Second Quarter Update Strategic Storage Growth Trust, Inc. H. Michael Schwartz – Founder, Chairman & CEO Exhibit 99.1

Disclaimer & Risk Factors This investor presentation may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. These risks, uncertainties and contingencies include, but are not limited to: uncertainties relating to changes in general economic and real estate conditions; uncertainties relating to the implementation of our real estate investment strategy; uncertainties relating to financing availability and capital proceeds; uncertainties relating to the closing of property acquisitions; uncertainties related to the timing and availability of distributions; and other risk factors as outlined in the Company’s public filings with the Securities and Exchange Commission. This is neither an offer nor a solicitation to purchase securities. See our Form 10-K and recent Form 10-Q for specific risks associated with Strategic Storage Growth Trust, Inc. As of June 30, 2018, our accumulated deficit was approximately $18.4 million, and we anticipate that our operations may not be profitable in 2018. We have paid distributions from sources other than our cash flows from operations, including from the net proceeds of our public offering. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions. For the years ended December 31, 2014 and 2015, we funded 100% of our distributions using proceeds from our offering. For the year ended December 31, 2016, the payment of distributions was paid 4.1% from cash flows from operations and 95.9% from offering proceeds. For the year ended December 31, 2017, the payment of distributions was paid 25.1% from cash flows from operations and 74.9% from offering proceeds. For the six months ended June 30, 2018, the payment of distributions was paid 27.2% from cash flows from operations and 72.8% from offering proceeds. If we continue to pay distributions from sources other than cash flows from operations, we will have fewer funds available for acquiring properties, which may reduce our stockholders’ overall returns. Additionally, to the extent distributions exceed cash flows from operations, a stockholder’s basis in our stock may be reduced and, to the extent distributions exceed a stockholder’s basis, the stockholder may recognize a capital gain. No public market currently exists for shares of our common stock and there may never be one; therefore it will be difficult for our stockholders to sell their shares. If you sell your shares, it will likely be at a substantial discount. Our charter does not require us to pursue a liquidity transaction at any time. We may only calculate the value per share for our shares annually and, therefore, you may not be able to determine the net asset value of your shares on an ongoing basis. We cannot assure our stockholders that we will be successful in the marketplace. We may be unable to pay or maintain cash distributions over time. We have no employees and are dependent on our advisor to select investments and conduct our operations, and there is no guarantee that our advisor will devote adequate time or resources to us. There are substantial conflicts of interest among us and our sponsor, advisor, property manager, and dealer manager. Our advisor will face conflicts of interest relating to the purchase of properties, including conflicts with Strategic Storage Trust II, Inc. and Strategic Storage Trust IV, Inc., and such conflicts may not be resolved in our favor, which could adversely affect our investment opportunities. We will pay substantial fees and expenses to our advisor and its affiliates for the services they provide to us, which will reduce cash available for investment and distribution. We may be required to pay our advisor a significant distribution if our advisory agreement is involuntarily terminated. We may incur substantial debt, which could hinder our ability to pay distributions to our stockholders or could decrease the value of your investment. We may fail to qualify as a REIT, which could adversely affect our operations and our ability to make distributions. Our board of directors may change any of our investment objectives without stockholder consent.

Additional Information Regarding NOI, FFO & MFFO Funds from Operations (“FFO”) and Modified Funds from Operations (“MFFO”) Due to certain unique operating characteristics of real estate companies, the National Association of Real Estate Investment Trusts, or NAREIT, an industry trade group, has promulgated a measure known as funds from operations, or FFO, which SSGT believes to be an appropriate supplemental measure to reflect the operating performance of a REIT. The use of FFO is recommended by the REIT industry as a supplemental performance measure. FFO is not equivalent to SSGT’s net income (loss) as determined under GAAP. SSGT defines FFO, a non-GAAP measure, consistent with the standards established by the White Paper on FFO approved by the Board of Governors of NAREIT, as revised in February 2004, or the White Paper. The White Paper defines FFO as net income (loss) computed in accordance with GAAP, excluding gains or losses from sales of property and asset impairment write downs, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect FFO on the same basis. SSGT’s FFO calculation complies with NAREIT’s policy described above. The historical accounting convention used for real estate assets requires straight-line depreciation of buildings and improvements, which implies that the value of real estate assets diminishes predictably over time. Diminution in value may occur if such assets are not adequately maintained or repaired and renovated as required by relevant circumstances or other measures necessary to maintain the assets are not undertaken. However, SSGT believes that, since real estate values historically rise and fall with market conditions, including inflation, interest rates, the business cycle, unemployment and consumer spending, presentations of operating results for a REIT using historical accounting for depreciation may be less informative. In addition, in the determination of FFO, SSGT believes it is appropriate to disregard impairment charges, as this is a fair value adjustment that is largely based on market fluctuations and assessments regarding general market conditions which can change over time. An asset will only be evaluated for impairment if certain impairment indications exist and if the carrying value, or book value, exceeds the total estimated undiscounted future cash flows (including net rental revenues, net proceeds on the sale of the property, and any other ancillary cash flows at a property or group level under GAAP) from such asset. Testing for impairment is a continuous process and is analyzed on a quarterly basis. Investors should note, however, that determinations of whether impairment charges have been incurred are based partly on anticipated operating performance, because estimated undiscounted future cash flows from a property, including estimated future net rental revenues, net proceeds on the sale of the property, and certain other ancillary cash flows, are taken into account in determining whether an impairment charge has been incurred. While impairment charges are excluded from the calculation of FFO as described above, investors are cautioned that due to the fact that impairments are based on estimated future undiscounted cash flows and that SSGT intends to have a relatively limited term of its operations; it could be difficult to recover any impairment charges through the eventual sale of the property. To date, SSGT has not recognized any impairments. Historical accounting for real estate involves the use of GAAP. Any other method of accounting for real estate such as the fair value method cannot be construed to be any more accurate or relevant than the comparable methodologies of real estate valuation found in GAAP. Nevertheless, SSGT believes that the use of FFO, which excludes the impact of real estate related depreciation and amortization and impairments, assists in providing a more complete understanding of its performance to investors and to its management, and when compared year over year, reflects the impact on SSGT’s operations from trends in occupancy rates, rental rates, operating costs, general and administrative expenses, and interest costs, which may not be immediately apparent from net income (loss). However, FFO or modified funds from operations (“MFFO”), discussed below, should not be construed to be more relevant or accurate than the current GAAP methodology in calculating net income (loss) or in its applicability in evaluating SSGT’s operating performance. The method utilized to evaluate the value and performance of real estate under GAAP should be considered a more relevant measure of operational performance and is, therefore, given more prominence than the non-GAAP FFO and MFFO measures and the adjustments to GAAP in calculating FFO and MFFO. Changes in the accounting and reporting rules under GAAP that were put into effect and other changes to GAAP accounting for real estate subsequent to the establishment of NAREIT’s definition of FFO have prompted an increase in cash-settled expenses, specifically acquisition fees and expenses. Prior to January 1, 2018, when SSGT adopted new accounting guidance, such costs were entirely expensed as operating expenses under GAAP. Subsequent to January 1, 2018, certain of such costs continue to be expensed, albeit to a much lesser extent. SSGT believes these fees and expenses do not affect its overall long-term operating performance.

Additional Information Regarding NOI, FFO & MFFO Publicly registered, non-traded REITs typically have a significant amount of acquisition activity and are substantially more dynamic during their initial years of investment and operation. The purchase of properties, and the corresponding expenditures associated with that process, is a key feature of SSGT’s business plan in order to generate operational income and cash flow in order to make distributions to investors. While other start-up entities may also experience significant acquisition activity during their initial years, SSGT believes that publicly registered, non-traded REITs are unique in that they typically have a limited life with targeted exit strategies within a relatively limited time frame after the acquisition activity ceases. As disclosed in the prospectus for SSGT’s offering, SSGT has used the proceeds raised in its offering, including under its distribution reinvestment plan, to acquire properties and SSGT expects to begin the process of achieving a liquidity event (i.e., listing of its shares of common stock on a national securities exchange, a merger or sale, the sale of all or substantially all of its assets, or another similar transaction) within three to five years after the completion of its offering, which is generally comparable to other publicly registered, non traded REITs. Thus, SSGT does not intend to continuously purchase assets and intends to have a limited life. The decision whether to engage in any liquidity event is in the sole discretion of the board of directors of SSGT. Due to the above factors and other unique features of publicly registered, non traded REITs, the Investment Program Association, or the IPA, an industry trade group, has standardized a measure known as MFFO, which the IPA has recommended as a supplemental measure for publicly registered, non- traded REITs and which SSGT believes to be another appropriate supplemental measure to reflect the operating performance of a publicly registered, non-traded REIT having the characteristics described above. MFFO is not equivalent to SSGT’s net income (loss) as determined under GAAP, and MFFO may not be a useful measure of the impact of long-term operating performance on value if SSGT does not ultimately engage in a liquidity event. SSGT believes that, because MFFO excludes any acquisition fees and expenses that affect its operations only in periods in which properties are acquired and that SSGT considers more reflective of investing activities, as well as other non-operating items included in FFO, MFFO can provide, on a going-forward basis, an indication of the sustainability (that is, the capacity to continue to be maintained) of SSGT’s operating performance after the period in which it is acquiring properties and once its portfolio is in place. By providing MFFO, SSGT believes it is presenting useful information that assists investors and analysts to better assess the sustainability of its operating performance after its offering has been completed and its properties have been acquired. SSGT also believes that MFFO is a recognized measure of sustainable operating performance by the publicly registered, non- traded REIT industry. Further, SSGT believes MFFO is useful in comparing the sustainability of its operating performance after its offering and acquisitions are completed with the sustainability of the operating performance of other real estate companies that are not as involved in acquisition activities. Investors are cautioned that MFFO should only be used to assess the sustainability of SSGT’s operating performance after its offering has been completed and properties have been acquired, as it excludes any acquisition fees and expenses that have a negative effect on SSGT’s operating performance during the periods in which properties are acquired. SSGT defines MFFO, a non-GAAP measure, consistent with the IPA’s Guideline 2010-01, Supplemental Performance Measure for Publicly Registered, Non-Listed REITs: Modified Funds From Operations (the “Practice Guideline”) issued by the IPA in November 2010. The Practice Guideline defines MFFO as FFO further adjusted for the following items included in the determination of GAAP net income (loss): acquisition fees and expenses; amounts relating to straight line rents and amortization of above or below intangible lease assets and liabilities; accretion of discounts and amortization of premiums on debt investments; non-recurring impairments of real estate related investments; mark-to-market adjustments included in net income; non-recurring gains or losses included in net income from the extinguishment or sale of debt, hedges, foreign exchange, derivatives or securities holdings where trading of such holdings is not a fundamental attribute of the business plan, unrealized gains or losses resulting from consolidation from, or deconsolidation to, equity accounting, adjustments relating to contingent purchase price obligations included in net income, and after adjustments for consolidated and unconsolidated partnerships and joint ventures, with such adjustments calculated to reflect MFFO on the same basis. The accretion of discounts and amortization of premiums on debt investments, unrealized gains and losses on hedges, foreign exchange, derivatives or securities holdings, unrealized gains and losses resulting from consolidations, as well as other listed cash flow adjustments are adjustments made to net income (loss) in calculating cash flows from operations and, in some cases, reflect gains or losses which are unrealized and may not ultimately be realized. SSGT’s MFFO calculation complies with the IPA’s Practice Guideline described above. In calculating MFFO, SSGT excludes acquisition related expenses. The other adjustments included in the IPA’s Practice Guideline are not applicable to SSGT for the periods presented. Acquisition fees and expenses are paid in cash by SSGT, and it has not set aside or put into escrow any specific amount of proceeds from its offering to be used to fund acquisition fees and expenses. SSGT does not intend to fund acquisition fees and expenses in the future from operating revenues and cash flows, nor from the sale of properties and subsequent re-deployment of capital and concurrent incurring of acquisition fees and expenses.

