Exhibit 99.2 Investor and Analyst Day May 10, 2022 © 2022 Benefitfocus.com, Inc. 1

© 2022 Benefitfocus.com, Inc. 2

Welcome Doug Kuckelman, VP Investor Relations Vision & Return to Profitable Growth Matt Levin, President & CEO Product Enhancements & Strategy Tina Provancal, Chief Product Officer Break Service Excellence Sue Leary, Chief Customer Officer Sales & Marketing Craig Maloney, Chief Commercial Officer Our Agenda Break Forward Looking Financials & Alpana Wegner, Chief Financial Officer Capital Allocation Guidance Q&A Closing Thoughts Matt Levin, President & CEO Optional: Lunch & Product Demo Station © 2022 Benefitfocus.com, Inc. 3

Disclaimer Safe Harbor Except for historical information, all of the statements, expectations, and assumptions contained in this presentation are forward-looking statements. Actual results might differ materially from those explicit or implicit in the forward-looking statements. Important factors that could cause actual results to differ materially include: our need to achieve consistent GAAP profitability; fluctuations in our financial results; our ability to maintain our culture and recruit, integrate and retain qualified personnel, including on our board of directors; our ability to compete effectively and implement our growth strategy; market developments and opportunities; the need to innovate and provide useful products and services; risks related to changing healthcare and other applicable regulations; the immature and volatile nature of the market for our products and services; privacy, security and other risks associated with our business; management of growth; volatility and uncertainty in the global economy and financial markets in light of the evolving COVID-19 pandemic and war in Ukraine; and the other risk factors set forth from time to time in our SEC filings, copies of which are available free of charge within the Investor Relations section of the Benefitfocus website at https://investor.benefitfocus.com/sec- filings or upon request from our Investor Relations Department. Benefitfocus assumes no obligation and does not intend to update these forward-looking statements, except as required by law. © 2022 Benefitfocus.com, Inc. 4

Disclaimer Non-GAAP Financial Measures The company uses certain non-GAAP financial measures in this presentation, including non-GAAP gross profit, operating income/loss, net loss/income, net loss/income per common share, adjusted EBITDA and free cash flow. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance or financial position that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. Non-GAAP gross profit, operating income/loss, net loss/income and net loss/income per common share exclude stock-based compensation expenses, amortization of acquisition-related intangible assets, transaction and acquisition-related costs expensed, expense related to the impairment of goodwill, intangible assets and long-lived assets, gain or loss on extinguishment of debt, and costs not core to our business. We define adjusted EBITDA as net loss before net interest, taxes, and depreciation and amortization expense, adjusted to eliminate stock-based compensation expense; transaction and acquisition-related costs expensed; restructuring costs; impairment of goodwill, intangible assets and long-lived assets; gain or loss on extinguishment of debt; other costs not core to our business; and loss on settlement of lawsuits. We define free cash flow as cash provided by or used in operating activities less capital expenditures, adjusted to eliminate cash paid for restructuring costs. Please note that other companies might define their non-GAAP financial measures differently than we do. Management presents these non-GAAP financial measures in this presentation because it considers them to be important supplemental measures of performance. Management uses these non-GAAP financial measures for planning purposes, including analysis of the company's performance against prior periods, the preparation of operating budgets and to determine appropriate levels of operating and capital investments. Management believes that these non-GAAP financial measures provide additional insight for analysts and investors in evaluating the company's financial and operational performance. Management also intends to provide these non-GAAP financial measures as part of the company’s future earnings discussions and, therefore, their inclusion should provide consistency in the company’s financial reporting. © 2022 Benefitfocus.com, Inc. 5

Matt Levin President & CEO 20+ years health care, benefits, and technology experience Expertise in corporate development and strategic planning Proven track record developing and executing growth strategies © 2022 Benefitfocus.com, Inc. 6

Compelling Investment Thesis ü Expanding presence in large, growing and underpenetrated Large and Growing TAM addressable market with opportunity to grow into adjacencies ü Favorable industry tailwinds ü Leveraging differentiated, scalable technology platform and Differentiated & Scalable Technology capabilities to solve complex problems across Employers and Health Plans ü Attractive, durable business model supported by subscription revenue and repositioned for sustainable growth Durable Business Model ü Strong heritage in the industry and long-lasting customer relationships ü Strengthening the core ü Growing with intent Transformation Growth Strategy ü Increasing operational efficiency ü Tenured management team with deep industry experience Unrivaled Leadership Team executing the business transformation © 2022 Benefitfocus.com, Inc. 7

Simplified Benefits Administration Drives Improved Health and Outcomes We help customers simplify the complexity of benefits administration. Mission To improve lives with benefits. We are lowering the costs of health care. Vision To be THE preferred partner in the health and benefits industry. We unlock the potential for better health and improved outcomes. © 2022 Benefitfocus.com, Inc. 8

Seasoned Team of Results-Driven Industry Veterans Matt Levin Tina Provancal Sue Leary Craig Maloney Alpana Wegner Kristin Adams President & CEO Chief Product Officer Chief Customer Officer Chief Commercial Officer Chief Financial Officer Chief People Officer ~200 combined years of industry experience Tim Sand Ana Perez Greg Mercer SVP, Customer Chief Marketing Officer SVP, Sales Operations Joined within last 12 months © 2022 Benefitfocus.com, Inc. 9

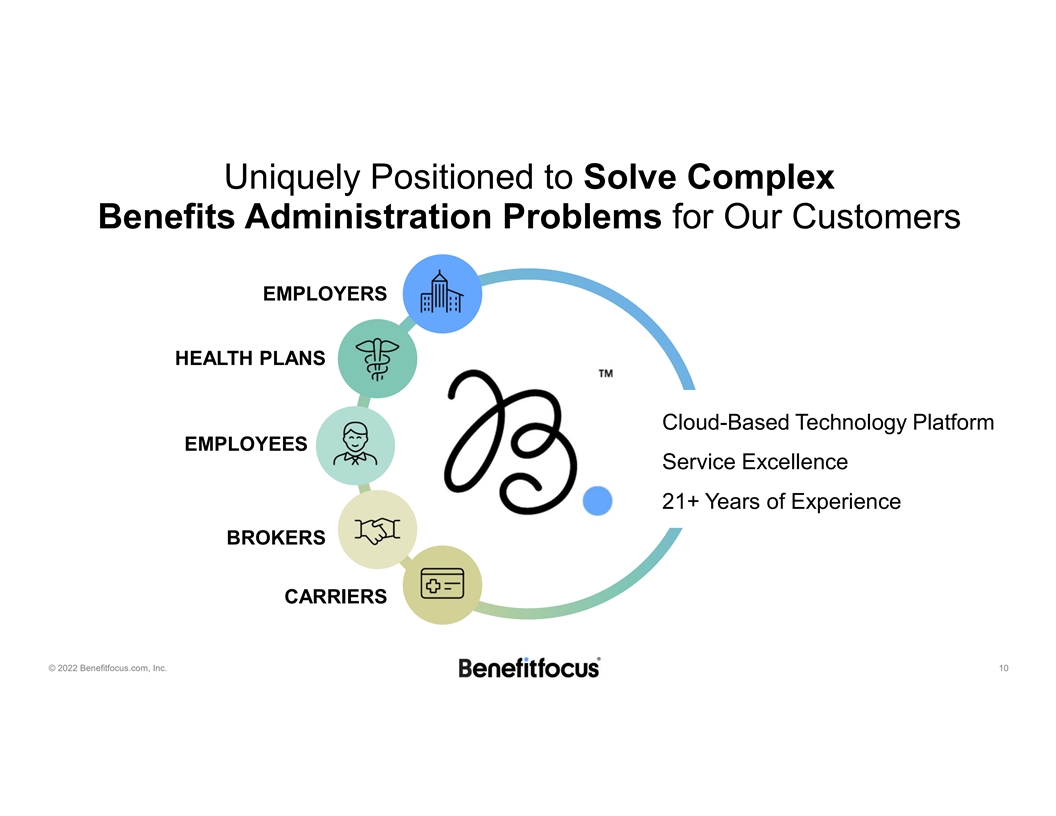

Uniquely Positioned to Solve Complex Benefits Administration Problems for Our Customers EMPLOYERS HEALTH PLANS Cloud-Based Technology Platform EMPLOYEES Service Excellence 21+ Years of Experience BROKERS CARRIERS © 2022 Benefitfocus.com, Inc. 10

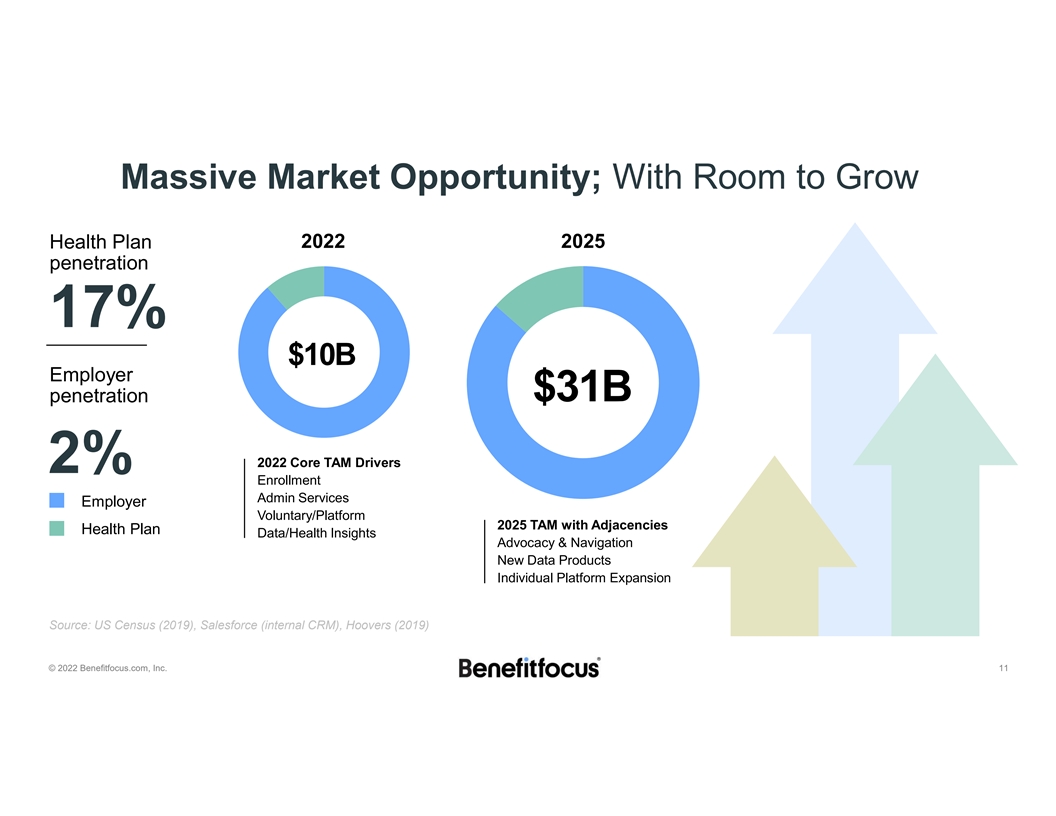

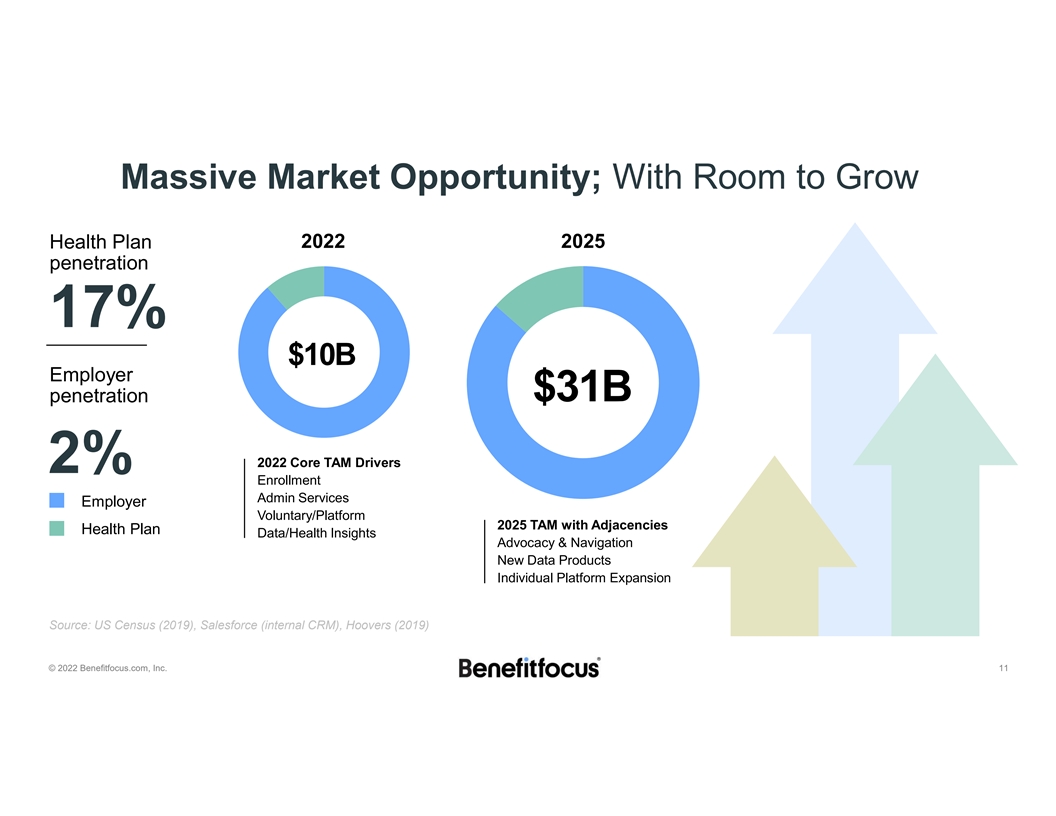

Massive Market Opportunity; With Room to Grow 2022 2025 Health Plan penetration 17% $10B Employer $31B penetration 2022 Core TAM Drivers 2% Enrollment Admin Services Employer Voluntary/Platform 2025 TAM with Adjacencies Health Plan Data/Health Insights Advocacy & Navigation New Data Products Individual Platform Expansion Source: US Census (2019), Salesforce (internal CRM), Hoovers (2019) © 2022 Benefitfocus.com, Inc. 11

Partner of Choice for a Diversified Customer Base 25M Lives 1 of every 12 U.S. Employees Employers Health Plans 560+ Employer Customers ~60% of the Blues We serve 50+ Enterprise Customers 35+ Health Plan Customers We work with 50+ Brokers 100+ Carrier Partners © 2022 Benefitfocus.com, Inc. 12

