Investor Deck August ‘19 Exhibit 99.1

Forward-Looking Statements: Certain statements in this presentation are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. Any statements contained herein (including, but not limited to, statements to the effect that Sprouts Farmers Market, Inc. (the “Company”) or its management "anticipates," "plans," "estimates," "expects," "believes," or the negative of these terms and other similar expressions) that are not statements of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company’s guidance, outlook, growth and opportunities. These statements involve certain risks and uncertainties that may cause actual results to differ materially from expectations as of the date of this presentation. These risks and uncertainties include, without limitation, risks associated with the Company’s ability to successfully compete in its intensely competitive industry; the Company’s ability to successfully open new stores; the Company’s ability to manage its rapid growth; the Company’s ability to maintain or improve its comparable store sales and operating margins; the Company’s ability to identify and react to trends in consumer preferences; product supply disruptions; general economic conditions; the Company’s ability to manage its transition to a new CEO and a new CFO; accounting standard changes, including the new lease accounting guidelines; and other factors as set forth from time to time in the Company’s Securities and Exchange Commission filings. The Company intends these forward-looking statements to speak only as of the date of this presentation and does not undertake to update or revise them as more information becomes available, except as required by law. Non-GAAP Financial Measures: In addition to reporting financial results in accordance with accounting principles generally accepted in the United States (“GAAP”), the Company presents EBITDA, adjusted EBITDA, adjusted net income and adjusted diluted earnings per share. These measures are not in accordance with, and are not intended as alternatives to, GAAP. The Company's management believes that this presentation provides useful information to management, analysts and investors regarding certain additional financial and business trends relating to its results of operations and financial condition. In addition, management uses these measures for reviewing the financial results of the Company, and certain of these measures may be used as components of incentive compensation. The Company defines EBITDA as net income before interest expense, provision for income tax, and depreciation, amortization and accretion and adjusted EBITDA as EBITDA excluding the impact of special items. The Company defines adjusted net income and adjusted diluted earnings per share by adjusting the applicable GAAP measure to remove the impact of special items. The Company also provides information regarding Return on Invested Capital (“ROIC”) as additional information about its operating results. ROIC is a non-GAAP financial measure used by management to evaluate the Company’s investment returns on capital and provides a meaningful measure of the effectiveness of its capital allocation over time. The Company defines ROIC as net operating profit after tax (“NOPAT”), including the effect of capitalized operating leases, divided by average invested capital. Non-GAAP measures are intended to provide additional information only and do not have any standard meanings prescribed by GAAP. Use of these terms may differ from similar measures reported by other companies. Because of their limitations, non-GAAP measures should not be considered as a measure of discretionary cash available to use to reinvest in the growth of the Company’s business, or as a measure of cash that will be available to meet the Company’s obligations. Each non-GAAP measure has its limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. Please see the Appendix to this presentation for a reconciliation of these non-GAAP measures to the comparable GAAP measures. The financial information included herein is presented through the end of the Company’s 2018 fiscal year. For 2019 results, please refer to the Company’s filings with the Securities and Exchange Commission.

Welcome to Sprouts Farmers Market…

A long history of fresh foods at great prices 17 PLUS YEARS OF EXPERIENCE HAVE MADE US THE DESTINATION KNOWN FOR “HEALTHY LIVING FOR LESS”! 2002 In 2002, “Healthy Living for Less” was born when Stan and Shon Boney, Henry’s son and grandson, opened the first Sprouts Farmers Market in Chandler, Arizona. The healthy grocery store featured abundant produce and a wide selection of fresh, natural and organic foods and grocery items at great prices.

Our Brand Brand Heritage Our roots trace back to 1943, when Henry Boney opened a simple fruit stand in Southern California. From those humble beginnings, our founding family built on its passion to make healthy food affordable for everyone . Health And Wellness From affordable organic produce to natural vitamins, supplements & body care, we offer products with wholesome ingredients that encourage better choices and lead to better lives. Fresh And Natural Our customers trust us to offer an abundance of ripe, seasonal fruits and vegetables, grown by responsible farmers. Our focus extends to our entire selection. Natural Foods Authority We’ve always pioneered and championed natural and organic foods. We’re still the go-to authority in the natural foods industry, educating ourselves and our customers on healthy, wholesome choices. Higher Purpose We’re here to make a difference. We want everyone to have the opportunity to live better through high- quality, affordable and naturally good-for-you options. We make healthy living easy and affordable.

A Grocery Shopping Experience that Makes Healthy Living Easy & Affordable Health Value Selection Engagement SELECTION VALUE KNOWLEDGEABLE SERVICE & ENGAGEMENT HEALTH

A Healthy Grocery Store that Flips the Conventional Model PRODUCE surrounded by a complete grocery offering Promote VALUE everyday DIFFERENTIATED selection of high-quality, healthy foods Farmers market-inspired OPEN STORE LAYOUT with low profile displays CONVENIENT Small-box Friendly, ENGAGED CUSTOMER SERVICE, easy to shop environment

