- SFM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Sprouts Farmers Market (SFM) CORRESPCorrespondence with SEC

Filed: 3 Jul 13, 12:00am

Morgan, Lewis, & Bockius LLP

101 Park Avenue

New York, New York 10178

(212) 309-6000

July 3, 2013

United States Securities and Exchange Commission

Division of Corporation Finance

Washington, D.C. 20549

Attention: Mara L. Ransom

Assistant Director

| Re: | Sprouts Farmers Markets, LLC |

Registration Statement on Form S-1 (File No. 333-188493)

Dear Ms. Ransom:

On behalf of our client, Sprouts Farmers Markets, LLC (the “Company”), set forth below is the Company’s response to the letter dated June 27, 2013 (the “Comment Letter”) from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”), which relates to Amendment No. 1 to the Company’s Registration Statement on Form S-1, File No. 333-188493 (the “Registration Statement”) filed with the Commission on June 17, 2013 (the “First Amendment”). The Company is filing Amendment No. 2 to the Registration Statement (the “Second Amendment”), which includes revisions made to the Registration Statement in response to the Comment Letter, simultaneously with this letter.

The numbered paragraphs and headings below correspond to the headings set forth in the Comment Letter. Each of the Staff’s comments is set forth in bold, followed by the Company’s response to each comment. The page numbers in the bold captions refer to pages in the First Amendment, while the page numbers in the Company’s responses refer to page numbers in the Second Amendment. Capitalized terms used in this letter but not defined herein have the meaning given to such terms in the Second Amendment.

Selected Consolidated Historical and Pro Forma Financial and Other Data, page 43

Non-GAAP Reconciliation, page 48

| 1. | We note your response to comment 14 in our letter dated June 6, 2013. However, we believe your statement “that management believes these costs do not directly reflect the ongoing performance of our store operations” characterizes the charge in substance as non-recurring when in fact it is recurring. Please revise your statement to refrain from using wording such as “do not directly reflect ongoing performance” in describing the charge. |

Response:In response to this comment, the Company has revised footnote (d) on page 49 of the Second Amendment. A conforming change has also been made to footnote (d) on page 13 of the Second Amendment.

Notes to Unaudited Condensed Consolidated Statement of Operations, page 56

Note 2. Pro Forma for Sunflower Transaction, Adjustment (b), page 57

United States Securities and Exchange Commission

Division of Corporation Finance

July 3, 2013

Page 2

| 2. | We note your response to comment 15 in our letter dated June 6, 2013. Please explain to us why the long-lived assets’ impairment tests were appropriately performed during the pre-combination period using the apparent methodologies for assets classified as held and used while the tests were triggered by their corresponding sale transactions. Tell us whether these assets were classified as held for sale upon the expectation of the transactions during the pre-combination period. If not, please explain. Note that assets classified as held for sale should be measured at the lower of carrying amounts or the fair value less selling costs. Refer to ASC 360-10-35-43. If you conclude the impairment tests were appropriately performed, please provide disclosure similar to your response that clearly explains the asset write-down as part of the purchase price allocation along with the prospective decrease in depreciation. |

Response: In response to this comment, the Company has revised the disclosure on page 58 of the Second Amendment and supplementally advises the Staff as follows:

Long-lived asset impairment tests during the pre-combination periods were conducted on the basis that the assets were held and used. Neither acquired company classified its long-lived assets as held for sale before the transaction as the assets were not held for sale separately from the entire entity and did not meet the criteria in ASC 360-10-45-9. Furthermore, as these were sales of the business (effected through a stock sale) and not a sale of assets, there would be no requirement to classify the assets as held for sale in the financial statements of the entities whose owners planned to sell their ownership interests. Impairment indicators assessed for the held and used assets were based on those reviewed by the acquired companies each quarter to determine if any assets or groups of assets should be tested for recoverability in the ordinary course of business. The decrease in the carrying value of the assets to the fair value that arose as a result of the fair value measurements prepared for acquisition accounting were not the indicator that triggered testing in either case.

