INVESTOR DECK – MARCH ‘16 Exhibit 99.1

Forward-Looking Statements & Non-Gaap Financial Measures Certain statements in this presentation are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. Any statements contained herein (including, but not limited to, statements to the effect that Sprouts Farmers Market, Inc. (the “Company”) or its management "anticipates," "plans," "estimates," "expects," "believes," or the negative of these terms and other similar expressions) that are not statements of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company’s estimated growth, expected results and financial targets. These statements involve certain risks and uncertainties that may cause actual results to differ materially from expectations as of the date of this presentation. These risks and uncertainties include, without limitation, risks associated with the Company’s ability to successfully compete in its intensely competitive industry; the Company’s ability to successfully open new stores; the Company’s ability to manage its rapid growth; the Company’s ability to maintain or improve its comparable store sales and operating margins; the Company’s ability to identify and react to trends in consumer preferences; product supply disruptions; general economic conditions; and other factors as set forth from time to time in the Company’s Securities and Exchange Commission filings. The Company intends these forward-looking statements to speak only as of the date of this presentation and does not undertake to update or revise them as more information becomes available, except as required by law. In addition to reporting financial results in accordance with GAAP, the Company has presented adjusted net income and adjusted EBITDA. These measures are not in accordance with, or an alternative to GAAP. The Company's management believes that these presentations provide useful information to management, analysts and investors regarding certain additional financial and business trends relating to its results of operations and financial condition. In addition, management uses these measures for reviewing the financial results of the Company as well as a component of incentive compensation. The Company defines adjusted net income as net income excluding store closure and exit costs, one-time costs associated with its April 2011 combination (the “Henry’s Transaction”) with Henry’s Holdings, LLC (“Henry’s”) and its May 2012 business combination with Sunflower Farmers Market, Inc. (“the Sunflower Transaction,” and collectively, the “Transactions”), gain and losses from disposal of assets, IPO bonus, expenses incurred by the Company in its secondary public offerings and employment taxes paid by the Company in connection with options exercised in those offerings (“Public Offering Expenses”), the loss on extinguishment of debt and the related tax impact of those adjustments. The Company defines EBITDA as net income before interest expense, provision for income tax, and depreciation, amortization and accretion, and defines adjusted EBITDA as EBITDA excluding store closure and exit costs, one-time costs associated with the Transactions, gains and losses from disposal of assets, Public Offering Expenses, and the loss on extinguishment of debt. These non-GAAP measures are intended to provide additional information only and do not have any standard meanings prescribed by GAAP. Use of these terms may differ from similar measures reported by other companies. Because of their limitations, none of these non-GAAP measures should be considered as a measure of discretionary cash available to use to reinvest in growth of the Company’s business, or as a measure of cash that will be available to meet the Company’s obligations. Each of these non-GAAP measures has its limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. See the Appendix for reconciliation for these non-GAAP measures to the comparable GAAP measures.

