August 3rd, 2022 siriuspt.com Q2 2022 COMPANY OVERVIEW

DISCLAIMER Non-GAAP Financial Measures This presentation may also contain non-GAAP financial information. SiriusPoint’s management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of SiriusPoint’s financial performance, identifying trends in our results and providing meaningful period-to-period comparisons. Core underwriting income, Core net services income, Core income, and Core combined ratio are non-GAAP financial measures. Management believes it is important to review Core results as it better reflects how management views the business and reflects the Company’s decision to exit the runoff business. Basic book value per share, tangible basic book value per share, diluted book value per share and tangible diluted book value per share are also non-GAAP financial measures. SiriusPoint’s management believes that long-term growth in book value per share is an important measure of the Company’s financial performance because it allows management and investors to track over time the value created by the retention of earnings. In addition, SiriusPoint’s management believes this metric is useful to investors because it provides a basis for comparison with other companies in the industry that also report a similar measure. Reconciliations of such measures to the most comparable GAAP figures are included in the attached financial information in accordance with Regulation G. 2 Forward- Looking Statements We make statements in this report that are forward-looking statements within the meaning of the U.S. federal securities laws. We intend these forward- looking statements to be covered by the safe harbor provisions for forward-looking statements in the U.S. Federal securities laws. These statements involve risks and uncertainties that could cause actual results to differ materially from those contained in forward-looking statements made on behalf of SiriusPoint. These risks and uncertainties include our ability to attract and retain key senior management; a downgrade or withdrawal of our financial ratings; our ability to execute on our strategic transformation, including changing the mix of business between insurance and reinsurance; the impact of the novel coronavirus (“COVID-19”) pandemic or other unpredictable catastrophic events including uncertainties with respect to current and future COVID-19 losses across many classes of insurance business and the amount of insurance losses that may ultimately be ceded to the reinsurance market, supply chain issues, labor shortages and related increased costs, changing interest rates, equity market volatility and ongoing business and financial market impacts of COVID-19; the costs, expenses and difficulties of the integration of the operations of Sirius International Insurance Group, Ltd. (“Sirius Group”); fluctuations in our results of operations; inadequacy of loss and loss adjustment expense reserves, the lack of availability of capital, and periods characterized by excess underwriting capacity and unfavorable premium rates; the performance of financial markets, impact of inflation, and foreign currency fluctuations; legal restrictions on certain of SiriusPoint’s insurance and reinsurance subsidiaries’ ability to pay dividends and other distributions to SiriusPoint; our ability to compete successfully in the (re)insurance market and the effect of consolidation in the (re)insurance industry; technology breaches or failures, including those resulting from a malicious cyber-attack on us, our business partners or service providers; the effects of global climate change, including increased severity and frequency of weather-related natural disasters and catastrophes and increased coastal flooding in many geographic areas; our ability to retain highly skilled employees and the effects of potential labor disruptions due to COVID-19 or otherwise; the outcome of legal and regulatory proceedings, regulatory constraints on our business, including legal restrictions on certain of our insurance and reinsurance subsidiaries’ ability to pay dividends and other distributions to us, and losses from unfavorable outcomes from litigation and other legal proceedings; reduced returns or losses in SiriusPoint’s investment portfolio; our concentrated exposure in funds and accounts managed by Third Point LLC, our lack of control over Third Point LLC, our limited ability to withdraw our capital accounts and conflicts of interest among various members of Third Point Advisors LLC, TP Enhanced Fund, Third Point LLC and us; our potential exposure to U.S. federal income and withholding taxes and our significant deferred tax assets, which could become devalued if we do not generate future taxable income or applicable corporate tax rates are reduced; future strategic transactions such as acquisitions, dispositions, investments, mergers or joint ventures and other risks and factors listed in the Company's most recent Annual Report on Form 10-K and subsequent periodic and current disclosures filed with the Securities and Exchange Commission. Except as required by applicable law or regulation, we disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, or new information, data or methods, future events or other circumstances after the date of this report.

CONTENTS 3 4-6 OVERVIEW OF SIRIUSPOINT: KEY HIGHLIGHTS GLOBAL INSURER & REINSURER GLOBAL PLATFORM 8-9 BUSINESS SEGMENTS 7 EXECUTIVE LEADERSHIP TEAM 10 - 11 INSURANCE & SERVICES 13 INVESTMENT PORTFOLIO 14 -17 APPENDIX: SIRIUSPOINT LTD. ISSUED CAPITAL INSTRUMENTS 2Q 2022 SEGMENT REPORTING 6M 2022 SEGMENT REPORTING 12 REINSURANCE

