | | | — | |

Acquisition expenses | | | 822,798 | | | | 775,620 | | | | 117,075 | | | | 550,236 | | | | 488,236 | | | | 179,075 | |

Debt issuance costs | | | 143,773 | | | | 41,523 | | | | 102,250 | | | | 65,015 | | | | 142,000 | | | | 25,265 | |

Capitalized | | | | | | | | | | | | | | | | | | | | | | | | |

Debt issuance costs | | | — | | | | 165,542 | | | | — | | | | — | | | | — | | | | — | |

Other assets | | | 20,000 | | | | 107,405 | | | | — | | | | — | | | | — | | | | — | |

Additional Paid-in Capital | | | | | | | | | | | | | | | | | | | | | | | | |

Selling commissions | | | 1,462,535 | | | | 1,490,534 | | | | — | | | | 1,589,162 | | | | 1,589,162 | | | | — | |

Dealer Manager fee | | | 365,634 | | | | 372,474 | | | | 5,161 | | | | 397,290 | | | | 396,024 | | | | 6,427 | |

Offering costs | | | 471,519 | | | | 1,850,917 | | | | 2,812 | | | | 168,310 | | | | 80,604 | | | | 90,518 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | $ | 4,618,721 | | | $ | 6,215,172 | | | $ | 252,997 | | | $ | 3,586,256 | | | $ | 3,273,436 | | | $ | 565,817 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | During the year ended December 31, 2015, and the six months ended June 30, 2016, property management fees include approximately $92,000 and $225,000 of fees paid to the sub-property manager of our properties. |

Third Quarter Cash Distribution Declaration

On June 9, 2016, our board of directors declared a daily distribution in the amount of $0.0010928962 per day per share (equivalent to an annualized distribution rate of 4.00% assuming the Class A share was purchased for $10.00 and approximately 3.6% assuming the Class A share was purchased for $11.17, and an annualized rate of approximately 4.2% assuming the Class T share was purchased for $9.47 and approximately 3.8% assuming the Class T share was purchased for $10.58) on the outstanding shares of common stock payable to stockholders of record at the close of business on each day of the period commencing on July 1, 2016 and ending September 30, 2016. In connection with this distribution, after the stockholder servicing fee is paid, approximately $0.0008341530 per day will be paid per Class T share purchased at $9.47 and approximately $0.0008038251 per day will be paid per Class T share purchased at $10.58. Such distributions payable to each stockholder of record during a month will be paid on such date of the following month as our Chief Executive Officer may determine.

Distribution Declaration History

The “Description of Shares – Distribution Declaration History” section on pages 165-166 of the prospectus is hereby updated to include the following:

The following table shows the cash distributions we have paid through June 30, 2016:

| | | | | | | | | | | | | | | | |

Quarter | | Preferred

Unitholders | | | OP Unit

Holders | | | Common

Stockholders (1) | | | Distributions

Declared per

Common Share | |

1st Quarter 2014 | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

2nd Quarter 2014 | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

3rd Quarter 2014 | | $ | 41,513 | | | $ | — | | | $ | — | | | $ | — | |

4th Quarter 2014 | | $ | 151,008 | | | $ | — | | | $ | — | | | $ | — | |

3

| | | | | | | | | | | | | | | | |

Quarter | | Preferred

Unitholders | | | OP Unit

Holders | | | Common

Stockholders (1) | | | Distributions

Declared per

Common Share | |

1st Quarter 2015 | | $ | 121,579 | | | $ | — | | | $ | — | | | $ | — | |

2nd Quarter 2015 | | $ | 384,709 | | | $ | — | | | $ | — | | | $ | — | |

3rd Quarter 2015 | | $ | 298,384 | | | $ | — | | | $ | — | | | $ | — | |

4th Quarter 2015 | | $ | 276,536 | | | $ | — | | | $ | 5,983 | | | $ | 0.016 | |

1st Quarter 2016 | | $ | 276,906 | | | $ | 978 | | | $ | 37,736 | | | $ | 0.050 | |

2nd Quarter 2016 | | $ | 375,248 | | | $ | 1,684 | | | $ | 104,540 | | | $ | 0.100 | |

| (1) | Declared distributions are paid monthly in arrears. |

The following shows our cash distributions and the sources of such distributions for the six months ended June 30, 2016 (no cash distributions were paid for the six months ended June 30, 2015):

| | | | | | | | |

| | | Six Months Ended

June 30, 2016 | |

Distributions paid in cash — common stockholders | | $ | 142,276 | | | | | |

Distributions paid in cash — Operating Partnership unitholders | | | 2,662 | | | | | |

Distributions paid in cash — preferred unitholders | | | 652,154 | | | | | |

Distributions reinvested | | | 329,022 | | | | | |

| | | | | | | | |

Total distributions | | $ | 1,126,114 | | | | | |

| | | | | | | | |

Source of distributions | | | | | | | | |

Cash flows provided by operations | | $ | — | | | | — | |

Offering proceeds from Primary Offering | | | 797,092 | | | | 70.8 | % |

Offering proceeds from distribution reinvestment plan | | | 329,022 | | | | 29.2 | % |

| | | | | | | | |

Total sources | | $ | 1,126,114 | | | | 100.0 | % |

| | | | | | | | |

From our inception through June 30, 2016, we paid cumulative distributions of approximately $2.4 million (including approximately $1.9 million related to our preferred unitholders), as compared to cumulative net loss attributable to our common stockholders of approximately $11.1 million. For the six months ended June 30, 2016, we paid distributions of approximately $1.1 million, as compared to a net loss attributable to our common stockholders of approximately $3.8 million. Net loss attributable to our common stockholders for the six months ended June 30, 2016 reflects non-cash depreciation and amortization of approximately $2.1 million, acquisition related expenses of approximately $0.7 million, and distributions to preferred unitholders of approximately $1.0 million. Cumulative net loss attributable to our common stockholders reflects non-cash depreciation and amortization of approximately $4.8 million, acquisition related expenses of approximately $2.4 million, and distributions to preferred unitholders of approximately $3.3 million.

For the six months ended June 30, 2016, we paid total distributions of approximately $1.1 million. For the six months ended June 30, 2015, we declared no cash distributions on our common stock. From our commencement of paying cash distributions on our common shares in November 2015 through June 30, 2016, the payment of distributions has been paid solely from public offering proceeds. We must distribute to our stockholders at least 90% of our taxable income each year in order to meet the requirements for being treated as a REIT under the Code. Our directors may authorize distributions in excess of this percentage as they deem appropriate. Because we may receive income from interest or rents at various times during our fiscal year, distributions may not reflect our income earned in that particular distribution period, but may be made in anticipation of cash flow that we expect to receive during a later period and may be made in advance of actual receipt of funds in an attempt to make distributions relatively uniform. To allow for such differences in timing between the receipt of income and the payment of expenses, and the effect of required debt payments, among other things, we could be required to borrow funds from third parties on a short-term basis, issue new securities, or sell assets to meet the distribution requirements that are necessary to achieve the tax benefits associated with

4

qualifying as a REIT. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions. These methods of obtaining funding could affect future distributions by increasing operating costs and decreasing available cash, which could reduce the value of our stockholders’ investment in our shares. In addition, such distributions may constitute a return of investors’ capital.