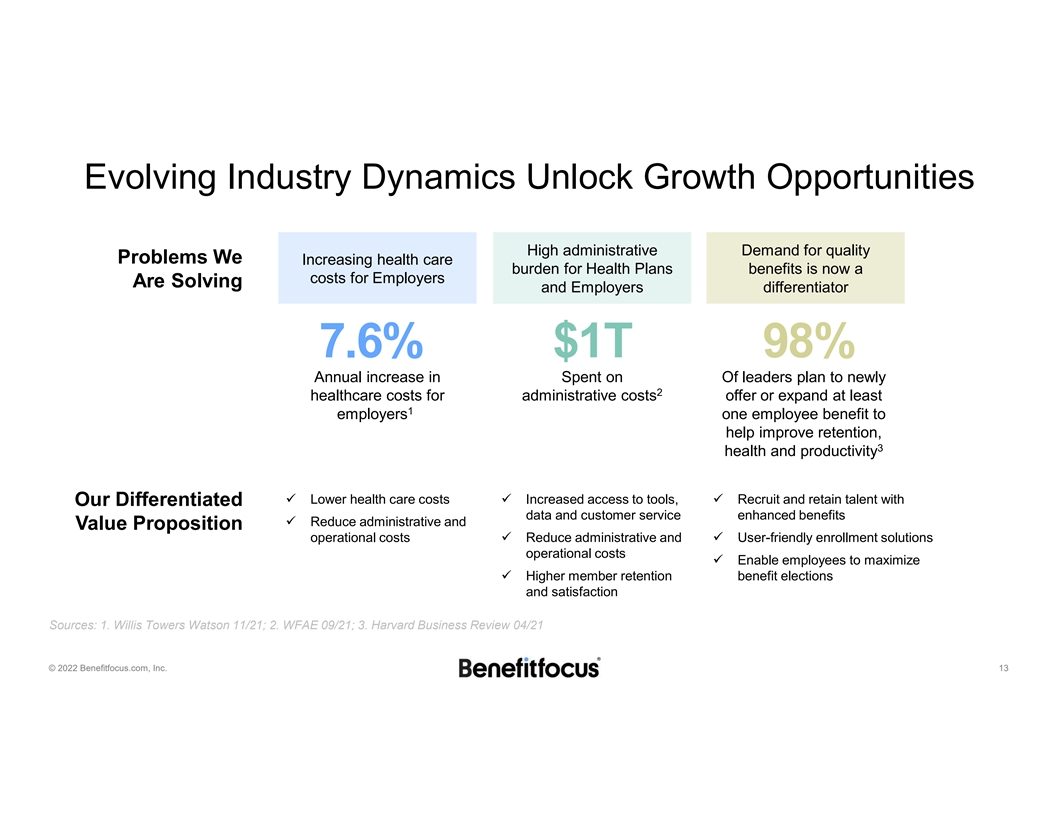

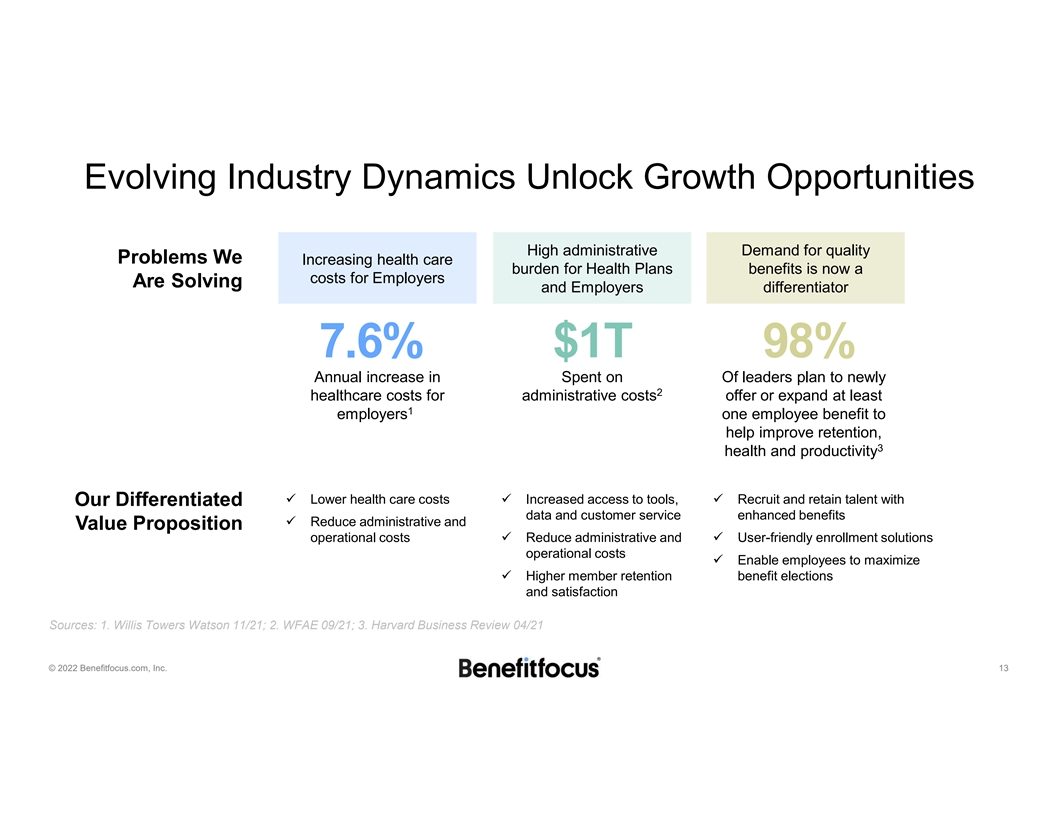

Evolving Industry Dynamics Unlock Growth Opportunities High administrative Demand for quality Problems We Increasing health care burden for Health Plans benefits is now a costs for Employers Are Solving and Employers differentiator 7.6% $1T 98% Annual increase in Spent on Of leaders plan to newly 2 healthcare costs for administrative costs offer or expand at least 1 employers one employee benefit to help improve retention, 3 health and productivity ü Lower health care costsü Increased access to tools, ü Recruit and retain talent with Our Differentiated data and customer service enhanced benefits ü Reduce administrative and Value Proposition operational costsü Reduce administrative and ü User-friendly enrollment solutions operational costs ü Enable employees to maximize ü Higher member retention benefit elections and satisfaction Sources: 1. Willis Towers Watson 11/21; 2. WFAE 09/21; 3. Harvard Business Review 04/21 © 2022 Benefitfocus.com, Inc. 13

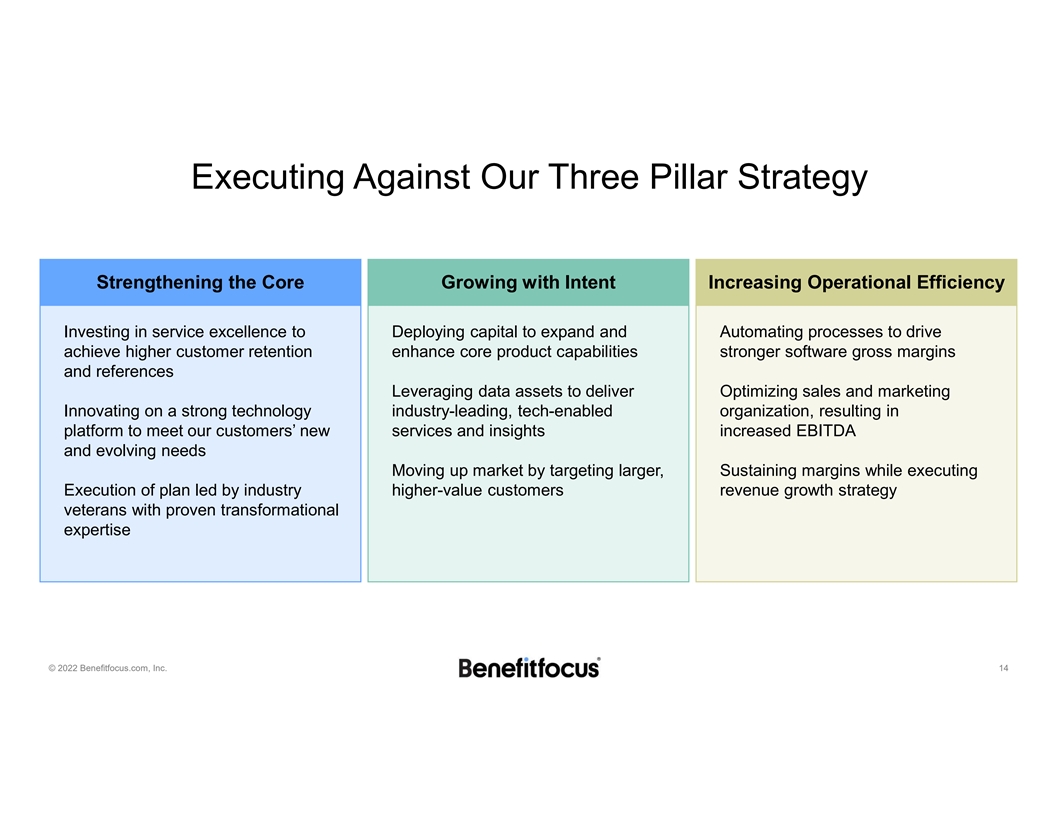

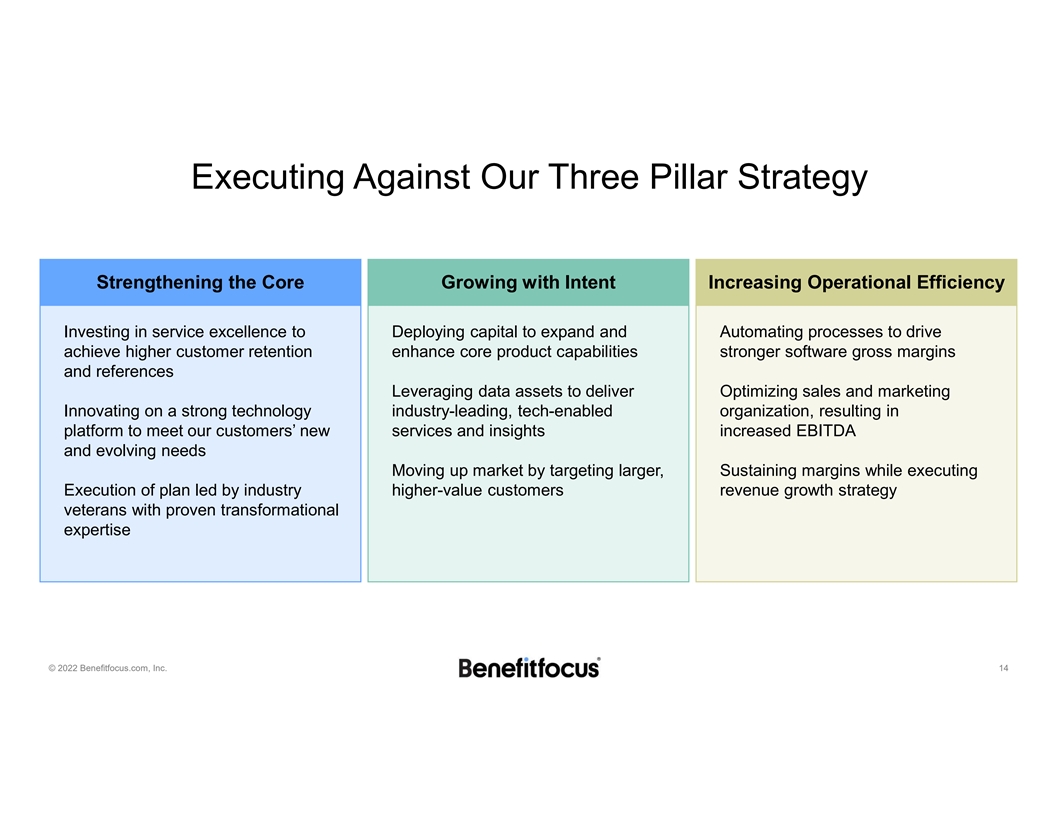

Executing Against Our Three Pillar Strategy Strengthening the Core Growing with Intent Increasing Operational Efficiency Investing in service excellence to Deploying capital to expand and Automating processes to drive achieve higher customer retention enhance core product capabilities stronger software gross margins and references Leveraging data assets to deliver Optimizing sales and marketing Innovating on a strong technology industry-leading, tech-enabled organization, resulting in platform to meet our customers’ new services and insights increased EBITDA and evolving needs Moving up market by targeting larger, Sustaining margins while executing Execution of plan led by industry higher-value customers revenue growth strategy veterans with proven transformational expertise © 2022 Benefitfocus.com, Inc. 14

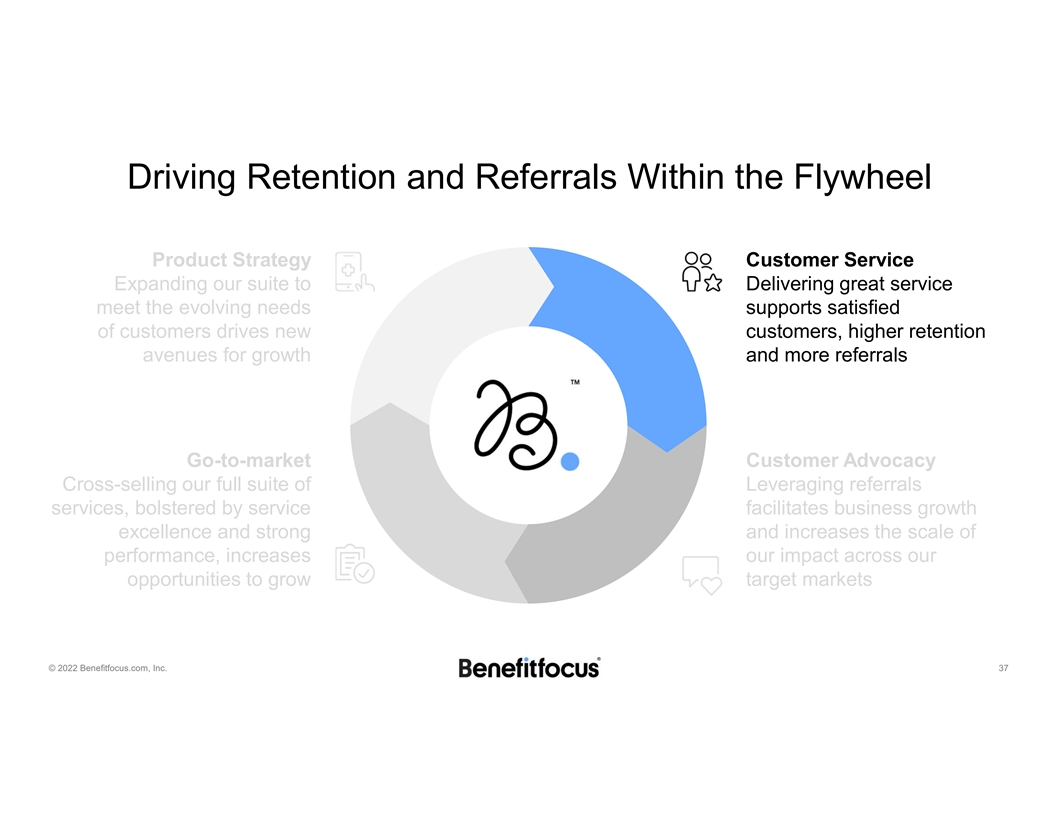

Putting the Benefitfocus Flywheel In Motion Product Strategy Customer Service Expanding our suite to Delivering great service meet the evolving needs supports satisfied of customers drives new customers, higher retention avenues for growth and more referrals Go-to-market Customer Advocacy Cross-selling our full suite of Leveraging referrals services, bolstered by service facilitates business growth excellence and strong and increases the scale of performance, increases our impact across our opportunities to grow target markets © 2022 Benefitfocus.com, Inc. 15

Delivering On Our Commitments With Momentum Launch Health Insights 2.0 In market Individual (Winter 2022) Quoting & Activation Best OE in Company (Summer 2022) History; Record High Launch Employer Full Engagement Customer Satisfaction Aon Panel Large Market & Navigation Suite Ratings (2021) (Spring 2022) Offerings (Fall 2022) (Fall 2023) STRENGTHEN THE CORE GROW WITH INTENT INCREASE OPERATING EFFICIENCY Launch Engagement Call Center Campaigns Tango Enhanced COBRA Efficiencies Launch Individual (Spring 2022) Acquisition Features (Fall 2022) Enhanced Quoting & Activation (2021) (Summer 2022) Billing (Winter 2023) Features (Winter 2022) © 2022 Benefitfocus.com, Inc. 16

Compelling Investment Thesis ü Expanding presence in large, growing and underpenetrated addressable market with opportunity to grow into adjacencies Large and Growing TAM ü Favorable industry tailwinds ü Leveraging differentiated, scalable technology platform and capabilities to solve complex problems across Employers and Differentiated & Scalable Technology Health Plans ü Attractive, durable business model supported by subscription revenue and repositioned for sustainable growth Durable Business Model ü Strong heritage in the industry and long-lasting customer relationships ü Strengthening the core ü Growing with intent Transformation Growth Strategy ü Increasing operational efficiency ü Tenured management team with deep industry experience Unrivaled Leadership Team executing the business transformation © 2022 Benefitfocus.com, Inc. 17

Investor and Analyst Day May 10, 2022 © 2022 Benefitfocus.com, Inc. 18

Tina Provancal Chief Product Officer 25+ years of industry experience Benefits design, administration, business transformation, clinical advocacy Consultant and co-creator with health plans and employers © 2022 Benefitfocus.com, Inc. 19

Health Care is Costly and Increasingly Complex 1 2 3 4 $6.8T7.6%$32B80% Projected US Increase in Unnecessary People choose the healthcare spend 2030 benefit costs ER spend wrong medical plan Sources: 1. CMS 3/22, 2. Willis Towers Watson 11/21, 3. United Healthcare 7/19, 4. NerdWallet 10/19 © 2022 Benefitfocus.com, Inc. 20

Help People Get the Most Out of Their Benefits © 2022 Benefitfocus.com, Inc. 21

Enhancing Capabilities to Support Growth Product Strategy Customer Service Expanding our suite to Delivering great service meet the evolving needs supports satisfied of customers drives new customers, higher retention avenues for growth and more referrals Go-to-market Customer Advocacy Cross-selling our full suite of Leveraging referrals services, bolstered by service facilitates business growth excellence and strong and increases the scale of performance, increases our impact across our opportunities to grow target markets © 2022 Benefitfocus.com, Inc. 22

