Exhibit 99.4

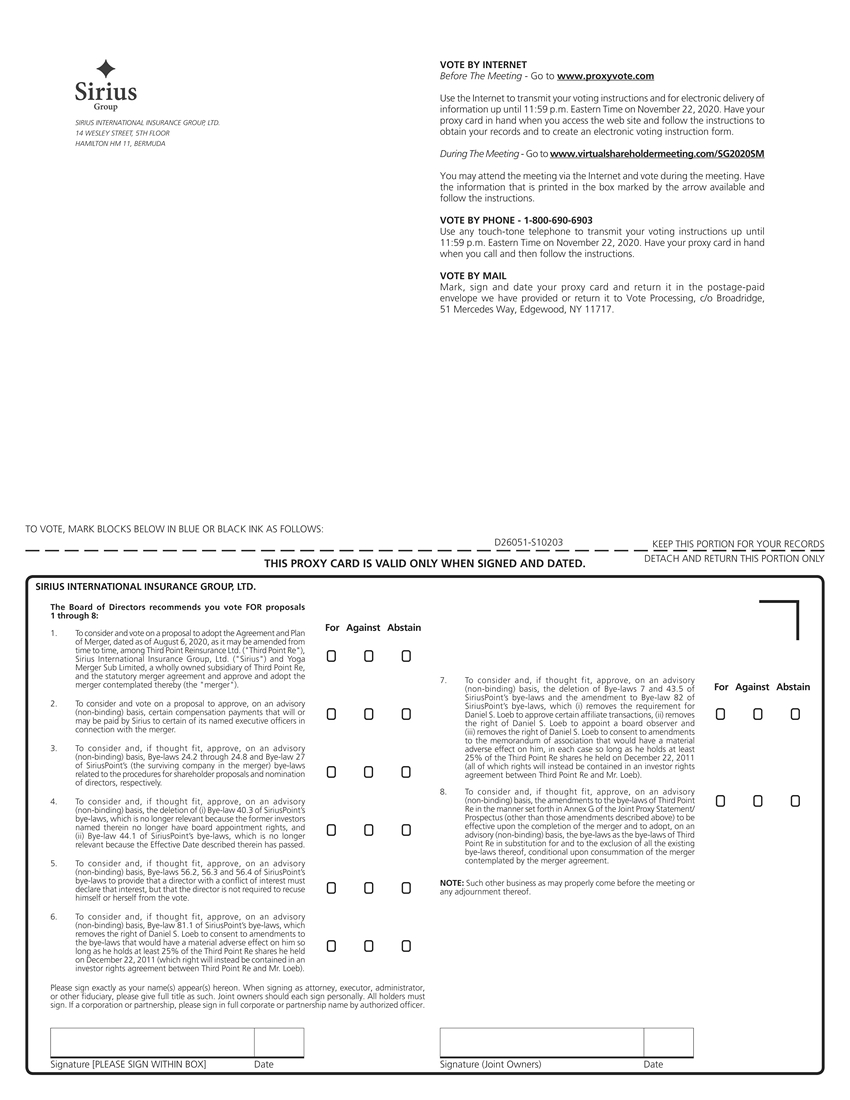

VOTE BY INTERNET Before The Meeting - Go to www.proxyvote.comSIRIUS INTERNATIONAL INSURANCE GROUP, LTD. 14 WESLEY STREET, 5TH FLOOR HAMILTON HM 11, BERMUDAUse the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time on November 22, 2020. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.During The Meeting - Go to www.virtualshareholdermeeting.com/SG2020SMYou may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions.VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time on November 22, 2020. Have your proxy card in hand when you call and then follow the instructions.VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:D26051-S10203KEEP THIS PORTION FOR YOUR RECORDSTHIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.DETACH AND RETURN THIS PORTION ONLYSIRIUS INTERNATIONAL INSURANCE GROUP, LTD.The Board of Directors recommends you vote FOR proposals 1 through 8:1. To consider and vote on a proposal to adopt the Agreement and Plan of Merger, dated as of August 6, 2020, as it may be amended from time to time, among Third Point Reinsurance Ltd. ("Third Point Re"),For Against AbstainSirius International Insurance Group, Ltd. ("Sirius") and Yoga ! ! ! Merger Sub Limited, a wholly owned subsidiary of Third Point Re, and the statutory merger agreement and approve and adopt the merger contemplated thereby (the "merger").2. To consider and vote on a proposal to approve, on an advisory7. To consider and, if thought fit, approve, on an advisory (non-binding) basis, the deletion of Bye-laws 7 and 43.5 of SiriusPoint’s bye-laws and the amendment to Bye-law 82 of SiriusPoint’s bye-laws, which (i) removes the requirement forFor Against Abstain(non-binding) basis, certain compensation payments that will or may be paid by Sirius to certain of its named executive officers in connection with the merger.3. To consider and, if thought fit, approve, on an advisory (non-binding) basis, Bye-laws 24.2 through 24.8 and Bye-law 27 of SiriusPoint’s (the surviving company in the merger) bye-laws related to the procedures for shareholder proposals and nomination of directors, respectively.4. To consider and, if thought fit, approve, on an advisory (non-binding) basis, the deletion of (i) Bye-law 40.3 of SiriusPoint’s bye-laws, which is no longer relevant because the former investors named therein no longer have board appointment rights, and (ii) Bye-law 44.1 of SiriusPoint’s bye-laws, which is no longer relevant because the Effective Date described therein has passed.5. To consider and, if thought fit, approve, on an advisory (non-binding) basis, Bye-laws 56.2, 56.3 and 56.4 of SiriusPoint’s bye-laws to provide that a director with a conflict of interest must declare that interest, but that the director is not required to recuse himself or herself from the vote.6. To consider and, if thought fit, approve, on an advisory (non-binding) basis, Bye-law 81.1 of SiriusPoint’s bye-laws, which removes the right of Daniel S. Loeb to consent to amendments to the bye-laws that would have a material adverse effect on him so long as he holds at least 25% of the Third Point Re shares he held on December 22, 2011 (which right will instead be contained in an investor rights agreement between Third Point Re and Mr. Loeb).Daniel S. Loeb to approve certain affiliate transactions, (ii) removes ! ! ! the right of Daniel S. Loeb to appoint a board observer and (iii) removes the right of Daniel S. Loeb to consent to amendments to the memorandum of association that would have a material adverse effect on him, in each case so long as he holds at least 25% of the Third Point Re shares he held on December 22, 2011 (all of which rights will instead be contained in an investor rights agreement between Third Point Re and Mr. Loeb).8. To consider and, if thought fit, approve, on an advisory (non-binding) basis, the amendments to the bye-laws of Third Point Re in the manner set forth in Annex G of the Joint Proxy Statement/ Prospectus (other than those amendments described above) to be effective upon the completion of the merger and to adopt, on an advisory (non-binding) basis, the bye-laws as the bye-laws of Third Point Re in substitution for and to the exclusion of all the existing bye-laws thereof, conditional upon consummation of the merger contemplated by the merger agreement.NOTE: Such other business as may properly come before the meeting or any adjournment thereof.Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer.Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date