We have not been able to and may not be able to pay distributions from our cash flows from operations, in which case distributions may be paid in part from debt financing or from proceeds from the issuance of common stock in our primary offering and pursuant to our distribution reinvestment plan. The payment of distributions from sources other than cash flows from operations may reduce the amount of proceeds available for investment and operations or cause us to incur additional interest expense as a result of borrowed funds.

Over the long-term, we expect that a greater percentage of our distributions will be paid from cash flows from operations. However, our operating performance cannot be accurately predicted and may deteriorate in the future due to numerous factors, including our ability to raise and invest capital at favorable yields, the financial performance of our investments in the current real estate and financial environment and the types and mix of investments in our portfolio. As a result, future distributions declared and paid may exceed cash flow from operations.

Selected Quarterly Financial Data

Below is our selected quarterly financial data for the periods shown below.

| | | | | | | | | | | | | | | | | | | | |

| | | Three months ended | |

| | | June 30, 2015 | | | September 30, 2015 | | | December 31, 2015 | | | March 31, 2016 | | | June 30, 2016 | |

Total revenues | | $ | 1,241,755 | | | $ | 1,292,224 | | | $ | 1,371,775 | | | $ | 2,072,885 | | | $ | 2,249,591 | |

Total operating expenses | | | 1,619,962 | | | | 1,836,662 | | | | 2,159,038 | | | | 2,979,250 | | | | 2,954,341 | |

Operating loss | | | (378,207 | ) | | | (544,438 | ) | | | (787,263 | ) | | | (906,365 | ) | | | (704,750 | ) |

Net loss | | | (590,767 | ) | | | (758,800 | ) | | | (1,191,825 | ) | | | (1,520,001 | ) | | | (1,279,833 | ) |

Net loss attributable to the common stockholders | | | (1,154,918 | ) | | | (1,314,402 | ) | | | (1,693,559 | ) | | | (2,021,593 | ) | | | (1,783,520 | ) |

Net loss per Class A share-basic and diluted | | | (1.36 | ) | | | (1.26 | ) | | | (0.82 | ) | | | (0.63 | ) | | | (0.39 | ) |

Net loss per Class T share-basic and diluted | | | — | | | | — | | | | (0.82 | ) | | | (0.63 | ) | | | (0.39 | ) |

Update Regarding When We Cease Paying Stockholder Servicing Fees

The disclosures regarding when we cease paying the stockholder servicing fee with respect to the Class T shares, as described on (i) page 7, in Footnote 1 of the answer to the question “Why are you offering two classes of your common stock, and what are the similarities and differences between the classes?” contained in the “Questions and Answers About This Offering” section of our prospectus, (ii) page 101 in the description of the stockholder servicing fee set forth in the table contained in the “Management Compensation” section of our prospectus, (iii) page 159 in the “Class T Shares” subsection of the “Description of our Shares” section of our prospectus, (iv) page 182 in the “Compensation of Dealer Manager and Participating Broker-Dealers” subsection of the “Plan of Distribution” section of our prospectus, and (v) pages 183-184 in Footnote 3 to the table contained in the “Underwriting Compensation and Organization and Offering Expenses ” subsection of the “Plan of Distribution” section of our prospectus are hereby removed and replaced with the following sentence:

We will cease paying the stockholder servicing fee with respect to the Class T shares sold in our primary offering at the earlier of (i) the date we list our shares on a national securities exchange, merge or consolidate with or into another entity, or sell or dispose of all or substantially all of our assets, (ii) the date at which the aggregate underwriting compensation from all sources equals 10% of the gross proceeds from the sale of both Class A shares and Class T shares in our primary offering (i.e., excluding proceeds from sales pursuant to our distribution

5

reinvestment plan), which calculation shall be made by us with the assistance of our dealer manager commencing after the termination of our primary offering; (iii) the fifth anniversary of the last day of the fiscal quarter in which our primary offering (i.e., excluding our distribution reinvestment plan offering) terminates; and (iv) the date that such Class T share is redeemed or is no longer outstanding.

Redemption of Preferred Units

SSTI Preferred Investor, LLC (the “Preferred Investor”) invested an aggregate of approximately $17.5 million in our operating partnership in 2014 and 2015 in order to partially fund certain of our acquisitions and in exchange received approximately 700,000 Series A Cumulative Redeemable Preferred Units (the “Preferred Units”) in our operating partnership. On September 23, 2015, we redeemed $1.5 million in Liquidation Amount of the Preferred Units; on June 29, 2016, we redeemed $1 million in Liquidation Amount of the Preferred Units; on July 29, 2016, we redeemed $1 million in Liquidation Amount of the Preferred Units; on August 16, 2016, we redeemed $1 million in Liquidation Amount of the Preferred Units; on August 19, 2016 we redeemed $1 million in Liquidation Amount of the Preferred Units, reducing the amount outstanding to approximately $12 million in Liquidation Amount of Preferred Units.

Volume Discounts

The “Volume Discounts” section on pages 185-187 of the prospectus is hereby deleted and replaced with the following:

We are offering, and participating broker-dealers and their registered representatives will be responsible for implementing, volume discounts to investors who purchase more than $500,000 of either class of shares of our common stock in the primary offering from the same participating broker-dealer, whether in a single purchase or as the result of multiple purchases. The net proceeds to us from a sale of shares eligible for a volume discount will be the same, but the sales commissions and, in some cases, the dealer manager fee we pay will be reduced. Because our dealer manager will reallow all sales commissions and a portion of the dealer manager fee to participating broker-dealers, the amount of commissions participating broker dealers receive for such sales of shares will be reduced.

The following table shows the discounted price per share and the reduced sales commissions and dealer manager fee payable for volume sales of our Class A shares based on the primary offering price of $11.17 per share.

| | | | | | | | | | | | | | | | | | | | |

Amount of Class A Shares Purchased | | Price Per

Share to

the

Investor* | | | Commission

Percentage | | Amount of

Commission

Paid

Per Share* | | | Dealer

Manager Fee

Percentage | | Amount of

Dealer

Manager

Fee Paid

Per Share* | | | Net Offering

Proceeds

Per Share | |

Up to $500,000 | | $ | 11.17 | | | 7% | | $ | 0.78 | | | 3.0% | | $ | 0.34 | | | $ | 10.05 | |

$500,001 to $1,000,000 | | $ | 11.06 | | | 6% | | $ | 0.67 | | | 3.0% | | $ | 0.34 | | | $ | 10.05 | |

$1,000,001 to $2,000,000 | | $ | 10.89 | | | 5% | | $ | 0.56 | | | 2.5% | | $ | 0.28 | | | $ | 10.05 | |

$2,000,001 to $5,000,000 | | $ | 10.78 | | | 4% | | $ | 0.45 | | | 2.5% | | $ | 0.28 | | | $ | 10.05 | |

$5,000,001 to $7,500,000 | | $ | 10.61 | | | 3% | | $ | 0.34 | | | 2.0% | | $ | 0.22 | | | $ | 10.05 | |

$7,500,001 to $10,000,000 | | $ | 10.44 | | | 2% | | $ | 0.22 | | | 1.5% | | $ | 0.17 | | | $ | 10.05 | |

$10,000,001 and over | | $ | 10.27 | | | 1% | | $ | 0.11 | | | 1.0% | | $ | 0.11 | | | $ | 10.05 | |

| * | Numbers are rounded within $0.01 for purposes of this table only. |

6

We will apply the reduced selling price, sales commission and dealer manager fee to the entire purchase. All sales commission and dealer manager fee rates are calculated assuming a price per share of $11.17. For example, an investment of $2,500,000 in Class A shares in a single transaction would result in a total purchase of approximately 231,911 Class A shares at a purchase price of $10.78 per share (instead of approximately 223,814 Class A shares if you had paid $11.17 per share), 4% sales commissions and a 2.5% dealer manager fee. The net offering proceeds we receive from the sale of Class A shares are not affected by volume discounts.

