Exhibit 10.1

Execution Version

CONTRIBUTION AGREEMENT

between

AZURE MIDSTREAM ENERGY, LLC,

the “Contributor”,

and

AZURE MIDSTREAM PARTNERS, LP,

the “Partnership”

Dated August 6, 2015

Concerning the Acquisition of all of the Equity Interests in Azure ETG, LLC

TABLE OF CONTENTS

| | | | | | |

Article I DEFINITIONS AND INTERPRETATIONS | | | 2 | |

1.1 | | Definitions | | | 2 | |

1.2 | | Interpretations | | | 2 | |

| |

Article II CONTRIBUTION OF THE INTERESTS | | | 2 | |

2.1 | | Contribution of the Interests | | | 2 | |

2.2 | | Consideration for the Interests | | | 2 | |

2.3 | | Proposed Closing Statement and Post-Closing Adjustment | | | 3 | |

2.4 | | 1060 Allocation | | | 4 | |

| |

Article III REPRESENTATIONS AND WARRANTIES OF CONTRIBUTOR | | | 5 | |

3.1 | | Organization; Qualification | | | 5 | |

3.2 | | Authority; Enforceability. | | | 5 | |

3.3 | | Non-Contravention; Consents and Approvals | | | 6 | |

3.4 | | Governmental Approvals | | | 6 | |

3.5 | | Capitalization | | | 7 | |

3.6 | | Financial Statements. | | | 7 | |

3.7 | | Absence of Certain Changes | | | 8 | |

3.8 | | Compliance with Law | | | 8 | |

3.9 | | Legal Proceedings | | | 8 | |

3.10 | | Environmental | | | 8 | |

3.11 | | Qualifying Income | | | 9 | |

3.12 | | Adequacy of Assets | | | 10 | |

3.13 | | Assets Other than Real Property Interests | | | 10 | |

3.14 | | Title to Real Property. | | | 10 | |

3.15 | | Material Contracts. | | | 11 | |

3.16 | | Consideration Value Adjustments | | | 12 | |

3.17 | | Permits | | | 13 | |

3.18 | | Intellectual Property | | | 13 | |

3.19 | | Taxes. | | | 13 | |

3.20 | | Employee Benefits; Employment and Labor Matters | | | 14 | |

3.21 | | Regulatory Status | | | 14 | |

3.22 | | Brokers’ Fee | | | 15 | |

3.23 | | Securities Laws | | | 15 | |

3.24 | | Bankruptcy | | | 15 | |

3.25 | | Books and Records | | | 16 | |

| |

Article IV REPRESENTATIONS AND WARRANTIES REGARDING THE PARTNERSHIP | | | 16 | |

4.1 | | Organization; Qualification | | | 16 | |

4.2 | | Authority; Enforceability | | | 16 | |

4.3 | | Non-Contravention | | | 16 | |

4.4 | | Governmental Approvals | | | 17 | |

4.5 | | Equity Consideration Units | | | 17 | |

4.6 | | Delivery of Fairness Opinion | | | 17 | |

i

| | | | | | |

4.7 | | Excluded Assets | | | 18 | |

4.8 | | Brokers’ Fee | | | 18 | |

4.9 | | Securities Laws | | | 18 | |

| |

Article V COVENANTS OF THE PARTIES | | | 18 | |

5.1 | | Expenses. | | | 18 | |

5.2 | | Tax Matters | | | 19 | |

5.3 | | Financial Statements | | | 19 | |

5.4 | | Further Assurances | | | 20 | |

| |

Article VI CLOSING | | | 20 | |

6.1 | | Closing | | | 20 | |

6.2 | | Deliveries by Contributor | | | 20 | |

6.3 | | Deliveries by the Partnership | | | 20 | |

| |

Article VII INDEMNIFICATION | | | 21 | |

7.1 | | Indemnification by Contributor | | | 21 | |

7.2 | | Indemnification by the Partnership | | | 21 | |

7.3 | | Limitations and Other Indemnity Claim Matters | | | 22 | |

7.4 | | Indemnification Procedures. | | | 23 | |

7.5 | | Express Negligence | | | 24 | |

7.6 | | No Reliance. | | | 25 | |

7.7 | | Tax Treatment | | | 25 | |

| |

Article VIII GOVERNING LAW AND CONSENT TO JURISDICTION | | | 26 | |

8.1 | | Governing Law | | | 26 | |

8.2 | | Consent to Jurisdiction; Waiver of Right to Trial by Jury | | | 26 | |

| |

Article IX GENERAL PROVISIONS | | | 26 | |

9.1 | | Amendment and Modification | | | 26 | |

9.2 | | Waiver of Compliance; Consents | | | 27 | |

9.3 | | Notices | | | 27 | |

9.4 | | Assignment | | | 27 | |

9.5 | | Third Party Beneficiaries | | | 28 | |

9.6 | | Entire Agreement | | | 28 | |

9.7 | | Severability | | | 28 | |

9.8 | | Representation by Counsel | | | 28 | |

9.9 | | Disclosure Schedules | | | 28 | |

9.10 | | Facsimiles; Counterparts | | | 29 | |

| | |

EXHIBITS: |

|

Exhibit A - Definitions |

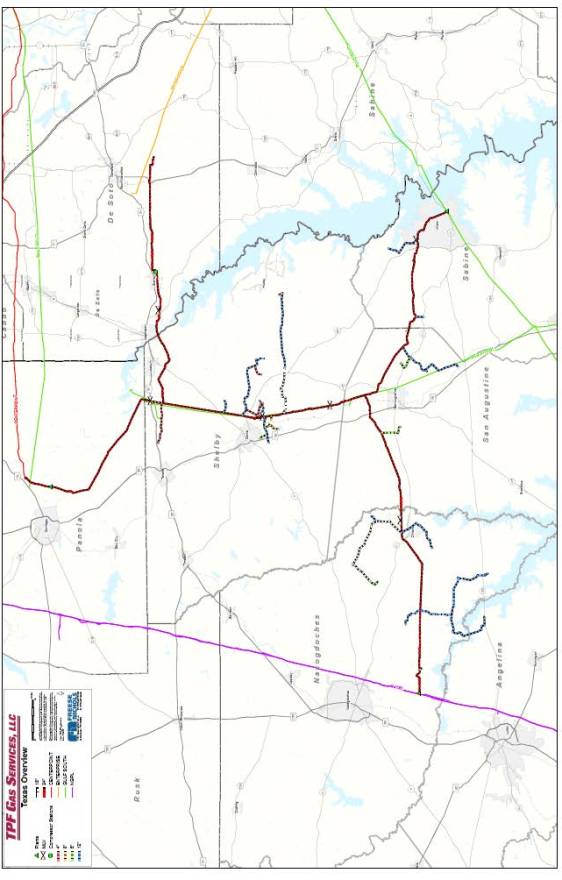

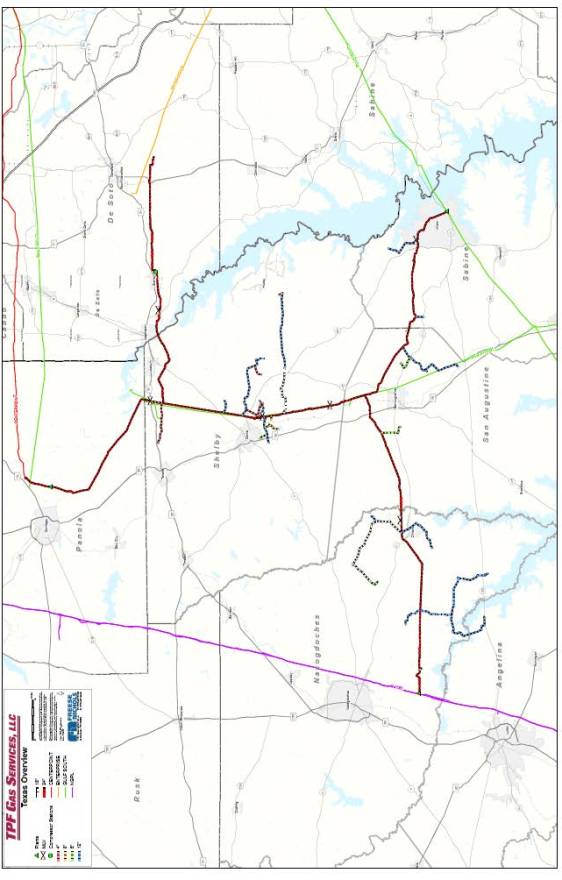

Exhibit B-1 - ETG Gathering System |

Exhibit B-2 - ETG Personal Property |

Exhibit B-3 - ETG Real Property Interests |

Exhibit B-4 - Certain ETG Contracts |

Exhibit C - Excluded Assets Assignment |

|

SCHEDULES: |

|

Contributor Disclosure Schedules |

Partnership Disclosure Schedules |

ii

CONTRIBUTION AGREEMENT

THIS CONTRIBUTION AGREEMENT (this “Agreement”) executed and delivered on August 6, 2015 (the “Closing Date”) is made and entered into by and between Azure Midstream Energy, LLC, a Delaware limited liability company (the “Contributor”), and Azure Midstream Partners, LP, a Delaware limited partnership (the “Partnership”). The above-named entities are sometimes referred to in this Agreement each as a “Party” and collectively as the “Parties.”

