INVESTOR DECK March 2021 Exhibit 99.1

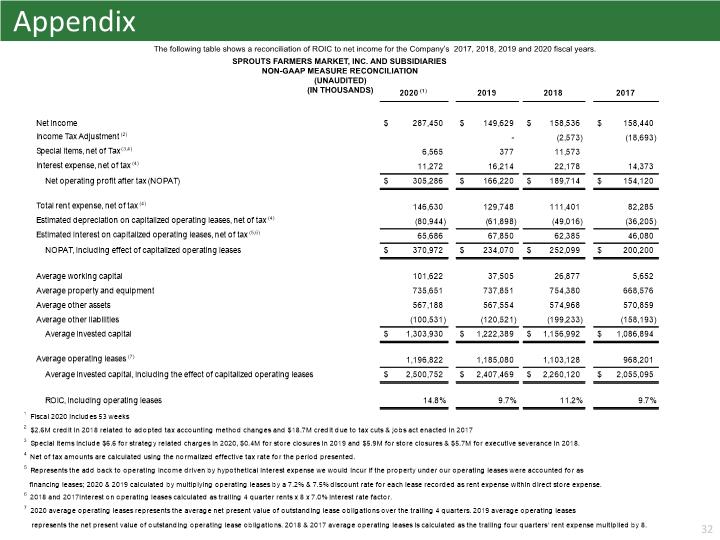

2 Forward-Looking Statements Certain statements in this presentation are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. Any statements contained herein (including, but not limited to, statements to the effect that Sprouts Farmers Market, Inc. (the “Company”) or its management "anticipates," "plans," "estimates," "expects," "believes," or the negative of these terms and other similar expressions) that are not statements of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company’s guidance, outlook, strategy, financial targets, growth and opportunities. These statements involve certain risks and uncertainties that may cause actual results to differ materially from expectations as of the date of this presentation. These risks and uncertainties include, without limitation, risks associated with the COVID-19 pandemic; the Company’s ability to execute on its long-term strategy; the Company’s ability to successfully compete in its competitive industry; the Company’s ability to successfully open new stores; the Company’s ability to manage its rapid growth; the Company’s ability to maintain or improve its comparable store sales and operating margins; the Company’s ability to identify and react to trends in consumer preferences; product supply disruptions; general economic conditions; accounting standard changes; and other factors as set forth from time to time in the Company’s Securities and Exchange Commission filings. The Company intends these forward-looking statements to speak only as of the date of this presentation and does not undertake to update or revise them as more information becomes available, except as required by law. Non-GAAP Financial Measures We refer to EBITDA, adjusted EBITDA, EBITDA Margin, EBIT, adjusted EBIT, adjusted EBIT Margin, adjusted diluted earnings per share and ROIC, each of which is a Non-GAAP Financial Measure. These measures are not prepared in accordance with, and are not intended as alternatives to, generally accepted accounting principles in the United States, or GAAP. The Company's management believes that such measures provide useful information to management, analysts and investors regarding certain additional financial and business trends relating to its results of operations and financial condition. In addition, management uses these measures for reviewing the financial results of the Company, and certain of these measures may be used as components of incentive compensation. The Company defines EBITDA as net income before interest expense, provision for income tax, and depreciation, amortization and accretion and adjusted EBITDA as EBITDA excluding the impact of special items. The Company defines EBIT, as net income before interest expense and provision for income tax, and adjusted EBIT as EBIT, excluding the impact of special items. EBITDA Margin and adjusted EBIT Margin reflect adjusted EBITDA and adjusted EBIT respectively, divided by net sales for the applicable period. The Company defines adjusted diluted earnings per share as diluted earnings per share excluding the impact of special items. The Company defines ROIC as net operating profit after tax (“NOPAT”), including the effect of capitalized operating leases, divided by average invested capital. Non-GAAP measures are intended to provide additional information only and do not have any standard meanings prescribed by GAAP. Use of these terms may differ from similar measures reported by other companies. Because of their limitations, non-GAAP measures should not be considered as a measure of discretionary cash available to use to reinvest in the growth of the Company’s business, or as a measure of cash that will be available to meet the Company’s obligations. Each non-GAAP measure has its limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. To the extent forward looking non-GAAP financial measures are provided herein, they are not reconciled to comparable forward-looking GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation.

3

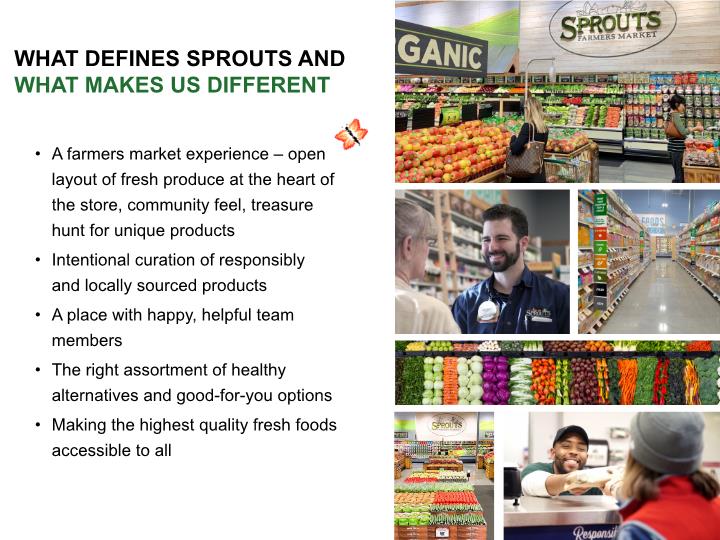

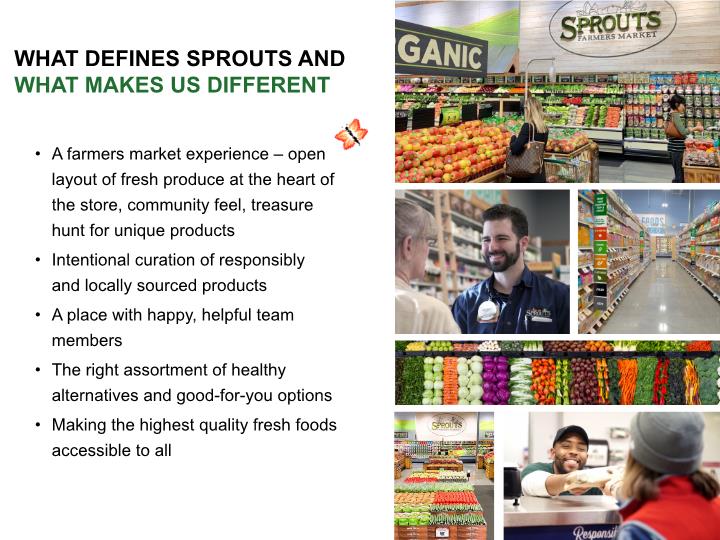

4 A farmers market experience – open layout of fresh produce at the heart of the store, community feel, treasure hunt for unique products Intentional curation of responsibly and locally sourced products A place with happy, helpful team members The right assortment of healthy alternatives and good-for-you options Making the highest quality fresh foods accessible to all WHAT DEFINES SPROUTS AND WHAT MAKES US DIFFERENT

5 Targeted 10%+ annual unit growth beyond 2021 and incredible white space Strong and improving unit economics Sustainable robust cash flows Building an advantaged fresh supply chain Unique farmers market experience Innovative & differentiated products with lifestyle friendly ingredients WHY INVEST IN SPROUTS? A POWERFUL GROWTH BUSINESS