If an investor purchases more than $1,000,000 of Class A shares in the primary offering through a distribution channel under which sales commissions are not paid, we will apply a reduced dealer manager fee in accordance with the amounts set forth above.

The following table shows the discounted price per share and the reduced sales commissions and dealer manager fee payable for volume sales of our Class T shares based on the primary offering price of $10.58 per share.

| | | | | | | | | | | | | | | | | | | | |

Amount of Class T Shares Purchased | | Price Per

Share to

the

Investor* | | | Commission

Percentage | | Amount of

Commission

Paid

Per Share* | | | Dealer

Manager Fee

Percentage | | Amount of

Dealer

Manager

Fee Paid

Per Share* | | | Net Offering

Proceeds

Per Share | |

Up to $500,000 | | $ | 10.58 | | | 2.0% | | $ | 0.21 | | | 3.0% | | $ | 0.32 | | | $ | 10.05 | |

$500,001 to $1,000,000 | | $ | 10.53 | | | 1.5% | | $ | 0.16 | | | 3.0% | | $ | 0.32 | | | $ | 10.05 | |

$1,000,001 to $2,000,000 | | $ | 10.47 | | | 1.5% | | $ | 0.16 | | | 2.5% | | $ | 0.26 | | | $ | 10.05 | |

$2,000,001 to $5,000,000 | | $ | 10.42 | | | 1.0% | | $ | 0.11 | | | 2.5% | | $ | 0.26 | | | $ | 10.05 | |

$5,000,001 to $7,500,000 | | $ | 10.37 | | | 1.0% | | $ | 0.11 | | | 2.0% | | $ | 0.21 | | | $ | 10.05 | |

$7,500,001 to $10,000,000 | | $ | 10.26 | | | 0.5% | | $ | 0.05 | | | 1.5% | | $ | 0.16 | | | $ | 10.05 | |

$10,000,001 and over | | $ | 10.05 | ** | | 0.0% | | $ | 0.00 | | | 1.0% | | $ | 0.11 | | | $ | 10.05 | |

| * | Numbers are rounded within $0.01 for purposes of this table only. |

| ** | With respect to Class T Shares sold at $10.05 per share pursuant to the table above, our advisor will pay us a 1% dealer manager fee based on a $10.58 undiscounted price per share, or approximately $0.11 per share, which we will remit to our dealer manager. |

We will apply the reduced selling price, sales commission and dealer manager fee to the entire purchase. All sales commission and dealer manager fee rates are calculated assuming a price per share of $10.58. For example, an investment of $2,500,000 in Class T shares in a single transaction would result in a total purchase of approximately 239,923 Class T shares at a purchase price of $10.42 per share (instead of approximately 236,295 Class T shares if you had paid $10.58 per share), 1% sales commissions and a 2.5% dealer manager fee. The net offering proceeds we receive from the sale of Class T shares are not affected by volume discounts. Volume discounts will not affect the stockholder servicing fee associated with the Class T shares, which accrues daily in an amount equal to 1/365th of 1% of the purchase price per share (ignoring any volume discounts) of Class T shares sold in our primary offering.

To qualify for a volume discount as a result of multiple purchases of our Class A shares or Class T shares, a stockholder must check the “Additional Investment” box and write his, her or its existing account number on the subscription agreement or complete an additional investment subscription agreement. We are not responsible for failing to combine purchases if a stockholder fails to check the “Additional Investment” box or complete an additional investment subscription agreement. If you qualify for a particular volume discount as a result of multiple purchases of our Class A or Class T shares, you will receive the benefit of the applicable volume discount only for the individual purchase that qualified you for the volume discount and all subsequent purchases, but you will not be entitled to the benefit for prior purchases.

7

As set forth below, a “single purchaser” may combine purchases by other persons for the purpose of qualifying for a volume discount, and for determining commissions payable to participating broker-dealers. You must request that your share purchases be combined for this purpose by designating such on your subscription agreement. For the purposes of such volume discounts, the term “single purchaser” includes:

| | • | | an individual, his or her spouse and their parents or children under the age of 21 who purchase the common shares for his, her or their own accounts; |

| | • | | a corporation, partnership, association, joint-stock company, trust fund or any organized group of persons, whether incorporated or not; |

| | • | | an employees’ trust, pension, profit-sharing or other employee benefit plan qualified under Section 401(a) of the Code; and |

| | • | | all commingled trust funds maintained by a given bank. |

Any request to combine purchases of our shares will be subject to our verification that such purchases were made by a “single purchaser.”

Requests to combine subscriptions as part of a combined order for the purpose of qualifying for volume discounts must be made in writing by the participating broker-dealer, and any resulting reduction in commissions will be applicable to each of the separate subscribers. As with volume discounts provided to qualifying single purchasers, the net proceeds we receive from the sale of shares will not be affected by volume discounts provided as a result of a combined order.

Regardless of any reduction in any commissions for any reason, any other fees based upon gross proceeds of the offering or the purchase price of the shares, including stockholder servicing fees, will be calculated as though the purchaser paid $11.17 per Class A share and $10.58 per Class T share. An investor qualifying for a volume discount will receive a higher percentage return on his or her investment than investors who do not qualify for such discount.

California and Minnesota residents should be aware that volume discounts will not be available in connection with the sale of shares made to such investors to the extent such discounts do not comply with the laws of California and Minnesota. Pursuant to this rule, volume discounts can be made available to California or Minnesota residents only in accordance with the following conditions:

| | • | | there can be no variance in the net proceeds to us from the sale of the shares to different purchasers of the same offering; |

| | • | | all purchasers of the shares must be informed of the availability of volume discounts; |

| | • | | the minimum amount of shares as to which volume discounts are allowed cannot be less than $10,000; |

| | • | | the variance in the price of the shares must result solely from a different range of commissions, and all discounts allowed must be based on a uniform scale of commissions; and |

| | • | | no discounts are allowed to any group of purchasers. |

Accordingly, volume discounts for California and Minnesota residents will be available in accordance with the foregoing tables of uniform discount levels based on dollar amount of shares purchased for single purchasers. However, no discounts will be allowed to any group of purchasers, and no subscriptions may be aggregated as part of a combined order for purposes of determining the dollar amount of shares purchased.

You should ask your financial advisor and broker-dealer about the ability to receive volume discounts through any of the circumstances described above.

8

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with our financial statements and notes thereto contained elsewhere in this supplement.

Overview

Strategic Storage Growth Trust, Inc. was formed on March 12, 2013 under the Maryland General Corporation Law for the purpose of engaging in the business of investing in self storage facilities and related self storage real estate investments. Our year end is December 31. As used in this supplement, “we,” “us,” “our,” and “Company” refer to Strategic Storage Growth Trust, Inc. and each of our subsidiaries.