RECITALS

WHEREAS, the Contributor owns, directly or indirectly, all of the outstanding membership interests (the “Interests”) in Azure ETG, LLC, a Delaware limited liability company formerly named TPF II East Texas Gathering, LLC (“ETG”) that owns and operates the East Texas Gathering System, a map of which is attached as Exhibit B-1;

WHEREAS, the Contributor desires to sell, transfer and convey the Interests (as defined herein) to the Partnership or its designee, subject to the Partnership’s payment of the Consideration (as defined herein) and its entering into the Transaction Documents (as defined herein) and agreeing to its undertakings and Obligations (as defined herein) set forth therein;

WHEREAS, the Conflicts Committee of the Board of Directors of the General Partner (the “Conflicts Committee”) has (i) received an opinion of Simmons & Company International (“Simmons”), the financial advisor to the Conflicts Committee, that the consideration to be paid by the Partnership for the Interests pursuant to this Agreement is fair to the Partnership and the Partnership’s common unitholders (other than the General Partner (as defined herein) and its Affiliates (as defined herein)) from a financial point of view, (ii) determined that the transactions contemplated by the Transaction Documents are (x) in the best interest of the Partnership Group (as defined in the Partnership Agreement), (y) fair and reasonable to the Partnership, taking into account the totality of the relationships among the parties involved, and (z) on terms no less favorable to the Partnership than those generally provided to or available from unrelated third parties, and (iii) granted Special Approval pursuant to Section 7.9 of the Partnership Agreement and recommended that the Board of Directors of the General Partner approve the transactions contemplated by the Transaction Documents and, subsequently, the Board of Directors of the General Partner has approved the transactions contemplated by the Transaction Documents;

WHEREAS, the Partnership wishes to purchase and acquire the Interests from Contributor, and in consideration therefor pay the Payoff Consideration (as defined herein) and the cash Consideration and issue and deliver the Equity Consideration Units (as defined herein), and enter into the Transaction Documents and agree to its undertakings and Obligations thereunder;

1

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants set forth herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound, hereby undertake and agree as follows:

ARTICLE I

DEFINITIONS AND INTERPRETATIONS

1.1 Definitions. Capitalized terms used in this Agreement but not defined in the body of this Agreement shall have the meanings ascribed to them inExhibit A.

1.2 Interpretations. In this Agreement, unless a clear contrary intention appears: (a) the singular includes the plural and vice versa; (b) reference to a Person includes such Person’s successors and assigns but, in the case of a Party, only if such successors and assigns are permitted by this Agreement, and reference to a Person in a particular capacity excludes such Person in any other capacity; (c) reference to any gender includes each other gender; (d) references to any Exhibit, Schedule, Section, Article, Annex, subsection and other subdivision refer to the corresponding Exhibits, Schedules, Sections, Articles, Annexes, subsections and other subdivisions of this Agreement unless expressly provided otherwise; (e) references in any Section or Article or definition to any clause means such clause of such Section, Article or definition; (f) “hereunder,” “hereof,” “hereto” and words of similar import are references to this Agreement as a whole and not to any particular provision of this Agreement; (g) the word “or” is not exclusive, and the word “including” (in its various forms) means “including without limitation”; (h) each accounting term not otherwise defined in this Agreement has the meaning commonly applied to it in accordance with GAAP; (i) references to “days” are to calendar days; and (j) all references to money refer to the lawful currency of the United States. The Table of Contents and the Article and Section titles and headings in this Agreement are inserted for convenience of reference only and are not intended to be a part of, or to affect the meaning or interpretation of, this Agreement.

ARTICLE II

CONTRIBUTION OF THE INTERESTS

2.1 Contribution of the Interests. Simultaneously with the Parties’ execution and delivery of this Agreement, (a) the Contributor has contributed, transferred, conveyed and delivered to Marlin Midstream, LLC, a Delaware limited liability company and the Subsidiary designated by the Partnership to hold the Interests (“Marlin Midstream”), all of the Interests, free and clear of all Liens (other than Permitted Liens of the type set forth in parts (h)-(i) of such definition), in exchange for the consideration set forth inSection 2.2 and (b) the Partnership has acquired, assumed and accepted the Interests.

2.2 Consideration for the Interests. In consideration for the contribution of the Interests, the Partnership is obligated to deliver the Consideration to the Contributor. At the Closing, the Partnership delivered to (or for the benefit of) the Contributor the following:

(a) to the Contributor, the Equity Consideration Units;

(b) directly to the administrative agent under that certain Credit Agreement, dated as of November 15, 2013 (as amended), among Azure Midtream Holdings LLC, Contributor and the financial institutions party thereto $80,000,000 (the “Payoff Consideration”); and

(c) to the Contributor, an amount equal to the estimated Consideration less the sum of (x) the Payoff Consideration and (y) $3,000,000.

2

2.3 Proposed Closing Statement and Post-Closing Adjustment.

(a) Prior to the Closing Date, the Contributor, with the reasonable assistance of the Partnership, prepared and delivered to the Partnership a statement (the “Proposed Closing Statement”), setting forth the Contributor’s reasonable good faith estimate, including reasonable detail, of the Consideration and the components thereof including any Consideration Increases and Consideration Decreases and any other adjustments expressly provided in this Agreement.

(b) As soon as reasonably practical, but in any event no later than 45 days following the Closing Date, the Contributor, with the reasonable assistance of the Partnership, shall cause to be prepared and delivered to the Partnership a statement, including reasonable detail, of the Consideration and the components thereof including any Consideration Increases and Consideration Decreases, and any other adjustments expressly provided in this Agreement, which statement shall be, except to the extent not reasonably practical, similar in all material respects in form and scope to that presented by the Contributor in the Proposed Closing Statement (the “Closing Statement”). The Partnership shall provide the Contributor and its representatives reasonable access, upon reasonable notice and during the regular business hours of the Partnership, to the books and records of ETG that is reasonably necessary for the Contributor to prepare the Closing Statement.

(c) Upon receipt of the Closing Statement, the Partnership and the Partnership’s independent accountants shall be permitted to examine the schedules and other information used or generated in connection with the preparation of the Closing Statement and such other documents as the Partnership may reasonably request in connection with its review of the Closing Statement. Within 30 days of receipt of the Closing Statement, the Partnership shall deliver to the Contributor a written statement describing in reasonable detail its objections, if any, to any amounts or items set forth on the Closing Statement. If the Partnership does not raise objections within such period, then the Closing Statement shall become final and binding upon the Partnership. If the Partnership raises objections, the Parties shall negotiate in good faith to resolve any such objections. If the Parties are unable to resolve any disputed item (other than disputes involving the application or interpretation of the Law or other provisions of this Agreement) within 30 days after the Partnership’s delivery to the Contributor of its written statement of objections to the Closing Statement, any such disputed item shall be submitted to a nationally recognized independent accounting firm mutually agreeable to the Parties who shall be instructed to resolve such disputed item in accordance with the terms of this Agreement within 30 days. The resolution of disputes by the accounting firm so selected shall be set forth in writing and shall be conclusive, binding and non-appealable upon the Parties, and the Closing Statement, as adjusted by the resolution of the disputed items, shall thereupon become final and binding. The fees and expenses of such accounting firm shall be paid one-half by the Partnership and one-half by the Contributor. The Parties agree that any disputed item related to the application or interpretation of the Law or other provisions of this Agreement shall not be resolved by the designated accounting firm, but shall instead be resolved by litigation among the Parties if the Parties are unable to resolve such disputed item through agreement.