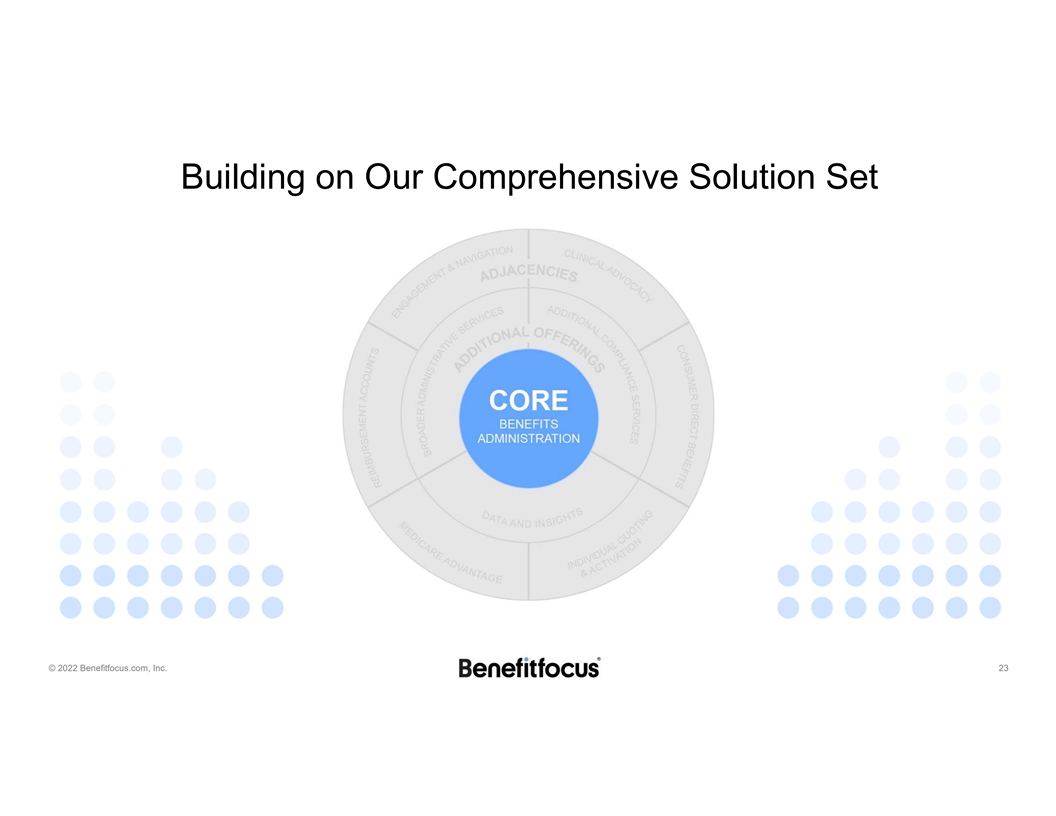

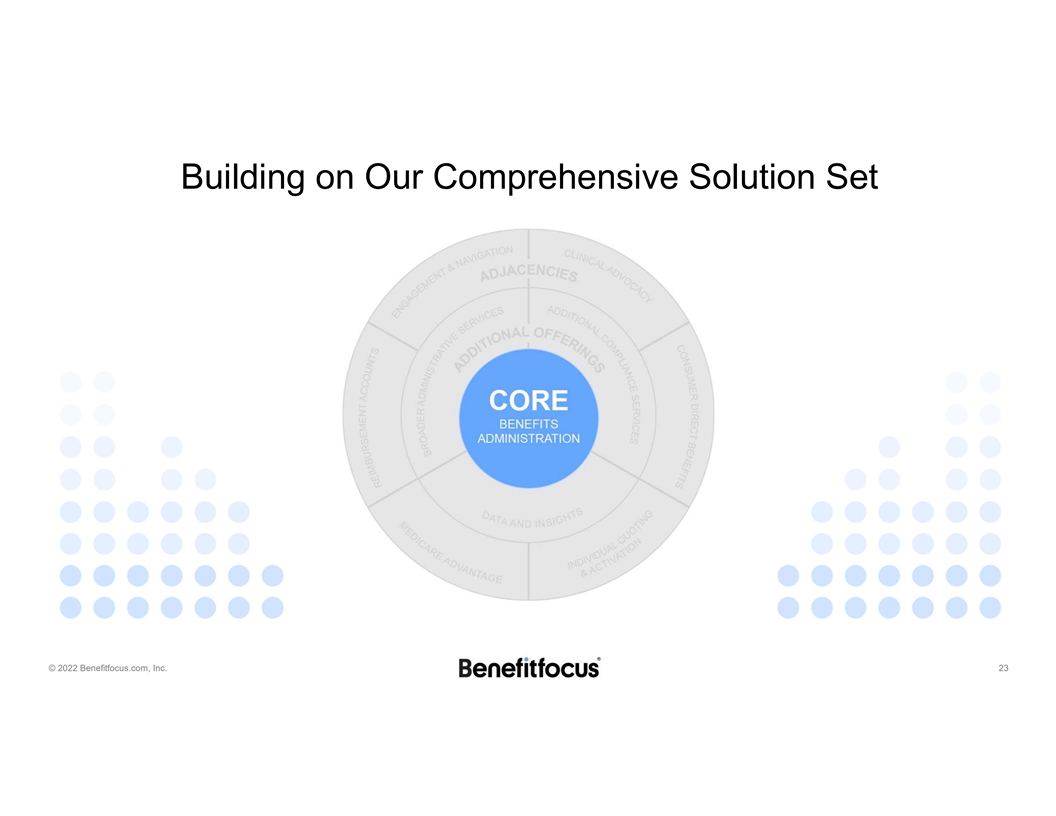

Building on Our Comprehensive Solution Set © 2022 Benefitfocus.com, Inc. 23

Stronger and Expanded Core Capabilities • Deliver industry-leading administrative and compliance services • Increase automation driving operational efficiencies • Accessing more TAM • Moderate development, large return © 2022 Benefitfocus.com, Inc. 24

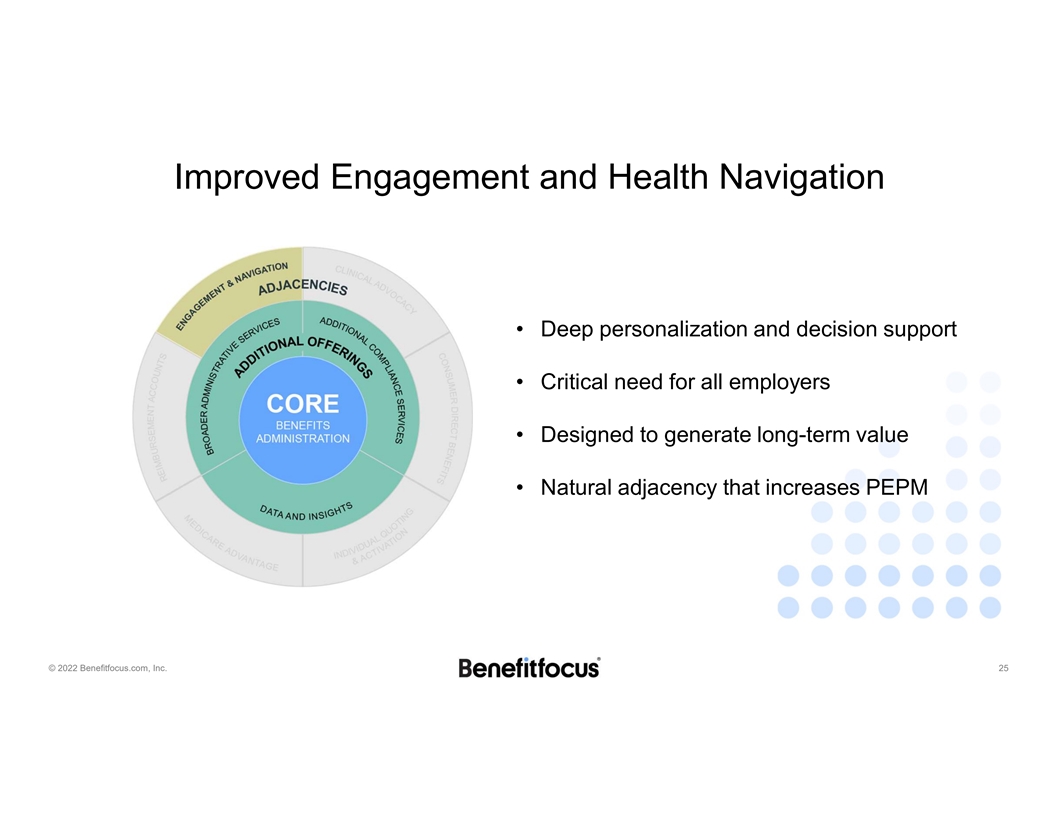

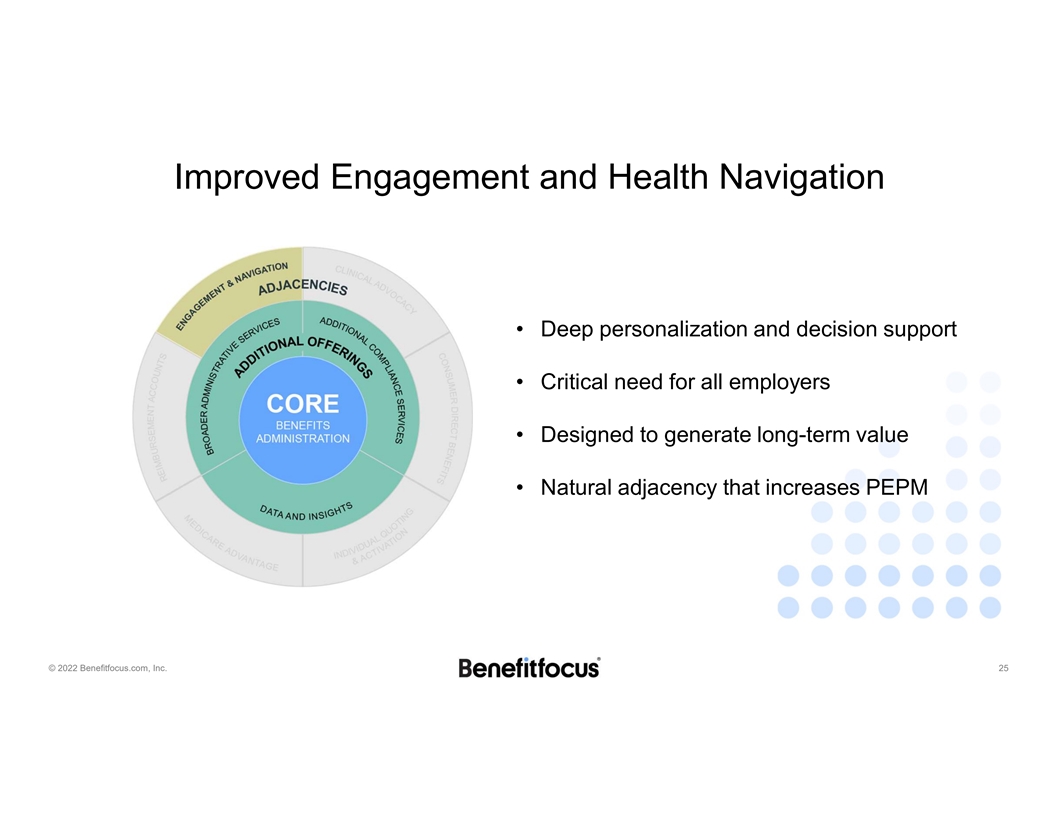

Improved Engagement and Health Navigation • Deep personalization and decision support • Critical need for all employers • Designed to generate long-term value • Natural adjacency that increases PEPM © 2022 Benefitfocus.com, Inc. 25

Extension Into Individual Market • Leverage existing capabilities to win in adjacent, fast-growing market • Opportunity for competitive differentiation • Top 10 Health Plans represent ~70% of TAM • 4 of 10 are customers today © 2022 Benefitfocus.com, Inc. 26

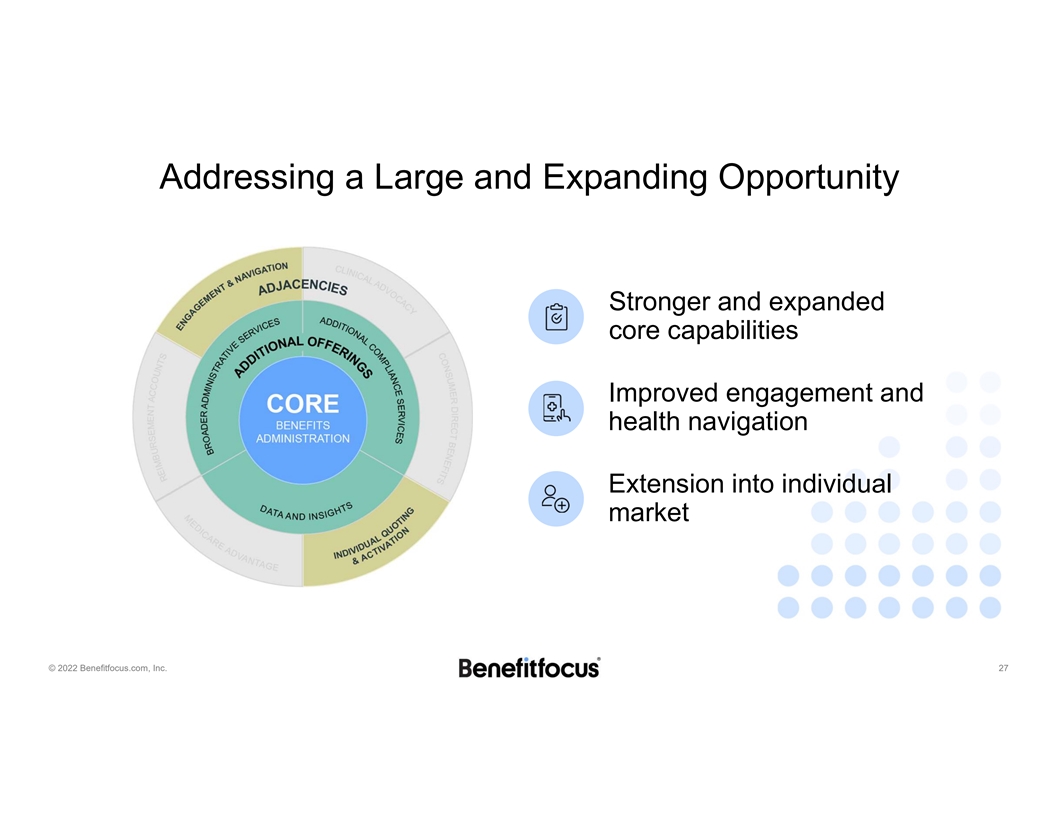

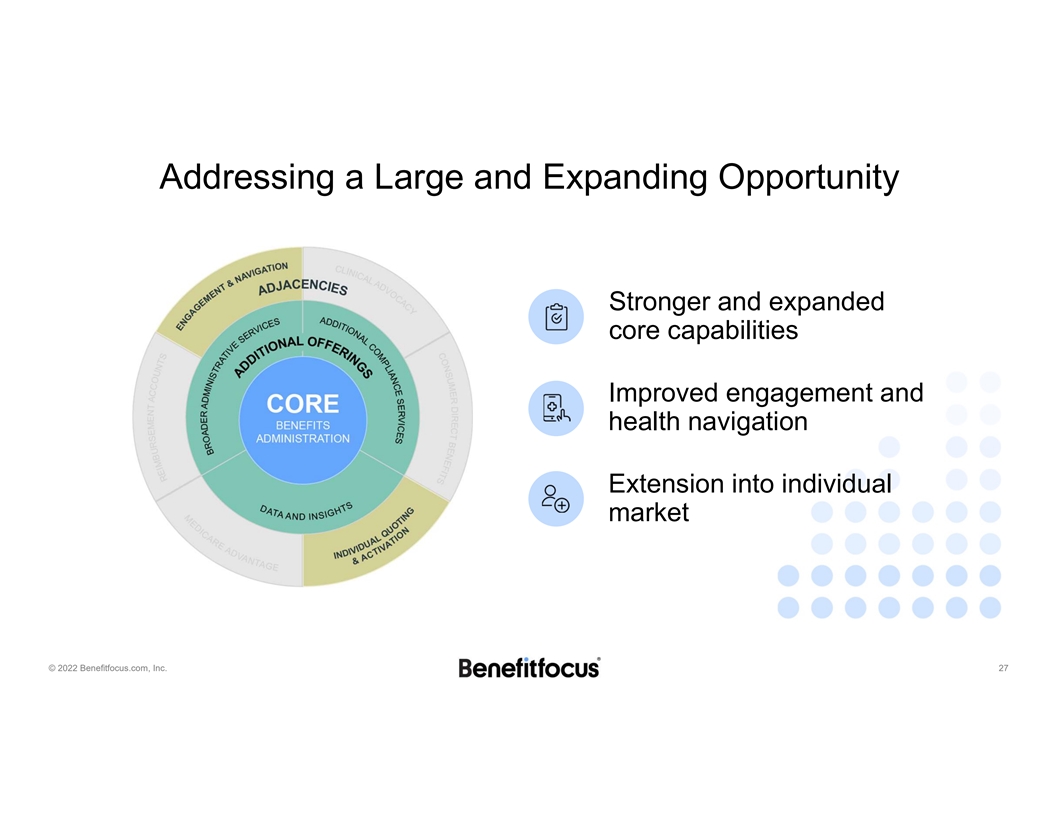

Addressing a Large and Expanding Opportunity Stronger and expanded core capabilities Improved engagement and health navigation Extension into individual market © 2022 Benefitfocus.com, Inc. 27