SmartStop Asset Management, LLC (our “Sponsor”), is the sponsor of our Public Offering (as defined below). Our Sponsor became our sponsor on October 1, 2015 in connection with the merger of SmartStop Self Storage, Inc. into Extra Space Storage, Inc. Our Sponsor owns 97.5% of the economic interests (and 100% of the voting membership interests) of SS Growth Advisor, LLC, a Delaware limited liability company (our “Advisor”) and owns 100% of SS Growth Property Management, LLC, a Delaware limited liability company (our “Property Manager”). See Note 1 of the Notes to the Consolidated Statements contained in this supplement for further details about our affiliates.

On June 17, 2013, we commenced a private placement offering to accredited investors only for a maximum of $109.5 million in shares of common stock, including shares being offered pursuant to our distribution reinvestment plan (the “Private Offering”). On May 23, 2014, we satisfied the minimum offering requirements of $1 million from our Private Offering and commenced formal operations. We terminated the Private Offering on January 16, 2015. We raised gross offering proceeds of approximately $7.8 million from the issuance of approximately 830,000 shares pursuant to the Private Offering.

On January 20, 2015, we commenced a public offering of a maximum of $1.0 billion in common shares for sale to the public (the “Primary Offering”) and $95.0 million in common shares for sale pursuant to our distribution reinvestment plan (collectively, the “Public Offering,”). On September 28, 2015, we revised our Primary Offering and are now offering two classes of shares of common stock: Class A common stock, $0.001 par value per share (the “Class A Shares”) and Class T common stock, $0.001 par value per share (the “Class T Shares”). As of June 30, 2016, we had sold approximately 4.6 million Class A Shares and approximately 280,000 Class T Shares in our Public Offering and Private Offering for gross proceeds of approximately $46.0 million and approximately $2.8 million, respectively. We intend to invest the net proceeds from our offerings primarily in opportunistic self storage facilities, which may include facilities to be developed, currently under development or in lease-up and self storage facilities in need of expansion, redevelopment or repositioning.

9

As of June 30, 2016, our self storage portfolio was comprised as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

State | | No. of

Properties | | | Units(1) | | | Sq. Ft.

(net)(2) | | | % of Total

Rentable

Sq. Ft. | | | Physical

Occupancy

%(3) | | | Rental

Income(5) | |

Arizona | | | 1 | | | | 840 | | | | 94,000 | | | | 8.8 | % | | | N/A | (3) | | | 0.3 | % |

California | | | 3 | | | | 1,830 | | | | 173,600 | | | | 16.2 | % | | | 95.1 | % | | | 21.0 | % |

Colorado | | | 2 | | | | 1,120 | | | | 121,300 | | | | 11.3 | % | | | 81.4 | % | | | 12.5 | % |

Florida | | | 1 | | | | 770 | | | | 88,400 | | | | 8.2 | % | | | 99.7 | % | | | 6.8 | % |

Illinois | | | 2 | | | | 1,090 | | | | 116,300 | | | | 10.8 | % | | | 80.5 | % | | | 9.2 | % |

Nevada | | | 2 | | | | 2,250 | | | | 260,100 | | | | 24.2 | % | | | 91.1 | % | | | 21.5 | % |

Texas | | | 3 | | | | 1,400 | | | | 220,200 | | | | 20.5 | % | | | 90.5 | % | | | 28.7 | % |

Toronto, Canada(4) | | | 2 | | | | 1,680 | | | | 166,600 | | | | N/A | (4) | | | N/A | (4) | | | N/A | (4) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 16 | | | | 10,980 | | | | 1,240,500 | | | | 100 | % | | | 90.0 | %(3) | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Includes all rentable units, consisting of storage units, and parking units (approximately 380 units). |

| (2) | Includes all rentable square feet consisting of storage units, and parking units (approximately 117,000 square feet). |

| (3) | Represents the occupied square feet of all facilities we owned in a state divided by total rentable square feet of all the facilities we owned in such state as of June 30, 2016. We acquired the Baseline Property in Arizona on May 26, 2016. The property’s occupancy of approximately 14% as of June 30, 2016 was excluded from the above. |

| (4) | Our two properties in Toronto, Canada are self storage properties that are under construction and the numbers are approximate. |

| (5) | Represents rental income for all facilities we owned in a state divided by our total rental income for the month of June 2016. |

Critical Accounting Policies

We have established accounting policies which conform to generally accepted accounting principles (“GAAP”). Preparing financial statements in conformity with GAAP requires management to use judgment in the application of accounting policies, including making estimates and assumptions. Following is a discussion of the estimates and assumptions used in setting accounting policies that we consider critical in the presentation of our financial statements. Many estimates and assumptions involved in the application of GAAP may have a material impact on our financial condition or operating performance, or on the comparability of such information to amounts reported for other periods, because of the subjectivity and judgment required to account for highly uncertain items or the susceptibility of such items to change. These estimates and assumptions affect our reported amounts of assets and liabilities, our disclosure of contingent assets and liabilities at the dates of the financial statements and our reported amounts of revenue and expenses during the period covered by this supplement. If management’s judgment or interpretation of the facts and circumstances relating to various transactions had been different, it is possible that different accounting policies would have been applied or different amounts of assets, liabilities, revenues and expenses would have been recorded, thus resulting in a materially different presentation of the financial statements or materially different amounts being reported in the financial statements. Additionally, other companies may use different estimates and assumptions that may impact the comparability of our financial condition and results of operations to those companies.

We believe that our critical accounting policies include the following: real estate purchase price allocations; the evaluation of whether any of our long-lived assets have been impaired; the determination of the useful lives of our long-lived assets; and the evaluation of the consolidation of our interests in joint ventures. The following discussion of these policies supplements, but does not supplant the description of our significant accounting policies, as contained in Note 2 of the Notes to the Consolidated Financial Statements contained in this supplement, and is intended to present our analysis of the uncertainties involved in arriving upon and applying each policy.

Real Estate Purchase Price Allocation

We allocate the purchase prices of acquired properties based on a number of estimates and assumptions. We allocate the purchase prices to the tangible and intangible assets acquired and the liabilities assumed based on estimated fair values. These estimated fair values are based upon comparable market sales information for land and estimates of depreciated replacement cost of equipment, building and site improvements. Acquisitions of

10

portfolios of properties are allocated to the individual properties based upon an income approach or a cash flow analysis using appropriate risk adjusted capitalization rates which we estimate based upon the relative size, age, and location of the individual property along with actual historical and estimated occupancy and rental rate levels, and other relevant factors. If available, and determined by management to be appropriate, appraised values are used, rather than these estimated values. Because we believe that substantially all of the leases in place at properties we acquire will be at market rates, as the majority of the leases are month-to-month contracts, we do not expect to allocate any portion of the purchase prices to above or below market leases. The determination of market rates is also subject to a number of estimates and assumptions. Our allocations of purchase prices could result in a materially different presentation of the financial statements or materially different amounts being reported in the financial statements, as such allocations may vary dramatically based on the estimates and assumptions we use.

