SIRIUSPOINT LTD. – A GLOBAL UNDERWRITER 2024 Full Year and Fourth Quarter Results February 18, 2025

Basis of Presentation and Non-GAAP Financial Measures: Unless the context otherwise indicates or requires, as used in this presentation references to “we,” “our,” “us,” the “Company,” and "SiriusPoint" refer to SiriusPoint Ltd. and its directly and indirectly owned subsidiaries, as a combined entity, except where otherwise stated or where it is clear that the terms mean only SiriusPoint Ltd. exclusive of its subsidiaries. We have made rounding adjustments to reach some of the figures included in this presentation and, unless otherwise indicated, percentages presented in this presentation are approximate. In presenting SiriusPoint’s results, management has included financial measures that are not calculated under standards or rules that comprise accounting principles generally accepted in the United States (“GAAP”). SiriusPoint’s management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of SiriusPoint’s financial performance, identifying trends in our results and providing meaningful period-to-period comparisons. Core underwriting income, Core net services income, Core income, Core combined ratio, accident year loss ratio, accident year combined ratio and attritional loss ratio are non-GAAP financial measures. Management believes it is useful to review Core results as it better reflects how management views the business and reflects the Company’s decision to exit the runoff business. Book value per diluted common share excluding accumulated other comprehensive income (loss) ("AOCI") and tangible book value per diluted common share, as presented, are non-GAAP financial measures and the most directly comparable U.S. GAAP measure is book value per common share. Management believes it is useful to exclude AOCI because it may fluctuate significantly between periods based on movements in interest and currency rates. Management believes the effects of intangible assets are not indicative of underlying underwriting results or trends and make book value comparisons to less acquisitive peer companies less meaningful. Underlying net income is a non-GAAP financial measure and the most directly comparable U.S. GAAP measure is net income. Underlying net income excludes items which we believe are not indicative of the operations of our underlying businesses, including realized and unrealized gains (losses) on strategic and other investments and liability-classified capital instruments, income (expense) related to loss portfolio transfers, deferred tax assets attributable to the enactment of the Bermuda corporate income tax, development on COVID-19 reserves resulting from the COVID-19 reserve study performed concurrently with the settlement of the Series A Preference shares in the third quarter of 2024, and foreign exchange gains (losses). We believe it is useful to review underlying net income as it better reflects how we view the business, as well as provides investors with an alternative metric that can assist in predicting future earnings and profitability that are complementary to GAAP metrics. Underlying return on average common shareholders’ equity is calculated by dividing underlying net income available to SiriusPoint common shareholders for the period by the average common shareholders’ equity, excluding AOCI. Management believes it is useful to exclude AOCI because it may fluctuate significantly between periods based on movements in interest and currency rates. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measure is contained in our Form 10-K, earnings release or financial Supplement for the fiscal year ended December 31, 2024. Safe Harbor Statement Regarding Forward-Looking Statements: This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond the Company’s control. The Company cautions you that the forward-looking information presented in this presentation is not a guarantee of future events, and that actual events may differ materially from those made in or suggested by the forward-looking information contained in this presentation. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “believes,” “intends,” “seeks,” “anticipates,” “aims,” “plans,” “targets,” “estimates,” “expects,” “assumes,” “continues,” “guidance,” “should,” “could,” “will,” “may” and the negative of these or similar terms and phrases. Specific forward-looking statements in this press release include, but not limited to, statements regarding the trend of our performance as compared to the previous guidance, the success of our strategic transaction with CMIG, the current insurtech market trends, our ability to generate shareholder value and whether we will continue to have momentum in our business in the future. Actual events, results and outcomes may differ materially from the Company’s expectations due to a variety of known and unknown risks, uncertainties and other factors. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements are the following: our ability to execute on our strategic transformation, including re-underwriting to reduce volatility and improve underwriting performance, de-risking our investment portfolio, and transforming our business; the impact of unpredictable catastrophic events, including uncertainties with respect to current and future COVID-19 losses across many classes of insurance business and the amount of insurance losses that may ultimately be ceded to the reinsurance market, supply chain issues, labor shortages and related increased costs, changing interest rates and equity market volatility; inadequacy of loss and loss adjustment expense reserves, the lack of available capital, and periods characterized by excess underwriting capacity and unfavorable premium rates; the performance of financial markets, impact of inflation and interest rates, and foreign currency fluctuations; our ability to compete successfully in the insurance and reinsurance market and the effect of consolidation in the insurance and reinsurance industry; technology breaches or failures, including those resulting from a malicious cyber-attack on us, our business partners or service providers; the effects of global climate change, including increased severity and frequency of weather-related natural disasters and catastrophes, including wildfires, and increased coastal flooding in many geographic areas; geopolitical uncertainty, including the ongoing conflicts in Europe and the Middle East and the new presidential administration in the U.S.; our ability to retain key senior management and key employees; a downgrade or withdrawal of our financial ratings; fluctuations in our results of operations; legal restrictions on certain of SiriusPoint’s insurance and reinsurance subsidiaries’ ability to pay dividends and other distributions to SiriusPoint; the outcome of legal and regulatory proceedings and regulatory constraints on our business; reduced returns or losses in SiriusPoint’s investment portfolio; our exposure or potential exposure to corporate income tax in Bermuda and the E.U., U.S. federal income and withholding taxes and our significant deferred tax assets, which could become devalued if we do not generate future taxable income or applicable corporate tax rates are reduced; risks associated with delegating authority to third party managing general agents; future strategic transactions such as acquisitions, dispositions, investments, mergers or joint ventures; SiriusPoint’s response to any acquisition proposal that may be received from any party, including any actions that may be considered by the Company’s Board of Directors or any committee thereof; and other risks and factors listed under "Risk Factors" in the Company's most recent Annual Report on Form 10-K and other subsequent periodic reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date made and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. 2 Disclaimer

Agenda 3 Full Year and Quarterly Results Update • Fourth Quarter 2024 Results • Full Year 2024 Results • Premium Trends & Premium Analysis • Underwriting Performance • Catastrophe Losses & Portfolio Volatility • Investment Income • Balance Sheet, Capital & Liquidity Introduction • Key Messages • Actions Towards Strategic Priorities • Building a Track Record • Specialized Business Model • Infrastructure Investment • Growth Amongst Pricing Discipline • CMIG Transaction Update

Introduction 4

5 Key Messages: Strong Performance, Major Reshaping Complete Notes: [1] Excludes releases related to loss portfolio transactions. [2] Continuing lines premium adjusts prior year comparators for $422m of Cyber and Workers' Compensation premiums exited during 2023. [3] See page 11 for more details. [4] Diluted Book Value Per Common Share. [5] Underlying ROE represents a non-GAAP measure. See page 2 for further details and Appendix 2 on page 25 for a reconciliation. [6] ROE calculated as annualized net income available to SiriusPoint common shareholders divided by average common shareholders' equity. [7] SiriusPoint Group Bermuda Solvency Capital Ratio calculated as available economic capital and surplus divided by the enhanced capital requirement. Q4'24 figure is an estimate. Good steward of capital, with relentless focus on value creation 9th consecutive quarter of positive U/W result and targeted growth • The agreement with CMIG announced on December 30, 2024 is set to close on or before February 28, 20253 • Simplified shareholder and governance structure, while reducing volatility in P&L from legacy financial instruments • Agreement immediately accretive to BVPS4 and meaningfully accretive to EPS & ROE • Announcing that upon completion, all of the common shares repurchased from CMIG are to be fully retired • Underlying FY 24 ROE5 of 14.6%, at upper end of target range; headline ROE (including one-offs)6 of 9.1% • Diluted BVPS (ex. AOCI) up 3% in the quarter and 10% YTD to $14.64 • BSCR7 strong at 214% as of FY 24, with debt to capital ratio of 24.8%, post December CMIG transaction All three earnings engines outperforming • Underwriting profit for the Core Business of $200m for FY 24 (up 34% vs. FY 23 ex. LPT) • 100%-owned A&H MGAs net service fee income up 36% to $42m in FY 24, with carrying book value of $89m • Net investment income of $304m in FY 24, ahead of updated guidance Strong capital position and healthy balance sheet producing target returns Continued prudent approach to reserving and managing volatility • 15 consecutive quarters of favourable PYD, surpassing insurance reserves liability duration of 3.0 years • External reserve review completed during the quarter, further validating our reserves as prudent • Hurricane Milton is an estimated loss of $40m, aligned with the guidance provided at Q3'24 • California Wildfires initial net loss estimate is $60m to $70m, shielded from deterioration by our retrocession program • FY 24 Core COR of 91.0%, which is a 2 ppt improvement ex. LPT1, driven by 4 ppts of attritional loss ratio improvement YoY • Strong continuing lines2 GPW growth of 21% in Q4 contributed to overall growth of 10% YoY in FY 24 • Expanded distribution through the addition of 19 new programs via MGA Centre of Excellence in the year (2023: 9)

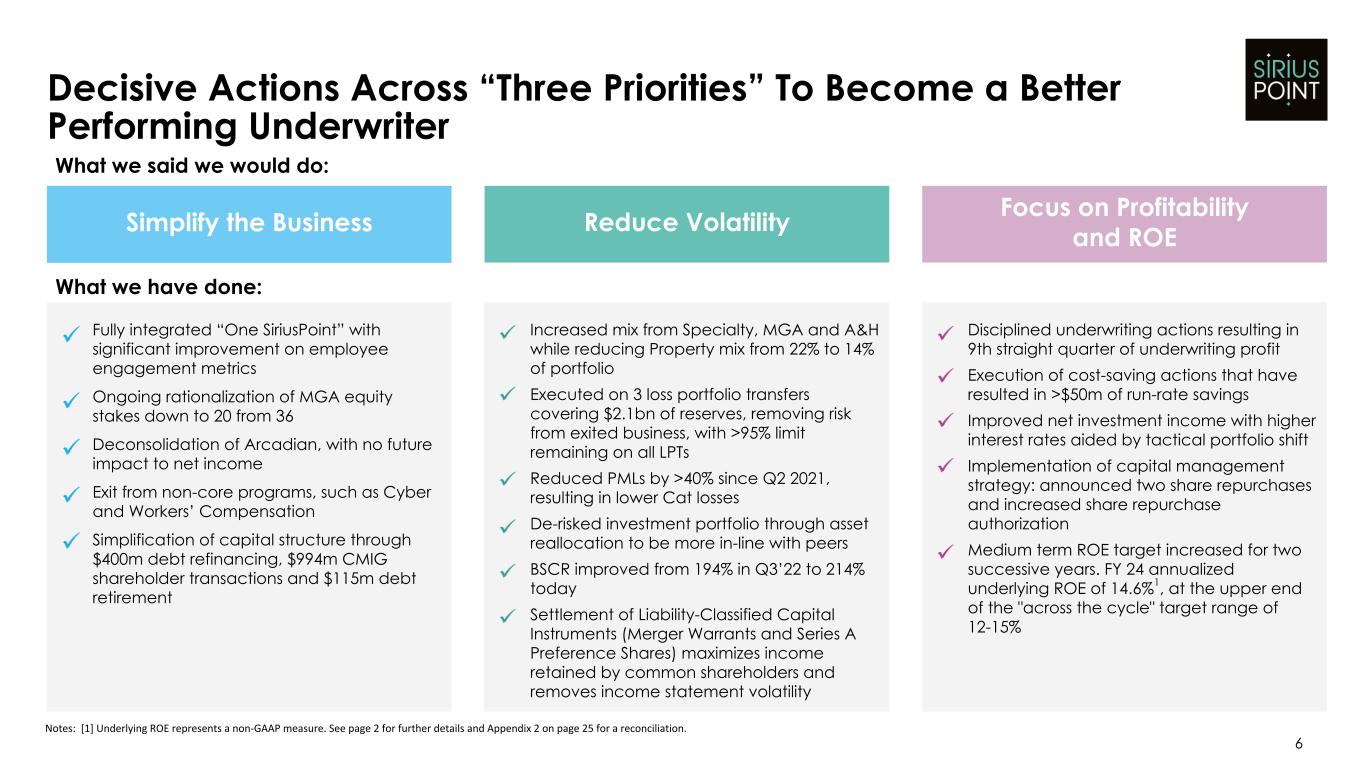

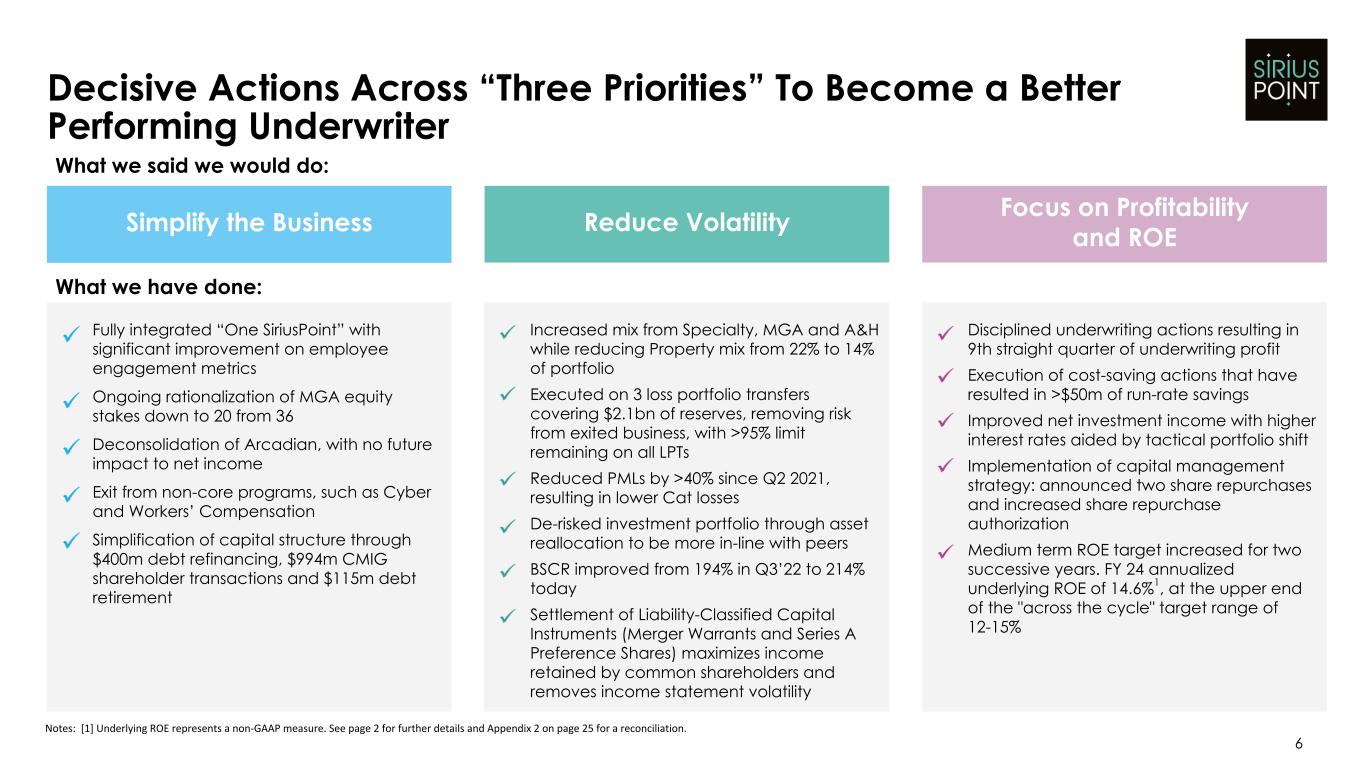

6 Decisive Actions Across “Three Priorities” To Become a Better Performing Underwriter Simplify the Business Reduce Volatility Focus on Profitability and ROE What we said we would do: What we have done: Fully integrated “One SiriusPoint” with significant improvement on employee engagement metrics Ongoing rationalization of MGA equity stakes down to 20 from 36 Deconsolidation of Arcadian, with no future impact to net income Exit from non-core programs, such as Cyber and Workers’ Compensation Simplification of capital structure through $400m debt refinancing, $994m CMIG shareholder transactions and $115m debt retirement Increased mix from Specialty, MGA and A&H while reducing Property mix from 22% to 14% of portfolio Executed on 3 loss portfolio transfers covering $2.1bn of reserves, removing risk from exited business, with >95% limit remaining on all LPTs Reduced PMLs by >40% since Q2 2021, resulting in lower Cat losses De-risked investment portfolio through asset reallocation to be more in-line with peers BSCR improved from 194% in Q3’22 to 214% today Settlement of Liability-Classified Capital Instruments (Merger Warrants and Series A Preference Shares) maximizes income retained by common shareholders and removes income statement volatility Disciplined underwriting actions resulting in 9th straight quarter of underwriting profit Execution of cost-saving actions that have resulted in >$50m of run-rate savings Improved net investment income with higher interest rates aided by tactical portfolio shift Implementation of capital management strategy: announced two share repurchases and increased share repurchase authorization Medium term ROE target increased for two successive years. FY 24 annualized underlying ROE of 14.6%1, at the upper end of the "across the cycle" target range of 12-15% Notes: [1] Underlying ROE represents a non-GAAP measure. See page 2 for further details and Appendix 2 on page 25 for a reconciliation.