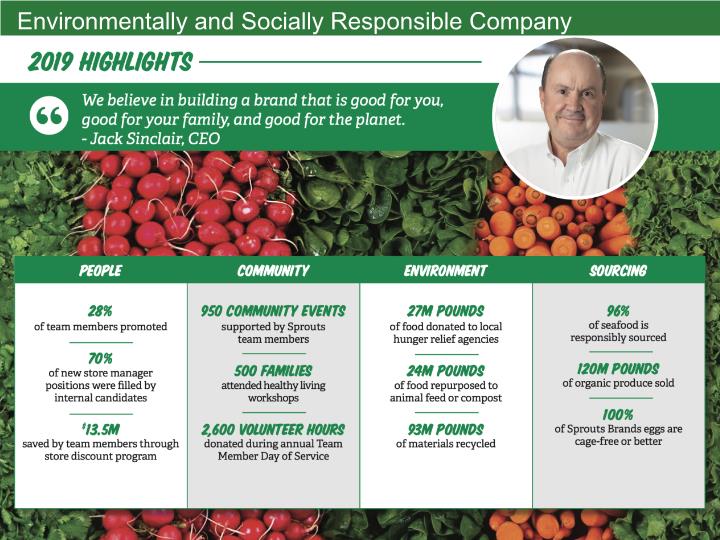

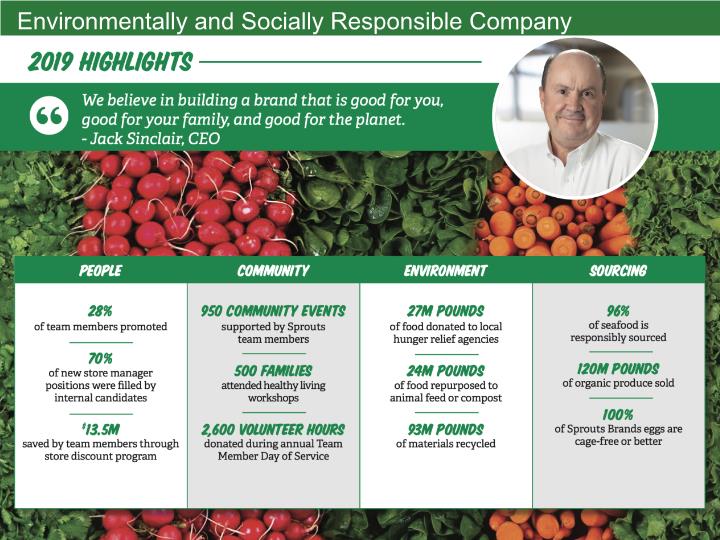

6 Environmentally and Socially Responsible Company

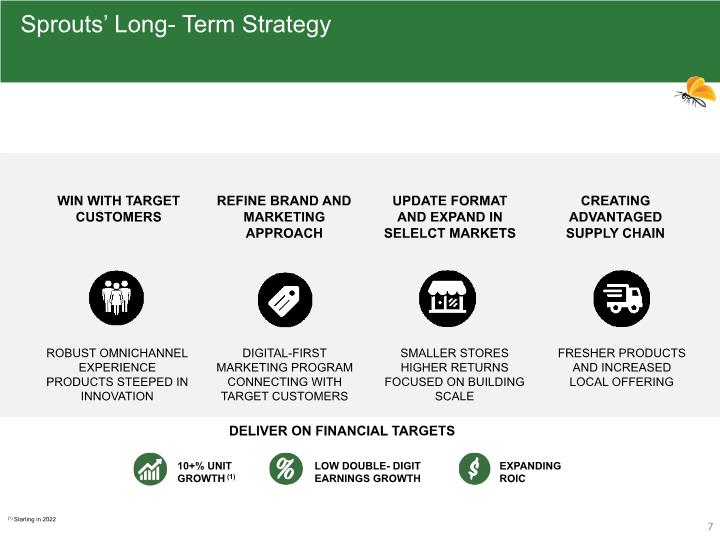

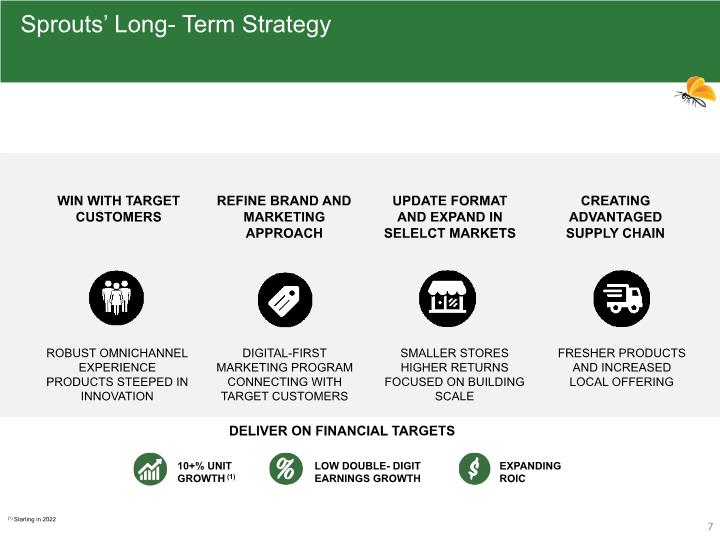

7 Sprouts’ Long- Term Strategy 10+% UNIT GROWTH (1) LOW DOUBLE- DIGIT EARNINGS GROWTH EXPANDING ROIC REFINE BRAND AND MARKETING APPROACH WIN WITH TARGET CUSTOMERS UPDATE FORMAT AND EXPAND IN SELELCT MARKETS CREATING ADVANTAGED SUPPLY CHAIN DIGITAL-FIRST MARKETING PROGRAM CONNECTING WITH TARGET CUSTOMERS ROBUST OMNICHANNEL EXPERIENCE PRODUCTS STEEPED IN INNOVATION SMALLER STORES HIGHER RETURNS FOCUSED ON BUILDING SCALE FRESHER PRODUCTS AND INCREASED LOCAL OFFERING (1) Starting in 2022 DELIVER ON FINANCIAL TARGETS

