Investor Deck August ‘17 Exhibit 99.1

Certain statements in this presentation are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. Any statements contained herein (including, but not limited to, statements to the effect that Sprouts Farmers Market, Inc. (the “Company”) or its management "anticipates," "plans," "estimates," "expects," "believes," or the negative of these terms and other similar expressions) that are not statements of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company’s estimated growth, expected results and financial targets. These statements involve certain risks and uncertainties that may cause actual results to differ materially from expectations as of the date of this presentation. These risks and uncertainties include, without limitation, risks associated with the Company’s ability to successfully compete in its intensely competitive industry; the Company’s ability to successfully open new stores; the Company’s ability to manage its rapid growth; the Company’s ability to maintain or improve its comparable store sales and operating margins; the Company’s ability to identify and react to trends in consumer preferences; product supply disruptions; general economic conditions; and other factors as set forth from time to time in the Company’s Securities and Exchange Commission filings. The Company intends these forward-looking statements to speak only as of the date of this presentation and does not undertake to update or revise them as more information becomes available, except as required by law. In addition to reporting financial results in accordance with generally accepted accounting principles (“GAAP”), the Company has presented EBITDA for 2016- 2017 and for 2012-2015, adjusted net income and adjusted EBITDA. These measures are not in accordance with, and are not intended as an alternative to, GAAP. The Company's management believes that these presentations provide useful information to management, analysts and investors regarding certain additional financial and business trends relating to the Company’s results of operations and financial condition. In addition, management uses these measures for reviewing the financial results of the Company and as a component of incentive compensation. The Company defines EBITDA as net income before interest expense, provision for income tax, and depreciation and amortization, and defines adjusted EBITDA as EBITDA as further adjusted to exclude store closure and exit costs, costs associated with acquisitions and integrations, gains and losses from disposal of assets, bonuses paid to certain employees in connection with the Company’s initial public offering (“IPO Bonus”), expenses incurred by the Company in its secondary public offerings and employment taxes paid by the Company in connection with options exercised in those offerings (“Public Offering Expenses”) and the loss on extinguishment of debt (collectively, the “Adjustments”). The Company defines adjusted net income as net income excluding the Adjustments and the related tax impact of those Adjustments. For fiscal year 2016 and 2017 to date, such further Adjustments to net income and EBITDA were immaterial; thus only EBITDA is presented. In addition to reporting financial results in accordance with GAAP, the Company provides information regarding Return on Invested Capital (“ROIC”) as additional information about its operating results for 2014-2017. ROIC is a non-GAAP financial measure used by management to evaluate the Company’s investment returns on capital and provides a meaningful measure of the effectiveness of its capital allocation over time. The Company defines ROIC as net operating profit after tax (“NOPAT”), including the effect of capitalized operating leases, divided by average invested capital. These non-GAAP measures are intended to provide additional information only and do not have any standard meanings prescribed by GAAP. Use of these terms may differ from similar measures reported by other companies. Because of their limitations, none of these non-GAAP measures should be considered as a measure of discretionary cash available to use to reinvest in growth of the Company’s business, or as a measure of cash that will be available to meet the Company’s obligations. Each of these non-GAAP measures has its limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. Please see the Appendix to this presentation for a reconciliation of these non-GAAP measures to the comparable GAAP measures.

Overview of Sprouts

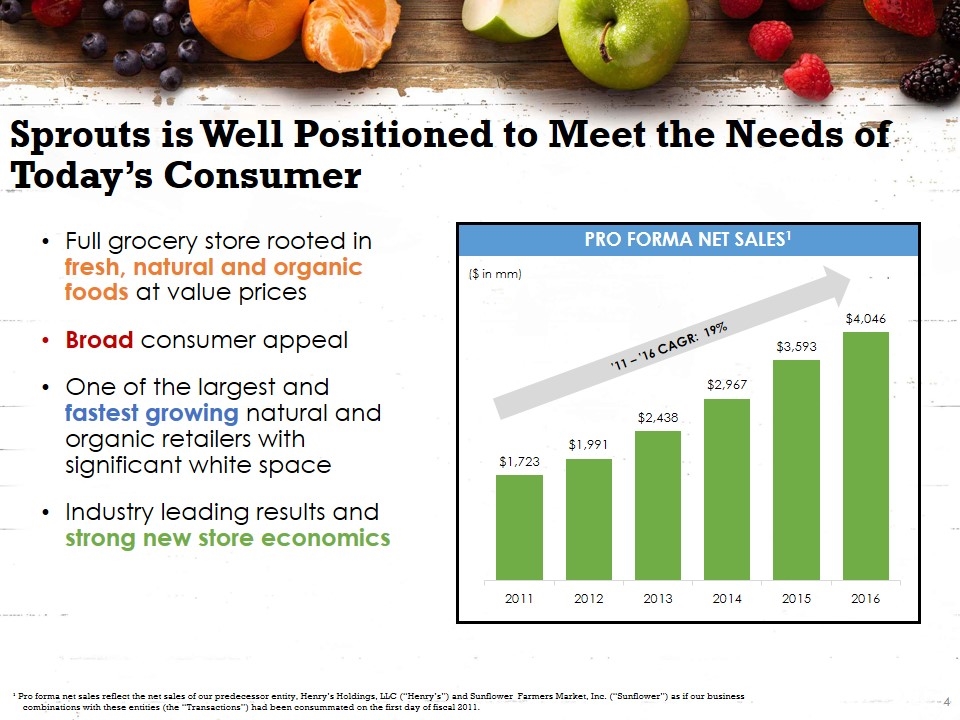

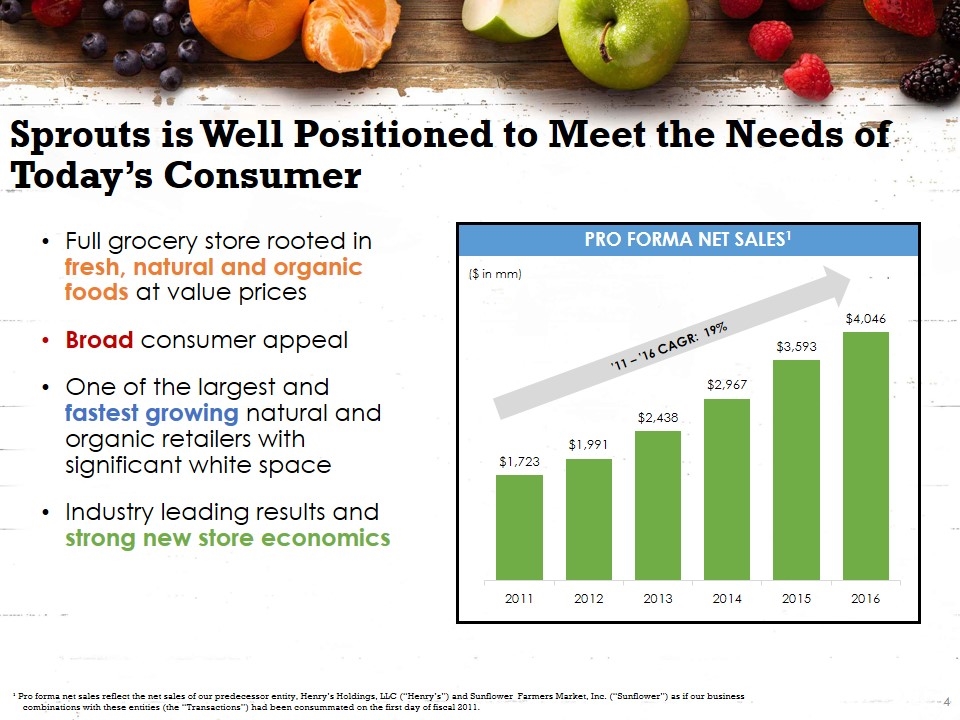

Pro Forma Net Sales1 Full grocery store rooted in fresh, natural and organic foods at value prices Broad consumer appeal One of the largest and fastest growing natural and organic retailers with significant white space Industry leading results and strong new store economics Sprouts is Well Positioned to Meet the Needs of Today’s Consumer ’11 – ’16 CAGR: 19% ($ in mm) ¹ Pro forma net sales reflect the net sales of our predecessor entity, Henry’s Holdings, LLC (“Henry’s”) and Sunflower Farmers Market, Inc. (“Sunflower”) as if our business combinations with these entities (the “Transactions”) had been consummated on the first day of fiscal 2011.