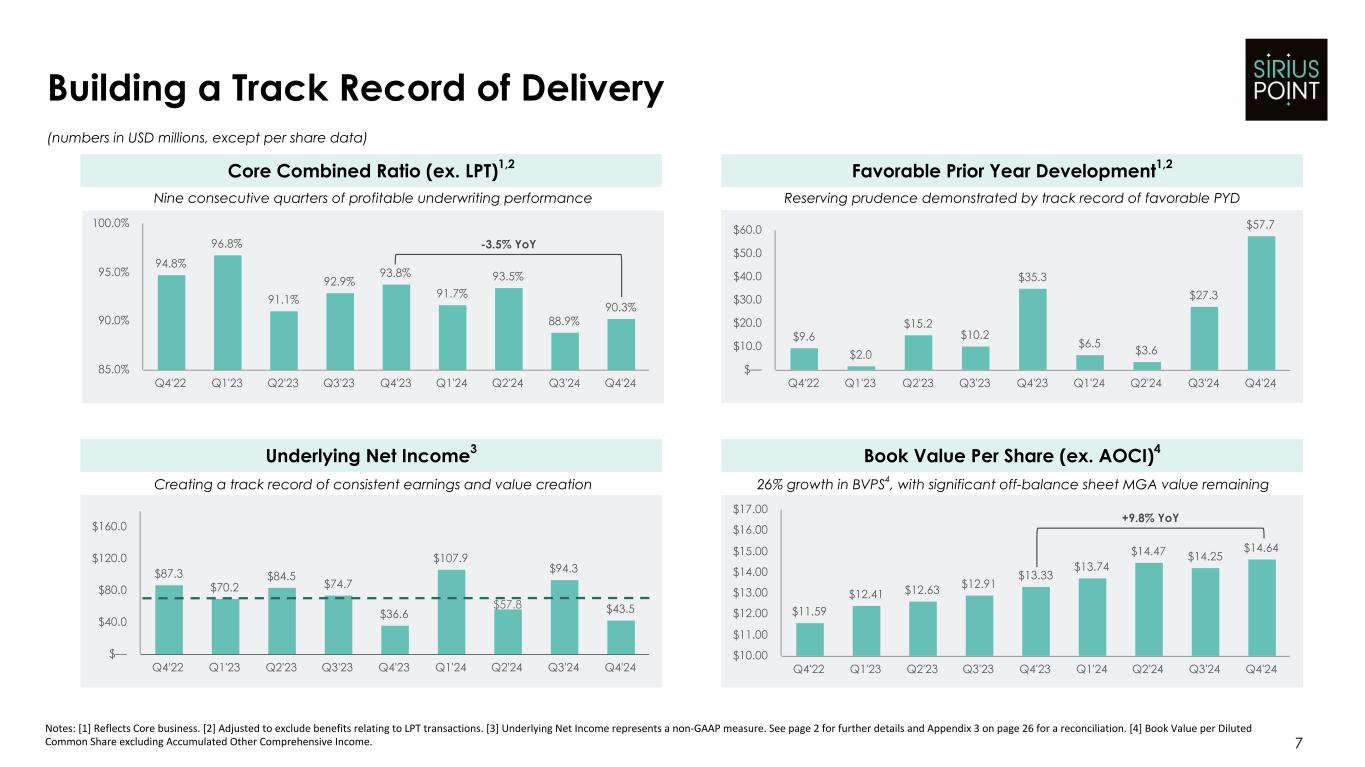

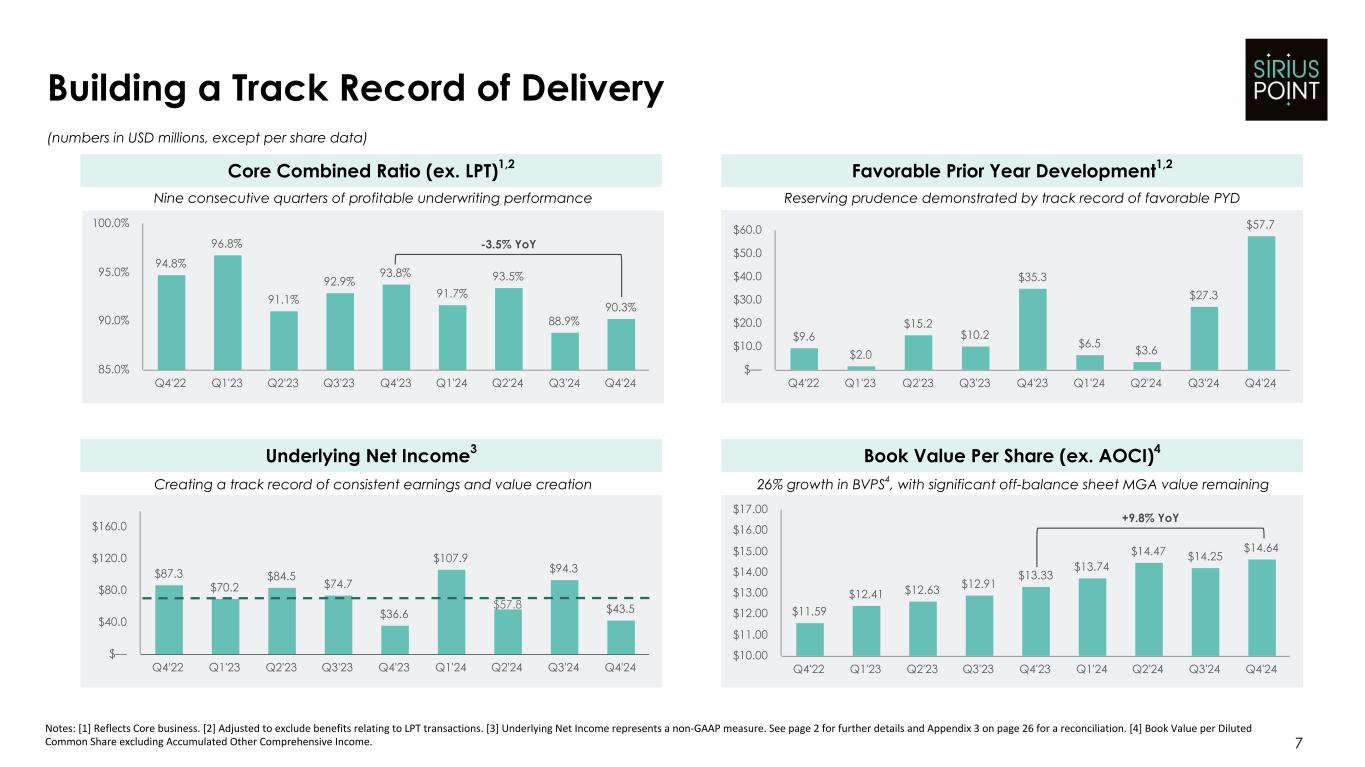

$11.59 $12.41 $12.63 $12.91 $13.33 $13.74 $14.47 $14.25 $14.64 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 $10.00 $11.00 $12.00 $13.00 $14.00 $15.00 $16.00 $17.00 $87.3 $70.2 $84.5 $74.7 $36.6 $107.9 $57.8 $94.3 $43.5 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 $— $40.0 $80.0 $120.0 $160.0 7 Building a Track Record of Delivery Notes: [1] Reflects Core business. [2] Adjusted to exclude benefits relating to LPT transactions. [3] Underlying Net Income represents a non-GAAP measure. See page 2 for further details and Appendix 3 on page 26 for a reconciliation. [4] Book Value per Diluted Common Share excluding Accumulated Other Comprehensive Income. Core Combined Ratio (ex. LPT)1,2 Underlying Net Income3 Book Value Per Share (ex. AOCI)4 Favorable Prior Year Development1,2 $9.6 $2.0 $15.2 $10.2 $35.3 $6.5 $3.6 $27.3 $57.7 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 $— $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 94.8% 96.8% 91.1% 92.9% 93.8% 91.7% 93.5% 88.9% 90.3% Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 85.0% 90.0% 95.0% 100.0% Nine consecutive quarters of profitable underwriting performance Reserving prudence demonstrated by track record of favorable PYD (numbers in USD millions, except per share data) Creating a track record of consistent earnings and value creation -3.5% YoY $57.8 +9.8% YoY 26% growth in BVPS4, with significant off-balance sheet MGA value remaining

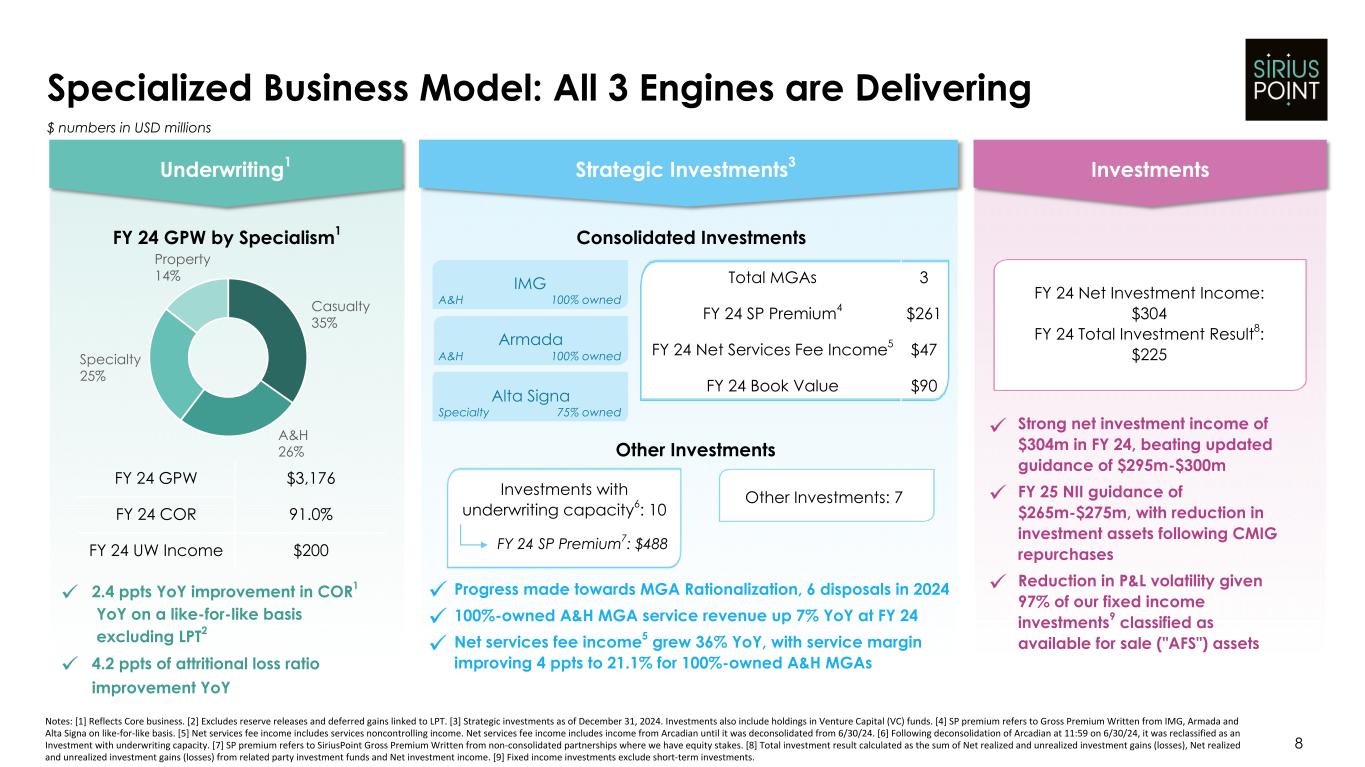

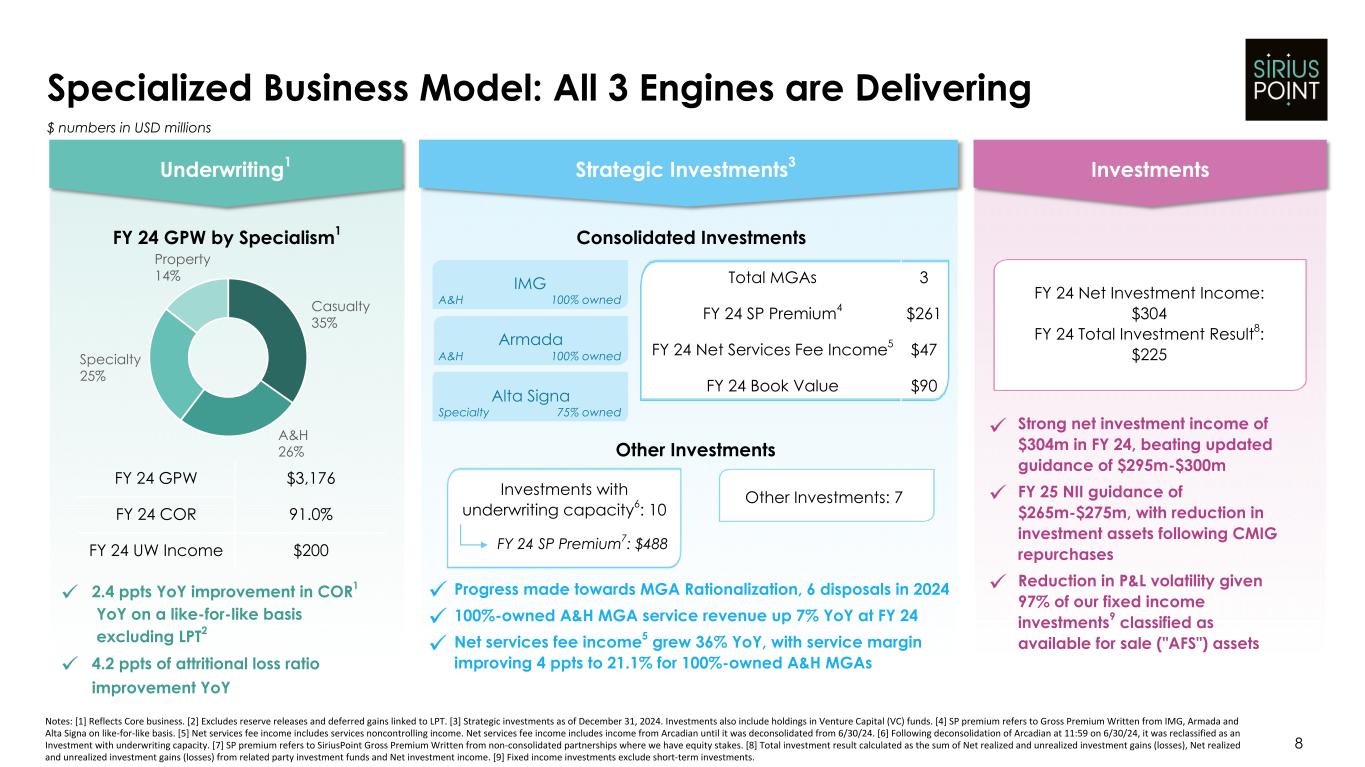

Casualty 35% A&H 26% Specialty 25% Property 14% 8 Specialized Business Model: All 3 Engines are Delivering Notes: [1] Reflects Core business. [2] Excludes reserve releases and deferred gains linked to LPT. [3] Strategic investments as of December 31, 2024. Investments also include holdings in Venture Capital (VC) funds. [4] SP premium refers to Gross Premium Written from IMG, Armada and Alta Signa on like-for-like basis. [5] Net services fee income includes services noncontrolling income. Net services fee income includes income from Arcadian until it was deconsolidated from 6/30/24. [6] Following deconsolidation of Arcadian at 11:59 on 6/30/24, it was reclassified as an Investment with underwriting capacity. [7] SP premium refers to SiriusPoint Gross Premium Written from non-consolidated partnerships where we have equity stakes. [8] Total investment result calculated as the sum of Net realized and unrealized investment gains (losses), Net realized and unrealized investment gains (losses) from related party investment funds and Net investment income. [9] Fixed income investments exclude short-term investments. Underwriting1 InvestmentsStrategic Investments3 FY 24 GPW by Specialism1 FY 24 GPW $3,176 FY 24 COR 91.0% FY 24 UW Income $200 2.4 ppts YoY improvement in COR1 YoY on a like-for-like basis excluding LPT2 4.2 ppts of attritional loss ratio improvement YoY Consolidated Investments Other Investments FY 24 Net Investment Income: $304 FY 24 Total Investment Result8: $225 IMG Alta Signa Investments with underwriting capacity6: 10 Other Investments: 7 Progress made towards MGA Rationalization, 6 disposals in 2024 100%-owned A&H MGA service revenue up 7% YoY at FY 24 Net services fee income5 grew 36% YoY, with service margin improving 4 ppts to 21.1% for 100%-owned A&H MGAs Strong net investment income of $304m in FY 24, beating updated guidance of $295m-$300m FY 25 NII guidance of $265m-$275m, with reduction in investment assets following CMIG repurchases Reduction in P&L volatility given 97% of our fixed income investments9 classified as available for sale ("AFS") assets FY 24 SP Premium7: $488 $ numbers in USD millions Armada Total MGAs 3 FY 24 SP Premium4 $261 FY 24 Net Services Fee Income5 $47 FY 24 Book Value $90 100% owned 100% owned 75% owned A&H A&H Specialty

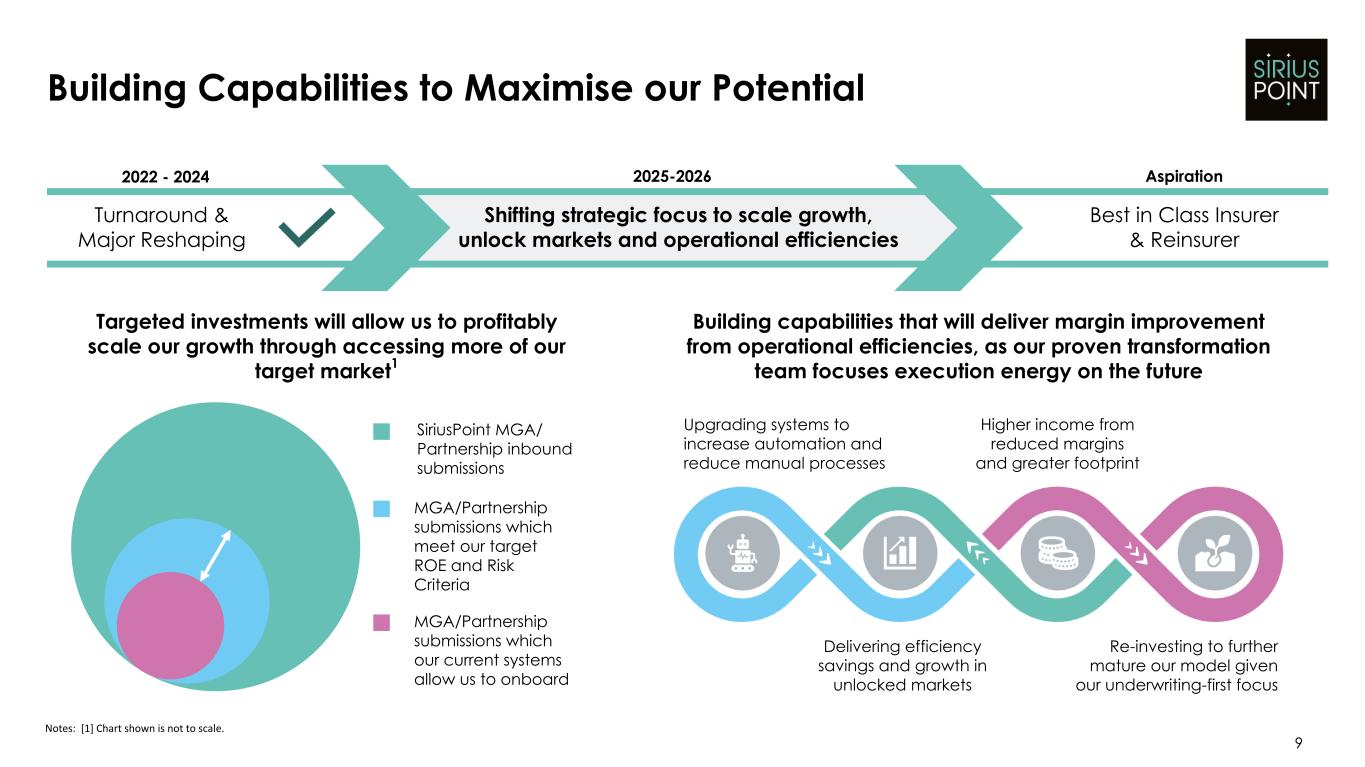

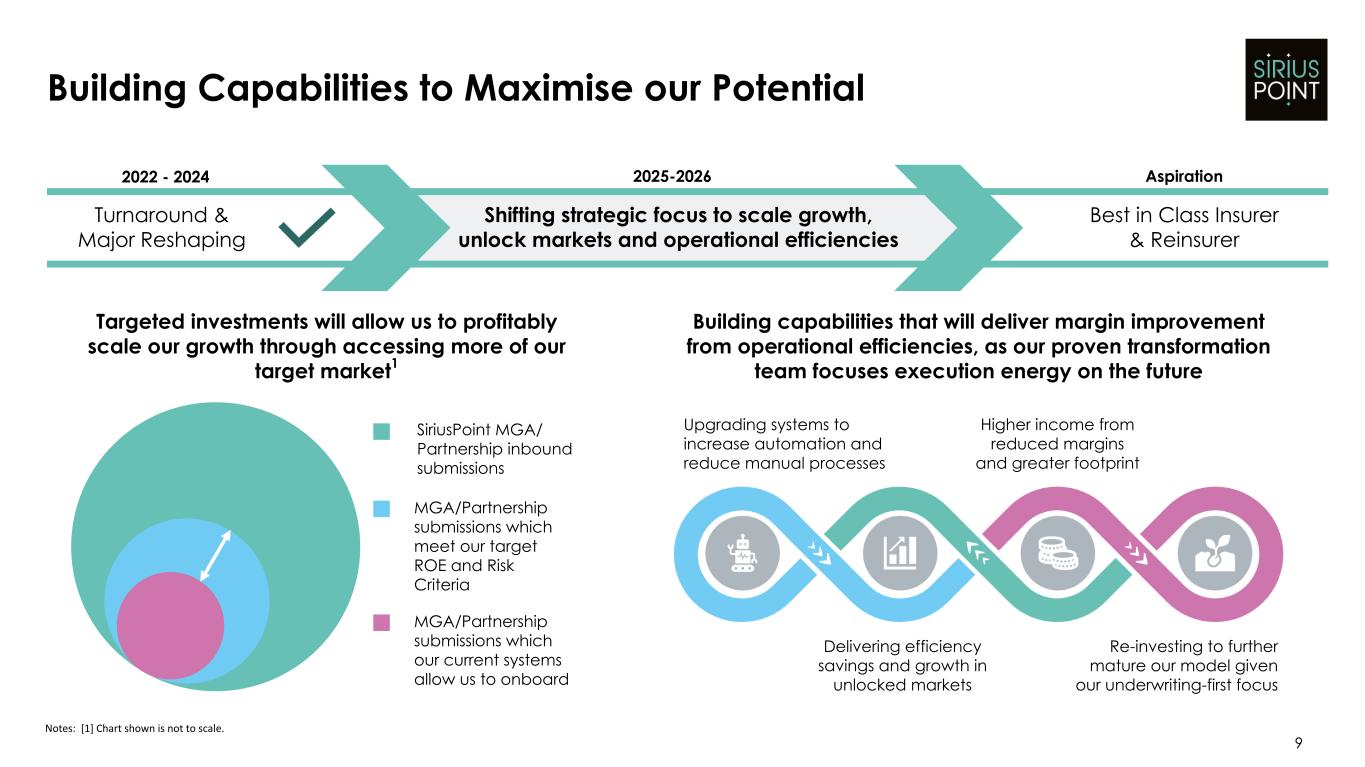

Building Capabilities to Maximise our Potential Notes: [1] Chart shown is not to scale. Turnaround & Major Reshaping Shifting strategic focus to scale growth, unlock markets and operational efficiencies Best in Class Insurer & Reinsurer 2022 - 2024 2025-2026 Aspiration Targeted investments will allow us to profitably scale our growth through accessing more of our target market1 SiriusPoint MGA/ Partnership inbound submissions MGA/Partnership submissions which meet our target ROE and Risk Criteria MGA/Partnership submissions which our current systems allow us to onboard Building capabilities that will deliver margin improvement from operational efficiencies, as our proven transformation team focuses execution energy on the future Upgrading systems to increase automation and reduce manual processes Delivering efficiency savings and growth in unlocked markets Higher income from reduced margins and greater footprint Re-investing to further mature our model given our underwriting-first focus 9

