- XPRO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Expro (XPRO) CORRESPCorrespondence with SEC

Filed: 16 Jul 13, 12:00am

FRANK’S INTERNATIONAL, NV

Prins Bernhardplein 200 1097 JB, Amsterdam The Netherlands |

July 15, 2013

H. Roger Schwall

Assistant Director

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549-3561

| Re: | Frank’s International N.V. |

Amendment No. 1 to Registration Statement on Form S-1

Filed June 25, 2013

File 333-188536

Ladies and Gentlemen:

Set forth below are the responses of Frank’s International N.V. (the “Company,” “we,” “us” or “our”) to comments received from the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) by letter dated July 9, 2013 with respect to Amendment No. 1 to the Registration Statement on Form S-1, File No. 333-188536, filed with the Commission on June 25, 2013 (the “Registration Statement”).

Concurrently with the submission of this letter, we are filing through EDGAR Amendment No. 2 to the Registration Statement (“Amendment No. 2”). For your convenience, we will hand deliver three full copies of Amendment No. 2, as well as three copies of Amendment No. 2 that are marked to show all changes made since the filing of Amendment No. 1 to the Registration Statement.

For your convenience, each response is prefaced by the exact text of the Staff’s corresponding comment in bold, italicized text. Unless otherwise specified, all references to page numbers and captions correspond to Amendment No. 2.

Securities and Exchange Commission

July 15, 2013

Page 2

Risk Factors, page 16

Risks Related to Our Organizational Structure, page 28

| 1. | We note that Mr. Mosing is the sole board member and the sole member of the Supervisory Board. You disclose on page 99 that his compensation arrangements were passed on by the Supervisory Board. Provide a risk factor addressing this fact. Address also that there do not appear to be threshold or maximum levels for his 2% of EBITDA bonus. |

RESPONSE:

Historically, our board of directors has consisted of other members in addition to Mr. Mosing (as further described below). In addition, all historical compensation decisions for Mr. Mosing were passed on by the board of directors of Frank’s International, Inc. (“FII”), which consisted of multiple members in addition to Mr. Mosing. Mr. Mosing historically abstained from voting on and involvement in discussions regarding his compensation. Going forward, our supervisory board, which will consist of multiple members, will determine Mr. Mosing’s compensation. While we expect that Mr. Mosing will continue to abstain from voting on and involving himself in discussions regarding his compensation, two of the other supervisory directors will also be members of the Mosing family. We have revised Amendment No. 2 to clarify the nature of historical compensation decisions related to Mr. Mosing and to disclose in a risk factor the conflict of interest that could arise from the relationship between Mr. Mosing and other supervisory directors following the completion of this offering. Please see pages 28, 93-95 and 99-104 of Amendment No. 2.

In the future, as disclosed in Amendment No. 2, we expect that our bonus structure will be more consistent with those typical for a public company and in line with the executive compensation practices of other public companies in our industry. In particular, we do not expect that our future bonus structure will provide for bonus payments as a percentage of EBITDA, or any other single performance metric, without a threshold or maximum for our CEO or otherwise. Please see page 103 of Amendment No. 2.

The Mosing family will hold a majority of the combined..., page 28

| 2. | Please expand your risk factor disclosure to discuss in more detail the extent to which the Mosing family will control the company’s management and affairs. For example, we note the Mosing family’s financing of the company’s activities at pages 114-115. |

RESPONSE:

We acknowledge the Staff’s comment and respectfully refer the Staff to the risk factor entitled “The Mosing family will hold a majority of the combined voting power of the FINV Stock and, accordingly, will have substantial control over our management and affairs” on page 28 of Amendment No. 2, in which we disclose the extent that the Mosing family will control the Company’s management and affairs, including their majority stock ownership and

Securities and Exchange Commission

July 15, 2013

Page 3

their ability to elect all of the members of our supervisory board. In addition, we have revised this risk factor to disclose that pursuant to our amended and restated articles of association, the Mosing family will have the right to recommend one director for nomination to the supervisory board for each 10% of our outstanding common stock they collectively hold, up to a maximum of five directors.