(d) If the Consideration as set forth on the Closing Statement exceeds the estimated Consideration as set forth on the Proposed Closing Statement, the Partnership shall pay the Contributor cash in the amount of such excess. If the estimated Consideration as set forth on the

3

Proposed Closing Statement exceeds the Consideration as set forth on the Closing Statement, the Contributor shall pay to the Partnership cash in the amount of such excess. After giving effect to the foregoing adjustments, any amount to be paid by the Partnership to the Contributor, or to be paid by the Contributor to the Partnership, as the case may be, shall be paid in the manner and with interest as provided inSection 2.3(e) at a mutually convenient time and place within five Business Days after the later of acceptance of the Closing Statement or the resolution of the Partnership’s objections thereto.

(e) Any cash payments pursuant to thisSection 2.3 shall be made by causing such payments to be credited in immediately available funds to such account or accounts of the Partnership or the Contributor, as the case may be, as may be designated by the Partnership or the Contributor, as the case may be. If any cash payment is being made after the fifth Business Days referred to inSection 2.3(d), the amount of the cash payment to be made pursuant to thisSection 2.3(e) shall bear interest from and including such fifth Business Day to, but excluding, the date of payment at a rate per annum equal to the Prime Rate plus two percent. Such interest shall be payable in cash at the same time as the payment to which it relates and shall be calculated on the basis of a year of 365 days and the actual number of days for which payment is due.

(f) The Parties acknowledge and agree that any inaccuracies, omissions, mischaracterizations or similar errors contained in the Proposed Closing Statement or the Closing Statement shall not be subject to any “deductible” provided inSection 7.3(a), including the Deductible Amount, or any “cap” provided inSection 7.3(b), including the Cap Amount.

2.4 1060 Allocation. Contributor will, not later than thirty (30) days after the date hereof, prepare and deliver to the Partnership a schedule (the “Allocation Schedule”) allocating the Consideration, adjusted as necessary for federal income tax purposes, among the proportionate share of the ETG Assets relating to the Interests in accordance with Section 1060 of the Code and the Treasury Regulations. The Partnership will have the right to raise objections to the Allocation Schedule within fifteen (15) days after its receipt thereof, in which event the Partnership and Contributor will negotiate in good faith to resolve such objections. If the Partnership and Contributor are unable to resolve any dispute within ten (10) days, the Partnership and Contributor shall retain a jointly-selected accountant to resolve the disputed items on an expedited basis. Upon resolution of the disputed items, the Allocation Schedule shall be adjusted to reflect such resolution. The costs, fees and expenses of the accountant shall be borne equally by the Partnership and Contributor. Except to the extent otherwise required by applicable Law, each of the Partnership and Contributor (i) will, and will cause each of its Affiliates to, prepare and file all Tax Returns, in a manner consistent with the Allocation Schedule and (ii) will not, and will cause each of its Affiliates not to, make any inconsistent statement or adjustment on any Tax Return or during the course of any IRS or other Tax audit or otherwise, unless required by a final determination of an applicable Tax authority. The Allocation Schedule shall be revised by mutual agreement of the Partnership and Contributor from time to time following the determination thereof as necessary to reflect any matters that need updating. In the event that the foregoing Consideration allocation is disputed by any Tax authority, the Party (or the Party’s Affiliate) receiving notice of the dispute shall promptly notify the other Party hereto, and the Parties agree to use commercially reasonable efforts to defend, and to cause their respective Affiliates to defend, such Consideration allocation in any audit or similar Tax proceeding.

4

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF CONTRIBUTOR

Contributor hereby represents and warrants to the Partnership as of the Closing Date as follows:

3.1Organization; Qualification. Each Contributor Party is a limited liability company duly formed, validly existing and in good standing under the laws of the State of Delaware. Each Contributor Party has full limited liability company power and authority to own and hold the respective properties and assets they now own and hold and to carry on their respective business as and where such properties are now owned or held and such business is now conducted, except as could not materially impair such Person’s ability to consummate the transactions contemplated by the Transaction Documents to which such Person is a party. Each Contributor Party is duly licensed or qualified to do business as a foreign limited liability company and is in good standing in the states in which the character of the properties and assets now owned or held by them or the nature of the business now conducted by them requires them it to be so licensed or qualified, except where the failure to be so qualified or in good standing could not materially impair such Person’s ability to consummate the transactions contemplated by the Transaction Documents to which such Person is a party. Contributor has made available to the Partnership true and complete copies of the Organizational Documents of ETG as in effect as of the Closing Date, and there are no amendments, modifications or rescissions with respect thereto.

3.2Authority; Enforceability.

(a) Each Contributor Party has the requisite limited liability company power and authority to execute and deliver the Transaction Documents to which it is a party, to consummate the transactions contemplated thereby and to perform all the terms and conditions thereof to be performed by it. The execution and delivery by each Contributor Party of each Transaction Document to which it is a party, the consummation by each Contributor Party of the transactions contemplated thereby and the performance by each Contributor Party of all of the terms and conditions thereof to be performed by it have been duly and validly authorized by such Contributor Party, and no other proceedings on the part of such Contributor Party are necessary to authorize the Transaction Documents to which it is a party, to consummate the transactions contemplated by the Transaction Documents to which it is a party or to perform all of the terms and conditions thereof to be performed by it.

(b) The Transaction Documents to which each Contributor Party is a party have been duly executed and delivered by such Contributor Party, and, assuming the due authorization, execution and delivery by the other parties thereto, each Transaction Document to which such Contributor Party is a party constitutes the valid and binding agreement of such Contributor Party, enforceable against it in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and similar Laws relating to or affecting creditors’ rights generally and subject, as to

5

enforceability, to legal principles of general applicability governing the availability of equitable remedies, including principles of commercial reasonableness, good faith and fair dealing (regardless of whether such enforceability is considered in a proceeding in equity or at law) (collectively, “Creditors’ Rights”).

3.3Non-Contravention; Consents and Approvals. Except as set forth onSchedule 3.3 of the Contributor Disclosure Schedules, the execution, delivery and performance of the Transaction Documents to which each Contributor Party is a party by such Contributor Party and the consummation by such Contributor Party of the transactions contemplated thereby does not and will not: (a) conflict with any of, or require the consent of any Person under, or result in any breach of, any provision of the Organizational Documents of such Contributor Party; (b) conflict with any of, or require the consent of any Person under, or constitute a default (or an Event that with the giving of notice or passage of time or both would give rise to a default) or cause any obligation under, or give rise to any right of termination, cancellation, amendment, preferential purchase right or acceleration (with or without the giving of notice, or the passage of time or both) under any of the terms, conditions or provisions of any Contract to which such Contributor Party or any of their respective Subsidiaries is a party or by which any property or asset of such Contributor Party or any of their respective Subsidiaries is bound or affected; (c) assuming compliance with the matters referred to inSection 3.4, conflict with or violate any Law to which such Contributor Party or any of their respective Subsidiaries is subject or by which any property or asset of such Contributor Party or any of their respective Subsidiaries is bound; (d) constitute (with or without the giving of notice or the passage of time or both) an Event which would result in the creation of, or afford any Person the right to obtain, any Lien (other than Permitted Liens) on any asset of such Contributor Party or any of their respective Subsidiaries; or (e) result in the revocation, cancellation, suspension, or material modification, individually or in the aggregate, of any Governmental Approval that is necessary or desirable for the ownership, lease or operation of the ETG Assets or the ETG Business as now conducted, including any Governmental Approvals under any applicable Environmental Law, except, in the cases of clauses (b), (c), (d) and (e), for such defaults or rights of termination, cancellation, amendment, acceleration, violations or Liens as could materially impair such Person’s ability to consummate the transactions contemplated by the Transaction Documents to which such Person is a party.

3.4Governmental Approvals. Except as set forth onSchedule 3.4 of the Contributor Disclosure Schedules, no declaration, filing or registration with, or notice to, or authorization, consent or approval of, any Governmental Authority, including any declaration, filing or registration with, or notice to, or authorization, consent or approval of, any Governmental Authority under any applicable Environmental Law, is necessary for (i) the consummation by each Contributor Party of the transactions contemplated by the Transaction Documents to which it is a party or (ii) the enforcement against any Contributor Party of its Obligations under the Transaction Documents except in the cases of clauses (i) and (ii), other than such declarations, filings, registrations, notices, authorizations, consents or approvals that have been obtained or made or that would in the ordinary course be made or obtained after the Closing, or which, if not obtained or made, could not reasonably be expected to materially impair such Person’s ability to consummate the transactions contemplated by the Transaction Documents to which such Person is a party.

6

3.5Capitalization.