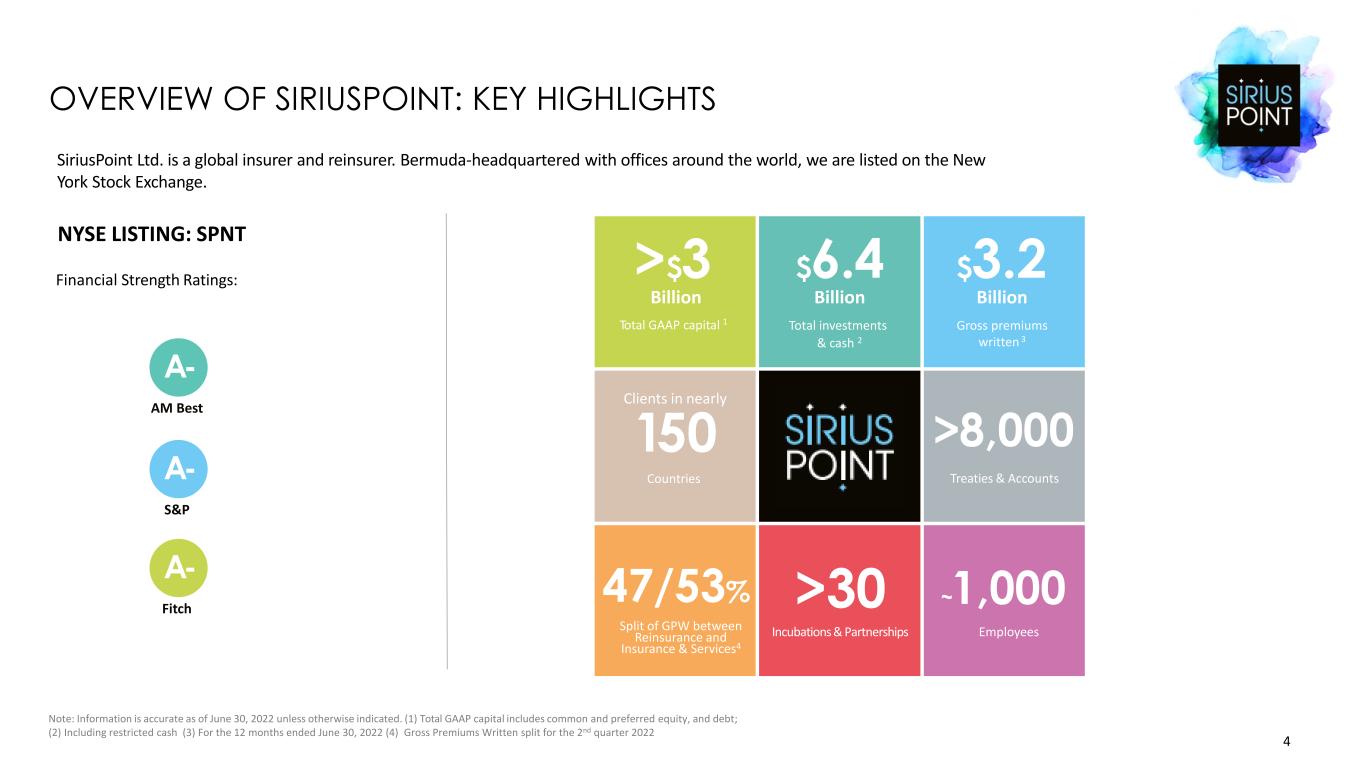

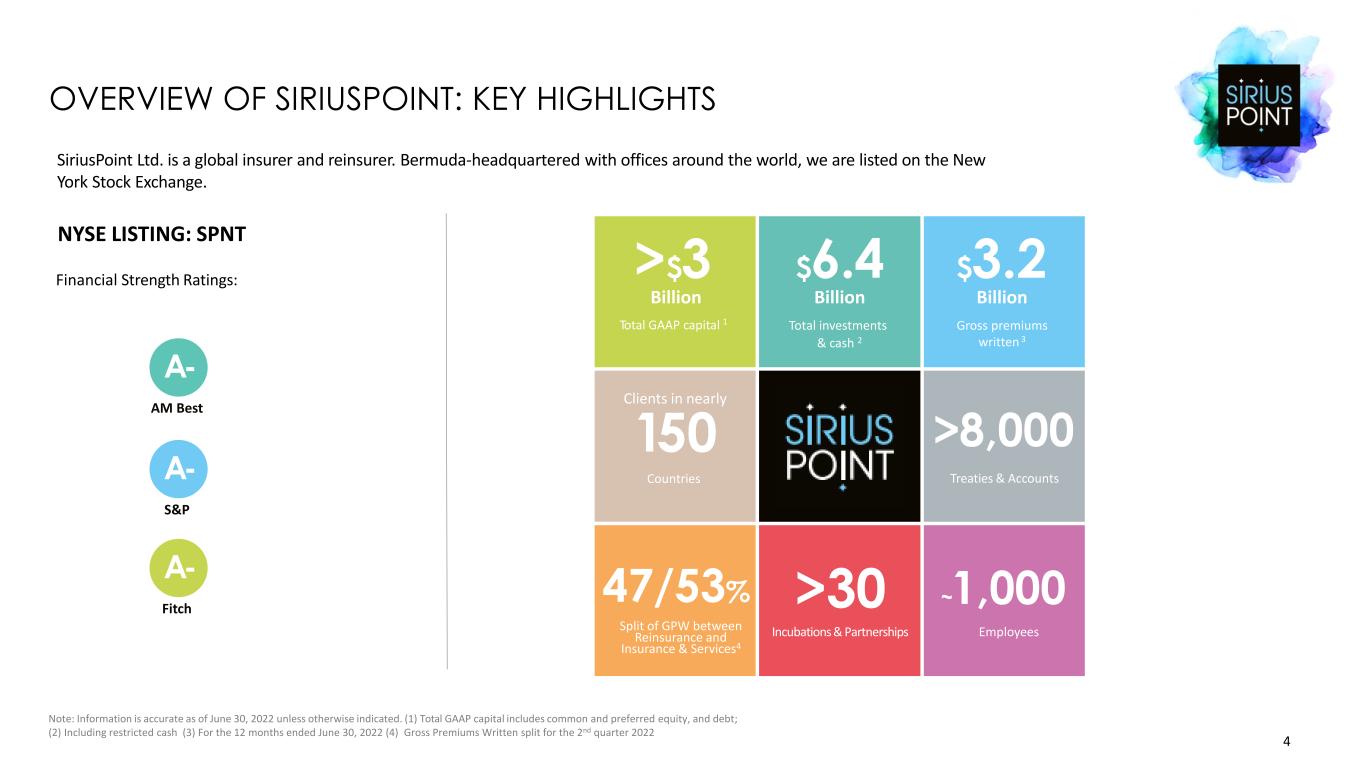

4 Financial Strength Ratings: >$3 Billion $6.4 Billion $3.2 Billion Clients in nearly 150 >8,000 47/53% >30 ~1,000 Note: Information is accurate as of June 30, 2022 unless otherwise indicated. (1) Total GAAP capital includes common and preferred equity, and debt; (2) Including restricted cash (3) For the 12 months ended June 30, 2022 (4) Gross Premiums Written split for the 2nd quarter 2022 A- AM Best NYSE LISTING: SPNT SiriusPoint Ltd. is a global insurer and reinsurer. Bermuda-headquartered with offices around the world, we are listed on the New York Stock Exchange. Incubations & PartnershipsSplit of GPW between Reinsurance and Insurance & Services4 Employees Total GAAP capital 1 Total investments & cash 2 Gross premiums written 3 Treaties & AccountsCountries OVERVIEW OF SIRIUSPOINT: KEY HIGHLIGHTS A- S&P A- Fitch

SIRIUSPOINT: A GLOBAL INSURER AND REINSURER 5 ▪ With $3 billion total capital, we are a fast-moving, responsive partner that combines best-in-class underwriting and risk management with pioneering ideas ▪ We write a global portfolio of Accident & Health (A&H), Specialty, and Property across our insurance and reinsurance franchise ▪ SiriusPoint has partnered with and invested in over 30 high-quality Managing General Agents (MGAs) and insurance service providers to access specialty insurance business ▪ We maintain a strong pipeline of strategic partnership opportunities globally to grow our Insurance & Services segment ▪ Our focus is on underwriting insurance and reinsurance profitably and with discipline, and managing risk and volatility ▪ Our priorities are: ▪ Re-underwriting Reinsurance and reducing Property Cat ▪ Growing our Insurance & Services business ▪ De-risking our capital investments portfolio

▪ Headquartered in Bermuda ▪ Clients across almost 150 countries and appetite and expertise across (re)insurance business globally ▪ Admitted and E&S licenses in the US ▪ Lloyd’s Syndicate 1945 and London Company Market paper ▪ European branch network and licenses ▪ Bermuda Class 4 entity ▪ Branches across all major global hubs and local branches where reinsurance is originated, mirroring broker footprint ▪ Global capabilities across product lines ▪ Depth of expertise in North America, continental Europe and emerging markets ▪ Unique capability in structured (re)insurance transactions in Bermuda ▪ Local and personal relationships built over decades LONDON BALTIMORE, MD MIAMI, FL BERMUDA NEW YORK, NY INDIANAPOLIS, IN TORONTO CARDIFF STOCKHOLM HAMBURG ZURICH LIÈGE SINGAPORE 6 SIRIUSPOINT: A GLOBAL PLATFORM

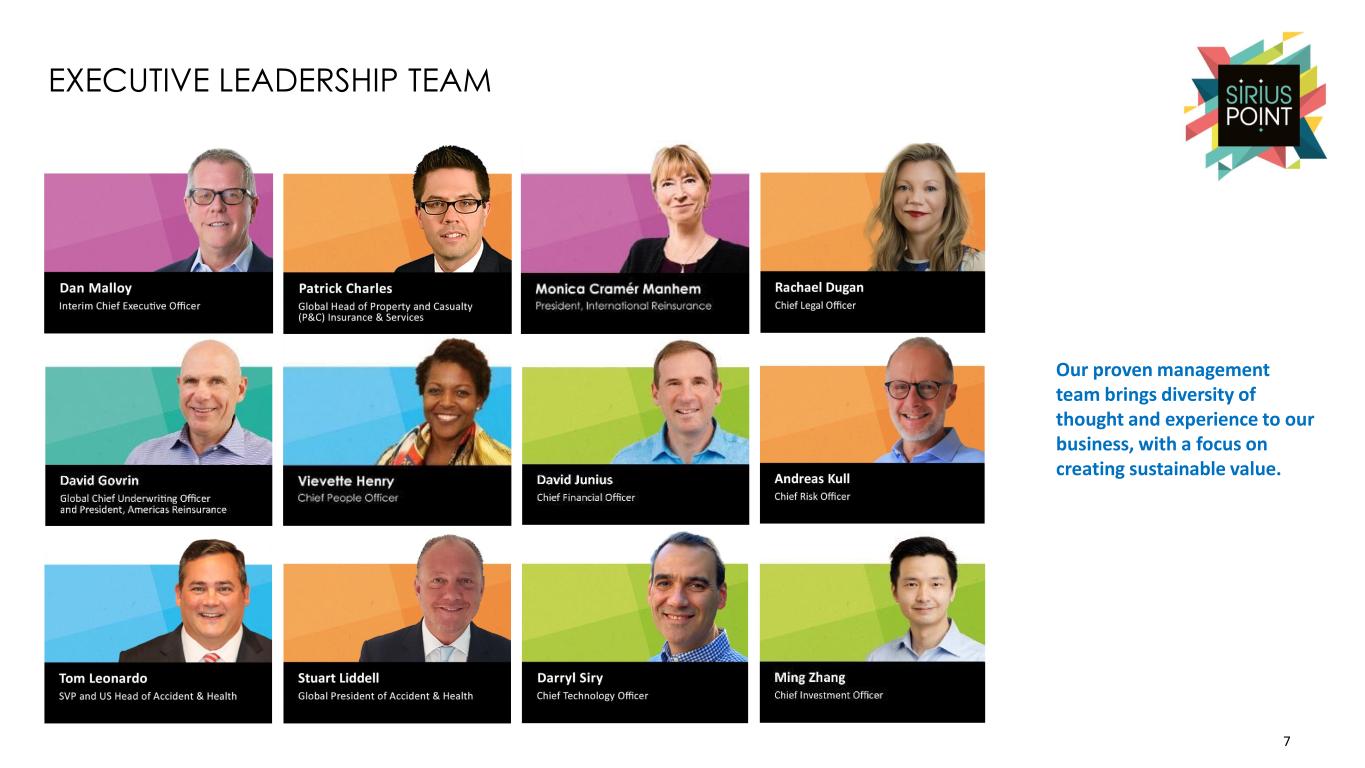

EXECUTIVE LEADERSHIP TEAM 7 Our proven management team brings diversity of thought and experience to our business, with a focus on creating sustainable value.