OVERVIEW OF SPROUTS

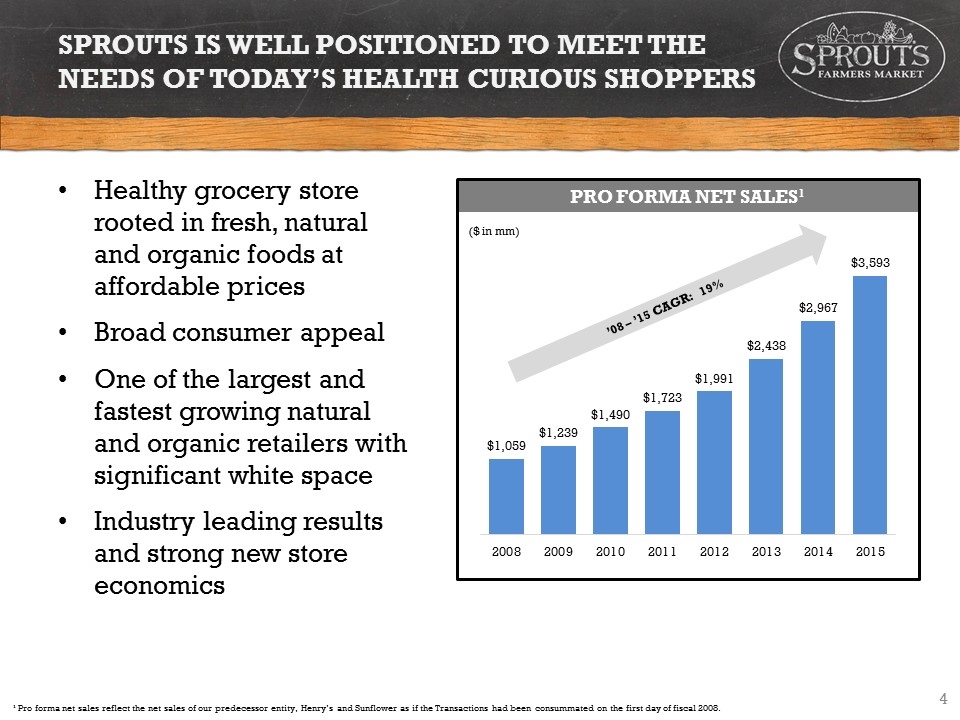

Pro Forma Net Sales1 Sprouts Is Well Positioned to Meet the Needs of Today’s Health Curious Shoppers Healthy grocery store rooted in fresh, natural and organic foods at affordable prices Broad consumer appeal One of the largest and fastest growing natural and organic retailers with significant white space Industry leading results and strong new store economics ¹ Pro forma net sales reflect the net sales of our predecessor entity, Henry’s and Sunflower as if the Transactions had been consummated on the first day of fiscal 2008. ’08 – ’15 CAGR: 19% ($ in mm)

A Grocery Shopping Experience that Makes Healthy Living Easy & Affordable Differentiated Business Model Focused on Four Pillars Health Value Selection Engagement HEALTH SELECTION VALUE ENGAGEMENT

Sprouts – A Healthy Grocery Store that Flips the Conventional Model Produce surrounded by a complete grocery offering Promote value everyday Differentiated assortment of high-quality, healthy foods: High standard Private Label Fresh natural and organic offering Doesn’t sell most national branded packaged goods Farmers market inspired, open store layout with low profile displays Convenient, small-box: average 28-30k sq. ft. Friendly, easy to shop environment

37 7 3 27 7 29 82 5 5 2 2 3 8 TN GA AL MO KS OK TX NM AZ UT CO NV CA AR MS LA FL SC NC PROVEN CONCEPT: 217 STORES IN 13 STATES AS OF DECEMBER 31, 2015 Sprouts’ footprint and near-term expansion covers high growth areas Demographics allows for deep penetration in markets Model works well in densely populated, urban areas as well as smaller metropolitan markets Successful in “natural / lifestyle” markets and more “traditional” markets Balanced unit growth with 70% coming from existing markets 14% unit growth for the long-term 1,200 Potential Store Count1 and Estimated 15+ Years of New Store Growth ¹ Based on an assumed new store growth rate of 14% per year and internal projections. Existing Market Mid-Term Expansion Market

Reaching a Broad Base of Consumers Through Traditional & Digital MEDIUMS ¹ Represents actual promotions at each store during FY 2015. BROAD CUSTOMER DEMOGRAPHICS Middle income and higher Medium to above average education Boomers, Gen-X and rising Millennial demographic Diverse ethnic background Value conscious BRAND AWARENESS & REACH Distribute more that 15 million circulars each week Digital and social platforms Amazon partner for eCommerce Over 1.3 million Facebook fans and over 1 million eSubscribers Digital video content 30+ annual promotions1 Increasing word-of-mouth and grass-root efforts driving traffic