We further respectfully submit that the Mosing family’s historical financing of the Company’s activities has been limited in nature and is consistent with the activities of a privately held, family company. For instance, these financing activities have primarily consisted of (i) a distribution made in the form of a promissory note, which will be repaid in full with the proceeds from the offering, and (ii) financing for certain aircraft through credit agreements, which assets will be not be contributed to FICV. Any financing of the Company’s activities by the Mosing family on a historical basis has been the result of our structure as a closely held private company, rather than out of necessity. The amounts subject to financing by the Mosing family were not material to our historical operations, and we do not expect that they will be continued once we are a public company. As disclosed in Amendment No. 2, we expect to enter into credit facilities that will provide us with a financing source other than the Mosing family. In light of the immaterial (and non-continuing) nature of the Mosing family’s historical financing activities for us, we believe that the risk factor, as revised, fully reflects the extent to which the Mosing family will control the Company’s management and affairs.

Business, page 69

Industry, page 74

Trends in the Industry, page 78

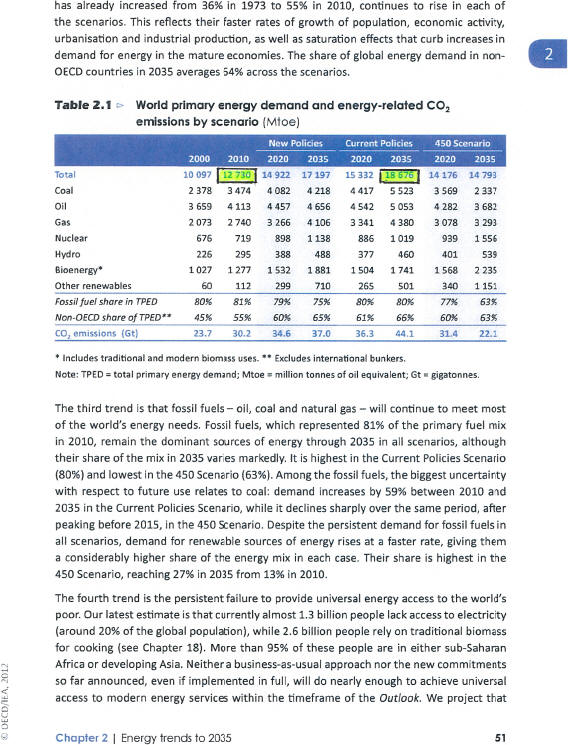

| 3. | We note your response to prior comment 6 and the relevant portion of the International Energy Agency report provided. Please provide support for your statement that according to the IEA, global energy demand will increase 47% from 2010. |

RESPONSE:

We acknowledge the Staff’s comment and respectfully submit that the support for this statement has been included on page 51 of the International Energy Agency report (the “IEA Report”) cited in the Registration Statement, which is attached as Annex A to this letter. We have marked the IEA Report to highlight the applicable numeric figures. Specifically, we cite the amount of the global energy demand in 2010 of 12,730 Mtoe, as compared to the projected global energy demand for 2035 of 18,676 Mtoe. We derived the stated 47% increase as follows: (18,676 Mtoe – 12,730 Mtoe)/12,730 Mtoe = 46.7%.

Securities and Exchange Commission

July 15, 2013

Page 4

Compensation Discussion and Analysis, page 97

Overview of Executive Compensation and Our Compensation Process, page 98

| 4. | Please provide further analysis of how you arrived at and why you paid each of the particular levels and forms of compensation for 2012. For example, you provide little, if any, of your specific company and/or individual goals and objectives that otherwise would not apply to any company. Provide a description of the specific levels of achievement of each named executive officer relative to the targets as well as any additional information pertaining to each individual’s performance that the informal compensation committee considered in determining specific payout levels for 2012. Please provide sufficient quantitative and qualitative analysis of the factors the compensation committee, chief executive officer, or executive chairman of the board considered in making specific compensation awards. See Item 402(b)(1) of Regulation S-K. |