Additional Information Regarding NOI, FFO & MFFO Acquisition fees and expenses include payments to SSGT’s advisor and third parties. Certain acquisition related expenses under GAAP are considered operating expenses and as expenses included in the determination of net income (loss) and income (loss) from continuing operations, both of which are performance measures under GAAP. All paid and accrued acquisition fees and expenses will have negative effects on returns to investors, the potential for future distributions, and cash flows generated by SSGT, unless earnings from operations or net sales proceeds from the disposition of other properties are generated to cover the purchase price of the property, these fees and expenses and other costs related to such property. In the future, if SSGT is not able to raise additional proceeds from its offering, this could result in SSGT paying acquisition fees or reimbursing acquisition expenses due to its advisor, or a portion thereof, with net proceeds from borrowed funds, operational earnings or cash flows, net proceeds from the sale of properties, or ancillary cash flows. As a result, the amount of proceeds available for investment and operations would be reduced, or SSGT may incur additional interest expense as a result of borrowed funds. Further, under GAAP, certain contemplated non-cash fair value and other non-cash adjustments are considered operating non-cash adjustments to net income (loss) in determining cash flows from operations. In addition, SSGT views fair value adjustments of derivatives and the amortization of fair value adjustments related to debt as items which are unrealized and may not ultimately be realized or as items which are not reflective of on-going operations and are therefore typically adjusted for when assessing operating performance. SSGT uses MFFO and the adjustments used to calculate it in order to evaluate its performance against other publicly registered, non-traded REITs which intend to have limited lives with short and defined acquisition periods and targeted exit strategies shortly thereafter. As noted above, MFFO may not be a useful measure of the impact of long-term operating performance if SSGT does not continue to operate in this manner. SSGT believes that its use of MFFO and the adjustments used to calculate it allow it to present its performance in a manner that reflects certain characteristics that are unique to publicly registered, non-traded REITs, such as their limited life, limited and defined acquisition period and targeted exit strategy, and hence that the use of such measures may be useful to investors. For example, acquisition fees and expenses are intended to be funded from the proceeds of SSGT’s offering and other financing sources and not from operations. By excluding expensed acquisition fees and expenses, the use of MFFO provides information consistent with management’s analysis of the operating performance of the properties. Additionally, fair value adjustments, which are based on the impact of current market fluctuations and underlying assessments of general market conditions, but can also result from operational factors such as rental and occupancy rates, may not be directly related or attributable to SSGT’s current operating performance. By excluding such charges that may reflect anticipated and unrealized gains or losses, SSGT believes MFFO provides useful supplemental information. Presentation of this information is intended to provide useful information to investors as they compare the operating performance of different REITs, although it should be noted that not all REITs calculate FFO and MFFO the same way, so comparisons with other REITs may not be meaningful. Furthermore, FFO and MFFO are not necessarily indicative of cash flow available to fund cash needs and should not be considered as an alternative to net income (loss) or income (loss) from continuing operations as an indication of SSGT’s performance, as an alternative to cash flows from operations, which is an indication of SSGT’s liquidity, or indicative of funds available to fund SSGT’s cash needs including its ability to make distributions to its stockholders. FFO and MFFO should be reviewed in conjunction with other measurements as an indication of SSGT’s performance. MFFO may be useful in assisting management and investors in assessing the sustainability of operating performance in future operating periods, and in particular, after the offering and acquisition stages are complete. Neither the SEC, NAREIT, nor any other regulatory body has passed judgment on the acceptability of the adjustments that SSGT uses to calculate FFO or MFFO. In the future, the SEC, NAREIT or another regulatory body may decide to standardize the allowable adjustments across the publicly registered, non-traded REIT industry and SSGT would have to adjust its calculation and characterization of FFO or MFFO. Net Operating Income (“NOI”) NOI is a non-GAAP measure that SSGT defines as net income (loss), computed in accordance with GAAP, generated from properties before corporate general and administrative expenses, costs incurred in connection with the property management change, asset management fees, interest expense, depreciation, amortization, acquisition expenses and other non-property related expenses. SSGT believes that NOI (also referred to as property operating income) is useful for investors as it provides a measure of the operating performance of its operating assets because NOI excludes certain items that are not associated with the ongoing operation of the properties. Additionally, SSGT believes that NOI is a widely accepted measure of comparative operating performance in the real estate community. However, SSGT’s use of the term NOI may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount.

Strategic Storage Growth Trust, Inc. Develop Lease-Up / Certificate of Occupancy Redevelop / Expansion

Strategic Storage Growth Trust, Inc. Develop SmartStop® Self Storage – Phoenix, Arizona Lease-up – 75% or less occupancy, redevelop/expansion, develop Investment objectives(1) Future income needs Greater capital appreciation potential Modest leverage (between 55% and 65% loan to cost)(2) Geographic area – moderate to high density (top 100 MSAs) 3-5 year anticipated hold after completion of public offering(3) (1) There is no assurance that these objectives will be met. (2) Our charter limits borrowing to 75% of the cost of our assets. At times our leverage may be greater than 65%. See Part I, Item 1 of our Form 10-K for details of our borrowing policy. (3) The timing of our exit strategy is subject to market conditions and the discretion of our Board of Directors. There is no assurance that we will achieve one or more of the liquidity events we intend to seek within this time frame or at all. Ground up from vacant land Low cap rate environment promotes building Redevelop / Expansion Conversion to repurpose an existing building – typically an industrial building Additional rentable square feet to an existing self storage facility Lease-Up / Certificate of Occupancy Existing self storage facility management unable to boost occupancy Take over at Certificate of Occupancy (0%) and lease-up to stabilization

Strategic Storage Growth Trust, Inc. Institutional Management Economies of scale Institutional marketing platform Expense efficiencies Institutional hiring, training, and management

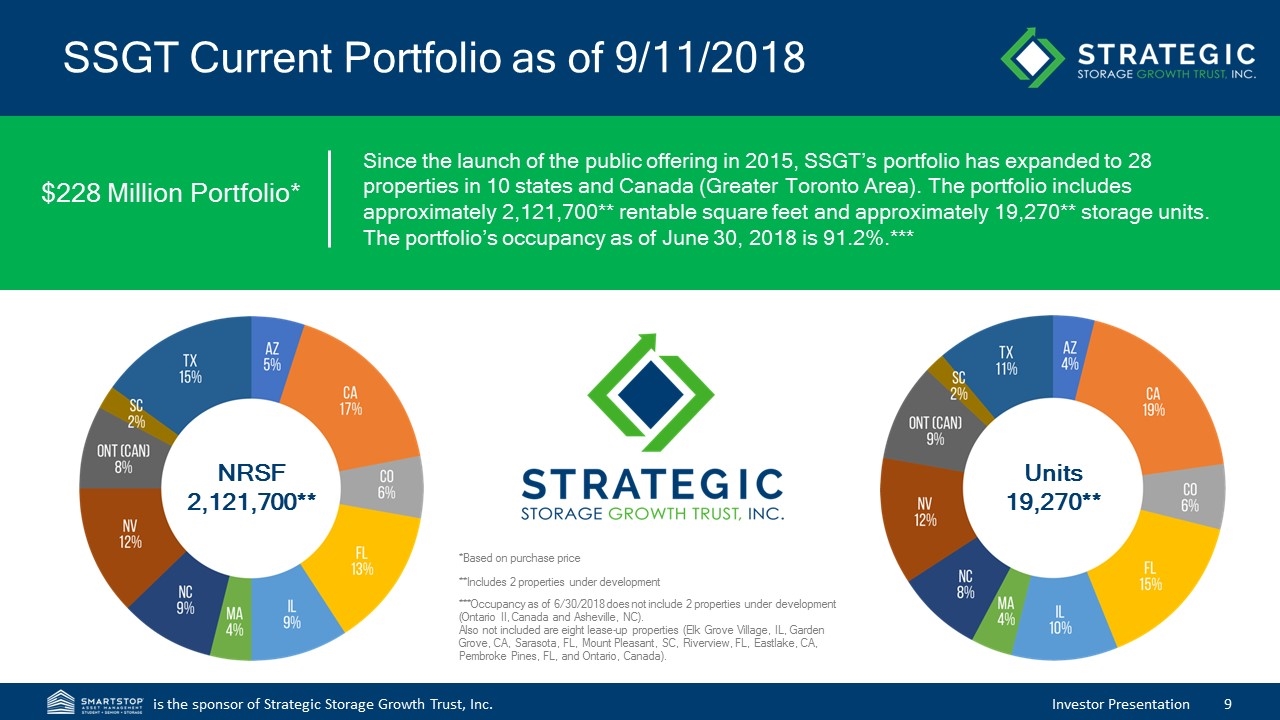

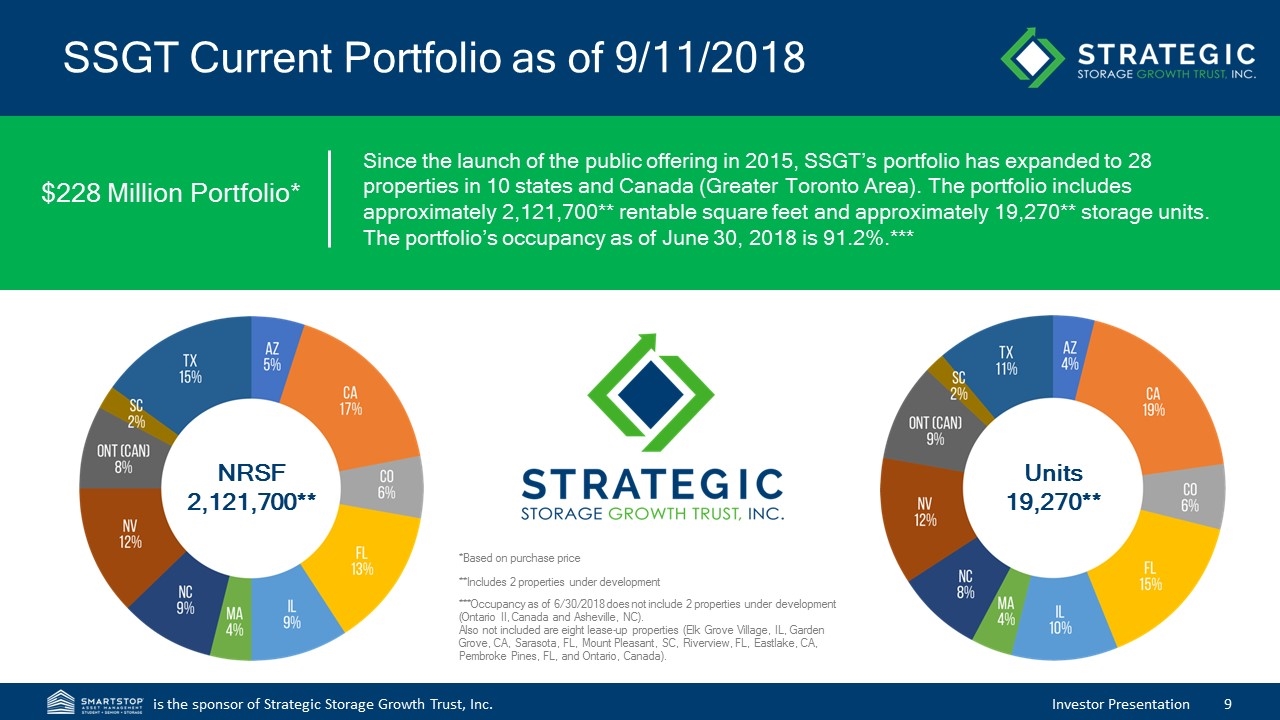

SSGT Current Portfolio as of 9/11/2018 $228 Million Portfolio* Since the launch of the public offering in 2015, SSGT’s portfolio has expanded to 28 properties in 10 states and Canada (Greater Toronto Area). The portfolio includes approximately 2,121,700** rentable square feet and approximately 19,270** storage units. The portfolio’s occupancy as of June 30, 2018 is 91.2%.*** *Based on purchase price NRSF 2,121,700** Units 19,270** ***Occupancy as of 6/30/2018 does not include 2 properties under development (Ontario II, Canada and Asheville, NC). Also not included are eight lease-up properties (Elk Grove Village, IL, Garden Grove, CA, Sarasota, FL, Mount Pleasant, SC, Riverview, FL, Eastlake, CA, Pembroke Pines, FL, and Ontario, Canada). **Includes 2 properties under development

