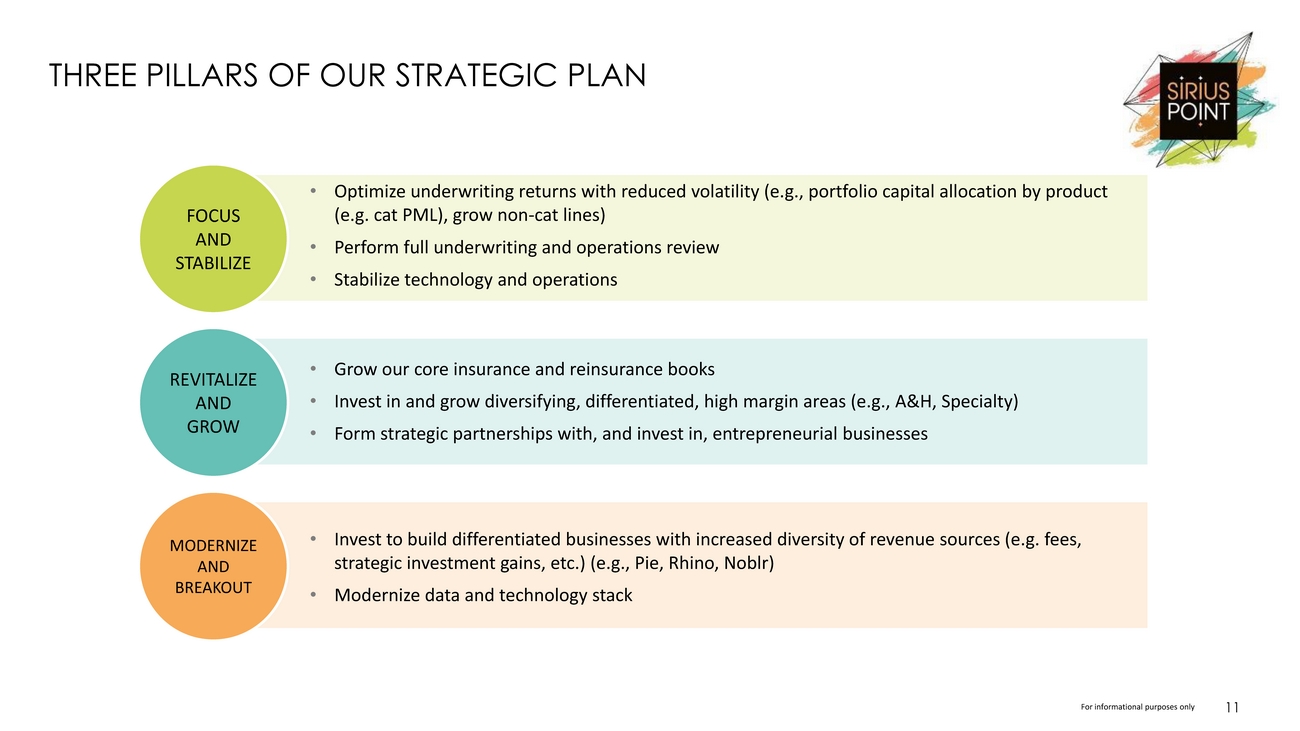

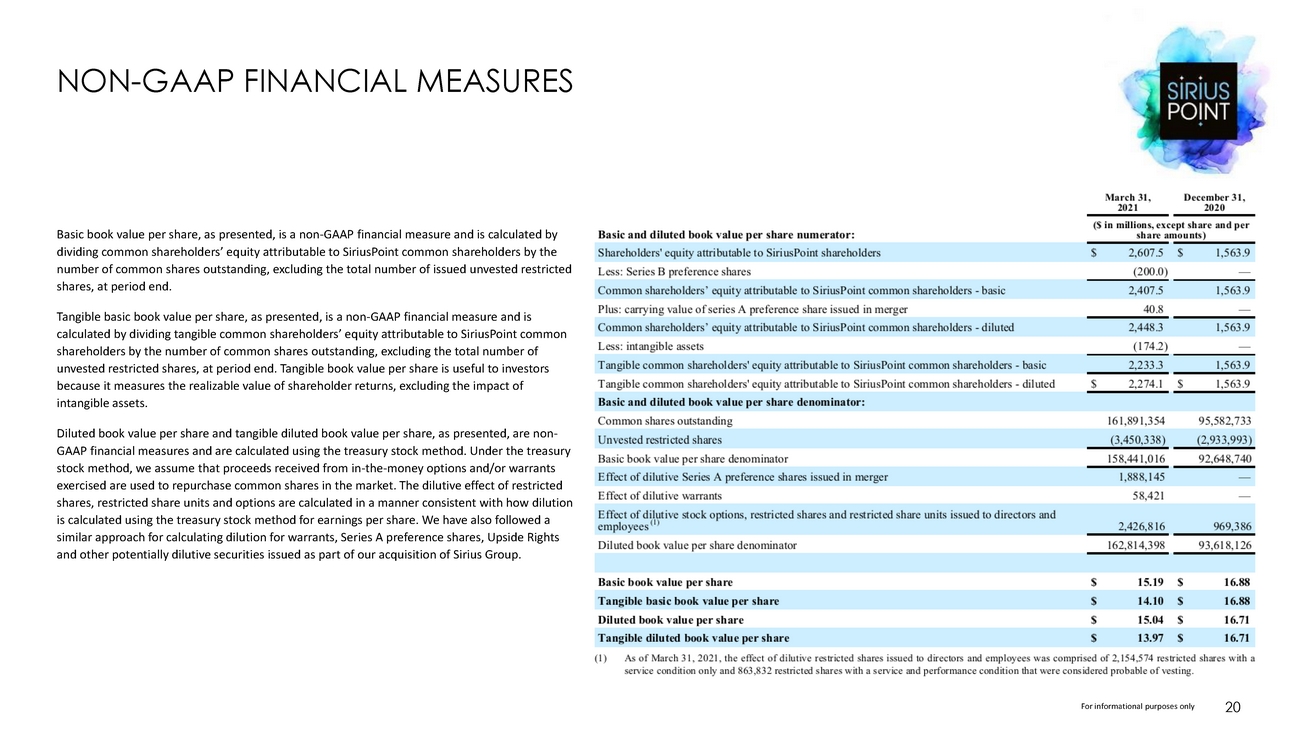

| DISCLAIMER For informational purposes only 5 Forward- Looking Statements We make statements in this report that are forward-looking statements within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995, including statements related to our intent to optimize our underwriting returns with reduced volatility, stabilize technology operations, grow our core insurance and reinsurance books, invest in and grow diversifying, differentiated, high margin business lines, form strategic partnerships with entrepreneurial businesses, invest and build businesses with increased diversity of revenue sources and modernize data and technology stack, the outcome of our strategic plan and the recovery of IMG’s business during the second half of 2021. SiriusPoint Ltd.(the “Company “) cautions you that the forward-looking information presented in this presentation is not a guarantee of future events, and that actual events may differ materially from those made in or suggested by the forward- looking information contained in this presentation. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “plan,” “seek,” “comfortable with,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe” or “continue” or the negative thereof or variations thereon or similar terminology. Actual events, results and outcomes may differ materially from the Company’s expectations due to a variety of known and unknown risks, uncertainties and other factors. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements are the following: the costs, expense and difficulties of the integration of the operations of Sirius International Insurance Group, Ltd.(“Sirius Group”); the impact of the novel coronavirus (COVID-19) pandemic or other unpredictable catastrophic events that could adversely affect our results of operations and financial condition; fluctuations in our results of operations; a downgrade or withdrawal of our financial ratings would significantly and negatively affect our ability to implement our business strategy successfully; loss and loss adjustment expenses reserves may be inadequate to cover SiriusPoint’s ultimate liability for losses and as a result its financial results could be adversely affected; global climate change and/or periods characterized by excess underwriting capacity and unfavorable premium rates may have an adverse effect on our business, operating results and financial conditions; SiriusPoint’s investment portfolio may suffer reduced returns or losses; adverse changes in interest rates, foreign currency exchange rates, equity markets, debt markets or market volatility could result in significant losses to SiriusPoint’s investment portfolio; legal restrictions on certain of SiriusPoint’s insurance and reinsurance subsidiaries’ ability to pay dividends and other distributions to SiriusPoint; SiriusPoint’s significant deferred tax assets, which could become devalued if either SiriusPoint does not generate sufficient future taxable income or applicable corporate tax rates are reduced; the lack of availability of capital; future