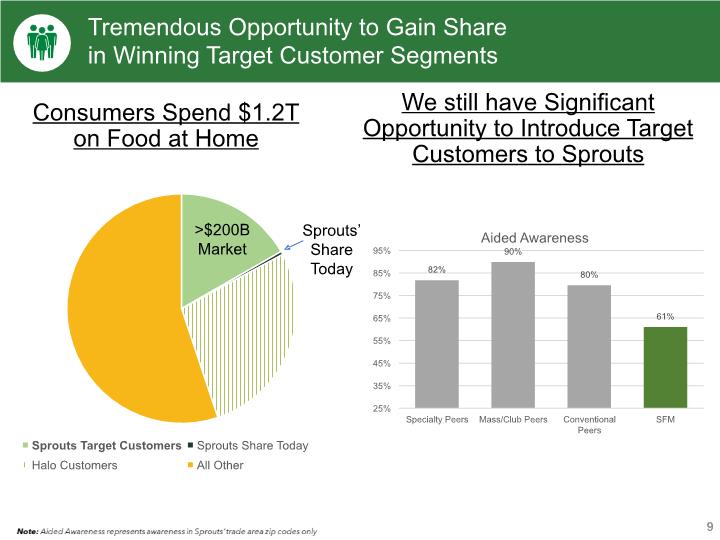

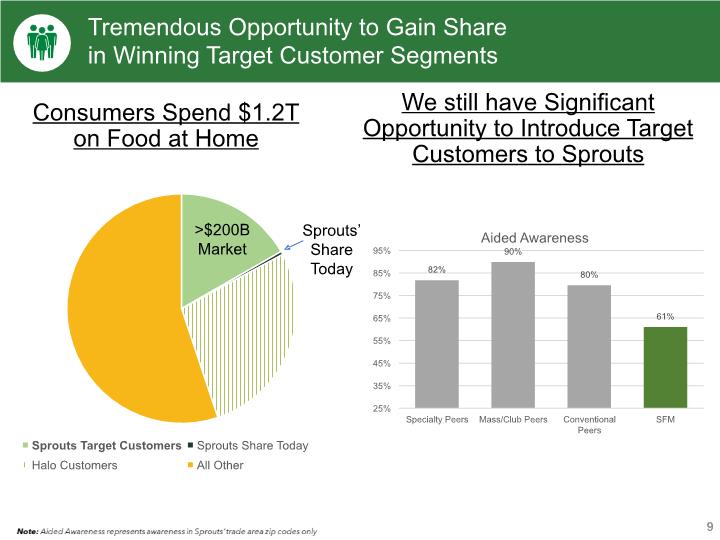

8 WE EXIST FOR THE HEALTH ENTHUSIASTS WE EXIST FOR THE EXPERIENCE SEEKERS What brings them together is simple: They’re into their food – like, really into it. Cover a wide range of income Age demographics - Gen Z to Baby Boomers Healthy and organic options, better for you, quality products Innovative and differentiated products Great store experience They are engaged and connected to the what they eat – how it makes them feel, where it comes from, the role it can play in their lives. Focusing on Sprouts’ Target Customers who Represent More than $200B of Food Spend

9 Tremendous Opportunity to Gain Share in Winning Target Customer Segments 9 Consumers Spend $1.2T on Food at Home Sprouts’ Share Today >$200B Market We still have Significant Opportunity to Introduce Target Customers to Sprouts

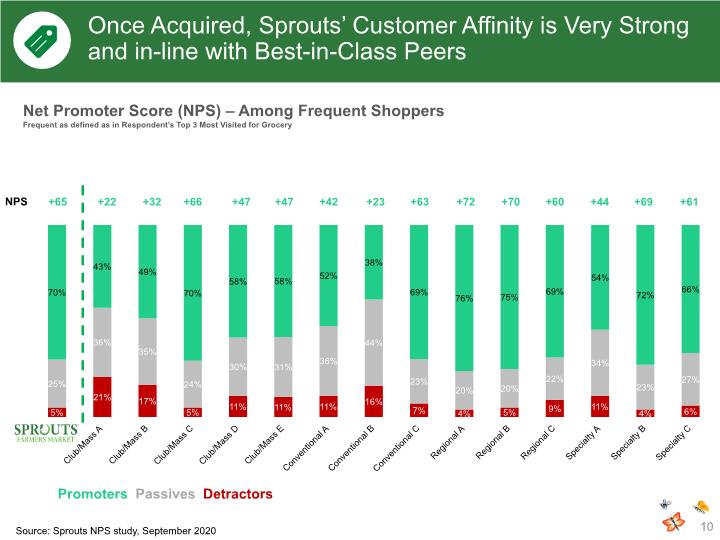

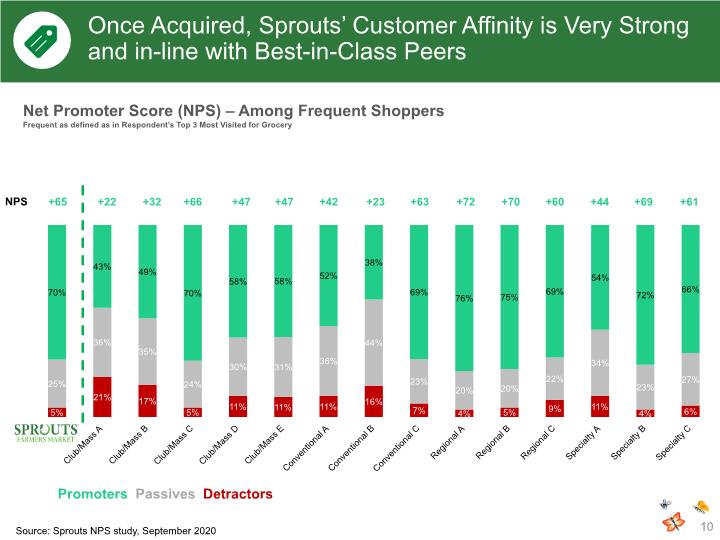

10 Once Acquired, Sprouts’ Customer Affinity is Very Strong and in-line with Best-in-Class Peers Net Promoter Score (NPS) – Among Frequent Shoppers Frequent as defined as in Respondent’s Top 3 Most Visited for Grocery +65 +22 +69 NPS +23 +47 +47 +42 +32 +66 +44 +61 +63 +72 +70 +60 Source: Sprouts NPS study, September 2020

11 Pivoting Our Marketing Strategy to Drive More Profitable Growth with a Broader Reach OUR DIGITAL-FIRST MARKETING PLATFORM IS FOCUSED ON CONNECTING WITH OUR MOST IMPORTANT CUSTOMERS Target Audience: Connect with Health Enthusiasts and Experience Seekers Geo-Targeting: Align media investments with our most valuable trading zone zip codes Continuous Optimization: Improve customer connections in real-time across all their screens Personal Relevance: Employ data-driven comms addressing target audience’s needs and affinities HIGHER VALUE CUSTOMERS TAPPING INTO CONSUMER NEEDS HYPER-PRECISION TARGETING DATA-DRIVEN MEDIA