Balance Sheet Chula Vista, California Loan-To-Value June 30, 2018 = 6%* *Based on acquisition cost Cash On Hand June 30, 2018 = $3 Million Credit Facility June 30, 2018 Availability = $41 Million

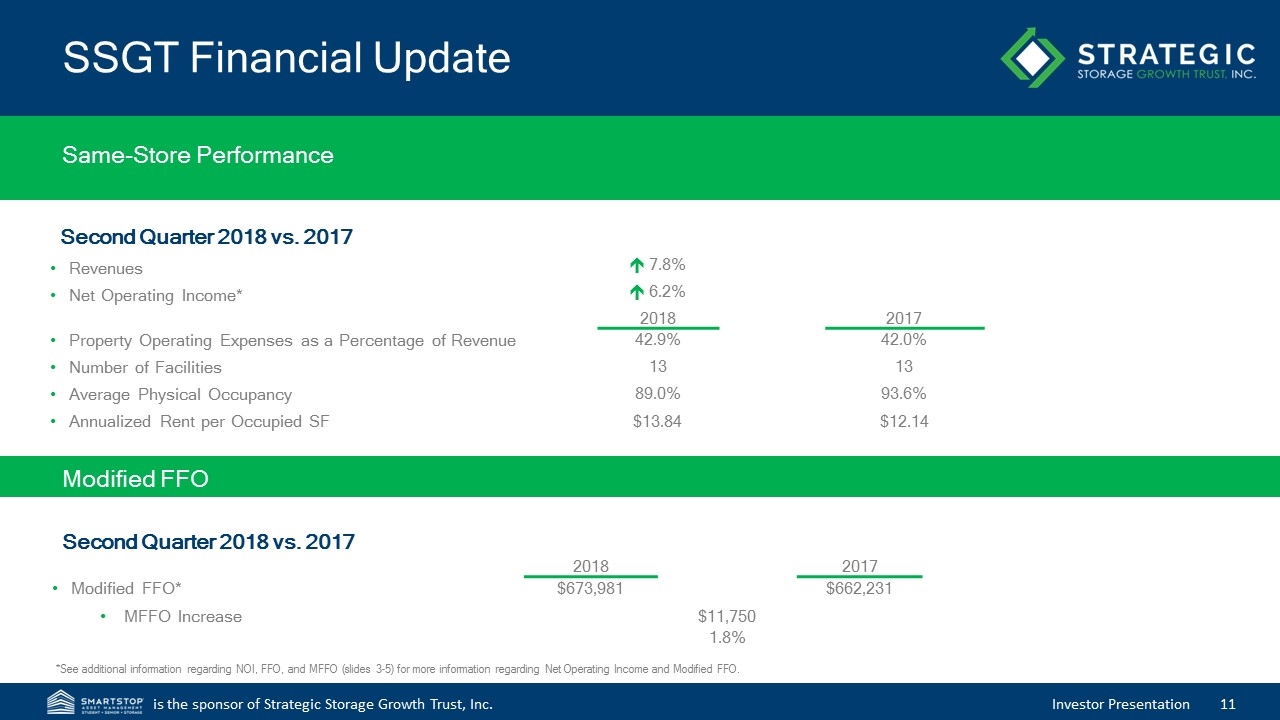

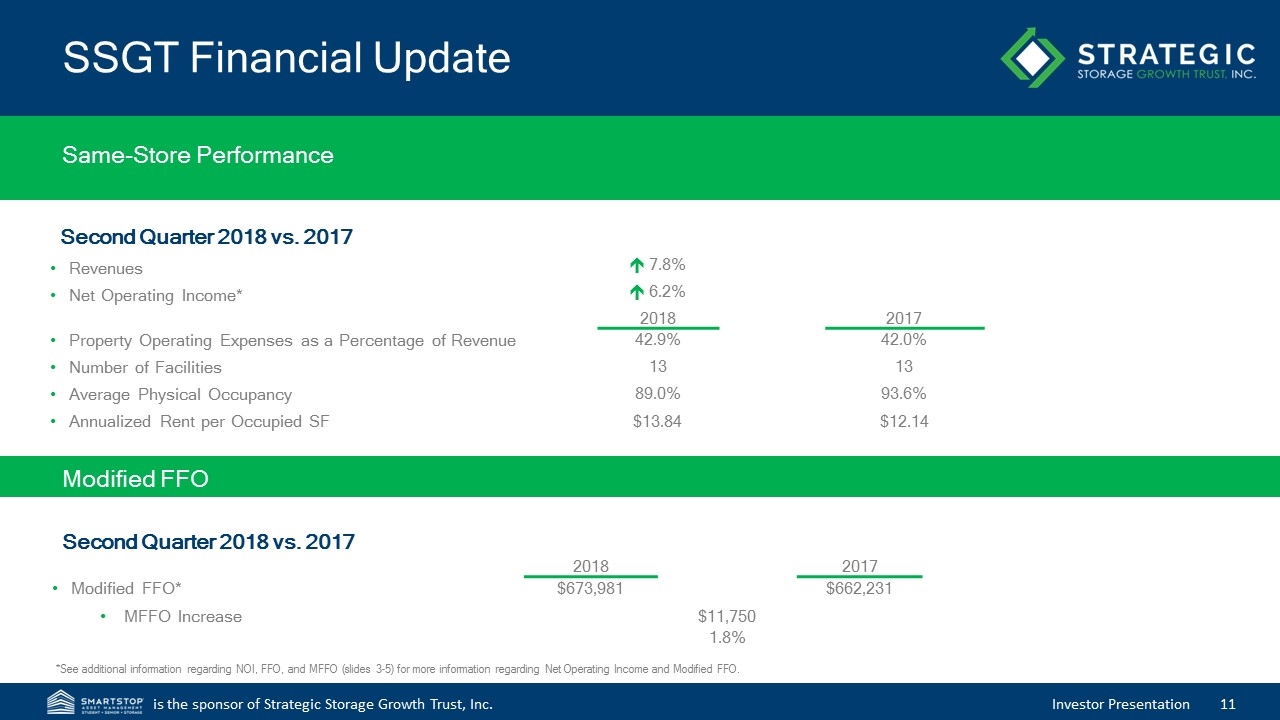

SSGT Financial Update Second Quarter 2018 vs. 2017 Revenues Net Operating Income* Property Operating Expenses as a Percentage of Revenue Number of Facilities Average Physical Occupancy Annualized Rent per Occupied SF Same-Store Performance é 7.8% é 6.2% 2018 2017 42.9% 42.0% 13 13 89.0% 93.6% $13.84 $12.14 *See additional information regarding NOI, FFO, and MFFO (slides 3-5) for more information regarding Net Operating Income and Modified FFO. Modified FFO* MFFO Increase Modified FFO Second Quarter 2018 vs. 2017 2018 2017 $673,981 $662,231 $11,750 1.8%