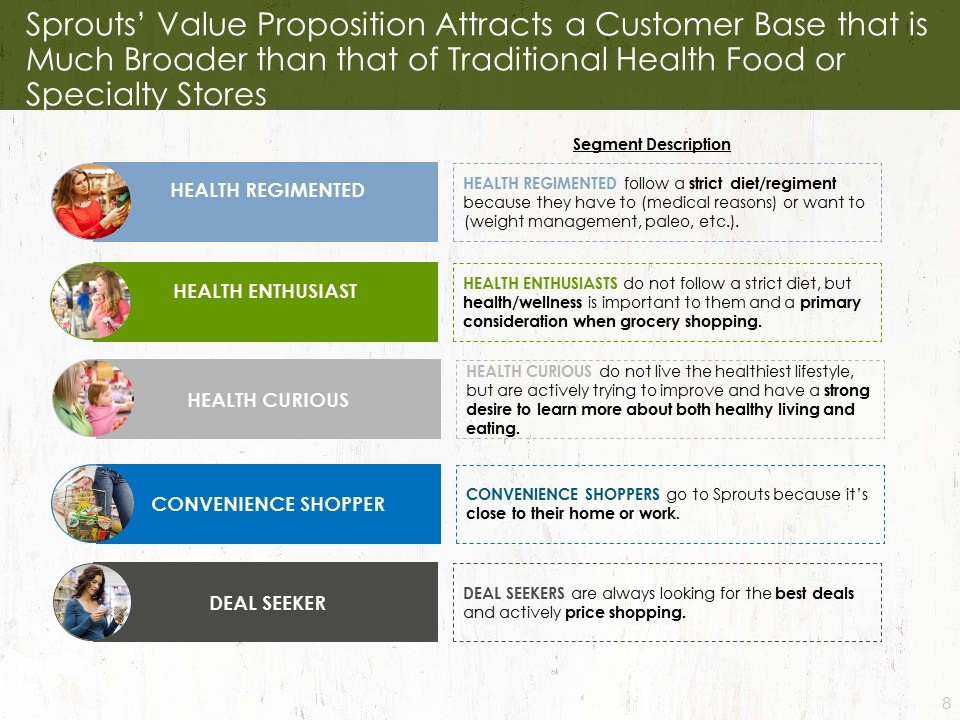

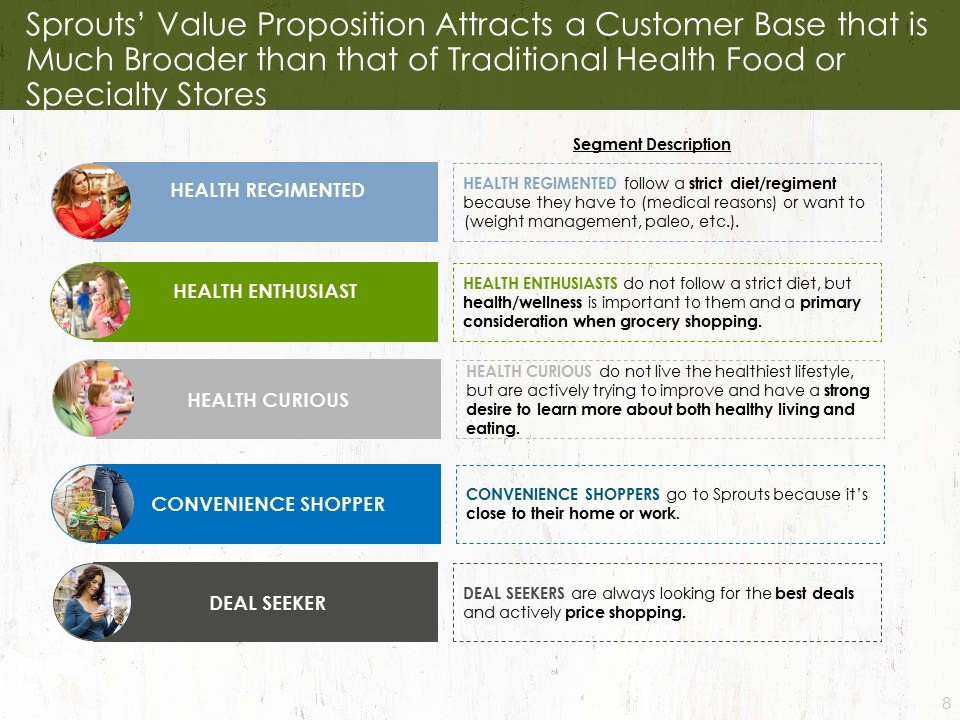

Sprouts’ Value Proposition Attracts a Customer Base that is Much Broader than that of Traditional Health Food or Specialty Stores HEALTH REGIMENTED HEALTH ENTHUSIAST Segment Description HEALTH REGIMENTED follow a strict diet/regiment because they have to (medical reasons) or want to (weight management, paleo, etc.). HEALTH ENTHUSIASTS do not follow a strict diet, but health/wellness is important to them and a primary consideration when grocery shopping. HEALTH CURIOUS HEALTH CURIOUS do not live the healthiest lifestyle, but are actively trying to improve and have a strong desire to learn more about both healthy living and eating. CONVENIENCE SHOPPER CONVENIENCE SHOPPERS go to Sprouts because it’s close to their home or work. DEAL SEEKER DEAL SEEKERS are always looking for the best deals and actively price shopping.

Continued Top Line Growth in a Dynamic Marketplace ’14 – ’18 CAGR: 15% ($ in mm) Net Sales

Expanding our Footprint Q2: Louisiana and New Jersey open their doors to Sprouts guests Next up…Virginia Demographics allow for deep penetration in markets Model works well in densely populated, urban areas as well as smaller metropolitan markets Successful in “natural / lifestyle” markets and more “traditional” markets Plan to open approximately 30 stores per year for the coming years Existing Markets as of June 30, 2019– 326 stores NM TX CO UT AZ NV CA 11 44 40 9 118 13 5 31 OK KS MO TN NC 5 3 6 16 3 AL GA FL 10 4 Near Term Expansion Market 2 MD SC 1 1 PA WA 2 LA VA NJ 1 1

Private Label Differentiation and Loyalty Driver Strong Private Label Results 11 Sales growth north of 25%, almost quadrupling since 2013 Accounts for nearly 14% of revenue, outpaces overall company net sales and comp growth Continually introducing new staple, trending and unique products , along with deeper messaging to drive further trial, engagement and loyalty Approximately 70% of all Sprouts Brand packaged food products are non-GMO or organic

Extending Our Brand Experience Digitally Expanded grocery delivery offering to more than 270 stores and expanded grocery pickup pilot to more states. Educated millions of guests with healthy living content on a new website and engaged with 2.35 MM+ email subscribers. Introduced new tools to save and learn through the Sprouts app, including hundreds of exclusive digital coupons. 12