A Grocery Shopping Experience that Makes Healthy Living Easy & Affordable Health Value Selection Engagement SELECTION VALUE KNOWLEDGEABLE SERVICE & ENGAGEMENT HEALTH

Produce surrounded by a complete grocery offering Promote value everyday Differentiated assortment of high-quality, healthy foods: Do not carry most national- branded CPG items Fresh, natural and organic offering High standard Private Label rooted in quality and taste Farmers market-inspired open store layout with low profile displays Convenient, small-box: 30k sq. ft. Friendly, engaged customer service, easy to shop environment Sprouts – A Healthy Grocery Store that Flips the Conventional Model

Sprouts’ footprint and near-term expansion covers high growth areas Demographics allows for deep penetration in markets Model works well in densely populated, urban areas as well as smaller metropolitan markets Successful in “natural / lifestyle” markets and more “traditional” markets Balanced unit growth with 60% - 70% coming from existing markets Will open approximately 30 stores per year Years of New Store Growth Existing Market – 279 stores NM TX CO UT AZ NV CA 10 42 34 7 104 6 5 32 OK KS MO TN NC 5 3 6 16 4 AL GA FL 4 1

Reaching A Broad Base of Consumers Through Traditional & Digital Mediums BROAD CUSTOMER DEMOGRAPHICS Middle income and higher Medium to above average education Boomers, Gen-X and rising Millennial demographic Diverse ethnic background Value conscious BRAND AWARENESS & REACH Distribute more than 17 million circulars each week Reaching 1.8M unique digital subscribers Launched digital coupons in 2016 Growing home delivery with Amazon Prime Now partnership Increasing grass-root efforts and community engagement to drive traffic

Follows a specific diet because they need to (medical reasons) or they want to (weight management / ingredient avoidance) Sprouts’ Consumers are at Different Stages of Adoption ¹ Company consumer insight study DIET FOLLOWER Does not follow a strict or specific diet, but health / wellness is important to them and a primary consideration when grocery shopping HEALTH ENTHUSIAST Does not live the healthiest lifestyle, but is actively trying to improve and has a strong desire to learn more about both healthy living and eating HEALTH CURIOUS Shops at Sprouts primarily because it is close to their home or work—appreciates the convenience of the small-box and quick shopping experience CONVENIENCE-FOCUSED Are always looking for the best deals and actively price shopping—likes the low priced produce and the flyer promotions VALUE-FOCUSED SEGMENTATION DESCRIPTION1

2016 Sustainability RESPONSIBLE SOURCING ZERO WASTE REDUCED CARBON FOOTPRINT HEALTHY COMMUNITIES Committed to Zero Waste by 2020, a 90% waste diversion rate per EPA Diverted over 30M pounds of food from landfills through our Food Rescue, Composting and Animal Feed Programs Recycled more than 70M pounds of cardboard saving approximately 500k trees “Green Leaders” at each store led and executed zero waste and sustainability practices 39 Stores received EPA “Green Chill” certification Built all new stores to LEED green standards Converted to lower Global Warming Potential (GWP) refrigerants Installed LED lighting, EMC motors, night curtains and anti-sweat controls on refrigeration equipment Publicly launched Sprouts Healthy Communities Foundation Raised more than $2.6M for non-profits and community partners Created more than 4,350 jobs Promoted 16 percent of team members Supported more than 550 community events Continued developing standards for sustainable seafood, ethical purchasing, product traceability and fair treatment of people and animals Carried more than 3,350 organic items across the store Transitioned all Sprouts eggs to cage-free or better and committed to carrying a completely cage-free or better assortment by 2022

Business & Financial Performance

7-8% Natural and Organic Sector Growth1 Powerful Growth Business – Results Driven GROWTH RESULTS One of the Best White Space Opportunities in Retail Healthy Unit Growth Rate 1 SPINS LLC projections for natural and organic food and supplement sales growth through 2020 Compelling Store-Level Economics Mid Teens Sales Growth Strong Free Cash Flow Generation Business Ongoing Share Repurchase Program

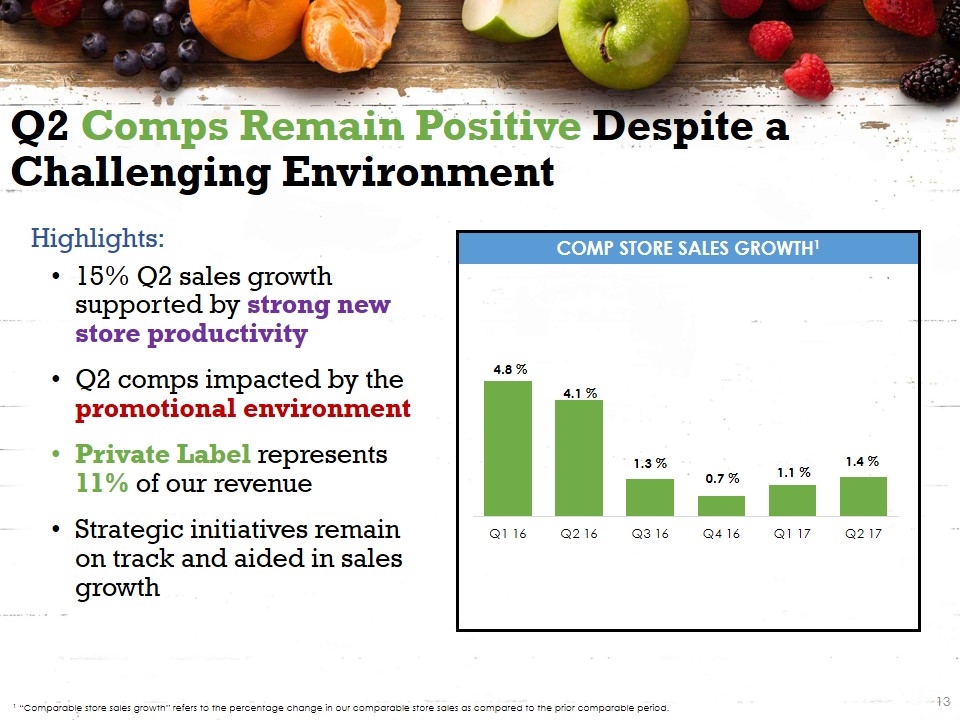

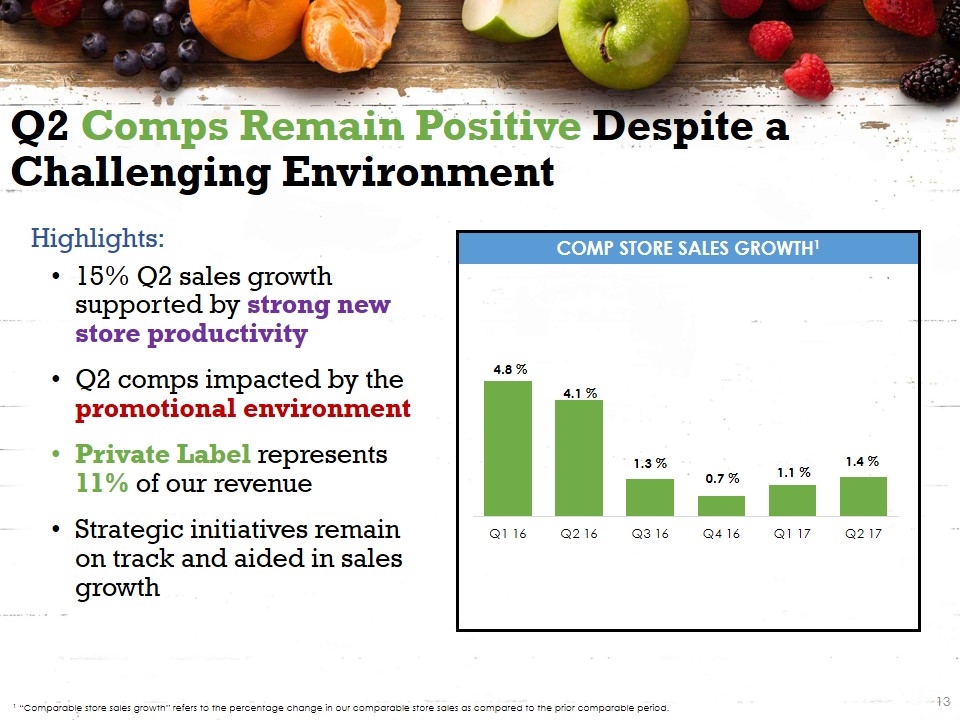

COMP STORE SALES GROWTH1 15% Q2 sales growth supported by strong new store productivity Q2 comps impacted by the promotional environment Private Label represents 11% of our revenue Strategic initiatives remain on track and aided in sales growth Q2 Comps Remain Positive Despite a Challenging Environment 1 “Comparable store sales growth” refers to the percentage change in our comparable store sales as compared to the prior comparable period. Highlights:

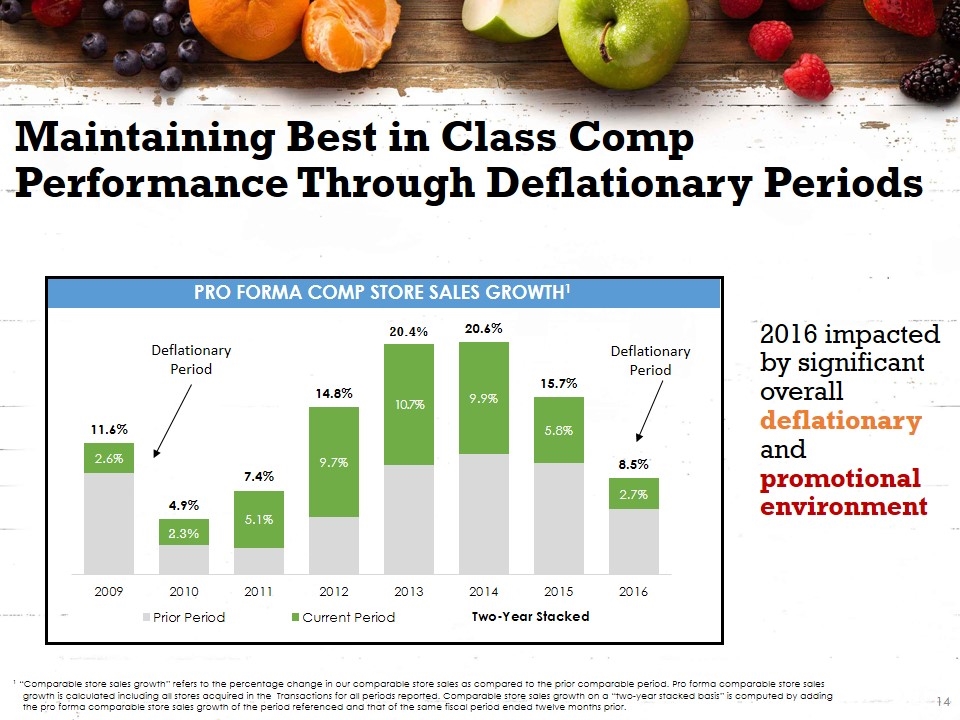

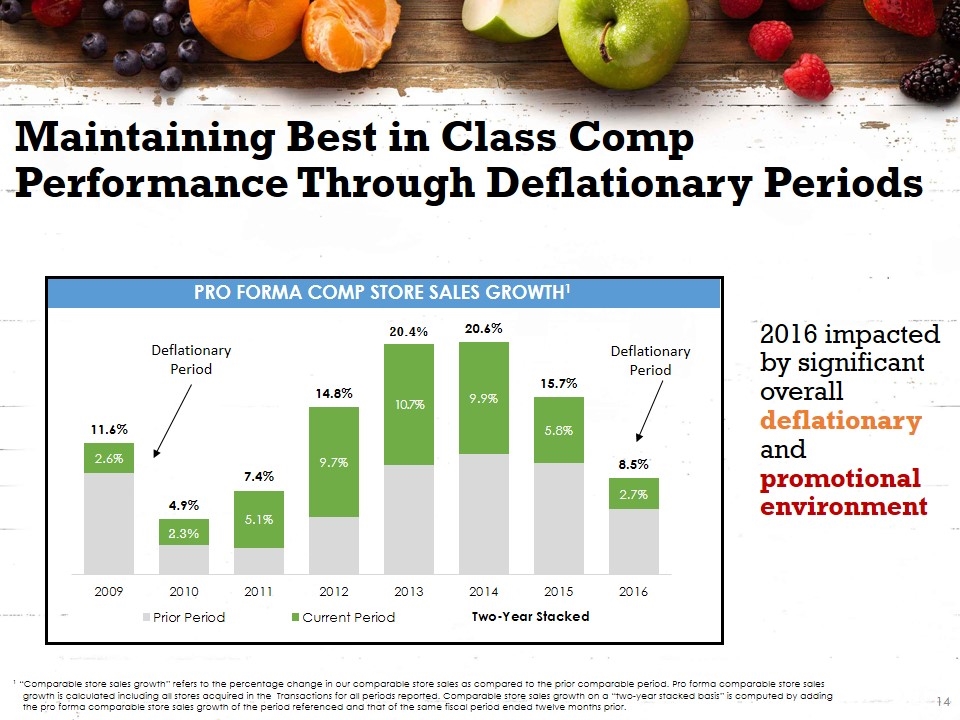

Pro Forma COMP STORE SALES GROWTH1 Maintaining Best in Class Comp Performance Through Deflationary Periods 1 “Comparable store sales growth” refers to the percentage change in our comparable store sales as compared to the prior comparable period. Pro forma comparable store sales growth is calculated including all stores acquired in the Transactions for all periods reported. Comparable store sales growth on a “two-year stacked basis” is computed by adding the pro forma comparable store sales growth of the period referenced and that of the same fiscal period ended twelve months prior. Deflationary Period Deflationary Period 2016 impacted by significant overall deflationary and promotional environment