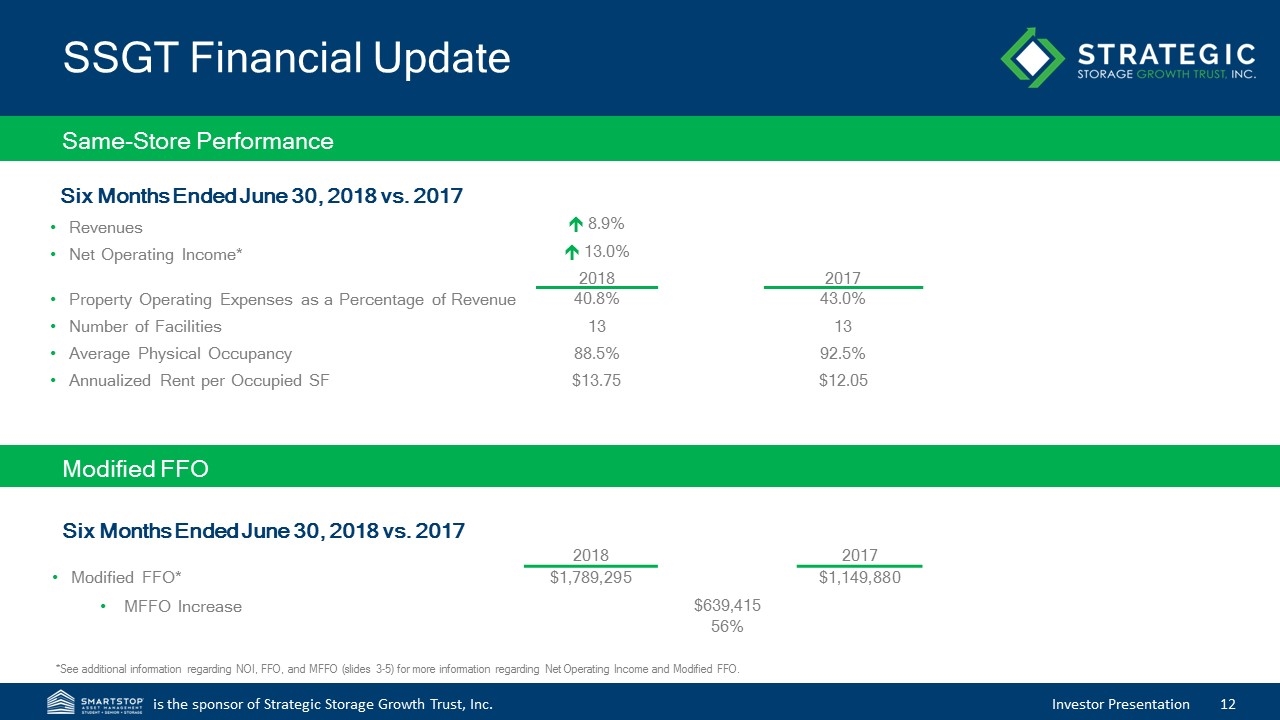

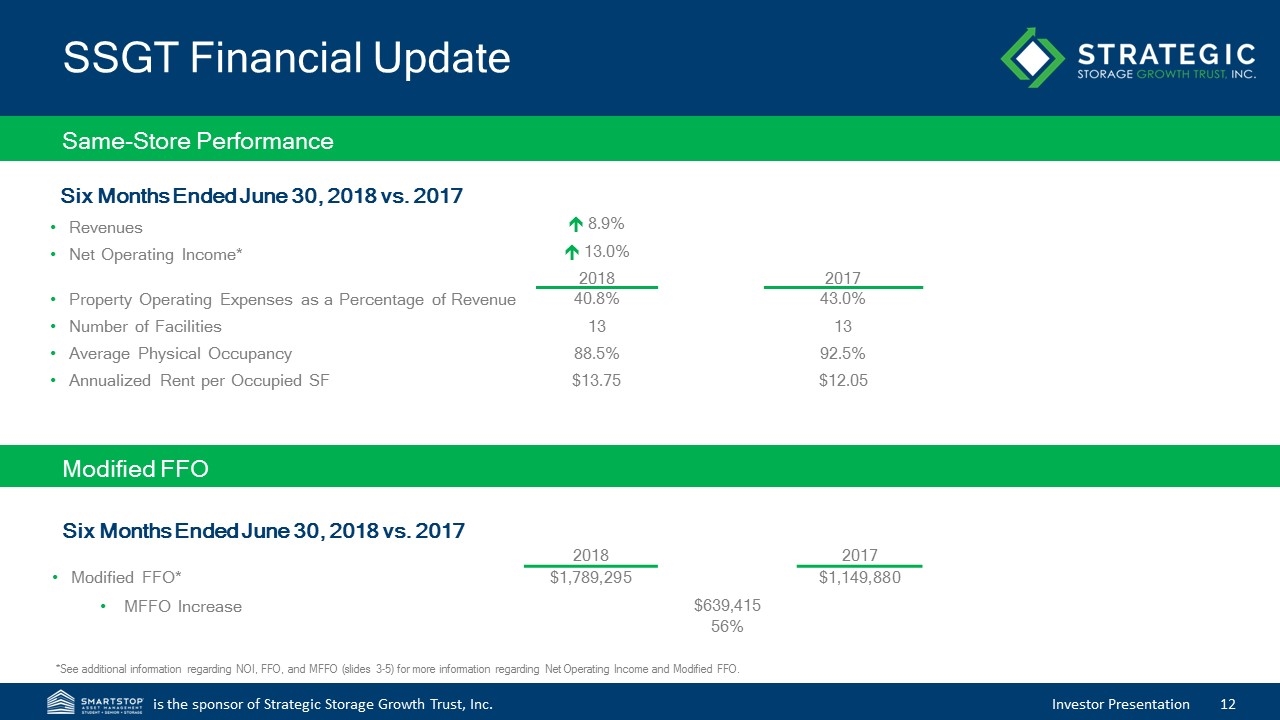

SSGT Financial Update Six Months Ended June 30, 2018 vs. 2017 Revenues Net Operating Income* Property Operating Expenses as a Percentage of Revenue Number of Facilities Average Physical Occupancy Annualized Rent per Occupied SF Same-Store Performance Modified FFO* MFFO Increase Modified FFO Six Months Ended June 30, 2018 vs. 2017 é 8.9% é 13.0% 2018 2017 40.8% 43.0% 13 13 88.5% 92.5% $13.75 $12.05 2018 2017 $1,789,295 $1,149,880 $639,415 56% *See additional information regarding NOI, FFO, and MFFO (slides 3-5) for more information regarding Net Operating Income and Modified FFO.

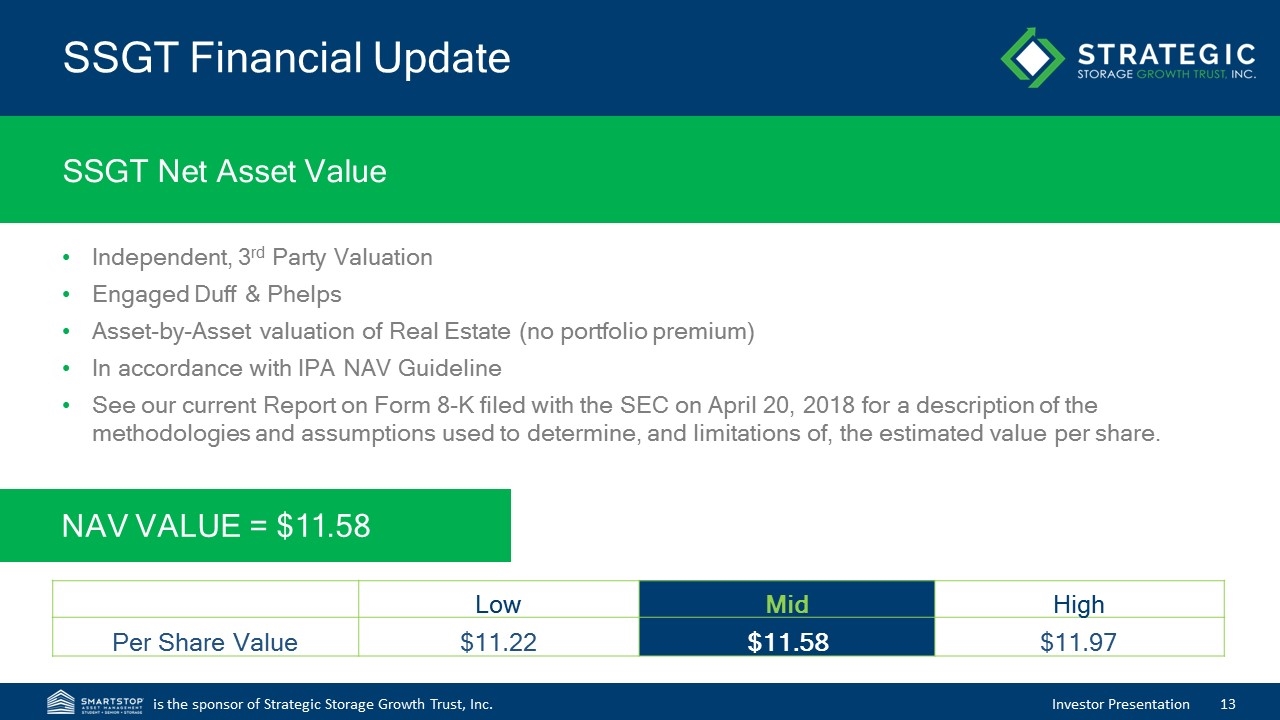

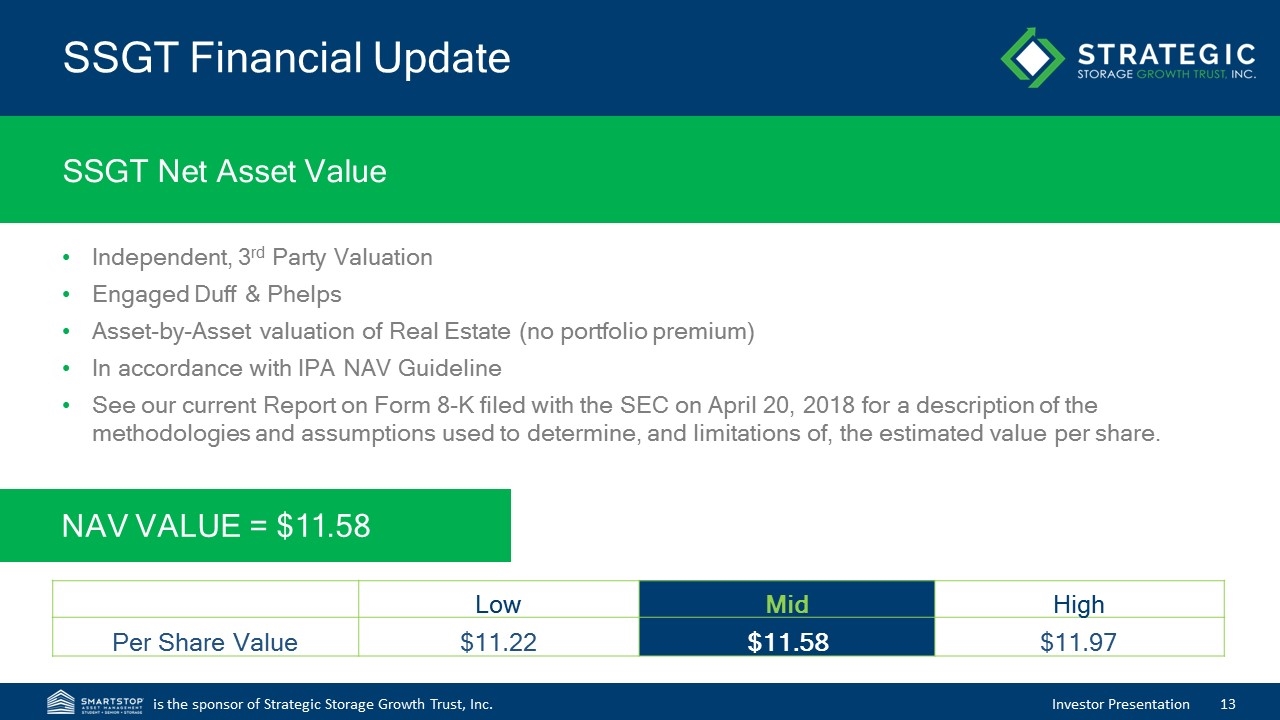

SSGT Financial Update SSGT Net Asset Value Independent, 3rd Party Valuation Engaged Duff & Phelps Asset-by-Asset valuation of Real Estate (no portfolio premium) In accordance with IPA NAV Guideline See our current Report on Form 8-K filed with the SEC on April 20, 2018 for a description of the methodologies and assumptions used to determine, and limitations of, the estimated value per share. NAV VALUE = $11.58 Low Mid High Per Share Value $11.22 $11.58 $11.97

SmartStop Self Storage – Property Management* *The SmartStop® Self Storage brand is owned by our sponsor, SmartStop Asset Management, LLC.

SmartStop Self Storage* – Branding Brand Awareness Strong, well-known brand name Brand protection Registered trademarks in U.S./Canada 125 U.S./Canadian domain names Processes in place to act upon potential brand infringement Store Branding Locations feature SmartStop signage and colors The SmartStop brand appears on: Moving supplies SmartStop website Advertising and marketing efforts Special events/team sponsorships Employee uniforms, name tags, etc. Flags, banners and printed materials *The SmartStop® Self Storage brand is owned by our sponsor, SmartStop Asset Management, LLC.

SmartStop Self Storage*– Website Website SmartStop.com State-of-the-art/responsive Multi-platform views Customer-intuitive user interface Full Integration Store operating system Reservation management system Call center Search engine optimization (SEO) Search engine marketing (SEM) / pay per click (PPC) campaigns Social media On-demand functionality with pricing and promotions *The SmartStop® Self Storage brand is owned by our sponsor, SmartStop Asset Management, LLC.