Sprouts’ Consumers are at Different Stages of Adoption ¹ Company consumer insight study Follows a specific diet because they have to (medical reasons) or they want to (weight management / ingredient avoidance) DIET FOLLOWER Does not follow a strict or specific diet, but health / wellness is important to them and a primary consideration when grocery shopping HEALTH ENTHUSIAST Does not live the healthiest lifestyle, but is actively trying to improve and has a strong desire to learn more about both healthy living and eating HEALTH CURIOUS Shops at Sprouts primarily because it is close to their home or work—appreciates the convenience of the small-box and quick shopping experience CONVENIENCE-FOCUSED Are always looking for the best deals and actively price shopping—likes the low priced produce and the flyer promotions VALUE-FOCUSED SEGMENTATION DESCRIPTION1

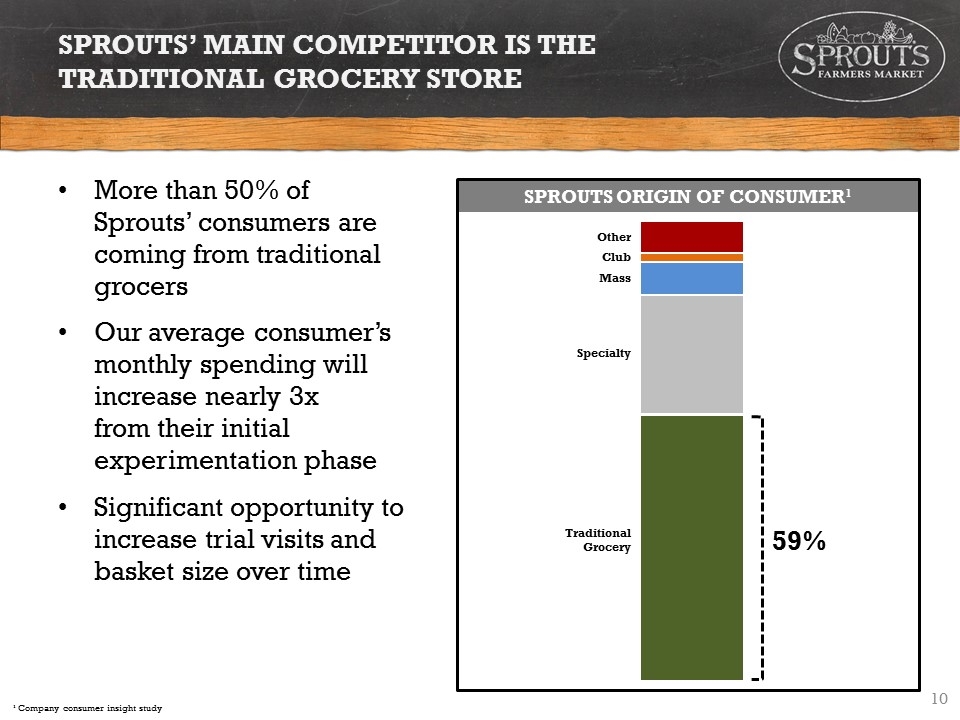

Sprouts’ Main Competitor is the Traditional Grocery Store More than 50% of Sprouts’ consumers are coming from traditional grocers Our average consumer’s monthly spending will increase nearly 3x from their initial experimentation phase Significant opportunity to increase trial visits and basket size over time ¹ Company consumer insight study SPROUTS ORIGIN OF CONSUMER1 Other Club Mass Specialty Traditional Grocery 59%