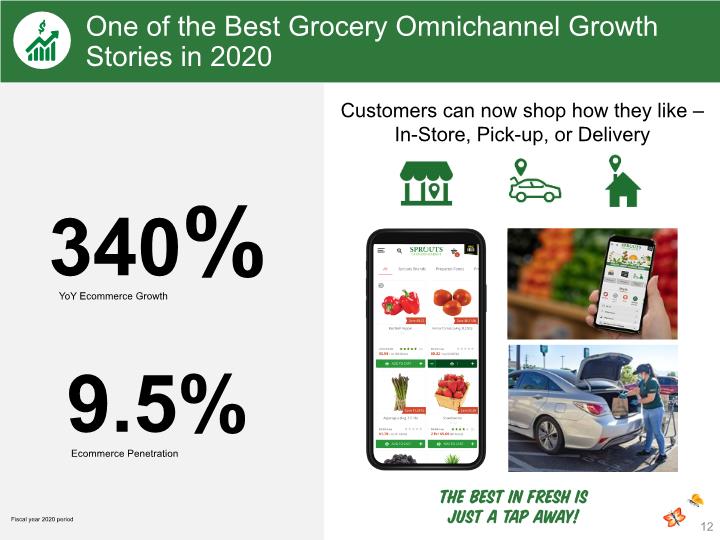

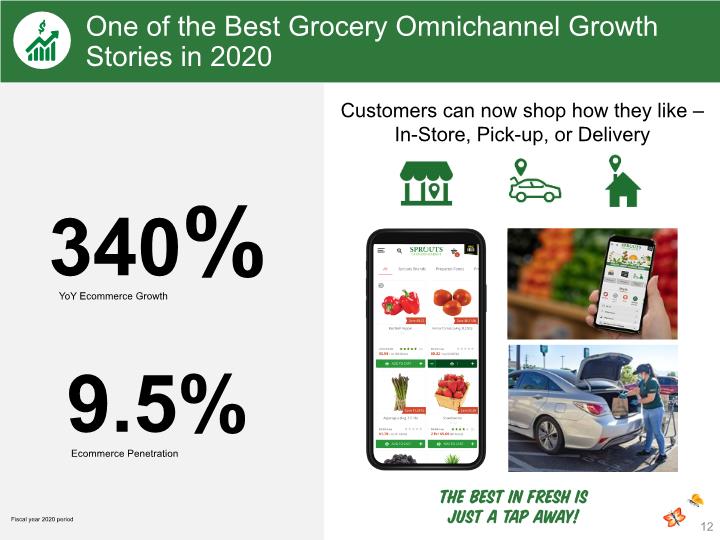

12 One of the Best Grocery Omnichannel Growth Stories in 2020 340% YoY Ecommerce Growth Ecommerce Penetration 9.5% Fiscal year 2020 period Customers can now shop how they like – In-Store, Pick-up, or Delivery

13 Produce Remains the Heart of the Store Hybrid produce buying model – centralized and regional teams allow us to be flexible and react to the produce markets quickly Meaningful farmer partnerships which deliver new varietals and favorable pricing to our customers through spot buys New distribution channels will allow for increased local buying and deliver fresher products to our customers Building a path forward to grow with farmers as we grow

14 14 Sprouts’ Stores are Filled with a Curation of Differentiated Good-For-You Products 68% of Products Sold in Sprouts are Attribute Driven: Organics, Paleo, Keto, Plant Based, Non-GMO, Gluten Free, Vegan, Dairy-free, Grass Fed, Raw Includes all produce

15 15 Deliver a Unique, Friendly Experience with Healthy, Innovative Products in a Smaller Box with Higher Returns Format to Stay True to our Fresh-focused Farmers Market Heritage Prioritize Categories For Growth Potential Continue to Offer all Categories 21K-25K Small Market Layout square foot box From… To… 30K Enhanced Layout square foot box

16 16 Lower Cost to Build Reduce Non-Selling Space Decreased Occupancy Cost Reduce Operating Cost Sales Remain Flat Strong Returns & Ability to Accelerate Growth Smaller Store Benefits

High Growth Retailer – Annual Unit Growth Target of 10% or More Beyond 2021 Unit growth (1) 300 – 400 New Stores in Expansion Markets 2019 & 2020 actual unit growth, 2021 outlook, 2022 and beyond represent a range of potential growth Expansion Markets Existing DCs Future DCs Existing Markets DCs opening in 2021

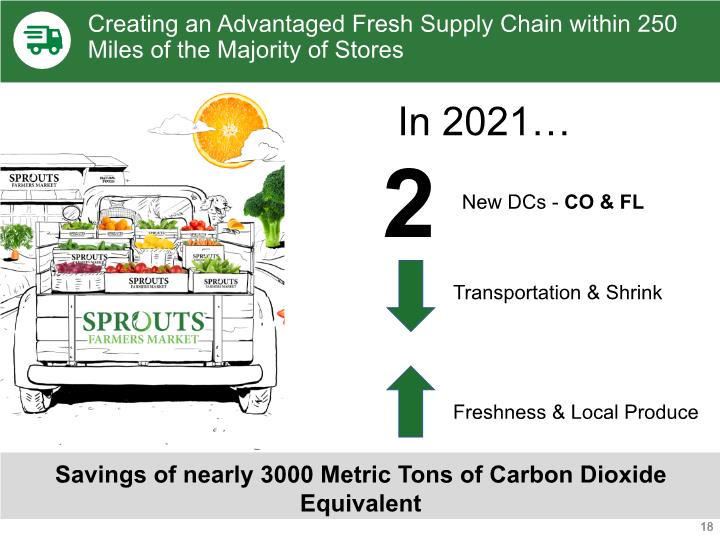

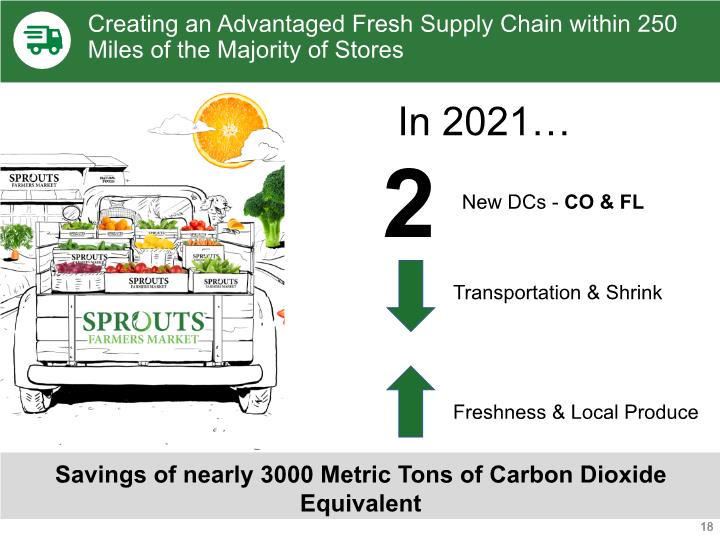

18 18 Creating an Advantaged Fresh Supply Chain within 250 Miles of the Majority of Stores 2 New DCs - CO & FL Transportation & Shrink Freshness & Local Produce In 2021… Savings of nearly 3000 Metric Tons of Carbon Dioxide Equivalent

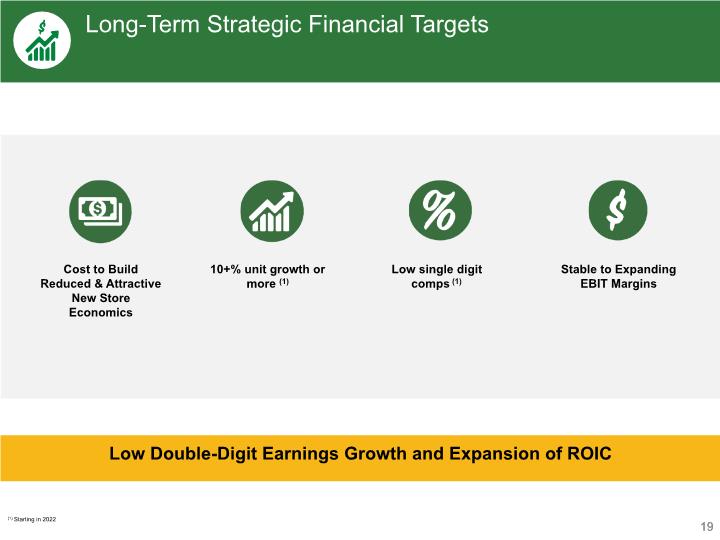

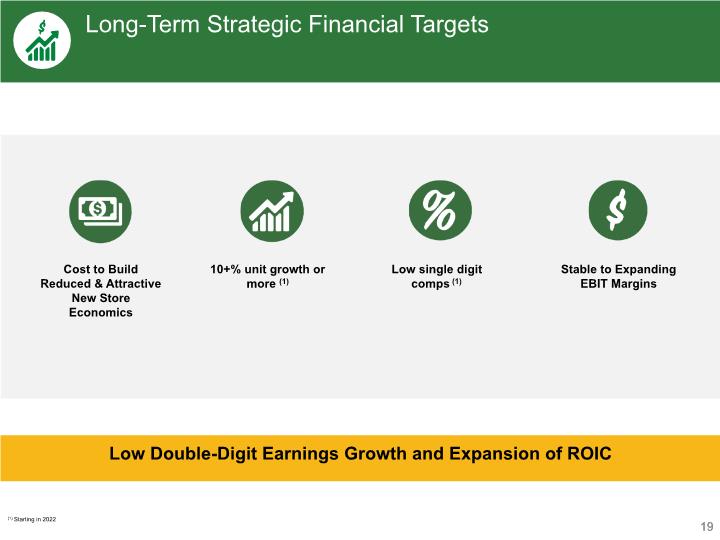

19 19 Long-Term Strategic Financial Targets Low Double-Digit Earnings Growth and Expansion of ROIC Cost to Build Reduced & Attractive New Store Economics 10+% unit growth or more (1) Low single digit comps (1) Stable to Expanding EBIT Margins (1) Starting in 2022