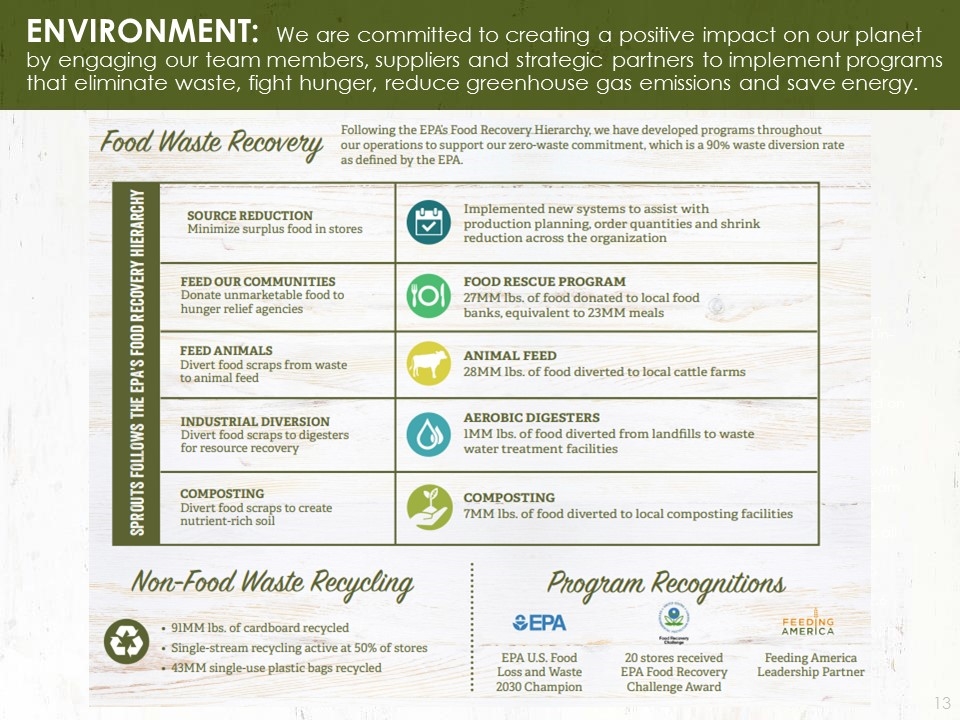

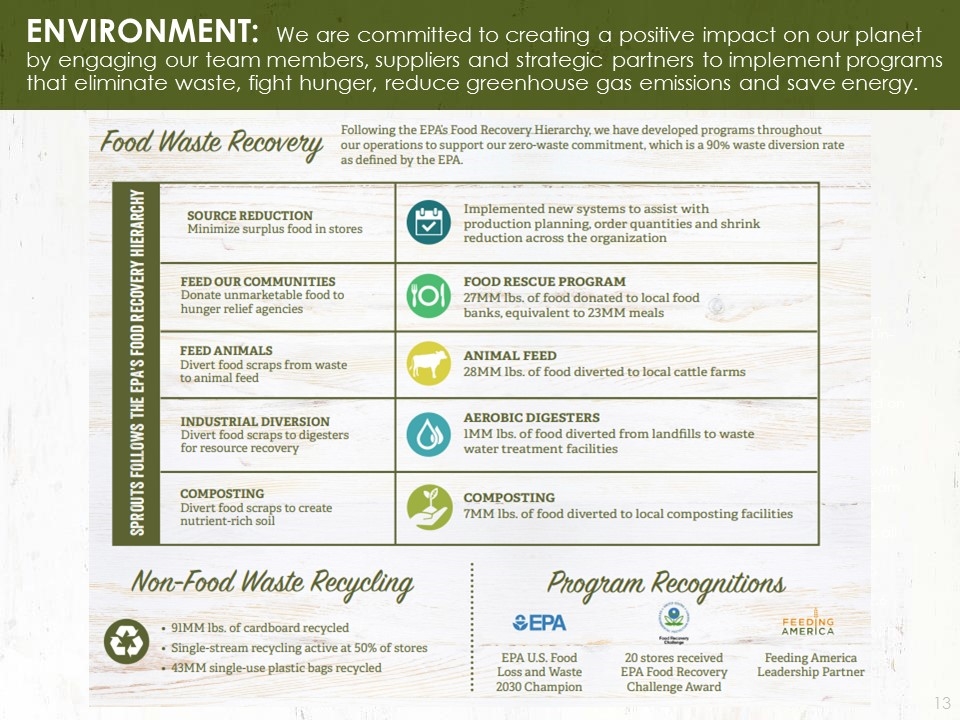

ENVIRONMENT: We are committed to creating a positive impact on our planet by engaging our team members, suppliers and strategic partners to implement programs that eliminate waste, fight hunger, reduce greenhouse gas emissions and save energy. SOURCING - 98% of Sprouts fresh and frozen seafood sourced responsibly - Ranked #8 in the nation by Greenpeace for sustainable seafood sourcing - Surveyed more than 230 suppliers for sustainable sourcing practices - 20% of Sprouts products are organic certified COMMUNITY - Raised $2.3 MM from vendor partners and in-store fundraising - Awarded $2.2MM to more than 130 organizations focused on children’s health and nutrition education - Launched “Day of Service” campaign with over 500 volunteer Team Members supporting over 28 community service events across all regions - Provided funding to distribute essential vitamins to approx. 2.6 million children and expectant mothers with Vitamin Angels

SOURCING: 90% of our More than 20,000 Products are Natural or Organic SOURCING - 98% of Sprouts fresh and frozen seafood sourced responsibly - Ranked #8 in the nation by Greenpeace for sustainable seafood sourcing - Surveyed more than 230 suppliers for sustainable sourcing practices - 20% of Sprouts products are organic certified COMMUNITY - Raised $2.3 MM from vendor partners and in-store fundraising - Awarded $2.2MM to more than 130 organizations focused on children’s health and nutrition education - Launched “Day of Service” campaign with over 500 volunteer Team Members supporting over 28 community service events across all regions - Provided funding to distribute essential vitamins to approx. 2.6 million children and expectant mothers with Vitamin Angels

INVESTING IN OUR TEAM MEMBERS: Cultivating a Dedicated Team rooted in Sprouts Culture All numbers stated are based on 2018 Annual Stats 15% off for Team Members Every Day

COMMUNITY: Our Commitment to Helping others in our Community Extends beyond our Stores

Business & Financial Performance

Powerful Growth Business – Results Driven 6% Natural and Organic Sector Growth1 One of the Best White Space Opportunities in Retail Healthy Unit Growth Rate 1 SPINS LLC industry projections for natural and organic food and supplement sales growth through 2020 Compelling Store-Level Economics Strong Free Cash Flow Generation Business Growth Results

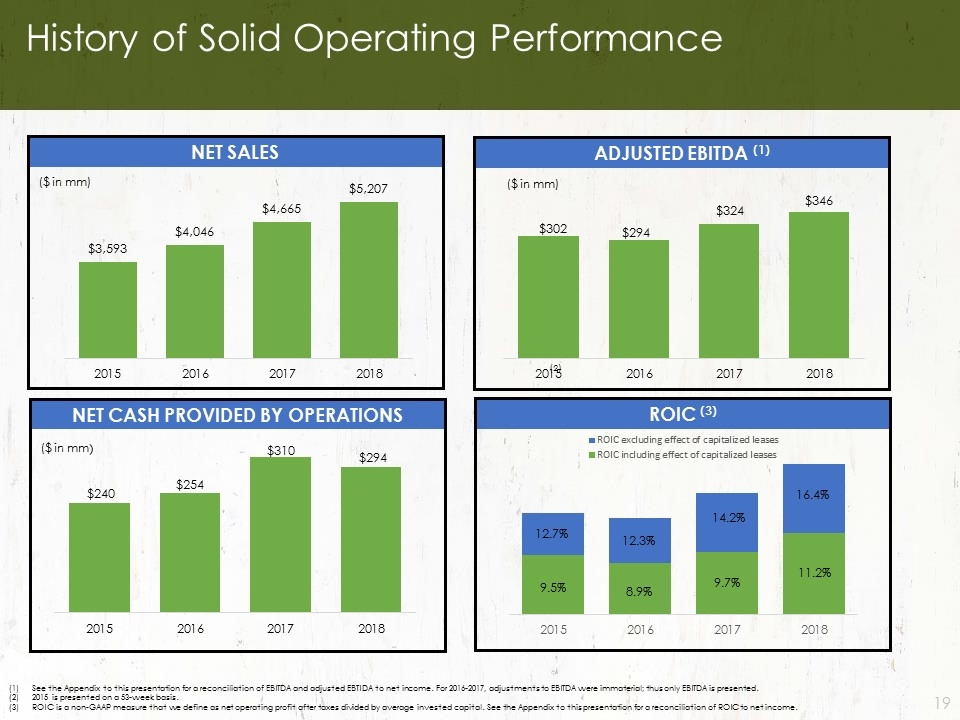

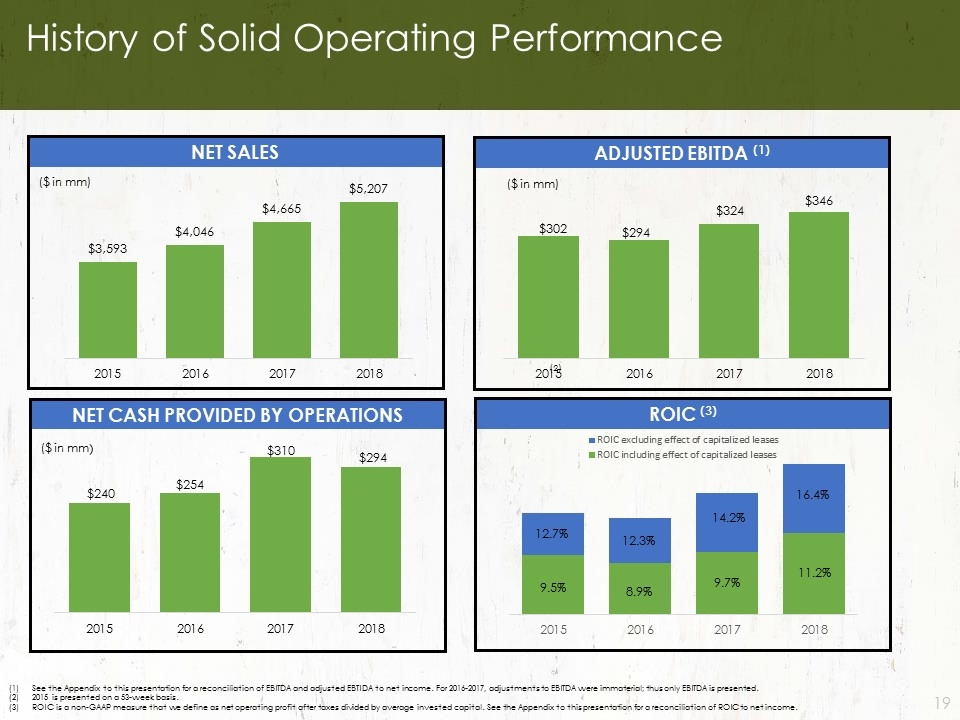

NET SALES ADJUSTED EBITDA (1) ROIC (3) NET CASH PROVIDED by OPERATIONS History of Solid Operating Performance See the Appendix to this presentation for a reconciliation of EBITDA and adjusted EBTIDA to net income. For 2016-2017, adjustments to EBITDA were immaterial; thus only EBITDA is presented. 2015 is presented on a 53-week basis. ROIC is a non-GAAP measure that we define as net operating profit after taxes divided by average invested capital. See the Appendix to this presentation for a reconciliation of ROIC to net income. ($ in mm) ($ in mm) (2)

