Exhibit 99.1

SPROUTS FARMERS MARKET

INVESTOR DECK AUGUST 2015

Forward-Looking Statements and Non-GAAP Financial Measures

SPROUTS FARMERS MARKET

Certain statements in this presentation are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. Any statements contained herein (including, but not limited to, statements to the effect that Sprouts Farmers Market, Inc. (the “Company”) or its management “anticipates,” “plans,” “estimates,” “expects,” “believes,” or the negative of these terms and other similar expressions) that are not statements of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company’s estimated growth, expected results and long-term financial targets. These statements involve certain risks and uncertainties that may cause actual results to differ materially from expectations as of the date of this presentation. These risks and uncertainties include, without limitation, risks associated with the Company’s ability to successfully compete in its intensely competitive industry; the Company’s ability to successfully open new stores; the Company’s ability to manage its rapid growth; the Company’s ability to maintain or improve its comparable store sales and operating margins; the Company’s ability to identify and react to trends in consumer preferences; product supply disruptions; general economic conditions; and other factors as set forth from time to time in the Company’s Securities and Exchange Commission filings. The Company intends these forward-looking statements to speak only as of the date of this presentation and does not undertake to update or revise them as more information becomes available, except as required by law.

In addition to reporting financial results in accordance with GAAP, the Company has presented adjusted net income, adjusted earnings per share and adjusted EBITDA. These measures are not in accordance with, or an alternative to GAAP. The Company’s management believes that these presentations provide useful information to management, analysts and investors regarding certain additional financial and business trends relating to its results of operations and financial condition. In addition, management uses these measures for reviewing the financial results of the Company as well as a component of incentive compensation. The Company defines adjusted net income as net income excluding store closure and exit costs, one-time costs associated with its April 2011 combination (the “Henry’s Transaction”) with Henry’s Holdings, LLC (“Henry’s”) and its May 2012 business combination with Sunflower Farmers Market, Inc. (“the Sunflower Transaction,” and collectively, the “Transactions”), gain and losses from disposal of assets, IPO bonus, expenses incurred by the Company in its secondary public offerings and employment taxes paid by the Company in connection with options exercised in those offerings (“Public Offering Expenses”), the loss on extinguishment of debt and the related tax impact of those adjustments. The Company defines adjusted basic and diluted earnings per share as adjusted net income divided by the weighted average basic and diluted shares outstanding. The Company defines EBITDA as net income before interest expense, provision for income tax, and depreciation, amortization and accretion, and defines adjusted EBITDA as EBITDA excluding store closure and exit costs, onetime costs associated with the Transactions, gains and losses from disposal of assets, Public Offering Expenses, and the loss on extinguishment of debt.

These non-GAAP measures are intended to provide additional information only and do not have any standard meanings prescribed by GAAP. Use of these terms may differ from similar measures reported by other companies. Because of their limitations, none of these non-GAAP measures should be considered as a measure of discretionary cash available to use to reinvest in growth of the Company’s business, or as a measure of cash that will be available to meet the Company’s obligations. Each of these non-GAAP measures has its limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. See the Appendix for reconciliation for these non-GAAP measures to the comparable GAAP measures.

2

SPROUTS FARMERS MARKET

OVERVIEW OF SPROUTS

Sprouts is Well Positioned to Meet the Needs of Today’s Health Conscious Consumers

SPROUTS FARMERS MARKET

Healthy grocery store that offers fresh, natural and organic foods at affordable prices

Broad consumer appeal

One of the largest and fastest growing natural and organic retailers

Industry leading results

Significant white space opportunity and strong new store economics

4

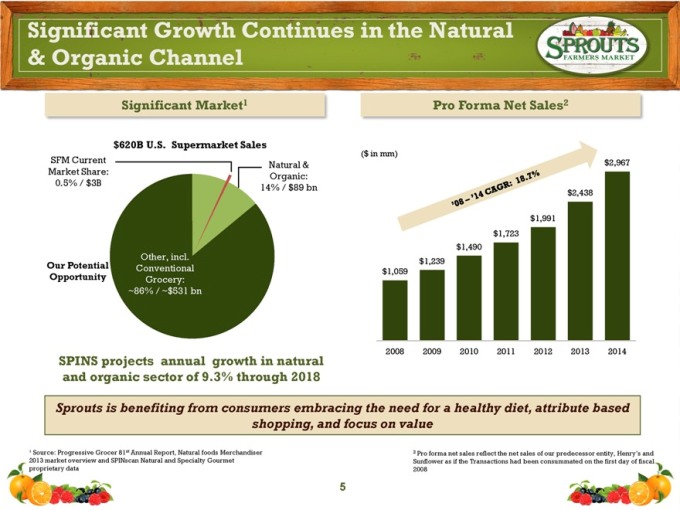

Significant Growth Continues in the Natural

& Organic Channel

SPROUTS FARMERS MARKET

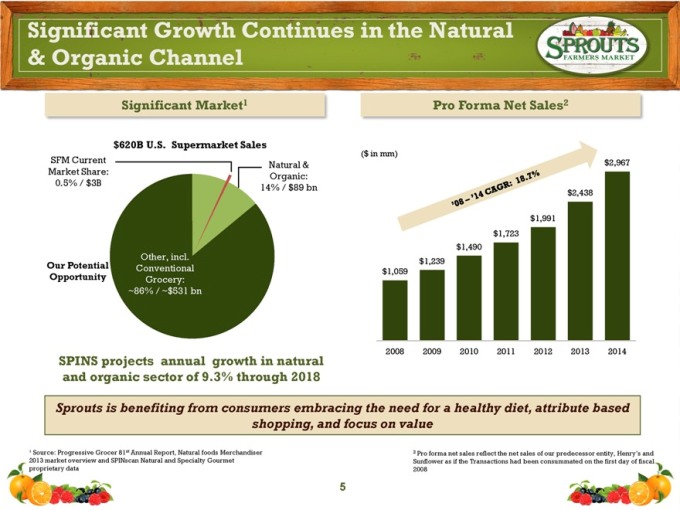

Significant Market1

$620B U.S. Supermarket Sales

SFM Current Market Share: 0.5% / $3B

Natural & Organic: 14% / $89 bn

Our Potential Opportunity

Other, incl. Conventional Grocery: ~86% / ~$531 bn

SPINS projects annual growth in natural and organic sector of 9.3% through 2018

Pro Forma Net Sales2

($ in mm)