(a) All of the Interests are duly authorized and validly issued in accordance with the Organizational Documents of ETG, and are fully paid (to the extent required under the Organizational Documents of ETG) and nonassessable (except as nonassessability may be affected by Sections 18-303, 18-607 and 18-804 of the Delaware LLC Act) and have not been issued in violation of any preemptive rights, rights of first refusal or other similar rights of any Person. Contributor owns all of the Interests free and clear of all Liens other than (i) transfer restrictions imposed by federal and state securities laws, and (ii) any transfer restrictions contained in ETG’s Organizational Documents. The Interests are certificated.

(b) There are no preemptive rights, rights of first refusal or other outstanding rights, options, warrants, conversion rights, equity appreciation rights, redemption rights, repurchase rights, agreements, arrangements, calls, subscription agreements, commitments or rights of any kind that obligate either Contributor or ETG to issue or sell any equity interests of ETG or any securities or Obligations convertible or exchangeable into or exercisable for, or giving any Person a right to subscribe for or acquire, any equity interests in ETG, and no securities or Obligations evidencing such rights are authorized, issued or outstanding.

(c) ETG has no outstanding bonds, debentures, notes or other Obligations the holders of which have the right to vote on any matter (or convertible into or exercisable for securities having the right to vote on any matter) with the holders of ETG’s equity interests.

(d) Neither Contributor nor ETG is a party to any agreements, arrangements, or commitments obligating it to grant, deliver or sell, or cause to be granted, delivered or sold, the Interests, by sale, lease, license or otherwise, other than this Agreement.

(e) There are no voting trusts, proxies or other agreements or understandings to which either Contributor or ETG is bound with respect to the voting of the Interests.

3.6Financial Statements.

(a) Contributor has made available to the Partnership (i) an unaudited consolidated balance sheet of the ETG Business as of December 31, 2014 and December 31, 2013, and the related unaudited income statement and statement of cash flows, for thetwelve-month period of operations of the ETG Business ending December 31, 2014 and the related unaudited income statement and statement of cash flows, for the period of operations of the ETG Business from November 15, 2013 to December 31, 2013, together with the footnotes thereto, if any (the “ETG Unaudited Annual Financial Statements”); and (ii) unaudited consolidated balance sheets of the ETG Business as of the period ended June 30, 2015 and June 30, 2014 and the related unaudited consolidated income statement and statement of cash flows for the periods of operations of the ETG Business then ended, together with the footnotes thereto, if any (the “ETG Unaudited Interim Financial Statements” and, together with the ETG Unaudited Annual Financial Statement, the “ETG Financial Statements”). The ETG Financial Statements (A) are consistent with the books and records of Contributor, (B) have been prepared in accordance with GAAP and (C) present fairly, in all material respects, the consolidated financial position and operating results, equity and cash flows of the ETG Business as of, and for the periods ended on, the respective dates thereof.

7

(b) None of Contributor, ETG and their respective Subsidiaries has any liability, whether accrued, contingent, absolute,un-liquidated or otherwise, whether due or to become due, or any unrealized or unanticipated loss, which was then or is reasonably expected to be material to the ETG Assets or the ETG Business and that would be required to be included in the ETG Financial Statements (including the footnotes thereto) under GAAP except for (i) Obligations set forth in the ETG Financial Statements; and (ii) Obligations relating to the ETG Business that have arisen since and including July 1, 2015 in the ordinary course of business consistent with past practice.

3.7Absence of Certain Changes. Except as set forth onSchedule 3.7 of the Contributor Disclosure Schedules or as expressly contemplated by this Agreement, since December 31, 2014, (a) the ETG Assets have been operated or utilized in the ordinary course and in substantially the same manner consistent with past practices and (b) there have been no changes in the ETG Assets or the ETG Business that could reasonably be expected to have an ETG Material Adverse Effect. Since December 31, 2014, there has not been any physical damage, destruction or loss in excess of $250,000 to any portion of the ETG Business, whether or not covered by insurance.

3.8Compliance with Law. Except for Environmental Laws (which are the subject ofSection 3.10(a)) and except as to matters that could not reasonably be expected to have an ETG Material Adverse Effect, (a) Contributor, ETG and their respective Subsidiaries are in compliance with all Laws applicable to the conduct of the ETG Business as currently conducted or the ownership and use of the ETG Assets; (b) neither Contributor, ETG nor any of their respective Subsidiaries has received written notice of any violation of any Laws applicable to the conduct of the ETG Business as currently conducted or the ownership and use of the ETG Assets; and (c) to the Knowledge of Contributor or to ETG, neither Contributor, ETG nor any of their respective Subsidiaries is under investigation by any Governmental Authority for potential non-compliance with any Law applicable to the conduct of the ETG Business as currently conducted or the ownership and use of the ETG Assets.

3.9Legal Proceedings. Other than with respect to Proceedings arising under Environmental Laws which are the subject ofSection 3.10(c) and except as set forth onSchedule 3.9 of the Contributor Disclosure Schedules, there are no Proceedings pending or, to the Knowledge of Contributor or ETG, threatened against or by Contributor, ETG and their respective Subsidiaries (a) relating to or affecting the ETG Business or the ETG Assets, which if determined adversely to Contributor, ETG or any of their respective Subsidiaries, could reasonably be expected to have an ETG Material Adverse Effect or (b) that question or involve the validity or enforceability of the Obligations of each Contributor Party under this Agreement or the other Transaction Documents or that seeks to prevent or delay, or seeks damages in connection with, the consummation of the transactions contemplated by this Agreement.

3.10Environmental. Except as set forth inSchedule 3.10 of the Contributor Disclosure Schedules, and except for matters that could not reasonably be expected to have an ETG Material Adverse Effect:

(a) ETG, the ETG Assets and the ETG Business have complied and are in compliance with Environmental Laws;

8

(b) Contributor has complied, is in compliance with, and has obtained all Permits required under Environmental Laws in connection with the ETG Assets, the operation of the ETG Assets and the ETG Business, and all such Permits are valid and currently in full force and effect, free from breach and there are no Proceedings pending to revoke or limit any of such Permits;

(c) ETG, the ETG Assets and the ETG Business are not subject to any pending or, to the Knowledge of Contributor or ETG, threatened Proceeding pursuant to Environmental Laws, nor has Contributor or any of its Subsidiaries received any written notice of actual or alleged violation, noncompliance, or enforcement or any notice of investigation or remediation from any Governmental Authority pursuant to Environmental Laws (including designation as a potentially responsible party under the Comprehensive Environmental Response, Compensation, and Liability Act, as amended);

(d) There has been no Release of a Hazardous Substance on or from the ETG Assets or from or in connection with the operation of the ETG Business in a manner that would reasonably be expected to give rise to any response cost, or remedial or corrective action Obligations pursuant to Environmental Laws;

(e) To the Knowledge of Contributor or ETG, there has been no exposure of any Person or property to any Hazardous Substances in connection with the ETG Assets that would reasonably be expected to form the basis of a material claim for damages or compensation;

(f) None of the following exists at any of the ETG Assets: (i) under or above-ground storage tanks, (ii) asbestos containing material in any form or condition, (iii) materials or equipment containing polychlorinated biphenyls, or (iv) landfills, surface impoundments, or disposal areas;

(g) Neither Contributor nor any of its predecessors or Affiliates has, either expressly or by operation of Law, assumed or undertaken any liability, including any obligation for corrective or remedial action, of any other Person relating to Environmental Laws; and

(h) No facts, events or conditions relating to ETG, the ETG Assets or the ETG Business, nor Contributor or any of its predecessors or Affiliates, will prevent, hinder, or limit continued compliance with Environmental Laws or give rise to any damages or any other Obligations under Environmental Laws.

ThisSection 3.10 contains the sole and exclusive representations of Contributor with respect to Environmental Laws, Hazardous Substances and environmental matters.

3.11Qualifying Income. For the twelve-month period ended December 31, 2014 and the six-month period ended June 30, 2015, more than 90% of the gross income (as determined for U.S. federal income tax purposes) of the ETG Business was “qualifying income” within the meaning of Section 7704(d) of the Code.

9

3.12Adequacy of Assets. Except as set forth onSchedule 3.12 of the Contributor Disclosure Schedules, all of the assets, interests and other rights necessary to own the ETG Assets, and conduct the ETG Business in the ordinary course and in substantially the same manner as currently being conducted and consistent with past practices, are owned or leased by Contributor and its Subsidiaries and constitute a portion of the ETG Assets, all of which will be assets of ETG upon assignment of the Interests pursuant to the Interests Assignment, except as could not reasonably be expected to have an ETG Material Adverse Effect.