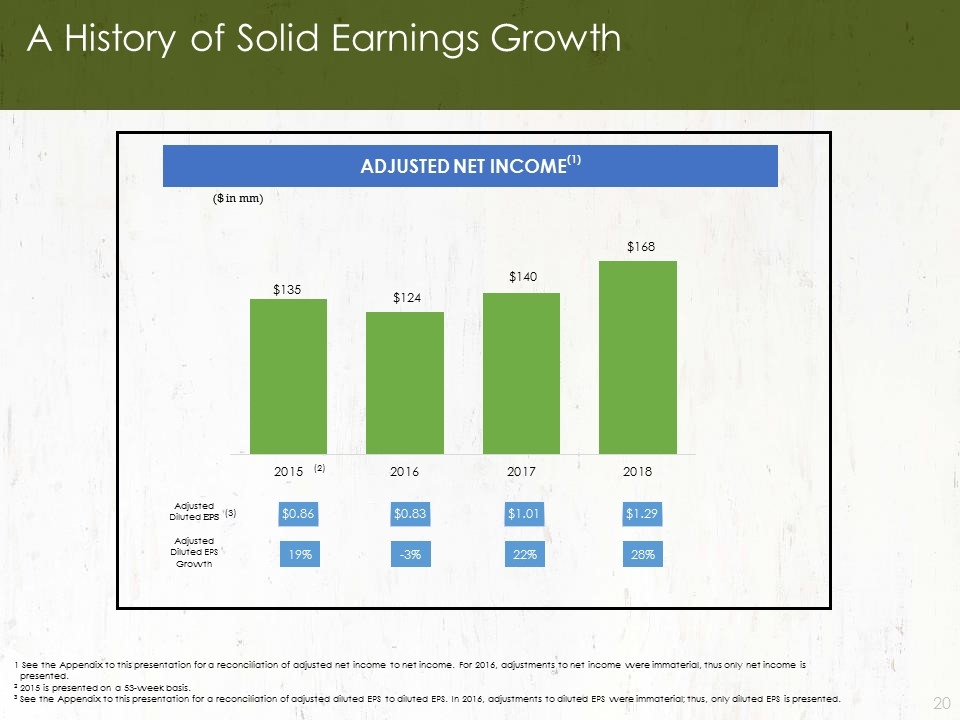

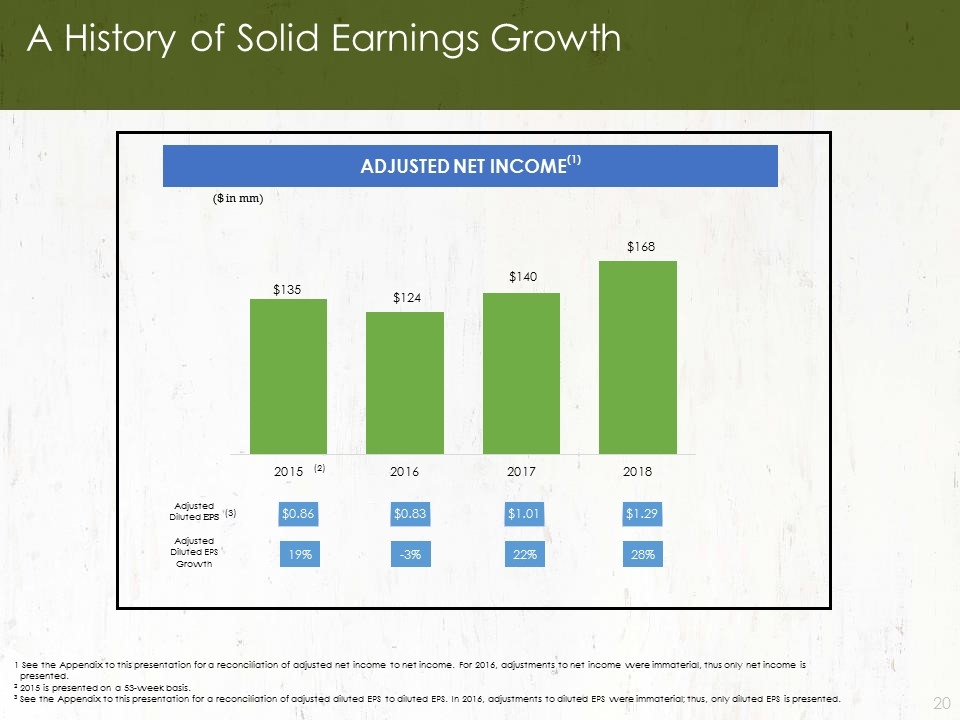

A History of Solid Earnings Growth 1 See the Appendix to this presentation for a reconciliation of adjusted net income to net income. For 2016, adjustments to net income were immaterial, thus only net income is presented. 2 2015 is presented on a 53-week basis. 3 See the Appendix to this presentation for a reconciliation of adjusted diluted EPS to diluted EPS. In 2016, adjustments to diluted EPS were immaterial; thus, only diluted EPS is presented. ($ in mm) Adjusted Diluted EPS Adjusted Diluted EPS Growth (2) $0.86 $0.83 19% -3% $1.01 22% $1.29 28% (3) ADJUSTED NET INCOME(1)