’08 – ’14 CAGR: 18.7%

$1,059

$1,239

$1,490

$1,723

$1,991

$2,438

$2,967

2008 2009 2010 2011 2012 2013 2014

Sprouts is benefiting from consumers embracing the need for a healthy diet, attribute based shopping, and focus on value

1 Source: Progressive Grocer 81st Annual Report, Natural foods Merchandiser 2013 market overview and SPINscan Natural and Specialty Gourmet proprietary data

2 Pro forma net sales reflect the net sales of our predecessor entity, Henry’s and Sunflower as if the Transactions had been consummated on the first day of fiscal 2008

5

Sprouts is Changing the Way People Perceive And Shop for Fresh, Natural and Organic Foods

SPROUTS FARMERS MARKET

HEALTH

Sprouts has evolved from a specialty food store into a healthy grocery Store

Continue to benefit from consumers’ growing interest in eating healthier

SELECTION

Full-line healthy grocery store with more than 17,000 fresh, natural & organic products

Full selection of unique specialty items: 2900+ organic 3200+ gluten-free 2800+ non-GMO

VALUE

Produce prices significantly below competitors

Highly promotional - communicate our competitive prices week in and week out

Promote value across the store

SERVICE

Convenient, friendly and easy-to-shop

Trusted, knowledgeable and engaging customer service focused on educating customers

6

Sprouts - A Healthy Grocery Store that Flips the Conventional Model

SPROUTS FARMERS MARKET

Value-leader in fresh produce (drives traffic)

Produce surrounded by a complete grocery offering

Differentiated assortment of high-quality, healthy foods

High standard private label

Fresh, natural & organic offering

Don’t sell most national branded packaged goods

Farmers market inspired, open store layout with low profile displays

Convenient, small-box: average 28-30k sq. ft.

Comfortable, easy to shop environment

FROZEN FOODS

DAIRY

FROZEN FOODS

GROCERY

VITAMINS & BODYCARE

PRODUCE

BULK FOODS

PROMOTIONAL DISPLAY

CHECKSTANDS

FLORAL

ENTRANCE

DELI SEATING

BEER & WINE

MEAT

DELI

BAKERY

7

Reaching a Broad Base of Consumers Through Both Traditional and Digital Mediums

SPROUTS FARMERS MARKET

Broad Customer Demographics

Middle income and higher

Medium to above average education

Boomers, Gen-X, and rising Millennial demographic

Diverse ethnic backgrounds

Value conscious

Brand Awareness & Recognition

Strong marketing and pre-opening programs reaching customers through a variety of channels

More than 14 million weekly circulars

30+ annual promotions1

Digital & social platforms

Increasing word-of-mouth and grass-root efforts driving traffic

Over 1.2 million Facebook fans

Sprouts’ You Tube videos

VITAMIN & BODY CARE

EXTRAVAGANZA

Don’t Miss Out!

Yes, Everything is 25% OFF

DOUBLE AD WEDNESDAYS!

Twice as many nice prices

Gluten FREE

Jubilee

25% OFF

1 Represents actual promotions at each store during FY 2014.

8

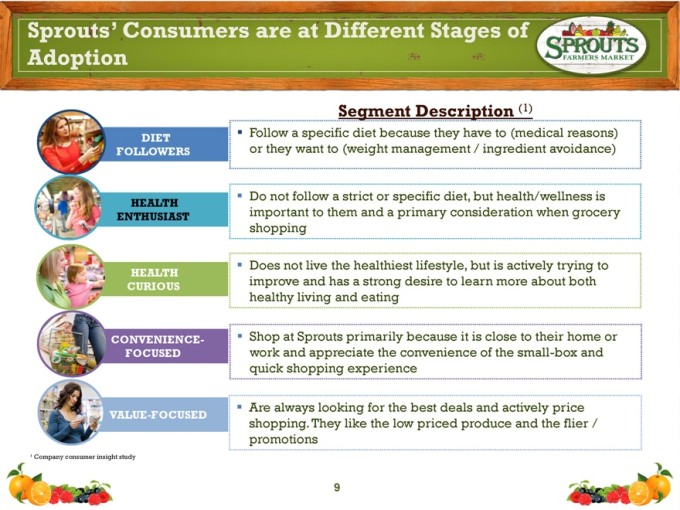

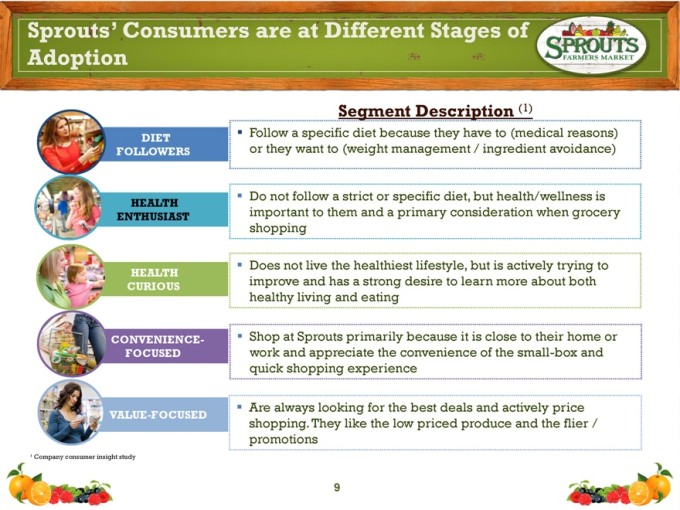

Sprouts’ Consumers are at Different Stages of Adoption

SPROUTS FARMERS MARKET

Segment Description (1)

DIET FOLLOWERS

HEALTH ENTHUSIAST

HEALTH CURIOUS

CONVENIENCE-FOCUSED

VALUE-FOCUSED

Follow a specific diet because they have to (medical reasons) or they want to (weight management / ingredient avoidance)

Do not follow a strict or specific diet, but health/wellness is important to them and a primary consideration when grocery shopping

Does not live the healthiest lifestyle, but is actively trying to improve and has a strong desire to learn more about both healthy living and eating

Shop at Sprouts primarily because it is close to their home or work and appreciate the convenience of the small-box and quick shopping experience