Impairment of Long-Lived Assets

The majority of our assets consist of long-lived real estate assets as well as intangible assets related to our acquisitions. We will continually evaluate such assets for impairment based on events and changes in circumstances that may arise in the future and that may impact the carrying amounts of our long-lived assets. When indicators of potential impairment are present, we will assess the recoverability of the particular asset by determining whether the carrying value of the asset will be recovered, through an evaluation of the undiscounted future operating cash flows expected from the use of the asset and its eventual disposition. This evaluation is based on a number of estimates and assumptions. Based on this evaluation, if the expected undiscounted future cash flows do not exceed the carrying value, we will adjust the value of the long-lived asset and recognize an impairment loss. Our evaluation of the impairment of long-lived assets could result in a materially different presentation of the financial statements or materially different amounts being reported in the financial statements, as the amount of impairment loss, if any, recognized may vary based on the estimates and assumptions we use.

Estimated Useful Lives of Long-Lived Assets

We assess the useful lives of the assets underlying our properties based upon a subjective determination of the period of future benefit for each asset. We record depreciation expense with respect to these assets based upon the estimated useful lives we determine. Our determinations of the useful lives of the assets could result in a materially different presentation of the financial statements or materially different amounts being reported in the financial statements, as such determinations, and the corresponding amount of depreciation expense, may vary dramatically based on the estimates and assumptions we use.

Consolidation of Investments in Joint Ventures

We will evaluate the consolidation of our investments in joint ventures in accordance with relevant accounting guidance. This evaluation requires us to determine whether we have a controlling interest in a joint venture through a means other than voting rights, and, if so, such joint venture may be required to be consolidated in our financial statements. Our evaluation of our joint ventures under such accounting guidance could result in a materially different presentation of the financial statements or materially different amounts being reported in the financial statements, as the joint venture entities included in our financial statements may vary based on the estimates and assumptions we use.

REIT Qualification

We made an election under Section 856(c) of the Internal Revenue Code of 1986 (the Code) to be taxed as a REIT under the Code, commencing with the taxable year ended December 31, 2014. By qualifying as a REIT for federal income tax purposes, we generally will not be subject to federal income tax on income that we distribute to our stockholders. If we fail to qualify as a REIT in any taxable year, we will be subject to federal income tax on our taxable income at regular corporate rates and will not be permitted to qualify for treatment as a REIT for federal income tax purposes for four years following the year in which our qualification is denied. Such an event could materially and adversely affect our net income and could have a material adverse impact on our financial condition and results of operations. However, we believe that we are organized and operate in a manner that will enable us to continue to qualify for treatment as a REIT for federal income tax purposes, and we intend to continue to operate as to remain qualified as a REIT for federal income tax purposes.

11

Results of Operations

Overview

We derived revenues principally from: (i) rents received from tenants who rent storage units under month-to-month leases at each of our self storage facilities and (ii) sales of packing- and storage-related supplies at our storage facilities. Therefore, our operating results depend significantly on our ability to retain our existing tenants and lease our available self storage units to new tenants, while maintaining and, where possible, increasing the prices for our self storage units. Additionally, our operating results depend on our tenants making their required rental payments to us.

Competition in the market areas in which we operate is significant and affects the occupancy levels, rental rates, rental revenues and operating expenses of our facilities. Development of any new self storage facilities would intensify competition of self storage operators in markets in which we operate.

As of June 30, 2016 and 2015, we owned 16 and 9 self storage facilities, respectively. The comparability of our results of operations was significantly affected by our acquisition activity in 2016 and 2015 as listed below.

| | • | | The three months ended June 30, 2015 includes full quarter results for nine self storage facilities. The three months ended June 30, 2016 includes full quarter results for 13 self storage facilities and partial quarter results for one operating property acquired on May 26, 2016. |

| | • | | The six months ended June 30, 2015 includes full six month results for three self storage facilities and partial results for the six facilities we acquired during the quarter ended March 31, 2015. The six months ended June 30, 2016 includes full six month results for those nine self storage facilities plus full six month results for an additional three self storage facilities acquired during the fourth quarter of 2015 and partial results for one operating property acquired on January 6, 2016 and one operating property acquired on May 26, 2016. |

Therefore, we believe there is little basis for comparison between the three and six months ended June 30, 2016 and 2015. Operating results in future periods will depend on the results of operations of our existing properties and of the real estate properties that we acquire in the future.

Comparison of Operating Results for the Three Months Ended June 30, 2016 and 2015

Self Storage Rental Revenue

Rental revenue for the three months ended June 30, 2016 and 2015 were approximately $2.2 million and $1.2 million, respectively. The increase in rental revenue is primarily attributable to the acquisition of one operating self storage property during the first quarter of 2016, the acquisition of three operating self storage properties during the fourth quarter of 2015, and increased same-store revenues (approximately $0.3 million or 22%). We expect rental revenue to increase in future periods commensurate with our future acquisition activity.

Property Operating Expenses

Property operating expenses for the three months ended June 30, 2016 and 2015 were approximately $1.1 million and $0.5 million, respectively. Property operating expenses includes the cost to operate our facilities including payroll, utilities, insurance, real estate taxes, and marketing. The increase in property operating expenses is attributable to the acquisition of one operating self storage property during the first quarter of 2016 and the acquisition of three operating self storage properties during the fourth quarter of 2015. The three months ended June 30, 2016 were also negatively impacted by increased property tax expense related to increases in assessed values at two of our properties in Texas. We expect property operating expenses to increase in future periods commensurate with our future acquisition activity.

12

Property Operating Expenses – Affiliates

Property operating expenses – affiliates for the three months ended June 30, 2016 and 2015 were approximately $0.2 million and $0.1 million, respectively. Property operating expenses – affiliates includes property management fees and asset management fees. The increase in property operating expenses is primarily attributable to the acquisition of one operating self storage property during the first quarter of 2016 and the acquisition of three operating self storage properties during the fourth quarter of 2015. We expect property operating expenses – affiliates to increase in future periods commensurate with our future acquisition activity.

General and Administrative Expenses

General and administrative expenses for the three months ended June 30, 2016 and 2015 were approximately $0.5 million and $0.3 million, respectively. General and administrative expenses consist primarily of legal expenses, transfer agent fees, directors’ and officers’ insurance expense, an allocation of a portion of our Advisor’s payroll related costs, accounting expenses and board of directors’ related costs. The increase in general and administrative expenses is primarily attributable to increases in accounting, transfer agent, legal costs and other professional services commensurate with our increased operational activity. We expect general and administrative expenses to increase in the future as our operational activity increases, but decrease as a percentage of total revenues.

Depreciation and Amortization Expenses

Depreciation and amortization expenses for the three months ended June 30, 2016 and 2015 were approximately $0.8 million and $0.6 million, respectively. Depreciation expense consists primarily of depreciation on the buildings and site improvements at our properties. Amortization expense consists of the amortization of intangible assets resulting from our acquisitions. The increase in depreciation and amortization expense is primarily attributable to the acquisition of one operating self storage property during the first quarter of 2016 and the acquisition of three operating self storage properties during the fourth quarter of 2015. We expect depreciation and amortization expense to increase in future periods commensurate with our future acquisition activity.

Acquisition Expenses – Affiliates

Acquisition expenses – affiliates for the three months ended June 30, 2016 and 2015 were approximately $0.2 million and $50,000, respectively. These acquisition expenses primarily relate to the costs associated with the self storage properties acquired in the respective periods. We expect acquisition expenses – affiliates to fluctuate commensurate with our acquisition activities.