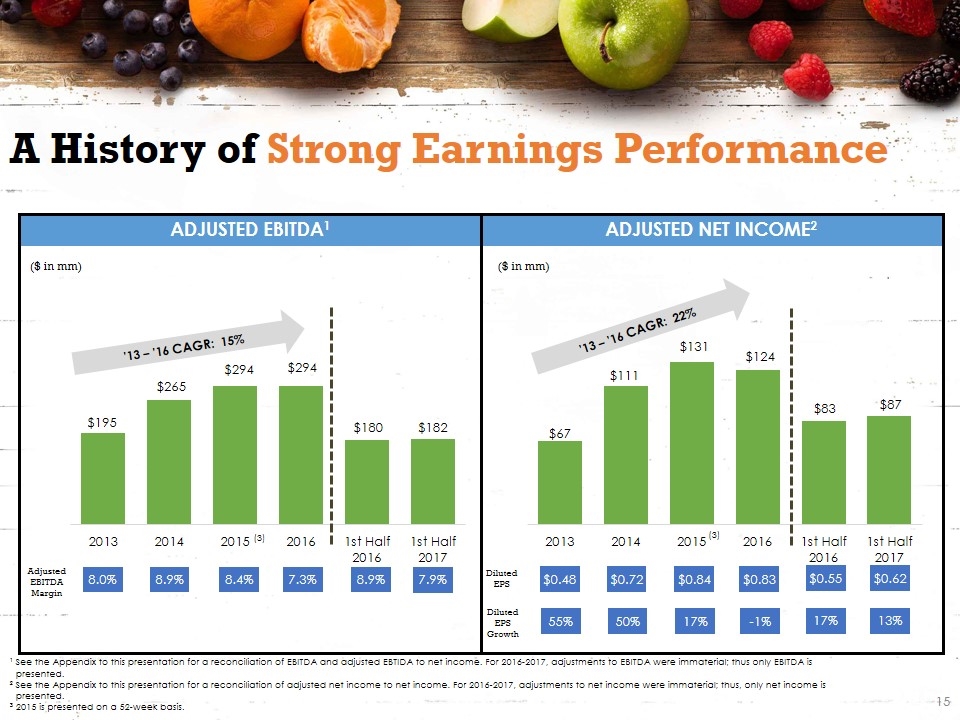

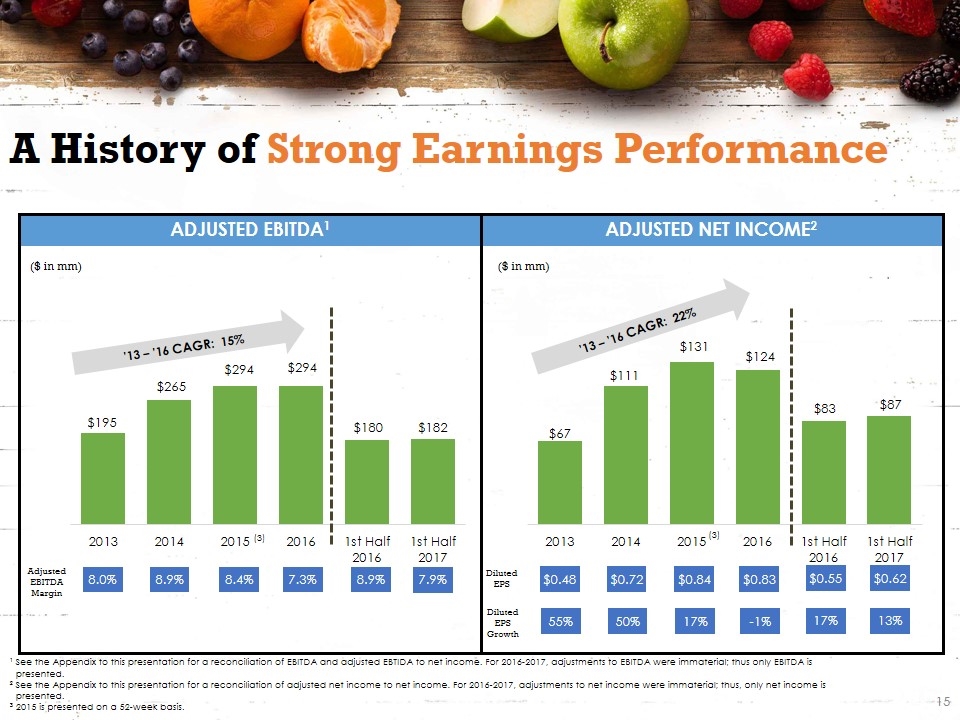

ADJUSTED NET INCOME2 ADJUSTED EBITDA1 A History of Strong Earnings Performance ¹ See the Appendix to this presentation for a reconciliation of EBITDA and adjusted EBTIDA to net income. For 2016-2017, adjustments to EBITDA were immaterial; thus only EBITDA is presented. ² See the Appendix to this presentation for a reconciliation of adjusted net income to net income. For 2016-2017, adjustments to net income were immaterial; thus, only net income is presented. 3 2015 is presented on a 52-week basis. ($ in mm) ($ in mm) Adjusted EBITDA Margin 8.0% 8.9% 8.4% ’13 – ’16 CAGR: 15% ’13 – ’16 CAGR: 22% 7.3% Diluted EPS $0.48 $0.72 $0.84 $0.83 Diluted EPS Growth 55% 50% 17% -1% (3) (3) 7.9% 8.9% $0.55 17% $0.62 13%

Store Count Plan to Open Approximately 30 Stores Per Year Double Digit Unit Growth 1 As of August 3, 2017

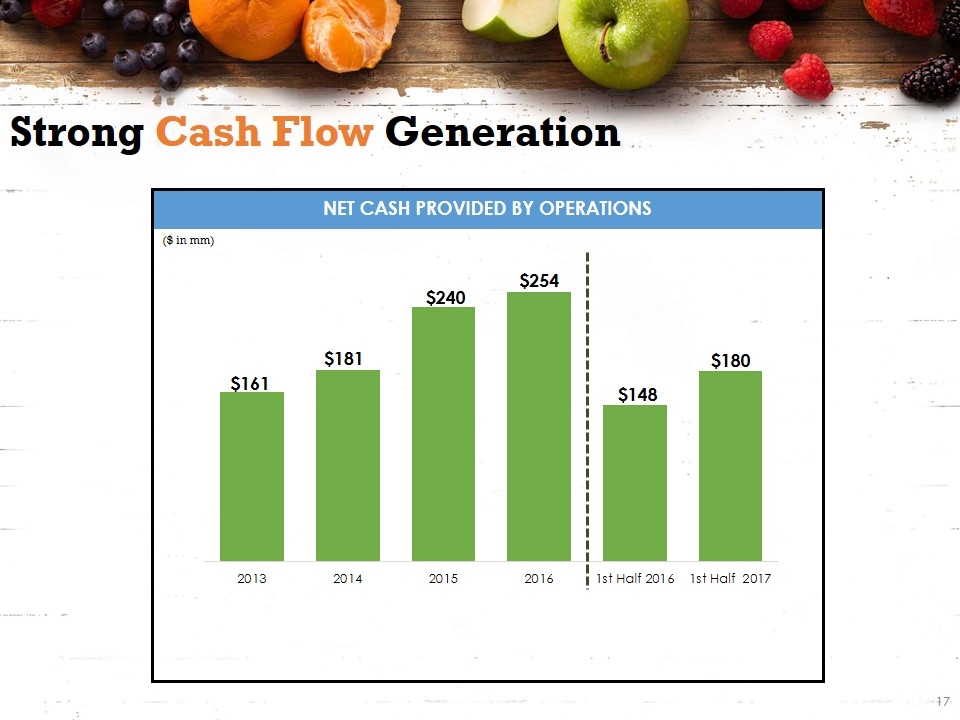

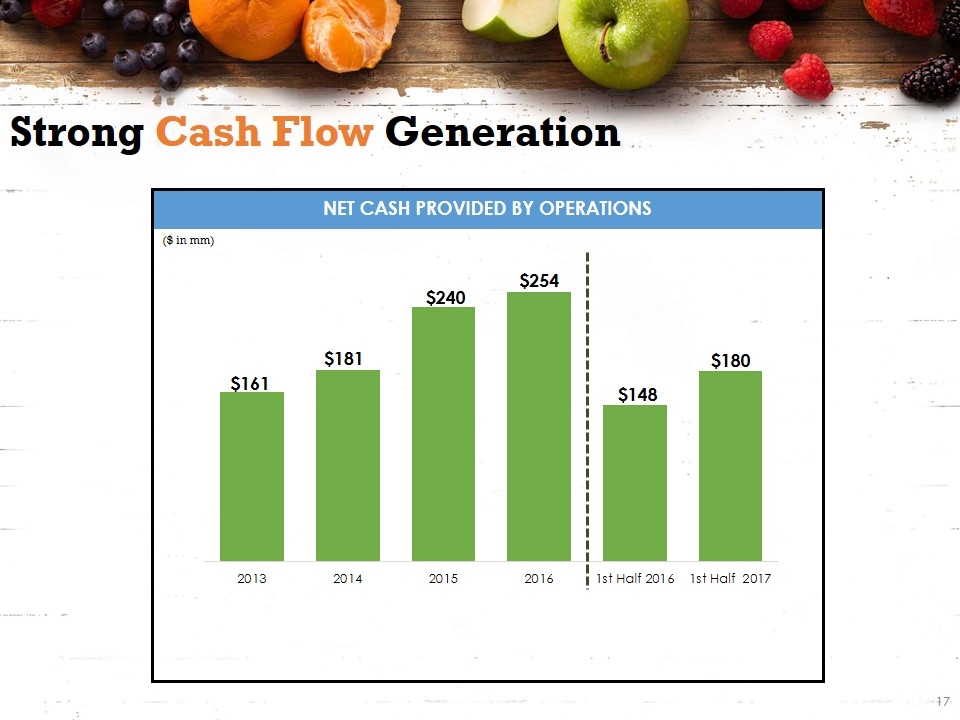

Net cash provided by operations Strong Cash Flow Generation ($ in mm)