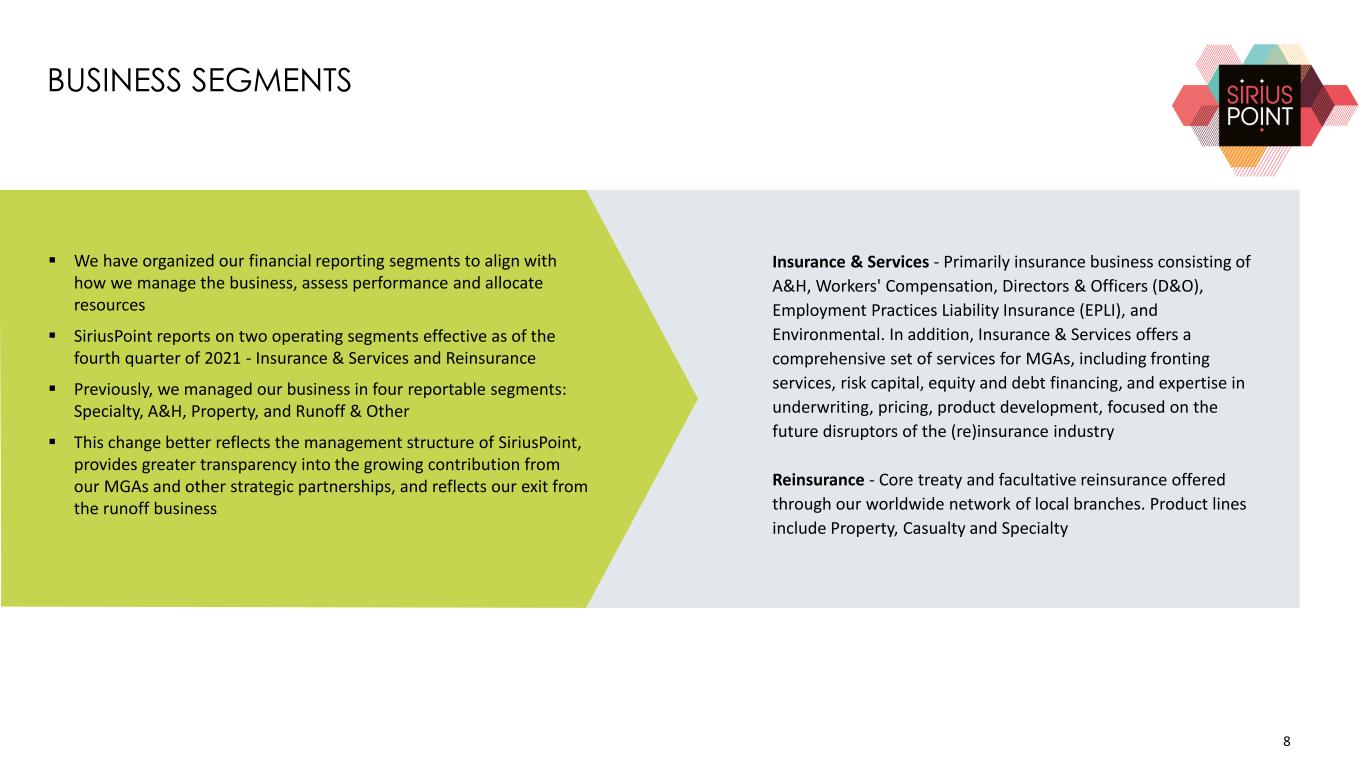

BUSINESS SEGMENTS ▪ We have organized our financial reporting segments to align with how we manage the business, assess performance and allocate resources ▪ SiriusPoint reports on two operating segments effective as of the fourth quarter of 2021 - Insurance & Services and Reinsurance ▪ Previously, we managed our business in four reportable segments: Specialty, A&H, Property, and Runoff & Other ▪ This change better reflects the management structure of SiriusPoint, provides greater transparency into the growing contribution from our MGAs and other strategic partnerships, and reflects our exit from the runoff business Insurance & Services - Primarily insurance business consisting of A&H, Workers' Compensation, Directors & Officers (D&O), Employment Practices Liability Insurance (EPLI), and Environmental. In addition, Insurance & Services offers a comprehensive set of services for MGAs, including fronting services, risk capital, equity and debt financing, and expertise in underwriting, pricing, product development, focused on the future disruptors of the (re)insurance industry Reinsurance - Core treaty and facultative reinsurance offered through our worldwide network of local branches. Product lines include Property, Casualty and Specialty 8