Recent Acquisition Pines Blvd. & SW 186th Avenue, Pembroke Pines, Florida 870 Units 84,000 NRSF *Occupancy number as of 6/30/2018 Acquired 2/1/18 Approx. 28% Occupancy*

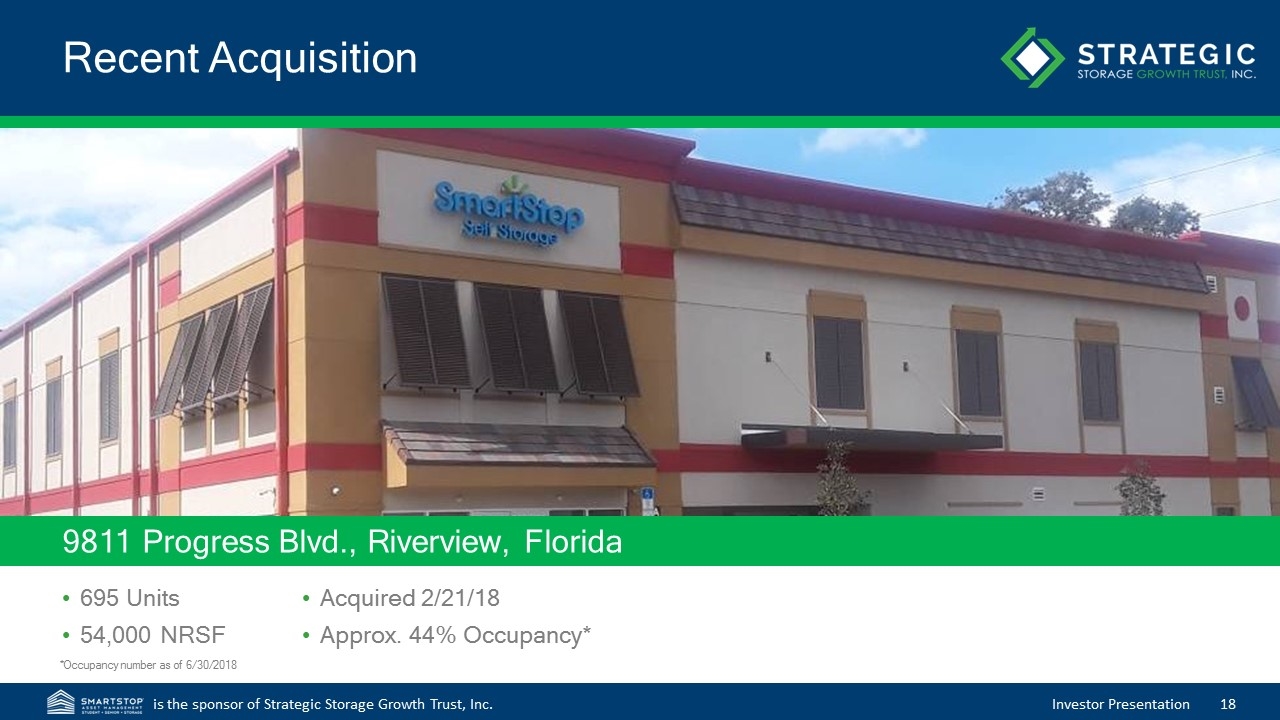

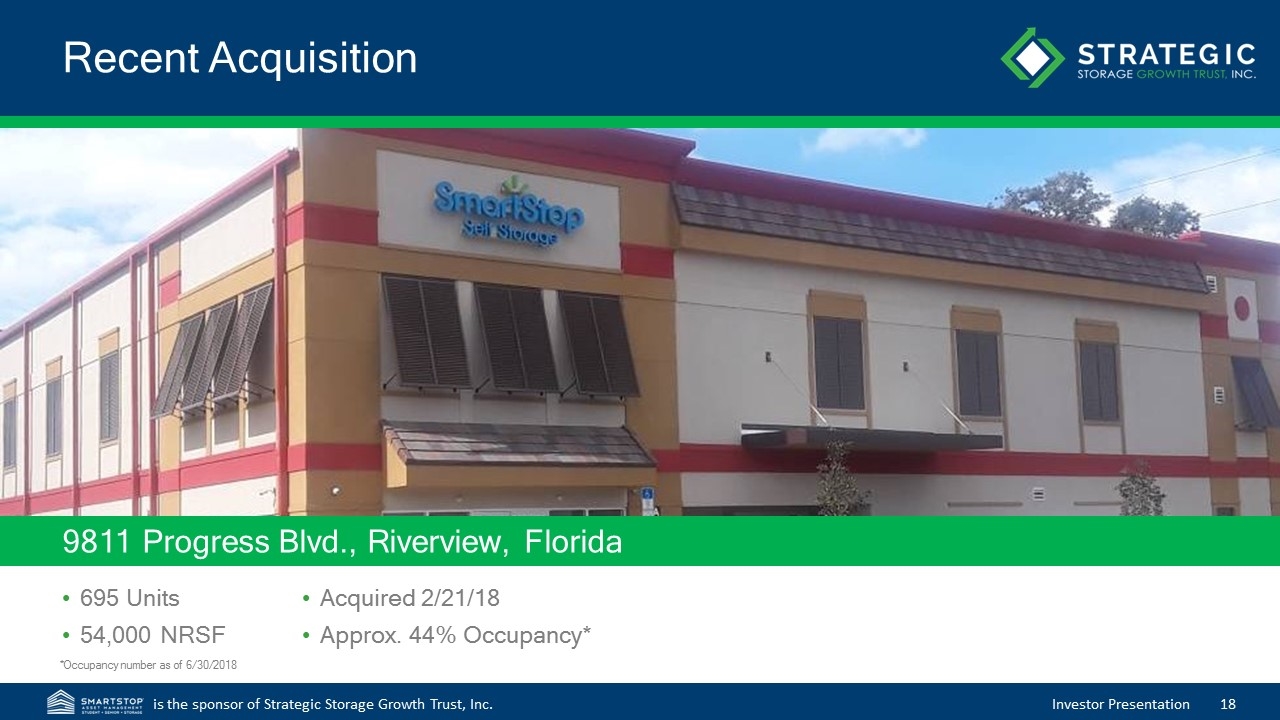

Recent Acquisition 9811 Progress Blvd., Riverview, Florida Acquired 2/21/18 Approx. 44% Occupancy* 695 Units 54,000 NRSF *Occupancy number as of 6/30/2018

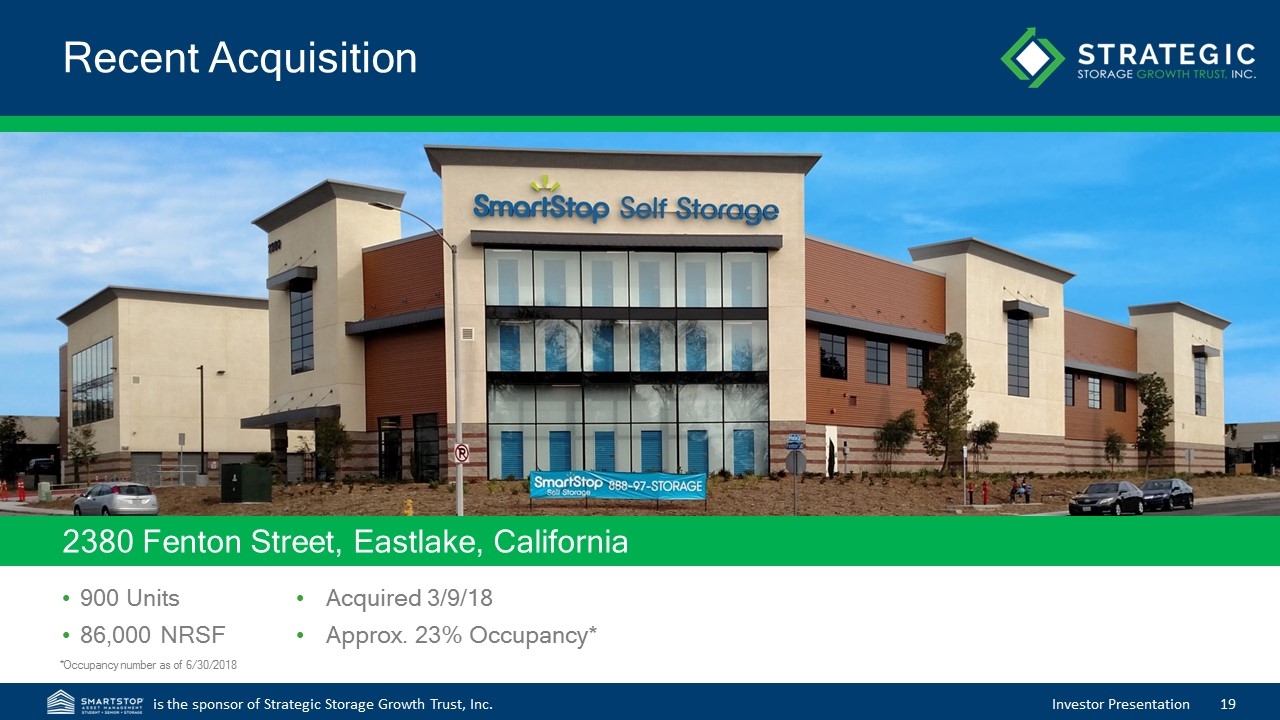

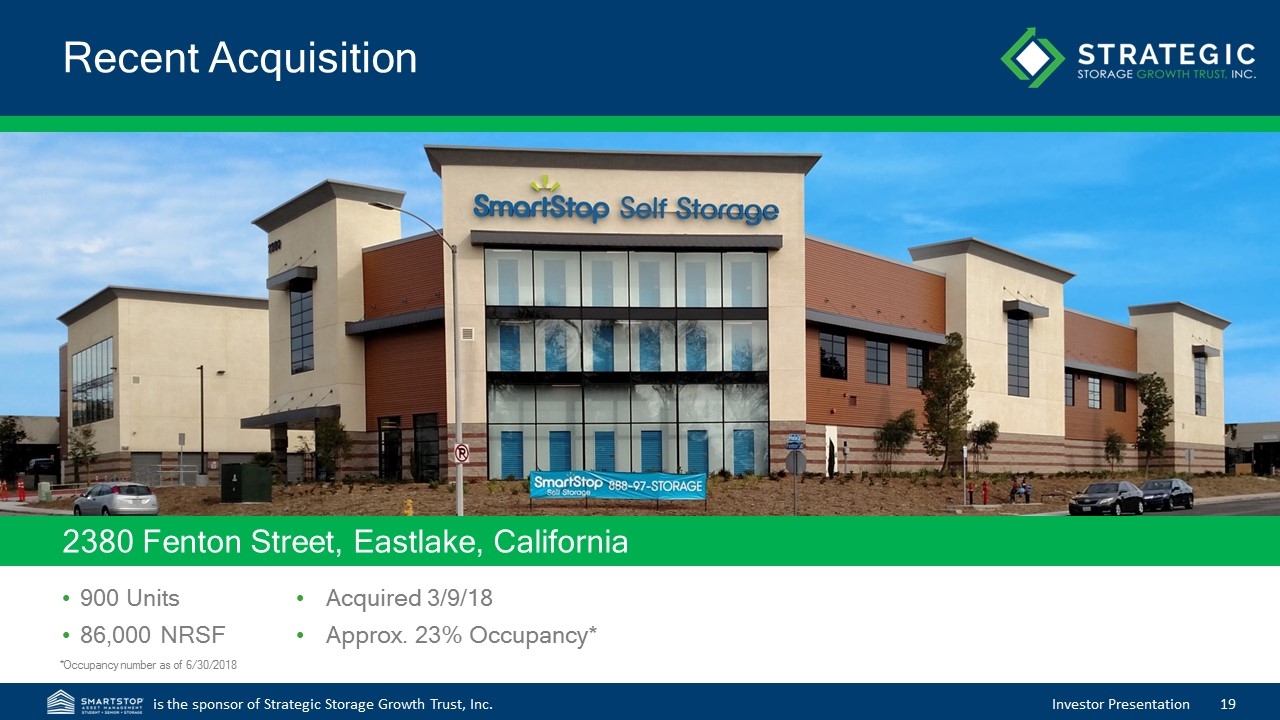

Recent Acquisition 2380 Fenton Street, Eastlake, California Acquired 3/9/18 Approx. 23% Occupancy* 900 Units 86,000 NRSF *Occupancy number as of 6/30/2018

