Q1 2021 Earnings May 2021 Exhibit 99.2

2 Forward-Looking Statements Certain statements in this presentation are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. Any statements contained herein (including, but not limited to, statements to the effect that Sprouts Farmers Market, Inc. (the “Company”) or its management "anticipates," "plans," "estimates," "expects," "believes," or the negative of these terms and other similar expressions) that are not statements of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company’s guidance, outlook, strategy, financial targets, growth and opportunities. These statements involve certain risks and uncertainties that may cause actual results to differ materially from expectations as of the date of this presentation. These risks and uncertainties include, without limitation, risks associated with the COVID-19 pandemic; the Company’s ability to execute on its long-term strategy; the Company’s ability to successfully compete in its competitive industry; the Company’s ability to successfully open new stores; the Company’s ability to manage its rapid growth; the Company’s ability to maintain or improve its comparable store sales and operating margins; the Company’s ability to identify and react to trends in consumer preferences; product supply disruptions; general economic conditions; accounting standard changes; and other factors as set forth from time to time in the Company’s Securities and Exchange Commission filings. The Company intends these forward-looking statements to speak only as of the date of this presentation and does not undertake to update or revise them as more information becomes available, except as required by law. Non-GAAP Financial Measures We refer to EBIT, adjusted EBIT, adjusted EBIT Margin, and adjusted diluted earnings per share, each of which is a Non-GAAP Financial Measure. These measures are not prepared in accordance with, and are not intended as alternatives to, generally accepted accounting principles in the United States, or GAAP. The Company's management believes that such measures provide useful information to management, analysts and investors regarding certain additional financial and business trends relating to its results of operations and financial condition. In addition, management uses these measures for reviewing the financial results of the Company, and certain of these measures may be used as components of incentive compensation. The Company defines EBIT, as net income before interest expense and provision for income tax, and adjusted EBIT as EBIT, excluding the impact of special items. Adjusted EBIT Margin reflects adjusted EBIT, divided by net sales for the applicable period. The Company defines adjusted diluted earnings per share as diluted earnings per share excluding the impact of special items. Non-GAAP measures are intended to provide additional information only and do not have any standard meanings prescribed by GAAP. Use of these terms may differ from similar measures reported by other companies. Because of their limitations, non-GAAP measures should not be considered as a measure of discretionary cash available to use to reinvest in the growth of the Company’s business, or as a measure of cash that will be available to meet the Company’s obligations. Each non-GAAP measure has its limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. To the extent forward looking non-GAAP financial measures are provided herein, they are not reconciled to comparable forward-looking GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation.

3 Jack Sinclair CEO

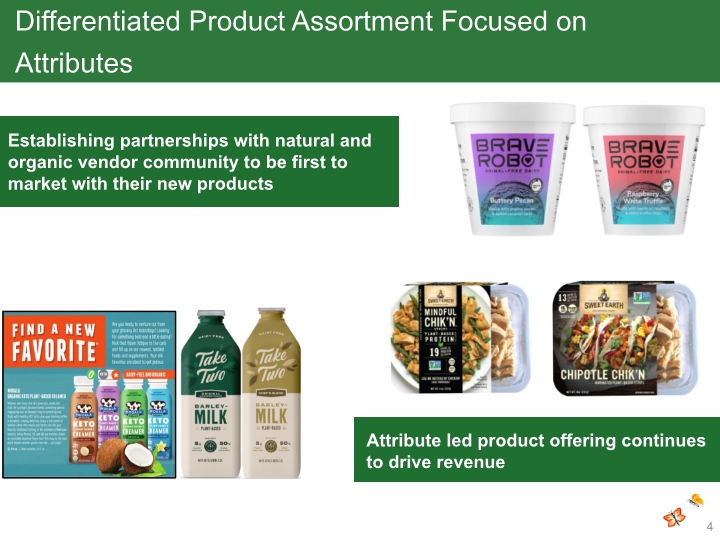

4 Differentiated Product Assortment Focused on Attributes Attribute led product offering continues to drive revenue Establishing partnerships with natural and organic vendor community to be first to market with their new products