Are always looking for the best deals and actively price shopping. They like the low priced produce and the flier / promotions

1 Company consumer insight study

9

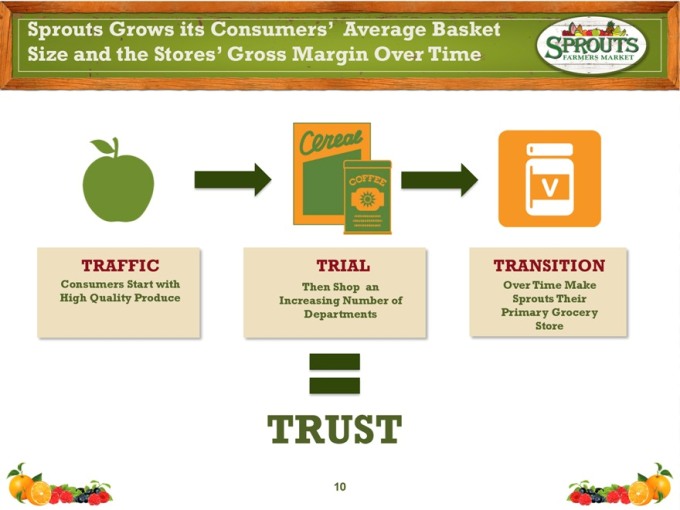

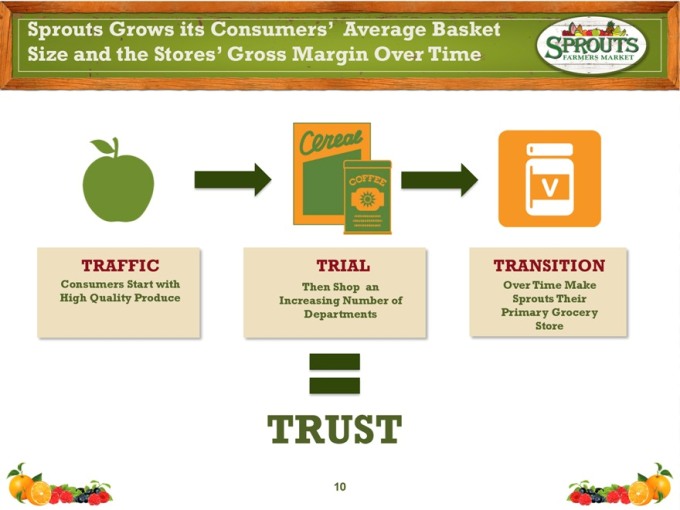

Sprouts Grows its Consumers’ Average Basket Size and the Stores’ Gross Margin Over Time

SPROUTS FARMERS MARKET

Cereal

COFFEE

TRAFFIC

Consumers Start with High Quality Produce

TRIAL

Then Shop an Increasing Number of Departments

TRANSITION

Over Time Make Sprouts Their Primary Grocery Store

TRUST

10

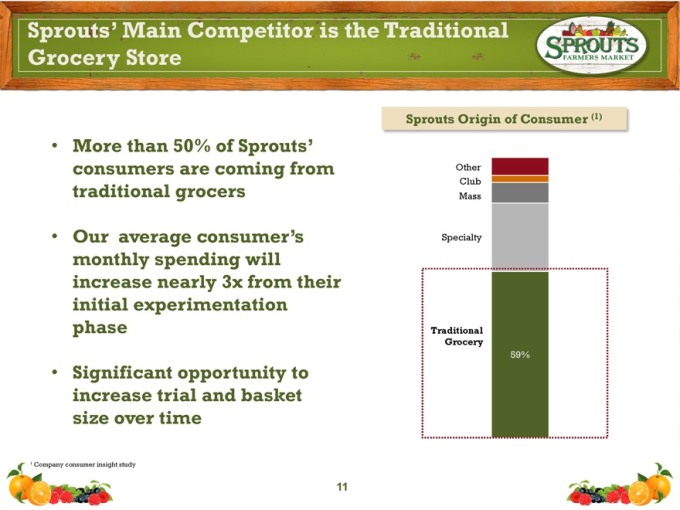

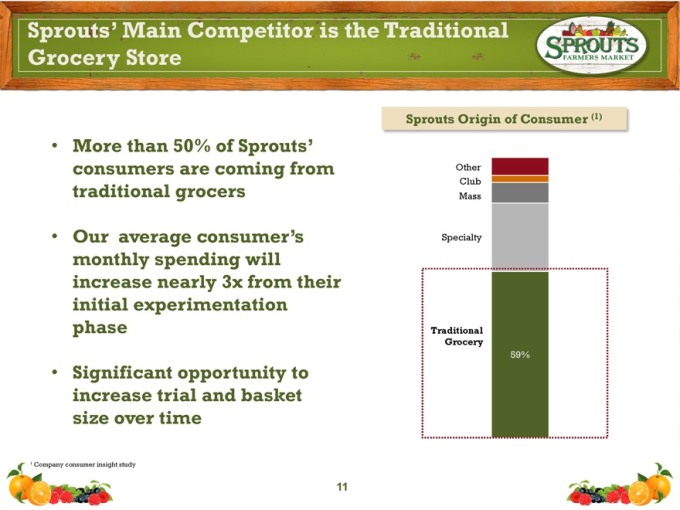

Sprouts’ Main Competitor is the Traditional Grocery Store

SPROUTS FARMERS MARKET

More than 50% of Sprouts’ consumers are coming from traditional grocers

Our average consumer’s monthly spending will increase nearly 3x from their initial experimentation phase

Significant opportunity to increase trial and basket size over time

Sprouts Origin of Consumer (1)