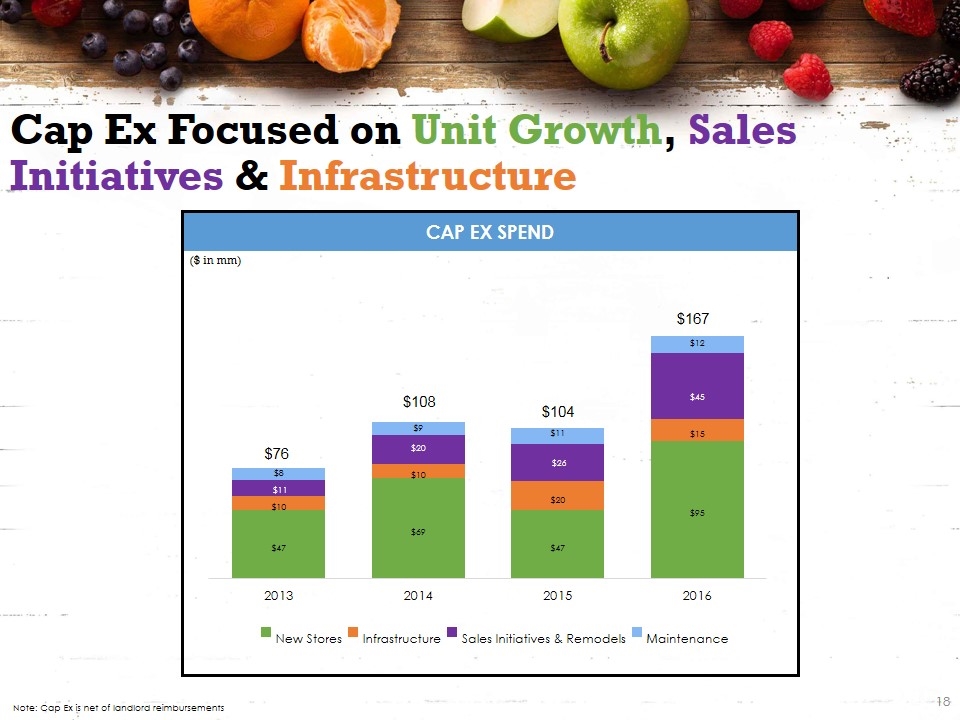

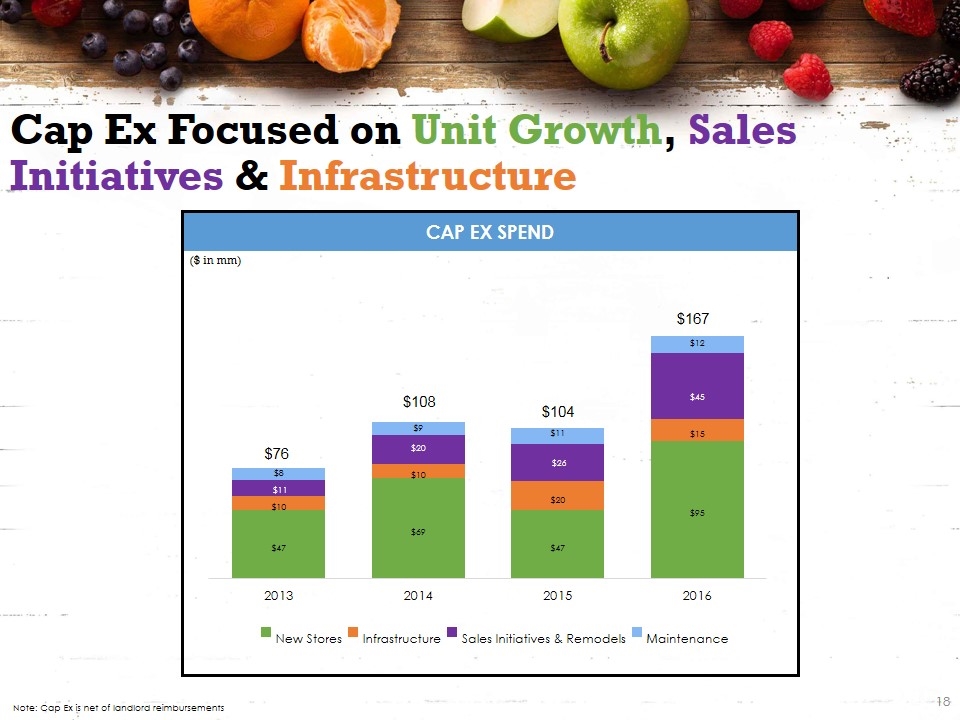

Cap ex spend Cap Ex Focused on Unit Growth, Sales Initiatives & Infrastructure ($ in mm) Note: Cap Ex is net of landlord reimbursements

Compelling New Store Economics Average sq ft. store size Net Cash Investment1 First Year Sales Initial Sales Growth over 3 to 4 years ¹ Includes store build-out (net of contributions from landlords), inventory (net of payables) and cash pre-opening expenses. 30K $3.3M ~$12M - $14M 20% - 30% Pre-Tax Cash-on-Cash Returns of 35% to 40% within 3 to 4 years

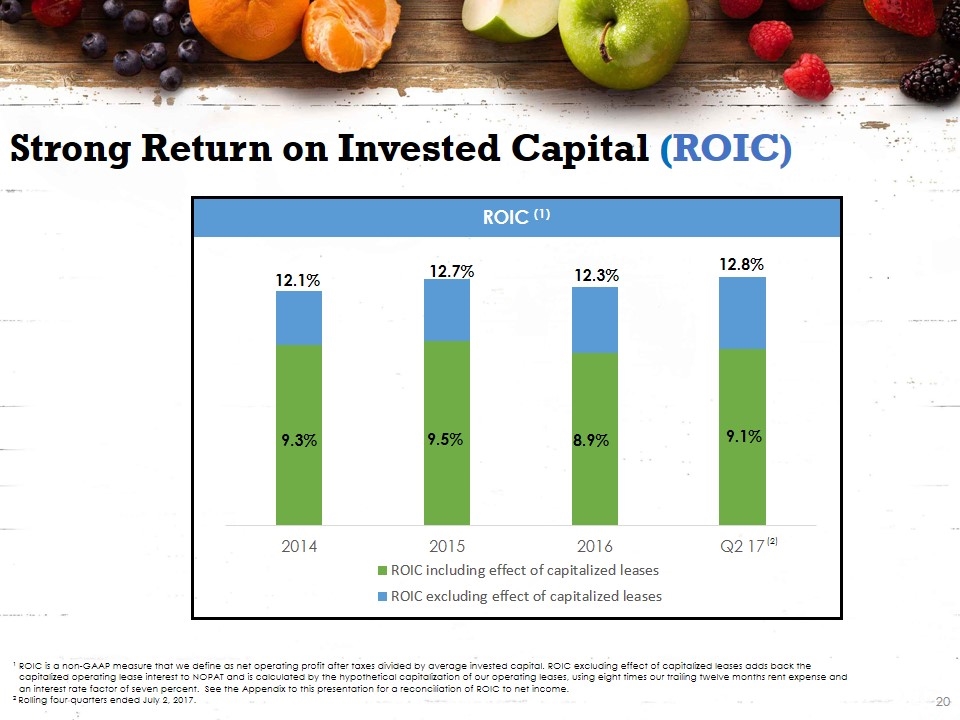

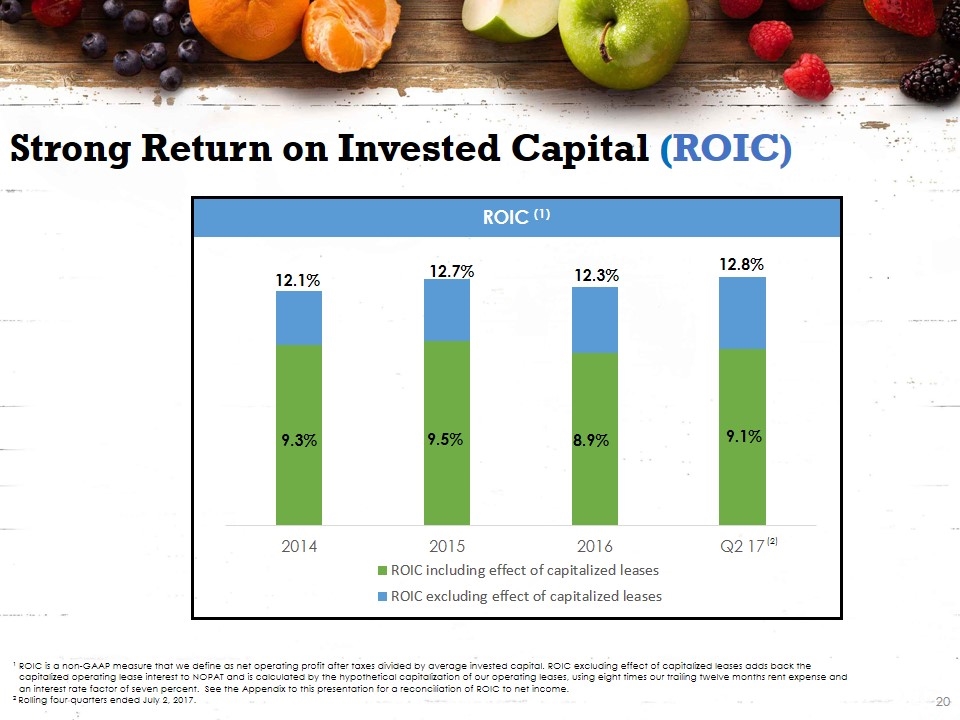

ROIC (1) Strong Return on Invested Capital (ROIC) ¹ ROIC is a non-GAAP measure that we define as net operating profit after taxes divided by average invested capital. ROIC excluding effect of capitalized leases adds back the capitalized operating lease interest to NOPAT and is calculated by the hypothetical capitalization of our operating leases, using eight times our trailing twelve months rent expense and an interest rate factor of seven percent. See the Appendix to this presentation for a reconciliation of ROIC to net income. 2 Rolling four quarters ended July 2, 2017. 12.7% 12.3% 12.8%