5 5 New Aurora, CO Distribution Center Supports our Growth Strategy Focused on Fresh, Local and Organic Offerings We are creating an advantaged fresh supply chain with distribution centers within 250 miles of the majority of our stores Meet our Local Farmer Partners

6 ESG activities are improving our bottom line and the planet! Transitioned 100% of pork supply to be sourced from suppliers that utilize open-pen or group-housed facilities Safe, Healthy Food and Responsible Sourcing Environment & Climate overall landfill diversion rate by repurposing and recycling nearly 78,000 tons of food and waste 58% Reduced Scope 1 emissions 16% driven by reduction in fugitive refrigeration emissions. Achieved Scope 2 emissions slightly below unit growth rate. Reduced Scope 3 waste-related emissions by sending less waste to landfills. 68% of food waste recovered, and donated equivalent to 23 million meals Committed to sustainable palm oil in Sprouts Brand products by 2022 22% sales increase of products that promote health and nutrition 20% sales increase of products with a sustainable attribute, representing nearly $3.5 billion or more than 50% in sales 100% of Sprouts Brand eggs are now cage free 23% of total sales are from organically grown products 2020 Highlights

7 We put customers, team members, and local communities first! Awarded $1.6 million in grants and donations to programs supporting youth nutrition education and academic support, and food system equity Supported an estimated 350,000 students with nutrition programs, taught virtually, during school closures Community Engagement Team Members 87% of Sprouts’ board members are independent 25% of Sprouts’ board members are female and 13% are ethnically diverse Corporate Governance Formed a board-level Risk Committee to monitor enterprise risk management program and provide oversight of our risks related to cybersecurity, critical systems, and environmental and social matters among others. 7,200 promotions! Paid $100+ million in team member bonuses and covered 100% of the costs for testing Paying up to 4 hours of paid sick time off to receive the vaccine COVID-19 Response 55% were female 49% were ethnically diverse Filled 72% of store manager positions with internal candidates Team members received 475,000 hours of in-store training $17.42/hour average store team member pay Workforce Diversity: 48% ethnically diverse and 51% female 2020 Highlights

8 Denise Paulonis CFO

NET SALES $1.6B ADJUSTED DILUTED Earnings Per Share $0.70 9 Ongoing Strategic Changes are Producing Solid Financials 9 ($ in mm) (1) See the Appendix to this presentation for a reconciliation of adjusted diluted EPS to net income