RESPONSE:

We acknowledge the Staff’s comment and have revised our disclosure in Amendment No. 2 to reflect that our bonuses and forms of compensation have historically been determined in the discretion of our chief executive officer (“CEO”) with respect to the other named executive officers and by the FII board of directors (less the CEO) with respect to our CEO. We believe that such compensation program was not inappropriate for a closely-held, family company. While no formal structure was in place, factors that were considered from time to time in evaluating the amount of compensation for each of our named executive officers included overall market conditions, our CEO’s or the FII board’s determination of the amounts necessary to remain competitive in the marketplace, the particular named executive officer’s collaboration and teamwork skills, and for all of the named executive officers other than our CEO and chief financial officer (“CFO”), the financial performance of the business or geographical unit led by the named executive officer as compared to the performance of the market in our industry. Consideration has also historically been given to the compensation received by the individual in prior years as compared to performance in those years relative to the performance of the individual in the most recent fiscal year. Since we have not historically provided any of the named executive officers with grants of equity, we have previously focused on annual bonuses and deferred compensation plan contributions to incentivize short-term and long-term performance. While our prior compensation decisions may have been based on more of a subjective assessment, we anticipate that our future compensation decisions will be guided by more qualitative and quantitative analysis.

In addition, we have revised our disclosure to state that the process of modifying our executive compensation policies and practices is still underway, but we have received recommendations from Meridian Consultants, LLC (“Meridian”) that we expect will be used to implement new compensation arrangements in connection with and following this offering. Please see page 100 of Amendment No. 2.

Securities and Exchange Commission

July 15, 2013

Page 5

| 5. | We note your response to our prior comment 21 and we note your disclosure at page 98 that you target your total executive compensation to be in line with your peer group. Please identify the members of your peer group and disclose any specific benchmarks of your compensation against your peer group, and where your actual compensation payments fell within your targeted parameters. |

RESPONSE:

We acknowledge the Staff’s comment and we have revised our disclosure to state that we are working closely with Meridian and using market data to develop an understanding of the current compensation practices among our peers and to ensure that our executive compensation program is competitive within the industry. In addition, with Meridian’s assistance, we have identified an initial peer group and expect that our existing informal compensation committee will approve certain benchmarks of our compensation against that peer group. Consistent with our disclosure in Amendment No. 2 and as described above in comment 4, we have not historically had a formal compensation structure in place and, as a result, we have not historically benchmarked our compensation against members of a peer group. Please see page 101 of Amendment No. 2.

Description of Capital Stock, page 119 Dividends, page 121

| 6. | We note your disclosure here and elsewhere that you intend to pay quarterly dividends on your common stock and an annual dividend on your Series A preferred stock. Please provide us with your basis for your dividend projection, including any assumptions supporting that projection. |

RESPONSE:

We acknowledge the Staff’s comment and respectfully submit that, pursuant to our amended and restated articles of association, our dividend policy with respect to our common stock will be within the discretion of our management board, with the approval of our supervisory board, and will depend upon various factors, including our results of operations, financial condition, capital requirements and investment opportunities. Although the amount of the quarterly dividend to be paid on our common stock will ultimately be within our management board’s discretion, we currently anticipate that the aggregate annual dividend on our common stock will total only $60 million in the aggregate. In order to make that $60 million distribution, FICV would be required to distribute approximately $80 million to its partners. The annual dividend on our Series A preferred stock will be equal to 0.25% of its par value of €0.01, or less than $10,000 in the aggregate based upon the expected number of shares of Series A preferred stock outstanding upon completion of the offering. As further described below in our response to comment 7, these amounts are significantly less than our historical net income and Adjusted EBITDA.