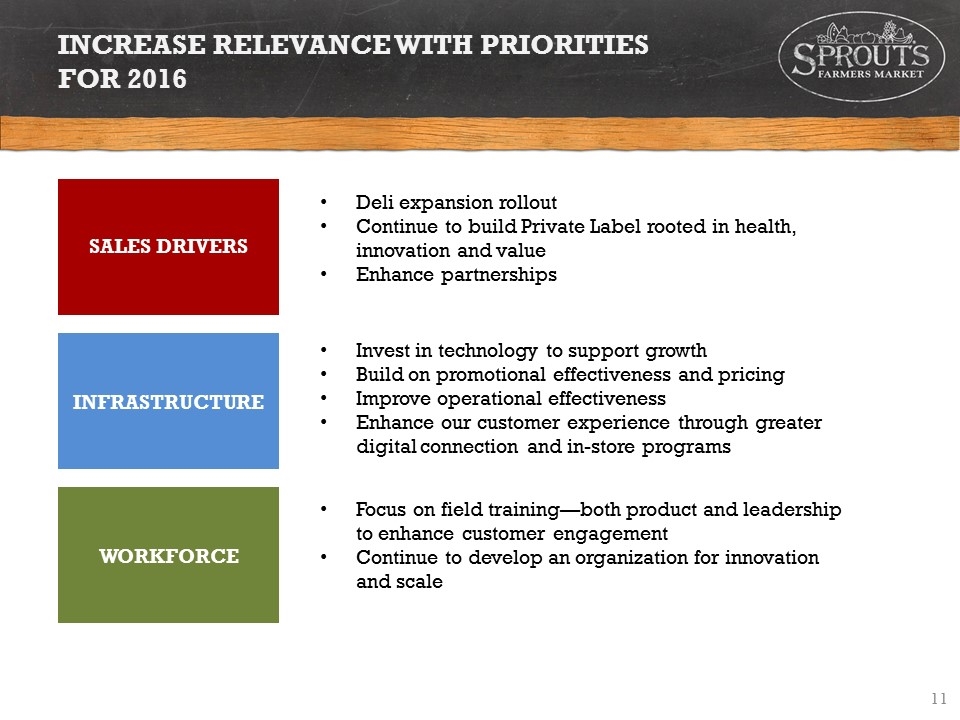

INCREASE RELEVANCE WITH PRIORITIES FOR 2016 SALES DRIVERS INFRASTRUCTURE WORKFORCE Deli expansion rollout Continue to build Private Label rooted in health, innovation and value Enhance partnerships Invest in technology to support growth Build on promotional effectiveness and pricing Improve operational effectiveness Enhance our customer experience through greater digital connection and in-store programs Focus on field training—both product and leadership to enhance customer engagement Continue to develop an organization for innovation and scale

RESPONSIBLE RETAILING FOR SPROUTS IS COMPRISED OF FOUR MAIN FOCUS AREAS Food Rescue Program—donated approximately 14M pounds of food in 2015 Composting at 50 stores diverted 5.5 million pounds from the landfill in 2015 Recycled 60M pounds of cardboard in 2015 In-store “Green Leaders” engaged to implement sustainability practices at the store level RESPONSIBLE OPERATIONS 39 Stores received EPA Green Chill Certifications in 2015 Piloting solar and battery storage systems in select California stores LEED equivalent building specs for all new stores Lower Global Warming Potential (GWP) refrigerant conversions RESPONSIBLE BUILDING Founded our 501(c)3 “Sprouts Healthy Communities Foundation” Donated more than $2.2M to non-profits and in scholarships Created more than 2,650 jobs in 2015 Promoted 20% of our team members in 2015 Supported more than 450 community events in 2015 RESPONSIBLE NEIGHBOR Developing standards for sustainable sourcing, ethical purchasing, product traceability and fair treatment of people and animals 50% of Sprouts brand food products are Non-GMO 65% of egg sales in 2015 were from cage free or better facilities. Commitment for Sprouts Brand to be 100% cage free by 2018 and all brands by 2022 RESPONSIBLE SOURCING

BUSINESS & FINANCIAL PERFORMANCE

POWERFUL GROWTH BUSINESS – RESULTS DRIVEN GROWTH RESULTS 9% Natural and Organic Sector Growth1 One of the Best White Space Opportunities in Retail 14% Unit Growth Compelling Store-Level Economics Mid to High Teens Sales Growth with Industry Leading Comps Deleveraged Capital Structure Ideal Free Cash Flow Generation Business Instituted Share Buy-Back Program 1 SPINS LLC projections for natural and organic food and supplement sales growth through 2019