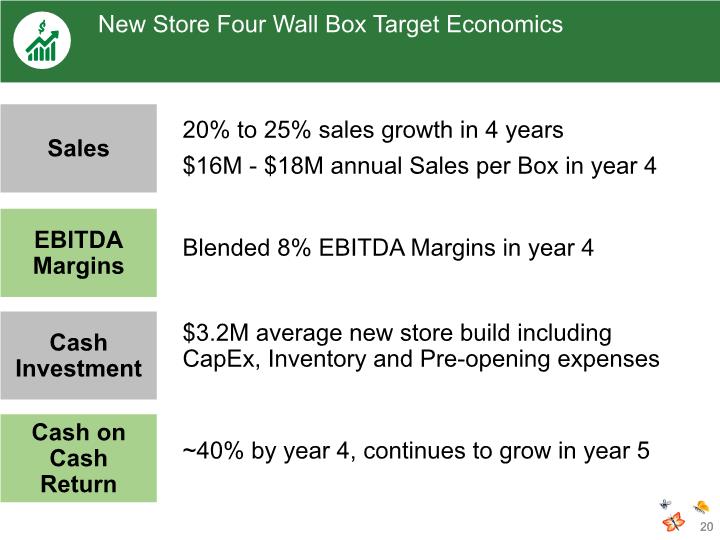

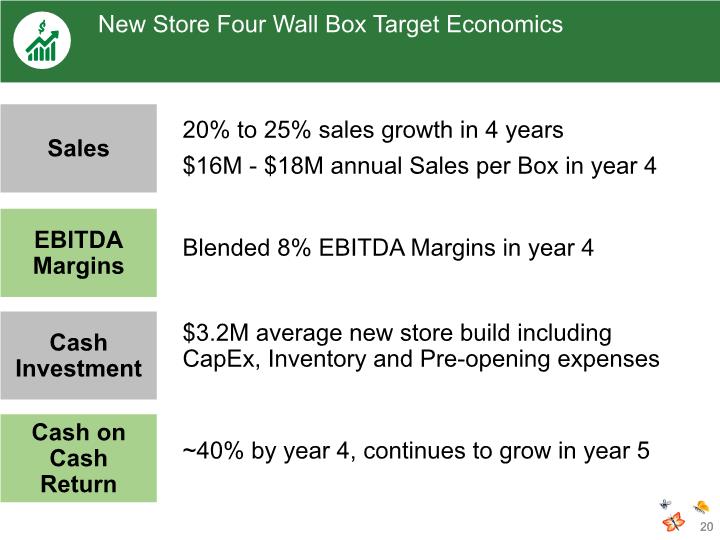

20 20 New Store Four Wall Box Target Economics Sales EBITDA Margins 20% to 25% sales growth in 4 years $16M - $18M annual Sales per Box in year 4 Blended 8% EBITDA Margins in year 4 Cash on Cash Return ~40% by year 4, continues to grow in year 5 Cash Investment $3.2M average new store build including CapEx, Inventory and Pre-opening expenses

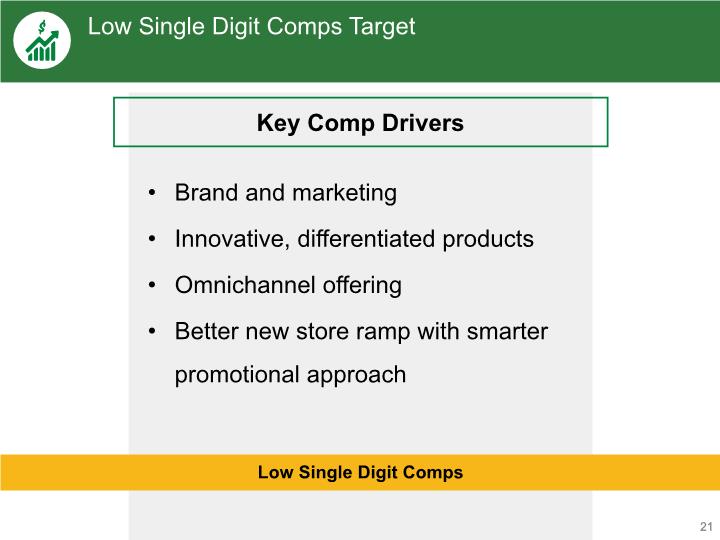

21 21 Low Single Digit Comps Target Key Comp Drivers Low Single Digit Comps Brand and marketing Innovative, differentiated products Omnichannel offering Better new store ramp with smarter promotional approach

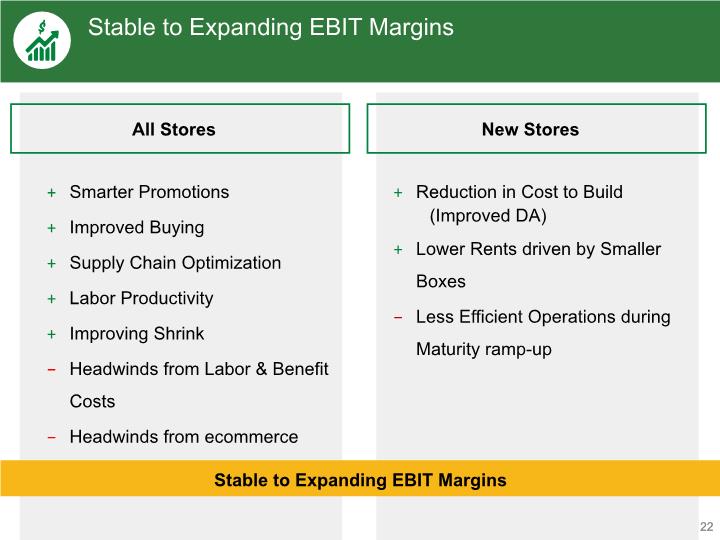

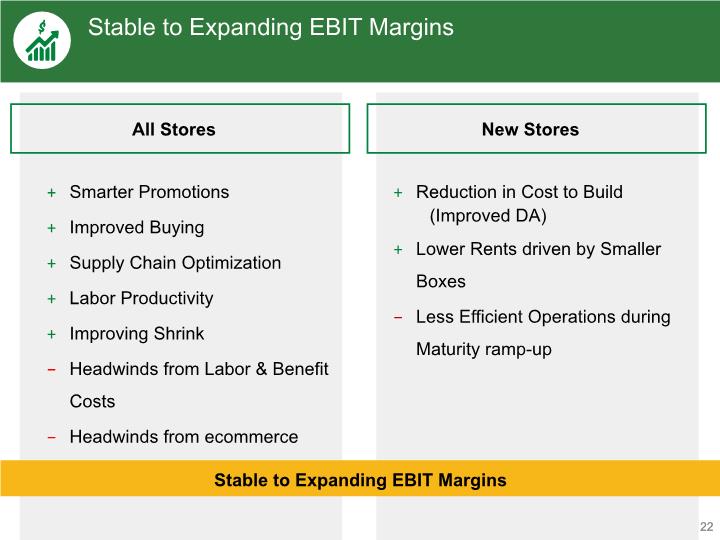

22 22 Stable to Expanding EBIT Margins Stable to Expanding EBIT Margins All Stores New Stores Smarter Promotions Improved Buying Supply Chain Optimization Labor Productivity Improving Shrink Headwinds from Labor & Benefit Costs Headwinds from ecommerce Reduction in Cost to Build (Improved DA) Lower Rents driven by Smaller Boxes Less Efficient Operations during Maturity ramp-up