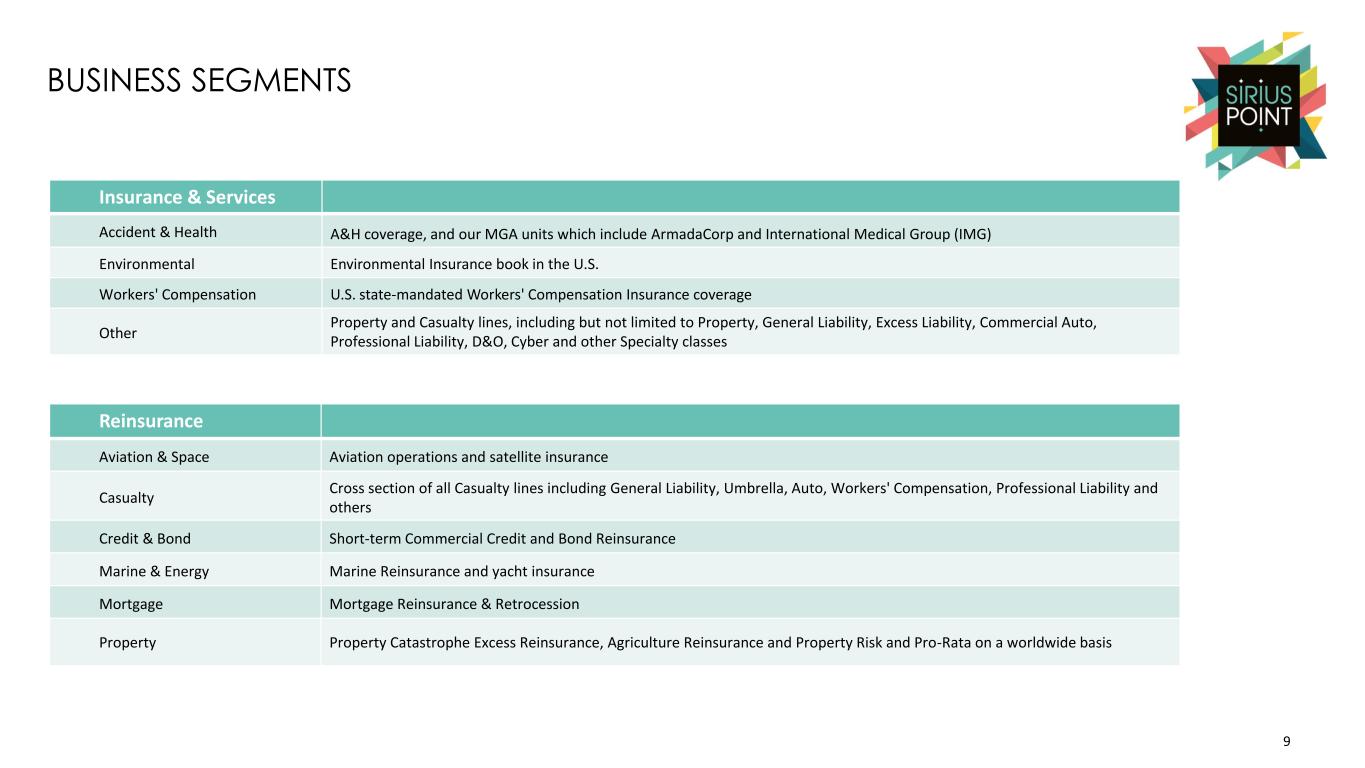

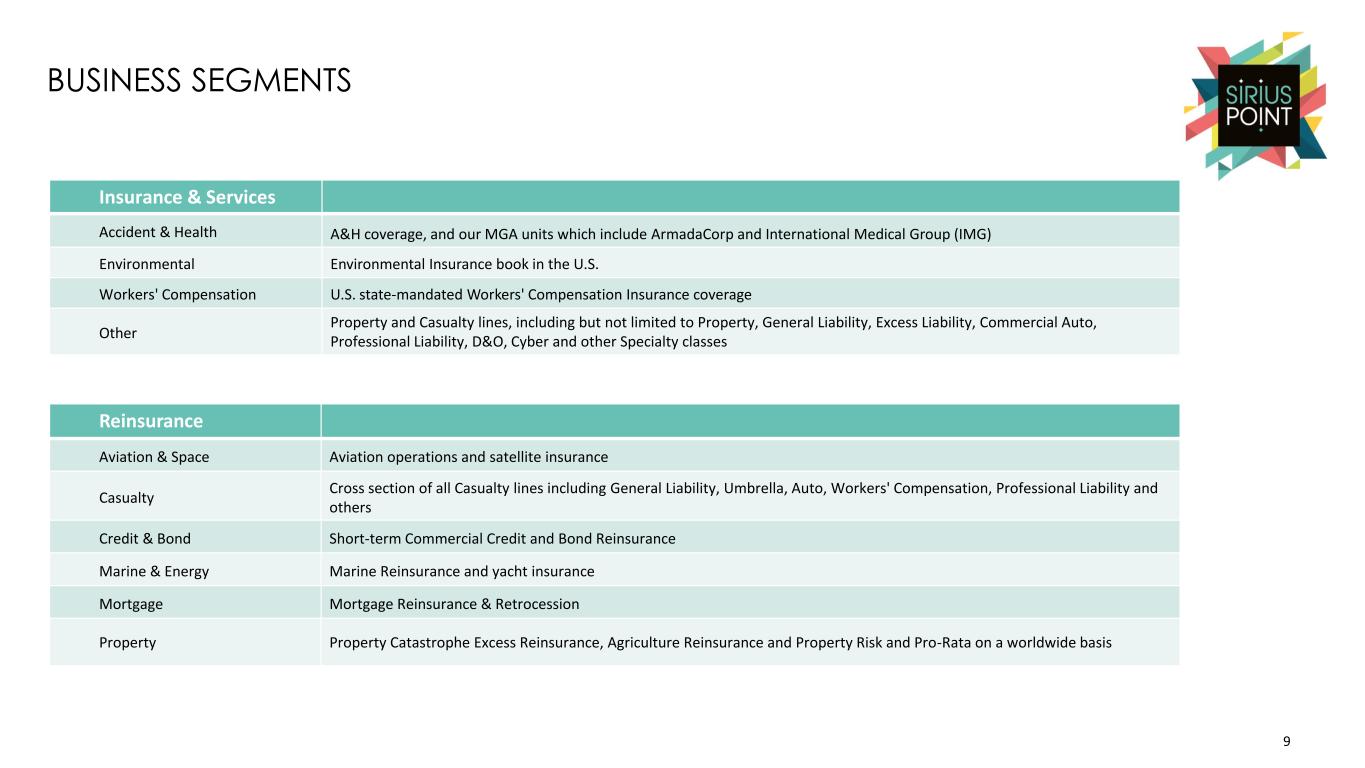

Insurance & Services Accident & Health A&H coverage, and our MGA units which include ArmadaCorp and International Medical Group (IMG) Environmental Environmental Insurance book in the U.S. Workers' Compensation U.S. state-mandated Workers' Compensation Insurance coverage Other Property and Casualty lines, including but not limited to Property, General Liability, Excess Liability, Commercial Auto, Professional Liability, D&O, Cyber and other Specialty classes Reinsurance Aviation & Space Aviation operations and satellite insurance Casualty Cross section of all Casualty lines including General Liability, Umbrella, Auto, Workers' Compensation, Professional Liability and others Credit & Bond Short-term Commercial Credit and Bond Reinsurance Marine & Energy Marine Reinsurance and yacht insurance Mortgage Mortgage Reinsurance & Retrocession Property Property Catastrophe Excess Reinsurance, Agriculture Reinsurance and Property Risk and Pro-Rata on a worldwide basis BUSINESS SEGMENTS 9