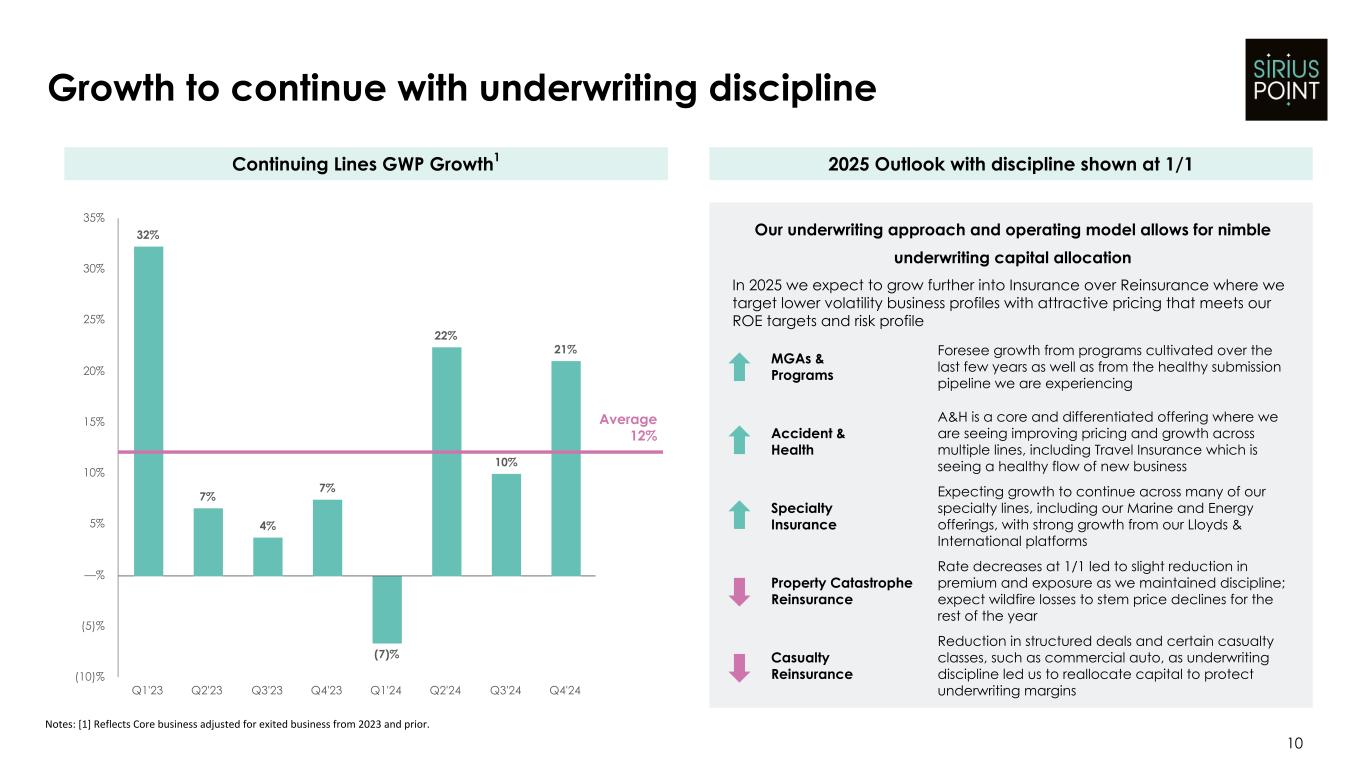

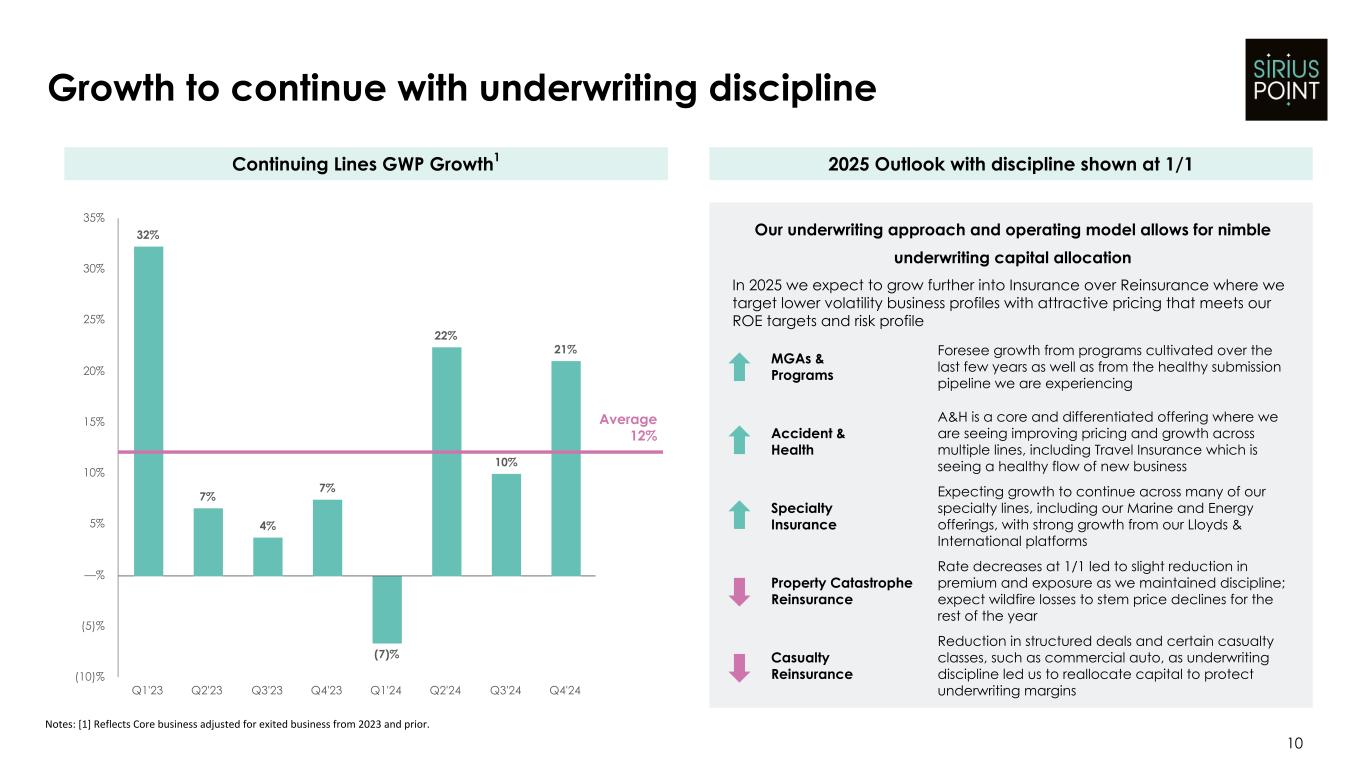

Growth to continue with underwriting discipline 10 Notes: [1] Reflects Core business adjusted for exited business from 2023 and prior. 32% 7% 4% 7% (7)% 22% 10% 21% Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 (10)% (5)% —% 5% 10% 15% 20% 25% 30% 35% Average 12% Continuing Lines GWP Growth1 2025 Outlook with discipline shown at 1/1 Property Catastrophe Reinsurance Rate decreases at 1/1 led to slight reduction in premium and exposure as we maintained discipline; expect wildfire losses to stem price declines for the rest of the year Casualty Reinsurance Reduction in structured deals and certain casualty classes, such as commercial auto, as underwriting discipline led us to reallocate capital to protect underwriting margins Our underwriting approach and operating model allows for nimble underwriting capital allocation In 2025 we expect to grow further into Insurance over Reinsurance where we target lower volatility business profiles with attractive pricing that meets our ROE targets and risk profile MGAs & Programs Foresee growth from programs cultivated over the last few years as well as from the healthy submission pipeline we are experiencing Accident & Health A&H is a core and differentiated offering where we are seeing improving pricing and growth across multiple lines, including Travel Insurance which is seeing a healthy flow of new business Specialty Insurance Expecting growth to continue across many of our specialty lines, including our Marine and Energy offerings, with strong growth from our Lloyds & International platforms

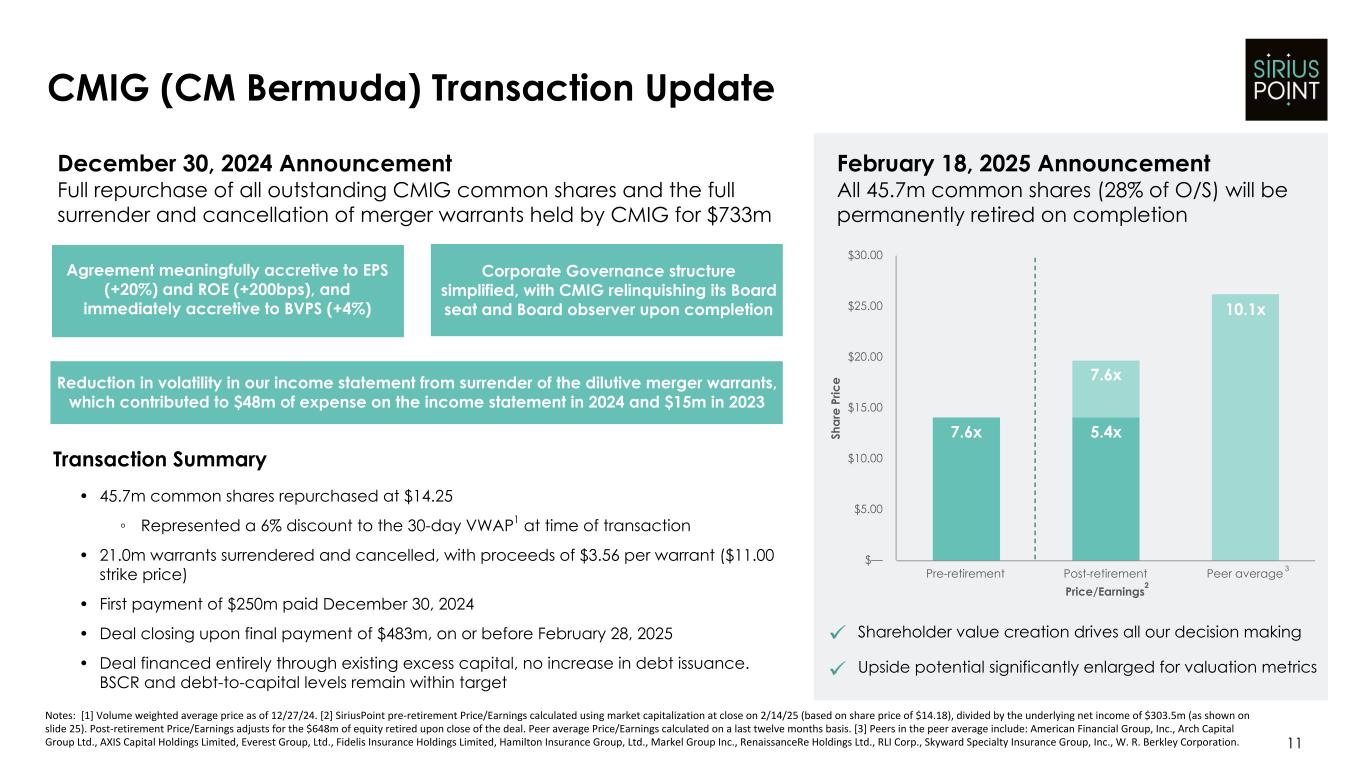

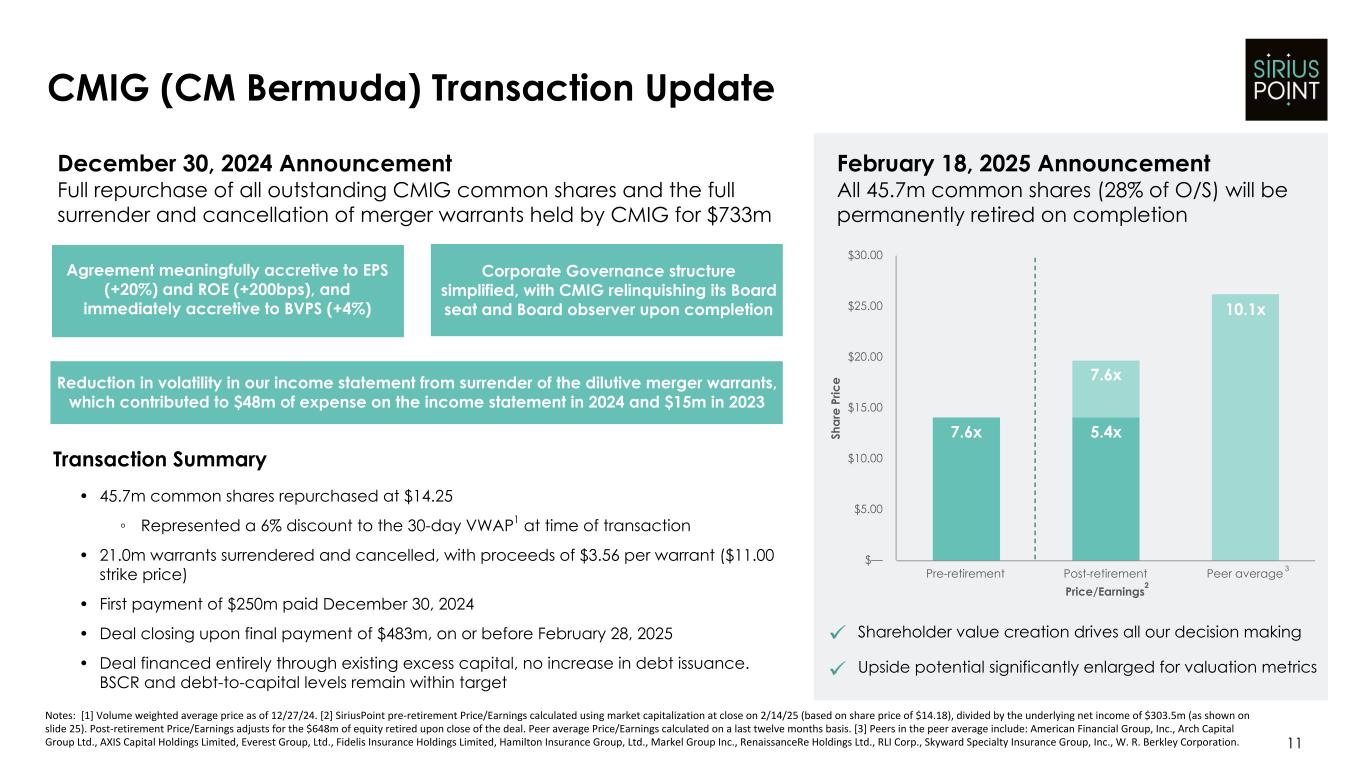

CMIG (CM Bermuda) Transaction Update Notes: [1] Volume weighted average price as of 12/27/24. [2] SiriusPoint pre-retirement Price/Earnings calculated using market capitalization at close on 2/14/25 (based on share price of $14.18), divided by the underlying net income of $303.5m (as shown on slide 25). Post-retirement Price/Earnings adjusts for the $648m of equity retired upon close of the deal. Peer average Price/Earnings calculated on a last twelve months basis. [3] Peers in the peer average include: American Financial Group, Inc., Arch Capital Group Ltd., AXIS Capital Holdings Limited, Everest Group, Ltd., Fidelis Insurance Holdings Limited, Hamilton Insurance Group, Ltd., Markel Group Inc., RenaissanceRe Holdings Ltd., RLI Corp., Skyward Specialty Insurance Group, Inc., W. R. Berkley Corporation. • 45.7m common shares repurchased at $14.25 ◦ Represented a 6% discount to the 30-day VWAP1 at time of transaction • 21.0m warrants surrendered and cancelled, with proceeds of $3.56 per warrant ($11.00 strike price) • First payment of $250m paid December 30, 2024 • Deal closing upon final payment of $483m, on or before February 28, 2025 • Deal financed entirely through existing excess capital, no increase in debt issuance. BSCR and debt-to-capital levels remain within target December 30, 2024 Announcement Full repurchase of all outstanding CMIG common shares and the full surrender and cancellation of merger warrants held by CMIG for $733m 11 February 18, 2025 Announcement All 45.7m common shares (28% of O/S) will be permanently retired on completion Shareholder value creation drives all our decision making Upside potential significantly enlarged for valuation metrics Price/Earnings Sh a re P ric e Pre-retirement Post-retirement Peer average $— $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 7.6x 5.4x 7.6x 10.1x Transaction Summary Agreement meaningfully accretive to EPS (+20%) and ROE (+200bps), and immediately accretive to BVPS (+4%) Corporate Governance structure simplified, with CMIG relinquishing its Board seat and Board observer upon completion Reduction in volatility in our income statement from surrender of the dilutive merger warrants, which contributed to $48m of expense on the income statement in 2024 and $15m in 2023 2 3