Product Differentiation Unlocks Customer Value Technology Data Experience © 2022 Benefitfocus.com, Inc. 28

Cloud-native to allow for dynamic scaling and distributed processing. Modern platform to reduce maintenance costs and enable greater focus on innovation. Single codebase architecture to enable fast implementations and accelerated product Technology development and innovation. An agile and scalable technology platform that Low-code/no-code development tools to increase collaboration and speed in our releases. accelerates innovation. © 2022 Benefitfocus.com, Inc. 29

Real-time access to insights to empower actionable strategies that deliver health care ROI for our customers. Leveraging AI and ML to advance existing personalization capabilities and expand into additional insight offerings. Data Access to differentiated Defense-in-depth security model to secure critical data, mitigate cyber risk and data for insights that maintain PCI, SOC, and HITRUST certifications. empower outcomes. © 2022 Benefitfocus.com, Inc. 30

Real-time member data to deliver personalized interactions that drive benefits satisfaction and decision support. Omni-channel to enable a seamless user experience and drive greater health and benefit engagement. Experience Self-service capabilities An intuitive user to help educate and support users anytime, anywhere. experience designed to maximize engagement. © 2022 Benefitfocus.com, Inc. 31

Investor and Analyst Day May 10, 2022 © 2022 Benefitfocus.com, Inc. 32

Uniquely Positioned to Unlock Customer Value and Transform Our Growth Strategy TECHNOLOGY Help People Get the DATA Most Out of Their Benefits EXPERIENCE © 2022 Benefitfocus.com, Inc. 33

Key Takeaways We have a large and expanding opportunity to become the preferred partner for benefit administration, driving long-term value for customers and shareholders. We are executing on a product strategy to deliver growth in existing markets and unlock new larger addressable markets. Our technology and robust data insights, combined with our intuitive customer experience, sets us up for driving highly differentiated value. © 2022 Benefitfocus.com, Inc. 34

Investor and Analyst Day May 10, 2022 © 2022 Benefitfocus.com, Inc. 35

Sue Leary Chief Customer Officer 25+ experience in service & delivery Deep background in Health Plans Extensive service experience in growth-focused businesses © 2022 Benefitfocus.com, Inc. 36

Driving Retention and Referrals Within the Flywheel Product Strategy Customer Service Expanding our suite to Delivering great service meet the evolving needs supports satisfied of customers drives new customers, higher retention avenues for growth and more referrals Go-to-market Customer Advocacy Cross-selling our full suite of Leveraging referrals services, bolstered by service facilitates business growth excellence and strong and increases the scale of performance, increases our impact across our opportunities to grow target markets © 2022 Benefitfocus.com, Inc. 37

Job #1 Customer Retention © 2022 Benefitfocus.com, Inc. 38

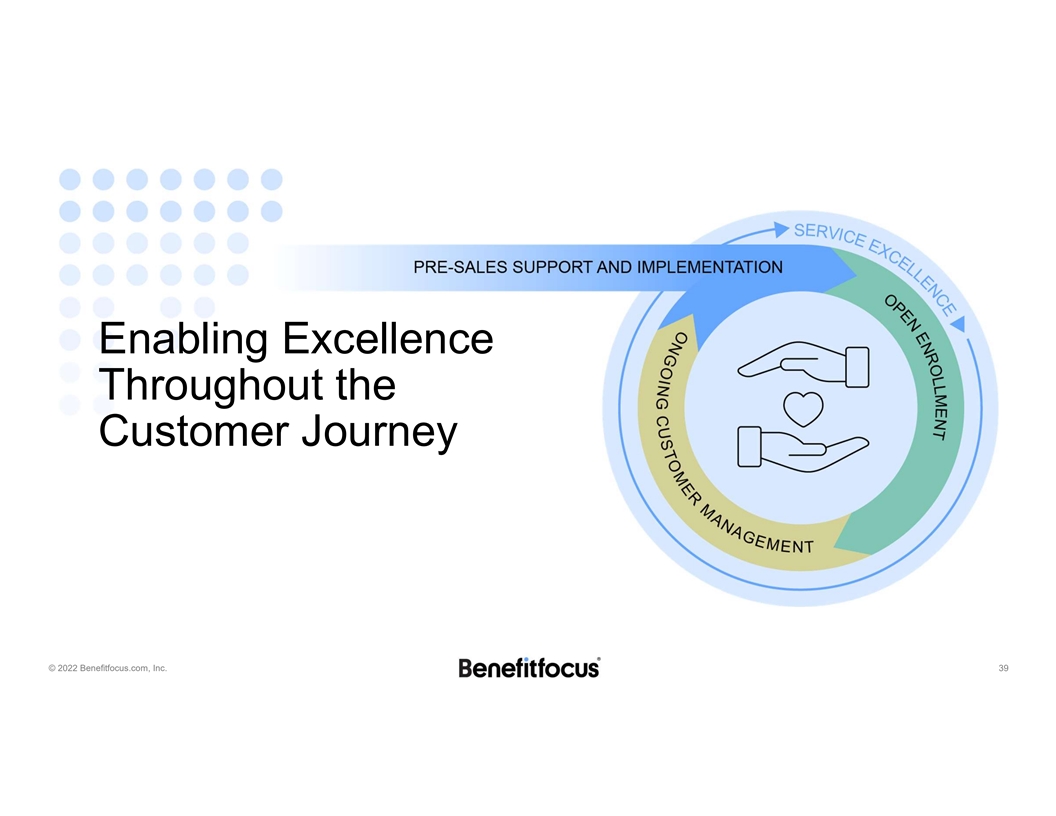

Enabling Excellence Throughout the Customer Journey © 2022 Benefitfocus.com, Inc. 39

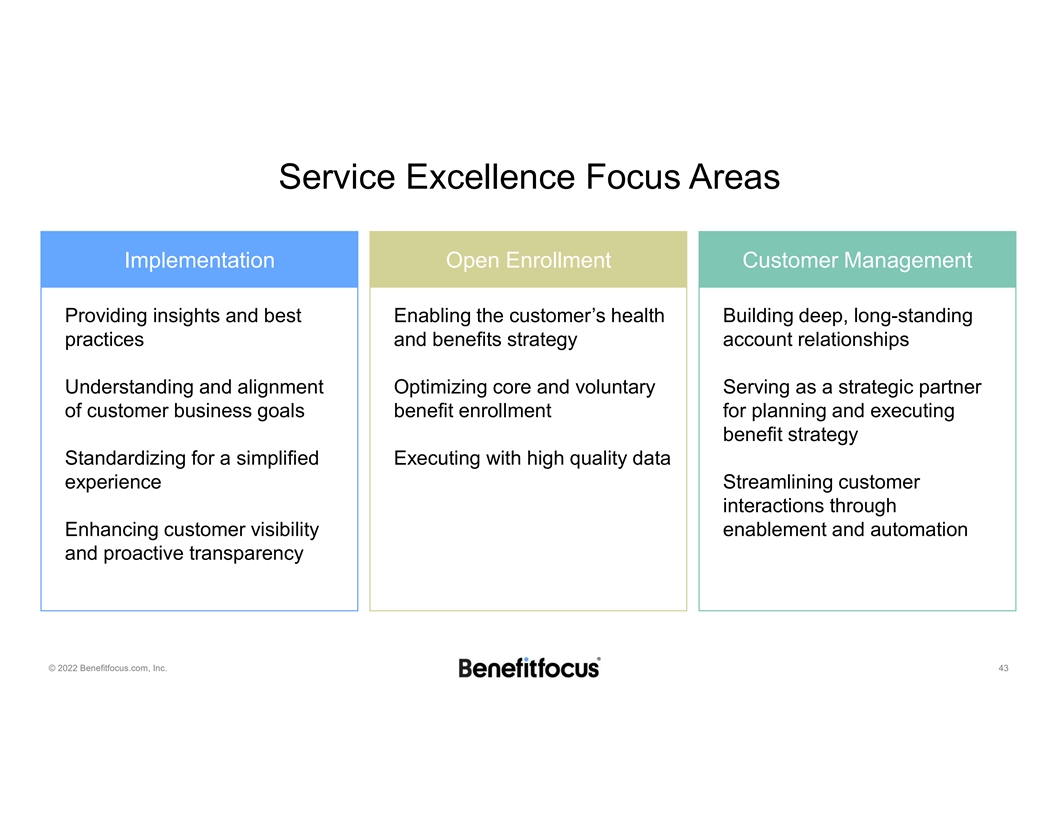

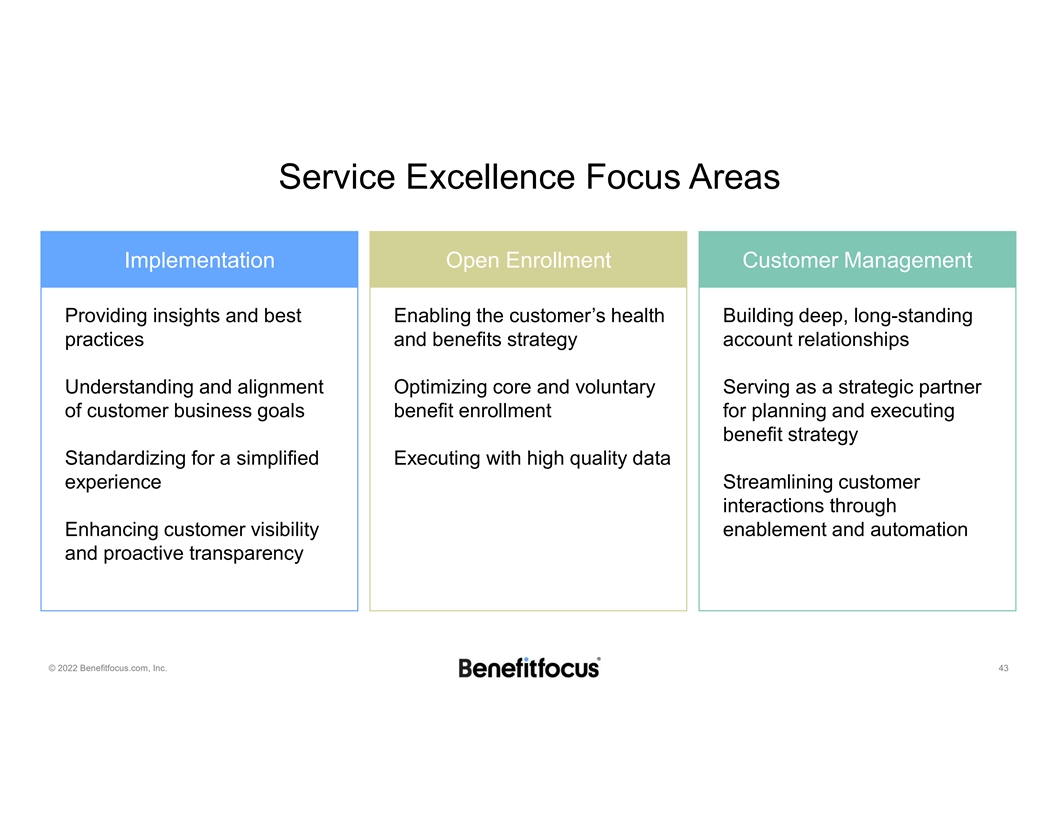

Service Excellence Focus Areas Implementation Open Enrollment Customer Management Providing insights and best Enabling the customer’s health Building deep, long-standing practices and benefits strategy account relationships Understanding and alignment Optimizing core and voluntary Serving as a strategic partner of customer business goals benefit enrollment for planning and executing benefit strategy Standardizing for a simplified Executing with high quality data experience Streamlining customer interactions through Enhancing customer visibility enablement and automation and proactive transparency © 2022 Benefitfocus.com, Inc. 40

Service Excellence Focus Areas Implementation Open Enrollment Customer Management Providing insights and best Enabling the customer’s health Building deep, long-standing practices and benefits strategy account relationships Understanding and alignment Optimizing core and voluntary Serving as a strategic partner of customer business goals benefit enrollment for planning and executing benefit strategy Standardizing for a simplified Executing with high quality data experience Streamlining customer interactions through Enhancing customer visibility enablement and automation and proactive transparency © 2022 Benefitfocus.com, Inc. 41

Strategic Actions Delivering Record Success Metrics 95% 100% on-time customer satisfaction OE start for health plans rating 99% 19M enrollments during on time 2021 OE OE start for employers enrollment eligibility delivery payroll data delivery Source: Benefitfocus © 2022 Benefitfocus.com, Inc. 42

Service Excellence Focus Areas Implementation Open Enrollment Customer Management Providing insights and best Enabling the customer’s health Building deep, long-standing practices and benefits strategy account relationships Understanding and alignment Optimizing core and voluntary Serving as a strategic partner of customer business goals benefit enrollment for planning and executing benefit strategy Standardizing for a simplified Executing with high quality data experience Streamlining customer interactions through Enhancing customer visibility enablement and automation and proactive transparency © 2022 Benefitfocus.com, Inc. 43

Service Excellence Focus Areas Implementation Open Enrollment Customer Management Providing insights and best Enabling the customer’s health Building deep, long-standing practices and benefits strategy account relationships Understanding and alignment Optimizing core and voluntary Serving as a strategic partner of customer business goals benefit enrollment for planning and executing benefit strategy Standardizing for a simplified Executing with high quality data experience Streamlining customer interactions through Enhancing customer visibility enablement and automation and proactive transparency © 2022 Benefitfocus.com, Inc. 44

Large Equipment Retailer 46,000 employees I am SO pleased with my Open Enrollment configuration and the quality of the set up and quick turnaround and feedback on the test issues identified. Benefitplace OE is the least of my concerns right now.” Health and Wellbeing Director © 2022 Benefitfocus.com, Inc. 45

Key Takeaways Delivering service excellence is a top priority, and a key point of differentiation for Benefitfocus. We are focused on three key areas to maximize retention and satisfaction: implementations, ongoing customer support and open enrollment. We have made tremendous progress across the last year and will continue to enhance our model to maximize retention and growth. © 2022 Benefitfocus.com, Inc. 46

Investor and Analyst Day May 10, 2022 © 2022 Benefitfocus.com, Inc. 47

Craig Maloney Chief Commercial Officer 30+ years of industry experience SaaS/Ben Admin, Channel Partnerships, Voluntary Benefits Track record of leading high growth organizations © 2022 Benefitfocus.com, Inc. 48

