Investor Deck February ‘19 Exhibit 99.1

Forward-Looking Statements: Certain statements in this presentation are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. Any statements contained herein (including, but not limited to, statements to the effect that Sprouts Farmers Market, Inc. (the “Company”) or its management "anticipates," "plans," "estimates," "expects," "believes," or the negative of these terms and other similar expressions) that are not statements of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company’s guidance, outlook, growth and opportunities. These statements involve certain risks and uncertainties that may cause actual results to differ materially from expectations as of the date of this presentation. These risks and uncertainties include, without limitation, risks associated with the Company’s ability to successfully compete in its intensely competitive industry; the Company’s ability to successfully open new stores; the Company’s ability to manage its rapid growth; the Company’s ability to maintain or improve its comparable store sales and operating margins; the Company’s ability to identify and react to trends in consumer preferences; product supply disruptions; general economic conditions; the Company’s ability to manage its transition to a new CEO; accounting standard changes, including the new lease accounting guidelines; and other factors as set forth from time to time in the Company’s Securities and Exchange Commission filings. The Company intends these forward-looking statements to speak only as of the date of this presentation and does not undertake to update or revise them as more information becomes available, except as required by law. Non-GAAP Financial Measures: In addition to reporting financial results in accordance with accounting principles generally accepted in the United States (“GAAP”), the Company presents EBITDA, adjusted EBITDA, adjusted net income and adjusted diluted earnings per share. These measures are not in accordance with, and are not intended as alternatives to, GAAP. The Company's management believes that this presentation provides useful information to management, analysts and investors regarding certain additional financial and business trends relating to its results of operations and financial condition. In addition, management uses these measures for reviewing the financial results of the Company, and certain of these measures may be used as components of incentive compensation. The Company defines EBITDA as net income before interest expense, provision for income tax, and depreciation, amortization and accretion and adjusted EBITDA as EBITDA excluding the impact of special items. The Company defines adjusted net income and adjusted diluted earnings per share by adjusting the applicable GAAP measure to remove the impact of special items. The Company also provides information regarding Return on Invested Capital (“ROIC”) as additional information about its operating results for 2014-2018. ROIC is a non-GAAP financial measure used by management to evaluate the Company’s investment returns on capital and provides a meaningful measure of the effectiveness of its capital allocation over time. The Company defines ROIC as net operating profit after tax (“NOPAT”), including the effect of capitalized operating leases, divided by average invested capital. Non-GAAP measures are intended to provide additional information only and do not have any standard meanings prescribed by GAAP. Use of these terms may differ from similar measures reported by other companies. Because of their limitations, non-GAAP measures should not be considered as a measure of discretionary cash available to use to reinvest in the growth of the Company’s business, or as a measure of cash that will be available to meet the Company’s obligations. Each non-GAAP measure has its limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. Please see the Appendix to this presentation for a reconciliation of these non GAAP measures to the comparable GAAP measures.

Overview of Sprouts

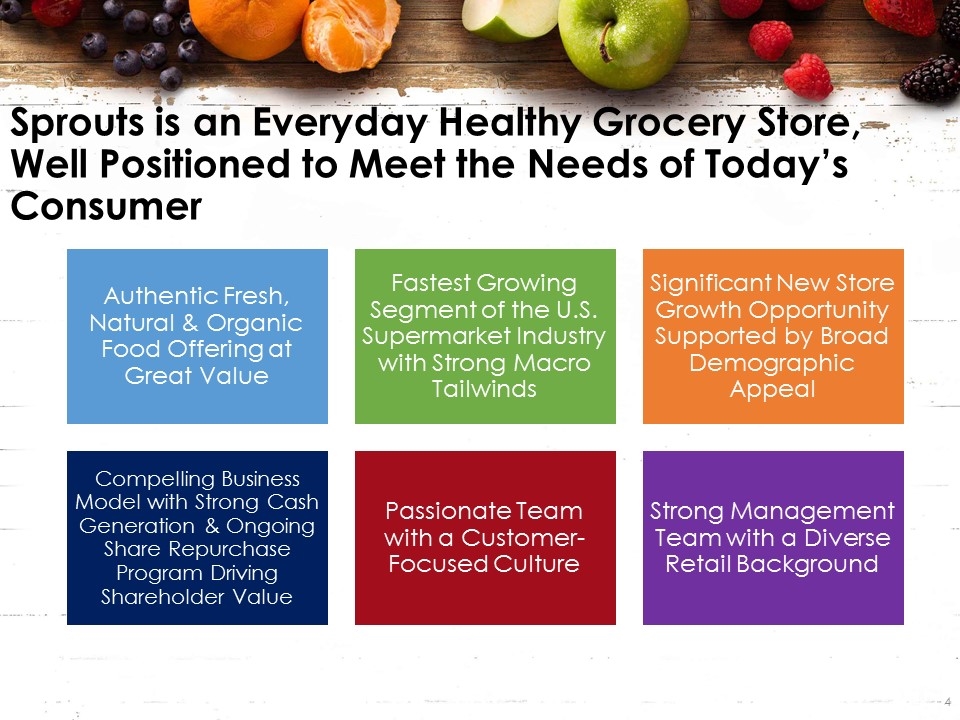

Sprouts is an Everyday Healthy Grocery Store, Well Positioned to Meet the Needs of Today’s Consumer Authentic Fresh, Natural & Organic Food Offering at Great Value Fastest Growing Segment of the U.S. Supermarket Industry with Strong Macro Tailwinds Significant New Store Growth Opportunity Supported by Broad Demographic Appeal Compelling Business Model with Strong Cash Generation & Ongoing Share Repurchase Program Driving Shareholder Value Passionate Team with a Customer-Focused Culture Strong Management Team with a Diverse Retail Background

A Grocery Shopping Experience that Makes Healthy Living Easy & Affordable Health Value Selection Engagement SELECTION VALUE KNOWLEDGEABLE SERVICE & ENGAGEMENT HEALTH

Produce surrounded by a complete grocery offering Promote value everyday Differentiated assortment of high-quality, healthy foods: Fresh, natural and organic offering High standard Private Label rooted in quality and taste Do not carry most national branded CPG items Farmers market-inspired open store layout with low profile displays Convenient, small-box: 30k sq. ft. Friendly, engaged customer service, easy to shop environment Sprouts – A Healthy Grocery Store that Flips the Conventional Model