strategic transactions such as acquisitions, dispositions, mergers or joint ventures; technology breaches; our concentrated exposure in Third Point Enhanced LP (the “TP Fund”) whose investment strategy may bear substantial investment risks; conflicts of interest among various members of TP Fund, Third Point LLC and SiriusPoint may adversely affect us; risks and factors listed in the Quarterly Report on Form 10-Q for the period ended March 31, 2021 and any subsequent reports filed with the Securities and Exchange Commission (the “SEC”). Non-GAAP Financial Measures This presentation contains non-GAAP financial information. SiriusPoint’s management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of SiriusPoint’s financial performance, identifying trends in our results and providing meaningful period-to-period comparisons but these non-GAAP measures should not be viewed as a substitute for measures determined in accordance with U.S. GAAP. Book value per share metrics, including basic book value per share, tangible book value per share, diluted book value per share and tangible book value per share included in this presentation, are non-GAAP financial measures, and there are no comparable GAAP measures. We believe that long-term growth in book value per share is an important measure of our financial performance because it allows our management and investors to track over time the value created by the retention of earnings. In addition, we believe this metric is used by investors because it provides a basis for comparison with other companies in our industry that also report a similar measure although these non-GAAP financial measures may be defined or calculated differently by other companies. See the Appendix for definitions of these non-GAAP measures and reconciliations to the most comparable U.S. GAAP measure. The Company has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Company has filed with the SEC for more complete information about the Company and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the underwriters participating in the offering will arrange to send you the prospectus by contacting: Morgan Stanley & Co. LLC, Attention: Prospectus Department, 180 Varick Street, 2nd Floor, New York, NY 10014; BofA Securities, Inc., Attention: Prospectus Department, NC1-004-03-43, 200 North College Street, 3rd Floor, Charlotte, NC 28255 or by email at dg.prospectus_requests@bofa.com; UBS Securities LLC, Attention: Prospectus Department, 1285 Avenue of the Americas, New York, NY 10019, by telephone at (888) 827-7275, or by email at ol-prospectus-request@ubs.com; or Wells Fargo Securities, LLC, Attention: WFS Customer Service, 608 2nd Avenue South, Suite 1000, Minneapolis, MN 55402, by telephone at (800) 645-3751, or by email at wfscustomerservice@wellsfargo.com This offering of securities is made only by means of a preliminary prospectus supplement together with the accompanying prospectus, which has been filed with the SEC. You may obtain a copy of the preliminary prospectus supplement and accompanying prospectus for the offering by visiting EDGAR on the SEC website at www.sec.gov. |