3.13Assets Other than Real Property Interests

(a) ETG has good and valid title to all the ETG Assets (other than real property, which is the subject ofSection 3.14(a)), free and clear of all Liens except for Permitted Liens.

(b) All the ETG Assets which constitute property, plant and equipment have been maintained in accordance with generally accepted industry practice and are in good operating condition and repair, ordinary wear and tear excepted, and adequate for the purposes for which they are currently being used or held for use. ThisSection 3.13 does not relate to real property or interests in real property, such items being the subject ofSection 3.14.

3.14Title to Real Property.

(a) Other than as set forth onSchedule 3.14(a) of the Contributor Disclosure Schedules, the ETG Assets include a valid right and interest for ETG to conduct the ETG Business on land whereupon such ETG Business is currently being conducted, which interest is sufficient for the ETG Business as such ETG Business is being conducted as of the Closing Date (collectively, the “ETG Property”), free and clear of all Liens except Permitted Liens, and except as could not reasonably be expected to have an ETG Material Adverse Effect.

(b) Other than as set forth onSchedule 3.14(b) of the Contributor Disclosure Schedules, with respect to any ETG Property that consists of real property owned in fee by ETG, ETG has good and indefeasible title to such real property, free and clear of all Liens except Permitted Liens.

(c) Other than as set forth onSchedule 3.14(c) of the Contributor Disclosure Schedules, ETG has, and the ETG Assets include, such consents, easements, rights-of-way, permits, real property licenses and surface leases (collectively, “Rights-of-Way”) as are sufficient to operate the ETG Assets as such ETG Assets are being operated as of the Closing Date, except as could not reasonably be expected to have an ETG Material Adverse Effect. ETG has fulfilled and performed all its material Obligations with respect to such Rights-of-Way and, to the Knowledge of Contributor or ETG, no Event has occurred that allows, or after notice or lapse of time would allow, revocation or termination thereof or that would result in any impairment of the rights of the holder of any such Rights-of-Way, except for such revocations, terminations and impairments that could not reasonably be expected to have an ETG Material Adverse Effect.

(d) Other than as set forth onSchedule 3.14(d) of the Contributor Disclosure Schedules (i) (A) there are no pending Proceedings to modify the zoning classification of, or to condemn or take by power of eminent domain, all or any part of the ETG Property and (B)

10

neither Contributor nor ETG has any Knowledge of any such threatened Proceeding, which (in either case), if pursued, could reasonably be expected to have an ETG Material Adverse Effect, (ii) to the extent located in jurisdictions subject to zoning, the ETG Property is properly zoned for the existence, occupancy and use of the ETG Assets located on such ETG Property, except as could not reasonably be expected to have an ETG Material Adverse Effect, and (iii) none of the ETG Assets and the operations thereof are subject to any conditional use permits or “permitted non-conforming use” or “permitted non-conforming structure” classifications or similar permits or classifications, except as would not, either currently or in the case of a rebuilding of or additional construction of improvements, reasonably be expected to have an ETG Material Adverse Effect.

3.15Material Contracts.

(a) Except as set forth onSchedule 3.15 of the Contributor Disclosure Schedules, as of the Closing Date, none of Contributor, ETG and their respective Subsidiaries is a party to or bound by any Contract used in the ETG Business or included among the ETG Assets that:

(i) contains any provision or covenant which materially restricts ETG from engaging in any lawful business activity or competing with any Person or operate at any location, including any preferential rights, rights of first refusal or rights of first offer granted to third parties;

(ii) (A) relates to the creation, incurrence, assumption, or guarantee of any Indebtedness or other Obligations by ETG (including so-called take-or-pay or keepwell agreements) or (B) creates a capitalized lease obligation;

(iii) is in respect of the formation of any partnership, joint venture or other arrangement or otherwise relates to the joint ownership or operation of the assets owned by ETG or which requires ETG to invest funds in or make loans to, or purchase any securities of, another Person;

(iv) relates to any commodity or interest rate swap, cap or collar agreements or other similar hedging or derivative transactions;

(v) is a bond, letter of credit, guarantee or security deposit posted (or supported) by or on behalf of ETG;

(vi) includes the acquisition of assets or properties or the sale of assets or properties (whether by merger, sale of stock, sale of assets or otherwise);

(vii) involves a sharing of profits, losses, costs or Obligations by ETG with any other Person other than gas processing contracts;

(viii) relates as of the Closing Date to (A) the purchase of materials, supplies, goods, services, equipment or other assets, (B) the purchase, sale, transporting, treating, gathering, processing or storing of, or gas compressing services rendered in connection with, natural gas, condensate or other liquid or gaseous hydrocarbons or the products therefrom, or the provision of services related thereto, (C) the construction of capital

11

assets, (D) the management of any part or all of the ETG Assets or ETG Business, (E) services provided to or in connection with, the ETG Assets or the ETG Business, (F) the paying of commissions related to the ETG Business, (G) advertising contracts and (H) other similar types of Contracts of the kind listed in (A) through (G) above, in the cases of clauses (A), (B), (C), (D), (E), (F), (G) and (H), that provides for annual payments by or to ETG in excess of $250,000;

(ix) provides for indemnification of one or more Persons by ETG or the assumption of any Tax, environmental or other liability of any Person; and

(x) otherwise involves the annual payment by or to ETG of more than $250,000 and cannot be terminated by ETG on 90 days or less notice without payment by ETG of any material penalty.

(b) Contributor has made available to the Partnership a true and correct copy of each Contract required to be disclosed onSchedule 3.15 of the Contributor Disclosure Schedules.

(c) Each ETG Contract is a valid and binding obligation of ETG, and is in full force and effect and enforceable in accordance with its terms against such entity and, to the Knowledge of Contributor or ETG, the other parties thereto, except, in each case, as enforcement may be limited by Creditors’ Rights, and no defenses, off-sets or counterclaims have been asserted or, to the Knowledge of Contributor or ETG, threatened by any other party thereto nor has ETG executed any waiver that waives any material rights thereunder.

(d) ETG is not, and to the Knowledge of Contributor or ETG, no other party to any ETG Contract is in default or breach in any material respect under the terms of any ETG Contract and no Event has occurred that with the giving of notice or the passage of time or both would constitute a breach or default in any material respect by ETG or, to the Knowledge of Contributor or ETG, any other party to any ETG Contract, or would permit termination, modification or acceleration under any ETG Contract.

(e) None of Contributor, ETG and their respective Subsidiaries has received any material prepayment, advance payment, deposit or similar payment, and has no refund obligation, with respect to any gas or other hydrocarbons (including liquid products) or products purchased, sold, transported, gathered, stored or processed by or on behalf of ETG with respect to the ETG Business; and (ii) none of Contributor, ETG and their respective Subsidiaries has received any material compensation for transportation, gathering, storage or processing services with respect to the ETG Business which would be subject to any refund or create any repayment obligation either by or to ETG, and to the Knowledge of Contributor or ETG, there is no basis for a claim that a refund is due with respect to the ETG Business.

3.16Consideration Value Adjustments.

(a) As of the date of the Effective Time and the Closing Date, ETG has (and will have) a Working Capital Amount (Actual) equal to or in excess of the Working Capital Amount (Normal), which is an amount adequate for its level of operations, consistent with past practices.

(b) ETG has no Indebtedness.

12

(c) Except for the Non-Current Liabilities of $11,625,000 listed in the ETG Unaudited Interim Financial Statements, ETG has no Non-Current Liabilities.

(d) Except for cash distributions in respect of the equity interests in ETG prior to the Effective Time which constitutes a Consideration Increase, since December 31, 2014, ETG has not transferred any ETG Assets to any Person or entered into any Contracts with Affiliates. Except for the Gathering Agreement, ETG is not a party to any Contract with any Affiliate of ETG.

(e) Except asSchedule 3.16, all customer accounts receivable and notes receivable of ETG, whether reflected in the most recent ETG Financial Statements or subsequently created, have arisen from bona fide transactions in the ordinary course of business and have been collected or are good and collectible at the aggregate recorded amounts thereof, net of any applicable reserves for doubtful accounts reflected in the most recent ETG Financial Statements or reflected in the Working Capital Amount (Actual). ETG has good and marketable title to its accounts receivable, free and clear of all Liens.Schedule 3.16 sets forth, by customer name and account, all receivables of ETG which would be classified as current assets under the classification “accounts receivable” on ETG’s balance sheets (a) that have remained or are expected to remain unpaid for more than 75 days after the due date of the original invoice or 120 days after the date of the invoice, (b) as to which any unresolved dispute with the customer exists or (c) that are owed by a debtor in any bankruptcy or insolvency case.