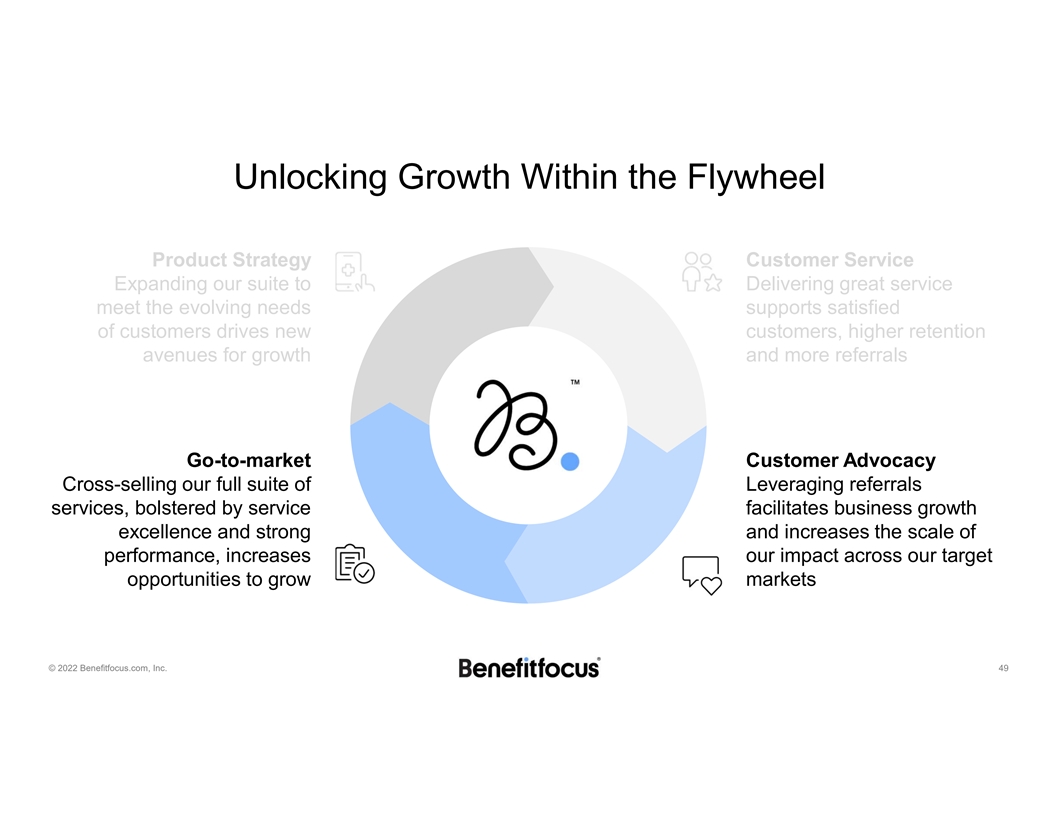

Unlocking Growth Within the Flywheel Product Strategy Customer Service Expanding our suite to Delivering great service meet the evolving needs supports satisfied of customers drives new customers, higher retention avenues for growth and more referrals Go-to-market Customer Advocacy Cross-selling our full suite of Leveraging referrals services, bolstered by service facilitates business growth excellence and strong and increases the scale of performance, increases our impact across our target opportunities to grow markets © 2022 Benefitfocus.com, Inc. 49

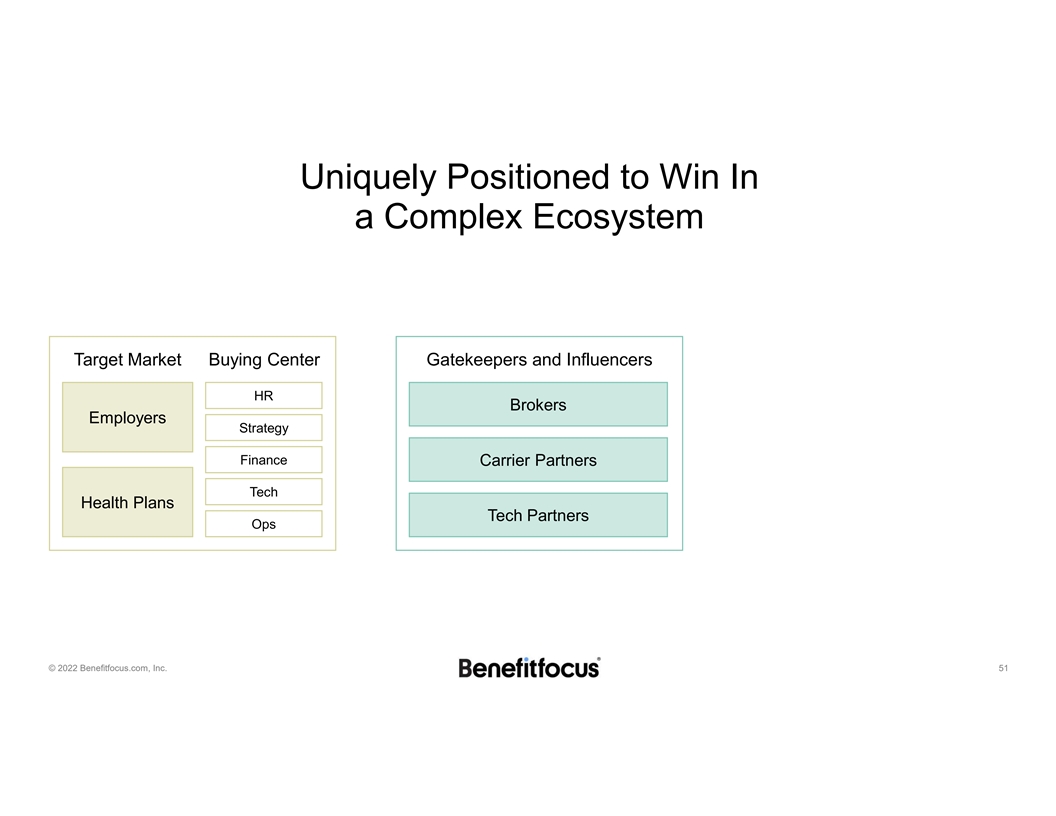

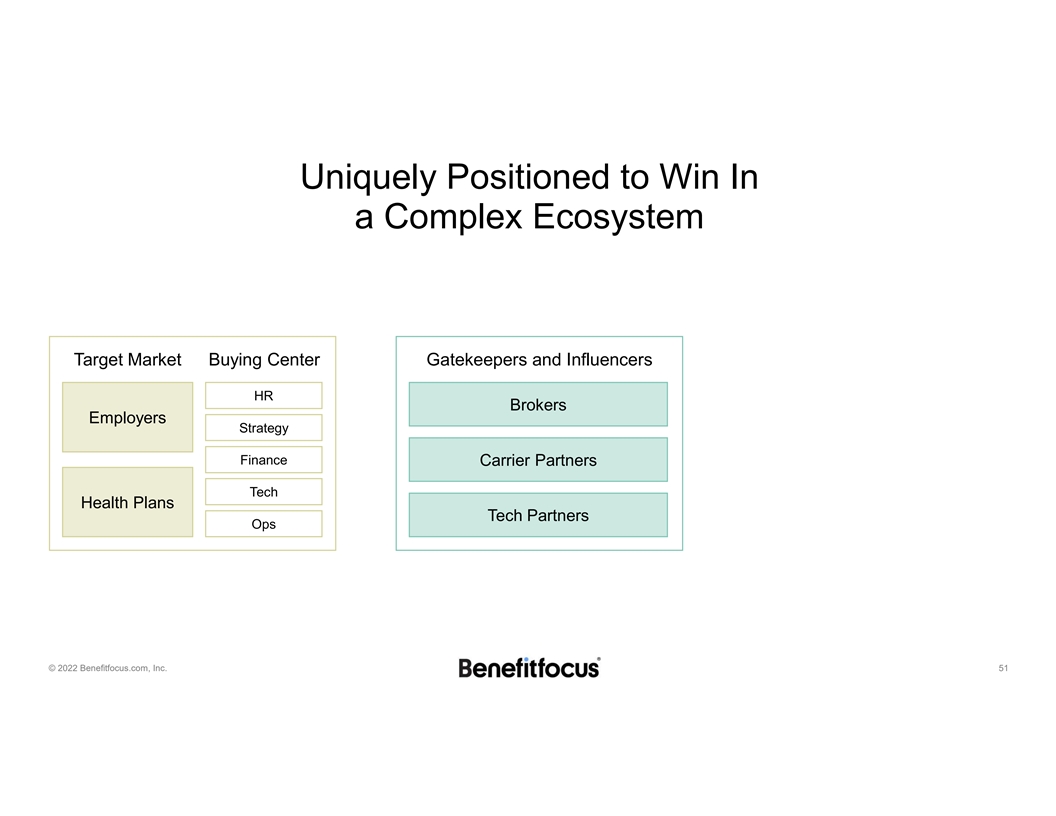

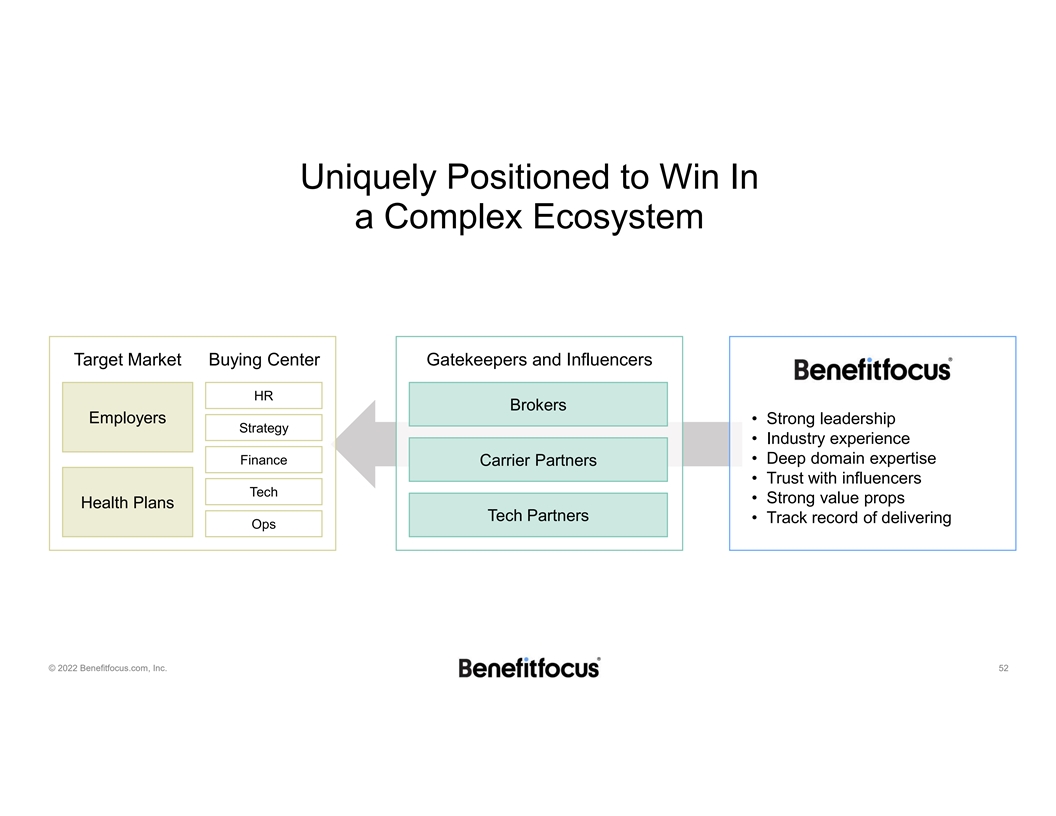

Uniquely Positioned to Win In a Complex Ecosystem Target Market Buying Center HR Employers Strategy Finance Tech Health Plans Ops © 2022 Benefitfocus.com, Inc. 50

Uniquely Positioned to Win In a Complex Ecosystem Target Market Buying Center Gatekeepers and Influencers HR Brokers Employers Strategy Finance Carrier Partners Tech Health Plans Tech Partners Ops © 2022 Benefitfocus.com, Inc. 51

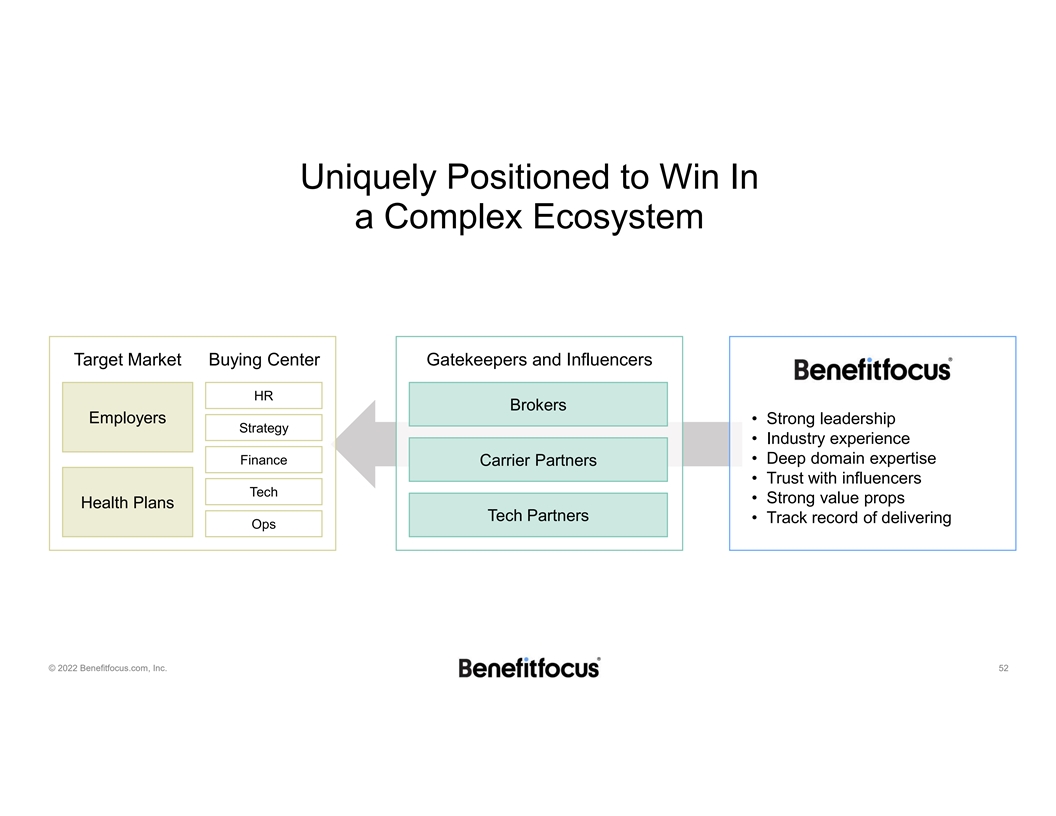

Uniquely Positioned to Win In a Complex Ecosystem Target Market Buying Center Gatekeepers and Influencers HR Brokers Employers • Strong leadership Strategy • Industry experience • Deep domain expertise Finance Carrier Partners • Trust with influencers Tech • Strong value props Health Plans Tech Partners • Track record of delivering Ops © 2022 Benefitfocus.com, Inc. 52

We Have a Strong Customer Base from Which to Capture More of the TAM © 2022 Benefitfocus.com, Inc. 53

We Have a Massive Growth Opportunity State Government Employers Health Plans and University Systems 9M 1-10k 10-50k >50k 110M Number of Number of Number of Number of Number of EMPLOYEES EMPLOYEES EMPLOYEES EMPLOYEES COVERED MEMBERS NO. OF NO. OF NO. OF NO. OF NO. OF ACCOUNTS ACCOUNTS ACCOUNTS ACCOUNTS ACCOUNTS 1,000 200 70 9,000 80 LARGE JUMBO MID-MARKET Source: US Census (2019), Salesforce (internal CRM), Hoovers (2019) © 2022 Benefitfocus.com, Inc. 54

Our Sales and Marketing Org Aligns to Our Growth Strategy Net New Net New Up Sell/Cross Sell Renewals Employers Health Plans DIRECT SALES rd Broker 3 Party Tech Partner Carrier Partner Management Evaluators Management Management INDIRECT SALES SALES EFFECTIVENESS Marketing | Lead Generation | Analytics | Sales Operations © 2022 Benefitfocus.com, Inc. 55

Our Sales and Marketing Org Aligns to Our Growth Strategy Net New Net New Up Sell / Cross Renewals Employers Health Plans Sell DIRECT SALES Broker 3rd Party Tech Partner Carrier Partner Management Evaluators Management Management INDIRECT SALES SALES EFFECTIVENESS Marketing | Lead Generation | Analytics | Sales Operations © 2022 Benefitfocus.com, Inc. 56

Our Sales and Marketing Organization is Experienced and Tenured 1 18%16740% Annual investment as Average years of Average years at Percent of sales team percent of revenue industry experience Benefitfocus with ops experience Geographically deployed Locally Managed Commissioned 1. Source: Benefitfocus 2021 Form 10-K © 2022 Benefitfocus.com, Inc. 57

Channel Management is a Priority to Unlock Growth... PARTNERS BROKER Gatekeeper Role Influencer New leads Value Referenceability Outcomes Lower cost of sale Examples © 2022 Benefitfocus.com, Inc. 58

Channel Management is a Priority to Unlock Growth... PARTNERS BROKER CARRIERS Gatekeeper Influencer Role Influencer Advocate New leads New leads Value Referenceability Product development Outcomes Lower cost of sale Service integration Examples © 2022 Benefitfocus.com, Inc. 59

Channel Management is a Priority to Unlock Growth... PARTNERS BROKER CARRIERS TECH PARTNERS Gatekeeper Influencer Platform Integrator Role Influencer Advocate 3rd Party Distribution New leads New leads New leads Value Referenceability Product development Platform integrations Outcomes Lower cost of sale Service integration Lower Implementation Cost Examples © 2022 Benefitfocus.com, Inc. 60