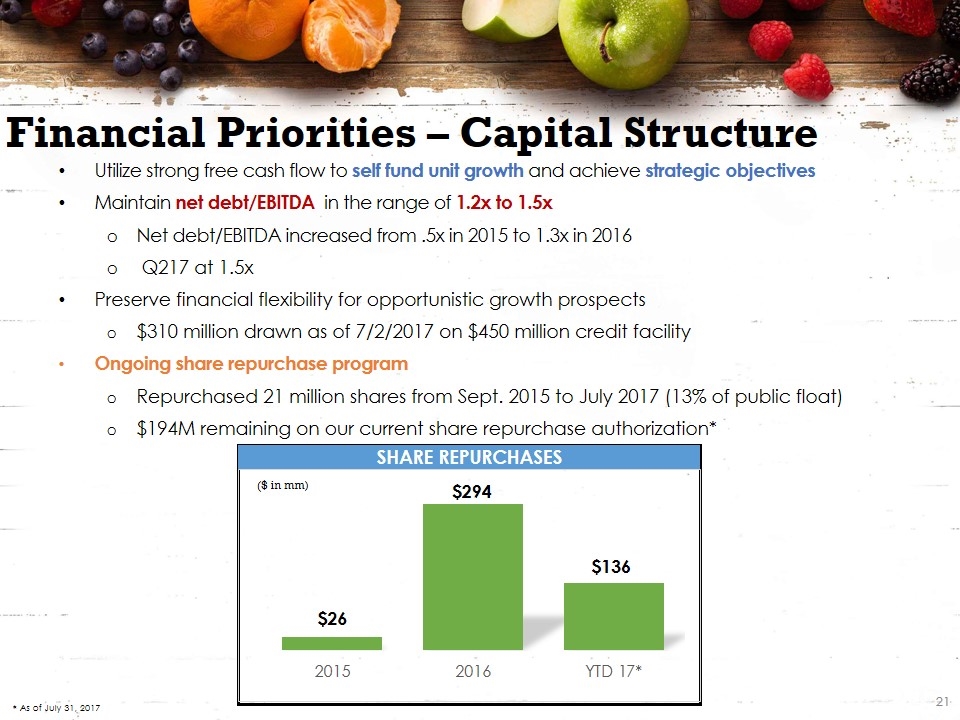

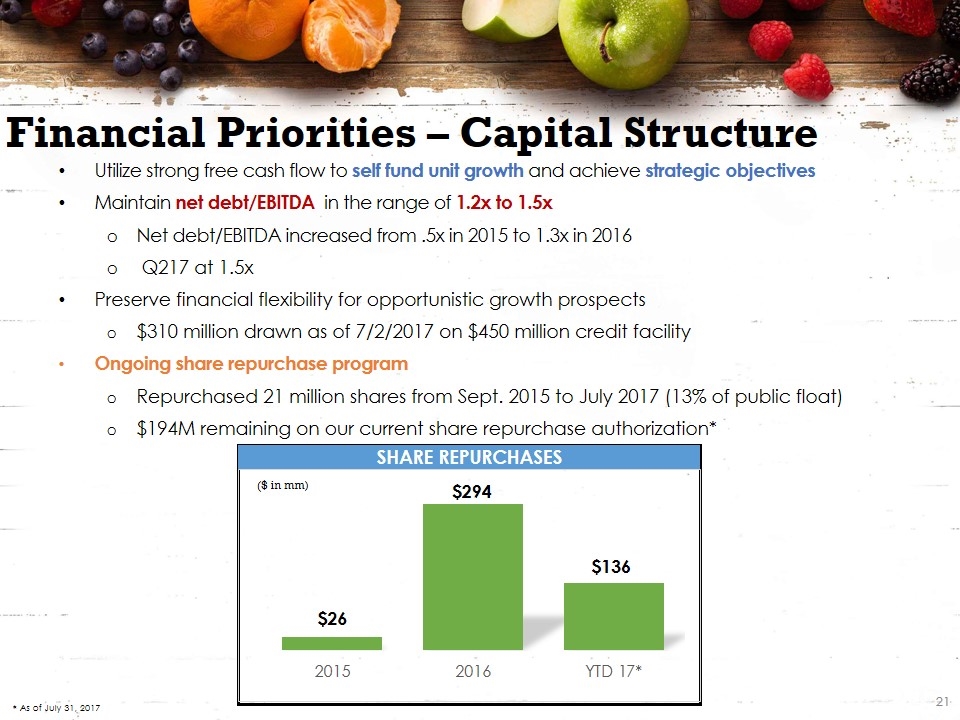

Share repurchases Utilize strong free cash flow to self fund unit growth and achieve strategic objectives Maintain net debt/EBITDA in the range of 1.2x to 1.5x Net debt/EBITDA increased from .5x in 2015 to 1.3x in 2016 Q217 at 1.5x Preserve financial flexibility for opportunistic growth prospects $310 million drawn as of 7/2/2017 on $450 million credit facility Ongoing share repurchase program Repurchased 21 million shares from Sept. 2015 to July 2017 (13% of public float) $194M remaining on our current share repurchase authorization* Financial Priorities – Capital Structure ($ in mm) * As of July 31, 2017

Why Sprouts is a Compelling Investment Authentic Fresh, Natural & Organic Food Offering at Great Value Fastest Growing Segment of the U.S. Supermarket Industry with Strong Macro Tailwinds Significant New Store Growth Opportunity Supported by Broad Demographic Appeal Compelling Business Model with Strong Cash Generation & Ongoing Share Repurchase Program Driving Shareholder Value Passionate Team with a Customer-Focused Culture Strong Management Team with a Diverse Retail Background

Appendix: Supplemental Materials

Management Team with Grocery & Retail Experience Amin Maredia Jim Nielsen Brad Lukow Dan Sanders Dan Bruni Ted Frumkin Shawn Gensch Brandon Lombardi Chief Executive Officer 6 Years with Sprouts President & Chief Operating Officer 6 Years with Sprouts Chief Financial Officer 1Year with Sprouts Chief Operations Officer 2 Years with Sprouts Chief Information Officer 2 Years with Sprouts Chief Development Officer 5 Years with Sprouts Chief Marketing Officer 2 Years with Sprouts Chief Human Resources & Legal Officer 5 Years with Sprouts