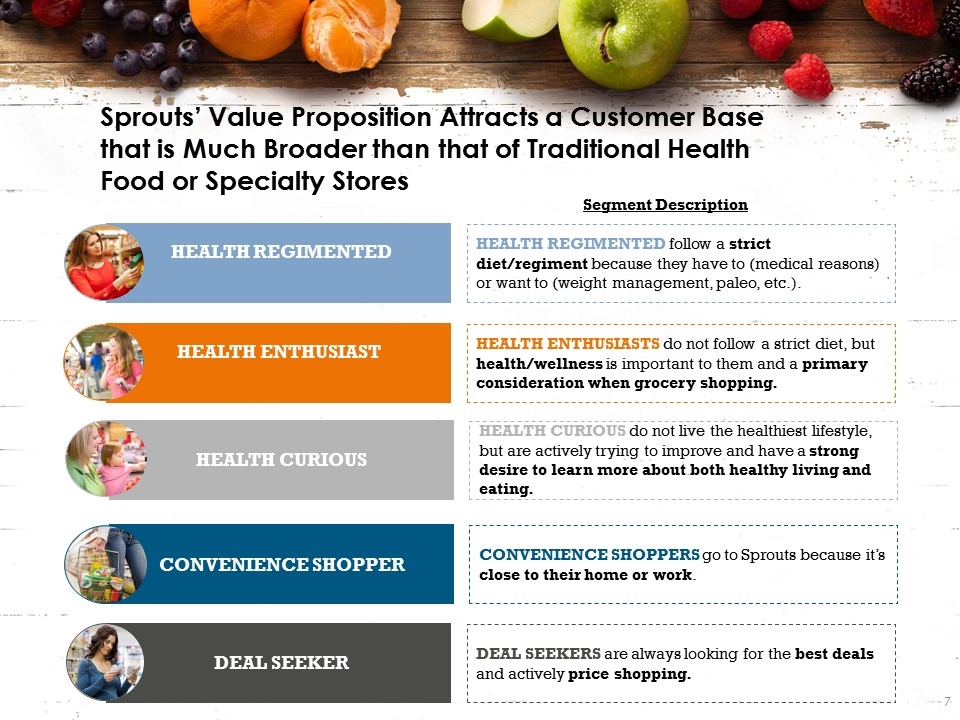

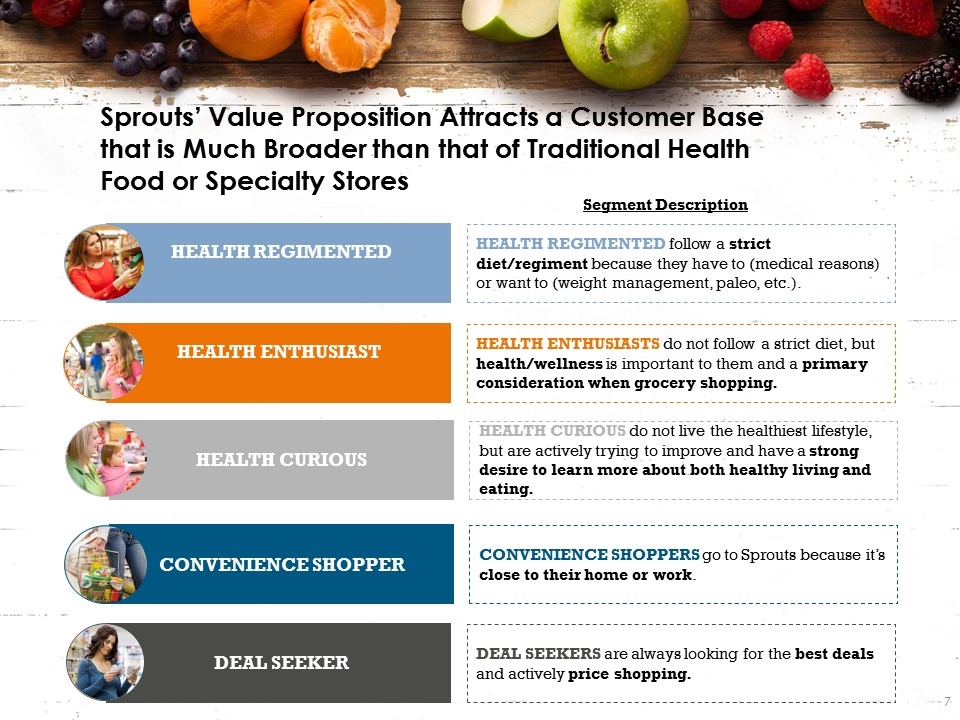

HEALTH REGIMENTED HEALTH ENTHUSIAST Segment Description HEALTH REGIMENTED follow a strict diet/regiment because they have to (medical reasons) or want to (weight management, paleo, etc.). HEALTH ENTHUSIASTS do not follow a strict diet, but health/wellness is important to them and a primary consideration when grocery shopping. HEALTH CURIOUS HEALTH CURIOUS do not live the healthiest lifestyle, but are actively trying to improve and have a strong desire to learn more about both healthy living and eating. CONVENIENCE SHOPPER CONVENIENCE SHOPPERS go to Sprouts because it’s close to their home or work. DEAL SEEKER DEAL SEEKERS are always looking for the best deals and actively price shopping. Sprouts’ Value Proposition Attracts a Customer Base that is Much Broader than that of Traditional Health Food or Specialty Stores

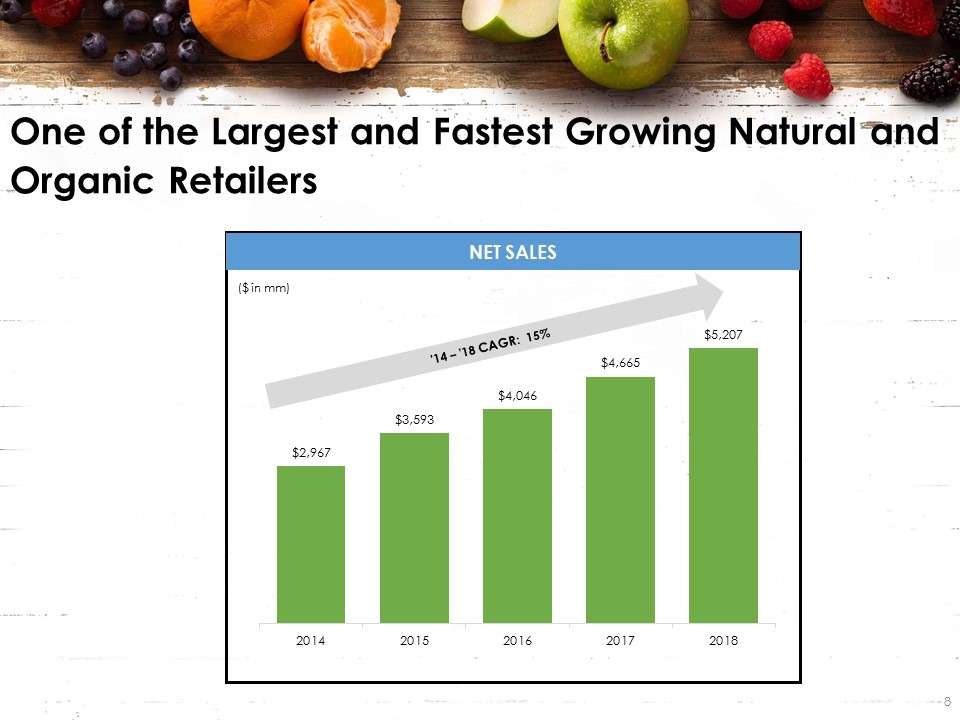

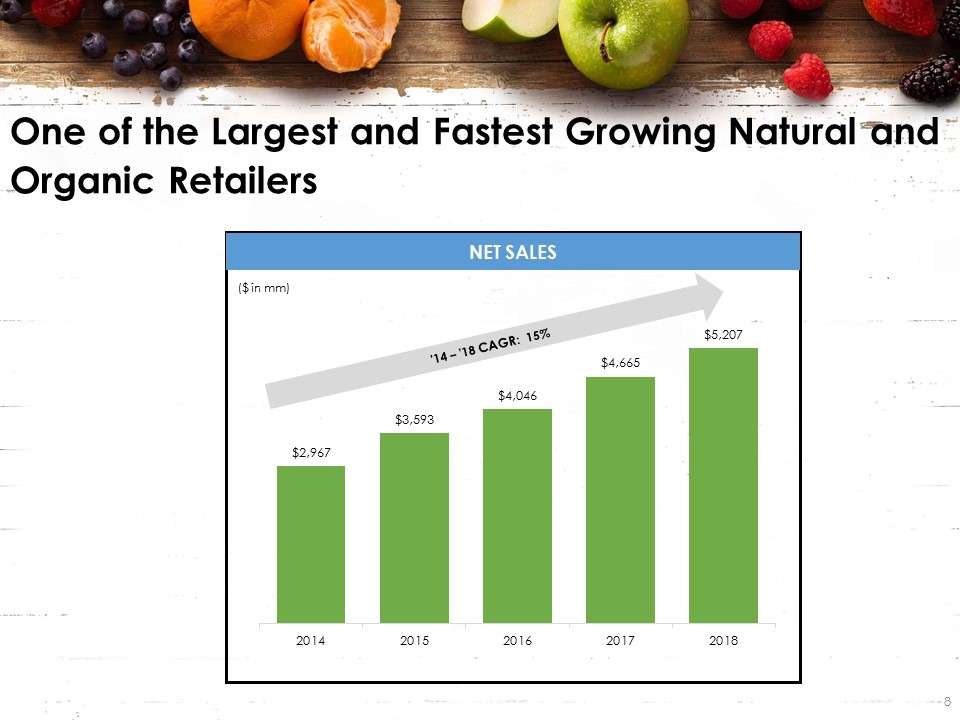

’14 – ’18 CAGR: 15% ($ in mm) Net Sales One of the Largest and Fastest Growing Natural and Organic Retailers