Securities and Exchange Commission

July 15, 2013

Page 6

| 7. | We note your disclosure at page 61 that you expect to fund part of the dividend on common stock with the tax distribution from FICV. Please disclose here and elsewhere whether your historical cash flows would have been sufficient to fund both your common stock and Series A preferred stock dividends and whether there are any rights and preferences with respect to the payment of such dividends. Finally, identify and quantify, if practicable, any debt covenants or similar restrictions that would limit your ability to pay the dividend. |

RESPONSE:

We acknowledge the Staff’s comment and we have revised our disclosure on pages 42, 61 and 130 of Amendment No. 2 to demonstrate that our historical cash flows would have been sufficient to fund both our common stock and Series A preferred stock dividends. In order to demonstrate this, we have quantified what our estimated aggregate dividend payments on our common stock and Series A preferred stock would have been after giving effect to the offering relative to our net income and Adjusted EBITDA. For the year ended December 31, 2012, based upon the estimated aggregate annual dividends described in comment 6 above, the dividend on our common stock would have represented less than 17% of our net income and less than 35% of our Adjusted EBITDA, and the dividend on our Series A preferred stock would have represented significantly less than one tenth of one percent of both our net income and our Adjusted EBITDA.

In addition, as disclosed on page 130 of the Amendment No. 2, each share of Series A preferred stock will have a liquidation preference equal to its par value of €0.01 per share and will be entitled to an annual dividend equal to 0.25% of its par value. We confirm that there are no other rights or preferences with respect to the payments of dividends on our common stock and our Series A preferred stock.

We have also revised our disclosure on pages 62-63 of Amendment No. 2 to describe the terms of the revolving credit facilities that we intend to enter into in connection with the offering. The credit facilities will be undrawn at the closing of the offering and we do not have any near-term intention to make material borrowings thereunder. We do not believe that any of the covenants in such credit facilities will restrict our ability to make distributions in accordance with our dividend policy. The forms of our credit facilities will be filed as exhibits to the Registration Statement in a subsequent filing.

* * * * *

Securities and Exchange Commission

July 15, 2013

Page 7

Please direct any questions that you have with respect to the foregoing or if any additional supplemental information is required by the Staff, please contact Douglas E. McWilliams of Vinson & Elkins L.L.P. at (713) 758-3613.

Very truly yours, | ||

Frank’s International N.V. | ||

By: | /s/ Mark G. Margavio | |

Name: | Mark G. Margavio | |

Title: | Chief Financial Officer | |

Enclosures

| cc: | Mark Wojciechowski (U.S. Securities and Exchange Commission) |

John Cannarella (U.S. Securities and Exchange Commission)

Karina V. Dorin (U.S. Securities and Exchange Commission)

Donald Keith Mosing (Frank’s International N.V.)

Brian D. Baird (Frank’s International N.V.)

Douglas E. McWilliams (Vinson & Elkins L.L.P.)

Jeffery K. Malonson (Vinson & Elkins L.L.P.)

Sean T. Wheeler (Latham & Watkins LLP)

Annex A

Supplemental Documentation for Comment #3 – International Energy Agency Report

Page 51 of the “World Energy Outlook 2012” report prepared by the International Energy Agency is attached to this Annex A, with the relevant numeric figures highlighted.

has already increased from 36% in 1973 to 55% in 2010, continues to rise in each of the scenarios. This reflects their faster rates of growth of population, economic activity, urbanisation and industrial production, as well as saturation effects that curb increases in demand for energy in the mature economies. The share of global energy demand in non-OECD countries in 2035 averages 64% across the scenarios.

has already increased from 36% in 1973 to 55% in 2010, continues to rise in each of

the scenarios. This reflects their faster rates of growth of population, economic activity,

urbanisation and industrial production, as well as saturation effects that curb increases in

demand for energy in the mature economies. The share of global energy demand in non-

OECD countries in 2035 averages 64% across the scenarios.