3.17Permits. Other than with respect to Permits issued pursuant to or required under Environmental Laws, which are the subject ofSection 3.10(b), ETG has, and the ETG Assets include, all Permits necessary for the ownership and operation of the ETG Assets except for those the failure of which to have could not reasonably be expected to have an ETG Material Adverse Effect.

3.18Intellectual Property.Schedule 3.18 of the Contributor Disclosure Schedules sets forth a true and complete list of all patents, registered trademarks and registered copyrights and applications therefor (collectively, “Registered Intellectual Property”) included among the ETG Assets that are material to the operation of the ETG Business. With respect to registered trademarks included among the Registered Intellectual Property,Schedule 3.18 of the Contributor Disclosure Schedules sets forth a list of all jurisdictions in which such trademarks are registered or applied for as of the Closing Date, and all registration and application numbers. Except as set forth onSchedule 3.18 of the Contributor Disclosure Schedules, ETG owns the right to use without claim of infringement by any other person, all intellectual property that is material to the operation of the ETG Business as currently conducted. The consummation of the transactions contemplated hereby will not impair or require the consent of any person with respect to any such rights, in each case, except as could not, individually or in the aggregate, have, or reasonably be expected to have, an ETG Material Adverse Effect.

3.19Taxes.

(a) All material Tax Returns required to be filed by ETG or with respect to ETG, the ETG Business and ETG Assets prior to the Closing Date (taking into account any valid extension of the due date for filing) have been timely filed, all such Tax Returns are complete and correct in all material respects and all Taxes due from ETG or relating to ETG, the ETG Business and ETG Assets have been paid in full.

13

(b) No material Tax audits or administrative or judicial proceedings are being conducted or are pending with respect to ETG or any portion of ETG, the ETG Assets or the ETG Business.

(c) All material Taxes required to be withheld, collected or deposited by or with respect to ETG, the ETG Assets and ETG Business have been timely withheld, collected or deposited as the case may be, and to the extent required, have been paid to the relevant taxing authority.

(d) There are no outstanding agreements or waivers extending the applicable statutory periods of limitation for any material Taxes associated with ETG or the ownership of ETG or operation of the ETG Assets and the ETG Business for any period.

(e) ETG is not a party to any Tax sharing agreement, Tax indemnity agreement Tax allocation agreement or similar agreement (excluding customary Tax indemnification provisions in commercial Contracts not relating to Taxes).

(f) ETG has not been a party to a transaction that is a “reportable transaction,” as such term is defined in Treasury Regulations Section 1.6011-4(b)(1).

(g) Since its formation, ETG has been, and is currently classified as, an entity disregarded as separate from its owner for U.S. federal income tax purposes and ETG has not elected to be treated as a corporation for U.S. federal income tax purposes.

(h) ETG has not been a member of or is a successor to an entity that has been a member of an affiliated group filing a consolidated federal income Tax Return or has any liability for the Taxes of any Person under Treasury Regulation Section 1.1502-6 (or any similar provision of state, local or foreign Law), as a transferee or successor, by contract, or otherwise.

3.20Employee Benefits; Employment and Labor Matters. ETG does not have any employees and does not sponsor, maintain or contribute to any “employee benefit plan”, as such term is defined in Section 3(3) of ERISA, or any other employee benefit plan or compensation plan. ETG has no actual or potential liability with respect to any pension plan subject to Title IV of ERISA.

3.21Regulatory Status. ETG is not (a) an “investment company” or a company “controlled” by an “investment company” within the meaning of the Investment Company Act of 1940, as amended, and the rules and regulations promulgated thereunder or (b) a “holding company,” a “subsidiary company” of a “holding company,” an “affiliate” of a “holding company,” a “public utility” or a “public-utility company,” as each such term is defined in the Public Utility Holding Company Act of 2005. ETG has not been operated or provided services as a “natural gas company” subject to the jurisdiction of FERC under the Natural Gas Act of 1938, as amended. ETG has not utilized its facilities to provide service as a common carrier subject to the jurisdiction of FERC under the Interstate Commerce Act as such statute is implemented by FERC pursuant to the Department of Energy Organization Act of 1977. None

14

of the “intrastate pipelines” that are part of the ETG Business provide transportation services pursuant to Section 311 of the Natural Gas Policy Act of 1978. None of the “intrastate pipelines” that are part of the ETG Business provide service to public utilities in Louisiana thereby becoming subject to Louisiana Public Service Commission jurisdiction.

3.22Brokers’ Fee. Except as set forth onSchedule 3.22 of the Contributor Disclosure Schedules, neither Contributor nor ETG has entered (directly or indirectly) into any agreement with any broker, investment banker, financial advisor or other Person that would obligate the Partnership or any of its Subsidiaries to pay any broker’s, finder’s, financial advisor’s or other similar fee or commission in connection with this Agreement or the transactions contemplated herein.

3.23Securities Laws.

(a) Contributor has such knowledge and experience in financial and business matters so as to be capable of evaluating the merits and risks of its investment in the Equity Consideration Units and is capable of bearing the economic risk of such investment. The Contributor is an “accredited investor” as that term is defined in Rule 501 of Regulation D (without regard to Rule 501(a)(4)) promulgated under the Securities Act. The Contributor is acquiring the Equity Consideration Units for investment for its own account and not with a view toward or for sale in connection with any distribution thereof, or with any present intention of distributing or selling the Equity Consideration Units. The Contributor does not have any Contract or arrangement with any Person to sell, transfer or grant participations to such Person or to any third Person, with respect to the Equity Consideration Units. The Contributor acknowledges and understands that (i) the acquisition of the Equity Consideration Units has not been registered under the Securities Act and that the Contributor is acquiring the Equity Consideration Units in reliance on an exemption therefrom and (ii) the Equity Consideration Units will, upon such acquisition, be characterized as “restricted securities” under state and federal securities laws. The Contributor agrees that the Equity Consideration Units may be sold, transferred or offered for sale or otherwise disposed of except pursuant to an effective registration statement under the Securities Act or pursuant to an available exemption from the registration requirements of the Securities Act, and in compliance with other applicable state and federal securities laws.

(b) The Contributor has undertaken such investigation as it has deemed necessary to enable it to make an informed and intelligent decision with respect to the execution, delivery and performance of this Agreement and the acquisition of the Equity Consideration Units. The Contributor has had an opportunity to ask questions and receive answers from the Partnership regarding the terms and conditions of the sale and transfer of the Equity Consideration Units and has had the opportunity to ask questions and receive answers from the Partnership concerning the Equity Consideration Units and the Partnership’s business and assets.

3.24Bankruptcy. There are no bankruptcy, reorganization or arrangement proceedings pending against, being contemplated by, or to the Knowledge of Contributor or ETG, threatened against Contributor or any of its Subsidiaries.

15

3.25Books and Records. The books and records of ETG, the ETG Business that are necessary for the ownership and operation of the ETG Assets have been maintained in accordance with prudent industry practice and such books and records have been made available to the Partnership.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES REGARDING THE PARTNERSHIP

The Partnership represents and warrants to Contributor as of the Closing Date as follows:

4.1Organization; Qualification. The Partnership is a limited partnership duly formed, validly existing and in good standing under the law of the State of Delaware. The Partnership has full partnership power and authority to own and hold the properties and assets it now owns and holds and to carry on its business as and where such properties are now owned or held and such business is now conducted, except as could not materially impair the Partnership’s ability to consummate the transactions contemplated by the Transaction Documents to which it is a party. The Partnership is duly licensed or qualified to do business as a foreign partnership, and is in good standing in the states in which the character of the properties and assets now owned or held by it or the nature of the business now conducted by it requires it to be so licensed or qualified, except where the failure to be so qualified or in good standing could not materially impair such the Partnership’s ability to consummate the transactions contemplated by the Transaction Documents to which it is a party. The Partnership has made available to Contributor true and complete copies of the Organizational Documents of the Partnership as in effect on the Execution Date.

4.2Authority; Enforceability.

(a) The Partnership has the requisite limited partnership power and authority to execute and deliver the Transaction Documents to which it is a party, to consummate the transactions contemplated thereby and to perform all the terms and conditions thereof to be performed by it. The execution and deliver by the Partnership of the Transaction Documents to which it is a party, the consummation by it of the transactions contemplated thereby and the performance by it of all of the terms and conditions thereof to be performed by it, have been duly and validly authorized by the Partnership, and no other proceedings on the part of the Partnership are necessary to authorize the Transaction Documents to which it is a party, to consummate the transactions contemplated by the Transaction Documents to which it is a party or to perform all of the terms and conditioned thereof to be performed by it.