Other Property Acquisition Expenses

Other property acquisition expenses for the three months ended June 30, 2016 and 2015 were approximately $0.1 million and approximately $25,000, respectively. These acquisition expenses primarily relate to the costs associated with the self storage properties acquired in the respective periods. We expect acquisition expenses to fluctuate commensurate with our acquisition activities.

Interest Expense

Interest expense for the three months ended June 30, 2016 and 2015 were approximately $0.4 million and $0.2 million, respectively. The increase in interest expense is primarily attributable to the interest incurred on the KeyBank Facility to fund the acquisition of one operating self storage property during the first quarter of 2016 and the acquisition of three operating self storage properties during the fourth quarter of 2015. We expect interest expense to increase in future periods commensurate with our future debt level.

Debt Issuance Costs Expense

Debt issuance costs expense for the three months ended June 30, 2016 and 2015 were approximately $0.2 million and $50,000, respectively. The increase in debt issuance costs expense is attributable to the costs incurred in connection with obtaining financing for one operating self storage property during the first quarter of 2016, the

13

acquisition of three operating self storage properties during the fourth quarter of 2015, and one operating self storage property during the second quarter of 2016. We expect debt issuance costs expense to increase commensurate with our future financing activity.

Distributions to the Preferred Unitholder in our Operating Partnership

Distributions to the preferred unitholder (the “Preferred Unitholder”) in SS Growth Operating Partnership, L.P., our operating partnership (the “Operating Partnership”), for the three months ended June 30, 2016 and 2015 were approximately $0.5 million and $0.5 million, respectively. Our distributions to the Preferred Unitholder will fluctuate commensurate with the amount outstanding.

Same-Store Facility Results

The following table sets forth operating data for our same-store facilities (those properties included in the consolidated results of operations since April 1, 2015) for the three months ended June 30, 2016 and 2015. We consider the following data to be meaningful as this allows for the comparison of results without the effects of acquisition or development activity.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Same-Store Facilities | | | Non Same-Store Facilities | | | Total | |

| | | 2016 | | | 2015 | | | % Change | | | 2016 | | | 2015 | | | % Change | | | 2016 | | | 2015 | | | % Change | |

Revenue(1) | | $ | 1,468,952 | | | $ | 1,241,755 | | | | 18.3 | % | | $ | 780,639 | | | $ | — | | | | N/M | | | $ | 2,249,591 | | | $ | 1,241,755 | | | | 81.2 | % |

Property operating expenses (2) | | | 672,671 | | | | 619,624 | | | | 8.6 | % | | | 559,109 | | | | — | | | | N/M | | | | 1,231,780 | | | | 619,624 | | | | 98.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income | | $ | 796,281 | | | $ | 622,131 | | | | 28.0 | % | | $ | 221,530 | | | $ | — | | | | N/M | | | $ | 1,071,811 | | | $ | 622,131 | | | | 63.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Number of facilities | | | 9 | | | | 9 | | | | | | | | 7 | | | | — | | | | | | | | 16 | | | | 9 | | | | | |

Rentable square feet (3) | | | 700,200 | | | | 700,200 | | | | | | | | 540,300 | | | | — | | | | | | | | 1,240,500 | | | | 700,200 | | | | | |

Average physical occupancy (4) | | | 89.3 | % | | | 80.9 | % | | | | | | | N/M | | | | N/M | | | | | | | | 88.6 | % | | | 80.9 | % | | | | |

Annualized rent per occupied square foot (5) | | $ | 10.23 | | | $ | 9.55 | | | | | | | | N/M | | | | N/M | | | | | | | $ | 11.01 | | | $ | 9.55 | | | | | |

N/M Not meaningful

| (1) | Revenue includes rental revenue, ancillary revenue, and administrative and late fees. |

| (2) | Property operating expenses excludes corporate general and administrative expenses, asset management fees, interest expense, depreciation, amortization expense and acquisition expenses, but includes property management fees. |

| (3) | Of the total rentable square feet, parking represented approximately 117,000 and approximately 76,000 as of June 30, 2016 and 2015, respectively. On a same-store basis, for the same periods, parking represented approximately 76,000 square feet. |

| (4) | Determined by dividing the sum of the month-end occupied square feet for the applicable group of facilities for each applicable period by the sum of their month-end rentable square feet for the period. Properties are included in the respective calculations in their first full month of operations, as appropriate. |

| (5) | Determined by dividing the aggregate realized revenue for each applicable period by the aggregate of the month-end occupied square feet for the period. Properties are included in the respective calculations in their first full month of operations, as appropriate. We have excluded the realized revenue and occupied square feet related to parking herein for the purpose of calculating annualized rent per occupied square foot. |

Our increase in same-store revenue of approximately $0.2 million was primarily the result of increased average physical occupancy of approximately 8.4% and increased rent per occupied square foot of approximately 7.1% for the three months ended June 30, 2016 over the three months ended June 30, 2015.

14

Our same-store property operating expenses increased by approximately $0.1 million for the three months ended June 30, 2016 compared to the three months ended June 30, 2015 primarily due to increased advertising and repairs and maintenance expense.

Comparison of Operating Results for the Six Months Ended June 30, 2016 and 2015

Self Storage Rental Revenue

Rental revenue for the six months ended June 30, 2016 and 2015 were approximately $4.3 million and $2.1 million, respectively. The increase in rental revenue is primarily attributable to the acquisition of one operating self storage property during the first quarter of 2016, the acquisition of three operating self storage properties during the fourth quarter of 2015, and a full six months of operations from the six properties acquired in the first quarter of 2015. We expect rental revenue to increase in future periods commensurate with our future acquisition activity.

Property Operating Expenses

Property operating expenses for the six months ended June 30, 2016 and 2015 were approximately $2.0 million and $1.0 million, respectively. Property operating expenses includes the cost to operate our facilities including payroll, utilities, insurance, real estate taxes, and marketing. The increase in property operating expenses primarily attributable to the acquisition of one operating self storage property during the first quarter of 2016, the acquisition of three operating self storage properties during the fourth quarter of 2015, and a full six months of operations from the six properties acquired in the first quarter of 2015. We expect property operating expenses to increase in future periods commensurate with our future acquisition activity.

Property Operating Expenses – Affiliates

Property operating expenses – affiliates for the six months ended June 30, 2016 and 2015 were approximately $0.5 million and $0.3 million, respectively. Property operating expenses – affiliates includes property management fees and asset management fees. The increase in property operating expenses – primarily attributable to the acquisition of one operating self storage property during the first quarter of 2016, the acquisition of three operating self storage properties during the fourth quarter of 2015, and a full six months of operations from the six properties acquired in the first quarter of 2015. We expect property operating expenses – affiliates to increase in future periods commensurate with our future acquisition activity.

General and Administrative Expenses

General and administrative expenses for the six months ended June 30, 2016 and 2015 were approximately $1.0 million and $0.6 million, respectively. General and administrative expenses consist primarily of legal expenses, transfer agent fees, directors’ and officers’ insurance expense, an allocation of a portion of our Advisor’s payroll related costs, accounting expenses and board of directors’ related costs. The increase in general and administrative expenses is primarily attributable to increases in accounting, transfer agent, legal costs and other professional services commensurate with our increased operational activity. We expect general and administrative expenses to increase in the future as our operational activity increases, but decrease as a percentage of total revenues.