…And Early Results Are Strong Brokers Carrier Partner Prospecting Activities +300% YOY 100% Partner Referenceable Appointed to Lockton Ben Admin Panel 100% Partner Retention Appointed to Aon Ben Admin Panel System Integration Programs with Top 15 Launched Benefitfocus Consulting Business Reviews and Shared Advisory Board Marketing Plans © 2022 Benefitfocus.com, Inc. 61

Customer Case Studies – The Flywheel In Action • Large health care organization • Original annual contract value of $630,000 • Collaboration with broker to identify opportunities/green space • Upsell Renewal Bundle to add services and broaden scope by $350,000 • Increase annual revenue by 55% • Large school district • Collaboration with national broker. Broker initiated lead • Closed the deal 60 days later for $204,000 • Early success led to a reference to sister district and second win for $271,000 • Mid-market retailer • Original contract $187,000 • Tango ACA solution upsold to solve immediate need • Increase in annual revenue of 14% © 2022 Benefitfocus.com, Inc. 62

Go-To-Market Progress and Proof Points 25%10x62%25% Total Qualified ACA SAP Qualified Voluntary Benefit Pipeline YoY Pipeline YoY Pipeline YoY Pilot Enrollments © 2022 Benefitfocus.com, Inc. 63

Key Takeaways Benefitfocus is uniquely positioned to win in a complex ecosystem. The TAM is large with significant green space. Our go-to-market teams are now aligned to capture meaningful share. Channel management is a priority within our growth strategy. © 2022 Benefitfocus.com, Inc. 64

Investor and Analyst Day May 10, 2022 © 2022 Benefitfocus.com, Inc. 65

Alpana Wegner Chief Financial Officer 20+ years finance and accounting leadership experience Experience in SaaS and tech industry Strategic, operational and P&L ownership experience © 2022 Benefitfocus.com, Inc. 66

Accountability and Focus Accelerates A Winning Innovative Product Growth and Drives Scale Strategy Roadmap Delivering Service Effective GTM Excellence Strategy © 2022 Benefitfocus.com, Inc. 67

Unlocking Value Durable Business Growth Strategy Unlocking Substantial Model Long-term Value © 2022 Benefitfocus.com, Inc. 68

Unlocking Value Durable Business Growth Strategy Unlocking Substantial Model Long-term Value Double-digit revenue growth Mid 20% Adjusted EBITDA margin © 2022 Benefitfocus.com, Inc. 69

Unlocking Value Durable Business Growth Strategy Unlocking Substantial Model Long-term Value © 2022 Benefitfocus.com, Inc. 70

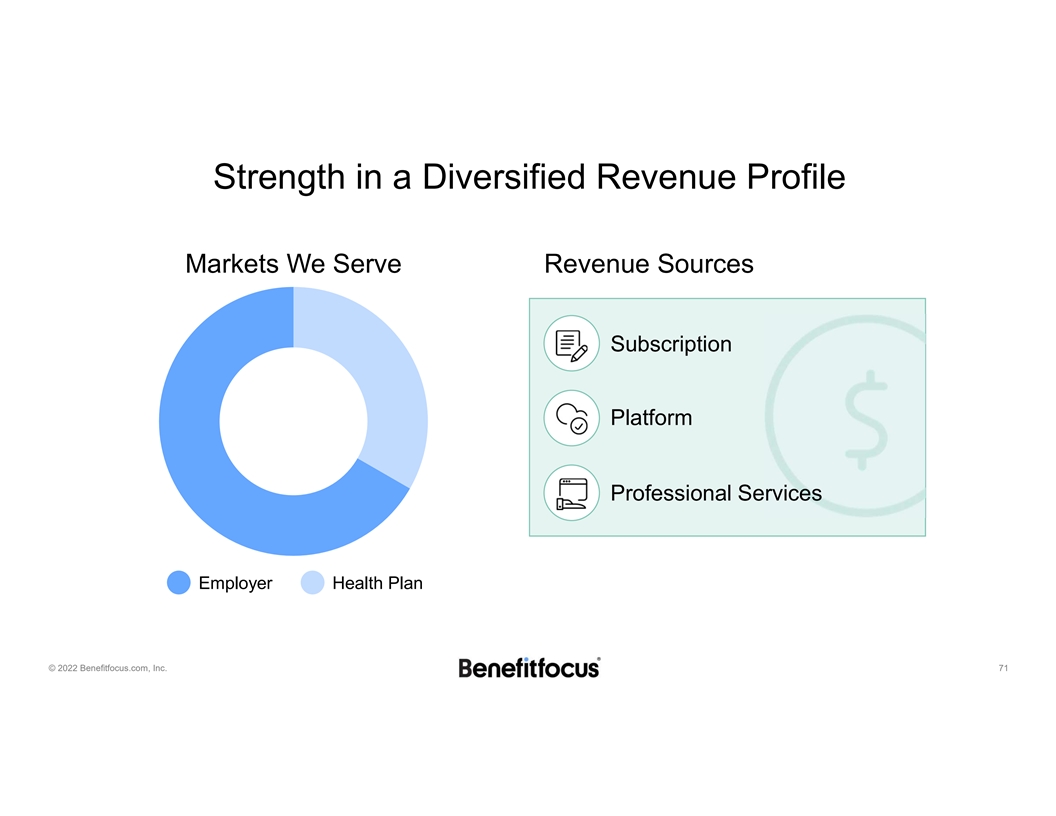

Strength in a Diversified Revenue Profile Markets We Serve Revenue Sources Subscription Platform Professional Services Employer Health Plan © 2022 Benefitfocus.com, Inc. 71

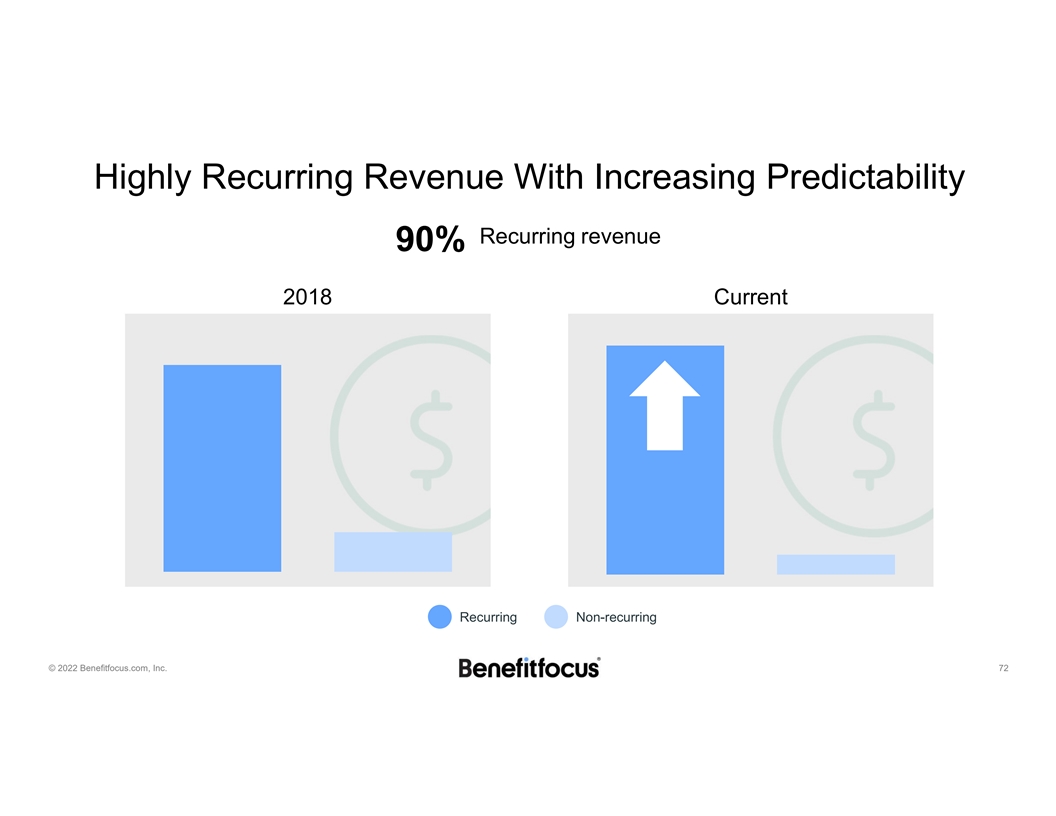

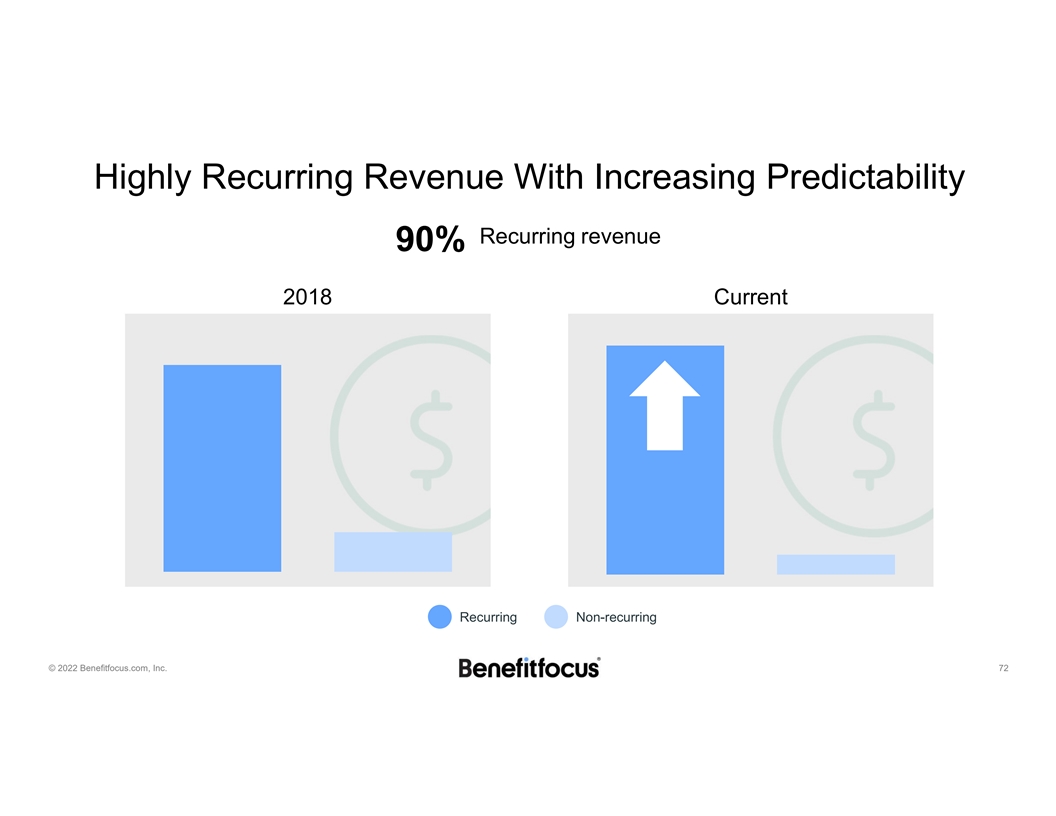

Highly Recurring Revenue With Increasing Predictability Recurring revenue 90% 2018 Current Recurring Non-recurring © 2022 Benefitfocus.com, Inc. 72

Stability in the Customer Base Improving Employers Distributed Across multi-year ARR Multiple Industries renewals 60% customers with contract minimums 90%+ increase in average employer group size YoY 20% © 2022 Benefitfocus.com, Inc. 73

Business Model to Unlock Value at Benefitfocus Durable Business Growth Strategy Unlocking Substantial Model Long-term Value © 2022 Benefitfocus.com, Inc. 74

Paths to Revenue Growth Improve revenue retention Cross sell and upsell to existing customers Win new customers © 2022 Benefitfocus.com, Inc. 75

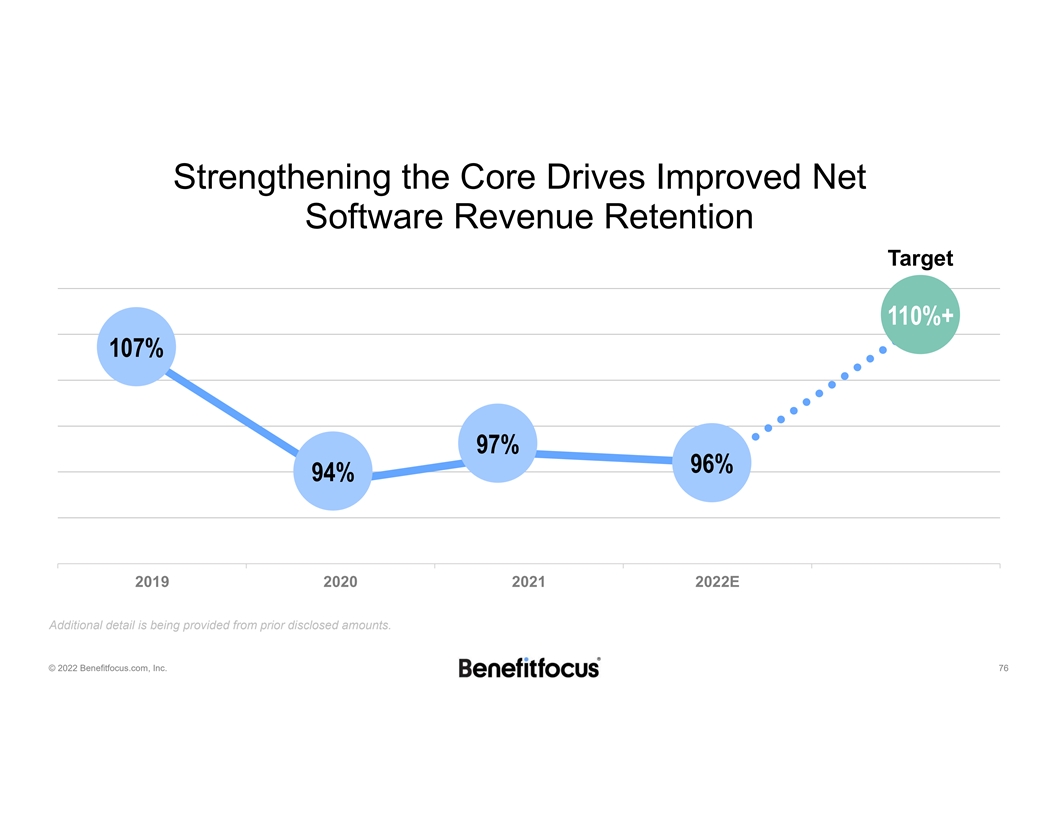

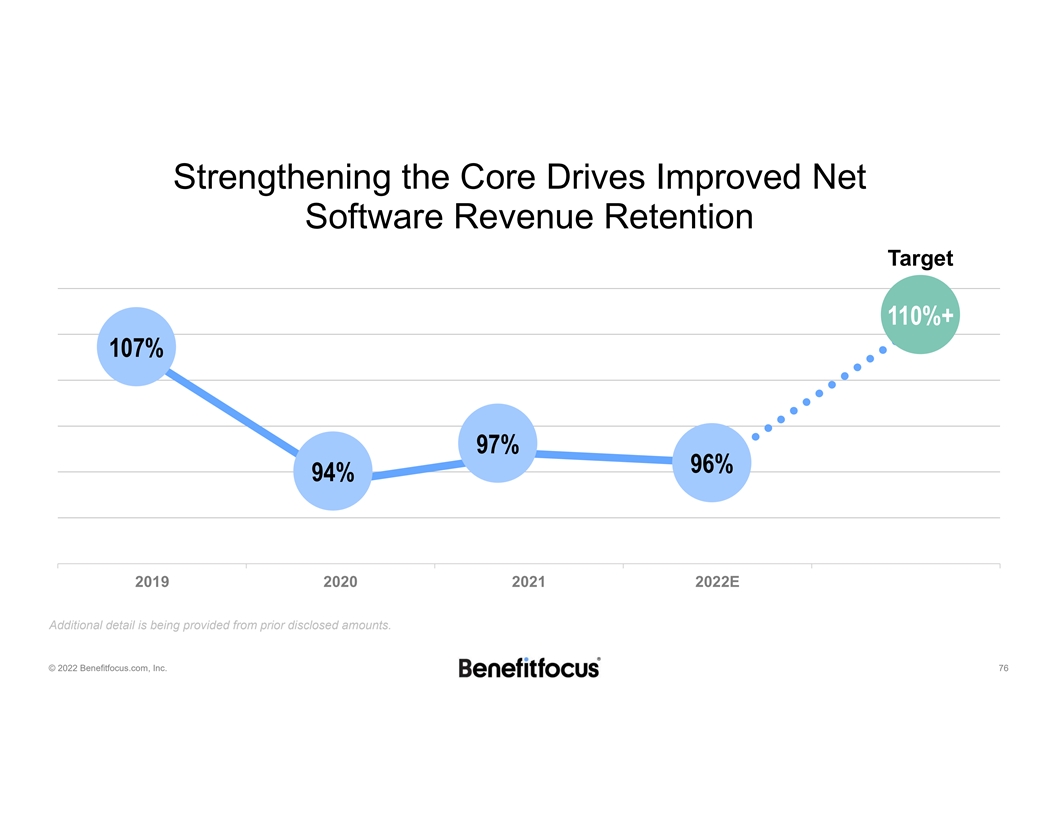

Strengthening the Core Drives Improved Net Software Revenue Retention Target 110%+ 107% 97% 96% 94% 2019 2020 2021 2022E Additional detail is being provided from prior disclosed amounts. © 2022 Benefitfocus.com, Inc. 76