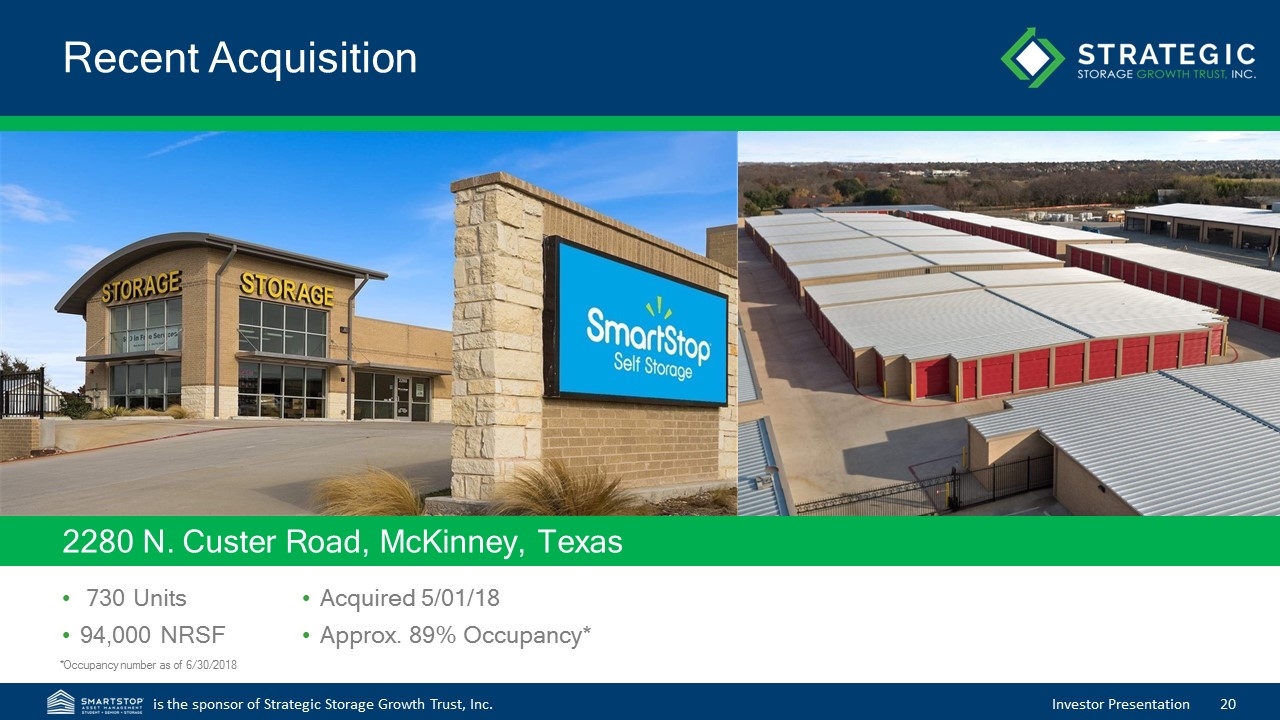

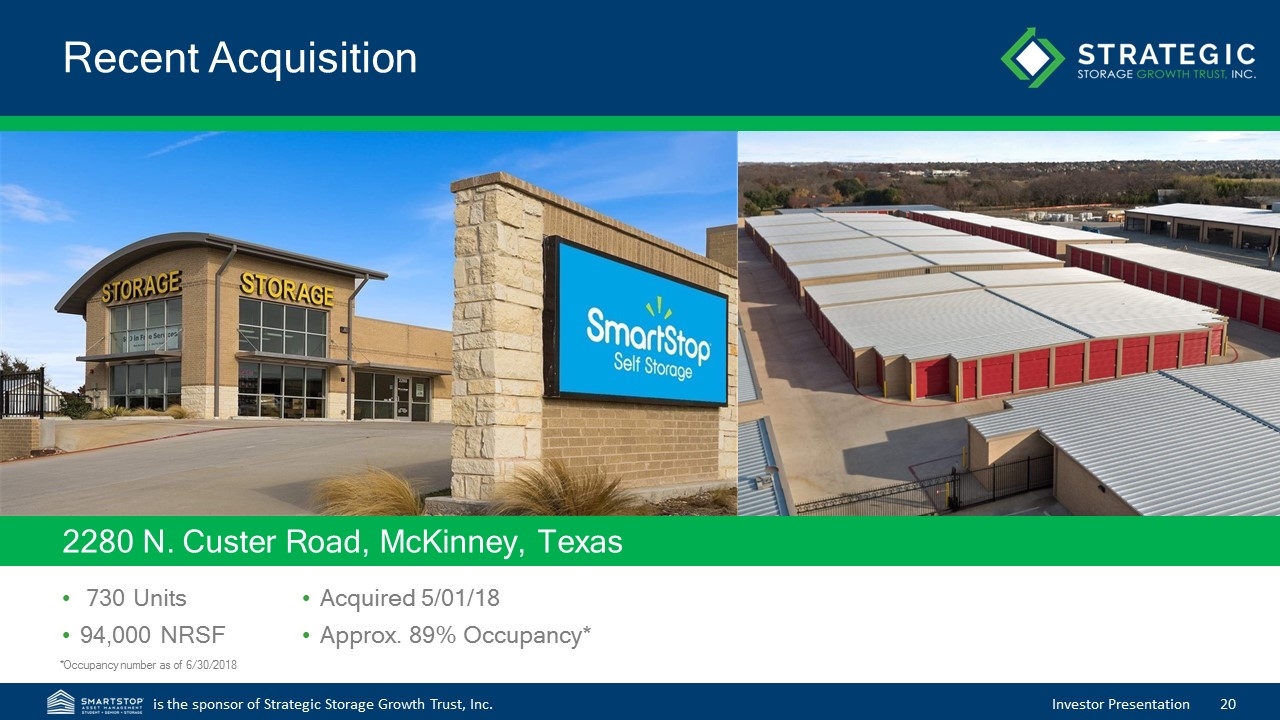

Recent Acquisition 2280 N. Custer Road, McKinney, Texas Acquired 5/01/18 Approx. 89% Occupancy* 730 Units 94,000 NRSF *Occupancy number as of 6/30/2018

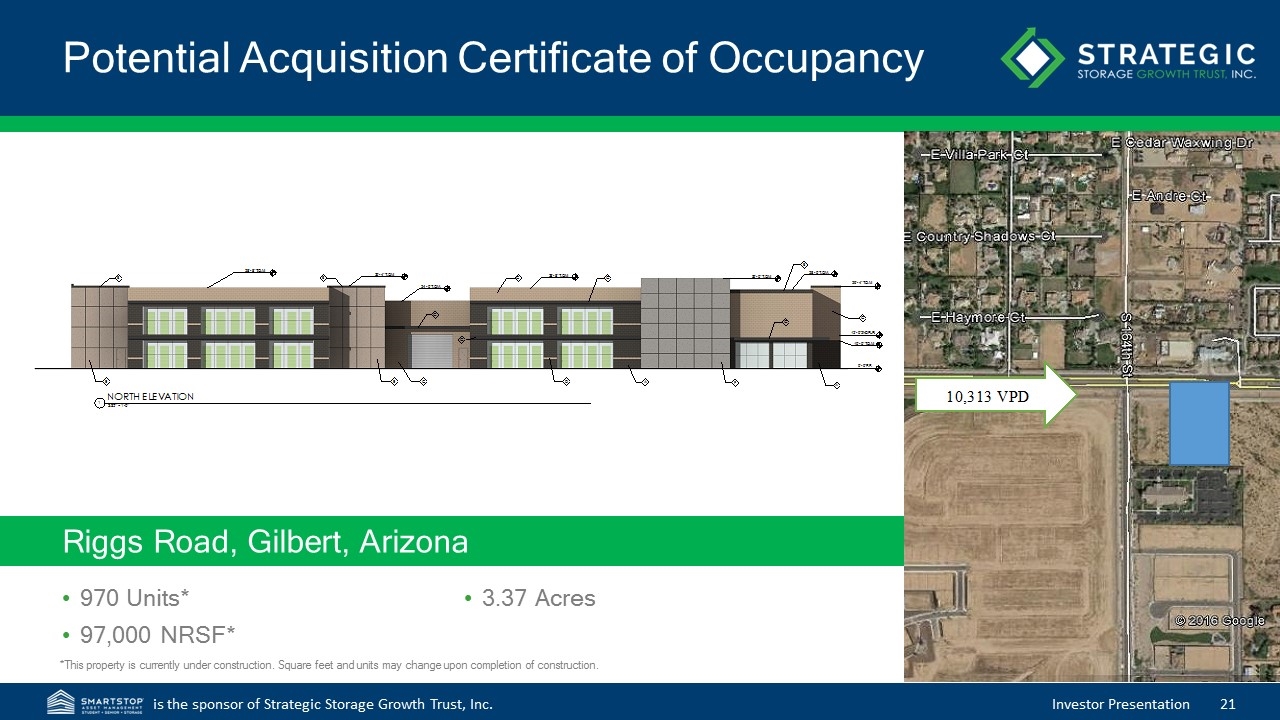

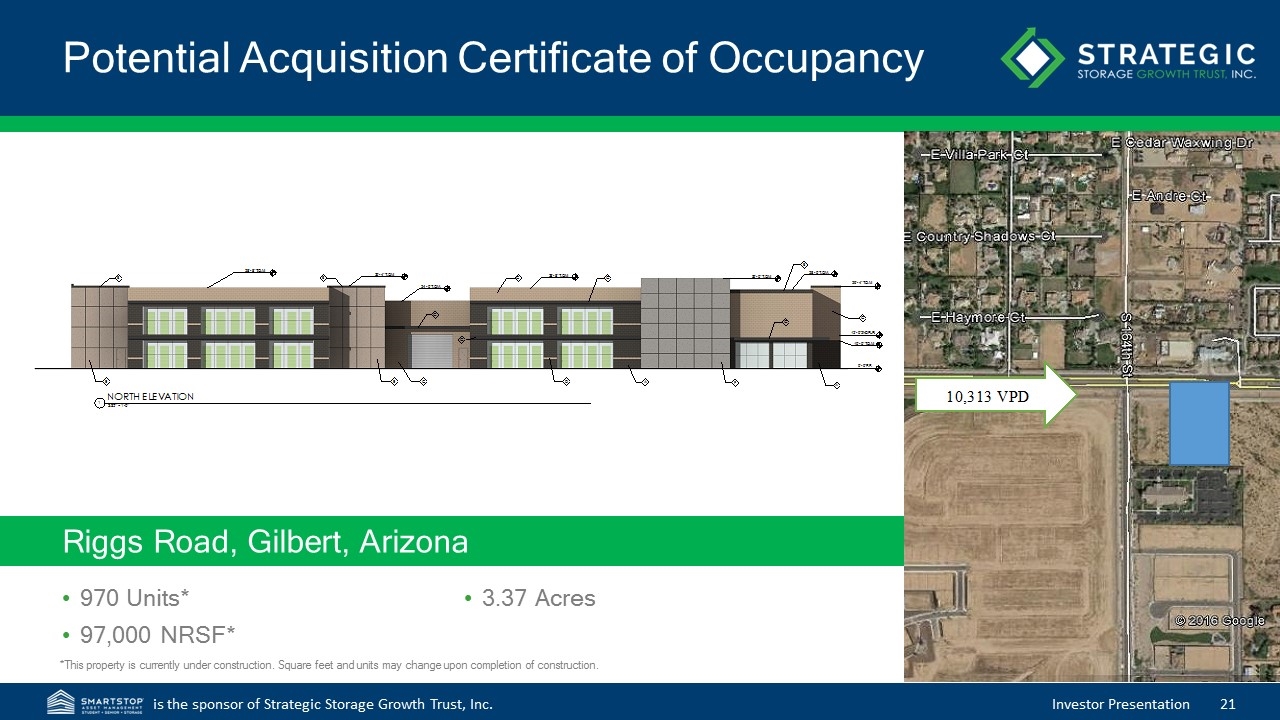

Potential Acquisition Certificate of Occupancy Riggs Road, Gilbert, Arizona 970 Units* 97,000 NRSF* 3.37 Acres *This property is currently under construction. Square feet and units may change upon completion of construction.