Depreciation and Amortization Expenses

Depreciation and amortization expenses for the six months ended June 30, 2016 and 2015 were approximately $1.7 million and $1.1 million, respectively. Depreciation expense consists primarily of depreciation on the buildings and site improvements at our properties. Amortization expense consists of the amortization of intangible assets resulting from our acquisitions. The increase in depreciation and amortization expense primarily attributable to the acquisition of one operating self storage property during the first quarter of 2016, the acquisition of three operating self storage properties during the fourth quarter of 2015, and a full six months of operations from the six properties acquired in the first quarter of 2015. We expect depreciation and amortization expense to increase in future periods commensurate with our future acquisition activity.

15

Acquisition Expenses – Affiliates

Acquisition expenses – affiliates for the six months ended June 30, 2016 and 2015 were approximately $0.6 million and $0.2 million, respectively. These acquisition expenses primarily relate to the costs associated with the self storage properties acquired in the respective periods. We expect acquisition expenses – affiliates to fluctuate commensurate with our acquisition activities.

Other Property Acquisition Expenses

Other property acquisition expenses for the six months ended June 30, 2016 and 2015 were approximately $0.1 million and $0.1 million, respectively. These acquisition expenses primarily relate to the costs associated with the self storage properties acquired in the respective periods. We expect acquisition expenses to fluctuate commensurate with our acquisition activities.

Interest Expense

Interest expense for the six months ended June 30, 2016 and 2015 were approximately $0.8 million and $0.3 million, respectively. The increase in interest expense is primarily attributable to the interest incurred on the KeyBank Facility to fund the acquisition of one operating self storage property during the first quarter of 2016, the acquisition of three operating self storage properties during the fourth quarter of 2015, and a full six months of expense associated with the six properties acquired in the first quarter of 2015. We expect interest expense to increase in future periods commensurate with our future debt level.

Debt Issuance Costs Expense

Debt issuance costs expense for the six months ended June 30, 2016 and 2015 were approximately $0.3 million and $0.1 million, respectively. The increase in debt issuance costs expense is primarily attributable to the costs incurred in connection with obtaining financing for one operating self storage property during the first quarter of 2016, the acquisition of three operating self storage properties during the fourth quarter of 2015, and a full six months of expense associated with the six properties acquired in the first quarter of 2015. We expect debt issuance costs expense to increase commensurate with our future financing activity.

Distributions to the Preferred Unitholder in our Operating Partnership

Distributions to the Preferred Unitholder in our Operating Partnership for the six months ended June 30, 2016 and 2015 were approximately $1.0 million and $0.9 million, respectively. The increase in distributions to the Preferred Unitholder is attributable to the increase in the preferred equity investment in our Operating Partnership which was used to partially finance the acquisitions of six properties acquired in the first quarter of 2015. We expect distributions to the Preferred Unitholder to fluctuate commensurate with the amount outstanding.

Same-Store Facility Results

The following table sets forth operating data for our same-store facilities (those properties included in the consolidated results of operations since January 1, 2015) for the six months ended June 30, 2016 and 2015. We consider the following data to be meaningful as this allows for the comparison of results without the effects of acquisition or development activity.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Same-Store Facilities | | | Non Same-Store Facilities | | | Total | |

| | | 2016 | | | 2015 | | | % Change | | | 2016 | | | 2015 | | | % Change | | | 2016 | | | 2015 | | | % Change | |

Revenue (1) | | $ | 1,232,201 | | | $ | 1,024,141 | | | | 20.3 | % | | $ | 3,090,275 | | | $ | 1,169,267 | | | | N/M | | | $ | 4,322,476 | | | $ | 2,193,408 | | | | 97.1 | % |

Property operating expenses (2) | | | 511,033 | | | | 502,685 | | | | 1.7 | % | | | 1,758,005 | | | | 634,662 | | | | N/M | | | | 2,269,038 | | | | 1,137,347 | | | | 99.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income | | $ | 721,168 | | | $ | 521,456 | | | | 38.3 | % | | $ | 1,332,270 | | | $ | 534,605 | | | | N/M | | | $ | 2,053,438 | | | $ | 1,056,061 | | | | 94.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Number of facilities | | | 3 | | | | 3 | | | | | | | | 13 | | | | 6 | | | | | | | | 16 | | | | 9 | | | | | |

Rentable square feet (3) | | | 348,500 | | | | 348,500 | | | | | | | | 892,000 | | | | 351,700 | | | | | | | | 1,240,500 | | | | 700,200 | | | | | |

Average physical occupancy (4) | | | 88.3 | % | | | 76.0 | % | | | | | | | N/M | | | | N/M | | | | | | | | 85.6 | % | | | 80.1 | % | | | | |

Annualized rent per occupied square foot (5) | | $ | 9.11 | | | $ | 8.75 | | | | | | | | N/M | | | | N/M | | | | | | | $ | 11.0 | | | $ | 8.49 | | | | | |

16

N/M Not meaningful

| (1) | Revenue includes rental revenue, ancillary revenue, and administrative and late fees. |

| (2) | Property operating expenses excludes corporate general and administrative expenses, asset management fees, interest expense, depreciation, amortization expense and acquisition expenses, but includes property management fees. |

| (3) | Of the total rentable square feet, parking represented approximately 117,000 and approximately 76,000 as of June 30, 2016 and 2015, respectively. On a same-store basis, for the same periods, parking represented approximately 72,000 square feet. |

| (4) | Determined by dividing the sum of the month-end occupied square feet for the applicable group of facilities for each applicable period by the sum of their month-end rentable square feet for the period. Properties are included in the respective calculations in their first full month of operations, as appropriate. |

| (5) | Determined by dividing the aggregate realized revenue for each applicable period by the aggregate of the month-end occupied square feet for the period. Properties are included in the respective calculations in their first full month of operations, as appropriate. We have excluded the realized revenue and occupied square feet related to parking herein for the purpose of calculating annualized rent per occupied square foot. |

Our increase in same-store revenue of approximately $0.2 million was primarily the result of increased average physical occupancy of approximately 12.3% and increased rent per occupied square foot of approximately 4.2% for the six months ended June 30, 2016 over the six months ended June 30, 2015.

Our same-store property operating expenses increased by approximately $0.1 million for the six months ended June 30, 2016 compared to the six months ended June 30, 2015 primarily due to increased advertising and repairs and maintenance expense.

Cash Flows

A comparison of cash flows for operating, investing and financing activities for the six months ended June 30, 2016 and 2015 is as follows:

| | | | | | | | | | | | |

| | | Six Months Ended | | | | |

| | | June 30, 2016 | | | June 30, 2015 | | | Change | |

Net cash flow provided by (used in): | | | | | | | | | | | | |

Operating activities | | $ | (575,717 | ) | | $ | 384,045 | | | $ | (959,762 | ) |

Investing activities | | | (24,562,252 | ) | | | (15,911,743 | ) | | | (8,650,509 | ) |

Financing activities | | | 21,421,336 | | | | 15,325,734 | | | | 6,095,602 | |

Cash flows used in operating activities for the six months ended June 30, 2016 were approximately $0.6 million as compared to cash flows provided by operating activities for the six months ended June 30, 2015 of approximately $0.4 million, a reduction in cash provided year to year of approximately $1.0 million. The change in cash provided by our operating activities is primarily the result of incurring a larger net loss, adjusted for depreciation and amortization, which primarily related to increased acquisition expenses and general and administrative expenses and changes in balance sheet accounts, primarily amounts due to affiliates, accounts payable and accrued liabilities.