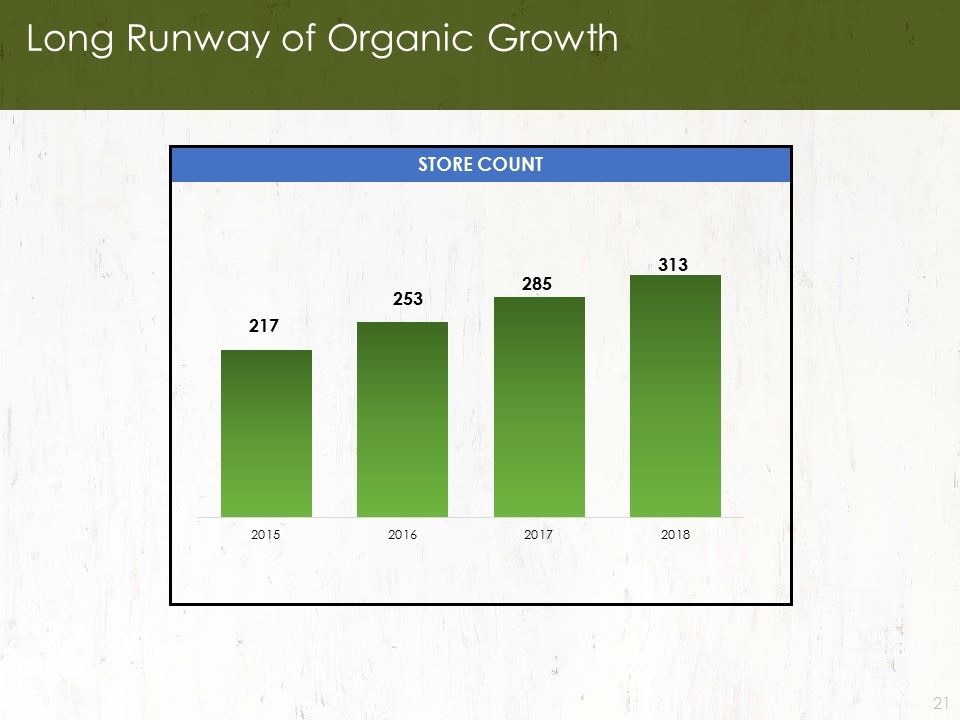

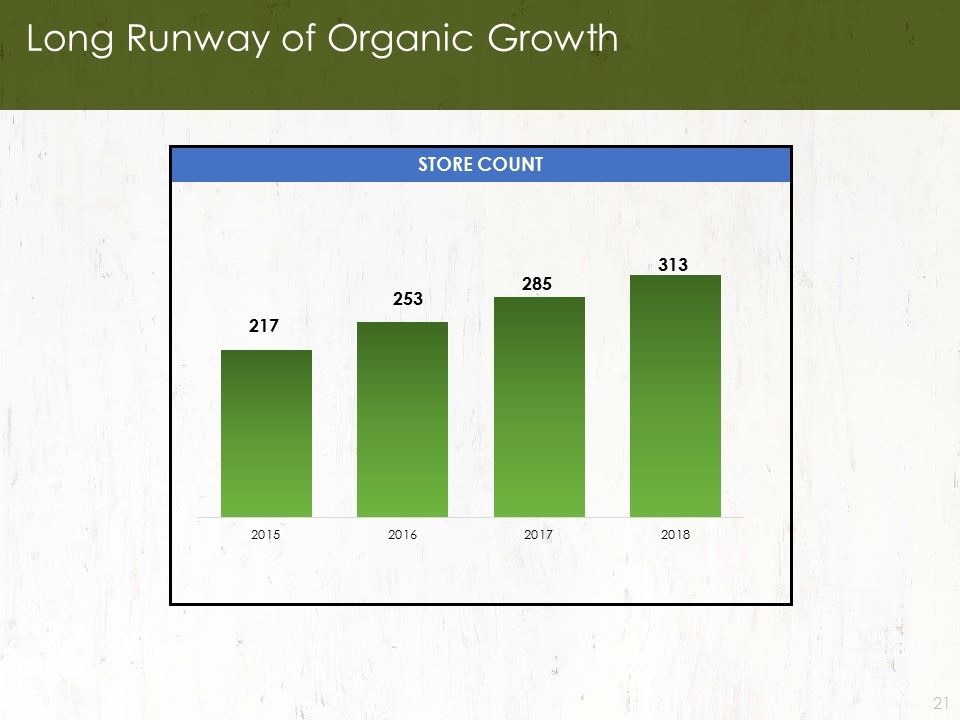

Long Runway of Organic Growth Store Count

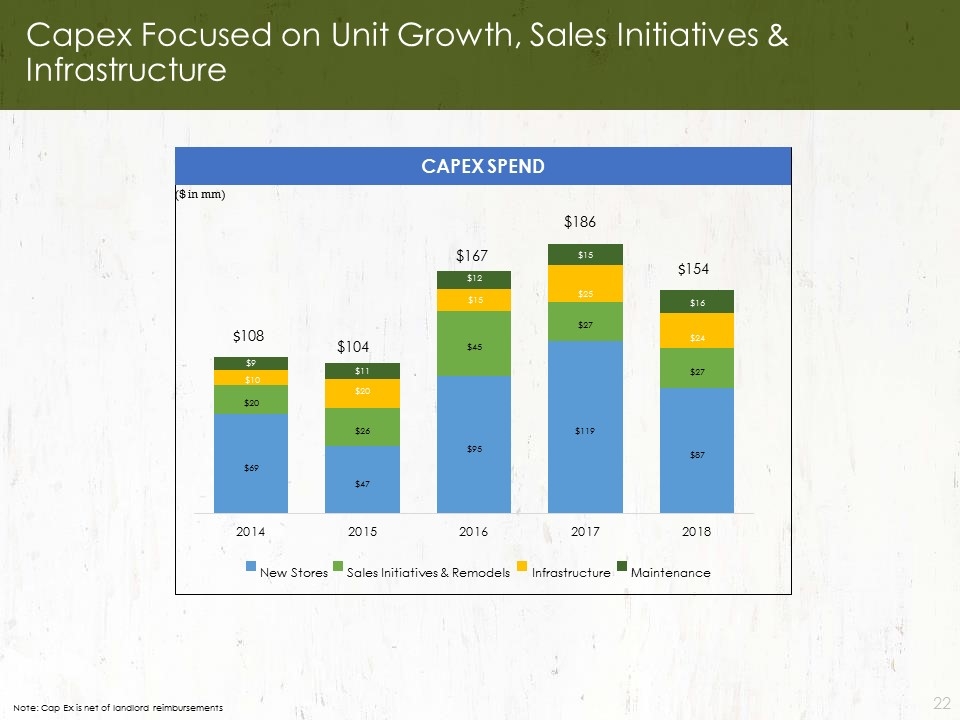

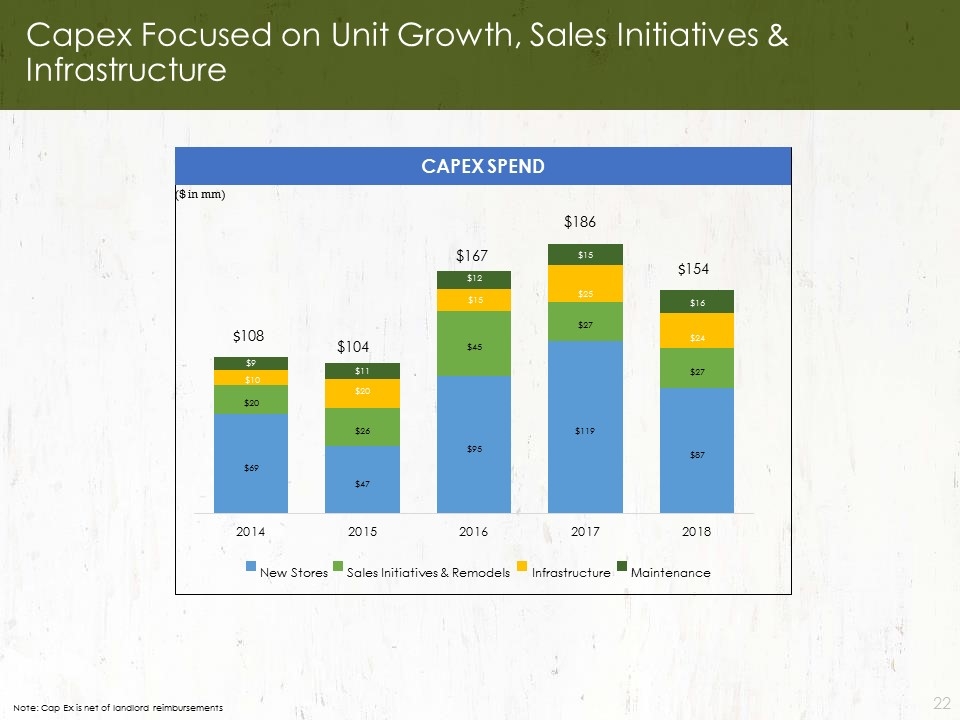

Capex Focused on Unit Growth, Sales Initiatives & Infrastructure Capex Spend ($ in mm) Note: Cap Ex is net of landlord reimbursements