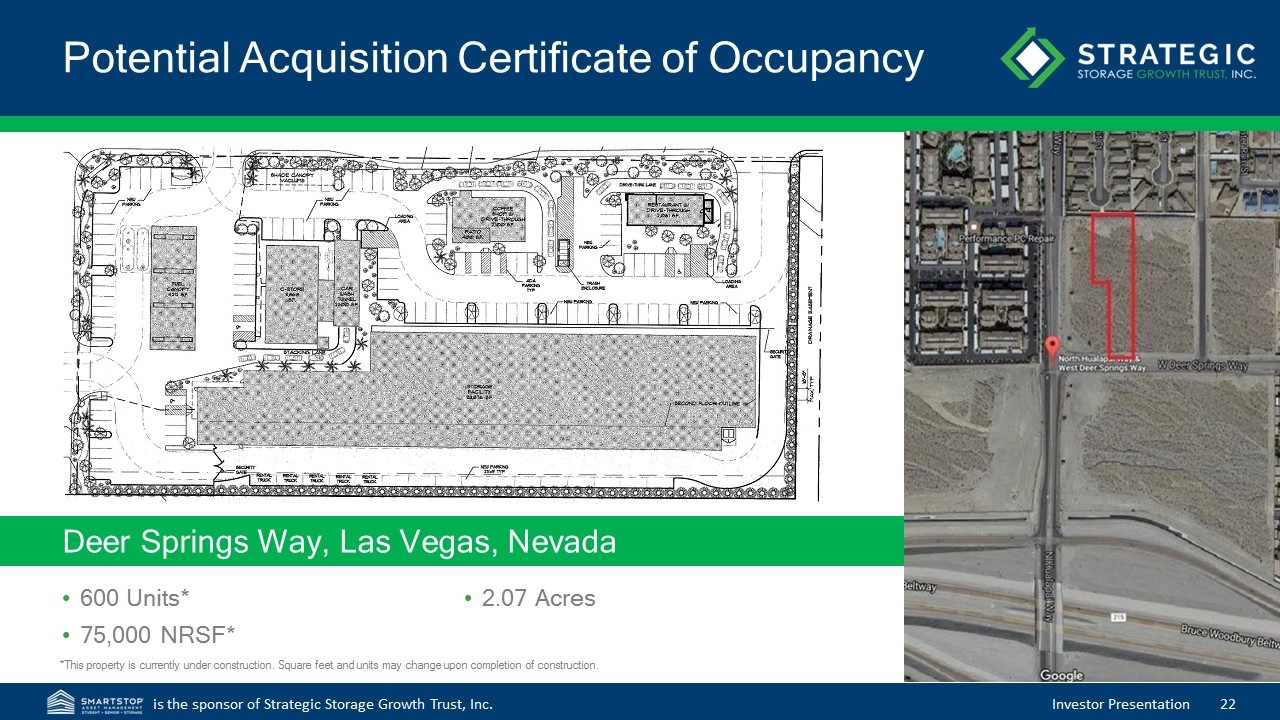

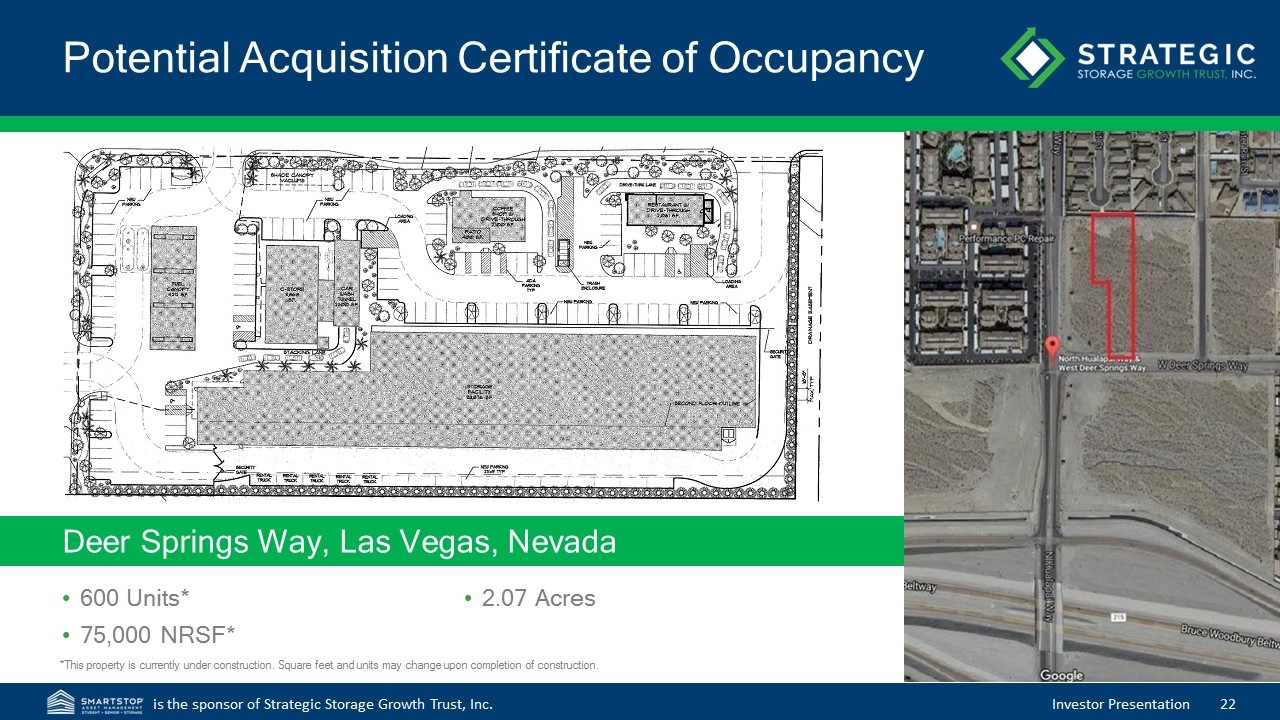

Potential Acquisition Certificate of Occupancy Deer Springs Way, Las Vegas, Nevada 600 Units* 75,000 NRSF* 2.07 Acres *This property is currently under construction. Square feet and units may change upon completion of construction.