Full Year and Quarterly Results Update 12

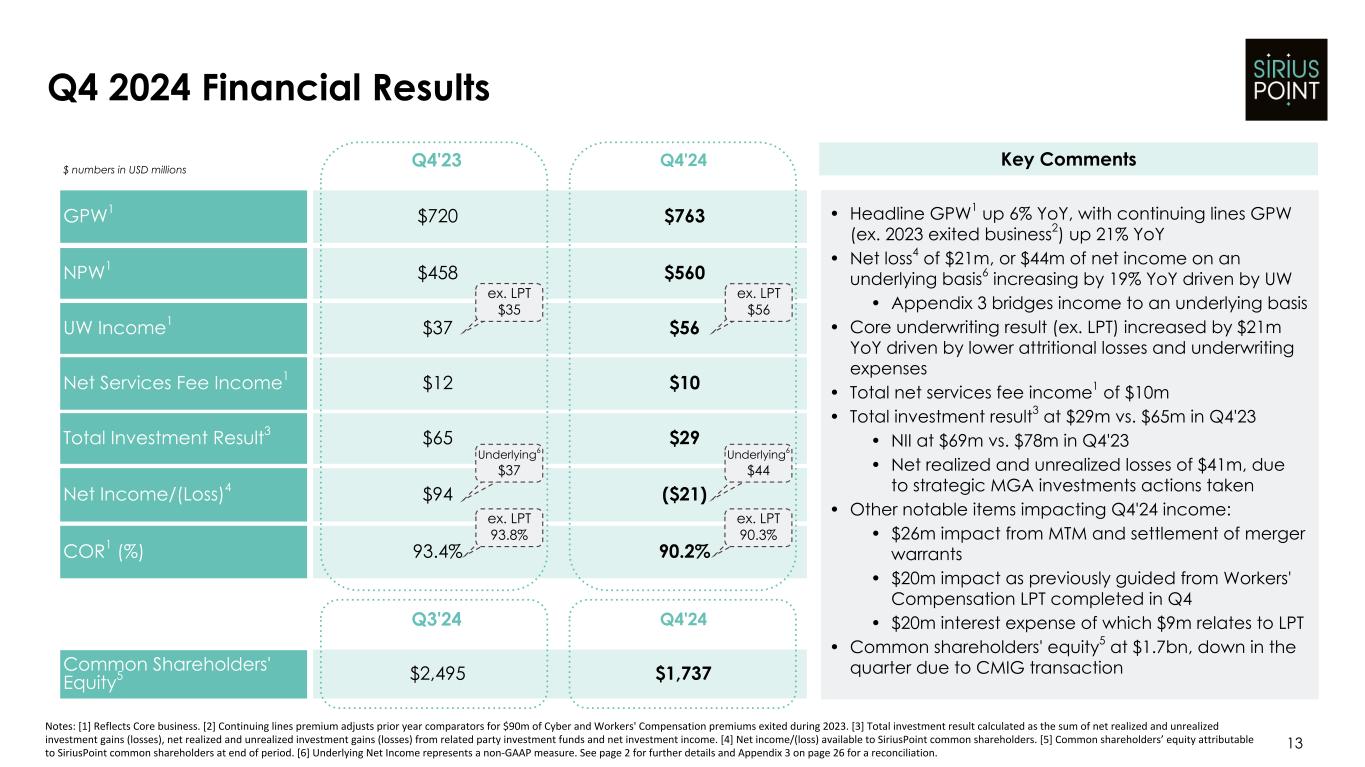

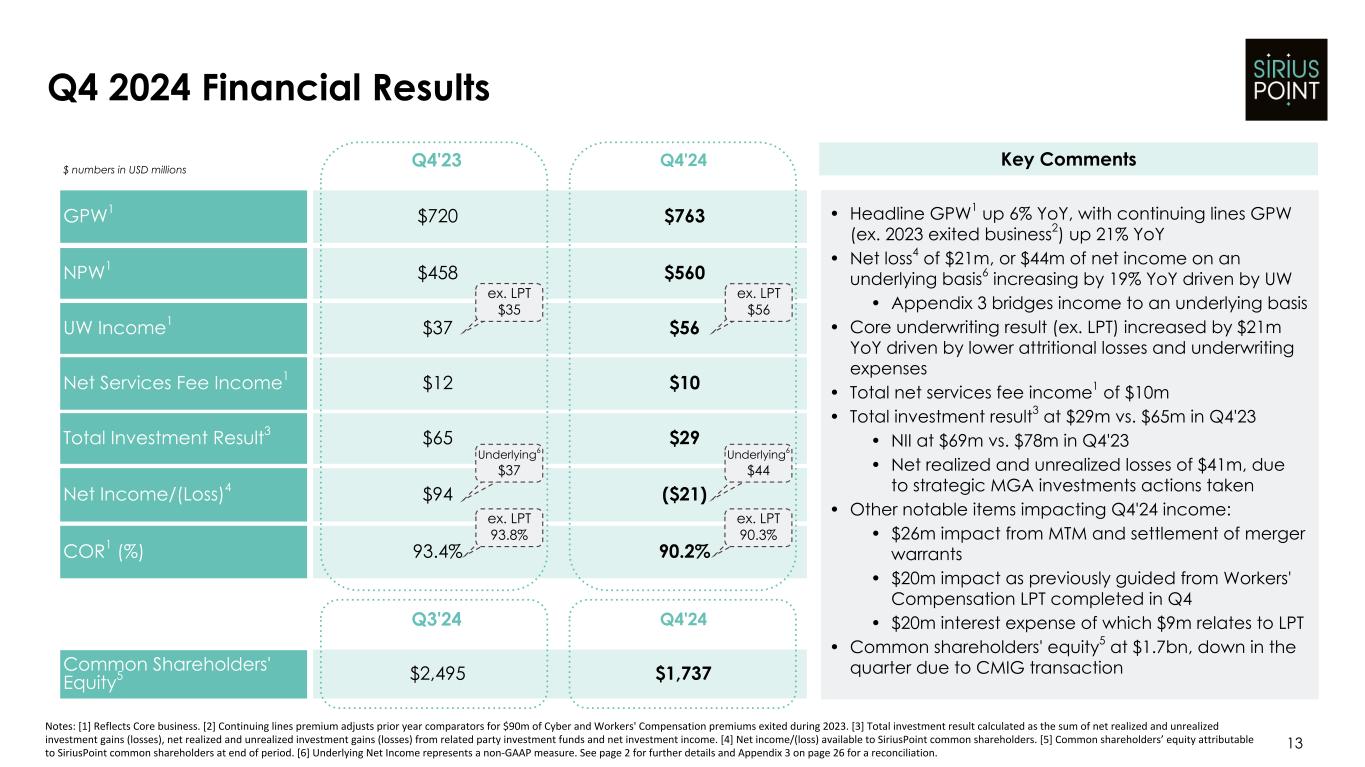

$ numbers in USD millions Q4'23 Q4'24 GPW1 $720 $763 NPW1 $458 $560 UW Income1 $37 $56 Net Services Fee Income1 $12 $10 Total Investment Result3 $65 $29 Net Income/(Loss)4 $94 ($21) COR1 (%) 93.4% 90.2% Q4 2024 Financial Results 13 Notes: [1] Reflects Core business. [2] Continuing lines premium adjusts prior year comparators for $90m of Cyber and Workers' Compensation premiums exited during 2023. [3] Total investment result calculated as the sum of net realized and unrealized investment gains (losses), net realized and unrealized investment gains (losses) from related party investment funds and net investment income. [4] Net income/(loss) available to SiriusPoint common shareholders. [5] Common shareholders’ equity attributable to SiriusPoint common shareholders at end of period. [6] Underlying Net Income represents a non-GAAP measure. See page 2 for further details and Appendix 3 on page 26 for a reconciliation. • Headline GPW1 up 6% YoY, with continuing lines GPW (ex. 2023 exited business2) up 21% YoY • Net loss4 of $21m, or $44m of net income on an underlying basis6 increasing by 19% YoY driven by UW • Appendix 3 bridges income to an underlying basis • Core underwriting result (ex. LPT) increased by $21m YoY driven by lower attritional losses and underwriting expenses • Total net services fee income1 of $10m • Total investment result3 at $29m vs. $65m in Q4'23 • NII at $69m vs. $78m in Q4'23 • Net realized and unrealized losses of $41m, due to strategic MGA investments actions taken • Other notable items impacting Q4'24 income: • $26m impact from MTM and settlement of merger warrants • $20m impact as previously guided from Workers' Compensation LPT completed in Q4 • $20m interest expense of which $9m relates to LPT • Common shareholders' equity5 at $1.7bn, down in the quarter due to CMIG transaction Key Comments ex. LPT 93.8% ex. LPT $35 ex. LPT $56 Underlying6 $37 Underlying6 $44 ex. LPT 90.3% Q3'24 Q4'24 Common Shareholders' Equity5 $2,495 $1,737

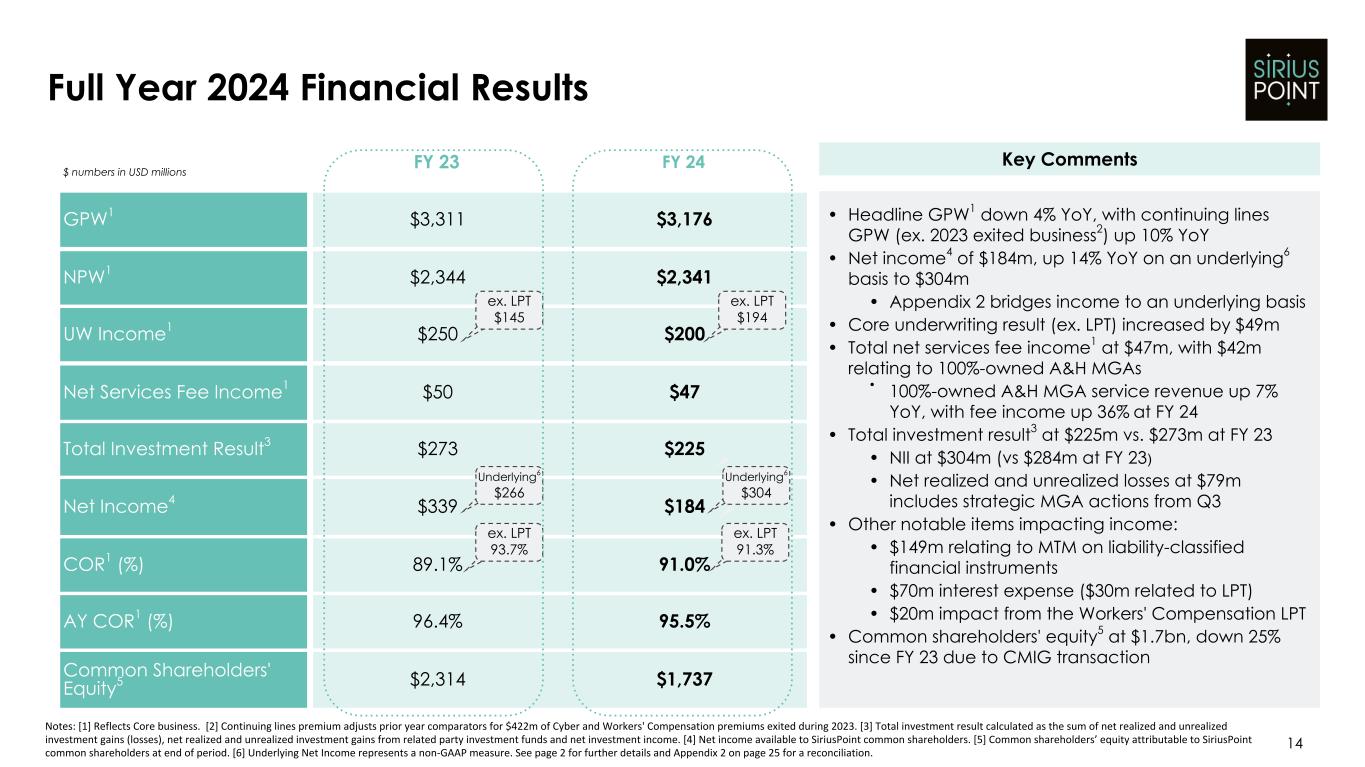

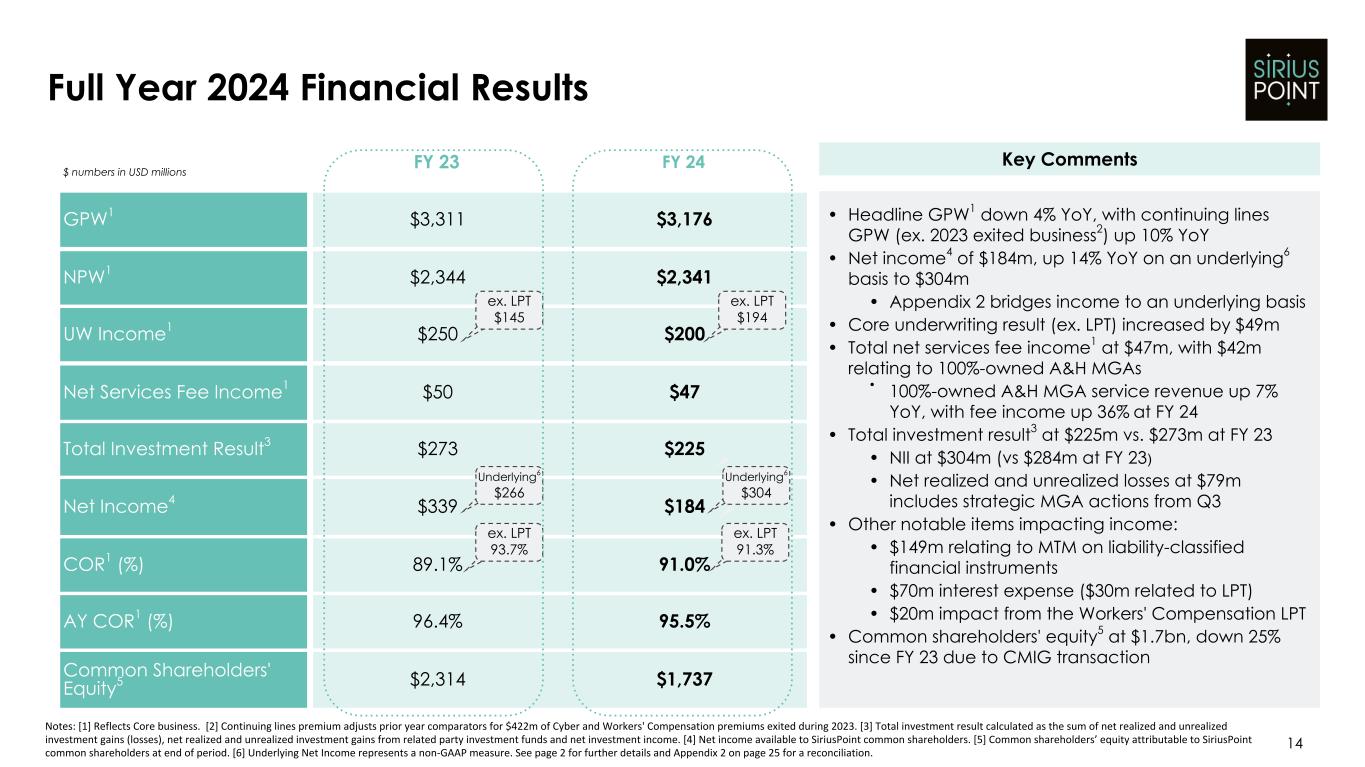

$ numbers in USD millions FY 23 FY 24 GPW1 $3,311 $3,176 NPW1 $2,344 $2,341 UW Income1 $250 $200 Net Services Fee Income1 $50 $47 Total Investment Result3 $273 $225 Net Income4 $339 $184 COR1 (%) 89.1% 91.0% AY COR1 (%) 96.4% 95.5% Common Shareholders' Equity5 $2,314 $1,737 Full Year 2024 Financial Results 14 Notes: [1] Reflects Core business. [2] Continuing lines premium adjusts prior year comparators for $422m of Cyber and Workers' Compensation premiums exited during 2023. [3] Total investment result calculated as the sum of net realized and unrealized investment gains (losses), net realized and unrealized investment gains from related party investment funds and net investment income. [4] Net income available to SiriusPoint common shareholders. [5] Common shareholders’ equity attributable to SiriusPoint common shareholders at end of period. [6] Underlying Net Income represents a non-GAAP measure. See page 2 for further details and Appendix 2 on page 25 for a reconciliation. • Headline GPW1 down 4% YoY, with continuing lines GPW (ex. 2023 exited business2) up 10% YoY • Net income4 of $184m, up 14% YoY on an underlying6 basis to $304m • Appendix 2 bridges income to an underlying basis • Core underwriting result (ex. LPT) increased by $49m • Total net services fee income1 at $47m, with $42m relating to 100%-owned A&H MGAs • 100%-owned A&H MGA service revenue up 7% YoY, with fee income up 36% at FY 24 • Total investment result3 at $225m vs. $273m at FY 23 • NII at $304m (vs $284m at FY 23) • Net realized and unrealized losses at $79m includes strategic MGA actions from Q3 • Other notable items impacting income: • $149m relating to MTM on liability-classified financial instruments • $70m interest expense ($30m related to LPT) • $20m impact from the Workers' Compensation LPT • Common shareholders' equity5 at $1.7bn, down 25% since FY 23 due to CMIG transaction Key Comments ex. LPT $145 Underlying6 $266 ex. LPT 93.7% ex. LPT $194 Underlying6 $304 ex. LPT 91.3%

$ numbers represent Gross Premiums Written in USD millions Key Comments • Strong continuing lines growth (ex. 2023 exited business2) of 21% in Q4'24 and 10% for FY 24 • Core premiums decreased 4% on a headline basis for FY 24, with exited business impacting GPW throughout 2024 • Strong FY 24 Insurance & Services continuing lines growth of 14% driven by Specialty and Property programs, with significant contributions from Programs launched in 2023 • FY 24 Reinsurance GPW up 5%, with growth in Property and Specialty lines offset by continued reduction in US Casualty • Growth of 24% for Reinsurance in Q4, driven by new business in International Specialty and Bermuda Property lines $3,311 $3,176 $2,040 $1,841 $1,271 $1,336 FY 23 FY 24 FY 23 FY 24 FY 23 FY 24 Core Insurance & Services Reinsurance 15 Premium Trends: Continuing Lines Growth Continues Notes: [1] The dotted area represents $422m of Cyber and Workers' Compensation business put into run off in 2023. [2] Continuing lines premium adjusts prior year comparators for Cyber and Workers' Compensation premiums exited during 2023. [3] On a continuing lines basis. +14% YoY +5% YoY +10% YoY Q4'24 GPW Growth3 19% 1 1 Q4'24 GPW Growth3 24% Q4'24 GPW Growth3 21%