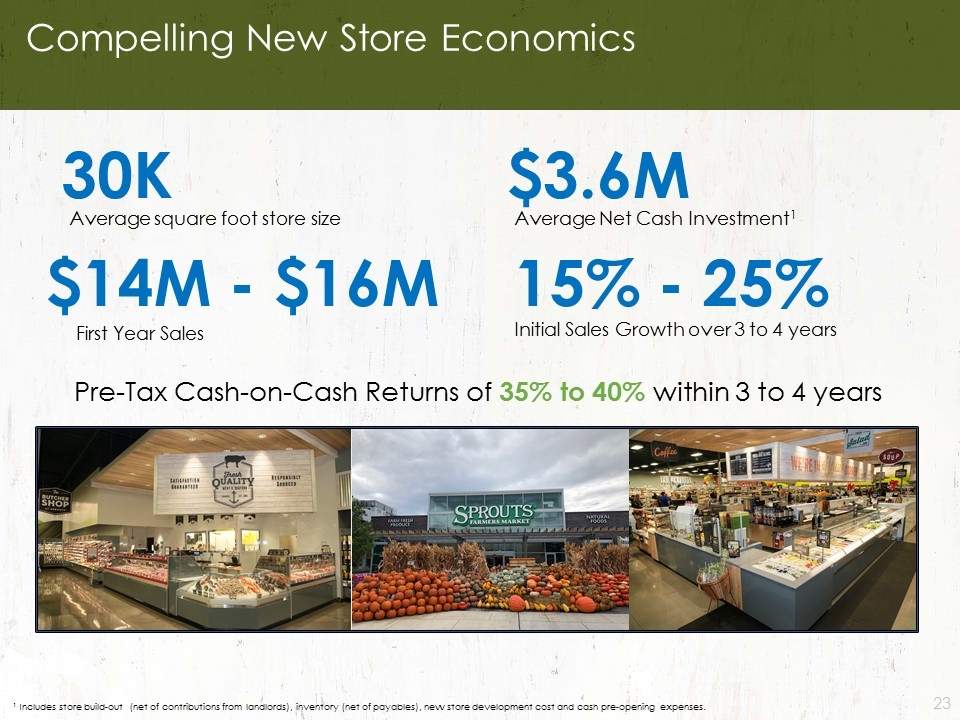

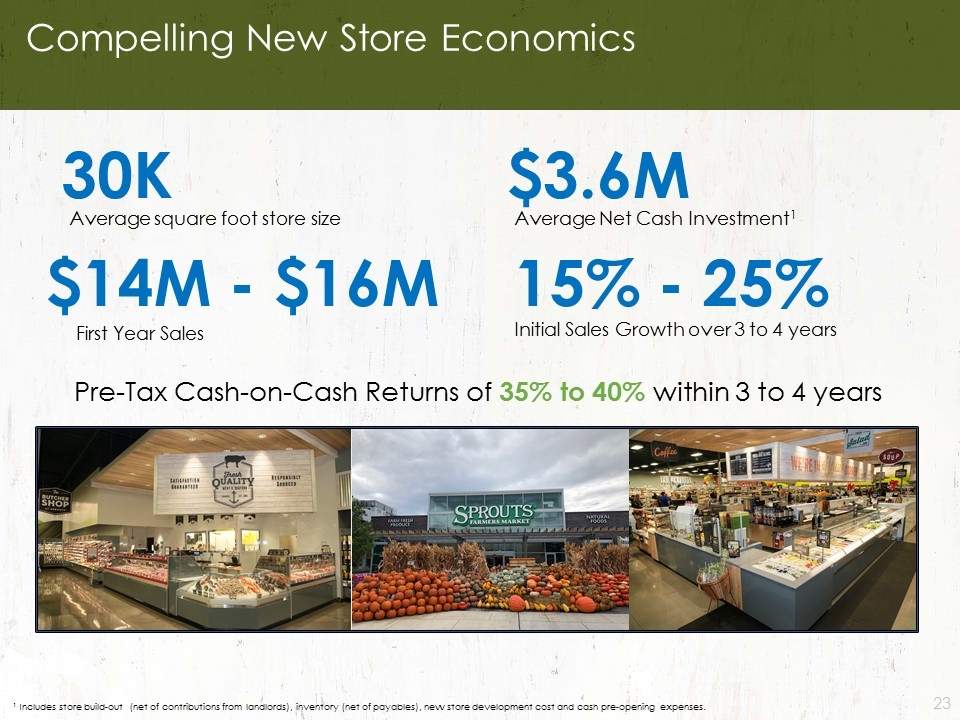

Compelling New Store Economics Average square foot store size Average Net Cash Investment1 First Year Sales Initial Sales Growth over 3 to 4 years ¹ Includes store build-out (net of contributions from landlords), inventory (net of payables), new store development cost and cash pre-opening expenses. 30K $3.6M $14M - $16M 15% - 25% Pre-Tax Cash-on-Cash Returns of 35% to 40% within 3 to 4 years

Sprouts is an Everyday Healthy Grocery Store Well- Positioned to Meet the Needs of Today’s Consumer Authentic Fresh, Natural & Organic Food Offering at Great Value Fastest Growing Segment of the U.S. Supermarket Industry Robust New Store Growth Opportunity Supported by Broad Demographic Appeal Compelling Business Model with Strong Cash Generation Passionate Team with a Customer-Focused Culture Strong Management Team with a Diverse Retail Background