Opportunity to Expand ARR Per Customer by 3.5x as we Add Initial Adjacencies Benefits Administration Compliance & Data & Insights Engagement Individual Quoting Administrative & Navigation & Activation Services CORE ADDITIONAL OFFERINGS 60% of customers have ADJACENCIES less than three products © 2022 Benefitfocus.com, Inc. 77

Employer Case Study – Expanding ARR 4.5x Benefit Catalog Large Health Care Customer $1.3 $0.6 $ Add-on Services Benefit Service $M ARR $0.2 Center $0.2 Benefitplace $0.3 Today Initial Purchase © 2022 Benefitfocus.com, Inc. 78

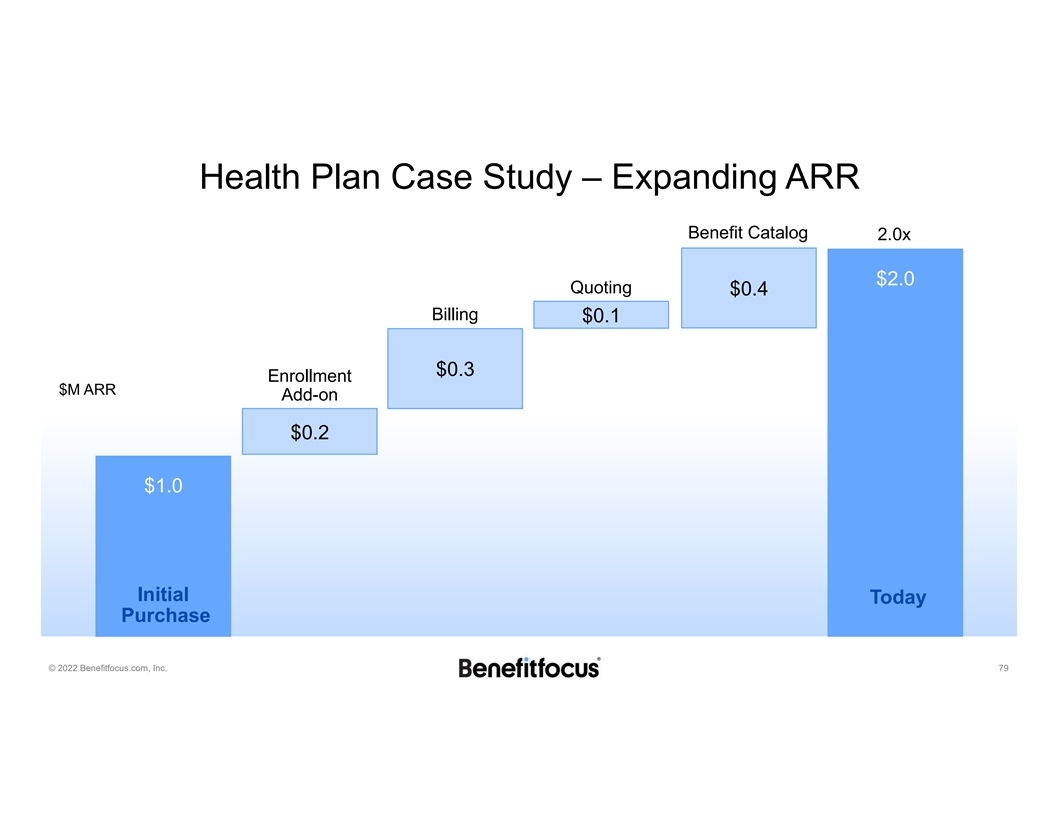

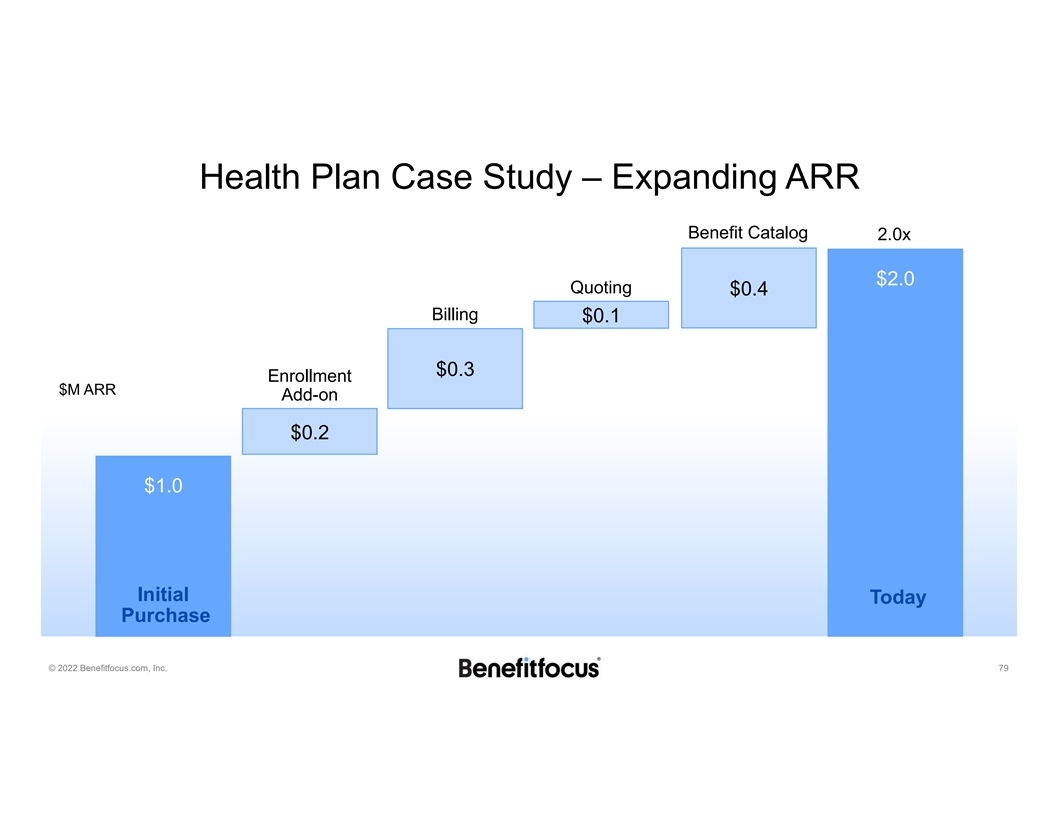

Health Plan Case Study – Expanding ARR Benefit Catalog 2.0x $2.0 Quoting $0.4 Billing $0.1 $0.3 Enrollment $M ARR Add-on $0.2 Enrollment $1.0 $1.0 Initial Initial Today Today Purchase Purchase © 2022 Benefitfocus.com, Inc. 79

Strategy to Win New Customers • Strengthened channel relationships • Increased customer references Increased • Differentiated technology and services Market Share • New product offerings to meet evolving needs © 2022 Benefitfocus.com, Inc. 80

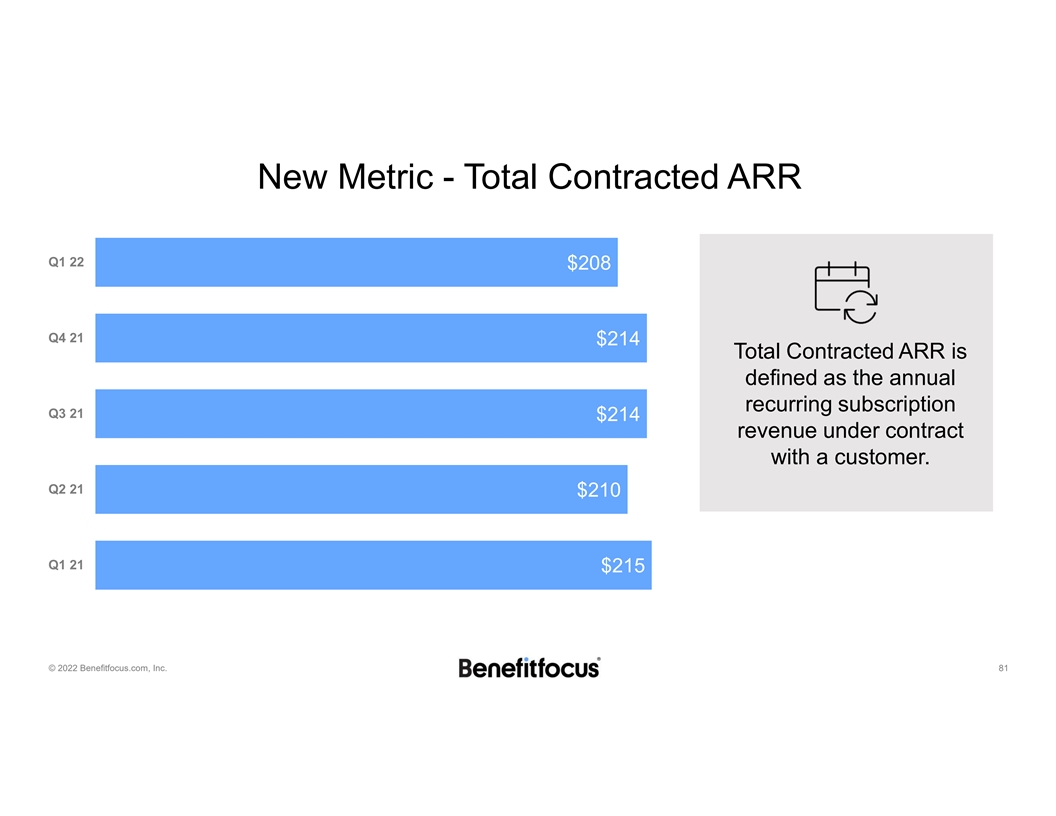

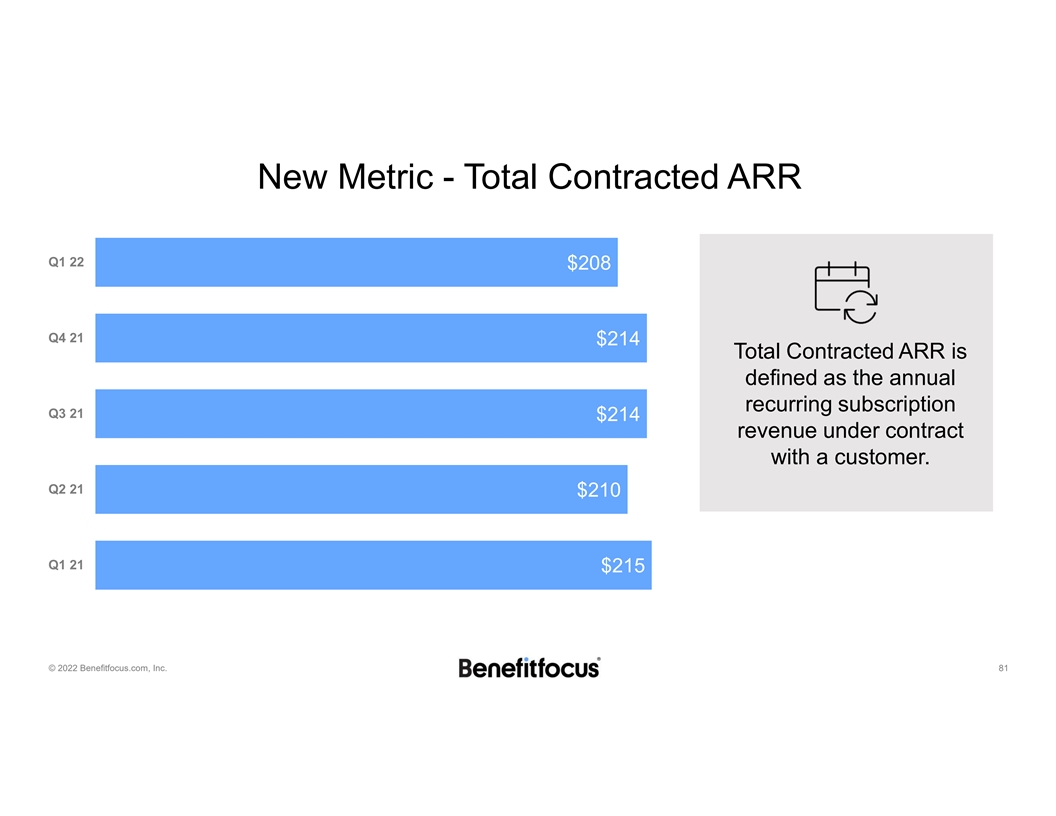

New Metric - Total Contracted ARR Q1 22 $208 Q4 21 $214 Total Contracted ARR is defined as the annual recurring subscription Q3 21 $214 revenue under contract with a customer. Q2 21 $210 Q1 21 $215 © 2022 Benefitfocus.com, Inc. 81