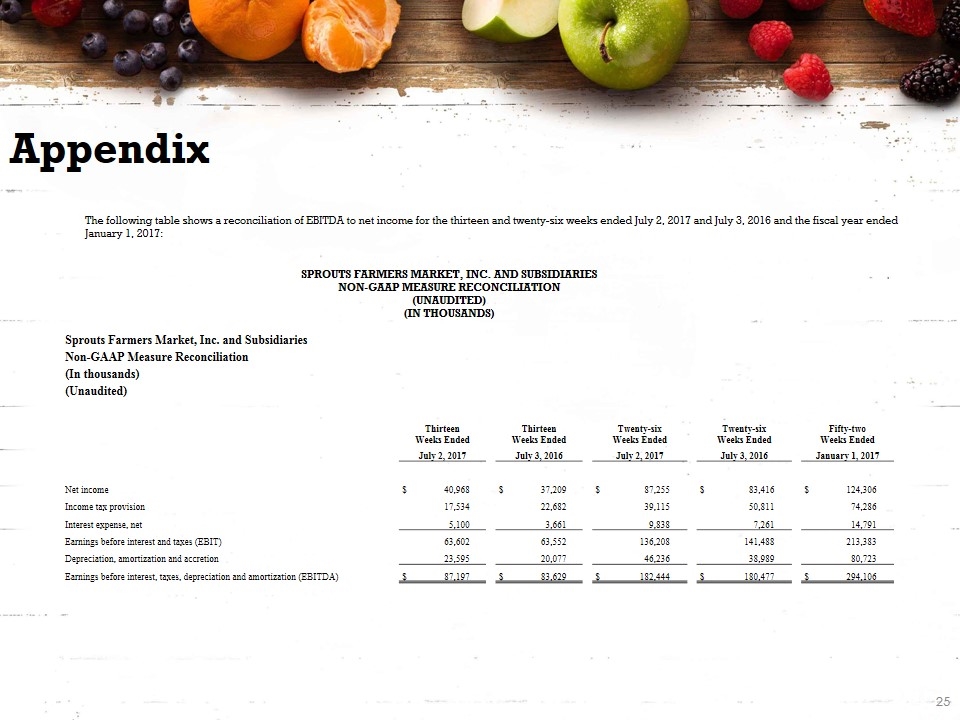

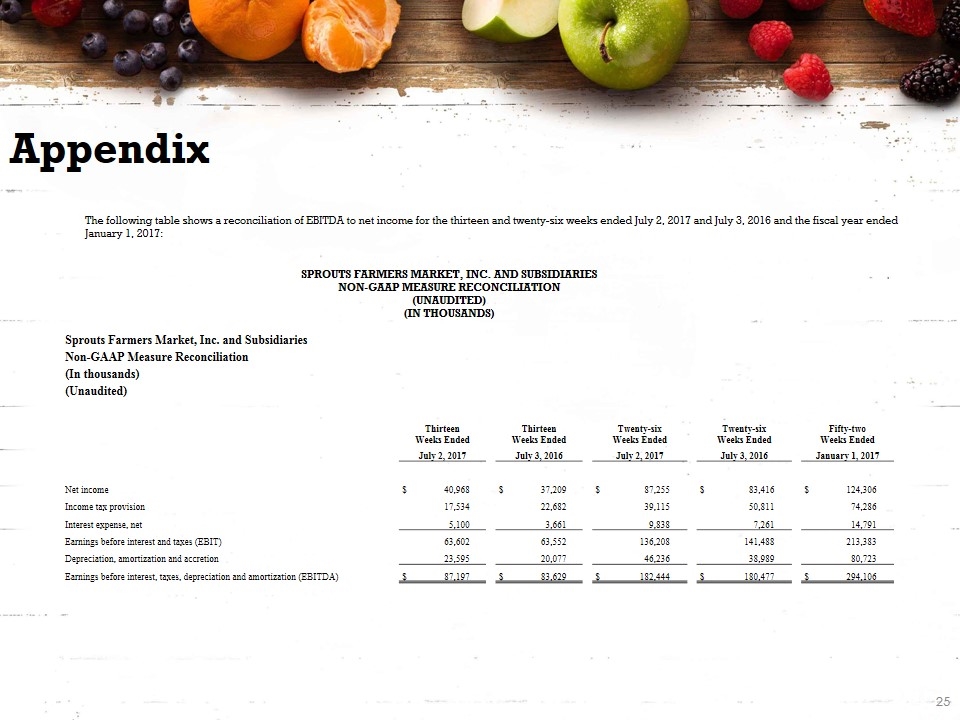

Appendix SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES NON-GAAP MEASURE RECONCILIATION (UNAUDITED) (IN THOUSANDS) The following table shows a reconciliation of EBITDA to net income for the thirteen and twenty-six weeks ended July 2, 2017 and July 3, 2016 and the fiscal year ended January 1, 2017: Sprouts Farmers Market, Inc. and Subsidiaries Non-GAAP Measure Reconciliation (In thousands) (Unaudited) Thirteen Weeks Ended Thirteen Weeks Ended Twenty-six Weeks Ended Twenty-six Weeks Ended Fifty-two Weeks Ended July 2, 2017 July 3, 2016 July 2, 2017 July 3, 2016 January 1, 2017 Net income $ 40,968 $ 37,209 $ 87,255 $ 83,416 $ 124,306 Income tax provision 17,534 22,682 39,115 50,811 74,286 Interest expense, net 5,100 3,661 9,838 7,261 14,791 Earnings before interest and taxes (EBIT) 63,602 63,552 136,208 141,488 213,383 Depreciation, amortization and accretion 23,595 20,077 46,236 38,989 80,723 Earnings before interest, taxes, depreciation and amortization (EBITDA) $ 87,197 $ 83,629 $ 182,444 $ 180,477 $ 294,106

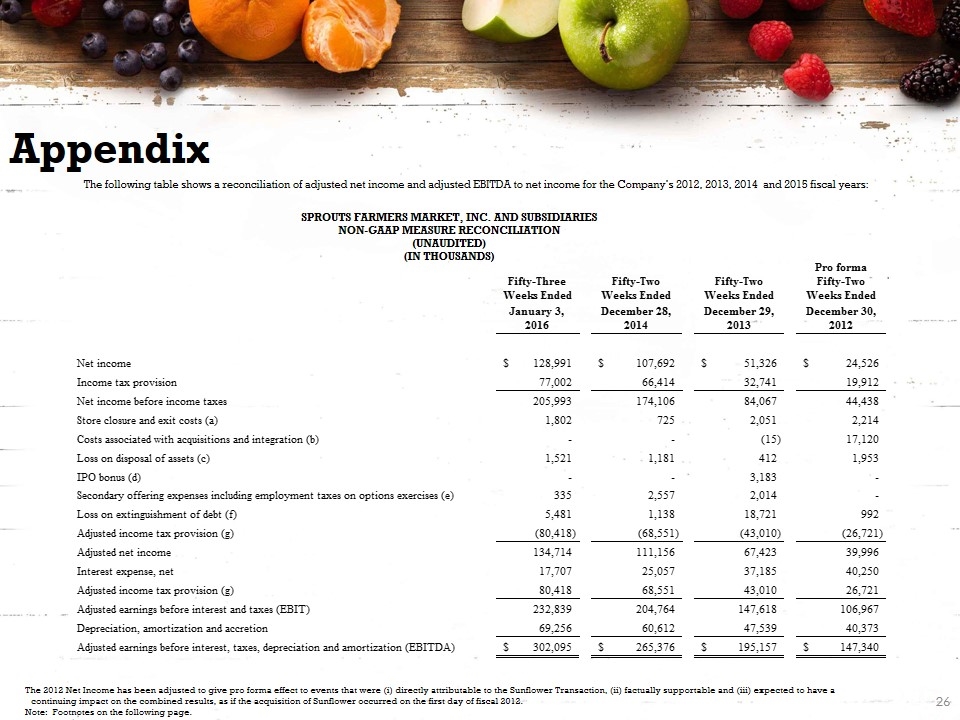

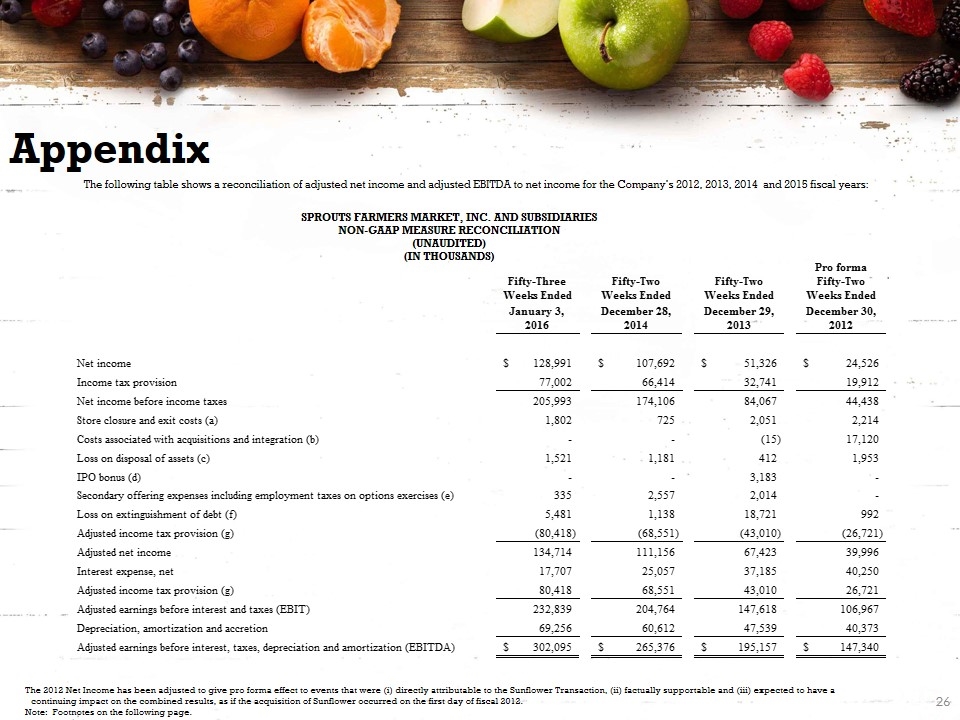

Appendix The following table shows a reconciliation of adjusted net income and adjusted EBITDA to net income for the Company’s 2012, 2013, 2014 and 2015 fiscal years: The 2012 Net Income has been adjusted to give pro forma effect to events that were (i) directly attributable to the Sunflower Transaction, (ii) factually supportable and (iii) expected to have a continuing impact on the combined results, as if the acquisition of Sunflower occurred on the first day of fiscal 2012. Note: Footnotes on the following page. SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES NON-GAAP MEASURE RECONCILIATION (UNAUDITED) (IN THOUSANDS)