Note 2. Pro Forma for Sunflower Transaction, Adjustment (h), page 57

| 3. | Please explain why adjustment 2(b) decreased depreciation expense while adjustment 2(h) increased depreciation expense. |

Response:The Company supplementally advises the Staff as follows:

The pro forma depreciation adjustment was calculated using the acquisition date fair values based on revised remaining useful lives of the acquired assets. The impact of the reduction in the value of the assets results in a decrease in pro forma depreciation expense as compared to historical depreciation expense recognized. The impact of the revised useful lives (remaining useful lives were shortened) is an acceleration of (increase in) pro forma depreciation expense as compared to historical depreciation expense. The thirteen weeks ended April 1, 2012 was a pre-acquisition period and therefore, amounts recorded as depreciation expense and reflected in the “Historical Sunflower” column of the pro forma table on page 54 of the Second Amendment are reflective of the pre-acquisition higher

United States Securities and Exchange Commission

Division of Corporation Finance

July 3, 2013

Page 3

asset values and longer depreciable lives. The depreciation adjustment for the thirteen weeks ended April 1, 2012 as described in footnote 2(h) reflects the adjustment required to reflect decreased asset values as well as shorter depreciable lives. The impact on depreciation expense from the decreased asset values was outweighed by the additional depreciation expense related to the adjustment of the useful lives in the thirteen weeks ended April 1, 2012 and therefore the resulting pro forma depreciation adjustment was an increase in depreciation expense.

In subsequent quarters of fiscal 2012 the impact of the fair value adjustments outweighs the impact of the revised useful lives therefore causing a decrease in pro forma depreciation expense as compared to historical depreciation expense recognized for all of fiscal 2012 as described in footnote 2(b) on page 58 of the Second Amendment.

Consolidated Financial Statements, Sprouts Farmers Markets, LLC, page F-2

Notes to Consolidated Financial Statements, Page F-9

Note 4. Business Combinations, page F-21

| 4. | We note your response to comment 29 in our letter dated June 6, 2013 and have the following additional comments. |

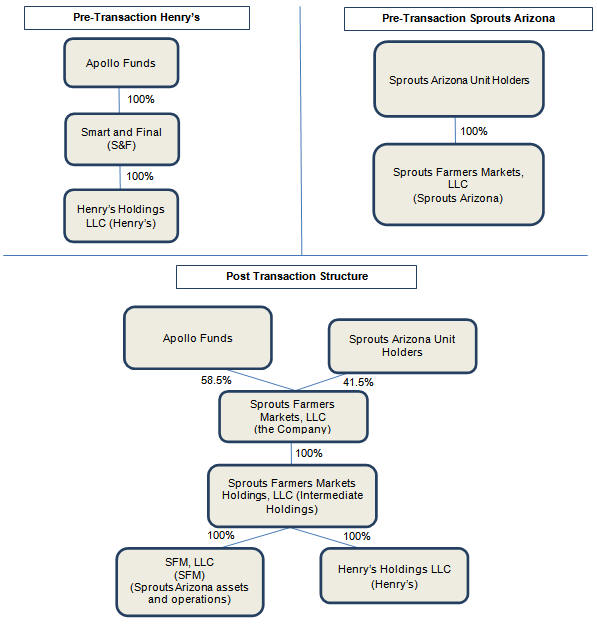

To aid the Staff in its review of the Company’s response to Comment 4, the Company is providing to the Staff the following summary of the Sprouts-Henry’s business combination that occurred in April 2011 (the “Henry’s Transaction”). In connection with the description of the Henry’s Transaction set forth below (the “Transaction Summary”), the following defined terms are used and are consistent with the terms used in Note 1 to the consolidated financial statements on page F-9 of the Second Amendment:

“Apollo Funds” – Investment funds affiliated with, and co-investment vehicles managed by, Apollo Management VI, L.P., and affiliated with Apollo Global Management, LLC, which engaged in identifying the potential acquisition opportunity on behalf of Apollo/Henry’s, negotiating the business combination and assisting in arranging financing relating thereto.

“Company” – Sprouts Farmers Markets, LLC, a Delaware limited liability company, formed in January 2011 for the purpose of consummating the Henry’s Transaction. Prior the consummation of the Henry’s Transaction, the Company engaged in no pre-combination activities. For the Staff’s benefit this is the entity that has been referred to as “New Sprouts” in previous responses.

“Henry’s” – Henry’s Holdings LLC, a Delaware limited liability company and owner/operator of all of the assets relating to the Henry’s Farmers Market business.

United States Securities and Exchange Commission

Division of Corporation Finance

July 3, 2013

Page 4

“Intermediate Holdings” – Sprouts Farmers Markets Holdings, LLC, a Delaware limited liability company and wholly-owned subsidiary of the Company formed in March 2011 for the purpose of consummating the Henry’s Transaction. Prior to the consummation of the Henry’s Transaction, Intermediate Holdings engaged in no pre-combination activities.