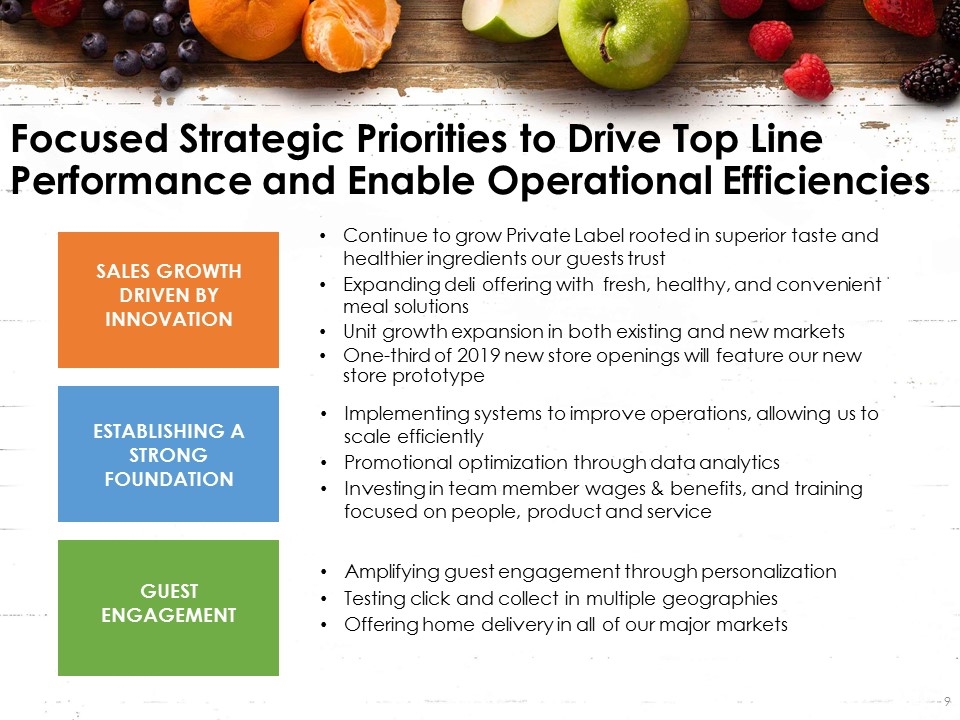

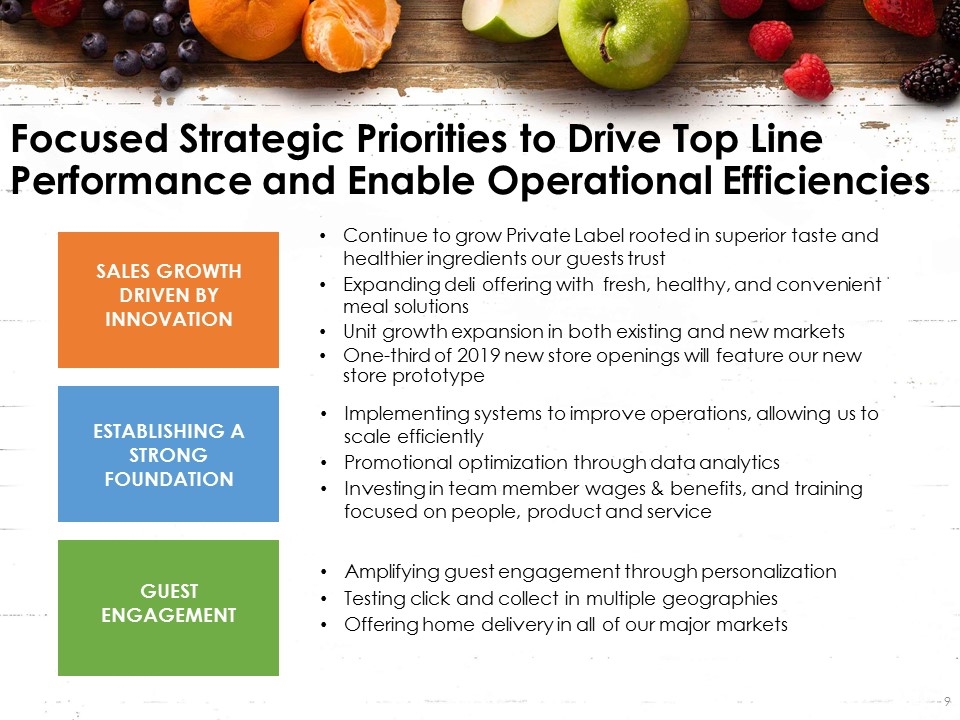

Focused Strategic Priorities to Drive Top Line Performance and Enable Operational Efficiencies SALES GROWTH DRIVEN BY INNOVATION ESTABLISHING A STRONG FOUNDATION GUEST ENGAGEMENT Continue to grow Private Label rooted in superior taste and healthier ingredients our guests trust Expanding deli offering with fresh, healthy, and convenient meal solutions Unit growth expansion in both existing and new markets One-third of 2019 new store openings will feature our new store prototype Implementing systems to improve operations, allowing us to scale efficiently Promotional optimization through data analytics Investing in team member wages & benefits, and training focused on people, product and service Amplifying guest engagement through personalization Testing click and collect in multiple geographies Offering home delivery in all of our major markets

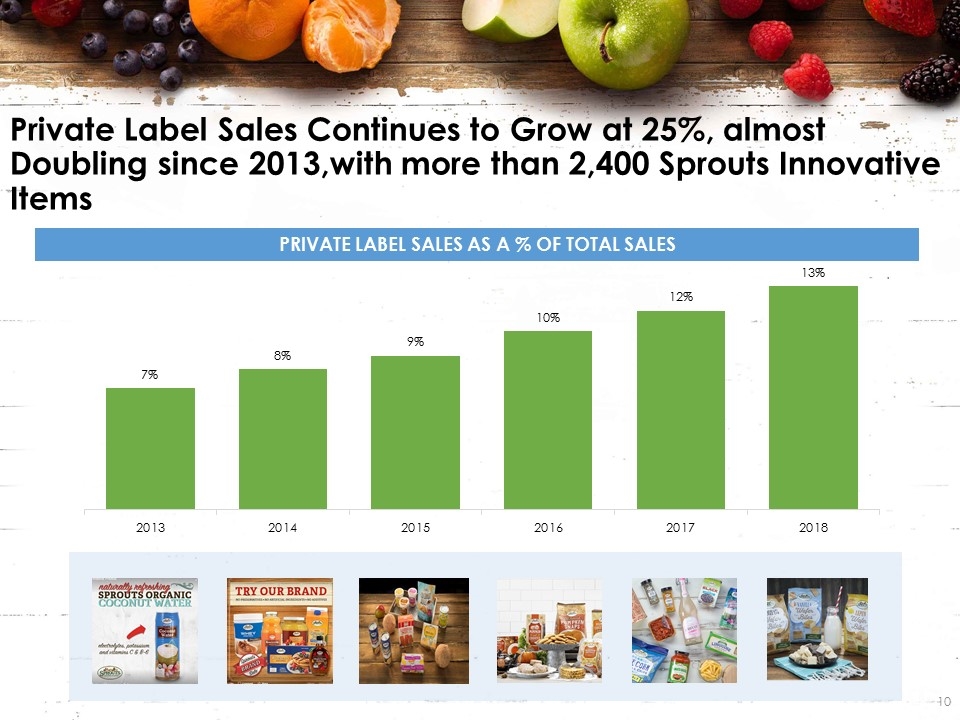

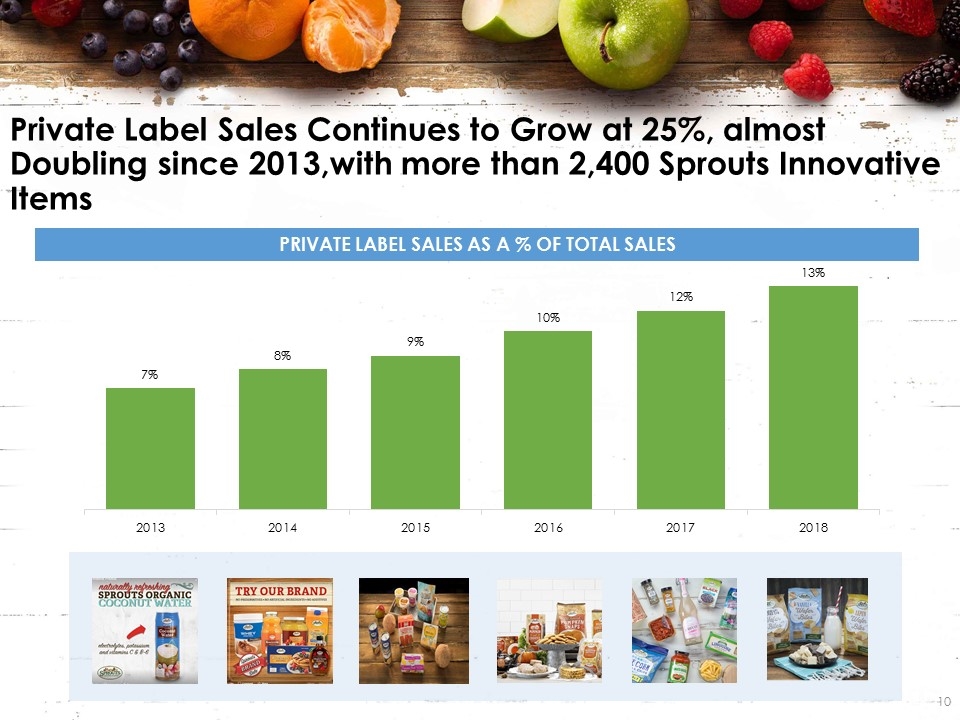

Private Label Sales Continues to Grow at 25%, almost Doubling since 2013,with more than 2,400 Sprouts Innovative Items Private label sales as a % of total sales

Entering the new states of LA, NJ & VA in 2019 Demographics allow for deep penetration in markets Model works well in densely populated, urban areas as well as smaller metropolitan markets Successful in “natural / lifestyle” markets and more “traditional” markets Plan to open approximately 30 stores per year for the coming years Years of New Store Growth Existing Markets as of December 30, 2018 – 313 stores NM TX CO UT AZ NV CA 11 43 39 9 114 12 5 32 OK KS MO TN NC 5 3 6 16 3 AL GA FL 6 4 Near Term Expansion Markets 2 MD SC 1 1 PA WA 1

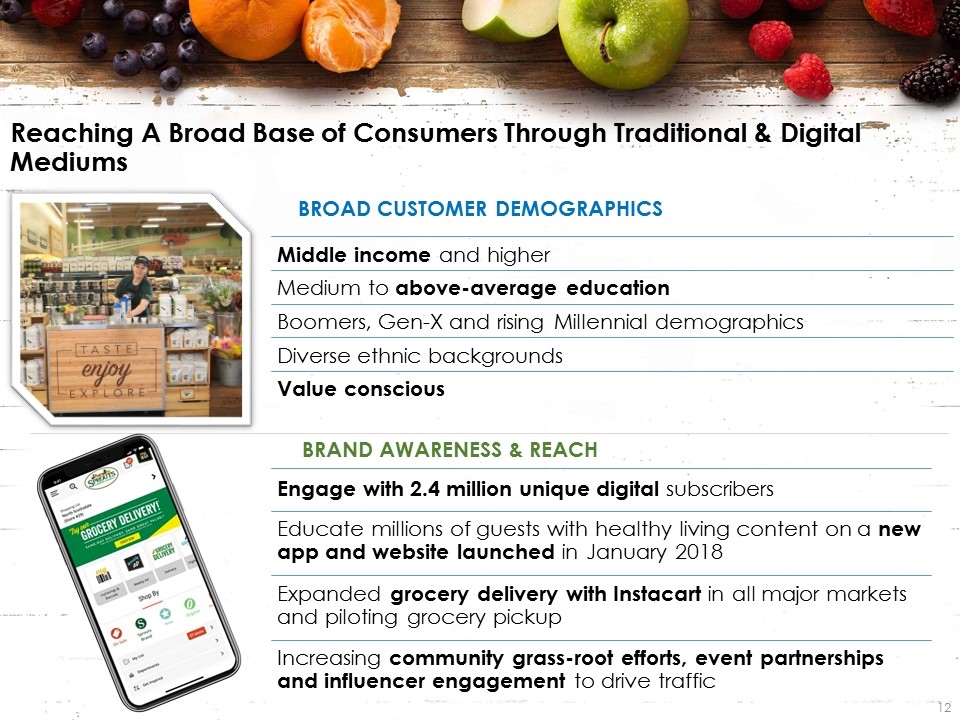

Reaching A Broad Base of Consumers Through Traditional & Digital Mediums BROAD CUSTOMER DEMOGRAPHICS BRAND AWARENESS & REACH Middle income and higher Medium to above-average education Boomers, Gen-X and rising Millennial demographics Diverse ethnic backgrounds Value conscious Engage with 2.4 million unique digital subscribers Educate millions of guests with healthy living content on a new app and website launched in January 2018 Expanded grocery delivery with Instacart in all major markets and piloting grocery pickup Increasing community grass-root efforts, event partnerships and influencer engagement to drive traffic