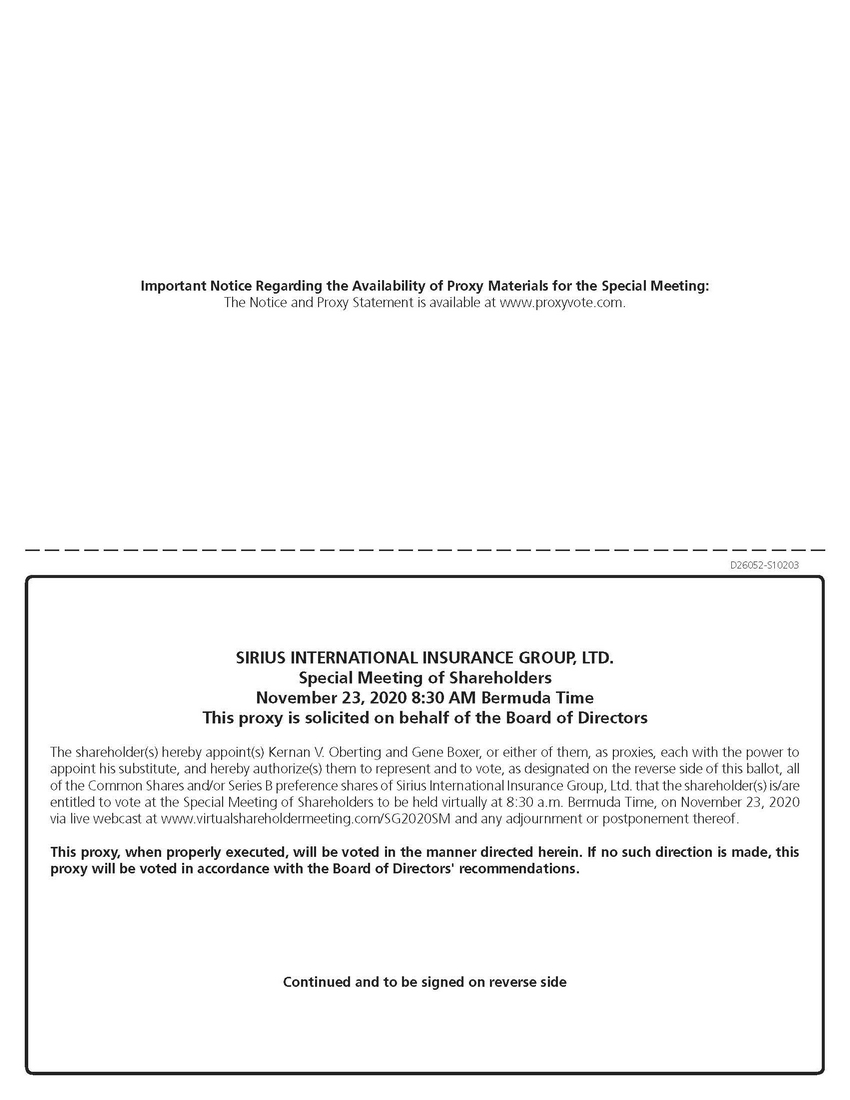

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting: The Notice and Proxy Statement is available at www.proxyvote.com.D26052-S10203SIRIUS INTERNATIONAL INSURANCE GROUP, LTD. Special Meeting of Shareholders November 23, 2020 8:30 AM Bermuda Time This proxy is solicited on behalf of the Board of DirectorsThe shareholder(s) hereby appoint(s) Kernan V. Oberting and Gene Boxer, or either of them, as proxies, each with the power to appoint his substitute, and hereby authorize(s) them to represent and to vote, as designated on the reverse side of this ballot, all of the Common Shares and/or Series B preference shares of Sirius International Insurance Group, Ltd. that the shareholder(s) is/are entitled to vote at the Special Meeting of Shareholders to be held virtually at 8:30 a.m. Bermuda Time, on November 23, 2020 via live webcast at www.virtualshareholdermeeting.com/SG2020SM and any adjournment or postponement thereof.This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted in accordance with the Board of Directors' recommendations.Continued and to be signed on reverse side