“SFM” – SFM, LLC, a Delaware limited liability company formed in February 2011 as a wholly-owned subsidiary of Sprouts Arizona for the purpose of consummating the Henry’s Transaction.

“Sprouts Arizona” – Sprouts Farmers Markets, LLC, an Arizona limited liability company and owner/operator of all of the assets relating to the Sprouts Farmers Market business prior to the Henry’s Transaction. For the Staff’s benefit this is the entity that has been referred to as “Old Sprouts” in previous responses.

“S&F” – Smart & Final Stores LLC, a California limited liability company wholly owned by the Apollo Funds and the sole member of Henry’s.

Description of Henry’s Transaction:

On April 18, 2011, the following transactions took place contemporaneously:

| • | Pursuant to a Membership Interest Purchase Agreement, Sprouts Arizona agreed to acquire from S&F all of the membership interests of Henry’s for consideration of approximately $274.6 million. Prior to the consummation of the Henry’s Transaction, Sprouts Arizona assigned the Membership Interest Purchase Agreement, which included the right to purchase Henry’s, to Intermediate Holdings. Pursuant to a Credit Agreement, Intermediate Holdings (as a result of Apollo-led sponsorship) borrowed $310.0 million, and paid $274.6 million to S&F for the membership interests of Henry’s pursuant to the terms of the Membership Interest Purchase Agreement. As a result, Intermediate Holdings was the legal acquirer of Henry’s. |

| • | Pursuant to a Contribution and Purchase Agreement: |

| • | Sprouts Arizona contributed all of the assets relating to the Sprouts Farmers Market business to SFM, its wholly-owned subsidiary; |

| • | Sprouts Arizona contributed all of its subsidiaries, including SFM, to Intermediate Holdings; |

| • | Apollo Funds purchased 58.5% of the membership interests of the Company for $214.0 million; |

United States Securities and Exchange Commission

Division of Corporation Finance

July 3, 2013

Page 5

| • | The Company issued 41.5% of its membership interests to Sprouts Arizona; and used the funds invested by the Apollo Funds to make a distribution to Sprouts Arizona of approximately $199.1 million in exchange for its contribution of the assets of the Sprouts Farmers Market business. |

As the foregoing description illustrates, the Apollo Funds held a controlling (100%) interest in Henry’s through ownership of S&F prior to the consummation of the Henry’s Transaction and, as a result of the Apollo Funds’ purchase of a majority interest in the Company, the Apollo Funds owned a controlling interest (58.5%) in Henry’s after the consummation of the Henry’s Transaction. The following shows the pre- and post- Henry’s Transaction structure and the continued Apollo Funds’ majority ownership.

United States Securities and Exchange Commission

Division of Corporation Finance

July 3, 2013

Page 6

United States Securities and Exchange Commission

Division of Corporation Finance

July 3, 2013

Page 7

| • | Refer to the first bullet point and the opening paragraph of the response. We note you state that New Sprouts made a cash payment of $274.6 million to Smart and Final (“S&F”), Henry’s former parent company, in exchange for a 100% equity interest in Henry’s. In that regard, your statement is inconsistent with your disclosure on page F-9 and elsewhere throughout the filing that Old Sprouts acquired Henry with $274.6 million cash. Please reconcile your statement to your disclosure and revise. |

Response:As indicated in the above summary, as part of the contemporaneous transactions related to the business combination, Sprouts Arizona assigned the right to purchase Henry’s under the Membership Interest Purchase Agreement to Intermediate Holdings; therefore, Intermediate Holdings purchased Henry’s. The disclosures on F-9 and F-22 of the Second Amendment have been revised to clarify this.

| • | Refer to the second bullet of the response. Please further explain to us how you reasonably conclude that New Sprouts and Henry can be both accounting acquirers in the Henry’s transaction under the GAAP literature within ASC 805. In addition, we remain unclear regarding how Apollo’s indirect control of Henry’s before and after the Henry’s transaction makes Henry’s the accounting acquirer. Please explain. Also advise us if New Sprouts was engaged in other substantive pre-combination activities including identifying acquisition targets, negotiating transactions, or promoting the business combination in your determination that it is also the accounting acquirer in the transaction. |