Table 2.1 World primary energy demand and energy-related CO2

emissions by scenario (Mtoe)

New Policies Current Policies 450 Scenario

2000 2010 2020 2035 2020 2035 2020 2035

Total 10097 12730 14922 17197 15332 18676 14176 14793

Coal 2378 3474 4082 4218 4417 5523 3569 2337

Oil 3659 4113 4457 4656 4542 5053 4282 3682

Gas 2073 2740 3266 4106 3341 4380 3078 3293

Nuclear 676 719 898 1138 886 1019 939 1556

Hydro 226 295 388 488 377 460 401 539

Bioenergy* 1027 1277 1532 1881 1504 1741 1568 2235

Other renewables 60 112 299 710 265 501 340 1151

Fossilfuel shore in TPED 80% 81% 79% 75% 80% 80% 77% 63%

Non-OECDshare of TPED*’ 45% 55% 60% 65% 61% 66% 60% 63%

CO, ernisslonr (Gt) 23.7 30.2 34.6 37.0 36.3 44.1 3l.4 22.1

* Includes traditional and modern biomass uses. ** Excludes international bunkers.

Note: TPED = total primary energy demand; Mtoe = million tonnes of oil equivalent; Gt = gigatonnes.

The third trend is that fossil fuels -oil, coal and natural gas -will continue to meet most of the world’s energy needs. Fossil fuels, which represented 81% of the primary fuel mix in 2010, remain the dominant sources of energy through 2035 in all scenarios, although their share of the mix in 2035 varies markedly. It is highest in the Current Policies Scenario (80%)and lowest in the 450 Scenario (63%). Among the fossil fuels, the biggest uncertainty with respect to future use relates to coal: demand increases by 59% between 2010 and 2035 in the Current Policies Scenario, while it declines sharply over the same period, after peaking before 2015, in the 450 Scenario. Despite the persistent demand for fossil fuels in all scenarios, demand for renewable sources of energy rises at a faster rate, giving them a considerably higher share of the energy mix in each case. Their share is highest in the 450 Scenario, reaching 27% in 2035 from 13% in 2010.

The fourth trend is the persistent failure to provide universal energy access to the world’s poor. Our latest estimate is that currently almost 1.3 billion people lack access to electricity (around 20% of the global population), while 2.6 billion people rely on traditional biomass for cooking (see Chapter 18). More than 95% of these people are in either subBaharan Africa or developing Asia. Neither a business-as-usual approach nor the new commitments so far announced, even if implemented in full, will do nearly enough to achieve universal access to modern energy services within the timeframe of the Outlook. We project that

Chapter 2 | Energy trends to 2035

* Includes traditional and modern biomass uses. ** Excludes international bunkers.

Note: TPED = total primary energy demand; Mtoe = million tonnes of oil equivalent; Gt = gigatonnes.

The third trend is that fossil fuels – oil, coal and natural gas – will continue to meet most of the world’s energy needs. Fossil fuels, which represented 81% of the primary fuel mix in 2010, remain the dominant sources of energy through 2035 in all scenarios, although their share of the mix in 2035 varies markedly. It is highest in the Current Policies Scenario (80%) and lowest in the 450 Scenario (63%). Among the fossil fuels, the biggest uncertainty with respect to future use relates to coal: demand increases by 59% between 2010 and 2035 in the Current Policies Scenario, while it declines sharply over the same period, after peaking before 2015, in the 450 Scenario. Despite the persistent demand for fossil fuels in all scenarios, demand for renewable sources of energy rises at a faster rate, giving them a considerably higher share of the energy mix in each case. Their share is highest in the 450 Scenario, reaching 27% in 2035 from 13% in 2010.

The fourth trend is the persistent failure to provide universal energy access to the world’s poor. Our latest estimate is that currently almost 1.3 billion people lack access to electricity (around 20% of the global population), while 2.6 billion people rely on traditional biomass for cooking (see Chapter 18). More than 95% of these people are in either sub-Saharan Africa or developing Asia. Neither a business-as-usual approach nor the new commitments so far announced, even if implemented in full, will do nearly enough to achieve universal access to modern energy services within the timeframe of the Outlook. We project that

Chapter 2 | Energy trends to 2035

51