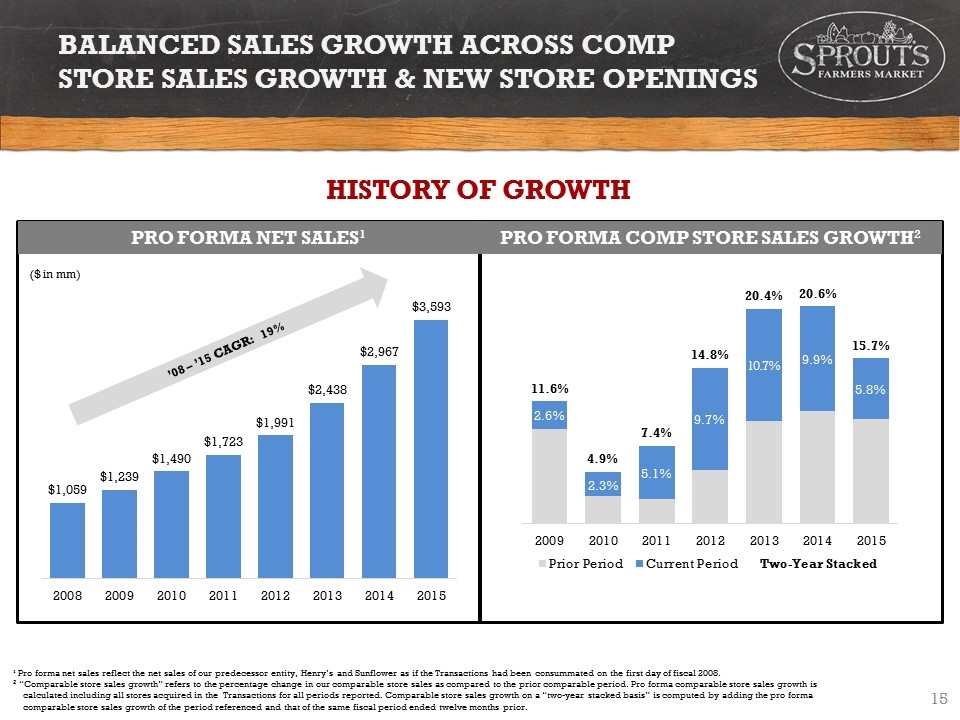

BALANCED SALES GROWTH ACROSS COMP STORE SALES GROWTH & NEW STORE OPENINGS ¹ Pro forma net sales reflect the net sales of our predecessor entity, Henry’s and Sunflower as if the Transactions had been consummated on the first day of fiscal 2008. 2 “Comparable store sales growth” refers to the percentage change in our comparable store sales as compared to the prior comparable period. Pro forma comparable store sales growth is calculated including all stores acquired in the Transactions for all periods reported. Comparable store sales growth on a “two-year stacked basis” is computed by adding the pro forma comparable store sales growth of the period referenced and that of the same fiscal period ended twelve months prior. Pro Forma COMP STORE SALES GROWTH2 HISTORY OF GROWTH ’08 – ’15 CAGR: 19% ($ in mm) Pro Forma net SALES1