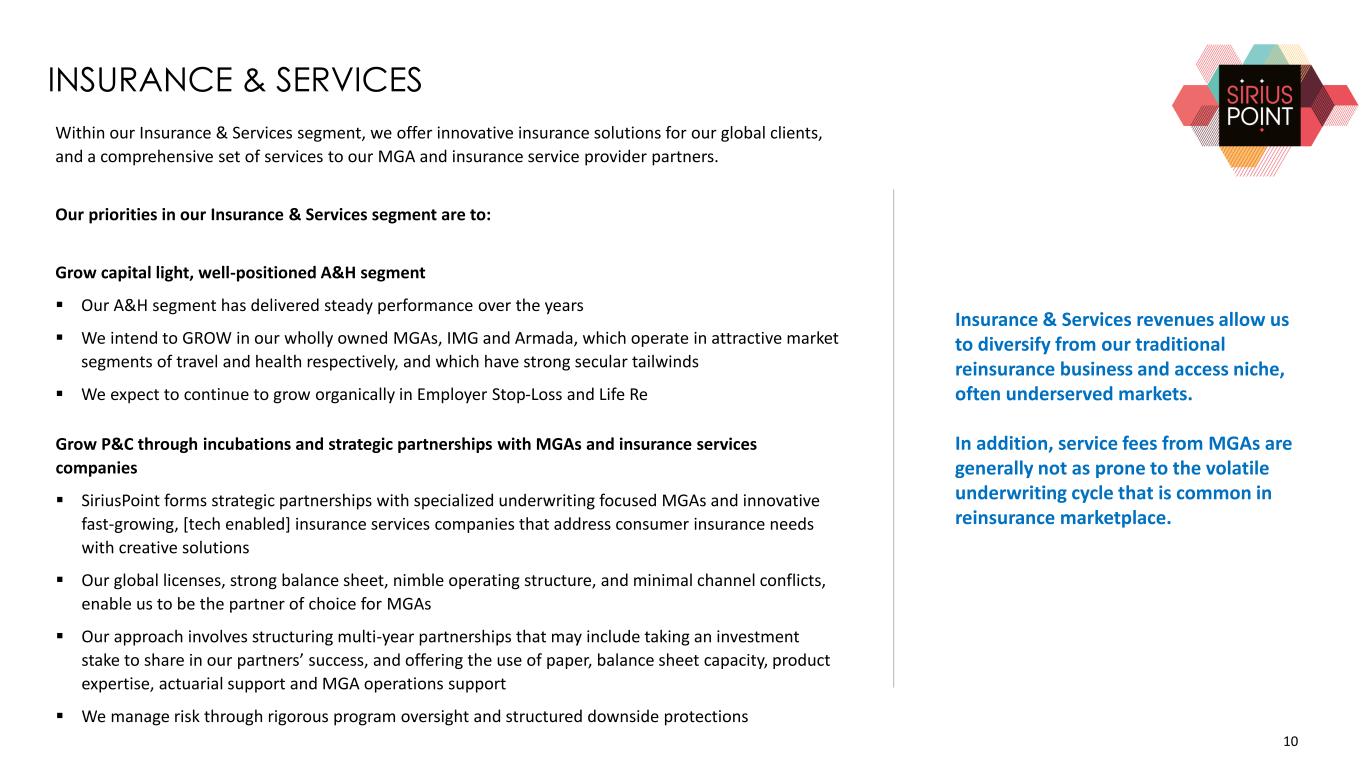

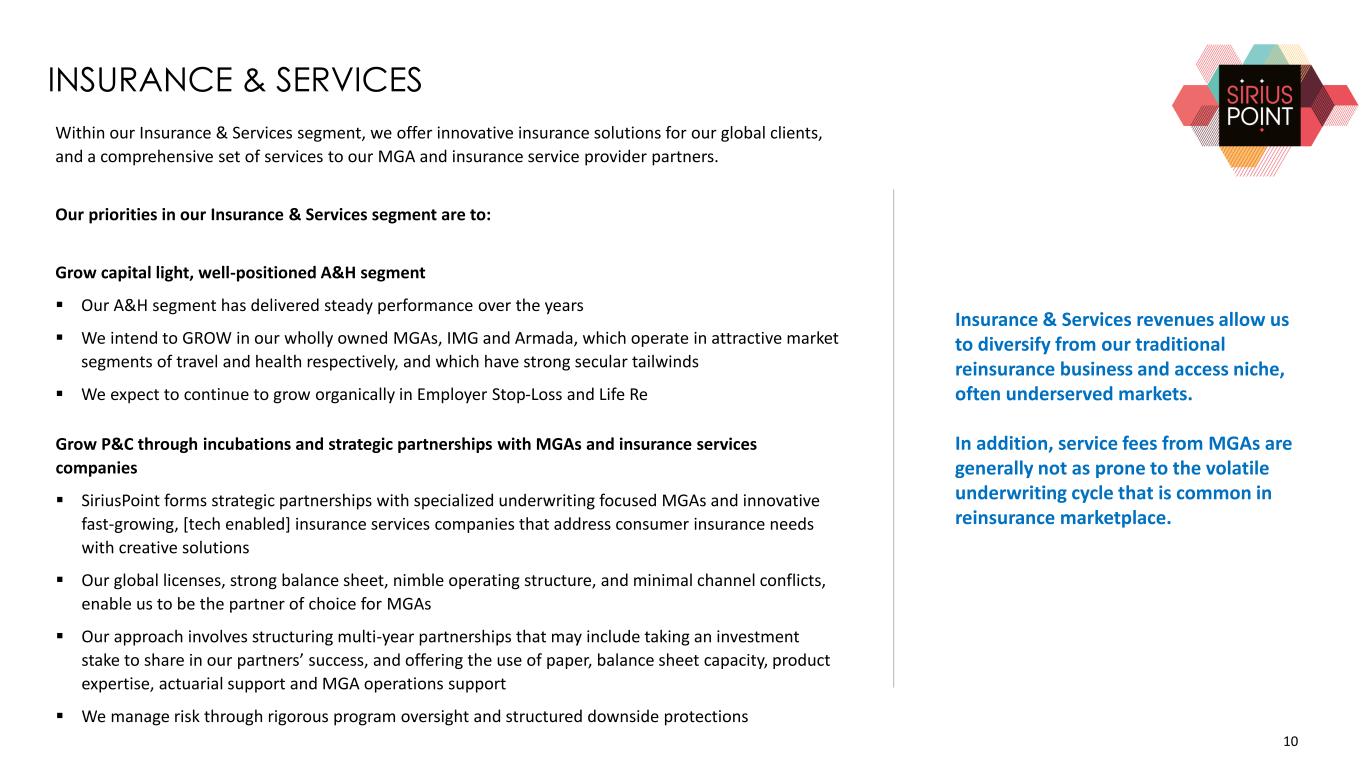

Grow P&C through incubations and strategic partnerships with MGAs and insurance services companies ▪ SiriusPoint forms strategic partnerships with specialized underwriting focused MGAs and innovative fast-growing, [tech enabled] insurance services companies that address consumer insurance needs with creative solutions ▪ Our global licenses, strong balance sheet, nimble operating structure, and minimal channel conflicts, enable us to be the partner of choice for MGAs ▪ Our approach involves structuring multi-year partnerships that may include taking an investment stake to share in our partners’ success, and offering the use of paper, balance sheet capacity, product expertise, actuarial support and MGA operations support ▪ We manage risk through rigorous program oversight and structured downside protections INSURANCE & SERVICES Within our Insurance & Services segment, we offer innovative insurance solutions for our global clients, and a comprehensive set of services to our MGA and insurance service provider partners. Our priorities in our Insurance & Services segment are to: Grow capital light, well-positioned A&H segment ▪ Our A&H segment has delivered steady performance over the years ▪ We intend to GROW in our wholly owned MGAs, IMG and Armada, which operate in attractive market segments of travel and health respectively, and which have strong secular tailwinds ▪ We expect to continue to grow organically in Employer Stop-Loss and Life Re Insurance & Services revenues allow us to diversify from our traditional reinsurance business and access niche, often underserved markets. In addition, service fees from MGAs are generally not as prone to the volatile underwriting cycle that is common in reinsurance marketplace. 10