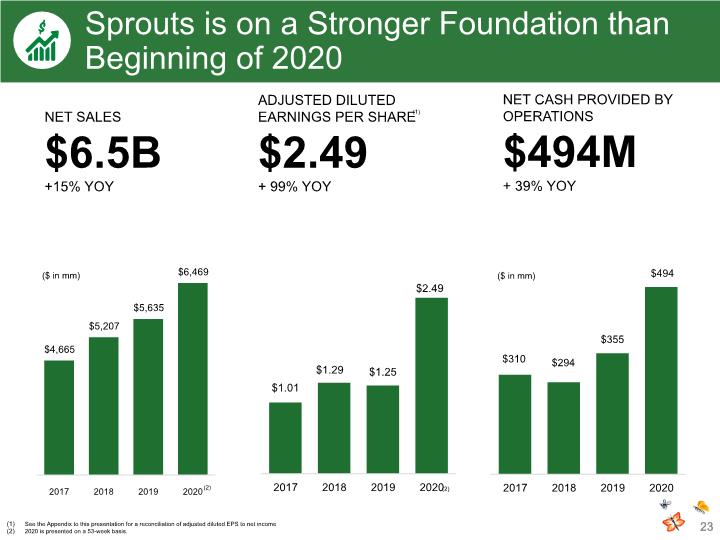

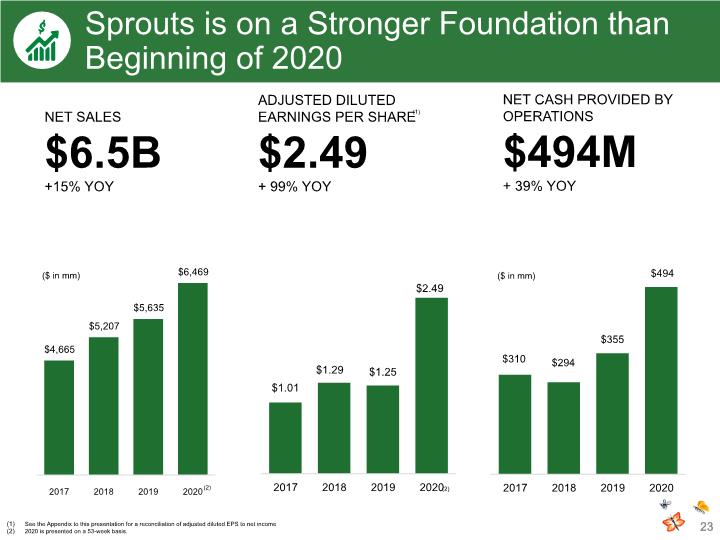

23 Sprouts is on a Stronger Foundation than Beginning of 2020 23 NET SALES $6.5B +15% YoY NET CASH PROVIDED by OPERATIONS $494M + 39% YOY ADJUSTED DILUTED Earnings Per Share $2.49 + 99% YOY ($ in mm) ($ in mm) (1) See the Appendix to this presentation for a reconciliation of adjusted diluted EPS to net income 2020 is presented on a 53-week basis. (2) (2)

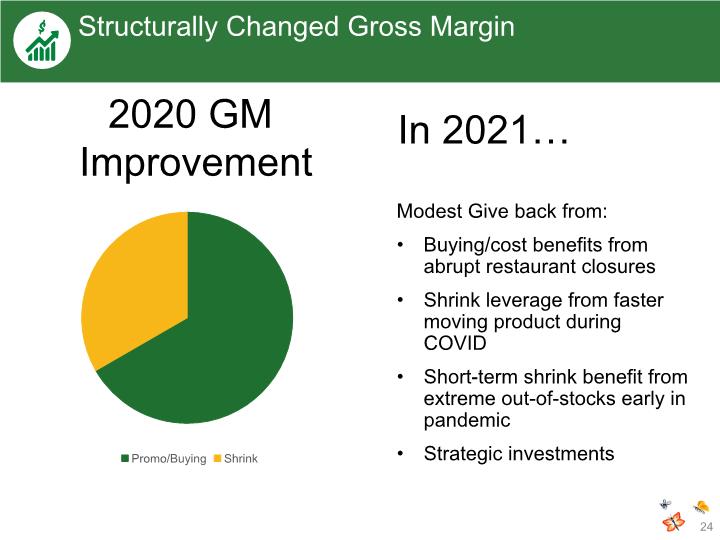

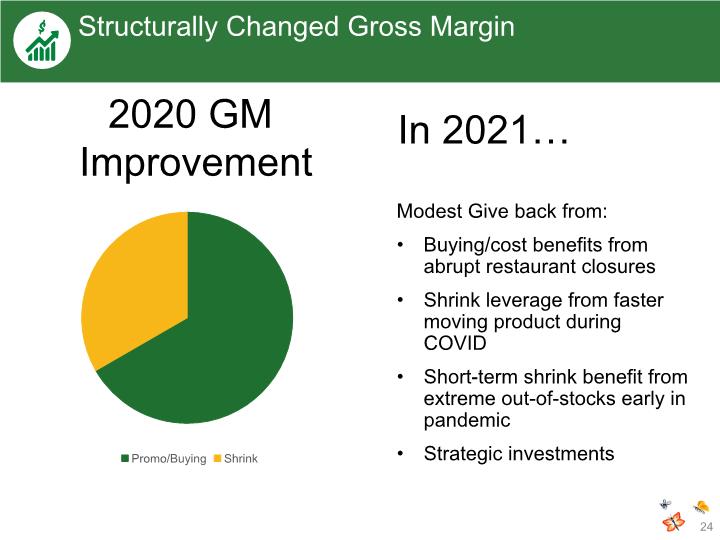

24 Structurally Changed Gross Margin Modest Give back from: Buying/cost benefits from abrupt restaurant closures Shrink leverage from faster moving product during COVID Short-term shrink benefit from extreme out-of-stocks early in pandemic Strategic investments In 2021… 2020 GM Improvement