Response:As discussed on page 18-20 of our original response and as illustrated in the above summary, the Apollo Funds controlled Henry’s prior to the transaction (through 100% equity ownership of Henry’s parent, S&F) and continued to control the combined business after the transaction through its control of the Company (which was formed solely to effect the transaction) through majority equity ownership, voting rights, control over the governing body and management composition. Therefore, accounting for the transfer of Henry’s under a common control model would be applicable – with a change in reporting entity from Henry’s to the Company that would be followed by an acquisition of the Sprouts Arizona business by the Company. The Company also notes that the attribution of the newly formed company (e.g., the Company) to the party who obtains control in an integrated series of transactions that results in a business combination is consistent with SEC staff views as articulated in a speech by SEC staff member Eric Casey (1998). The Company has clarified in its disclosure on page F-9 (and pages 8, 44, and 68) that after the change in reporting entity from Henry’s to the Company, the Company is the accounting acquirer.

United States Securities and Exchange Commission

Division of Corporation Finance

July 3, 2013

Page 8

The Company and Intermediate Holdings were established for the sole purpose of effecting the Henry’s Transaction. There were no pre-combination activities in either of these entities. The Company is the top level holding company and Intermediate Holdings is a mid-tier holding company that holds a 100% interest in the operating companies (“Henry’s” and “SFM”) and is the borrower under the Company’s current and former credit facilities.

| • | In addition, you state that there has been a change in reporting entity since Henry’s is the accounting acquirer. However, we did not note such a change in reporting entity in your financial statement presentation since you did not present predecessor and successor financial statements with New Sprouts and Henry’s as the successor and predecessor, respectively. Please explain. |

Response:Since the Apollo Funds’ contribution of Henry’s was accounted for as a common control transaction, Henry’s basis of accounting was carried over together with its historical financial statements and those financial statements became the financial statements of the Company. Since Henry’s was the entity first controlled by the Apollo Funds and because the Company was established solely for the purpose of effecting the transaction, the historical results of Henry’s are presented through the day immediately preceding the Henry’s Transaction, April 17, 2011. Because the transaction results in a change in reporting entity from Henry’s to the Company, it would not be appropriate to bifurcate the financial statements into two separate periods, because there was no change in accounting basis in the underlying assets and liabilities presented during the period of presentation.

| • | Refer to the third bullet of the response. We note you derived the equity value of the Class A units issued to Old Sprout unit holders based on the gross up value calculated from Apollo’s equity value in New Sprouts. In that regard, explain to us why the equity valuation for Old Sprouts is appropriate without considering any control premium existed within Apollo’s valuation and why you state Old Sprouts and Apollo share equally in synergies in light of their different equity interest amounts in New Sprouts. |

Response:The Company does not believe, based on review of the underlying economics of the transaction or participation rights by both parties, that a control premium would be applicable. While the Apollo Funds have the ability to influence the decisions of the Company, the resulting benefits of such decision-making are shared proportionately by the Apollo Funds and Sprouts Arizona unit holders. Further, there are no synergies benefitting other Apollo Funds portfolio companies as a result of the Henry’s Transaction that would indicate the Apollo Funds shared disproportionately in returns. The Company determined there was no objective and reliable information evident in any projections used for the valuation or in the terms of the Company’s LLC agreement that would indicate disproportionate returns to any unit holders. All

United States Securities and Exchange Commission

Division of Corporation Finance

July 3, 2013

Page 9

unit holders benefit proportionately in the synergies of the combined company. As such the Company determined that no control premium existed.

| 5. | We note your response to comment 30 in our letter dated June 6, 2013 and the revised disclosure on page F-24 that inventory were valued at net realizable value using an income approach in the purchase price allocation. In that regard, explain to us how the income approach works in terms of valuing inventory and why the derived net realizable value represents fair value. |

Response:In response to this comment, the Company has revised the disclosure on page F-24 and supplementally advises the Staff as follows:

The acquired inventories were valued using net realizable value (“NRV”) (selling price less costs to dispose plus a reasonable profit) and not an income method. The Company believes NRV is an appropriate methodology based on the FASB Valuation Resource Group (VRG) Issue 2008-5. In that VRG Issue, the FASB staff indicated NRV was an appropriate basis for valuing acquired inventories in a business combination accounted for under FAS 141(R) (currently codified in ASC 805), citing paragraph A24(f) of FAS 157.

If you have any questions, please contact the undersigned at (212) 309-6843 or Jeff Letalien at (212) 309-6763.

Very truly yours,

/s/ Howard Kenny

| cc: | Sprouts Farmers Markets, LLC |