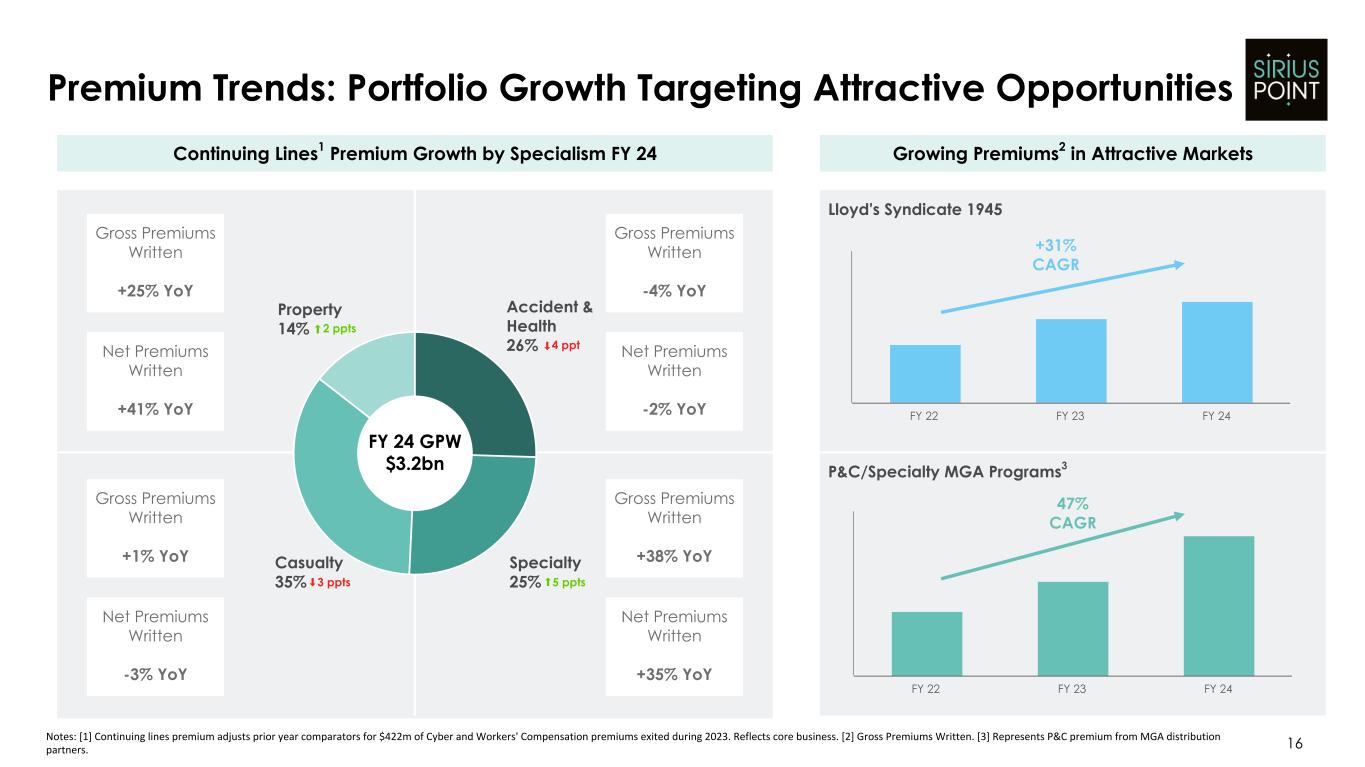

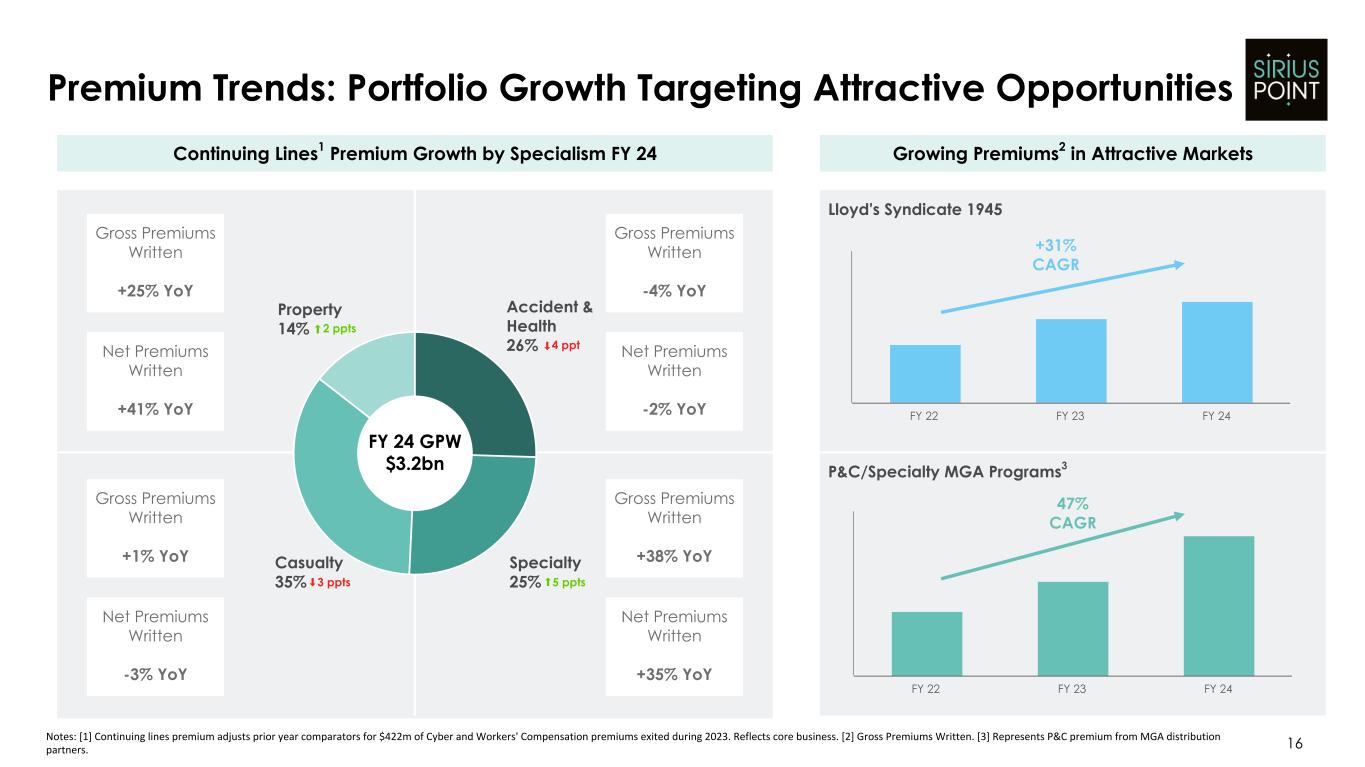

16 Premium Trends: Portfolio Growth Targeting Attractive Opportunities Notes: [1] Continuing lines premium adjusts prior year comparators for $422m of Cyber and Workers' Compensation premiums exited during 2023. Reflects core business. [2] Gross Premiums Written. [3] Represents P&C premium from MGA distribution partners. Accident & Health 26% Specialty 25% Casualty 35% Property 14% Gross Premiums Written +25% YoY Net Premiums Written +41% YoY Gross Premiums Written -4% YoY Gross Premiums Written +1% YoY Net Premiums Written -3% YoY Gross Premiums Written +38% YoY Net Premiums Written +35% YoY Growing Premiums2 in Attractive Markets FY 22 FY 23 FY 24 Continuing Lines1 Premium Growth by Specialism FY 24 Lloyd's Syndicate 1945 P&C/Specialty MGA Programs3 +31% CAGR FY 22 FY 23 FY 24 47% CAGR FY 24 GPW $3.2bn Net Premiums Written -2% YoY 5 ppts 4 ppt 2 ppts 3 ppts

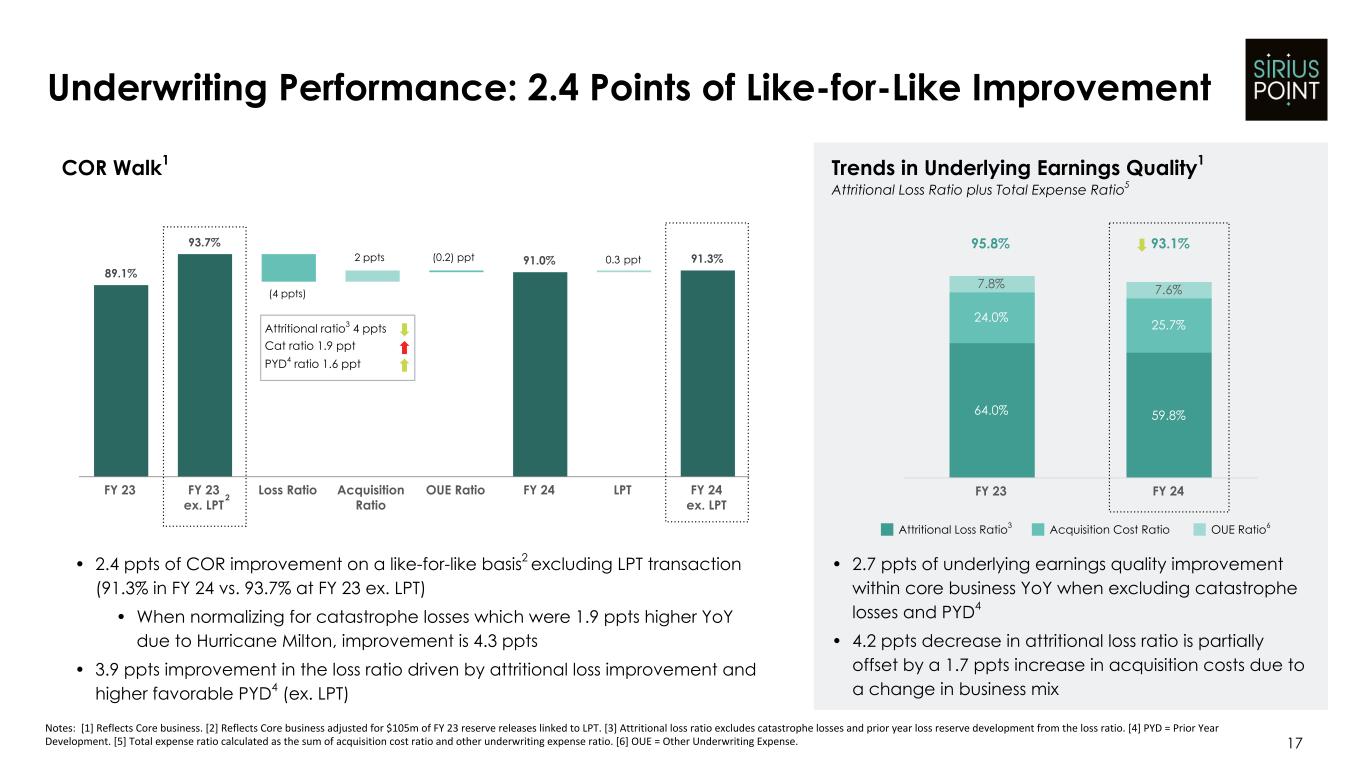

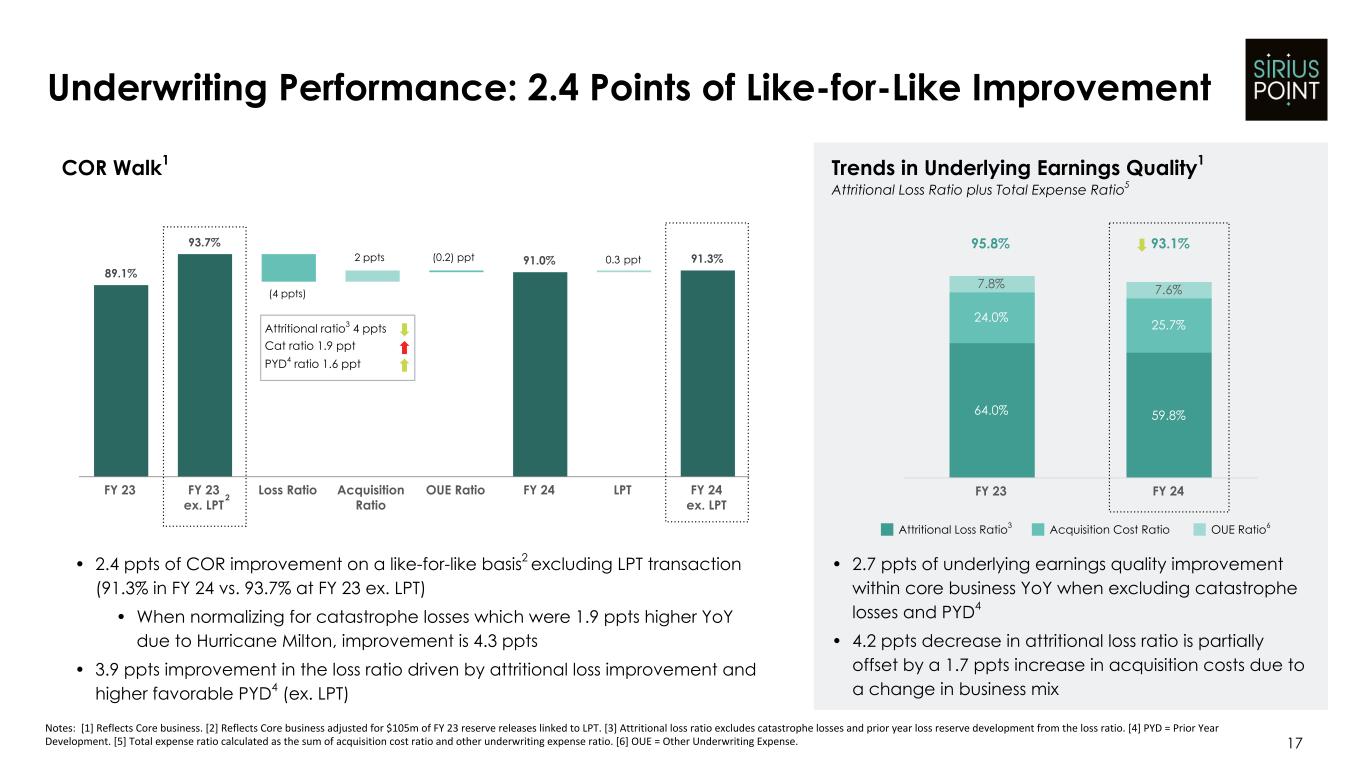

Underwriting Performance: 2.4 Points of Like-for-Like Improvement 17 Attritional Loss Ratio3 OUE Ratio6 Notes: [1] Reflects Core business. [2] Reflects Core business adjusted for $105m of FY 23 reserve releases linked to LPT. [3] Attritional loss ratio excludes catastrophe losses and prior year loss reserve development from the loss ratio. [4] PYD = Prior Year Development. [5] Total expense ratio calculated as the sum of acquisition cost ratio and other underwriting expense ratio. [6] OUE = Other Underwriting Expense. 64.0% 59.8% 24.0% 25.7% 7.8% 7.6% FY 23 FY 24 • 2.7 ppts of underlying earnings quality improvement within core business YoY when excluding catastrophe losses and PYD4 • 4.2 ppts decrease in attritional loss ratio is partially offset by a 1.7 ppts increase in acquisition costs due to a change in business mix 95.8% 93.1% Trends in Underlying Earnings Quality1 Attritional Loss Ratio plus Total Expense Ratio5 Acquisition Cost Ratio 89.1% 93.7% 91.0% 91.3% FY 23 FY 23 ex. LPT Loss Ratio Acquisition Ratio OUE Ratio FY 24 LPT FY 24 ex. LPT Attritional ratio3 4 ppts Cat ratio 1.9 ppt PYD4 ratio 1.6 ppt (4 ppts) 2 ppts (0.2) ppt 0.3 ppt COR Walk1 • 2.4 ppts of COR improvement on a like-for-like basis2 excluding LPT transaction (91.3% in FY 24 vs. 93.7% at FY 23 ex. LPT) • When normalizing for catastrophe losses which were 1.9 ppts higher YoY due to Hurricane Milton, improvement is 4.3 ppts • 3.9 ppts improvement in the loss ratio driven by attritional loss improvement and higher favorable PYD4 (ex. LPT) 2

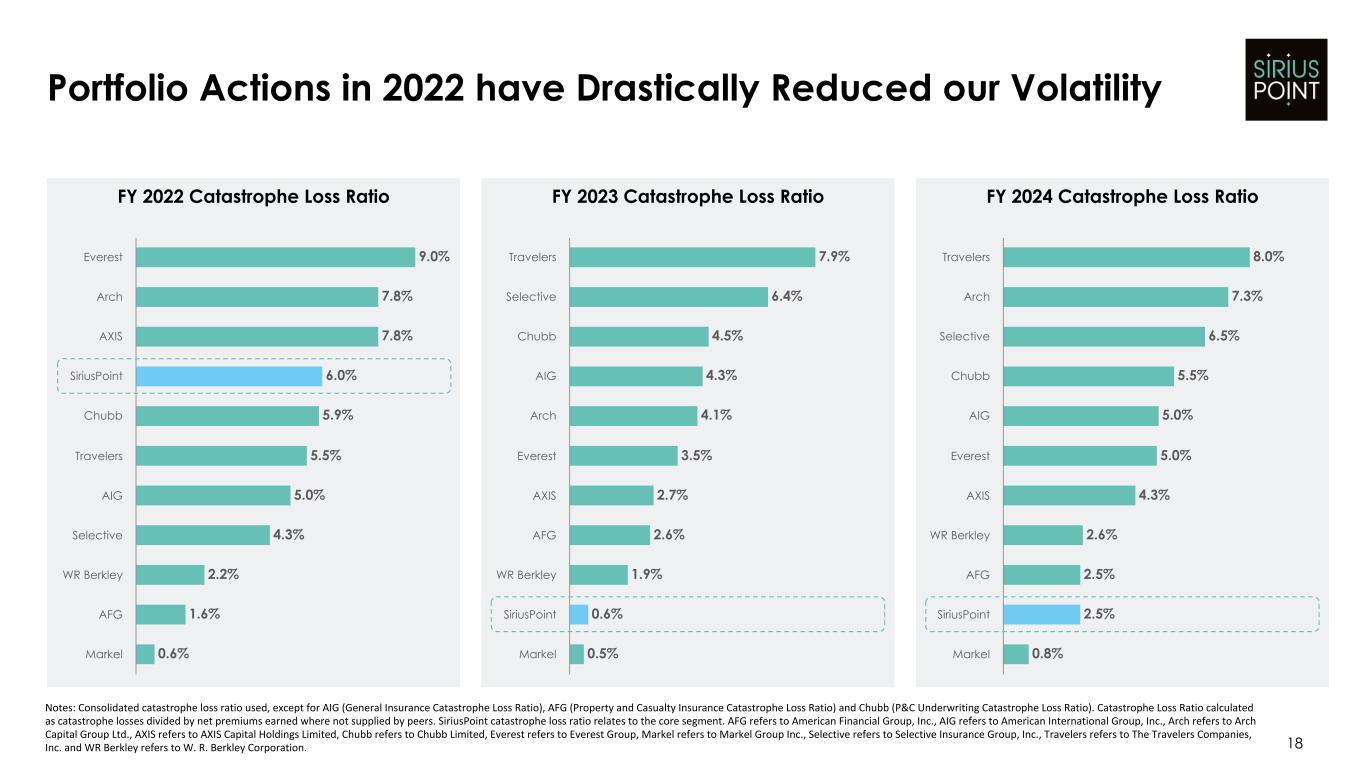

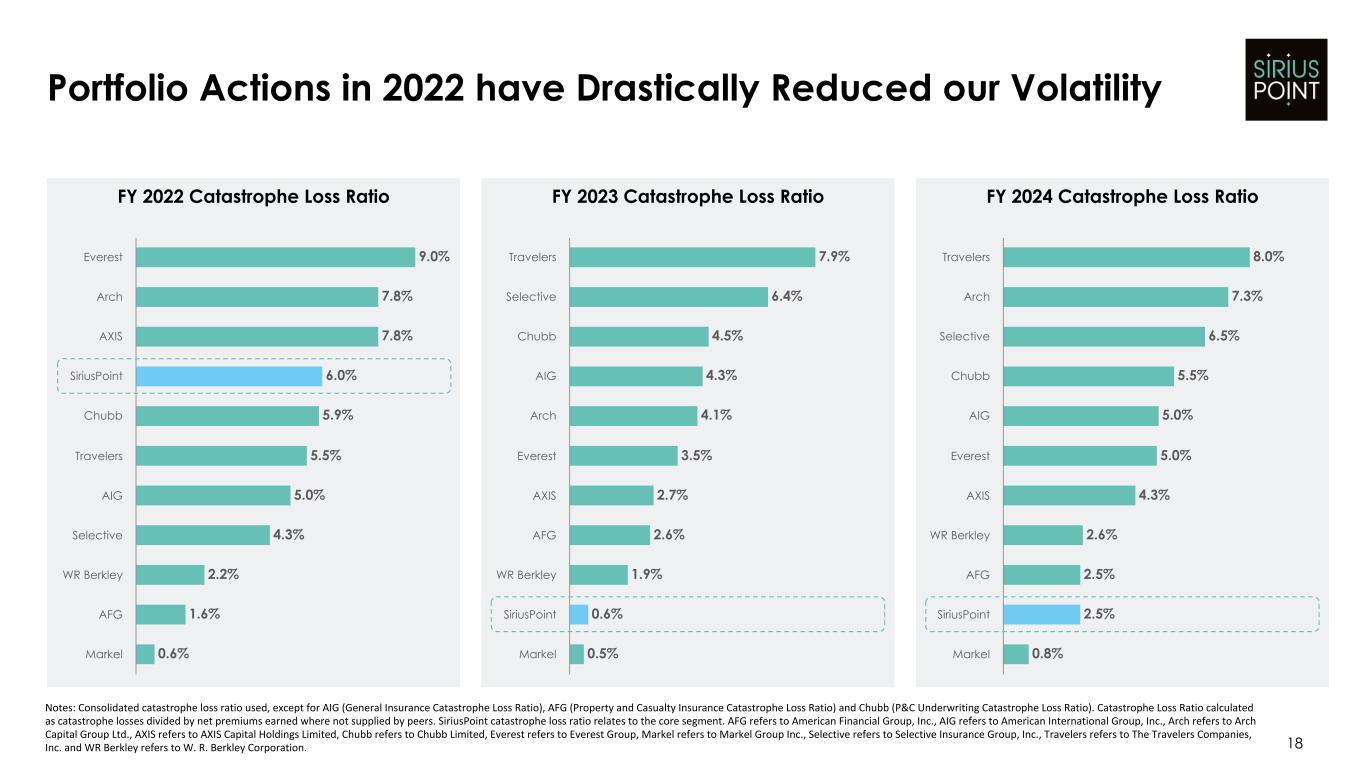

18 Portfolio Actions in 2022 have Drastically Reduced our Volatility Notes: Consolidated catastrophe loss ratio used, except for AIG (General Insurance Catastrophe Loss Ratio), AFG (Property and Casualty Insurance Catastrophe Loss Ratio) and Chubb (P&C Underwriting Catastrophe Loss Ratio). Catastrophe Loss Ratio calculated as catastrophe losses divided by net premiums earned where not supplied by peers. SiriusPoint catastrophe loss ratio relates to the core segment. AFG refers to American Financial Group, Inc., AIG refers to American International Group, Inc., Arch refers to Arch Capital Group Ltd., AXIS refers to AXIS Capital Holdings Limited, Chubb refers to Chubb Limited, Everest refers to Everest Group, Markel refers to Markel Group Inc., Selective refers to Selective Insurance Group, Inc., Travelers refers to The Travelers Companies, Inc. and WR Berkley refers to W. R. Berkley Corporation. 9.0% 7.8% 7.8% 6.0% 5.9% 5.5% 5.0% 4.3% 2.2% 1.6% 0.6% Everest Arch AXIS SiriusPoint Chubb Travelers AIG Selective WR Berkley AFG Markel 7.9% 6.4% 4.5% 4.3% 4.1% 3.5% 2.7% 2.6% 1.9% 0.6% 0.5% Travelers Selective Chubb AIG Arch Everest AXIS AFG WR Berkley SiriusPoint Markel 8.0% 7.3% 6.5% 5.5% 5.0% 5.0% 4.3% 2.6% 2.5% 2.5% 0.8% Travelers Arch Selective Chubb AIG Everest AXIS WR Berkley AFG SiriusPoint Markel FY 2022 Catastrophe Loss Ratio FY 2023 Catastrophe Loss Ratio FY 2024 Catastrophe Loss Ratio