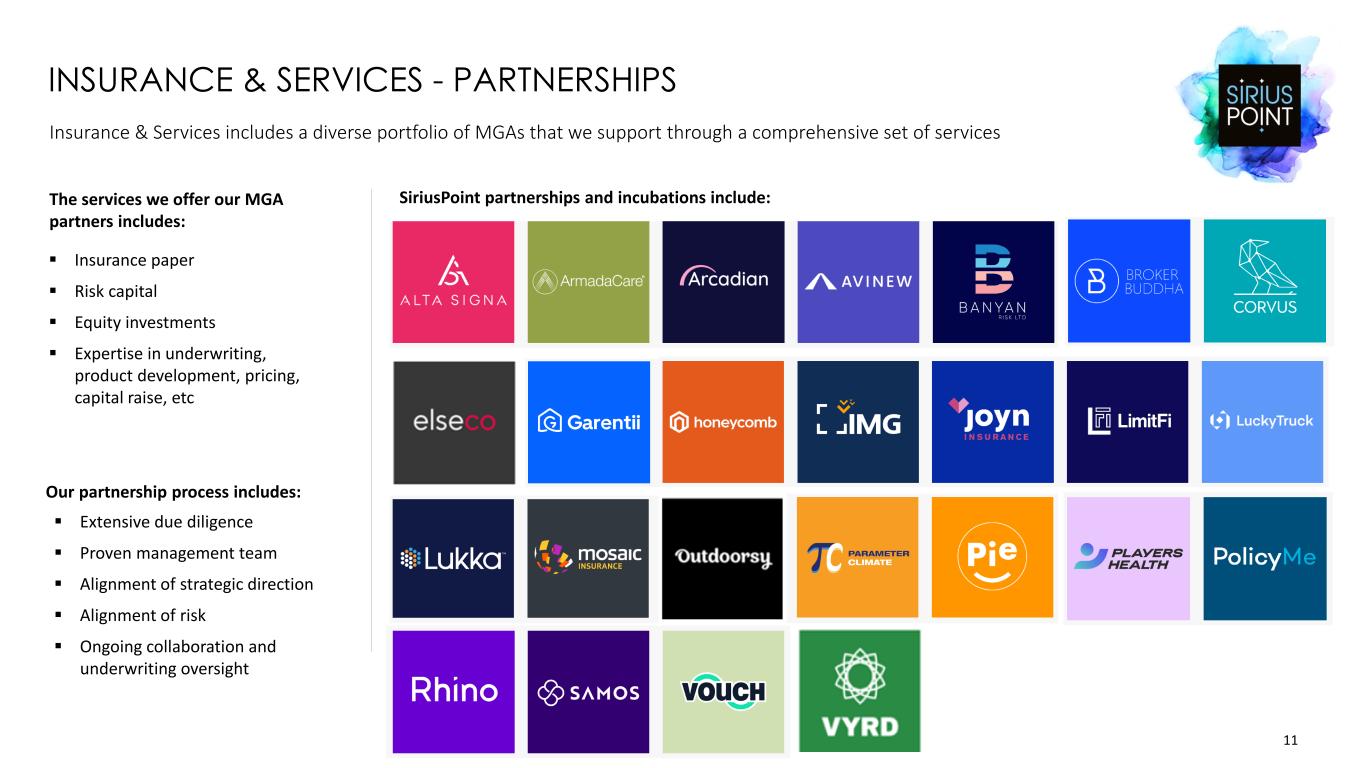

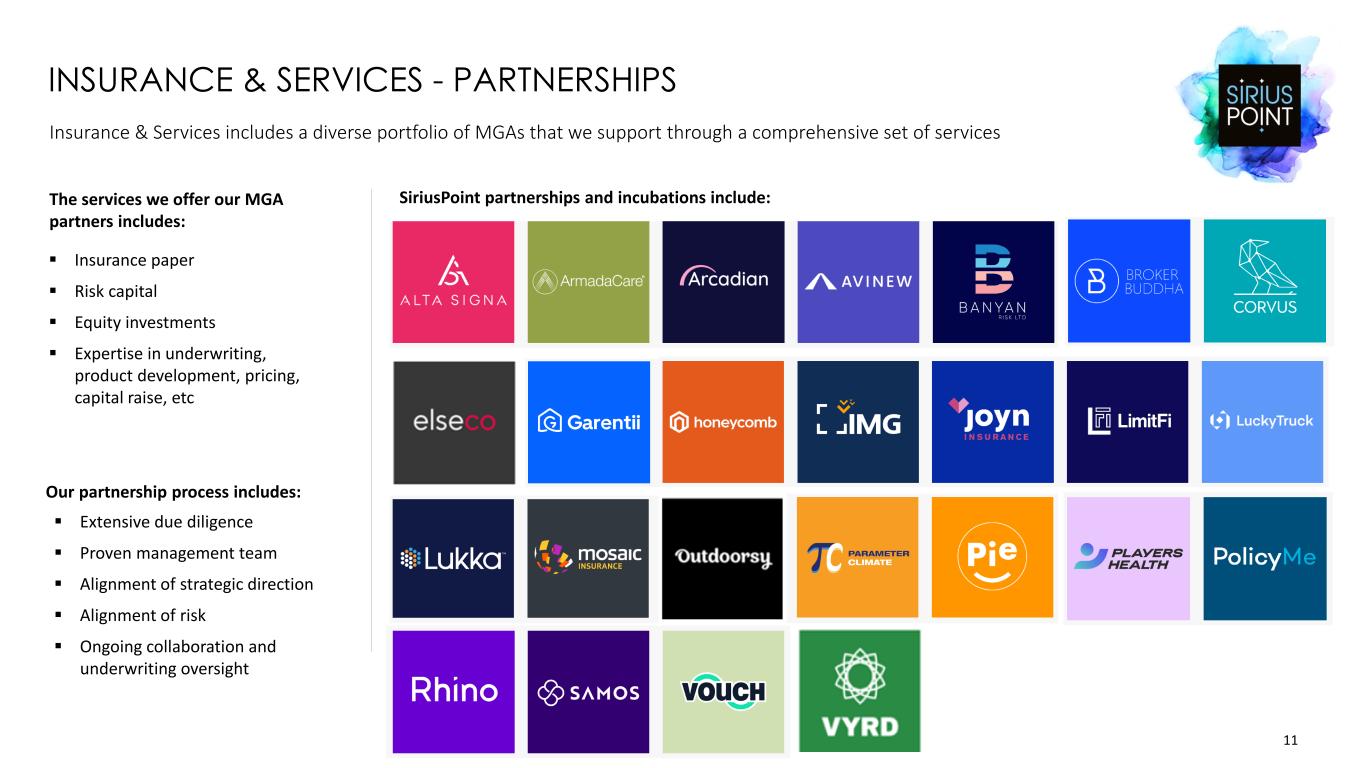

The services we offer our MGA partners includes: INSURANCE & SERVICES - PARTNERSHIPS Insurance & Services includes a diverse portfolio of MGAs that we support through a comprehensive set of services ▪ Insurance paper ▪ Risk capital ▪ Equity investments ▪ Expertise in underwriting, product development, pricing, capital raise, etc ▪ Extensive due diligence ▪ Proven management team ▪ Alignment of strategic direction ▪ Alignment of risk ▪ Ongoing collaboration and underwriting oversight Our partnership process includes: SiriusPoint partnerships and incubations include: 11

▪ SiriusPoint is a leading global reinsurer. SiriusPoint offers treaty and facultative reinsurance through our network of international branch offices, our Lloyd's Syndicate and our platforms in the U.S. and Bermuda ▪ We access profitable business by leveraging our relationships with local and international insurers and brokers ▪ Following actions taken as a result of an extensive underwriting review, SiriusPoint expects to have: ▪ a reduced catastrophe volatility profile ▪ an improved and differentiated global specialty and casualty business ▪ a more balanced business profile ▪ shifting mix of business from reinsurance to insurance ▪ Our ongoing focus is on allocating our capital to profitable underwriting opportunities while being a partner of choice for clients and brokers REINSURANCE 12 With our opportunistic approach, we maintain the flexibility to shift our strategy to reinsurance renewals annually based on market conditions and risk appetite.