Other

Club

Mass

Specialty

Traditional

Grocery

59%

1 Company consumer insight study

11

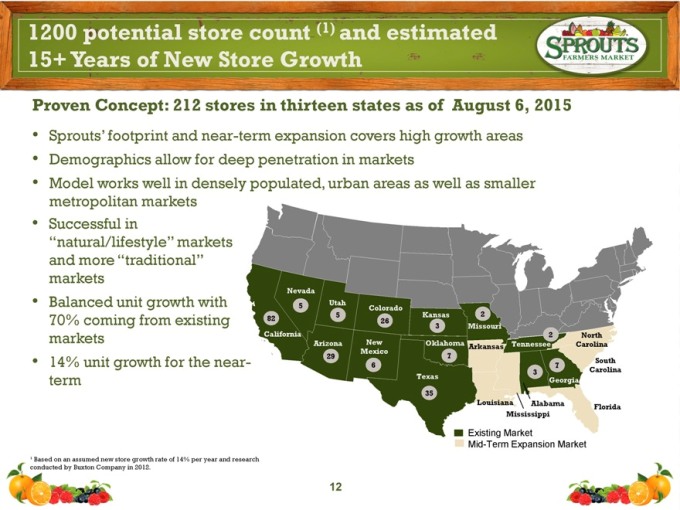

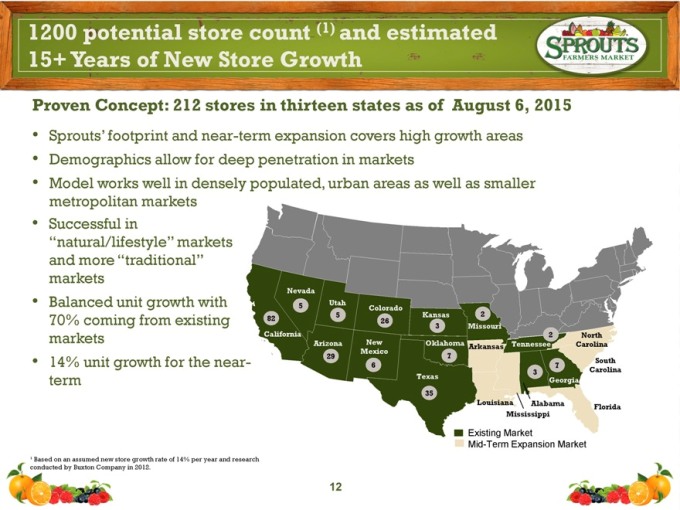

1200 potential store count (1) and estimated 15+ Years of New Store Growth

SPROUTS FARMERS MARKET

Proven Concept: 212 stores in thirteen states as of August 6, 2015

Sprouts’ footprint and near-term expansion covers high growth areas

Demographics allow for deep penetration in markets

Model works well in densely populated, urban areas as well as smaller metropolitan markets

Successful in

“natural/lifestyle” markets and more “traditional” markets

Balanced unit growth with 70% coming from existing markets

14% unit growth for the near-term

Nevada

5

Utah

5

Colorado

26

Kansas

3

Missouri

2

California

82

Tennessee

2

Arizona

29

Oklahoma

7

South Carolina

Arkansas

New Mexico

6

7

Texas

35

3

North Carolina

Georgia

Louisiana

Alabama

Mississippi

Florida

Existing Market

Mid-Term Expansion Market

1 Based on an assumed new store growth rate of 14% per year and research conducted by Buxton Company in 2012.

12

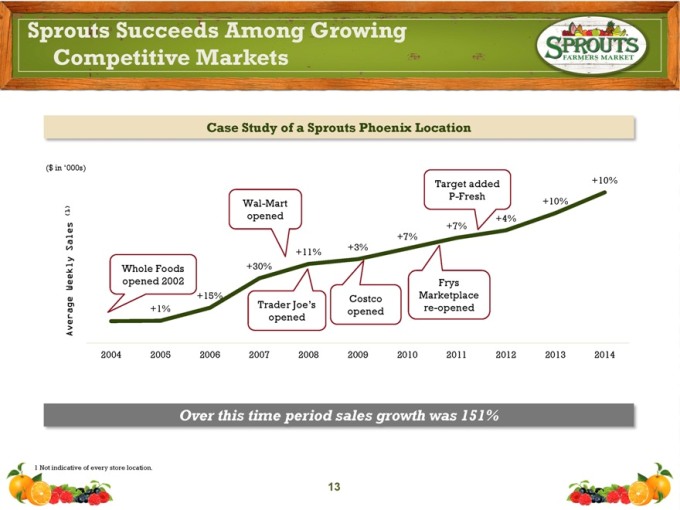

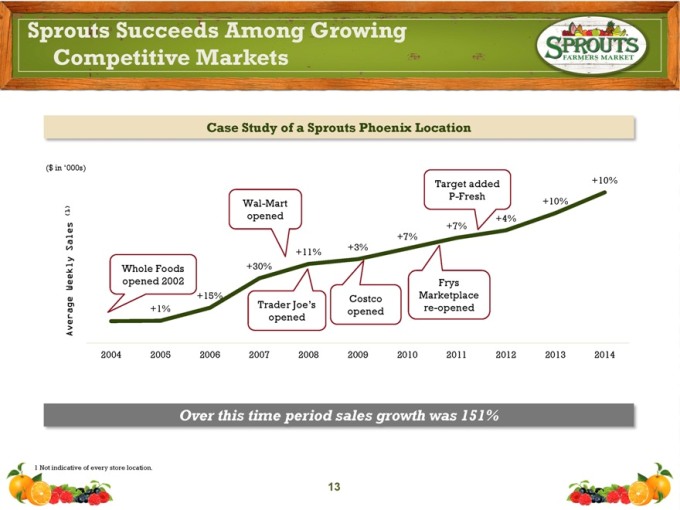

Sprouts Succeeds Among Growing Competitive Markets

SPROUTS FARMERS MARKET

Case Study of a Sprouts Phoenix Location

($ in ‘000s)

Average Weekly Sales (1)

Whole Foods opened 2002

Wal-Mart opened

Target added P-Fresh

+1%

+15%

+30%

+11%

+3%

+7%

+7%

+4%

+10%

+10%

Trader Joe’s opened

Costco opened

Frys Marketplace re-opened

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Over this time period sales growth was 151%

1 Not indicative of every store location.

13

Sprouts is Growing Responsibly

SPROUTS FARMERS MARKET

Responsible retailing for Sprouts is comprised of four main focus areas:

RESPONSIBLE OPERATIONS • RESPONSIBLE BUILDING

RESPONSIBLE NEIGHBOR • RESPONSIBLE SOURCING

RESPONSIBLE OPERATIONS

Food Rescue

Program – Donated approximately 8.4 million lbs. of food in 2014

Cardboard and pallet recycling at all stores

Piloting composting at 46 stores

RESPONSIBLE BUILDING

LED lighting and retrofits in 2014

LEED equivalent in all new stores

Launched EMC motor/night curtains/anti-sweat control

• Transcritical CO2 refrigeration pilot in GA

• Energy retro commissioning

RESPONSIBLE NEIGHBOR Donated almost $2M to non-profits and in scholarships

Established Healthy Sprouts Communities Foundation

Created more than 3000 jobs in 2014

Building health & wellness programs for team members

Promoted more than 20% of our team members in 2014

RESPONSIBLE SOURCING

Received Leaping Bunny certifications

Working with vendors on Non-GMO Project certification

Developing produce traceability & tracking requirements and Animal Welfare positions

Developing private label sustainability requirements

14

SPROUTS FARMERS MARKET

BUSINESS & FINANCIAL PERFOMANCE

Powerful Growth Business – Results Driven

SPROUTS FARMERS MARKET

9%+ Natural and Organic Sector Growth

Compelling Store-Level Economics

Leverage Infrastructure for Scale and Growth

One of the Best White Space Opportunities in Retail

33 consecutive quarters of positive comp growth

14% new store unit growth, strong new store productivity

Cumulative pro-forma EBITDA growth (organic growth) of more than 150% over the past three years

Deleveraged capital structure

16

Balanced Sales Growth Across Comparable Store Sales Growth and New Store Openings

SPROUTS FARMERS MARKET

Pro Forma Net Sales1

($ in mm)

‘08 – ‘14 CAGR: 19%

$2,967

$2,438

$1,991

$1,723

$1,490

$1,239

$1,059

2008 2009 2010 2011 2012 2013 2014

Pro Forma Comparable Store Sales Growth2

11.6%

2.6%

4.9%

2.3%

7.4%

5.1%

14.8%

9.7%

20.4%

10.7%

20.6%

9.9%

2009 2010 2011 2012 2013 2014

Prior Period Current Period Two-Year Stacked

History of Growth

1 Pro forma net sales reflect the net sales of our predecessor entity, Henry’s and Sunflower as if the Transactions had been consummated on the first day of fiscal 2008.

2 “Comparable store sales growth” refers to the percentage change in our comparable store sales as compared to the prior comparable period. Pro forma comparable store sales growth is calculated including all stores acquired in the Transactions for all periods reported. Comparable store sales growth on a “two-year stacked basis” is computed by adding the pro forma comparable store sales growth of the period referenced and that of the same fiscal period ended twelve months prior.

17

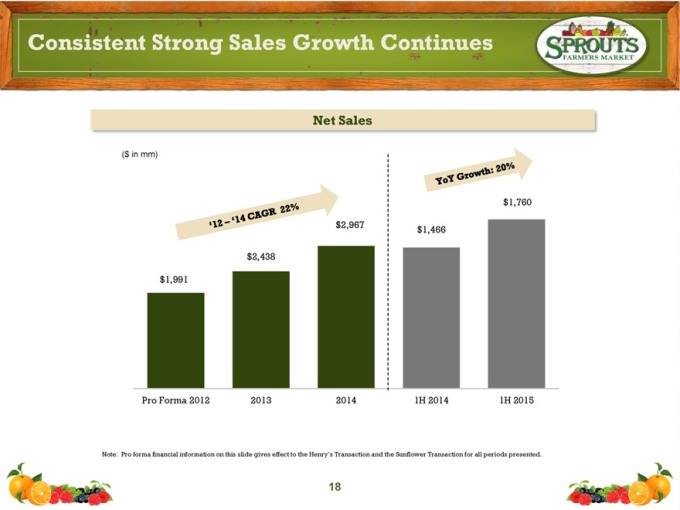

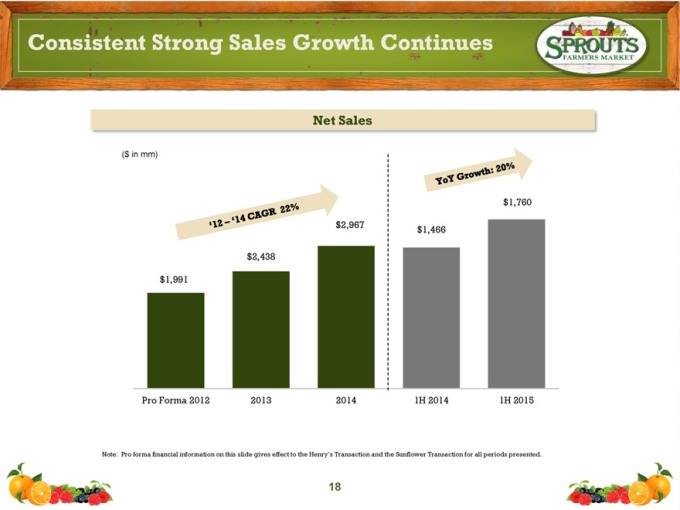

Consistent Strong Sales Growth Continues

SPROUTS FARMERS MARKET

Net Sales

($ in mm)

‘12 – ‘14 CAGR 22%

YoY Growth: 20%

$1,991

Pro Forma 2012

$2,438

2013

$2,967

2014

$1,466

1H 2014

$1,760

1H 2015

Note: Pro forma financial information on this slide gives effect to the Henry’s Transaction and the Sunflower Transaction for all periods presented.