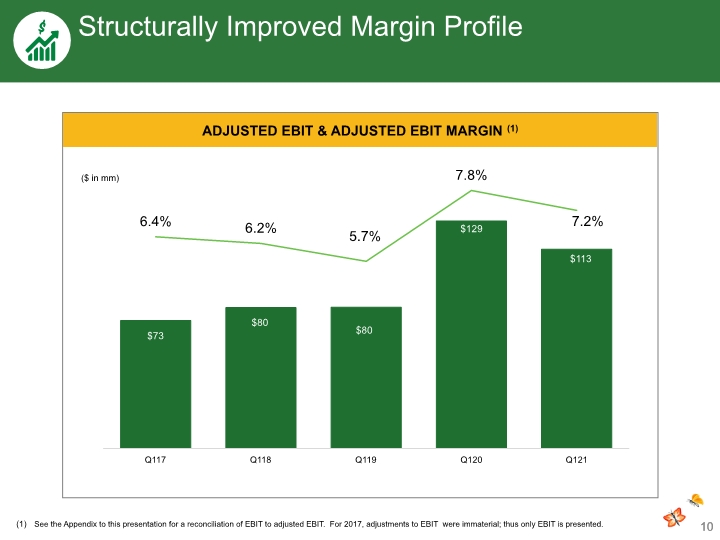

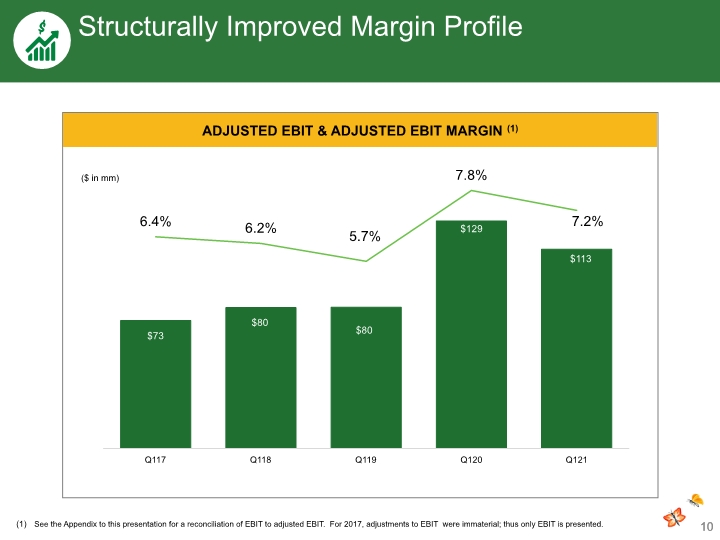

10 Structurally Improved Margin Profile 10 ADJUSTED EBIT & Adjusted EBIT Margin (1) See the Appendix to this presentation for a reconciliation of EBIT to adjusted EBIT. For 2017, adjustments to EBIT were immaterial; thus only EBIT is presented.

11 Ecommerce Sales Remain Elevated as Customers have Continued to Rely on Home Delivery and Pick-up Ecommerce Penetration Customers can now shop how they like – In-Store, Pick-up, or Delivery

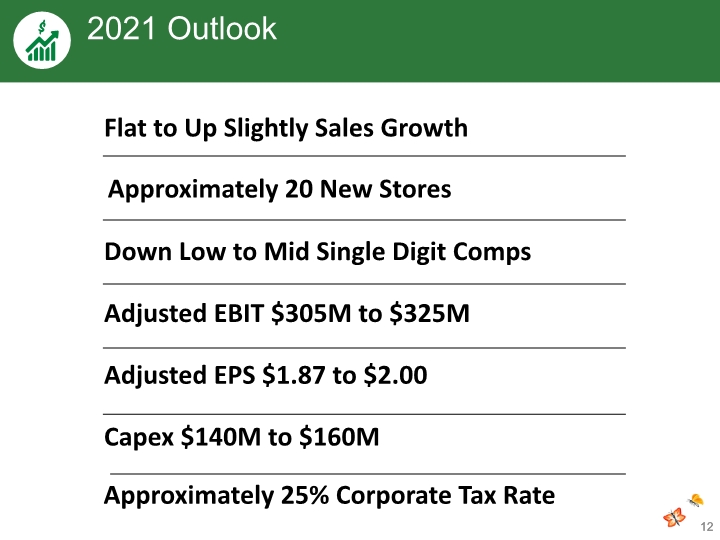

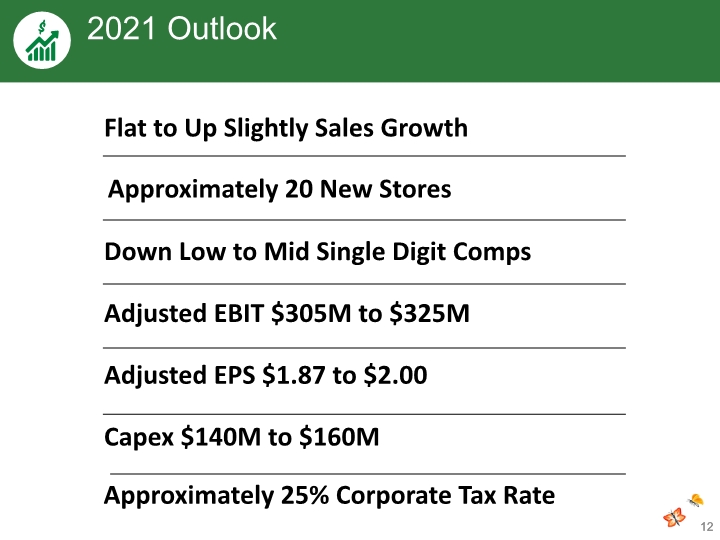

12 2021 Outlook 12 Flat to Up Slightly Sales Growth Approximately 20 New Stores Down Low to Mid Single Digit Comps Adjusted EBIT $305M to $325M Adjusted EPS $1.87 to $2.00 Capex $140M to $160M Approximately 25% Corporate Tax Rate