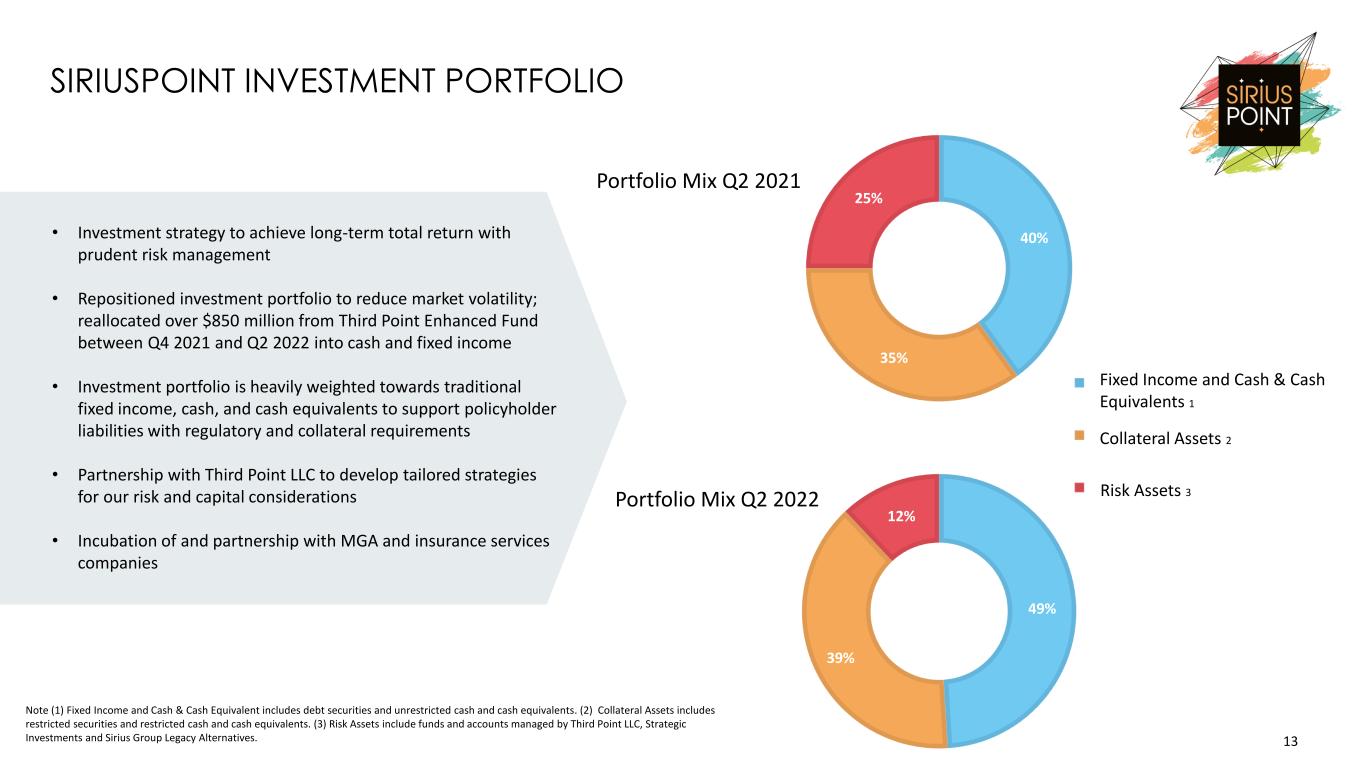

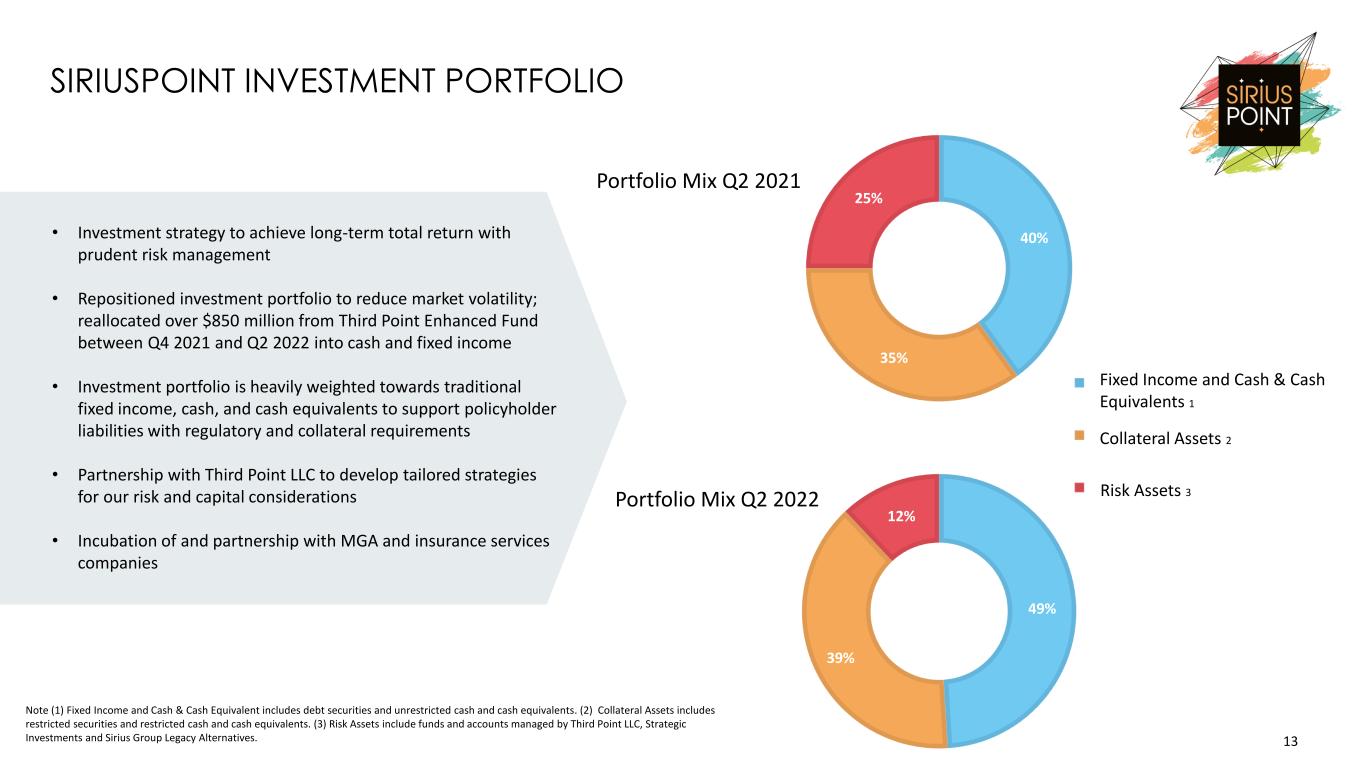

40% 35% 25% SIRIUSPOINT INVESTMENT PORTFOLIO Note (1) Fixed Income and Cash & Cash Equivalent includes debt securities and unrestricted cash and cash equivalents. (2) Collateral Assets includes restricted securities and restricted cash and cash equivalents. (3) Risk Assets include funds and accounts managed by Third Point LLC, Strategic Investments and Sirius Group Legacy Alternatives. • Investment strategy to achieve long-term total return with prudent risk management • Repositioned investment portfolio to reduce market volatility; reallocated over $850 million from Third Point Enhanced Fund between Q4 2021 and Q2 2022 into cash and fixed income • Investment portfolio is heavily weighted towards traditional fixed income, cash, and cash equivalents to support policyholder liabilities with regulatory and collateral requirements • Partnership with Third Point LLC to develop tailored strategies for our risk and capital considerations • Incubation of and partnership with MGA and insurance services companies 13 Fixed Income and Cash & Cash Equivalents 1 Collateral Assets 2 Risk Assets 3 49% 39% 12% Portfolio Mix Q2 2021 Portfolio Mix Q2 2022

PRESENTATION TITLE OES HERE 14 14 APPENDIX: 15 SIRIUSPOINT LTD. ISSUED CAPITAL INSTRUMENTS 16 2Q 2022 SEGMENT REPORTING 17 6M 2022 SEGMENT REPORTING For information purposes only