(b) The Transaction Documents to which the Partnership is a party have been duly executed and delivered by the Partnership and, assuming the due authorization, execution and delivery by the other parties thereto, each Transaction Document to which the Partnership is a party constitutes the valid and binding agreement of the Partnership, enforceable against the Partnership in accordance with its terms, except as such enforceability may be limited by Creditors’ Rights.

4.3Non-Contravention. Except as set forth onSchedule 4.3 of the Partnership Disclosure Schedules, the execution, delivery and performance of the Transaction Documents to

16

which the Partnership is a party by the Partnership and the consummation by the Partnership of the transactions contemplated thereby does not and will not: (a) conflict with any of, or require the consent of any Person under, or result in any breach of, any provision of the Organizational Documents of the Partnership; (b) conflict with any of, or require the consent of any Person under, or constitute a default (or any Event that with the giving of notice of passage of time or both would give rise to a default) or cause any obligation under, or give rise to any right of termination, cancellation, amendment, preferential purchase right or acceleration (with or without the giving of notice, or the passage of time or both) under any of the terms, conditions or provisions of any Contract to which the Partnership is a party or by which any property or asset of the Partnership is bound of affected; (c) assuming compliance with the matters referred to inSection 4.4, conflict with or violate any Law to which the Partnership is subject or by which any property or asset of the Partnership is bound; (d) constitute (with or without the giving of notice or the passage of time or both) an Event which would result in the created of, or afford any Person the right to obtain, any Lien (other than Permitted Liens) on any asset of the Partnership or (e) result in the revocation, cancellation, suspension, or material modification, individually or in the aggregate, of any Governmental Approval that is necessary or desirable for the ownership, lease or operation of any Partnership property and other assets utilized in carrying on its business as now conducted, including any Governmental Approvals under any applicable Environmental Law, except, in the case of clauses (b), (c), (d) and (e), other than such defaults or rights of termination, cancellation, amendment, acceleration, violations or Liens as could not reasonably be expected to materially impair the Partnership’s ability to consummate the transactions contemplated by the Transaction Documents to which it is a party.

4.4Governmental Approvals. Except as set forth inSchedule 4.4 of the Partnership Disclosure Schedules, no declaration, filing, or registration with, or notice to, or authorization, consent or approval of, any Governmental Authority, including any declaration, filing or registration with, or notice to, or authorization, consent or approval of, any Governmental Authority under any applicable Environmental Law, is necessary for (i) the consummation by the Partnership of the transactions contemplated by the Transaction Documents to which it is a party or (ii) the enforcement against the Partnership of its Obligations under the Transaction Documents, except in the cases of clauses (i) and (ii), other than such declarations, filings, registrations, notices, authorizations, consents or approvals that have been obtained or made or that would in the ordinary course be made or obtained after the Closing, or which, if not obtained or made, could not reasonably be expected to materially impair the Partnership’s ability to consummate the transactions contemplated by the Transaction Documents to which it is a party.

4.5Equity Consideration Units. The Equity Consideration Units have been duly authorized and validly issued in accordance with the Partnership Agreement, and have not been issued in violation of any preemptive rights, rights of first refusal or other similar rights of any Person. The Partnership’s Common Units, including the Equity Consideration Units, are listed on the NYSE, and the Partnership has not received any notice of delisting.

4.6Delivery of Fairness Opinion. The Conflicts Committee has received an opinion of Simmons, the financial advisor to the Conflicts Committee, that the consideration to be paid by the Partnership as consideration for the Interests pursuant to this Agreement is fair to the Partnership and its common unitholders (other than General Partner and its Affiliates) from a financial point of view.

17

4.7Excluded Assets. The Partnership acknowledges and confirms that, at or prior to the Closing Date, ETG transferred its right, title and interest in the Excluded Assets pursuant to the Excluded Assets Assignment and that no Excluded Asset constitutes and ETG Asset.

4.8Brokers’ Fee. Except as set forth onSchedule 4.7 of the Partnership Disclosure Schedules, the Partnership has not entered (directly or indirectly) into any agreement with any broker, investment banker, financial advisor or other Person that would obligate Contributor or any of its Affiliates to pay any broker’s, finder’s, financial advisor’s or other similar fee or commission in connection with this Agreement or the transactions contemplated herein.

4.9Securities Laws.

(a) The Partnership has such knowledge and experience in financial and business matters so as to be capable of evaluating the merits and risks of its investment in the Interests and is capable of bearing the economic risk of such investment. The Partnership is an “accredited investor” as that term is defined in Rule 501 of Regulation D (without regard to Rule 501(a)(4)) promulgated under the Securities Act. The Partnership is acquiring the Interests for investment for its own account and not with a view toward or for sale in connection with any distribution thereof, or with any present intention of distributing or selling the Interests. The Partnership does not have any Contract or arrangement with any Person to sell, transfer or grant participations to such Person or to any third Person, with respect to the Interests. The Partnership acknowledges and understands that (i) the acquisition of the Interests has not been registered under the Securities Act and that the Partnership is acquiring the Interests in reliance on an exemption therefrom and (ii) the Interests will, upon such acquisition, be characterized as “restricted securities” under state and federal securities laws. The Partnership agrees that the Interests may be sold, transferred or offered for sale or otherwise disposed of except pursuant to an effective registration statement under the Securities Act or pursuant to an available exemption from the registration requirements of the Securities Act, and in compliance with other applicable state and federal securities laws.

(b) The Partnership has undertaken such investigation as it has deemed necessary to enable it to make an informed and intelligent decision with respect to the execution, delivery and performance of this Agreement and the acquisition of the Interests. The Partnership has had an opportunity to ask questions and receive answers from Contributor regarding the terms and conditions of the sale and transfer of the Interests and has had the opportunity to ask questions and receive answers from Contributor concerning the ETG Business and the ETG Assets.

ARTICLE V

COVENANTS OF THE PARTIES

5.1Expenses.

(a) Except as otherwise provided for in this Agreement, (i) Contributor shall pay all costs and expenses incurred by it in connection with the Transaction Documents and the transactions contemplated thereby and (ii) the Partnership shall pay all costs and expenses incurred by it in connection with the Transaction Documents and the transactions contemplated thereby.

18

(b) Notwithstanding any of the foregoing, if any action at law or equity is necessary to enforce or interpret the terms of the Transaction Documents, the prevailing Party shall be entitled to reasonable attorneys’ fees and expenses in addition to any other relief to which such Party may be entitled.

5.2Tax Matters.

(a) Each of the Parties shall cooperate fully, as and to the extent reasonably requested by the other Party, in connection with the filing of Tax Returns and any audit, litigation or other proceeding with respect to Taxes. Such cooperation shall include the retention and (upon the other Party’s request) the provision of records and information relevant to any such audit, litigation or other proceeding and making employees available on a mutually convenient basis to provide additional information and explanation of any material provided hereunder.

(b) All excise, sales, use, registration, stamp, recording, documentary, conveyancing, franchise, property, transfer, gains and similar Taxes, levies, charges and fees (collectively, “Transfer Taxes”) arising from the transactions contemplated by this Agreement shall be borne equally by Contributor and the Partnership. Notwithstanding anything to the contrary in this Section 5.3(b), any Tax Returns that must be filed in connection with Transfer Taxes shall be prepared and filed when due by the Party primarily or customarily responsible under the applicable local law for filing such Tax Returns, and such Party will use reasonable efforts to provide such Tax Returns to the other Party at least ten days prior to the due date for such Tax Returns. Upon the filing of Tax Returns in connection with Transfer Taxes, the filing Party shall provide the other Party with evidence satisfactory to the other Party that such Transfer Taxes have been filed and paid.

(c) All Taxes attributable to the period of Contributor’s ownership of ETG or operation of the ETG Assets before and including the Effective Time shall remain the responsibility of Contributor. All Taxes attributable to the ownership of ETG or operation of the ETG Assets after the Effective Time shall be the Partnership’s responsibility. All real estate, ad valorem and personal property and similar Taxes associated with the ETG Assets shall be prorated between the Contributor and the Partnership as of the Effective Time based upon the number of days during the applicable Tax period each Party owned the Assigned Assets subject to such Taxes. Notwithstanding any other provision hereof, the Contributor shall be responsible for income, capital gains, franchise and other Taxes imposed on them and resulting from the sale of the Interests.