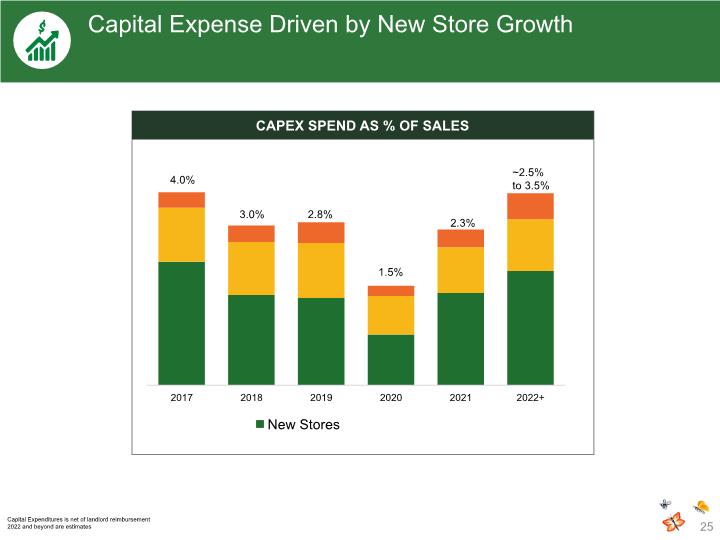

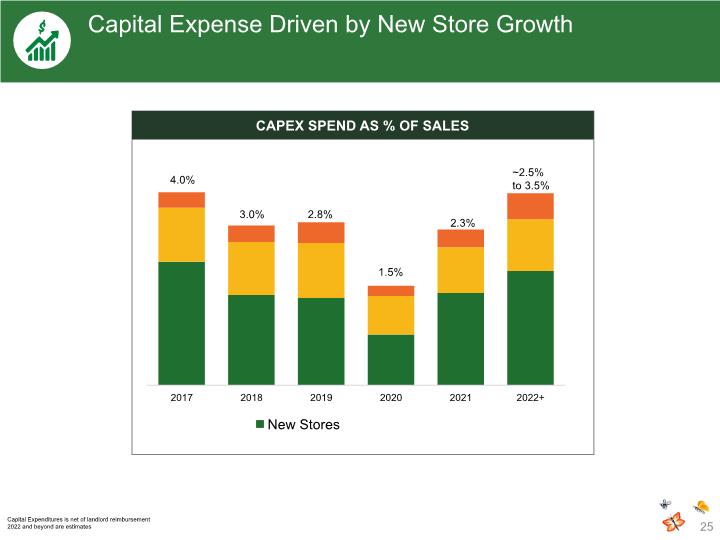

25 Capital Expense Driven by New Store Growth Capex Spend as % of Sales Capital Expenditures is net of landlord reimbursement 2022 and beyond are estimates 2.3%

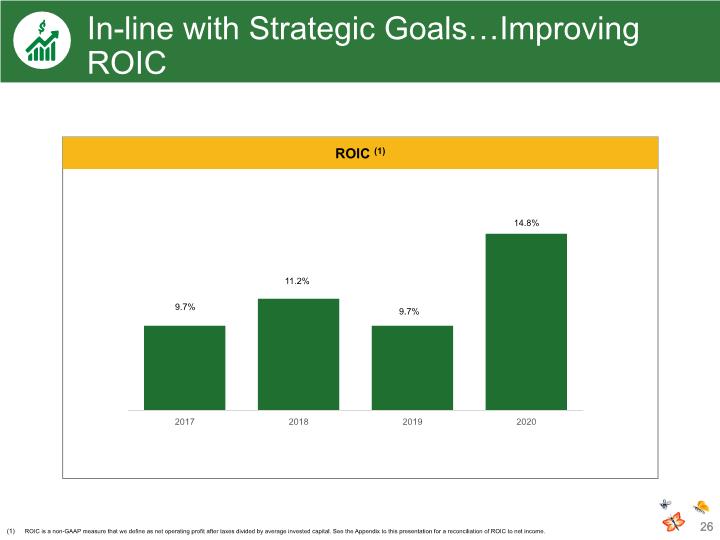

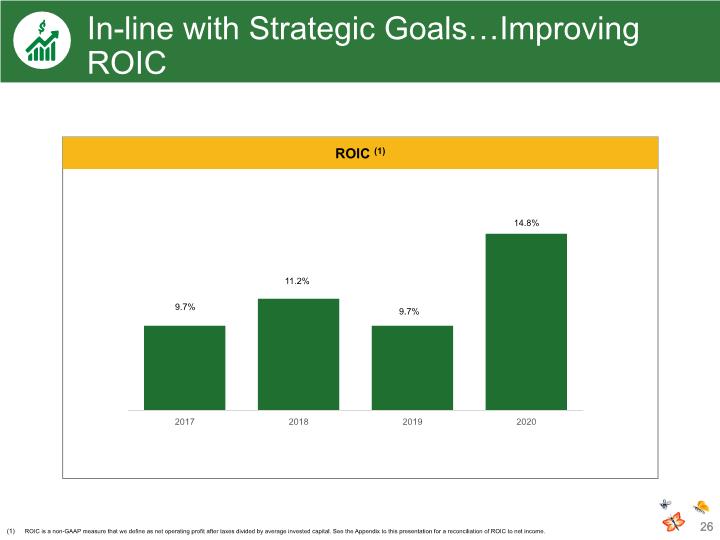

26 In-line with Strategic Goals…Improving ROIC 26 ROIC (1) ROIC is a non-GAAP measure that we define as net operating profit after taxes divided by average invested capital. See the Appendix to this presentation for a reconciliation of ROIC to net income.

27 DELIGHT IN THE GOODNESS OF FRESH, HEALTHY FOODS… Sprouts delivers a unique farmers market experience that brings together passionate, knowledgeable team members and the best assortment of high-quality food that is good for us, and good for the world.