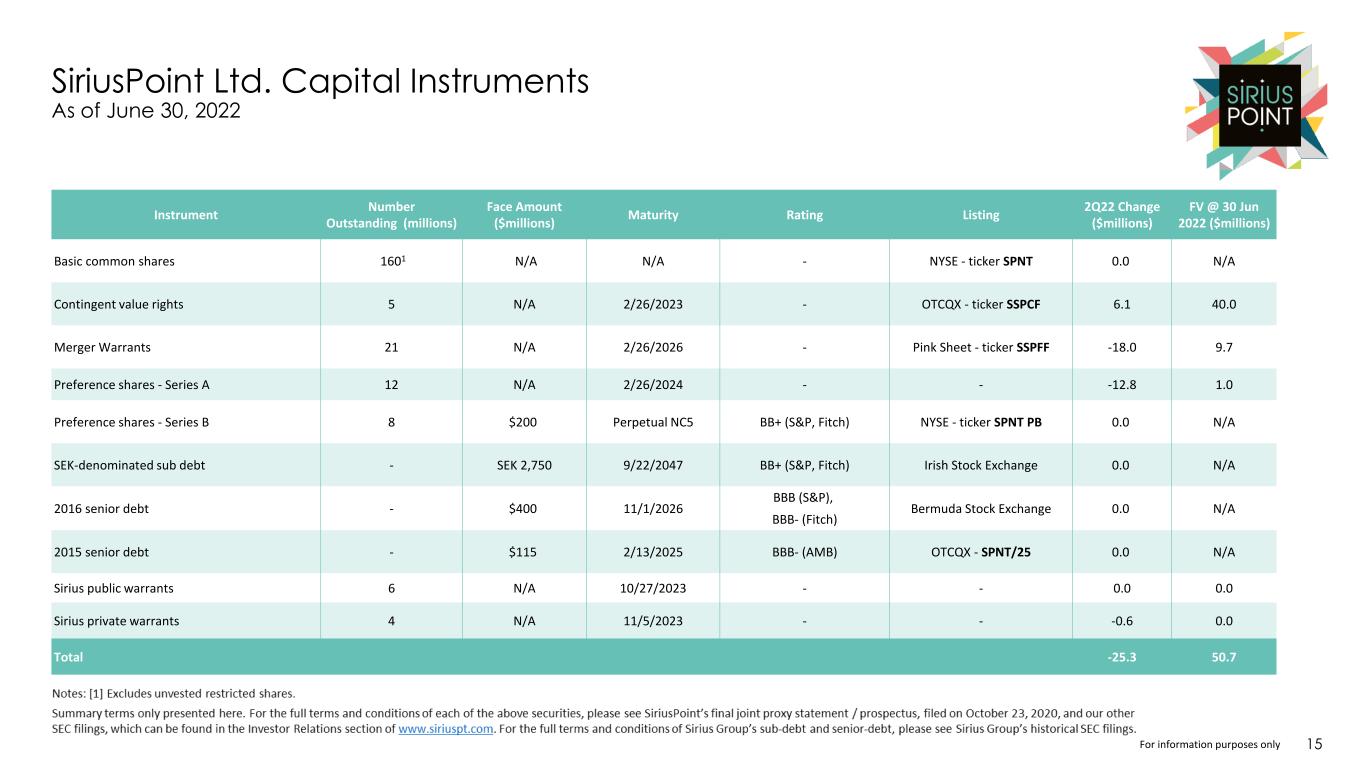

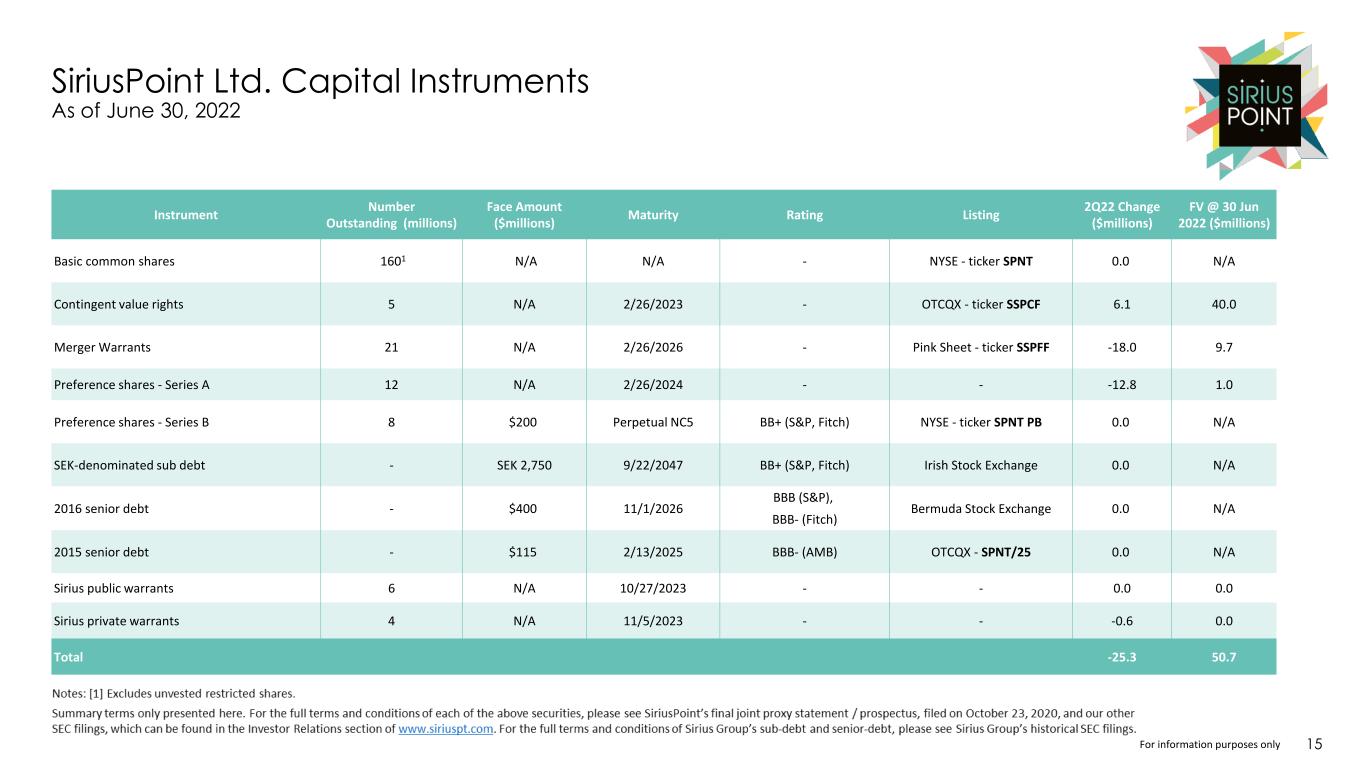

For information purposes only SiriusPoint Ltd. Capital Instruments As of June 30, 2022 15 Instrument Number Outstanding (millions) Face Amount ($millions) Maturity Rating Listing 2Q22 Change ($millions) FV @ 30 Jun 2022 ($millions) Basic common shares 1601 N/A N/A - NYSE - ticker SPNT 0.0 N/A Contingent value rights 5 N/A 2/26/2023 - OTCQX - ticker SSPCF 6.1 40.0 Merger Warrants 21 N/A 2/26/2026 - Pink Sheet - ticker SSPFF -18.0 9.7 Preference shares - Series A 12 N/A 2/26/2024 - - -12.8 1.0 Preference shares - Series B 8 $200 Perpetual NC5 BB+ (S&P, Fitch) NYSE - ticker SPNT PB 0.0 N/A SEK-denominated sub debt - SEK 2,750 9/22/2047 BB+ (S&P, Fitch) Irish Stock Exchange 0.0 N/A 2016 senior debt - $400 11/1/2026 BBB (S&P), Bermuda Stock Exchange 0.0 N/A BBB- (Fitch) 2015 senior debt - $115 2/13/2025 BBB- (AMB) OTCQX - SPNT/25 0.0 N/A Sirius public warrants 6 N/A 10/27/2023 - - 0.0 0.0 Sirius private warrants 4 N/A 11/5/2023 - - -0.6 0.0 Total -25.3 50.7

For information purposes only 2Q 2022 SEGMENT REPORTING 1 2 4 3 Income related to consolidated MGAs. Commission/Fee Income for business that is written on SiriusPoint paper is eliminated and third-party business re-classed to Other Revenues. Investment gains/losses from investment in the strategic partners. Presented in net realized and unrealized investment gains (losses) on U.S. GAAP basis, the line item shows the fair value gain (loss) of the partial ownership which is core to the new strategy. Represents minority ownership (usually MGA management) results attributable to the consolidated MGAs such as Arcadian, Joyn, and Banyan, determined by the Services Revenue, before eliminations, less Services Expense multiplied by the MGA ownership percentage. Direct expenses of consolidated MGAs plus allocated corporate expenses aligned with sourcing, signing and management of the MGA relationships. 16 Three months ended June 30, 2022 Actuals $ in mm Reinsurance Insurance & Services Core Eliminations Corporate Segment Measure Reclass Total Net premiums earned 319.5 244.3 563.8 - 5.0 - 568.8 Loss and loss adjustment expenses incurred, net 204.7 154.8 359.5 (1.1) 1.9 - 360.3 Acquisition costs, net 86.3 63.9 150.2 (26.8) 0.2 - 123.6 Other underwriting expenses 28.7 15.8 44.5 0.0 1.6 - 46.1 Underwriting income (loss) (0.2) 9.8 9.6 27.9 1.3 - 38.8 Services revenue - 56.6 56.6 (36.7) - (19.9) - Services expenses - 44.8 44.8 0.0 - (44.8) - Net services fee income - 11.8 11.8 (36.7) - 24.9 - Services noncontrolling loss - (0.7) (0.7) 0.0 - 0.7 - Net investment gains (losses) from strategic investments - (0.5) (0.5) 0.0 - 0.5 - Net services income - 10.6 10.6 (36.7) - 26.1 - Segment income (loss) (0.2) 20.4 20.2 (8.8) 1.3 26.1 38.8 Net realized and unrealized investment (losses) (97.9) (0.5) (98.4) Net investment loss from investments in related party investment funds (60.5) - (60.5) Other net investment income 17.4 - 17.4 Other revenues 25.9 19.9 45.8 Net corporate and other expenses (27.2) (44.8) (72.0) Intangible asset amortization (2.0) - (2.0) Interest expense (9.4) - (9.4) Foreign exchange gains 56.5 - 56.5 Loss before income tax benefit (0.2) 20.4 20.2 (8.8) (95.9) 0.7 (83.8) Income tax (expense) benefit - - 27.7 - 27.7 Net Income (loss) 20.2 (8.8) (68.2) 0.7 (56.1) Net loss (income) attributable to noncontrolling interest - - 0.0 (0.7) (0.7) Net income (loss) attributable to SiriusPoint 20.2 (8.8) (68.2) - (56.8) Combined Ratio 100.1% 96.1% 98.3% 93.1% 1 2 3 4 4 3 1 2

For information purposes only 6M 2022 SEGMENT REPORTING 1 2 4 3 Income related to consolidated MGAs. Commission/Fee Income for business that is written on SiriusPoint paper is eliminated and third-party business re-classed to Other Revenues. Investment gains/losses from investment in the strategic partners. Presented in net realized and unrealized investment gains (losses) on U.S. GAAP basis, the line item shows the fair value gain (loss) of the partial ownership which is core to the new strategy. Represents minority ownership (usually MGA management) results attributable to the consolidated MGAs such as Arcadian, Joyn, and Banyan, determined by the Services Revenue, before eliminations, less Services Expense multiplied by the MGA ownership percentage. Direct expenses of consolidated MGAs plus allocated corporate expenses aligned with sourcing, signing and management of the MGA relationships. 17 Six months ended June 30, 2022 Actuals $ in mm Reinsurance Insurance & Services Core Eliminations Corporate Segment Measure Reclass Total Net premiums earned 627.1 457.1 1,084.2 - 13.9 - 1,098.1 Loss and loss adjustment expenses incurred, net 399.2 288.8 688.0 (2.3) 14.7 - 700.4 Acquisition costs, net 166.2 117.4 283.6 (52.4) 0.9 - 232.1 Other underwriting expenses 58.8 31.5 90.3 0.0 3.0 - 93.3 Underwriting income (loss) 2.9 19.4 22.3 54.7 (4.7) - 72.3 Services revenue - 113.4 113.4 (67.5) - (45.9) - Services expenses - 88.1 88.1 0.0 - (88.1) - Net services fee income - 25.3 25.3 (67.5) - 42.2 - Services noncontrolling loss - 0.1 0.1 0.0 - (0.1) - Net investment gains (losses) from strategic investments - (0.8) (0.8) 0.0 - 0.8 - Net services income - 24.6 24.6 (67.5) - 42.9 - Segment income (loss) 2.9 44.0 46.9 (12.8) (4.7) 42.9 72.3 Net realized and unrealized investment (losses) (179.5) (0.8) (180.3) Net investment loss from investments in related party investment funds (191.5) - (191.5) Other net investment income 25.2 - 25.2 Other revenues 37.1 45.9 83.0 Net corporate and other expenses (61.3) (88.1) (149.4) Intangible asset amortization (3.9) - (3.9) Interest expense (18.7) - (18.7) Foreign exchange gains 75.9 - 75.9 Loss before income tax benefit 2.9 44.0 46.9 (12.8) (321.4) (0.1) (287.4) Income tax (expense) benefit - - 18.0 - 18.0 Net Income (loss) 46.9 (12.8) (303.4) (0.1) (269.4) Net loss (income) attributable to noncontrolling interest - - (0.5) 0.1 (0.4) Net income (loss) attributable to SiriusPoint 46.9 (12.8) (303.9) - (269.8) Combined Ratio 99.6% 95.8% 98.0% 93.4% 1 2 3 4 4 3 1 2

PRESENTATION TITLE OES HERE THANK YOU