2018 Sustainability & Social Responsibility ENVIRONMENT - Committed to Zero Waste by 2020 - Donated 27 million pounds of food to local food banks - Diverted 37 million pounds of organics to local cattle farms and compost facilities - Recycled 91 million pounds of cardboard - 89 stores achieved Sustainability recognition through Grocery Stewardship Certification TEAM - Created 4,000 job opportunities - Promoted 28% of our team members - More than 580,000 hours dedicated to team member training and growth - 84% of team members said their supervisor treats them with respect SOURCING - 98% of Sprouts fresh and frozen seafood sourced responsibly - Ranked #8 in the nation by Greenpeace for sustainable seafood sourcing - Surveyed more than 230 suppliers for sustainable sourcing practices - 20% of Sprouts products are organic certified COMMUNITY - Raised $2.3 MM from vendor partners and in-store fundraising - Awarded $2.2MM to more than 130 organizations focused on children’s health and nutrition education - Launched “Day of Service” campaign with over 500 volunteer Team Members supporting over 28 community service events across all regions - Provided funding to distribute essential vitamins to approx. 2.2 million children and expectant mothers with Vitamin Angels

Business & Financial Performance

7-8% Natural and Organic Sector Growth1 Powerful Growth Business – Results Driven GROWTH RESULTS One of the Best White Space Opportunities in Retail Healthy Unit Growth Rate 1 SPINS LLC industry projections for natural and organic food and supplement sales growth through 2020 Compelling Store-Level Economics Double Digit Sales Growth Strong Free Cash Flow Generation Business Ongoing Share Repurchase Program

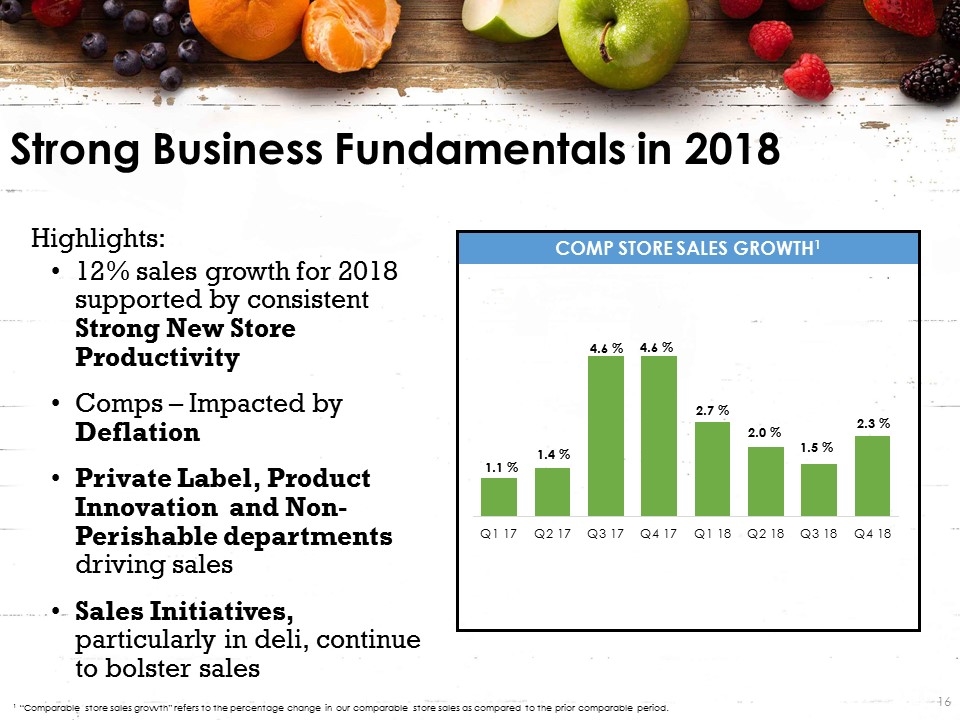

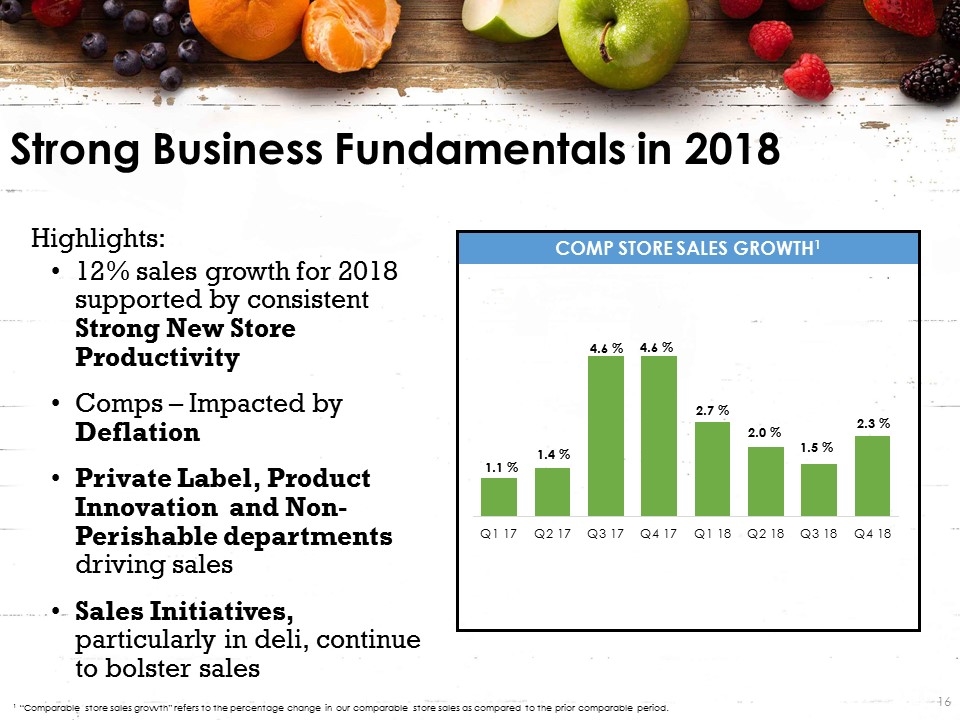

COMP STORE SALES GROWTH1 12% sales growth for 2018 supported by consistent Strong New Store Productivity Comps – Impacted by Deflation Private Label, Product Innovation and Non-Perishable departments driving sales Sales Initiatives, particularly in deli, continue to bolster sales Strong Business Fundamentals in 2018 1 “Comparable store sales growth” refers to the percentage change in our comparable store sales as compared to the prior comparable period. Highlights:

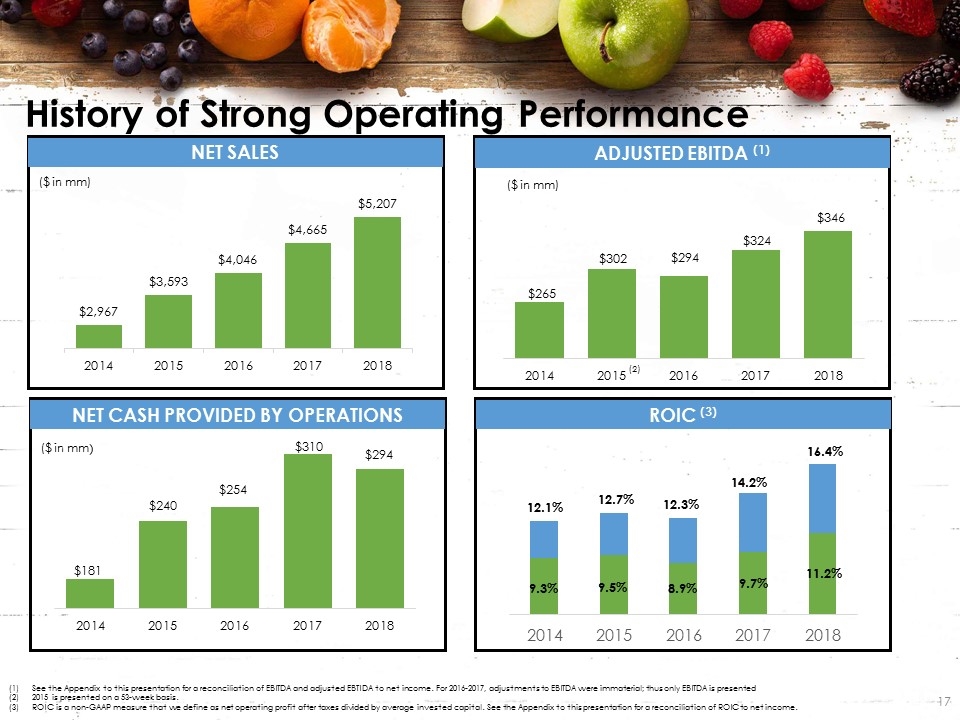

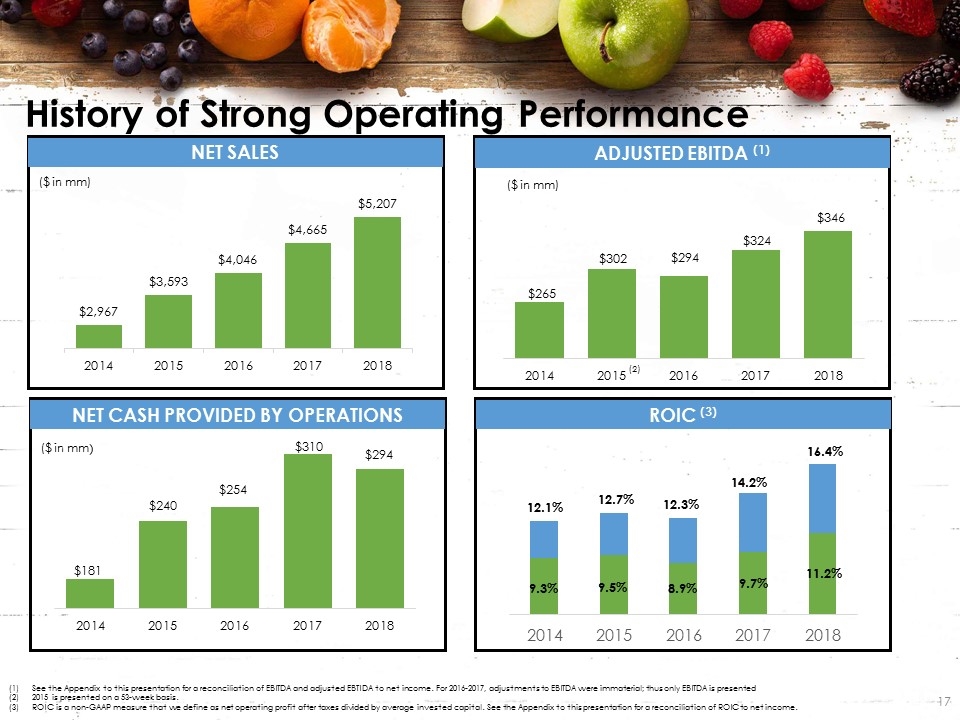

NET CASH PROVIDED by OPERATIONS History of Strong Operating Performance See the Appendix to this presentation for a reconciliation of EBITDA and adjusted EBTIDA to net income. For 2016-2017, adjustments to EBITDA were immaterial; thus only EBITDA is presented 2015 is presented on a 53-week basis. ROIC is a non-GAAP measure that we define as net operating profit after taxes divided by average invested capital. See the Appendix to this presentation for a reconciliation of ROIC to net income. ($ in mm) NET SALES ($ in mm) ROIC (3) ADJUSTED EBITDA (1) (2)

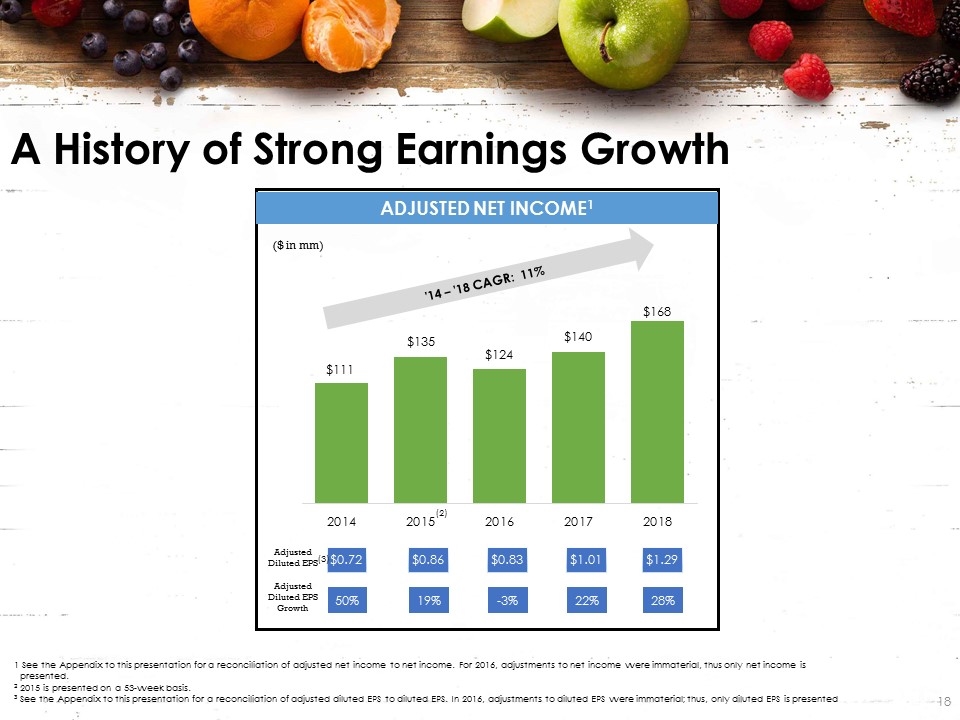

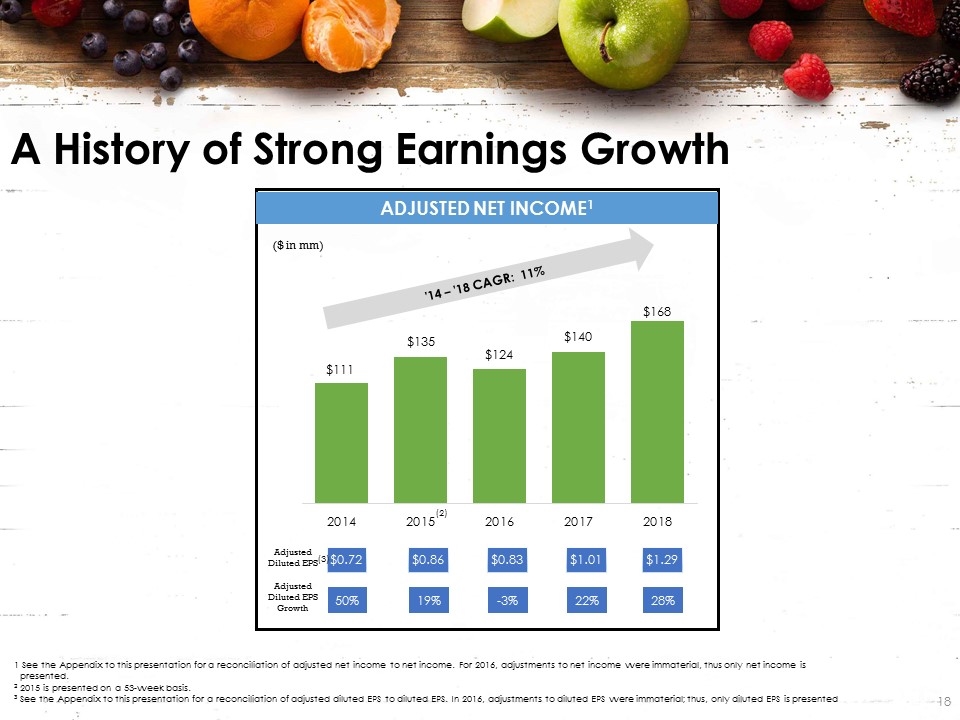

ADJUSTED NET INCOME1 A History of Strong Earnings Growth 1 See the Appendix to this presentation for a reconciliation of adjusted net income to net income. For 2016, adjustments to net income were immaterial, thus only net income is presented. 2 2015 is presented on a 53-week basis. 3 See the Appendix to this presentation for a reconciliation of adjusted diluted EPS to diluted EPS. In 2016, adjustments to diluted EPS were immaterial; thus, only diluted EPS is presented ($ in mm) ’14 – ’18 CAGR: 11% Adjusted Diluted EPS Adjusted Diluted EPS Growth (2) $0.72 $0.86 $0.83 50% 19% -3% $1.01 22% $1.29 28% (3)