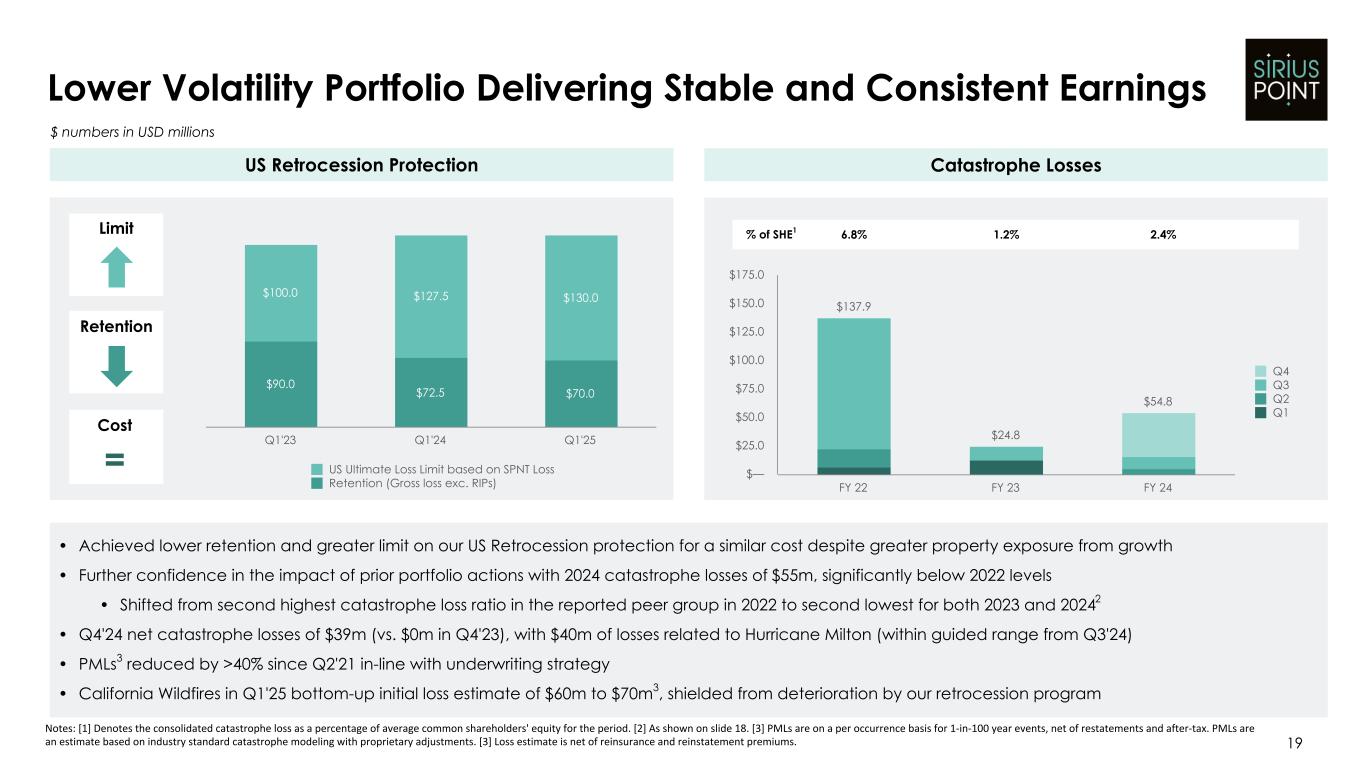

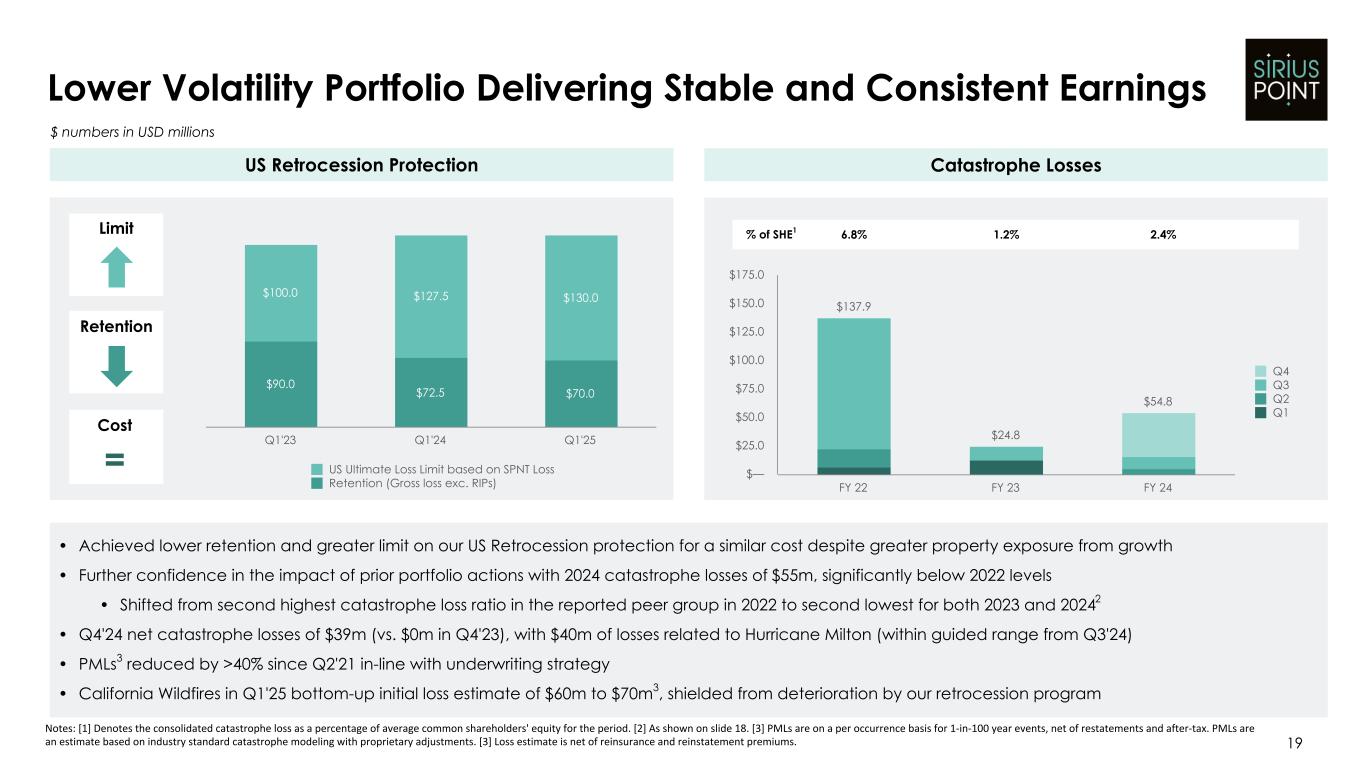

19 Lower Volatility Portfolio Delivering Stable and Consistent Earnings Notes: [1] Denotes the consolidated catastrophe loss as a percentage of average common shareholders' equity for the period. [2] As shown on slide 18. [3] PMLs are on a per occurrence basis for 1-in-100 year events, net of restatements and after-tax. PMLs are an estimate based on industry standard catastrophe modeling with proprietary adjustments. [3] Loss estimate is net of reinsurance and reinstatement premiums. US Retrocession Protection • Achieved lower retention and greater limit on our US Retrocession protection for a similar cost despite greater property exposure from growth • Further confidence in the impact of prior portfolio actions with 2024 catastrophe losses of $55m, significantly below 2022 levels • Shifted from second highest catastrophe loss ratio in the reported peer group in 2022 to second lowest for both 2023 and 20242 • Q4'24 net catastrophe losses of $39m (vs. $0m in Q4'23), with $40m of losses related to Hurricane Milton (within guided range from Q3'24) • PMLs3 reduced by >40% since Q2'21 in-line with underwriting strategy • California Wildfires in Q1'25 bottom-up initial loss estimate of $60m to $70m3, shielded from deterioration by our retrocession program $ numbers in USD millions Catastrophe Losses $137.9 $24.8 $54.8 Q4 Q3 Q2 Q1 FY 22 FY 23 FY 24 $— $25.0 $50.0 $75.0 $100.0 $125.0 $150.0 $175.0 % of SHE1 6.8% 1.2% 2.4% $90.0 $72.5 $70.0 $100.0 $127.5 $130.0 US Ultimate Loss Limit based on SPNT Loss Retention (Gross loss exc. RIPs) Q1'23 Q1'24 Q1'25 Limit Retention Cost = $274 $204 $180 $130 $116 $108 $134 $159 Q2'21 Q4'21 Q2'22 Q4'22 Q2'23 Q4'23 Q2'24 Q4'24 $— $50 $100 $150 $200 $250 $300 —% 2.5% 5.0% 7.5% 10.0% 12.5%

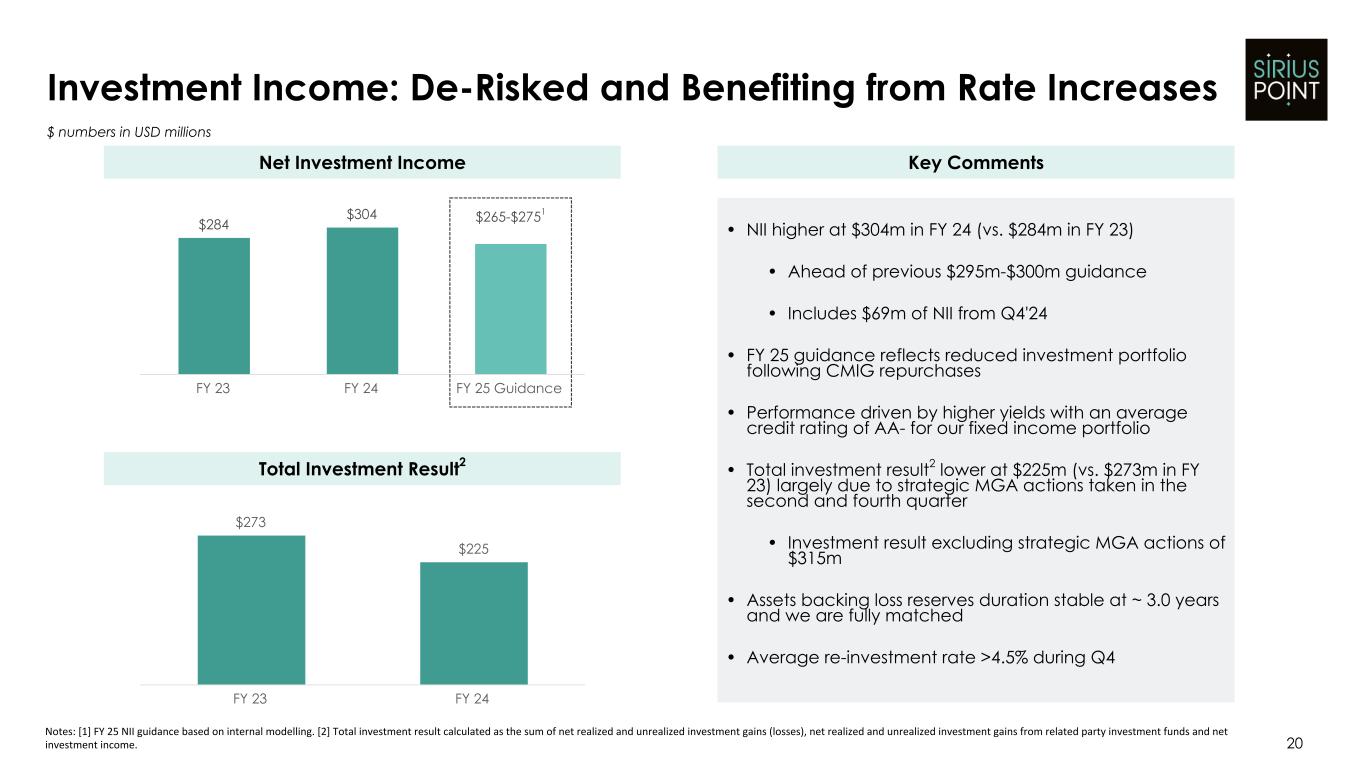

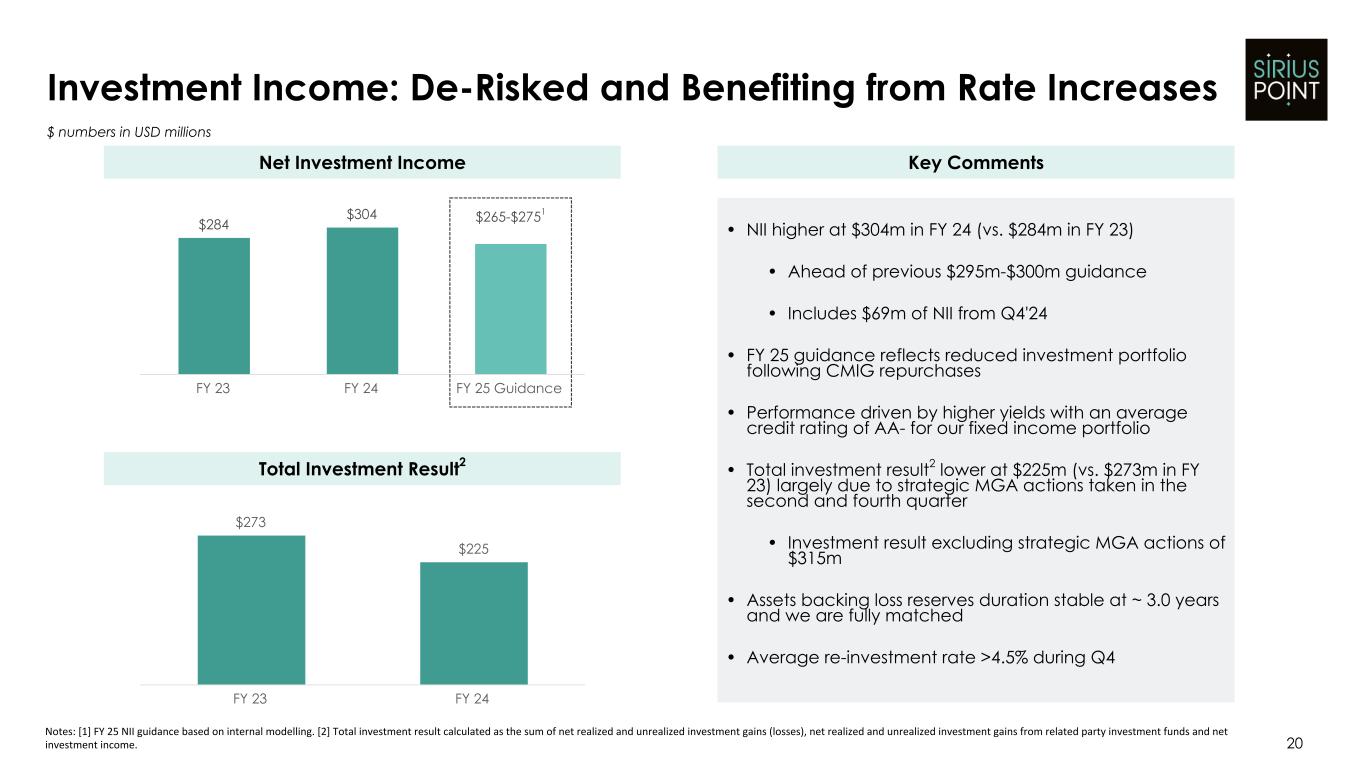

$273 $225 FY 23 FY 24 $284 $304 FY 23 FY 24 FY 25 Guidance Investment Income: De-Risked and Benefiting from Rate Increases 20 $ numbers in USD millions Key Comments Notes: [1] FY 25 NII guidance based on internal modelling. [2] Total investment result calculated as the sum of net realized and unrealized investment gains (losses), net realized and unrealized investment gains from related party investment funds and net investment income. $265-$2751 Net Investment Income Total Investment Result2 • NII higher at $304m in FY 24 (vs. $284m in FY 23) • Ahead of previous $295m-$300m guidance • Includes $69m of NII from Q4'24 • FY 25 guidance reflects reduced investment portfolio following CMIG repurchases • Performance driven by higher yields with an average credit rating of AA- for our fixed income portfolio • Total investment result2 lower at $225m (vs. $273m in FY 23) largely due to strategic MGA actions taken in the second and fourth quarter • Investment result excluding strategic MGA actions of $315m • Assets backing loss reserves duration stable at ~ 3.0 years and we are fully matched • Average re-investment rate >4.5% during Q4

$1,324 $1,273 $3,524 $2,725 Required Capital Available Capital Q3'24 Q4'24 21 Notes: [1] SiriusPoint Group BSCR calculated as available economic capital and surplus divided by the enhanced capital requirement as of September 30, 2024 and December 31, 2024, respectively. BSCR is an estimate. [2] Financial strength ratings for the operating subsidiaries, SiriusPoint International Insurance Corporation, SiriusPoint Bermuda Insurance Company, SiriusPoint America Insurance Company and SiriusPoint Specialty Insurance Corporation. [3] Q3'24 and Q4'24 capital mix is our internal view. [4] Debt to Capital Ratio calculated as debt divided by total capital. Total capital represents the sum of shareholders’ equity and debt. Debt in this calculation excludes preference shares. Strong Balance Sheet 266% 214% • Continue to operate the business against 'AA’ rating requirement under S&P model • Debt to capital ratio4 of 24.8%, within target range at Q4'24 (Q4'23: 23.8%), increased slightly due to CMIG share repurchases • BSCR1 strong at 214% as of Q4'24 (Q3'24: 266%) • $400m undrawn Revolving Credit Facility for backup liquidity and financial flexibility, increased by $100m during Q4'24 refinancing Financial Strength Rating (FSR)2: Key Comments A- (Stable) A- (Stable) A- (Stable) 61% 50% 28% 35% 11% 15% Tier 1 Tier 2 Tier 3 Q3'24 Q4'24 Affirmed March 12, 2024 Affirmed January 24, 2025 Affirmed April 26, 2024 Strong Mix of Capital3 BSCR1 $ numbers in USD millions A3 (Stable) Assigned March 19, 2024