28 APPENDIX

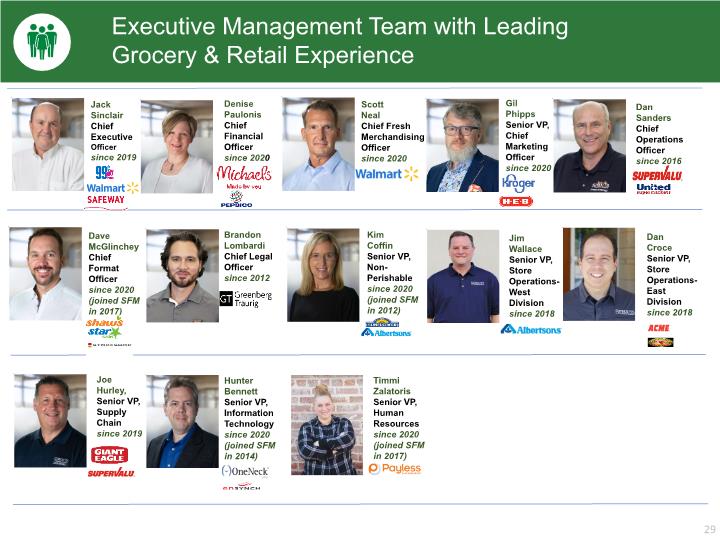

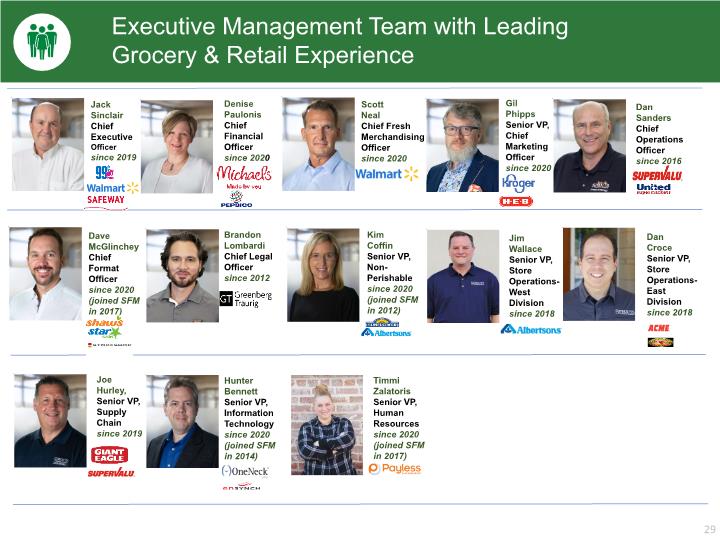

29 Executive Management Team with Leading Grocery & Retail Experience Jack Sinclair Chief Executive Officer since 2019 Denise Paulonis Chief Financial Officer since 2020 Scott Neal Chief Fresh Merchandising Officer since 2020 Dan Sanders Chief Operations Officer since 2016 Jim Wallace Senior VP, Store Operations-West Division since 2018 Gil Phipps Senior VP, Chief Marketing Officer since 2020 Dave McGlinchey Chief Format Officer since 2020 (joined SFM in 2017) Brandon Lombardi Chief Legal Officer since 2012 Kim Coffin Senior VP, Non- Perishable since 2020 (joined SFM in 2012) Dan Croce Senior VP, Store Operations-East Division since 2018 Joe Hurley, Senior VP, Supply Chain since 2019 Hunter Bennett Senior VP, Information Technology since 2020 (joined SFM in 2014) Timmi Zalatoris Senior VP, Human Resources since 2020 (joined SFM in 2017)

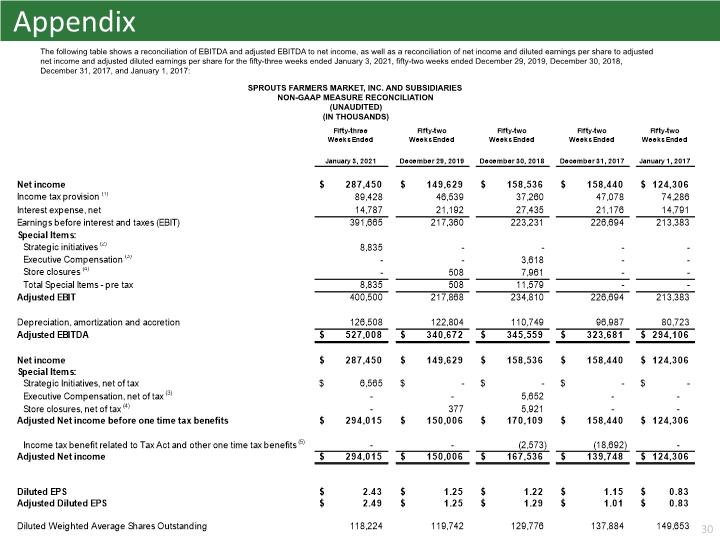

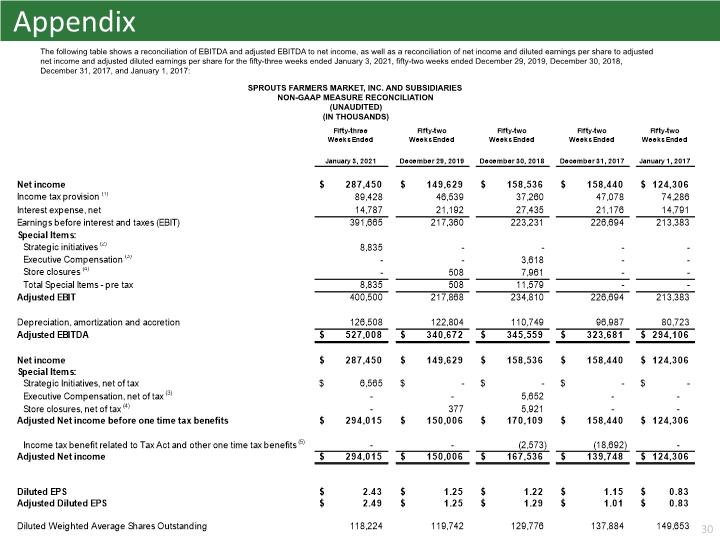

30 SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES NON-GAAP MEASURE RECONCILIATION (UNAUDITED) (IN THOUSANDS) The following table shows a reconciliation of EBITDA and adjusted EBITDA to net income, as well as a reconciliation of net income and diluted earnings per share to adjusted net income and adjusted diluted earnings per share for the fifty-three weeks ended January 3, 2021, fifty-two weeks ended December 29, 2019, December 30, 2018, December 31, 2017, and January 1, 2017: Appendix

31 Appendix Income tax provision includes approximately $12 million (or $0.10 per diluted share) benefit during the fifty-two weeks ended December 30, 2018 and $10 million (or $0.08 per diluted share) in the fifty-two weeks ended December 31, 2017, in excess federal and state tax benefits for share based compensation primarily associated with the exercise of expiring pre-IPO options. Prior to 2017, these tax credits were credited to stockholders’ equity. Includes professional fees related to our ongoing strategic initiatives. After-tax impact includes the tax benefit on the pre-tax charge. During the fifty-two weeks ended December 30, 2018, the Company recorded one-time pretax compensation charges of $4 million, associated with the resignation of the former CEO. The after-tax impact includes incremental tax expense associated with certain nondeductible executive compensation costs. Includes the direct costs associated with store closures and relocation. During the fifty-two weeks ended December 30, 2018, in connection with the closure of two stores, the Company recorded one-time non-cash pre-tax charges of $8 million primarily related to the estimated fair value of the lease termination obligations and asset impairments. After-tax impact includes the tax benefit on the pre-tax charge. During the fifty-two weeks ended December 30, 2018, the Company adopted a tax calculation method change for the accelerated deduction of certain items, resulting in a discrete tax benefit of $3 million. During the fifty-two weeks ended December 31, 2017, the Company recorded a one-time benefit associated with the adoption of the 2017 Tax Cuts and Jobs Act.

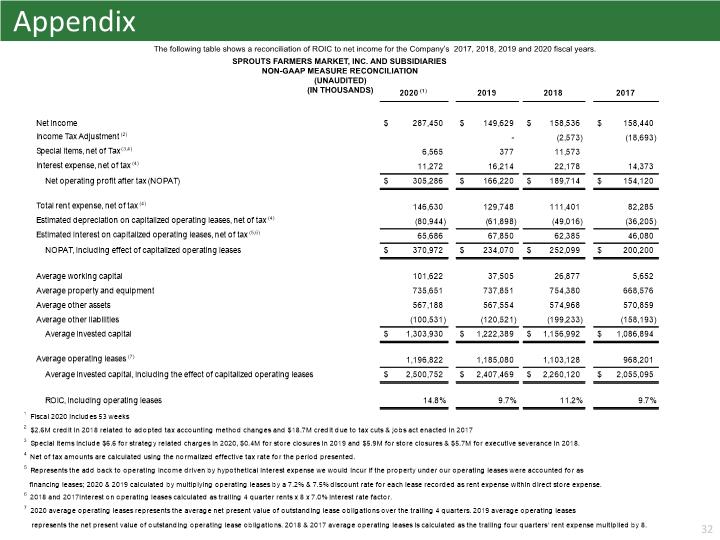

32 Appendix The following table shows a reconciliation of ROIC to net income for the Company’s 2017, 2018, 2019 and 2020 fiscal years. SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES NON-GAAP MEASURE RECONCILIATION (UNAUDITED) (IN THOUSANDS)