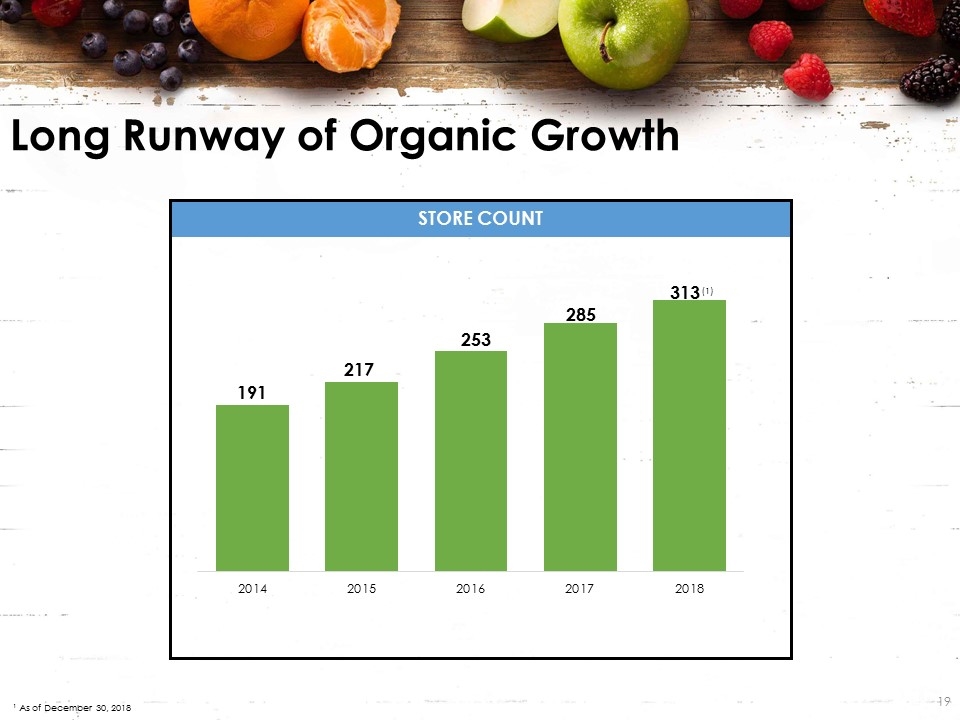

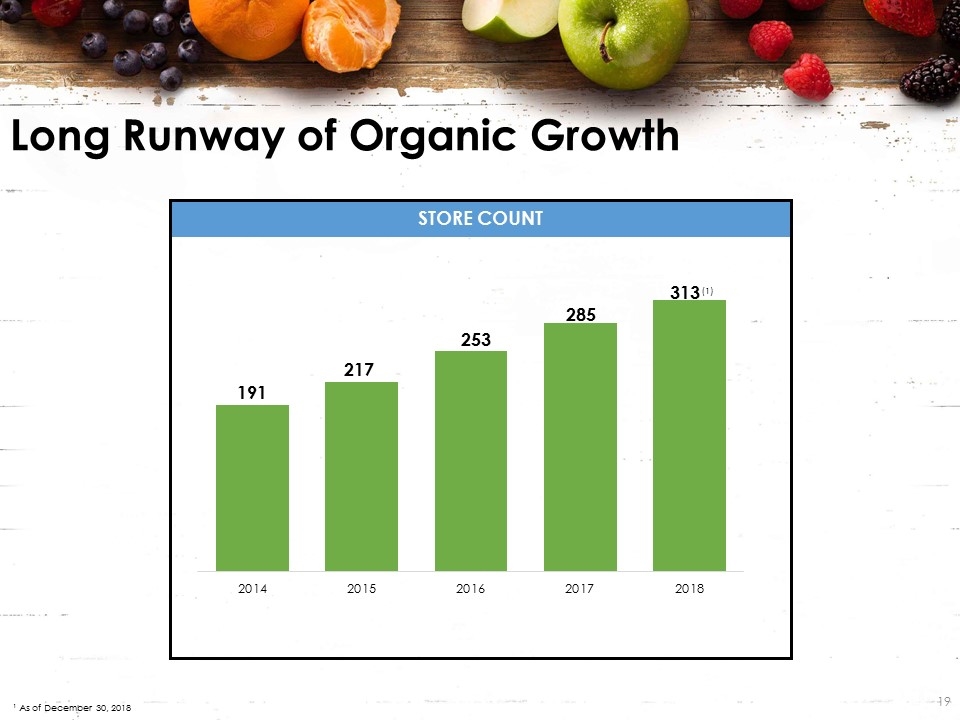

Store Count Long Runway of Organic Growth 1 As of December 30, 2018

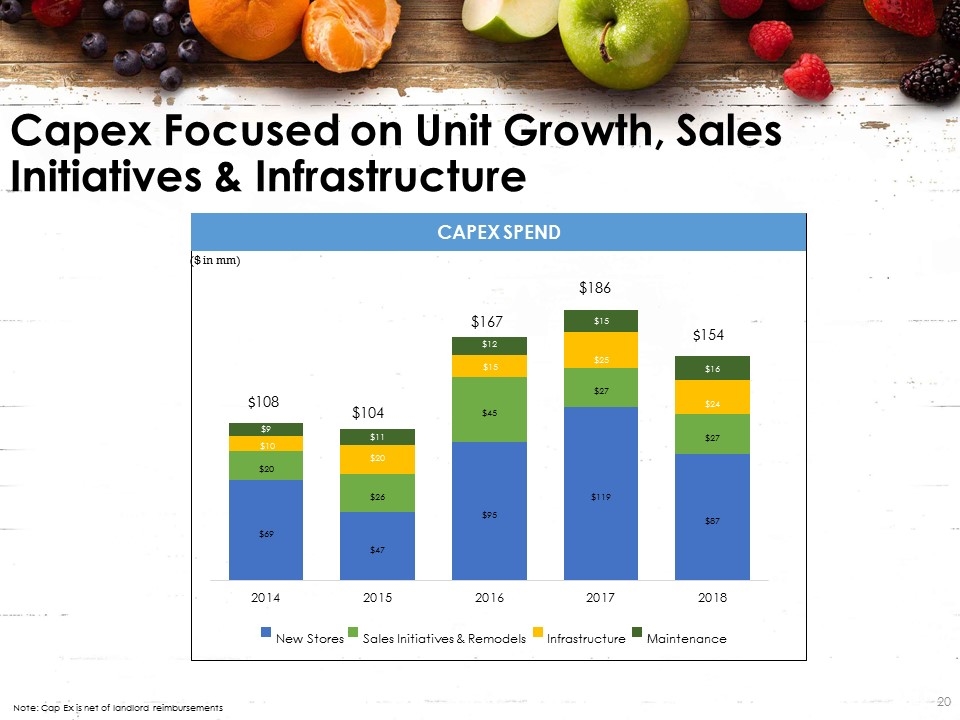

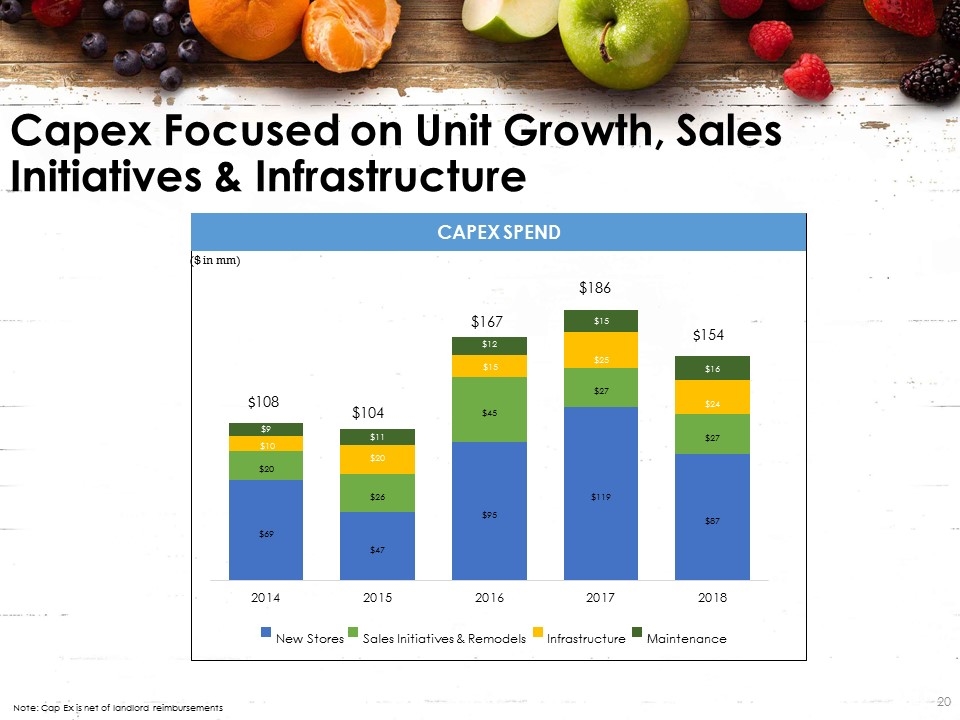

Capex Spend Capex Focused on Unit Growth, Sales Initiatives & Infrastructure ($ in mm) Note: Cap Ex is net of landlord reimbursements

Compelling New Store Economics Average square foot store size Net Cash Investment1 First Year Sales Initial Sales Growth over 3 to 4 years ¹ Includes store build-out (net of contributions from landlords), inventory (net of payables), new store development cost and cash pre-opening expenses. 30K $3.6M $14M - $16M 15% - 25% Pre-Tax Cash-on-Cash Returns of 35% to 40% within 3 to 4 years