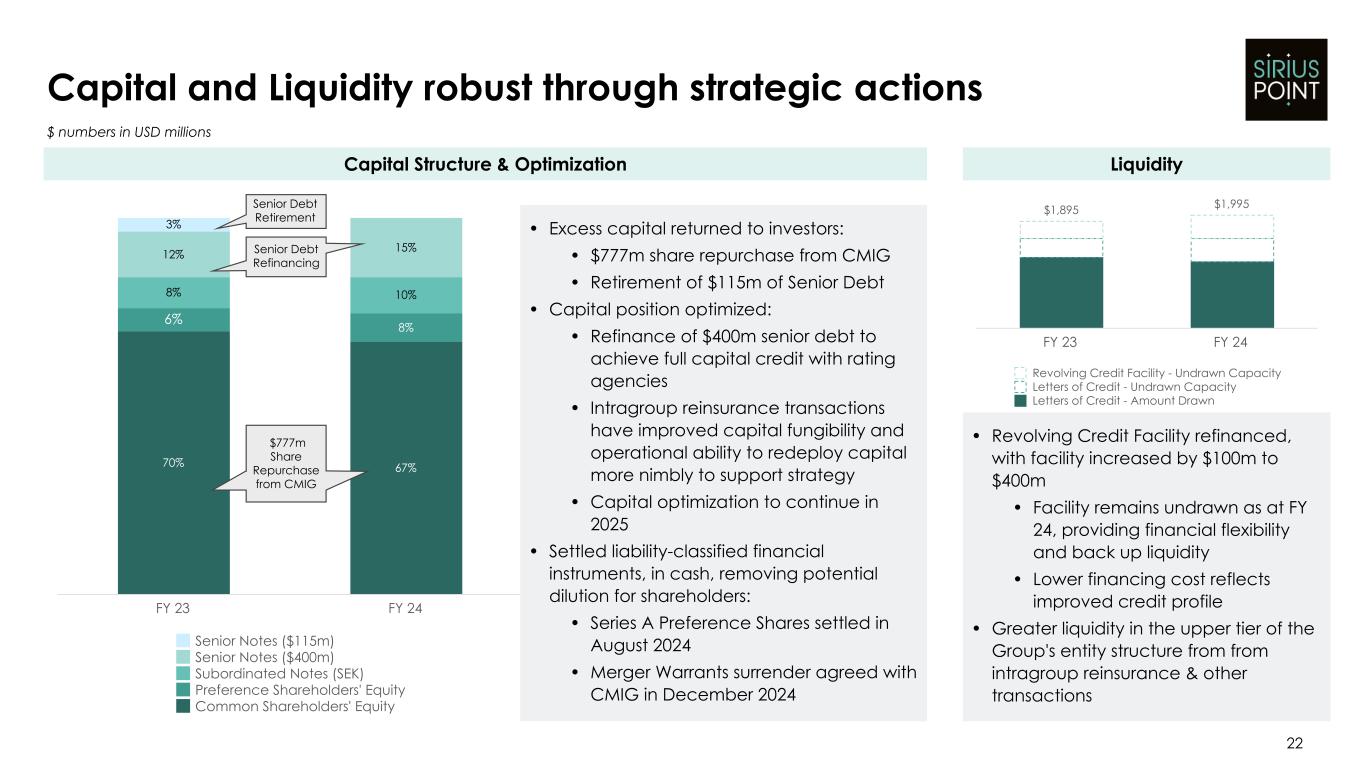

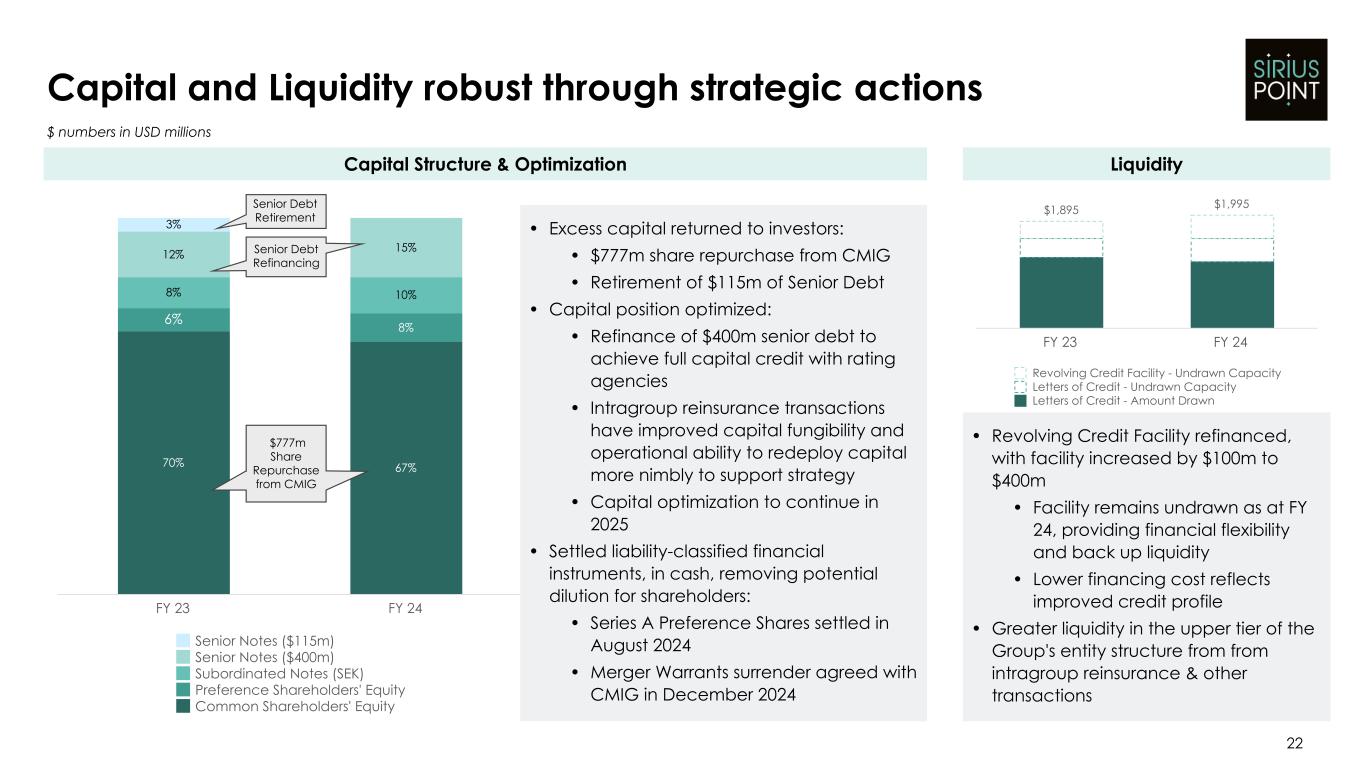

70% 67% 6% 8% 8% 10% 12% 15% 3% Senior Notes ($115m) Senior Notes ($400m) Subordinated Notes (SEK) Preference Shareholders' Equity Common Shareholders' Equity FY 23 FY 24 22 Capital and Liquidity robust through strategic actions $ numbers in USD millions Capital Structure & Optimization $777m Share Repurchase from CMIG Senior Debt Refinancing Senior Debt Retirement Liquidity • Excess capital returned to investors: • $777m share repurchase from CMIG • Retirement of $115m of Senior Debt • Capital position optimized: • Refinance of $400m senior debt to achieve full capital credit with rating agencies • Intragroup reinsurance transactions have improved capital fungibility and operational ability to redeploy capital more nimbly to support strategy • Capital optimization to continue in 2025 • Settled liability-classified financial instruments, in cash, removing potential dilution for shareholders: • Series A Preference Shares settled in August 2024 • Merger Warrants surrender agreed with CMIG in December 2024 • Revolving Credit Facility refinanced, with facility increased by $100m to $400m • Facility remains undrawn as at FY 24, providing financial flexibility and back up liquidity • Lower financing cost reflects improved credit profile • Greater liquidity in the upper tier of the Group's entity structure from from intragroup reinsurance & other transactions $1,895 $1,995 Revolving Credit Facility - Undrawn Capacity Letters of Credit - Undrawn Capacity Letters of Credit - Amount Drawn FY 23 FY 24

Appendix

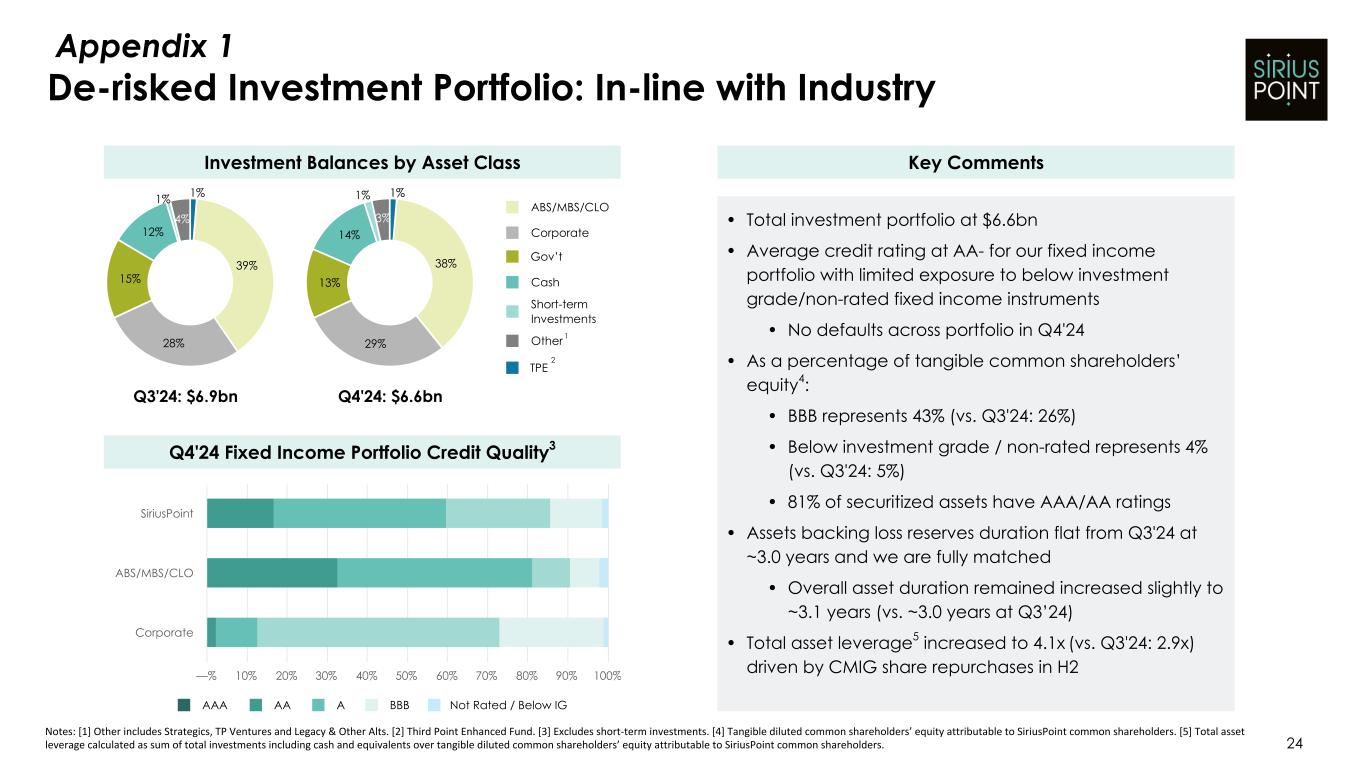

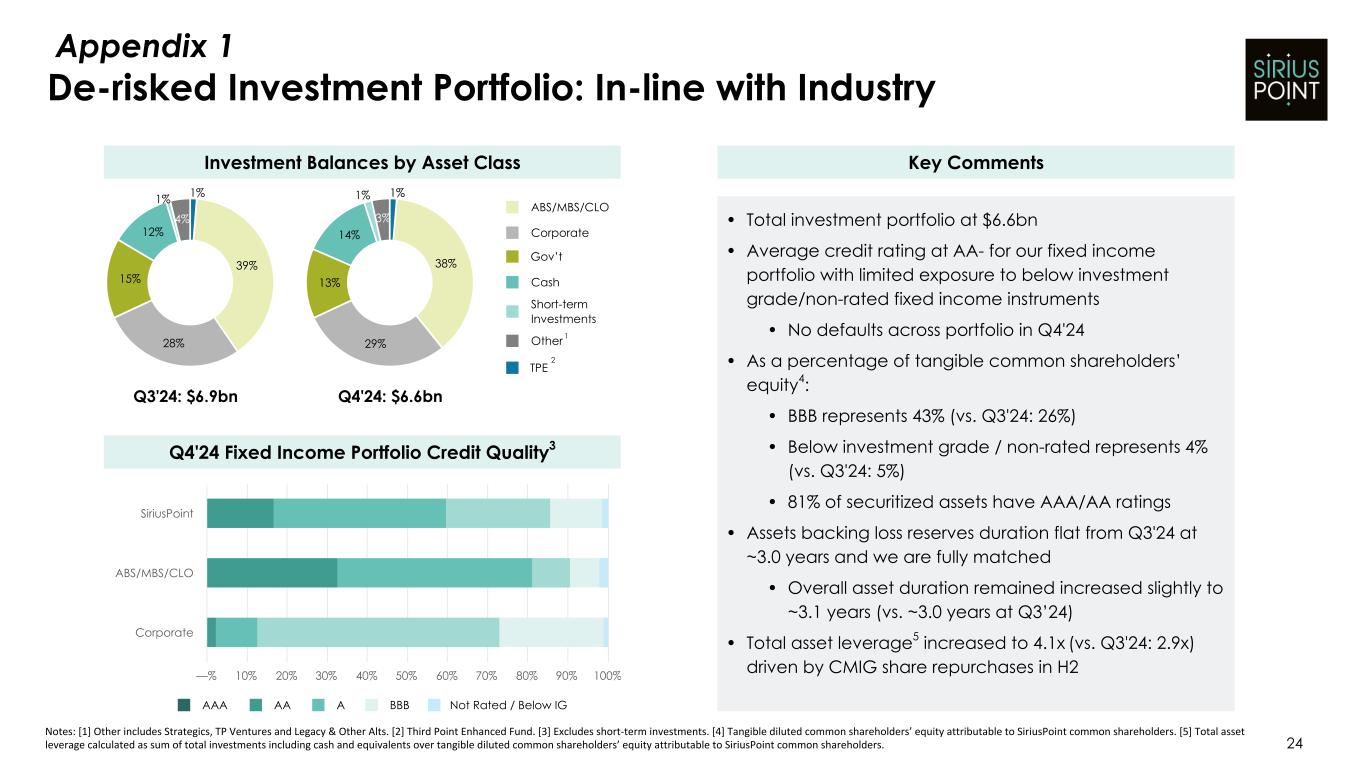

1% 38% 29% 13% 14% 1%3% TPE Short-term Investments De-risked Investment Portfolio: In-line with Industry 24 Q4'24: $6.6bn Notes: [1] Other includes Strategics, TP Ventures and Legacy & Other Alts. [2] Third Point Enhanced Fund. [3] Excludes short-term investments. [4] Tangible diluted common shareholders’ equity attributable to SiriusPoint common shareholders. [5] Total asset leverage calculated as sum of total investments including cash and equivalents over tangible diluted common shareholders’ equity attributable to SiriusPoint common shareholders. Q3'24: $6.9bn 1 2 AAA AA A BBB Not Rated / Below IG Gov’t ABS/MBS/CLO Cash Corporate Other —% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% SiriusPoint ABS/MBS/CLO Corporate Q4'24 Fixed Income Portfolio Credit Quality3 Key Comments • Total investment portfolio at $6.6bn • Average credit rating at AA- for our fixed income portfolio with limited exposure to below investment grade/non-rated fixed income instruments • No defaults across portfolio in Q4'24 • As a percentage of tangible common shareholders’ equity4: • BBB represents 43% (vs. Q3'24: 26%) • Below investment grade / non-rated represents 4% (vs. Q3'24: 5%) • 81% of securitized assets have AAA/AA ratings • Assets backing loss reserves duration flat from Q3'24 at ~3.0 years and we are fully matched • Overall asset duration remained increased slightly to ~3.1 years (vs. ~3.0 years at Q3’24) • Total asset leverage5 increased to 4.1x (vs. Q3'24: 2.9x) driven by CMIG share repurchases in H2 Investment Balances by Asset Class 1% 39% 28% 15% 12% 1% 4% 1% Appendix 1