Appendix: Supplemental Materials

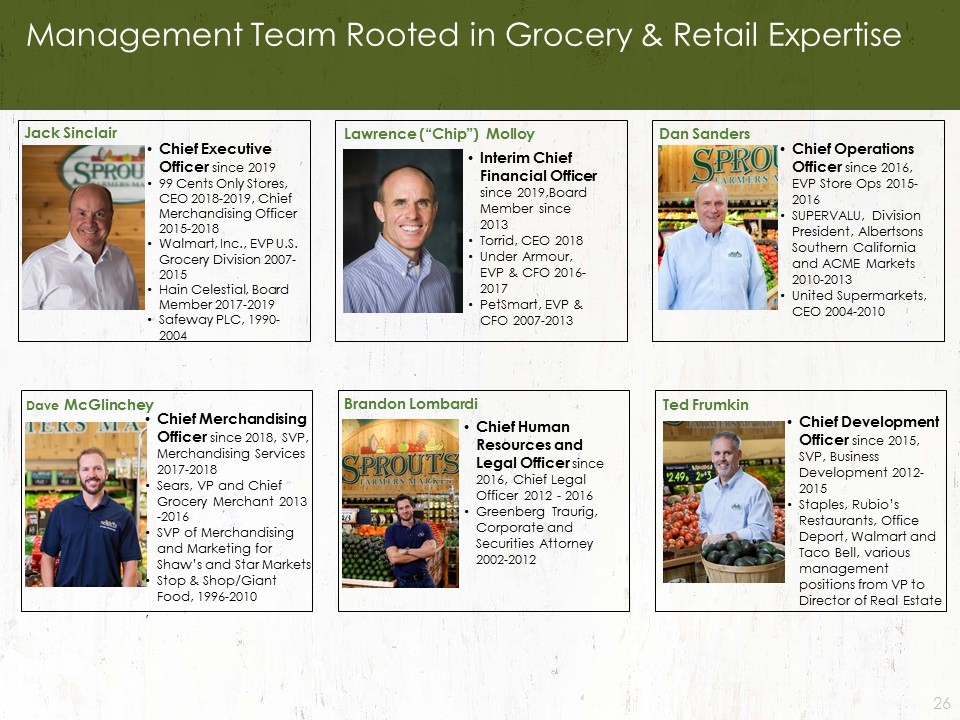

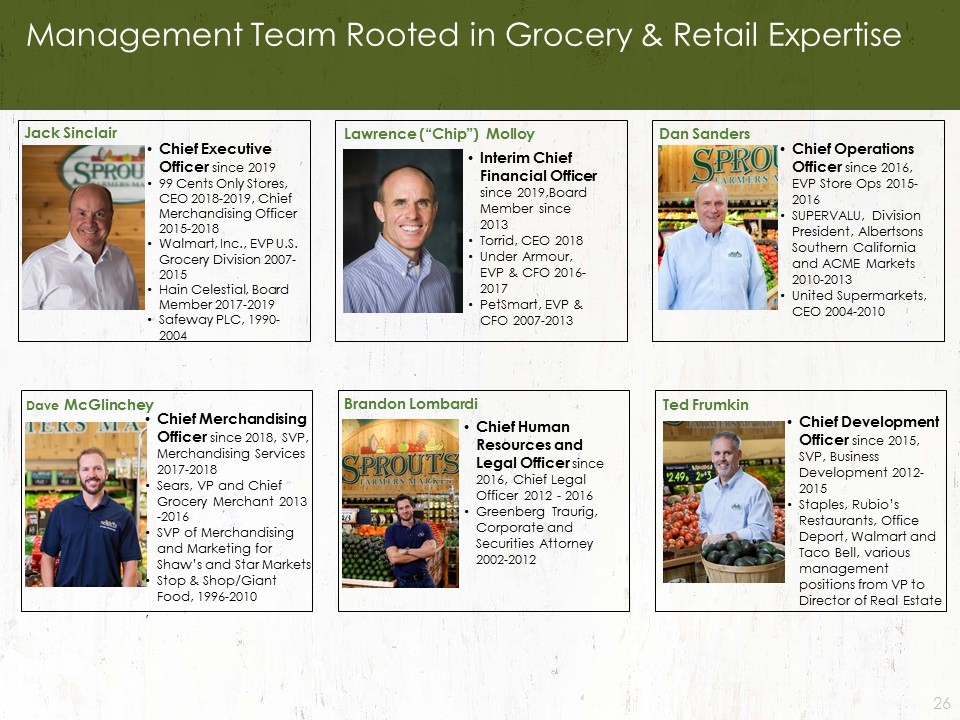

Management Team Rooted in Grocery & Retail Expertise Jack Sinclair Chief Executive Officer since 2019 99 Cents Only Stores, CEO 2018-2019, Chief Merchandising Officer 2015-2018 Walmart, Inc., EVP U.S. Grocery Division 2007-2015 Hain Celestial, Board Member 2017-2019 Safeway PLC, 1990-2004 Lawrence (“Chip”) Molloy Interim Chief Financial Officer since 2019,Board Member since 2013 Torrid, CEO 2018 Under Armour, EVP & CFO 2016-2017 PetSmart, EVP & CFO 2007-2013 Dan Sanders Chief Operations Officer since 2016, EVP Store Ops 2015-2016 SUPERVALU, Division President, Albertsons Southern California and ACME Markets 2010-2013 United Supermarkets, CEO 2004-2010 Dave McGlinchey Chief Merchandising Officer since 2018, SVP, Merchandising Services 2017-2018 Sears, VP and Chief Grocery Merchant 2013 -2016 SVP of Merchandising and Marketing for Shaw’s and Star Markets Stop & Shop/Giant Food, 1996-2010 , Brandon Lombardi Chief Human Resources and Legal Officer since 2016, Chief Legal Officer 2012 - 2016 Greenberg Traurig, Corporate and Securities Attorney 2002-2012 Ted Frumkin Chief Development Officer since 2015, SVP, Business Development 2012-2015 Staples, Rubio’s Restaurants, Office Deport, Walmart and Taco Bell, various management positions from VP to Director of Real Estate

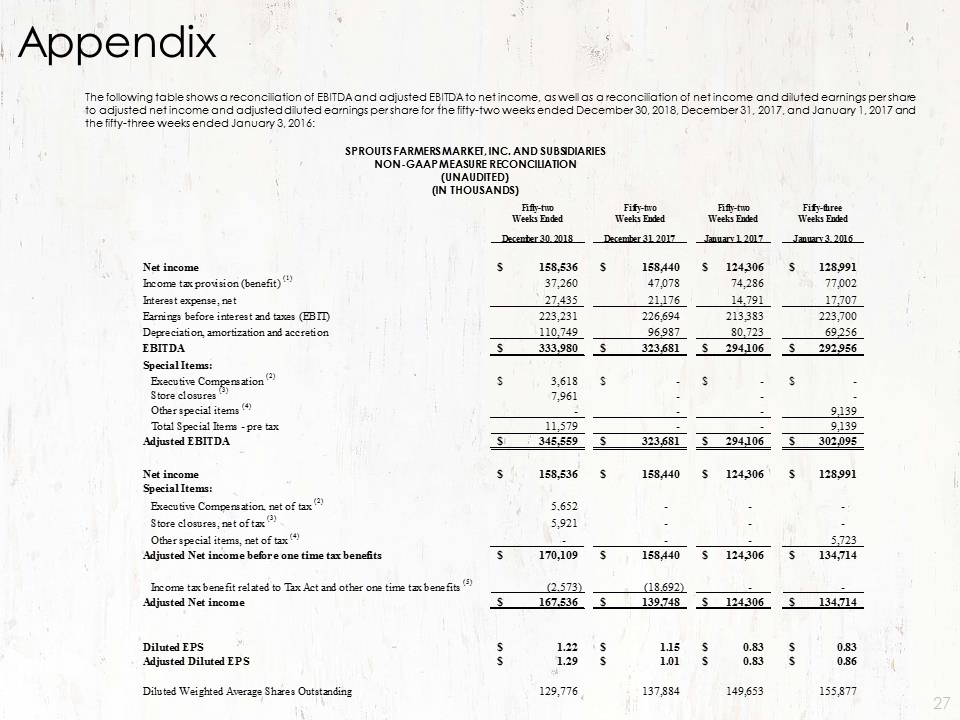

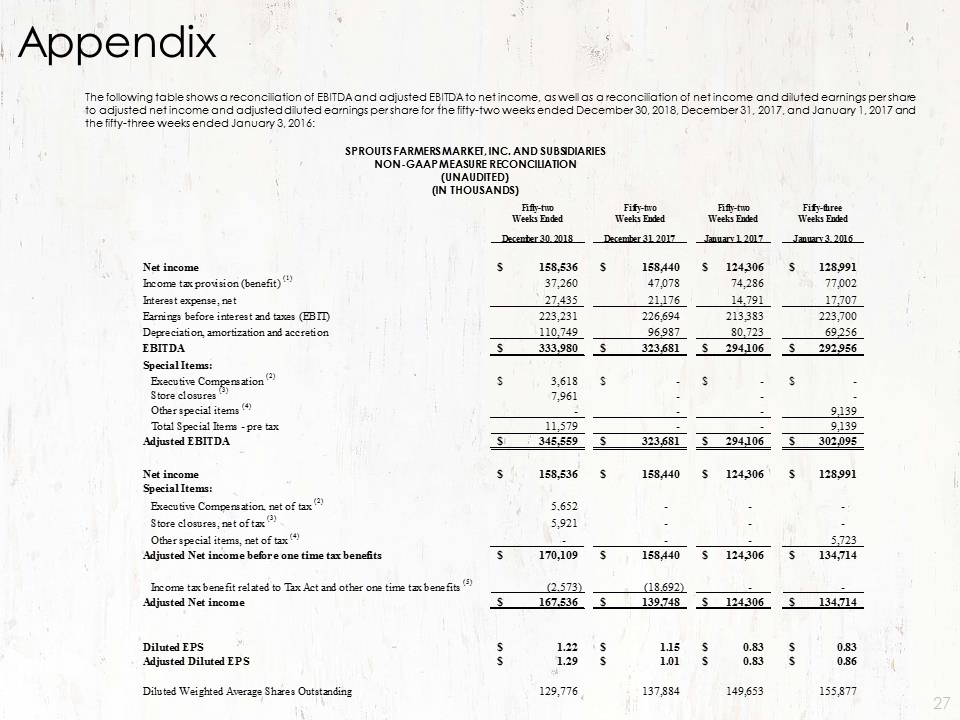

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES NON-GAAP MEASURE RECONCILIATION (UNAUDITED) (IN THOUSANDS) The following table shows a reconciliation of EBITDA and adjusted EBITDA to net income, as well as a reconciliation of net income and diluted earnings per share to adjusted net income and adjusted diluted earnings per share for the fifty-two weeks ended December 30, 2018, December 31, 2017, and January 1, 2017 and the fifty-three weeks ended January 3, 2016: Appendix