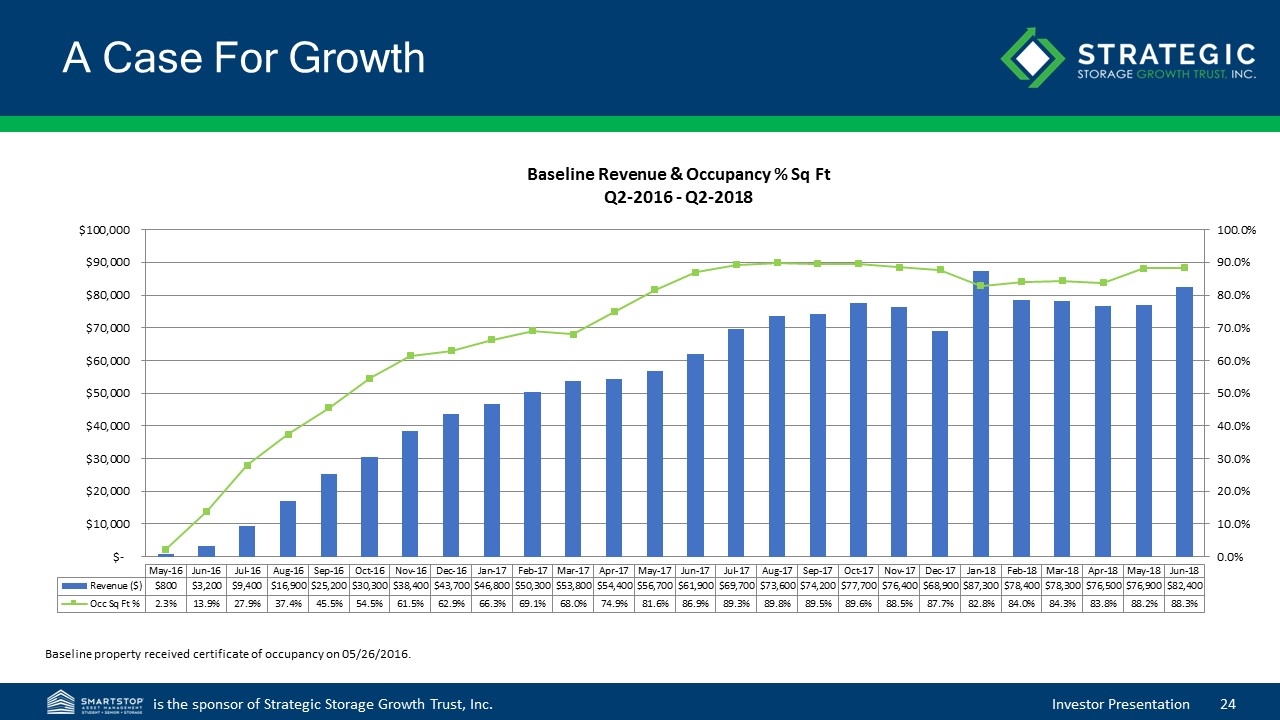

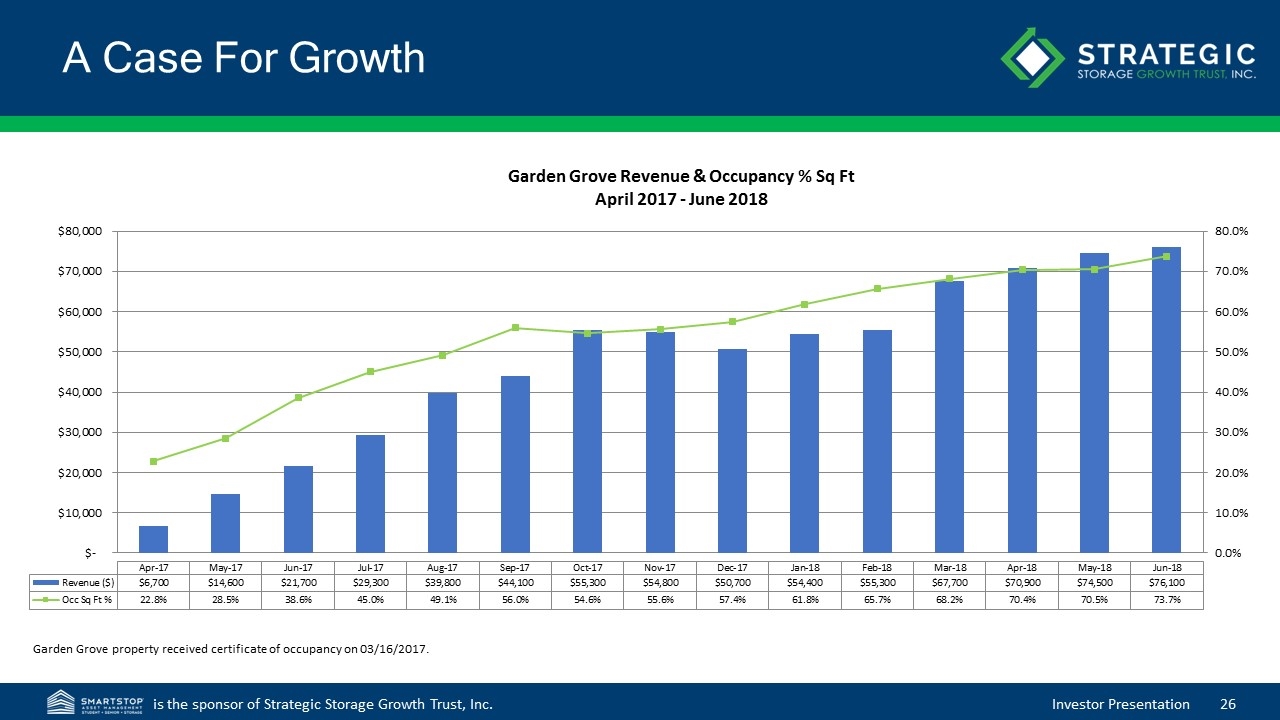

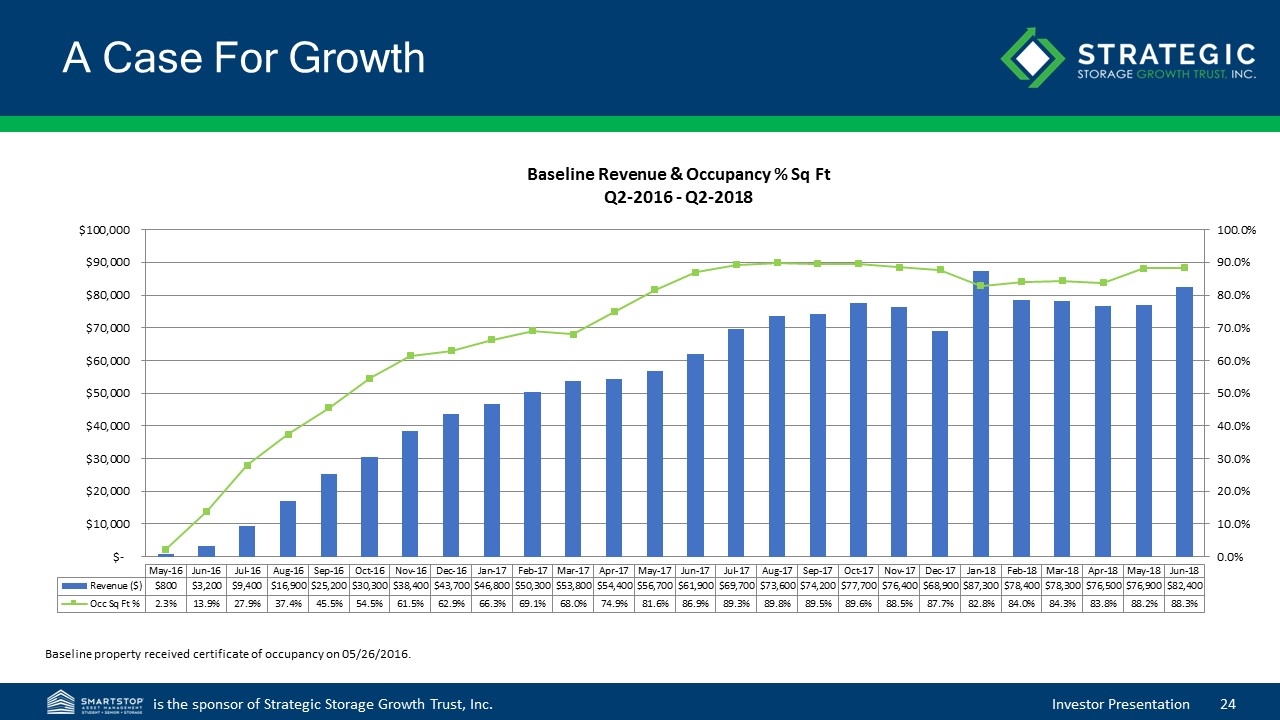

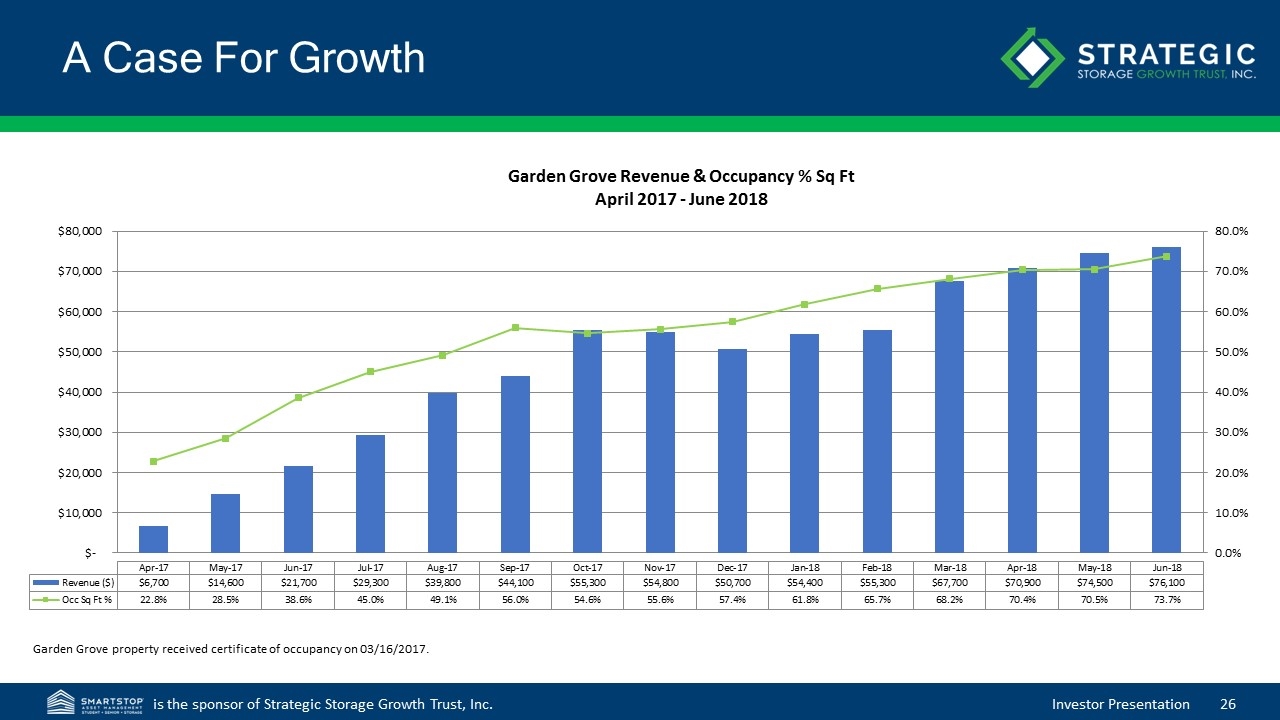

A Case For Growth

A Case For Growth

A Case For Growth

A Case For Growth

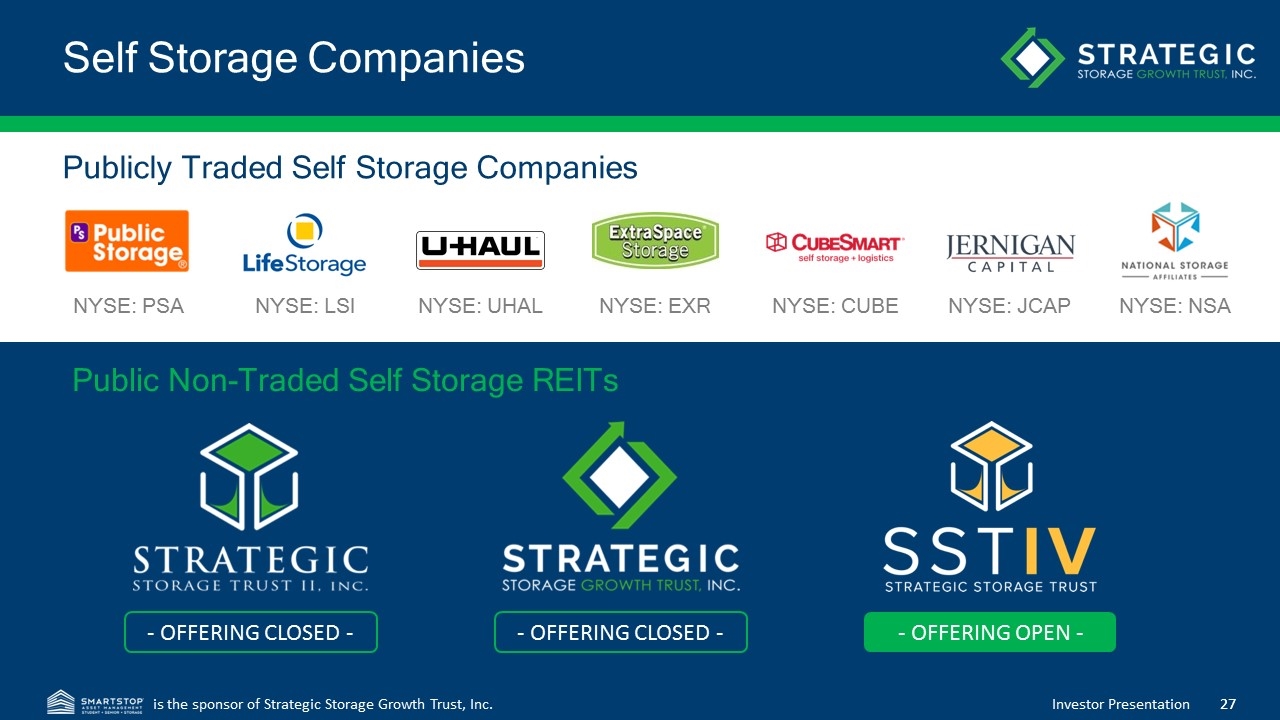

NYSE: EXR NYSE: PSA NYSE: CUBE NYSE: LSI NYSE: UHAL NYSE: JCAP NYSE: NSA Public Non-Traded Self Storage REITs - OFFERING CLOSED - - OFFERING CLOSED - - OFFERING OPEN - Publicly Traded Self Storage Companies Self Storage Companies

Questions?