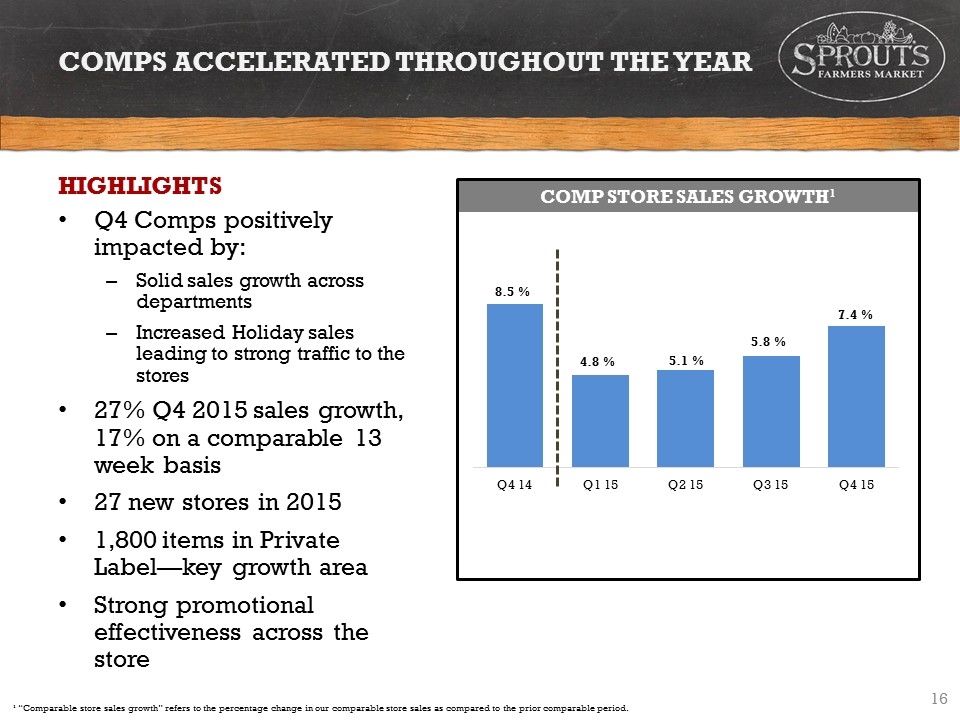

COMP STORE SALES GROWTH1 COMPS accelerated throughout the year HIGHLIGHTS Q4 Comps positively impacted by: Solid sales growth across departments Increased Holiday sales leading to strong traffic to the stores 27% Q4 2015 sales growth, 17% on a comparable 13 week basis 27 new stores in 2015 1,800 items in Private Label—key growth area Strong promotional effectiveness across the store ¹ “Comparable store sales growth” refers to the percentage change in our comparable store sales as compared to the prior comparable period.