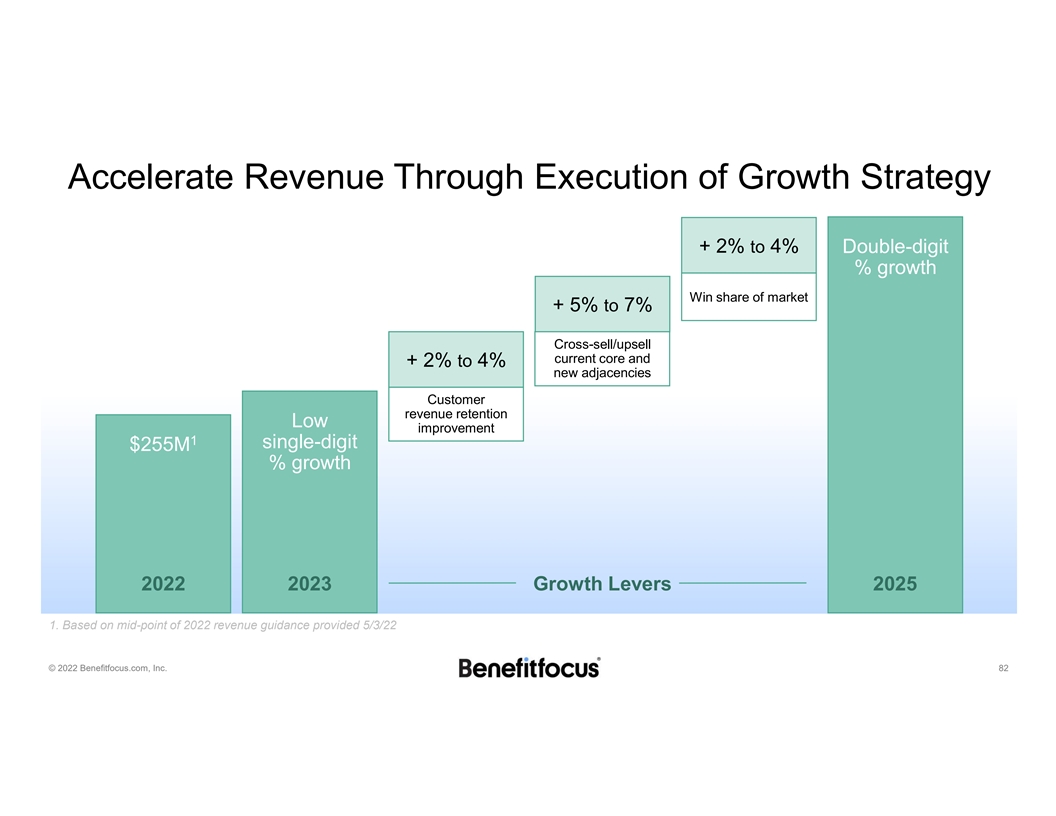

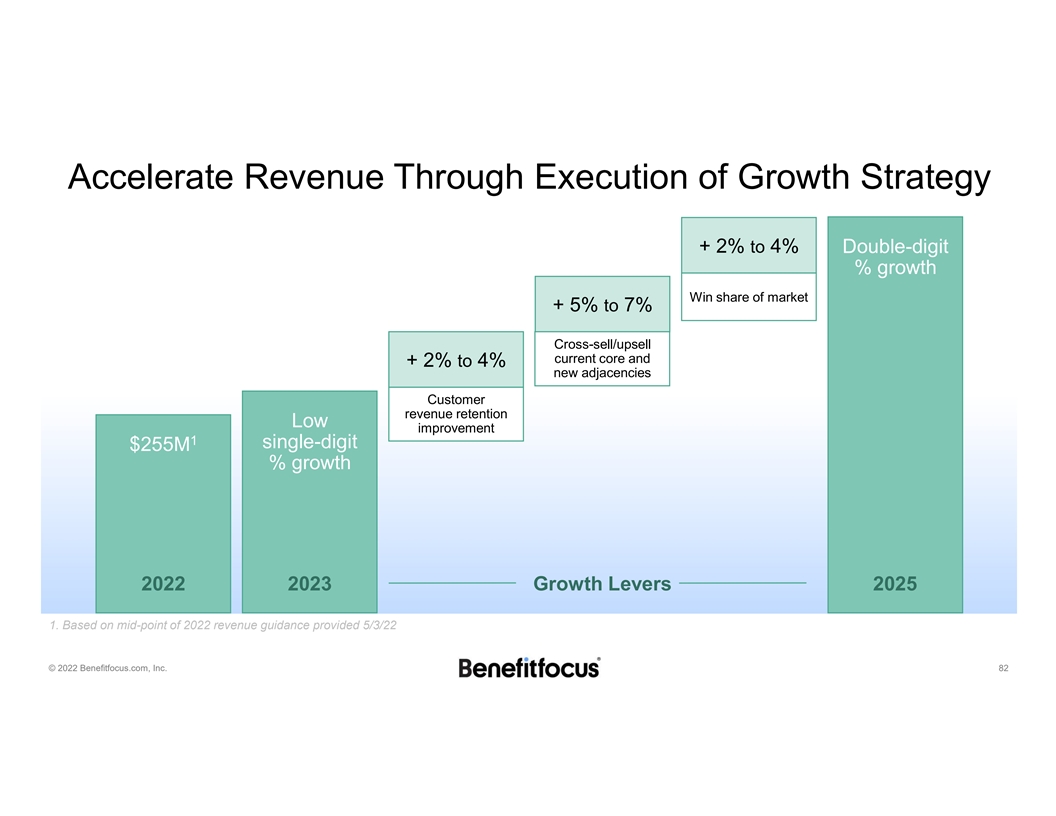

Accelerate Revenue Through Execution of Growth Strategy + 2% to 4% Double-digit % growth Win share of market + 5% to 7% Cross-sell/upsell current core and + 2% to 4% new adjacencies Customer revenue retention Low improvement 1 single-digit $255M % growth 2022 2023 Growth Levers 2025 1. Based on mid-point of 2022 revenue guidance provided 5/3/22 © 2022 Benefitfocus.com, Inc. 82

Business Model to Unlock Value at Benefitfocus Durable Business Grow with Unlocking Substantial Model Intent Long-term Value © 2022 Benefitfocus.com, Inc. 83

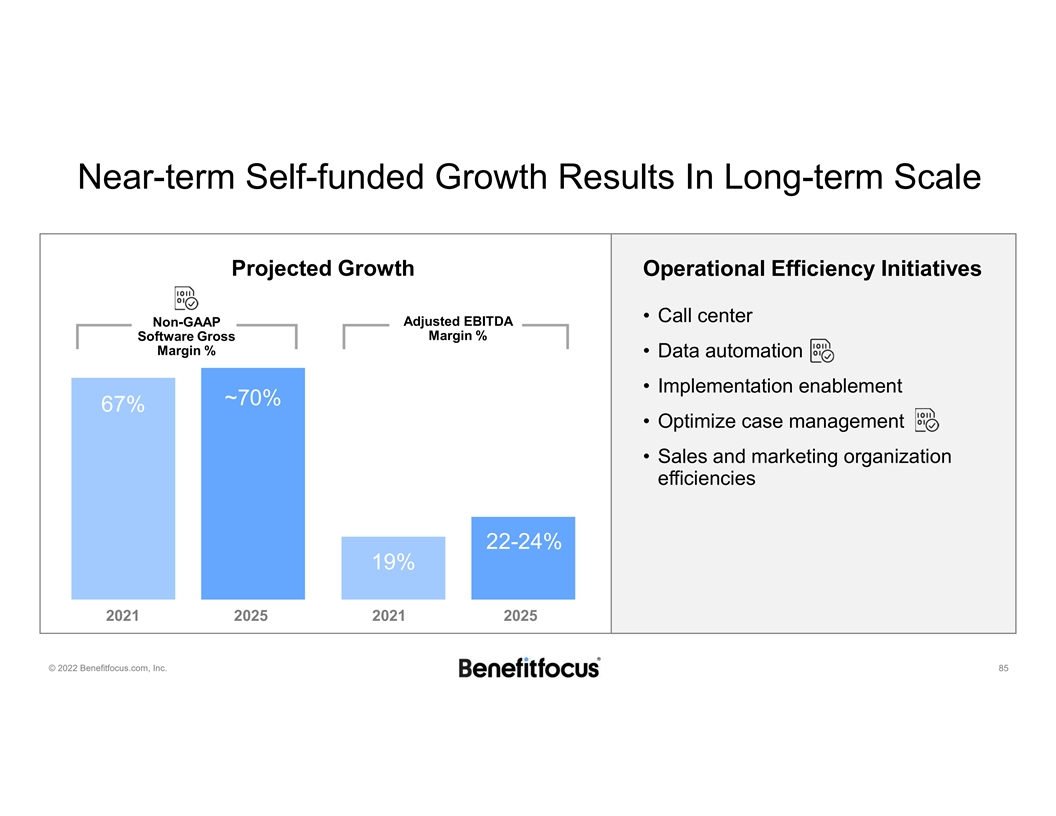

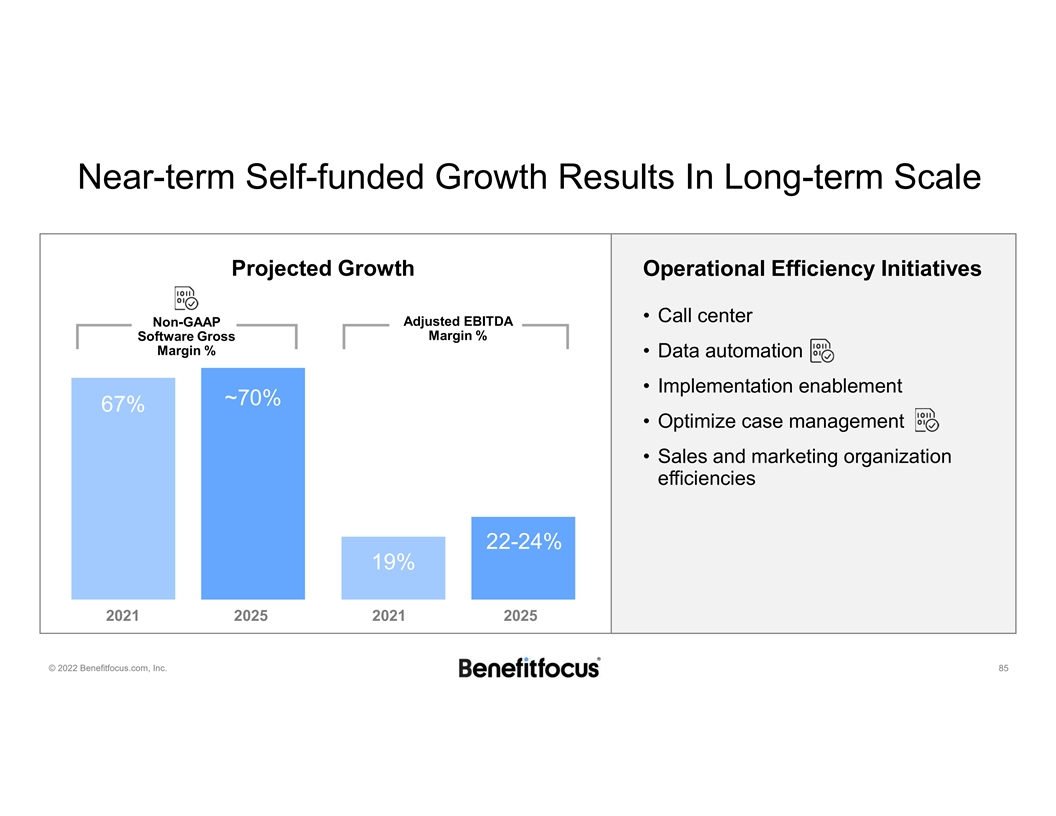

Medium-term Financial Targets Key Line Items 2021 2025E Revenue Growth (2%) 10-12% 1 Recurring Revenue Mix 90%+ 90%+ Software Services Gross Margin 67% 70%+ Adjusted EBITDA Margin 19% 22-24% 1. Recurring Revenue includes Software Services and Benefit Service Center (recurring Professional Services) © 2022 Benefitfocus.com, Inc. 84

Near-term Self-funded Growth Results In Long-term Scale Projected Growth Operational Efficiency Initiatives • Call center Non-GAAP Adjusted EBITDA Margin % Software Gross Margin % • Data automation • Implementation enablement ~70% 67% • Optimize case management • Sales and marketing organization efficiencies 22-24% 19% 2021 2025 2021 2025 © 2022 Benefitfocus.com, Inc. 85

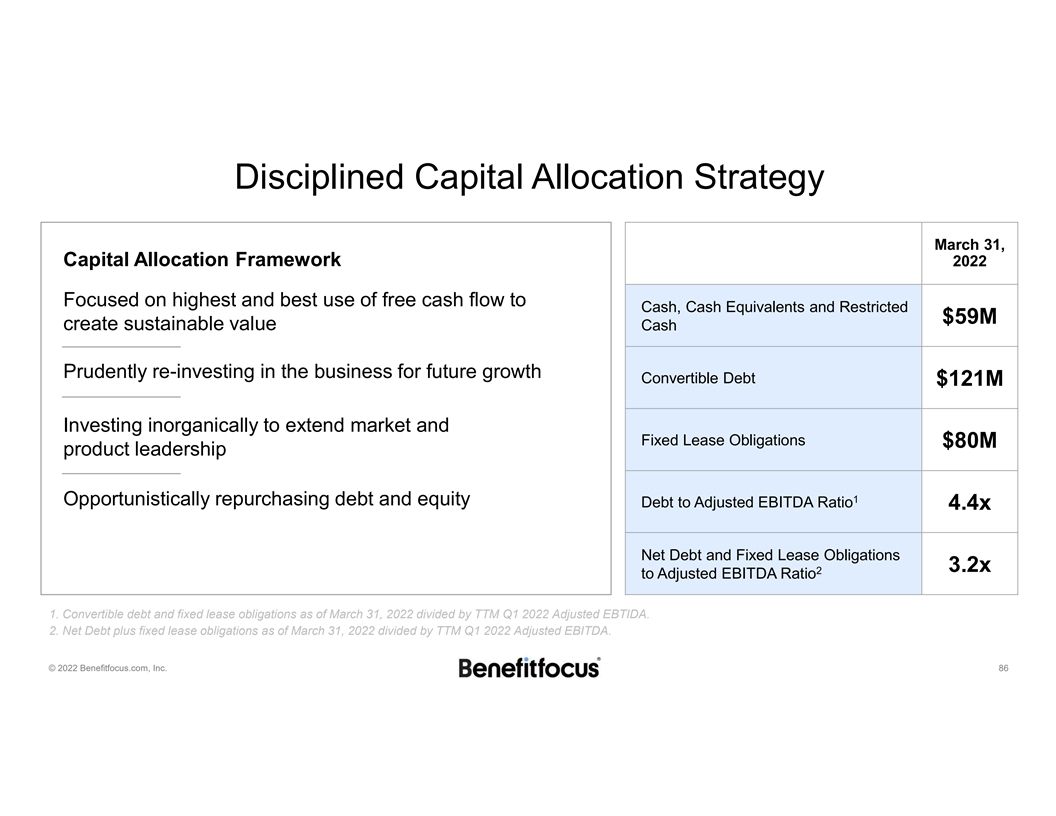

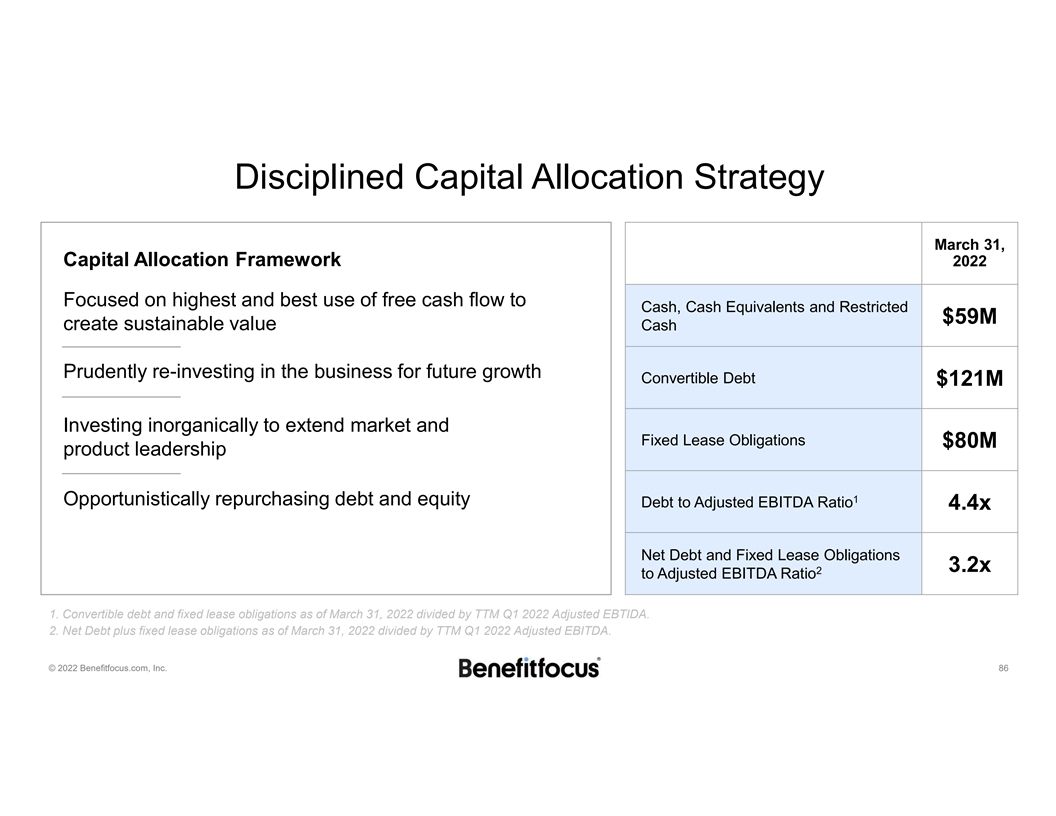

Disciplined Capital Allocation Strategy March 31, Capital Allocation Framework 2022 Focused on highest and best use of free cash flow to Cash, Cash Equivalents and Restricted $59M create sustainable value Cash Prudently re-investing in the business for future growth Convertible Debt $121M Investing inorganically to extend market and Fixed Lease Obligations $80M product leadership 1 Opportunistically repurchasing debt and equity Debt to Adjusted EBITDA Ratio 4.4x Net Debt and Fixed Lease Obligations 3.2x 2 to Adjusted EBITDA Ratio 1. Convertible debt and fixed lease obligations as of March 31, 2022 divided by TTM Q1 2022 Adjusted EBTIDA. 2. Net Debt plus fixed lease obligations as of March 31, 2022 divided by TTM Q1 2022 Adjusted EBITDA. © 2022 Benefitfocus.com, Inc. 86

ESG at Benefitfocus Highlights Environmental • >80% of 2021 revenues derived from energy-efficient cloud services Social • Driving increased diversity across the organization from the board through the entire organization • Recognized as one of the Best Employers for Diversity Governance • Independent chair and seven of nine directors independent • Enhancement made including actively de-staggering board © 2022 Benefitfocus.com, Inc. 87

Key Takeaways Durable business model gives us a strong foundation for growth Clear path for growth that translates to increased ARR Executing on our growth strategy unlocks long-term shareholder value © 2022 Benefitfocus.com, Inc. 88

© 2022 Benefitfocus.com, Inc. 89

Add a slide for Matt to have for closing comments © 2022 Benefitfocus.com, Inc. 90

© 2022 Benefitfocus.com, Inc. 91