Cash flows used in investing activities for the six months ended June 30, 2016 and 2015 were approximately $24.6 million and $15.9 million, respectively, an increase in the use of cash of approximately $8.7 million. The change in cash used in investing activities primarily relates to an increase in cash consideration paid for the purchase of real estate and additions thereto.

17

Cash flows provided by financing activities for the six months ended June 30, 2016 and 2015 were approximately $21.4 million and $15.3 million, respectively, a change of approximately $6.1 million. The increase in cash provided by financing activities over the prior period was primarily the result of an increase of approximately $19.5 million from the net proceeds from the issuance of common stock, primarily offset by approximately $7.2 million in proceeds from the issuance of preferred equity in our Operating Partnership in the prior period and by approximately $4.9 million in net proceeds on secured debt.

Liquidity and Capital Resources

Short-Term Liquidity and Capital Resources

We generally expect that we will meet our short-term operating liquidity requirements from the combination of proceeds of our Public Offering, proceeds from secured or unsecured financing from banks or other lenders, net cash provided by property operations and advances from our Advisor which will be repaid, without interest, as funds are available after meeting our current liquidity requirements, subject to the limitations on reimbursement set forth in our advisory agreement with our Advisor. Per the advisory agreement, all advances from our Advisor shall be reimbursed no less frequently than monthly, although our Advisor has indicated that it may waive such a requirement on a month-by-month basis. The organizational and offering costs associated with the Public Offering may be paid by us or our Advisor. Our Advisor must reimburse us within 60 days after the end of the month in which the Public Offering terminates to the extent we paid or reimbursed organization and offering costs (excluding sales commissions, dealer manager fees and stockholder servicing fees) in excess of 3.5% of the gross offering proceeds from the Primary Offering. Operating cash flows are expected to increase as properties are added to our portfolio and as our properties continue to lease-up.

Distribution Policy

As a result of our investment focus on opportunistic self storage properties, we cannot assure our stockholders we will continue to make cash distributions. Until we are generating operating cash flow sufficient to make distributions to our stockholders, we may decide to make stock distributions or to make distributions using a combination of stock and cash, and to fund some or all of our distributions from the proceeds of our Public Offering or from borrowings in anticipation of future cash flow, which may reduce the amount of capital we ultimately invest in properties. Because substantially all of our operations will be performed indirectly through our Operating Partnership, our ability to pay distributions depends in large part on our Operating Partnership’s ability to pay distributions to its partners, including to us. In the event we do not have enough cash from operations to fund cash distributions, we may borrow, issue additional securities or sell assets in order to fund the distributions or make the distributions out of net proceeds from our Public Offering. Though we have no present intention to make in-kind distributions, we are authorized by our charter to make in-kind distributions of readily marketable securities, distributions of beneficial interests in a liquidating trust established for our dissolution and the liquidation of our assets in accordance with the terms of the charter or distributions that meet all of the following conditions: (a) our board of directors advises each stockholder of the risks associated with direct ownership of the property; (b) our board of directors offers each stockholder the election of receiving such in-kind distributions; and (c) in-kind distributions are only made to those stockholders who accept such offer.

Over the long-term, we expect that a greater percentage of our distributions will be paid from cash flows from operations. However, our operating performance cannot be accurately predicted and may deteriorate in the future due to numerous factors, including our ability to raise and invest capital at favorable yields, the financial performance of our investments in the current real estate and financial environment and the types and mix of investments in our portfolio. As a result, future distributions declared and paid may exceed cash flow from operations.

Distributions are paid to our stockholders based on the record date selected by our board of directors. We currently declare and pay cash distributions monthly based on daily declaration and record dates so that investors may be entitled to distributions immediately upon purchasing our shares. Distributions will be authorized at the discretion of our board of directors, which will be directed, in substantial part, by its obligation to cause us to comply with the REIT requirements of the Code. Our board of directors may increase, decrease or eliminate the distribution rate that is being paid at any time. Distributions will be made on all classes of our common stock at

18

the same time. The per share amount of distributions on Class A Shares and Class T Shares will likely differ because of different allocations of class-specific expenses. Specifically, distributions on Class T Shares will likely be lower than distributions on Class A Shares because Class T Shares are subject to ongoing stockholder servicing fees. The funds we receive from operations that are available for distribution may be affected by a number of factors, including the following:

| | • | | the amount of time required for us to invest the funds received in the Public Offering; |

| | • | | our operating and interest expenses; |

| | • | | the amount of distributions or dividends received by us from our indirect real estate investments; |

| | • | | our ability to keep our properties occupied; |

| | • | | our ability to maintain or increase rental rates; |

| | • | | construction defects or capital improvements; |

| | • | | capital expenditures and reserves for such expenditures; |

| | • | | the issuance of additional shares; and |

| | • | | financings and refinancings. |

The following shows our cash distributions and the sources of such distributions for the six months ended June 30, 2016 (no cash distributions were paid for the six months ended June 30, 2015):

| | | | | | | | |

| | | Six Months Ended

June 30, 2016 | |

Distributions paid in cash — common stockholders | | $ | 142,276 | | | | | |

Distributions paid in cash — Operating Partnership unitholders | | | 2,662 | | | | | |

Distributions paid in cash — preferred unitholders | | | 652,154 | | | | | |

Distributions reinvested | | | 329,022 | | | | | |

| | | | | | | | |

Total distributions | | $ | 1,126,114 | | | | | |

| | | | | | | | |

Source of distributions | | | | | | | | |

Cash flows provided by operations | | $ | — | | | | — | |

Offering proceeds from Primary Offering | | | 797,092 | | | | 70.8 | % |

Offering proceeds from distribution reinvestment plan | | | 329,022 | | | | 29.2 | % |

| | | | | | | | |

Total sources | | $ | 1,126,114 | | | | 100.0 | % |

| | | | | | | | |

From our inception through June 30, 2016, we paid cumulative distributions of approximately $2.4 million (including approximately $1.9 million related to our preferred unitholders), as compared to cumulative net loss attributable to our common stockholders of approximately $11.1 million. For the six months ended June 30, 2016, we paid distributions of approximately $1.1 million, as compared to a net loss attributable to our common stockholders of approximately $3.8 million. Net loss attributable to our common stockholders for the six months ended June 30, 2016 reflects non-cash depreciation and amortization of approximately $2.1 million, acquisition related expenses of approximately $0.7 million, and distributions to preferred unitholders of approximately $1.0 million. Cumulative net loss attributable to our common stockholders reflects non-cash depreciation and amortization of approximately $4.8 million, acquisition related expenses of approximately $2.4 million, and distributions to preferred unitholders of approximately $3.3 million.

For the six months ended June 30, 2016, we paid total distributions of approximately $1.1 million. For the six months ended June 30, 2015, we declared no cash distributions on our common stock. From our commencement of paying cash distributions on our common shares in November 2015 through June 30, 2016, the payment of distributions has been paid solely from Public Offering proceeds. We must distribute to our

19