5.3Financial Statements. The Contributor shall use its commercially reasonable efforts to prepare as soon as practicable after the Closing Date (but in any event within 30 days thereof) any financial statements (including completing audits and obtaining consents from auditors) that may be required to be filed with the SEC by the Partnership as a result of the transactions contemplated hereby, as necessary to satisfy any rule or regulation of the SEC, to satisfy relevant disclosure Obligations of the Partnership under the Securities Act or the Exchange Act, or as may otherwise be required by applicable Law or by any securities exchange. The Partnership shall pay and/or reimburse the Contributor for fifty percent of all reasonable costs incurred by such parties pursuant to or in accordance with thisSection 5.3.

19

5.4Further Assurances. In case at any time after the Closing any further action is necessary to carry out the purposes of this Agreement, each of the Parties shall take such further action (including the execution and delivery of such further instruments and documents) as the other Party reasonably may request, all at the sole cost and expense of the requesting Party (unless the requesting Party is entitled to indemnification therefor underArticle VII).

ARTICLE VI

CLOSING

6.1Closing. The closing (the “Closing”) of the transactions contemplated by this Agreement was held at the offices of Andrews Kurth LLP, 600 Travis Street, Suite 4200, Houston, Texas simultaneously with the execution of this Agreement.

6.2Deliveries by Contributor. At the Closing, Contributor delivered (or caused to be delivered) to the Partnership the following:

(a) a counterpart to that certain Assignment of ETG LLC Interests to Marlin Midstream, as the Partnership’s designee (the “Interests Assignment”) duly executed by Contributor;

(b) a counterpart to the Gathering Agreement duly executed by Contributor;

(c) a counterpart to that certain Excluded Assets Assignment duly executed by Contributor;

(d) a counterpart to that certain Parent Guaranty duly executed by Contributor;

(e) releases of Liens evidencing the discharge and removal of all Liens on the ETG Assets, if any, other than Permitted Liens; and

(f) all books and records relating to the ETG Assets (including books of account, Tax returns and supporting work papers, Right-of-Way files, Contract files and the like relating to the ETG Assets) that are in the possession of Contributor.

6.3Deliveries by the Partnership. At the Closing, the Partnership delivered (or caused to be delivered) the following to Contributor:

(a) the estimated Consideration as described inSection 2.2;

(b) certificates representing the Equity Consideration Units;

(c) a counterpart of the Interests Assignment, duly executed by the Partnership and Marlin Midstream;

(d) a counterpart of the Excluded Assets Assignment duly executed by ETG;

(e) a counterpart of the Gathering Agreement, duly executed by the ETG; and

20

(f) such other documents, certificates and other instruments as were requested by Contributor prior to the Closing to carry out the intent and purposes of this Agreement.

ARTICLE VII

INDEMNIFICATION

7.1Indemnification by Contributor. Solely for the purposes of the indemnities made in thisSection 7.1, the representations and warranties (other than inSection 3.6(b)) made by Contributor in this Agreement shall be deemed to have been made without regard to any materiality, ETG Material Adverse Effect, monetary or similar qualifiers. Subject to the terms of thisArticle VII, from and after the Closing, Contributor shall indemnify and hold harmless the Partnership and its partners, members, managers, directors, officers, employees, consultants and permitted assigns (collectively, the “Partnership Indemnitees”), to the fullest extent permitted by Law, from and against any losses, claims, damages, liabilities and costs and expenses (including reasonable attorneys’ fees and reasonable expenses of investigating, defending and prosecuting litigation) (collectively, “Losses”) incurred or suffered by the Partnership Indemnitees as a result of, caused by, arising out of or relating to:

(a) any breach, violation or inaccuracy of any of the Contributor Fundamental Representations (in each case, when made);

(b) any breach, violation or inaccuracy of any of the other representations or warranties (in each case, when made) of Contributor contained in this Agreement;

(c) any breach of any of the covenants or agreements of Contributor contained in this Agreement;

(d) Retained Obligations; and

(e) EOG Contract Losses, incurred as of each EOG EBITDA Period.

7.2Indemnification by the Partnership. Solely for the purposes of the indemnities made in thisSection 7.2, the representations and warranties made by Contributor in this Agreement shall be deemed to have been made without regard to any materiality, monetary or similar qualifiers. Subject to the terms of thisArticle VII, from and after the Closing, the Partnership shall indemnify and hold harmless the Contributor and its partners, members, managers, directors, officers, employees, consultants and permitted assigns (collectively, the “Contributor Indemnitees”), to the fullest extent permitted by Law, from and against any Losses incurred or suffered by the Contributor Indemnitees as a result of, caused by, arising out of or relating to:

(a) any breach, violation or inaccuracy of any of the Partnership Fundamental Representations (in each case, when made);

(b) any breach, violation or inaccuracy of any of the other representations or warranties (in each case, when made) of the Partnership contained in this Agreement; and

21

(c) any breach of any of the covenants or agreements of the Partnership contained in this Agreement.

7.3Limitations and Other Indemnity Claim Matters. Notwithstanding anything to the contrary in thisArticle VII or elsewhere in this Agreement (subject toSection 7.3(f)), the following terms shall apply to any claim for monetary damages arising out of this Agreement or related to the transactions contemplated hereby:

(a)Deductible. Neither Party will have any liability underSection 7.1(b) orSection 7.2(b), as applicable, unless and until the Partnership Indemnitees or the Contributor Indemnities, as applicable, have suffered Losses in excess of $830,000 in the aggregate (the “Deductible”) arising from Claims underSection 7.1(b) orSection 7.2(b), as applicable, and then recoverable Losses claimed underSection 7.1(b) orSection 7.2(b), as applicable, shall be limited to those that exceed the Deductible.

(b)Cap. Each Party’s aggregate liability underSection 7.1(b) orSection 7.2(b), as applicable, shall not exceed $8,300,000 in the aggregate (the “Cap”).

(c)Survival; Claims Period.

(i) The representations and warranties of the Parties under this Agreement shall survive the execution and delivery of this Agreement and shall continue in full force and effect until the 18-month anniversary of the Closing Date (the “Expiration Date”);provided that the Contributor Fundamental Representations and Partnership Fundamental Representations shall survive for a period equal to the applicable statute of limitations for each such representation (the “Fundamental Expiration Date”).

(ii) No action for any violation, breach or inaccuracy of any representation or warranty contained herein shall be brought after the Expiration Date or the Fundamental Expiration Date, as applicable, except for claims of which a Party has received a Claim Notice setting forth in reasonable detail the claimed misrepresentation or breach of warranty with reasonable detail, prior to the Expiration Date.

(d)Calculation of Losses. In calculating amounts payable to any Indemnitee (each such person, an “Indemnified Party”) for a claim for indemnification hereunder, the amount of any indemnified Losses shall be determined without duplication of any other Loss for which an indemnification claim has been made or could be made under any other representation, warranty, covenant or agreement and shall be computed net of (i) payments actually recovered by the Indemnified Party under any insurance policy with respect to such Losses and (ii) any prior or subsequent actual recovery by the Indemnified Party from any Person other than the applicable indemnifying party (an “Indemnifying Party”) with respect to such Losses. Notwithstanding anything herein to the contrary except as provided inSection 7.3(e), the recovery of an Indemnified Party pursuant toSection 7.1 orSection 7.2, as applicable, shall be limited to the actual Losses incurred by such Indemnified Party based on the economic ownership of such Indemnified Party in the Partnership as of the Closing.

(e)Waiver of Certain Damages. Notwithstanding any other provision of this Agreement except for the assertion of any claim based on fraud or willful misconduct, in no

22

event shall any Party be liable for punitive, special, indirect, consequential, remote, speculative or lost profits damages of any kind or nature, regardless of the form of action through which such damages are sought, except (i) for any such damages recovered by any third party against an Indemnified Party in respect of which such Indemnified Party would otherwise be entitled to indemnification pursuant to the terms hereof and (ii) in the case of consequential damages, (A) to the extent an Indemnified Party is required to pay consequential damages to an unrelated third party and (B) to the extent of consequential damages to an Indemnified Party arising from fraud or willful misconduct.

(f)Sole and Exclusive Remedy. Except for the assertion of any claim based on fraud or willful misconduct, the remedies provided in thisArticle VII shall be the sole and exclusive legal remedies of the Parties, from and after the Closing, with respect to this Agreement and the transactions contemplated hereby.

7.4Indemnification Procedures.