18

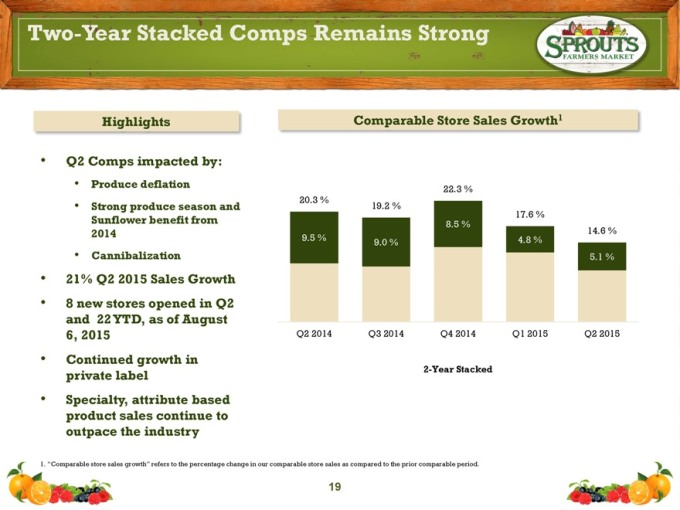

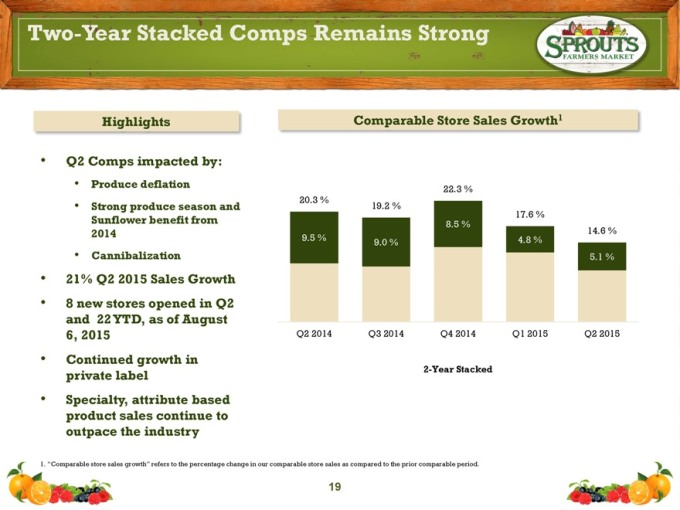

Two-Year Stacked Comps Remains Strong

SPROUTS FARMERS MARKET

Highlights

Q2 Comps impacted by:

Produce deflation

Strong produce season and Sunflower benefit from 2014

Cannibalization

21% Q2 2015 Sales Growth

8 new stores opened in Q2 and 22 YTD, as of August 6, 2015

Continued growth in private label

Specialty, attribute based product sales continue to outpace the industry

Comparable Store Sales Growth1

20.3 %

9.5 %

Q2 2014

19.2 %

9.0 %

Q3 2014

22.3 %

8.5 %

Q4 2014

17.6 %

4.8 %

Q1 2015

14.6 %

5.1 %

Q2 2015

2-Year Stacked

1. “Comparable store sales growth” refers to the percentage change in our comparable store sales as compared to the prior comparable period.

19

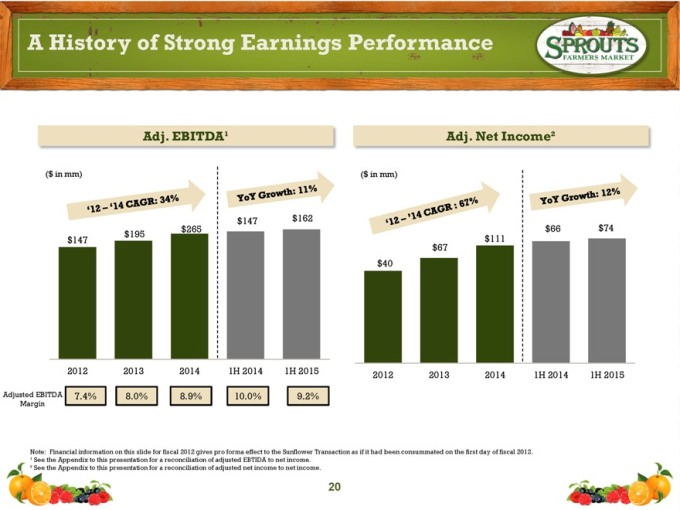

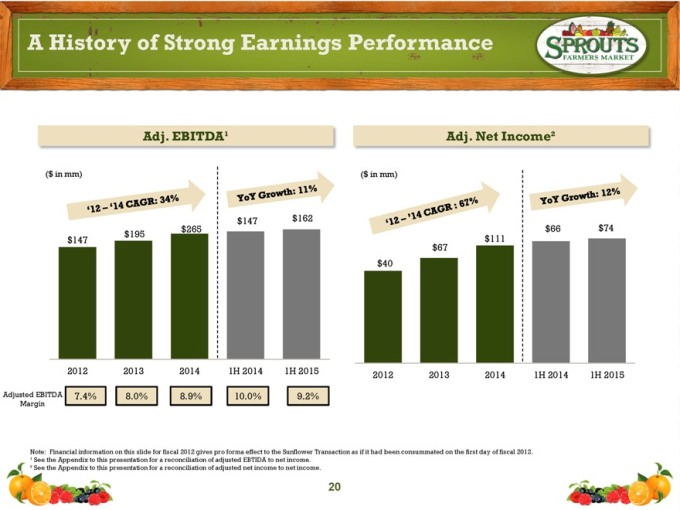

A History of Strong Earnings Performance

SPROUTS FARMERS MARKET

Adj. EBITDA1

($ in mm)

‘12 – ‘14 CAGR: 34%

YOY Growth: 11%

$147

2012

$195

2013

$265

2014

$147

1H 2014

$162

1H 2015

Adjusted EBITDA 7.4% 8.0% 8.9% 10.0% 9.2%

Margin

($ in mm)

‘12 – ‘14 CAGR: 67%

YOY Growth: 12%

$40

2012

$67

2013

$111

2014

$66

1H 2014

$74

1H 2015

Note: Financial information on this slide for fiscal 2012 gives pro forma effect to the Sunflower Transaction as if it had been consummated on the first day of fiscal 2012.