Appendix Income tax provision (benefit) includes approximately $12 million (or $0.10 per diluted share) in the fifty-two weeks ended December 30, 2018 and $10 million (or $0.08 per diluted share) in the fifty-two weeks ended December 31, 2017, in excess federal and state tax benefits for stock-based compensation primarily associated with the exercise of expiring pre-IPO options. Prior to 2017, these tax credits were credited to stockholders’ equity. During the fifty-two weeks ended December 30, 2018, the Company recorded one-time pretax compensation charges of $4 million, associated with the resignation of the former CEO. The after-tax impact includes incremental tax expense associated with certain nondeductible executive compensation costs. During the fifty-two weeks ended December 30, 2018, in connection with the closure of two stores, the Company recorded one-time non-cash pre-tax charges of $8 million primarily related to the estimated fair value of the lease termination obligations and asset impairments. During the fifty-three weeks ended January 3, 2016, the Company incurred several one time pretax charges associated with its secondary public offering expenses (including employment taxes paid by the Company in connection with options exercised in these offerings) of $0.3 million; pretax losses on early extinguishment of debt in connection with the Company’s April 2015 refinancing of $5.5 million and costs related to store closures, asset disposals and other exit costs of $3.3 million. After –Tax impact includes the tax benefit on these pretax charges. During the fifty-two weeks ended December 30, 2018, the Company adopted a tax calculation method change for the accelerated deduction of certain items, resulting in a discrete tax benefit of $3 million. During the fifty-two weeks ended December 31, 2017, the Company recorded a one-time benefit associated with the adoption of the 2017 Tax Cuts and Jobs Act.

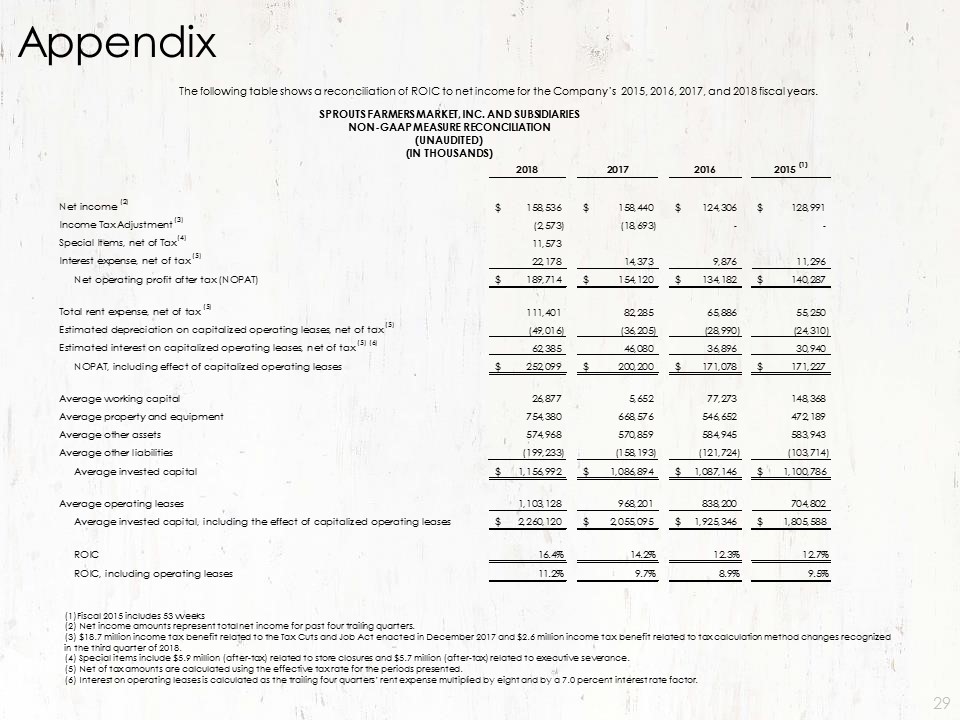

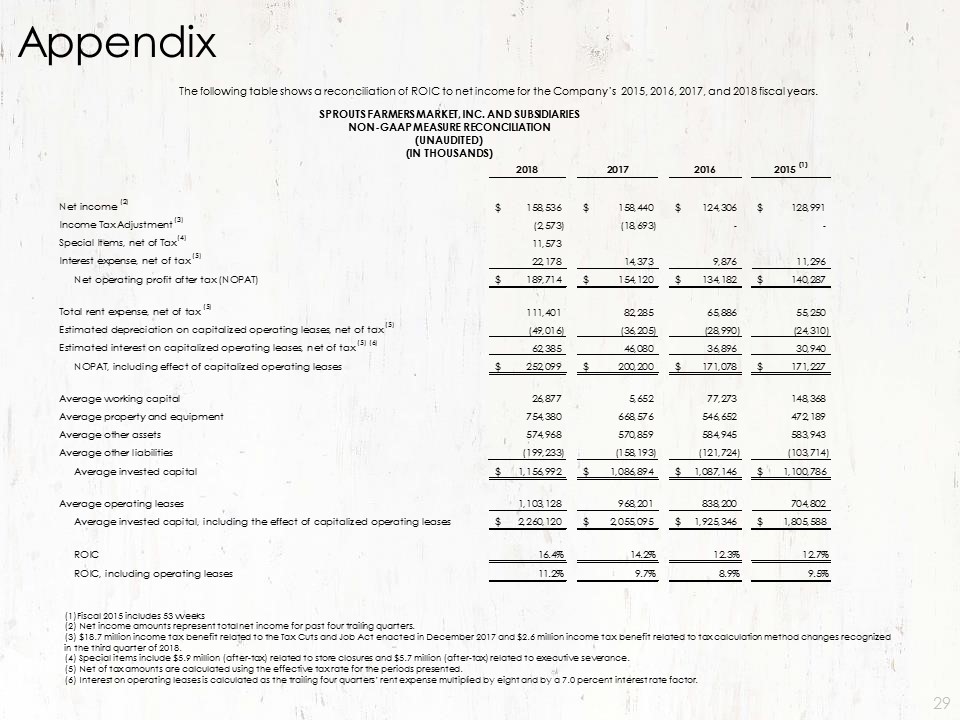

Appendix The following table shows a reconciliation of ROIC to net income for the Company’s 2015, 2016, 2017, and 2018 fiscal years. SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES NON-GAAP MEASURE RECONCILIATION (UNAUDITED) (IN THOUSANDS) (1)Fiscal 2015 includes 53 weeks (2) Net income amounts represent total net income for past four trailing quarters. (3) $18.7 million income tax benefit related to the Tax Cuts and Job Act enacted in December 2017 and $2.6 million income tax benefit related to tax calculation method changes recognized in the third quarter of 2018. (4) Special items include $5.9 million (after-tax) related to store closures and $5.7 million (after-tax) related to executive severance. (5) Net of tax amounts are calculated using the effective tax rate for the periods presented. (6) Interest on operating leases is calculated as the trailing four quarters’ rent expense multiplied by eight and by a 7.0 percent interest rate factor.