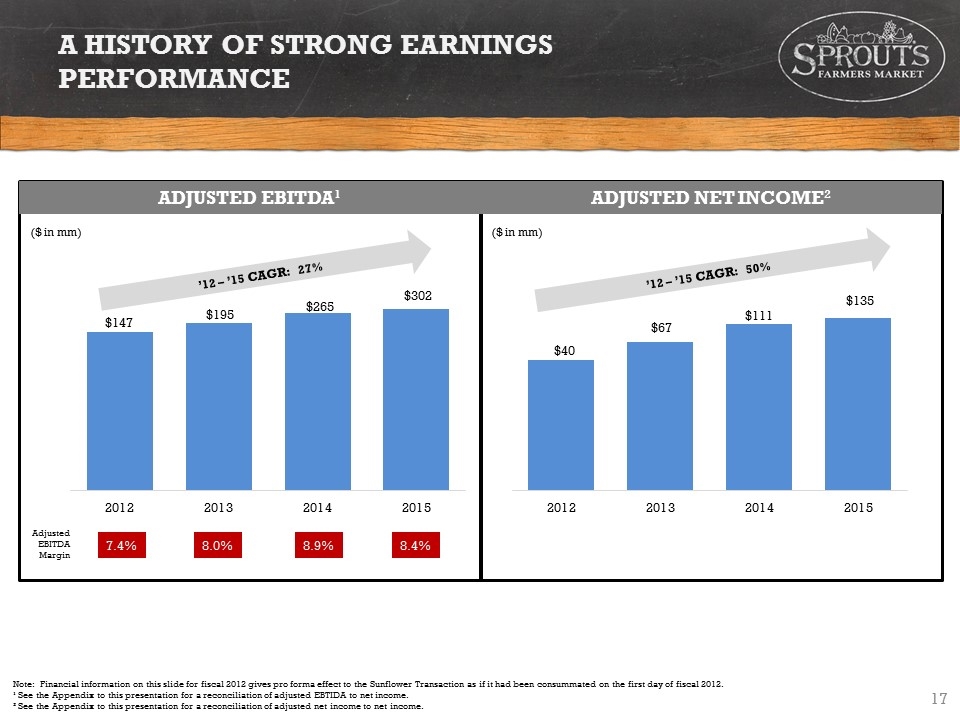

A HISTORY OF STRONG EARNINGS PERFORMANCE Note: Financial information on this slide for fiscal 2012 gives pro forma effect to the Sunflower Transaction as if it had been consummated on the first day of fiscal 2012. ¹ See the Appendix to this presentation for a reconciliation of adjusted EBTIDA to net income. ² See the Appendix to this presentation for a reconciliation of adjusted net income to net income. ADJUSTED EBITDA1 ADJUSTED NET INCOME2 ($ in mm) ($ in mm) Adjusted EBITDA Margin 7.4% 8.0% 8.9% 8.4% ’12 – ’15 CAGR: 27% ’12 – ’15 CAGR: 50%

COMPELLING UNIT ECONOMICS TARGET NEW STORE ECONOMICS Store Size Net Cash Investment1 First Year Sales Initial Sales Growth ¹ Includes store build-out (net of contributions from landlords), inventory (net of payables) and cash pre-opening expenses. Average 28k to 30k square feet $3.1 million ~$12 to $14 million 20% to 30% over 3 to 4 years Pre-Tax Cash-on-Cash Returns of 35% to 40% within 3 to 4 years

FINANCIAL PRIORITIES CAPITAL STRUCTURE Utilize strong free cash flow to self fund 14% unit growth and achieve strategic objectives Opportunistically employ $150 million share repurchase over next two years Preserve financial flexibility for opportunistic growth prospects $160 million outstanding on $450 million credit facility Note: These targets are forward-looking statements, are subject to significant business, economic, regulatory and competitive risks, uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may be material. For discussion of some of the important factors that could cause these variations, see the Forward-Looking Statements disclaimer to this presentation, as well as the risks and uncertainties described under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended January 3 2016 and the Company’s other filings with the Securities and Exchange Commission. Nothing in this presentation should be regarded as a representation by any person that these targets will be achieved, and the Company undertakes no duty to update its targets. MID-TERM FINANCIAL TARGETS ACHIEVE: 15%+ net sales growth Mid-single digits comp store sales growth 12-16% EBITDA growth 14-18% diluted earnings per share growth

WHY SPROUTS IS A COMPELLING INVESTMENT Authentic Fresh, Natural & Organic Food Offering at Great Value Fast Growing Segment of the U.S. Supermarket Industry with Strong Macro Tailwinds Significant New Store Growth Opportunity Supported by Broad Demographic Appeal Resilient Business Model with Compelling Unit Economics Passionate Team with a Customer-Focused Culture Significantly Lower Prices 9% CAGR to $166B in 20191 1,200 Potential Stores (5x Current Base) Target 35-40% Cash-on-Cash Returns 1 SPINS LLC projections for natural and organic food and supplement sales growth by 2019