1 See the Appendix to this presentation for a reconciliation of adjusted EBTIDA to net income.

2 See the Appendix to this presentation for a reconciliation of adjusted net income to net income.

20

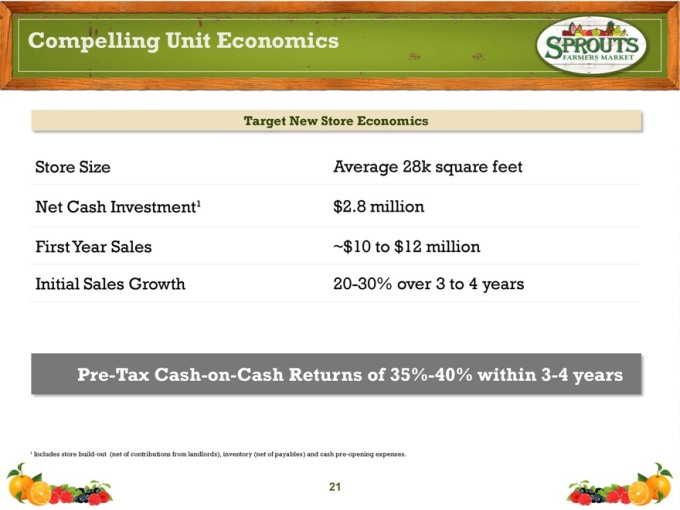

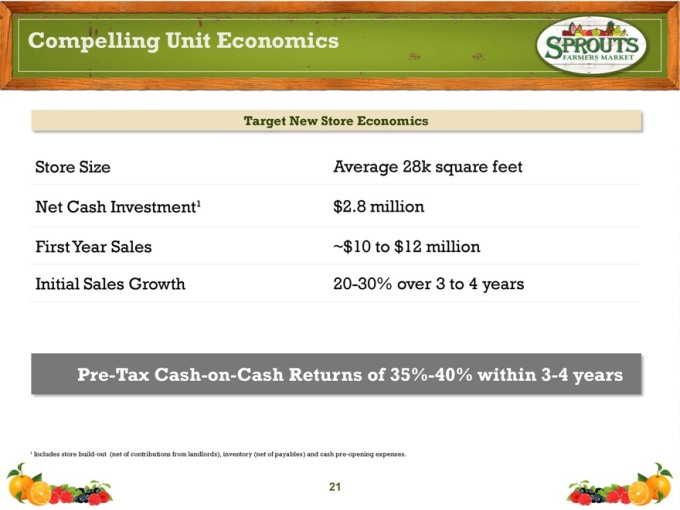

Compelling Unit Economics

SPROUTS FARMERS MARKET

Target New Store Economics

Store Size

Net Cash Investment1

First Year Sales

Initial Sales Growth

Average 28k square feet

$2.8 million

~$10 to $12 million

20-30% over 3 to 4 years

Pre-Tax Cash-on-Cash Returns of 35%-40% within 3-4 years

1 Includes store build-out (net of contributions from landlords), inventory (net of payables) and cash pre-opening expenses.

21

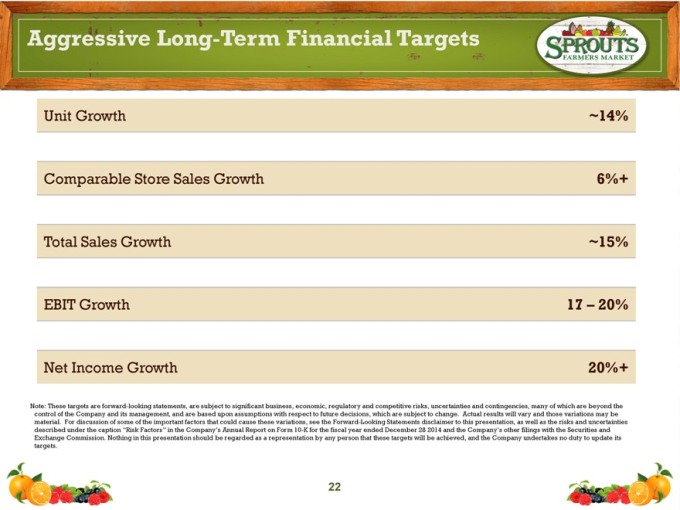

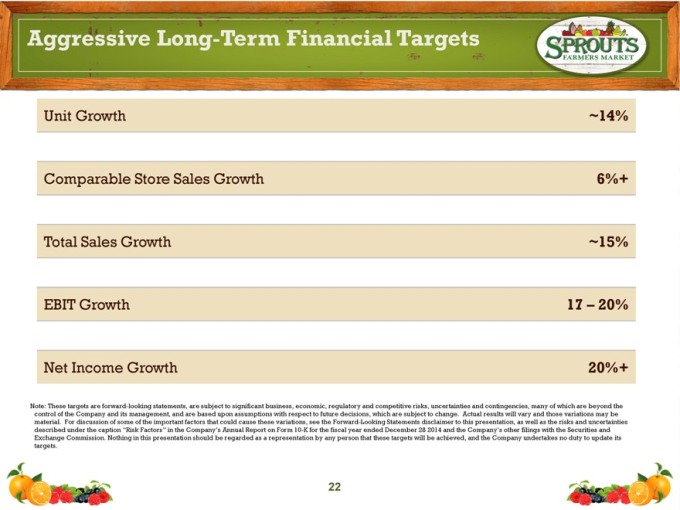

Aggressive Long-Term Financial Targets

SPROUTS FARMERS MARKET

Unit Growth

Comparable Store Sales Growth

Total Sales Growth

EBIT Growth

Net Income Growth

~14%

6%+

~15%

17 – 20%

20%+

Note: These targets are forward-looking statements, are subject to significant business, economic, regulatory and competitive risks, uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may be material. For discussion of some of the important factors that could cause these variations, see the Forward-Looking Statements disclaimer to this presentation, as well as the risks and uncertainties described under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 28 2014 and the Company’s other filings with the Securities and Exchange Commission. Nothing in this presentation should be regarded as a representation by any person that these targets will be achieved, and the Company undertakes no duty to update its targets.

22

Why Sprouts is a Compelling Investment

SPROUTS FARMERS MARKET

Authentic Fresh, Natural and Organic Food Offering at Great Value

Fast Growing Segment of the U.S. Supermarket Industry with Strong Macro Tailwinds

Significant New Store Growth Opportunity Supported by Broad Demographic Appeal

Resilient Business Model with Compelling Unit Economics

Passionate Team with a Customer-Focused Culture

Significantly lower prices

9% CAGR to $135B in 2018

1,200 potential stores (6x current base)