13 Appendix

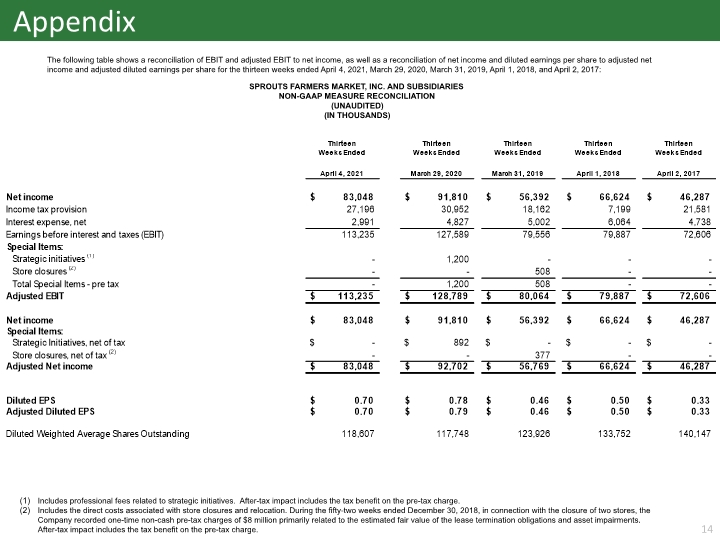

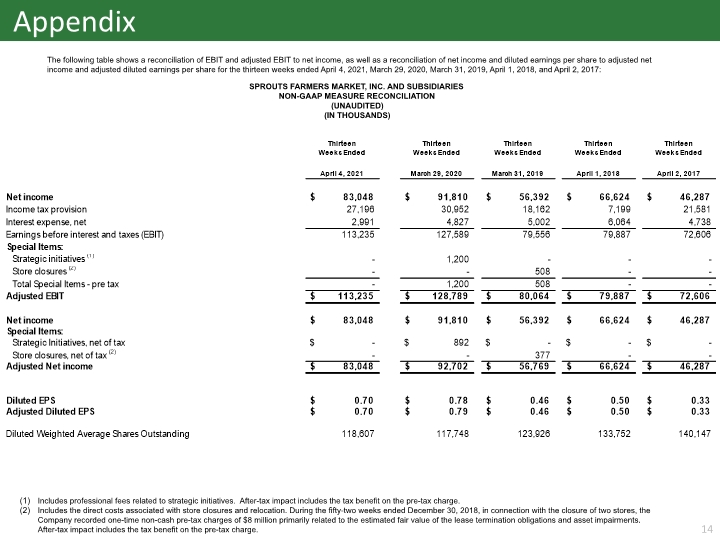

14 SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES NON-GAAP MEASURE RECONCILIATION (UNAUDITED) (IN THOUSANDS) The following table shows a reconciliation of EBIT and adjusted EBIT to net income, as well as a reconciliation of net income and diluted earnings per share to adjusted net income and adjusted diluted earnings per share for the thirteen weeks ended April 4, 2021, March 29, 2020, March 31, 2019, April 1, 2018, and April 2, 2017: Appendix Includes professional fees related to strategic initiatives. After-tax impact includes the tax benefit on the pre-tax charge. Includes the direct costs associated with store closures and relocation. During the fifty-two weeks ended December 30, 2018, in connection with the closure of two stores, the Company recorded one-time non-cash pre-tax charges of $8 million primarily related to the estimated fair value of the lease termination obligations and asset impairments. After-tax impact includes the tax benefit on the pre-tax charge.