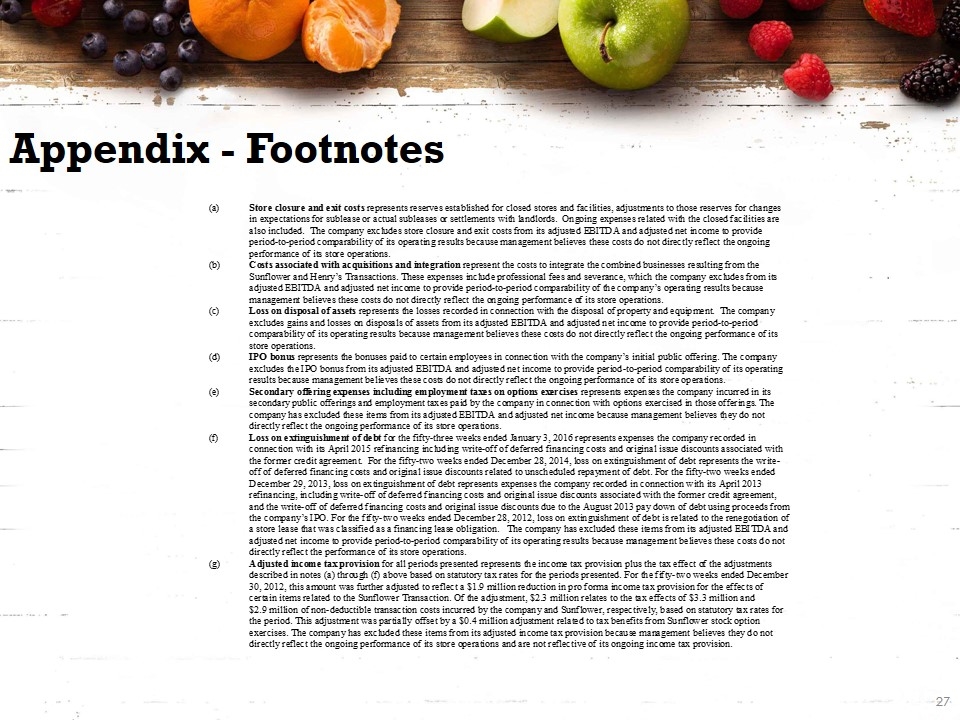

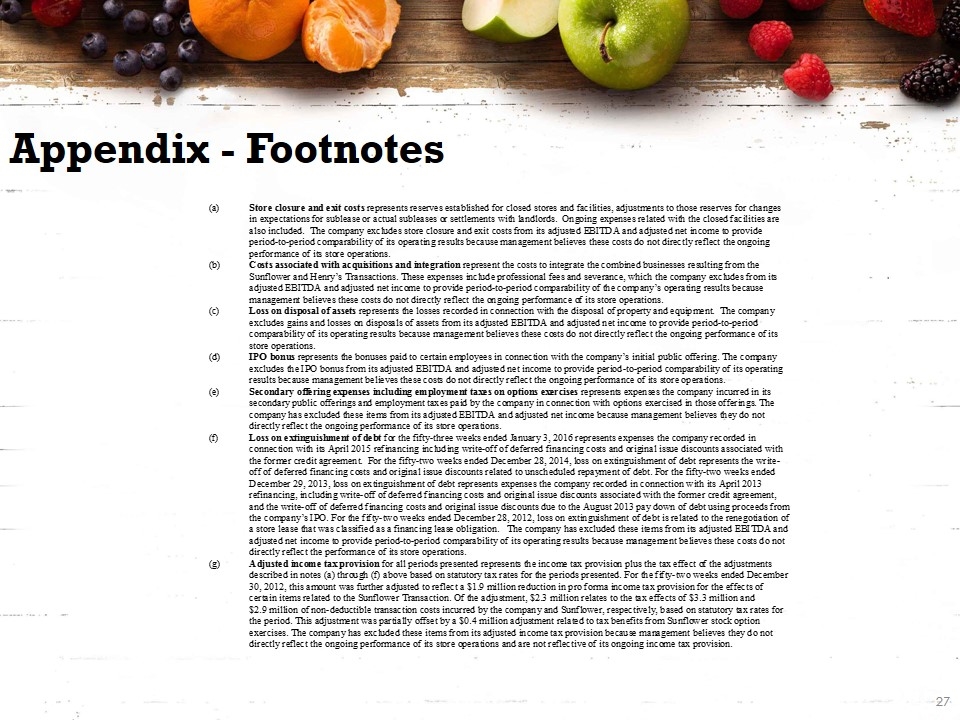

Appendix - Footnotes

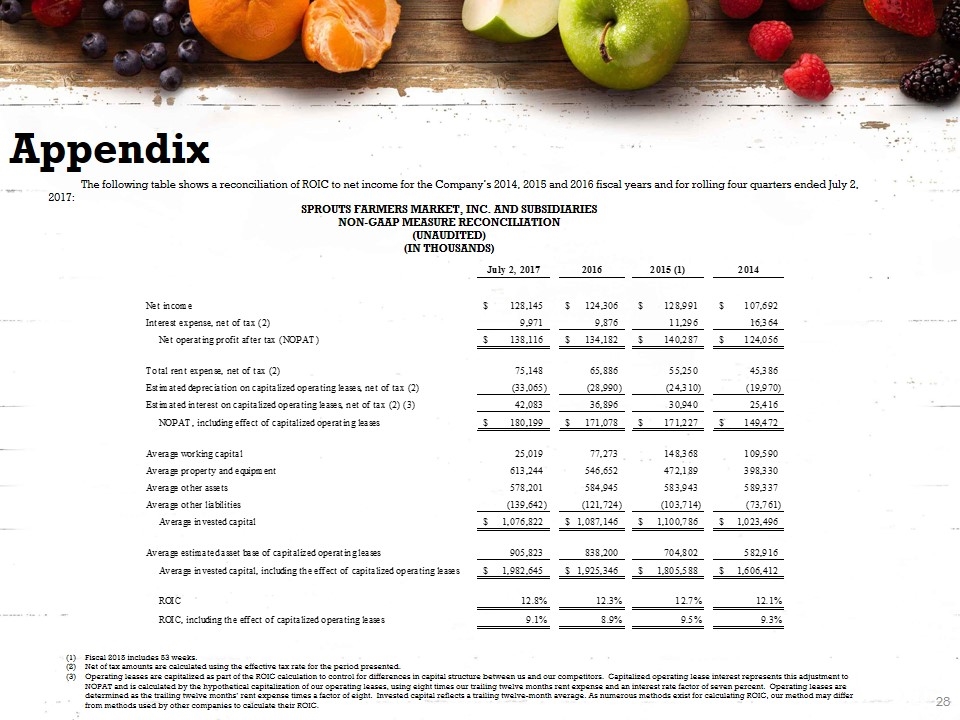

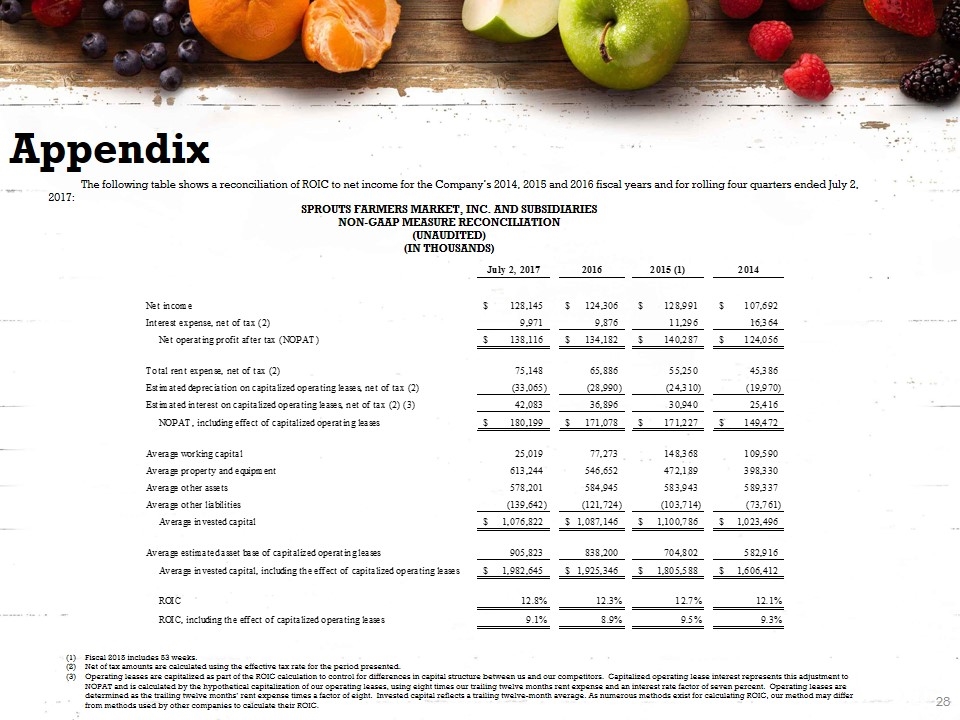

Appendix The following table shows a reconciliation of ROIC to net income for the Company’s 2014, 2015 and 2016 fiscal years and for rolling four quarters ended July 2, 2017: SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES NON-GAAP MEASURE RECONCILIATION (UNAUDITED) (IN THOUSANDS) (1)Fiscal 2015 includes 53 weeks. (2)Net of tax amounts are calculated using the effective tax rate for the period presented. (3)Operating leases are capitalized as part of the ROIC calculation to control for differences in capital structure between us and our competitors. Capitalized operating lease interest represents this adjustment to NOPAT and is calculated by the hypothetical capitalization of our operating leases, using eight times our trailing twelve months rent expense and an interest rate factor of seven percent. Operating leases are determined as the trailing twelve months’ rent expense times a factor of eight. Invested capital reflects a trailing twelve-month average. As numerous methods exist for calculating ROIC, our method may differ from methods used by other companies to calculate their ROIC.