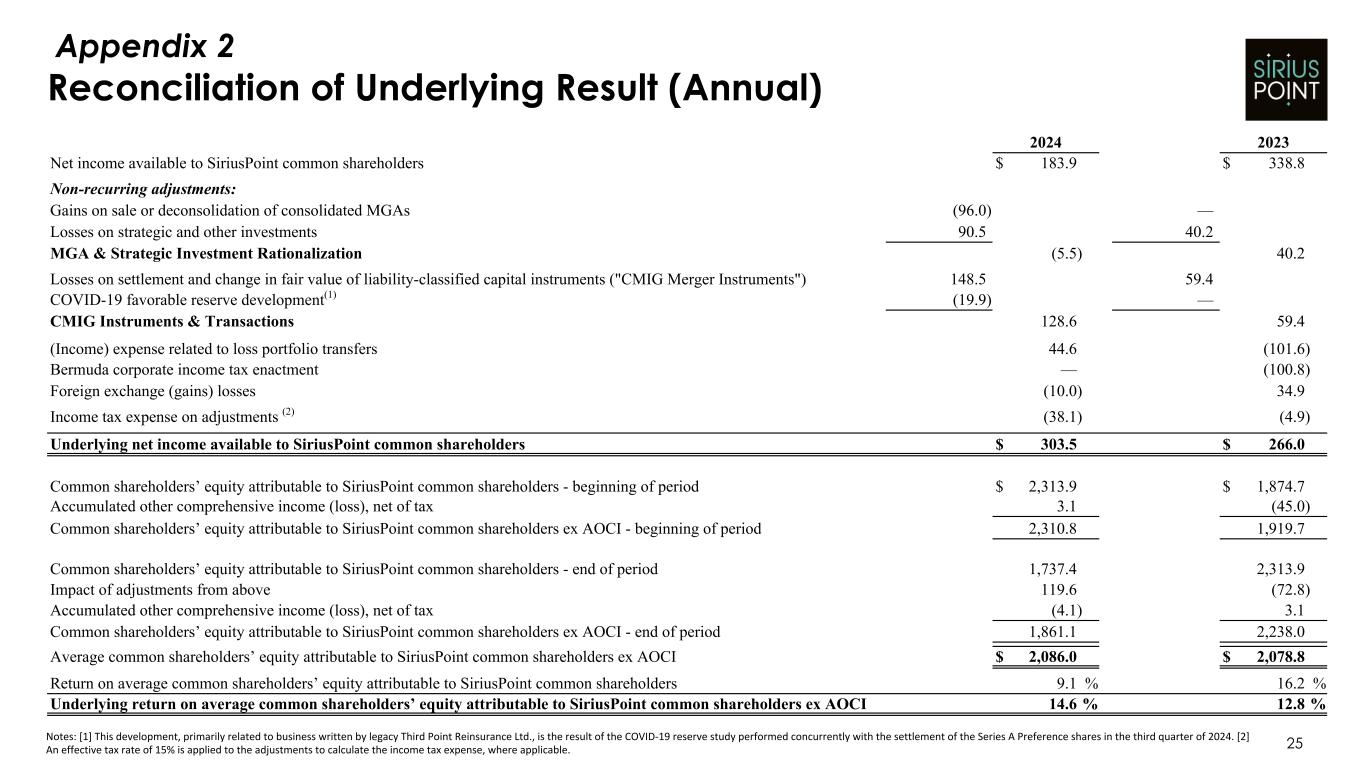

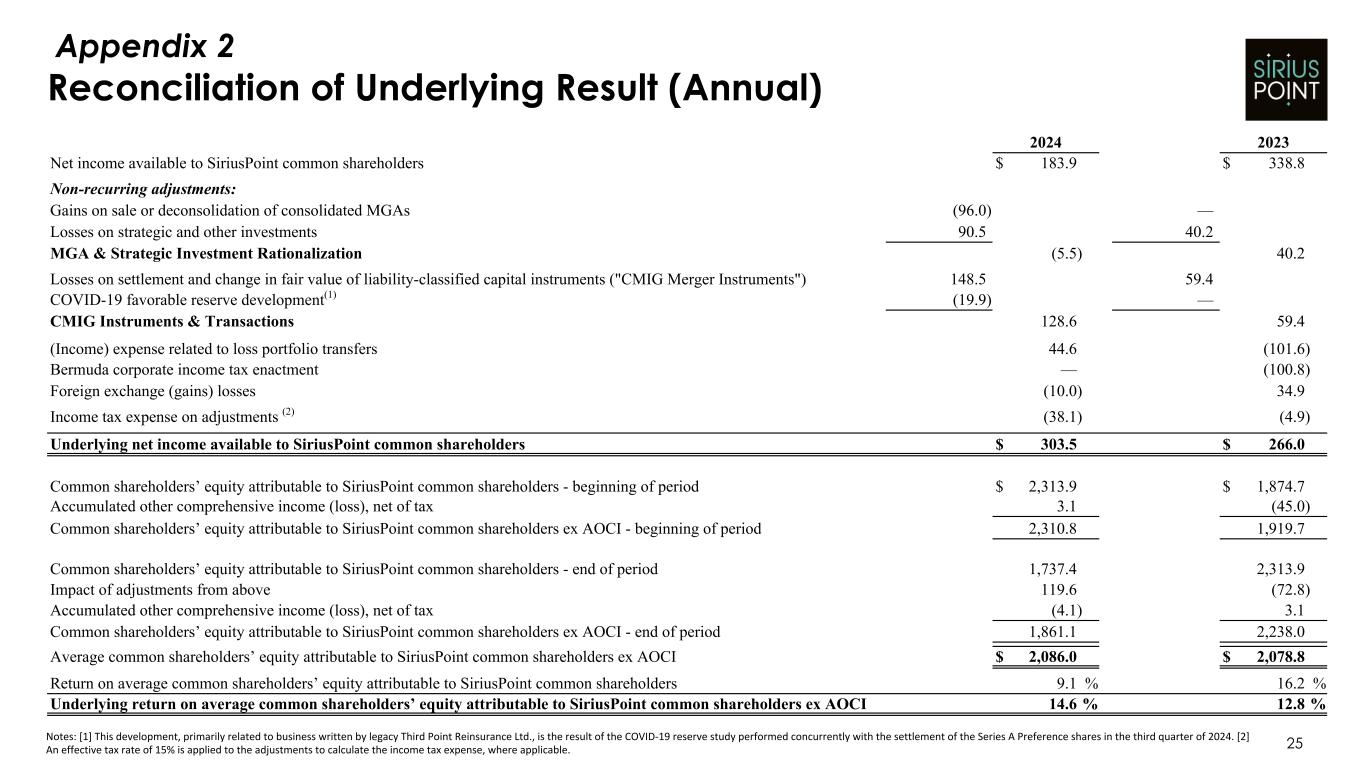

25 Appendix 2 Reconciliation of Underlying Result (Annual) 2024 2023 Net income available to SiriusPoint common shareholders $ 183.9 $ 338.8 Non-recurring adjustments: Gains on sale or deconsolidation of consolidated MGAs (96.0) — Losses on strategic and other investments 90.5 40.2 MGA & Strategic Investment Rationalization (5.5) 40.2 Losses on settlement and change in fair value of liability-classified capital instruments ("CMIG Merger Instruments") 148.5 59.4 COVID-19 favorable reserve development(1) (19.9) — CMIG Instruments & Transactions 128.6 59.4 (Income) expense related to loss portfolio transfers 44.6 (101.6) Bermuda corporate income tax enactment — (100.8) Foreign exchange (gains) losses (10.0) 34.9 Income tax expense on adjustments (2) (38.1) (4.9) Underlying net income available to SiriusPoint common shareholders $ 303.5 $ 266.0 Common shareholders’ equity attributable to SiriusPoint common shareholders - beginning of period $ 2,313.9 $ 1,874.7 Accumulated other comprehensive income (loss), net of tax 3.1 (45.0) Common shareholders’ equity attributable to SiriusPoint common shareholders ex AOCI - beginning of period 2,310.8 1,919.7 Common shareholders’ equity attributable to SiriusPoint common shareholders - end of period 1,737.4 2,313.9 Impact of adjustments from above 119.6 (72.8) Accumulated other comprehensive income (loss), net of tax (4.1) 3.1 Common shareholders’ equity attributable to SiriusPoint common shareholders ex AOCI - end of period 1,861.1 2,238.0 Average common shareholders’ equity attributable to SiriusPoint common shareholders ex AOCI $ 2,086.0 $ 2,078.8 Return on average common shareholders’ equity attributable to SiriusPoint common shareholders 9.1 % 16.2 % Underlying return on average common shareholders’ equity attributable to SiriusPoint common shareholders ex AOCI 14.6 % 12.8 % Notes: [1] This development, primarily related to business written by legacy Third Point Reinsurance Ltd., is the result of the COVID-19 reserve study performed concurrently with the settlement of the Series A Preference shares in the third quarter of 2024. [2] An effective tax rate of 15% is applied to the adjustments to calculate the income tax expense, where applicable.

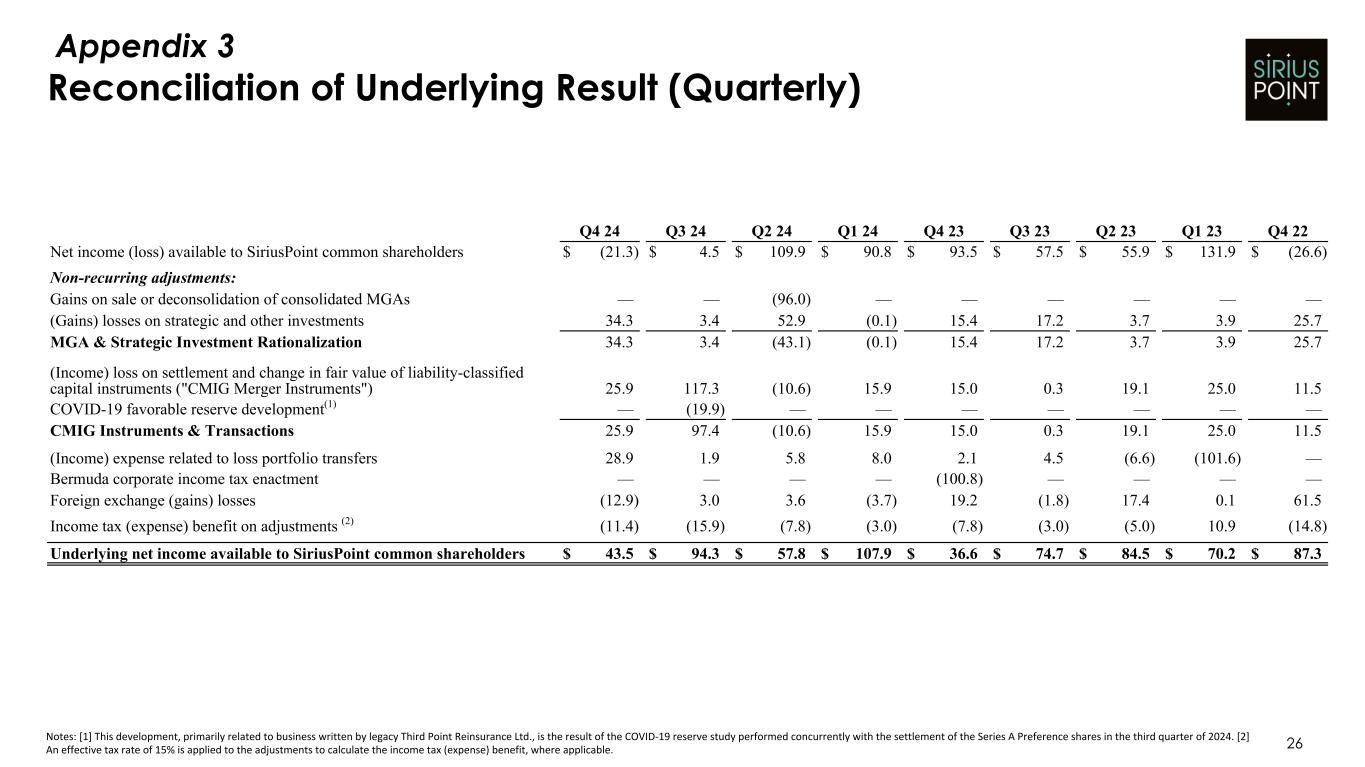

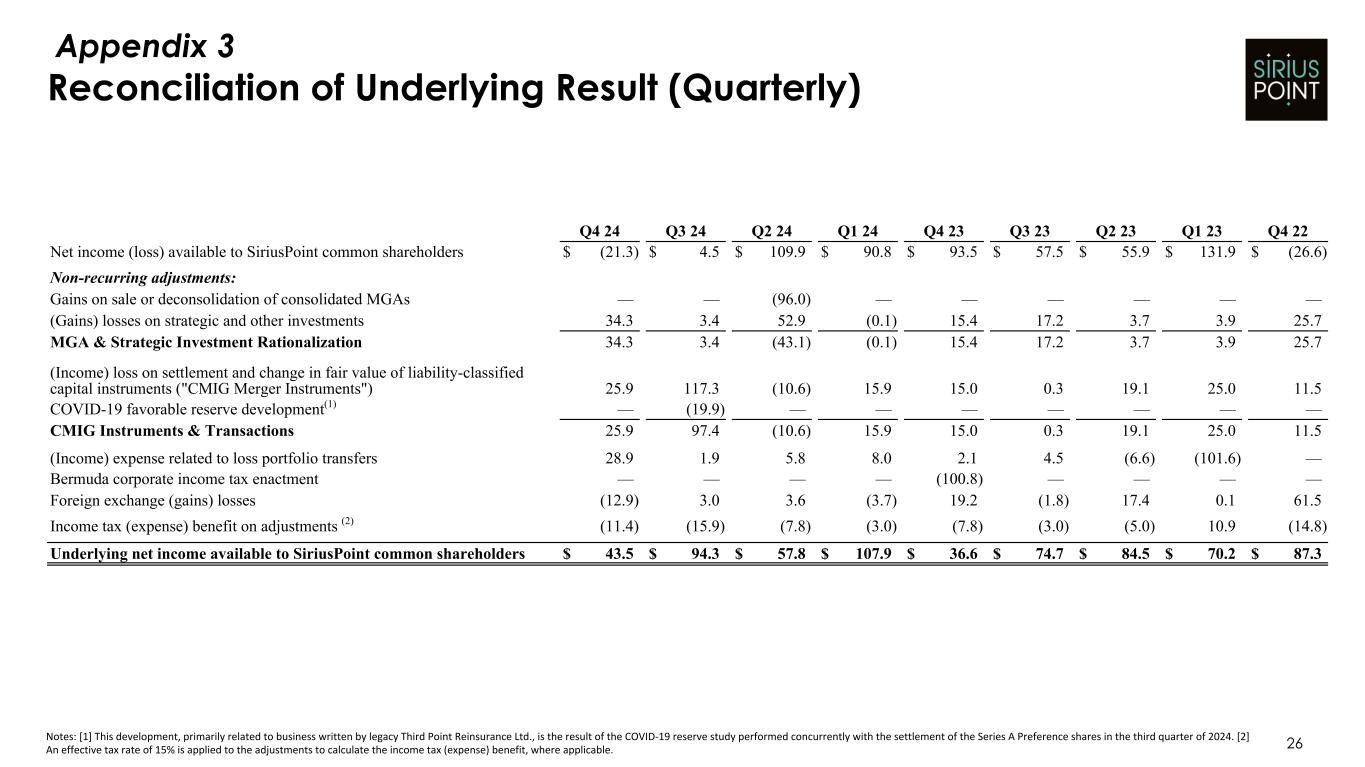

26 Appendix 3 Reconciliation of Underlying Result (Quarterly) Q4 24 Q3 24 Q2 24 Q1 24 Q4 23 Q3 23 Q2 23 Q1 23 Q4 22 Net income (loss) available to SiriusPoint common shareholders $ (21.3) $ 4.5 $ 109.9 $ 90.8 $ 93.5 $ 57.5 $ 55.9 $ 131.9 $ (26.6) Non-recurring adjustments: Gains on sale or deconsolidation of consolidated MGAs — — (96.0) — — — — — — (Gains) losses on strategic and other investments 34.3 3.4 52.9 (0.1) 15.4 17.2 3.7 3.9 25.7 MGA & Strategic Investment Rationalization 34.3 3.4 (43.1) (0.1) 15.4 17.2 3.7 3.9 25.7 (Income) loss on settlement and change in fair value of liability-classified capital instruments ("CMIG Merger Instruments") 25.9 117.3 (10.6) 15.9 15.0 0.3 19.1 25.0 11.5 COVID-19 favorable reserve development(1) — (19.9) — — — — — — — CMIG Instruments & Transactions 25.9 97.4 (10.6) 15.9 15.0 0.3 19.1 25.0 11.5 (Income) expense related to loss portfolio transfers 28.9 1.9 5.8 8.0 2.1 4.5 (6.6) (101.6) — Bermuda corporate income tax enactment — — — — (100.8) — — — — Foreign exchange (gains) losses (12.9) 3.0 3.6 (3.7) 19.2 (1.8) 17.4 0.1 61.5 Income tax (expense) benefit on adjustments (2) (11.4) (15.9) (7.8) (3.0) (7.8) (3.0) (5.0) 10.9 (14.8) Underlying net income available to SiriusPoint common shareholders $ 43.5 $ 94.3 $ 57.8 $ 107.9 $ 36.6 $ 74.7 $ 84.5 $ 70.2 $ 87.3 Notes: [1] This development, primarily related to business written by legacy Third Point Reinsurance Ltd., is the result of the COVID-19 reserve study performed concurrently with the settlement of the Series A Preference shares in the third quarter of 2024. [2] An effective tax rate of 15% is applied to the adjustments to calculate the income tax (expense) benefit, where applicable.

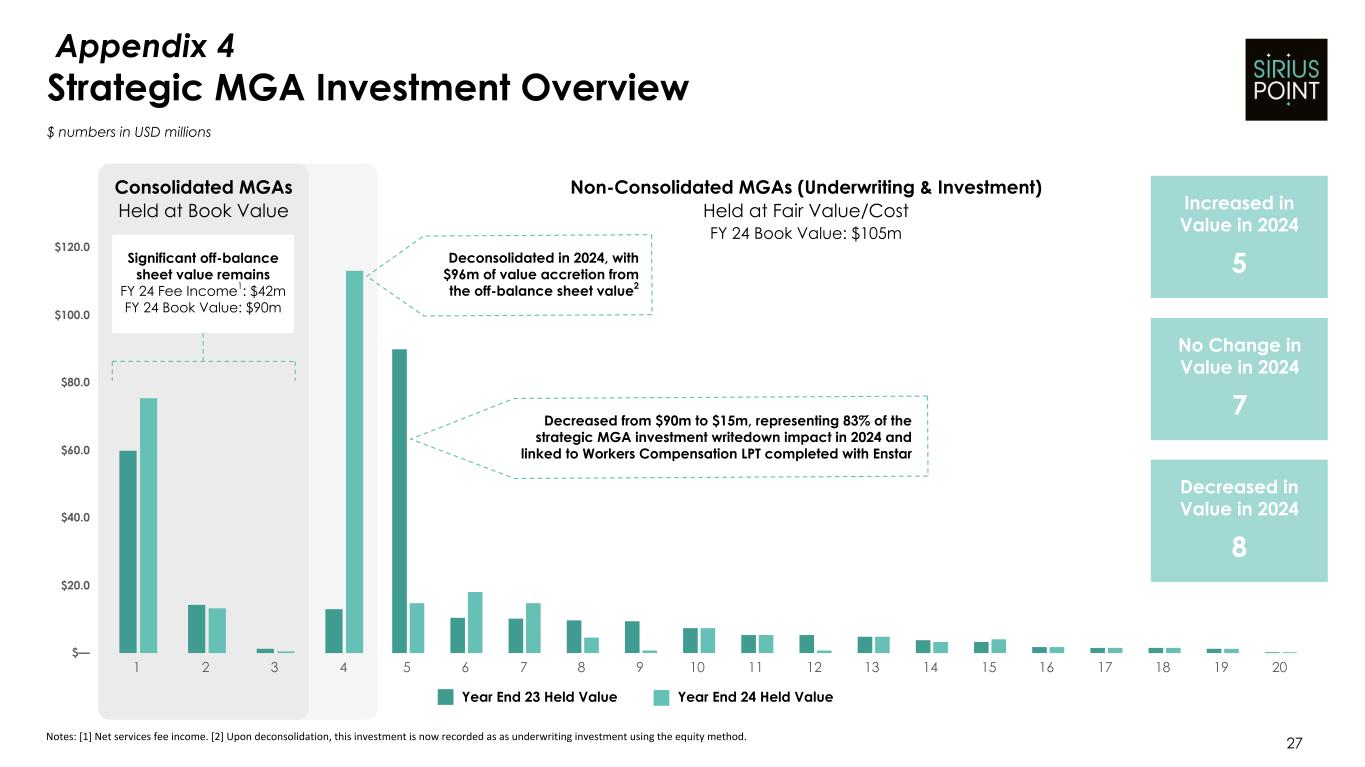

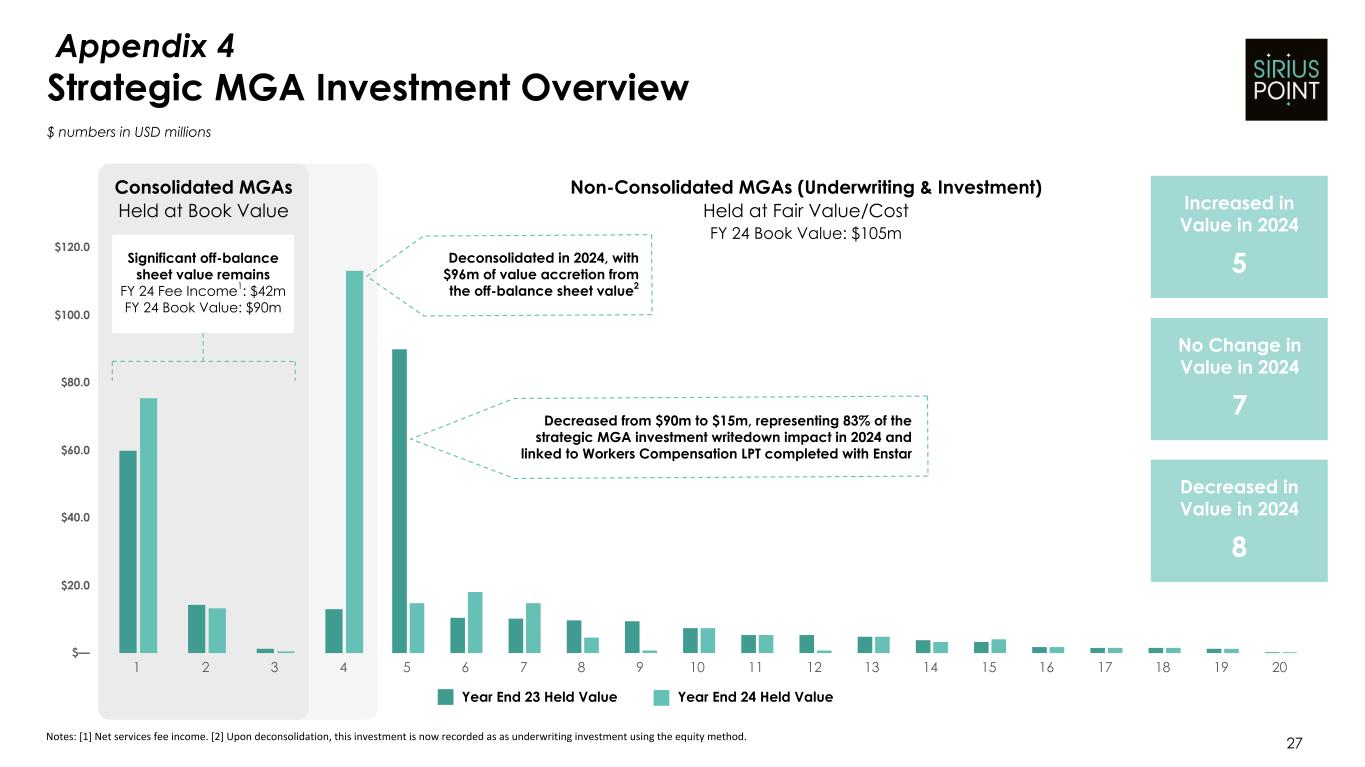

27 Appendix 4 Strategic MGA Investment Overview Consolidated MGAs Held at Book Value Non-Consolidated MGAs (Underwriting & Investment) Held at Fair Value/Cost FY 24 Book Value: $105m 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 201 2 3 4 $— $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 Decreased from $90m to $15m, representing 83% of the strategic MGA investment writedown impact in 2024 and linked to Workers Compensation LPT completed with Enstar Deconsolidated in 2024, with $96m of value accretion from the off-balance sheet value2 Significant off-balance sheet value remains FY 24 Fee Income1: $42m FY 24 Book Value: $90m Increased in Value in 2024 5 No Change in Value in 2024 7 Decreased in Value in 2024 8 Year End 23 Held Value Year End 24 Held Value Notes: [1] Net services fee income. [2] Upon deconsolidation, this investment is now recorded as as underwriting investment using the equity method. $ numbers in USD millions

Thank You