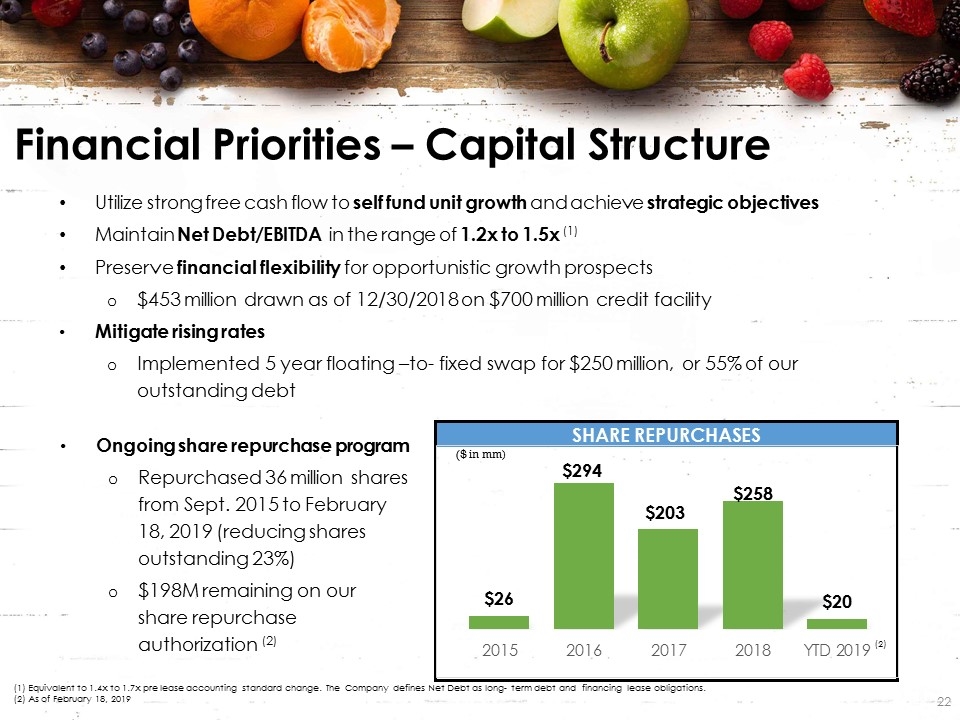

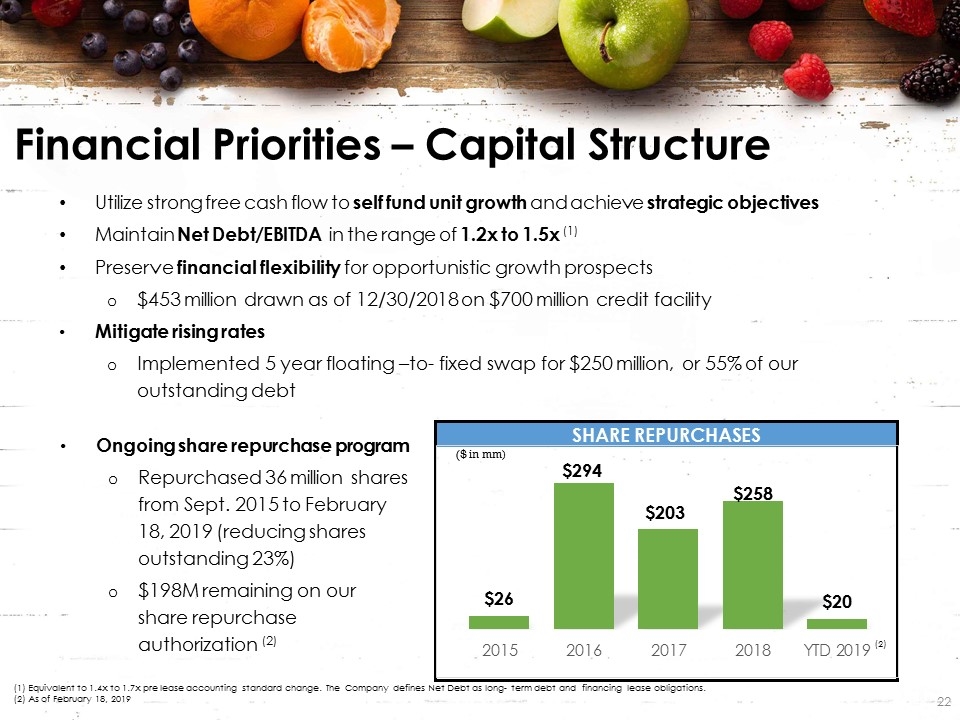

Share repurchases Utilize strong free cash flow to self fund unit growth and achieve strategic objectives Maintain Net Debt/EBITDA in the range of 1.2x to 1.5x (1) Preserve financial flexibility for opportunistic growth prospects $453 million drawn as of 12/30/2018 on $700 million credit facility Mitigate rising rates Implemented 5 year floating –to- fixed swap for $250 million, or 55% of our outstanding debt Financial Priorities – Capital Structure ($ in mm) (1) Equivalent to 1.4x to 1.7x pre lease accounting standard change. The Company defines Net Debt as long- term debt and financing lease obligations. (2) As of February 18, 2019 Ongoing share repurchase program Repurchased 36 million shares from Sept. 2015 to February 18, 2019 (reducing shares outstanding 23%) $198M remaining on our share repurchase authorization (2) (2)

Why Sprouts is a Compelling Investment Authentic Fresh, Natural & Organic Food Offering at Great Value Fastest Growing Segment of the U.S. Supermarket Industry with Strong Macro Tailwinds Significant New Store Growth Opportunity Supported by Broad Demographic Appeal Compelling Business Model with Strong Cash Generation & Ongoing Share Repurchase Program Driving Shareholder Value Passionate Team with a Customer-Focused Culture Strong Management Team with a Diverse Retail Background

Appendix: Supplemental Materials

Management Team with Grocery & Retail Experience Jim Nielsen Brad Lukow Dan Sanders Brandon Lombardi Ted Frumkin Shawn Gensch Interim Co-Chief Executive Officer, President & Chief Operating Officer 7 Years with Sprouts Interim Co-Chief Executive Officer and Chief Financial Officer 3 Years with Sprouts Chief Operations Officer 3 Years with Sprouts Chief Human Resources & Legal Officer 7 Years with Sprouts Chief Development Officer 6 Years with Sprouts Chief Customer Officer 3 Years with Sprouts Dave McGlinchey Chief Merchandising Officer 1 Year with Sprouts

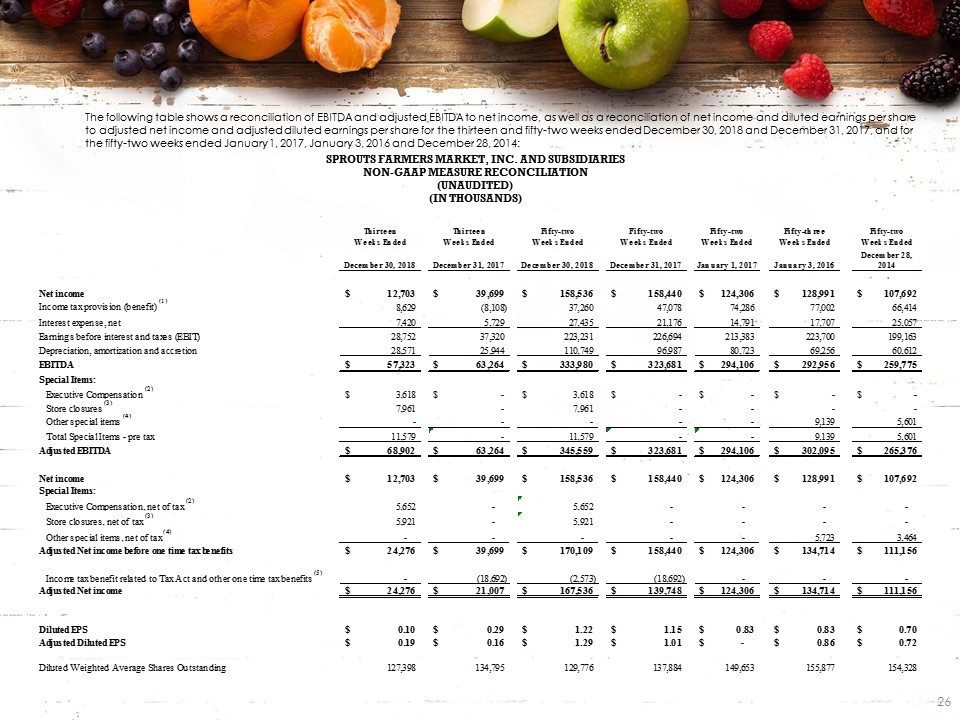

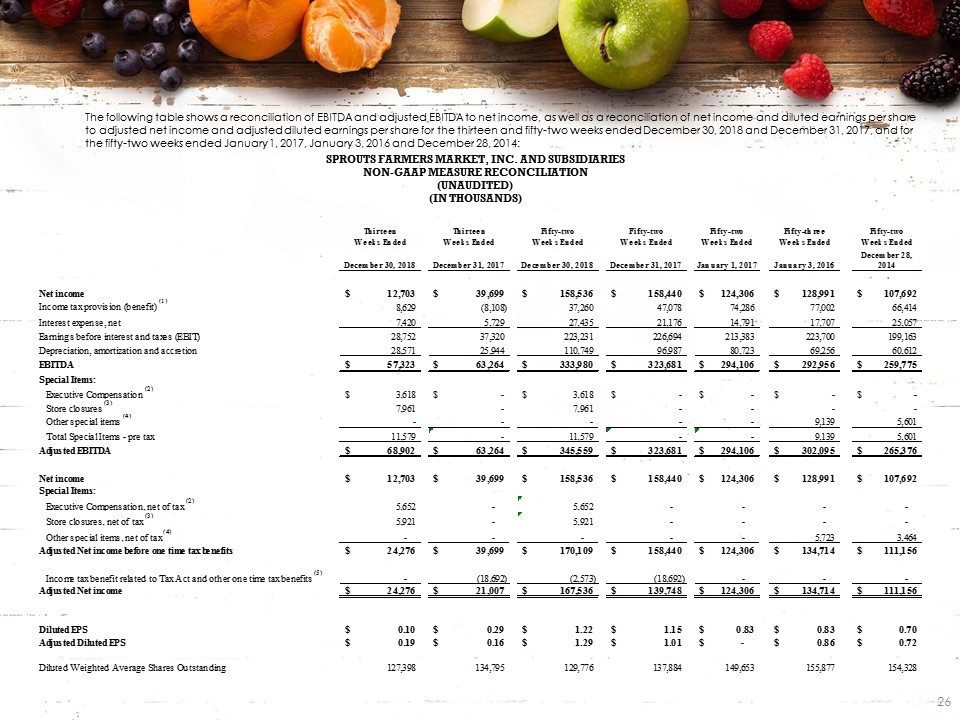

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES NON-GAAP MEASURE RECONCILIATION (UNAUDITED) (IN THOUSANDS) The following table shows a reconciliation of EBITDA and adjusted EBITDA to net income, as well as a reconciliation of net income and diluted earnings per share to adjusted net income and adjusted diluted earnings per share for the thirteen and fifty-two weeks ended December 30, 2018 and December 31, 2017, and for the fifty-two weeks ended January 1, 2017, January 3, 2016 and December 28, 2014:

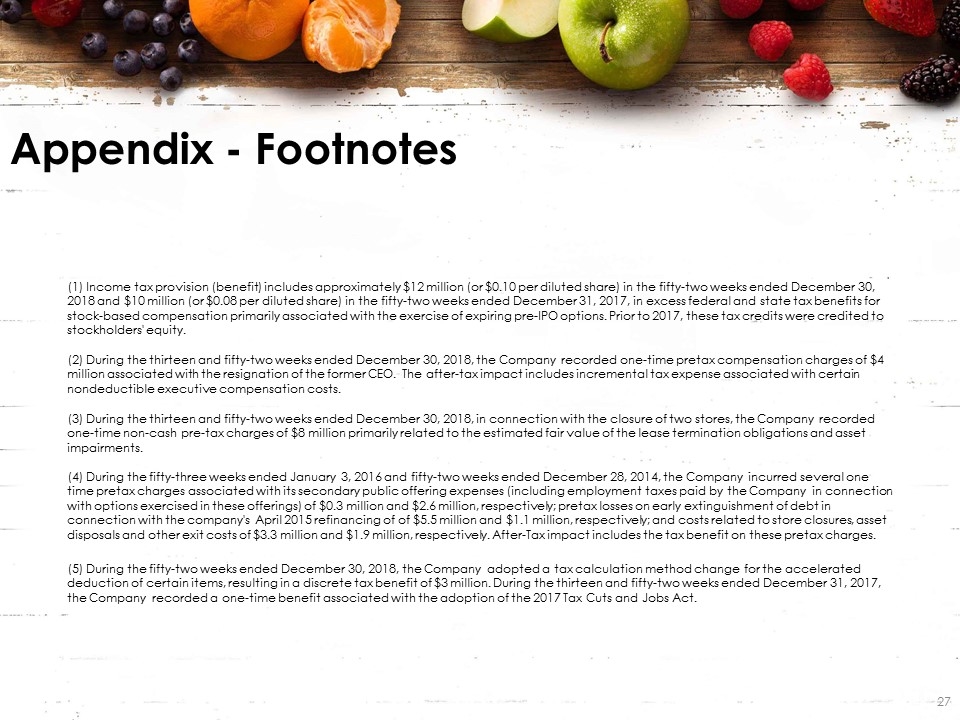

Appendix - Footnotes (1) Income tax provision (benefit) includes approximately $12 million (or $0.10 per diluted share) in the fifty-two weeks ended December 30, 2018 and $10 million (or $0.08 per diluted share) in the fifty-two weeks ended December 31, 2017, in excess federal and state tax benefits for stock-based compensation primarily associated with the exercise of expiring pre-IPO options. Prior to 2017, these tax credits were credited to stockholders' equity. (2) During the thirteen and fifty-two weeks ended December 30, 2018, the Company recorded one-time pretax compensation charges of $4 million associated with the resignation of the former CEO. The after-tax impact includes incremental tax expense associated with certain nondeductible executive compensation costs. (3) During the thirteen and fifty-two weeks ended December 30, 2018, in connection with the closure of two stores, the Company recorded one-time non-cash pre-tax charges of $8 million primarily related to the estimated fair value of the lease termination obligations and asset impairments. (4) During the fifty-three weeks ended January 3, 2016 and fifty-two weeks ended December 28, 2014, the Company incurred several one time pretax charges associated with its secondary public offering expenses (including employment taxes paid by the Company in connection with options exercised in these offerings) of $0.3 million and $2.6 million, respectively; pretax losses on early extinguishment of debt in connection with the company's April 2015 refinancing of of $5.5 million and $1.1 million, respectively; and costs related to store closures, asset disposals and other exit costs of $3.3 million and $1.9 million, respectively. After-Tax impact includes the tax benefit on these pretax charges. (5) During the fifty-two weeks ended December 30, 2018, the Company adopted a tax calculation method change for the accelerated deduction of certain items, resulting in a discrete tax benefit of $3 million. During the thirteen and fifty-two weeks ended December 31, 2017, the Company recorded a one-time benefit associated with the adoption of the 2017 Tax Cuts and Jobs Act.

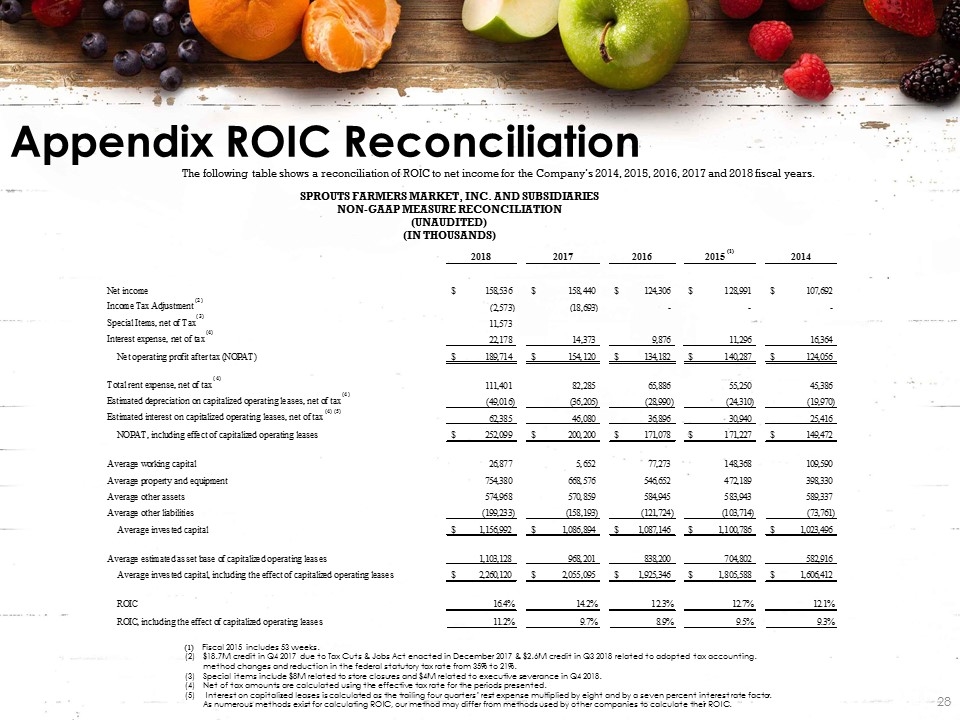

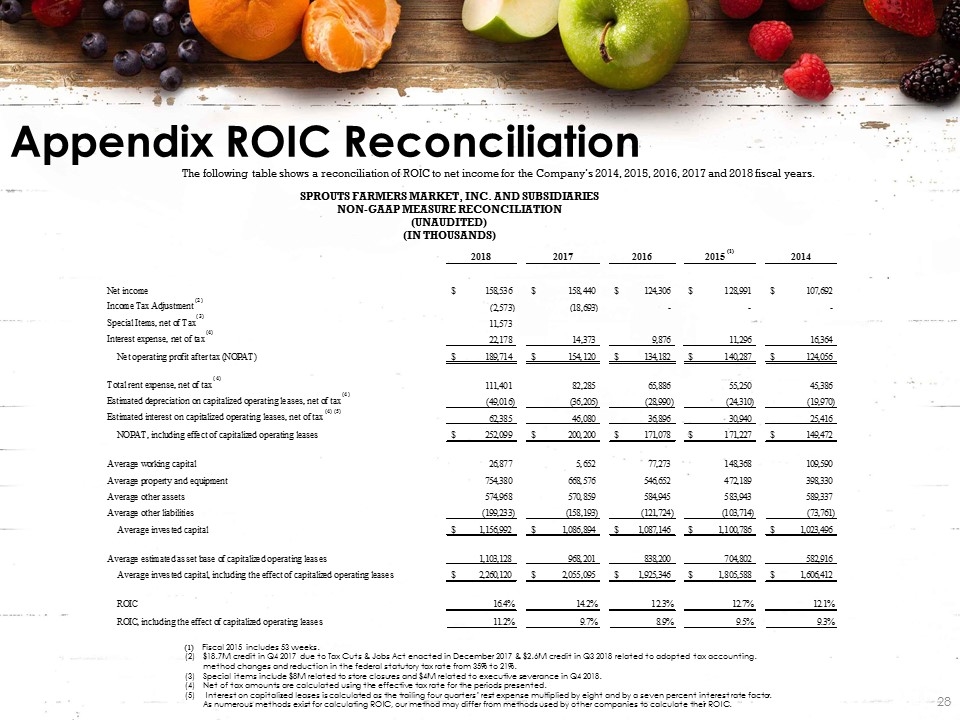

Appendix ROIC Reconciliation The following table shows a reconciliation of ROIC to net income for the Company’s 2014, 2015, 2016, 2017 and 2018 fiscal years. SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES NON-GAAP MEASURE RECONCILIATION (UNAUDITED) (IN THOUSANDS) (1) Fiscal 2015 includes 53 weeks. $18.7M credit in Q4 2017 due to Tax Cuts & Jobs Act enacted in December 2017 & $2.6M credit in Q3 2018 related to adopted tax accounting. method changes and reduction in the federal statutory tax rate from 35% to 21%. Special items include $8M related to store closures and $4M related to executive severance in Q4 2018. Net of tax amounts are calculated using the effective tax rate for the periods presented. (5) Interest on capitalized leases is calculated as the trailing four quarters’ rest expense multiplied by eight and by a seven percent interest rate factor. As numerous methods exist for calculating ROIC, our method may differ from methods used by other companies to calculate their ROIC.