APPENDIX: SUPPLEMENTAL MATERIALS

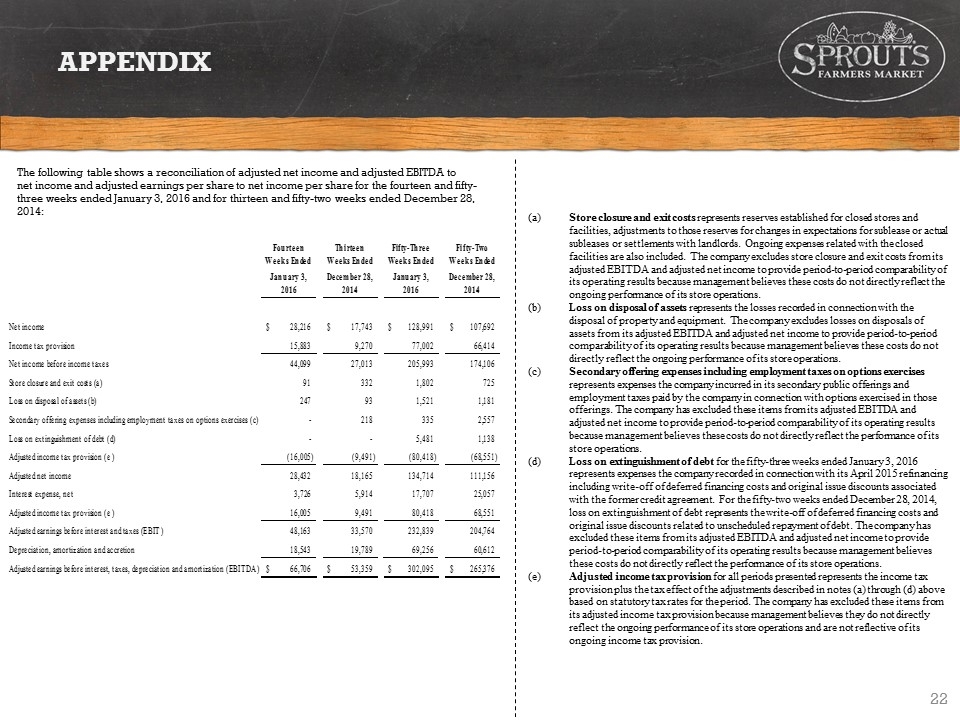

Appendix The following table shows a reconciliation of adjusted net income and adjusted EBITDA to net income and adjusted earnings per share to net income per share for the fourteen and fifty-three weeks ended January 3, 2016 and for thirteen and fifty-two weeks ended December 28, 2014: (a)Store closure and exit costs represents reserves established for closed stores and facilities, adjustments to those reserves for changes in expectations for sublease or actual subleases or settlements with landlords. Ongoing expenses related with the closed facilities are also included. The company excludes store closure and exit costs from its adjusted EBITDA and adjusted net income to provide period-to-period comparability of its operating results because management believes these costs do not directly reflect the ongoing performance of its store operations. (b)Loss on disposal of assets represents the losses recorded in connection with the disposal of property and equipment. The company excludes losses on disposals of assets from its adjusted EBITDA and adjusted net income to provide period-to-period comparability of its operating results because management believes these costs do not directly reflect the ongoing performance of its store operations. (c)Secondary offering expenses including employment taxes on options exercises represents expenses the company incurred in its secondary public offerings and employment taxes paid by the company in connection with options exercised in those offerings. The company has excluded these items from its adjusted EBITDA and adjusted net income to provide period-to-period comparability of its operating results because management believes these costs do not directly reflect the performance of its store operations. (d)Loss on extinguishment of debt for the fifty-three weeks ended January 3, 2016 represents expenses the company recorded in connection with its April 2015 refinancing including write-off of deferred financing costs and original issue discounts associated with the former credit agreement. For the fifty-two weeks ended December 28, 2014, loss on extinguishment of debt represents the write-off of deferred financing costs and original issue discounts related to unscheduled repayment of debt. The company has excluded these items from its adjusted EBITDA and adjusted net income to provide period-to-period comparability of its operating results because management believes these costs do not directly reflect the performance of its store operations. (e)Adjusted income tax provision for all periods presented represents the income tax provision plus the tax effect of the adjustments described in notes (a) through (d) above based on statutory tax rates for the period. The company has excluded these items from its adjusted income tax provision because management believes they do not directly reflect the ongoing performance of its store operations and are not reflective of its ongoing income tax provision.