Target 35% – 40% cash-on-cash returns

23

SPROUTS FARMERS MARKET

APPENDIX: SUPPLEMENTAL MATERIALS

Appendix

SPROUTS FARMERS MARKET

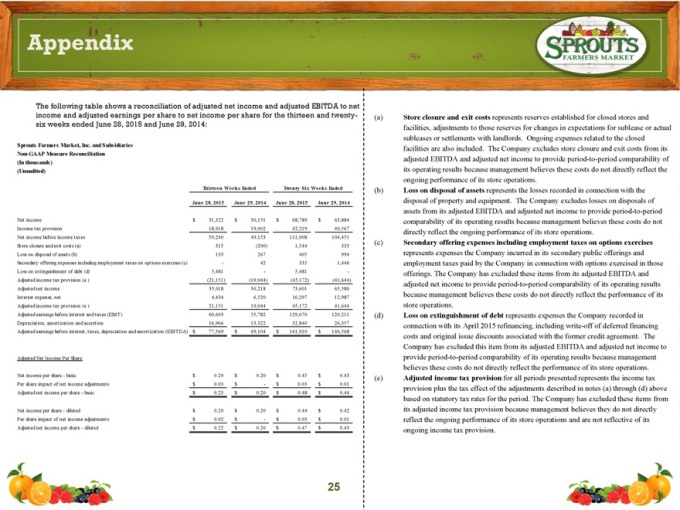

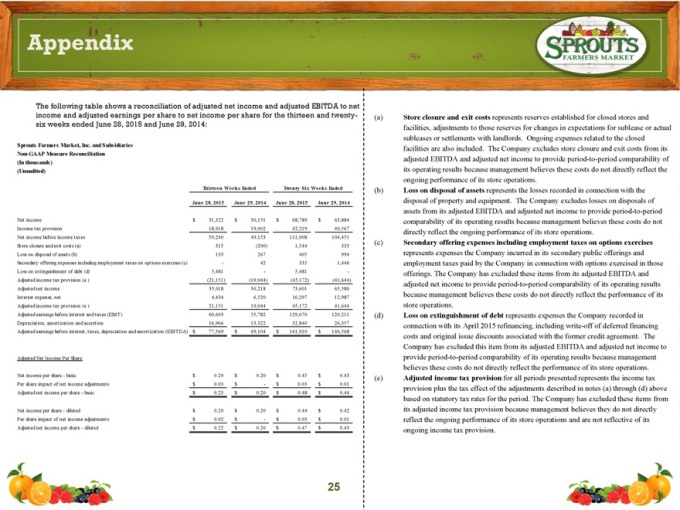

The following table shows a reconciliation of adjusted net income and adjusted EBITDA to net income and adjusted earnings per share to net income per share for the thirteen and twenty-six weeks ended June 28, 2015 and June 29, 2014:

Sprouts Farmers Market, Inc. and Subsidiaries

Non-GAAP Measure Reconciliation

(In thousands)

(Unaudited)

| | | | | | | | |

| | | Thirteen Weeks Ended | | Twenty-Six Weeks Ended |

| | | June 28,

2015 | | June 29,

2014 | | June 28,

2015 | | June 29,

2014 |

Net income | | $31,322 | | $30,151 | | $68,789 | | $63,884 |

Income tax provision | | 18,918 | | 19,002 | | 42,219 | | 40,567 |

Net income before income taxes | | 50,240 | | 49,153 | | 111,008 | | 104,451 |

Store closure and exit costs (a) | | 315 | | (200) | | 1,544 | | 333 |

Loss on disposal of assets (b) | | 133 | | 267 | | 405 | | 994 |

Secondary offering expenses including employment taxes on options exercises (c) | | - | | 42 | | 335 | | 1,446 |

Loss on extinguishment of debt (d) | | 5,481 | | - | | 5,481 | | - |

Adjusted income tax provision (e) | | (21,151) | | (19,044) | | (45,172) | | (41,644) |

Adjusted net income | | 35,018 | | 30,218 | | 73,601 | | 65,580 |

Interest expense, net | | 4,434 | | 6,520 | | 10,297 | | 12,987 |

Adjusted income tax provision (e ) | | 21,151 | | 19,044 | | 45,172 | | 41,644 |

Adjusted earnings before interest and taxes (EBIT) | | 60,603 | | 55,782 | | 129,070 | | 120,211 |

Depreciation, amortization and accretion | | 16,966 | | 13,322 | | 32,840 | | 26,357 |

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) | | $77,569 | | $69,104 | | $161,910 | | $146,568 |

Adjusted Net Income Per Share | | | | | | | | |

Net income per share - basic | | $0.20 | | $0.20 | | $0.45 | | $0.43 |

Per share impact of net income adjustments | | $0.03 | | $ - | | $0.03 | | $0.01 |

Adjusted net income per share - basic | | $0.23 | | $0.20 | | $0.48 | | $0.44 |

Net income per share - diluted | | $0.20 | | $0.20 | | $0.44 | | $0.42 |

Per share impact of net income adjustments | | $0.02 | | $ - | | $0.03 | | $0.01 |

Adjusted net income per share - diluted | | $0.22 | | $0.20 | | $0.47 | | $0.43 |

(a) Store closure and exit costs represents reserves established for closed stores and facilities, adjustments to those reserves for changes in expectations for sublease or actual subleases or settlements with landlords. Ongoing expenses related to the closed facilities are also included. The Company excludes store closure and exit costs from its adjusted EBITDA and adjusted net income to provide period-to-period comparability of its operating results because management believes these costs do not directly reflect the ongoing performance of its store operations.

(b) Loss on disposal of assets represents the losses recorded in connection with the disposal of property and equipment. The Company excludes losses on disposals of assets from its adjusted EBITDA and adjusted net income to provide period-to-period comparability of its operating results because management believes these costs do not directly reflect the ongoing performance of its store operations.

(c) Secondary offering expenses including employment taxes on options exercises represents expenses the Company incurred in its secondary public offerings and employment taxes paid by the Company in connection with options exercised in those offerings. The Company has excluded these items from its adjusted EBITDA and adjusted net income to provide period-to-period comparability of its operating results because management believes these costs do not directly reflect the performance of its store operations.

(d) Loss on extinguishment of debt represents expenses the Company recorded in connection with its April 2015 refinancing, including write-off of deferred financing costs and original issue discounts associated with the former credit agreement. The Company has excluded this item from its adjusted EBITDA and adjusted net income to provide period-to-period comparability of its operating results because management believes these costs do not directly reflect the performance of its store operations.

(e) Adjusted income tax provision for all periods presented represents the income tax provision plus the tax effect of the adjustments described in notes (a) through (d) above based on statutory tax rates for the period. The Company has excluded these items from its adjusted income tax provision because management believes they do not directly reflect the ongoing performance of its store operations and are not reflective of its ongoing income tax provision.

25

SPROUTS

FARMERS MARKET

Thank you!